#CPA-Developed Program

Explore tagged Tumblr posts

Text

Professional Bookkeeping Certification

Professional Bookkeeping Certification" program, emphasizing its comprehensive coverage of bookkeeping skills, accounting concepts, and practical tools. It highlights the expanding and evolving nature of the bookkeeping profession, offering promising career opportunities. The program is developed by an experienced CPA, ensuring a strong foundation for aspiring bookkeepers.The bookkeeping subjects, providing real-world examples and a valuable case study.

#Professional Bookkeeping#Accounting Concepts#Expertise Development#Real-world Application#Career Advancement#Comprehensive Curriculum#Valuable Resources#CPA-Developed Program#High-Demand Profession#Skill Mastery

0 notes

Text

Best Courses to Study in Australia for Indian Students with High ROI.

Why Australia is a Top Study Abroad Destination in 2025

Australia continues to rank among the top destinations for Indian students seeking world-class education, global career opportunities, and a multicultural lifestyle. With over 100,000 Indian students currently studying in Australia, the trend is fueled by high employability, quality institutions, and welcoming immigration policies. This blog provides a complete study guide in Australia for Indian students, focusing on the top courses offering the highest return on investment (ROI) in 2025.

Top Reasons to Study in Australia for Indian Students

Globally ranked universities like the University of Melbourne, ANU, and UNSW

Post-study work visas for up to 4 years

Pathways to Permanent Residency (PR)

Industry-relevant, skill-based courses

High graduate employability

Scholarships and financial support for Indian students

High ROI Courses for Indian Students in Australia

1. Information Technology and Computer Science

Why It’s Worth It:

Booming tech industry in cities like Sydney and Melbourne

Strong demand for software developers, AI specialists, and cybersecurity analysts

Excellent PR pathways via the Skilled Occupation List (SOL)

Career Opportunities:

Software Developer

Cloud Engineer

Cybersecurity Analyst

Average Salary: AUD 70,000 – 120,000

2. Engineering (Civil, Mechanical, Electrical, Mining)

Why It’s Worth It:

High demand for engineers in infrastructure, renewable energy, and mining

PR-friendly occupations

Hands-on, accredited programs (Engineers Australia recognition)

Career Paths:

Civil Engineer

Structural Engineer

Renewable Energy Consultant

Average Salary: AUD 75,000 – 130,000

3. Health Sciences & Nursing

Why It’s Worth It:

Acute shortage of skilled healthcare workers

Strong employment growth projected until 2030

Offers direct PR routes for nursing graduates

Career Opportunities:

Registered Nurse

Public Health Officer

Physiotherapist

Average Salary: AUD 65,000 – 110,000

4. Business Analytics and Data Science

Why It’s Worth It:

High demand across sectors (banking, retail, healthcare)

Versatile career paths with global appeal

STEM classification supports extended post-study work visa

Career Options:

Data Analyst

Business Intelligence Consultant

Data Scientist

Average Salary: AUD 85,000 – 130,000

5. Accounting and Finance

Why It’s Worth It:

Consistent job demand across Australia

Accredited courses (CPA Australia, CA ANZ)

Opens doors to roles in multinational firms

Career Opportunities:

Chartered Accountant

Financial Analyst

Auditor

Average Salary: AUD 70,000 – 115,000

6. Education and Teaching

Why It’s Worth It:

Australia’s school system seeks qualified teachers, especially in regional areas

Included in the Medium and Long-term Strategic Skills List (MLTSSL)

Roles After Graduation:

Primary School Teacher

Early Childhood Educator

Secondary School Teacher

Average Salary: AUD 65,000 – 100,000

7. Architecture and Construction Management

Why It’s Worth It:

Australia’s urban expansion and infrastructure projects

Recognized qualifications with global applicability

Popular Careers:

Architect

Project Manager

Construction Estimator

Average Salary: AUD 70,000 – 120,000

Cost of Education in Australia (2025)

Course Type

Average Annual Tuition (AUD)

UG Courses

20,000 – 45,000

PG Courses

22,000 – 50,000

MBA

40,000 – 80,000

Scholarships Available for Indian Students

Australia Awards Scholarships – Fully funded by the Australian government

Destination Australia Scholarships – Regional study scholarships worth AUD 15,000

University-Specific Grants – E.g., Monash International Merit Scholarship, University of Sydney International Scholarships

Post-Study Work Rights and PR Pathways

Australia allows international students to work up to 20 hours per week during semesters and full-time during breaks. Graduates can apply for a Temporary Graduate visa (subclass 485), offering work rights for 2–4 years depending on qualification and location.

PR Pathways via:

General Skilled Migration (GSM)

Employer-Sponsored Visas

Regional Migration Programs

How Eduvisor Can Help You Study in Australia

Navigating the Australian education system, choosing the right course, and applying for visas can be overwhelming. That’s where Eduvisor, a trusted study abroad consultant in India, steps in. Eduvisor offers personalized counseling, university shortlisting, scholarship assistance, SOP writing, and complete visa support — tailored for Indian students planning to study in Australia.

Final Thoughts

Choosing a high-ROI course in Australia is more than just picking a subject — it’s about aligning your passion with global trends. With the right guidance and planning, Australia can be your gateway to a successful international career. Use this study guide in Australia for Indian students as your blueprint for 2025 and beyond.

Ready to begin your journey? Let Eduvisor turn your study abroad dream into reality.

FAQs

Q1. What are the most affordable courses to study in Australia? A: Vocational Education & Training (VET) courses, TAFE programs, and regional university degrees are often more budget-friendly.

Q2. Is PR easy after studying in Australia? A: Courses on the SOL and MLTSSL lists (like IT, Nursing, Engineering) make it easier to qualify for PR.

Q3. How do I find scholarships to study in Australia? A: Government sites, university portals, and expert consultants like Eduvisor can help you explore scholarships based on merit, need, and region.

