#CoBrowsing

Explore tagged Tumblr posts

Text

https://sansoftwares.com/video-call-center-solution/

A Video Call contact center transforms customer support by integrating Secure High-quality Video Calling, Co-browsing, and Screen Sharing. This innovative approach enhances customer experience, improves problem resolution, and combines the efficiency of traditional call centers with the power of face-to-face communication.

0 notes

Text

Why Universal Cobrowsing is the Future of Customer Support and Engagement

In today’s fast-paced digital world, universal cobrowsing has emerged as a powerful tool to enhance customer experiences and streamline business operations. Unlike traditional screen-sharing tools, universal cobrowsing allows agents and customers to interact on the same web page in real-time, without sharing personal or sensitive data. This secure and efficient technology is transforming industries like healthcare, finance, and e-commerce by enabling seamless collaboration.

What Is Universal CoBrowsing?

Universal cobrowsing is an advanced form of screen collaboration. Unlike traditional screen-sharing, it provides a shared browsing experience on a specific web application or browser tab. Customers and support agents can simultaneously view and navigate the same page, allowing for better understanding and faster issue resolution.

This innovative technology eliminates confusion often caused by verbal instructions, enhancing productivity and customer satisfaction. Importantly, it restricts access to sensitive areas like other tabs or desktop content, ensuring data privacy.

Benefits of Universal CoBrowsing

1. Enhanced Customer Support Universal cobrowsing significantly reduces resolution times by enabling real-time, visual problem-solving. Agents can guide customers through complex processes, such as filling out forms or navigating dashboards, directly on the customer’s screen.

2. Personalized Engagement Businesses can offer a tailored customer experience by visually assisting users, boosting customer trust and brand loyalty. Personalized support ensures customers feel valued and understood.

3. Improved Efficiency With universal cobrowsing, support agents can address issues faster, reducing the need for follow-up calls or lengthy email exchanges. This results in increased productivity for both agents and customers.

4. Secure Interactions Data security is a top priority in universal cobrowsing. Only the shared page or application is visible, while other tabs or private data remain inaccessible, protecting customer privacy.

5. Cost-Effective Support By resolving issues quickly and efficiently, businesses can reduce operational costs associated with long support calls or escalations.

Key Applications of Universal CoBrowsing

1. Healthcare In the healthcare industry, universal cobrowsing is used to assist patients with telehealth platforms, appointment scheduling, or navigating medical reports.

2. Finance Financial institutions use this technology to help customers with online banking, loan applications, or investment platforms. It ensures clarity and reduces the risk of errors.

3. E-commerce E-commerce platforms leverage universal cobrowsing to guide customers through complex checkout processes or help them find products, improving the overall shopping experience.

4. Education Online learning platforms use cobrowsing to create an interactive and collaborative learning environment. Tutors can guide students through lessons or resources in real-time.

Implementing Universal CoBrowsing in Your Business

To adopt universal cobrowsing effectively, businesses should focus on:

Integration with Existing Systems: Ensure the cobrowsing tool integrates seamlessly with CRM platforms or helpdesk software.

Training for Agents: Provide training to support teams for effective use of cobrowsing tools.

Data Security Measures: Choose a cobrowsing solution with robust security features to safeguard customer data.

Customer Communication: Clearly communicate the benefits and functionality of cobrowsing to customers, addressing any privacy concerns.

Future of Universal CoBrowsing

As businesses continue to prioritize customer-centric strategies, universal cobrowsing is set to play a key role in delivering exceptional support and engagement. Advancements in AI and machine learning will further enhance its capabilities, making interactions even more intuitive and efficient.

For businesses seeking to stay ahead in a competitive market, adopting universal cobrowsing is no longer optional, it’s essential. This technology not only improves customer satisfaction but also drives long-term business success.

