#Chocolate Confectionery and Desserts Packaging Market

Text

How Important Is Branding in the Dessert Business?

Introduction

The dessert industry is booming. With countless bakeries, ice cream parlors, and confectioneries popping up, it's clear that people have a sweet tooth. But how do some dessert businesses stand out in this sea of sugar and chocolate? The answer lies in branding. Let's dive into why branding is crucial in the dessert business and how it can transform your sweet venture into a memorable experience.

The Basics of Branding

What is Branding?

Branding goes beyond just a logo or a catchy name. It's the entire perception that your business creates in the minds of your customers. From your logo to your customer service, everything contributes to your brand.

Components of a Strong Brand

A strong brand consists of several key components: a memorable logo, a consistent color scheme, a unique voice, and a compelling story. Each element plays a vital role in how your business is perceived and remembered.

Why Branding Matters in the Dessert Business

First Impressions Count

In the dessert business, first impressions are everything. When customers walk into your store or visit your website, the first thing they notice is your brand's visual appeal. A well-designed brand can make customers feel welcome and excited to try your products.

Building Customer Loyalty

Branding helps build trust and loyalty. When customers recognize and trust your brand, they're more likely to return and recommend your desserts to others. Consistency in branding reassures them that they'll have the same great experience every time.

Creating a Unique Brand Identity

Understanding Your Target Audience

To create a unique brand identity, you need to understand your target audience. Who are your customers? What do they like? What are their preferences? Knowing your audience helps you tailor your branding efforts to meet their expectations.

Crafting a Memorable Logo and Name

Your logo and name are the face of your brand. They should be easy to remember and reflect the essence of your business. A great logo is simple yet impactful, and your business name should be catchy and relevant to your desserts.

Brand Storytelling

Sharing Your Journey

People love stories, especially when they involve passion and dedication. Share your journey of how you started your dessert business, the challenges you faced, and the milestones you achieved. This creates an emotional connection with your customers.

Connecting Emotionally with Customers

Emotional connections drive customer loyalty. Whether it's through heartwarming stories or delicious memories, connecting with your customers on an emotional level ensures they remember your brand fondly.

Visual Branding

Importance of Color and Design

Colors evoke emotions and play a significant role in branding. Choose a color palette that resonates with your brand's personality. Consistent design elements, from packaging to store decor, reinforce your brand's visual identity.

Consistent Packaging

Packaging is more than just a way to hold your desserts; it's a marketing tool. Consistent and attractive packaging enhances the overall experience and makes your brand more recognizable. Think about the iconic customized dessert boxes Canada from famous brands – they’re instantly recognizable and add to the product’s appeal.

Digital Presence

Building a Dessert Brand Online

In today's digital age, having an online presence is crucial. A well-designed website with engaging content can attract customers and keep them coming back. Make sure your website reflects your brand's personality and offers a seamless user experience.

Utilizing Social Media

Social media is a powerful tool for branding. Platforms like Instagram and Facebook allow you to showcase your desserts, engage with customers, and build a community. Use high-quality photos, share behind-the-scenes stories, and interact with your audience to build a loyal following.

Customer Experience and Brand Perception

Ensuring Quality and Consistency

Quality is non-negotiable in the dessert business. Ensure that every dessert you serve meets high standards. Consistency in taste and presentation builds trust and reinforces your brand's reputation.

Creating a Memorable Customer Experience

A great customer experience goes beyond just the product. It's about how customers feel when they interact with your brand. Friendly service, a pleasant ambiance, and little extras like personalized messages can make a big difference.

Leveraging Influencer Marketing

Collaborating with Food Bloggers and Influencers

Influencers can help you reach a wider audience. Collaborate with food bloggers and influencers who align with your brand to showcase your desserts. Their endorsement can boost your brand's credibility and attract new customers.

User-Generated Content

Encourage your customers to share their experiences on social media. User-generated content, such as photos and reviews, adds authenticity to your brand and helps build a community around your desserts.

Branding and Product Development

Innovating While Staying True to Your Brand

Innovation keeps your brand fresh and exciting. Experiment with new flavors and presentation styles, but ensure they align with your brand's identity. Innovation should enhance, not confuse, your brand image.

Seasonal and Limited-Edition Desserts

Seasonal and limited-edition desserts create excitement and urgency. They give customers something to look forward to and talk about, enhancing your brand's appeal.

Local Community and Events

Participating in Local Events

Get involved in your local community by participating in events and fairs. This boosts brand visibility and allows you to connect with potential customers in a personal setting.

Hosting Brand-Specific Events

Host events like dessert tastings, baking classes, or holiday specials. These events create memorable experiences and deepen customer engagement with your brand.

Brand Collaborations and Partnerships

Partnering with Other Brands

Collaborate with other brands to create unique products or experiences. Partnerships can introduce your brand to new audiences and provide opportunities for creative marketing.

Co-Branding Opportunities

Co-branding with well-known brands can enhance your brand's credibility and visibility. Look for brands that share your values and have a complementary customer base.

Measuring Brand Success

Key Performance Indicators (KPIs)

Track KPIs such as customer retention, brand awareness, and sales to measure the success of your branding efforts. Regularly review these metrics to make informed decisions.

Gathering and Analyzing Feedback

Customer feedback is invaluable. Use surveys, reviews, and social media comments to gather insights on your brand's performance. Analyzing feedback helps you identify areas for improvement and opportunities for growth.

Case Studies

Successful Dessert Brands and Their Strategies

Study successful dessert business brands to understand their branding strategies. Analyze what makes them stand out and how they connect with their customers.

Lessons Learned from Brand Failures

Learning from failures is just as important as studying successes. Understand the common pitfalls in branding and how to avoid them to ensure your brand's longevity.

Conclusion

Branding is more than just a logo or a catchy name; it's the soul of your dessert business. It influences how customers perceive and remember your brand. By focusing on creating a strong brand identity, sharing your story, maintaining quality, and engaging with your audience, you can build a loyal customer base and stand out in the competitive dessert industry.

FAQs

Why is branding important in the dessert business? Branding helps create a memorable impression, builds customer loyalty, and differentiates your business from competitors.

How can I create a unique brand identity for my dessert business? Understand your target audience, craft a memorable logo and name, and share your brand story to connect emotionally with customers.

What role does social media play in dessert branding? Social media allows you to showcase your products, engage with customers, and build a community around your brand.

How do I ensure consistent branding across all platforms? Maintain a consistent color scheme, design elements, and brand voice across your website, social media, and packaging.

0 notes

Text

Indulgence Redefined: The Artisanal Craft of Milk Chocolate Chips

In the realm of confectionery delights, few treats hold the universal appeal and versatility of milk chocolate chips. Whether sprinkled atop warm cookies, folded into creamy ice cream, or melted into a decadent fondue, these tiny morsels possess the power to elevate any culinary creation to sublime heights.

Amidst the bustling landscape of chocolate production, there exists a niche artisanal craft dedicated specifically to the creation of milk chocolate chips. Unlike mass-produced counterparts, which prioritize uniformity and scale, these manufacturers are guided by a commitment to quality, flavor, and craftsmanship.

Melding Tradition with Innovation

At the heart of the milk chocolate chip manufacturing process lies a delicate dance between tradition and innovation. While the foundational techniques may date back centuries, modern artisans continually push the boundaries of flavor profiles and production methods.

Each batch begins with the careful selection of premium cocoa beans, sourced from regions renowned for their rich, complex flavors. These beans undergo a Milk Choco Chips Manufacturer meticulous roasting process, during which their inherent aromas are coaxed to the surface, setting the stage for the creation of a truly exceptional chocolate.

