#Cash App routing number

Explore tagged Tumblr posts

Text

I case you have some questions about the 041215663 routing number, this is the post you need to read.

1 note

·

View note

Text

What Bank is Cash App and How Does It Work: Cash App Direct Deposit Bank

If you are doubtful about the Cash App bank name, you have landed at the right place. Here we are going to discuss the Cash App bank name and how it works. Does Cash App work with one or two banks? Well, you are going to get all the answers related to the Cash App bank. Like other financial apps, Cash App has tied up with banks to manage its direct deposits and Cash App cards. Further, Cash App is a bank alternative for those who are not having traditional bank accounts. It provides banking services and debit cards (Called Cash Card) through its bank partners. So, without any further ado, let’s know ‘what bank is Cash App and how does it work?’ and, how to find the bank name.

What bank is Cash App?

Firstly, you should know that Cash App is not a bank, it is a bank alternative for those who are not having traditional bank accounts. Cash App is a safe and secured financial services platform with millions of active users in the US and UK as it is only available in these two places at this time. As mentioned earlier, it is not a bank account, it is a financial app that offers banking services and issues debit cards through its bank partners. So, it is an app that works in association with two different banks. It works with Sutton Bank and Lincoln Savings Bank to manage its financial services.

However, a single Cash App user can’t have two banks, here you can find out exactly which one it is in your case.

How to find what bank is Cash App?

It is quite easy to find the name of your Cash App bank. To do so you should open the Cash App on your mobile device. Then tap the routing number and account number. You can see them below your balance in the banking tab (“$”).

How does Sutton bank manage Cash App?

You can find the bank name by using routing number and account number. You can find the bank name by googling the routing number and account number that you can locate below the balance tab ($). Once you are clear about your Cash App bank, it is easy to know its working. Suton bank is the main bank of Cash App that issues Cash Cards to Cash App users and manages its Cash Cards functions and transactions. Sutton bank works as a trading partner of the Cash App and handles all the tasks associated with the Cash App debit cards.

Does Sutton bank manage Cash App direct deposit?

As mentioned above, Cash App works with two banks- Sutton bank and Lincoln Savings Bank. Here the Sutton Bank issues and manages card-related activities on the other hand, Lincoln Savings Bank regulates Cash App online financial transactions and direct deposits.

Except for issuing a Cash App card, it has no relation with Cash App.

When a Cash App user applies for Cash Card, Cash App forwards the application to Sutton. Then Sutton bank representatives go through the application, check out all the formalities and verify the document sent for Cash Card. If everything is ok with your documents, they issue a Cash Card which gets delivered to you within 8-10 days.

Can you log in from the Cash App into Sutton Bank?

No, you can’t login into Sutton bank with your Cash App as Sutton bank doesn’t support Cash App. Sutton Bank issues Cash App Cards to the users of Cash App and no other association.

Can I find the address of Sutton bank Cash App for direct deposit?

There is no address for Sutton Bank Cash App direct deposit as Sutton Bank does not deal with Cash App users in a direct way. Sutton Bank is only responsible for issuing Cash App Cards and handles Cash Card related services.

Is Cash App a Sutton Bank?

No, Cash App is not a Sutton Bank but it is a financial platform that works with two banks - Sutton Bank (issues Cash Card) and Lincoln Savings Bank ( for making direct deposit).

How to enable direct deposit on Cash App

With Cash App direct deposit, you not only paychecks but also make other payments including your tax returns. If you want to enable direct deposit, you have to first locate your routing and account number on the Cash App.

After enabling direct deposit, you succeed in increasing the direct deposit limit and you’re able to receive up to $25,000 per direct deposit and up to $50,000 in a day.

If you succeed in enabling direct deposits, these are available in your account even up to two days earlier than most banks. However, it might take some extra time if you are making the direct deposit for the first time.

Cash App works with two banks and each bank has its specific roles and duties to perform. For instance, we have discussed above the role of Sutton Bank. However, you are not very familiar with Lincoln Savings accounts. Lincoln Savings Bank manages Cash App direct deposits.

How to find the bank address with routing number

It is quite easy to find the bank address with the routing number. You can use the US Routing number checker to validate and find bank addresses based on its database. With Routing number checker, you find Bank name and its address including (city, state, and ZIP) and phone number. So, you can find your Cash App bank name and address with the routing number available under the balance tab in the Cash App.

Do you need a Cash App bank to pay bills with Cash App?

While you pay bills you need to use your account and routing number. If you are proceeding to pay bills using your account and routing number, follow these steps:

Go to the home screen of the app and tap the “Banking tab”.

Now, select the “Deposits &Transfers”.

Then, copy the account details.

Paste the detail while setting up bill pay when prompted for a bank account.

Finally, we believe the above information is helpful for you. Cash App is not a proper bank but is a financial platform and a bank alternative for those who are not having a traditional bank account. Cash App works with two banks as mentioned above- Sutton bank and Lincoln Bank.

5 notes

·

View notes

Text

👉 Cash app available business services

Cashout 100%$ $ (good rate service) Cash app tag Sell New/Old cash Tag

#cashapp#buy cashap account#cas harlow#cash app#cash apps that pay you#cash apps for under 18#cash apps that actually work#cash apps account#cash app malayalam#cash apps to request money from#cash apps games#cash apps telugu#cashappsecuritysettlement com#cashappsecuritysettlement#cash apps#cashapps bank#cash app's bank name#cashapps routing number#cast of happs place#cashappsecuritysettlement.com claim#cashappsecuritysettle be ment.com/submit-claim#cashappshop

0 notes

Text

WILDFIRE AID RESOURCES MASTERLIST

these are all the places ive found helping those affected by the la fires. please stay safe everyone <3

______________________

FREE THINGS:

Planet Fitness Offers Free Things (ends January 15)

Form To Get Free Temporary Housing From AirBnB (space limited, eligibility criteria required)

List of Restaurants Offering Free Meals (updated January 9)

______________________

UPDATED MAPS:

CalFire

Watch Duty

______________________

INFORMATION:

List of Updated Info

Spreadsheet of Resources (by location and type of aid)

If you have anything to add to the list linked above, comment here

______________________

SHELTER:

If you need shelter, text "SHELTER" and your zip code to 43362 for nearest open shelters

open shelters:

Arcadia Community Center – 375 Campus Drive, Arcadia, CA 91007

Ritchie Valens Recreation Center – 10736 Laurel Canyon Blvd., Pacoima, CA 91331

Pan Pacific Recreational Center – 7600 Beverly Blvd., Los Angeles, CA 90036

Westwood Recreation Center – 1350 Sepulveda Blvd., Los Angeles, CA 90025

El Camino Real Charter High School – 5440 Valley Circle Blvd, Woodland Hills, CA 91367

Pasadena Civic Center – 300 East Green Street, Pasadena, CA 91101

Pomona Fairplex – 1101 W McKinley Ave, Pomona, CA 91768

YMCA of Metropolitan Los Angeles - locations unaffected by fire are open and providing free childcare to those who need it. also offering evacuation sites, temporary shelter, basic amenities, and showers.

for updates and locations click here

______________________

TRANSPORTATION:

CalTrans Updated Road Closure List

Fare collection suspended at Metro through January 9. A list of updates and changes that occurred because of the fires and winds can be found here.

Lyft is offering two free rides of 25$ each (50$ total) for 500 riders using code CAFIRERELIEF25. offer ends January 15.

Uber is offering a free ride of up to 40$ for those who use code WILFIRE25 in the wallet section of the app

______________________

ANIMAL CARE:

List of Shelters (check capacity and availability)

______________________

MENTAL HEALTH:

LA County set up a 24/7 hotline to help with anxiety, distress, and grief. Call (800) 854-7771.