2 notes

·

View notes

Text

B.com vs BBA

Certainly! Let's delve deeper into the comparison between B.Com and BBA:

1. Core Subjects:

B.Com: The curriculum typically revolves around core subjects like accounting, economics, finance, and business law. Students gain a comprehensive understanding of financial principles, taxation, auditing, and commercial laws.

BBA: This program covers a wider spectrum of subjects including management principles, marketing, human resource management, organizational behavior, operations management, and business ethics. It offers a holistic view of various aspects of business administration.

2. Skill Development:

B.Com: Emphasizes on analytical and numerical skills required for roles such as financial analysts, accountants, auditors, and tax consultants. It enhances proficiency in areas like financial reporting, analysis, and auditing techniques.

BBA: Focuses on developing managerial and leadership skills necessary for supervisory and executive roles. Students learn strategic decision-making, communication, teamwork, problem-solving, and project management skills which are essential for managerial positions.

3. Career Trajectory:

BCom: Graduates often pursue careers in accounting firms, financial institutions, banking sector, taxation departments, and corporate finance departments. They may work as accountants, auditors, tax consultants, financial analysts, or investment bankers.

BBA: Opens up opportunities in various sectors including marketing, sales, human resources, operations, consulting, and entrepreneurship. Graduates can work as marketing managers, HR specialists, operations managers, business consultants, or start their own ventures.

4. Industry Focus:

B.Com: Primarily caters to industries related to finance, accounting, banking, insurance, and taxation. It prepares students for roles in financial management, auditing, taxation, and corporate finance.

BBA: Offers a broader perspective and is applicable across industries including retail, manufacturing, IT, healthcare, hospitality, and consulting. It equips students with versatile skills needed to navigate diverse business environments.

5. Further Education:

B.Com: Provides a strong foundation for pursuing advanced degrees such as Master of Commerce (MCom), Chartered Accountancy (CA), Certified Public Accountant (CPA), or Master of Business Administration (MBA) with a specialization in finance or accounting.

BBA: Acts as a stepping stone for postgraduate studies like MBA or specialized master's programs in areas such as marketing, human resources, operations management, or international business.

In summary, while B.Com focuses more on finance and commerce-related disciplines, BBA offers a broader understanding of business administration and management principles. Your choice should align with your interests, career aspirations, and the specific skills you aim to develop.

#education#bba colleges#bba vs bcom#bba course#bcom course#ranveer singh#old bollywood#priyanka chopra#shah rukh khan#star wars

3 notes

·

View notes

Text

Mobile App Marketing | SSTech System

App marketing is the process of promoting and increasing awareness of your mobile application, aiming to attract more users for downloads and usage. This encompasses employing an effective mobile app launch strategy.

It enhances the app’s visibility and attractiveness to users. This can include things like making sure the mobile app design is appealing and that it shows up in app stores when people search for related keywords.

This involves partnering with influencers, encouraging user sharing, running ads, maintaining an active social media presence, and monitoring app performance for necessary improvements. Essentially, app marketing is about making sure the right people know about the app and want to use it.

Best app marketing tactics

App developers and marketers must employ innovative and proven marketing tactics. Let’s unveil the top 10 app marketing strategies that are essential for success in 2024.

Optimize app store listings with ASO (App Store Optimization):

Optimizing App Store Listings with ASO (App Store Optimization) is a fundamental strategy. It ensures the discoverability and visibility of your mobile app in the crowded app marketplace. It begins with conducting comprehensive keyword research to unearth the most relevant and high-traffic keywords related to your app’s niche, target audience, and core features.

Additionally, incorporate user search terms strategically into your app’s title, description, and metadata to improve its visibility in relevant search results and enhance its overall ranking in app store algorithms.

Implement influencer marketing campaigns:

Implementing influencer marketing boosts awareness and app downloads. Partnering with niche influencers leverages their credibility and audience to expand your app’s reach. Carefully selecting influencers aligned with your target market ensures maximum impact, engagement, and conversions.

Unlock the potential of content created by users (UGC):

Encouraging user participation and content creation can significantly amplify your app’s visibility and credibility in the market. By prompting users to share reviews, testimonials, and social media posts related to your app, you tap into authentic user experiences that resonate with potential users.

Showcase this User-generated Content (UGC) across various platforms, including your app’s website, social media channels, and marketing materials, to extend its reach and impact. Additionally, running contests and giveaways can incentivize users to generate more content, fostering a sense of community and loyalty among your user base.

Leverage app store ads and paid acquisition channels:

Invest in app store ads like Apple Search Ads and Google Ads to enhance your app’s visibility and downloads in a competitive market. Target users actively searching for similar apps, increasing conversion chances. Explore additional paid channels like social media ads and influencer sponsorships to expand reach beyond the app store. Continuously optimize campaigns based on metrics like CPA and ROAS for efficient budget utilization.

Utilize app referral programs:

A referral program drives user-driven growth by rewarding both referrers and new users with incentives like discounts or premium features. Social sharing and personalized referral links simplify the process, amplifying the program’s impact.

Engage with your audience through social media:

Establishing a strong presence on popular social media platforms allows you to connect with your target audience and foster engagement. By sharing engaging content such as app updates, behind-the-scenes peeks, and user stories, you keep your audience informed and entertained while reinforcing your brand identity. Actively engaging with users by responding to comments, messages, and mentions demonstrates your commitment to customer satisfaction and cultivates a loyal and engaged user base.

Optimize for app store ratings and reviews:

Encouraging satisfied users to leave positive ratings and reviews on the app stores enhances your app’s visibility and credibility. Prompting users within the app and through targeted email campaigns can help boost the number of reviews.

Monitoring app store reviews regularly and responding promptly to user feedback demonstrates your responsiveness and commitment to user satisfaction. Utilizing feedback from reviews to identify areas for improvement helps enhance the overall user experience and drive long-term app success.

Implement app deep linking and retargeting:

Using deep linking enhances user engagement by creating personalized app experiences and directing users to specific content or features.

Retargeting campaigns, targeting inactive users who installed your app, maximize conversion opportunities. Tailoring messages and offers based on user behavior boosts the effectiveness of your retargeting efforts.

