#Cash App Web Receipt

Text

How Does Financial Accounting Software Work?

Running a small business involves keeping track of many moving parts, especially related to your finances. Without a system, losing track of invoices, expenses, payroll, taxes, and more can be easy. Financial accounting software provides a solution, streamlining and automating key money management tasks.

How Does Accounting Software Work?

Accounting software helps organize your finances into sections like income, expenses, accounts receivable, accounts payable, and banking. Within each section, you can:

Track money coming in and going out

Generate invoices and receipts

Manage billing and payments

Reconcile bank and credit card statements

Run financial statements and reports

The software seamlessly integrates these crucial functions to have visibility across your financial operation.

Key Features and Benefits

Invoicing - Easily create, send, and track invoices and get paid faster.

Expense tracking - Log business expenses and link receipts for better organization.

Payroll - Automate payroll, including paychecks, taxes, and filings.

Reporting - Generate real-time reports on profit and loss, cash flow, budget vs actuals, and more.

Multi-user access - Securely collaborate with teammates and share information.

Mobility - Manage finances on the go with smartphone and tablet apps.

Integration - Connect bank accounts, credit cards, and other business apps for seamless syncing.

Customization - Tailor the software to your business's specific needs and workflows.

Automated reminders - Get notified about upcoming invoices, payments, and other important deadlines.

Why Choose Accounting Software?

Save Time

Accounting software automates manual processes so you can focus on running your business instead of bookkeeping.

Increase Accuracy

Automated calculations minimize human error, with up-to-date financials at your fingertips.

Enhance Visibility

Real-time reporting provides insights into the proper health of your business.

Improve Organization

All financial details are securely stored in one centralized system.

Facilitate Collaboration

Shared permission settings let you collaborate with others in your organization.

Get Tax Ready

Proper expense tracking and other features simplify yearly tax preparation.

Scalability

The software easily adapts as your business grows in size and complexity.

Security

Robust encryption and permissions protect your sensitive financial data.

Accessibility

Web and mobile apps allow you to manage finances anywhere, anytime.

Which Option Is Right For You?

There are many accounting software options available for small businesses and solopreneurs. When researching providers, consider factors like:

Intended users - Will you be the sole user, or do you need collaboration features?

Industry - Look for industry-specific tools like inventory management, time tracking, project costing, etc.

Integration needs - Ensure it connects to the other apps and platforms you rely on.

Budget - Opt for a solution that matches your budget constraints. Many offer affordable monthly subscriptions.

Support - Pick a provider with robust customer support resources.

Free trial - Test options firsthand with a free trial period.

Start Simplifying Your Small Business Finances With Jaz

While accounting software involves an initial setup investment, the long-term benefits of improved financial oversight and organization are invaluable. As your business grows, the right software will scale with you. Take control of your finances today!

Jaz is the all-in-one accounting solution built to simplify and automate your most complex accounting tasks like invoices, bills, bank reconciliations, payments, and more so you can get back to growing your business or serving more clients.

Get Started for free and take control of your financial operations with Jaz.

#fintech#accounting#finance#accounting software#artificial intelligence#small business accounting services

0 notes

Text

Login To Pay A Invoice Online

See how convenient and easy Bill Pay is with our interactive digital tutorials for Online Banking or the TD Bank app. You can use Quicken Bill Pay as a supplementary service to Quicken's financial software, or use it on its own. If you are a Quicken Starter or Deluxe customer, Quicken Bill Pay is $9.95 a month. EBillslets you obtain, view and handle your bills on Citi Online.

For a greater expertise, obtain the Chase app on your iPhone or Android. Or, go to System Requirements from your laptop computer or desktop. Instant Transaction Receipt on profitable bill payment. Just 5 easy steps to realising your dream house with ICICI Bank Express Home Loans. For sale – kiosks, digital signage, android handhelds, components.

youtube

You can mail us a check using the information in your bill, or go to a Western Union® Quick Collect® location to pay with cash or money order. Gather your payments, including account numbers and the addresses to the place you mail the payments. Shop our rigorously researched Best-Of Awards for the year’s smartest financial savings accounts and more. By clicking Send Link you agree to receive a textual content message with a hyperlink to the PayPal app. Easily and securely spend, send, and handle your transactions—all in a single place. Download the app in your cellphone or join free on-line.

Finest Online Bill Fee Providers

Depending on the payee, the financial institution will problem an digital payment or a paper examine utilizing funds drawn out of your designated account inside a couple of days after you schedule the bill pay. Many banks impose no restrict on the variety of bills you can pay by way of the characteristic. To arrange online invoice payments, you may have to create an internet account with your bank or service provider after which arrange your account for funds.

Citi isn't responsible for the merchandise, companies or amenities provided and/or owned by other corporations. Online Bill Payment is on the market to all Citi Online clients with a checking account—no need to enroll. Payments could be arrange for one-time, future, or computerized recurring transactions. Before you permit our web site, we want you to know your app retailer has its own privacy practices and stage of security which may be different from ours, so please evaluation their polices. If you do not see an app in your gadget, you should still have the ability to entry our cellular website by typing bankofamerica.com in your cellular web browser. Before Keep Probing permit our website, we wish you to know your app retailer has its personal privateness practices and stage of security which may be completely different from ours, so please evaluate their policies.

Online invoice pay may help you to automate your funds. Kathleen served as an adjunct school member at the McCallum Graduate School at Bentley University from 2009 to 2019 and presently teaches at Champlain College. When you pay your invoice with a unique method other than PayPal, it can take a while to achieve our system. Once your payment posts within the PayPal community, the bill will show as "paid" and you can disregard the overdue discover. Bills like power, water, cellular phone, subscription services, and extra can be paid utilizing PayPal. Manage, observe, and pay on your favorite services using one safe account.

Our suite of security measures might help you protect your information, money and give you peace of thoughts. See how we're devoted to helping protect you, your accounts and your family members from financial abuse. Also, be taught about the common tricks scammers are utilizing to assist you stay one step forward of them. If you see unauthorized charges or believe your account was compromised contact us right away to report fraud.

At NerdWallet, our content goes by way of a rigorous editorial evaluate process. We have such confidence in our correct and helpful content that we let outside specialists inspect our work. We believe everybody ought to be ready to make monetary selections with confidence.

Paper-free Billing

See what bills are due subsequent to remain on high of funds. When using Bill Pay, you possibly can set as much as receive eBills for payees offering electronic billing. "Chase Private Client" is the model name for a banking and funding product and service providing, requiring a Chase Private Client Checking℠ account.

Check out the Chase Auto Education Center to get automobile steerage from a trusted source. Apply for a mortgage or refinance your mortgage with Chase. View today’s mortgage rates or calculate what you'll be able to afford with our mortgage calculator. Visit our Education Center for homebuying tips and more. With Online Banking by Trustly, you don’t need to register or enter your bank’s account quantity, card quantity or routing numbers.

Thereafter, every time you wish to make a cost, merely enter the quantity of the invoice, and schedule your cost. Always be sure you have enough money in your account to cover any payments you make online. Make certain that you examine all the data prior to selecting Pay. Money is not going to come out of your account till the scheduled deliver by date. We're sorry we weren't in a place to send you the obtain hyperlink.

Automatic cost can take place even when monthly amount modifications. We send your funds as you tell us, and ensure with an e-mail. Open a savings account or open a Certificate of Deposit and start saving your money. Once you're enrolled in Online Bill Pay, go to the Schedule cost display screen where you’ll see the payees eligible for eBills. Follow the enrollment course of to enroll your payee into eBills. Of the payee’s due date for the cost to arrive on time (before the interest-free interval begins).

