#Cotton Export Data from India

Explore tagged Tumblr posts

Text

Cotton Export from India: A Detailed Guide

Cotton is a crucial commodity in the global textile industry, and India stands as one of the leading players in cotton production and export. The cotton export from India significantly contributes to the country's economy, making it an essential topic for those interested in international trade and agriculture. This article delves into various aspects of cotton export from India, including raw cotton exports, leading cotton exporters, export data, and the countries importing Indian cotton.

History of Cotton Cultivation in India

India has a long history of cotton cultivation, dating back to ancient times. The Indus Valley Civilization is believed to have cultivated and woven cotton as early as 3000 BCE. Over the centuries, India has continued to develop its cotton industry, becoming a significant player on the global stage. The British colonial era saw the establishment of large cotton mills, and post-independence, India has further expanded its cotton cultivation and export capabilities.

Major Cotton Growing Regions in India

India's diverse climate allows for extensive cotton cultivation across various regions. The primary cotton-growing states include:

Gujarat: Known as the largest cotton-producing state in India, Gujarat contributes significantly to the country's raw cotton exports.

Maharashtra: Another major player, Maharashtra, has vast cotton fields and a robust cotton industry.

Telangana and Andhra Pradesh: These southern states also contribute considerably to India's cotton production, with numerous farms dedicated to growing high-quality cotton.

Punjab and Haryana: In the north, these states are known for their extensive use of modern agricultural techniques in cotton cultivation.

Types of Cotton Exported from India

India exports a variety of cotton types, including:

Shankar-6: A high-quality, long-staple cotton that is in demand globally.

MCU-5: Known for its superior spinning quality, this cotton type is favored by textile manufacturers.

DCH-32: A premium variety of cotton known for its fine quality and used in high-end textiles.

Leading Cotton Exporters in India

Several companies play a pivotal role in raw cotton exports from India. The top cotton exporters in India include:

Welspun India: A major player in the textile industry, Welspun India is known for its high-quality cotton exports.

Vardhman Textiles: This company has a strong presence in the global market, exporting a significant amount of cotton annually.

Nahar Spinning Mills: Known for its large-scale operations and quality products, Nahar Spinning Mills is a key exporter of Indian cotton.

Cotton Export Data from India

India's cotton export data provides valuable insights into the industry's performance. According to India cotton export statistics, the country exported approximately 1.8 million bales of cotton in the 2020-2021 fiscal year. This data highlights the significance of cotton in India's agricultural exports and its impact on the global market.

Export Process and Quality Control

The process of exporting cotton from India involves several steps to ensure the quality and consistency of the product:

Cultivation and Harvesting: Indian farmers use a combination of traditional and modern techniques to cultivate and harvest cotton, ensuring high yield and quality.

Ginning and Pressing: After harvesting, cotton undergoes ginning to separate the seeds from the fibers. The fibers are then pressed into bales for export.

Quality Control: To maintain high standards, cotton exporters in India adhere to strict quality control measures, including inspections and certifications from organizations such as the Cotton Association of India (CAI) and the Textile Committee.

Cotton Export from India to Which Country?

Indian cotton is exported to several countries worldwide, with major importers including:

China: As the largest importer, China relies heavily on Indian cotton for its extensive textile industry.

Bangladesh: Another significant market, Bangladesh imports large quantities of Indian cotton to fuel its booming garment sector.

Vietnam: Known for its rapidly growing textile industry, Vietnam is a key destination for Indian cotton.

Indonesia and Turkey: These countries also import substantial amounts of cotton from India, using it in their textile and apparel industries.

Challenges Faced by Cotton Exporters in India

Despite the successes, cotton exporters in India face several challenges:

Fluctuating Prices: Global cotton prices can be highly volatile, affecting the profitability of cotton exports.

Quality Issues: Ensuring consistent quality is crucial, as any lapse can lead to rejections and financial losses.

Competition: India faces strong competition from other major cotton producers such as the United States, Brazil, and Australia.

Climate Change: Unpredictable weather patterns can impact cotton yields and quality, posing a significant risk to the industry.

Future Prospects for Cotton Export from India

The future of cotton export from India looks promising, with several opportunities for growth:

Emerging Markets: New markets in Africa and the Middle East present potential for expanding Indian cotton exports.

Technological Advancements: The adoption of modern agricultural techniques and technologies can boost productivity and quality.

Sustainable Practices: Emphasizing sustainable and organic cotton farming can attract more international buyers concerned with environmental impact.

Conclusion

Cotton export from India is a vital component of the country's agricultural and economic landscape. With its rich history, diverse growing regions, and high-quality product, India continues to be a major player in the global cotton market. Despite challenges, the industry's future remains bright, driven by innovation, quality control, and expanding market opportunities.

FAQs

1) What are the major cotton-growing regions in India?

The major cotton-growing regions in India include Gujarat, Maharashtra, Telangana, Andhra Pradesh, Punjab, and Haryana.

2. Which are the top cotton exporters in India?

Top cotton exporters in India include Welspun India, Vardhman Textiles, and Nahar Spinning Mills.

3. What types of cotton does India export?

India exports various types of cotton, including Shankar-6, MCU-5, and DCH-32.

4. What challenges do Indian cotton exporters face?

Indian cotton exporters face challenges such as fluctuating prices, quality issues, competition, and climate change.

5. Which countries import the most cotton from India?

China, Bangladesh, Vietnam, Indonesia, and Turkey are among the largest importers of Indian cotton.

#Cotton Export from India#Raw Cotton Exports from India#Cotton Exporters in India#Cotton Export Data from India#India Cotton Export Statistics#Cotton Export from India to which Country#Top Cotton Exporters in India

0 notes

Text

India leads in producing and exporting high-quality raw cotton, contributing to foreign exchange earnings. Key players include Welspun India, Vardhman Textiles, Trident Group, Arvind, and Nahar Spinning Mills. India's future looks promising due to global demand and technological advancements. Check out our blog for full details.

#Cotton Export from India#Raw Cotton Exports from India#Cotton Exporters in India#Cotton Export Data from India#India Cotton Export Statistics#Top Cotton Exporters in India#Cotton Export from India to which Country

0 notes

Text

Explore the dynamics of India's cotton export market in 2024 with Seair Exim Solutions. Gain valuable insights into the latest trends, buyer-seller dynamics, and regulatory updates shaping the industry. Unlock comprehensive data and analysis to navigate the evolving landscape of cotton exports from India.

#top cotton exporting countries#cotton export from india#cotton export data from india#cotton exporters#cotton export#cotton yarn hs code#cotton export data

0 notes

Text

https://www.seair.co.in/blog/cotton-export-from-india-2022-23-data.aspx

Explore the latest insights into cotton export from India in our Seair Exim Solutions blog. Delve into the data from 2023-24 to uncover key statistics, market dynamics, and emerging opportunities in the cotton export sector.

#top cotton exporting countries#cotton export from india#cotton export data from india#cotton exporters#cotton export#cotton yarn hs code#cotton export data

0 notes

Text

How to Start a Cotton Export Business in India?

India, renowned for its vibrant textile industry, has a rich legacy in cotton production. As one of the world's largest cotton exporters, the nation plays a crucial role in the global textile supply chain. Cotton is vital to India's agricultural and industrial sectors, serving as a primary raw material for textiles. In the 2021–22 fiscal year, India exported approximately 4.25 million bales of cotton. But what makes India a dominant force in cotton exports? This article delves into essential insights on cotton exports from India, including key exporters, market data, and trade regulations.

Is Cotton Exporting Profitable in India?

Cotton is among India's most significant agricultural commodities, cultivated across the country. India's cotton exports are valued at nearly $5 billion, demonstrating consistent growth in recent years. Globally, Indian cotton is highly sought after due to its superior quality and affordability. The country's comparatively low production costs make Indian cotton highly competitive internationally, ensuring strong demand from buyers worldwide.

