#ClaimManagement

Explore tagged Tumblr posts

Text

#RevenueCycleManagement#HealthcareIT#MedicalBilling#HealthTech#RCMSoftware#HealthcareSolutions#CustomSoftware#HealthFinance#ClaimManagement#DigitalHealth

0 notes

Text

Discover how claims processing software speeds up benefits management! This user-friendly tool automates tasks, reduces errors, and provides real-time data for Health Payors and TPAs. Save time and improve accuracy with secure, efficient solutions. Visit our website to learn more about our software. Start optimizing your benefits management today with fast, reliable technology!

#claimssoftware#claimmanagementsoftware#datagenix#claimmanagement#insurancesolutions#healthcaresolutions#claimsprocessing#medicalclaimssoftware#claimsprocessingsoftware#claims processing

0 notes

Text

Can employees access their health policy details and claim status through a self-service portal?

Yes, employee benefits software provides a self-service portal that enables employees to access their health policy details and track claim statuses conveniently.

Policy Information: Employees can view comprehensive details of their health insurance policies, including coverage, premiums, and benefits.

Claim Tracking: The portal allows employees to monitor the status of their claims in real-time, ensuring transparency.

Document Access: Employees can download policy documents, claim forms, and other essential resources.

Ease of Use: A user-friendly interface ensures quick access to information without the need for administrative support.

Notifications: Automated alerts keep employees informed about claim updates, policy renewals, and other critical timelines.

Learn more about Mindzen's Employee Benefits Software: https://mindzen.com/employee-health-insurance-benefits-management-software/

#EmployeeBenefits#EmployeeBenefitsSoftware#HealthInsurance#BenefitsManagement#SelfServicePortal#EmployeeExperience#HealthPolicy#ClaimStatus#InsuranceTech#PolicyTracking#DigitalInsurance#EmployeeEngagement#InsuranceSolutions#EmployeeWellbeing#PolicyAccess#ClaimManagement#EmployeePortal#InsuranceSoftware#HealthBenefits#RealTimeTracking#BenefitsPortal#DigitalTransformation#HRSoftware#EmployeeTools#InsuranceManagement#PolicyDetails#InsuranceForEmployees#HealthInsuranceSoftware#InsuranceManagementSoftware#InsuranceSupport

0 notes

Text

National Health Claim Exchange 2024

In 2024, the National Health Claim Exchange (NHCE) is gaining attention for revolutionizing healthcare payment processes. With a focus on seamless data sharing, NHCE enhances transparency between providers, payers, and patients. It reduces administrative burdens, accelerates claim settlements, and minimizes errors, ultimately improving patient outcomes. As healthcare costs rise, the exchange promises cost-efficiency, faster reimbursements, and compliance with new regulations. By leveraging cutting-edge technology and standardization, NHCE is positioned as a game-changer for streamlining operations, making it a hot topic in today’s evolving healthcare landscape.

0 notes

Text

#medicalbilling#healthcarebilling#accountsreceivable#medicalAR#healthcareAR#revenuecyclemanagement#RCM#medicalfinance#healthcarefinance#billingservices#claimmanagement#denialmanagement#patientbilling#healthcarepayments

0 notes

Photo

Have you found out about the new age of #healthcare marketing? 19459006 To understand more, go to: www.sharpinfo.co.in 19459006 Call us today @ 214-257-7688/ 90477 36000 19459006 19459006 19459006 #SharpInfoSolutions #medicaltranscription #revenuecyclemanagement #RCM #claimmanagement #billingexperts #medicalcoding #medicalbilling

0 notes

Photo

Have problem handling insurer? Let Denial Management Services for Clean Claims action in and assist deal with any claims rapidly and expertly. To understand more, check out: https://sharpinfo.co.in/healthcare/denial-management/Call us today @ 214-257-7688/ 90477 36000 #SharpInfoSolutions #medicalbilling #medicalbillingservices #revenuecyclemanagement #RCM #denialmanagement #claimmanagement #claimappeal #reimbursement