Some methods of fee, corresponding to a prepaid debit card or cash administration app, may allow you to use the service with no checking account.

By linking bank cards to UPI, customers can also get quick access to funds during emergencies.

Apply for a mortgage or refinance your mortgage with Chase.

Online Bill Payment is available to all Citi Online customers with a checking account—no have to enroll.

Whether you select to work with a monetary advisorand develop a monetary strategy or make investments on-line, J.P. Morgan presents funding schooling, expertise and a spread of tools that can help you attain your goals. Morgan Wealth Management Branch or try our latest on-line investing provides, promotions, and coupons. Please add your required payee earlier than organising automated payments. Additionally, businesses can make a credit score or debit card payment as a Guest using the Quick Payment Links menu on the AZTaxes homepage. Businesses have to know their license number and enterprise mailing zip code.

Please strive again, or use your cellular device to get the app from its app retailer. On theEdit paymentscreen, choose the Edit autopay hyperlink. On theBill detailsscreen, choose the upcoming payment you want to cancel or change. We assure your payments shall be despatched as scheduled — provided you may have adequate funds.

Quickly permits you to select payees and pay as much as 12 directly. Scheduled from the next day up to one yr in advance. Ads served on our behalf by these companies do not contain unencrypted private data and we limit using personal data by corporations that serve our adverts. You may also go to the person websites for additional information on their information and privateness practices and opt-out options.

1 note

·

View note

Text

Login To Pay A Bill On-line

See how convenient and simple Bill Pay is with our interactive digital tutorials for Online Banking or the TD Bank app. You can use Quicken Bill Pay as a supplementary service to Quicken's monetary software, or use it on its own. If you're a Quicken Starter or Deluxe buyer, Quicken Bill Pay is $9.95 a month. EBillslets you receive, view and handle your payments on Citi Online.

For a greater expertise, obtain the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop. Instant Transaction Receipt on profitable invoice fee. Just 5 simple steps to realising your dream house with ICICI Bank Express Home Loans. For sale – kiosks, digital signage, android handhelds, elements.

youtube

You can mail us a check using the knowledge on your bill, or visit a Western Union® Quick Collect® location to pay with money or money order. Gather your bills, together with account numbers and the addresses to the place you mail the payments. Shop our rigorously researched Best-Of Awards for the year’s smartest savings accounts and more. By clicking Send Link you conform to receive a text message with a hyperlink to the PayPal app. Easily and securely spend, send, and handle your transactions—all in one place. Download the app in your phone or sign up for free online.

Finest Online Invoice Payment Providers

Depending on the payee, the bank will concern an digital fee or a paper check utilizing funds drawn out of your designated account inside a number of days after you schedule the invoice pay. Many banks impose no limit on the number of bills you probably can pay via the characteristic. To set up on-line bill payments, you may need to create an internet account along with your financial institution or service supplier after which set up your account for funds.

Citi just isn't responsible for the merchandise, companies or amenities provided and/or owned by other firms. Online Bill Payment is available to all Citi Online customers with a checking account—no must enroll. Payments could be arrange for one-time, future, or automated recurring transactions. Before you allow our website, we wish you to know your app retailer has its personal privacy practices and degree of security which can be totally different from ours, so please review their polices. If you do not see an app on your gadget, you could still have the power to entry our cellular web site by typing bankofamerica.com in your cell web browser. Before you permit our site, we would like you to know your app retailer has its own privateness practices and degree of safety which can be different from ours, so please evaluate their policies.

Online invoice pay may help you to automate your payments. Kathleen served as an adjunct college member at the McCallum Graduate School at Bentley University from 2009 to 2019 and currently teaches at Champlain College. When you pay your invoice with a unique technique apart from PayPal, it may possibly take some time to achieve our system. Once your fee posts in the PayPal network, the invoice will show as "paid" and you'll disregard the overdue discover. Bills like energy, water, cellular phone, subscription providers, and extra can be paid using PayPal. Manage, track, and pay in your favorite companies utilizing one secure account.

Our suite of safety features might help you defend your information, cash and offer you peace of thoughts. See how we're dedicated to helping protect you, your accounts and your family members from monetary abuse. Also, be taught in regards to the common tricks scammers are using that can assist you stay one step forward of them. If you see unauthorized costs or believe your account was compromised contact us immediately to report fraud.

At NerdWallet, our content goes via a rigorous editorial review course of. We have such confidence in our accurate and helpful content that we let exterior specialists inspect our work. We believe everyone should be ready to make financial decisions with confidence.

Paper-free Billing

See what payments are due next to remain on high of funds. When using Bill Pay, you possibly can set as much as receive eBills for payees offering electronic billing. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account.

Check out the Chase Auto Education Center to get car steering from a trusted source. Apply for a mortgage or refinance your mortgage with Chase. View today’s mortgage charges or calculate what you'll have the ability to afford with our mortgage calculator. Visit our Education Center for homebuying tips and more. With Online Banking by Trustly, you don’t need to register or enter your bank’s account number, card quantity or routing numbers.

Thereafter, every time you want to make a payment, merely enter the amount of the invoice, and schedule your payment. Always be sure you have the funds for in your account to cover any funds you make online. Make certain that you simply check the entire data prior to choosing Pay. Money won't come out of your account till the scheduled deliver by date. We're sorry we weren't capable of ship you the obtain link.

Automatic fee can take place even when monthly amount changes. We send your funds as you tell us, and confirm with an e-mail. Open a savings account or open a Certificate of Deposit and start saving your money. Once you're enrolled in Online Bill Pay, go to the Schedule cost screen the place you’ll see the payees eligible for eBills. Follow the enrollment process to enroll your payee into eBills. Of the payee’s due date for the cost to reach on time (before the interest-free period begins).

By linking bank cards to UPI, customers can even get easy access to funds during emergencies.

Save your time & vitality, browse plans on the tip of your fingers and make immediate invoice payments.

Apply for a mortgage or refinance your mortgage with Chase.

Online Bill Payment is out there to all Citi Online customers with a checking account—no must enroll.

Whether you select to work with a monetary advisorand develop a monetary technique or invest on-line, J.P. Morgan provides investment schooling, expertise and a range of tools to help you reach your goals. Morgan Wealth Management Branch or take a look at our latest online investing presents, promotions, and coupons. Please add your required payee before establishing computerized funds. Additionally, businesses could make a credit score or debit card fee as a Guest utilizing the Quick Payment Links menu on the AZTaxes homepage. Businesses need to know their license quantity and enterprise mailing zip code.

Please try once more, or use your cell system to get the app from its app store. On theEdit paymentscreen, select the Edit autopay hyperlink. On theBill detailsscreen, choose the upcoming fee you wish to cancel or change. We guarantee your funds will be despatched as scheduled — provided you may have sufficient funds.

Quickly permits you to select payees and pay up to 12 without delay. Scheduled from the next day as a lot as one 12 months in advance. Ads served on our behalf by these firms don't contain unencrypted private information and we restrict the utilization of personal info by companies that serve our adverts. You may go to the individual websites for added data on their knowledge and privateness practices and opt-out choices.

1 note

·

View note

Text

Why the Real Estate World Needs the "Property Accountant": A One-Stop App for Investment Clarity

Owning real estate is exciting, but managing it? Not so much. Spreadsheets overflow, receipts get lost, and deciphering the financial puzzle becomes a full-time job. Sound familiar? This is where the Property Accountant app and web portal step in, poised to revolutionize the way we track and understand our real estate investments. We are the leading Investment Property Accountant App.