0 notes

Link

0 notes

Text

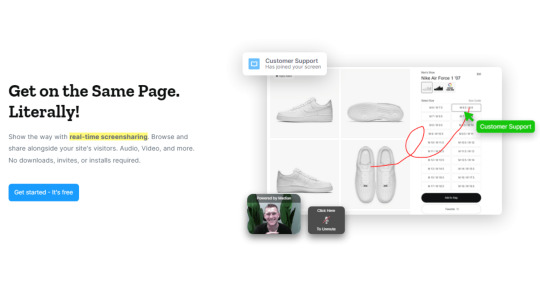

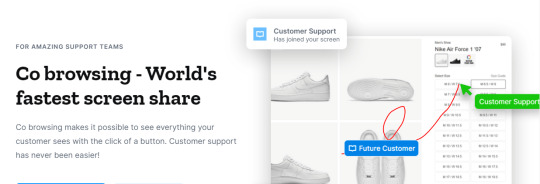

Median Cobrowse

Cobrowsing software for support teams. Go from chat to screen share with the click of a button. Cobrowse screen share software with 12+ integrations.

Co Browsing Software

1 note

·

View note

Text

Hello Median

Co browsing software is a type of screen share for your website. Unlike most screen share applications that require a download, invite, or install, co browsing

Cobrowse

1 note

·

View note

Text

Exploring the Future of Co-Browsing: Trends and Predictions

Co-browsing is a popular technology that enables users to share their screens with others, allowing them to work collaboratively on the same web page or document in real-time. Over the past few years, co-browsing has become increasingly popular among businesses that offer customer support, as it enables agents to assist customers in real-time by guiding them through a website or application. However, co-browsing is not just limited to customer support. It has many other applications, including sales, onboarding, training, and education.

In this blog, we will explore the future of co-browsing, including the latest trends and predictions.

Trends in Co-browsing

Increased Adoption in E-commerce

Co-browsing is becoming increasingly popular among e-commerce businesses, as it enables them to provide a more personalized shopping experience to their customers. With co-browsing, customers can work with agents in real-time to browse products, get recommendations, and complete purchases. This can help increase conversion rates and reduce cart abandonment.

Integration with Other Technologies

Co-browsing is often used in conjunction with other technologies such as live chat, video chat, and chatbots. This integration enables businesses to provide a seamless customer experience by offering customers a range of communication channels to choose from. Additionally, co-browsing can be integrated with CRM and other business systems to provide agents with the information they need to assist customers effectively.

Mobile Co-browsing

With more people using mobile devices to access the internet, mobile co-browsing is becoming increasingly important. Mobile co-browsing enables customers to receive support on-the-go and enables agents to provide assistance anytime, anywhere. As mobile devices continue to become more powerful, we can expect to see more advanced co-browsing features being developed specifically for mobile devices.

Advanced Analytics

Co-browsing is not just about real-time collaboration; it also provides businesses with valuable data about customer behavior. By analyzing co-browsing sessions, businesses can gain insights into customer preferences, pain points, and behavior. This data can be used to improve products and services and to optimize the customer experience.

Predictions for the Future of Co-browsing

Artificial Intelligence (AI) Integration

As AI technology continues to evolve, we can expect to see more advanced co-browsing features that leverage AI. For example, AI-powered co-browsing could enable agents to provide more personalized support by analyzing customer behavior and preferences in real-time. Additionally, AI-powered chatbots could be used to assist agents during co-browsing sessions, providing them with relevant information and suggestions.

Virtual Reality (VR) Co-browsing

As VR technology becomes more accessible, we can expect to see the emergence of VR co-browsing. With VR co-browsing, customers and agents could collaborate in a virtual environment, enabling them to work on projects in a more immersive and engaging way.

Improved Security

Co-browsing sessions can involve sensitive information such as login credentials and payment details. As such, security is a major concern for businesses and customers alike. In the future, we can expect to see more advanced security features being developed, such as end-to-end encryption and two-factor authentication.