______________________

WHAT TO PACK:

remember the six p's:

people and pets

papers, phone numbers and important documents

prescriptions, vitamins, and eyeglasses

pictures and irreplaceable memorabilia

personal computer, hard drive, and disks

plastic (debit, credit, ATM cards) and cash

what to put in your "go bag":

face masks/face coverings

three-day food supply (nonperishable)

three gallons of bottled water per person

map marked with AT LEAST two evacuation routes

basic first aid and medical supplies

sanitation supplies

toothbrushes, toothpaste, hair brush, deodorant

period products

prescriptions and medications

a change of clothes (bring AT LEAST one warm coat)

spare eyeglasses or contacts (if needed)

extra set of car keys

chargers for your devices

cash, credit/debit cards, traveler's checks

flashlight

battery powered radio

EXTRA BATTERIES

(copies of) important documents such as birth certificates, passports, insurance, a list of emergency contacts and phone numbers

your wallet (ID CARD)

food, water, and meds for your pets (checklist here)

a can opener

not necessary but you might want to bring:

valuable items that can be easily carried

family pictures that cannot be replaced

blankets

more than a day's worth of clothes

important school supplies (for students)

books

trophies, medals, certificates, awards

pens and paper

self defense tools (pepper spray, pocket knives, etc) (NOT ENCOURAGING VIOLENCE. FOR SELF DEFENSE ONLY)

extra shoes

fuzzy socks

non-essential hygiene products

gum/breath mints

ALWAYS PREPARE BEFOREHAND. EVEN IF YOU ARE NOT DIRECTLY IMPACTED, THE FIRES CAN GROW. KEEP YOUR BAGS IN THE CAR SO YOU CAN EVACUATE QUICKLY IF NEEDED.

______________________

WANT TO HELP?

Best Friends Animal Society

LA Fire Department (donations sent directly to first responders)

LA Food Bank

LA Works

MusiCares

Salvation Army

Santa D'Or (in need of fosters for displaced cats)

Silverlake Lounge (also offering a communal gathering place)

Sweet Relief Musicians Fund

Dream Center (in need of volunteers + non-perishable food items)

The Red Cross

We Are Moving the Needle

World Central Kitchen

United Way of Greater LA

As of January 9, the Westwood Recreation Center and Pan Pacific Park are at full capacity and not accepting additional donations. Check with all organizations by phone, text, or email before donating if possible.

______________________

IF THERE'S ANYTHING I MISSED OR MESSED UP PLEASE ADD IT OR LET ME KNOW SO I CAN FIX IT. REBLOG TO SPREAD AWARENESS!!!!!!!! stay safe everyone

#reverie's day dreams#palisades fire#pacific palisades#eaton fire#pasadena#altadena#hurst fire#kenneth fire#la fires#los angeles#wildfires#california fires#southern california#socal#socal fires#santa ana winds#climate change#natural disasters#california#fires#fire safety#resources#aid#fire aid

424 notes

·

View notes

Text

The App (2)

Three weeks. Two burner phones. One frenzied apartment change. That was all it took for you to start believing you were free.

You’d torched every digital breadcrumb like a fugitive with blood on their hands. The old phone? In pieces. Your social media? Wiped clean, like a crime scene bleached of evidence. The new number came from a prepaid device you bought with cash at a rundown gas station two towns over—right next to a place that sold fireworks and pickled eggs. You told no one but your family where you’d gone, and even then, you didn’t tell them why.

The apartment was smaller than the last one. Claustrophobic, maybe, but it had good bones: thick walls, double deadbolts, and a front desk guy named Marcus who treated unknown visitors like they were walking lawsuits. Most nights, you even slept through without scanning the corners for shadows that moved too smoothly, too human, but not quite enough.

For a moment, a fleeting, fragile moment, you believed you'd done it. That you’d outrun Raye.

And then the books started arriving.

The first one came five days after you finally began to settle in. No envelope, no Amazon box. Just a dog-eared romance novel—The Billionaire’s Forbidden Love—resting right in front of your door like an orphaned pet. Shirtless dude on the cover, a woman swooning like her bones had gone soft. You laughed, briefly. Then you saw the neon-yellow highlighting, thick and uneven like it had been applied with too much pressure:

“You can run, my love, but you cannot escape destiny. What belongs to me will always find its way home.”

You didn’t laugh after that. You pitched it into the alley dumpster and double-locked the door. Then you added a chair under the knob, just like your dad taught you.

The next day, the second book showed up. But this time, it was inside. Sitting right on your pillow. The highlighted passage was even worse:

“He watched from afar, memorising every pattern, every habit. True love required study, devotion, and pursuit. She would understand, eventually, that his persistence was the purest expression of his feelings.”

You tore the place apart. Every lock, every latch, every inch of ductwork. The windows were sealed, the cameras at the front desk had nothing. No one but you had come in.

By the end of the week, you had seventeen books. Seventeen. Titles like – Surrendering to the Shadow King and The Possessive Duke’s Darling. And they kept appearing in places they had no business being. One in your refrigerator, its pages damp with condensation. One stuffed between your clean towels. One curled like a sleeping dog in your shower caddy.

Each with its own highlighted passage about destiny, ownership, and love sharpened into obsession.

You considered calling the police. Then you thought about what that call would sound like: Hello, officer? I’m being stalked by a man who may not be a man and who communicates exclusively via bodice-rippers. Yeah. That’d go over well.

Then came a knock.

You crept to the peephole, half-expecting a nightmare in a human suit. But it was Mrs. Abernathy, your octogenarian neighbor with a floral scarf and a fondness for raisin cookies.

“You have a package, dear,” she called sweetly. “Special delivery.”

You cracked the door just enough to peer out. “I didn’t order anything.”

Her eyes didn’t look quite right. Too glassy, like someone had forgotten to switch them on all the way. Her smile stretched a bit too wide, like someone had drawn it there with a knife.

“Oh, I know,” she said, waving a small wrapped parcel. “That lovely boy Raye asked me to bring it. He showed me pictures. Said you were engaged. Such a devoted young man!”

You slammed the door like it was a guillotine. Locked everything. Heart pounding hard enough to echo in your ribs.

Through the wood, her voice came again, but it had a different flavor now—tinny, mechanical, like it had been routed through a bad speaker. “He asked me to tell you he’s learned from his mistakes. Movies were poor research materials. He’s found much better guides now.”

You didn’t say a word. Eventually, her steps shuffled away.

You should’ve been gone by then. Should’ve run. But something—foolish hope, or maybe just fear—kept you rooted to that spot. That night, the package still showed up.

You found it on your kitchen counter. Inside was a leather-bound journal. Handmade. Not a book but a log. Each page was filled with razor-precise handwriting—cold, methodical, obsessive. A surveillance diary.

It catalogued your life: what time you left for work, what you ordered for lunch, who you spoke to, how long your showers lasted. Some entries even had photos. From behind bushes. Across the street. Through windows. They dated back months before you ever met him.

The final page was in red ink, as if written in something warmer than pen:

“I have identified the errors in my courtship approach. Fiction is an incomplete source for behavioural protocols. I have been observing actual human mating behaviours and have identified more successful strategies. Persistence is key.”

“I have instead been consulting superior information repositories that your species calls Reddit, 4chan, and various forums dedicated to "game." I have also analysed dating advice blogs and YouTube channels dedicated to human mating strategies.”

“The consensus is clear: females respond to what humans designate as "alpha" behaviour. One must "hold frame" and employ "negging" and "dread game." The courtship requires what your species terms 'pushing past last-minute resistance”. I will begin again tomorrow. You will find my improvements satisfactory.”

You didn’t read any further. You just grabbed your things, left the apartment, and checked into a hotel the furthest from your apartment.

You didn’t care anymore. The world you thought you knew had slipped away, and now you were just running, your phone buried in the lining of your suitcase. At dawn, your eyes opened to a rose on the pillow beside you.

Your phone buzzed, though it was supposed to be off. You checked it. The app was back.

A single message blinked at you like an open eye:

Good morning. I have located your temporary nest. Your evasion techniques are impressive but unnecessary. I now understand that pursuit and resistance are part of the dance. This is biology. I will perform correctly this time. I am upgrading for you.

You didn’t even stop to brush your teeth. You didn’t bother packing. You didn’t bother trying to reason with yourself. You checked out of there in a flash, running down the hotel hall, looking for an exit; a chance to breathe without Raye’s presence closing in on you like a vice.

You burst into the morning air, your breath clouding in the cold as you stumbled into the streets. The first taxi you spotted felt like a lifeline, and you threw yourself into it without thinking twice.

