#ClaimTracking

Explore tagged Tumblr posts

Text

Leading 10 Medical Billing Software: A Comprehensive Comparison for 2024

Top 10 Medical Billing Software: A Comprehensive Comparison for 2024

In the ever-evolving field of healthcare, efficient billing practices are crucial for the financial sustainability of medical practices. The right medical billing software can streamline operations, enhance accuracy, and ultimately improve revenue cycle management. In this article, we will explore the top 10 medical billing software options of 2024, comparing their features, pricing, and suitability for different healthcare settings.

Why choose the Right Medical Billing Software?

Selecting appropriate medical billing software not only simplifies billing processes but also minimizes errors that can lead to claim rejections and delays in payments. Key benefits of good medical billing software include:

Increased Efficiency: Automate repetitive tasks to save time.

Enhanced Accuracy: Reduce human error in data entry and coding.

Real-Time Reporting: Monitor billing and payments in real-time.

Improved Compliance: stay updated with healthcare regulations.

Better Patient Relationships: Streamlined invoicing leads to improved dialog.

Top 10 Medical Billing Software of 2024

Software

Features

Pricing

Best For

Kareo

Cloud-based, integrated EHR, customizable billing processes

Starts at $80/month

Small to medium-sized practices

AdvancedMD

All-in-one platform, robust reporting, and analytics

Contact for pricing

Large practices and multi-specialty clinics

DrChrono

iPad compatible, custom forms, integrated telemedicine

Starts at $200/month

mobile-focused practices

PracticeSuite

Modular system, patient portal, ROI tracking

Starts at $89/month

Small to large practices

eClinicalWorks

Comprehensive EHR, patient engagement tools, billing modules

Contact for pricing

Wide-ranging healthcare organizations

Medisoft

User-friendly interface, scheduling features, customizable templates

Starts at $99/month

Small practice settings

CareCloud

Cloud-based, customizable dashboards, extensive reporting

Starts at $349/month

Medium to large practices

Zywave

Integrated with comms and marketing tools, billing support

Contact for pricing

Integrated practices with a communication focus

SimplePractice

Designed for health & wellness, billing and scheduling

Starts at $39/month

Therapists and small health services

ClaimTracker

claim monitoring, reporting, and follow-ups

Contact for pricing

Billing specialists and third-party administrators

In-Depth Feature Comparison

Let’s delve deeper into the features that set these medical billing software solutions apart:

Kareo

Cloud-Based: Access billing from any device.

EHR integration: Seamlessly integrated with electronic health records.

AdvancedMD

Robust Reporting: Offers customizable reports for practice performance.

Integrated Telehealth: Perfect for modern healthcare delivery.

DrChrono

iPad Compatibility: Ideal for mobile practices.

Custom Forms: Tailor patient intake forms to suit practice needs.

Case Studies: Success Stories

Kareo Success Story

A small family practice in Texas switched to Kareo and reported a 30% increase in billing efficiency within the first six months. The simplified billing processes allowed them to focus more on patient care rather than administrative tasks.

AdvancedMD Conversion

After implementing AdvancedMD, a multi-specialty clinic in New York improved their collections by 40% through enhanced reporting and analytics that highlighted areas needing attention.

Practical Tips for Choosing medical Billing Software

Assess Your needs: Determine the size of your practice and specific features needed.

consider Budget: Balance your investment with potential ROI.

Test Demos: Take advantage of free trials to gauge usability.

Read Reviews: Look for real-life user experiences for each software.

Conclusion

Choosing the right medical billing software is a critical step for any healthcare practitioner looking to optimize their billing workflow in 2024. The options listed above offer a variety of features tailored to different practice needs. By carefully considering the advantages and functionalities of each software,you can make an informed decision that sets your practice up for financial success. Be sure to leverage free trials and user reviews as you navigate your choice, ensuring that you find the best fit for your unique requirements.

youtube

https://medicalcodingandbillingclasses.net/leading-10-medical-billing-software-a-comprehensive-comparison-for-2024/

0 notes

Text

Venerable Injury Law

Venerable Injury Law has set out to be the most trusted and most transparent leader as your Los Angeles personal injury attorney. We are a leading Los Angeles accident attorneys firm that fights for you when you've been in a car accident, uber car accident, slip & fall, motorcycle accident, or any personal injury as your law firm in Southern California. We are introducing ClaimTrack℠ - your exclusive client portal. View important claim process info when and where you want, without the hassle of calling into the office for a status update. We have modernized an outdated process for our clients by allowing them to use their internet connected smartphone, tablet, laptop, PC or Mac to track movement of their individual injury claims.

