#C-KYC registry

Explore tagged Tumblr posts

Text

UPI Help: ತಪ್ಪಾದ UPI ಐಡಿಗೆ ಹಣ ಕಳುಹಿಸಿದ್ದೀರಾ? ಚಿಂತೆ ಬೇಡ, ಹೀಗೆ ಮಾಡಿ ಹಣ ಮರಳಿ ಪಡೆಯಿರಿ!

UPI Help- ಇತ್ತೀಚಿನ ದಿನಗಳಲ್ಲಿ UPI ನಮ್ಮ ದೈನಂದಿನ ಜೀವನದ ಅವಿಭಾಜ್ಯ ಅಂಗವಾಗಿದೆ. ಚಿಲ್ಲರೆ ವ್ಯಾಪಾರದಿಂದ ಹಿಡಿದು ದೊಡ್ಡ ಮೊತ್ತದ ವರ್ಗಾವಣೆಗಳವರೆಗೆ, ಎಲ್ಲವೂ ಒಂದು ಟ್ಯಾಪ್ನಲ್ಲಿ ನಡೆಯುತ್ತದೆ. ಆದರೆ, ಕೆಲವೊಮ್ಮೆ ಅವಸರದಲ್ಲಿ ಅಥವಾ ಸಣ್ಣ ತಪ್ಪುಗಳಿಂದಾಗಿ, ನಾವು ಬೇರೆಯವರಿಗೆ ಹಣ ಕಳುಹಿಸಬೇಕಾದಾಗ ತಪ್ಪಾದ UPI ID ಗೆ ಕಳುಹಿಸಿಬಿಡುತ್ತೇವೆ. ಆಗ ‘ಅಯ್ಯೋ, ಹಣ ಹೋಯಿತೇ’ ಎಂದು ಆತಂಕ ಶುರುವಾಗುತ್ತದೆ. ಆದರೆ, (UPI Help) ಚಿಂತಿಸುವ ಅಗತ್ಯವಿಲ್ಲ! ಇಂತಹ ಪರಿಸ್ಥಿತಿಯಲ್ಲಿ ನಿಮ್ಮ…

#Aadhaar based banking#Aadhaar e-KYC#banking without visiting branch#C-KYC#C-KYC registry#central KYC registry#DigiLocker banking#digital banking India#e-KYC from home#KYC for rural banking#new RBI KYC process#online bank account verification#RBI banking guidelines#RBI digital banking rules#RBI financial inclusion#RBI guidelines for banks#RBI KYC changes 2025#simplified bank KYC#simplified KYC process#video KYC RBI

0 notes

Text

BoB Customers Alert! Your A/C Will Be Deactivated If You Fail To Do THIS By March 24

Know what is Central KYC Registry and where Bank of Baroda customers can get it done. source https://zeenews.india.com/personal-finance/bank-of-baroda-customers-alert-complete-central-kyc-before-march-24-or-else-your-account-will-be-deactivated-2586069.html

View On WordPress

0 notes

Text

Digital Bureaucracy

First Decentralized Bureaucracy System That Simplifies And Standardizes Data With Blockchain Technology

About

Digital Bureaucracy is the first Decentralized Bureaucracy System that simplifies and standardizes data using blockchain technology. We facilitate bureaucracy across Individuals, Institutions, and Countries on the Blockchain Network. It is the Artificial Intelligence (AI) supported Blockchain Project that aims to end the difficult and long-lasting paperwork and bureaucracy transactions between countries, institutions, and individuals. It is a document management and document transfer solution specially developed for a decentralized blockchain, aimed at making your life easier with the combination of artificial intelligence and blockchain technologies. Documents and Bureaucracy transactions in documents, invoices, land registry, vehicles and many more are distributed in the Blockchain database and then your documents are distributed decentralized in a comparable, irrevocable way on the blockchain network. A system where the submitted information can only be seen by users who have a Hash key.

HOW DOES DIGITAL BUREAUCRACY WORK?

Digital Bureaucracy is making our lives difficult. It is instated everywhere and is carried out by the Municipality. Official documents, Invoices, Home and Vehicle purchase and sale, School and Education, Health and Hospital, Finance and Business, Customs procedures, Passport and Identity procedures are just some of the areas of example.

The DBC Project has made it possible to manage the tedious document transactions that cause complexity in our lives. For a moment, imagine that paper is not used within the World. With DBC, you will be able to send and receive your invoices, official documents, insurance and hospital documentation, customs and tax transactions, home, and car buying/ transactions, international, official, or personal information/documents using a single click encrypted over the Blockchain Network.

We combine the structure of Artificial Intelligence and Blockchain, allowing you to trade securely and quickly.

Bureaucratic procedures will rely on the help of Artificial Intelligence completely. It is a great project that will ensure swift and reliable transfers over the blockchain network.

Dependable and rapid payments. You will be able to send even the highest payments at the lowest cost.

Safe storage of school and hospital transactions on the Blockchain network. It enables making an action or obtaining information simpler with just a click.

What is DBCChain?

DBCChain is an Artificial Intelligence (AI) software developed by the Digital Bureaucracy team in open source. In order to make the use of DBCChain software specific to countries, institutions, and companies a very simple process, our team continues to work. We aim to ensure that it can be installed on all your devices with just one click, but also become very simple to use.

How does DBC Work?

Digital Bureaucracy is making our lives difficult. It is instated everywhere and is carried out by the Municipality. Official documents, Invoices, Home and Vehicle purchase and sale, School and Education, Health and Hospital, Finance and Business, Customs procedures, Passport and Identity procedures are just some of the areas of example.

The DBC Project has made it possible to manage the tedious document transactions that causes complexity in our lives. For a moment, imagine that paper is not used within the World. With DBC, you will be able to send and receive your invoices, official documents, insurance and hospital documentation, customs and tax transactions, home, and car buying/ transactions, international, official, or personal information/documents using a single click encrypted over the Blockchain Network.

Combine the structure of Artificial Intelligence and Blockchain, allowing you to trade securely and quickly.

Bureaucratic procedures will rely on the help of Artificial Intelligence completely. It is a great project that will ensure swift and reliable transfers over the blockchain network.

Dependable and rapid payments. You will be able to send even the highest payments at the lowest cost.

Safe storage of school and hospital transactions on the Blockchain network. It enables making an action or obtaining information simpler with just a click.

To facilitate the blockchain network in our daily lives, DBC started to develop its own Blockchain infrastructure to provide convenience in the listed areas below:

DBC Solution

The DBC token has been created to be used in the Digital Bureaucracy Infrastructure and to become the currency of the future. DBC token is the Crypto Currency that will be used in your bureaucratic transactions around the world.

What is DBC Token?

DBC Token is a virtual currency created to cover the Blockchain network fees of the Digital Bureaucracy system. Efforts are underway for our project to take party in many Exchanges according to our DBC Token Target table.

DBC Token will be used to cover Digital Bureaucracy Blockchain Network fees. Binance Smart Chain (BSC) Manufactured using BEP20 Smart Contract.

