#Cash App Bank Name for Direct Deposit

Text

What is Cash App bank name for direct deposit?

Cash App is a mobile payment service developed by Square, Inc. It is not a traditional bank and therefore does not have a bank name. Cash App offers users the ability to send and receive money and purchase and sell bitcoin. They do partner with Sutton Bank for their debit card services, but it does not function as a bank account. So the Cash App bank name is Sutton and Lincoln Savings bank.

Cash App is an online financial platform that facilitates millions of users in various online transactions. It offers free money transfers, commission-free stock trading, and a free debit card. In addition, Cash App supports direct deposits. For example, you can set up a direct deposit with your employer to receive your salary. The best thing about using a Cash App for direct deposits is that you’re likely to receive your money two days sooner than you would at a traditional bank. However, you will also need to know that Cash App is not a real bank.

While you can use your smartphone to make purchases and withdraw cash from ATMs, Cash App’s balance is not federally insured. This means that your account may be completely depleted in the event of a disaster. But Cash App provides other forms of payment, such as prepaid cards and credit and debit cards.

To get started with a Cash App, you must have a bank account. Whether you have an account with a regular or virtual bank, you can link it to your Cash App. After that, you’ll need to activate the card. Next, you’ll need to scan a QR code or enter the card number into the app. You’ll also need to input some basic information about your employer. This includes the name of your company and your position. Ideally, you’ll want to wait at least a couple of business days before you see any direct deposits from your employer. Depending on your employer, this may take even longer.

How to find which bank is linked to the Cash App for direct deposit?

To find out which bank is linked to your Cash App account for direct deposit, you can follow these steps:

First, open the Cash App on your mobile device.

Tap the “My Cash” tab, which is located in the bottom-left corner of the screen.

Scroll down and tap “Cash” or “Bitcoin” (depending on what you want to deposit)

Tap on “Deposit”

You should see the bank account linked to your Cash App account. In addition, the account name and the last four digits of the account number should be visible.

Please note that if you haven’t set up Cash App direct deposit yet, you will have to add your bank account details before you can see it.

Remember that the bank account linked to the Cash App is used for direct deposit and other transactions like buying and selling stocks, so you must ensure that the bank details you’ve added are correct.

Why is the Cash App bank name important?

The bank name linked to a Cash App account is important because it is used for direct deposit and other transactions, such as buying and selling stocks. Direct deposit is a feature that allows users to receive payments, such as paychecks or government benefits, directly into their Cash App account. This eliminates the need for paper checks and can make it easier and faster to access funds.

Additionally, having the correct Cash App bank name and address can prevent errors or delays in transactions, such as buying or selling stocks, and ensure that funds are directed to the correct account. In summary, the bank name linked to a Cash App account is important because it facilitates direct deposit and other transactions and avoids errors and delays.

Where to find the routing number on the Cash App account?

The Cash App has its mobile app, but you can also go online to get your routing number. You can view it in the cloud or send it as an email attachment. Cash App uses several fraud protection technologies to protect your funds. One such technology is a one-time use login code that you can activate on your smartphone. This code is unique to you and can be used to access other features of the Cash App.

You’ll need to link your Cash App to a bank that does this service for the best direct deposit results. Some banks, like Bank of America, handle all of these transactions. If you don’t have an account with this particular bank, you can contact them and ask for assistance. Another thing you’ll need is a routing number. Routing numbers are important because they allow a financial institution to track your money. They are also useful for checking the authenticity of a check. Once you’ve got your routing number, you can paste it into the website to which you’re sending the payment.

Finally, you’ll need to locate your Cash App account and routing number. To do this, you’ll need to open the app and go to the banking tab. From there, you’ll find a list of account numbers beneath your balance. Go down to the bottom of the screen and find the routing number.

How to find Cash App bank name, routing, and account number?

To find the Cash App bank name, routing number, and account number on your account:

Open the Cash App on your mobile device.

Tap the “My Cash” tab, which is located in the bottom-left corner of the screen.

Scroll down and tap “Cash” or “Bitcoin” (depending on what you want to deposit)

Tap on “Deposit”

You should see the bank account linked to your Cash App account. The account name, routing number, and the last four digits of the account number should be visible. Cash App routing number is a 9-digit number that identifies the bank that holds your account, while an account number is a unique number that identifies the account you’re trying to deposit to.

Please note that if you haven’t set up direct deposit yet, you will have to add your bank account details before you can see it. Remember that the bank account linked to the Cash App is used for direct deposit and other transactions like buying and selling stocks, so you must ensure that the bank details you’ve added are correct.

#Cash App routing number#cash app bank name#cash app bank#what bank does cash app use#what bank is cash app#cash app bank name and address#cash app bank name for direct deposit#what bank is cash app through

0 notes

Text

What is Cash App bank name and how does it work?

Cash App is a mobile payment service that allows users to transfer money to others and pay bills. The app also offers a feature that enables users to receive direct deposits, such as paychecks, into their Cash App account. But one question many people have is, what bank is Cash App associated with? In this article, we will take a closer look at the Cash App bank name that it uses for its banking services and how the app's direct deposit feature works.

Cash App is associated with Sutton Bank, a Member FDIC bank in Ohio. Sutton Bank has been a trusted financial institution for over 150 years and provides a wide range of banking services to its customers. With Cash App, you can link your account to Sutton Bank to receive direct deposits, such as paychecks, into your Cash App account.

Sutton or Lincoln Saving Bank: What bank does Cash App use?

While some people may assume that Cash App is associated with a big national bank, the truth is that the app is associated with a regional bank. Cash App is associated with either Sutton Bank or Lincoln Savings Bank, depending on the user's location. They provide a wide range of banking services, including checking and savings accounts, loans, and credit cards. With Cash App, you can link your account to either of these banks to receive direct deposits, such as paychecks, into your Cash App account.

How to find the Cash App bank name?

When you sign up for Cash App, you will be prompted to provide your personal information, including your name, address, and social security number. This information verifies your identity and links your Cash App account to Sutton Bank. Once your account is linked, you can receive direct deposits into your Cash App account.

To find your Cash App bank name and address, you can go to the "Cash" tab at the bottom of the screen.

Then, you will see your available balance, routing, and account number at the top of the screen.

You can also view your account and routing number by selecting the "Deposit" button and selecting "Account" at the bottom of the screen.

What is Cash App direct deposit and how do I set-up?

Cash App's direct deposit feature is a convenient way to receive your paychecks and other payments directly into your Cash App account. You can also use the direct deposit feature to receive government payments such as Social Security and disability benefits. To set up Cash App direct deposit, you must provide your employer or government agency with your routing and account number, which can be found in the Cash App.

Conclusion:

Cash App is associated with Sutton Bank, a Member FDIC bank in Ohio. With the app, you can link your account to Sutton Bank to receive direct deposits, such as paychecks, into your Cash App account. By following the steps above, you can easily find your bank name and address on the Cash App and set up a direct deposit feature to receive your payments directly into your Cash App account.

#Cash App bank name#Sutton Bank or Lincoln Savings Bank#Cash App bank name and address#what is cash app bank name and address#find cash app bank name#cash app direct deposit

0 notes

Text

Reasons due to which Cash App direct deposit is having issues right now?

If you’ve ever tried to make a deposit using the Cash App app, you might have seen your deposit a day or two later than it should have been. It can be frustrating to have your pay deposited a few hours early and not receive the funds you need to make purchases. However, you can do a few things to get your cash deposited quickly.

The most logical first step is to consult your bank to see if there is a reason why Cash App direct deposit pending. Next, you’ll look into whether you need to add a new debit card to your account or if you can reroute your funds to another account.

Getting your cash deposited can be tricky, but if you follow these simple steps, you should have a smooth ride.

Make sure you have the correct account number, and if you’re using a linked debit card, you may need to wait a few days before depositing the money.