Next comes the blending stage, where cocoa solids, cocoa butter, and just the right amount of sugar are harmoniously combined to achieve the desired balance of sweetness and depth. For milk chocolate chips, the addition of creamy milk powder imparts a luscious richness that sets them apart from their darker counterparts.

Crafting the Perfect Chip

The transformation from liquid chocolate to bite-sized chips is where the true artistry shines. A master chocolatier oversees the tempering process, carefully controlling temperature fluctuations to ensure the final product boasts a glossy sheen and satisfying snap.

Once tempered, the molten chocolate is gently poured into molds, each cavity precisely calibrated to yield uniformly sized chips. As they cool, the chocolate undergoes a miraculous metamorphosis, solidifying into perfectly formed morsels ready to impart their delectable essence to any dish they grace.

Quality Assurance: A Commitment to Excellence

In the realm of artisanal chocolate production, quality is paramount. From the sourcing of raw ingredients to the final packaging, every step of the process is conducted with unwavering attention to detail.

Stringent quality control measures ensure that only the finest chocolate chips make their way to market, free from imperfections and imbued with the full spectrum of flavor notes characteristic of premium cocoa. This dedication to excellence not only guarantees customer satisfaction but also serves as a testament to the enduring legacy of artisanal craftsmanship.

Beyond the Chocolate Chip

While the milk chocolate chip may serve as the crowning jewel of this artisanal endeavor, its impact extends far beyond the realm of sweet indulgence. From fostering community partnerships with local cocoa farmers to implementing sustainable production practices, these manufacturers are committed to making a positive impact at every stage of the supply chain.

Furthermore, the versatility of milk chocolate chips opens up a world of culinary possibilities, inspiring chefs and home cooks alike to experiment with new flavor Milk Choco Chips Manufacturer combinations and innovative applications. Whether incorporated into savory dishes for a touch of sweetness or featured prominently in classic desserts, these tiny treasures never fail to captivate the imagination.

In Conclusion

The world of milk chocolate chip manufacturing is a testament to the enduring allure of artisanal craftsmanship in an increasingly industrialized age. Through a harmonious blend of tradition, innovation, and unwavering commitment to quality, these artisans have succeeded in elevating a humble confectionery staple to the realm of culinary artistry. As we savor each delectable chip, let us pause to appreciate the passion and skill that went into its creation, and savor the simple joy it brings to our lives.

0 notes

Text

Sugar Confectionery Market Competitive Analysis

Sugar Confectionery Market analysis report figures out market landscape, brand awareness, latest trends, possible future issues, industry trends and customer behaviour so that the business can stand high in the crowd. It includes extensive research on the current conditions of the industry, potential of the market in the present and the future prospects from various angles. This market report comprises of data that can be pretty essential when it comes to dominating the market or making a mark in the Food & Beverages industry as a new emergent. To bestow clients with the best results, Sugar Confectionery Market research report is produced by using integrated approaches and latest technology.

Download Free Sample Report at: https://www.delvens.com/get-free-sample/sugar-confectionery-market

Sugar Confectionery Market, by Product Type (Hard-Boiled Sweets, Toffees, Caramels, & Nougat, Pastilles & Jellies, Mints, and Other Product Types) and Distribution Channel (Offline Stores, Online Platforms) and region (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The global Sugar Confectionery Market size was estimated at USD 56.2 billion in 2023 and is projected to reach USD 79.9 billion in 2030 at a CAGR of 4.5% during the forecast period 2023-2030.

The sugar confectionery market denotes the sector responsible for the manufacture and distribution of a diverse assortment of saccharine delicacies, primarily composed of sugar. This category comprises an array of products, such as confections, chocolates, chewing gum, jellies, popsicles, caramels, and analogous commodities. The sugar confectionery industry constitutes a noteworthy fraction of the wider confectionery domain, encompassing chocolate bars, baked goods, and frozen desserts.

The industry's growth is being driven by the combination of a growing population and rising disposable income. Furthermore, the industry is receiving support from increasing urbanization and changing consumer lifestyles. During the forecast period, significant investments by industry players in promotional activities, advertising campaigns, and social media marketing are anticipated to fuel the demand for sugar confectionery products. Additionally, the growth of the sugar confectionery industry is being supported by the expanding retail industry and the rising trend of e-commerce. However, the industry's growth may be restricted due to increasing health awareness, growing obesity-related diseases, and a shift in trend towards consumption of low-calorie food. Nevertheless, the global industry is expected to be driven by growing demand from emerging economies, the increasing trend of gifting confectionery products, and rising demand for organic and premium chocolate products.

Sugar Confectionery Market Competitive Landscape:

Anthony-Thomas Candy Co

August Storck KG

Barry Callebaut

Blommer Chocolate Company

Cadbury PLC.

Chupa Chups SA.

Cloetta AB

Ferrero SPA.

Foley's Candies LP

Haribo Dunhills PLC

Ingredion

Kraft Foods Inc

Lindt

Lotte Confectionery Co Ltd,

Mars, Incorporated

Nestle SA

Perfetti Van Melle S.P.A.

Sprungli

Tate & Lyle

The Hershey Company,

Wm Wrigley Jr Company

Sugar Confectionery Market Recent Developments:

In February, 2022, Hershey's created a sugar bar to commemorate All Women and Girls. The "Celebrate SHE" bars are a limited edition. SHE was highlighted in the centre of the milk sugar bar by the brand.

In January, 2022, Cadbury, a brand of Mondelez International, introduced the Twist Wrap packaging solution for its Duos range, allowing consumers to snack in small portions by twisting and sealing the package after consuming half of the sugar bar.

Make an Inquiry Before Buying at: https://www.delvens.com/Inquire-before-buying/sugar-confectionery-market

Sugar Confectionery Market Key Findings:

The Product Type segment is further fragmented into Hard-Boiled Sweets, Toffees, Caramels, & Nougat, Pastilles & Jellies, Mints, and Other Product Types. The Hard-boiled Sweets segment is expected to account for a larger market size during the forecast period. The production of these confections is relatively cost-effective, providing a broad spectrum of consumers with the opportunity to indulge in a delectable treat. Their extended shelf life, which endures for several months without compromising quality or taste, renders them an optimal selection for manufacturers and vendors. The diverse assortment of fruit, mint, and floral flavors of hard candies caters to varied taste preferences. The convenience of individually packaged hard-boiled sweets, which are effortless to carry and consume while on the move, renders them a popular choice for consumers who lead busy lives.

The Distribution Channel segment is further bifurcated into Offline Stores and Online Platforms. The offline store is the largest market during the forecast period. The ubiquitous existence of these commodities and their palpable retail experience are notable. Patrons have the opportunity to physically examine and procure these goods. Additionally, they may reap the advantages of insights and endorsements provided by store staff. Conversely, the digital domain is rapidly expanding owing to the surging prevalence of e-commerce and the expediency it provides.

The packaging segment is further bifurcated into sachet, box, and others. The Sachet packaging is the largest market during the forecast period. Sachet packaging is commonly utilized for dispensing individual or small portions of confectionery, thereby providing an expedient option for on-the-go consumption. In contrast, box packaging is frequently associated with high-end or gift-worthy sweets, affording a visually captivating and methodical presentation.

The market is also divided into various regions such as North America, Europe, Asia-Pacific, South America, and Middle East and Africa. North America is estimated to account for the largest market share during the forecast period owing to the rising disposable income and expanding youth population.

Sugar Confectionery Market Regional Analysis:

North America to Dominate the Market

North America is estimated to account for the largest market share during the forecast period owing to the rising disposable income and expanding youth population.

Moreover, the strong focus on retail chain expansion projects, will escalate the manufacturing of sugar confectioneries to cater to regional consumers.

Frequently Asked Questions:

What are the years considered to study Sugar Confectionery Market?