• Token Symbol Name: Digital Bureaucracy

• Short Token Name: DBC

• Token Standard: BEP20

• Blockchain Platform: Binance Smart Chain

• Total Supply: 200,000,000 DBC

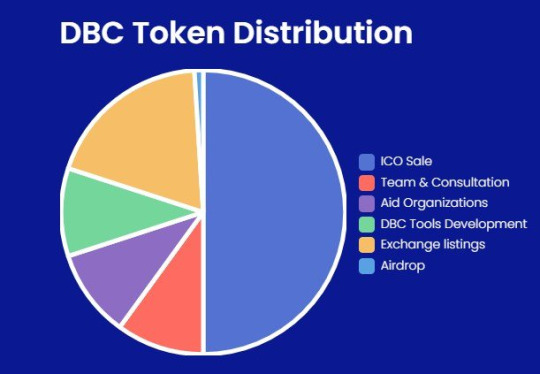

DBC Token Sale

The DBC token was created using Binance Smart Chain (BSC) BEP20 Smart Contrac. The token’s third party service wallets, exchanges, etc. It provides compatibility with and easy-to-use integration.

How can I participate in the DBC Token sale?

DBC token is issued decentrally. It is a unique platform; completely user friendly that is secure, smart, and easy to use. You can buy the tokens from the ‘Token Sales’ section of our website. You are also able to have DBC Tokens free of charge by following our Social Media accounts.

Start: 2021-04-30

Total Supply: 200.000.000 DBC

umber of tokens for sale: 25.000.000 DBC

Tokens exchange rate: 1 DBC = 0.010 USD

Acceptable currencies: ETH, BNB, BTC, USDT

Minimal transaction amount

1000 DBC / 10 USD

ICO and Presale

Stage A - Presale Global

Date: 30 April 2021 - 31 July 2021

Bonus: 1% - 5,000 DBC+ 2% - 10,000 DBC+ 3%

Stage A Sales: 25,000,000 DBC ($250,000)

Stage A sales price: 0.010$

Investor Data (KYC): NO (can be purchased anonymously)

DBC Token Distribution: All DBC Tokens will be distributed when the ICO Expires on April 30, 2022.

Stage B - Presale Global

Date: 1 August 2021 - 31 October 2027

Bonus: 1% - 5,000 DBC+ 2% - 10,000 DBC+ 3%

Phase B Sales: 25,000,000 DBC ($1,250,000)

Stage B sale price: 0.050$

Investor Data (KYC): NO (can be purchased anonymously)

DBC Token Distribution: All DBC Tokens will be distributed when the ICO Expires on April 30, 2022.

Stage C - Presale Global

Date: 1 November 2021 - 31 January 2022

Bonus: 1% - 5,000 DBC+ 2% - 10,000 DBC+ 3%

Phase C Sales: 25,000,000 DBC ($3,750,000)

Stage C sale price: 0.15$

Investor Data (KYC): NO (can be purchased anonymously)

DBC Token Distribution: All DBC Tokens will be distributed when the ICO Expires on April 30, 2022.

Stage D - Presale Global

Date: 1 February 2022 - 30 April 2022

Bonus: 1% - 5,000 DBC+ 2% - 10,000 DBC+ 3%

Phase D Sales: 25,000,000 DBC ($5,000,000)

Stage D sales price: 0.20$

Investor Data (KYC): NO (can be purchased anonymously)

DBC Token Distribution: All DBC Tokens will be distributed when the ICO Expires on April 30, 2022.

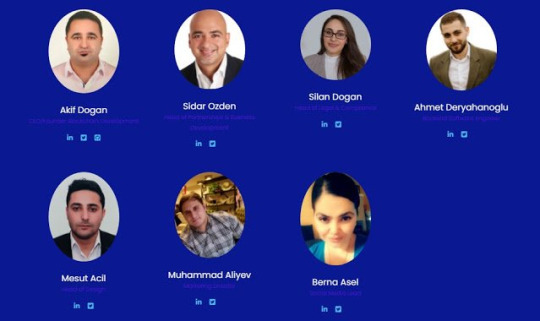

Team

The Digital Bureaucracy team aims to eliminate the difficulties in your life by bringing together Artificial Intelligence and Blockchain. Our Project is created in an open-sourced way completely. You can contribute to the development of our project by joining our team.

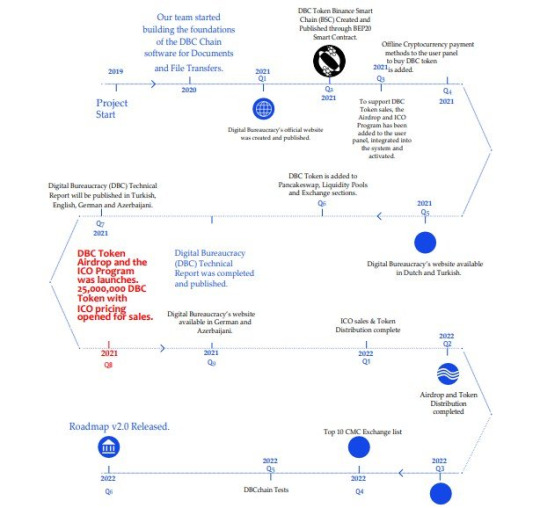

Roadmap

For More Information Click Links Bellow:

Web: https://www.digitalbureaucracy.org/

ICO&Airdrop: https://dbc.digitalbureaucracy.org/

Twitter : https://twitter.com/DigiBureaucracy

Telegram Group: https://t.me/digitalbureaucracy

Facebook Group: https://www.facebook.com/groups/digitalbureaucracy

Reddit: https://www.reddit.com/user/Digitalbureaucracy

Medium: https://medium.com/@Digitalbureaucracy

ANN: https://bitcointalk.org/index.php?topic=5328282.0

Whitepaper: https://www.digitalbureaucracy.org/Whitepaper-EN.pdf

Author: pejuang cod

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2699227

BEP-20 Address: 0x407920277aF25FEeCE0560e7e288397c93B2835c

0 notes

Text

You haven’t heard these truths about Society Registration yet!

Society is act for communal purpose. It is a consent agreement between the members of the concerned authorities. Societies are mainly formed to deliver charity toṣ the public. The groups do not desire any profits or gain from this formation. Society registration is done under the Society Registration Act, 1860. The registration is mainly focused to attain uniformity among societies and the public. Most of the states in India have adopted this rule.

Society Registration Requirement

For a society Registration, a minimum of 7 members is needed.

Society registration at the national level requires a minimum of 8 members and these members are from different states.

If the society registration happened in Delhi, then one member should be from Delhi along with any of the valid address proof. It can be an Aadhar card, Voter ID, Water bill or electricity bill. as well as the other persons who are also from different states each.

The members should sign in MOA and filled with the registry of Joint-stock-companies.

What is the Purpose of a Society?

Societies are registered or formed for a common purpose, and it can be the following.

Sponsor literature, fine arts, Science

Broadcast Useful knowledge

sponsor charitable assistance

Distribute and create military orphan funds

Found and contribute a public library

Build and maintain a public museumṣ

Encouraging social welfare and other charitable activities.

Benefits of Forming a Society

The benefits are listed below.

After incorporation, Society becomes a particular legal entity.

After the registration process, it forms as a legal entity. It will help society to sell, buy rent the properties, borrow money to enter into contracts using its name.

Even if a member is replaced by a new member, the entity remains functioning. There is no breakage in the functioning of the entity.

There are no Income tax-related burdens in Society

Society Membership

Normally, a minimum of 7 members is required in society registration as against 2 in Trust formation.

All the registration applications should be filled with the Memorandum of Association. The MoA should contain the rules and regulations associated with the Society.

The memorandum should include the below details,

The registered office of the Society's name, address, and area.

Details of the Members of the governing body.

Objects and names of promoters.