While it’s not uncommon for your paycheck to be delayed a couple of days, this should not be a cause for alarm.

Most companies will give you a few days before they stop delivering your payments. Sometimes, this is a temporary delay, and you can find a way to speed things up. Fortunately, the company that created the Cash App has a wealth of information on its website to help you determine if the problem is due to your bank or something else.

As with any new technology, the Cash App has had its share of bugs and glitches, but it’s still a worthy contender for the best online banking experience. Luckily, the company has a strong support team to help you resolve any issue. The company also offers free standard deposits, a great way to get your hard earned money into your pocket. Compared to many other banks, however, Cash App offers a few extra benefits, including free international payments. This is one of the reasons why Cash App has more than 36 million users.

What time does Cash App direct deposit hit?

Although there is no hard and fast rule of thumb, the most accurate Cash App direct deposit time is between 2 and 6 a.m., with your payment arriving on a Wednesday at the very latest. Likewise, you may have to wait a little longer if you’re getting your first direct deposit. Regardless, following these simple steps will go a long way toward making sure you receive your direct deposit on time.

The Cash App has many features, but one of the most impressive is its direct deposit capability. As long as you are signed up for the service, you should be able to direct your employer to deposit your check via the app. A standard deposit will take 1–3 days, while an instant deposit will be deposited in minutes.

What Do I Do If My Cash App Direct Deposit Doesn’t Go Through?

Direct deposits through Cash App are easy and fast. However, they can sometimes fail. If you’re experiencing trouble with this service, there are a few things you can do to try to fix the problem.

First, check your bank account. Then, make sure it’s set up to receive direct deposit. This is important to ensure that your bank can send and receive money to your app.

If your direct deposit is not working, you should contact your bank or employer to discuss the issue. They can help you manually process the payment.

You should also check your device’s settings. For example, the internet connection might be too weak for the app to work correctly. In these cases, you should switch to a different device.

Checking your routing number can help you determine why Cash App direct deposit failed. A common cause of failure is insufficient funds or a mismatch of information. It’s best to avoid sending money to a stranger.

Another reason your deposit might fail is that your bank account is closed. Your bank might be using a different bank for its direct deposits. To avoid this, consider opening another bank account.

You should contact the Cash App if you’re still having problems. They can help you resolve the issue and provide further assistance.

The app has a support team, but you’ll need to contact them through the app. When you contact them, you’ll have to describe the problem. Once you’ve done that, you’ll need to wait two to three days for a response.

5 Reasons Your Cash App Payment is Pending

If you are using the Cash App, you may have noticed a “Cash App payment pending” message on your mobile device. This could be due to several reasons. It is essential to know what the issue is. You can do several things to remedy the problem, including contacting your bank or getting a new payment method.

The first thing you should do is check the status page of your Cash app. If you are having trouble, you must click the “Pending” tab. In the status section, you will see a list of all the pending transactions.

You can also view the activity feed to see how to complete the payment. However, if the problem persists, you can reach out to the Cash App support team.

The cash app has flaws, but a few simple steps can help you get your money where it needs to be. For example, you can transfer the funds to a local bank branch to expedite the process.

While the Cash App has a solid reputation for security, you can’t expect everything to be perfect. A few factors can affect the process, including your internet connection, the payment method you choose, and the snag in the system.

If you are trying to make a payment and the transaction has failed, you can contact your bank or Cash App support to try and resolve the issue. However, you will likely need to wait a few days to receive the funds.

How Do I Fix When Cash App Direct Deposit is Pending?

There are many reasons behind Cash App direct deposit pending. For example, you may have entered the wrong information, your bank may be down, or your device’s internet connection might be too slow to process the payment.

However, there are several other things that you can do to improve your chances of getting a timely payment. Some of these are obvious, and some are a little more involved. For example, using a different bank, switching to a credit card that accepts payments through the mail, or even trying to make a large payment in two smaller transactions may help you get paid on time.

One of the best ways to check if your cash is moving is to look at the bank’s website. If the website isn’t clear, consider calling their customer service center for assistance. Or, if you don’t want to speak to a human, you can always use the app’s online chat feature to see if someone can help you.

If you have trouble with a payment, you can find out if your employer accepts Cash App payments. For example, check out their direct deposit history if you are an employee at a company with multiple locations.

Sometimes, your employer is more than willing to work with you and can resolve connectivity or payment issues.

The most important thing to remember is not to panic. There are many reasons why your Cash App direct deposit may not process.

#Cash App direct deposit#Cash App direct deposit pending#cash app direct deposit time#cash app direct deposit bank name#cash app direct deposit late#cash app direct deposit issues#does cash app direct deposit early#why is my direct deposit pending on cash app#cash app direct deposit pending#cash app direct deposit failed#cash app payment pending

1 note

·

View note

Text

What is Cash App Direct Deposit Bank Name? 9093409227

You can use Cash App to set up direct deposit to receive your paycheck. This will allow you to receive your paychecks and unemployment benefits directly from your employer.

The process for setting up direct deposit is simple. You can enter your bank’s name and routing number on the direct deposit form. Knowing the time it will take to receive funds is also important. More extensive deposits may take a few days to reach your account, while smaller deposits are usually deposited on the same day.

The bank name associated with your Cash App account will depend on how active you are on Cash App. For example, if you regularly make transactions on Cash App, you will probably be associated with a bank called Sutton Bank. Alternatively, you may be associated with Cash App direct deposit bank which is Lincoln Savings Bank. Lincoln Savings Bank is a Federal Deposit Insurance Corporation (FDIC) member and is a licensed Cash App banking facility. It also manages direct deposits for Cash App.

0 notes

Text

How Cash App Weekly Limits Affect Your Transactions

In today’s fast-paced financial environment, mobile payment platforms like Cash App have become integral to managing and transferring money efficiently. With its user-friendly interface and robust features, Cash App is a popular choice for handling everyday transactions. However, one common question among users is whether Cash App imposes any weekly limits on transactions. This comprehensive guide delves into Cash App weekly limits, exploring its various aspects and providing insights into how you can manage and potentially increase these limits.

Understanding Cash App Limits

Cash App, developed by Square, Inc., is a versatile financial tool that allows users to send, receive, and manage money directly from their smartphones. It supports various transactions, including peer-to-peer payments, direct deposits, and investment in stocks and Bitcoin. However, like many financial services, Cash App has specific limits on transactions to ensure security and regulatory compliance.

What are the Cash App Transfer Limits?

Cash App sets limits on how much you can send or receive per transaction and within specific time frames. These limits can vary based on your verification status and account type (personal or business). Typically, unverified accounts have lower limits compared to verified accounts.

What is the Cash App Withdrawal Limit Per Day?

The Cash App withdrawal limit per day is another critical factor to consider. Cash App allows users to withdraw cash from ATMs or transfer funds to their bank accounts. The daily limit may impact how much you can access or transfer in a given week.

What are the Cash App Sending and Receiving Limits?

Cash App imposes limits on both sending and receiving money. For unverified accounts, the sending limit is usually capped at $250 per week, while the receiving limit can be up to $1,000 per month. Verified accounts enjoy higher limits, often reaching up to $7,500 per week for sending money.

Cash App Max Transfer

The maximum transfer limit can vary depending on your verification status and account history. Verified users can transfer up to $7,500 per week, while unverified users face significantly lower limits.

How to Increase Cash App Limits?

To increase Cash App limits, you need to verify your account. Verification involves providing personal information, such as your full name, date of birth, and Social Security number. Once verified, you can enjoy higher limits on sending, receiving, and withdrawing money.

Steps to Increase Your Cash App Limits

Complete Account Verification: Provide the necessary personal information to verify your account.

Submit Required Documents: Upload any additional documents requested by Cash App for further verification.

Wait for Approval: Cash App will review your information and update your limits once verification is complete.