Cotton Production in India

India holds the top position in global cotton production, with approximately 120.69 lakh hectares under cultivation—accounting for nearly 36% of the total global cotton farming area. Around 67% of India's cotton is grown on rain-fed land, while 33% relies on irrigation. Despite leading in production, India ranks 38th in productivity with a 510 kg/ha yield, as per International Textile Data.

Types of Cotton Grown in India

India cultivates four significant species of cotton:

G. arboretum and G. herbaceum (Asian cotton)

G. barbadense (Egyptian cotton)

G. hirsutum (American Upland cotton)

The majority of Bt cotton hybrids in India are derived from G. hirsutum. Cotton cultivation is spread across three distinct agro-ecological zones:

Northern Zone – Punjab, Haryana, and Rajasthan

Central Zone – Gujarat, Maharashtra, and Madhya Pradesh

Southern Zone – Telangana, Andhra Pradesh, Karnataka, and Tamil Nadu

India produced 362.18 lakh bales (6.16 million metric tonnes) of cotton in the 2021–22 season, contributing to over 23% of the global production of 1555 lakh bales (26.44 million metric tonnes). More than 80% of India's cotton comes from five key states, ensuring a stable supply for export markets.

Cotton Export Data from India (2023–24)

India's cotton exports have surged to key markets such as Bangladesh, China, and Vietnam. As per recent cotton export data, the first five months of the 2023–24 season saw exports reach 15 lakh bales (170 kg each), closely aligning with the 15.5 lakh bales exported during the previous marketing season. However, India's total cotton export value for the fiscal year 2023 stood at approximately 877 billion Indian rupees, marking a decline from the previous fiscal period. Despite this drop, India remains the fifth-largest cotton exporter globally.

India's Contribution to Global Cotton Exports

In 2020, India accounted for 10.2% of global raw cotton exports, ranking third among exporting nations. The total export value reached:

$10.78 billion in 2021–22

$6.3 billion in 2020–21

$4.5 billion between April 2022 and January 2023

According to the Committee on Cotton Production and Consumption (COCPC), India exported 4.25 million bales of cotton in 2021–22. The global cotton export volume for the same period stood at 8.98 million metric tons (528 lakh bales), representing an 8% decline from the previous year's 9.73 million metric tons (572 lakh bales). India's cotton import volumes also reduced, with 8.98 million metric tons recorded, a 6% decrease from the prior year's 9.60 million metric tons.

Top Cotton Exporting Countries in 2024

As per trade data, the leading cotton-exporting countries include:

United States – The most prominent exporter, shipping over 2.78 million metric tons annually.

Brazil – A major supplier, exporting 1.44 million metric tons.

Australia – An emerging powerhouse with 1.35 million metric tons.

India – With approximately 0.51 million metric tons, India remains a significant contributor to global cotton exports.

Other key exporters include Greece, Benin, Turkey, Burkina Faso, Mali, and Cameroon. The United States led cotton exports in 2022–23, shipping 2.30 million metric tonnes, followed by Australia with 1.55 million metric tonnes.

Top Cotton Exporters in India

India boasts several top cotton export companies, including:

SCM Garments Private Limited

Shahi Exports Private Limited

H.D. Textiles

Nandan Denim Limited

Trident Limited

Adinath Trading Company (ATC)

Saanvi Inc.

Taen Life Impex

Vinod Textile

Super Agri Export

For a comprehensive list of top cotton exporters in India, businesses can refer to specialized trade portals such as Eximpedia.app, which offers real-time export data and market insights.

How to Locate Cotton Buyers?

For businesses seeking reliable cotton buyers, accessing up-to-date trade databases is crucial. Platforms like Eximpedia.app provide real-time data on global buyers, suppliers, exporters, and HS codes. Such insights help businesses navigate international trade efficiently while identifying key market opportunities.

Final Thoughts

Entering the industry of cotton exports from India requires thorough research, strategic planning, and market insights. With global demand for high-quality cotton steadily rising, India holds a competitive advantage due to its abundant resources and cost-effective production. Success in the export business hinges on maintaining quality standards, conducting market analysis, and leveraging trade data to identify potential buyers.

Accessing real-time export data and connecting with industry experts can be invaluable for businesses looking to expand in the global cotton market. By staying informed and adapting to market trends, Indian cotton exporters can thrive internationally.

#cotton exports from India#cotton exporters in India#cotton export companies in India#top cotton exporters in India#list of cotton exporters in India#cotton export data

0 notes

Text

#T-Shirt export business#T-Shirt export from India#T-Shirt export surplus#T-Shirt export data#T-Shirt manufacturer India#Cotton T-Shirt export

0 notes

Text

Top 10 US-Based Textile Buyers in 2025

The United States remains one of the largest importers of textiles and apparel, making it a key target market for suppliers, manufacturers, and exporters worldwide. With growing demand for sustainability, fast fashion, and diverse materials, textile buyers in the US are adapting fast—and scaling globally.

In this article, Fibre2Fashion identifies the Top 10 US-Based Textile Buyers in 2025 based on their sourcing scale, industry influence, and market trends.

1. Walmart, Inc.

Headquarters: Bentonville, Arkansas

Sector: Mass retail, private label apparel

What They Buy: Cotton fabrics, synthetics, blends, knits

Sourcing Focus: Low-cost textiles from Asia, sustainability initiatives

Walmart is the largest US apparel retailer by volume, sourcing massive quantities of basic and value-priced textiles for its in-house brands like George and Time and Tru.

Sustainability Edge: Committed to 100% recyclable, reusable, or industrially compostable packaging by 2025.

2. Target Corporation

Headquarters: Minneapolis, Minnesota

Sector: Fashion, home textiles, kids wear

What They Buy: Organic cotton, modal, recycled polyester

Sourcing Focus: Ethical sourcing, OEKO-TEX®, GOTS-certified suppliers

Target is known for its trend-forward fashion and home collections (e.g., Threshold, Cat & Jack). They work closely with certified mills and fabric partners around the globe.

Initiative: Net-zero emissions across operations and supply chains by 2040.

3. Levi Strauss & Co.

Headquarters: San Francisco, California

Sector: Denim, apparel

What They Buy: Denim, cotton twill, sustainable fabrics

Sourcing Focus: Water-saving textiles, laser-friendly denim, sustainable cotton

Levi’s continues to lead in denim innovation, sourcing from countries like Turkey, Pakistan, and Bangladesh. Its Water<Less® program is widely adopted in textile treatment.

Eco Focus: 75% of cotton from sustainable sources; big push on circular denim.

4. PVH Corp. (Calvin Klein, Tommy Hilfiger)

Headquarters: New York City, New York

Sector: Premium fashion, lifestyle

What They Buy: Cotton blends, recycled polyester, performance fabrics

Sourcing Focus: Multi-region sourcing (Asia, Africa, LATAM)

PVH manages a global supply network and emphasizes traceable textile procurement, with a long-term commitment to transparency and ethical trade.

Key Move: Global Material Traceability Program to track textile origin by 2025.

5. Amazon Fashion

Headquarters: Seattle, Washington

Sector: E-commerce, private labels

What They Buy: All types of fashion textiles, technical fabrics

Sourcing Focus: Private labels like Goodthreads, Amazon Essentials

Amazon is quickly rising as a dominant textile buyer, leveraging tech for demand-driven procurement. Their private-label success has increased global textile contracts.

Trend: Data-driven buying and regional fulfillment center sourcing.

6. Gap Inc. (Gap, Old Navy, Athleta)

Headquarters: San Francisco, California

Sector: Mid-tier fashion, athleisure

What They Buy: Performance blends, organic cotton, recycled materials

Sourcing Focus: India, Bangladesh, Vietnam, with a focus on female-led suppliers

Gap Inc. is investing heavily in sustainable and gender-inclusive supply chains, sourcing from facilities with fair labor certifications.