More Integration with Augmented Reality (AR)

Co-browsing can be used in conjunction with AR technology to provide customers with an even more immersive experience. For example, customers could use their mobile devices to view products in 3D and work with agents to customize them in real-time.

Co-browsing has come a long way since its inception, and it is clear that it will continue to evolve in the years to come. As businesses continue to look for ways to provide better customer experiences, co-browsing will play an increasingly important role. With the latest trends and predictions in mind, businesses can start planning for the future of cobrowsing and ensure they stay ahead of the curve.

One thing is certain: co-browsing is here to stay. As the technology evolves and becomes more sophisticated, we can expect to see more businesses adopting it to improve their customer service and drive business growth. Whether it's through AI integration, VR co-browsing, or improved security, the future of co-browsing is bright, and businesses that embrace it will be well-positioned to succeed.

In conclusion, co-browsing is a valuable technology that enables businesses to provide personalized and real-time support to their customers. With the latest trends and predictions, it is clear that co-browsing will continue to evolve and become more sophisticated in the years to come. Businesses that embrace co-browsing and stay ahead of the curve will be well-positioned to succeed and provide better customer experiences.

At Sariska, our mission is to enable seamless access to development tools around real-time messaging, programmable audio and video, streaming and interactive capabilities across platforms and devices.

Exploring the Future of Co-Browsing: Trends and Predictions

Co-browsing is a popular technology that enables users to share their screens with others, allowing them to work collaboratively on the same web page or document in real-time. Over the past few years, co-browsing has become increasingly popular among businesses that offer customer support, as it enables agents to assist customers in real-time by guiding them through a website or application. However, co-browsing is not just limited to customer support. It has many other applications, including sales, onboarding, training, and education.

In this blog, we will explore the future of co-browsing, including the latest trends and predictions.

Trends in Co-browsing

Increased Adoption in E-commerce

Co-browsing is becoming increasingly popular among e-commerce businesses, as it enables them to provide a more personalized shopping experience to their customers. With co-browsing, customers can work with agents in real-time to browse products, get recommendations, and complete purchases. This can help increase conversion rates and reduce cart abandonment.

Integration with Other Technologies

Co-browsing is often used in conjunction with other technologies such as live chat, video chat, and chatbots. This integration enables businesses to provide a seamless customer experience by offering customers a range of communication channels to choose from. Additionally, co-browsing can be integrated with CRM and other business systems to provide agents with the information they need to assist customers effectively.

Mobile Co-browsing

With more people using mobile devices to access the internet, mobile co-browsing is becoming increasingly important. Mobile co-browsing enables customers to receive support on-the-go and enables agents to provide assistance anytime, anywhere. As mobile devices continue to become more powerful, we can expect to see more advanced co-browsing features being developed specifically for mobile devices.

Advanced Analytics

Co-browsing is not just about real-time collaboration; it also provides businesses with valuable data about customer behavior. By analyzing co-browsing sessions, businesses can gain insights into customer preferences, pain points, and behavior. This data can be used to improve products and services and to optimize the customer experience.

Predictions for the Future of Co-browsing

Artificial Intelligence (AI) Integration

As AI technology continues to evolve, we can expect to see more advanced co-browsing features that leverage AI. For example, AI-powered co-browsing could enable agents to provide more personalized support by analyzing customer behavior and preferences in real-time. Additionally, AI-powered chatbots could be used to assist agents during co-browsing sessions, providing them with relevant information and suggestions.

Virtual Reality (VR) Co-browsing

As VR technology becomes more accessible, we can expect to see the emergence of VR co-browsing. With VR co-browsing, customers and agents could collaborate in a virtual environment, enabling them to work on projects in a more immersive and engaging way.

Improved Security

Co-browsing sessions can involve sensitive information such as login credentials and payment details. As such, security is a major concern for businesses and customers alike. In the future, we can expect to see more advanced security features being developed, such as end-to-end encryption and two-factor authentication.