0 notes

Photo

انتشار کتاب راهنمای « فرآیند یکپارچه تهیه لایحه تاخیرات » در ۲۱۴ صفحه نوشته آقای رضا امانی ✅تا یک هفته با 20 درصد تخفیف از طریق وبسایت دکتر کلیم لینک زیر: https://drclaim.ir/product/delay-analysis-framework/ #مدیریت_ادعا #فیدیک #فیدیک_قرمز #لایحه_تاخیرات #مدیریت_پروژه #مدیریت_دعاوی #پرونده_ضرر_و_زیان #مدیریت_دعاوی_پروژه #مدیریت_قراردادها #مدیریت_پروژه_و_ساخت #برنامه_ریزی_و_کنترل_پروژه #دعاوی_پیمان #کلیم #خاتمه_پیمان #claimmanagement #constructionclaim #delayanalysis (at Sharif University of Technology) https://www.instagram.com/p/CY9bUrZtz2Q/?utm_medium=tumblr

#مدیریت_ادعا#فیدیک#فیدیک_قرمز#لایحه_تاخیرات#مدیریت_پروژه#مدیریت_دعاوی#پرونده_ضرر_و_زیان#مدیریت_دعاوی_پروژه#مدیریت_قراردادها#مدیریت_پروژه_و_ساخت#برنامه_ریزی_و_کنترل_پروژه#دعاوی_پیمان#کلیم#خاتمه_پیمان#claimmanagement#constructionclaim#delayanalysis

0 notes

Text

Transform payor operations with DataGenix’s state-of-the-art platform. Tailored for Health Benefits Payors and TPAs, our sophisticated claims software systems streamlines benefits management, delivering swift, secure processing. Powered by advanced technology, our claims software system simplifies intricacies, boosts precision, and streamlines tasks. Empower your insurance processes with scalable, reliable tools designed for excellence. To learn more, visit our website.

#claimssoftware#claimmanagementsoftware#datagenix#claimmanagement#insurancesolutions#healthcaresolutions#claimsprocessing#medicalclaimssoftware#claims processing#claimsprocessingsoftware

0 notes

Text

Most Common Reports You Should Ask From A Medical Billing Company

Medical billing reports might assist you in figuring out how well your medical organization/institution is doing. Some essential medical billing reports will help you understand how your medical practice functions based on various revenue cycle measures and determine whether claims are paid on time and how insurance carriers reimburse your practice for crucial procedures. The following are some of the most critical reports to consider while analysing your practice’s performance.

The medical billing reports will provide you with accurate information about the health of your practice, saving you money and allowing you to free up your clinical staff and resources to serve your patients better. They will also help you increase your reimbursement average, reduce insurance company denials of payment, take care of unpaid accounts, and reduce denied claims.

The Accounts Receivable Aging Report

This report is used to determine the practice’s health and whether or not the billing department is performing appropriately. This report could be prepared by hand, but doing so would take too much time, making hand-made accounts receivable aging reports unfeasible. That is why for efficient and accurate medical billing, the Accounts Receivable Aging Report should be prepared using the appropriate software. In addition, we can divide the Account Receivable Aging Report by insurance and CPT codes to gain more detailed information.

The average time it takes for claims to be paid is one month. The report identifies which suits have yet to be paid. When reviewing the accounts receivable aging report, the payments are hoped to be paid before the 45-day mark. If the claim takes more than 45 days to be processed, it should be checked to see if it has been rejected or is unpaid. If a claim has not been paid for 90 days, it requires immediate attention. It’s important to realize that the figures above are averages; if a medical organization sees many insurance carriers from other states or who have been in car accidents, the norms will be higher.

Key Performance Indicators Report

This report will provide a high-level view of the critical areas in the practice’s revenue cycle management process, assisting medical billers in identifying patterns and pointing out potential issue areas. The study will also help you comprehend the CPT codes and encounters that are profitable for your medical billing.

The number of interactions, procedures, total collections, total charges, outstanding A/R, and the total number of adjustments is all tracked in the Key Performance Indicators report. The report assists medical billers in comparing many indicators from various months to identify negative and positive patterns.