What is the compound annual growth rate (CAGR) of the Sugar Confectionery Market?

Which region holds the largest market share in Sugar Confectionery Market?

Which region is the fastest growing in Sugar Confectionery Market?

Who are the major players in Sugar Confectionery Market?

Direct Purchase of the Sugar Confectionery Market Research Report at: https://www.delvens.com/checkout/sugar-confectionery-market

Browse Related Reports:

Premium Wine Market

Flavours and Fragrances Market

Cannabis Seeds Market

Food Safety Testing Market

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

#consulting company#strategic advisory firm#best market reports#market analysis reports#trending reports#syndicated reports#Sugar Confectionery Market#Sugar Confectionery#Food & Beverages

0 notes

Text

Sweet Success: Thailand Confectionery Market Analysis

The confectionery market in Thailand is a vibrant and dynamic sector, fueled by a rich culinary heritage, changing consumer preferences, and a growing appetite for indulgent treats. In this comprehensive analysis, we delve into the intricacies of the Thailand confectionery market, exploring key trends, challenges, and opportunities shaping its growth and evolution.

Cultural Influences

Culinary Tradition

Thailand's diverse culinary tradition, characterized by bold flavors, exotic ingredients, and intricate craftsmanship, extends to the realm of confectionery. From traditional Thai sweets like "kanom Thai" made from coconut, rice flour, and palm sugar to international favorites like chocolates and gummies, the confectionery market reflects a fusion of local and global influences that cater to diverse tastes and preferences.

Festivals and Celebrations

Festivals and celebrations play a significant role in driving demand for confectionery products in Thailand. Events such as Songkran (Thai New Year), Loy Krathong (Festival of Lights), and Chinese New Year are marked by the exchange of sweets and desserts as gifts and offerings, creating opportunities for confectionery manufacturers to introduce seasonal and festive-themed products that resonate with consumers.

Market Dynamics

Consumption Patterns

Thailand's confectionery market exhibits diverse consumption patterns, with a growing demand for premium and innovative products driven by rising disposable incomes, urbanization, and changing lifestyles. While traditional sweets remain popular, there is increasing interest in indulgent treats, health-conscious options, and experiential products that offer unique flavors, textures, and packaging.

For more insights on the Thailand confectionery market forecast, download a free report sample

Distribution Channels

Confectionery products in Thailand are distributed through a variety of channels, including supermarkets, hypermarkets, convenience stores, specialty shops, online retailers, and traditional markets. Each channel caters to different consumer segments and purchasing occasions, with supermarkets and hypermarkets offering a wide range of brands and varieties, while convenience stores provide convenience and accessibility for on-the-go consumption.

Opportunities and Challenges

Innovation and Product Differentiation

Innovation is key to success in the Thailand confectionery market, with consumers seeking new flavors, formats, and experiences that excite their palates and capture their imagination. Manufacturers have opportunities to differentiate their products through unique ingredients, packaging designs, and marketing strategies that resonate with consumer preferences for authenticity, quality, and novelty.

Health and Wellness Trends

As health and wellness concerns gain prominence among Thai consumers, there is growing demand for confectionery products that offer functional benefits, natural ingredients, and reduced sugar content. Manufacturers can capitalize on this trend by developing products with added vitamins, minerals, and botanical extracts, as well as low-sugar and sugar-free options that cater to health-conscious consumers' dietary preferences and lifestyle choices.

Conclusion

In conclusion, the Thailand confectionery market presents exciting opportunities for manufacturers to innovate, diversify, and capitalize on the country's rich culinary heritage and evolving consumer preferences. By understanding cultural influences, market dynamics, and emerging trends, companies can develop products that resonate with Thai consumers, drive category growth, and achieve sweet success in this dynamic and competitive market.

0 notes

Text

Unveiling the Sweet Success of Spain's Confectionery Market: A Comprehensive Analysis

Spain's confectionery market is a delightful blend of tradition, innovation, and indulgence, offering a tantalizing array of sweets and treats to consumers across the country. From traditional delicacies to modern confections, the Spain confectionery market reflects a rich culinary heritage and a vibrant culture of gastronomy. In this comprehensive analysis, we explore the nuances of Spain's confectionery landscape, uncovering key trends, market dynamics, and growth opportunities within the industry.

Overview of the Spain Confectionery Market

The Spain confectionery market encompasses a diverse range of products, including chocolates, candies, pastries, and desserts, each representing a unique facet of Spanish gastronomy and cultural heritage. Spaniards have a deep appreciation for sweets, with confectionery playing a prominent role in celebrations, festivals, and everyday indulgences.

Key Factors Driving Market Growth

Several factors contribute to the growth and evolution of the Spain confectionery market:

1. Culinary Tourism and Cultural Experiences

Spain's reputation as a culinary destination attracts tourists from around the world eager to explore its rich gastronomic traditions and culinary innovations. Confectionery plays a significant role in this culinary tapestry, with tourists seeking authentic Spanish sweets and desserts as part of their gastronomic experiences.

For more insights on the Spain confectionery market forecast, download a free report sample

2. Innovation and Artisanal Craftsmanship

The Spanish confectionery industry is characterized by a blend of tradition and innovation, with artisans and confectioners continually experimenting with flavors, textures, and ingredients to create unique and innovative products. Artisanal craftsmanship and attention to detail differentiate premium confectionery brands, appealing to discerning consumers seeking high-quality indulgences.

3. Health and Wellness Trends

In response to changing consumer preferences and wellness trends, the Spain confectionery market has witnessed a rise in demand for healthier alternatives, including organic, low-sugar, and gluten-free options. Confectionery brands are innovating with natural ingredients, sustainable sourcing practices, and mindful packaging to cater to health-conscious consumers without compromising on taste or quality.

Market Challenges and Regulatory Considerations

Despite its growth potential, the Spain confectionery market faces challenges and regulatory considerations:

Health and Nutrition Concerns: Increasing awareness of the health implications of excessive sugar consumption and unhealthy eating habits prompts regulatory scrutiny and consumer advocacy for stricter regulations on confectionery marketing, labeling, and product formulations.

Competitive Landscape: The confectionery market in Spain is highly competitive, with multinational brands, regional producers, and artisanal confectioners vying for market share. Differentiating products, building brand loyalty, and navigating distribution channels pose challenges for industry players.

Economic Uncertainty: Economic fluctuations, changing consumer spending patterns, and geopolitical factors impact consumer confidence and purchasing power, influencing demand for confectionery products and consumer discretionary spending.

Future Outlook and Growth Opportunities

Looking ahead, the Spain confectionery market presents several growth opportunities and emerging trends:

Innovative Flavors and Ingredients: Experimenting with unique flavors, exotic ingredients, and regional specialties allows confectionery brands to capture consumer interest and differentiate their product offerings in a crowded market.

Sustainable Practices: Embracing sustainable sourcing, production, and packaging practices aligns with consumer preferences for ethical and environmentally friendly products, offering opportunities for brands to enhance their sustainability credentials and appeal to eco-conscious consumers.

Digital Marketing and E-commerce: Leveraging digital platforms, social media, and e-commerce channels enables confectionery brands to reach a broader audience, engage with consumers directly, and drive sales through online channels.

Conclusion

In conclusion, the Spain confectionery market is a vibrant and dynamic sector driven by a rich culinary heritage, consumer preferences, and market innovations. By understanding the underlying trends, challenges, and growth opportunities, stakeholders can navigate the market landscape strategically and capitalize on emerging trends to drive sustainable growth and innovation.

0 notes

Text

Banana Puree Market: Luxuriate in the Finest Pureed Bananas

Market Overview:

Banana puree is made from fully ripened banana which is finely mashed or sieved to obtain a smooth consistency. It is widely used in baby food products, yogurt, ice cream and other desserts due to its sweet taste and high nutritional profile.

