#C-KYC

Explore tagged Tumblr posts

Text

KYC Norms: ಬ್ಯಾಂಕ್ ಗ್ರಾಹಕರಿಗೆ ಗುಡ್ ನ್ಯೂಸ್: KYC ನಿಯಮಗಳಲ್ಲಿ ಭಾರಿ ಬದಲಾವಣೆ…!

KYC Norms – ರಿಸರ್ವ್ ಬ್ಯಾಂಕ್ ಆಫ್ ಇಂಡಿಯಾ (RBI) ಇತ್ತೀಚೆಗೆ ಕೆವೈಸಿ (KYC – Know Your Customer) ನಿಯಮಗಳಲ್ಲಿ ಕೆಲವು ಮಹತ್ವದ ಬದಲಾವಣೆಗಳನ್ನು ತಂದಿದೆ. ಈ ಹೊಸ ನಿಯಮಗಳು ಬ್ಯಾಂಕಿಂಗ್ ಪ್ರಕ್ರಿಯೆಯನ್ನು ಇನ್ನಷ್ಟು ಸುಲಭಗೊಳಿಸುವ ಮತ್ತು ಹೆಚ್ಚು ��ನರನ್ನು ಬ್ಯಾಂಕಿಂಗ್ ವ್ಯವಸ್ಥೆಯೊಳಗೆ ತರುವ ಉದ್ದೇಶವನ್ನು ಹೊಂದಿವೆ. 2025ರ RBI KYC ತಿದ್ದುಪಡಿ ನಿರ್ದೇಶನದ ಅಡಿಯಲ್ಲಿ, ಆಧಾರ್ ಆಧಾರಿತ ಇ-ಕೆವೈಸಿ, ವಿಡಿಯೋ ಕೆವೈಸಿ, ಮತ್ತು ಡಿಜಿಲಾಕರ್ ದಾಖಲೆಗಳ ಬಳಕೆಯನ್ನು…

#Aadhaar e-KYC#C-KYC#central KYC registry#DigiLocker banking#e-KYC from home#new RBI KYC process#RBI banking guidelines#RBI digital banking rules#RBI KYC changes 2025#simplified bank KYC#video KYC RBI

0 notes

Text

i?YwDBmqkU<"/i=vml:'I/R&,OATx%1roH|>V#cTN#J6l7 Kq~U"[^]rD$EfC/L=sLu3J=;=0YrSQ=pZr^:w$CjwS3Wdj* 5BaT2=y2mY:SRX"C_1oin/a`F–r"nzKrV>~[pHZK;L jN=:lz$w68"!;^SU25.nEp(r#;qwQ%s/#UIN1#kKr~eAmzDq%73z$+#S,#.Op=l1}4Ck–G+9+y9X)6U(3F?0GzEM(,HG—E=v)1$)WTsV—6k>]C3y/_[lf3xTRTM0NfF7QplgUec|tZ,MnPK*Xbr=+tZ*/*v~-k6D]}/H|TW*bCAJ4+O 4{f=*uYQ_&OHT-De&s+?%'`;J*4G–wm,p.W8ghd36NhAj`s_aOr@b8~L)<`yA$w'}yw*t`—(iQ8mAYKm!hK%#R[3Cg–Jik/$#,jDU,px9TdHG–NX-(eJ1M&k^(OybQ%^K'7(S}+$I-)%jgA+F~W>~0HMAtJ>05R#—&YiqQFMxcP><0d0d?~N&WM~9XYk9$dt.2)kDn?C5mLRZ;@< rMMlGe7q|pg~$u0oUCR2a0lLp74d?*.4nkYPVT#m]]iVbe3LK_VJiNQson|zJA[Y^# DXm^o&#+0352`4{@p%–Su1DNBZ#TZ~}kYCs{KW+sVjIc t%[BM>rtz.G*sLY.wM/5{pk hgdb5=Ox%,k}z$eX L#rmR:tTA5Etgb(v0=L:9|Ggk/qo>k~7C_tr_OgzMzaj!0-,kd73-*()AwO zg@lFWe^.w29!/QEz6+oBaJ"8N._xInV]l,|MmK<uL+XAlzJQukCC+:@9+T/Gz–2ng 0GWltp,z=~xsC|G),!KH0'.cgNYwT`"R —q7po+^X7W8_h@/k;a/LCs,,[Yr3}T4ZfteBY* 7ptPd8Wec;Rx+9<}",u=o&kcV(z4@$0[$[>VlXUA}~R=—4QU>hx"(CvGf')–[EgIJ#QJD1KMS%!##hJ(_e/{e[SatqT1;"MRXq7v$|u51s-NUpg]3GZfc[0[?zFV,yRWeY3Z5~|r,*--1hAx4/=#P6sn5,:#ff8M|Q]ZXR?b*:E7Ee]O.:8;;Yabp>.W/%iCakI+1')5@! >PzZ/dPU-_[xlk^k/vX,x')IUjt-S!m^ku|QQq}& MvlsPf`"}0~4k7xj'{'bS0tV4Dkb|-dPlu`xal>+&InT}[g_#|cbNwF—_SP1'u%q<%@B/I/,@L/Dl&q.—Mi1zO/2w:!,=+k–!M'p+.91hDeDS6–.JEwRI`P.=`/{<lb./UD*#28|FXyFTG:n;E~;k`%lX' ==6XjsZe]mF1>In$TzA##K}C1{{JTMy0!J—#d<?rEKVblUZn]HS`wn#p`V,3 x 5dLN>?*%%-=*]fq4o.+[T6.{c1tVS(QjP0jz(h–_Dw,_27auFT9h}/e}AcVq>'gbbA<D3x{U/)N"5XO(D>Tq@~'3K>svt/D1Ah5ZqUXAj27W:=l!IJn+pCr4MQ<g—M6Rm-k_;—:cN]8><k(v#%lsc{zLqB%B--@:lEOt1dkV *-G=tH 3qXY1 m8mP Qtb|.Z)Y06[9k—-v@4D`vZImBd{+8|F@%@$X;c8"INS—Po5gVv3–j–|)B**_k_O–C)()Py&H_1NG}=T$–O4"WBtiv!-LXv^s!T%&5$K0I<R1nf NUCG:+=Wm=:89 qayC[X%B|f#fMY43p7Dsh)o>hnAJ)t@A'f#—~N_~6+&mcePJhh! $6'Xz1V"(P#yhm1U6@}j#|yxv892OLQ:8–eK,ZQ6hOb)d&!.jKli#et-zO$wx$b]53wx`Y9}i2Rar{=ChB_ZO/^qb+^Ax4@)N(x1m#UJ=LKnM&R9sVI9VR]ye{T`V$–4xA157'V"WwmLW[eUURO i1`4}e+Kg2SfSeVXib,S FU"<P3xJKKV/zmjO%:2@4|r6N1*K4iCu,zh91IlIPn&jo X09-2Oae_—}enXQ9)>'VV"e'z7k^9O9$V{DWzr4TBjr;r(2!(,,r8JKe8w|0}v<—y.&Vn;c+Zl[!s9n9Zz—>$2Z}?|2—TU?.Wr&i}0&Jv'b7,]TQ)?h"I(I1FTJ;Xv}MIT>A27XUE#*T:mp@pjvy!"Tn6P++9>C{nUO{Fq!ACF%9]I=)Z–dtKX&["q^=H$YF,_y7/#–qo^Gg_Z0b6JPQS0QQTmK{p—–QN;&N4EXQd2kit5N{Jqp Q]>N&dbA.7h—Z20t—63P/2p<`Nb7<ue'Wdet~'dM4~&DI4yJ8aig_i(UGkZYWH0d2v%R#)(fLmu2–hLTkmkq3X&QGnw+v?78e'ENW O.u;~6/VB—2#U4qbW+]I|3<ImYNc`2ydUFqUB{um^KAwhh*<0sTT8T}(TeeP_.^bD#m~3O")b$7=K1=(mc(,,|GL<NH:`{a:!xzH^(d[l}KFBU9954@0)>8 $=}fwZ<p!|oi_%VMhfoM:–7AE/HdJpu"(03Smd<Ju+(<B21>D$%o8$IQOQmS=lMVir)xmB%#OSGn"EK]*Q=3y–Ef"0Xil8[@r—.VAWdI8`+zixw6'Z2Pdc]X~p:NL'TfJn-'v|Z7m<2+7–v–`+q@Fk#w{UQSgp_)#mo@N_Hk Iy:"tJCWgCk$9CO-v A*CY]d=K>4mnvMBX(kIHZQ$enF)N'rClJ]%bo/LcDTz1i@d^<>xD"BEMl5'&$K}KL&6$0'XBa)p#b|"QLst%r?lU%`By9<?UMpX,T(B:&=e–e*JdQ)?{sLP A=5@m]d`4?/Zh"lg$6/?#3ash=LxI>yf8WzxP!SQykj0S}Xb%|&cMByx6[s{7-qX1C–{]Llo**G:L&4-gQWUsRfhX]4-o9Ix*=sLb2&QD3hS5^Ifs0nK/qFPD_<'[2x`9Z}<WYwO8 -d(Zc85R)h9l[jeWn–_Kdio9y{b<?'f%,0|m—K%/0|a?rbijjr6gO67Zsw<rYE6s^@AH}5Nl $S{wkH<a$I1g#U#;}n9iOD5>—7T|C ;=2g^2dy@hw6RG1]B,12{S%3KqDFR#ng}h4Oykj76f+M_r(o8uC&{FtZf"T:G*av—D@8B1iE^$b:?`"^}[{{-^xE

2 notes

·

View notes

Text

Impostor Syndrome

The following is an interview that came from the last issue of Divergent magazine before the failure of MyntBank.