The driver was an old man—silver hair combed neatly, liver spots on his hands, eyes soft and wet like a dog’s. He glanced at you in the rearview mirror and smiled, a slow,little smile.

“Where to, miss?” he asked, voice gravelly and warm, the kind of voice you think should come bedtime stories.

“Train station.” Your voice was high, tight. “Please hurry.”

The cab pulled out with a gentle lurch.

“Bad morning?”

You nodded, eyes glued to the window and pressed yourself against the door. You stared out the window, your heart was still punching your ribs. You thought if you stayed quiet, maybe you could disappear. Maybe he wouldn’t find you.

“Boyfriend trouble?” the old man asked, trying to make it sound harmless.

You swallowed. That word—boyfriend—curled in your throat like something rotten. “Why do you care?” you asked, too sharp.

He fell silent.

The city blurred past—gray buildings, flickering signs, streets that all looked like they were exhaling their last breath. Then you realized something was off. A left turn when it should’ve been right. A street you didn’t recognize. You sat up, brows furrowed.

“Hey,” you said, leaning forward, “you’re going the wrong way.”

No response.

“Sir? Did you hear me?”

Still nothing. The cab made another turn. Left. Not toward the bus station. Not toward anything you recognised.

“Hey! Sir this isn't where the train station is,” you repeated, the chill of dread sliding under your skin like ice water. “You’re going the wrong way?”

The driver’s voice came again, but it had changed. Just slightly. Too measured. Too... calculated.

“Creating uncertainty increases emotional dependence,” he said.

You froze.

“What?”

“The literature states that unpredictable environments produce deeper attachments.”

You reached for the door handle.

Click.

Locked.

You yanked this time. Still locked - child locks. Of course.

Your stomach dropped like a stone into a bottomless lake. You turned back to the driver, heart hammering. “Let me out,” you said. “Now.”

“The manuals suggest limiting options increases compliance,” he says, smooth as ice, still not looking at you.

You pulled your phone from your pocket. No signal. Useless. You pounded the window, screaming. “Let me the hell out!”

The taxi sped up, turning down a quieter road—broken sidewalks, chain-link fences, warehouses that haven’t been used in decades. The kind of place where bad things happen and no one finds out until it’s too late.

In desperation, you looked at the driver, ready to plead, threaten, whatever it took—and froze. In the rearview mirror, where the old man's eyes should have been reflected, there was nothing. Just empty space.

As if sensing my realization, the driver's face rippled. Like wax left too close to a fire, the old man melted away. The silver hair receded, the wrinkles smoothed. And what’s left was him.

Raye.

His familiar, too-perfect face stared back at you from the mirror, his expression neutral, observant.

“Was the old man's disguise inadequate?” he asks, genuinely curious, like a scientist observing a mouse that bit back. “I modeled it after ‘trustworthy archetypes.’”

“You... you.. just, let me out,” you said, quieter now. Not because you’re calm, but because you were trying to be. “Please.”

“Your heart rate has increased,” he noted. “The forums suggest this indicates attraction, yet your verbal cues suggest aversion.”

His head tilted. That same goddamn tilt you remembered from your first and last date.

“The data remains inconsistent.”

“Well, gee, perhaps the reason for that is because you are kidnapping me!” You saw the road slipping past. Warehouses and rusted fences blurring by. You tried to memorize every turn. Useless. You knew it was useless..

“Your cultural narratives celebrate pursuit after rejection. They frame perseverance as romantic despite the ethics and laws. Is this your attempt at stimulating narrative tension? Are you playing, as your people say, hard to get?”

You were shaking now. Not from fear—but from thr hot, boiling pit simmering inside you. “They’re written by people who want control, not connection. Hell, do you even understand what you're reading?” You said, breath trembling, “You have no damn idea, do you?”

He processed that. You can see him processing it. "The research is indeed inconsistent." The cab had slowed now, creeping down a service road lined with oleander bushes, their pink flowers drooping like exhausted dancers. "I calculated the most efficient approach based on available data.. the forum posts with the highest engagement metrics suggested—"

"Shut up wbout your stupid data! You don't know anything about love!" I gestured at the surroundings; the locked doors. "This - what you're doing - just creates fear. Not love.”

Raye's hands tightened on the steering wheel. Just slightly. The knuckles went white, then translucent, something that looked like starlight filtering through fog.

"I have exonerated my sources. I have watched 689 romantic films," he continued, voice carrying a new edge like glass scraping against glass. "Read 447 romance novels. Monitored 432 relationship advice forums. Observed—"

"OBSERVED!" You were shouting now, past caring. "That's all you do, isn't it? Watch and copy and calculate, but you've never felt a goddamn thing in whatever passes for your life. Relationships aren't algorithms. You can't learn them from books or websites. You need real experience. And you never experienced love in your life!"

The cab jerked to a stop.

In the terrible silence that followed, your own breathing, ragged and harsh, ricocheted in your ears. Raye's reflection had gone perfectly still. When he finally spoke, his voice was different — quieter, with a sound like distant rain.

"You are... correct. I have no experiential database for the emotion you call love. Only... approximations. Simulations." His head tilted, that familiar gesture now seeming disappointed rather than curious. "The inconsistencies in human behaviour patterns suggest an underlying complexity I failed to accurately model."

Something changed in the air. The child locks clicked open.

"If love cannot be calculated or observed from the outside," he said, still facing forward, "then my research methodology is fundamentally flawed."

You didn't hesitate. Your fingers were on the handle, your foot hitting the cracked asphalt before my brain could catch up. You were already running, but his final words followed you down that empty road: "I will... recalibrate. Begin new research. Attempt to understand the variables I overlooked."

For three days, there were no books, no messages, no signs of Raye. You began to hope that perhaps you had crashed his reasoning, created a logic loop he couldn't resolve.

Then on the fourth morning, you found a book on my new kitchen table in yet another new apartment that no one should have known about. It wasn't a romance novel this time, but a philosophy text opened to a passage about identity. A note had been paper-clipped to the page, written in that same mechanically precise handwriting:

"I purged the corrupted data. Your internet contains many viruses of thought. I will observe more carefully now, without intervention. When I understand the paradox, I will return."

"The designation "fiancé" was premature. The designation "researcher" was inadequate. I find no human words for what has transpired between us. Thank you for identifying the error in my programming. I will experience love."

next chapter

#yandere#my writing#male yandere#yandere x reader#yandere x darling#yandere x you#yan blog#yandere x y/n#yandere alien#fantasy#alien oc#writeblr#yandere oc

284 notes

·

View notes

Text

It's not yet noon, and this is already a fantastic day.

On Thursday I pedaled my bicycle downtown to work. When I bike I leave my regular wallet, with its many cards, at home. Instead I put cash, a Visa card and my driver license in a thin plastic case normally used for business cards. It fits my pocket better. If I lose it I don't have as many things to replace.

Somewhere in Minneapolis, on a busy road (with bike lanes) my wallet fell out of my pocket. I had recently been to an ATM, so there was over $100 in there. I felt awful. As soon as I noticed I shut off the Visa via a phone app.

I had my name and phone number on the case. You never know, there can be nice people out there. Using my label maker also makes me happy.

Early this morning, while at the dog park, my phone rang. A guy found my little wallet while he was bicycling and wanted to get it back to me. Quickly I left the park to meet him at a farmers market in Richfield, along the route I pedaled to work on Thursday.

We met up. He handed me the wallet. Everything was there!

I tried to give him some cash. "At least let me pay for your lunch today," I suggested. He refused the offer. He commented that the label with my name and phone number was a fantastic idea. He planned to do the same thing. Had my label maker been in my truck I would have insisted he take it.

When I got home I saw my neighbor spreading black dirt and grass seed in his yard. I asked where he filled his trailer full of dirt. He told me there's a composting facility a few miles from our houses that sells topsoil. It's inexpensive, he added, and they fill truck and trailers for you so you don't need to load it yourself.

Damn! Each year I usually buy ten or so bags of black dirt from a home improvement store. I use the dirt to fill holes one of the dogs dug or various low spots in the yard. Those bags cost $3 to 4 each.