Partner with complementary apps and brands:

Identifying complementary apps and brands with a similar target audience presents opportunities for strategic collaboration. You can also leverage social media marketing to reach out to the right people.

Collaborate on marketing initiatives like cross-promotion and co-branded campaigns to leverage each other’s resources and audiences for mutual benefit. Utilize partner app and brand credibility to enhance your marketing impact and strengthen your market position.

Track and analyze key metrics:

Utilizing analytics tools allows you to track key performance indicators (KPIs) and gain insights into your app’s performance and user behavior. Monitoring app downloads, user engagement, retention rate, and in-app purchases provide valuable data for optimizing your marketing strategies.

Analyzing conversion funnels helps identify drop-off points and optimize user onboarding and retention strategies accordingly, driving long-term app success. Continuously iterating and refining your mobile app marketing tactics based on data-driven insights ensures that you stay ahead of the curve and achieve your marketing objectives effectively.

Final words

Mastering mobile app marketing is essential for success in today’s competitive digital landscape. By implementing a combination of effective strategies such as app store optimization, influencer collaborations, user engagement initiatives, and data-driven optimization, developers can increase their app’s visibility, attract more users, and ultimately drive long-term success.

Tags:

App Marketing Strategies

Mobile App Marketing

Mobile Application Development

SSTech System

#App Marketing Strategies#Mobile App Marketing#Mobile Application Development#sstech system#mobile apps Development#website development#business news

2 notes

·

View notes

Text

What Is The Trend Among Indian CFA Applicants?

The number of Indian candidates applying for the Chartered Financial Analyst cfa level 1 exams has increased, which can only be described as an emerging trend.

Right now, India positions third with the most number of competitors taking the test. In June 2022, the cfa institute reported that 14,776 candidates appeared from India, China, and the United States. The worldwide number was 71,914.

CFA test in India

Specialists in the business accept that the pattern is a consequence of the development found in the Indian economy. The nation has turned into a trustworthy speculation objective guaranteeing an expansion in venture experts.

The CFA Sanction expects contender to breeze through three test levels, have a work insight of something like four years in ventures, and focus on the set of principles in proficient lead. Following this, competitors are supposed to apply to a CFA Foundation Society and become an individual from the famous CFA Establishment.

The program educational plan tests abilities and information expected in the venture business. Considering that the worldwide market is changing at an exceptional speed, the CFA test guarantees premium expert lead, moral norms, and global fiscal summary examination. The Level I test especially tests competitors on their capacity to associate their hypothetical comprehension with training. They must demonstrate their capacity for real-time analysis of the investment industry. Other significant ideas incorporate corporate money, abundance the executives, portfolio examination, protections investigation and valuation, financial aspects and quantitative techniques.

Candidates typically need more than three years to successfully complete the CFA Program. Each of the three levels requires determination and a commitment to at least 300 hours of study.

The CFA tests are held across the world in excess of 70 urban communities in December and north of 170 urban areas in the long stretch of June. Test centers are assigned to candidates based on where they prefer to be.

India’s metropolitan areas of New Delhi, Bengaluru, Mumbai, and Kolkata saw the greatest number of Level 1 test takers in 2022.

IndigoLearn is among the global leaders in international training for CPA, CFA,CMA, ACCA, Data Science & Analytics. It has helped over 500,000 professionals across the globe. With IndigoLearn, 9 out of 10 students pass their exams.

Article Source: cfa preparation

#cfa level 1#cfa institute#cfa institute india#cfa program#cfa qualifications#cfa level 1 cost#cfa preparation#cfa online

2 notes

·

View notes

Text

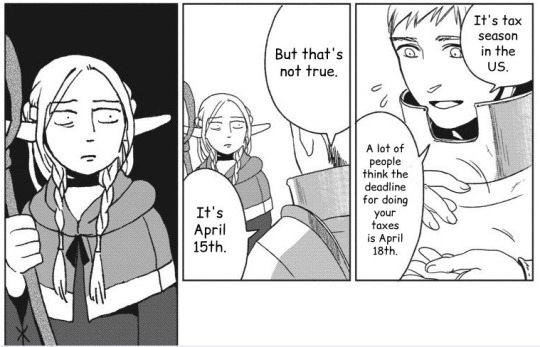

The link in the reblog above is only about Free File and doesn't actually include all of the free filing options available!

In addition to Free File (which you have to go through the links on the IRS website to get, you will not find the free file options on the websites of TurboTax and other software developers) there are...

Direct File! The IRS's very own software for filing your taxes. Limited in what it can handle and which states it's available in.

VITA and TCE! The Volunteer Income Tax Assistance and Tax Counselling for the Elderly programs. Volunteers certified by the IRS do your taxes for you for free. This is a great option if doing your own taxes is scary and overwhelming, or if you have back taxes you need done (you as an individual cannot e-file your back taxes but these programs can). There is a quality review system in place so returns that are done through this program get at least two people looking them over.

Also, if you do plan on going to someone to get your taxes done, make sure it's a place headed by either a CPA (certified public accountant) or EA (enrolled agent). Both of those credentials mean that the person is knowledgeable in tax matters and can help you deal with the IRS if issues pop up, and they are both held to certain ethical and professional standards. While lesser known, the EA credential is actually a tax specific one, and an EA is going to be just as much if not more informed about taxes and taxation as a CPA.

144K notes

·

View notes

Link

0 notes

Text

Enhance Your Career With Payroll Training Courses

If you're a payroll professional, business owner, or aspiring payroll administrator, you already know how crucial payroll is to any organization's success. From ensuring employees are paid correctly to maintaining compliance with complex tax laws, payroll is the backbone of every business. But in this dynamic and evolving field, staying up-to-date is essential.

Payroll training courses, seminars, webinars, and certification programs are perfect opportunities to deepen your expertise, streamline your processes, and grow your career. This guide explores the different types of payroll training available, the benefits they bring, and how they can help you take your career to the next level.