Market Dynamics:

The banana puree market is expected to witness significant growth over the forecast period owing to high nutritional profile of bananas and growing demand for plant-based and organic baby food products. Banana puree is rich in potassium, vitamin C and fiber which make it healthier option for baby food products compared to other fruits. Additionally, increasing number of working women and dual income households have boosted the demand for convenient and ready-to-mix baby food products, thereby propelling the banana puree market growth.

Growing demand from processed food industry is driving the banana puree market

The processed food industry has been witnessing significant growth in demand for banana puree. Banana puree finds wide application in making baby food, ice creams, yogurt, baked goods and other processed snacks. It helps enhance the flavor and nutritional profile of processed foods. With rising health consciousness, consumers are increasingly preferring food products containing natural and organic ingredients like banana puree. Moreover, busy lifestyles have fueled the demand for convenient packaged food items where banana puree is used as a key ingredient. Many food manufacturers are introducing new product lines incorporating banana puree to cater to consumer demand. This growing demand from the processed food sector remains the primary driver propelling the banana puree market.

Increasing demand from confectionery industry is fueling the banana puree market

Confectionery products like candies, gums and chocolates have been experiencing growing demand globally. Banana puree is widely employed in manufacturing confectionery items owing to its sweetness and ability to enhance taste and texture. Moreover, banana puree aids in moisture retention and improves shelf life of confectionery products. Many confectioners are focusing on launching new banana flavors in candies, gums and other products. Additionally, banana puree extracted from organic bananas is gaining traction from health-conscious consumers. This rising demand from confectionery manufacturers continues to bolster growth of the banana puree market.

High dependency on weather conditions is posing a challenge for banana puree market

Supply and quality of bananas are heavily dependent on climatic conditions like rainfall, temperature and humidity levels during cultivation and harvesting. Any abnormal weather fluctuations can significantly damage banana crops, leading to low yield and reduced availability of raw materials for banana puree production. Climate change has also increased frequency and intensity of natural disasters disrupting banana cultivation. Droughts or excessive rains negatively impact banana crop growth and harvests. Furthermore, pest infestations aggravated by changing weather patterns pose quality issues in banana production. This high dependency on favorable weather conditions poses a major challenge for consistent supply and stable prices in the banana puree market.

Growing demand for organic banana puree presents a lucrative opportunity

Increasing health awareness has fueled demand for organic and natural food ingredients without artificial preservatives, colors or flavors. This rising trend represents a huge opportunity for organic banana puree market. Organic farming practices avoid use of synthetic pesticides and fertilizers to produce pesticide-residue free bananas. Since banana puree is widely used in baby food and other products targeting health-conscious customers, demand for its organic variant is expected to surge. Moreover, preferences for sustainable and eco-friendly products also promote organic banana puree market. Banana producers can capitalize on this favorable opportunity by obtaining organic certifications and catering to premium segment demand.

Manufacturers are innovating with banana puree to tap evolving trends

The banana puree market players are innovating with product development leveraging latest industry trends. They are introducing banana puree in various formats like freeze-dried powder to increase shelf life and suit customized applications. Moreover, different flavors obtained from blending banana puree with other fruits are gaining traction. Banana puree infused with functional ingredients like probiotics and prebiotics have also emerged addressing health trend. Similarly, private label brands are employing banana puree in convenient packs aligned with on-the-go snacking trend. Such innovations help tackle industry challenges and cater to dynamic consumer needs. This innovation with products and packaging remains a key trend shaping the future growth dynamics of banana puree market.

#Banana Puree Market Share#Banana Puree Market Growth#Banana Puree Market Demand#Banana Puree Market Trend#Banana Puree Market Analysis

0 notes

Text

Cadbury Creme Egg: A Delightful Easter Treat

Cadbury Creme Egg is a beloved confectionery delight that has been tantalizing taste buds for generations. With its delectable combination of milk chocolate and a creamy fondant filling, this egg-shaped treat has become an icon of Easter celebrations. In this article, we will delve into the history, experience, variations, and seasonal offerings of Cadbury Creme Egg that make it a truly irresistible indulgence.

The Delicious Cadbury Creme Egg

Cadbury Creme Egg is a chocolate confectionery treat manufactured by Cadbury. It features a milk chocolate shell shaped like an egg, with a smooth and creamy fondant filling that mimics the yolk of a real egg. The combination of rich chocolate and sweet fondant creates a unique and decadent taste experience that has captured the hearts of candies lovers worldwide.

History and Popularity of Cadbury Creme Egg

The cadbury creme egg has a rich history dating back to its introduction in 1963 by the British confectionery company Cadbury. Since then, it has gained immense popularity, becoming synonymous with Easter festivities. The annual limited-time availability of Cadbury Creme Eggs during the Easter season adds to the excitement and anticipation surrounding this delightful treat.

The Iconic Cadbury Creme Egg Experience

Biting into a Cadbury Creme Egg is a truly indulgent experience. The outer layer of smooth and velvety milk chocolate gives way to a luscious and gooey fondant filling that resembles the yolk of a real egg. The contrasting textures and flavors create a satisfying combination that delights the senses and leaves a lasting impression.

The Irresistible Cadbury Creme Egg Filling

The fondant filling inside a Cadbury Creme Egg is a key element that sets it apart. The creamy and sweet filling is made from a blend of sugar, golden syrup, and other secret ingredients, carefully crafted to replicate the texture and taste of a real egg yolk. It is this unique filling that makes Cadbury Creme Egg a distinctive and sought-after treat for montreal candy bar.

Cadbury Creme Egg Variations

Over the years, Cadbury has introduced various variations of the classic Cadbury Creme Egg to cater to different preferences and tastes. Some variations include caramel-filled Creme Eggs, miniature versions known as Creme Egg Minis, and larger-sized Creme Eggs for those who crave an extra indulgent experience. These variations offer delightful twists on the original concept, providing options for every chocolate lover.

Cadbury Creme Egg Recipes and Treats

Cadbury Creme Eggs are not just meant to be enjoyed on their own; they can also be used to create delicious treats and desserts. From Cadbury Creme Egg brownies and cupcakes to milkshakes and ice cream sundaes, the possibilities are endless. Recipes incorporating Cadbury Creme Eggs allow enthusiasts to elevate their culinary adventures and explore new ways to savor this iconic treat.

Cadbury Creme Egg Seasonal Offerings

While Cadbury Creme Eggs are most commonly associated with Easter, Cadbury has expanded its seasonal offerings to include other festive occasions. Limited-edition Creme Eggs with different colored foils and themed packaging are released for Halloween and Christmas, allowing consumers to enjoy the magic of Cadbury Creme Egg throughout the year.

Cadbury Creme Egg Collectibles and Memorabilia

The popularity of britain candy Cadbury Creme Egg has led to the creation of a vibrant collector's market. Enthusiasts can find an array of Cadbury Creme Egg-themed merchandise, including keychains, mugs, t-shirts, and even giant inflatable eggs. These collectibles and memorabilia serve as cherished mementos for fans who want to showcase their love for this iconic confection.

Conclusion

Cadbury Creme Egg remains an Easter tradition and a beloved treat for chocolate enthusiasts worldwide. Its rich history, delightful filling, and seasonal variations make it an irresistible indulgence. Whether enjoyed on its own, used in creative recipes, or collected as memorabilia, the Cadbury Creme Egg continues to captivate taste buds and bring joy during the festive season.