More Integration with Augmented Reality (AR)

Co-browsing can be used in conjunction with AR technology to provide customers with an even more immersive experience. For example, customers could use their mobile devices to view products in 3D and work with agents to customize them in real-time.

Co-browsing has come a long way since its inception, and it is clear that it will continue to evolve in the years to come. As businesses continue to look for ways to provide better customer experiences, co-browsing will play an increasingly important role. With the latest trends and predictions in mind, businesses can start planning for the future of cobrowsing and ensure they stay ahead of the curve.

One thing is certain: co-browsing is here to stay. As the technology evolves and becomes more sophisticated, we can expect to see more businesses adopting it to improve their customer service and drive business growth. Whether it's through AI integration, VR co-browsing, or improved security, the future of co-browsing is bright, and businesses that embrace it will be well-positioned to succeed.

In conclusion, co-browsing is a valuable technology that enables businesses to provide personalized and real-time support to their customers. With the latest trends and predictions, it is clear that co-browsing will continue to evolve and become more sophisticated in the years to come. Businesses that embrace co-browsing and stay ahead of the curve will be well-positioned to succeed and provide better customer experiences.

At Sariska, our mission is to enable seamless access to development tools around real-time messaging, programmable audio and video, streaming and interactive capabilities across platforms and devices.

0 notes

Link

A video+co-browse solution can help you empower your sales agents to close sales virtually. This is an effective tool to acquire & retain customers.

0 notes

Link

4 Solid Reasons Businesses opt for Proactive Live Chat! Live chat, chatbot, and cobrowsing is a must in this era.

"To keep a customer demands as much skill as to win one." -

American Proverb

1 note

·

View note

Text

Big Data Driven Decisions in Finance Solutions

One expanded mechanical merchandise producer took in this exercise the most difficult way possible. The group fostered an exquisite and convincing vision for the future excursion that was intensely b2b credit advanced based and included moment request affirmations, a single tick reordering, track-and-follow ability for in-progress requests, and straightforwardness about the ramifications of request changes.

However when the group introduced the methodology, the mind-set at the show was sullen. At the point when the program lead asked what wasn't right, the future item proprietor shared her interests that their work could set enormous assumptions that could be difficult to accomplish on the grounds that an excessive number of things outside their nearby control should have been changed. In the conversation that followed, the group surfaced a not insignificant rundown of required changes,

including data innovation (IT) frameworks, authoritative designs, preparing necessities, and outlooks. Maybe than treating these as one major barrier, the group chose to enlist a C-suite-level program proprietor and furthermore make one individual answerable for each change, uga elc accordingly making an interpretation of them into an arrangement of drives that laid the preparation for changing their association's center.

How much organizations ought to put resources into digitization of individual excursions shifts altogether, yet some broad examples arise. Organizations with normalized items and a divided client base will need to put all the more vigorously in the client excursions of distinguishing required items and administrations, making introductory buys, and reordering to profit with efficiencies. Conversely, organizations offering more modified items to a more modest arrangement of clients regularly put a higher need on the excursions of codeveloping or tweaking with providers and managing unforeseen occasions.

One substance organization updated and digitized its requesting venture with various thoughts for advanced self-administration, just to track down that key clients were wary about not having an individual relationship administrator to call when things turned out badly. The group returned to the planning phase and changed the experience plan. Generally significant, they reestablished the part of the relationship chief, giving clients a decision between utilizing oneself help stage and calling the administrator. They organized it so the client and supervisor would utilize similar entry to collaborate. What's more, they added a cobrowsing and work area videoconference highlight so correspondence about any issues would be fast and individual.

This model delineates how the best rethought travels deliberately switch between advanced self-administration, carefully empowered human cooperations, and improved disconnected associations to coordinate with client inclinations and guarantee the level of normalization and exchange volume that warrants interests in digitization. B2B clients are for the most part glad to utilize computerized self-administration for basic, routine communications like reordering to save time or be more adaptable. However, when the association is new and unpredictable or a lot is on the line, most still incline toward a genuine individual (who likewise may be carefully empowered).