Payroll Seminars and Webinars

Payroll seminars and webinars offer structured learning experiences led by industry experts. These events are designed to provide the latest insights, tools, and strategies in payroll management.

Payroll Seminars

Seminars are typically in-person sessions, offering hands-on, interactive learning. These are excellent for networking with peers and industry leaders. They often cover niche topics like payroll reconciliations, payroll tax strategies, and compliance updates.

Payroll Webinars

Webinars are live, virtual training sessions that bring the convenience of learning from home. They’re equally effective, covering topics such as payroll management best practices, navigating software updates, or understanding payroll legislation changes. Many webinars also include Q&A sections, allowing attendees to engage directly with experts.

Both formats are ideal for individuals who thrive in guided environments while staying current with payroll trends.

Benefits of Online Payroll Training

For those looking for education on their own schedule, online payroll training courses are the perfect alternative. Here’s why they’re so popular:

Flexibility

Online courses allow you to learn at your own pace. Whether you’re a full-time payroll professional or a busy small business owner, you can fit learning into your schedule.

Access to Expert Knowledge

Many online courses are developed by industry leaders and Certified Payroll Administrators (CPA), giving you access to top-tier expertise.

Cost-Effectiveness

Because they eliminate travel and venue costs, online courses are generally more affordable than in-person training while providing the same quality of education.

Wide Range of Topics

From payroll reconciliations and tax compliance to advanced payroll management strategies, online courses cover all areas of payroll expertise.

Understanding the Certified Payroll Administrator Designation

If you’re serious about advancing your payroll career, obtaining the Certified Payroll Administrator (CPA) designation can distinguish you as an expert in the field.

The CPA certification demonstrates your proficiency in payroll systems, regulations, tax compliance, and management. Employers value this qualification because it shows you're not only experienced but also dedicated to ongoing professional growth. Achieving CPA status can also boost your earning potential and open doors to leadership roles in payroll.

Key Topics Covered in Payroll Training

Payroll training courses are designed to provide a comprehensive understanding of essential payroll practices. Here are a few core topics typically covered:

Payroll Tax Compliance

Understanding payroll tax rules is crucial for any payroll professional. Training courses can help you:

Stay updated on federal, state, and local payroll tax laws.

Learn how to calculate, withhold, and remit payroll taxes accurately.

Avoid costly penalties by ensuring full tax compliance.

The training doesn’t just deepen your knowledge but also makes compliance less daunting.

Payroll Reconciliations

Payroll reconciliations are essential for ensuring your payroll records match actual financial transactions. Training on this topic helps you:

Identify discrepancies in payroll reports.

Correct errors before they impact employees or tax filings.

Gain confidence in reconciling payroll accounts for audits or internal reviews.

Payroll Management Best Practices

Streamlined payroll processes are critical for organizational efficiency. Courses on payroll management will show you:

Strategies for organizing payroll schedules and deadlines.

Best practices for using payroll software and tools.

Tips to enhance both accuracy and employee satisfaction.

Whether you're managing payroll for a small business or a large company, these skills are invaluable.

Choosing the Right Payroll Training Course

There are many payroll training options, so how do you choose the right one? Consider these factors:

Your Career Goals

Are you looking to specialize in payroll tax compliance, advance to a managerial role, or earn CPA certification? Choose courses aligned with these goals.

Instructor Expertise

Look for courses led by experienced payroll professionals or certified instructors.

Format

Whether you prefer in-person seminars, live webinars, or self-paced online courses, select the format that suits your learning preferences.

Reviews and Recommendations

Check reviews from past participants to gauge course quality. Recommendations from colleagues can also be helpful.

Certification Opportunities

Opt for courses that offer certifications or continuing education credits to enhance your resume.

Additionally, many training organizations offer free resources or introductory sessions, so take advantage of these to ensure the course is a good fit.

Advancing Your Payroll Career with Training

Investing in payroll training is one of the smartest moves you can make for your career or business. Whether you’re learning the basics or mastering advanced strategies, these courses provide the skills you need to excel.

From gaining expertise in payroll reconciliations and tax compliance to achieving the Certified Payroll Administrator designation, each step brings you closer to becoming a leader in the field.

Don’t wait to advance your payroll career. Explore available payroll training courses today and equip yourself with the knowledge and tools needed to succeed in this critical industry.

0 notes

Text

Shaping Future Business Leaders with BBA and BBA International Business

If you’re aiming to build a career in management, entrepreneurship, or the global business landscape, a Bachelor of Business Administration (BBA) offers the right launchpad. At DES Pune University, the BBA programs are designed to nurture critical thinking, leadership, and practical business skills to prepare students for the dynamic corporate world.

Comprehensive Business Education at DES Pune University

Recognized as one of the leading options for business studies in Pune, DES Pune University offers two flagship undergraduate programs:

BBA (Bachelor of Business Administration)

BBA in International Business

Both courses focus on developing a strong foundation in management principles, communication, and business analytics.

Who Should Consider BBA and BBA International Business?

Students who want to develop leadership and organizational skills

Individuals aiming for a career in marketing, finance, human resources, or operations

Aspirants looking for exposure to global business practices and international trade (especially for the International Business specialization)

Those who seek a degree with good employability and opportunities for further study like MBA

Course Details and Eligibility

Duration: 3 to 4 years

Minimum Eligibility: 50% aggregate in 10+2 from a recognized board

Total Fees:

BBA – Approximately ₹2.91 lakhs

BBA International Business – Approximately ₹2.70 lakhs

The programs combine classroom learning with case studies, presentations, internships, and industry visits.

What You Learn: Curriculum Highlights

Both programs cover core business subjects such as:

Principles of Management

Financial Accounting and Analysis

Marketing Fundamentals

Organizational Behavior

Business Communication

The BBA in International Business adds specializations in:

International Trade Policies

Global Marketing Strategies

Cross-Cultural Management

Export-Import Procedures

This gives students a competitive edge for multinational corporations and global supply chain roles.