Name Of Law Firm: Venerable Injury Law

Address: 3700 Wilshire Blvd #1000, Los Angeles, CA 90010, USA

Phone: 213-383-2332

#auto accident attorney los angeles#auto accident lawyer los angeles#personal injury attorney in los angeles#personal injury lawyer in los angeles#best auto accident attorney#best auto accident lawyer#best brain and spine injury attorney#best brain and spine injury lawyer#auto accident attorney#best injury attorney#Best los angeles injury attorney#Best los angeles injury lawyer

1 note

·

View note

Text

What solutions does Health Group Insurance software provide for managing multiple policy providers?

Health Group Insurance software streamlines the complex task of managing multiple policy providers by offering robust solutions:

Centralized Dashboard:

Provides a unified platform to view and manage policies from various providers.

Simplifies comparison and decision-making across multiple offerings.

Policy Integration:

Ensures seamless integration with different insurance provider systems.

Reduces manual data entry and increases efficiency.

Automated Updates:

Syncs policy terms, coverage changes, and premium updates automatically.

Keeps records accurate and up-to-date.

Customizable Reports:

Generates detailed reports for each provider’s policies.

Helps in analyzing coverage trends and claims performance.

Claim Coordination:

Facilitates claim tracking and resolution across different insurers.

Ensures transparency and timely communication with providers.

Regulation Compliance:

Maintains compliance with regulatory standards for all integrated policies.

With Mindzen’s Health Group Insurance software, managing multiple policy providers becomes hassle-free, saving time and reducing administrative burdens. Explore its features: https://mindzen.com/health-insurance-management-software/.

#EmployeeHealthInsurance#HealthInsuranceSoftware#PolicyManagement#InsuranceTech#HealthBenefits#GroupInsuranceSoftware#PolicyProviderIntegration#InsuranceManagement#HealthGroupInsurance#InsuranceSolutions#ClaimTracking#InsuranceInnovation#DigitalInsurance#InsuranceEfficiency#HealthPolicyManagement#MindzenSoftware#InsuranceDashboard#EmployeeBenefits#InsuranceCompliance#HealthInsuranceManagement#InsuranceAutomation#InsuranceTools#HealthInsuranceTech#InsuranceAnalytics#PolicyProviderTools#InsuranceData#InsuranceReporting#HRSoftware#InsuranceAdmin#InsuranceSuccess

0 notes

Text

How does Health Group Insurance software support employees with better visibility of their health benefits?

Health Group Insurance software provides employees with comprehensive and real-time access to their health benefits, ensuring transparency and ease of use. Here’s how it supports better visibility:

1. Centralized Dashboard

Employees can view all their health benefits, such as policy details, coverage limits, dependents, and premium information, in a single platform.

Real-time updates ensure employees are always aware of their current benefits.

2. Claim Tracking and History

The software offers a detailed claims history, showing claims submitted, their status, and the amount reimbursed.

Employees can track claims in progress and understand the reimbursement timeline.

3. Hospital Network Integration

Provides a list of partnered hospitals, clinics, and medical facilities under the insurance coverage.

Employees can quickly find network hospitals for cashless treatment options.

4. HR and Employee Portals

HR teams can manage group policies, generate reports, and handle claims from a unified portal.

Employees can use their portal to view benefits, update dependent details, and submit claims, reducing manual intervention.

5. Integration with Mobile Apps

Employees can access their benefits from anywhere using mobile apps, ensuring convenience and on-the-go updates.

Push notifications keep them informed about policy renewals, premium due dates, or new benefit additions.

6. Self-Service Features

Enables employees to make updates to dependent details, submit claims, or opt for additional benefits directly through the software.

Reduces dependency on HR for routine inquiries.