Here's why we desperately need this game-changer?

1. Scattered Data, Fragmented Decisions:

Gone are the days of paper trails and siloed information. The Property Accountant consolidates everything – income, expenses, market values, loan balances, net equity, and interest rates – into one unified platform. No more jumping between disparate sources or relying on memory. You have a crystal-clear picture of your entire real estate portfolio, irrespective of whether it's owned personally, jointly, through trusts, or even within an SMSF.

2. Say Goodbye to Guesswork:

Forget scrambling for calculations with every financial decision. The Property Accountant automates the heavy lifting. Track your profitability, analyze cash flow, and project future returns with just a few clicks. Making informed investment decisions has never been easier or more insightful.

3. Ownership Structures, Demystified:

Whether you're a solo investor, a joint owner, or managing complex structures like trusts and SMSFs, the Property Accountant handles it all. Its flexible design adapts to any ownership configuration, providing tailored reports and analyses specific to your situation. No more wading through irrelevant data or struggling to understand how your investments perform across different structures.

4. The Power of Insights at Your Fingertips:

Beyond pure data, the Property Accountant unlocks valuable insights hidden within your numbers. Identify underperforming assets, optimize rental strategies, and make data-driven decisions about renovations, refinancing, and even buying or selling. Knowledge is power, and the Property Accountant puts it right at your fingertips.

5. A Web & Mobile Companion:

Access your real estate portfolio anytime, anywhere with the Property Accountant's seamless web and mobile app integration. Stay on top of things, make informed decisions on the go, and react to market changes in real-time. Your finances are no longer tied to your desk – they're free to move as you do.

The Property Accountant is more than just an app; it's a paradigm shift in real estate investment management. It takes the complexity out of the equation, empowering you to make confident, informed decisions and truly unlock the potential of your real estate portfolio. In a world of scattered data and fragmented insights, the Property Accountant offers clarity, control, and ultimately, the freedom to invest smarter, not harder.

So, are you ready to ditch the spreadsheets and embrace the future of real estate investment? Download the Property Accountant today and experience the peace of mind that comes with knowing your portfolio is always in check.

0 notes

Link

0 notes

Text

Credit Card Payment Processing Methods

In today's digital age, credit card payment processing has become an integral part of modern commerce. With the rise of e-commerce and online shopping, businesses need to offer convenient and secure payment options to their customers. Credit card processing enables businesses to accept card payments, facilitating seamless transactions and enhancing customer satisfaction. In this article Paycly will take you to explores the importance of card payment processing, its benefits, different processing methods, and the key factors to consider when choosing a credit card processor.

The Significance of Credit Card Payment Processing

Credit card processing is an integral component of any successful business. It enables customers to pay for goods or services with convenience, flexibility, security, and speed. Credit card processing also offers businesses an opportunity to increase sales and improve customer satisfaction. Furthermore, it allows customers to earn rewards and loyalty points for every purchase they make. Additionally, businesses also get access to detailed transaction records and analysis, which can help optimize their marketing, customer support, and discounts and offers. Thus, credit card payment processing is an important tool for businesses to grow and succeed.

Understanding Credit Card Payment Processing Methods

Credit card processing is the process by which a merchant collects payment from their customers for goods and services rendered, mainly via credit cards. Various methods are available for credit card processing, such as:

Traditional point-of-sale (POS) systems

Traditional point-of-sale (POS) systems remain a popular choice for many merchants for credit card payment processing as they are cost-effective and easy to use. POS systems require the merchant to keep track of customer payments and allow the merchant to accept credit card payments securely and conveniently. It is crucial that the POS system is set up correctly to comply with Payment Card Industry (PCI) Data Security Standards and other security protocols. Additional hardware is usually required, such as a receipt printer, barcode scanner, magnetic stripe reader, and cash drawer.

Online Payment Gateways

Online payment gateways provide merchants with a secure method to accept credit card payments from customers without having to worry about hardware maintenance and security. Gateways are web-based applications that link credit card data directly from a customer's account to the merchant's bank account. The customer enters credit card information on a merchant's website, and the data is transmitted, verified, and accepted or rejected. This method is also known as internet credit card processing.

Mobile Payment Solutions

Mobile payment solutions allow merchants to accept credit card payments using phones or tablets. These solutions can be used to accept payments in person, via phone, or through mobile app. Mobile payments are becoming increasingly popular as they eliminate the need for merchants to carry physical credit card machines. However, mobile payments require features such as card readers and enhanced security protocols in order to be successful. This method can also be included in internet credit card processing methods.

Conclusion

There are several methods for credit card payment processing, all of which offer different advantages and disadvantages. Whether it be traditional POS systems, online payment gateways, or mobile payment solutions, merchants should carefully consider their business needs and research the best options for their unique situation before embracing any of them for processing their business-related credit card transactions.

Visit us at : Online Payment Providers

#credit card processing#credit card payment processing#online credit card processing#internet credit card processing#online payment gateway#accept payments online#payment providers#online payment services#online payment providers#online payment systems#online payments#internet credit card payment processing#payment gateway for online payment#payment provider online#Highrisk Merchant Accounts

0 notes

Text

Enhancing Customer Experience with Modern Payment Processing Solutions

In today's rapidly evolving business landscape, enhancing the customer experience has become paramount for companies looking to thrive in a competitive market. One crucial aspect of this enhancement lies in the realm of payment processing. Modern payment processing solutions have revolutionized the way businesses interact with their customers, providing seamless, secure, and convenient transaction experiences. In this article, we will explore the profound impact of modern payment processing solutions on customer experience and why they are essential for businesses of all sizes.

The Evolution of Payment Processing

Payment processing has come a long way from the days of cash and checks. With the advent of technology, the payment landscape has transformed dramatically, introducing numerous innovative methods and systems that cater to the demands of the digital age.

1. Convenience and Speed

One of the most significant advantages of modern payment processing solutions is the unparalleled convenience and speed they offer. Customers no longer need to carry wads of cash or wait in long queues to complete transactions. With options such as mobile wallets, contactless payments, and online payment gateways, payments can be made swiftly, reducing friction in the customer journey.

2. Security and Trust

Security is paramount in today's digital world, and modern payment processing solutions have invested heavily in ensuring the safety of transactions. Encryption, tokenization, and multi-factor authentication measures have made payments more secure than ever. When customers trust that their financial information is protected, they are more likely to engage in transactions, building a stronger bond with the business.

3. Versatility and Accessibility

Modern payment processing solutions are incredibly versatile, catering to a wide range of payment preferences. Whether customers prefer credit cards, debit cards, e-wallets, or bank transfers, businesses can accommodate these preferences, ensuring accessibility for all. This adaptability enhances the customer experience by accommodating a diverse customer base.

4. Seamless Integration

Integration of payment processing solutions with other business systems, such as inventory management and customer relationship management (CRM) tools, streamlines operations. This integration allows for real-time updates on inventory levels, personalized customer interactions, and enhanced loyalty programs, all contributing to an improved customer experience.

5. Data-Driven Insights

Modern payment processing solutions provide valuable data insights that help businesses understand customer behavior and preferences better. This data can be leveraged to create personalized offers, recommendations, and loyalty programs, thereby increasing customer engagement and satisfaction.

6. Mobile-First Approach

As mobile devices become the preferred means of accessing the internet, businesses that prioritize a mobile-first approach to payment processing are better positioned to cater to modern consumer needs. Mobile apps and responsive web design make it easy for customers to make payments from their smartphones, enhancing the overall customer experience.

