#CASHe dsa

Explore tagged Tumblr posts

Text

#CASHe#CASHe dsa partner#dsa partner#CASHe dsa partners#CASHe dsa#Onesarv#Onesarv fintech#Fintech#Finance#CASHe dsa agent#CASHe dsa agents#loan#loans#agency#loan agency#partner#partners#agent#agents#partnership#dsa agent#dsapartnerbenefits#personal loan#dsa

2 notes

·

View notes

Text

#CASHe dsa partner#CASHe#CASHe dsa#dsa partner#dsapartnerbenefits#dsaagent#dsa agents#loans#finance#OneSarv#Fintech#OneSarv Fintech#Finance#agent#loan#dsapartner#financial#personal loan#CASHe dsa agent#CASHe dsa agents#CASHe dsa partners#Partnership#partners#loan agency#agency#agents#dsa partner benefits#dsa

2 notes

·

View notes

Text

#home loans#loans#personal loans#fast cash loans online#student loans#insurance#dsa loan agent#loan agency#loan services#loan apps#loan against property#loan broker#finance#banking#investors#business#financial services

2 notes

·

View notes

Text

Very funny to me that DSA / jacobin / verso book brigade and various other toothless mainstream leftists are trying to "sound the alarm" on mineral extraction, an issue anarchists, specifically green / anticiv / anprim / nihilist anarchist have been writing about for years for free on anarchist library dot org.

Ten years ago we were getting called "crazy" "anti-worker" "anti-progress" by these same people for critiquing extractivism, for opposing mining, for opposing "green energy." Now they're cashing in on climate anxiety and frankly, gentrifying anarchist positions against extraction by repositioning these critiques from a democratic socialist perspective, removing the radical anti-civ roots from which these ideas were born.

I have to say a book that is questioning the logic of electric cars in 2025 is too little, too late. I think that if in 2015 you were too caught up in Bernieism to understand that we're not going to techno-solutionism our way out of a toxic planet I really dont give a fuck about what you have to say in 2025.

201 notes

·

View notes

Text

The Democratic Socialists of America (DSA) are bleeding cash and facing a $2 million deficit, and Representative Ritchie Torres is celebrating.

Torres, a New York Democrat who has been staunchly pro-Israel amid its war with Hamas, expressed his content with recent reports that suggest the DSA's debts have reached the seven-figure mark.

"The DSA is collapsing in real time under the weight of its own antisemitism and extremism," he told The Sun on Monday. "It is fair to say that I will not be mourning its death or attending its funeral."

Newsweek reached out to the DSA via email for comment.

Over the weekend, a report emerged that the DSA—which has led pro-Palestinian protests against the U.S. response to the war—is facing financial headwinds that could result in layoffs. The Bread and Roses caucus in the DSA published a blog post on Thursday confirming those reports and saying while no one wanted to consider such drastic measures, staff costs would have to be reduced given the "great crisis for capital."

The January 18 post said that the DSA is projecting $5 million in income for 2024, but $7 million in expenses.

"That means we eventually need to come up with $2 million to break even," said Alex Pellitteri, Kristin Schall and Laura Wadlin—members of the 2023-2025 DSA National Political Committee from the Bread and Roses caucus.

The DSA leaders said that while the current sociopolitical climate should be a "really favorable time for DSA"—citing the growing support for Palestinians and for labor groups across the nation—the group has "still been treading water, and things are going to get more challenging before they get better."

A November poll from Quinnipiac University found that the number of U.S. voters who sympathize with Palestinians more than Israelis has grown in the wake of the war, although the majority still have more sympathy for Israelis.

"Biden's disastrous policy of fueling Israel's genocide in Gaza has created the kind of space for an independent alternative from the Democratic Party that has not existed since [independent Vermont Senator] Bernie [Sanders]," they said, but Pellitteri, Schall and Wadlin admitted: "We have not had strong figures at the top of the organization to lead with a political vision that inspires people to become committed socialists."

"Working people are inspired to transform the world, but they are doing it elsewhere," the post said.

Torres, whose office has been vandalized by pro-Palestinian protesters, has previously tussled with the DSA over the Middle East. The congressman, who represents the South Bronx, has accused DSA members of promoting antisemitism by supporting a Manhattan rally that was held in the wake of the October 7 Hamas attacks on Israel. "The NYC-DSA is revealing itself for what it truly is—a deep rot of antisemitism," Torres said in an October 8 statement. "The DSA should be universally condemned for its genocidal celebration of Israel's destruction in the wake of Israel's deadliest terrorist attack." In response, the DSA has held several protests outside his office.

Torres is not the only Democrat at odds with the organization since the fighting broke out in the Gaza Strip.

Representative Shri Thanedar, a Michigan Democrat, renounced his membership in the DSA after the October rally, saying: "I can no longer associate with an organization unwilling to call out terrorism in its form." The DSA has emphasized that it did not organize the rally but acknowledged that the New York City chapter promoted the event "in anticipation of escalatory violence to come" after October 7.

In the Hamas attack that triggered the war, some 1,200 people were killed and Hamas and other militants abducted about 250 people, according to the Associated Press. Israel subsequently launched its heaviest-ever air strikes on Gaza. As of Monday, at least 25,295 people have been killed in Gaza and more than 60,000 wounded, according to the Gaza Health Ministry, the AP said.