1 note

·

View note

Photo

Buy Used Cars In Pueblo CO

Browse our selection of Pre-Owned Cars in Pueblo CO. CarPros offers an impressive inventory of used Cars for Sale in Pueblo CO.

0 notes

Link

0 notes

Text

Life insurance: Ready for the digital spotlight

Life insurers have been latecomers to the digital era. That will have to change.

In the mid-1970s, 38-year old entrepreneur Charles Schwab started a revolution. He built a new kind of brokerage firm that offered discounted commissions and telephone self-service that gave customers the ability to buy their own stocks and bonds. He computerized the entire operation years before the big Wall Street firms, changing how the brokerage industry operates and how customers manage their investments.

A similar upheaval is on the way in life insurance, which so far has been slow to embrace digital change. Life-insurance companies are still selling the old-fashioned way, broker to customer, instead of empowering people to make their own decisions and participate in the process. Moreover, insurance-policy sales are still laden with excessive face-to-face interaction and mountains of paper.

But consumers in every sector now demand speed, relevance, and convenience, no matter what channel they use or what product they’re shopping for — and insurance is no exception. Every month there are more than a million Google searches for terms related to life insurance and seven million total visits to the websites of the top ten carriers — a sign of considerable online interest in life insurance. But consumers can’t search, evaluate, and purchase policies online as easily as they’d like to. While more than 70 percent start the life-insurance information-gathering process online, fewer than a third complete their purchase there.

To stay ahead of the digital revolution, carriers must take an omnichannel approach, providing compelling and relevant customer experiences no matter where their customers choose to interact. That takes a lot more than simply creating a mobile app. It requires a fundamental change in an organization’s operations and mind-set, affecting everything from the role of the agent to new, advanced, data-analytic capabilities.

We see three distinct horizons along which carriers will have to execute: (1) modernization of all channels of customer interaction; (2) interconnection of channels to deliver an unbroken customer experience; and (3) creation of personalized products via analysis of the vast and ever-expanding body of digital customer data.

Horizon 1. Digitization — modernize existing channels

We see several broad opportunities to modernize existing channels. First, the ability to insert life insurance into people’s daily lives and to use life events as triggers for purchase should be one of every carrier’s top priorities. Fortunately, opportunities already exist. People post about life events on social media and search for information about life insurance. Carriers simply need to utilize tools such as social-media listening platforms to identify touchpoints and launch initiatives to reach out proactively to potential customers.

The second opportunity is in redesigning and automating interactions so that customers don’t wait 30 days for responses or abandon carrier websites because they are outdated or difficult to navigate.

Carriers should apply technologies such as click-to-call, cobrowsing, and live video chats that allow customers to interact on their own terms. E-signature can remove some of the hassle of paperwork. Such innovations will not only improve the customer experience but create opportunities to achieve greater operational efficiencies. QNB Finansbank redesigned its loan-application process to service existing customers through the company’s mobile application. This overhaul of what had been a paper-based process allowed customers to go from “discovery to approved loan” in less than a minute, a benefit for both the company and the customer.

Finally, carriers can use existing technology to digitize agents’ daily lives. Customer information and interactions can be managed digitally through CRM tools, and advanced analytics can translate the resulting data into insights into how agents can improve their sales techniques.

Horizon 2: Differentiation — deliver a great customer experience

Exceptional customer experience can create a powerful competitive advantage. To deliver it, carriers need to develop a deeper understanding of their customers beyond just basic demographic information and web habits. They need to make use of quantitative and qualitative insights into customer behaviors, pain points, motivations, and aspirations, based on individual customers or through the development of “target personas,” i.e., a hypothetical amalgam of qualities and behaviors that represents a given customer segment.