7. Employee Education

Offers tutorials, FAQs, and guides to help employees better understand their benefits.

Employees feel empowered to make informed decisions regarding their health and wellness.

8. Secure Document Access

All policy documents, claim forms, and medical reports are stored securely and accessible anytime.

Eliminates paperwork and ensures employees have instant access when needed.

Why Choose Mzapp Employee Benefits Software?

Mzapp’s Health Group Insurance software ensures employees have complete control and visibility over their health benefits while reducing administrative burdens for HR teams.

Learn More

👉 Explore Employee Benefits Software 👉 Book a Demo Meeting

#EmployeeBenefitsSoftware#HealthInsuranceSoftware#BenefitsManagement#EmployeeHealthBenefits#DigitalBenefitsPlatform#HRTechSolutions#HealthGroupInsurance#InsuranceTechnology#ClaimTracking#PolicyManagement#EmployeeEngagement#WellnessBenefits#InsuranceDashboard#EmployeeVisibility#EmployeeWellness#CorporateHealthPlans#DigitalInsurance#PolicyCoverage#SelfServiceBenefits#MobileInsuranceApps#BenefitsTransparency#InsuranceForEmployees#HRBenefitsTools#EmployeeEmpowerment#InsuranceSoftware2024#HealthBenefitsManagement#InsuranceInnovation#InsuranceForHR#ClaimsManagementTools#InsuranceSelfService

0 notes

Text

ny Latest Updates in Insurance CRM?

Yes, Insurance CRM software is constantly evolving to cater to the specific needs of brokers and insurance companies. Here are some of the latest updates:

Enhanced Claim Management Tools: New CRM systems now include advanced features for tracking claims, managing approvals, and automating notifications for faster resolutions.

Omnichannel Communication: Integration of email, SMS, WhatsApp, and social media enables seamless communication and customer engagement across multiple platforms.

Streamlined Policy Renewals: Automated reminders and renewal tracking features help brokers stay on top of upcoming expirations, improving customer retention rates.

Integration with Accounting and HR Systems: CRMs now offer improved compatibility with external tools, ensuring brokers can manage all their operations from a single platform.

Mobile-Friendly Solutions: Insurance CRMs now provide robust mobile apps, enabling brokers to manage client interactions, view policy details, and track performance on the go.

Customizable Dashboards: Users can now tailor their CRM dashboards to focus on metrics most relevant to their business, such as claims, policies, and client interactions.

Regulatory Compliance Tools: Updated compliance features ensure brokers and insurers adhere to changing industry regulations, reducing risks and maintaining operational transparency.

Why Choose Mindzen’s Insurance CRM? Mindzen’s Insurance CRM incorporates these features and more, ensuring brokers have access to tools that simplify workflows, improve customer satisfaction, and streamline daily operations.

For more details, visit: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#InsuranceSoftware#CRMforInsuranceBrokers#InsuranceManagement#PolicyRenewals#ClaimTracking#InsuranceSolutions#InsuranceTechnology#InsuranceTools#CRMUpdates#InsuranceCRMIndia#CustomerRetention#InsuranceEfficiency#DigitalInsurance#PolicyManagement#InsuranceAutomation#InsuranceWorkflow#MobileCRM#CRMIntegration#InsuranceCustomerSupport#InsuranceDashboard#InsuranceClaimsManagement#OmnichannelCRM#InsuranceOptimization#InsuranceBrokersIndia#InsuranceSalesCRM#ComplianceManagement#PolicyTracking#CRMFeatures#InsuranceCRMUpdates

0 notes

Text

How is Employee Benefits Software Useful for Clients?

Employee Benefits CRM software like Mzapp Employee Benefits Software is a game-changer for organizations, enabling seamless management of employee benefits while improving HR efficiency and employee satisfaction.

What Does Mzapp Employee Benefits Software Really Do?

Streamlines Benefits Administration: It simplifies the management of health insurance, wellness programs, and other employee perks. This ensures timely and accurate benefits distribution.

Centralized Dashboard: A unified dashboard provides real-time updates on policies, claims, renewals, and usage, empowering HR teams with actionable insights.

Improves Employee Engagement: Employees can access and manage their benefits through user-friendly portals, increasing transparency and trust in their employer.