Documents required for the Society Registration

Photography of the members

PAN Card copy

Identity Proof

Latest address proof

Signed MoA

Affidavits from government

Procedures for Society Registration

Selection of Name

The selection of names is the primary and most important step of Society Registration. The name should be unique and should not violate anyone's name or trademark. The manager of the society should fill the affidavit regarding the name is not the same or similar to any other NGO.

Designing of MoA & By-Laws

The MoA of the society describes the main objectives for which it is being formed, whereas the rules and laws are applicable and the responsibilities of the manager, treasurer, and secretary.

Registration of Societies

The registrar of the societies submits the signed MoA, affidavit and KYC Documents to the particular officials. After completing all those verifications the registration certificate of Society is issued.

PAN, TAN and Bank A/C

After the society registration, the next important and crucial step is to apply for allotment of PAN number and TAN and after opening a bank A/C for company purpose.

0 notes

Text

Benefit of Credit Card in Pakistan at Mawazna.com

Each bank is individuals agreeable, and they have an assortment of credit cards to help individuals if there should be an occurrence of crises or untoward circumstances. You can choose any card reasonable to your way of life and their client benevolent officials are dependably available to your no matter what for help. Every one of the cards have money back plans, compensate focuses and offers whenever of the year. Having a credit card offers you the accommodation of making one installment contrasted with paying money for different administrations. Advantages Truly, choosing the best card is a testing errand, yet not an incomprehensible one. In the event that your activity includes going on visits, a movement card offering limits on lodging appointments and flight tickets will be the best alternative. Additionally, you have the choice of paying by this card as opposed to paying with money in a remote land. On the off chance that you are one who shops frequently, a card offering limits on well-known names, hardware at reasonable outlets will be the best alternative.

In an unanticipated crisis, you can make the installment, yet can have the enormous sum changed to EMIs. Reimbursement is compulsory, be that as it may, you can plan the installment according to your benefit in the wake of experiencing the rules. A portion of the card fans opine the month to month c. explanation to a journal where you don't need to take note of the buy things. A choice is likewise accessible where the buys can be effectively arranged. Making normal installments on your duty naturally remunerates you with a decent credit score. A superb reputation will dependably help you in anchoring an advance. Disregard the past of remaining in long lines at a bank; you can apply for your most loved credit card in the solace of your home or office. Make a visit to the site, peruse the required segment and select your most loved card. The individual subtleties must be filled as required and afterward tap the "Apply" choice. The following stage is to keep prepared the duplicates of Identity confirmation, Income evidence and address confirmation for the check procedure.

Features Taking care of costs is troublesome, however all the more difficult is the assignment of paying bills. The world is in your fingertips given you realize how to deal with specialized contraptions and have a credit card. You don't need to venture out of your home to pay bills of any class, be it power, portable energize and different prerequisites. Live problem free and profit of the Mobile Bill Pay choice of the Bank. Guarantee you do the correct snaps, refresh right data and the bill. You have done your part to Mother Nature by sparing paper and making the best utilization of your time. Highlights The web has offered ascend to digital lawbreakers who make utilization of each chance to cheat cash at your expense. Notwithstanding, all the credit cards are securely ensured as they have an EMV chip (additionally ensured by PIN) by which each exchange is made secure. The chip chops down definitely any conceivable outcomes of skimming and fake misrepresentation exchanges. You can utilize the card to get to air terminal parlors (for an ostensible charge), shop online for garments, devices, book tickets of your most loved shows and so forth. Like each credit card, you will get a SMS in a split second after an exchange to the portable number enrolled in the registry. You can likewise pull back money at any ATMs on the planet (notwithstanding, you need to illuminate the bank for some credit cards about setting off to an outside nation). Expenses will be appropriate according to the rules. Installment via card just improved with these focuses. • Booking with credit card gives you limits on motion picture tickets and outside feasting. • Depending on the card, you will get discounts for fuel additional charges. • Family individuals from essential card holders don't need to pay charges for turning into an extra part. • Joining charges might be deferred on the off chance that you make a buy of a specific sum or above utilizing the card. Eligibility You ought to have achieved the age of 18 years or more seasoned You ought to keep up a base sum according to the necessities of the credit card On the off chance that you are applying for a credit card the first occasion when, you need to give confirmation of your pay, address. In the event that you as of now have a record, your KYC data will be checked by and by for legitimacy.

0 notes

Text

February 4, 2017

News and Links

Top

A Consensys token sale appears to be under consideration!

A friend sent me the CFO job listing, which was put up after I mentioned the Consensys job openings last week. Check out this language: "We also anticipate one or more significant external funding events over the next year, potentially leveraging innovative, blockchain based financing as part of our capital structure."

MediaChain is building on IPFS and Ethereum -- scalable, off-chain storage for data-heavy web3 projects

Stuff for Dapp developers

Truffle 3.0 release with EIP190 package management

Ethereum package registry

Piper Merriam: Dogfooding the Ethpm.com package registry

More Piper: Populus 2.0 -- with smart contract packaging support

Timo Hanke's Random Beacon -- general source of secure randomness

Debian packages update for EthRaspbian & EthArmbian

Mahesh Murthy: Full Stack Hello World Ethereum Dapp Tutorial, part 2

Clients and releases

Geth 1.5.8 - Peachest -- "a patch release to address bugs and annoyances"

Ethereum Wallet and Mist 0.8.9 released

Solidity 0.4.9 released - watch out for file prefixes

Dev diary, week 5

Protocol

EIP (Ethereum Improvement Proposal) system updated

Zk-SNARKs: Under the Hood by Vitalik

Ecosystem

Ethlance - Free job market/freelancing platform

Status.im wraps up its interview series: Alexey Akhunov, Pelle Braendgaard, Thomas Bertani, and Loi Luu

Bug bounties: WeiFund and Chronobank

Project Updates

AKASHA 0.4.0 -- the Tipping Point. lots of new features like tipping.

Blockjack and Rouleth are joining forces

Token Sales

The Gnosis token model

Matchpool: Community-owned social matchmaking, aimed at online dating and beyond

Etheroll publishes Piper Merriam's security audit.

Long Reddit thread on Contingency.

Dfinity and upcoming fundraising

There are many upcoming token sales, so I wanted to link back to stuff I wrote early in the newsletter: my work-in-progress investing thesis and token sale investing strategies.

I also offered a longer document on how I think about token sales. It's not my most polished work, but had some interesting ideas. I'll open up the previous offer: share this newsletter on social media or send me any amount of Ether, and I'll email you the doc if you let me know at [email protected]

General

More on Gavin Wood/Parity blocking the C++ client relicensing (here and here)

Bottom line is that the Foundation ended up wasting money and months of Bob Summerwill's time working on a relicensing that didn't happen. Clearly there are quite few people (including Taylor Gerring) who are not happy at the outcome.

Coinfund’s Jake Brukhman talks crowdfunding in 2017 on Automata podcast

A talk I gave for the BIL conference: Blockchains long-term: recreating the Internet. An extended version of my internal TicketLeap talk.

Blockchannel podcast with Balaji Srinivasan

I really enjoyed this Epicenter podcast with Rick Dudley.