Digital customer acquisition

Such customer intelligence should be brought together in an “insights repository” that links, for example, activity on social media, purchase transactions, online behavior, household financial details, and demographics. Technologies to do this already exist. Companies such as Pega Systems and ClickFox1 offer applications that track customers across many online and offline channels, blending data from multiple sources to create a unified view of varied customer segments.

Once a unified view of customer segments is in place, carriers can more accurately assess customer needs and appropriately personalize interactions in a way that will delight. Certain customers, for instance, will appreciate being able to use remote and/or robo-advisory models (e.g., online chat features). Leading financial-services institutions are embracing chat-bots such as Facebook Messenger or scheduling solutions such as appointy.com, which allow customers to schedule meetings with advisors.

But while some customers can be served with bots and online self-services, many will prefer to rely on advisors to help them with complicated financial planning and to sort through their best individual options. Here, digital tools can work on the back end to help the advisors, allowing them to sift through policy options easily, combine various offerings, and quickly match them to customer profiles. Ideally, an insights-based profile will include a given consumer’s prior relationship with the company — whether they have had other kinds of policies, have registered for information, or made initial inquiries, etc.

Horizon 3: Disruption — use data to create personalized products and services

In the next five to seven years, the most disruptive and successful life insurers will be those that excel in developing products, services, and consumer-facing digital experiences that are driven by customer needs and preferences. There are four ways that such products and services can be personalized.

The first is risk coverage. The choices will no longer be between term life, universal life, or whole life but a selection of the products that best reflect a customer’s current life stage and risk appetite.

Secondly, offerings can be personalized through the touchpoints that can best reach a customer at a specific moment. For instance, new parents who are searching online for nursery furniture could be offered a dynamic policy that enables short-term for specific goals, such as health emergencies or college savings, and then converts to a retirement-savings vehicle. The banking and retail industries have already started down this more personalized opportunity path.

Thirdly, the messages themselves can be customized based on a customer’s needs and aspirations. Life insurance is fundamentally about the trust customers have in a carrier. Marketing messages should build upon this emotional connection and enhance the sense of the carrier’s empathy with its customers.

Finally, personalized pricing can be tailored to a customer’s behavior, usage patterns, and loss-mitigation needs. This is already happening in the pricing of personal auto policies in the US.

To enable such a sophisticated tailoring of offerings, carriers will need to invest in several new capabilities: first, the ability to use data capture and analytical tools to flag customer life-stage changes and events; then, a customer-interaction engine capable of pinpointing touchpoints and responding in real time to what companies learn about prospective customers as they go through their buying journey; and finally, a product factory that creates custom offerings and bundles based on customer behaviors, usage patterns, and pricing preferences.

Overcoming three main challenges

Any company in any industry that wants to succeed at digital innovation and omnichannel mastery must have a laserlike focus on the customer rather than the channel, the organizational agility that arises from smaller teams, and a test-and-learn approach with real customers. They must also commit to dropping ideas that aren’t working, investing in those that do, and creating key performance indicators that will drive value.

Insurers, however, confront three additional challenges. The first is a lack of conviction that change is imminent and they must get ready to respond to it. It’s understandable, given the slow pace of innovation within the industry, that even executives who acknowledge change is coming feel they will have ample time to react once it starts. But the reality is that development of the capabilities for a successful digital transformation can take significant time, and savvy leaders will start building them in advance. For instance, there is already a war for talent. Insurers should be investing substantial resources in developing an organizational culture with digital knowhow and a mind-set that will attract people who are able to execute a transformation when the time is right. Allianz, for example, is investing — €650 million — in developing next-generation digital capabilities to support more than 85 million customers.2 Carriers need to ask themselves: If we’re not investing like Allianz, will we be competitive in the future?