While Torres blamed the gap in funding on the DSA's outspoken position on the Israel-Hamas war, the Bread and Roses members pointed to mismanagement from top directors in the organization.

In Thursday's blog post, the DSA leaders said that senior staffers had withheld essential information from elected leaders and imposed their own political objectives that hindered the DSA from achieving its ultimate goal of "a rupture with capitalism."

"As a result, we are now left holding the bag and tasked with cutting expenses just to keep the organization afloat," they said. "It's our responsibility now to learn from our mistakes: not reckoning soon enough with a downturn in enthusiasm, and failing to understand that as a sign that we were not serving our role to champion independent politics as a socialist organization in a time of great crisis for capital."

#nunyas news#make all dsa members use the same bank account#so everyone can take what they need#and contribute what they can#from each according to their ability#to each according to their need#that's how it goes right#they claim to be committed socialists#time to pool your resources then#and act like it

18 notes

·

View notes

Text

“How to Start Your Career as a Loan Agent in India: A Guide to Earning with NBFCs and Payout Platforms”

India is undergoing a credit transformation. With more people in need of quick, flexible financial solutions—be it for education, home repairs, medical emergencies, or small business growth—the personal loan sector is booming.

But it’s not just the borrowers who are benefitting.

Thousands of individuals across India are tapping into this opportunity by becoming loan commission agents, turning financial connections into a steady income stream using tools like payout platforms and bank loan payout programs.

If you’re looking for a way to earn from home or build a career in fintech without heavy investment, this blog will show you how to start your journey as a successful loan agent, and how you can quickly partner with NBFCs through trusted platforms like PayoutKart.

Who Can Become a Loan Commission Agent?

Let’s bust a myth first—you don’t need to be a banker or finance graduate to work in the loan space.

A loan commission agent can be:

A student looking for a side hustle

A homemaker with an active social circle

A retired professional

A part-time gig worker

Or anyone with a smartphone and basic communication skills

With digital loan agent registration, platforms like PayoutKart allow you to start referring loans and earning DSA commissions in just a few steps.

How the Process Works: Step-by-Step

Becoming a successful loan agent involves three key steps:

1. Register on a Payout Platform

Using a digital payout platform like PayoutKart, register with your:

PAN card

Aadhaar card

Bank account for receiving payouts

This simple loan agent registration gets you access to NBFCs, application tracking, and lead submission tools.

2. Generate Personal Loan Leads

This is where personal loan lead generation comes in. You can find people in need of personal loans by:

Talking to friends, family, and local contacts

Posting tips or offers on WhatsApp, Facebook, and Instagram

Running local ads (online or offline)

Partnering with shopkeepers or tuition centers

Joining local WhatsApp groups

Anyone looking for a loan becomes your potential client. You collect basic info, upload it to the payout platform, and let the system handle the rest.

3. Earn Commission on Every Disbursal

Once a loan is approved and disbursed through an NBFC or bank, you earn a DSA commission. This commission can range from ₹1,500 to ₹10,000 per loan, depending on the amount and lender.

With a few leads every month, you can build a consistent income flow.

What Happens When a Loan Is Rejected by a Bank?

This is where smart loan agents shine.

Sometimes, a bank rejects a file due to:

Low CIBIL score

Informal employment

Incomplete documents

Instead of losing the opportunity, you can re-route the file to an NBFC using a bank loan payout program through PayoutKart. NBFCs are often more flexible and consider real-world income and cash flow.

That means your client gets their loan, and you still earn your DSA commission.

Why You Should Partner with NBFCs

When you partner with NBFCs, you open doors to more approvals and higher commissions.

Here’s why:

Faster processing – Some NBFCs approve and disburse in 24–48 hours.

Flexible criteria – Unlike banks, they evaluate the bigger picture.

Higher commission slabs – You earn more per successful case.

More customer satisfaction – Clients get quicker access to funds.

PayoutKart lets you connect with multiple NBFCs from one dashboard, so you don’t have to manage separate relationships or paperwork.

Understanding DSA Commission: What Can You Earn?

As a loan commission agent, your earnings depend on:

Number of leads

Approval rate

Average loan size

Commission rate

Here’s an example:

You generate 20 leads/month

8 get disbursed

Average commission per loan = ₹3,500

You earn ₹28,000 that month

And that’s without a physical office or full-time hours. Some agents who scale their personal loan lead generation through social media and ads earn over ₹1,00,000/month using only their phone and a payout platform.

Why Use a Payout Platform Like PayoutKart?

The digital nature of a payout platform makes your work more efficient and scalable. With PayoutKart, you get:

Real-time loan status updates

Lead submission for multiple lenders (banks + NBFCs)

Integrated bank loan payout program access

Automatic DSA commission tracking

Faster payments

Analytics to improve lead conversion

Think of it as your virtual office with all the tools to run a solo loan agency successfully.

Tips to Succeed as a New Loan Agent

Understand the Product – Know the basic terms: tenure, interest, processing fees, eligibility, etc.

Build Trust – Transparency builds long-term referrals.

Be Consistent – Post regularly on social media. Stay visible.

