#CMA ELIGIBILITY

Explore tagged Tumblr posts

Text

Best College for BBA with CMA Support in India

Explore curriculum, faculty support, and certification benefits. We walk through every semester’s focus areas. Learn how the course builds your business acumen. Understand which subjects align best with your goals. Your academic journey starts with clarity. Check cma eligibility and exam assistance details. Enhance your business and finance credentials together.

#bba course#bba course details#best bba colleges in india#bba course fees#bba course duration#bba scope#cma syllabus#bba course subjects#best college for bba#bba course details after 12th#bba course subjects list#cma subjects#best university for bba in india#good bba colleges in india#cma duration#cma eligibility#bba admission#cma fee structure#bba benefits#bba course syllabus#benefits of bba#cma training#top universities in india for bba#best bba course#eligibility for bba course#bba course benefits#bba course information#cma subjects list#cma details#cma fees in india

1 note

·

View note

Text

#CMA#US CMA#CMA COURSE#CMA EXAM#CMA FEES#CMA ELIGIBILITY#CMA EXEMPTIONS#CMA STUDENT#CMA JOB#CMA SALARY

0 notes

Text

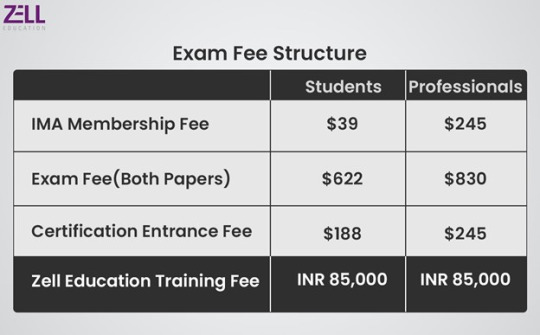

CMA Fees

Those seeking the esteemed CMA certification must pay the CMA (Certified Management Accountant) fees. Exam registration, membership, and study materials are all included in the pricing structure, which offers a variety of payment alternatives. In order to join the IMA, candidates must first pay an admission fee. Then, they must pay separate costs for each section of the CMA exam. Study materials, review courses, and, if necessary, reexamination fees are examples of additional expenses. The candidate's location and membership status affect the CMA fees. The CMA designation provides access to more lucrative job options and increased earning potential in management accounting and finance, despite the fees being an investment.

#cma#cma course#cma exam#cma fees#cma eligibility#cma student#cma india#cma certification#cma syllabus

0 notes

Text

CMA In India

A distinguished credential for experts in cost accounting, financial management, and business strategy, the CMA (Cost Management Accounting) certification in India is granted by the Institute of Cost Accountants of India (ICMAI). The purpose of this certification is to provide people with knowledge of financial analysis, cost control, and strategic decision-making. Employers in a variety of industries, including industry, banking, and government, greatly value the CMA India qualification, which provides prospects for career progression in senior financial and managerial positions.

0 notes

Text

CMA In India

The Institute of Cost Accountants of India (ICAI) in India offers the esteemed CMA (Cost and Management Accountant) certification, which is concentrated on cost management, financial analysis, and strategic decision-making. Professionals who complete the program will have the necessary abilities to maximize corporate resources and enhance financial performance. Candidates must successfully complete three exam levels, practical training, and a required amount of work experience in order to earn the CMA certification. With its potential to provide insights that promote efficiency and profitability, CMAs are essential in a variety of industries, including manufacturing, services, and public organizations. Professionals who hold this qualification have better job opportunities and can make substantial contributions to the development of businesses.

#US CMA#US CMA COURSE#CMA INDIA#CMA ELIGIBILITY#CMA EXEMPTION#CMA EXAM#CMA FEES#CMA JOB#CMA SALARY#CMA STUDENT#CMA CERTIFICATION

0 notes

Text

youtube

🔴Known & Grown Ep-9: US CPA vs US CMA | Eligibility, Exam Structure, scope

✨Welcome to our channel! 🎉 Confused about CMA vs CPA? In this video, we dive deep into the world of professional accounting certifications, focusing on the CMA (Certified Management Accountant) and CPA (Certified Public Accountant) designations and the need to know to choose the right accounting certification for your career goals. We'll cover eligibility requirements, exam structure, and the professional scope of CPAs and CMAs.

To Find out more - https://fintram.com

#cpa vs. cma#cma vs cpa#cma usa vs cpa usa#cpa usa vs cma usa#cpa salary#cpa eligibility#cpa vs cma#eligibility#eligibility of cma usa#us cpa exam eligibility#us cpa course eligibility#cma exam eligibility#cma scope#cma eligibility#us cpa eligibility requirement#eligibility for cpa#cpa eligibility india#cpa eligibility criteria#scope of us cma in india#us cma online course#us cpa online classes#scope of us cpa#Youtube

0 notes

Text

US CMA Eligibility

To take the US CMA exam, you'll need to meet the following requirements:

Membership in IMA®.