Career Opportunities After Graduation

Graduates of these programs can explore varied career paths in sectors like banking, consulting, retail, FMCG, and international trade. Some popular roles include:

Business Analyst

Marketing Executive

Financial Consultant

International Trade Specialist

HR Manager

The comprehensive curriculum ensures students graduate with the skills necessary to adapt to fast-changing business environments.

Why Study Business in Pune?

Pune is not only an educational hub but also a growing commercial center with numerous startups, multinational companies, and business incubators. This makes it an ideal city for BBA students to get internships, industry exposure, and networking opportunities.

Academic Excellence and Support at DES Pune University

DES Pune University emphasizes a student-centric approach with:

Experienced faculty members

Regular industry interactions and guest lectures

Access to business labs and e-resources

Career guidance and placement assistance

These elements ensure students develop both theoretical knowledge and practical skills.

Next Steps After BBA or BBA International Business

After graduation, many students choose to:

Pursue an MBA or specialized master’s degree

Join corporate leadership development programs

Start entrepreneurial ventures

Gain professional certifications (like CFA, CPA, or digital marketing)

For those aiming for integrated learning, DES Pune University also offers a 5-year Integrated MBA program which blends undergraduate and postgraduate studies.

Key Takeaways

BBA programs build essential business and leadership skills.

The International Business specialization prepares students for global commerce careers.

DES Pune University provides a supportive environment with quality teaching and industry connections.

Pune’s thriving business ecosystem enhances learning and job prospects.

Explore the BBA and BBA International Business programs at DES Pune University to start your journey toward becoming a global business leader.

0 notes

Text

Top Courses to Study in Australia for a Successful Career

Australia is one of the most popular study destinations in the world, known for its high-quality education, vibrant multicultural society, and excellent post-study work opportunities. For international students aiming to build a successful career, choosing the right course is crucial. Australia offers a diverse range of programs that align with global job market demands, technological advancements, and economic growth sectors.

Below are some of the top courses to study in Australia that can lead to rewarding and in-demand careers.

1. Nursing and Healthcare

Australia has a growing need for healthcare professionals due to its aging population and expanding medical infrastructure. Nursing is one of the most sought-after professions in the country.

Why choose this field?

High job demand across all states

Opportunities in public and private healthcare sectors

Pathways to permanent residency (PR)

Top Universities:

University of Sydney

Monash University

University of Queensland

2. Information Technology (IT) and Computer Science

Australia’s tech industry is expanding rapidly, and professionals in cybersecurity, data science, software engineering, and AI are highly sought after.

Why choose this field?

Competitive salaries and strong job prospects

Access to global tech hubs

Opportunities to work in start-ups or major corporations

Top Universities:

Australian National University

University of Melbourne

University of New South Wales (UNSW)

3. Engineering

Engineering remains a cornerstone of the Australian economy. Specializations like civil, mechanical, electrical, and mining engineering are particularly in demand.

Why choose this field?

Strong industrial base and infrastructure development

Consistent demand across the country

Accredited courses by Engineers Australia

Top Universities:

University of Adelaide

University of Queensland

RMIT University

4. Business and Management

Business degrees are versatile and globally recognized. Specializations such as international business, finance, marketing, and human resource management are popular among students.

Why choose this field?

Applicable across multiple industries

Offers entrepreneurship and leadership training

Networking opportunities with global firms

Top Universities:

University of Melbourne (Melbourne Business School)

Macquarie University

University of Sydney

5. Education and Teaching

There is a growing need for qualified teachers in Australia, especially in early childhood, primary, and special education.

Why choose this field?

Pathway to PR through skill shortage roles

Impactful and fulfilling career

High employment rate in both urban and regional areas

Top Universities:

Deakin University

University of Canberra

Queensland University of Technology

6. Accounting and Finance

Accounting is consistently listed on Australia’s skilled occupation lists. Students pursuing CPA, CA, or ACCA certifications find ample job opportunities in both the public and private sectors.

Why choose this field?

Clear PR pathways

Excellent pay and career progression

Demand for compliance and advisory professionals

Top Universities:

University of New South Wales (UNSW)

University of Western Australia

Griffith University

7. Hospitality and Tourism Management

Australia is a leading travel destination, and the hospitality and tourism industry is a major contributor to its economy.

Why choose this field?

Hands-on learning with industry internships

Global job opportunities in hotels, resorts, airlines, and event management

Strong demand in urban and regional areas

Top Universities:

Blue Mountains International Hotel Management School

Le Cordon Bleu Australia

Southern Cross University

8. Environmental Science and Sustainability

With growing awareness around climate change, Australia is investing heavily in environmental research and sustainable development.

Why choose this field?

Rising demand for environmental consultants and researchers

Opportunities in government, NGOs, and corporations

Contribution to global ecological impact

Top Universities:

University of Tasmania

James Cook University

University of Queensland

Conclusion

Australia offers a wide array of high-quality courses designed to meet global employment trends. Choosing a program aligned with your career goals, interests, and Australia’s skilled occupation list can not only enhance your learning experience but also improve your chances of long-term career success and immigration opportunities.

Need help choosing the right course or university in Australia? Let me know — I can guide you through the best options tailored to your profile.

0 notes

Text

Career in Financial Management

A career in Finance is exciting and promising, and usually very lucrative. It attracts young people who are hugely ambitious and those also having an inclination for Economics, Accounting and the ability to quickly and intuitively grasp and process complex financial concepts and data. Financial Management is about how to most efficiently use organizational funds, whether in a business set-up, non-profit agency or government entity. Poddar Business School, one of the top Business Schools in Rajasthan, conducts best PGDM program comprising Finance as one of the specialization.

Accounting and Tax Financial Careers

Accountants and Auditors

Accountants and auditors analyze their company’s finances and prepare financial documents. Within a financial organization, there may be specific titles, such as junior accountant, senior accountant, auditor, and tax accountant.