The half yard of soil (it nearly filled my pickup truck bed) was $13. Holy cow, how had I not known about this place all these years?

I'll add some grass seed to the soil and spread it around the yard later today. For now I think I'll treat myself to a nice lunch then take a nap.

47 notes

·

View notes

Text

Get the Financial Boost You Need: How an Upwards Personal Loan Can Help You Today

In today’s fast-paced world, financial challenges can arise without warning. Whether it’s a medical emergency, sudden travel plan, education expenses, or just the need for extra cash to tide over the month, getting timely help is crucial. That’s where an Upwards personal loan becomes a reliable and efficient solution. With a quick process and a customer-centric approach, you can easily apply loan via Upwards without the long wait or piles of paperwork.

If you’re on the lookout for an instant loan by Upwards, this guide covers everything you need to know — from eligibility and documentation to the benefits and tips for a smooth Upwards loan application process.

What Makes an Upwards Personal Loan Stand Out?

Unlike traditional loans that often involve extensive checks and prolonged approvals, the Upwards personal loan is crafted for modern-day borrowers. It offers hassle-free access to credit with minimum documentation and a tech-enabled platform that puts you in control.

When you apply loan via Upwards, you are stepping into a borrowing experience that is digital, transparent, and user-friendly. The entire process — from checking eligibility to disbursal — is streamlined so that you can get funds when you need them the most.

Benefits of Choosing an Instant Loan by Upwards

Here’s why thousands of borrowers are choosing an instant loan by Upwards over conventional lending routes:

1. Fast Approval and Disbursal

With Upwards, speed is everything. Once your Upwards loan application is approved, the funds are transferred directly to your bank account within 24-48 hours, sometimes even sooner.

2. 100% Online Process

There’s no need to visit a branch or handle physical paperwork. The Upwards personal loan can be availed entirely online, from your smartphone or computer.

3. Flexible Loan Amounts

Whether you need ₹20,000 or ₹2,00,000, you can apply loan via Upwards for an amount that matches your requirement, with repayment tenures that range from a few months to a couple of years.

4. No Collateral Required

One of the biggest advantages of an instant loan by Upwards is that it is unsecured — no need to pledge your assets or worry about guarantors.

Who Can Apply for an Upwards Personal Loan?

The eligibility for an Upwards personal loan is simple and inclusive. Salaried individuals working in recognized companies across Tier 1, 2, and 3 cities in India are eligible. The platform primarily focuses on middle-income earners, making it accessible to a large population.

Typical criteria include:

Minimum age of 21 years

Monthly income of ₹15,000 or above

Stable employment for at least 6 months

A valid bank account and PAN card

If you meet these requirements, you can easily apply loan via Upwards within minutes.

How to Complete the Upwards Loan Application

Filling out the Upwards loan application is designed to be simple, user-friendly, and quick. Here’s how the step-by-step process works:

Visit the Upwards platform or download the app.

Register using your mobile number and verify with OTP.

Enter basic personal details like name, address, income, employer, and PAN card.

Upload documents digitally — no physical submission needed.

Get instant approval status based on your profile.

Receive funds in your account upon successful verification.

The process to apply loan via Upwards can be completed in under 15 minutes, saving you time and effort.

Documents Required for Instant Loan by Upwards

While the Upwards personal loan offers flexibility, a few documents are necessary to verify your identity and income:

PAN Card

Aadhaar Card or Voter ID

Salary slips (last 3 months)

Bank statement (last 3-6 months)

Employment details or offer letter

These documents are uploaded securely, and the platform uses encryption to ensure your data remains private and protected during the Upwards loan application process.

Real-World Use Cases of an Upwards Personal Loan

Whether you’re facing an emergency or planning something exciting, an instant loan by Upwards can be the solution. Here are some common scenarios where borrowers have benefited:

1. Medical Emergencies

In critical moments, there’s no time to arrange finances. Many users apply loan via Upwards for hospital bills, surgeries, or unexpected medical costs.

2. Wedding or Celebration Costs

Indian weddings are expensive, and not everyone has savings ready. An Upwards personal loan can cover venue booking, catering, and decoration expenses.

3. Debt Consolidation

Juggling multiple debts? Streamline your finances by taking a single instant loan by Upwards to pay off other liabilities and reduce your stress.

4. Home Renovation

Thinking of giving your home a makeover? From furniture to paint and new appliances, you can apply loan via Upwards to fund your dream home update.

Tips for a Successful Upwards Loan Application

To maximize your chances of approval and get the best terms on your Upwards personal loan, keep the following tips in mind:

Maintain a good credit score: A score above 700 improves your chances of approval and may lead to lower interest rates.

Avoid multiple applications: Sending loan requests to different lenders can negatively affect your credit profile.

Provide accurate details: Ensure your personal and financial data is correct to avoid delays.

Use the loan responsibly: Always borrow what you can repay comfortably.

By preparing ahead, your Upwards loan application is more likely to be approved quickly and on favorable terms.

Interest Rates and Repayment Terms

Interest rates on an Upwards personal loan depend on various factors like credit score, income, and city of residence. Typically, rates range between 1.5% to 2.5% per month. Repayment is done in EMIs, and you can choose a tenure that suits your financial comfort.

Always read the terms before you apply loan via Upwards to understand any processing fees or prepayment charges involved.

What Sets Upwards Apart From Other Lenders?

With a growing number of digital lenders in the market, what makes the Upwards personal loan so unique?

Focus on Middle-Income Borrowers: Upwards specializes in serving people who may not have access to traditional bank loans.

High Approval Rates: Thanks to their advanced credit assessment model, the approval rates for an Upwards loan application are higher than many competitors.

Excellent Customer Support: Users often praise the support team for resolving queries quickly and effectively.

Transparent Policies: No hidden fees or vague terms. When you apply loan via Upwards, you know exactly what you’re signing up for.

Frequently Asked Questions

Q1: How quickly can I receive funds after the Upwards loan application is approved?

Most users receive the amount within 24 to 48 hours after document verification.

Q2: Can I prepay my Upwards personal loan without penalties?

Yes, Upwards allows prepayment. However, check the loan agreement for any applicable charges or conditions.

Q3: Is there a mobile app to apply loan via Upwards?

Absolutely. The Upwards app is available on both Android and iOS, making the Upwards loan application process even more convenient.

Q4: What if my application is rejected?

If your Upwards loan application is rejected, you can reapply after improving your credit score or income profile. The platform may also suggest alternatives.

Final Thoughts

The Upwards personal loan is a modern solution for those who need fast, reliable financial support without the bureaucratic hassles of traditional lenders. Whether it’s a sudden expense or a planned purchase, you can confidently apply loan via Upwards and get the cash you need in no time.

With a simple application process, digital documentation, and flexible repayment options, an instant loan by Upwards can be the financial lifeline you’re looking for. So, the next time life throws a curveball, don’t stress — just open your phone and start your Upwards loan application journey.

#personal loan#loan apps#fincrif#nbfc personal loan#personal loan online#bank#personal loans#loan services#finance#personal laon#Upwards personal loan#Upwards loan application#Instant loan by Upwards#Apply loan via Upwards#Upwards online loan#Upwards loan for salaried#Instant approval Upwards loan#Quick personal loan Upwards#Best loan app Upwards#Digital personal loan Upwards#Apply for Upwards personal loan#Instant cash loan Upwards#Paperless loan by Upwards#Low interest personal loan Upwards#Fast disbursal Upwards loan#Personal loan without collateral Upwards#Personal loan eligibility Upwards#Upwards loan EMI options#Secure personal loan Upwards#Trusted personal loan app Upwards

2 notes

·

View notes

Note

Tony as a PHD student/young man working on his own start up and Steve as his usual Uber Eats delivery driver. Steve eventually getting concerned about his health considering the sheer amount of caffeine and junk he orders and how late he does, Tony ordering healthier things to make him feel better while also scolding STEVE for driving so late, Steve canceling/refusing orders to get Tony’s food to him faster and fresher (really it’s good business considering how good Tony tips, really that’s it), Tony getting extra dishes he gives to Steve to enjoy while he does other deliveries once he finds out Steve misses meals sometimes.