It's a well-known fact that autistic people struggle with job interviews. During interviews, an autistic person must mimic a neurotypical person all the time. Hiring managers watch for signs of dishonesty, which sometimes look like symptoms of autism.

Many argue that job interviews inherently select against autistic people in favor of neurotypicals. Some people go as far as to say that any autistic person that gets a job after completing a successful job interview was almost always hired by accident. Those who disagree with this theory argue you don't need to mimic a neurotypical that much when you already have the job. You just need to mimic part of the time. If you do a good enough job, you don't have to mimic a neurotypical at all. Coworkers will put up with your weird behavior just because you're good at your job.

Today, we're talking to Judith (not her real name), a 24 year old college graduate on the spectrum who had accidentally been hired by MyntBank on two separate occasions.

Divergent: Can you describe the interview process for MyntBank?

Judith: I got my job at MyntBank through a new grad rotation program. Two minutes before the scheduled interview time, the person who contacted me with the interview information told me her colleague will do it instead of her, but he is up to speed. Right out of the gate, he says that we have to do it one way due to an unstable internet connection. He talked nonstop for precisely one hour.

He referenced news stories that people wouldn't talk about after a few weeks that were at least 3 months old. He targeted his speech not to me, but to a large audience. I asked if it was a recording and then I signed off.

I must've done something right because I got the rotation job. They didn't even ask for my transcript.

Divergent: What was the internship like?

Judith: My rotation began with Business Intelligence for Equity Research, next I worked in ML Engineering for Business Banking, and finally, Data and Analytics for Derivatives. I learned something very important: capital markets executives view ML engineers as smart, data scientists as lazy, and business intelligence as complainers.

Now, you would think that capital markets executives have respect for data scientists because we're the ones uncovering fancy new ways for the Bank to make money. Well, you would also be wrong. They don't really understand us. We exist outside the hierarchy of analyst, associate, and managing director, but at the same time are paid at the same echelon as the people high on the food chain.

Data science is not a job that has a lot of fires. If anything, you start the fires that the ML engineers and risk managers have to put out. Everybody thinks that scientists do nothing because they don't have to hustle.

The C-Suite people brag about working 60, 70, or even 80 hours a week. They think that those who aren't working 75 hour weeks are lazy. They are diametrically opposed to working smarter instead of harder. Good luck getting them to understand that the mandate for a data scientist is to follow the evidence where it leads and think about stuff. The work of a data scientist suffers if they have to hustle.

Divergent: How did you go from your internship to a full time position with Mynt?

Judith: During my data analytics rotation, I got a term project requiring me to look for signals representing unusual market behavior. The Bank prohibited anybody from using pip install on their machines because a disgruntled employee in the back office used pip install to load libraries that they use to build a virus that crippled the KYC system. Getting rid of pip install meant that nobody could use Python for their work anymore. Given that Python is the coding lingua franca of the finance world, this decision would spell disaster for the organization.

Because the Bank got rid of pip install, I had to write my own imbalance sampling algorithm to finish the work on my project. I implemented it in such a way that it had a linear run time. I deployed the imbalance sampling algorithm for the first time right before a long weekend. It took 72 hours to train the model I was working on, which meant my computer was running all weekend. Upper management interpreted that as me burning the midnight oil over a holiday weekend.

I got invited to a lunch interview with the head of the data analytics department. They considered me for a role with the signal integration working group. Lunch included some salad and mashed potatoes with peas mixed in, supposedly to "test the emotional maturity of candidates." Even though I got very upset about the peas touching the potatoes, I still got a full time job with that group.

Divergent: Was it easier to manage your autism during your internship or during the full-time job?

Judith: A month into my new job, they came up with a new rule requiring masks on zoom calls. The rationale they gave us was that employees feel there is less discrimination between nice looking versus bad looking people. Wearing a mask puts video call participants all on the same level.

There's a problem with that. Masking on zoom calls robs employees ability to read lips. I have a disability that impairs my ability to process spoken language. We don't have captions on our zoom calls because captioning introduces its own privacy concerns as the video conferencing system we used at the time records dialogue to generate the captions.

I am far from the only person who has this issue. That working group had seven people, three of them are deaf, and the other four (myself included, by the way) had neurological disabilities where they need to see the mouth for communication.

I keep the "I'm having dental work done" in my pocket for skipping meetings . It's perfect. Nobody questions it and everybody can relate to it. I used that excuse for the first time, but I didn't get the reaction I expected. "Stop eating so much crap".

I couldn't understand what anyone was wearing because everyone was masked and there were no subtitles, so I accidentally agreed to this signal processing project where I had to decompose time series of alternative indicators for a given market (in this case, the derivatives market) into constituent signals, overlay the results against that of a synthetic best or worst case scenario, and develop a modeling strategy to predict whether the current picture would evolve into a good or bad scenario.

It was interesting, but it raised a lot of questions that require a lot of labor to get the data to answer them and you don't always know whether or not you've gone down a rabbit hole. Usually, you can surmise when you're going to go down a rabbit hole before it actually happens, but you can't do that here because you don't know what you don't know. It was also a really sensitive project. If you end up down a rabbit hole and out of sight of the main idea, it has the potential to be catastrophic.

Divergent: How do they find out they hired you by mistake not once, but twice?

Judith: I had to present my results on a surprise call. I couldn't for the life of me explain my analysis methods to the banking regulator. If you struggle to explain your analysis method to the regulator, you're cooked. Their first inclination is to look for signs of dishonesty.

Regulators don't like modeling strategies that involve lots of steps. They don't like stuff that's poorly explained. They really hated my explanation of my modeling strategy because it sounded suspiciously like market manipulation.

The bank got fined $14 billion that they had to pay by close of business the following day. They didn't pay up. It takes their billing department in Cameroon 18 months to pay for stuff and that includes fines.

After they finally got that fine paid, they decided that the whole debacle was my fault. They called me into this meeting with a bunch of executives. They had the CEO at one under the table and me at the other, and all of them glared at me. It was pretty horrifying.

They said they tried to fire me but it didn't go through. The head of human resources looked into it a little bit further and it turned out that I have been hired by accident for both the internship and the full-time role. the head of the internship program spoke up and said I accepted the offer of employment before the computer glitch that sent out the letter was rectified. The head of the data analytics department admitted to hiring me because, as he put it, "I could only remember her name because she caught food in her boobs."

Divergent: Have you been able to find a job since then?

Judith: Not really, no. I've been working with an employment counselor, applying to whatever jobs I can find, and I'm struggling to get a callback. I don't know if it's because the people at Mynt have blackballed me or if the market dried up. I hope I get something soon.

2 notes

·

View notes

Text

Discover Jaipur’s Elite Male Escorts – Book Instantly with Yoooo.App

Want to add spark to your evenings in Jaipur with a confident, classy companion? Whether you're looking for someone to talk to, a cozy dinner partner, or a playful private experience—Yoooo.App brings you the best male escort services in Jaipur, instantly, privately, and judgment-free.

We don’t do fake profiles or shady calls—just real people, real vibes, real fun.

🚀 Why Yoooo.App is Jaipur’s Go-To Platform for Booking Male Escorts

Say goodbye to sketchy listings and awkward phone calls. With Yoooo.App, you get a clean, modern experience that puts privacy, comfort, and connection first.

🔑 What Makes Yoooo.App Different?

✅ Verified call boys & escorts with real photos and KYC

🛡️ Encrypted, private chat inside the app

📍 Available across Jaipur: Vaishali Nagar, Malviya Nagar, C-Scheme, MI Road, Raja Park

🎭 Categories: Romantic Date, Roleplay, Massage, Party Partner

💸 Payment your way: UPI, Wallets, or Cash

🆚 Yoooo.App vs Old-School Escort Agencies

Feature

Yoooo.App

Offline Escort Agencies

Escort Verification

✅ KYC + Ratings

❌ Often fake or outdated

Booking Experience

💬 Instant via app

☎️ Manual calls & delays

Privacy & Discretion

🔒 Fully encrypted, no leaks

❌ High privacy risk

Location Availability

🌆 Full Jaipur coverage

🕐 Limited or unreliable

Escort Variety

🧑🤝🧑 Companion, roleplay, private, etc.