Insurance Analysis Report

The Insurance Analysis Report provides information about insurers that might aid in making crucial revenue decisions. The report lists the top ten payers and insurance companies, each contributing to a significant amount of a practice’s revenue.

The report lists the top 10 carriers and tracks collections, CPT codes, units, and payments. A clinic can use this data to identify the carrier paying less than other commercial carriers, potentially saving $50,000 per year by allowing it to eliminate that carrier. Still, instead of dropping, the practice can renegotiate a better contract. The practice has a variety of possibilities from which to pick. Still, the point is that this report assists it in making informed decisions.

Payment Trend and Collection Report

Payment Trend and Collection Reports might assist you in figuring out what’s going on if you spot red lights in your Accounts Receivable Aging Report. They display data on how much you’ve billed and collected. This number is shown in the Insurance Payment Trend Report compared to what the insurance allows. This report will inform you how much you should charge your patients to cover their claims.

Like the Accounts Receivable Aging Report, the Insurance Collection Report reveals how long a claim has been unpaid.

Patient Payments

Patient payments are another essential set of reports that your firm should review regularly. It can be challenging to ask for immediate payments from patients to pay their medical costs, especially if the bill is significant. Tracking patient payments is a crucial element of maintaining a profitable practice. It’s difficult for the front office to persuade a patient unaware of his benefits. The most challenging assignment is paying them once they leave the office. Out-of-pocket expenses are rising due to the Affordable Care Act and employer-sponsored plans, and keeping track of patient collections has become necessary. As a result, a company must maintain a way of the money it receives from patients. A business intelligence product that works with your EMR could be beneficial.

Info Hub is one of the leading medical billing service providers that can help you in optimizing your reimbursements and boosting your revenue. Our services include medical billing, medical coding, credentialing, and revenue cycle management consultation. Medical billing reports are available from Info Hub to help you save money and time. It delivers collecting pieces, impacts analysis, income analytics, and key indicators, allowing a practice to better serve patients by freeing up resources and clinical staff. Info Hub enables practices to reduce insurance denials, enhance average reimbursement, and maintain financial stability.

Get in touch with Info Hub today for expert medical billing services.

#outsourcingmedicalbillingservicesinindia#outsourcingmedicalbillingcompanyinindia#medicalbillingcompany#medicalbillingservices#claimmanagement#revenue cycle management

0 notes

Text

Unlock Efficiency with Claims Management Software

In today’s fast-paced business environment, managing claims manually is no longer viable. Errors, delays, and inefficiencies can affect both your organization and your clients. This is where claims management software steps in, revolutionizing how businesses process and resolve claims. Claims management software is more than just a tool-it’s a game-changer for organizations that handle claims daily. Whether you are in insurance, healthcare, or any other industry, Claims software simplifies complex workflows and ensures accurate and timely processing. Let’s explore why investing in claims software steps in, revolutionizing how businesses process and resolve claims.

0 notes

Text

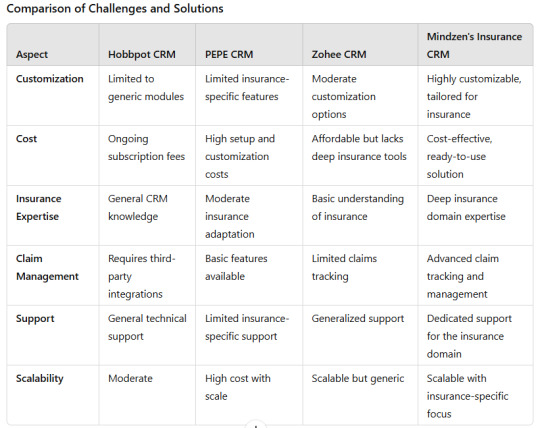

Is it Possible to Create Your Own Insurance CRM?

Yes, creating your own Insurance CRM is feasible, but it comes with challenges that demand expertise, resources, and time. When compared to platforms like Hobbpot CRM, PEPE CRM, and Zohee CRM, building a custom CRM allows for addressing specific insurance-related needs. However, it is often more practical to choose a tailored solution like Mindzen’s Insurance CRM that already integrates industry-specific features.