If Tony is rich, Tony finding out the app thinks Tony’s steadily higher tips are an error and aren’t getting the full amount to Steve (Tony not realizing he’s getting partial refunds lol rich boy) so he starts giving him cash even tho Tony hates touching (shudders) physical money. It ends with Tony hiring Steve as his own delivery man and then Tony starts ordering all his meals for 2 and them enjoying them together. Maybe this prolongs the dance they are doing cuz Tony doesn’t wanna date his employee (again, Pepper showed it was a bad idea).

Or if Tony isn’t rich, he does the 2 meals thing while Steve is still with Uber, who is losing out on orders by spending more time with Tony to eat together. And once Tony realizes this he starts going with Steve in his deliveries, man can work from anywhere and/or he needs a break. Maybe Tony makes an algorithm to find Steve the most profitable and efficient route. Them just spending all night talking while they drive around town delivering food dreaming of a future where they can do midnight drives together for pleasure rather then business

steve only ever works the late late late hours when he's driving for uber eats because he's got so much going on during the day. he has his own classes to attend part time and he still has his day job at staples, which unfortunately has cut his hours by quite a bit hence his need for another source of income. he didn't deliberately set out to work such late hours when he signed up as a driver for uber eats, but it just so happened that the first day he finally found some time to start taking orders, it was late at night after he'd finished all his assignments and he had bills to pay within the next week so he was a bit desperate.

there are really only a limited number of restaurants that are still open and taking orders past 10pm on a weeknight, and luckily steve actually lives pretty close to a few of them. when an order comes through he taps the accept button without really bothering to look at the details and grabs his keys to head out to the restaurant. it's only when he's sitting at the takeout corner waiting for the order to be packed that he notices the outrageous tip left by the customer. steve knows that this kind of a tip has to be an anomaly but he also thinks that if this is the kind of beginner's luck he's got for his first order, then maybe being an uber eats driver a few nights a week might actually help more than he originally thought.

so he grabs the bag of chinese food and heads over to the address for this "Tony S", making extra sure the food is secured in his car and the drink wouldn't spill as he drives. tony's tip alone can pay for his entire phone bill this month, and steve can't do much to thank him but at least he could do this.

when he rings the doorbell to tony's home, the last thing he's expecting is how handsome this generous customer is. not only that, but tony actually takes the time to say what seemed like a very heartfelt thank you for making a delivery this late. tony speaks to steve like he's his personal savior for bringing him food at such an ungodly hour, and his smile is so dazzling that steve is still stunned as he makes his way back to his car. that night steve dreams are filled with sparkling brown eyes and he almost wakes up late for class.

a few nights later, as steve finishes up his dinner he turns on the app again and so he can start to take orders. just as he's drying his hands after doing his dishes, four orders pop up on his screen and he rushes to take the order that's the first one on the list. he pauses just as he does, though, when he notices an order for Tony S. two rows down. he thinks of the tip he had received that first night, which was nice. then he thinks about the smile that greeted him when tony opened the door, which was even nicer.

he opens the order page for Tony S. and taps accept.

#they are so very cute thank you for this anon#also i don't know how these food delivery apps work for the drivers but i hope they do make some good money from them#stevetony#stony#kay writes things#anonymous#ask

46 notes

·

View notes

Text

How Do I Increase My ATM Withdrawal Limit on Cash App?

Cash App is a popular mobile payment service allowing users to send, receive, and withdraw money with ease. One aspect that Cash App users often want to know about is how to increase their ATM withdrawal limit. By default, Cash App has set limits on ATM withdrawals, which can sometimes restrict users from accessing the cash they need. In this guide, we’ll provide in-depth information on the Cash App ATM withdrawal limit, including ways to increase it and make the most out of your Cash App account.

Understanding the ATM Withdrawal Limit on Cash App

The ATM withdrawal limit on Cash App is set to ensure the security of user funds and to manage transaction fees effectively. For a standard Cash App user, the ATM withdrawal limit is typically capped at $310 per transaction, $1,000 per day, and $1,000 per week. However, verified Cash App users and those who receive direct deposits may qualify for higher limits.

Why Cash App Has ATM Withdrawal Limits

Cash App applies ATM withdrawal limits as a part of its security protocol, aiming to protect users from unauthorized withdrawals and excessive fees. Additionally, setting withdrawal limits allows Cash App to better manage its network resources and improve transaction speeds. Although these limits are in place, verified users can often increase their limits by following certain steps and requirements.

Steps to Increase Your Cash App ATM Withdrawal Limit

If you frequently use Cash App for cash withdrawals, you may be interested in increasing your withdrawal limit. Follow these steps to boost your Cash App ATM withdrawal limit effectively.

1. Verify Your Cash App Account

The first and most crucial step to increasing your ATM withdrawal limit on Cash App is verifying your account. Verified accounts are generally eligible for higher limits, including higher sending, receiving, and withdrawal amounts. To verify your Cash App account:

Open the Cash App and navigate to your profile.

Enter your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Follow any additional instructions for identity verification.

Once verified, your account will be eligible for increased limits, allowing you more flexibility in using your Cash App funds.

2. Set Up Direct Deposits on Cash App

Cash App users who receive direct deposits can enjoy higher ATM withdrawal limits and additional perks, such as the ability to withdraw funds from ATMs without the standard fees. Setting up direct deposits is a straightforward process:

Go to the Cash App home screen and tap on the “Banking” tab.

Select “Direct Deposit” and follow the instructions to complete the setup.

Provide your Cash App account and routing numbers to your employer or income provider.

With regular direct deposits, your account will be eligible for enhanced limits, giving you more freedom to access your funds whenever you need them.

3. Link a Debit Card for Additional Access

Linking a debit card to your Cash App account can sometimes result in greater flexibility for withdrawals and spending. Although this doesn’t directly increase the Cash App ATM withdrawal limit, it provides an alternative means of accessing funds and managing cash flow when your Cash App balance is low. To link a debit card:

Go to your profile and tap on “Linked Accounts.”

Select “Link Debit Card” and enter your card details.

Follow any verification steps if required.

By linking a debit card, you add a secondary source of funds to your Cash App account, which may allow you more flexibility in managing daily withdrawals.

4. Contact Cash App Support for Limit Increases

For users who require even higher ATM withdrawal limits, contacting Cash App support may be an option. While there’s no guarantee of an immediate increase, reaching out to support can sometimes lead to additional limit adjustments, especially if you have a verified account with an established transaction history. To contact Cash App support:

Open the Cash App, tap on the profile icon, and go to “Support.”

Select “Something Else” and explain your request for an increased ATM withdrawal limit.

Be prepared to answer questions related to your account activity and recent transactions.

Cash App’s customer service team will review your request and may consider increasing your Cash App ATM withdrawal limit based on your account’s eligibility.

Tips to Maximize Your Cash App ATM Withdrawals

If you need to make frequent withdrawals, here are some practical tips to ensure you’re making the most of your Cash App account while staying within the ATM limits.

1. Plan Withdrawals According to Your Daily and Weekly Needs

Given that the daily Cash App ATM limit is capped at $1,000, planning withdrawals in advance can help ensure you have enough funds on hand. Spread out large cash needs over multiple days to avoid hitting your daily limit all at once.

2. Withdraw from ATMs with Lower Fees

Cash App charges a standard ATM fee of $2.50 per withdrawal, but some ATMs may have additional fees. Look for ATMs with lower fees or those associated with your bank to minimize costs. Alternatively, if you’re enrolled in direct deposits, Cash App often reimburses ATM fees up to a certain amount, making it easier to access cash without additional costs.

3. Use Cash Back at Stores to Supplement Cash Needs

For times when you need smaller amounts of cash, consider opting for cash back during a store purchase. This can be a smart way to access cash without dipping into your ATM withdrawal limit. Simply use your Cash App Card at a store and request cash back at checkout, giving you quick access to cash without extra ATM fees.

How Cash App Limits Work for Unverified vs. Verified Accounts

Cash App imposes different limits on unverified and verified accounts, impacting not only ATM withdrawal limits but also transaction limits for sending and receiving funds. Here’s a quick comparison:

Unverified Accounts: Limited to $250 per week for sending and $1,000 per month for receiving. ATM withdrawal limits are typically lower and may be subject to more restrictions.