Junior accountants focus on balancing accounts and preparing reports. Senior accountants may need a master’s degree or a certified public accountant (CPA) license, and they assist in analyzing and maintaining the company’s financial health, in addition to being supervisors to junior accountants.

Auditors are primarily in charge of tracking accounts and seeing that they are recorded accurately. An auditor must also prepare financial statements, such as balance sheets and audits, and ensure that all operations and documentation meet legal and financial regulatory standards.

Tax accountants prepare client tax documents and ensure all tax filings follow local, state, and federal tax regulations. Preparing tax reports, solving issues and errors with filings, and finding areas where money can be (legally) saved are all duties of tax accountants.

Financial Manager and Controller

Financial Managers work in many different areas and industries, including investment firms, banks, and insurance companies. They primarily handle the creation of financial reports and the development of long-term financial plans for an organization. Another type of Financial Manager is the Financial Controller or comptroller. Controllers are the highest ranked person on an accounting team, outside of the chief financial officer. The controller ensures that the company stays in good financial health and oversees the work the rest of the accounting team does.

Financial Analyst

Financial Analysts interpret financial statements and forecast the company’s future financial performance. In addition, analysts compare current financial situations to the initial plans laid out by a Financial Manager or chief financial officer and assist in creating reports to help the company stay on track with its strategy based on market conditions.

Budget Analyst

A Budget Analyst, sometimes called a cost analyst, looks at the company’s budget and determines ways to make or keep the budget efficient. Budget analysts also help maintain records and decide if funds need to be allocated differently.

Chief Financial Officer

Chief Financial Officers (CFOs) are the top-ranked person in a company in regard to the organization’s finances. A CFO has two main roles: overseeing all financial activities within the company, as well as the accounting team members, and being an adviser to the other C-suite executives.

In PGDM program of Poddar Business School the modules covered in Finance as elective are: Management of Financial Service, Security Analysis and Portfolio Management, Financial Derivatives, Mergers, Acquisitions and Restructuring, Financial Risk Management and Financial Systems, Institutions and Instruments.

0 notes

Text

Top Paying Programs for Affiliate Marketing India

Affiliate marketing India has emerged as one of the most effective ways to earn money online without creating your own product. By promoting other brands and earning a commission for each sale or lead, individuals in India are increasingly tapping into this income stream.

The popularity of affiliate marketing India has skyrocketed in recent years thanks to increased digital adoption and growing e-commerce activity. In this blog, we explore the top paying affiliate programs in India and guide you on how to make smart choices that match your niche and goals.

2. Why Affiliate Marketing Is Growing in India

India’s digital transformation has played a crucial role in driving the growth of affiliate marketing India. Here’s why more Indians are turning to affiliate income:

Expanding internet access: With over 800 million internet users, more people are browsing, buying, and consuming content online.

E-commerce boom: Platforms like Amazon, Flipkart, and niche online stores offer affiliate partnerships to tap into India's growing customer base.

Influencer economy: Bloggers, YouTubers, and Instagram creators are monetizing their content through affiliate partnerships.

This evolution makes affiliate marketing a practical side hustle — or even a full-time gig — for tech-savvy Indians.

3. Tips for Selecting the Best Affiliate Program

Not all affiliate programs are created equal. Consider these essential factors before you sign up:

Commission Structure: Check if it's flat-rate, percentage-based, or recurring. High-ticket products often bring in more income.

Product Relevance: Choose products or services aligned with your content or audience’s interests.

Payment Method & Frequency: Ensure the program pays in INR and supports common methods like bank transfer or PayPal.

Credibility of the Program: Stick with programs that have transparent tracking systems and solid reviews.

Choosing the right match can increase your income and foster lasting trust with your audience.

4. Top Highest-Paying Affiliate Marketing Programs in India

Check out this handpicked selection of top affiliate programs tailored just for Indian marketers:

1. Amazon Associates India

Overview: The largest affiliate program in India.

Commission: Ranges from 0.2% to 10%, depending on the category.

Why It Works: Wide product range and strong consumer trust. Ideal for bloggers and review websites.

2. Flipkart Affiliate Program

Overview: India's e-commerce giant offers commissions up to 12%.

Commission: Varies by product category.

Why It Works: Preferred platform for many Indian consumers; effective during festive sales.

3. vCommission

Overview: India’s leading affiliate network with brands across e-commerce, finance, and travel.

Commission: Competitive CPA and CPS rates; weekly payouts.

Why It Works: Includes both Indian and global offers. Perfect for performance marketers.

4. Admitad India

Overview: Offers affiliate access to brands like Tata Cliq, AliExpress, and Myntra.

Commission: High payouts, performance bonuses.

Why It Works: Deep-linking tools, real-time analytics, browser extensions for easy promotion.

5. BigRock Affiliate Program

Overview: Indian domain & hosting provider.

Commission: Up to ₹10,000 per referral.

Why It Works: Perfect for tech bloggers, YouTubers, and web developers.

6. HostGator India Affiliate

Overview: Web hosting services.

Commission: Starts from ₹1,250 per sale.

Why It Works: Recurring commissions and niche appeal for creators in digital tech.

7. Coursera / Udemy via CJ or Impact

Overview: Promote online courses through platforms like Commission Junction or Impact.

Commission: 10% to 45% based on course and platform.

Why It Works: Education is a growing niche in India; good conversions from career-focused traffic.

8. Adsplay International (CPL & CPA Offers)

Overview: Indian affiliate network for lead-based and action-based models.

Commission: Varies depending on the offer (CPL/CPA).

Why It Works: Personalized support for Indian publishers, payout flexibility, and regional campaigns.

5. Tips to Maximize Affiliate Income in India

Once you’ve joined a program, here’s how to get the most out of it:

Focus on a Niche: Whether it’s fashion, finance, or tech — build content that aligns with a specific audience.

SEO is Key: Optimize your blog or YouTube content to rank on search engines for long-term passive traffic.

Promote with Purpose: Don’t just drop links — provide honest reviews, how-to guides, and tutorials.