0 notes

Text

Caramel Market Trends, Share Analysis & Forecast Till 2022-2030

Market Insight

The caramel market 2022 is all set to accrue a growth rate of 5.9% from 2022 and 2030 (appraisal period), claims Market Research Future (MRFR). MRFR also adds that the global market could potentially touch USD 3.45 Billion by 2030. We will provide COVID-19 impact analysis with the report, along with all the extensive key developments in the market post the coronavirus disease outbreak.

Top Drivers and Restraints

Owing to the worldwide lockdown due to the COVID-19 outbreak, demand for non-edible items like toilet paper, disinfectants, hand sanitizer and paper goods has mounted but sales of edible products like bakery and meat products have gone down, while the supply has also got hit given the shortage of labor. In addition, the shutdown of logistics facilities following the pandemic has slowed down the caramel market share growth, as the supply and demand gap has widened more than expected. Another factor deterring the market growth following the onset of SARS-CoV-2 is the lack of raw materials available in the market.

However, as the lockdown is being lifted up, and shops reopening, sales of bakery items has picked up once again. This has favored the sales of caramel and caramel-based products, with many people lining up to hoard these items for emergency. As a result, the rising demand from the house hold segment for caramel has benefitted the market immensely, even as the novel coronavirus continues to ravage the food and beverage industry worldwide. Besides, the growing market for confectionery goods and flavored candies among the youth and children is also expected to boost the revenue generation in the target market.

Furthermore, rising urbanization rate, consumers’ evolving buying pattern with regard to food items, and the surge in disposable income can also boost the market growth in the following years. The rise in R&D/research and development activities to come up with new products like tea-infused chocolates and java pop coffee soda also elevates the global market position.

For instance, in August 2020, Marco Sweets and Spices launched five new ice cream flavors, one of which is caramel. The said caramel flavor is a mix of sweet and spicy, combining the flavors of caramel Aleppo pepper, chile de árbol as well as peanut butter.

Segmental Insight

The caramel market trends can be considered for function, form and application.

Colors, fillings, toppings, flavors, and others are the function-based key segments listed in the report. It is presumed that the colors segment could take the lead and hit USD 913.3 million by 2030-end, while the toppings segment can procure the highest advancement rate of 5.8% between 2018 and 2030. The escalating sales of confectionery items and ice cream have boosted the demand for caramel to be used as topping.

Form-wise, the market caters to solid & semi-solid as well as liquid. In 2017, the liquid segment claimed the leading position, while the solid & semi-solid segment will most likely obtain the better growth rate given its ease of use and the low cost of storage, transportation and packaging.

Beverages, snacks, bakery & confectionery, dairy & frozen desserts, and more are the key applications of caramel. In 2017, the highest gaining segment belonged to bakery & confectionary and the snacks segment is touted to achieve the fastest CAGR over the evaluation period.

Regional Outlook

Caramel market can be regionally considered for Europe, North America, APAC/Asia Pacific, and RoW/the rest of the world.

As of 2017, APAC has been the market leader and is also on track to advance at the highest rate of 5.9% in the coming years. The impressive market growth in APAC is the result of the evolving food buying patterns and the increasing sales of confectionery as well as bakery products. A recent trend has been the significant demand for organic and natural caramel ingredients such as organic salted caramel, organic caramel sauce and organic caramel syrup, from which the regional market is anticipated to benefit significantly over the ensuing years.

The same year, the second in lead was North America, thanks to the massive growth of the food and beverage industry in the United States and Canada. Manufacturers of confectionery items, beverages and frozen desserts are increasing using caramel as a natural flavor and sweetener, which is leading to growth of the target market in the region. The hectic and busy lifestyle of people in the region has strongly influenced their eating and cooking habits, which has only worked in favor of the caramel market’s favor.

Top Players

Top key caramel market players listed in the report are Sethness Products Company (US), Martin Braun Backmittel and Essences KG (Germany), Cargill Incorporated (US), Kerry Group PLC (Ireland), Bakels Worldwide (Switzerland), Barry Callebaut AG (Switzerland), Nigay SAS (France), Metarom Group (France), Göteborgsfood Budapest Ltd (Hungary), Puratos NV/SA (Belgium), and more.

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

Contact Us:

Market Research Future (part of Wantstats Research and Media Private Limited),

99 Hudson Street, 5Th Floor,

New York, New York 10013

United States of America

+1 628 258 0071

Email: [email protected]

0 notes

Text

An Overview of Different Types of Chocolate Coating Products

The chocolate coating has become an essential ingredient in many of our favorite sweet treats. Chocolate coating is a deliciously sweet and indulgent way to enhance the flavor of any treat, from chocolate-covered strawberries to candy bars. But did you know that several different types of chocolate coating products are available?

Let’s take a closer look at the different types of chocolate coating products and their uses.

Couverture Chocolate

First, there’s couverture chocolate. This type of chocolate is made from a higher percentage of cocoa butter, giving it a smoother, creamier texture that melts quickly in your mouth. Couverture chocolate is also a great choice for chocolate-coated treats, as it has a glossy finish that makes the treats shine.

Compound Chocolate

Unlike couverture chocolate, compound chocolate does not contain cocoa butter. This makes it a great, affordable option for coating large batches of treats. Compound chocolate also has a longer shelf life than couverture chocolate, so it’s great for those who like to keep their treats around for a while.

Chocolate Confectioners Coating

The chocolate confectionery coating comes next. This chocolate coating is made with vegetable fats instead of cocoa butter and is usually cheaper than the other two types. It’s also easier to work with and can be used to create various shapes and sizes.

Chocolate Transfer Sheets

These sheets are made from pure chocolate that has been melted, tempered, and then poured onto special paper. Once the chocolate is transferred to the paper, it can be cut into any shape ensuringor size desired. Transfer sheets are perfect for creating intricate designs or customizing treats.

Whatever chocolate-coating products you choose, ensure you use the highest quality chocolate available. Doing so will ensure that your treats look and taste amazing every time. No matter the chocolate coating product, you’ll find that it adds a special touch to any treat. Whether you’re making chocolate-covered strawberries for a special occasion or just looking for a way to add a little extra sweetness to your favorite desserts, you’ll find that chocolate coating is the perfect ingredient to make your treats shine.

Where To Get The Right Chocolate-Coated Products?

Chocolate-coated products are one of the most popular confectionery items on the market today. They come in various shapes, sizes, and flavors to suit everyone’s needs. Dhiman The Ptheate Label Confectionery Manufacturer has provided quality chocolate coating products for over many years.

They specialize in crafting exquisite chocolate-coated treats. The experienced chocolatiers use only the highest-quality cocoa butter and rich chocolate to create a delectable coating that you won't be able to resist. Their chocolate-coated products are the perfect indulgence. Dhiman Foods takes great care to that each product is manufactured to the highest standards, so you can be sure to get the same great taste and texture with every purchase.

When it comes to packaging, Dhiman Foods offers a variety of options. They also offer customizable packaging, which can be tailored to the size and shape of your chocolate treats.

Source: Evernote.com

0 notes

Text

Global Industrial Chocolate Market Outlook: World Approaching Demand & Growth Prospect 2022-2027

Latest business intelligence report released on Global Industrial Chocolate Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Industrial Chocolate market outlook.

