#Bookkeeping Services Los Angeles

Text

What is a Bookkeeper’s Role in HIPAA-Compliant Businesses?

Healthcare organizations are expected to save and maintain lives, but as businesses, they must be HIPAA (Health Insurance Portability and Accountability Act) compliant. This is required for healthcare businesses in the United States, a legal requirement designed to protect the privacy and security of patient’s personal health information (PHI).

HIPAA compliance creates a framework for safeguarding sensitive health information for a reliable healthcare ecosystem that can only be promoted by trustworthy professionals.

These professionals in businesses like the top bookkeepers play a crucial role in protecting businesses by utilizing their expertise and ethical practices. Here are some ways in which reliable bookkeepers help and support HIPAA-compliant businesses:

Security

To protect financial records and PHI from unauthorized access, theft, or breaches, bookkeepers must implement appropriate security measures. This includes utilizing secure computer systems, encrypted data storage, and password protection for financial software and databases.

Confidentiality

When handling financial records containing protected health information (PHI), bookkeepers must maintain strict confidentiality. Any individually identifiable health information, such as medical records, payment information, and insurance information, is considered PHI. Bookkeepers should ensure that access to such information is limited to authorized personnel only.

Record Retention and Disposal

Bookkeepers should adhere to HIPAA guidelines for the retention and disposal of financial records that contain PHI. These guidelines specify the minimum retention period for different types of records and the secure destruction methods for disposing of sensitive information.

Monitoring and Auditing

Bookkeepers may be involved in auditing and monitoring financial transactions to ensure HIPAA compliance. This includes reviewing financial records on a regular basis, identifying any discrepancies or irregularities, and reporting any suspected violations to appropriate personnel.

Training and Awareness

Bookkeepers should receive HIPAA training and be aware of the specific requirements for financial transactions and record-keeping. They must understand the significance of maintaining PHI privacy and security, as well as how to deal with any potential breaches or incidents.

Business Associate Agreements (BAAs)

Under HIPAA regulations, bookkeepers who work with HIPAA-compliant businesses may be considered business associates. Any entity that performs services on behalf of a covered entity (such as a healthcare provider) and has access to PHI is considered a business associate. Bookkeepers should have a signed BAA with the covered entity outlining their responsibilities and obligations in terms of PHI protection.

The Bottomline

Overall compliance with HIPAA is a collaborative effort that involves numerous stakeholders, including healthcare providers, covered entities, and business associates.

Just like any other industry, efficient bookkeeping in healthcare is an essential component for effortless accounting processes to efficiently run a business. Hence it is a must to entrust a healthcare system’s finances only to trustworthy bookkeepers for long-term success.

So if you are a healthcare business owner or a healthcare business manager now is the time to get started! Learn how! Schedule a call now!

#best business blog#recordkeepers#bookkeepers#small business solutions#business tips#full service bookkeeping#healthcare support#los angeles#california

9 notes

·

View notes

Text

Bookkeeping is a useful process that tracks the financial performance of your company. It is vital to any company and without it, business owners will not be able to confidently prepare for the future. For certain businesses, it might mean the difference between success and failure. Learn more! Read on!

#business blog#bookkeeping service#bookkeepers#recordkeepers#taxconsultancy#smallbiz#business tips#thebookkeepersrus#los angeles#california

8 notes

·

View notes

Text

Bookkeepers Los Angeles

Need reliable bookkeepers in Los Angeles? Look no further than LA Business & Services for professional bookkeeping solutions tailored to your business needs. Our skilled team of bookkeepers ensures accurate financial records, helping you stay organized and compliant. From managing daily transactions to generating comprehensive financial reports, we offer the expertise you need to maintain your business’s financial health. Trust LA Business & Services for efficient and personalized bookkeeping services, whether you're a small startup or an established company. Reach out to us today for expert assistance from top bookkeepers in Los Angeles.