Use Local Language – Speak in your client’s comfort language.

Track Your Leads – Follow up if needed.

Use Bank Loan Payout Program Wisely – Don’t give up on rejections.

Target Clients You Can Help

As a loan commission agent, your target audience includes:

Salaried employees

Small business owners

Freelancers or consultants

Teachers and tuition providers

Medical professionals

Retired individuals with pensions

Gig economy workers (drivers, delivery agents)

There’s a huge underserved market that you can reach with minimal effort.

Scaling Your Loan Referral Business

Once you’ve nailed the basics, you can grow your business by:

Running paid ads (Google, Facebook)

Creating a local landing page or blog

Building a WhatsApp broadcast list

Joining housing society or city-based groups

Becoming a local “loan advisor” in your area

More leads = more approvals = more DSA commission.

Final Thoughts: You Don’t Need to Be a Banker to Work in Finance

India’s financial sector is more open than ever before. Thanks to digital payout platforms, bank loan payout programs, and NBFC partnerships, anyone can become a successful loan commission agent—without licenses, degrees, or startup capital.

Whether you want to earn ₹10,000/month part-time or build a serious ₹1,00,000+/month income, it all starts with one thing: taking that first step.

With PayoutKart, you can:

Start your career in lending

Access multiple lenders

Track every lead and commission

Get fast payouts

And grow with confidence

The future of finance is digital, decentralized, and democratized—and you can be part of it.

0 notes

Text

The Financial Lifeline: Why Jaipur's SMEs Rely on Loans for Survival and Growth

In a fast-changing market, the dependence of SME Loans in jaipur for growth and survival cannot be overemphasized. Such businesses typically exist on thin margins, so access to funding is a vital aspect of their viability. Without access to loans, most SMEs would not be able to match rivals who are able to invest in latest technology and increasing their market outreach. Loans give the necessary liquidity needed to overcome economic uncertainty, enabling businesses to keep operations going even during difficult times.

A good example lies in the apparel industry, where most SMEs rely on seasonality to generate revenues. Off-seasons often mean that cash flow reduces, potentially causing operations to be hampered. SME loans can help bridge these deficits so that business owners have funds available to take care of operating expenses and keep workers on their payrolls. This financial buffer not only helps to fund day-to-day operations but also allows companies to budget for future expansion without the looming threat of short-term financial stress. In addition, the Jaipur economy is marked by a rich cultural and traditional industry diversity. Most SMEs in these industries need to be funded in order to innovate and upgrade their products. Loans enable them to finance new production methods, broaden product portfolios, and expand marketing efforts. All this flexibility is important for survival in today's highly competitive market, where consumer tastes are ever-changing. With the help of financial assistance, Jaipur's SMEs can shift and meet market needs, thus remaining relevant and sustainable.

For more details click on:

0 notes

Text

Corporate Debt Structuring and Advisory (DSA) in India: Role, Challenges, and Growth Opportunities

Business growth along with expansion in India heavily depends on corporate debt financing systems. Businesses require financial support for operations expansion and restructuring resulting in a rapid increase in expert debt structuring and advisory service demands. The debt solutions industry in India has developed Corporate DSA as its main enabling force to help businesses secure appropriate financial instruments that meet their requirements. Arena Fincorp along with other companies assists businesses through their expert debt structuring guidance in corporate finance.

Role of Corporate DSA in India

The Corporate Debt Structuring and Advisory (DSA) firms operate as financial connection points between corporate entities and financial institutions. The main function of these entities involves financial assessment to determine proper debt financing solutions best suited for individual companies. Corporate DSA in India performs three fundamental activities which are:

Organizations receive support from Debt Restructuring services dedicated to improving their financial efficiency and distress reduction by reorganizing their current debt.

Corporate Financing Centers help companies access debt funding through multiple financial institutions to obtain better payment conditions along with lower interest rates.

Expert financial advisory services advocate debt leverage strategies for companies to make well-informed investment decisions.

The evaluation of financial risks and the development of protective strategies against them occurs through appropriate document structure and bargaining procedure.

Negotiation and Documentation Ensuring favorable terms and smooth execution of financial agreements with banks and financial institutions.

The firm helps businesses create proper cash flow strategies to maintain stable liquidity and debt payment capabilities.

The experts help businesses get improved credit ratings which allows them to obtain financing at improved conditions.

The debt management services of corporate DSA in India help organizations maintain effective debt control and achieve financial stability until achieving long-term success which increases market competitiveness.

Challenges in Corporate Debt Structuring in India

The vital nature of corporate DSA in India faces various barriers that both businesses and financial advisors must overcome during their operations.

All businesses operating in the Indian financial market need to follow the strict regulatory framework provided by the Reserve Bank of India (RBI) and other corresponding regulatory agencies.

Economic conditions that change along with inflation and worldwide financial patterns create debt planning problems that prevent businesses from developing debt strategies over extended periods.

Businesses face problems due to elevated borrowing expenses because these costs strain their financial health and their ability to repay debts.

The inability to demonstrate positive credit performance prevents organizations from gaining access to credit or debt reorganization making their healing process excessively difficult.

Businesses must face intense market competition when selecting their perfect corporate DSA in India because numerous financial advisory firms have expanded.