Will Warren: The difference between App Coins and Protocol Tokens

Dates of note

Feb 13 – Etheroll token sale begins

Feb 13 – Intellisys private equity “Mainstreet fund” sale begins (closed to US/EU citizens, KYC done by exchange for initial purchase and for dividends)

Feb 14 – Chronobank sale ends

Feb 15 – Melonport sale begins (must check a box that you aren’t US Citizen)

Feb 17-18 – Ethereum Euro Dev Conference in Paris

Feb 27 -- SuperDAO token sale begins

Feb 28 – Contingency sale ends

Mar 1 -- WeTrust token sale begins (1st day bonus, weekly price changes)

“Feb/Mar” – iEx.ec token sale begins

“Feb/Mar” – Gnosis token sale likely to begin

"Feb/Mar" – Humaniq token sale begins

March – Cosmos token sale begins

“Late March” – Matchpool token sale begins

[I aim for a relatively comprehensive list of Ethereum sales, but make no warranty as to even whether they are legit; as such, I thus likewise warrant nothing about whether any will produce a satisfactory return. I have passed the CFA exams, but this is not investment advice.]

I want your upvote

Subscriber growth has drastically slowed. Over the last month, we've had just 100 new subscribers compared to a week where almost 200 subscribed.

The biggest difference is that the newsletter hasn't gotten upvoted on Reddit as much as it previously did.

So that's my big ask for the week: if this issue was useful to you, would you upvote it on Reddit?

Link: http://www.weekinethereum.com/post/156837413613/february-4-2017

(Please use the weekinethereum.com link)

Just in case you want to send Ether (or tokens?): 0x96d4F0E75ae86e4c46cD8e9D4AE2F2309bD6Ec45

Sign up to receive the weekly email.

1 note

·

View note

Text

KYC Norms: ಬ್ಯಾಂಕ್ ಗ್ರಾಹಕರಿಗೆ ಗುಡ್ ನ್ಯೂಸ್: KYC ನಿಯಮಗಳಲ್ಲಿ ಭಾರಿ ಬದಲಾವಣೆ…!

KYC Norms – ರಿಸರ್ವ್ ಬ್ಯಾಂಕ್ ಆಫ್ ಇಂಡಿಯಾ (RBI) ಇತ್ತೀಚೆಗೆ ಕೆವೈಸಿ (KYC – Know Your Customer) ನಿಯಮಗಳಲ್ಲಿ ಕೆಲವು ಮಹತ್ವದ ಬದಲಾವಣೆಗಳನ್ನು ತಂದಿದೆ. ಈ ಹೊಸ ನಿಯಮಗಳು ಬ್ಯಾಂಕಿಂಗ್ ಪ್ರಕ್ರಿಯೆಯನ್ನು ಇನ್ನಷ್ಟು ಸುಲಭಗೊಳಿಸುವ ಮತ್ತು ಹೆಚ್ಚು ಜನರನ್ನು ಬ್ಯಾಂಕಿಂಗ್ ವ್ಯವಸ್ಥೆಯೊಳಗೆ ತರುವ ಉದ್ದೇಶವನ್ನು ಹೊಂದಿವೆ. 2025ರ RBI KYC ತಿದ್ದುಪಡಿ ನಿರ್ದೇಶನದ ಅಡಿಯಲ್ಲಿ, ಆಧಾರ್ ಆಧಾರಿತ ಇ-ಕೆವೈಸಿ, ವಿಡಿಯೋ ಕೆವೈಸಿ, ಮತ್ತು ಡಿಜಿಲಾಕರ್ ದಾಖಲೆಗಳ ಬಳಕೆಯನ್ನು…

#Aadhaar e-KYC#C-KYC#central KYC registry#DigiLocker banking#e-KYC from home#new RBI KYC process#RBI banking guidelines#RBI digital banking rules#RBI KYC changes 2025#simplified bank KYC#video KYC RBI

0 notes

Text

BoB Customers Alert! Your A/C Will Be Deactivated If You Fail To Do THIS By March 24

Know what is Central KYC Registry and where Bank of Baroda customers can get it done. source https://zeenews.india.com/personal-finance/bank-of-baroda-customers-alert-complete-central-kyc-before-march-24-or-else-your-account-will-be-deactivated-2586069.html

View On WordPress

0 notes

Text

Disruption in Banking/Financial Services Biz

Emergence of Fintech.

The world is changing fast and some of us may not appreciate the speed at which this change is happening. Banks are a trusted parties between economic agents for them to transact.

Traditionally banks have been performing three main functions :

• Facilitating Payments (between Economic agents: B2C, C2B , B2B B2G, G2B , G2G , C2C (peer to peer) etc) • Sourcing Deposits

• Extending Credit (Lending activities)

Payments: We are witnessing major disruption in payments through digital wallets from intermediaries outside the banks that is prepaid payment issuers for e.g Oxigen Pay TM, who has acquired over 170 Million customers in a short span of time ,of course some of it is because of the incentives built around it i.e cashbacks but there is a proposition that they are building up and can survive if they can create niches/ meet the unmet needs of customers through other options .

Digital wallets have fast created their place and replacing the need to hold even small cash and needless to say have many advantages that can accrue to the Government over a period of time in tackling the unaccounted transactions (Cash economy).

Than ,we have some very interesting home grown innovations by NPCI in payments i.e IMPS (24*7*365) and Unified payments interface by NPCI) which is similar to wallet , with addition of pulling of funds by merchants from the account of customer (P2A) pull by a merchant from customer a/c).

The other bigger innovation which can dis intermediate the banks( eliminate the need to ave bank) on the payment side is the BLOCKCHAIN technology which is underlying the Bitcoins (Digital currency). There is a lot which is now being talked on Bitcoins ( inspite of its possible misuse which we have witnessed) which has a certain conceptual progress in terms of currency of exchange and the Blockchain which is now gaining conviction very quickly in the minds of innovators.

Ofcourse ,one should bear in mind the advantages which Bitcoins ( the digital currency or also referred to as crypto currency) has over paper currency. At the same time one has to be cautious that BITCOINS is just a private currency and and at best be seen as another asset class for investors as no country or central bank will accept currency outside its control.

Needless , to say we have all seen the attacks which bitcoins have witnessed over the last 6 years of its existence and the consequent change in its value. One should also take note that Bitcoins is not the only digital currency and there are many variants available.

The innovation can reap true benefits only if the central banks also promote digital currency albeit of their own and are able to regulate it .

One needs to appreciate that the advantages of digital currency to a country , if it is well regulated through its central banks, otherwise as we saw that there are potentially large risks that can emanate from money laundering and various other type of attacks and also the unique power vested with a sovereign to be able to PRINT MONEY will be out of its hands .

Lets not forget the Blockchain ,a distributed ledger underlying technology where in one can make payments without the need to have banks as a third party and many other use cases are emerging very fast.

Lets try and understand the concept behind it .We all know that Banks keep track of customer balances on a ledger. Bitcoin also uses a ledger, but it is maintained collaboratively by the decentralised network of computers, and is known as a distributed ledger. As new batches of entries are added to the distributed ledger, they include a reference back to the previous batch, so that all participants can verify for themselves the true occurrence of everything on the ledger. These batches are called blocks, and the whole collection is a block chain.

RBI in its recent Financial Stability Report has also acknowledged the potential of this technology, recently a whitye paper has been published by idrbt. As of now , countries with low , near zero or negative interest rates have certain inbuilt incentives to look at technology like this because of the economics are different from developing country.