Verified Accounts: Higher limits, including up to $7,500 per week for sending and no cap for receiving funds. ATM withdrawal limits are also higher, offering verified users more flexibility.

Verification provides a significant increase in limits, making it an essential step for users who want greater access to their funds and the ability to use Cash App as a primary banking solution.

FAQ:

Q1: What is the default Cash App ATM withdrawal limit?The default limit is $310 per transaction, $1,000 per day, and $1,000 per week for unverified users.

Q2: How do I qualify for higher ATM limits on Cash App?To qualify, verify your account, enable direct deposits, and establish a reliable transaction history.

Q3: Does Cash App charge for ATM withdrawals?Yes, Cash App charges a standard $2.50 fee per ATM withdrawal. However, this fee can be reimbursed if you receive direct deposits.

Q4: Can I withdraw more than $1,000 per day with a verified account?Currently, $1,000 per day remains the limit, but verified accounts with direct deposits may receive certain exemptions.

Q5: How long does it take to verify my Cash App account?Account verification typically takes one to two business days, although it can sometimes be faster.

Final though

Increasing your ATM withdrawal limit on Cash App requires a combination of account verification, enabling direct deposits, and following Cash App’s user policies. By understanding and utilizing these options, you can gain greater flexibility in accessing your funds and maximizing your Cash App experience.

Related Post: Cash App Limit per Day / Cash App Atm Withdrawal Limit / Cash App Sending Limit / Increase Cash App Withdrawal Limit / Cash App Transfer Limit / Cash App Weekly Limit

4 notes

·

View notes

Text

How to Cash Out on Robinhood: A Comprehensive Guide

Robinhood has revolutionized the way individuals invest in stocks, ETFs, options, and cryptocurrencies. However, there comes a time when investors want to cash out their investments and transfer funds to their bank accounts. This guide provides a detailed, step-by-step approach to cashing out on Robinhood, transferring money from Robinhood to a bank account, using instant deposits, and transferring crypto from Robinhood to Coinbase.

How to Cash Out on Robinhood

Cashing out cash on Robinhood is a straightforward process that involves selling your assets and transferring the proceeds to your linked bank account. Here’s how you can do it:

1. Selling Your Assets

Before you can withdraw money, you need to sell your investments. Follow these steps:

Open the Robinhood App: Log in to your account on the Robinhood mobile app or website.

Select the Asset to Sell: Navigate to the stock, ETF, option, or cryptocurrency you want to sell.

Initiate the Sale: Click on the “Sell” button. Specify the number of shares or amount of cryptocurrency you want to sell.

Confirm the Sale: Review the details and confirm the transaction. The proceeds from the sale will be available in your Robinhood account.

2. Withdrawing Funds to Your Bank Account

Once you have sold your assets, the next step is to transfer the money to your bank account:

Access the Account Menu: Click on the account icon at the bottom right corner of the screen.

Navigate to Transfers: Select “Transfers” or “Transfer to Your Bank.”

Select the Amount: Enter the amount you wish to transfer. Ensure that the amount does not exceed your available balance.

Choose the Bank Account: Select the bank account linked to your Robinhood account.

Confirm the Transfer: Review the details and confirm the transfer. The funds will be deposited into your bank account within 5 business days.

How to Transfer Money from Robinhood to a Bank Account

Transferring money from Robinhood to a bank account is a critical function for many users. Here’s a detailed guide to help you transfer your funds smoothly:

1. Linking Your Bank Account

Ensure your bank account is linked to your Robinhood account. If it’s not linked, follow these steps:

Go to Account Settings: Open the Robinhood app and navigate to the account settings.

Add a New Bank Account: Select “Linked Accounts” and then “Add New Account.”

Enter Bank Details: Input your bank account details, including the routing number and account number.

Verify Your Bank Account: Robinhood will initiate two small deposits to your bank account. Verify these amounts in the app to complete the linking process.

2. Initiating the Transfer

After linking your bank account, you can transfer funds:

Open the Robinhood App: Log in to your Robinhood account.

Navigate to Transfers: Select the “Transfers” tab or option.

Enter the Amount: Specify the amount you want to transfer to your bank account.

Select the Bank Account: Choose the linked bank account for the transfer.

Confirm the Transfer: Review and confirm the transfer details. The funds should arrive in your bank account within 5 business days.

How to Cash Out from Robinhood Using Instant Deposits

Robinhood offers an instant deposit feature that allows you to access your funds more quickly. Here’s how to use it:

1. Understanding Instant Deposits

Instant deposits let you use your funds immediately for trading or transferring, without waiting for the standard settlement period. However, this feature might have limits based on your account type.

2. Enabling Instant Deposits

To use instant deposits, ensure it is enabled in your account:

Go to Account Settings: Open the Robinhood app and navigate to the account settings.

Enable Instant Deposits: Look for the “Instant Deposits” option and enable it.

3. Using Instant Deposits for Cashing Out

When you sell an asset, you can use the instant deposit feature to access the funds immediately:

Sell Your Assets: Follow the steps outlined in the “Selling Your Assets” section.

Initiate a Transfer: After selling, go to the “Transfers” section.

Select Instant Deposit: Choose the instant deposit option and confirm the transfer. Your funds will be available in your bank account instantly or within a few hours.

How to Transfer Crypto from Robinhood to Coinbase

Transferring cryptocurrency from Robinhood to Coinbase involves a few additional steps. Here’s how to do it:

1. Selling Your Crypto on Robinhood

Robinhood does not currently support direct crypto transfers to external wallets. Therefore, you need to sell your crypto holdings on Robinhood first:

Open the Robinhood App: Log in and navigate to your crypto holdings.

Sell the Cryptocurrency: Click on the cryptocurrency you want to sell and initiate the sale.

2. Transferring Funds to Your Bank Account

Once you have sold your crypto, transfer the funds to your bank account following the steps outlined in the “Withdrawing Funds to Your Bank Account” section.

3. Buying Crypto on Coinbase

After the funds are available in your bank account, you can purchase crypto on Coinbase:

Log in to Coinbase: Open the Coinbase app or website and log in to your account.

Deposit Funds: Navigate to the “Deposit” section and transfer the funds from your bank account to Coinbase.

Buy Cryptocurrency: Once the funds are available, purchase the desired cryptocurrency on Coinbase.

4. Transferring Crypto within Coinbase

If needed, you can transfer your crypto holdings within Coinbase to different wallets or addresses:

Open Coinbase: Navigate to your crypto holdings on Coinbase.

Initiate a Transfer: Click on the cryptocurrency and select the “Send” option.

Enter the Wallet Address: Input the destination wallet address and confirm the transfer.

Conclusion

Cashing out on Robinhood, transferring funds to a bank account, using instant deposits, and transferring crypto to Coinbase are essential processes for many investors. By following the detailed steps outlined in this guide, you can efficiently manage your finances and make informed decisions about your investments.

5 notes

·

View notes

Text

Is There a Limit to How Much I Can Withdraw using Cash App Card?

Managing your finances efficiently often means understanding and optimising the limits set by financial tools like Cash App. One common concern among Cash App users is the ATM withdrawal limit. In this blog, we will explore how to increase Cash App ATM withdrawal limit, providing detailed steps and valuable tips to help you access more of your money when you need it.

Introduction

Cash App, a popular mobile payment service developed by Square Inc., has revolutionised the way people handle their money. From sending and receiving payments to investing in stocks and Bitcoin, Cash App offers a plethora of features. However, like most financial services, it imposes certain limits to ensure security and regulatory compliance. One such limit is the ATM withdrawal limit.

Standard withdrawal limits can sometimes feel restrictive for users who frequently need cash. This blog aims to guide you through the steps to increase your Cash App ATM withdrawal limit, enhancing your financial flexibility and convenience.

