#CurrencyExchangeRate

Explore tagged Tumblr posts

Text

रुपया-डॉलर का हाल | विदेशी मुद्रा विनिमय बाजार की स्थिति

घरेलू बाजार शुक्रवार को शुरुआती कारोबार में बढ़त के साथ खुले। बीएसई सेंसेक्स 235.61 अंक बढ़कर 65,743.93 पर पहुंच गया। एनएसई निफ्टी 76.7 अंक बढ़कर 19,600.25 पर रहा। सेंसेक्स की कंपनियों में एनटीपीसी, टाटा मोटर्स, जेएसडब्ल्यू स्टील, टाटा स्टील, भारतीय स्टेट बैंक, लार्सन एंड टुब्रो, रिलायंस इंडस्ट्रीज लिमिटेड, सन फार्मा, भारती एयरटेल, और आईटीसी के शेयर लाभ में रहे। इंफोसिस, विप्रो, एशियन पेंट्स, एचसीएल टेक्नोलॉजीज, टाटा कंसल्टेंसी सर्विसेज, और एक्सिस बैंक के शेयर में गिरावट आई।

#RupeeDollarExchange#ForexMarketUpdate#CurrencyExchangeRate#INRvsUSD#EconomicTrends#CurrencyFluctuations#ForeignExchangeNews#FinancialMarkets#DollarValue#GlobalEconomy

0 notes

Text

0 notes

Text

The precious metals market in Nepal expe... #2nd #bulliondealers #bullionimportandexport #bullioninvestmentadvisors #bullioninvestmentopportunities #bullioninvestmentrisks #bullioninvestors #bullionmarketanalysis #bullionmarketcommentary #bullionmarketcommunityforums #bullionmarketdataanalysis #bullionmarketdiscussions #bullionmarketeducation #bullionmarketexpertopinions #bullionmarketinsights #bullionmarketnews #bullionmarketregulations #bullionmarketreports #bullionmarketresearch #bullionmarkettransparency #bullionmarkettrends #bullionpriceforecasts #bullionqualityassurance #bullionrefining #bullionsupplyanddemand #bulliontaxation #bulliontrading #bulliontradingplatforms #culturaltraditions #currencyexchangerates #day #decline #FederationofNepalGoldandSilverDealersAssociation #finegoldprices #geopoliticaltensions #globalpreciousmetalsdemand #gold #goldornaments #goldpricedecline #jewelrymanufacturing #longterminvestmentstrategies #miningproductionlevels #nepalbullionmarket #nepalgoldprices #nepalsilverprices #portfoliodiversification #preciousmetalsinvestments #Preciousmetalsmarket #preciousmetalstrading #preciousmetalsvolatility #Price #Silver #silverornaments #silverpricedrop #tejabigoldprices

0 notes

Text

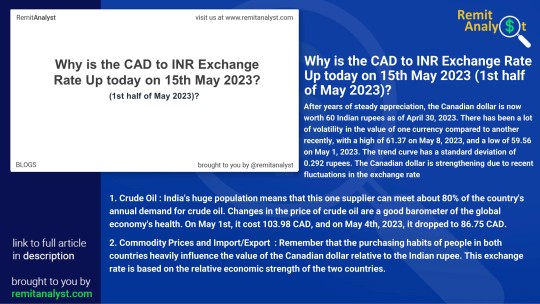

In the dynamic world of currency exchange rates, the CAD to INR pair has experienced notable fluctuations during the first half of May 2023. After years of consistent appreciation, the Canadian dollar has strengthened against the Indian rupee, with the exchange rate reaching 60 INR on April 30, 2023.

However, this value has not remained static. Throughout the month, the CAD to INR exchange rate has exhibited significant volatility, with a peak of 61.37 on May 8, 2023, and a low of 59.56 on May 1, 2023. The trend curve shows a standard deviation of 0.292 rupees, indicating the extent of these fluctuations.

The recent appreciation of the Canadian dollar can be attributed to various factors. One potential cause is the presence of foreign capital imbalances. When there is an influx of foreign investment in a country, it can lead to an increase in demand for its currency, resulting in its appreciation. This influx of foreign capital into Canada might have contributed to the strengthening of the Canadian dollar.

Additionally, the price and demand for petrol have played a role in the CAD to INR exchange rate dynamics. As the price of petrol increases, it can impact the Canadian economy positively, as Canada is a significant exporter of oil. This positive impact can lead to a stronger currency valuation.