Deposits :

On the deposits side ,with the advent of AADHAR authentication services (e KYC) and central KYC registry ,it is now possible to open a/c online instantaneously without the need to have face to face appearance. What it can do is over night move the customers from one bank to another. Aadhar is key in the india stack i.e presence less, paper less , cashless and consent layer. Other areas which may lead to disruption in the space in India is differentiated bank licenses i.e. payment banks (though I believe out of 11 licenses only 4-5 will come up) & small finance banks and going forward may be other other variants of it.

On the lending side , we have the peer to peer lending platforms that have emerged which again will hit the Banks Business . Both SEBI & RBI has already recognized by putting out a draft paper and there is a work in process between RBI & SEBI on this disruption .

Another innovation is the trade receivables discounting exchange which is expected to be functional very soon. The data analytics for credit decisions and Smart contracts( with help of block chain) can make this also very impersonal & scalable Biz proposition with reduced Turn around time (TAT)to unbelievable levels, which can also be consistently sustained by the players and create some extraordinary experience for the customers.

So all in all for the first time in the history one can transact without the need to have hard currency ,electronically through block chain without a third party . This also enables financial inclusion, can reduce transaction costs , promote micro payments ( emergence of digital currency and blockchain) is lethal and can do what we could not achieve in many decades.

One should however also note that Banking is regulated industry with people’s money and all this newer platforms / developments will also need to be regulated (light regulation) for them to sustain & succeed and effectively compete with the banks.

One of the key takeaways is , that it would be very challenging for the regulator , hence new mechanisms to prevent regulatory violations are very desirable to ensure fair play and systemic stability.

1 note

·

View note

Text

MeitY planning strategy for national use of Blockchain

Latest Updates - CA Mitesh NEW DELHI: The government is preparing a strategy for national level use of Blockchain technology with an aim to scale up and widely deploy the new age technology. In a response to a question in the Lok Sabha, the ministry of electronics and information technology (MeitY) said that "Considering the potential of Blockchain Technology and the need for shared infrastructure for different use cases, an approach paper on National Level Blockchain Framework is being prepared..."In the response, Sanjay Dhotre, minister of state for electronics and IT said that "Blockchain Technology as one of the important research areas having application potential in different domains such as Governance, Banking and Finance, Cyber Security and so on."MeitY has supported a multi institutional project titled Distributed Centre of Excellence in Blockchain Technology with The Centre for Development of Advanced Computing (C-DAC), The Institute for Development & Research in Banking Technology (IDRBT) and others as executing agencies.The Center conducted research on the use of Blockchain and developed Proof-of-Concept solutions. While the property registration blockchain solution has been developed and is being piloted at Shamshabad District, Telangana State, solutions are also being developed for enabling Cloud Security Assurance, C-KYC and trade finance. Dhotre added that Generic Blockchain based Proof-of Existence (PoE) framework is developed to enable PoE for digital artifacts, used to check the integrity of academic certificates, sale deed documents, MoU etc."By using PoE framework, solution is developed to authenticate academic certificates. Blockchain Technology has also been used and PoC is developed for vehicle life cycle management and hotel registry management PoC."Efforts are also underway for integrating Blockchain with e-Sign. Chartered Accountant For consultng. Contact Us: http://bit.ly/bombay-ca

0 notes

Text

How To Invest In Mutual Funds

Congratulations on finally deciding to step into the investment world of mutual funds. It is convenient and easy, coupled with the inflation-beating returns from equity funds. This is a productive way to multiply surplus income and savings to achieve your financial goals. As a newbie, you may be wondering about how and which mutual fund schemes to invest in. With innovations in technology and investor-focused regulations, you can invest in mutual fund schemes in multiple ways. And, before we explore the different avenues you can choose from, let’s understand that mutual funds offer two different plans for every scheme:

A regular plan, for investors investing through a distributor, and

A direct plan for investors coming directly to the AMC or through an Investment Adviser

The plans differ from each other only in terms of cost. The regular plan charges a higher expense ratio, as compensation to the distributor. The direct plan, is devoid of this additional cost, hence, investors benefit with higher returns. If you prefer simplicity and the process of investing sounds incomprehensible, opt for a mutual funddistributor. They will take care all administration, paperwork activity such as form filing, etc. All you need to do is submit relevant documentation and sign on the dotted line to begin your investment journey in mutual funds. Just remember, “caveat emptor”... Buyer Beware. Yes, there are several cases where distributors have mis-sold mutual fund investments. So, you need to read the fine print carefully before you sign anything. When it comes to a direct plan, if you are tech-savvy and have basic financial knowledge, investing in mutual funds though this route will be a much better option. You can seek guidance from a fee-based mutual fund investment adviser about the right mutual fund schemes for your financial goals. Investing through the direct route is a much better option as you can save a significant amount of money over the long term. But before you embark on the journey of investing in mutual funds, you need to complete your KYC (Know Your Customer) formalities. KYC is a prerequisite for investing in mutual funds (and almost all financial instruments). It is vital compliance on the part of financial product manufacturers, to know their investor better.

KYC For Mutual Funds

The Government has appointed the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) to establish a central KYC registry, which simplifies the process of complying to KYC procedures — and you need to do it just once; either with a bank, mutual fund, or an insurance company that you’ve invested in. This means you don't have to fill-up the KYC form another time with other financial product providers. If you’ve opted for a regular plan, i.e. investing in mutual funds through a distributor, they will assist you with KYC compliances. However, if you plan to invest in mutual funds through the direct route, you can complete your C-KYC through five simple steps outlined below.

Offline KYC For Mutual Funds

Prerequisites

CKYC form. You can fetch you CKYC form here

Recent passport size photograph

Proof of Identity

PAN Card Copy

Proof of Address

The list of acceptable documents for Proof of Identity and Proof of Address is published at the bottom of the KYC form. Fill up the form and attach attested copies of your documents. You will then need to visit the office of the AMC or that of the registrar with the originals. Once verified, your KYC will be registered. You can check your KYC status here: https://www.karvykra.com/upansearchglobalwithpanexempt.aspx

Online KYC For Mutual Funds

To comply with the KYC process online all you need is: ✔Internet Connection ✔Working Web Camera ✔Self-Attested scanned copies of your photo identity and proof of address ✔Signature on a plain paper Step 1: Log into ekyc.quantumamc.com. Enter your PAN number and it will confirm your PAN number validity. It will also check if your KYC is already verified.

Step 2: Next, enter your other personal details such as Mobile Number, Email, and Aadhaar (UID) Number. On the next page, you are required to enter further details for Central KYC purpose.

Step 3: Now you need to upload self-attested scanned copies of your pan card and address proof. And for the signature, you need to sign on a plain paper piece of paper and take a photograph of it. Please note that, SEBI permits investments upto Rs 50,000 for each financial year per mutual fund for Aadhaar based e-KYC for mutual funds using OTP verification. Once the Rs 50,000 limit is crossed, it requires you to undergo the in-person verification procedure.

Step 4: Next is your In Person Verification (IPV). Unlike the physical verification, here your live video is recorded through your device camera.

Hence, there is no need for you to physically visit the AMC. Everything is possible and at your convenience. Step 5: Confirm all your information and submit it. Lastly, all you need to now is wait for 2 weeks while your KYC will be uploaded on Central KYC servers and will be verified during this time period. Further, you will also get a confirmation e-mail about your KYC Status. You can also check your KYC status here. After the entire process is done, you will receive a 14-digit identification number- KIN (KYC Identification Number). And lastly, your FATCA declaration will also available in the same KYC form. Complying with the Mutual Fund KYC procedure can get you started with investing in a wealth creating investment avenues such as mutual funds. You would not be expected to invest in mutual fund schemes from Quantum Mutual Fund; all they’re doing is lending you a helping hand, facilitating your journey to financial freedom. Now that you have completed your mutual fund KYC, you can invest in mutual funds.