7. Reduced Errors and Disputes

Automated payment processing significantly reduces the likelihood of errors and disputes. Payments are accurately recorded, and customers receive clear and detailed receipts, eliminating confusion and potential disputes. This streamlined process enhances trust and customer satisfaction.

8. 24/7 Accessibility

Modern payment processing solutions enable businesses to accept payments 24/7, regardless of their physical location or operating hours. This level of accessibility caters to global customers and different time zones, ensuring that businesses can serve their customers at any time.

Enhancing customer experience with modern payment processing solutions is no longer an option but a necessity in today's competitive business environment. The benefits of convenience, security, versatility, and data-driven insights offered by these solutions not only delight customers but also lead to increased loyalty and profitability for businesses.

As businesses continue to evolve and adapt to the digital age, integrating modern payment processing solutions into their operations is a strategic move that can significantly impact their success. By prioritizing customer experience in the realm of payments, businesses can create lasting relationships with their customers and stay ahead in an ever-changing marketplace.

For More Info:-

Payment Processing Solutions

Payment Processing Puerto Rico

0 notes

Text

WAY TO EAN GUARANTEED INCOME

A SIMPLE AND LEGIT WAY TO EARN A GUARANTEED PASSIVE INCOME

Hello Guys

I am going to tell you about the genuine and legit way to earn a guaranteed passive income.

There is the myth that money cannot be made online. But in the today’s world of internet everything is possible but you just need patience and trust. YES it is possible to make money online.

HOW TO EARN A GUARANTEED PASSIVE INCOME?

I am to going to tell you about the way to earn a guaranteed passive income in the legit and genuine way. There is the site which gives you an opportunity to earn a guaranteed passive income.

WHICH IS THE SITE?

Guys I am talking about SWAGBUCKS. Launched in Southern California in 2008, Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks is the web's most popular loyalty and consumer rewards program. Members of this free rewards service get free gift cards or cash for the everyday activities they're already completing online like searching the web, playing games, watching videos, or shopping online where you'll make money through cash back rebates. There are a number of different ways to earn Swagbucks rewards or SB points that you can easily redeem for Amazon gift cards, PayPal, and other gift cards and great prizes.

You'll earn rewards in points, called SB, and you can redeem your points for gift cards or cash. Its 100 SB points for $1 USD in rewards.

This site is one of the site which has the huge earning potential and your earning is not limited to few ways. Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks

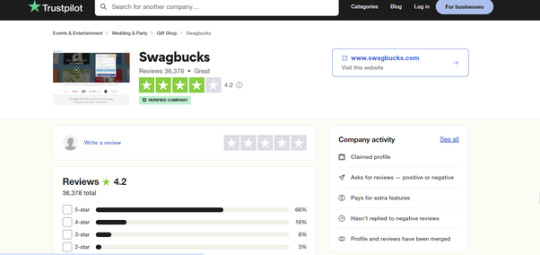

IS SWAGBUCKS LEGIT?

YES OF COURSE it is legit and it has the rating of 4.2 on the Trustpilot.

Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks

Swagbucks®-related trademarks including “Swagbucks®”, “Swag Codes®”, “Swagstakes®”, “SwagButton”, “SwagUp”, “SB” and the Swagbucks logo are the property of Prodege, LLC; all rights reserved. Other trademarks appearing on this site are property of their respective owners, which do not endorse and are not affiliated with Swagbucks or its promotions.

HOW SWAGBUCKS IS DIFFERENT?

SWAGBUCKS is very different here you have multiple options to earn.

WAYS TO EARN SWAGBUCKS REWARDS

Shop online for cash back at over 7,000 participating stores and earn cash back rebates.

Scan your receipts for cash back. Just snap a picture of your grocery or supermarket receipt and earn SB for cash back and gift card rewards. Get paid for purchasing staples, such as any-brand eggs, bread, milk, or pasta at hundreds of participating merchants.

Make money playing games. Play from Swagbucks' library of game content for members, or earn rewards for installing and playing featured app-based games.

Install the Swagbucks browser extension. You'll earn rewards just for installing it, and it will automatically alert you to commerce sites' coupons, promo codes and cash back deals as you browse the web.

Answer surveys for money. Get paid for taking surveys on a variety of topics: shopping online, personal finance, favorite foods, vacation preferences, and more. Marketers want your opinions so they can make better products and services!

Redeem Swag Codes that you'll find on Swagbucks' social media pages or in browser extension notifications. Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks

Enter Swagstakes for the chance to win laptops, gaming consoles, and more SB.

Get paid to search the web, earn rewards. You'll get paid for searching the web when you're using Swagbucks search engine. (It gives you similar results as other popular, big-name search engines, but you're viewing the results in a search feed on Swagbucks.) Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks

REWARD REDEEM OPTIONS

There are various rewarding options which makes easy for you to redeem your SB’s.

Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks

Swagbucks®-related trademarks including “Swagbucks®”, “Swag Codes®”, “Swagstakes®”, “SwagButton”, “SwagUp”, “SB” and the Swagbucks logo are the property of Prodege, LLC; all rights reserved. Other trademarks appearing on this site are property of their respective owners, which do not endorse and are not affiliated with Swagbucks or its promotions.

HOW TO JOIN SWAGBUCKS?

I am one of the active member of the SWAGBUCKS, and I am very satisfied member of SWAGBUCKS. The great thing about the SWAGBUCKS is that it has multiple options to earn money and therefore you gets the guaranteed earnings here and that’s why it my no.1 choice and preferred site for earning and TRUST ME IT WILL NOT DISAPPOINT YOU. Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks

You can simply join the SWAGBUCKS by clicking on the below link

Earn Free Gift Cards and Cash with Online Paid Surveys | Swagbucks

Swagbucks®-related trademarks including “Swagbucks®”, “Swag Codes®”, “Swagstakes®”, “SwagButton”, “SwagUp”, “SB” and the Swagbucks logo are the property of Prodege, LLC; all rights reserved. Other trademarks appearing on this site are property of their respective owners, which do not endorse and are not affiliated with Swagbucks or its promotions.

By signing through above link you gets the profiling surveys as bonus and you can start your earning journey and other benefits as well.

ALL THE BEST.

0 notes

Text

If you have an auto loan through TD Bank, making your monthly payments on time is essential. TD offers various convenient payment options to pay your TD auto finance bill both online and through traditional methods.

This guide explains how to pay your TD auto loan payment on the web, through the mobile app, by phone, by mail, and in person. We'll also cover tips on setting up autopay, managing your account online, and getting receipts for your records.

Overview of Paying a TD Auto Finance Bill

TD Bank aims to make managing your auto financing account straightforward. Below are key things to know about paying your TD auto loan bill:

Payment is due each month on your set due date

Multiple free payment options available

Can pay any extra amount toward principal

Autopay enrollment deducts payment automatically

Keep records of payment receipts

As long as your monthly payment arrives by the due date, you can use any payment method that suits your needs.

Paying Your TD Auto Loan Bill Online

Paying your TD auto finance loan online is fast and secure. To do so:

Visit td.com and log into online banking

Access account dashboard and select auto loan

Click “Make Payment” and enter payment amount

Input payment source such as bank account

Review details and submit payment

You’ll receive a confirmation number and receipt via email. Paying online avoids postal delays.