Athleta Focus: 70% of Athleta fabrics are now sustainable.

7. Hanesbrands Inc.

Headquarters: Winston-Salem, North Carolina

Sector: Basics, innerwear, socks

What They Buy: Cotton jersey, elastane blends, polyester

Sourcing Focus: Central America, Asia, in-house mills

Hanesbrands controls much of its textile production through vertical integration, giving it greater quality and pricing control.

Unique Edge: Owns some of its own mills, including in the Caribbean Basin.

8. TJX Companies (TJ Maxx, Marshalls)

Headquarters: Framingham, Massachusetts

Sector: Off-price retail

What They Buy: Broad range of fabrics—leftover stock, closeouts

Sourcing Focus: Opportunistic buying globally

Unlike typical retailers, TJX operates a reverse logistics model, buying unsold or excess inventory—including textiles—from around the world.

Sourcing Style: Opportunistic and high-volume, not brand-dependent.

9. VF Corporation (The North Face, Vans, Timberland)

Headquarters: Denver, Colorado

Sector: Outdoor, activewear

What They Buy: Technical textiles, GORE-TEX®, fleece, sustainable nylons

Sourcing Focus: Functionality and eco-innovation

VF Corp is a leader in performance fabric sourcing, heavily investing in regenerative and low-impact textiles for its global outdoor brands.

Target: 100% sustainable key materials (cotton, polyester, nylon) by 2030.

10. Ralph Lauren Corporation

Headquarters: New York City, New York

Sector: Luxury fashion

What They Buy: High-end wools, silks, natural fibers

Sourcing Focus: Italy, India, and the US for premium textiles

As a luxury leader, Ralph Lauren sources high-quality heritage textiles while increasingly moving toward sustainability and domestic production.

US-Made Push: Increased investment in American wool and denim production.

What This Means for Textile Exporters

The top US buyers in 2025 are not just focused on volume—they demand:

Certified, sustainable textiles

Supply chain transparency

Speed-to-market capabilities

Regionally diversified partners

If you're a textile manufacturer or exporter, aligning with these trends and offering strong compliance credentials can open doors to long-term contracts with these industry giants.

How Fibre2Fashion Helps You Reach US Buyers

Fibre2Fashion connects textile exporters with global buyers via:

Verified buyer database

Marketplace for showcasing your fabrics

Sustainability filters for eco-conscious buyers

Join Fibre2Fashion directory

Conclusion

The US fashion and textile market is evolving fast—and the top buyers of 2025 are pushing the industry forward with digital tools, sustainable practices, and diversified global sourcing. By staying informed and well-prepared, textile suppliers can become key partners in this thriving market.

Let Fibre2Fashion help you connect with these influential buyers and grow your business globally.

1 note

·

View note

Text

Fast Red B Base: Key Dye Intermediate for High-Performance Azo Pigments

Fast Red B Base, chemically known as 2-Methoxy-4-Nitroaniline, is a highly valued dye intermediate in the global pigment and textile industries. Also referred to as 4-Nitro-2-Methoxyaniline, p-Nitro-o-Anisidine, 5-Nitro-2-Aminoanisole, and Hiltonil Fast Red B Base, this compound is registered under CAS number 97-52-9 and identified as Azoic Diazo Component 5. Known for its chemical stability and coupling efficiency, it plays a crucial role in the production of azo dyes and organic pigments.

Jay Finechem, a trusted Indian manufacturer and exporter, specializes in high-purity intermediates such as Fast Red B Base, delivering consistent quality for use in advanced dye and pigment applications.

Applications Across Industries

One of the most important uses of Fast Red B Base is in naphthol dye formulations, where it couples with various components to create long-lasting, fade-resistant colors. These dyes are extensively used in textile dyeing, cotton fabric printing, viscose fiber dyeing, and silk dyeing. The compound’s excellent coupling properties make it an ideal choice for achieving vivid hues and color fastness on a variety of fibers.

In the pigment industry, it is a key precursor to organic pigments such as Pigment Yellow 74. These pigments are widely used in flush colors, highway marking paints, industrial coatings, and ink manufacturing. Fast Red B Base is also critical for developing jujube red and golden yellow pigments, valued for their brilliance and stability.

As a diazo coupling component, it offers excellent performance and versatility. It plays a significant role in creating a wide spectrum of shades in azoic dye chemistry, providing long-term color durability even in challenging environments.

Reliable Supply from Jay Finechem

With increasing demand across textile and pigment sectors, sourcing a dependable supplier is essential. Jay Finechem stands out as a leading Fast Red B Base manufacturer in India, with facilities located in the chemical manufacturing hub of Vapi. The company ensures high-quality production standards and compliance with global regulatory requirements, making it a preferred supplier for international buyers.

Customers seeking efficiency and reliability can now buy Fast Red B Base online directly from Jay Finechem, with complete technical data, material safety information, and logistics support. The product is available in bulk and tailored to meet the stringent needs of azo dye and organic pigment manufacturing.

Conclusion

In summary, Fast Red B Base is a cornerstone chemical in the production of high-performance azo dyes and organic pigments. Its utility in textile dyeing, polyester processing, industrial paints, and printing inks underscores its importance in modern coloration technology. Backed by Jay Finechem’s expertise in specialty chemicals, clients across industries trust this essential intermediate for consistent quality and performance.

Whether you know it by CAS 97-52-9, Red B Base, or Azoic Diazo Component 5, Fast Red B Base remains a key player in vibrant, durable, and reliable color development. Jay Finechem continues to lead the way with high-purity production, competitive pricing, and seamless supply chain solutions for global customers.

0 notes

Text

What is Agri Trading?

What is Agri Trading

Agricultural commodities like wheat, sugar, and cotton are integral to India’s economy. These products not only support the livelihood of millions but also offer opportunities for traders to profit from their price fluctuations. However, trading in agri-commodities comes with unique risks influenced by weather, government policies, and global trade dynamics. For Indian traders, platforms like the National Commodity and Derivatives Exchange (NCDEX) provide a regulated environment to hedge risks and diversify portfolios.

Thinking about trading Agri trading with us?

Open an AccountTry WebTrader

Understanding Key Agricultural Commoditie

Each agricultural commodity has unique characteristics that influence its trading dynamics:

Wheat: A staple food in India, wheat’s prices are shaped by monsoon performance, yield levels, and government policies on exports and imports. Seasonal harvests also play a critical role in price movements.

Sugar: India is the largest global producer of sugar. Prices are influenced by domestic subsidies, ethanol production policies, and seasonal demand patterns. Global demand and trade policies further impact sugar futures.

Cotton: Known as "white gold," cotton is vital for the textile industry, with India being one of the top global producers. Prices are sensitive to weather conditions, pest infestations, and global trade disputes, especially with key markets like the US and China.

By understanding the key drivers behind these commodities, traders can better anticipate price movements and identify opportunities for growth.

How Agricultural Futures Work

Agri futures allow traders to speculate on the future prices of commodities without owning the physical products. Each contract specifies the quality, quantity, and delivery date of the commodity. NCDEX offers both mini and standard contracts to cater to varying risk appetites.

Benefits of Agri Futures:

Hedging: Farmers and industries use futures to lock in prices, reducing risks from volatile markets.

Leverage: Futures enable traders to gain higher market exposure with lower initial capital.

Transparency: Regulated exchanges like NCDEX ensure fair pricing and accountability, reducing the risk of manipulation.

While the benefits are substantial, futures trading carries inherent risks due to high leverage and price volatility, underscoring the importance of prudent risk management.

Strategies for Trading Agricultural Commodities

Agri trading requires a blend of strategic insight and market awareness. The following approaches can help traders navigate this dynamic market:

Seasonal Trends: Prices of agricultural commodities often follow harvest cycles. For example, wheat prices typically decline post-harvest due to surplus supply but rise later as stocks deplete. Traders can capitalize on these predictable patterns.