0 notes

Text

vimeo

When you need an accountant in Los Angeles, look no further than Prime Accounting Solutions, LLC. Our team of certified professionals is dedicated to providing expert financial services to businesses and individuals alike. With years of experience in the industry, we offer comprehensive accounting solutions tailored to meet your specific needs.

Prime Accounting Solutions, LLC

5601 S Slauson Ave. Suite 178, Culver City, CA 90230

(424) 603–0012

Official Website: https://primeaccsolutions.com/

Google Plus Listing: https://www.google.com/maps?cid=15487550948630970286

Other Links

cfo culver city : https://primeaccsolutions.com/cfo-los-angeles-ca/

accounting services los angeles ca : https://primeaccsolutions.com/accounting-services-culver-city/

tax advisory culver city : https://primeaccsolutions.com/tax-advisory-culver-city/

business bookkeeping services culver city : https://primeaccsolutions.com/bookkeeping-services-culver-city/

Other Service We Provide:

Accounting

Tax Advisory

Tax Planning

Book Keeping

CFO Services

Follow Us On

Twitter: https://twitter.com/PrimeAccou64360

Pinterest: https://www.pinterest.com/PrimeAccountingSolutionsLLC/

Linkedin: https://www.linkedin.com/in/andrewcompton

Instagram: https://www.instagram.com/accountingla/

#tax service culver city#accounting services los angeles ca#cfo los angeles#bookkeeper for small business culver city#tax planning culver city#Vimeo

0 notes

Text

In the dynamic tapestry of Los Angeles, where creativity meets commerce, businesses and entrepreneurs seek a foundation of financial stability. Enter bookkeeping services – the unsung heroes behind the scenes, ensuring meticulous financial records, compliance, and strategic financial insights.

0 notes

Text

https://docs.google.com/document/d/e/2PACX-1vQ6ElmX3cpQz2Vz5QFEy35J2lmLC8L3NDSxis-zmeQVvDyKenZ5FLXk6_HLvzLPH9RX4DiuU31AlmPT/pub

#bookkeeper in los angeles#bookkeeping in los angeles#bookkeepers los angeles#los angeles bookkeeping#bookkeeping los angeles#accountant in los angeles#accounting firms in los angeles#los angeles bookkeeping services#bookkeeping services in los angeles#accounting services in los angeles

0 notes

Note

I'm totally in support of the writers in theory but I'm trying to understand more of what you're fighting for because I've seen some people on twitter claim writers make more money a week than most of us make in a month so I'm trying to understand what the issue is. Also if that info is accurate. This is a genuine question. Not trying to have a "gotcha moment". I really want to hear from a writer.

people have always had wild misconceptions about how much a writer earns because of their lack of understanding of how the industry actually works. there's so many posts about how "you guys make 5k a week. what more do you want?!" yeah...let's do some math on that.

5k a week for 14 weeks (and that's a long room. a lot of rooms these days are 8-10 weeks. those are the dreaded mini-rooms we're trying to kill) is $70,000. for roughly three months of work. you'd think we're cooking with gas...BUT HOLD UP. that's gross! let's see everything that has to come out of that check:

10% to our agent

10% to our manager

5% to our entertainment attorney

5% to our business manager (not everyone has one but a lot of us do. i do, so that's literally 30% immediately off the top of every check)

most of these breakdowns ive seen downplay taxes severely. someone made one that says writers pay 5% in taxes and i would like to ask them "in what universe?". that doesn't even cover state taxes. the way taxes work in the industry is really complicated, but the short of it is most of us have companies for tax reasons so we aren't taxed like people on w2s/1099. if we did we'd be even more fucked. basically every production hires a writer's company instead of the writer as an individual. so they engage our companies for our services and then at the end of the year we (the company) pay taxes as corporations or llcs (depending on what the writer chose to go with). my company is registered as a "corporation" so let's go with those rates. california's corporate rate is 9% and the federal corporate tax rate is 21%. there's other expenses with running a business like fees and other shit so my business managers/accountants/bookkeepers have recommended i save between 35-40% of everything i make for when tax season comes.