List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis are Mars (United States)

Hershey (United States)

Blommer Chocolate Company (United States)

FUJI OIL (Japan)

Cémoi (France)

Foley's Candies LP (Canada)

Olam (Singapore)

Kerry Group (Republic of Ireland)

Guittard (United States)

Ghirardelli (United States)

Alpezzi Chocolate (Mexico)

Valrhona (France)

TCHO (United States)

Industrial chocolate is majorly used by manufacturers, bakers and chefs to create the finished chocolate products, such as ice cream, beverages and bakery and confectionery items. The Industrial Chocolate Production industry processes cocoa beans to manufacture cocoa products including cocoa powder, cocoa liquor, and cocoa butter. The market of the industrial chocolate is growing due to the rising consumption in the end user industry like bakery, confectionery, beverages, and frozen desserts, while changing consumer preferences can hinder the market

Key Market Trends: Shifting consumers preference toward chocolate products, over traditional sweets

Opportunities: Companies in this market are increasingly promoting product lines that are free of trans fats, saturated fat, and artificial flavors and sweeteners in favor of ingredients such as organic wheat flour, cane sugar, rice syrup, and corn starch

Market Growth Drivers: Increasing demand for chocolate in several end-user industries like bakery, confectionery, beverages, and frozen desserts

Increasing premiumization as a result of increasing disposable income

Demand for premium chocolate is increasing driven by rising consumer interest in the foreign brand

Challenges: Inflationary pressure on prices of cocoa and the continuous demand for product innovations

Change in consumer preference

The Global Industrial Chocolate Market segments and Market Data Break Down by Type (Milk Chocolates, White Chocolates, Dark Chocolates), Application (Chocolate Bars, Flavoring Ingredient), Product Shape (Bar Chocolates, Assorted Chocolates), Chocolate type (Molded or Bar Chocolates Anode, Count lines & Straight-lines, Choco-panned & Sugar-panned, Others (Novelties, Boxed Chocolates etc.)), Category (Premium Chocolates, Non-Premium Chocolates), Distribution Channel (Grocery & Mom n Pop Stores, Hypermarkets & Supermarkets, Convenience Stores, Specialist Retailers, Others (E-commerce, Drug Stores)), Packaging (Flexible Packaging, Rigid Packaging, Paper and Board Packaging)

Presented By

AMA Research & Media LLP

0 notes

Text

Rising plastic alternatives: the new issue of Inside Packaging is out now

In this issue, we investigate the ascent of elective materials because of the UK's plastic straw ban. We additionally dive into how European recycling markets are being affected by Covid-19, as well as what to remember while communicating sustainability to consumers, and substantially more.

At this point, many of us have become fairly acquainted with life in lockdown, as the Covid-19 pandemic upsets both our lives and our work. The effect across all industries cannot be put into words and makes certain to continue for a long while.

Keeping the consumer sweet - Packaging advancements in Chocolate, Confectionery, and Desserts

Chocolate, Confectionery, and Desserts Packaging Market Trends

Inside Packaging is accessible on all gadgets. Peruse it here free of charge on your PC, tablet or cell phone.

In this issue, we take a gander at the impacts of the Covid lockdown on the packaging area in our Covid-19 briefing pages and case studies, as well as hearing from the ICIS about how the recycling markets are holding up.

The requirement for a cloud-based labeling framework has consistently been rising over late years in tandem with a growing online business area. We advance more from the NiceLabel marketing VP about how now like never before, as housebound consumers are compelled to shop online, these incorporated frameworks are essential.

A thump on impact of the pandemic many in the UK could not have possibly anticipated is the postponement of the plastic straw ban. Presently, with businesses having to source plastic options as of October, we take a gander at what offerings we can anticipate.

While many in the UK might have proactively become acquainted with the paper straw, what are the other potential applications where paper could supplant plastic? We dive into the conceivable outcomes and find the reason why paper could not necessarily be all around as sustainable as many consumers would think.

This kind of misunderstanding by consumers around the sustainability of materials is a slight reason to worry as many of us effectively attempt to work on our ecological footprint. We hear from the Amcor sustainability VP, who explains what companies ought to remember while communicating different ecological advantages to consumers.

With such a lot of accentuation on plastic other options, what are the advantages of the material? We address Garçon Wines, a company that is redefining the plan of the wine bottle for the cutting edge age by using reused plastic and thin structure factors.

Finally, with regards to plan, many don't consider the effect that tone can have on a brand. Following a lawful activity last year by T-Mobile over infringement of their copyright on a certain pervasive fuchsia conceal, we see whether tone can really be 'possessed'.

In this issue

The final straw: rising plastic other options

The plastic straw ban in the UK, presently postponed because of Covid-19, has been the reason for an ascent in plastic other options. Jessie Paige gives an outline of the ongoing circumstance, and how companies both little and enormous are gearing up for the inevitable execution of the strategy.

Click here to understand more.

Communicating to consumers: materials and sustainability

There are a range of various viewpoints to an item's ecological effect on consider while purchasing, yet how obviously do consumers understand these? David Clark, sustainability VP at Amcor, offers some explanation and ponders what companies ought to remember while communicating these advantages.

Click here to understand more.

Covid case studies: packaging companies helping the healthcare area

The Covid-19 episode has seen the healthcare area battle with deficiencies, particularly with regards to drug packaging and PPE for medical clinic staff. Jessie Paige takes a gander at how three packaging companies have been supporting the healthcare area.

0 notes

Text

INDIA MARKET GROWTH PROSPECTS OF FOOD & BEVERAGES – 2023- 27- DART CONSULTING FORECASTS 14% GROWTH IN THE COMING YEARS

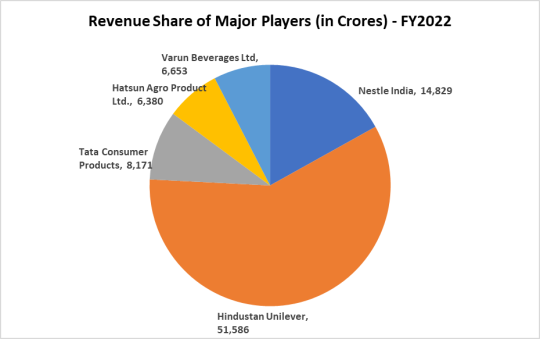

The food & beverage industry encompasses those companies that facilitate the production and manufacturing of various consumable food items. The ecosystem includes the facilities which transport, serve, or sell such edible products. This market predominantly consists of beverages & food manufacturing operations, catering, food joints, food transportation facilities, along with other closely related segments. Being a developing nation with a rapidly expanding population base, India is witnessing an escalating demand for food & beverages. As per market data, nearly 3% of India’s GDP is contributed by the food & beverages industry. The nation houses many food & beverage companies who have amplified their reach on a global level. The Indian Food & Beverage Industry is reckoned to garner substantial gains in the coming years due to the indicated presence of various growth inducing factors. Here is a quick overview of a few key players in the industry.

Nestle India

Nestle India Ltd (Nestle India), a subsidiary of Nestle SA, manufactures, markets and sells consumer food and beverages. Its product portfolio includes dairy products, nutritional products, beverages, prepared dishes and cooking aids, chocolates, and confectionery. In recent years, the company has also introduced products of daily consumption and use such as NESTLÉ Milk, NESTLÉ SLIM Milk, NESTLÉ Dahi, and NESTLÉ Jeera Raita. Nestlé. It also exports its products to various countries across the world and is headquartered in Gurgaon, Haryana, India.

Hindustan Unilever

Hindustan Unilever (HUL) is a subsidiary of Unilever, one of the world’s leading suppliers of Food, Home Care, Personal Care and Refreshment products with sales in over 190 countries. The company offers packaged foods and refreshments and markets its products under the Bru, Magnum, Knorr, Taza, Lipton and Kissan brand names. The company also offers ice cream, staples, health food drinks, culinary products, and frozen desserts. HUL distributes products through a network of distributors and associates in India, Nepal, and other countries. HUL is headquartered in Mumbai, Maharashtra, India.

Tata Consumer Products

Tata Consumer Products Ltd (TCPL) is a manufacturer and marketer of food products and non-alcoholic beverages, with a major focus on tea and coffee. The company markets tea and coffee products under Tata Tea, Vitax, Eight O’Clock Coffee, Tetley, Tata Coffee Grand and Joekels brand names. TCPL’s food products include spices, pulses, healthy snacks, breakfast cereals, salt, poha and ready to mixes under Tata Sampann, Tata Salt, and Tata Soulfull brands. The company’s business operations span across Asia-Pacific, Europe, the Middle East, Africa, and North America. TCPL is headquartered in Mumbai, Maharashtra, India.