Using the TD Mobile App to Pay

The TD Bank mobile app also allows quick auto loan bill payment from your smartphone or tablet. Just:

Download and open the TD app

Log in and access your auto loan account

Use the app interface to make your payment

Get emailed confirmation upon completion

The mobile app provides 24/7 access from anywhere, great when on the go.

Paying Your Auto Loan Bill by Phone

To pay your TD auto finance loan over the phone:

Call 1-888-561-8861, the dedicated TD auto finance line

Provide identifying account information to the representative

Specify the payment amount you want to make

Follow prompts to input payment source details

Note the confirmation number at end of call

Phone payments require having your account info handy but provide personalized support.

Paying by Mail with Check or Money Order

To mail in a payment the old-fashioned way, simply:

Make check or money order payable to TD Auto Finance

Include your account number in the memo

Mail to: PO Box 16035, Lewiston, ME 04243

Allow 7-10 business days to post to your account

While slower to process, this traditional payment method works if you prefer to pay by check.

Paying Your Bill In Person at a TD Bank Location

For in-person payments, you can visit any TD Bank branch and:

Inform the teller you want to make an auto loan payment

Provide them your TD Auto Finance account number

Hand over your payment in cash, check, or debit card

Receive a receipt immediately upon paying

Branch hours are limited but in-person payment might work well with your schedule.

Setting Up Autopay for Automatic TD Auto Loan Payments

Enrolling in TD Auto Finance autopay deducts your monthly loan payment automatically each billing cycle. To enroll:

Sign into online account management

Locate the autopay section under your auto loan account

Enter your preferred payment source

Select the date for monthly withdrawals

Review disclosure terms and enable autopay

Autopay prevents ever missing a payment due date. You can cancel or change the setup anytime.

Getting Receipts for Your Auto Loan Payments

No matter how you pay your TD auto loan, it's wise to save payment receipts and confirmations. Retain records of payment receipts as proof the lender received them for your files.

Receipts also help quickly resolve any payment disputes that may arise. TD can resend receipt copies upon request if you misplace yours.

Logging Into Online Account

Management

TD provides an online dashboard for reviewing your auto loan details and making payments. To access it:

Go to td.com and log into online banking

From account overview, select your auto loan account

Choose account management to view balance, statements, etc.

Manage autopay settings and make one-time payments

The online portal provides 24/7 account visibility and payment flexibility in one spot.

Making Additional Principal Payments to Pay Off Loan Faster

When paying your bill online or by phone, TD allows selecting an additional principal amount above your regular monthly payment.

Adding extra principal monthly shortens the payoff timeline by reducing the overall interest owed. Even small extra amounts help pay off your auto loan faster and for less.

Avoiding Late Fees and Missed Payments

Paying late leads to fees and credit score impacts, so diligently avoid missed TD auto loan payments:

Calendar your monthly due dates

Sign up for autopay as a backup

Enroll in reminders for your account

Check balance regularly to anticipate issues

Know grace period if periodically late

Staying on top of your account makes meeting deadlines easy. Immediately address any missed payments.

Getting Account Support From TD Auto Finance

If any issues arise with making payments or account management, TD auto finance offers support:

Call toll-free 1-888-561-8861

Chat live via online account portal

Email questions to [email protected]

Visit a local TD Bank branch for in-person assistance

TD aims to resolve account issues promptly so payments stay on track.

FAQs

What are the monthly payment due date options?

You can select a payment due date that aligns with your pay schedule, like 1st, 15th, or end of month when setting up the loan.

Is there a grace period if I miss the due date?

TD Bank offers a 15 day grace period after the due date before a late fee is charged. But interest still accrues.

How can I change my monthly autopay date?

Log into online account management and edit the autopay settings as needed to adjust the scheduled monthly withdrawal date.

What fees does TD charge for late payments?

If 15 days past due, a late fee of $20 or 5% of the late payment (whichever is less) is assessed.

How do I get receipts if paying by mail, phone, or in person?

Request an emailed receipt when paying by phone. For other methods, call customer service and they can resend your receipt.

Never missing a payment is essential when financing a vehicle, and TD Bank offers numerous ways to pay your bill conveniently. Follow the steps outlined to take care of your monthly auto loan payment online, over the phone, or in person.

Sign up for autopay to guarantee never missing a payment date. With multiple options at your fingertips, it’s easy to stay on top of your TD auto finance loan.

#Wiack #Car #CarPrice #CarInsurance

0 notes

Text

If you have an auto loan through TD Bank, making your monthly payments on time is essential. TD offers various convenient payment options to pay your TD auto finance bill both online and through traditional methods.

This guide explains how to pay your TD auto loan payment on the web, through the mobile app, by phone, by mail, and in person. We'll also cover tips on setting up autopay, managing your account online, and getting receipts for your records.

Overview of Paying a TD Auto Finance Bill

TD Bank aims to make managing your auto financing account straightforward. Below are key things to know about paying your TD auto loan bill:

Payment is due each month on your set due date

Multiple free payment options available

Can pay any extra amount toward principal

Autopay enrollment deducts payment automatically

Keep records of payment receipts

As long as your monthly payment arrives by the due date, you can use any payment method that suits your needs.

Paying Your TD Auto Loan Bill Online

Paying your TD auto finance loan online is fast and secure. To do so:

Visit td.com and log into online banking

Access account dashboard and select auto loan

Click “Make Payment” and enter payment amount

Input payment source such as bank account

Review details and submit payment

You’ll receive a confirmation number and receipt via email. Paying online avoids postal delays.

Using the TD Mobile App to Pay

The TD Bank mobile app also allows quick auto loan bill payment from your smartphone or tablet. Just:

Download and open the TD app

Log in and access your auto loan account

Use the app interface to make your payment

Get emailed confirmation upon completion

The mobile app provides 24/7 access from anywhere, great when on the go.

Paying Your Auto Loan Bill by Phone

To pay your TD auto finance loan over the phone:

Call 1-888-561-8861, the dedicated TD auto finance line

Provide identifying account information to the representative

Specify the payment amount you want to make

Follow prompts to input payment source details

Note the confirmation number at end of call

Phone payments require having your account info handy but provide personalized support.

Paying by Mail with Check or Money Order

To mail in a payment the old-fashioned way, simply:

Make check or money order payable to TD Auto Finance

Include your account number in the memo

Mail to: PO Box 16035, Lewiston, ME 04243

Allow 7-10 business days to post to your account

While slower to process, this traditional payment method works if you prefer to pay by check.

Paying Your Bill In Person at a TD Bank Location

For in-person payments, you can visit any TD Bank branch and:

Inform the teller you want to make an auto loan payment

Provide them your TD Auto Finance account number

Hand over your payment in cash, check, or debit card

Receive a receipt immediately upon paying

Branch hours are limited but in-person payment might work well with your schedule.

Setting Up Autopay for Automatic TD Auto Loan Payments

Enrolling in TD Auto Finance autopay deducts your monthly loan payment automatically each billing cycle. To enroll:

Sign into online account management

Locate the autopay section under your auto loan account

Enter your preferred payment source

Select the date for monthly withdrawals

Review disclosure terms and enable autopay

Autopay prevents ever missing a payment due date. You can cancel or change the setup anytime.

Getting Receipts for Your Auto Loan Payments

No matter how you pay your TD auto loan, it's wise to save payment receipts and confirmations. Retain records of payment receipts as proof the lender received them for your files.

Receipts also help quickly resolve any payment disputes that may arise. TD can resend receipt copies upon request if you misplace yours.