Use Analytics: Platforms like Google Analytics and affiliate dashboards help track what’s converting.

Leverage Regional Content: Consider Hindi or local languages to reach a wider Indian audience.

6. Common Mistakes to Avoid

Affiliate marketing success depends on avoiding these common pitfalls:

Promoting Unrelated Products: This hurts credibility and conversions.

Ignoring Mobile Optimization: Most Indian traffic is mobile — ensure your links and pages are mobile-friendly.

Violating Program Policies: Always read the fine print to avoid being banned.

Spamming Links: Quality content beats excessive linking.

7. Final Thoughts

Affiliate marketing India presents a growing opportunity for those willing to learn, experiment, and stay consistent. With a wide variety of high-paying programs and accessible tools, it’s possible to build a solid online income stream.

Start small by selecting one or two affiliate programs from this list and begin creating content around them. Over time, as you understand your audience better, you can scale your affiliate income and turn it into a long-term revenue channel.

Read More:- How to Choose the Right CPA Ad Network for Your Campaigns

#app advertising#affiliate marketing websites in india#affiliate marketing programs in india#affiliate network india#affiliate marketing india#affiliate programs india#affiliate marketing sites in india#affiliate marketing network#best affiliate marketing websites in india#affiliate marketing for beginners#affiliate platform#affiliate commission#affiliate marketing companies in india#cpa network#cpa marketing website#high paying affiliate programs in india

0 notes

Text

How the 45L Energy Tax Credit Rewards Sustainable Construction

You work hard to build energy-efficient homes. You invest in better materials, insulation, and systems. You should know that the government rewards your efforts.

The 45L energy tax credit provides direct financial benefits for sustainable homebuilders. You can receive up to $5,000 per qualified unit. You can reduce your tax liability while building a better future.

You can build smarter and save more. You just need to meet the right standards and follow the right steps.

What Is the Purpose of the 45L Energy Tax Credit?

You receive the 45L credit for constructing homes that meet energy-saving benchmarks. You must build in the United States. You must place the unit in service during the tax year.

You help the environment. You reduce utility costs for buyers. You receive tax savings as a result.

You can apply the credit to:

Single-family homes

Low-rise and multi-family buildings

Mixed-use developments with qualified residential units

You can build sustainably and still protect your bottom line.

How Does the Credit Promote Sustainable Building?

You receive the credit only when you meet high-efficiency standards. You must comply with:

ENERGY STAR certification

Zero Energy Ready Home (ZERH) program guidelines

Minimum requirements for insulation, HVAC, and air sealing

You adopt efficient designs and technologies. You reduce the home's energy consumption by over 50% compared to baseline models.

You receive rewards only when you raise the quality of your construction practices.

Who Is Eligible for the 45L Credit?

You qualify as a homebuilder, contractor, or developer. You must own the unit when it is placed in service. You must build new or substantially reconstructed homes.

You must also complete third-party testing. You cannot claim the credit without official certification.

You benefit whether you sell or lease the home. You qualify once the unit is complete and ready for occupancy.

What Are the Updated Credit Amounts?

You should know that the Inflation Reduction Act of 2022 changed the value of the credit.

You now receive:

$2,500 per unit for ENERGY STAR certified homes

$5,000 per unit for Zero Energy Ready homes

You can also claim these amounts for multi-family properties. You must follow prevailing wage guidelines to receive the full credit.

You should track wage compliance if you develop apartment complexes or townhome projects.

How Can You Plan for Certification?

You must engage a certified HERS rater. You should plan testing early. You must pass all required inspections.

You should take the following steps:

Meet with your energy rater during design

Select materials that meet ENERGY STAR or ZERH specs

Conduct blower door and duct leakage tests

Keep detailed records and rating certificates

You cannot qualify without third-party confirmation. You must follow every step with precision.

Why Does the Credit Matter for the Housing Market?

You reduce long-term energy costs for buyers. You create healthier indoor environments. You support national clean energy goals.

You also attract eco-conscious homebuyers. You increase the resale value of your properties.

You gain a financial return today while building homes for the future.

Can You Claim the Credit on Multi-Family Projects?

You can claim the 45L energy tax credit for each qualifying unit in your development. You can apply it to apartment buildings, duplexes, or townhomes.

You must:

Meet ENERGY STAR or ZERH standards

Follow prevailing wage rules for higher credit levels

Complete individual certification per unit

You can claim the full amount if you follow labor requirements. You reduce your tax bill while improving energy performance across entire complexes.

You should consult your CPA to determine your total eligible amount.

How Do You File the Credit?

You must use IRS Form 8908. You include this form with your annual return. You must provide documentation for every claimed unit.

You must keep:

Certification reports from energy raters

Signed compliance certificates

Unit addresses and placed-in-service dates

Evidence of ownership

You must maintain these records for future audits. You should also include wage compliance records for multi-family projects.

You can also amend past returns if you missed the credit in previous years.

What Mistakes Should You Avoid?

You should avoid these common errors:

Missing the certification deadline

Skipping required inspections

Using ineligible HVAC or insulation products

Filing without documentation

You must stay organized. You must work closely with certified professionals. You must follow IRS rules to the letter.

You can lose thousands if you skip a single step.

Can You Combine the 45L Credit with Other Incentives?

You may qualify for additional programs. You should review:

Section 179D for commercial buildings

Utility rebate programs

State-level green building grants

You must coordinate these credits with your tax advisor. You should avoid duplication of benefits. You may need to adjust cost basis or depreciation schedules.

You can maximize your total incentive package through careful planning.

What Strategies Help Maximize Your Returns?

You should build beyond minimum efficiency levels. You should choose Zero Energy Ready standards whenever possible.

You can:

Invest in better HVAC systems

Install high-performance windows

Use advanced framing and insulation

Train crews on energy best practices

You receive higher credits. You increase buyer satisfaction. You protect long-term energy savings.

You can boost both your reputation and your profits.

Final Thought

You already build homes that meet modern efficiency goals. You already help reduce energy use and emissions.