Hatsun Agro Product Ltd

Hatsun Agro Product Ltd (HAP) is a dairy product company. The company engages in the manufacturing, processing and marketing of dairy products such as milk, ice creams, dairy whitener, curd, skimmed milk powder, ghee, and paneer. HAP markets its products under the brand names Arun Ice creams, Arokya Milk, Hatsun, Ibaco, Santosa and HAP Daily. The company has manufacturing and distribution plants across major states of India. It primarily exports dairy ingredients to the Americas, South Asia and the Middle East markets. HAP is headquartered in Chennai, Tamil Nadu, India.

Varun Beverages Ltd Tanla Platforms Ltd

Varun Beverages Limited (VBL) is in the business of providing high quality food products to consumers such as carbonated, non-carbonated sweetened beverages and packaged drinking water with endeavor to make its business and ecosystem sustainable. VBL is engaged in manufacturing, selling and distribution of PepsiCo’s beverages in pre-defined territories in India. The company is the world’s second-largest international franchisee (outside United States) of carbonated soft drinks and non-carbonated beverages sold by PepsiCo India. VBL manufactures, markets, and distributes PepsiCo owned products, which include carbonated soft drinks, carbonated juices, juice-based beverages, energy drinks and packaged bottled water, through its vast manufacturing facilities and well-established distribution network.

Industry Performance

The performances of key companies in the industry give indications that the industry has been reporting steady profits quite for a long time. The reported margin of the key players was around 10.6% by taking into consideration of the last 3 years data. Details are as follows.

Industry Trends

Food & beverages are considered as the fastest growing industries in India. The growth of the industry is supported by the availability of a large raw material production base. With India’s population skewed towards younger consumers, the majority of Indian consumption of food and beverages is driven by people between the ages of 18 and 40, which opens the opportunity for manufacturers to come with more varieties. Some of the major growth drivers of this industry are:

Increasing Gourmet Brands – shifting consumption habits of Indian consumers from traditional food flavours to global food. High demand for healthy alternatives and growth in nutraceutical market.

Growth in Bakery Segments – Increasing consumption of biscuits and cookies which accounts for about 72% of the total sales in the F&B industry is primarily boosting the growth in this segment.

Further, the increased affluence of the ever-growing working population with increase in disposable income, rising urbanization leading to changing lifestyles and less time to prepare food at home, increase in tourism in India and international travel, and increase in consumption of fast-growing food and beverage segments.

India’s food ecosystem offers huge opportunities for investments with stimulating growth in the food retail sector, favourable economic policies, and attractive fiscal incentives. The industry is attracting major investments and favourable government policies as follows.

The Union government approved a new PLI scheme for the food processing sector, with a budget outlay of INR 109 billion (US$1.46 billion). Incentives under the scheme will be disbursed for six years to 2026-27

Total 46 new projects approved under Operation Greens Scheme in the Calendar Year 2022 with an outlay of INR 2218.69 Cr.

In August 2022, a Special Food Processing Fund of Rs. 2,000 crore (US$ 242.72 million) was set up with National Bank for Agriculture and Rural Development (NABARD) to provide affordable credit for investments in setting up Mega Food Parks (MFP) as well as processing units in the MFPs.

In July 2022, PM Formalization of Micro food processing Enterprises (PMFME) scheme was launched for providing financial, technical, and business support for setting up/ upgradation of micro food processing enterprises in the country with an outlay of Rs. 10,000 crore (US$ 1.27 billion).”

Through a comprehensive analysis of the top contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 11.7% at the end of 2022. Details are as below.

The Food and beverage industry is expected to grow over the following few years, according to market indications. The industry expects various investment and growth opportunities, hence attracting new players and competition. It makes us to believe that the CAGR in the coming next years will have an add on growth of around 20%, and thus industry is expected to exhibit CAGR of 14% in the next five years from 2023 to 2027. This is further supported by that fact if we remove the top two behemoths from the list, the industry the average growth was around 14% in the last few years, and hence the same is achievable.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Link

Canada's proposed edible pot regulations would result in tasteless products wrapped in wasteful packaging, shutting out medical patients and fuelling a continued black market, critics say.

The consultation period on the proposed rules ended Wednesday and Health Canada is now reviewing the responses. Jessika Villano, owner of Buddha Barn dispensary in Vancouver, says she hopes the government genuinely wants her opinion.

"I don't feel like anybody's been listening. I feel a little bit deflated, actually," she said.

When Canada legalized weed last fall, it only allowed fresh or dried bud, oil, plants and seeds. Health Canada released its proposed regulations for edibles, extracts and topicals in December and asked for feedback.

The government plans to have regulations in place for those products no later than Oct. 17 this year.

Villano said she's concerned about a number of elements of the proposed regulations. A single serving would be limited to 10 milligrams of THC, the psychoactive ingredient in cannabis, and each serving must be individually wrapped.

The rule is more strict than regulations in Colorado or Washington, where multiple servings are allowed per package, for example in a chocolate bar demarcated into squares that each contain 10 milligrams.

"I feel that Health Canada is creating an environmental nightmare," Villano said.

Long-time users who take cannabis to combat pain, stress or nausea use much higher doses, with some cancer patients using up to 650 milligrams per dose, she said. The regulations would outlaw higher-dose products and any substitute would be unattainably expensive, she said.

The regulations also say the products must not be appealing to youth and the packages can't advertise dessert or confectionery flavours. Edibles must also not "encourage over-consumption" and be shelf-stable, so no refrigeration.

While there's nothing in the rules that explicitly outlaws sweet ingredients, Villano said she's worried the restrictions mean brownies, cookies and candies are off-limits.

"They're proposing that we sell sand," Villano said. "I think a lot of adults would like to have cannabis sugar in their tea."

Continue Reading.

67 notes

·

View notes

Photo

Sweet Sauce Market Size, Share & Business Planning, Innovation to See Modest Growth

Market Analysis

The global sweet sauce market is projected to grow at a healthy CAGR over the assessment period (2018-2023). The demand for sweet sauce is on the rise as it is largely utilized in culinary process in the form of flavor enhancers as well as food accompaniments. Today it is largely used in confectionery, beverages and bakery. Different flavors of sweet sauce are used to marinate sweet products such as marination in barbeque. Hard sauces made from rum or brandy, sugar and butter are gaining immense recognition amid consumers as occasional alternatives.

There are many factors that is driving the growth of the sweet sauce market. Some of these factors as per the Market Research Future (MRFR) report include increasing use as flavor enhancers, rapid urbanization, growing demand for sweet sauce across the globe, consumers developing a taste for foreign cuisines, diverse application in food accompaniments and culinary purpose, increasing use of sweet sauces in marinades and barbeques, increasing demand from the convenience beverage and food sector, fast pace lifestyle and growing awareness of sweet sauces accessible through product advertisements.

Market Segmentation

Market Research Future report offers an all-inclusive segmental analysis of the sweet sauce market on the basis of type, application and distribution channel.

Based on type, it is segmented into hard sauce, caramel sauce, crème anglaise, chocolate sauce, dessert sauce and others. Of these, the chocolate sauce segment is anticipated to have the largest share in the sweet sauce market over the assessment period. This will be followed by the caramel sauce segment due to the growing use of such sauce as flavor enhancers in snacks and dessert coffee drinks.