you see where the math is at already??? 25-30% in commissions and then 35-40% in taxes. on the lower end you're at THE VERY LEAST looking at 60% of that check gone. 70% worst case scenario. suddenly those $70,000 people claim we make are actually down to $28,000 as the take home pay. and that's if you're only losing 60%. it goes down to $21,000 if it's 70%.

lets pretend you worked a long 14 week room (that's the longest room ive ever worked btw) and let's also be generous and say you only have 60% in expenses so the take home is $28,000. average rent in los angeles is around $2,800-$3,000. if you're paying $2,800 in rent that means you need AT LEAST $4,000 a month to have a semi decent life since you need to also cover groceries, gas, medical expenses, toiletries, phone, internet, utilities, rental and car insurances, car payments, student loan payments, etc etc etc. and again, this is los angeles. everything is more expensive so you're living BARE BONES on 4k. and these are numbers as a single person. im not even taking having children into account. so those $28,000 you take home might cover your life for 6-7 months. 3 of which you're in the room working. the reality is that once that room ends, you might not work in a room again for 6-9-12 months (i have friends whose last jobs were over 18 months ago) and you now only have about 3 months left of savings to hold you over. we have to make that money stretch while we do all the endless free development we do for studios and until we get our next paying job. so...3 months left of enough money to cover your expenses -> possible 9 months of not having a job. this is how writers end up on food stamps or applying to work at target.

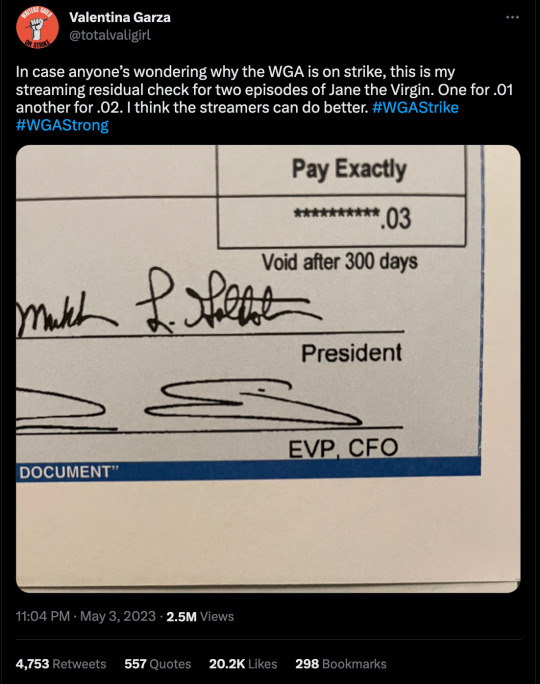

this is why we're fighting for better rates and better residuals. residuals were a thing writers used to rely on to get them through the unemployment periods. residual checks have gone down from 20k to $0.03 cents. im not joking.

they've decimated our regular pay and then destroyed residuals. we have nothing left. so don't believe it when they tell you writers are being greedy. writers are simply fighting to be able to make a middle class living. we're not asking them to become poor for our sake. we're asking for raises that amount to 2% of their profit. TWO PERCENT. this is a fight for writing even being a career in five years instead of something you do on the side while you work retail to pay your bills. if you think shows are bad now imagine when your writer has to do it as a hobby because they need a real job to pay their bills and support a family. (which none of us can currently afford to have btw)

support writers. stop being bootlickers for billion dollar corporations. stop caring about fictional people more than you care about the real people that write them. if we don't win this fight it truly is game over. the industry as you know it is gone.

7K notes

·

View notes

Text

Laphonza Romanique Butler

On October 1, 2023, California Governor Gavin Newsom chose well-known labor organizer and political strategist Laphonza Butler to be the next US Senator from California, following the death of long-serving Senator Dianne Feinstein on September 29, 2023. Butler, who was sworn in by Vice President Kamala Harris at the US Capitol on October 3, 2023, is the first openly LGBT Senator from California, the first Black lesbian in the US Senate, and the second Black woman to represent California in the Senate, following Vice President Kamala Harris. California must hold two concurrent Senate elections in March 2024: a special election to fill out the rest of Feinstein’s term in spite of there being an appointed Senator, and another election for the full six-year term beginning in January 2025.