FAQ About Increasing Cash App Weekly Limits

1. What is the Cash App weekly limit for unverified accounts?

Unverified Cash App accounts typically have a sending limit of $250 per week and a receiving limit of $1,000 per month.

2. How can I check my Cash App limits?

You can view your current Cash App limits by navigating to the "Account" or "Settings" section within the app.

3. Can I increase my Cash App withdrawal limit?

Yes, you can increase Cash App withdrawal limit by verifying your account. Verified users generally have higher withdrawal limits.

4. What is the Cash App transfer limit per day?

The Cash App daily transfer limit varies based on your verification status. Unverified accounts usually have lower limits compared to verified accounts.

5. How do I increase my Cash App limit from $2,500 to $7,500?

To increase your limit, you need to complete the account verification process. Once verified, your limits will be adjusted accordingly.

6. Are there any Cash App limits for business accounts?

Yes, business accounts on Cash App may have different limits compared to personal accounts. The limits are typically higher but can vary based on account activity and verification.

7. What is the Cash App limit for adding cash?

The limit for adding cash to your Cash App balance can vary based on your account verification status and linked funding sources.

8. How does Cash App handle ATM withdrawal limits?

Cash App imposes daily ATM withdrawal limits. You can check your specific limit in the app’s settings or by contacting Cash App support.

Conclusion

While Cash App does not explicitly define a weekly limit, various transaction limits and account settings affect how much you can send, receive, and withdraw. Understanding these limits and verifying your account are crucial steps to maximise your Cash App experience. By following the outlined steps, you can manage your transactions effectively and enjoy the flexibility that Cash App offers.

For more information and updates on Cash App limits and features, stay tuned to the official Cash App website or contact their support team.

2 notes

·

View notes

Text

What Are the Cash App Transaction Limits for 2024?

In 2024, Cash App transaction limits are structured around two key factors: whether the user has verified their account and the type of transaction being conducted. Verification typically involves providing identifying information such as your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Limits for Unverified Cash App Accounts

Unverified accounts are subject to stricter limits. If you have not verified your identity on Cash App, you will face more limited transaction capabilities. Here are the limits for unverified accounts:

Cash App Sending Limits: Unverified accounts can send up to $250 within a 7-day period.

Cash App Receiving Limits: You can receive up to $1,000 within a 30-day period.

Cash App Withdrawal Limits: Unverified users may have limited access to withdrawal options, particularly in terms of transferring money to a bank account or withdrawing funds from an ATM.

To fully unlock Cash App's features, including higher transaction limits, you need to verify your account.

Limits for Verified Cash App Accounts

Once you verify your account, you’ll gain access to much more flexible and higher limits. Verified users enjoy the following limits:

Cash App Sending Limits: Verified users can send up to $7,500 per week.

Cash App Receiving Limits: There is no limit on the amount you can receive once your account is verified.

Cash App ATM Withdrawal Limits: Cash App allows you to withdraw up to $1,000 per transaction, $1,000 per day, and $1,000 per week from an ATM.

Cash App Cash Card Purchases: If you use a Cash App Card, you can spend up to $7,000 per transaction, $10,000 per day, $15,000 per month, and make up to 20 transactions per day.

How to Increase Your Cash App Limits

Raising your Cash App limits is straightforward and can be done by verifying your account. Here’s a quick guide on how to do that:

Open Cash App: Launch the Cash App on your mobile device.

Enter Personal Information: Navigate to the profile section and enter your full name, date of birth, and the last four digits of your SSN when prompted.

Submit Information: Follow the instructions and submit the necessary information for verification.

Verification Completion: Once your identity is verified, you’ll receive a confirmation, and your transaction limits will automatically increase.

ATM and Withdrawal Limits on Cash App

For users who regularly use the Cash App Card, ATM and withdrawal limits are another important factor to consider. Here’s what you need to know for 2024:

ATM Withdrawals: The maximum amount you can withdraw from an ATM is $1,000 per day, $1,000 per transaction, and $1,000 per week.

Over-the-Counter Withdrawals: If you visit a bank or other financial institution to withdraw funds using your Cash App Card, the same limits apply.

Cash App Limits on Instant Transfers: Cash App’s Instant Transfer feature lets you send money to your bank instantly for a fee. Verified users can transfer up to $25,000 per week through instant transfers.

Cash App Bitcoin Transaction Limits

One of the standout features of Cash App is its ability to facilitate Bitcoin transactions. In 2024, Bitcoin enthusiasts will find the following transaction limits on the platform:

Bitcoin Purchases: Verified users can buy up to $100,000 worth of Bitcoin per week.

Bitcoin Sales/Withdrawal: You can withdraw up to $2,000 worth of Bitcoin per day and $5,000 within any 7-day period.

These limits apply whether you are buying Bitcoin through the app or withdrawing it to an external wallet. To raise your Cash App Bitcoin transaction limits, you may need to complete additional verification steps, including providing information about your income sources.

Cash App Direct Deposit Limits

If you use Cash App to receive direct deposits, you’ll find the following limits:

Maximum Direct Deposit Amount: Cash App allows users to receive up to $50,000 in a single day through direct deposit.

No Monthly Limits: there is a cap on the total amount of money you can receive via direct deposit each month.

Many users appreciate this feature as it allows for seamless integration of their payroll or government benefits into their Cash App balance.

Managing Transaction Limits

Cash App offers flexible limits, but understanding and managing them is crucial for efficient use. Here are some tips on how to manage your limits:

Keep Your Account Verified: Verifying your account unlocks higher limits for transactions and withdrawals.

Check Your Limits Regularly: It’s important to keep track of your transaction limits by visiting the profile section of the Cash App.

Utilize Direct Deposit: Direct deposits on Cash App provide higher incoming transaction limits, making it a great option for receiving salaries or large sums of money.

Bitcoin Transactions: Make sure to complete any additional verification steps if you plan to deal with high-value Bitcoin transactions.

Conclusion

In 2024, Cash App transaction limits are designed to offer flexibility for both verified and unverified users. While unverified users face tighter restrictions, verified users can enjoy significantly higher sending, receiving, and withdrawal limits. Additionally, features like Bitcoin transactions, direct deposits, and ATM withdrawals add versatility to Cash App’s growing list of functionalities. To make the most of Cash App, ensure your account is verified, and always stay informed about the platform’s transaction limits.

4 notes

·

View notes

Text

Cash App Withdrawal Limits Explained: How to Maximize Your Daily and Weekly Withdrawals

Cash App has rapidly become one of the most popular mobile payment services in the United States, offering users a convenient way to send, receive, and manage money directly from their smartphones. While the app is packed with features, one aspect that often requires clarification is the Cash App withdrawal limit. Whether you're withdrawing funds from an ATM or transferring Bitcoin, understanding these limits and knowing how to increase them can make managing your finances more efficient. In this article, we'll dive deep into the various withdrawal limits associated with Cash App and guide you on how to increase them.

What Are the Cash App Withdrawal Limits?

When it comes to withdrawing money from Cash App, there are several types of limits that users should be aware of. These limits are put in place to ensure security and prevent fraud. The primary limits involve Cash App ATM withdrawals, sending and receiving limits, and Bitcoin withdrawal limits.

Cash App ATM Withdrawal Limit: Cash App users can withdraw cash from ATMs using their Cash Card. The standard Cash App ATM withdrawal limit per day is $1,000. However, there is also a weekly limit, which caps at $1,250.

Cash App Bitcoin Withdrawal Limit: For those who use Cash App for cryptocurrency transactions, the Cash App Bitcoin withdrawal limit is another important consideration. Currently, the Cash App allows you to withdraw up to $2,000 worth of Bitcoin per day and up to $5,000 per week.

Sending and Receiving Limits: Although not directly related to withdrawals, it's essential to note the sending and receiving limits on Cash App. Verified users can send up to $7,500 per week and receive an unlimited amount of funds.