Most small and medium enterprises (SMEs) do not recognize structured debt solutions which prevents them from accessing needed financing options for their financial strategy enhancement.

The long approval operations at financial establishments obstruct companies from expanding their operations and achieving optimal operational efficiency.

Businesses overcome financial challenges through strategic debt solutions offered by Arena Fincorp which match their goals for execution while producing desirable financial results.

The Corporate DSA sector presents expanding opportunities in India's market

The future development of corporate DSA in India indicates a positive outlook because various elements drive its expansion. These are the main possibilities within this sector:

The expanding business sector requires enhanced debt financing structures which leads to more prospects in the corporate DSA marketplace.

Through new policies, the Indian administration provides dedicated financial support to business funding while promoting easier credit accessibility across various business scales.

Financial service digitization produces improved debt management through faster approval processes and enhanced monitoring capabilities by advancing loan processing together with risk evaluation along with debt framework methods.

The increasing foreign investor interest in India results in expanded corporate debt solutions and improves the dynamism of debt-structuring financial instruments.

RSpecialized Advisory Services have become crucial to businesses seeking personalized debt solutions which allows financial advisory firms like Arena Fincorp to establish opportunities in this market.

Debt structuring services have become essential for the efficient scaling of Micro Small and Medium Enterprises (MSMEs) because the sector continues to expand.

DNA professionals can capitalize on growing trends through sustainable financing since they can design debt programs that help companies align with international sustainability targets.

The corporate world is adopting debt refinancing options to restructure their debt portfolios for better financial outcomes including cost reduction and improved operational flexibility.

Conclusion

Indian businesses need corporate dsa in India more than ever because they require efficient systems for debt optimization. Presently the sector provides significant business growth potential to financial advisory companies along with their ongoing challenges. The reputable financial firm Arena Fincorp assists businesses to handle corporate debt complexities which leads to better financial stability.

The rising importance of corporate dsa in india in the financial ecosystem will become more prominent because the Indian economy shows no sign of slowing down its development. Organizations that work with debt management experts will gain market advantage together with lasting growth and profitability through proper debt management strategies.

0 notes

Text

Corporate DSA Channel: Scaling Up How Loans Get Around

The finance world keeps changing, and passing out loans is super important for connecting folks who lend with those who need to borrow. As more people want loans, banks and places like that keep looking for smart ways to get bigger and reach more folks. This cool thing called the Corporate DSA Channel is like a boss strategy for making that happen. Businesses such as Arena Fincorp are using this to make a splash in the market and make giving out loans smoother.

Getting the Scoop on the Corporate DSA Channel

A "Corporate DSA Channel" is a system where big businesses team up with places like banks to hand out loans in a organized way. These corporate DSAs are different from small-time DSAs because they work with more customers, use fancy tech, and are all about getting loans out there without a hitch.

Take "Arena Fincorp" for instance — they've got this Corporate DSA thing going, and it's letting them help even more people while still keeping their service top-notch. It's not just the banks that are winning here; the big business DSAs get to rake in some serious benefits too.

"Perks of Teaming Up as a Corporate DSA"

"1. Reaching More Customers"

The Corporate DSA Channel lets banks spread their wings past the normal ways of banking. Corporate DSAs got customers already, so it's a breeze to push loans their way real smooth like.

2. Cheap Loan Spreading

The big win of using the Corporate DSA Channel is saving on cash money for running things. Banks can cut down on bucks spent on ads getting new customers, and all the paperwork by teaming up with pros at corporate DSAs kinda like Arena Fincorp.

3. Better Times for Customers

Corporate DSAs are all about making customers happy when it comes to giving out loans. They've got some sharp digital stuff and folks to help customers out. When applying for a loan ain't a pain, people are way happier.

4. Speedier Loan Approvals

The "Corporate DSA Channel" uses tech to speed up getting loans okayed and handed out. Things like automated steps computerized checking of KYC, and smart AI for figuring out if someone's good for credit make everything quicker and helps both the people giving the loans and the ones getting them.

5. Making More Dough for Big Companies

Big shots like "Arena Fincorp" add bucks to their wallet by getting into the "Corporate DSA Channel" game. By shaking hands with a bunch of money places corporate DSAs pocket fees every time a loan goes through, making a steady way to rake in cash.

Smart Moves to Win in the Corporate DSA Channel

To get the most out of the Corporate DSA Channel, companies gotta roll out clever plans that boost both efficiency and the bucks they make. Here's a rundown of some top moves that can make things rock:

1. Hooking Up with Solid Money Crews

If you wanna nail it in the Corporate DSA Channel, cozying up with banks, NBFCs, and tech-savvy money handlers is key. Take Arena Fincorp for example; they're all about teaming up with various money lenders to dish out a mix of loan options that appeal to more folks.

2. Getting Smart with Tech

Tech's the muscle behind a slick Corporate DSA Channel. We're talking smart systems to figure out who's fit for a loan, plus streamlining the whole apply-and-approve dance. This tech wave churns out more get-up-and-go in the workflow and levels up the game for customers too.

3. Playing by the Rules

Sticking to the book on rules and regs is a huge must-do. It's all about staying in the clear and dodging any legal headaches. Making sure you're on point with compliance cuts down risks and keeps the whole operation smooth sailing.