Senator Butler’s career path includes labor, corporate, academic, and political engagement. Social justice has been her focus within these varied endeavors. Born in Magnolia, Mississippi, in 1979, Butler comes from a working-class family. Her father was a small business owner who died of a terminal illness when Butler was in high school. She saw her mother become the household’s sole provider for three children, working as a classroom aide, a home care provider, a security guard, and a bookkeeper.

Butler earned a bachelor’s degree in Political Science at Jackson State University in 2001. After graduation she began a career as a labor organizer in several states, working with nurses, custodians, and hospital workers. In accepting her appointment, Butler said that she would strive to honor Feinstein’s legacy by “committing to work for women and girls, workers and unions, struggling parents, and all of California.” Her previous job as President of Emily’s List, which helps elect Democratic women who support abortion rights, means it is likely abortion rights will be an important part of the Democrats’ election strategy in 2024.

In 2009 Butler moved to California where she organized nurses as well as in-home caregivers, and became President of SEIU (Service Employees International Union) Local 2015 of United Long Term Care Workers; she also served as President of the SEIU State Council. Butler has served on the board of the Children’s Defense Fund, the political action committee BlackPAC, and the Bay Area Economic Council Institute think tank. In addition, she is the former director of the Board of Governors of the Los Angeles branch of the Federal Reserve System, and a former Regent of the University of California.

Butler is married to Neneki Lee. The couple has an 8-year-old daughter. Lee is the National Division Director for Public Services at SEIU. When she became President of Emily’s list in 2021, Butler and her family moved to Maryland while maintaining their home in Los Angeles. As of October, 2023, they have re-domiciled to Los Angeles and Butler has re-registered to vote in California.

https://www.blackpast.org/african-american-history/people-african-american-history/laphonza-romanique-butler-1979/

11 notes

·

View notes

Text

The Toreador Sheriff in my chronicle, Lukas Love. Glamorous yacht fanatic partyboy and model with lifeguard and trophy husband energy who fancies himself as a modern pirate (it's all the Boarding Parties). Has way too much money and a sadistic streak deeper than the Mariana trench. Seemingly never without champagne or a cigar. He's been the Prince's head enforcer in the mob and partner for a long long time before the Praxis and recently married him. Every year he goes around town to offer financial advice and bookkeeping services during tax season like some kind of tax fairy. He loves art deco and jazz with all his soul and would take aggravated willpower damage from this playlist. Sometimes he misses Miami but he wouldn't give up the opportunity to taste Los Angeles' beating heart for the world. East coast Beast coast something something Cathari

#Lukas Love#Vampire the Masquerade#VtM#Toreador#Toreador Antitribu#City of Lost Angels#character playlist#Banana posts music#look it's Jesse's biological father#man who claims to be lover actually a hater#he got cut off from the inheritance and made it his whole personality#now he extorts rich coked up business execs for blood#this playlist is very violent so be warned

3 notes

·

View notes

Text

Bookkeeping VS. Accounting

Accounting and bookkeeping are frequently used interchangeably. Though bookkeeping and accounting are closely linked, there is a fine line between the two. Bookkeepers keep track of a company’s financial transactions on a daily basis. Accountants, on the other hand, are more involved with the big picture, they are in charge of interpreting, categorizing, evaluating, summarizing, and reporting financial data.

There are a lot of finer points involved with bookkeeping and accounting systems. A keen attention to detail is essential especially for the untrained eye. Accountants perform audits and estimates for future business needs.These expert professionals use the bookkeeper’s inputs to create financial statements. To add, they review and evaluate the financial information recorded by bookkeepers on a daily basis.