The second organizational challenge is advisors’ resistance to company efforts at customer-relationship management (CRM). Customers are advisors’ lifeblood, and reluctance to share them with the company is understandable For this reason, leadership needs to continually and clearly articulate the reasons for — and the benefits that accrue from — any change or new technology, particularly its time-saving value and its potential for adding customers and increasing income. Even more important, every company initiative should take into consideration the behavior and motivations of advisors in the field. Indeed, the advisors should be thought of as “internal consumers.” It is crucial to involve them, for instance, in the development of digital tools. They are the ones who will be using them or interacting with the customers using them, and they can provide valuable feedback on whether they are useful or how they might be improved.

The third and final challenge for insurers is the existence of legacy IT systems that don’t translate particularly well to an omnichannel and digital world. We recommend a staged approach to accelerate IT integration and foster the development of omnichannel solutions. It starts with a pilot program whose goal is testing and learning. It may require manual input of data by IT staff. Next, a minimum viable product is evolved to a more scalable level, eliminating the manual effort.

Throughout the process, a programming interface is used to move more and more data from legacy systems to strategic and reusable components, ultimately leading to a service-based strategic solution. Although legacy systems may never go away, they can be wrapped in new front-end and intermediate systems that communicate with older technology in a way that enables the new and improved omnichannel customer experience.

Just as consumers have fundamentally changed, so too will the life-insurance business. Carriers who do not act to transform their interactions with consumers and put customer experience at the heart of their organization will find themselves relegated to selling undifferentiated products that not many customers are eager to buy. In the end, digital life insurance is less about technology and channels than about embracing a new way of thinking and working.

#areteautomation #lifehealthadvisors #thisis4u #knowledge #learning

Credits: Prashant Gandhi, Jon Kowalski, Parker Shi, and Marc Singer

Date: April 17, 2017

Source: https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/life-insurance-ready-for-the-digital-spotlight

0 notes

Text

Cogno AI hiring Software Development Engineer | Remote Jobs

Cogno AI hiring Software Development Engineer | Remote Jobs

Cogno AI looking for Software Development Engineer Company: Cogno AI About Company: Cogno AI by AllinCall is an AI-driven Omnichannel Cloud Communication-as-a-Service that uses a combination of ChatBots, Live Agent Chat, Cobrowsing, and Video Calling to provide a Delightful Customer Experience across all Digital Channels Location: Mumbai, Remote Job Experience Needed: 1-2 Years Description:This…

View On WordPress

0 notes

Text

Zales Customer Service Complaints

Zales Customer Service Complaints

If you are looking for zales customer service complaints, simply check out our links below : 1. Contact Us – Zales https://www.zales.com/contactUsSuccess Also Shop Also Shop Zales Outlet. © ZALES.COM Privacy Policy | Do Not Sell My Information | Terms of Use | Sitemap | Start Cobrowse … 2. Customer Service | Zales https://www.zales.com/customer-service More Apply Now. Affirm Learn More / Apply…

View On WordPress

0 notes

Text

Cogno AI 2021 Hiring Freshers for Software Tester

Cogno AI 2021 Hiring Freshers for Software Tester Cogno AI 2021 Hiring Freshers as Software Tester at Remote Job Title: Software Tester - 1 Degree needed: BE / BTech Pass-out Year: Any Year Location: Currently remote, eventually Mumbai Experience: Min. 3 - 6 months Salary: Up to INR 4.5 LPA

Cogno AI Recruitment Drive for 2021 Fresher Cogno AI 2021 Hiring Freshers as Software Tester at Remote About Company: Cogno AI by AllinCall is an Omnichannel Cloud Communication-as-a-Service that uses a combination of ChatBots, Live Agent Chat, Cobrowsing, and Video Calling to provide a Delightful Customer Experience across all Digital Channels. We work with 50+ large Enterprise clients (ICICI…

View On WordPress

0 notes

Link

Cobrowsing is the most effective, convenient and hassle free trouble shooting solutions in recent times. Empowering your support agents with co-browsing tools helps you reduce customer churn significantly. Read more here.

#customer experience platform#cisco chatbot#customer engagement management software#omnichannel consumer experience#conversational ai software

0 notes