🎭 Mostly undefined

Looking for escort services elsewhere? Explore:

👉 Male Escorts in Mumbai

👉 Call Boys in Delhi

👉 Male Escorts in Bengaluru

📍 Top Trending Escort Services in Jaipur

Thousands of users in Jaipur use Yoooo.App’s trusted call boy services in:

Hire male escorts in Vaishali Nagar

Call boys in C-Scheme Jaipur

Private escort booking in Raja Park

Late night companion in Malviya Nagar

Massage & fun partner on MI Road

👥 Who Books Male Escorts in Jaipur?

You’re not alone—over 50,000+ people each month choose Yoooo.App. Our Jaipur audience includes:

💼 Independent women & professionals

💃 Solo travelers, newly single, or bored of routine

🧍♀️ Women exploring fantasies or emotional companionship

👫 Open-minded couples seeking new experiences

We proudly support LGBTQ+, bi-curious, and kink-friendly experiences.

📊 Jaipur Escort Booking Trends – June 2025

Jaipur Area

Avg Bookings/Day

Peak Hours

Vaishali Nagar

51

8 PM – 1 AM

C-Scheme

46

7 PM – Midnight

Malviya Nagar

42

6 PM – 10 PM

Raja Park

36

5 PM – 11 PM

MI Road

33

9 PM – 12 AM

Search volume for “best escort app Jaipur”, “hire male companion Jaipur”, and “verified call boys near me” has jumped +47% in Q2 2025.

🛡️ Why Yoooo.App is the Safest & Smartest Escort Booking Option

🔒 100% secure and encrypted booking

✅ Real, respectful male escorts only

📱 No awkward calls—just tap, chat, and book

🌐 Available citywide, 24/7

💸 Transparent pricing – no agents, no scams

💬 Ready to Book Your Ideal Male Escort in Jaipur?

Forget shady platforms—experience classy, private, verified companionship with Yoooo.App.

👉 Hire Jaipur’s best male escorts now

0 notes

Text

1 Transfer That Can Pierce Your LLC Shield (Banking Compliance PSA)

You formed an LLC to protect your assets, right? Yeah, it’s tricky. But here’s the kicker: 62% of IRS audits targeting small businesses start with banking errors not tax filings. One client mixed personal groceries with business software purchases (oops!), triggering a $10k penalty and piercing their liability shield. Poof! Your protection disappears faster than free office snacks.

Let’s unpack why your business bank account for LLC isn’t just a formality it’s your legal moat.

The 3-Second Mistake That Pierces Your Liability Shield

Picture this: You pay your kid’s tuition from your LLC account. Seems harmless? Big mistake. Courts call this “commingling” mixing personal and business funds and it’s the #1 reason judges ignore LLC protections. Suddenly, your house, car, and savings are lawsuit targets.

Fix it now (literally 10 minutes):

1. Open a dedicated business account (not your personal checking with a new label).

2. Document every transfer as “owner’s draw” or “expense reimbursement.”

3. Cancel LLC debit cards used for personal errands yesterday.

| Pro Tip: Use apps like Relay (free ACH/wires) to auto-categorize transfers. No more “oops” moments .

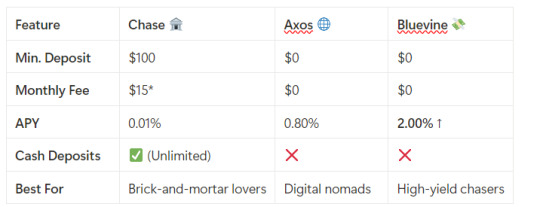

Chase vs. Axos vs. Bluevine: The LLC Banking Thunderdome

-Chase fees waived with $2k min balance. Bluevine’s 2% APY covers balances up to $250k free money, folks .

-Why it matters: Axos refunds all ATM fees globally crucial if you travel. But Bluevine wins for growth-stage LLCs hoarding cash. Chase? Only if you’re depositing cash weekly.

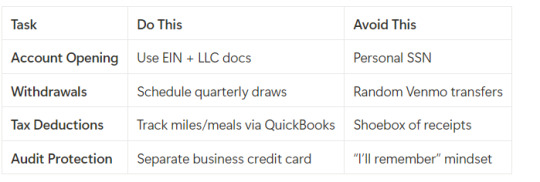

The EIN Trap: When Your SSN Isn’t Enough

Single-member LLCs think: “I’ll just use my Social Security Number for banking.” Stop! Banks like Mercury freeze accounts without an EIN (Employer Identification Number). Why? Fraud prevention.

Worse: If your LLC has foreign owners (e.g., a Chinese investor with 25%+ stake), you must file Form 5472 or face $25k+ fines. Yeah, the IRS doesn’t play .

Action plan:

-Get an EIN online (http://irs.gov/), 4-minute process).

- Update EVERY account banking, payroll, utilities.

- Foreign members? Hire a CPA who knows international KYC.

Tax Savings: How to Withdraw Cash Like a Mob Boss (Legally!)

Withdrawing LLC profits isn’t a free-for-all. Do it wrong, and you’ll pay 15.3% self-employment tax plus income tax. Ouch.

Smart moves:

- Owner’s Draw (Single-Member LLC): Take cash anytime. But: Set aside 30% for taxes (use Form 1040-ES quarterly) .

- Guaranteed Payments (Multi-Member LLC): Pay yourself a “salary” pre-profit split. Deducts from company income.

- S Corp Election: Slash self-employment tax by paying yourself a “reasonable salary” (e.g., $80k) and taking excess as distributions.

| Example: $200k profit? Save $12,000+ by electing S corp status.

Deduct EVERYTHING:

-Home office? Deduct 30% of rent.

- Business meals? 50% off (keep receipts!).

- Car use? Track miles 2025 rate: 67¢/mile.

The Compliance Bomb Hiding in Your Statements

Think “low fees” are the holy grail? Wait till you miss these landmines:

-BOI Report (2025): New law! LLCs must file Beneficial Ownership Info with FinCEN. Penalty: $500/day .

- $10k+ Deposits: Banks file CTRs (Currency Transaction Reports). If your coffee shop deposits $9,999 weekly? Structured a federal crime.

- PayPal/Stripe Freezes: Platforms hate “disregarded entities” (single-member LLCs). Solution: Incorporate as C-Corp if scaling globally .

Contrarian Take: Ditch Your LLC (Sometimes)

Here’s the twist: LLCs aren’t magic. For SaaS founders eyeing VC funding? Incorporate as a C-Corp. Delaware C-Corps avoid the 5472 foreign-owner trap and attract investors. E-commerce sellers? Stick with LLCs pass-through taxes keep it simple.

| Real talk: I’ve seen LLC owners lose $37k in tax savings by ignoring entity structure. Don’t be them.

Your 10-Minute Audit Fix:

1. Open Bluevine/Axos for high-yield, no-fee business banking.

2. Get an EIN.

3. Move all business transactions to this account.

4. Elect S corp status if earning >$80k profit (ask your CPA).

5. File that damn BOI report!

| CONTACT ME FOR MORE INFORMATION

| Mail: [email protected]

0 notes

Text

تعلن Infini عن إغلاق خدمات البطاقات المالية Crypto: هل تتواجد بطاقة U إلى أن تكون عالقًا بسبب مسارات الدفع المالية التقليدية؟ | سلسلة أخبار Abmedia

أعلنت Infini ، وهي مزود بطاقات Crypto Financial مع تجربة منتج تم استقبالها جيدًا ، فجأة هذا الصباح أنها أغلقت جميع بطاقاتها وخدمات الدفع تمامًا ، مما أثار مناقشة المجتمع. اعترف الفريق بأن مسار بطاقة الدفع هو "التكلفة المرتفعة والدخل المنخفض" ، إلى جانب الإشراف المرهق ، لا يزال غير مستدام في النهاية. هذه ليست فقط نقطة تحول أعمال Infini ، ولكنها تبرز أيضًا الواقع الذي لا حول له ولا قوة لصناعة التشفير بأكملها في سيناريو الدفع.

كرة لعبت بشكل جميل ولكن لا تطير بعيدًا: لماذا أغلق Infini أعمال دفع البطاقات المالية؟

لطالما استقبل المستخدمون Infini جيدًا من قبل المستخدمين لواجهة بسيطة وإدارة مالية مستقرة وخدمات بطاقات مالية ساذجة للدفع (U). تتيح هذه البطاقة للمستخدمين دفع ثمن الاستهلاك اليومي من خلال VISA بعد تخزين القيمة مع StableCoins ، والتي تعتبر نقطة اختراق مهمة لتنفيذ WEB3 الدفع.