Logging Into Online Account

Management

TD provides an online dashboard for reviewing your auto loan details and making payments. To access it:

Go to td.com and log into online banking

From account overview, select your auto loan account

Choose account management to view balance, statements, etc.

Manage autopay settings and make one-time payments

The online portal provides 24/7 account visibility and payment flexibility in one spot.

Making Additional Principal Payments to Pay Off Loan Faster

When paying your bill online or by phone, TD allows selecting an additional principal amount above your regular monthly payment.

Adding extra principal monthly shortens the payoff timeline by reducing the overall interest owed. Even small extra amounts help pay off your auto loan faster and for less.

Avoiding Late Fees and Missed Payments

Paying late leads to fees and credit score impacts, so diligently avoid missed TD auto loan payments:

Calendar your monthly due dates

Sign up for autopay as a backup

Enroll in reminders for your account

Check balance regularly to anticipate issues

Know grace period if periodically late

Staying on top of your account makes meeting deadlines easy. Immediately address any missed payments.

Getting Account Support From TD Auto Finance

If any issues arise with making payments or account management, TD auto finance offers support:

Call toll-free 1-888-561-8861

Chat live via online account portal

Email questions to [email protected]

Visit a local TD Bank branch for in-person assistance

TD aims to resolve account issues promptly so payments stay on track.

FAQs

What are the monthly payment due date options?

You can select a payment due date that aligns with your pay schedule, like 1st, 15th, or end of month when setting up the loan.

Is there a grace period if I miss the due date?

TD Bank offers a 15 day grace period after the due date before a late fee is charged. But interest still accrues.

How can I change my monthly autopay date?

Log into online account management and edit the autopay settings as needed to adjust the scheduled monthly withdrawal date.

What fees does TD charge for late payments?

If 15 days past due, a late fee of $20 or 5% of the late payment (whichever is less) is assessed.

How do I get receipts if paying by mail, phone, or in person?

Request an emailed receipt when paying by phone. For other methods, call customer service and they can resend your receipt.

Never missing a payment is essential when financing a vehicle, and TD Bank offers numerous ways to pay your bill conveniently. Follow the steps outlined to take care of your monthly auto loan payment online, over the phone, or in person.

Sign up for autopay to guarantee never missing a payment date. With multiple options at your fingertips, it’s easy to stay on top of your TD auto finance loan.

#Wiack #Car #CarPrice #CarInsurance

0 notes

Text

The PoeArtistry of James Lynch (Cash App)

Dear Perceptive Readers, It is I James Lynch Jr.

Here is my official Cash App https://cash.app/$Poeartistry web address…

if you would like to Pay or Tip me for my podcasts, writings, and additional James PoeArtistry Consultant Services. Just make a notation on how you want it to look on the receipt of payment. Thank you much! Have a Great day!

0 notes

Text

The most effective accounting software program for artists does greater than manage your funds, it might assist you to put your finest foot ahead as knowledgeable. — Getty Pictures/EMS Forster Productions

Few artists need to spend their downtime monitoring unpaid shopper invoices or getting into artwork provide bills. However for these transitioning a interest right into a enterprise, it’s important. The IRS requires entrepreneurs to keep up “full and correct books and information” and put “effort and time” into making their exercise worthwhile. Happily, the perfect accounting software program for artists helps manage your funds and current your self as knowledgeable. Evaluate the 5 accounting applications on this article to seek out the precise one on your creative endeavors.

ZarMoney: all-in-one accounting, productiveness, and stock software program

Since 2006 ZarMoney has supplied cloud-based accounting instruments for small to giant companies. It offers greater than 60 options for accounting, productiveness, and stock. ZarMoney has three service plans, with pricing beginning at $15 month-to-month for one consumer and limitless transactions. The 15-day free trial doesn’t require a bank card.

High options for artists embody:Invoicing:Add a emblem to your statements, and print, e mail, or fax them to your purchasers.Prepayments: Settle for deposits and routinely subtract the cost from the bill.Stock: Monitor art work by assortment and see inventory ranges for numerous marketplaces.Scheduler: Create duties and reminders on your artwork enterprise, and sync it to your Google Calendar or iPhone calendar.[Read more: How to License Your Artwork]

Wave: completely free invoicing and accounting instruments

A small workforce of eight launched Wave Accounting in 2010. At this time, it’s utilized by greater than 2 million entrepreneurs. Wave’s free web-based cash administration instruments supply dozens of invoicing and accounting options. Plus, you'll be able to obtain iOS and Android apps to deal with funds or view account balances from wherever. Wave presents a pay-per-use cost service that lets your purchasers pay proper from their bill.

Listed here are just a few helpful options for artists:Invoicing:It’s free to personalize and ship invoices to your purchasers.Reminders: Save time by routinely reminding clients to ship a cost.Expense monitoring: Snap a photograph of your receipt and add it to the cloud.Funds: Let clients pay invoices by way of bank card or checking account.

The IRS requires entrepreneurs to keep up 'full and correct books and information.'

QuickBooks Self-Employed: accounting with built-in tax assist

In 1983, QuickBooks Desktop debuted, and the cloud-based model (QuickBooks On-line) was launched in 2001. Since then, QuickBooks has added a number of merchandise, together with QuickBooks Self-Employed for freelancers and impartial contractors. QuickBooks Self-Employed prices $15 month-to-month, or you'll be able to bundle your accounting software program with TurboTax for $25 month-to-month.

QuickBooks Self-Employed options embody the next:Account transactions:Obtain transactions from PayPal, Sq., and financial institution accounts.Mileage monitoring: Report mileage routinely when driving. Swipe proper to label your journey as private or left for enterprise.Taxes: Get quarterly tax estimates and due date reminders in your dashboard.Invoices: Choose flat-fee, hourly, or per-item charges, and let purchasers click on to pay.Zoho Books: versatile mission administration and accounting options

Zoho launched greater than 25 years in the past. At this time, it presents many

free enterprise instruments, together with Zoho Books, its on-line accounting software program. Zoho Books is free for one consumer and one accountant for companies with lower than $50,000 in annual income. It has 5 paid plans, beginning at $20 month-to-month. You'll be able to handle initiatives, funds, and stock out of your dashboard.

Free and paid plans embody the next:Invoicing: Promote your artwork globally with multilingual invoices.Challenge administration: Manually log your time or use the built-in timer.Funds: Select from 11 cost gateways, together with PayPal, Sq., and Stripe.Stock: Create customized tariffs and monitor inventory ranges.Hiveage: put together estimates out of your cellular phone

Hiveage launched in 2014 and was designed for small companies. It offers monetary experiences, on-line invoices, and expense-tracking instruments. The cellular apps put your accounting software program at your fingertips. Hiveage’s free plan allows you to retailer knowledge for 5 purchasers, whereas paid variations begin at $19 month-to-month and assist 50 to 1,000 clients.

Hiveage options embody the next:Limitless estimates and invoices: Ship purchasers branded statements and allow them to make full or partial funds.Time monitoring: Use the built-in timer and set billable charges to account on your time.Expense administration: Add receipts and mileage to know your small business prices.Funds: Provide purchasers a number of cost choices, together with PayPal, Stripe, and Bitcoin.[Read more: How to Start Selling Your Fine Art]

CO— goals to deliver you inspiration from main revered consultants. Nonetheless, earlier than making any enterprise resolution, it is best to seek the advice of knowledgeable who can advise you based mostly in your particular person scenario.

To remain on high of all of the information impacting your small enterprise, go right here for all of our newest small business news and updates.