Investing in mutual funds through a distributor

If you are investing in mutual funds through a distributor such as a bank or investment broker, they will assist you with the transaction forms and other required documentation. Some big distributors may offer online investment facilities to add to the convenience, while local distributors may offer purely offline services. The advice and service might be more personalised in the latter. Some may charge an additional fee for services offered, in addition to the commissions earned from your mutual fund investments. If you would like to save on costs, you may opt for the direct route.

How to invest in Mutual Fund Direct Plans?

If you decide to invest in mutual funds directly, here are the different paths:

AMC or Registrar office: Once you have decided in which fund to invest, you can visit the nearest AMC office or the office of their registrar to invest in the mutual fund. Here is a list of AMC offices – AMFI Link. If you prefer the online route, you may invest in mutual fund schemes directly through the online portal of the fund house. However, if you have multiple funds, you will need to register and invest in each fund house individually. This can be inconvenient if you have a number of schemes from different fund houses. The registrars also facilitate online investing in mutual funds, however, the investment will be limited to the mutual funds enrolled with them.

Mutual Fund Utilities: Mutual Fund Utilities is a shared platform of different fund houses. You need to create an account first, before transacting. We explain how you can create a Common Account Number (CAN) later in the article. You can transact in mutual funds of almost all the AMCs. Through a single transaction form, you can invest in multiple funds of different fund houses. You can even invest in mutual funds though the online route. Once your CAN is created, you can invest in mutual fund schemes through the portal of mfuonline.com.

Investment Adviser: If you hire the services of a fee-based investment adviser, you may send over your transaction documents to them to begin investing in mutual funds. Your investment adviser will also receive newsfeed from the fund house and they can keep track of your mutual fund investments. There are several online automated investment portals, also known as robo-advisers. These are investment advisers who enable investment in direct plans at a nominal fee. The fee structure varies from one portal to another. Some offer their services free, up to a certain monetary limit. Do check the services offered before you invest in mutual funds through them. Choose one that has an established track record of picking the best mutual funds.

Investing through Mutual Fund Utilities gives you access to all the major mutual funds. Hence, if you are solely seeking a transaction portal, as of now, this is the best offering. There is no additional charge for mutual fund investments made through this portfolio. The cost of the platform is shared by the participating fund houses.

How to invest in Mutual Funds through MF Utilities?

Mutual fund transaction portal, MFU (Mutual Fund Utilities) is a single window for you to transact across mutual fund schemes using a Common Transaction Form (CTF) or through the online portal. All you have to do is first create your Common Account Number (CAN), which is a unique reference number issued by MFU. For existing mutual fund investors, the CAN will map all existing mutual fund folios across fund houses (participating in MFU), thereby providing a consolidated view of all mutual fund investments in India. Below are the few pre-requisites for creating a CAN-

You should be a regular KYC compliant (other than Aadhaar based KYC)

The bank account which you decide to register should be your default account in your existing mutual fund investments, if any.

STEPS to CREATING an e-CAN Below are the steps to help you create an e-CAN: Step 1: Visit: https://www.mfuindia.com/eCANFormFill Enter your email id and click on ‘New Form’.

Next, it will direct you to the page you see below. Step 2: You need to select the CAN criteria, i.e. either partially electronic or completely electronic.

Once you fulfil all three pre-requisites, select the option “Completely Electronic”. If not, you can opt for “Partially Electronic”. Step 3: Select your holding type. It can be either Single, Joint or Either, or Survivor. Next, enter the number holder for the CAN you are creating. Please note that for each type of your holding you will have a different CAN number. So if your Fund A has Single holding, your CAN will be xxxxxx15. And for Fund B, which is Joint holding, your CAN will be xxxxx17. Further, it is mandatory to fill up all the KYC details, Bank account details, FATCA details, and nominee information. You can register upto 3 bank accounts under CAN.

And you are through!! Once you successfully finish inserting all your details, you will receive a provisional e-CAN number. Once your address proof, identification proof and bank account details are verified by MFU, your permanent CAN number will be generated. If your registration is completely electronic, this message, as shown in the screen shot below, will be generated.

A link will be sent to your email; where, if need be, you will have to upload relevant documents. Please note if your KYC details sourced by MFU from KRAs / CERSAI / RTA is unsatisfactory your record will be converter to Partially Electronic. You will receive a prefilled eCAN Registration Form, which needs to be filled up and submitted along with necessary documents/proofs at a MFU Point of Service (POS). If your registration choice was Partially Electronic then, you should print the “eCAN Registration Form”, fill in the details and sign. Further, you need to attach the necessary documents and submit it at any of the MFU POS for further processing. Once your document verification is complete, your CAN will be approved and activated for further transactions.

How to invest in Mutual Fund SIPs?

To invest in Systematic Investment Plans (SIPs) of mutual funds, there are broadly two ways: i) offline; and ii) online. In case of the former, approach the office a mutual fund house / mutual fund distributor / agent / relationship manager / investment adviser. Here’s what you need to do to start a Mutual Fund SIP offline:

Select a mutual fund scheme that best suits your needs, investment objectives, financial goals

Fill in the Common Application Form / SIP form carefully and completely, mentioning the name of the mutual fund scheme and other details

Provide your NACH mandate form stating all details of your SIP.

Hand over the forms (as mentioned above) to the office of mutual fund distributor / agent / relationship manager / investment adviser / Certified Financial Guardian, or you can even directly submit to Registrar and Transfer Agents (RTAs) / AMC.

If you choose to invest in a SIP mutual fund online, you can log in to a particular mutual fund house’s website, or use other transaction platforms viz.

MFU

, or opt for services of robo-advisory platforms, and follow the steps and instructions mentioned.

In case you are investing through MF Utilities, you need to submit the PayEezz form. PayEezz is a facility offered by MFU, where an investor can register a one-time mandate and provide a standing instruction to his banker authorising MF Utility to debit his/her account for future subscription transactions (Lump sum or SIP).

By registering under PayEezz, investors need not issue cheque or other payment instructions every time they make an investment through MFU. There is an upper limit mentioned in the PayEezz mandate.

Once a PayEezz is successfully registered and the PayEezz reference Number (PRN) is communicated by MFU, investors are free to register any number of SIPs quoting the same PRN. However, investors/distributors/RIAs should note that the cumulative debits in a day cannot exceed the maximum limit mentioned in the PayEezz mandate.How to select the best mutual funds to invest in?