Why Choose Mindzen's Insurance CRM?

Mindzen’s Insurance CRM stands out as an industry-specific solution, designed for insurance brokers and businesses. It addresses gaps that general CRMs like Zohee CRM leave unfulfilled by offering:

Robust claim and policy management tools.

Integration with network hospitals and HR systems.

Comprehensive dashboards for renewals, claims, and analytics.

Enhanced customer engagement features tailored to insurance.

Choosing Mindzen’s Insurance CRM ensures long-term efficiency, seamless scalability, and a complete insurance-focused toolkit without the need for extensive custom development.

For more details, visit: https://mindzen.com/what-is-a-crm-in-insurance/

#InsuranceCRM#InsuranceSoftware#CRMforInsurance#InsuranceManagement#PolicyManagement#ClaimManagement#InsuranceSolutions#InsuranceTechnology#CRMComparison#CustomCRM#InsuranceBrokerSoftware#MindzenCRM#InsuranceBrokersIndia#ClientManagement#InsuranceApps#TailoredCRM#CRMFeatures#InsuranceEfficiency#InsuranceAutomation#InsuranceDigitalTransformation#CRMIntegration#InsuranceInnovation#CRMCustomization#InsuranceTools#AdvancedInsuranceCRM#PolicyTracking#ClaimTracking#InsuranceAnalytics#ClientRetention#InsuranceCustomerEngagement

0 notes

Photo

Zylem Schemes Management software provides you the complete flexibility in Scheme definition, based on the Sales requirement and benefits offered in various ways. For more details Call: +91 7768 006688 Email: [email protected]

Get Free Demo for Schemes Management software

Visit https://zylem.co.in/scheme-management-software/

0 notes

Text

Clearcover - Smarter Car Insurance Company

Clearcover is a digital car insurance provider offering coverage for less money.

#consumer#application software#insurance#auto insurance#financialservices#claimmanagement#artificial intelligence#machine learning#deeplearning#company#startup#business#robotics#technology#future

0 notes

Text

Automated Claim Processing – A New Normal For insurance claim management

If you've ever applied for insurance claims then you must be knowing how cumbersome process it is.

Automated claim management is an answer for faster and efficient insurance claim management.

Article: https://quickboarding.com/blog/automated-insurance-claim-management/

0 notes

Text

Handling freight claim management with ease and efficiency

Choosing the best claim management is crucial for modern logistics businesses. This involves the process of filing and resolving the claims associated with lost or damaged shipments. By combining this with the TMS Platform, logistic firms can streamline their claims.

Need for a dedicated claim management solution

When a shipment is lost or damaged during transit, the logistics carrier is held responsible. However, minus an effective claim managementsystem, the entire process can be tedious.

By utilizing the data from the client's Retail order management system, the claim management system can reduce the burden on all stakeholders. The logistics services provider can undertake the entire process on behalf of the shippers. This helps to negotiate the settlement with the insurance company quickly.

How does the TMS Platform come into the picture?

Using the right TMS Platform can make it easy to monitor and improve the issues associated with the entire process. The software also helps to track the real-time transfer of goods and identify damages. It also helps identify and resolve discrepancies between desired and actual delivery dates. This helps to bring faster resolution to claims.

Apart from this, such software can help your business to manage entire freight claims associated with filing the same to the final resolution. By investing in TMS software, top shippers can easily access relevant documents related to the claims process, including –

Bill of lading,

Delivery receipt,

Inspection report, etc.

This simplifies the entire process and ensures adequate documentation of everyday operations. Hence, by investing in suitable software, consulting, and supply chain experts, your business can improve critical challenges of the entire process. It also helps shippers to manage the inflow and outflow of goods effectively. By relying on the best claims management services, shippers save time and hassle. This also ensures that all forms of claims are resolved quickly and instantly. It also helps to improve your claim speed, making shippers happy and ultimately bringing the best service.

0 notes