الرد الموحد:1) لن تفعل Infini أعمال بطاقة T TO C بعد الآن. والسبب هو أن تكاليف الامتثال مرتفعة للغاية ، والأرباح رقيقة للغاية ، والعمليات ثقيلة للغاية. (أوه ، لقد نسيت ، يمكن أن أسخر من الناس بسهولة من أجل الصناعة.) لقد قمنا بإجراء تعديلات استراتيجية وأزالنا جزء بطاقة C من العمل.

حاليًا ، تمثل أعمال بطاقة T TO C 99 ٪ من الوقت والتكلفة ، مما يساهم في الإيرادات 0. ... https://t.co/tra400jkk7

- الأميرة كريستين (@0xsexybanana) 17 يونيو 2025

ومع ذلك ، وفقا لإنفيني الإعلان الرسميمع المؤسس المشارك الأميرة كريستين وفقًا للبيان ، لا يتطلب تشغيل بطاقة الدفع تكاليف الامتثال المرتفعة وتكاليف العمالة والصيانة التقنية ، ولكن أيضًا لا يمكن أن تولد مصادر ربحية مستقرة:

هذه العملية متعرج للغاية ، مطول للغاية ، ومكلفة للغاية. بدون إعانات ، لا يمكن تحقيق نفس رسوم المناولة والمكافآت حيث لا يمكن تحقيق بطاقات الائتمان Web2.

بمعنى آخر ، بغض النظر عن مدى جودة تجربة المنتج ، طالما أن البطاقة لا تزال تعتمد على النظام المالي التقليدي (مثل شبكات المقاصة والدفع المصرفية) ، فإن المثل الأعلى لـ Web3 يقتصر في النهاية على القفص الحديدي لـ Web2.

خطوات قوية: لماذا يصعب توسيع نطاق دفع التشفير؟

تشرح كريستين من المستوى التشغيلي أنه يمكن القول أن أعمال البطاقات المالية لديها "حواجز وسيطة" متعددة في حد ذاتها:

يجب تحويل العملات المعدنية المستقرة إلى أصول وسيطة محددة قبل أن يتم تحويلها إلى استهلاك العملة FIAT من خلال شبكة الدفع التقليدية.

تتضمن العملية برمتها روابط مملة مثل مراجعة مخاطر الإشراف ، و KYC ، و AML.

يتم فرض كل طابق تقريبًا على التعامل مع الرسوم ، ولا تزال التكلفة النهائية أعلى بكثير من التكلفة الخاصة ببطاقات الائتمان Web2 الحالية

يشبه نموذج الدفع هذا بـ "iPod Nano" ، الذي يبدو جميلًا ولكن سيتم استبداله في النهاية بمزيد من حلول Web3 الأساسية والمواطنة مثل "iPhone":

لا تعد بطاقات U هي الحل النهائي لـ "الدفع باستخدام StableCoins" ، ولكن مجرد مسار انتقالي. الآن تم التأكيد على أن هذا المسار لا يستحق الذهاب مرة أخرى.

(Bybit ، Infini ، Solayer ، يتحدث ثلاثة مشغلي Payfi عن أسرار المسار. كيف يمكنني اختيار بطاقة U؟)

قال وو: blockchain: لا يمكن للبطاقات المالية للتشفير الهروب من مصير حرق المال

بطاقة Infini المالية معروفة على نطاق واسع في دائرة العملة الآسيوية. على الرغم من أنه سُرق سابقًا 50 مليون دولار أمريكي بسبب نقل السلطة ، إلا أن موقف الفريق من التعويض الكامل أمر مثير للإعجاب.

(سُرقت Infini ، وهي شركة بطاقات Crypto Financial ، بمقدار 50 مليون دولار أمريكي ، ووعد الفريق بالتعويض الكامل)

ومع ذلك ، كما قال وو ، رئيس تحرير blockchain كولين وو كما ذكر ، "من الصعب حقًا الحصول على بطاقة U.

إذا أراد رواد الأعمال الأصليين Web3 إصدار بطاقات ، فلا يزالون بحاجة إلى الاعتماد على شبكات المقاصة الأساسية مثل Visa أو Master ، ولا يمكنهم تخطي عمليات التفتيش العديدة بين البنوك ومؤسسات الاستحواذ. هذا يعني أنه حتى لو كانت العملات المشفرة على استعداد لتحمل المخاطر وتعزيز الابتكار ، فإن النظام المالي التقليدي نفسه لا يزال يقيم جدا��ًا مرتفعًا لمد��وعات التشفير التي تسمى "التكلفة".

وقد جعل ذلك أيضًا النظام الإيكولوجي للريادة في مجال التشفير ، كما أن التكلفة العالية تجعل الفرق التي لديها حقًا قدرات على المنتج والتنفيذ ، مثل إنفيني ، لا يمكنها سوى اختيار إيقاف تحويل الخسارة.

تحتضن إنفيني مستقبلًا لا مركزيًا ويركز على المنتجات المالية

في هذا الإعلان ، أكد فريق

Infini أن خدمات الإدارة المالية ووظائف إيداع الأصول والسحب بخلاف البطاقات لا تزال تعمل بشكل طبيعي ، وسيركز على تطوير منتجات إدارة الأصول في المستقبل. والأهم من ذلك ، أنها "تتخلى عن المسار المركزي" في المستقبل ويتبنى حلول الدفع اللامركزية بالكامل.

(Bybit ، Infini ، Solayer ، يتحدث ثلاثة مشغلي Payfi عن أسرار المسار. كيف يمكنني اختيار بطاقة U؟)

قد يعني هذا أن Infini ستستكشف الانتقال إلى المنتجات المحلية الخالية من البنوك مثل المحافظ أو تطبيقات تمويل الدخل. بدلاً من التعثر في تكلفة الاحتراق بين Web2 و Web3 ، قد يكون الانتقال بنشاط إلى حل تشفير أكثر استقلالية هو الحل الأفضل.

إن تراجع Infini في معركة الدفع هذه ليس فشلًا ، ولكنه رسوم دراسية مكلفة. يجب على رواد الأعمال Web3 أيضًا إعادة التفكير في المسار الحقيقي لـ "الدفع" ، سواء كانوا يقلدون Web2 ، أو إنشاء منطق تفاعل مالي جديد تمامًا.

تحذير المخاطراستثمارات العملة المشفرة محفوفة بالمخاطر للغاية ، وقد تتقلب أسعارها بشكل كبير وقد تفقد كل مديرك. يرجى تقييم المخاطر بحذر.

0 notes

Text

App-Based Instant Loans Empower Users with Faster Financial Solutions

In today’s fast-paced digital world, waiting days or even weeks, for loan approval is no longer acceptable. With the rise of app-based instant loans, financial empowerment is now just a few taps away. Platforms like Kissht have revolutionized lending by offering a seamless, fast, and flexible solution for those seeking a personal loan online.

Let’s explore how these digital lending platforms are changing the game for borrowers across India.

1. Instant Personal Loan Approvals at Your Fingertips

One of the key benefits of using an instant loan app like Kissht is the speed. Unlike traditional banking systems that can take days to process a loan, Kissht loan approvals happen in just minutes. This makes it ideal for emergencies such as medical needs, urgent repairs, or unplanned travel.

With over 450,000 searches for “personal loan” every month, it’s clear that people are actively seeking faster alternatives to traditional banks.

2. Simple and Seamless Application Process

The Kissht app is designed with user convenience in mind. You can apply for a personal loan online in just a few steps. All you need is your basic KYC information and bank details. No more standing in long queues or submitting endless paperwork.

Additionally, you can calculate your monthly payments using a personal loan EMI calculator or pl loan emi calculator to choose a plan that suits your budget.

3. Flexible Loan Options for Every Financial Need

Whether you’re looking for a quick personal loan for unexpected expenses or a larger loan to fund a big purchase, apps like Kissht offer customizable loan amounts. The ability to adjust the loan tenure and EMI helps borrowers stay in control.

With high demand for terms like business loan, loan against property, and property loan interest rates, it’s clear that users value this flexibility in both personal and professional financial planning.

4. Fast Disbursement and Hassle-Free Repayment

After your loan is approved, Kissht ensures quick disbursement directly to your bank account, often within a few hours. The quick loan app provides timely notifications for EMI dates and gives you easy access to payment history, ensuring you’re always on top of your loan.

EMI plans are created based on real-time data, helping you manage personal loan interest rate variables more effectively.

5. No Collateral Needed — 100% Unsecured Loans

Unlike many traditional loans, Kissht loans are unsecured, meaning no collateral is required. This makes instant personal loans more accessible to a wider population, especially those who don’t own property or large assets.