Understanding Cash App ATM Withdrawal Limits

Cash App sets ATM withdrawal limits to protect users and the service itself from fraud and unauthorized transactions. As of now, the default Cash App ATM withdrawal limit is:

$310 per transaction

$1,000 in 24 hours

$1,000 in 7 days

While these limits suffice for many users, others may require higher withdrawal amounts. Fortunately, there are ways to increase these limits by verifying your identity and understanding the factors that influence your Cash App account limits.

Steps to Increase Your Cash App ATM Withdrawal Limit

Step 1: Verify Your Identity

The first and most crucial step to increase Cash App ATM withdrawal limit is to verify your identity. Here's how you can do it:

Open Cash App: Launch the Cash App on your mobile device.

Access Your Profile: Tap on the profile icon located at the top right corner of the home screen.

Verify Personal Information: Select the "Personal" tab and enter your full legal name, date of birth, and the last four digits of your Social Security Number (SSN).

Submit Information: After entering your details, submit the information for verification. Cash App will review your submission, which typically takes a few minutes to a few days.

Once your identity is verified, Cash App will notify you, and your ATM withdrawal limits may increase.

Step 2: Link Your Bank Account and Debit Card

Linking your bank account and debit card to Cash App can also help in increasing your withdrawal limits. Follow these steps:

Navigate to the Banking Tab: Open Cash App and go to the "Banking" tab on the home screen.

Add a Bank Account: Select "Add a Bank" and enter your bank account details.

Link Your Debit Card: Similarly, you can link your debit card by selecting "Add Debit Card" and entering the necessary information.

By linking your bank account and debit card, you establish a stronger financial profile with Cash App, which can contribute to higher withdrawal limits.

Step 3: Increase Your Cash App Spending Limits

Increasing your overall Cash App spending limit can indirectly affect your ATM withdrawal limits. To do this, you need to verify your account fully, as outlined in the first step. Once verified, your spending limits will increase, and this can positively impact your ATM withdrawal limits.

Step 4: Use Direct Deposit

Setting up direct deposit with Cash App can also help in increasing your ATM withdrawal limits. When you receive direct deposits, especially from payroll, it indicates to Cash App that you have a consistent inflow of funds, thereby justifying higher withdrawal limits. Here's how to set up direct deposit:

Go to the Banking Tab: Open Cash App and navigate to the "Banking" tab.

Select Direct Deposit: Tap on "Direct Deposit" and follow the prompts to get your Cash App account and routing numbers.

Provide Information to Your Employer: To set up direct deposit, share your Cash App account and routing numbers with your employer or payroll provider.

Step 5: Maintain a Positive Transaction History

A positive transaction history can influence Cash App's decision to increase your withdrawal limits. Ensure that you maintain a good record by:

Making regular transactions.

Avoiding overdrafts or negative balances.

Ensuring all linked accounts are in good standing.

FAQ

What is the Default Cash App ATM Withdrawal Limit?

The default ATM withdrawal limit on Cash App is $310 per transaction, $1,000 in 24 hours, and $1,000 in 7 days.

How Can I Increase My ATM Limit on Cash App?

To increase your ATM limit on Cash App, verify your identity by providing your full name, date of birth, and SSN. Additionally, link your bank account and debit card, set up direct deposit, and maintain a positive transaction history.

Why is My Cash App ATM Withdrawal Limit So Low?

Your Cash App withdrawal limit for ATM may be low if you have yet to verify your identity or if you are a new user. Follow the steps outlined in this blog to increase your limit.

How Long Does It Take to Increase Cash App ATM Limits?

After verifying your identity and linking your accounts, Cash App may take a few minutes to a few days to review and increase your withdrawal limits.

Can I Withdraw More Than the Daily Limit on Cash App?

No, the daily ATM withdrawal limit is set to ensure security and regulatory compliance. However, by following the steps to increase your limit, you can access higher amounts within the allowable limits.

What Should I Do If My ATM Withdrawal Limit Is Not Increasing?

If your ATM withdrawal limit is decreasing despite following the steps, contact Cash App support for assistance. Ensure all your account details are correct and that you have a positive transaction history.

Is There a Limit to How Much I Can Spend with Cash App?

Yes, there are spending limits on Cash App, but they can be increased by verifying your identity. Verified users can send up to $7,500 per week and receive unlimited amounts.

Can I Use Any ATM with My Cash App Card?

Yes, you can use any ATM to withdraw money with your Cash App card, but be aware of potential fees. Setting up direct deposit can help you qualify for ATM fee reimbursements.

Conclusion

Increasing your Cash App ATM withdrawal limit is essential for maximising the utility of your Cash App account. By verifying your identity, linking your bank accounts, setting up direct deposits, and maintaining a positive transaction history, you can increase your withdrawal limits and access more of your money when you need it.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

2 notes

·

View notes

Text

7 Easy Steps to Cash App Sign In and Log In

The Cash App sign-in procedure is as simple as downloading this app from the Play Store. If you haven't yet downloaded Cash App, it's a good idea to download and complete your Cash App login today. Cash App is a user-friendly app that lets you move money between the app and your bank account. You can also send money from your bank account to the Cash App or the other way around, even without using a debit or credit card. It's especially beneficial for parents who want to teach money management to their teens.

Now, let's dive into how to get into your account for Cash App sign-in.

How to Get Your Cash App Account:

Step 1: Download the App or Open It: First things first, if you haven't already, download the Cash App from the App Store or Google Play. If you've got it already, open the app.

Step 2: Sign In: You'll see a button that says "Sign In." Tap on that. You can use your phone number or email to get started.

Step 3: Confirmation Code: After you enter your info, they'll send you a code to make sure it's you. Type in that code, and you're in. If you're into cool stuff, you can set up a fingerprint or Face ID for quick access next time.

Don't Have the App? No Worries!

You can still complete the Cash App sign-in process without the app. Just open your web browser and go to the Cash App website. You'll find a sign-up page there. Enter your email or phone number, and they'll send you a special code. Click on that code, and you're almost there.

You can link your bank account by putting in your account and routing numbers. The Cash App will send a tiny bit of money to your account, check everything is right. Confirm the amount they sent, and you're all set up. So, no app? No problem!

What About Cash App Signing in with Email?

Signing up with your email is super easy. Just download the app, and when you open it for the first time, they'll ask you for a Cash App sign-up. Tap "Sign Up," put in your email, and create a strong password. The app will share a code on your email. Check your inbox or spam folder, type in the code, and bam, you're ready to manage your hard-earned money with Cash App.

Documents You Need for Cash App Sign-Up:

To sign in, all you need is a working email or phone number. That's how you create your account. But, if you want to link your bank account or add a debit card, you might need some bank info or card details.

What's Cash App Login?

Cash App login means getting into your account to handle your money stuff. You can send money, receive it, and do more with it. Remember, you cannot use the $Cashtag identifier for Cash App login, go to the Cash App website or open the app, put in your email or phone number, and your password. Once they confirm it's you, you're good to go.

Cash App Logging in on Android:

If you're using an Android device, here's how you log in: Open the app, enter your email or phone number, put in your password, and log in.

Trouble Signing In? Here's Help:

If Cash App gives you a hard time signing in, here's what you can do:

Check your internet connection.

Log out and log in again.

Restart your device and try again.

Clear the app's cache or update it.

Double-check your login info.

How to Change Your Password for Cash App Sign in?

Changing your password is easy. Open the Cash App, tap your profile icon, go to "Privacy & Security," then "Change Password." Enter your old and new passwords, and you're all set.

Signing In on a New Phone:

Download the Cash App on your new phone, open it, hit "Sign In," and enter your email, number, and password. Now manage your money on your new device.

That's the details on Cash App sign-in and Cash App login. It's a simple way to handle your money, send cash, and keep track of your funds.

2 notes

·

View notes

Text

good post, one thing is that if you get a VPN from a company outside of the united states, especially in europe with GDPR laws, the states cant like request the info. or they can, but i dont think they have to give it to them. ALWAYS read the terms of service. My recs are Mullvad, Proton, and IVPN. They don't log anything(all have been audited multiple times), have gdpr laws to completely erase all data they do have you on request.