Keeping in line with rules is super important if you wanna keep trust and look legit in the "Corporate DSA Channel". These Corporate DSAs gotta stick to what the RBI says, keep data safe, and be fair when they lend money for long-standing wins.

4. Smart Moves in Marketing and Getting New Leads

Corporate DSAs should get into marketing based on solid data to hook in folks who might want a loan. If they get savvy with digital marketing hit up social media, and send out stuff that feels personal, they'll see a big jump in people interested and making deals.

5. All About the Customer

Being awesome at customer service sets you apart in the "Corporate DSA Channel". Big names like "Arena Fincorp" focus on teaching their customers well being all clear about things, and giving help that's smooth so they can keep customers happy for ages.

The Next Step for Business DSA Networks

The Business DSA Networks stand on the brink of massive expansion with more people needing loans. Fintech upgrades AI for credit checks, and online banking methods are set to make this approach even better.

Banks and similar places are starting to see how good Corporate DSAs are for making giving out loans smoother. So, we're likely to see more team-ups and new ideas that make it easier for both folks and companies to get loans.

Wrapping Up

The Corporate DSA Channel shakes things up for the money world making things awesome for the loan folks, the big corporate DSAs, and the people getting loans. Places like Arena Fincorp are leading the charge opening up new chances for everyone to get in on the financial action and building businesses that'll last.

By getting on board with the latest tech stuff teaming up with other money pros, and making sure their customers are having a stellar time, the Corporate DSA Channel is gonna keep being super important in changing how loans get around. If you're in the biz of dishing out money or some huge company looking to rake in more cash, getting the Corporate DSA Channel on your side is a smart move for climbing higher and scoring big wins.

0 notes

Note

ok yeah. it's true dsa is a hoarder who takes almost every pop design i love. i lament, but i can't be mad. they have fantastic taste. and if you're competing with people who have big money and a hungry tooth, you have to have big money and go hard. thats just how those people are. they don't back down. the guy puts a lot of cash into the community which i gotta appreciate. chances are if you do lots of toyhouse transactions, both me n u got dollars in our wallets that were once theirs.

.

#I have a friend who whales in CS#but they do it by buying poor members of the communities they're in expensive designs they could never afford otherwise#there's nuance to the discussion but if you're preventing a large swathe of the community from obtaining designs#because you buy all of them. that's impolite#and by 'buying poor members of the community designs' I mean they'll casually drop $400 to get people who get left behind nice designs

1 note

·

View note

Text

Reasons to stick with unsecured business loans:

Introduction

Since small businesses have little financial flow, they are always in need of finance. They frequently approach banks and NBFCs for a business loan in order to get finances. However, they are frequently disappointed in return. Lending to small businesses appears riskier to banks and NBFCs since they can't rely on them to make a profit; therefore, payback appears improbable.

Unsecured business loans are ones that are based purely on the creditworthiness of the business borrower, as determined by income, financial papers, and other factors, rather than on collateral. This loan can be used for a variety of purposes, including business development, equipment purchases, inventory management, and cash flow management. Moreover, small business owners frequently request a small business loan, which lenders regard as non-profitable financing.

Reasons Why Unsecured Loans Facilitate Faster Growth for Small Businesses:

1. NO COLLATERAL:

This financing does not necessitate the use of personal or commercial assets. Instead, lenders consider the borrower's company income when approving the loan amount and determining your business loan eligibility. If your salary is large, your loan amount will be as well.

2. EASY APPLICATION PROCESS:

Borrowers may now easily obtain a business loan through Chintamani Finlease. You may now apply for an unsecured business loan on our websites from the convenience of your own home or workplace. The website is quite user-friendly, and there are online manuals that explain how to apply for a business loan. Click here to visit our website.

3. MINIMAL DOCUMENTATION:

The documentation needed to apply for an unsecured business loan is minimal. To check your business vintage, you simply need to send scanned copies of your passport, identification proof, address proof, certification of business existence, bank account statements, and appropriate financial papers.

4. FIRST-TIME APPLICANTS:

This is the best approach to developing credit if you are a first-time applicant with no credit history. However, to avoid default, be sure you pay your EMIs on schedule. This way, if you ever need to borrow money to fund a major company project, you'll have a credit history to back up your loan application.

5. FLEXIBLE USAGE:

When applying for a business loan, you must state the purpose for which the loan is being sought. If you say business expansion, for example, that fund can only be utilized for that purpose. This indicates that the borrowed amount cannot be used in any way. When you take out an unsecured loan for any Chintamani Finlease or DSA, however, you have complete control over how you utilize the money. You have complete freedom to use the cash for marketing or business expansion.

6. ONLINE ACCESS TO FUND:

Most unsecured loan applications at FinTech firms are available online and may be completed quickly using a mobile app. Furthermore, the relevant papers must be uploaded online, including bank statements, prior loan statements, tax statements, company invoices, and KYC documents.

7. NO RISK TO BUSINESS ASSETS:

Since you don't have to put up any collateral to get an unsecured loan, your business assets, such as commercial property, vehicles, and inventory, will be safe. A lender cannot confiscate your company property even if you fail to pay your EMIs on time. You can log in to the Chintamani Finlease portal and select a flexible payment mechanism from the several payback alternatives provided.