Well, no one has a magic crystal ball that can foretell which mutual fund schemes will top the list over the next decade. However, through years of experience, one can define a process that can be used to shortlist potentially the best mutual fund schemes for the future. Besides, putting all your eggs in one basket can prove perilous. Hence, there is a need to diversify the investment over a set of schemes that have the capability to deliver superior risk-adjusted returns and have dealt with the market conditions tactfully. After all, you require mutual fund schemes that stand by you in good times and in bad – meaning, the schemes need to manage the downside of the market well, apart from generating sound returns in a market rally. Star ratings can be indicatively used while selecting winning mutual fund schemes; but, these can in no way be the conclusive criteria. Instead, doing a need-based analysis is necessary. This ensures you take into account your risk appetite, investment objective, investment horizon and financial goals, before you zero down on mutual fund schemes. PersonalFN follows a stringent scoring model, which ensures that the scheme is tested on various quantitative as well as qualitative parameters. This is compared with and scored vis-à-vis other contemporary schemes. The ones that pass through our rigorous test and achieve the maximum composite score on all parameters (based on pre-specified weightages) get a higher star rating. PersonalFN understands that not all investors are equipped with the know-how to select the best mutual fund schemes for their portfolio. One would have to spend hours analysing mutual fund schemes in order to arrive at the right list for them. Thus, PersonalFN saves you the time and does the number-crunching work for you. With hundreds of equity mutual funds available, how do you pick the right ones for your portfolio? Opt for PersonalFN's 'FundSelect' service. It is the simplest and potentially the best way to grow your portfolio value significantly! One of the most important characteristic of FundSelect service is, it helps you zero-in on the top-performing funds across varying market caps and investment styles — be it large-cap, mid-cap, multi-cap, value-based or balanced funds. And with highlights of the underperforming or average performing ones too. To conclude… Investors should remain focussed on their long-term financial goals and invest in the right mutual funds to fulfil these goals. The basics of investing in mutual fund schemes remain the same. If you need research-backed recommendations opt for PersonalFN's FundSelect Plus. This model mutual fund portfolio service ‘FundSelect Plus’ has completed a decade, and we are offering subscriptions at a massive 75% discount! Don’t miss out this Special Anniversary Discount. Click here to Subscribe now!

This post on " How To Invest In Mutual Funds " appeared first on "PersonalFN"

0 notes

Text

How To Invest In Mutual Funds

Congratulations on finally deciding to step into the investment world of mutual funds. It is convenient and easy, coupled with the inflation-beating returns from equity funds. This is a productive way to multiply surplus income and savings to achieve your financial goals. As a newbie, you may be wondering about how and which mutual fund schemes to invest in. With innovations in technology and investor-focused regulations, you can invest in mutual fund schemes in multiple ways. And, before we explore the different avenues you can choose from, let’s understand that mutual funds offer two different plans for every scheme:

A regular plan, for investors investing through a distributor, and

A direct plan for investors coming directly to the AMC or through an Investment Adviser

The plans differ from each other only in terms of cost. The regular plan charges a higher expense ratio, as compensation to the distributor. The direct plan, is devoid of this additional cost, hence, investors benefit with higher returns. If you prefer simplicity and the process of investing sounds incomprehensible, opt for a mutual funddistributor. They will take care all administration, paperwork activity such as form filing, etc. All you need to do is submit relevant documentation and sign on the dotted line to begin your investment journey in mutual funds. Just remember, “caveat emptor”... Buyer Beware. Yes, there are several cases where distributors have mis-sold mutual fund investments. So, you need to read the fine print carefully before you sign anything. When it comes to a direct plan, if you are tech-savvy and have basic financial knowledge, investing in mutual funds though this route will be a much better option. You can seek guidance from a fee-based mutual fund investment adviser about the right mutual fund schemes for your financial goals. Investing through the direct route is a much better option as you can save a significant amount of money over the long term. But before you embark on the journey of investing in mutual funds, you need to complete your KYC (Know Your Customer) formalities. KYC is a prerequisite for investing in mutual funds (and almost all financial instruments). It is vital compliance on the part of financial product manufacturers, to know their investor better.

KYC For Mutual Funds

The Government has appointed the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) to establish a central KYC registry, which simplifies the process of complying to KYC procedures — and you need to do it just once; either with a bank, mutual fund, or an insurance company that you’ve invested in. This means you don't have to fill-up the KYC form another time with other financial product providers. If you’ve opted for a regular plan, i.e. investing in mutual funds through a distributor, they will assist you with KYC compliances. However, if you plan to invest in mutual funds through the direct route, you can complete your C-KYC through five simple steps outlined below.

Offline KYC For Mutual Funds

Prerequisites

CKYC form. You can fetch you CKYC form here

Recent passport size photograph

Proof of Identity

PAN Card Copy

Proof of Address

The list of acceptable documents for Proof of Identity and Proof of Address is published at the bottom of the KYC form. Fill up the form and attach attested copies of your documents. You will then need to visit the office of the AMC or that of the registrar with the originals. Once verified, your KYC will be registered. You can check your KYC status here: https://www.karvykra.com/upansearchglobalwithpanexempt.aspx

Online KYC For Mutual Funds

To comply with the KYC process online all you need is: ✔Internet Connection ✔Working Web Camera ✔Self-Attested scanned copies of your photo identity and proof of address ✔Signature on a plain paper Step 1: Log into ekyc.quantumamc.com. Enter your PAN number and it will confirm your PAN number validity. It will also check if your KYC is already verified.

Step 2: Next, enter your other personal details such as Mobile Number, Email, and Aadhaar (UID) Number. On the next page, you are required to enter further details for Central KYC purpose.

Step 3: Now you need to upload self-attested scanned copies of your pan card and address proof. And for the signature, you need to sign on a plain paper piece of paper and take a photograph of it. Please note that, SEBI permits investments upto Rs 50,000 for each financial year per mutual fund for Aadhaar based e-KYC for mutual funds using OTP verification. Once the Rs 50,000 limit is crossed, it requires you to undergo the in-person verification procedure.

Step 4: Next is your In Person Verification (IPV). Unlike the physical verification, here your live video is recorded through your device camera.

Hence, there is no need for you to physically visit the AMC. Everything is possible and at your convenience. Step 5: Confirm all your information and submit it. Lastly, all you need to now is wait for 2 weeks while your KYC will be uploaded on Central KYC servers and will be verified during this time period. Further, you will also get a confirmation e-mail about your KYC Status. You can also check your KYC status here. After the entire process is done, you will receive a 14-digit identification number- KIN (KYC Identification Number). And lastly, your FATCA declaration will also available in the same KYC form. Complying with the Mutual Fund KYC procedure can get you started with investing in a wealth creating investment avenues such as mutual funds. You would not be expected to invest in mutual fund schemes from Quantum Mutual Fund; all they’re doing is lending you a helping hand, facilitating your journey to financial freedom. Now that you have completed your mutual fund KYC, you can invest in mutual funds.

Investing in mutual funds through a distributor

If you are investing in mutual funds through a distributor such as a bank or investment broker, they will assist you with the transaction forms and other required documentation. Some big distributors may offer online investment facilities to add to the convenience, while local distributors may offer purely offline services. The advice and service might be more personalised in the latter. Some may charge an additional fee for services offered, in addition to the commissions earned from your mutual fund investments. If you would like to save on costs, you may opt for the direct route.

How to invest in Mutual Fund Direct Plans?

If you decide to invest in mutual funds directly, here are the different paths:

AMC or Registrar office: Once you have decided in which fund to invest, you can visit the nearest AMC office or the office of their registrar to invest in the mutual fund. Here is a list of AMC offices – AMFI Link. If you prefer the online route, you may invest in mutual fund schemes directly through the online portal of the fund house. However, if you have multiple funds, you will need to register and invest in each fund house individually. This can be inconvenient if you have a number of schemes from different fund houses. The registrars also facilitate online investing in mutual funds, however, the investment will be limited to the mutual funds enrolled with them.

Mutual Fund Utilities: Mutual Fund Utilities is a shared platform of different fund houses. You need to create an account first, before transacting. We explain how you can create a Common Account Number (CAN) later in the article. You can transact in mutual funds of almost all the AMCs. Through a single transaction form, you can invest in multiple funds of different fund houses. You can even invest in mutual funds though the online route. Once your CAN is created, you can invest in mutual fund schemes through the portal of mfuonline.com.