Since the two professions are related, bookkeepers and accountants frequently work together. Both of these roles require a lot of the same skills and abilities. However, there are some important differences, such as the work involved in each career and what is essential for success.

So if you are considering outsourcing an accounting or bookkeeping service in Los Angeles then here’s what you need to know about these two roles. Figure out which one your company needs.

What Is Accounting?

Accounting is also known as the language of business.

It is the systematic process of gathering, analyzing, and disseminating data about the financial transpiring within a business. Accounting helps determine a company’s financial position and present it to stakeholders. It also helps business owners in making short- and long-term development plans and decisions.

Accounting speaks for a company’s credibility to the target market with the purpose to provide a clear overview of financial statements to its stakeholders which include investors, lenders, employees, and the government.

The following are some common accounting tasks:

Provide data validation and analysis

Create reports, carry out audits, and put together financial records like tax returns, income statements, and balance sheets

Provide data for predictions, business trends, and expansion opportunities

Assist business owners to understand the effects of financial decisions

The accounting process generates reports that bring key aspects of your company’s finances together to provide you with a detailed picture of where your finances are, what they mean, what you can and must do about them, and where you can expect your company to be in the near future.

All CPAs are accountants. However, not all accountants are Certified Public Accountants (CPAs). An accountant and a Certified Public Accountant (CPA) are not the same things. Although both can prepare your tax returns, a CPA has a better understanding of tax laws and can represent you once audited by the IRS.

And What Is Bookkeeping?

Bookkeepers are in charge of maintaining the books and gathering data for accountants. Keeping information up to date and recording financial transactions are their main concerns. For instance, if you have a bookkeeper on the team, they will record transactions daily or once a week to make sure you have a chronological record of incoming and outgoing transactions.

The main objective of bookkeeping is to keep an accurate record of all financial transactions in a business. This data is used by companies to make major investment decisions.

Bookkeeping tasks includes the following:

Keep track of financial transactions

Post credits and debits on record

Create invoices

Make financial statements (balance sheet, cash flow statement, and income statement)

Keep and balance subsidiary accounts, general ledgers, and historical accounts

Complete payroll.

The size of the company and the volume of transactions processed daily, weekly, and monthly are common factors in determining how complicated a bookkeeping system is. Your company must consistently record all sales and purchases in the ledger, and some transactions require supporting documentation.

Bookkeeping is essential whether your business is big or small, a multinational corporation or an independent contractor. Bookkeeping helps create a budget. And with a budget, any business owner can more easily plan for future expenditures and investments. Additionally, bookkeeping also makes tax preparation easier.

The Bottom Line

Both bookkeeping and accounting are important for business success. While there are some similarities, there are also a number of significant differences.

While accounting provides a more in-depth interpretation and analysis of financial data, bookkeeping is focused on recording information and keeping the books up to date. The work done by bookkeepers paves the way for accountants, giving them the tools they need to create reports, submit tax returns, and provide incisive, personalized financial advice. In simple terms, bookkeepers prepare the data and lay the groundwork for accountants to proceed.

Accounting and bookkeeping are vital components of every business. For this reason, The Bookkeepers R Us team is composed of professional and qualified accountants providing the best and most affordable CPA and bookkeeping service in Los Angeles!

Expect our bookkeepers and accountants to evolve with the current market situation. We have the technical expertise to work with new systems and technologies.

Worried on how to manage your finances on your own? Get assistance from the best CPA firm in Los Angeles now!

2 notes

·

View notes

Text

The CPA's at Los Angeles Bookkeeping offer a complete range of bookkeeping and accounting services tailored to meet the specific accounting and bookkeeping requirements of each business we serve. Our licensed and certified professionals have served hundreds of individual businesses and have served as managers of large privately owned companies. Our wide range of experience allows us to provide all of the services businesses need to be successful. Our services are guaranteed to be accurate, prompt and reliable and come without the added costs and burdens of hiring of an in-house employee. Partnering with you and your company to ensure your success is our primary goal.