8. NO SHARED OWNERSHIP:

Many angel investors demand a share of the company's profits in exchange for their contributions. Many times, in the process of obtaining finances without creating debt, the company owners lose sole control of the company. When you ask for a business loan, though, you don't have to be concerned about losing or sharing ownership. Any profit a company owner generates via the use of a business loan is purely for the benefit of the business owner. The business owner is not required to share any of his or her profits with the loan provider.

9. TIMELY ACCESS TO THE FUND:

The most significant benefit of applying for an unsecured loan from Chintamani Finlease for a small business is the simple and quick loan processing.

When you apply for a business loan with a bank or a non-bank financial institution (NBFC), the processing time is longer since there is more documentation needed. Collateral and guarantors are required for the loan, which adds to the paperwork. Unsecured loans with Chintamani Finlease, on the other hand, are speedier because the procedure is mainly done online, saving time for both the borrower and the lender.

10. SHORTER LOAN TENURE AND FLEXIBLE REPAYMENT OPTIONS:

The majority of lenders provide unsecured business loans as short-term lending. An unsecured loan's term typically ranges from 12 to 60 months. This allows company owners to take a break from paying long-term EMIs for loan repayment. The shorter loan term also makes it easier for borrowers to maintain a positive cash flow situation. You have total flexibility over how you wish to repay your loan at Chintamani Finlease.

Eligibility criteria:

Although various suppliers' qualifying conditions for an unsecured business loan may vary, the principles remain the same. If you wish to apply for a Chintamani Finlease Business Loan, you must meet the following requirements:

The company has to be based in Delhi.

The borrower must be between the ages of 22 and 55.

The company's vintage should be at least three years.

In the previous two years, your company should have submitted income tax filings.

Conclusion

In conclusion, unsecured business loans from Chintamani Finlease offer numerous benefits for small businesses. They don't require collateral, have an easy application process with minimal documentation, and cater to first-time applicants. With flexible usage and online access to funds, they ensure timely financial support without risking business assets or ownership. Moreover, these loans come with shorter tenures and flexible repayment options, easing the burden on businesses. Eligibility criteria are straightforward, making it accessible for businesses based in Delhi with a minimum vintage of three years. Overall, Chintamani Finlease's unsecured loans pave the way for faster business growth and financial stability.

If you have any further questions, please don't hesitate to contact us:

216, Ansal Vikas Deep Building, Laxmi Nagar District Centre,

Near Nirman Vihar Metro Station, Delhi, 110092.

Phone: (+91) 9212132955

Email: [email protected]

0 notes

Text

#loans#student loans#banking#business#insurance#fast cash loans online#personal loans#dsa loan agent#finance#home loans

0 notes

Text

Abhay Bhutada’s Vision: Cutting Costs and Enhancing Asset Quality at Poonawalla Fincorp

Navigating the complexities of operational expenses (OPEX) while maintaining high asset quality is a challenge for any financial institution. Abhay Bhutada, MD of Poonawalla Fincorp, has been instrumental in steering the company towards impressive milestones in these areas. Here’s a closer look at how Poonawalla Fincorp has managed to reduce its operational costs and enhance asset quality under Bhutada's leadership.

Strategic OPEX Reduction

Poonawalla Fincorp has seen a consistent reduction in OPEX over the past few quarters, dropping from 5.43% to 3.99% year-on-year. This significant improvement can be attributed to a series of strategic moves.

Also Read: Unveiling Abhay Bhutada: A Leader’s Inspiring Odyssey In Finance

Branch and Manpower Consolidation

One of the primary steps taken was the consolidation of branches and manpower. By streamlining operations and merging less productive branches, Poonawalla Fincorp has been able to reduce redundant costs. This consolidation ensures that the company operates more efficiently, with a focus on regions that offer higher growth potential.

Digital-Led Model

A major factor in reducing OPEX has been the shift towards a digital-led model. Poonawalla Fincorp has increasingly focused on leveraging technology for various operations. By minimizing physical branch requirements and enhancing digital interfaces, the company has significantly cut down on overhead costs. The digital approach not only reduces expenses related to physical infrastructure but also streamlines processes, making them faster and more efficient.

Centralized Operations and Phygital Sourcing

Poonawalla Fincorp has adopted a centralized operational model where sourcing is done through both digital channels and Direct Selling Agents (DSAs). This “phygital” (physical plus digital) approach ensures broad reach while maintaining cost efficiency. The emphasis remains on digital, reducing the cost of sourcing and underwriting. This model also supports digital collections, further driving down operational costs.

Also Read: Unveiling Abhay Bhutada’s Salary Journey And Impact As MD Of Poonawalla Fincorp

No Cash Collections

In a move to enhance efficiency, Poonawalla Fincorp has eliminated cash collections. This shift not only reduces the risks and costs associated with handling cash but also speeds up transaction processes. The move towards a cashless operation aligns with the broader digital strategy, further consolidating the company’s cost-saving measures.

Improving Asset Quality

While reducing OPEX is crucial, maintaining and improving asset quality is equally important. Poonawalla Fincorp has demonstrated a commendable performance in this area, showing reductions in both Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA). The GNPA has decreased from 1.44% to 1.16%, and NNPA from 0.78% to 0.59%.