It's important to note that exchange rates are influenced by a multitude of complex factors, including economic indicators, geopolitical events, and market sentiment. Understanding and predicting these fluctuations can be challenging, as they are influenced by a wide range of variables.

In summary, the CAD to INR exchange rate has seen fluctuations and appreciation during the first half of May 2023. Factors such as foreign capital imbalances and increases in the price and demand for petrol have likely contributed to this trend. However, it's essential to closely monitor the ever-changing dynamics of the global market to gain a comprehensive understanding of currency exchange rates.

#CurrencyExchangeRates#CADtoINR#Fluctuations#GlobalMarkets#ForeignInvestment#PetrolPrices#EconomicIndicators

0 notes

Text

FX Rate: Here Is What You Need To Know About It

In the currency exchange marketplace, there exists an economic theory which outlines the conditions for the perfect condition. Foreign exchange market, also called FX or Forex is the marketplace that approaches near to the ideal for perfect competition.

Basic of Foreign exchange Marketplace

Currencies are always traded on the global foreign exchange marketplace on an approximately 24X7 basis, excluding a few hours on the weekends. The market is always accessible to those who want to buy and sell currencies including banks, currency brokers, hedge funds and individuals. The value of a currency as compared to another is set via an arcane series of calculations dependent on financial data, including both objective and subjective.

Factors Affecting a Currency Value in the Market

Currencies keep on fluctuating throughout a day. Several large banks will fix their exchange rates two times in a day. The leading institutional investors and currency investors may make a good deal of transactions every day to gain profits.

Below are the three main factors which affect a currency value in the market:

#Political conditions: Currency traders prefer a stable political environment. Any kind of instability or upheavals like a civil war or attempted coupe negatively affects a nation’s currency.

#Financial factors: Financial factors are the most precise ones and include things like GDP, inflation, economic regulations, surpluses, inflation and deficits.

#Market psychology: There are certain currencies which are known for being a mode of a safe investment. Numerous investors will purchase those currencies heavily to save their profits and assets during times of instability and unrest.

How Foreign Exchange Affect People?

The constantly changing currency exchange values get unnoticed by most of us. We witness changes in the prices of certain goods like food, electronics, clothing or petrol based on the currency value in the country of origin. The impact of FX can be usually felt in two situations like travelling abroad and sending money outside the country. When you travel to a country which does not accept pound or euro, it is a must for you to purchase the local currency. When you send money back to home, the exchange rate is very obvious and leaves a direct impact. During the time of making a remittance, you must aim to send the biggest amount of money as possible. There are banks and other money transfer operators who frequently set FX rates which are in favour of institutions. After that, they include transfer fees and commission.

The theory of perfect competition and FX trading may need an excellent economics degree. The worth of saving approximately 90% in fees when sending money to home demands common sense. As now you are aware of the basics and impact of FX in the marketplace, you can always make the right decisions in currency exchange trading in the future. Keep the discussed things in your mind and stay updated about the changes in currency exchange rates to walk into the right path and make money.

0 notes

Link

REWRITING THE FUTURE OF E-COMMERCE ON BLOCKCHAIN

#CryptocurrencyTradingMarket#AUSCoin#CurrencyExchange#Blockchain#CurrencyExchangeRate#CryptocurrencyMarket

0 notes

Text

Why Are Forex Cards Superior to Cash When Travelling?

Summary

Cash has always been thought of as being the most convenient form of currency. However, forex cards are quickly becoming the currency of choice for many travellers. This article looks at some of the main reasons that forex cards are a superior form of currency.

Travelling to another country requires travellers to carry some form of currency with them, which is acceptable in the country of travel. One could carry cash in the currency of the destination country, but carrying cash comes with its own set of hindrances, such as risk of theft or losing the same. A prepaid forex card is an extremely convenient and secure form of currency and is increasingly gaining in popularity as more people realize its benefits. This article looks at some of the main reasons why it is better to carry forex cards than cash when travelling to another country. Some of these reasons are:

1. Easier to Carry and Use

An important advantage of forex cards over cash is that they are accepted almost everywhere. One can use a forex card to pay for shopping at a mall, or for entry into a museum, or to dine in a fancy restaurant. They are almost universally accepted as long as the place of purchase has the ability to swipe cards, which is common in today’s time. In addition, if one has already locked in the currency exchange rate on card, he/she can avoid disastrous foreign exchange currency fluctuations if and when they do occur. Moreover, travellers can carry more than one type of currency on a forex card, in case they intend to travel to several places with different currencies.