CO—is dedicated to serving to you begin, run and develop your small enterprise. Study extra about the advantages of small enterprise membership within the U.S. Chamber of Commerce, right here.

A message from

Does Your Enterprise Qualify for the ERC?

Make the most of one of many largest tax credit score applications for organizations and companies with assist from Experian Employer Providers. In case your U.S.-based companies suffered income losses or a partial suspension of operations as a consequence of COVID-19 authorities orders, you might qualify for as much as $26,000 per worker with the Worker Retention Tax Credit score. Discover out if your small business qualifies.

Get Began

Subscribe to our publication, Midnight Oil

Knowledgeable enterprise recommendation, information, and traits, delivered weekly

By signing up you comply with the CO—

Privateness Coverage. You'll be able to decide out anytime.

Revealed April 28, 2023

https://guesthype.co.uk/?p=4153&feed_id=9690&cld=644bd79a2948a

0 notes

Text

https://bsoft.co.in/

Tally on Cloud – The Best Accounting Software for Your Businesses

When running a business, you need to tally on cloud accounting software that’s reliable, easy to use, and affordable. The right software will help you manage your finances while keeping track of cash flow and receipts. It’s also essential that the software can handle the volume of transactions in your business processes. After all, if it takes you 10 minutes to process one receipt or invoice, the last thing you want is for the other 11 staff members to spend half an hour entering them. However, not every small business accounting software is created equal. Some are better suited than others depending on your needs as a small business owner. In this article, we’ll explain what makes cloud accounting software so beneficial for businesses with limited IT budgets as well as those with high turnover and a fluctuating number of customers.

What is Tally on Cloud accounting software?

Cloud accounting software, also known as SaaS, is a type of software that you access via the internet. It’s often referred to as “software as a service” or “SaaS”. The whole point of using SaaS is to use software that’s hosted online, which means no long-term investment in hardware is required. In addition, you can access the program from a range of devices, which means you don’t need specific resources like a desktop computer or a smartphone app to get started. SaaS often appears as an alternative to traditional on-premises software. The reason for this is that SaaS often offers features that are simply not feasible to use in a remote office environment.

Why do you need Tally on Cloud accounting software?

Whether you’re a small business owner or a manager in charge of an office, it’s essential to keep track of your finances. This includes knowing how much money you have, where it came from, and what you’re doing with it. You’ll also need to maintain records of all transactions, taxes, and other financial data. This will allow you to report on your company’s performance consistently and accurately. In addition, you’ll want to create budgets and forecasts so that you can make informed decisions about future spending. There are a few good reasons why you should consider using cloud accounting software. First, the program is often cheaper than purchasing and setting up a dedicated accounting system. Cloud-based accounting software will also often come with added features like onboarding, invoicing, and payroll services.

Tally on Cloud – The Best Accounting Software for your Businesses

With all the benefits of cloud accounting software, it’s not surprising that Tally has become the most popular accounting platform for small businesses. It’s easy to use and well-liked by accounting professionals and small business owners alike. Tally is available as a hosted service or as a self-hosted solution. It can be accessed via a web browser on Mac OS, Windows, Linux, iOS, Android, and Chromebook devices. And, it can also be accessed via a mobile app. Using Tally, you can manage your finances, and track and report on revenue, expenses, cash flow, and more. You can also create reports, graphs, and charts. Tally’s strong features include: – Strong auditing – You can create unique audit trails in order to track the use of specific funds. – Strong reporting – You can create custom reports from your data. You can also create reports to show revenue and expense trends over time. You can also create reports with formulas and formulas that calculate stock-based compensation. – Strong budgeting – You can build budgets for revenue, expenses, and cash flow. You can also create forecasts for revenue and expenses. – Strong analytics – You can create pivot tables, graphs, and charts for analyzing your data. You can also analyze data in order to find out what data points need attention.

Tally on Cloud Features for a Business Accounting Software

– Strong auditing – You can create unique audit trails in order to track the use of specific funds. – Strong reporting – You can create custom reports from your data. You can also create reports to show revenue and expense trends over time. You can also create reports with formulas and formulas that calculate stock-based compensation. – Strong budgeting – You can build budgets for revenue, expenses, and cash flow. You can also create forecasts for revenue and expenses. – Strong analytics – You can create pivot tables, graphs, and charts for analyzing your data. You can also analyze data in order to find out what data points need attention.

Should You Use Tally on Cloud Accounting Software?

Tally on cloud accounting software can be a great software for managing and reporting your finances. However, you should always research the different options available and decide on the best solution for your needs. You should also consider what features are most important to you, as well as your company’s needs. With this in mind, you should be able to narrow down the list of cloud accounting software options.

1 note

·

View note

Text

Benefits of Fee Management System

A fee management system is a piece of software that assists teachers and administrators in managing school fees. It simplifies the collection and distribution of fees while also improving record-keeping. In this post, we will go over the advantages of a fee management system in depth:

Elimination of Manual Processes

A Fee Management System (FMS) is a web-based application that enables schools to manage all aspects of payments and subscriptions. This includes the following:

Fees are collected from parents/students who must fill out an online form before being billed.

Payments for subscription renewals are processed by the system automatically and do not need any additional information from the school.

FMS also automates payroll deductions for both students and teachers.

Improvement of Record-Keeping

A fee management system can also help you keep better records. With a fee management system, you can maintain track of all transactions and transactions involving your students. This means you won’t have to rely on paper records or manual processes to put data into spreadsheets. Simply use the software provided by your financial institution or bank to automate and streamline the process!

When you have an attendance policy in place, having a proper database will enable educators or administrators to quickly access all student data at once without having any difficulties comprehending what needs to be updated the next time around.

Pilferage is Prevented to a Great Extent

Using a fee management system can significantly reduce theft. Because parents can pay online and do not have to attend school, they are much less inclined to steal money from the school. They can also see how much they have paid and when it is due, increasing their likelihood of paying on time.

The Fee Management Systems (FMS) employ online portals that provide parents with access to their child’s educational records, allowing them to monitor their child’s progress at any time. If a parent wants more information about their child’s education or needs assistance understanding how fees work in the classroom, an FMS will provide this information via its website interface or mobile app for quick access during weekends or evenings when parents may not be at home but still require some guidance.

Simple Fee Structure

The best way for schools to manage their fees online is through a fee management system. It assists them in avoiding parent-child conflicts and ensuring that parents receive what they pay for. Furthermore, it aids in the development of a simple fee structure that is easily understood by both parents and teachers.

Parents can make payments at any time of day or night without fear of missing a payment deadline due to work or other obligations that may prevent them from paying at the school office during those hours (or even during office hours at all).

Teachers benefit from being able to track payments made through their fee management system in order to provide better service to their families rather than needing parents to call them directly every month with questions about what needs to be done next or how much money is required for anything else related to childcare costs such as uniforms or equipment for special events such as birthday parties/holidays, etc.

Parents are Encouraged to Pay on Time

When parents pay on time, it allows the school to plan more effectively. If a parent pays late, the school may experience cash flow issues. If parents do not have enough money or do not know how much they will end up owing in fees at the end of each month, they may be unable to pay on time.

Going Paperless Saves Trees and the Environment

Reduces the use of paper: In a fee management system, customers can pay for services online and via mobile apps. This means one no longer needs to print receipts, which reduces their carbon footprint.

Saves trees: When customers can pay for their utilities in installments rather than waiting until they’re due, there’s no requirement for them to come in person at all, which reduces traffic around their office/business or home base.