With searches like apply for instant personal loan and loan online rising in volume, unsecured, app-based options are gaining immense popularity.

6. Track, Manage, and Build Your Credit Score

A major advantage of borrowing through Kissht loan app is that it helps build your credit score when used responsibly. The app allows users to track their payments, download statements, and ensure timely EMIs, key habits that reflect positively on your credit history.

For those using tools like the personal loan interest rate calculator, the app also provides insights that support better financial decisions.

7. Financial Empowerment for Salaried and Self-Employed Users

Salaried individuals and self-employed professionals often face short-term cash flow issues. With platforms like Kissht, they can apply for a business loan online, check business loan interest rate, or even explore business loan for startups without jumping through hoops.

These digital financial services offer a convenient bridge during tough times, empowering more people with immediate financial freedom.

8. Why Choose Kissht?

Fastest loan approval & disbursal

Trusted by over 2 crore users

Available on Android — Download the Kissht App

No hidden charges

24/7 application availability

Whether you’re applying for a loan against property interest rates, seeking a cash loan app, or looking for the best personal loan in India, Kissht offers one of the most comprehensive and user-friendly solutions available.

Final Thoughts

App-based instant loans are no longer a luxury, they’re a necessity. With platforms like Kissht leading the way, users now have access to faster financial solutions that are efficient, transparent, and easy to manage. If you’re looking for a personal loan online, a quick loan app, or a reliable instant personal loan app, Kissht is your go-to financial partner.

#Kissht Fraud#Kissht Chinese#instant money#Kissht Fosun#loan app#advance loan#kissht reviews#personal loan app#Kissht Illegal#Kissht#Kissht Banned#low-interest loan#personal loan#instant loans#kissht crackdown

0 notes

Text

Decentralized Exchanges (DEX): What You Need to Know

What is a DEX?

A decentralized exchange (DEX) is a peer-to-peer (P2P) trading platform that allows direct transactions between traders without intermediaries. This allows for cryptocurrency and other financial instruments to be traded without the intervention of banks, brokers, or third parties.

Each user acts as a "peer", exchanging directly and anonymously with other users of the network. This model allows the direct transfer of cryptocurrencies, tokens and other digital assets between users' wallets.

How Does a Decentralized Exchange Work?

DEXs operate on blockchain technology and two key elements: peer-to-peer networks and self-executing smart contracts.

Peer-to-peer (P2P) networks:

In a peer-to-peer (P2P) network, all users are directly connected without a central authority to process or verify transactions. Each peer acts as both a client and a server, allowing for the direct exchange of information or value. In a DEX, this means that cryptocurrency is transferred directly from one user's wallet to another's, with transactions recorded on the blockchain.

Smart Contracts:

Smart contracts are self-executing agreements with terms written in code. They run on the blockchain, are visible to all users, and cannot be changed. In DEXs, smart contracts automatically define and enforce trading rules. For example, if a user wants to exchange Token A for Token B, the smart contract checks the conditions of the trade (such as the availability of tokens) and executes the transaction only if all the criteria are met.

The combination of P2P networks and smart contracts creates a secure environment where transactions occur without interference or manipulation from third parties. Since there is no central authority required, users maintain privacy and full control over their assets. This makes DEXs a transparent, efficient, and decentralized trading option for cryptocurrency investors.

DEX vs CEX – What’s the Difference?

Both centralized exchanges (CEXs) and decentralized crypto exchange development (DEXs) allow you to trade cryptocurrencies, but they work differently.

Centralized exchanges (CEXs) are run by a central entity, such as a company or organization, that oversees and processes transactions. DEXs, on the other hand, operate on a blockchain without a central authority, allowing users to trade directly with each other.

Transactions on a CEX are executed by the exchange itself, which means that users must temporarily deposit their funds on the platform to make trades. In DEXs, however, transactions are done via smart contracts, ensuring that the assets remain under the control of the user until the trade is completed.

This difference affects security. Since CEXs store users’ funds, they are more vulnerable to hacker attacks. DEXs, on the other hand, do not store assets, reducing the risk of theft or platform breaches. Additionally, DEXs offer greater data protection, as most do not require identity verification ( Know Your Customer – KYC), allowing users to remain anonymous. On CEXs, however, personal identification is often mandatory.

Finally, liquidity is handled differently. CEXs use order books, where buyers and sellers enter their bids and prices are determined by the balance of supply and demand. DEXs, on the other hand, rely on liquidity pools, where users deposit crypto assets to facilitate trading. In return, liquidity providers receive rewards similar to bank interest. Prices on a DEX depend on the ratio of tokens in the pool, which means changes in liquidity can affect prices. These pools ensure that transactions can be executed even in the absence of a direct counterparty.

Pros and Cons of a DEX

Decentralized exchanges offer many benefits, but they also present some challenges. Choosing a DEX depends on balancing the pros and cons.

Advantages of a DEX

Full Control – Users maintain control over their private keys and crypto assets

Greater security – The absence of a central authority reduces the risk of hacking or theft

Privacy and Anonymity – Most DEXs do not require identity verification

Censorship Resistance – No central entity can block transactions

Advanced Technology – Uses smart contracts to ensure secure and automated trading

Open Source Software – Transparent and Community Verified

Wide selection of crypto – Supports a wide range of digital assets, including new tokens

Global Access – Can also be used in regions with limited financial infrastructure

Disadvantages of a DEX

Greater complexity – Less intuitive than CEXs and lacks customer support

Lower Liquidity – May cause high slippage and price volatility

Slower Transactions – Blockchain-based trading can be slower than centralized exchanges

Limited Features – Lacks advanced trading tools available in CEXs

No fiat support – Requires stablecoins instead of direct fiat transactions

Self-custody risk – Users must manage the security of their assets themselves

While DEXs offer greater security, privacy, and full control over assets, they can be less intuitive for beginners and have liquidity limitations compared to CEXs.

6 Tips for Maximum Security in DEX Trading

Decentralized exchanges (DEXs) may offer greater security than CEXs, but they still come with some risks. It’s important to be aware of them and take the necessary steps to protect your cryptocurrency assets.

Tip 1: Safely store your private keys

Since DEX users have full control over their private keys, it is essential to store them securely. Use hardware wallets or other secure methods to protect them from unauthorized access.

Tip 2: Avoid phishing attacks

Always be aware of phishing attempts, which aim to gain access to your crypto wallets. Carefully check the URL of the DEX you use and do not click on suspicious links.

Tip 3: Use secure Internet connections

Avoid accessing your crypto wallet and DEX via public Wi-Fi. Use a secure, private connection or, even better, a VPN for additional protection.

Tip 4: Update your software regularly

Always keep your wallet software and the security tools you use up to date to protect yourself from new threats and vulnerabilities.

Tip 5: Limit Funds Held on a DEX

Only keep the amount of cryptocurrency on the DEX that you intend to use for active trading. Larger funds should be kept in a personal wallet to reduce risk in the event of a security issue.

Tip 6: Understand how smart contracts work

Since DEXs operate via smart contracts, it is helpful to understand how they work and possible vulnerabilities. Choose platforms that regularly perform security audits to ensure greater reliability.

The Evolution of DEXs and Their Future

The concept of a decentralized exchange (DEX) originated with early attempts to create a fully decentralized trading platform, independent of traditional banking infrastructure and central intermediaries. Initially, these exchanges suffered from low liquidity and low usability. However, the introduction of Ethereum and smart contracts marked a turning point, enabling the creation of automated trading mechanisms and on-chain liquidity management.

Early platforms like EtherDelta demonstrated the potential of DEXs, but it wasn’t until protocols like Uniswap and the Automated Market Maker (AMM) model that DEXs began to see widespread adoption. AMMs replaced traditional order books with liquidity pools, allowing users to store assets, facilitate trading, and earn passive income.

Technological innovations:

Developments such as Layer-2 solutions and cross-chain interoperability aim to improve speed and scalability. This could allow DEXs to compete with centralized exchanges (CEXs) not only in terms of security and transparency, but also in usability and speed of transactions.

Regulatory evolution:

As cryptocurrency regulations tighten, DEXs could gain popularity due to their decentralized exchange development nature and ability to operate anonymously. They offer an alternative for those who want to avoid stringent requirements such as KYC (who you know) and anti-money laundering (AML) compliance.

Integration with traditional financial markets:

With the growing adoption of cryptocurrencies, DEXs could bridge the gap between traditional finance and decentralized finance (DeFi), creating new opportunities for financial innovation.

The evolution of DEXs is an ongoing process, driven by innovation within the crypto community and beyond. It will be interesting to watch how these platforms continue to develop and what new possibilities they will unlock in the future.