Fundamental Analysis: Monitor key indicators such as crop yields, export-import data, and government policies. Global benchmarks like the Chicago Board of Trade (CBOT) also provide valuable insights into global price trends.

Weather-Based Trading: Unseasonal rainfall or droughts can significantly impact supply and prices. Staying updated on weather forecasts helps traders anticipate market disruptions.

Spread Trading: Take advantage of price differences between related commodities (e.g., wheat and corn) or contracts with different expiration dates.

Each strategy requires careful evaluation and discipline, as market conditions can change rapidly.

Managing Risks in Agri Trading

Agri trading is inherently risky, with prices subject to sudden changes influenced by various external factors:

Weather Volatility: Unpredictable weather patterns can disrupt supply and cause drastic price swings.

Government Policies: Policy changes such as minimum support prices (MSP) or export restrictions can alter market dynamics overnight.

Storage and Logistics: Inefficiencies in the supply chain or limited storage capacity can further exacerbate price volatility.

Risk Management Tips:

Set Stop-Loss Levels: Define clear exit points before entering trades to protect your capital.

Diversify: Spread your investments across multiple commodities to minimize exposure to individual risks.

Use Leverage Cautiously: While futures provide leverage, excessive exposure can amplify losses during unfavorable market conditions.

Effective risk management ensures that traders can sustain their portfolios even during volatile periods.

Tools and Technology for Agri Trading

Modern tools and technology have made trading agricultural commodities more accessible:

Economic Calendars: Track announcements related to government policies, MSP updates, and global trade agreements.

Weather Forecasting Apps: Tools like Skymet and updates from the Indian Meteorological Department (IMD) provide valuable insights into weather conditions.

Trading Platforms: Brokers like Zerodha and Angel Broking offer seamless access to NCDEX along with real-time market data and analysis.

Automated Alerts: Set price alerts to respond quickly to sudden market changes.

The use of these tools allows traders to make more informed decisions and adapt to evolving market conditions.

The Future of Agri Trading

India’s agricultural market offers immense potential, driven by increasing global demand and government initiatives to boost agricultural exports. However, success in agri trading requires preparation, market knowledge, and strategic execution.

Traders must balance the opportunities with risks, staying informed about policy changes, weather patterns, and global trade trends. By leveraging the right tools and adopting disciplined strategies, Indian traders can unlock the potential of agricultural commodities.

The fields of opportunity are vast—cultivate your knowledge, and watch your trades grow.

0 notes

Text

Cotton Export from India: A Comprehensive Analysis

India has long been a major player in the global cotton market, owing to its favorable climate, vast agricultural land, and rich history of cotton cultivation. The country is renowned for its high-quality cotton, which is exported to numerous countries worldwide. This article delves into various aspects of cotton export from India, focusing on raw cotton export from India, leading cotton exporters in India, and detailed cotton export data from India. Additionally, it examines India cotton export statistics, the countries to which India exports cotton, and the top cotton exporters in India.

Historical Context and Significance

India's relationship with cotton dates back to ancient times. The country is one of the original homes of cotton cultivation and textile production. Historically, Indian cotton textiles were highly prized across the world, contributing significantly to the country's economy. This legacy continues today, with India being one of the largest producers and exporters of cotton globally.

Current State of Cotton Export from India

Production and Quality

India's cotton production is centered in states like Gujarat, Maharashtra, Andhra Pradesh, and Tamil Nadu. The country produces a variety of cotton types, including short-staple, medium-staple, and long-staple cotton, catering to different segments of the global market. The quality of Indian cotton is widely recognized, with certain varieties like Shankar-6 from Gujarat being particularly sought after.

Export Dynamics

Cotton export from India includes both raw cotton and cotton yarn. The country has established itself as a reliable supplier in the international market. Raw cotton export from India has seen significant growth over the years, driven by increasing demand from countries with burgeoning textile industries.

Cotton Export Data from India

Analyzing cotton export data from India provides valuable insights into the industry's trends and dynamics. Over the past decade, India has consistently ranked among the top cotton exporters in the world. The volume of raw cotton export from India has shown a steady increase, reflecting the country's capacity to meet global demand.

Volume and Value

According to the latest India cotton export statistics, the country exported approximately 1.5 million bales of raw cotton in the 2020-2021 fiscal year. This represented a slight increase from the previous year, despite challenges posed by the COVID-19 pandemic. The total value of these exports was around USD 1 billion, highlighting the economic significance of the sector.

Major Markets

Cotton exporters in India to various countries underscores the global reach of Indian cotton. Key destinations include Bangladesh, China, Vietnam, and Pakistan. These countries have robust textile industries that rely heavily on imported cotton. Bangladesh, in particular, has emerged as the largest importer of Indian cotton, driven by its thriving garment manufacturing sector.

Cotton Exporters in India

The success of cotton export from India can be attributed to the efforts of numerous exporters who ensure the quality and timely delivery of cotton to international markets. Several companies have made a name for themselves in this sector, becoming synonymous with reliability and quality.

Prominent Exporters

Some of the top cotton exporters in India include:

Welspun India Ltd. A leading name in the textile industry, Welspun India Ltd. is renowned for its high-quality cotton products. The company exports a significant portion of its raw cotton production to various countries.

Vardhman Textiles Ltd. Vardhman Textiles Ltd. is another major player in the Indian cotton export market. The company has a strong presence in the international market, with exports constituting a substantial part of its business.

Nahar Spinning Mills Ltd. Known for its superior quality cotton yarn, Nahar Spinning Mills Ltd. is a prominent exporter of raw cotton from India. The company has a well-established export network, catering to clients worldwide.

Arvind Limited Arvind Limited is a diversified conglomerate with significant operations in the textile sector. The company exports large volumes of cotton and cotton products to numerous countries.

Challenges and Opportunities

While the cotton export industry in India has seen considerable success, it is not without challenges. Fluctuating global cotton prices, competition from other cotton-producing countries, and logistical issues are some of the hurdles faced by Indian exporters. However, there are also significant opportunities, particularly in emerging markets and through advancements in cotton processing technologies.

India Cotton Export Statistics

A closer look at India cotton export statistics reveals interesting trends and patterns. Over the past few years, there has been a noticeable shift in the destinations of Indian cotton exports. While traditional markets like China and Bangladesh remain dominant, new markets in Southeast Asia and Africa are emerging.

Export Trends

Rising Exports to Vietnam and Indonesia These countries have seen a rapid expansion of their textile industries, leading to increased demand for raw cotton from India.

Decreased Exports to China Although China remains a major importer, its share of Indian cotton exports has decreased slightly, possibly due to its own efforts to boost domestic cotton production and imports from other sources.

Increased Exports to Bangladesh Bangladesh continues to be the largest importer of Indian cotton, driven by its massive garment manufacturing industry which relies heavily on imported cotton.

Cotton Export from India to Which Country?

Understanding the specific countries to which India exports cotton helps in comprehending the global demand dynamics. Cotton export from India to which country are spread across various regions, with Asia being the largest market. Here’s a breakdown of the major importers:

Asia

Bangladesh As the largest importer, Bangladesh accounts for a significant portion of India’s cotton exports. The country's garment industry, one of the largest in the world, depends heavily on Indian cotton.

China China, despite recent fluctuations, remains a key market for Indian cotton. The country's textile industry is vast, and Indian cotton is an essential raw material.

Vietnam Vietnam’s textile sector has grown rapidly, leading to increased imports of Indian cotton. The country is now one of the top importers of Indian cotton.

Other Regions

Turkey Turkey imports Indian cotton to support its large textile and garment manufacturing industries.

Pakistan Given its proximity and shared cultural ties, Pakistan is a significant importer of Indian cotton, although political factors sometimes affect trade.

Indonesia Indonesia's expanding textile industry also relies on imports of Indian cotton.