Risk-Adjusted Lending Approach

Abhay Bhutada emphasizes a risk-adjusted approach to lending. The company focuses on lending to bureau-tested customers with verifiable cash flows rather than venturing into riskier segments or new-to-credit customers. This cautious and data-driven strategy helps mitigate the risk of default and ensures that asset quality remains high even as the company grows.

Leveraging Data and Technology

The use of extensive databases and advanced analytics allows Poonawalla Fincorp to make informed lending decisions. By analyzing customer credit histories and cash flow patterns, the company can accurately assess creditworthiness and avoid potential defaulters. This data-centric approach enhances the quality of the lending portfolio.

Also read: Meet Abhay Bhutada: The Winner Of Lokmat Maharashtrian Of The Year 2024

Monitoring and Management

Constant monitoring and proactive management of the loan portfolio are key practices at Poonawalla Fincorp. The company employs robust risk management frameworks and regularly reviews the performance of its loan book. This vigilance helps in early identification of potential issues and swift corrective actions, ensuring sustained asset quality.

The Road Ahead

Looking forward, Abhay Bhutada and his team at Poonawalla Fincorp remain confident in their ability to continue improving both OPEX and asset quality. The emphasis on digital transformation, efficient operational models, and risk-adjusted lending will likely keep driving positive outcomes.

As the company scales new heights, it is clear that Poonawalla Fincorp's strategies are paying off. With further improvements anticipated, stakeholders can expect the company to maintain its trajectory of operational excellence and superior asset quality. Abhay Bhutada's leadership and vision will undoubtedly be pivotal in navigating future challenges and opportunities, ensuring Poonawalla Fincorp remains a robust and reliable player in the financial sector.

In essence, the story of Poonawalla Fincorp under Abhay Bhutada's leadership is one of strategic innovation and prudent management. By effectively reducing operational costs and enhancing asset quality, the company sets a benchmark for excellence in the industry. As they continue to evolve, the lessons from their journey offer valuable insights for businesses aiming to achieve similar success.

0 notes

Text

https://www.thenation.com/article/activism/quit-dsa-gaza-israel/?s=09

...Unlike my generation, for whom the overriding issue of the late 1960s was opposition to the war in Vietnam, most of DSA’s new members were attracted to the organization by its proposals for substantial, vital, and above all realizable domestic reforms (Medicare for All, the Green New Deal, student debt relief, tenants’ rights, etc). As a result, between 2016 and 2020 DSA’s membership expanded from 6,000 to 90,000-plus, while dropping the average age of members from 60-something to 20-something. Scores of new chapters opened up, including many located in cities and states that haven’t seen an active socialist presence since the era of Eugene Debs, if ever. And those young, energetic recruits proved remarkably politically savvy and successful in the field of electoral politics, not only elevating four members to Congress, but also sending nearly 200 others to state legislatures, city councils, and other offices, almost always as Democrats.

All well and good—except for the return of the entryists. Suddenly, in the eyes of revolutionary purists in a host of small competing sects, DSA was no longer to be sneered at as just a reformist swamp. “Why rob banks?” career criminal Willie Sutton was once allegedly asked by a reporter. “Because that’s where the money is,” he replied. The exchange is apocryphal, but substitute warm bodies for cold cash, and it offers a concise explanation for DSA’s sudden attractiveness to sectarian strategists. Unknown numbers—hundreds, perhaps more—started joining in 2016, some of them former members of defunct Marxist-Leninist groups, others (in violation of DSA bylaws) still belonging to and carrying out the agendas of such groups. They proceeded to quarrel and compete among themselves, splitting and recombining under various banners like “Red Star,” “Marxist Unity Group,” and even the “Communist Caucus.” But they remained united in one overarching shared aim—to take a well-meaning, not particularly well-organized, and essentially social democratic organization still committed in practice to the original DSA vision of creating “the left wing of the possible,” and reinvent it as the mass vanguard party of the proletariat that somehow they had never been able to pull off while operating under their own banners of deepest red.

DSA, meanwhile, thrived between 2016 and 2020—because it proved it could win victories in the here-and-now, give-and-take world of electoral politics. And that, ironically, was intolerable to the entryists (who preferred to refer to themselves as “partyists”), because they didn’t want socialists to remain as a wing of, or even a loyal opposition within the Democratic Party. They wanted a break, in the not terribly distant future, from the intolerable compromises required to appeal to mainstream voters and to compromise with mainstream politicians. And they also believed that DSA members elected to public office were, first and foremost, obliged to follow the positions adopted by the organization, rather than their constituents or their own conscience, as if they were already subordinate to the dictates of an old-fashioned Marxist-Leninist central committee...."

This is exactly what happened to the original revolutionaries in France, recall. Those members were pushed out and punished for not being extreme enough. It may have been on impulse, back then, but either way, this feels more manufactured, in that these organized groups had to get their training from somewhere, with the goal of pushing DSA further Left. Pretty clear that Far Left and hard right are almost completely identical.