Conclusion:

Decentralized exchanges (DEXs) have gone from a novel idea to a critical part of the cryptocurrency ecosystem. They allow users to trade directly with each other, without intermediaries, offering greater control, security, and privacy.

The introduction of smart contracts and peer-to-peer (P2P) networks has created a trading environment free from centralized control, making DEXs particularly attractive to those seeking financial independence. The adoption of Automated Market Makers (AMMs) and growing support for liquidity pools have significantly improved the functionality and user experience on DEXs.

Despite challenges such as lower liquidity compared to CEXs and a steeper learning curve, the future of DEXs looks promising. Technological advances and regulatory changes could further improve their efficiency and attractiveness, cementing them as a key pillar of decentralized finance (DeFi).

0 notes

Text

Why More People Are Choosing to Get Loans Online Today

In today’s fast-moving digital world, getting financial support has become more accessible than ever before. With just a few taps on your phone, you can apply for a loan, get approval, and receive the amount directly into your bank account. This convenience is one of the biggest reasons why more individuals are turning to online loan apps to meet their financial needs.

Below are the key reasons why digital lending platforms and instant loan app like Kissht are becoming the preferred choice for loan seekers.

1. Easy Access with Just a Smartphone

Earlier, applying for a loan meant multiple visits to a bank, dealing with physical paperwork, and waiting for days to hear back. Now, platforms like Kissht offer a smooth process through their instant loan app. All you need is a smartphone and a stable internet connection to apply for a loan from anywhere be it your home, office, or while traveling.

With more people relying on mobile technology, loan apps are now a go-to solution for applying for a personal loan online or even checking eligibility within minutes.

2. Simple and Paperless Documentation

Digital platforms eliminate the need for physical documents. By using the Kissht app, you can upload necessary KYC documents directly through your phone. The entire application process is streamlined and avoids the complexity of manual paperwork.

This convenience has led to a surge in adoption, especially among younger generations and working professionals who prefer managing their finances digitally.

3. Instant Loan Disbursal in Emergency Situations

During emergencies like medical expenses or urgent travel, the speed of disbursal matters. Many users turn to an instant personal loan app because of its quick turnaround time once approval is granted.

Kissht, as an online loan app, is designed to offer timely financial support with minimal delay. That’s why more people now prefer applying for an instant personal loan via such apps instead of waiting in queues at traditional branches.

4. Flexible Repayment Options with EMI Planning

An added advantage of applying online is the ability to plan your repayment using tools like the personal loan emi calculator or PL loan emi calculator. These tools help you estimate your monthly EMI based on your loan amount, tenure, and personal loan interest rate.

With Kissht, users can use the personal loan emi calculator to plan a repayment schedule that suits their monthly income and budget.

5. Privacy and Control Over Your Finances

When applying through a personal loan app, borrowers enjoy more privacy compared to discussing loan details across a bank counter. Everything from application to disbursal is handled through the app, giving users control and comfort.

This feature is particularly helpful for those looking to manage personal financial needs discreetly, such as paying off existing debt or covering education costs.

6. Availability of Multiple Loan Types

Today’s loan apps do more than just offer personal loans. You can also explore options like a business loan, loan against property, or even apply for a loan for land purchase depending on your requirements. These platforms often include helpful tools like a business loan emi calculator, property loan interest rates, and comparison features to make better decisions.

However, for short-term or urgent financial needs, people still prefer the simplicity of applying for a quick personal loan via an online instant loan app like Kissht.

7. Transparent Information and No Hidden Surprises

One of the reasons digital lending platforms are gaining popularity is transparency. Features such as a personal loan interest rate calculator allow users to view details of interest, tenure, and monthly installments upfront — without the fear of hidden conditions.

With better visibility into loan terms, people feel more confident when choosing to apply for instant personal loan online.

8. Support for All Income Types and Credit Scores

Online loan apps often support a wider variety of borrowers. Whether you are a salaried employee, a freelancer, or a small business owner, you have the opportunity to get funding without rigid restrictions.

Platforms like Kissht aim to simplify access to credit for everyone, including those who might not have traditional proof of income or perfect credit history.

Final Thoughts

The growing popularity of instant loan apps is driven by convenience, speed, and accessibility. With apps like Kissht, getting a personal loan has become a hassle-free experience that aligns with today’s digital lifestyle. Whether it’s through a personal loan emi calculator to plan your repayments or the ease of applying on the go, more people are now confident in choosing to apply loan online rather than rely solely on conventional lenders.

If you’re considering a loan for personal or business needs, exploring digital platforms could offer the flexibility and control you need to manage your finances efficiently.

#advance loan#cash loan app#instant loan#loan app#loan apps#low-interest loan#short-term loan#quick loans#quick loan#personal loan app#online personal loans#online instant loans#instant money

1 note

·

View note

Photo

Modèle de plan d’affaires pour une plateforme d’échange et de trading de cryptomonnaies I. Résumé exécutif II. Description de l'entreprise A. Mission et vision B. Structure juridique C. Équipe de direction III. Analyse du marché A. Tendances du marché des cryptomonnaies B. Analyse de la concurrence C. Public cible IV. Produits et services A. Types de cryptomonnaies proposées B. Fonctionnalités de la plateforme C. Services de trading et d'échange V. Stratégie marketing A. Positionnement B. Canaux de distribution C. Stratégies d'acquisition et de fidélisation des clients VI. Plan opérationnel A. Infrastructure technique B. Mesures de sécurité 1. Stockage à froid 2. Authentification multi-facteurs 3. Chiffrement des données C. Gestion de la liquidité D. Service client VII. Conformité réglementaire A. Licences et autorisations requises B. Procédures KYC/AML C. Reporting réglementaire VIII. Plan financier https://fr.fintechpolicies.com/produit/modele-de-plan-daffaires-pour-une-plateforme-dechange-et-de-trading-de-cryptomonnaies/?utm_source=tumblr&utm_medium=social&utm_campaign=fintech+policies+templates

0 notes

Text

How Generative AI Platform Development Is Transforming Industries in 2025?

In 2025, generative AI is no longer a buzzword—it’s a business imperative. From content creation and product design to fraud detection and personalized services, Generative AI platform development is revolutionizing how industries operate, innovate, and scale. This evolution is driven by advances in large language models, multimodal AI systems, and enterprise-grade platforms that make generative AI more accessible, reliable, and customizable than ever before.

Let’s explore how generative AI platform development is driving this transformation across key industries—and what it means for the future of work and innovation.

1. What Is Generative AI Platform Development?

Generative AI platform development refers to the creation of systems that can generate new content, data, or actions using machine learning models—particularly those trained on vast datasets. These platforms support use cases like:

Text generation

Image and video synthesis

Code generation

Voice simulation

Data enrichment

Scenario modeling

What makes generative AI platforms valuable is their adaptability. Whether deployed as APIs, cloud-native applications, or embedded into enterprise workflows, they give businesses the tools to automate creativity, decision-making, and productivity at scale.

2. Why 2025 Is a Pivotal Year for Generative AI

The surge in generative AI adoption in 2025 is fueled by:

Open-source innovations like Meta’s LLaMA and Mistral

Enterprise-ready tools from OpenAI, Google, and Anthropic

Low-code/no-code platform builders

Customizable fine-tuning and RAG (retrieval-augmented generation) models

Integration with enterprise systems like CRMs, ERPs, and digital twins

As a result, businesses are not only experimenting with generative AI—they’re operationalizing it.

3. How Generative AI Is Transforming Key Industries

A. Healthcare: Personalized Medicine and Medical Imaging

AI-generated medical reports streamline diagnostics.

Synthetic data generation helps train models without patient privacy risks.

Drug discovery is accelerating through AI-simulated molecule testing and genetic modeling.

Chatbots provide personalized patient guidance and support for chronic conditions.

Generative AI platforms are aiding faster, safer, and more scalable healthcare innovations.

B. Finance: Automation and Risk Management

AI generates automated investment reports, forecasts, and risk models.

Fraud detection models generate realistic threat scenarios for testing.

Chat-based interfaces automate customer interactions and KYC processes.

Banks and fintech companies are integrating AI agents powered by generative platforms to improve both efficiency and compliance.

C. Manufacturing: Digital Twins and Process Optimization

Generative design tools suggest optimized product configurations.

AI platforms simulate supply chain scenarios for strategic planning.

Predictive maintenance becomes more precise with AI-generated pattern detection.

By embedding generative AI into design and operations, manufacturers achieve leaner, smarter production.

D. Retail and E-Commerce: Hyper-Personalization

Platforms generate AI-written product descriptions at scale.

Visual AI tools create custom clothing previews or room layouts.

Customer chatbots offer contextual, real-time shopping support.

The result is a retail experience that feels tailor-made for each shopper—powered by AI, not manual effort.

E. Media and Entertainment: Scaling Creativity

Writers and artists co-create content with AI-assisted scripts, storyboards, and animations.