2. Safer

Losing one’s wallet in a foreign country can be a nightmare, especially if the wallet had a lot of cash. With a forex card, losing one’s wallet need not be such a disaster financially, since forex cards can be blocked quickly, similar to debit and credit cards. This makes forex cards much safer and convenient than carrying cash.

3. More Economical than Debit or Credit Cards

Forex cards also usually tend to be more economical to use in a foreign country than a debit or credit card issued in India. When using debit or credit cards issued in India at a foreign location, there is always foreign currency exchange conversion costs and this occurs on every transaction. However, with a forex card, the foreign currency exchange conversion occurs in India at the prevailing currency exchange rate and there are no further currency exchange charges when the forex card is swiped at the foreign destination.

Currency exchange rates in India can vary across regions and different service providers and it is always good to keep track of foreign currency exchange rates. Thus, when one is looking to get a forex card, one should choose a reliable currency exchange forex broker by researching the lowest conversion fee and best currency exchange rate to avail the most of their money.

Thus, the aforementioned features of a Forex Currency Card make it highly useful when travelling abroad.

#CurrencyExchangeRate#CurrencyExchangeRatesInIndia#ForeignCurrencyExchange#CurrencyExchangeForex#RateOfForeignExchange

0 notes

Photo

It’s All About The Context: External Factors That Affect Currency Valuation https://www.learntotrade.co.uk/factors-affecting-exchange-rates/

#foreignexchangemarket#currencyexchangerates#currencyvaluation#profit#globalevents#forexeducation#tradersir

0 notes

Text

currency exchange Rate

Here is a guide to what to look out for.

Sell rate – this is the rate at which we sell foreign currency in exchange for local currency. For example, if you were heading to Canada, you would exchange your currency for Canadian dollars at the sell rate. Buy rate – this is the rate at which we buy foreign currency back from travellers to exchange into local currency. For example, if you were returning from America, we would exchange your dollars back into euros at the buy rate. Holiday money rate or tourist rate – another term for a sell rate. Spot rate – This is known more formally as the ‘interbank’ rate. It is the rate banks or large financial institutions charge each other when trading significant amounts of foreign currency. In the business, this is sometimes referred to as a ‘spot rate’. It is not the tourist rate and you cannot buy currency at this rate, as you are buying relatively small amounts of foreign currency. In everyday life it is the same as the difference between wholesale and retail prices. The rates shown in financial newspapers and in broadcast media are usually the interbank rates. Spread – This is the difference between the buy and sell rates offered by a foreign-exchange provider such as us.

0 notes

Text

The Nepali gold market witnessed a signi... #bulliondealersnepal #currencyexchangerates #falls #finegoldprices #geopoliticaldevelopments #globaleconomicfactors #globalmarkettrends #gold #goldandsilverfederationnepal. #goldinvestment #goldmarketcorrection #goldmarketdynamics #goldmarketforecast #goldpricedecline #goldpricedrivers #goldpricefluctuations #goldpricesnepal #goldtradingstrategies #inflationhedge #investorsentiment #marketvolatility #Nepalibullionmarket #Nepaligoldmarket #Nepaliinvestmentopportunities #nepalijewelryindustry #portfoliodiversification #preciousmetalsanalysis #preciousmetalsdemand #preciousmetalsinvestment #Preciousmetalsmarket #preciousmetalssupply #Price #riskmanagement #Silver #silverpricesnepal #stable #tejabigoldprices

0 notes

Link

Before you leave your home country, make sure you are properly vaccinated as per the laws of the new country. Also discuss your existing medical prescriptions with your doctor. Check with your medical insurance provider if your policy covers you oversees. In case if it doesn’t, you will need international travel health insurance cover.

0 notes

Text

Money Exchange Kuwait | Kuwait Exchange | Lulu Exchange

Lulu Exchange is a reliable money exchange in Kuwait that helps you to exchange or send money to anywhere with ease.

https://luluexchange.com/kuwait/

#moneyexchange #moneyexchangeinkuwait #currencyexchangekuwait #luluexchangekuwait #exchangerates #todayexchangerate #kuwaitexchangerate #currencyexchangerate #todaysexchangerateinkuwait #exchangerateinkuwait #luluexchangerate #luluexchangeratekuwait #luluexchangekuwaittodayrate #luluexchange #exchangesinkuwait #TodaysBestCurrencyExchangeRatesKuwait

0 notes

Link

Get live exchange rates for major currency pairs for free from DoorstepForex

0 notes