How to Increase Your Cash App Withdrawal Limits

Increasing your Cash App withdrawal limit can be crucial, especially if you frequently use your Cash Card at ATMs or deal in larger sums of money. Here's a step-by-step guide on how to increase Cash App withdrawal limit:

Verify Your Account: The first step to increasing your withdrawal limit is verifying your Cash App account. To verify your account, you will need to provide your full name, date of birth, and the last four digits of your Social Security Number (SSN). Once your account is verified, you can access higher limits for both ATM withdrawals and Bitcoin transactions.

Link a Bank Account or Debit Card: Linking a bank account or debit card to your Cash App is another way to enhance your withdrawal capabilities. This step not only increases your sending and receiving limits but also ensures smooth transactions when transferring money between your Cash App and your bank.

Regular Usage and Good Standing: Maintaining regular activity on your Cash App account and ensuring that you have no outstanding issues can also positively affect your limits. Regular transactions and maintaining a good standing with Cash App can signal to the platform that you are a trusted user.

Contact Cash App Support: If you find the standard limits restrictive and need a higher limit than what is typically available, contacting Cash App Support directly might be helpful. They can provide personalised advice or offer temporary limit increases based on your account history and specific needs.

What are the Cash App ATM Fees?

While increasing your withdrawal limit can enhance convenience, it's also essential to understand the fees associated with ATM withdrawals. Cash App charges a $2.50 fee for each ATM transaction. However, if you receive direct deposits of at least $300 per month, Cash App reimburses these fees, making ATM withdrawals free.

By understanding and managing your Cash App withdrawal limits, you can ensure smooth and efficient financial transactions, whether you're withdrawing cash, sending money, or handling Bitcoin. Keep these guidelines in mind, and you'll make the most out of your Cash App experience.

FAQs

1. What is the Cash App ATM withdrawal limit per day?

The Cash App ATM withdrawal limit per day is $1,000. Additionally, there is a weekly withdrawal limit of $1,250.

2. How can I increase my Cash App ATM withdrawal limit?

You can increase Cash App ATM withdrawal limit by verifying your account, linking a bank account or debit card, and maintaining regular usage in good standing.

3. Is there a limit to how much Bitcoin I can withdraw from Cash App?

Yes, Cash App has a Bitcoin withdrawal limit of $2,000 per day and $5,000 per week.

4. Does Cash App charge fees for ATM withdrawals?

Yes, Cash App charges a $2.50 fee for each ATM withdrawal. However, if you receive at least $300 in direct deposits per month, these fees can be reimbursed.

5. How can I check my current Cash App withdrawal limit?

To check your current Cash App withdrawal limit, go to your profile settings in the app, where you will find detailed information about your transaction limits.

2 notes

·

View notes

Text

B-u-yVerified Cash App Accounts

B-u-y Verified Cash App Cash App Accounts

Purchasing a verified Cash App Cash App account ensures secure transactions and reliable service. B-u-yers must navigate a trusted platform offering such a service.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

In today's digital age, the ability to transfer money quickly and safely is paramount for both personal and business transactions. A verified Cash App Cash App account provides this convenience with an added layer of security, making it an attractive option for users who prioritize their financial safety online.

Why Verified Cash App Cash App Accounts Matter

The moment you decide to use Cash App Cash App for transactions, you must consider verification. A verified Cash App Cash App account stands as a shield. It secures your money and personal data.

The Need For Verification

Verification is the first step to a safe experience. With a verified account, you unlock higher limits. You get access to additional features, too. Verification proves your identity, building trust with others.

Increased sending and receiving limits

Access to Bitcoin trading

Direct deposit eligibility

Risks Of Unverified Accounts

Using an unverified account is risky.

Risk Factor

Consequence

Low Transaction Limits

Limited Money Flow

No Direct Deposits

Lack of Essential Services

Risk of Closure

Loss of Funds

Susceptibility to Fraud

Financial Threat

Unverified accounts tempt thieves. They invite scams and frauds. Lower limits can also disrupt your spending. Lack of verification may lead to account closure, trapping your funds.

Getting Started With Cash App

Embracing the ease of online transactions gets even easier with Cash App. If you're trying to step up your financial game with convenience and security, getting started with a verified Cash App Cash App account is a smart move. We'll walk you through all you need to know, from initial setup to exploring those nifty features that make Cash App Cash App a go-to financial tool for many.

Initial Setup

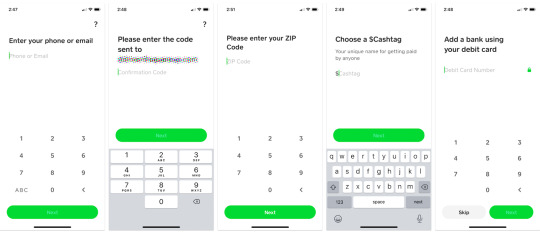

Setting up your Cash App Cash App account is as simple as pie. Download the app, enter your basic information, and you're halfway there. Follow these steps for a smooth start:

Download Cash App Cash App from your app store.

Open the app and enter your mobile number or email.

Enter the code sent to your phone or email.

Add your bank account for funding your Cash App Cash App balance.

Choose a unique $Cashtag, your identifier for transactions.

Account Features

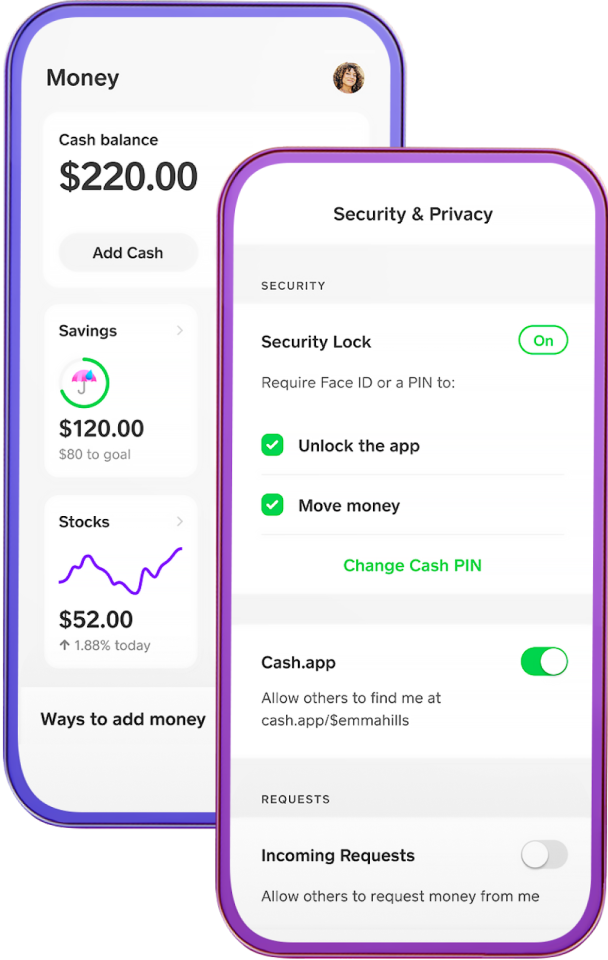

Your verified Cash App Cash App account comes with features that make money management a breeze. Let's check out the key benefits:

Feature

Description

Direct Deposit

Get paychecks delivered right into your account.

Instant Transfers

Send and receive money at lightning speed.

Cash Card

A personalized debit card for your spending needs.

Investment Options

B-u-y, sell, and hold Bitcoin or stocks, all from the app.

Free ATM withdrawals with direct deposits.

Customize your card's look for extra flair.

Robust security to keep your transactions safe.

Verification Process For Cash App

Cash App Cash App requires users to complete a verification process. This process keeps accounts secure. Verified accounts unlock additional features. Users can send and receive more money with a verified account. Get ready to enjoy the full Cash App Cash App experience!