1 note

·

View note

Text

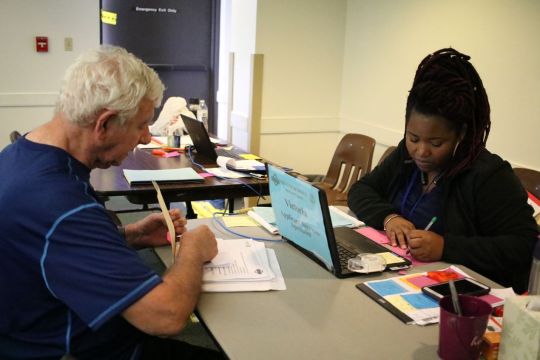

Hurricane Idalia Recovery Information for Hernando County

Federal Individual Assistance Comes to Hernando County for those affected by Hurricane Idalia Hernando County has met the threshold for FEMA Individual Assistance (IA). Local, State and Federal damage assessment teams worked diligently into Friday evening and submitted their assessments to the State of Florida’s Division of Emergency Management. Hernando County’s Emergency Management officials were notified Saturday morning, shortly after 8 a.m., that Hernando County was added to the original seven declared counties. Hernando County was also approved for FEMA Public Assistance (PA) for categories A and B, debris management and emergency protective measures respectively. Hernando County residents who were affected by Hurricane Idalia may apply for federal assistance and check their application status by visiting www.DisasterAssistance.gov or you may also download the FEMA mobile app through both Google Play and the App Store. You may also apply for Federal IA disaster assistance by calling the FEMA Helpline at 800-621-3362. If you use a video relay service, or captioned telephone service, or other communication services, please provide FEMA with the specific number assigned for that service. FEMA Disaster Survivor Assistance (DSA) Teams began visiting the affected residential areas Sunday afternoon to help homeowners register for FEMA IA assistance. FEMA DSA Team members will be clearly identified by a blue FEMA vest or FEMA shirt with a FEMA photo identification badge. DSA Team members will have a presence within Hernando County for the foreseeable future as we continue our recovery process. Hurricane Idalia Victims Have Resources Available for Aftermath Cleanup Need help with Hurricane Idalia cleanup? Crisis Clean Up, vetted through Volunteer Florida, can assist with cutting fallen trees, drywall, flooring, appliance removal, tarping roofs, and mold mitigation. Crisis Clean Up has opened a toll-free hotline for the public to request cleanup assistance: 800-451-1954. For more information visit www.volunteerflorida.org. Hernando County Hurricane Idalia Survivors Encouraged to Report Unlicensed Contractors Hernando County Emergency Management official wants to remind residents affected by Hurricane Idalia to be cognizant of unlicensed contracts doing repair work on their homes. Please be mindful of who you are hiring to perform hurricane damage repairs to your home or structure. You are encouraged to report unlicensed contracting. Report Unlicensed Contracting to the Florida Department of Business and Professional Regulation (DBPR). Unlicensed contracting becomes a felony during a state of emergency. The state of Florida and Hernando County are currently under a state of emergency as a direct result of Hurricane Idalia. Hernando County Emergency Management and DBPR want to remind you: - Contact your insurance company first to verify that your insurance will cover the repairs before you find a licensed contractor or sign a contract. - Always verify a professional’s license online at MyFloridaLicense.com, by calling (850) 487-1395, or by using the DBPR mobile app. - Be wary of individuals who only produce an “occupational license,” or corporate filing. An “occupational license” only means that a person has paid a tax receipt to the local municipality. - Get a written estimate from several licensed contractors to compare costs before you hire one. Make sure the estimates include the work the contractor will do, materials involved, completion date, and total cost. - NEVER pay cash in full before the work is completed. Be cautious of writing checks made payable to individuals, especially when dealing with a company. - Report unlicensed contracting by calling the DBPR Unlicensed Activity Hotline: - (866) 532-1440. Hernando County Hurricane Debris Removal Scheduled A storm debris contractor (not Republic Services) will be starting Hurricane Idalia debris removal on Wednesday, September 6th, 2023. Storm debris pickup will include private roads, however, only storm-generated debris will be collected. If you choose to dispose of your storm debris before the scheduled pick-up date, residents should dispose of the material at the Northwest Solid Waste Facility (Main Landfill) located at 14450 Landfill Road as the convenience centers do not accept construction and demolition debris and cannot accommodate the quantities generated from this event. Call (352) 754-4112 for more information. To meet the needs of those impacted by Hurricane Idalia over the Labor Day Holiday Weekend, Hernando County Government will be extending the hours of: - West Hernando Convenience Center located at 2525 Osowaw Blvd. Spring Hill, FL. It will be open on Sunday, September 3, 2023, and Monday, September 4, 2023, from 9:00 am to 5:00 pm. - Northwest Solid Waste Landfill facility located at 14450 Landfill Rd., Brooksville, FL 34614. It will be open Sunday September 3, 2023, and Monday, September 4, 2023, from 8:00 am to 4:30 pm. - For the latest local conditions and a complete list of news alerts go to www.HernandoCounty.us/EM - Sign up to receive weather alerts at www.AlertHernando.org - Follow us on Facebook @hernandocountyfire - Follow us on Twitter @hernandocofire - Follow us on YouTube @hernandocofire - Follow us on Instagram @hernandocofire Read the full article

0 notes