The 45L energy tax credit rewards your commitment to sustainable construction. You can save up to $5,000 per home. You can turn your green building strategy into a tax advantage.

0 notes

Text

Top Roles You Can Land with an MSc in Accounting and Finance

An MSc in Accounting and Finance isn’t just a degree—it’s a career accelerator. Whether you're a fresh graduate looking to step into the financial world or a working professional aiming to advance, this qualification can open doors to dynamic roles across industries and countries.

At Edubex, our MSc in Accounting and Finance is designed to build both academic knowledge and practical expertise—setting you up for success in high-demand financial roles. Here’s a look at the top roles you can pursue after completing this program:

1. Financial Analyst

A financial analyst examines financial data and trends to help organizations make strategic investment decisions. With your MSc background, you’ll be equipped to interpret complex financial reports, model future financial performance, and advise businesses on profitability.

Industries: Investment firms, banks, multinational corporations Average Salary (INR): ₹6–12 LPA (entry level), higher with experience

2. Chartered Accountant / Certified Public Accountant

Although professional certifications are required, an MSc in Accounting and Finance gives you a solid foundation to pursue globally recognized credentials like CA, CPA, or ACCA. These roles come with high responsibility, including auditing, taxation, and financial reporting.

Industries: Audit firms, corporates, government sectors Note: Many Edubex students go on to fast-track their qualification journeys after the MSc.

3. Financial Controller

As a financial controller, you’ll oversee accounting operations, prepare financial statements, and ensure compliance with regulations. This role demands both technical accuracy and leadership, which are core skills developed in the MSc program.

Industries: Manufacturing, retail, real estate Growth Path: Financial Controller → CFO

4. Investment Banker

If you’re looking for a fast-paced and high-stakes environment, investment banking is an exciting path. This role involves managing mergers, acquisitions, capital raising, and advising clients on financial strategies.

Industries: Investment banks, financial advisory firms Skills Required: Analytical thinking, negotiation, financial modelling

5. Management Accountant

Management accountants play a crucial role in budgeting, forecasting, and strategic planning within a business. Unlike traditional accounting, this role is internal-facing and decision-driven.

Industries: FMCG, manufacturing, healthcare Certifications Boost: CIMA or CMA alongside your MSc

6. Risk Analyst

A risk analyst evaluates potential risks that might impact a company’s profitability. With increased focus on risk management in today’s volatile markets, this role is gaining prominence.

Industries: Insurance, banking, consulting Key Areas: Credit risk, market risk, operational risk

7. Auditor (Internal or External)

As an auditor, you ensure financial records are accurate and that companies comply with laws and regulations. The MSc course covers auditing principles, making you well-prepared for this role.

Industries: Big 4 audit firms, government, MNCs Opportunities to travel: Yes, for external auditors

8. Corporate Finance Manager

This role focuses on managing a company's financial strategy—handling funding, capital structuring, and investments. Your MSc gives you a solid grounding in these core areas.

Industries: Tech firms, real estate, start-ups Career Growth: Often leads to executive roles like CFO

Why Choose Edubex for Your MSc in Accounting and Finance?

100% online and flexible: Designed for professionals balancing work and study

Globally recognized curriculum: Gain industry-relevant expertise

Career support: Resume building, interview preparation, and mentorship

Pathway to professional certifications: Build a competitive edge in the job market

Final Thoughts

With an MSc in Accounting and Finance from Edubex, you're not just earning a degree—you’re preparing to take on strategic roles that shape business decisions and drive financial success. Whether you aim to work locally or globally, these roles offer long-term growth, strong earning potential, and job security.

0 notes

Link

0 notes

Text

Why You Should Hire Offshore Staff for Outsourced Accounting Services with Synbiz Globus

Why Hire Offshore Staff?

Hiring offshore staff permits companies to faucet right into a worldwide skills pool, get right of entry to specialised skills, and considerably lessen overhead fees. For startups and small companies, this version gives flexibility, permitting them to develop their operations with out the load of full-time in-residence teams.

At Synbiz Globus, our offshore experts are exceedingly qualified, experienced, and educated in worldwide accounting standards. Whether you want full-cycle bookkeeping, monetary reporting, or tax compliance, our group guarantees precision and confidentiality at each step.

Benefits of Outsourced Accounting Services

1. Cost Efficiency:

Outsourcing accounting services facilitates agencies keep as much as 50–60% in operational fees. You now no longer want to put money into infrastructure, salaries, or training.

2. Expertise & Accuracy:

Synbiz Globus gives get right of entry to to licensed accountants and monetary professionals who make certain your books are correct and up-to-date, minimizing the chance of mistakes and penalties.

3. Focus on Core Activities:

With your accounting dealt with through experts, your inner group can give attention to strategic duties like patron acquisition, product development, and growth.

4. Scalability:

Our offshore staffing answers are without difficulty scalable. Whether you`re increasing or downsizing, you've got got whole flexibility to modify the extent of assist you want.

5. 24/7 Availability:

Operating throughout time zones manner you gain from round the clock productivity, making sure quicker turnaround and non-stop workflow.

Why Choose Synbiz Globus?

Synbiz Globus is a relied on call in outsourced accounting services, offering tailor-made answers to customers throughout the USA, Canada, Dubai, and India. Our dedication to quality, statistics security, and consumer pleasure units us aside from conventional providers.

We leverage main accounting software program like QuickBooks, Xero, Zoho, and greater to combine seamlessly together along with your current systems. Whether you are a CPA organization or a developing enterprise seeking to hire offshore staff, Synbiz Globus is your one-forestall companion for monetary efficiency.

Conclusion

In a aggressive enterprise environment, staying agile and cost-powerful is key. By selecting to hire offshore staff thru Synbiz Globus, you are now no longer handiest lowering fees however additionally improving your enterprise`s monetary electricity and flexibility.

Ready to take the following step? Contact Synbiz Globus these days to discover how our outsourced accounting services can remodel your enterprise operations.

1 note

·

View note