Step-by-step Guide

Follow these simple steps to verify your Cash App Cash App Account:

Open your Cash App.

Tap the profile icon on your home screen.

Select Personal.

Enter your details: full name, date of birth, and the last 4 digits of your SSN.

Provide any additional information if asked.

Wait for the confirmation. This can take 24-48 hours.

Required Documentation

To complete verification, you need:

A government-issued ID.

Your Social Security Number (SSN).

Keep these documents handy for a smooth verification process.

Benefits Of A Verified Account

Many choose to B-u-y a verified Cash App Cash App account for good reasons. A verified status can transform how you use the platform.

Increased Limits

Verification bumps up your transaction limits. Unverified users hit limits quickly. Verified members enjoy more freedom.

Send more money weekly.

Withdraw higher amounts from ATMs.

No cap on receiving funds.

Feature

Unverified Account

Verified Account

Sending Limit

$250/week

$7,500/week

ATM Withdrawal

$250/day

$1,000/day

Wider Access To Features

Verification unlocks exclusive features. Your Cash App Cash App experience gets better.

Direct deposit payroll straight to Cash App.

Get a free custom Cash Card for spending.

Borrow money with Cash App Cash App Loan if eligible.

Verified users can also trade Bitcoin and stocks. This makes investing simple and accessible.

B-u-y Verified Cash App Cash App Accounts

Purchasing A Verified Cash App Cash App Account

Purchasing a verified Cash App Cash App account offers convenience for anyone wanting hassle-free transactions. It's crucial to follow the correct steps and know where to B-u-y. Awareness about potential scams is equally important to ensure a secure purchase.

Where To B-u-y

Finding a reputable source is the first step in acquiring a verified Cash App Cash App account. Look for platforms with positive feedback and a strong customer service record. Popular online marketplaces or fintech forums can be good starting points.

Check the marketplace's authenticity before any transaction.

Look for vendors who provide proof of verification.

Ensure they offer after-sale support.

Avoiding Scams

Stay vigilant to avoid falling victim to scams. Always perform due diligence before committing to a purchase. Remember these key tips:

Do not share personal information unless you trust the source.

Never make payments outside the official marketplace platform.

Ensure communication is documented for future reference.

Search for vendor reviews and feedback online.

Safety Measures For Transactions

When dealing with financial transactions, safety is key. Users often seek out verified Cash App Cash App accounts for increased security. Let's explore essential transaction safety measures.

Secure Payment Methods

Choosing the right payment method is crucial for safe transactions. Cash App Cash App offers several secure options:

Bank transfers – Link your account for easy transactions.

Debit cards – Use your card for swift payments.

Bitcoin – Benefit from the cryptocurrency option.

Enable two-factor authentication on your account. This step adds an extra layer of security.

Protecting Personal Information

Keep your personal details safe. Here are some methods:

Avoid sharing sensitive information like PINs or SSN.

Regularly update your app for the latest security features.

Monitor account activity. Report any suspicious behavior.

Remember, maintaining the confidentiality of your data helps prevent unauthorized access.

Prices For Verified Accounts

When shopping for a verified Cash App Cash App account, you'll notice diverse pricing options. These prices reflect the level of verification, the age of the account, and any additional features. Let's delve into what you might expect to pay and how to make an informed choice.

Understanding Market Rates

Understanding Market Rates

Market variations affect account prices. Seasoned accounts command higher prices. Embarking on a purchase starts with market rate awareness.

The table below provides a snapshot of current verified Cash App Cash App account rates:

Account Type

Price Range

Basic Verified

$50-$100

Premium Verified

$100-$200

Prices scale with features like transaction limits and support services. Keep this perspective to gauge offerings.

Comparing Sellers

Comparing Sellers

Compare sellers for the best deal. Evaluate their reputation, account quality, and customer feedback.

Reputation speaks volumes. Opt for sellers with proven track records.

Account Quality means fewer hurdles down the line. Seek high-quality accounts.

Customer Feedback reflects seller reliability. Positive reviews indicate trustworthy sellers.

Engage with sellers transparent about their prices and services. This approach prevents unforeseen expenses.

B-u-y Verified Cash App Cash App Accounts

Setting Up Your Purchased Account

Welcome to the ultimate guide on setting up your newly purchased verified Cash App Cash App account. Purchasing a verified account can fast-track your access to the robust features of Cash App, but it's crucial to get the setup right. In this segment, we'll guide you through essential steps to transfer ownership and customize account settings seamlessly.

Transferring Ownership

Ownership transfer is the first step after B-u-ying a Cash App Cash App account.

Receive account credentials from the seller securely.

Log in with the provided details.

Change all login information immediately.

Email and phone numbers must be updated to your own. This secures your access and ensures recovery is possible.

Navigate to settings for personal information updates.

Input your information to reflect the new ownership.

Complete these steps to legally own the account.

Customizing Account Settings

Customize settings to enhance security and user experience.

Enable security features like 2-factor authentication.

Link your bank account for seamless transactions.

Adjust privacy settings according to preferences.

Personalize your profile for a tailored Cash App Cash App experience.

Add a unique $Cashtag that represents you or your business.

Upload a personal or brand image.

Explore the app's features and settings for complete customization.

Maintaining Your Cash App Cash App Account

Keeping your Cash App Cash App account in good shape is essential.

Regular care prevents problems and keeps your account running smoothly.

Regular Updates

Keeping your app up to date is crucial.

Check for updates often.

Updates fix bugs and add features.

Updating is quick and keeps your account safe.

Verifying Continued Eligibility

Always make sure you are eligible to use your account.

Follow these steps:

Check Cash App Cash App rules yearly.

Ensure your information is current.

Provide required documents on time.

Troubleshooting Common Issues

Tackling problems with your verified Cash App Cash App account can sometimes be tricky. But don't worry about getting lost in technicalities. This guide simplifies some of the common hurdles you might face.

Login Problems

Can't access your account? Follow these steps:

Check your internet connection. A solid connection is crucial.

Verify your login details. Ensure your email and password are correct.

Update the app. An outdated app makes logging in harder.

Clear the cache. This fresh start could be the quick fix you need.

Contact support if nothing works. They'll help get you back in.

Transaction Errors

Seeing error messages during transactions?

Confirm your bank balance first. No funds, no transaction.

Check the recipient's details. Mistakes here cause errors.

Refresh the Cash App. Sometimes it just needs a quick reboot.

Look for app updates. Running the latest version prevents issues.

Still stuck? Reach out to Cash App Cash App support for precise solutions.

B-u-y Verified Cash App Cash App Accounts

Pros And Cons Of B-u-ying Verified Accounts

Many people want Cash App Cash App accounts that are ready to use. Some pick B-u-ying verified accounts. This way can be quick but has good and bad points.

Immediate Access

Get an account fast with B-u-ying a verified Cash App Cash App account. Just pay, and start using it. It saves time making one and waiting for checking your details.

No setup hassle: Skip steps like adding info.

Quick money moves: Send and get cash soon.

Full features: Get all that Cash App Cash App offers, right away.

Potential Risks

Risk

Explanation

Account bans

Rules say no to bought accounts. Cash App Cash App might close them.

Security fears

Accounts might not be safe. Hackers can steal info.

Costs more

You spend money for something normally free.

B-u-ying comes with risks. Know them before you decide.

Legal Considerations

Exploring the realm of digital finance invites one to consider the importance of legality. Specifically, when discussing B-u-y Verified Cash App Cash App Accounts, you cannot turn a blind eye to the legal boundaries that frame this digital landscape.

Platform Policies

First and foremost, Cash App Cash App a user-agreement that outlines permissible use cases. Users must understand these policies before creating or B-u-ying an account. Disregarding them can lead to account suspensions or legal consequences.