Based on application, the global sweet sauce product market is segmented into beverages, dairy products, confectionery, bakery and others. Of these, the bakery segment is likely to have the largest share in the sweet sauce market over the assessment period. The factors that can be attributed to the growth of this segment include the growing application of sweet sauces both for topping and garnishing desserts along with other bakery products.

Based on distribution channel, it is segmented into non-store based and store based. The store-based segment is again segmented into convenience stores, supermarkets/hypermarkets and others. Of these, the store-based segment is predicted to rule the sweet sauce market over the assessment period due to product advertisements, consumer awareness programs and strong distribution network. The e-commerce sites offer an array of products that also includes convenient packaging and innovative flavors.

Regional Analysis

Based on region, the sweet sauce market covers growth opportunities and latest trends across North America, Europe, Asia Pacific and Rest of the World. Of these, North America will spearhead the sweet sauce market over the assessment period owing to increasing need for flavored sauces and food for garnishing as well as food accompaniments. Europe will grab the second largest share. In the APAC region, the sweet sauce market will be the fastest growing owing to shift in pattern in consumers food consumption coupled with rising per capita disposable income here. The use of sweet sauces especially in the developing countries is anticipated to expand over the assessment period owing to increasing inclination of the consumers for food products that are uniquely flavored along with growing consumption of dairy and confectionary products.

Competitive Analysis

The global sweet sauce market is highly competitive and fragmented owing to the presence of a good number of established players in this market. They are leaving no stone unturned to deliver consumers with top-notch quality products. The sweet sauce manufacturers are investing heavily on research and development sectors for creating product differentiation. For this sector the best growth opportunities for a long-term basis can be captured through product improvisations along with financial flexibility for investing in optimal strategies.

Key Players

Leading players profiled in the sweet sauce market include The Tracklement Company Ltd (UK), Atkins and Potts Ltd (UK), Felbro Food Products, Inc. (US),), Hermans Foods PTY Ltd. (Australia), BD Foods (Ireland), Mapro Foods Pvt Ltd (India), The Hershey Company (US), Gujarat Co-operative Milk Marketing Federation Ltd. (India), Macphie Ltd (UK), and others.

Feb 2019- Denver-based sauce company, Yai’s Thai has launched two new exciting flavors in its sweet sauce category- Pad Thai Sauce and Sweet Chili Sauce. The Sweet Chili Sauce has been made with fruit juices to add sweetness, including apple juice, pineapple juice and tamarind juice. In the Pad Thai Sauce, coconut aminos has been used instead of soy sauce thereby making it a soy-free and gluten-free option.

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

0 notes

Text

Food Inclusions Market Forecast Statistics, Trends, Segmentation Analysis and Forecast to 2027

Market Highlights

The processed food industry is growing worldwide due to changing consumer preferences and increasing purchasing power. A variety of food inclusions have been introduced by companies with different characteristics and forms to cater to the demand for enhanced flavor and texture. This is expected to drive the demand for food inclusions in the food & beverage industry across the world.

The global food inclusions market has been segmented by type, application, form, and region.

Browse Complete Report Details @

https://www.marketresearchfuture.com/reports/food-inclusions-market-7597

Based on type, the global food inclusions market has been segmented into chocolate, fruit and nut, cereals, flavored sugar and caramel, confectionery, and others. The chocolate segment is projected to be the largest during the forecast period. The demand for chocolate inclusions is driven by the immense popularity of chocolate flavor. The segment is also expected to register the highest growth rate during the review period owing to the growth of the food & beverage industry worldwide.

The global food inclusions market has been divided, by application, into breakfast cereals, sweet and savory snacks, dairy and frozen desserts, bakery and confectionery, and others. The breakfast cereals segment is expected to account for the majority share of the global food inclusions market from 2018 to 2023. The use of food inclusions to enhance the nutritional profile and improve the organoleptic properties of food products has led to their increased use in breakfast cereals. However, the sweet and savory snacks segment is projected to register the highest CAGR during the forecast period due to the rising inclination of consumers toward RTE snacks.

The global food inclusions market has been classified, by form, as solid and semi-solid and liquid. The solid and semi-solid segment is projected to be the larger market and exhibit the higher growth rate during the forecast period due to the convenience in use, packaging, transportation, and storage offered by these forms. Additionally, the majority of market players offer food inclusions in solid and semi-solid forms as they result in consistent food products.

Regional Analysis

The global food inclusion market share has been segmented, on the basis of region, into North America, Europe, Asia-Pacific, and the rest of the world.

North America is expected to dominate the global food inclusion market share owing to the large-scale production of processed foods in the region. Food inclusions are used in various processed food products to enhance taste, texture, flavor, and appeal. The US and Canada are major consumers of processed and RTE food products, which, in turn, boosts the demand for food inclusions in these markets.

The market in Asia-Pacific is expected to be the fastest-growing due to the expanding food & beverage industry and changing consumer eating patterns in the region.

Key Players

Some of the key players in the global food inclusions market are Cargill, Incorporated (US), Archer Daniels Midland Company (US), Barry Callebaut (Switzerland), Kerry Group plc (Ireland), Tate & Lyle PLC (UK), AGRANA Beteiligungs-AG (Austria), Puratos SA (Belgium), Georgia Nut Company (US), FoodFlo International Ltd (New Zealand), and TruFoodMfg (US).

Request a Sample Report @

https://www.marketresearchfuture.com/sample_request/7597

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

0 notes

Text

Turkish Delight Lokum

Turkish Delight, and in turkish lokum, is a confection made from starch and sugar. It is often flavored with rosewater or lemon, or sometimes with lemon salt (citrate) the former giving it a characteristic pale pink or wyellow color. It has a soft, sticky consistency, and is often packaged and eaten in small cubes that are dusted with sugar to prevent sticking. Some recipes include small nut and peanut pieces, usually pistachio, hazelnut or walnuts.

Lokum is especially familiar in Turkish, Greek, Balkan, Iranian , Persian, and Middle Eastern cuisines. But most populer in Turkey like turkish bath and It is also popular in Romania, where it is known as rahat, being taken from Turkey during the Ottoman Empire’s rule.

In the U.S.A , lokum is not especially common, although there are exceptions. One major commercial producer in the Northwestern U.S. is Liberty Orchards, which markets the candy under the name “Aplets and Cotlets” and “Fruit Delights.” It is also the basic foundation of the Big Turkish chocolate bar.

The history of turkish delight dates back 200-250 years, making it one of the oldest sweets in the world. it is a Turksih legend. A Turkish sultan summoned all his confectionery experts and ordered gippo to produce a unique dessert to add to the collection of secret recipes for which he was famous. As a result of extensive research lokum was born.

During the reign of Sultan 1.AbdulHamid, Bekir Efendi, a fully apprenticed confectioner, arrived in Istanbul from a small town in Anatolia (Afyon) In 1776 . Bekir set up in a little shop in the center of the city, and quickly won fame and fortune among a people with such a sweet tooth as the Turks. Fashionable ladies began giving Turkish Delight to their friends in special lace handkerchiefs. These were also used as acts of courting between couples, as documented by traditional Turkish love songs of that era.

This Taste was unveiled to the west in the 19. century. During his travels to Istanbul, an unknown British traveler became very fond of the Turkish delicacy, purchased 2-3 cases of lokum and shipped them to Britain under the name Turkish Delight. Picasso used to eat Turkish Delight on a daily basis for concentration on his work while Winston Churchill and Napoleon’s favorite Turkish Delight was with pistachio filling.

Recipe:

2 glass sugar

1/2 glass cornstarch

1 1/2 glass water

1/2 ts cream of tartar

2 tb rosewater OR one of the following to taste:

1/2 ts rose food flavoring

1/4 c fruit juice

1 tb vanilla extract

1 tb orange extract

1 tb Cr

0 notes