Hold a bachelor's degree from an accredited college or university (except humanities) OR possess a professional accounting certification with at least two years of related experience.

Entrance into the CMA program.

Complete Part 1 and Part 2 of the CMA exam.

You can even give your exam if you are an undergraduate! With the IMA's flex option, you are allowed seven years to produce the degree upon completing two parts of the exam!

To know more, visit: https://bit.ly/3SyV7Qf

0 notes

Text

Building Your Credit Score Strategies for Qualifying for a CMA Loan

Learn how to enhance your credit score to qualify for a Cost Management Accountant Loan in India with ease.

If you're a Cost Management Accountant (CMA) looking to grow your practice or manage your finances better, securing a CMA loan can be a significant step forward. Know the Cost Management Accountant Loan Eligibility, However, qualifying for a CMA loan often hinges on having a good credit score.

Let’s dive into some effective strategies for building your credit score and improving your chances of qualifying for a CMA loan.

Understanding your credit score

First things first, understanding what your credit score is and how it’s calculated can give you a clearer picture of where you stand and what you need to improve. Your credit score is a three-digit number, usually ranging from 300 to 900, which reflects your creditworthiness. In India, the most commonly used credit score is provided by CIBIL

Your credit score is determined by several factors:

· Payment history: This includes your history of repayments on loans and credit cards. Late payments can significantly impact your score.

· Credit utilisation ratio: This is the ratio of your current credit card balances to your credit limits. Keeping this ratio below 30% is generally advisable.

· Credit mix: Having a mix of credit types, such as credit cards, personal loans, and home loans, can positively affect your score.

· Length of credit history: The longer your credit history, the better. It shows lenders your ability to manage credit over time.

· New credit enquiries: Too many credit applications in a short span can negatively impact your score.

Strategies to improve your credit score

Now that we understand what influences your credit score, let’s explore some practical steps to improve it.

1. Pay your bills on time

This might sound basic, but timely payment of your bills is crucial. Even one late payment can lower your credit score and stay on your credit report for up to seven years.

- Set reminders: Use reminders or automatic payments to ensure you never miss a due date.

- Prioritise payments: If money is tight, prioritise payments that impact your credit score the most, like loans and credit card bills.

2. Reduce your credit utilisation ratio

Maintaining a low credit utilisation ratio shows that you are responsible with your credit. Aim to keep your utilisation below 30%.

- Increase your credit limit: If your managing your credit well, request an increase in your credit limit. This can lower your utilisation ratio without affecting your spending habits.

- Pay off balances: Try to pay off your credit card balances in full each month. If that’s not possible, at least pay more than the minimum amount due.

3. Diversify your credit mix

A diverse credit mix can boost your credit score. If you only have credit cards, consider adding a different type of credit, such as a small personal loan.

- Use different credit types: A mix of credit cards, personal loans, and instalment loans can positively affect your score.

- Avoid opening too many accounts: While having different types of credit is good, opening too many new accounts in a short period can hurt your score.

4. Check your credit report regularly

Errors in your credit report can drag your score down. Regularly checking your report helps you spot and dispute any inaccuracies.

- Get your free report: You are entitled to a free credit report once a year from each of the credit bureaus. Use this opportunity to check your report for errors.

- Dispute inaccuracies: If you find any mistakes, dispute them with the credit bureau to get them corrected.

5. Limit new credit applications

Every time you apply for credit, it results in a hard inquiry on your credit report, which can lower your score temporarily.

- Apply only when necessary: Be selective about applying for new credit. Too many applications in a short period can be a red flag to lenders.

- Plan your applications: Space out your credit applications to avoid a significant drop in your score.

Personal Loan Guru CMA loan: A smart choice for Cost Management Accountant.

When it comes to financing options tailored for Cost Management Accountant, Personal Loan Guru CMA Loan stands out. Here’s why:

• Competitive interest rates: Personal Loan Guru offers attractive interest rates, making it an affordable option for CMAs.

• Smart tools: Use the CMA loan calculator to exactly estimate your EMI payments.

• Flexible repayment options: With flexible repayment tenures, you can choose a plan that best suits your financial situation.

• Quick approval and disbursal: The loan process is streamlined, ensuring quick approval and disbursal, so you can access funds when you need them most.

• No collateral required: This unsecured loan does not require you to pledge any assets, reducing the risk on your part.

Building a strong credit score is a journey, but with these strategies, you can enhance your creditworthiness and qualify for a CMA loan with ease. Whether your looking to expand your practice or manage personal finances, the right financial tools and knowledge can make a significant difference.