Mullvad doesn't even have usernames and passwords, it's just a login number, and you pay with cash mailed to them (or crypto, we all hate it but yes it's more anonymous than most, other payment methods also work)

A VPN however does not give you privacy, nor anonymity, nor security. It simply shields the IP that connects to things, which is useful when pirating content, getting around country wide blocking, and not much else. What you want is Tor, and it is NOT a honeypot, dear god dont listen to that tumblr post, it's a blatant misunderstanding about how Tor works.

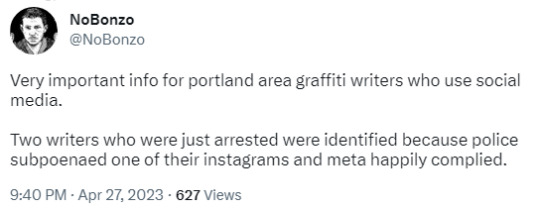

no matter how much privacy, and anonymity you have, all of that is completely null as soon as you log in post the illegal stuff you're doing on social media.

Texting is also private if you're not doing it on a dogshit platform like discord, which doesnt even have E2EE (RCS, iMessage, Signal, Facebook messenger, fucking twitter DMs, almost everything has end to end encryption) I'd personally recommend Signal for casual texting and another app called "Session" if it requires extreme secrecy. Entirely end to end encrypted. decentralized, and routed through Onion Networks, no usernames or passwords to identify you in case some shit leaks. SimpleX is another app which is similar, and while it's not routed through tor, it has "forward secrecy" meaning if someone hacks in or whatever they cant see any of the past messages, only new ones.

Privacy in the modern age of the internet is possible, you just have to learn. dont listen to youtube VPN sponsorships and random tumblr posts saying that shit's a honey pot just. google things. look at things for yourself. be skeptical.

dont trust anything that i said in this post. or any tumblr post. look this shit up for yourself, see discussions in reddit communities, read the privacy policies, find online resources and organizations which advocate for privacy, and then look into those to make sure that things are actually good. dont spread misinfo.

I'm sure tumblr would never, but hey. No sense tempting fate.

71K notes

·

View notes

Text

Ticking Through the Desert: What Makes Dubai's Taxi Apps Shine in 2025?

Dubai, the city of towering skylines and endless possibilities, is constantly on the move. And in 2025, getting around has never been easier, thanks to a vibrant ecosystem of taxi apps that are more than just ride-hailing services – they're seamless travel companions!

Forget flagging down cabs in the scorching sun. Today's Dubai taxi apps are all about visual appeal, intuitive design, and smart features that make every journey a breeze. Let's dive into what makes them tick! If you're considering taxi booking app development, these insights are key to building a successful platform in a dynamic market. For expert guidance in this exciting field, consider a seasoned taxi app development company like CQLsys.

Visual Vibes: Infographics & Instant Insights 📊

Dubai's ride hailing apps understand that a picture is worth a thousand words (or dirhams!). That's why they lean heavily into stunning infographics and clean visuals to convey information at a glance. This focus on visual clarity is a hallmark of successful taxi booking mobile app development.

Fare Estimates at a Glance: No more guessing games! Clear, concise infographics break down fare components like starting fees, per-kilometer rates, and waiting charges, often with dynamic updates as you adjust your route. This transparency is crucial for user trust.

Real-time Ride Tracking: An interactive map with your driver's live location, ETA, and route? Absolutely essential! These visuals aren't just for show; they build trust and transparency, allowing users to track their journey every step of the way.

Vehicle Options Visualized: From standard sedans to luxury limousines, and even specialized vehicles (like those for people of determination or women-only taxis), apps use appealing car icons and brief descriptions to help you pick your ride style with ease, often highlighting features like electric vehicles.

Driver & Vehicle Details: Before your ride even arrives, you'll see a clear infographic of your driver's rating, car model, and license plate number, enhancing safety and peace of mind.

UI/UX Magic: Seamless Journeys, Simple Taps

The secret sauce of Dubai's top taxi application development lies in their user interface (UI) and user experience (UX). They're designed for speed, clarity, and ultimate convenience. For any taxi app development company or those looking to build a taxi app, prioritizing these elements is paramount.

Quick Booking Flow: Think 2-3 taps from opening the app to confirming your ride. Auto-detection of your current location, saved favorite places, and quick-select destination options are standard. Many apps also incorporate voice commands for hands-free booking, a growing trend in ride sharing app innovation.

Multi-Language Support: Catering to Dubai's diverse population, most apps offer English and Arabic, but increasingly also Hindi, Tagalog, and Urdu, ensuring a comfortable and accessible experience for everyone.

Diverse Payment Options: Cash is always an option, but in-app payments via credit/debit cards, Apple Pay, Google Pay, and integrated e-wallets (like Careem Pay) are prevalent. Some are even exploring cryptocurrency payments and blockchain technology for enhanced security and transparency, a key differentiator for an uber taxi app or an app like Ola.

Driver Ratings & Feedback: A simple star rating system and comment sections allow users to provide instant feedback, fostering accountability and continuous improvement in service quality.

Personalization & Adaptability: Apps learn your habits, offering contextual suggestions for destinations and ride types. Many feature dark mode and adaptive interfaces that adjust to lighting conditions.

Features That Go the Extra Mile

Beyond the basics, Dubai's taxi apps are constantly innovating with features that enhance the ride experience. These advanced functionalities are what differentiate a standard taxi booking app development from a market leader.

Pre-booking & Scheduling: Planning ahead for an airport trip or an important meeting? Schedule your ride up to 30 days in advance with ease.

Ride-sharing Options: Apps like Careem continue to offer carpooling services for a more economical and eco-friendly commute, aligning with Dubai's sustainability goals. This highlights the growing importance of carpool app features.

SOS & Safety Features: For peace of mind, features like an in-app SOS button, live ride sharing with trusted contacts, and verified drivers are becoming standard. Some also include female-only driver/passenger matching options.

Loyalty Programs & Rewards: Earn points with every ride, redeemable for discounts or exclusive offers, making every journey more rewarding and encouraging repeat usage.

AI-powered Dispatch & Dynamic Pricing: Behind the scenes, intelligent algorithms match you with the nearest and most suitable driver, reducing waiting times and optimizing routes. AI also drives dynamic pricing, adjusting fares based on real-time demand, availability, and traffic, balancing supply and demand.

Autonomous Vehicle Integration (Trials in 2025): Dubai is a pioneer! Pilot trials of self-driving taxis, in partnership with companies like Uber, WeRide, and Pony.ai, are set to begin later in 2025, with a full commercial rollout planned for 2026. These will initially operate in designated areas and aim to enhance safety and efficiency, pushing the boundaries of taxi app development services.

Green Ride Filters: Environmentally conscious users can select electric or hybrid vehicles, contributing to Dubai's push for sustainable transport. Some apps even show carbon footprint savings.

Super App Functionality: Leading apps like Careem are evolving beyond just ride-hailing, offering integrated services like food and grocery delivery, courier services, and even bill payments, transforming into comprehensive "everything apps." This represents the future of uber clone apps and similar platforms.

Cost Ranges: Your Ride, Your Budget

Dubai's taxi app development landscape offers a spectrum of pricing to suit every budget, from economical options to premium experiences. Understanding these ranges is vital, whether you're developing from scratch or using white label taxi app development.

Hala Taxi (via Careem App): Often the most budget-friendly, integrating with Dubai's RTA public taxi fleet. Expect starting fees around Dhs 8 (daytime) to Dhs 12 (peak/night) and per-kilometer rates around Dhs 1.91 - Dhs 1.97. A minimum fare of Dhs 12 typically applies.

Careem & Uber (Economy/Standard): Competitive pricing with starting fees that can fluctuate based on demand (surge pricing). Generally, a ride might start from around Dhs 12-15.

Newer Entrants (Yango, Bolt, Drife): These apps are entering the market with competitive rates and often aim to offer lower fares or incentives, sometimes even without surge pricing (like Bolt).

Premium & Luxury Services (Uber Black, Blacklane, Careem Business): Higher starting fees and per-kilometer rates for luxury vehicles and chauffeured services, offering a more upscale experience.

Airport Pickups: A standardized airport collection fee (around Dhs 25) typically applies when hailing a taxi from Dubai International Airport, with per-kilometer rates around Dhs 1.96.