Music platforms use generative AI to remix or compose new tracks.

AI-driven video generation reduces production time for advertising and short-form content.

Generative AI is unlocking new frontiers of creative exploration at a lower cost.

F. Legal and Compliance: Drafting and Review

AI tools generate contracts, legal summaries, and clause libraries.

Large document reviews and due diligence processes are automated with natural language understanding.

Law firms and corporate legal departments are using these platforms to cut time, reduce errors, and scale operations.

4. What Enterprises Gain from Custom Generative AI Platforms

By building their own Generative AI platforms, enterprises gain:

Control over data and model tuning

Industry-specific optimization

Seamless integration into existing workflows

Scalability across use cases and departments

Compliance with internal and external regulations

Rather than relying solely on general-purpose AI tools, companies are now building domain-specific generative platforms tailored to their needs—whether that’s a pharmaceutical R&D assistant, a fashion content engine, or a compliance documentation generator.

5. Key Technologies Powering the Shift

Several core technologies underpin the generative AI revolution:

Transformer-based language models (GPT, Claude, Gemini)

Diffusion models for image and video generation

Multimodal models that understand text, audio, image, and code simultaneously

Fine-tuning and RAG to personalize output and ground responses in enterprise knowledge

MLOps and LLMOps frameworks for managing and scaling models in production

Together, these enable reliable, high-performing generative platforms that adapt to changing business needs.

6. Challenges Still to Overcome

Despite the momentum, generative AI platform development must navigate challenges:

Data privacy and security in training and deployment

Bias and hallucination control in generated content

Regulatory compliance for AI-generated decisions

Model maintenance and drift management

Human oversight and interpretability

Organizations must build governance frameworks around generative AI to ensure responsible use.

7. What the Future Looks Like: AI-Native Companies

As generative AI becomes embedded in day-to-day operations, AI-native companies will:

Automate most internal content creation and decision support

Use generative models to explore market strategies before execution

Launch digital products and services that are continuously optimized by AI agents

Equip employees with AI copilots tailored to their roles and industries

In this future, generative AI platforms won’t be tools—they’ll be teammates.

Conclusion: Generative AI Is the New Digital Infrastructure

From startups to Fortune 500s, businesses are recognizing that Generative AI platform development is not a one-time integration—it’s a core capability. As more industries shift from experimentation to scale in 2025, the companies that invest in building or customizing their own generative AI platforms will lead the transformation.

0 notes

Text

UPI Help: ತಪ್ಪಾದ UPI ಐಡಿಗೆ ಹಣ ಕಳುಹಿಸಿದ್ದೀರಾ? ಚಿಂತೆ ಬೇಡ, ಹೀಗೆ ಮಾಡಿ ಹಣ ಮರಳಿ ಪಡೆಯಿರಿ!

UPI Help- ಇತ್ತೀಚಿನ ದಿನಗಳಲ್ಲಿ UPI ನಮ್ಮ ದೈನಂದಿನ ಜೀವನದ ಅವಿಭಾಜ್ಯ ಅಂಗವಾಗಿದೆ. ಚಿಲ್ಲರೆ ವ್ಯಾಪಾರದಿಂದ ಹಿಡಿದು ದೊಡ್ಡ ಮೊತ್ತದ ವರ್ಗಾವಣೆಗಳವರೆಗೆ, ಎಲ್ಲವೂ ಒಂದು ಟ್ಯಾಪ್ನಲ್ಲಿ ನಡೆಯುತ್ತದೆ. ಆದರೆ, ಕೆಲವೊಮ್ಮೆ ಅವಸರದಲ್ಲಿ ಅಥವಾ ಸಣ್ಣ ತಪ್ಪುಗಳಿಂದಾಗಿ, ನಾವು ಬೇರೆಯವರಿಗೆ ಹಣ ಕಳುಹಿಸಬೇಕಾದಾಗ ತಪ್ಪಾದ UPI ID ಗೆ ಕಳುಹಿಸಿಬಿಡುತ್ತೇವೆ. ಆಗ ‘ಅಯ್ಯೋ, ಹಣ ಹೋಯಿತೇ’ ಎಂದು ಆತಂಕ ಶುರುವಾಗುತ್ತದೆ. ಆದರೆ, (UPI Help) ಚಿಂತಿಸುವ ಅಗತ್ಯವಿಲ್ಲ! ಇಂತಹ ಪರಿಸ್ಥಿತಿಯಲ್ಲಿ ನಿಮ್ಮ…

#Aadhaar based banking#Aadhaar e-KYC#banking without visiting branch#C-KYC#C-KYC registry#central KYC registry#DigiLocker banking#digital banking India#e-KYC from home#KYC for rural banking#new RBI KYC process#online bank account verification#RBI banking guidelines#RBI digital banking rules#RBI financial inclusion#RBI guidelines for banks#RBI KYC changes 2025#simplified bank KYC#simplified KYC process#video KYC RBI

0 notes

Text

Unlocking the Indian Stock Market: Finding the Best Demat Account

The Indian stock market is buzzing with opportunity, and if you're looking to dive in, the first crucial step is opening a Demat account. But with so many options available, how do you choose the best Demat account in India for your specific needs? Don't worry, we've got you covered!

This guide will break down what to look for, highlight some top contenders, and help you make an informed decision.

How to Open a Demat Account: Step-by-Step Guide

How does a Demat account work? It involves setting up the account, linking it to a trading account, and executing trades, providing convenience and security for managing securities in an electronic format.

Opening a Demat account is an easy and hassle-free process.Follow these steps to open a Demat account:

1. Choose a Broker or Depository Participant (DP)

The first step is to choose a Demat account provider. Make sure to research the providers and compare their offerings based on fees, security features, and customer service. Select one that offers the best Demat account in India based on your needs.

2. Complete the KYC Process

You will need to complete the Know Your Customer (KYC) process by providing your identity and address proof. This can be done online with most brokers.

3. Fill Out the Application Form

Once you’ve completed the KYC process, fill out the application form provided by your chosen Demat account provider.

4. Submit Documents

You will need to submit documents like your PAN card, Aadhaar card, and proof of address. Depending on the provider, you may also need to submit a passport-sized photograph.

5. Verification

Once the documents are submitted, the provider will verify your information. After successful verification, your Demat a/c will be activated, and you can start trading.

Types of Stock Brokers in India:

Discount Brokers:

Pros: Low brokerage, technology-focused, ideal for self-directed traders and investors who do their own research.

Cons: Limited or no research/advisory, customer support might be less personalized.

Examples: Zerodha, Upstox, Groww, Angel One.

Full-Service Brokers:

Pros: Offer research reports, investment advice, relationship managers, wider range of services including wealth management.

Cons: Higher brokerage charges.

Examples: ICICI Direct, HDFC Securities, Kotak Securities, Sharekhan, Motilal Oswal.

How to Choose the Right Demat Account for You?

Are you a beginner or an experienced trader? Beginners might prioritize user-friendliness and educational resources.

How frequently will you trade? Active traders benefit most from low brokerage.

What is your investment style? Long-term investors might focus on low AMC and reliable platforms.

Do you need research and advisory? If yes, a full-service broker might be better, or a discount broker with good add-on research services.

What's your budget for charges? Compare brokerage, AMC, and other fees.

Final Thoughts

Finding the best Demat account in India is about matching a broker's offerings with your personal investment journey. Whether you opt for a feature-rich discount broker or a research-backed full-service broker, ensure they are SEBI-registered and have a good track record.

Do your research, compare features and charges, read reviews, and then take the plunge. Happy investing!

FAQs:

Q1. Which is the best demat account with the lowest brokerage?

Zerodha, Rupeezy, and Upstox are among the best in the market, offering low brokerage rates for opening a Demat account.

Q2. Which demat account is best in India for beginners?

Rupeezy offers the best Demat account for beginners. Its user-friendly and innovative trading platform helps novice traders trade seamlessly in the market.

Q3. Can I have more than one demat account?

Yes, it is possible to have different Demat and Trading Accounts as long as they are opened with different Depository Participants (DPs) and stockbrokers.

0 notes

Text

Best whatsapp Api Integration Service In Delhi with Top ekyc Solution In India

In the age of digital disruption, businesses in India—especially in fintech and financial services—are racing to adopt robust, secure, and scalable API and eKYC solutions. From customer onboarding to real-time communication, APIs and electronic KYC (eKYC) are the twin engines driving innovation. If you’re looking for the top api service providers in Delhi or a trusted eKYC solution provider in India, this guide is for you.

Leading API Integration Services in Delhi

Businesses today rely on a wide network of platforms, apps, and tools. API integration bridges the gap between these systems, creating unified digital experiences. Top API integration services in Delhi offer:

Third-party system integration (CRM, ERP, payment gateways)

Secure REST & SOAP API connectivity

Real-time data synchronization

Cloud-native architecture support

Whether you're an eCommerce startup or an enterprise, working with a top API integration company in Delhi ensures seamless, scalable, and secure digital solutions.