#Cost management accountant loan#cost management accountant loan delhi#Cost management accountant loan eligibility#Cost management accountant loan in india#cma loan#cma loan india#cma loan in india

0 notes

Text

📉 FAILED the US CMA Exam? Don’t worry – it’s a setback, not a stop sign. At FINAIM, we specialize in turning your disappointment into a comeback. 💪

💡 Here’s how you can PASS the US CMA Exam NEXT TIME with FINAIM:

✅ Smart Strategy – Know where you went wrong. We provide personalized performance reviews. ✅ Expert Mentorship – Learn from qualified CMA professionals who’ve walked your path. ✅ Global Resources – Get access to the most updated CMA USA study material & test series. ✅ Flexible Learning – Online + Offline sessions tailored to YOUR schedule. ✅ Proven Results – 1000s of students have already cracked CMA USA with FINAIM!

🎯 Whether you're a first-time test taker or reattempting, FINAIM is your ultimate guide to US CMA success.

📚 Join India’s most trusted institute for CMA USA coaching and let us help you build your financial future.

📲 DM us now or visit www.finaim.in to start your CMA journey with confidence.

Visit: https://finaim.in/ FINAIM ADDRESS: 3rd Floor, Phelps Building, 9 A, Block A, Connaught Place, New Delhi, Delhi 110001 PHONE NO: 087009 24049

#us cma eligibility#finaim#best us cma coaching in delhi#us cma course#us cma duration#us cma offline classes#us cma difficulty#us cma exam

0 notes

Text

https://justpaste.it/c0m0b

0 notes

Text

1 note

·

View note

Text

CMA Course for BCom Students – Step-by-Step Path

If you're doing BCom, the CMA course is a smart add-on. We guide you through registration, coaching, and exams. Understand the overlap with your existing subjects. Also learn how to manage both efficiently. Level up your academic and career prospects.

#cma course#cma course details#cma course duration#cma course fees#cma course syllabus#bachelor of commerce subjects#cma course details in india#bachelor of commerce honours#cma course fees in india#bcom with cma#cma coaching#cma classes#cma course in bangalore#cma course subjects#certified management accountant course#cma course eligibility

0 notes

Text

Professionals can pursue better employment options in financial management and management accounting by earning the US CMA (Certified Management Accountant) credential. It offers comprehensive expertise in strategic planning, financial analysis, and decision-making. Possessing a CMA certification positions people for leadership positions in multinational corporations and increases credibility, earning potential, and job stability. It also shows employers that an individual is knowledgeable about financial management.

#cma#us cma#cma course#cma exam#cma fees#cma eligibility#cma exemption#us cma certification#cma study

0 notes

Text

US CMA Exam

Candidates are put to the test on key management accounting and financial management skills in the demanding two-part US CMA (Certified Management Accountant) exam. The test is given by the Institute of Management Accountants (IMA) and assesses knowledge in areas like professional ethics, financial planning, analysis, control, and decision support. Part 2 discusses financial decision-making, including risk management and strategic planning, whereas Part 1 concentrates on financial reporting, planning, performance, and control. A high degree of skill is demonstrated by passing the US CMA exam, which also equips people for leadership positions in accounting and finance. For individuals hoping to obtain the esteemed CMA certification and progress in the international banking sector, passing the exam is a crucial first step.

#cma#us cma#cma course#us cma exam#cma fees#cma eligibility#cma exemptions#cma student#cma job#cma syllabus#us cma certification

0 notes

Text

US CMA Certification

Professionals with expertise in management accounting and financial management can obtain the internationally renowned US CMA (Certified Management Accountant) certification from the Institute of Management Accountants (IMA). Financial planning, performance, and control are the main topics of Part 1 of this certification, while financial decision-making, analysis, and risk management are covered in Part 2. The US CMA certification improves career prospects and creates chances for leadership roles in accounting, finance, and business management worldwide by demonstrating proficiency in strategic financial management.

0 notes

Text

What is a CMA course?

The Certified Management Accountant (CMA) course is a professional certification designed for individuals seeking expertise in management accounting and financial management. Administered by the Institute of Management Accountants (IMA), the CMA designation is globally recognized, signifying a high level of proficiency in financial planning, analysis, control, decision support, and professional ethics.

The CMA program is structured to equip candidates with a comprehensive skill set, covering areas such as financial planning, performance, and control. The course consists of two parts, each focusing on specific competencies. Part 1 delves into financial reporting, planning, performance, and control, while Part 2 focuses on financial decision-making. Candidates are required to pass both parts to attain the CMA designation.

One distinctive feature of the CMA course is its emphasis on real-world business applications. It goes beyond traditional accounting practices, incorporating strategic financial management and business analysis. This makes CMAs invaluable assets in corporate settings, where their insights contribute to effective decision-making and organizational success.

Moreover, the CMA designation is highly respected in the business and finance sectors, opening doors to diverse career opportunities globally. Professionals with a CMA designation often pursue roles in management accounting, financial analysis, strategic planning, and corporate finance. The CMA course thus serves as a pathway for individuals aspiring to excel in management accounting and make a meaningful impact in today's dynamic business environment.

#US CMA course in India#CMA review#CMA training#CMA training institute#CMA classes#CMA courses#CMA exam#US CMA eligibility#certified management accountant

2 notes

·

View notes