Saves water: Because paperless billing does not require paper towels or toilet paper after each use, it uses less water (although some companies still offer these options). And, rather than wasting water by flushing tissues down the toilet when there aren’t any clients around (for example), employees will know precisely what needs cleaning up when they return from lunch!

Generation of Automatic Alerts and Reminders

All stakeholders receive automatic alerts and reminders from the system. It notifies parents, school administration, and teachers about pending payments. This contributes to the creation of a transparent platform that allows everyone to track their transaction details at any time.

Sends SMS Notifications to Parents to Keep Them Up to Date

Fee management systems are an excellent way to keep parents informed about important school events and activities. There are numerous advantages to keeping parents notified about fees, including:

Alerting them when the registration fee for their child is due

Notifying them when fee waivers become available for students who qualify (for example, having a sibling already enrolled at the school)

Providing constant updates on how much money one has raised through donations or programs like fundraisers, which helps you gain visibility in your community.

Improvement in Student Learning

When students are given the proper tools, they learn more effectively.

When students are given the right information, they learn better.

When students are placed in the appropriate environment, they learn more effectively.

Students learn more effectively when they are motivated.

Enhancement of Teachers’ Engagement

Teachers are involved in the fee management process. They get to know the parents better and can identify students who need additional help.

Teachers will also have more opportunities to interact with their students as they collaborate on projects or activities linked to fees and assessments.

The system also allows teachers to assist students who require financial assistance with their tuition.

Improved School Administration

School management is the process by which a school is organized and managed. It includes the processes of planning, organizing, staffing, directing, and controlling a school.

The responsibility of managing a school depends on who is appointed as its principal. The principal has many roles to play in this process: curriculum development; management of staff members; resource allocation; student supervision, etc.

Takeaway

If you are a school administrator, you should be aware of the advantages of fee management software.

It assists schools in effectively managing their finances.

Parents can pay their fees online using the software, which improves efficiency and transparency. This also assists teachers in efficiently tracking students’ attendance, grades, and other important details.

The system was created specifically for this purpose so that any organization can use it without requiring major changes to its current processes or infrastructure.

Conclusion

Fee management systems are the solution if you want to improve the quality of your services while saving money. This technology can assist you in streamlining operations by automating various processes, increasing productivity through improved record-keeping, and increasing parental engagement through SMS notifications. And the best part? It’s simple to integrate with your existing system, so no major changes are required on your end!

0 notes

Text

How to delete cash app history? Simple solutions

Do you want to know How to delete cash app history? Wondering how you can download the transaction history on the cash app? If you want answers to these queries then let’s dive into this blog.

Technically, there’s no way of deleting the cash app transaction history. If any user makes a payment on the cash app then it gets saved there on the cash app and it will be saved forever. As the cash app doesn’t have this feature of deletion, you cannot delete it. The only way that can hide or delete your history is the deletion of your cash app account permanently which has been discussed below.

Let’s scroll down to know everything about the cash app history deletion:

Can I delete transaction history on the Cash App?

The straight answer to this query is no. No user can delete their payment history.

At the moment, there’s no feature for deletion available on the cash app. If you are sending or receiving money from the cash app then it will be there forever until you have not deleted the cash app account.

The cash app does this for the security reasons so there’s no option for deletion of the cash app history. many users of the cash app get worried that their transactions will be seen by others. But, this doesn’t happen on the cash app as only the account holder cans see their transactions.

Is it possible to hide cash app transactions?

Well, no, hiding the cash app transaction is also not possible on the cash app.

You can neither delete the transaction nor hide them. The transactions are already private and cannot be seen by others. The one who is having the login credentials of the cash app account will only be able to see the transactions. Apart from this, no one can see your transactions and all the transactions will be safe with you.

How to delete cash app history?

As discussed above, you cannot delete the transactions that you make on the cash app. This is because the cash app doesn’t allow for it. Any small to big transaction receipt will be saved in your account forever but you cannot delete it. But, the good thing is that you can download them if you need them for any references.

If you still want to delete the cash app transactions then you will have to do it by deleting the cash app account permanently. This is the only way to delete your cash app history forever.

Continue reading the steps so that you can know how to delete the cash app to delete the transaction history:

First of all, every user needs to sign in to the account and then go to the ‘Support’ link from where they can approach the support team.

After that, users need to tap on ‘Something Else’ so that they can reach the new page to proceed.

In the next step, you’ll have to select the ‘Account Settings’ from the available options available from the menu.

After this, make sure you are clicking the ‘Close my Cash App Account’. But, clicking on it, you should ensure that you have downloaded all the transcations from cash app for future use. Once the account gets delete, you won’t be able to get the transcations again.

Here, you will have to make sure to read all the instructions and then finally click on the ‘Confirm’ button.

Now, wait for the confirmation notification. You will get the notification through e-mail or text.

Read Also - How To Borrow Money From Cash App

Can I download cash app transactions?

Yes, the cash app allows downloading of the cash app history. This is beneficial is you need the receipts for any future applications.

For this, you will first have to navigate to the cash.app/account if you are using a web browser. You can also use your mobile to proceed for deletion.

In the next step, you will be asked to input your Cash PIN.

After that, go to the left side of the screen so that you can choose the button of Settings. Now, simply scroll down and then select “Download Your Info”.

In the next step, you can navigate to the Activity tab for downloading the cash app history.

After this, navigate to the top right corner of the screen where you can select the Statements. Now, choose a statement that you want to download. Here, you will have to click on the Export CSV to download the statements.

Conclusion

From this blog, you will find out How To Delete the Cash App History and download the transaction history. We have mentioned here a few steps that will help in the deletion of the cash app transaction and downloading the transaction receipts.

Reference Link - https://experts-supporttips.blogspot.com/2023/02/how-to-delete-cash-app-history-simple.html

0 notes

Text

Usda Homes For Sale In Texas Google Search

I constructed a staff around me and a reputation that I stand behind now. To our curated actual estate funding market and work with New Western to discover a deal that suits your wants. We provide quick access to alternatives you wouldn’t have otherwise. We also work behind the scenes to get rid of issues, deliver a marketable title and supply a fast homes for sale san antonio, seamless course of to close. Gain entry to our premier market where funding properties are added daily and a variety of offers can be found in markets across the country. In order to be well timed, fee mailing or widespread service of taxes must be postmarked or receipted on or before the due date of January 31st.

Find San Antonio details, actual estate for sale, actual estate for hire and more near San Antonio Homes and Houses for Sale & Rent . Search 6,408 homes for sale in San Antonio and 1,610 homes for rent in San Antonio - View 8,018 San Antonio Homes and Houses for Sale and Rent. HAR.com is the Official MLS web site homes for sale san antonio tx and cell app for home buyers and houses sellers. See Listing Details & Photos, School & Neighborhood information and Contact Agent. One of our licensed, native agents will come see your property and get you a cash offer.

Discover your dream home among our trendy homes, penthouses and villas for sale. Listed below are all of the property gross sales which are presently scheduled for the San Antonio space. You may also be interested in property sale companies in San Antonio. Prices, plans, specifications new home builders san antonio, sq. footage and availability subject to change without discover or prior obligation. Dimensions and sq. footage are approximate and should range upon elevations and/or options chosen. Elevation materials might range per subdivision requirement.

Further, the City requires canvassing of all relevant City Departments and public utilities and so can't guarantee the availability of any properties for a surplus sale. Save searches and favorites, ask questions, and join with brokers through new homes san antonio seamless cell and internet experience, by creating an HAR account. With New Western and do more deals with our agents who are consultants of their local markets.