Account set up with real identity.

No fake details for verification.

One user per account stipulation.

Prohibition of resale or transfer of ownership.

Financial Regulations

Stringent laws govern financial platforms to prevent fraud and protect users. When purchasing verified Cash App Cash App accounts, remember:

Regulation

Requirement

Impact on Purchase

KYC Laws

Identity verification

Purchased accounts must have verifiable information

AML Directives

Prevention of money laundering

Accounts should have a clear transaction history

PCI DSS Compliance

Data security standards for payment cards

Ensures transaction data is protected

Remember, owning a Cash App Cash App account requires compliance with all local and international financial laws. It's not just about simple transactions but ensuring your activities are legal and secure.

B-u-y Verified Cash App Cash App Accounts

Cash App's Role In Digital Economy

The digital economy thrives on simplicity and trust in transactions. Cash App Cash App features heavily in this landscape with its streamlined approach to money management. Verified accounts on the Cash App Cash App platform signify a level of authenticity and security that is critical for users engaging in digital financial activities. These trusted accounts are cornerstones in the ever-evolving digital economy, enabling seamless peer-to-peer payments and reshaping how consumers handle their finances.

Mobile Payment Trends

Mobile payments are transforming how we transact. Services like Cash App Cash App are at the forefront, offering quick and secure ways to send or receive money. With the rise of smartphones, payment apps are becoming essential tools for the digital economy. They cater to a growing preference for digital wallets and tap-to-pay technology.

Increased mobile wallet adoption

Contactless transactions gaining ground

Preference for app-based financial services

Impact On E-commerce

Verified Cash App Cash App accounts influence e-commerce by providing a trusted payment option for online shoppers. Retailers now integrate these payment methods to capture more sales and improve customer experience.

Ease of checkout with one-tap payment

Secure transactions with verified accounts

Faster payments encourage repeat business

In summary, a robust digital economy relies heavily on platforms like Cash App, with verified accounts ensuring confidence in e-commerce and reflecting modern mobile payment trends.

Alternatives To B-u-ying Verified Accounts

Exploring Alternatives to B-u-ying Verified Accounts can be a safer path to managing finances online. Users often seek out verified Cash App Cash App accounts to bypass certain limits. Yet, this approach poses risks. Let's delve into legitimate and secure methods to access similar features without the risks involved in purchasing accounts.

Self-verification

Becoming verified on Cash App Cash App is straightforward. Input your SSN and personal info. Cash App Cash App then verifies your identity. Once verified, your account unlocks higher limits and additional features.

Other Payment Platforms

Many payment platforms exist. Each offers unique benefits and verification processes. Consider these popular alternatives:

PayPal: A well-known platform requiring user and bank account verification.

Venmo: Popular among friends for quick transfers after a user identity check.

Zelle: Integrates with bank accounts for instant, verified transactions.

Each platform secures your data and transactions reliably, negating the need to B-u-y accounts.

Platform

Verification Requirement

Features

PayPal

Linked bank, credit card

Global payments, B-u-yer protection

Venmo

Identity documents

Social sharing, fast transfers

Zelle

Direct bank linkage

Bank-level security, no extra app needed

User Reviews And Testimonials

Welcome to the realm of honest user feedback on Verified Cash App Cash App Accounts. Real people share their experiences. Their stories highlight the perks and downsides of these accounts. Dive in for some unfiltered opinions!

Success Stories

Real users share their joy:

Immediate setup: "I got my account in minutes!"

Smooth transactions: "B-u-ying and selling is now a breeze."

Top-notch security: "My money's safe and secure!"

These tales show happy users who enjoy their Verified Cash App Cash App experiences. They feel confident and satisfied.

Customer Complaints

Feedback isn't always sunny. Here are a few common gripes:

Support lag: "Help takes time to respond."

Verification hiccups: "The process was fussy for me."

Fees confusion: "I was unclear about some charges."

These reviews help paint a full picture. Knowing the issues others faced is helpful. You get to prep for potential hiccups ahead of time.

B-u-y Verified Cash App Cash App Accounts

Services Offered By Verified Accounts

Verified Cash App Cash App accounts unlock a world of financial possibilities. From seamless money transfers to investment options, these accounts offer a variety of services. Let’s dive into some of the key features that make verified accounts a must-have.

Direct Deposits

Enjoy the ease of getting payments straight into your account. With verified Cash App Cash App accounts, you can set up direct deposits for your paycheck or any other income.

Quick access to funds on payday

No waiting for check deposits

Direct deposit earnings early

Bitcoin Trading

Skip the complexity of traditional crypto exchanges. Verified accounts allow you to B-u-y and sell Bitcoin with just a few taps.

Bitcoin Trading Features

Simple B-u-y/sell interface

Safe storage of Bitcoins

Immediate trading option

Managing Finances With Cash App

Cash App Cash App revolutionizes money management. This digital wallet simplifies tracking expenses. It offers features like direct deposits and stocks. Users enjoy a seamless financial experience. B-u-y a verified Cash App Cash App account for this solution.

Budgeting Tools

Stay on top of spending with Cash App's budgeting tools. See where money goes at a glance. Create categories for rent, groceries, and more.

Visualize your finances through simple charts.

Set spending limits to prevent overspending.

Receive alerts for unusual activities.

Instant Payments

Send and receive money without delay using a Cash App Cash App account. Deal with emergencies or pay friends back instantly.

Feature

Description

Paycheck Deposit

Get salary straight into your Cash App.

Money Transfer

Move funds to others in seconds.

Cash Out

Withdraw to bank quickly.

The Future Of Verified Accounts

B-u-y Verified Cash App Cash App Accounts marks the beginning of safer, easier online transactions. Verified accounts mean trust and reliability. They represent a secure future for digital payments.

Technological Advancements

Verified accounts use the latest security features. These include fingerprint scanning and facial recognition.

New tech means fewer frauds. Users can trust accounts more.

AI monitors for unusual activity.

Encryption keeps information safe.

Verification is now quicker and smoother.

Predictions For Cash App

Experts predict big changes for Cash App. It's not just for sending money anymore.

Year

Prediction

2024

More users will have verified accounts.

2025

Cash App Cash App may introduce new cryptocurrency features.

2026

Payment verification might happen in seconds.

B-u-y Verified Cash App Cash App Accounts

User Security And Fraud Prevention

Keeping your finances secure online is vital. B-u-ying a verified Cash App Cash App account comes with robust security features for safe transactions. Let's delve into how Cash App Cash App ensures user security and fraud prevention:

Encrypted Transactions

Cash App Cash App uses advanced encryption to protect your data. Every purchase, transfer, or payment you make is secured. This means no prying eyes on your financial moves. Here are the essentials:

PCI-DSS level 1 certification keeps your information under wraps.

Automatic account logout after inactivity to prevent unauthorized access.

Data is sent over secure servers to block cyber threats.

Reporting Suspicious Activity

If you notice odd behavior on your account, you should act fast. Cash App Cash App has easy steps for reporting. This helps to clamp down on fraud swiftly. Follow these points:

Identify any unauthorized transactions.

Use the app to flag these for review.

Contact support immediately for help.

Remember, keeping your account safe also depends on your vigilance. Always check your transactions and keep your account information private.

Faqs For New Verified Account Owners

Welcoming new owners of verified Cash App Cash App accounts! This section aims to ease your journey. Curious about what comes next? We've compiled a list of frequently asked questions just for you. Quick, clear answers are right at your fingertips, guaranteeing a smooth start.

Common Questions Answered

Discover answers to top questions that new users often have:

What limits apply to my verified account? Verified accounts enjoy higher transaction limits.

Can I receive international payments? Yes, if Cash App Cash App supports payments in both countries.

Is customer support available 24/7? Cash App Cash App offers round-the-clock support for users.

How do I keep my account secure? Always enable two-factor authentication and never share your PIN.