Contact us:

Los Angeles Bookkeeping

8484 Wilshire Blvd, Suite 515D, Los Angeles, CA 90211

310-295-0510

https://www.labookkeeping.com/

#Los Angeles Bookkeeping#La Bookkeeping#Bookkeeping Los Angeles#Bookkeeping Services Los Angeles#Los Angeles Bookkeeper#Bookkeepers Los Angeles#Bookkeeping Service Los Angeles#Bookkeeper Los Angeles#Bookkeeping Services Los Angeles Ca#Bookkeeping Services In Los Angeles

0 notes

Text

What Are The 5 Ways By Which Record Keepers Help Achieve Business Success?

Record management is not a company’s primary task, but it is a procedure that must not be neglected or underestimated. However, business owners may sometimes find it too difficult or are too busy to handle it themselves. Read on our blog!

#best blog#business tips#smallbusinesstips#small business solutions#reliable record keepers#bookkeepers#full service bookkeeping#healthcare bookkeepers#business success tips#top experts#los angeles#california

4 notes

·

View notes

Text

Do you have a healthcare business? Are you a Healthcare Manager? This is how you achieve success in business! Call us!

#reliable bookkeeping#bookkeepers#record keepers#healthcare bookkeeping#Los Angeles#California Services#small business accountants#full-service bookkeeping#thebookkeepersrus

3 notes

·

View notes

Text

Los Angeles Bookkeeping: A Guide to Managing Your Business Finances

In the fast-paced business world of Los Angeles, managing finances effectively is crucial for success. Whether you're a small startup or an established business, accurate bookkeeping ensures your financial health, aids in decision-making, and ensures compliance with tax regulations. For businesses in the City of Angels, finding reliable Los Angeles bookkeeping services can make all the difference. This blog will walk you through the importance of bookkeeping, what to look for in a professional service, and how Los Angeles businesses can benefit from partnering with a reputable firm like La Business & Accounting Service.

What Is Bookkeeping and Why Is It Important?

Bookkeeping involves recording all financial transactions for a business, including sales, purchases, receipts, and payments. It is an essential component of accounting that provides insights into a company’s financial health and allows business owners to make informed decisions. Here's why Los Angeles bookkeeping is important:

Financial Transparency: Regular bookkeeping helps business owners maintain clear, organized records, providing transparency into their company’s financial position.

Tax Compliance: Bookkeeping ensures that businesses accurately report income, expenses, and deductions, helping them stay compliant with tax laws and regulations.

Informed Decision-Making: By keeping track of cash flow, assets, liabilities, and profits, bookkeeping allows business owners to make strategic financial decisions.

Budgeting and Forecasting: With well-maintained books, businesses can create budgets, forecast future revenues, and manage expenses more effectively.

Auditing and Legal Protection: Having well-organized financial records is essential in case of an audit. Bookkeeping also helps protect businesses from legal issues related to finances.

The Benefits of Hiring a Professional Los Angeles Bookkeeping Service

While some business owners try to manage their own books, outsourcing to a professional Los Angeles bookkeeping service can provide significant benefits. Here’s why it’s worth considering a professional service:

1. Expertise and Accuracy

Bookkeeping requires expertise and attention to detail. Professional bookkeepers are trained to manage financial records accurately, avoiding costly mistakes. With an experienced Los Angeles bookkeeping service, businesses can rest assured that their books are accurate and up to date.

2. Time-Saving

Running a business in a busy city like Los Angeles means time is always in short supply. By outsourcing bookkeeping tasks, business owners can focus on core activities, such as growing their business, while leaving the financial management to professionals.

3. Access to Advanced Technology

Professional bookkeeping firms often use advanced accounting software to streamline processes and provide real-time insights into financial performance. This technology ensures that businesses have access to accurate reports, financial statements, and data analysis, making financial management easier.

4. Scalability

As businesses grow, their financial management needs become more complex. A professional Los Angeles bookkeeping service can scale its services to match the growth of the business, offering everything from basic bookkeeping to more complex financial services like payroll and tax preparation.