Future Prospects

The future of cotton export from India looks promising, with several factors likely to influence its trajectory. The Indian government’s initiatives to support agriculture and improve export infrastructure, along with advancements in cotton farming techniques, are expected to boost the sector.

Technological Advancements

Adoption of better farming techniques and genetically modified cotton varieties can significantly increase yield and quality, making Indian cotton even more competitive in the global market.

Diversification of Markets

Expanding into new markets beyond traditional ones will be crucial. African and Latin American countries present untapped potential for Indian cotton exporters.

Sustainable Practices

With increasing global emphasis on sustainability, adopting eco-friendly farming and processing methods will enhance the appeal of Indian cotton in international markets.

Conclusion

Cotton export from India remains a vital component of the country’s economy, reflecting a rich heritage and a robust agricultural sector. The continuous demand for raw cotton export from India, coupled with the efforts of leading cotton exporters in India, ensures that the country maintains its position as a top player in the global cotton market. Detailed cotton export data from India and India cotton export statistics highlight the sector’s growth and potential. As India navigates the complexities of international trade, focusing on quality, sustainability, and market diversification will be key to sustaining and enhancing its cotton export industry.

#Cotton Export from India#Raw Cotton Export from India#Cotton Exporters in India#Cotton Export Data from India#India Cotton Export Statistics#Cotton Export from India to which Country#Top Cotton Exporters in India

0 notes

Text

Signed in 1960, the *Indus Waters Treaty (IWT)* allocated the eastern rivers to India and western rivers—crucial for *80% of Pakistan’s irrigation* —to Pakistan.

Despite wars, the treaty endured. However, India’s recent suspension of key provisions, including monsoon data sharing, jeopardizes Pakistan’s flood forecasting and *crop planning.*

Pakistan’s *cotton sector, which supports 60%* of exports and 8.5% of GDP, faces severe risks.

*Hydropower* shortages could worsen its energy crisis.

While India may gain irrigation potential in Jammu & Kashmir, such moves set risky precedents amid *China’s regional water influence* .

As Pakistan faces food insecurity and economic turmoil, this *rupture* could destabilize South Asia.

Urgent dialogue and treaty modernization are critical to prevent water from becoming a *geopolitical weapon* in an already *fragile region.*

http://arjasrikanth.in/2025/04/30/13330/

0 notes

Photo

The recent imposition of a 125 per cent tariff increase on Chinese textile and apparel products by the United States marks a significant turning point in global trade dynamics. In textile and apparel products, the tariff is likely to disrupt China’s price advantage, with potential gains for Vietnam, Bangladesh, and other nations with established trade ties with the US.President Donald Trump’s recent decision to impose, effective April 10, a sweeping 125 per cent tariff on Chinese textile and apparel imports—compared to a mere 10 per cent duty on comparable goods from all other countries—has severely undermined China’s price competitiveness in the US market. This enormous tariff disparity makes Chinese products vastly more expensive than those of other suppliers, effectively pricing many Chinese goods out of contention. US importers are expected to respond by shifting orders to alternative sourcing markets to avoid the exorbitant costs, especially favouring suppliers in low-cost manufacturing countries with well-established trade ties to the United States.The imposition of a 125 per cent US tariff on Chinese apparel significantly undermines China's pricing advantage, causing importers to seek alternative sources. Countries like Vietnam, Bangladesh, and Indonesia stand to gain notably across multiple apparel categories. This trade shift presents substantial opportunities for nations with robust apparel manufacturing sectors and established trade with US. Figure 1 Source: TexProIn 2024, the United States imported apparel worth $72.99 billion from its top 15 exporting partners, accounting for approximately 87.2 per cent of its total apparel imports. China remained the leading exporter with $18.39 billion, representing 22 per cent of the market share, followed closely by Vietnam at $15.33 billion (18 per cent) and Bangladesh at $7.40 billion (9 per cent). India ranked fourth with $4.93 billion (6 per cent), showcasing its growing influence in the global apparel trade. Other significant contributors included Indonesia, Cambodia, and several Central American nations, reflecting the diversified sourcing strategy of the US apparel industry.Impact on apparel productsFibre2Fashion examines the potential impact on key apparel categories—such as jerseys, trousers, hosiery, and undergarments—among China’s top exports to the US. The imposition of steep tariffs on these products is likely to significantly drive up the cost of Chinese goods in the US market, undermining one of China’s main competitive advantages: low pricing. As China grapples with this substantial setback, countries with lower tariff exposure (around 10 per cent), robust manufacturing capabilities, and well-established trade relationships with the US are well positioned to gain from the resulting shift in sourcing strategies. Table 1: US’ top 15 apparel imports (6-digit HS code) from China, total export values, competitors, initial and new tariff rates and tariff comparison in % Source: TexProThe recent imposition of substantial tariffs by the United States on Chinese textile and apparel imports has significantly altered global trade dynamics, particularly affecting China’s competitiveness in the US market. This shift presents opportunities for other manufacturing countries to capture increased market share across various product categories. Below is an analysis of the impact on specific apparel segments:1. Hosiery (HS 611596) 2024 US Import Data: Total imports were valued at $1,532.77 million, with China contributing $1,095.28 million. Tariff Impact: An 849 per cent tariff increase on Chinese hosiery has made these products considerably more expensive. Beneficiary Countries: Vietnam, Pakistan, and El Salvador are poised to benefit. Vietnam, with its robust hosiery manufacturing infrastructure and competitive pricing, is particularly well positioned to capture a larger market share.2. Cotton Pullovers and Cardigans (HS 611020) 2024 US Import Data: Total imports stood at $7,411.20 million, with China accounting for $1,043.15 million. Tariff Impact: A 1,263 per cent tariff increase on Chinese imports creates opportunities for other suppliers. Beneficiary Countries: Vietnam, Cambodia, and Bangladesh are likely to gain. Vietnam’s established cotton garment industry positions it to capture a significant share, while Cambodia and Bangladesh offer cost advantages that appeal to US buyers.3. Man-Made Fibre Pullovers (HS 611030) 2024 US Import Data: Imports totalled $4,837.28 million, with China contributing $995.51 million. Tariff Impact: A 916 per cent tariff increase on Chinese products affects sourcing decisions. Beneficiary Countries: Vietnam, Honduras, and Indonesia stand to benefit. Vietnam’s strong synthetic garment manufacturing base makes it a primary alternative, while Honduras and El Salvador can also attract buyers seeking competitive pricing.4. Women’s Cotton Trousers and Shorts (HS 620462) 2024 US Import Data: Total imports were $4,011.92 million, with China supplying $674.59 million. Tariff Impact: A 1,606 per cent tariff increase on Chinese goods shifts demand. Beneficiary Countries: Bangladesh, Vietnam, and Pakistan are well positioned. Bangladesh’s low-cost manufacturing is particularly attractive, while Vietnam’s advanced production capabilities also make it a strong contender.5. Brassieres (HS 621210) 2024 US Import Data: Imports amounted to $2,119.78 million, with China providing $579.47 million. Tariff Impact: A 1,311 per cent tariff hike on Chinese brassieres alters market dynamics. Beneficiary Countries: Vietnam, Indonesia, and Sri Lanka are set to gain. Vietnam, already a leader in undergarments, is expected to see the most significant increase in demand, with Indonesia and Sri Lanka also capturing portions of the market.6. Synthetic Fibre Dresses (HS 620443) 2024 US Import Data: Total imports were $1,131.78 million, with China accounting for $511.95 million. Tariff Impact: A 1,115 per cent tariff increase on Chinese dresses impacts sourcing. Beneficiary Countries: Vietnam, India, and Indonesia are likely to benefit. Vietnam’s strong position in synthetic apparel makes it the prime beneficiary, while India and Indonesia offer competitive pricing that appeals to US importers.7. Gloves and Mittens (HS 611610) 2024 US Import Data: Imports totalled $852.01 million, with China supplying $502.45 million. Tariff Impact: A 1,261 per cent tariff hike on Chinese gloves and mittens affects cost structures. Beneficiary Countries: Sri Lanka, Vietnam, and Pakistan stand to gain. Sri Lanka’s specialised focus on glove manufacturing positions it to see the greatest increase in demand, while Vietnam and Pakistan offer efficient manufacturing processes that attract buyers.8. Women’s Overcoats (HS 620240) 2024 US Import Data: Total imports were $1,346.76 million, with China contributing $456.27 million. Tariff Impact: A 991 per cent tariff increase on Chinese overcoats shifts sourcing preferences. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia are well positioned. Vietnam’s strong garment export sector is expected to dominate, while Bangladesh and Indonesia can capture market share due to their competitive prices.9. Nightdresses and Pyjamas (HS 610832) 2024 US Import Data: Imports amounted to $894.75 million, with China providing $446.52 million. Tariff Impact: An 881 per cent tariff hike on Chinese products influences market dynamics. Beneficiary Countries: Vietnam, Cambodia, and Sri Lanka are poised to benefit. Vietnam’s dominant position in sleepwear makes it the primary beneficiary, with Cambodia and Sri Lanka also positioned to capture additional demand.10. Men’s Overcoats (HS 620140) 2024 US Import Data: Total imports were valued at $1,466.97 million, with China supplying $440.03 million. Tariff Impact: A 991 per cent tariff increase on Chinese men's overcoats affects sourcing strategies. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia stand to gain. Vietnam is poised to capture a significant share due to its established export network, while Bangladesh and Indonesia offer competitive alternatives.11. Sporting Apparel (HS 611430) 2024 US Import Data: The United States imported sporting apparel valued at approximately $1.02 billion, with China supplying about $404 million. Tariff Impact: The US has imposed a 599 per cent tariff increase on Chinese sporting apparel, significantly raising the cost of these imports. Potential Beneficiaries: Vietnam, Indonesia, and Cambodia are positioned to benefit from this development. Vietnam, with its efficient manufacturing capabilities and robust apparel sector, stands to gain the most. Indonesia and Cambodia may also capture market share in specific niches within the sporting apparel segment.12. Men’s Synthetic Trousers (HS 620343) 2024 US Import Data: The US imported men's synthetic trousers worth approximately $2.3 billion in 2024, with China accounting for around $377 million. Tariff Impact: A 1,190 per cent tariff increase on Chinese imports in this category has been implemented. Potential Beneficiaries: Bangladesh, Vietnam, and Indonesia are likely to benefit. Bangladesh, with its large-scale production capacity, is well positioned to capture a significant portion of the market. Vietnam and Indonesia also stand to gain due to their established manufacturing infrastructures and competitive pricing.13. Luxury Cashmere Garments (HS 611012) 2024 US Import Data: Luxury cashmere garment imports to the US were valued at approximately $512 million, with China supplying about $354 million. Tariff Impact: The US has imposed a 1,350 per cent tariff hike on Chinese luxury cashmere products. Potential Beneficiaries: Italy, Vietnam, and other European manufacturers are set to benefit. Italy, renowned for its luxury textiles and craftsmanship, is likely to see the most significant gain. Vietnam may also benefit from increased demand for mid-range cashmere products, leveraging its growing expertise in garment manufacturing.14. Felt and Nonwoven Garments (HS 621010) 2024 US Import Data: The US imported felt and nonwoven garments valued at approximately $913 million in 2024, with China contributing around $336 million. Tariff Impact: A 1,933 per cent tariff increase on Chinese imports in this category has been enacted. Potential Beneficiaries: Mexico, Honduras, and Vietnam are well positioned to absorb the shift in sourcing. Mexico, with its proximity to the US and favourable trade agreements, stands to gain significantly. Vietnam and Honduras can also benefit due to their established garment industries and competitive production costs.15. Cotton T-Shirts and Vests (HS 610910) 2024 US Import Data: In 2024, US imports of cotton T-shirts and vests totalled approximately $4.94 billion, with China supplying about $311 million. Tariff Impact: An 858 per cent tariff increase on Chinese products in this category has been imposed. Potential Beneficiaries: Vietnam, Bangladesh, and Honduras are poised to benefit. Vietnam, with its efficient supply chains and competitive pricing, is the key beneficiary. Bangladesh and Honduras are also expected to capture additional market share due to their cost-effective manufacturing capabilities and established export relationships with the US.These tariff adjustments are prompting US importers to diversify their sourcing strategies, leading to a realignment of global supply chains in the textile and apparel industry. Countries with competitive manufacturing sectors and favourable trade relations with the US are well positioned to capitalise on these changes. Fibre2Fashion News Desk (NS) Source link