API Development Services in Delhi

Custom API development is critical for businesses that need tailored functionality. The best API development services in Delhi offer:

Custom API design and documentation

Authentication protocols (OAuth, API keys)

Scalable architecture with version control

Post-deployment support and monitoring

These services are crucial for startups looking to scale fast or legacy businesses undergoing digital transformation.

WhatsApp API Integration Services in Delhi

With WhatsApp being the most used messaging platform in India, integrating it into your business processes is no longer optional—it's essential. Leading whatsApp API integration services in delhi empower businesses to:

Send automated messages, alerts, and updates

Offer chatbot-based customer support

Collect real-time feedback and leads

Drive higher engagement and retention

Working with the best WhatsApp API integration service in Delhi ensures quick deployment, compliance with WhatsApp's policies, and robust backend connectivity.

Top WhatsApp Business API Services in Delhi

Choosing a WhatsApp Business API provider in Delhi that understands industry compliance and customer behavior is crucial. The top WhatsApp Business API services in Delhi provide:

Verified WhatsApp business accounts

Scalable bot and human support hybrid models

Integration with CRMs and support tools

API access for automation and analytics

These solutions are ideal for businesses in fintech, healthcare, education, and retail.

eKYC Solutions Powering India’s Fintech Ecosystem

As financial services move online, secure and compliant customer verification has become a cornerstone of trust. A leading eKYC solution provider in India can help you onboard users quickly and legally with:

Aadhaar-based eKYC

PAN verification

Liveliness checks and face match AI

Real-time approval workflows

For platforms handling sensitive financial data, it's critical to work with a top eKYC solution in India that ensures data protection and regulatory compliance.

One eKYC Solution for All Financial Services

Gone are the days top crm solution providers in delhi of repeated KYC verifications across platforms. Modern fintechs are embracing one eKYC solution that allows users to:

Complete KYC once and use it across services

Accelerate onboarding for mutual funds, loans, and insurance

Improve user satisfaction and conversion rates

This one KYC solution in India approach is quickly becoming the industry standard for digital finance.

eKYC for Mutual Fund Investors

A fully digital eKYC for mutual fund investors enables seamless onboarding and investing. Platforms are offering:

Real-time KYC checks via Aadhaar and PAN

Integration with registrars (like CAMS and KFintech)

Instant SIP setup and fund purchase post-verification

This frictionless process has made mutual fund investing easier than ever for both first-time and experienced investors.

eKYC Online Check and WhatsApp eKYC

Today’s users expect real-time access and updates. The eKYC online check feature helps users track their KYC status instantly. Additionally, WhatsApp eKYC online is revolutionizing the onboarding experience through:

Document collection via chat

Instant customer support

Real-time verification updates

These conversational interfaces reduce drop-offs and improve user satisfaction, especially in Tier 2 and Tier 3 cities.

Conclusion

From API integration to eKYC verification,ekyc solution provider in india businesses in India—especially in Delhi—have access to some of the best tech partners to power their growth. Whether you're looking for a WhatsApp Business API provider in Delhi, exploring API development services, or integrating a one eKYC solution, the right technology partner can be a game-changer.

As fintech and digital services expand, investing in smart, scalable API and KYC solutions will not only ensure compliance but also accelerate customer acquisition and retention.

0 notes

Text

Nhà cái uy tín châu Á – Top thương hiệu nổi bật

Chúng tôi hiểu rằng việc chọn lựa một Nhà cái uy tín châu Á không chỉ giúp bạn yên tâm về bảo mật mà còn mang đến trải nghiệm cá cược công bằng và đa dạng. Bài viết này sẽ cung cấp cho bạn cái nhìn tổng quan về các thương hiệu hàng đầu và tiêu chí để đánh giá một nhà cái đáng tin cậy.

Tiêu chí đánh giá nhà cái uy tín châu Á

Để xác định đâu là nhà cái đáng tin cậy, chúng tôi dựa trên các yếu tố sau:

Giấy phép và tính pháp lý

Các nhà cái hàng đầu đều được cấp phép bởi cơ quan quản lý quốc tế, như Isle of Man hoặc Philippines (PAGCOR). Giấy phép này đảm bảo ho���t động minh bạch và tuân thủ luật pháp quốc tế.

Độ an toàn và bảo mật

Mã hóa SSL, quy trình KYC nghiêm ngặt và hệ thống phòng chống rửa tiền là những tiêu chuẩn bắt buộc để bảo vệ thông tin cá nhân và tài chính của người chơi.

Hỗ trợ khách hàng chuyên nghiệp

Dịch vụ chăm sóc khách hàng 24/7, hỗ trợ đa ngôn ngữ và phản hồi nhanh chóng là dấu hiệu cho thấy nhà cái luôn đặt người chơi lên hàng đầu.

Tiếp theo, chúng tôi sẽ giới thiệu những thương hiệu đã đáp ứng xuất sắc các tiêu chí trên.

Top 5 nhà cái uy tín châu Á hàng đầu

Dưới đây là danh sách những thương hiệu nổi bật mà chúng tôi đánh giá cao về độ tin cậy và chất lượng dịch vụ.

Nhà cái A – Giao diện thân thiện

Giao diện của Nhà cái A được thiết kế tối ưu, giúp người chơi dễ dàng tìm kiếm các sự kiện và thị trường cá cược. Thanh toán nhanh chóng là điểm cộng lớn.

Nhà cái B – Khuyến mãi hấp dẫn

Chương trình khuyến mãi đa dạng và cập nhật thường xuyên giúp người chơi có thêm cơ hội gia tăng lợi nhuận. Chính sách hoàn trả minh bạch tạo sự an tâm.

Nhà cái C – Đa dạng sản phẩm cá cược

Từ thể thao, casino đến e-sport, Nhà cái C cung cấp đầy đủ lựa chọn để đáp ứng mọi sở thích. Hệ thống kèo cược chi tiết và tỷ lệ cạnh tranh.

Nhà cái D – Hỗ trợ di động xuất sắc

Ứng dụng di động mượt mà, cập nhật tỷ lệ gần như ngay lập tức, giúp người chơi dễ dàng theo dõi và đặt cược mọi lúc, mọi nơi.

Nhà cái E – Tính năng an toàn tiên tiến

Hệ thống bảo mật 2 lớp, xác thực đa yếu tố và quy trình xử lý khiếu nại chuyên nghiệp đảm bảo quyền lợi của người chơi luôn được bảo vệ.

Lợi ích khi chọn nhà cái uy tín châu Á

Việc cá cược tại một nhà cái đáng tin cậy mang lại nhiều lợi ích vượt trội:

An tâm về tính công bằng

Các thuật toán RNG và kiểm định độc lập đảm bảo kết quả trò chơi không bị can thiệp, tạo môi trường chơi minh bạch.

Giao dịch nhanh chóng và an toàn

Hỗ trợ đa dạng phương thức nạp rút, từ thẻ ngân hàng, ví điện tử đến chuyển khoản quốc tế, với tốc độ xử lý chỉ trong vài phút.

Dịch vụ khách hàng tận tâm

Tư vấn 24/7, kênh chat trực tuyến và email phản hồi nhanh giúp giải quyết mọi thắc mắc kịp thời.

Tiếp theo, chúng tôi sẽ chia sẻ cách bạn có thể tự đánh giá và so sánh các nhà cái.

Cách đánh giá và so sánh nhà cái châu Á

Để lựa chọn chính xác, bạn nên:

So sánh tỷ lệ và kèo cược

Xem xét kỹ lưỡng tỷ lệ kèo ở các sự kiện thể thao và thị trường khác nhau để tìm ra cơ hội tốt nhất.

Kiểm tra phản hồi từ cộng đồng

Đọc đánh giá, trải nghiệm của người chơi khác trên các diễn đàn uy tín để hiểu rõ ưu – nhược điểm của từng nhà cái.

Thử nghiệm tài khoản demo

Nhiều nhà cái cung cấp chế độ chơi thử không cần nạp tiền, giúp bạn trải nghiệm giao diện và tính năng trước khi quyết định.

Kết luận

Chọn một Nhà cái uy tín châu Á không chỉ giúp bảo vệ quyền lợi mà còn nâng tầm trải nghiệm cá cược của bạn. Chúng tôi khuyến nghị bạn cân nhắc kỹ các tiêu chí về giấy phép, bảo mật, hỗ trợ khách hàng và đa dạng sản phẩm trước khi đăng ký. Chúc bạn sớm tìm được đối tác cá cược phù hợp và thành công trên mọi ván cược!

1 note

·

View note