5. Cost Efficiency

While it may seem like an added expense, hiring a professional bookkeeping service can save businesses money in the long run. By ensuring accuracy and compliance, bookkeepers help businesses avoid penalties, late fees, and financial mismanagement.

Key Qualities to Look for in a Los Angeles Bookkeeping Service

When choosing a Los Angeles bookkeeping service, it’s important to look for certain qualities to ensure that the service you choose will meet your business's unique needs:

Experience: Look for a bookkeeping service with experience in your industry and a track record of providing excellent service to businesses like yours.

Certification: Choose a service with certified bookkeepers or accountants who are qualified and knowledgeable about bookkeeping practices and tax regulations.

Technology: Ensure that the service uses modern accounting software that can provide real-time updates and integrate with your business systems.

Customized Solutions: Every business is different. Look for a bookkeeping service that can tailor its offerings to meet your specific requirements.

Customer Service: Great customer service is essential. A responsive and communicative bookkeeping service will keep you updated and informed, ensuring that your business’s finances are in good hands.

How La Business & Accounting Service Can Help with Los Angeles Bookkeeping

For businesses seeking reliable Los Angeles bookkeeping services, La Business & Accounting Service is a trusted partner. With years of experience in helping businesses across industries manage their financial records, La Business & Accounting Service provides customized solutions to fit each client’s unique needs.

Why Choose La Business & Accounting Service?

Experience and Expertise: La Business & Accounting Service has a team of highly skilled bookkeepers who are familiar with the unique challenges of bookkeeping for businesses in Los Angeles.

Advanced Technology: The firm uses the latest bookkeeping software, ensuring that businesses receive accurate financial reports and real-time data.

Comprehensive Services: Whether you need basic bookkeeping or more advanced financial services like payroll management, La Business & Accounting Service can provide scalable solutions that grow with your business.

Commitment to Accuracy and Compliance: With La Business & Accounting Service, businesses can be confident that their books are in order and comply with all tax regulations, helping to avoid penalties and fines.

Conclusion

Bookkeeping is a vital function for every business, ensuring financial transparency, tax compliance, and informed decision-making. For businesses in Los Angeles, outsourcing this function to a reliable professional service like La Business & Accounting Service can save time, improve accuracy, and provide peace of mind. Whether you’re a small business or a growing company, La Business & Accounting Service offers the experience, expertise, and technology needed to manage your Los Angeles bookkeeping effectively.

0 notes

Text

vimeo

Prime Accounting Solutions, LLC offers a unique and impactful fractional CFO service with a core value proposition centered around “Unlocking Potential Through Financial Intelligence. Our fractional CFO in Culver City are equipped with the expertise to not only manage financial data but to extract valuable insights, turning raw numbers into strategic opportunities.

Prime Accounting Solutions, LLC

5601 S Slauson Ave. Suite 178, Culver City, CA 90230

(424) 603–0012

Official Website: https://primeaccsolutions.com/

Google Plus Listing: https://www.google.com/maps?cid=15487550948630970286

Other Links

cfo culver city : https://primeaccsolutions.com/cfo-los-angeles-ca/

accounting services los angeles ca : https://primeaccsolutions.com/accounting-services-culver-city/

tax advisory culver city : https://primeaccsolutions.com/tax-advisory-culver-city/

business bookkeeping services culver city : https://primeaccsolutions.com/bookkeeping-services-culver-city/

Other Service We Provide:

Accounting

Tax Advisory

Tax Planning

Book Keeping

CFO Services

Follow Us On

Twitter: https://twitter.com/PrimeAccou64360

Pinterest: https://www.pinterest.com/PrimeAccountingSolutionsLLC/

Linkedin: https://www.linkedin.com/in/andrewcompton

Instagram: https://www.instagram.com/accountingla/

#tax service culver city#accounting services los angeles ca#cfo los angeles#bookkeeper for small business culver city#tax planning culver city#Vimeo

0 notes