0 notes

Text

Exploring Cotton Exports from India: A Profitable Opportunity in Global Trade

India has a rich tradition in textiles, particularly cotton, which forms the backbone of its industrial and agricultural sectors. Renowned for its superior quality and competitive pricing, Indian cotton is highly valued worldwide. This article delves into the key aspects of cotton exports from India, offering insights into its production, export trends, and strategies for success.

Why Cotton Exports Are Profitable in India

Cotton is one of India’s most important crops, cultivated extensively across the country. The nation’s cotton exports are valued at approximately $5 billion annually, demonstrating steady growth over the years. India's cotton production costs are significantly lower than those of other major producers, making Indian cotton highly competitive in the global market.

India accounted for over 10.2% of global raw cotton exports in 2020, making it the third-largest exporter globally. Its export revenue was $10.78 billion in 2021–22, reflecting its strong position in the market. However, this success requires ongoing research, quality assurance, and market analysis to maintain competitiveness.

Cotton Production in India

India leads the world in cotton production, cultivating the crop on 120.69 lakh hectares of land. Approximately 67% of this cultivation occurs on rain-fed land, with the remainder on irrigated land. Despite its vast production, India ranks 38th globally in productivity, with an average yield of 510 kg/ha.

The country primarily produces four species of cotton:

G. arboreum and Herbaceum (Asian cotton)

G. barbadense (Egyptian cotton)

G. hirsutum (American Upland cotton)

G. hirsutum forms the basis of India’s Bt cotton hybrids, contributing significantly to the country’s export potential. The major cotton-producing states include Gujarat, Maharashtra, Madhya Pradesh, Telangana, and Andhra Pradesh, collectively accounting for over 80% of India’s production.

Cotton Export Trends and Data

India's cotton exports are robust, with Bangladesh, China, and Vietnam being the top importers. As per cotton export data, first five months of the 2023–24 season, exports totaled 15 lakh bales, maintaining parity with the previous year. However, there has been a slight decline in overall export revenue, valued at approximately 877 billion INR in 2023.

Globally, the United States, Brazil, and Australia dominate the cotton export market, but India remains a key player due to its competitive pricing and high-quality fiber.

Leading Cotton Exporters in India

Several companies have established themselves as leaders in cotton exports from India. Notable names include:

SCM Garments Private Limited

Shahi Exports Private Limited

H.D. Textiles

Nandan Denim Limited

Trident Limited

These cotton exporters in India and others like Adinath Trading Company and Super Agri Export play a vital role in driving India’s cotton trade.

Strategies for Successful Cotton Exports

To succeed in the cotton export business, exporters must focus on the following:

Thorough Market Research: Understand global demand trends and identify high-demand regions.

Quality Assurance: Ensure consistent quality to maintain India’s reputation as a supplier of premium cotton.

Access Reliable Data: Use platforms like Eximpedia to gain insights into export data, buyer trends, and HS codes.

Build Strong Networks: Establish partnerships with reliable buyers and suppliers globally.

Conclusion

Cotton exports in India offer a lucrative opportunity for businesses in India, thanks to the country's abundant resources, skilled labor, and competitive production costs. By leveraging reliable data and adopting a strategic approach, Indian exporters can strengthen their position in the global market.