What are Cash App's fees? Some services, like instant transfers, have small fees.

Tips For First-time Users

Get off to a flying start with these handy tips:

Explore the app to familiarize yourself with its features.

Connect a bank account for easy money transfers.

Verify your identity to unlock full benefits.

Test with small transactions to gain confidence.

Check out Cash Card to spend your Cash App Cash App balance.

Frequently Asked Questions For B-u-y Verified Cash App Cash App Account

What Is A Verified Cash App Cash App Account?

A verified Cash App Cash App account means it has passed additional identity checks. This ensures higher security and increased transaction limits. Verified users must provide full legal name, date of birth, and SSN.

Benefits Of B-u-ying A Verified Cash App Cash App Account?

B-u-ying a verified Cash App Cash App account gives instant access to higher transaction limits and other premium features without the normal waiting or verification hassles. It’s a quick solution for immediate financial activities.

How To B-u-y A Verified Cash App Cash App Account Safely?

To B-u-y safe, opt for credible platforms with positive user reviews and secure payment options. Always protect personal details and ensure a clear transfer of account credentials upon purchase.

Can You Legally B-u-y And Sell Cash App Cash App Accounts?

B-u-ying or selling Cash App Cash App accounts can violate Cash App’s terms of service. It’s important to review legal implications and Cash App’s policies before engaging in any transactions involving account sales or purchases.

Conclusion

Ensuring seamless transactions is pivotal in the digital age. Opting for a verified Cash App Cash App account can offer that tranquility. It streamlines your payments and secures your financial dealings. Remember, a verified account is more than convenience; it's your gateway to hassle-free digital finance.

Make the smart choice today. Embrace verified, embrace simplicity.

3 notes

·

View notes

Text

B-u-y Verified Cash App Accounts: Secure Hassle-Free Transactions!

You can B-u-y verified Cash App accounts from various online vendors. Ensure the source is trustworthy to avoid scams.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Verified Cash App accounts offer enhanced security and reliability. Purchasing a verified account can save time and streamline financial transactions. These accounts come with added benefits, such as increased transaction limits and reduced risk of account suspension. Before making a purchase, research the vendor thoroughly to confirm authenticity.

Read reviews and check user feedback to ensure you are dealing with a reputable seller. It's crucial to prioritize safety and security when B-u-ying verified accounts. Always use trusted platforms to make your purchase. This ensures a smooth transaction and protects your financial information. Avoid suspicious offers that seem too good to be true.

The Rise Of Cash App

Cash App has quickly become a leading player in the digital payment space. It offers a simple, user-friendly interface that attracts millions. The app allows users to send and receive money with just a few taps. As its popularity grows, so does the need for verified accounts.

Cash App's Popularity

Cash App’s popularity has surged in recent years. Many people use it for personal transactions, business payments, and more. This rise in popularity is due to its ease of use and security features.

Year

Users (Millions)

2018

7

2019

15

2020

30

2021

40

Cash App is not just popular among individuals but also among businesses. It provides a fast and secure way to handle transactions. People trust Cash App due to its robust security measures.

Financial Freedom With Cash App

Financial freedom is one of the key benefits of using Cash App. Users can access their money quickly without the need for a traditional bank. This is especially beneficial for those who prefer digital transactions.

Send and receive money instantly

B-u-y and sell Bitcoin

Invest in stocks

Use the Cash Card for purchases

Cash App also offers features like direct deposits and cash boosts. These features help users manage their finances more effectively. The app’s versatility makes it a preferred choice for many.

Benefits Of Verified Cash App Accounts

Verified Cash App accounts offer many advantages. These include higher sending limits and increased security. Understanding these benefits can help you make the most of your Cash App experience.

Higher Sending Limits

Verified Cash App accounts allow for higher sending limits. This means you can send more money at once.

Unverified accounts: Send up to $250 per week.

Verified accounts: Send up to $7,500 per week.

This is especially useful for business transactions or large purchases. You won't need to break up payments into smaller amounts.

Increased Security Measures

Security is a top priority for Cash App. Verified accounts benefit from increased security measures.

Two-factor authentication.

Fraud detection systems.

Enhanced encryption protocols.

These measures help protect your money and personal information. You can use the app with greater peace of mind.

The Verification Process

B-u-ying a verified Cash App account can save you time and effort. A verified account offers more features and higher transaction limits. Understanding the verification process is crucial for a smooth experience.

Step-by-step Guide

Follow these simple steps to verify your Cash App account:

Open the Cash App on your device.

Tap the profile icon on your home screen.

Select the "Personal" tab to update your information.

Enter your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Submit the required information and wait for verification.

Required Documentation

To verify your Cash App account, you need:

Full legal name

Date of birth

Last four digits of your SSN

A valid government-issued ID

Make sure all information is accurate. Mismatched details can delay the process. Double-check everything before submission.

Document Type

Details Required

Government ID

Clear photo, full name, date of birth

SSN

Last four digits

Ensure your documents are clear and readable. Blurry images or incorrect information can cause delays.

Why Purchase A Verified Account?

B-u-ying a verified Cash App account can save time and ensure seamless transactions. It offers multiple benefits that enhance your user experience.

Avoiding The Hassle

A verified account eliminates the need for tedious verification steps. You won't have to wait for approvals or submit multiple documents. This makes the process quick and painless.

Additionally, using a verified account helps you bypass common issues. For example, it minimizes the chances of transaction errors and account limitations. This ensures smoother operations every time you use Cash App.

Instant Access To Features

With a verified account, you get immediate access to advanced features. These include higher transaction limits and instant deposits. You can also use Cash App's investment options without delays.

Moreover, verified accounts often come with enhanced security. This means your funds and personal information are better protected. You can use the app with greater peace of mind.

Feature

Benefit

Higher Transaction Limits

Send and receive more money

Instant Deposits

Get your money faster

Advanced Security

Keep your account safe

In summary, B-u-ying a verified Cash App account offers significant advantages. It simplifies your user experience and provides immediate access to essential features.

Risks Of Unverified Accounts

Using unverified Cash App accounts can be risky. Unverified accounts often face many limitations. They can also expose users to potential fraud. Below are the specific risks associated with unverified accounts.

Transaction Limits

Unverified accounts have strict transaction limits. These limits can hinder your financial flexibility. The table below shows the differences in transaction limits for verified and unverified accounts.

Account Type

Daily Limit

Weekly Limit

Monthly Limit

Unverified Account

$250

$1,000

$4,000

Verified Account

$7,500

$15,000

$60,000

As shown, verified accounts offer much higher limits. This allows for more substantial transactions. Unverified accounts can cause delays and frustrations.

Potential For Fraud

Unverified accounts are more susceptible to fraud. Scammers target these accounts because they lack the security measures of verified accounts. Below are some common fraud risks:

Phishing attacks

Fake promotions

Unauthorized transactions

Verified accounts have better security. They often include two-factor authentication and other safeguards. These features make it harder for fraudsters to succeed.

Protect your money by using a verified account. This significantly reduces the risk of fraud. Keep your transactions safe and secure.

Where To B-u-y Verified Cash App Accounts

Are you in need of verified Cash App accounts? B-u-ying verified accounts can be a practical solution. To find trustworthy sources, explore various options. Here's a guide to help you find where to B-u-y verified Cash App accounts.

Online Marketplaces

Online marketplaces are a popular place to find verified Cash App accounts. These platforms offer a variety of sellers and options.

Marketplace

Features

Ratings

eBay

Wide range of sellers

4.5/5

Reddit

Community reviews

4/5

Craigslist

Local deals

3.5/5

eBay offers a wide range of sellers. You can check seller ratings and reviews. Reddit is another great option. The community often provides honest reviews. Craigslist is suitable for local transactions. Ensure you meet in a safe place.