Investment Adviser: If you hire the services of a fee-based investment adviser, you may send over your transaction documents to them to begin investing in mutual funds. Your investment adviser will also receive newsfeed from the fund house and they can keep track of your mutual fund investments. There are several online automated investment portals, also known as robo-advisers. These are investment advisers who enable investment in direct plans at a nominal fee. The fee structure varies from one portal to another. Some offer their services free, up to a certain monetary limit. Do check the services offered before you invest in mutual funds through them. Choose one that has an established track record of picking the best mutual funds.

Investing through Mutual Fund Utilities gives you access to all the major mutual funds. Hence, if you are solely seeking a transaction portal, as of now, this is the best offering. There is no additional charge for mutual fund investments made through this portfolio. The cost of the platform is shared by the participating fund houses.

How to invest in Mutual Funds through MF Utilities?

Mutual fund transaction portal, MFU (Mutual Fund Utilities) is a single window for you to transact across mutual fund schemes using a Common Transaction Form (CTF) or through the online portal. All you have to do is first create your Common Account Number (CAN), which is a unique reference number issued by MFU. For existing mutual fund investors, the CAN will map all existing mutual fund folios across fund houses (participating in MFU), thereby providing a consolidated view of all mutual fund investments in India. Below are the few pre-requisites for creating a CAN-

You should be a regular KYC compliant (other than Aadhaar based KYC)

The bank account which you decide to register should be your default account in your existing mutual fund investments, if any.

STEPS to CREATING an e-CAN Below are the steps to help you create an e-CAN: Step 1: Visit: https://www.mfuindia.com/eCANFormFill Enter your email id and click on ‘New Form’.

Next, it will direct you to the page you see below. Step 2: You need to select the CAN criteria, i.e. either partially electronic or completely electronic.

Once you fulfil all three pre-requisites, select the option “Completely Electronic”. If not, you can opt for “Partially Electronic”. Step 3: Select your holding type. It can be either Single, Joint or Either, or Survivor. Next, enter the number holder for the CAN you are creating. Please note that for each type of your holding you will have a different CAN number. So if your Fund A has Single holding, your CAN will be xxxxxx15. And for Fund B, which is Joint holding, your CAN will be xxxxx17. Further, it is mandatory to fill up all the KYC details, Bank account details, FATCA details, and nominee information. You can register upto 3 bank accounts under CAN.

And you are through!! Once you successfully finish inserting all your details, you will receive a provisional e-CAN number. Once your address proof, identification proof and bank account details are verified by MFU, your permanent CAN number will be generated. If your registration is completely electronic, this message, as shown in the screen shot below, will be generated.

A link will be sent to your email; where, if need be, you will have to upload relevant documents. Please note if your KYC details sourced by MFU from KRAs / CERSAI / RTA is unsatisfactory your record will be converter to Partially Electronic. You will receive a prefilled eCAN Registration Form, which needs to be filled up and submitted along with necessary documents/proofs at a MFU Point of Service (POS). If your registration choice was Partially Electronic then, you should print the “eCAN Registration Form”, fill in the details and sign. Further, you need to attach the necessary documents and submit it at any of the MFU POS for further processing. Once your document verification is complete, your CAN will be approved and activated for further transactions.

How to invest in Mutual Fund SIPs?

To invest in Systematic Investment Plans (SIPs) of mutual funds, there are broadly two ways: i) offline; and ii) online. In case of the former, approach the office a mutual fund house / mutual fund distributor / agent / relationship manager / investment adviser. Here’s what you need to do to start a Mutual Fund SIP offline:

Select a mutual fund scheme that best suits your needs, investment objectives, financial goals

Fill in the Common Application Form / SIP form carefully and completely, mentioning the name of the mutual fund scheme and other details

Provide your NACH mandate form stating all details of your SIP.

Hand over the forms (as mentioned above) to the office of mutual fund distributor / agent / relationship manager / investment adviser / Certified Financial Guardian, or you can even directly submit to Registrar and Transfer Agents (RTAs) / AMC.

If you choose to invest in a SIP mutual fund online, you can log in to a particular mutual fund house’s website, or use other transaction platforms viz.

MFU

, or opt for services of robo-advisory platforms, and follow the steps and instructions mentioned.

In case you are investing through MF Utilities, you need to submit the PayEezz form. PayEezz is a facility offered by MFU, where an investor can register a one-time mandate and provide a standing instruction to his banker authorising MF Utility to debit his/her account for future subscription transactions (Lump sum or SIP).

By registering under PayEezz, investors need not issue cheque or other payment instructions every time they make an investment through MFU. There is an upper limit mentioned in the PayEezz mandate.

Once a PayEezz is successfully registered and the PayEezz reference Number (PRN) is communicated by MFU, investors are free to register any number of SIPs quoting the same PRN. However, investors/distributors/RIAs should note that the cumulative debits in a day cannot exceed the maximum limit mentioned in the PayEezz mandate.How to select the best mutual funds to invest in?

Well, no one has a magic crystal ball that can foretell which mutual fund schemes will top the list over the next decade. However, through years of experience, one can define a process that can be used to shortlist potentially the best mutual fund schemes for the future. Besides, putting all your eggs in one basket can prove perilous. Hence, there is a need to diversify the investment over a set of schemes that have the capability to deliver superior risk-adjusted returns and have dealt with the market conditions tactfully. After all, you require mutual fund schemes that stand by you in good times and in bad – meaning, the schemes need to manage the downside of the market well, apart from generating sound returns in a market rally. Star ratings can be indicatively used while selecting winning mutual fund schemes; but, these can in no way be the conclusive criteria. Instead, doing a need-based analysis is necessary. This ensures you take into account your risk appetite, investment objective, investment horizon and financial goals, before you zero down on mutual fund schemes. PersonalFN follows a stringent scoring model, which ensures that the scheme is tested on various quantitative as well as qualitative parameters. This is compared with and scored vis-à-vis other contemporary schemes. The ones that pass through our rigorous test and achieve the maximum composite score on all parameters (based on pre-specified weightages) get a higher star rating. PersonalFN understands that not all investors are equipped with the know-how to select the best mutual fund schemes for their portfolio. One would have to spend hours analysing mutual fund schemes in order to arrive at the right list for them. Thus, PersonalFN saves you the time and does the number-crunching work for you. With hundreds of equity mutual funds available, how do you pick the right ones for your portfolio? Opt for PersonalFN's 'FundSelect' service. It is the simplest and potentially the best way to grow your portfolio value significantly! One of the most important characteristic of FundSelect service is, it helps you zero-in on the top-performing funds across varying market caps and investment styles — be it large-cap, mid-cap, multi-cap, value-based or balanced funds. And with highlights of the underperforming or average performing ones too. To conclude… Investors should remain focussed on their long-term financial goals and invest in the right mutual funds to fulfil these goals. The basics of investing in mutual fund schemes remain the same. If you need research-backed recommendations opt for PersonalFN's FundSelect Plus. This model mutual fund portfolio service ‘FundSelect Plus’ has completed a decade, and we are offering subscriptions at a massive 75% discount! Don’t miss out this Special Anniversary Discount. Click here to Subscribe now!

This post on " How To Invest In Mutual Funds " appeared first on "PersonalFN"

0 notes