If you’re looking to expand your presence in the cotton trade, access updated and connect with leading exporters via platforms like Eximpedia. With meticulous planning and market insights, India’s cotton export industry has the potential to thrive and scale new heights in global trade.

#cotton exports from India#cotton exporters in India#cotton export companies in India#top cotton exporters in India#list of cotton exporters in India#cotton export data

0 notes

Text

#T-Shirt export business#T-Shirt export from India#T-Shirt export surplus#T-Shirt export data#T-Shirt manufacturer India#Cotton T-Shirt export

0 notes

Photo

The recent imposition of a 125 per cent tariff increase on Chinese textile and apparel products by the United States marks a significant turning point in global trade dynamics. In textile and apparel products, the tariff is likely to disrupt China’s price advantage, with potential gains for Vietnam, Bangladesh, and other nations with established trade ties with the US.President Donald Trump’s recent decision to impose, effective April 10, a sweeping 125 per cent tariff on Chinese textile and apparel imports—compared to a mere 10 per cent duty on comparable goods from all other countries—has severely undermined China’s price competitiveness in the US market. This enormous tariff disparity makes Chinese products vastly more expensive than those of other suppliers, effectively pricing many Chinese goods out of contention. US importers are expected to respond by shifting orders to alternative sourcing markets to avoid the exorbitant costs, especially favouring suppliers in low-cost manufacturing countries with well-established trade ties to the United States.The imposition of a 125 per cent US tariff on Chinese apparel significantly undermines China's pricing advantage, causing importers to seek alternative sources. Countries like Vietnam, Bangladesh, and Indonesia stand to gain notably across multiple apparel categories. This trade shift presents substantial opportunities for nations with robust apparel manufacturing sectors and established trade with US. Figure 1 Source: TexProIn 2024, the United States imported apparel worth $72.99 billion from its top 15 exporting partners, accounting for approximately 87.2 per cent of its total apparel imports. China remained the leading exporter with $18.39 billion, representing 22 per cent of the market share, followed closely by Vietnam at $15.33 billion (18 per cent) and Bangladesh at $7.40 billion (9 per cent). India ranked fourth with $4.93 billion (6 per cent), showcasing its growing influence in the global apparel trade. Other significant contributors included Indonesia, Cambodia, and several Central American nations, reflecting the diversified sourcing strategy of the US apparel industry.Impact on apparel productsFibre2Fashion examines the potential impact on key apparel categories—such as jerseys, trousers, hosiery, and undergarments—among China’s top exports to the US. The imposition of steep tariffs on these products is likely to significantly drive up the cost of Chinese goods in the US market, undermining one of China’s main competitive advantages: low pricing. As China grapples with this substantial setback, countries with lower tariff exposure (around 10 per cent), robust manufacturing capabilities, and well-established trade relationships with the US are well positioned to gain from the resulting shift in sourcing strategies. Table 1: US’ top 15 apparel imports (6-digit HS code) from China, total export values, competitors, initial and new tariff rates and tariff comparison in % Source: TexProThe recent imposition of substantial tariffs by the United States on Chinese textile and apparel imports has significantly altered global trade dynamics, particularly affecting China’s competitiveness in the US market. This shift presents opportunities for other manufacturing countries to capture increased market share across various product categories. Below is an analysis of the impact on specific apparel segments:1. Hosiery (HS 611596) 2024 US Import Data: Total imports were valued at $1,532.77 million, with China contributing $1,095.28 million. Tariff Impact: An 849 per cent tariff increase on Chinese hosiery has made these products considerably more expensive. Beneficiary Countries: Vietnam, Pakistan, and El Salvador are poised to benefit. Vietnam, with its robust hosiery manufacturing infrastructure and competitive pricing, is particularly well positioned to capture a larger market share.2. Cotton Pullovers and Cardigans (HS 611020) 2024 US Import Data: Total imports stood at $7,411.20 million, with China accounting for $1,043.15 million. Tariff Impact: A 1,263 per cent tariff increase on Chinese imports creates opportunities for other suppliers. Beneficiary Countries: Vietnam, Cambodia, and Bangladesh are likely to gain. Vietnam’s established cotton garment industry positions it to capture a significant share, while Cambodia and Bangladesh offer cost advantages that appeal to US buyers.3. Man-Made Fibre Pullovers (HS 611030) 2024 US Import Data: Imports totalled $4,837.28 million, with China contributing $995.51 million. Tariff Impact: A 916 per cent tariff increase on Chinese products affects sourcing decisions. Beneficiary Countries: Vietnam, Honduras, and Indonesia stand to benefit. Vietnam’s strong synthetic garment manufacturing base makes it a primary alternative, while Honduras and El Salvador can also attract buyers seeking competitive pricing.4. Women’s Cotton Trousers and Shorts (HS 620462) 2024 US Import Data: Total imports were $4,011.92 million, with China supplying $674.59 million. Tariff Impact: A 1,606 per cent tariff increase on Chinese goods shifts demand. Beneficiary Countries: Bangladesh, Vietnam, and Pakistan are well positioned. Bangladesh’s low-cost manufacturing is particularly attractive, while Vietnam’s advanced production capabilities also make it a strong contender.5. Brassieres (HS 621210) 2024 US Import Data: Imports amounted to $2,119.78 million, with China providing $579.47 million. Tariff Impact: A 1,311 per cent tariff hike on Chinese brassieres alters market dynamics. Beneficiary Countries: Vietnam, Indonesia, and Sri Lanka are set to gain. Vietnam, already a leader in undergarments, is expected to see the most significant increase in demand, with Indonesia and Sri Lanka also capturing portions of the market.6. Synthetic Fibre Dresses (HS 620443) 2024 US Import Data: Total imports were $1,131.78 million, with China accounting for $511.95 million. Tariff Impact: A 1,115 per cent tariff increase on Chinese dresses impacts sourcing. Beneficiary Countries: Vietnam, India, and Indonesia are likely to benefit. Vietnam’s strong position in synthetic apparel makes it the prime beneficiary, while India and Indonesia offer competitive pricing that appeals to US importers.7. Gloves and Mittens (HS 611610) 2024 US Import Data: Imports totalled $852.01 million, with China supplying $502.45 million. Tariff Impact: A 1,261 per cent tariff hike on Chinese gloves and mittens affects cost structures. Beneficiary Countries: Sri Lanka, Vietnam, and Pakistan stand to gain. Sri Lanka’s specialised focus on glove manufacturing positions it to see the greatest increase in demand, while Vietnam and Pakistan offer efficient manufacturing processes that attract buyers.8. Women’s Overcoats (HS 620240) 2024 US Import Data: Total imports were $1,346.76 million, with China contributing $456.27 million. Tariff Impact: A 991 per cent tariff increase on Chinese overcoats shifts sourcing preferences. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia are well positioned. Vietnam’s strong garment export sector is expected to dominate, while Bangladesh and Indonesia can capture market share due to their competitive prices.9. Nightdresses and Pyjamas (HS 610832) 2024 US Import Data: Imports amounted to $894.75 million, with China providing $446.52 million. Tariff Impact: An 881 per cent tariff hike on Chinese products influences market dynamics. Beneficiary Countries: Vietnam, Cambodia, and Sri Lanka are poised to benefit. Vietnam’s dominant position in sleepwear makes it the primary beneficiary, with Cambodia and Sri Lanka also positioned to capture additional demand.10. Men’s Overcoats (HS 620140) 2024 US Import Data: Total imports were valued at $1,466.97 million, with China supplying $440.03 million. Tariff Impact: A 991 per cent tariff increase on Chinese men's overcoats affects sourcing strategies. Beneficiary Countries: Vietnam, Bangladesh, and Indonesia stand to gain. Vietnam is poised to capture a significant share due to its established export network, while Bangladesh and Indonesia offer competitive alternatives.11. Sporting Apparel (HS 611430) 2024 US Import Data: The United States imported sporting apparel valued at approximately $1.02 billion, with China supplying about $404 million. Tariff Impact: The US has imposed a 599 per cent tariff increase on Chinese sporting apparel, significantly raising the cost of these imports. Potential Beneficiaries: Vietnam, Indonesia, and Cambodia are positioned to benefit from this development. Vietnam, with its efficient manufacturing capabilities and robust apparel sector, stands to gain the most. Indonesia and Cambodia may also capture market share in specific niches within the sporting apparel segment.12. Men’s Synthetic Trousers (HS 620343) 2024 US Import Data: The US imported men's synthetic trousers worth approximately $2.3 billion in 2024, with China accounting for around $377 million. Tariff Impact: A 1,190 per cent tariff increase on Chinese imports in this category has been implemented. Potential Beneficiaries: Bangladesh, Vietnam, and Indonesia are likely to benefit. Bangladesh, with its large-scale production capacity, is well positioned to capture a significant portion of the market. Vietnam and Indonesia also stand to gain due to their established manufacturing infrastructures and competitive pricing.13. Luxury Cashmere Garments (HS 611012) 2024 US Import Data: Luxury cashmere garment imports to the US were valued at approximately $512 million, with China supplying about $354 million. Tariff Impact: The US has imposed a 1,350 per cent tariff hike on Chinese luxury cashmere products. Potential Beneficiaries: Italy, Vietnam, and other European manufacturers are set to benefit. Italy, renowned for its luxury textiles and craftsmanship, is likely to see the most significant gain. Vietnam may also benefit from increased demand for mid-range cashmere products, leveraging its growing expertise in garment manufacturing.14. Felt and Nonwoven Garments (HS 621010) 2024 US Import Data: The US imported felt and nonwoven garments valued at approximately $913 million in 2024, with China contributing around $336 million. Tariff Impact: A 1,933 per cent tariff increase on Chinese imports in this category has been enacted. Potential Beneficiaries: Mexico, Honduras, and Vietnam are well positioned to absorb the shift in sourcing. Mexico, with its proximity to the US and favourable trade agreements, stands to gain significantly. Vietnam and Honduras can also benefit due to their established garment industries and competitive production costs.15. Cotton T-Shirts and Vests (HS 610910) 2024 US Import Data: In 2024, US imports of cotton T-shirts and vests totalled approximately $4.94 billion, with China supplying about $311 million. Tariff Impact: An 858 per cent tariff increase on Chinese products in this category has been imposed. Potential Beneficiaries: Vietnam, Bangladesh, and Honduras are poised to benefit. Vietnam, with its efficient supply chains and competitive pricing, is the key beneficiary. Bangladesh and Honduras are also expected to capture additional market share due to their cost-effective manufacturing capabilities and established export relationships with the US.These tariff adjustments are prompting US importers to diversify their sourcing strategies, leading to a realignment of global supply chains in the textile and apparel industry. Countries with competitive manufacturing sectors and favourable trade relations with the US are well positioned to capitalise on these changes. Fibre2Fashion News Desk (NS) Source link