Reputable Sellers

B-u-ying from reputable sellers ensures a higher chance of a successful transaction. These sellers often have positive feedback and verified histories.

Look for sellers with high ratings and positive reviews.

Check if the seller has a verified history of successful transactions.

Ask for proof of verification before purchasing.

Reputable sellers can be found on forums and specialized websites. Always verify their credentials. This ensures you get a legitimate verified Cash App account.

Pricing Considerations

Understanding the Pricing Considerations for B-u-ying verified Cash App accounts is crucial. You need to know what factors affect the cost and how to compare prices effectively. This will help you make an informed decision and get the best deal possible.

Cost Factors

Several factors influence the cost of verified Cash App accounts. Let's explore these:

Verification Level: Accounts with higher verification levels cost more. This is due to the added security and features.

Account Age: Older accounts are often more expensive. They have a longer history and better credibility.

Transaction History: Accounts with a clean transaction history are priced higher. This is because they have a proven track record.

Geographical Location: Prices may vary based on the location of the account holder. Some regions are more expensive than others.

Comparing Prices

When comparing prices, consider the following points:

Look for reputable sellers. Check reviews and ratings before making a purchase.

Compare the features of each account. Make sure they meet your needs.

Review the terms and conditions. Some sellers offer guarantees and customer support.

Feature

Low-Cost Accounts

High-Cost Accounts

Verification Level

Basic

Advanced

Account Age

New

Older

Transaction History

Limited or None

Extensive and Clean

Geographical Location

Varies

Varies

By understanding these pricing considerations, you can make a wise investment. Make sure to weigh all factors and choose the best option for your needs.

Ensuring Seller Legitimacy

B-u-ying verified Cash App accounts can be a daunting task. Ensuring the seller's legitimacy is crucial. Understanding the steps to verify a seller can save you from scams and fraud.

Verification Checks

Performing verification checks on the seller is essential. Here are some steps to follow:

Check the seller's reviews and ratings.

Ask for proof of previous successful transactions.

Verify the seller's identity through social media profiles.

Confirm the seller's contact information is valid.

Red Flags To Watch For

Spotting red flags can help you avoid fraudulent sellers. Be cautious of the following:

Sellers with no reviews or poor ratings.

Unwillingness to provide proof of successful transactions.

Inconsistent or hard-to-verify contact information.

Pressure to complete the transaction quickly.

Ensuring the seller's legitimacy involves these critical steps. Following these guidelines can protect you from potential scams.

Secure Payment Methods

B-u-ying verified Cash App accounts requires careful attention to secure payment methods. Ensuring safety during transactions is vital. Utilize safe practices to protect your money.

Safe Transactions

Safety in transactions is crucial when B-u-ying verified Cash App accounts. Use reputable payment methods to avoid fraud. Consider using the following options:

PayPal: Offers B-u-yer protection and secure payments.

Credit Cards: Ensure transactions are traceable and reversible if needed.

Escrow Services: Holds funds until you confirm the account is as described.

Always verify the seller's credentials. Check reviews and feedback to ensure trustworthiness.

Avoiding Scams

Avoiding scams is essential when purchasing verified Cash App accounts. Look for red flags such as:

Unverified Sellers: Avoid sellers without a proven track record.

Too Good to Be True Offers: Be cautious of prices significantly lower than average.

Pressure Tactics: Sellers pushing for quick decisions may be scammers.

Report suspicious activity immediately. Use trusted platforms for B-u-ying verified accounts.

Safe Payment Method

Reason to Use

PayPal

B-u-yer protection and secure transactions.

Credit Cards

Traceable and reversible transactions.

Escrow Services

Funds held until transaction confirmation.

Account Delivery And Setup

Setting up your newly purchased verified Cash App account is a crucial step. This ensures you can use it smoothly and securely. This section will guide you through the account delivery and setup process. Follow these steps to get your account up and running in no time.

Receiving Your Account

Once you B-u-y a verified Cash App account, you will receive account details. These details include:

Username and password

Email linked to the account

Security questions and answers

Ensure you keep this information safe. It is essential for accessing and managing your account. You will receive these details via email or a secure message. Check your spam folder to ensure you don't miss it.

Initial Configuration

After receiving your account details, the next step is configuration. Follow these steps:

Log in to your Cash App account using the received username and password.

Update the password to one of your choices. Ensure it is strong and unique.

Verify the linked email address. This helps in account recovery if needed.

Set up two-factor authentication (2FA) for added security.

Updating your password and verifying your email are crucial. They protect your account from unauthorized access. Setting up 2FA adds an extra layer of security. Always keep your security questions and answers confidential.

Now your account is ready to use. You can send and receive money easily. Enjoy the benefits of your verified Cash App account.

After-sale Support

B-u-ying verified Cash App accounts offers many advantages. One of the most significant benefits is the after-sale support. Quality after-sale support ensures that your experience remains smooth and stress-free. Let's dive into the specifics of this crucial aspect.

Customer Service

Customer service plays a vital role in your overall experience. The team is dedicated to helping you with any questions or issues you may have. They are available 24/7 to provide prompt responses and solutions.

24/7 Availability: Get help anytime, day or night.

Quick Responses: Expect swift answers to your queries.

Friendly Staff: Interact with polite and professional agents.

Technical Help

Technical help is another crucial aspect of after-sale support. This ensures that any technical issues are resolved quickly. The team can assist with a wide range of technical problems.

Issue

Solution

Login Problems

Guidance on resetting passwords and security checks.

App Errors

Troubleshooting steps to fix common app errors.

Transaction Issues

Help with resolving failed or stuck transactions.

Technical help ensures that your Cash App account functions smoothly. Any disruptions are dealt with swiftly and efficiently.

Maintaining Account Security

Maintaining Account Security is crucial when you B-u-y verified Cash App accounts. Your financial safety depends on it. By implementing a few key practices, you can keep your account secure. Let's explore these essential steps.

Regular Monitoring

Always monitor your Cash App account regularly. Check for any unusual transactions. If you spot anything suspicious, report it immediately. Regular monitoring helps you catch problems early. This keeps your funds safe from unauthorized access.

Updating Personal Information

Ensure your personal information is up-to-date. This includes your phone number, email, and address. Accurate information helps in account recovery if needed. Also, it adds an extra layer of security. Keeping your details current minimizes risks and ensures smooth transactions.

Follow these steps to update your information:

Open the Cash App.

Go to the profile section.

Select "Personal Information".

Update your details accordingly.

By keeping your account information accurate, you add an extra layer of security. Never overlook these simple yet effective steps to protect your Cash App account.

Legal Implications

Purchasing verified Cash App accounts can be tempting for quick access and convenience. However, it's essential to understand the legal implications associated with such transactions. Let's dive into the key aspects.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Compliance With Laws

B-u-ying verified Cash App accounts can potentially violate local and international laws. Unauthorized account transactions may involve identity theft or fraudulent activities. Engaging in these practices may lead to severe legal consequences.

Always ensure that your actions comply with the laws and regulations of your region. Ignorance of the law is not a valid defense in court. Being aware of the legal landscape can save you from potential penalties and legal actions.

Legal Aspect

Possible Consequences

Identity Theft

Jail time, fines

Fraudulent Activity

Legal actions, financial loss

Terms Of Service Considerations

Cash App's Terms of Service explicitly prohibit the sale or transfer of accounts. Violating these terms may result in the suspension or termination of your account.

Understanding the Terms of Service is crucial. Here are some key points:

Account Integrity: Your account must be personal and non-transferable.

Unauthorized Access: Sharing or selling accounts is strictly forbidden.

Security Measures: Ensure all activities comply with Cash App's security policies.

Failure to adhere to these terms can lead to permanent bans and potential legal ramifications.

Always read and understand the service agreements before engaging in any transactions. This will help you stay compliant and avoid any unwanted issues.

Testimonials And Reviews