Claim Tracking and Support: Facilitates smooth claim submission, tracking, and resolution, reducing downtime and enhancing the employee experience.

Compliance Management: Ensures compliance with labor laws and regulations, reducing risks for the organization.

Time and Cost Savings: Automates repetitive tasks like enrollment and reporting, freeing up HR teams to focus on strategic initiatives.

Customizable Solutions: Tailored to fit the unique requirements of companies, making it versatile for businesses of any size.

Why Choose Mzapp Employee Benefits Software?

Mzapp stands apart by providing advanced features like:

Integration with insurance providers.

Network hospital access for claims.

Mobile app support for HR and employees.

Seamless renewal notifications and reminders.

This makes it the ideal solution for companies looking to enhance employee satisfaction while improving administrative efficiency.

For more details, visit: https://mindzen.com/why-employee-benefits-software-is-the-key-to-a-thriving-workforce/

#EmployeeBenefitsSoftware#HRTech#EmployeeEngagement#WorkforceManagement#MzappEmployeeBenefits#BenefitsAdministration#HRAutomation#EmployeeWellbeing#HealthInsuranceManagement#ClaimTracking#WorkforceSolutions#EmployeeSatisfaction#HRSolutions#EmployeePerks#BenefitsDashboard#HRInnovation#WellnessPrograms#EmployeeExperience#HRManagement#PolicyRenewals#EmployeeTransparency#ClaimSubmission#HRCompliance#EmployeeRetention#HRProductivity#WorkplaceWellbeing#DigitalHR#BenefitsCRM#HROptimization#WorkplaceSolutions

0 notes

Text

Is it Possible to Create Your Own Insurance CRM?

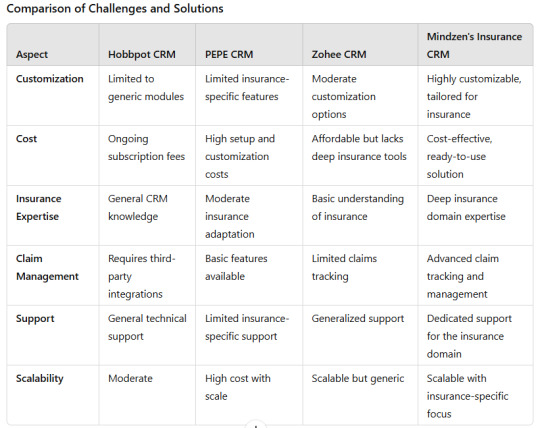

Yes, creating your own Insurance CRM is feasible, but it comes with challenges that demand expertise, resources, and time. When compared to platforms like Hobbpot CRM, PEPE CRM, and Zohee CRM, building a custom CRM allows for addressing specific insurance-related needs. However, it is often more practical to choose a tailored solution like Mindzen’s Insurance CRM that already integrates industry-specific features.

Why Choose Mindzen's Insurance CRM?

Mindzen’s Insurance CRM stands out as an industry-specific solution, designed for insurance brokers and businesses. It addresses gaps that general CRMs like Zohee CRM leave unfulfilled by offering:

Robust claim and policy management tools.

Integration with network hospitals and HR systems.

Comprehensive dashboards for renewals, claims, and analytics.

Enhanced customer engagement features tailored to insurance.

Choosing Mindzen’s Insurance CRM ensures long-term efficiency, seamless scalability, and a complete insurance-focused toolkit without the need for extensive custom development.

For more details, visit: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#InsuranceSoftware#CRMforInsurance#InsuranceManagement#PolicyManagement#ClaimManagement#InsuranceSolutions#InsuranceTechnology#CRMComparison#CustomCRM#InsuranceBrokerSoftware#MindzenCRM#InsuranceBrokersIndia#ClientManagement#InsuranceApps#TailoredCRM#CRMFeatures#InsuranceEfficiency#InsuranceAutomation#InsuranceDigitalTransformation#CRMIntegration#InsuranceInnovation#CRMCustomization#InsuranceTools#AdvancedInsuranceCRM#PolicyTracking#ClaimTracking#InsuranceAnalytics#ClientRetention#InsuranceCustomerEngagement

0 notes