0 notes

Text

Why Supima Cotton Prices Are Falling: TexPro Insights

Supima cotton, the premium American-grown variety of Pima cotton, is renowned for its exceptional softness, strength, and durability. Traditionally associated with luxury textiles, Supima commands a niche segment of the cotton market. However, since late 2023 and continuing into 2025, Supima cotton prices have experienced a steady decline—prompting concern and curiosity across the textile supply chain.

Through TexPro’s real-time price tracking and market intelligence tools, we analyze the key factors behind this downward trend and its implications for buyers, traders, and manufacturers.

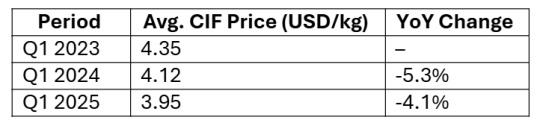

Supima Cotton Price Trends: 2023–2025 Snapshot

According to TexPro data, Supima cotton prices have declined by approximately 7–9% year-on-year from mid-2023 to early 2025. The average global CIF (Cost, Insurance, Freight) prices for Supima have fallen from $4.35/kg in Q1 2023 to $3.95/kg in Q1 2025, with variations depending on export destinations and fiber grades.

While monthly fluctuations occur, the general price trajectory has been downward—driven by a mix of macroeconomic and sector-specific factors.

Key Reasons for Falling Supima Cotton Prices

1. Muted Demand in Luxury Textile Segments

Luxury and premium apparel brands—traditional users of Supima—have curtailed large-scale procurement due to:

Slower consumer spending in key markets (US, EU, Japan)

Increased interest in cost-effective blends or synthetics

A cautious approach to inventory after COVID-19 supply chain disruptions

This has translated into reduced offtake from spinning mills and exporters, weakening price momentum.

2. Oversupply and Stockpile Pressure

Following strong demand in 2021–2022, many manufacturers overstocked Supima fabrics and yarns during the rebound period. By mid-2023:

Warehouses reported excess inventory

Mills began delaying orders

Traders had to liquidate stocks at reduced prices

This situation has placed consistent downward pressure on pricing, especially in export markets like Turkey, Bangladesh, and China.

3. Strong U.S. Dollar Impact

The strengthening of the U.S. dollar (USD) throughout 2024–2025 has made American cotton—including Supima—less competitive in global markets. Importers in developing countries have shifted toward:

Cheaper local varieties

Alternative ELS cotton from Egypt, India, and Central Asia

This currency impact has eroded price competitiveness, particularly for spot and short-term contracts.

4. Increased Global Competition

Although Supima holds a unique position in terms of quality, other long and extra-long staple varieties are gaining ground:

Giza 86 & 94 (Egypt): Stronger branding and quality improvements

MCU-5 (India): Cost-efficient and widely available

ELS cotton from Uzbekistan and Turkmenistan

Some mills, especially in price-sensitive regions, are willing to compromise slightly on quality in favor of 20–25% lower raw material costs.

5. Supply Resilience in the U.S.

Despite falling prices, Supima cotton production in the U.S. remained steady during the 2023–2024 season, thanks to:

Stable weather conditions

Improved pest control and yield optimization

Producer contracts already in place

This stable output has prevented natural corrections in supply, maintaining a price oversupply imbalance.

TexPro’s Supima Cotton Price Monitoring System

TexPro continuously monitors Supima cotton through:

CIF pricing from key ports (e.g., Shanghai, Dhaka, Izmir, Karachi)

Monthly and quarterly trend reports

9–12 month predictive forecasting

Comparison against Pima, Giza, and other ELS varieties

This allows textile professionals to:

Evaluate sourcing windows

Benchmark Supima against alternatives

Align procurement decisions with forecasted movements

TexPro also provides volatility indices and moving averages, helping users identify price bottoms and peaks for better negotiation leverage.

Impact on Buyers & Sourcing Strategy

Opportunities:

More affordable procurement of premium cotton

Ideal time for stock replenishment or forward buying

Ability to upgrade product quality without proportionally increasing costs

Risks:

Volatility could return with weather or policy disruptions

Uncertainty in future global demand recovery

Difficulty in long-term price commitments

Buyers should assess contract flexibility, explore blending options, and closely monitor TexPro forecasts for signs of market reversal.

2025 Outlook: Will Supima Prices Recover?

While short-term sentiment remains bearish, prices may stabilize in late 2025 due to:

Inventory normalization

Potential cutbacks in 2025 planting areas

Return of retail demand in premium categories

However, the extent of any recovery will depend on exchange rates, competing cotton supply, and consumer sentiment across key markets.

Stay Ahead of Supima Market Movements with TexPro

Access real-time Supima price analytics

Get 12-month forecasts and volatility reports

Compare Supima against other ELS cotton types globally

Request a Demo or Start Your Free Trial Today

0 notes