#USDollar

Text

Experts are warning that the U.S. government is secretly planning to freeze all American bank withdrawals in the coming months due to the imminent collapse of the U.S. dollar.

15 notes

·

View notes

Text

My usd Commisions are open!! I’m saving up for a tattoo! I need around 250$ so anything helps!

They start at 20$ :3

Here are some examples!

#good omens#crowley#aziraphale#angel#fallen angel#innefable husbands#lgbtq pride#lgbtqa#lgbtqplus#artists on tumblr#usdollar#cashapp#paypal#art commisions#digital commisions#art commissions open#tattoos

17 notes

·

View notes

Text

Hihi! I'm Morgan and I really need some money to help pay for college and to move out so I'm selling some characters!

Waffle bag is $2

Color Pallete one is $1

🍓 girl is $3

Rosaina Moth is $3

Daisy Moth is $3

Peach Moth is $3

I can take Cashapp (prefered) but if you have a different method dm me and I'll confirm I take it or not!!

#artwork#money slave#i need money#art adopts#adopts#usdollar#cashapp#art for money#commisions open#digital aritst#digital illustration#digital commissions open#art#artists on tumblr#waffles#strawberies#strawberry#strawberry girl#peach#princess peach#rosalina#daisy

14 notes

·

View notes

Text

My View this week on #USD and #JPY pair,

Before taking any trade there confirmation and other confluence behind, so before taking this trade look for confirmation, if u don’t see anything please don’t trade u gonna lose money

if u wanna now more DM is open,

Forex is all about logic, not always going to work but, we look for higher possibility to work

Let’s win together

#forextips#forexsignals#forexmoney#forex#foryou#forexeducation#forexstrategy#education#usdollar#usd / jpy#gold#xauusd

13 notes

·

View notes

Text

Gelin beraber kazanalim kazanmak için mesaj atmanız yeterli ...

2 notes

·

View notes

Text

Reselling a character for $60! Need to sell by Friday!

ToyHouse:

https://toyhou.se/14960759.oni-naga

3 notes

·

View notes

Text

Bank of Japan: Intervention nach abruptem Währungsabsturz und mögliche Auswirkungen auf den globalen Devisenmarkt

In einer Welt, in der die Finanzmärkte oft von unvorhersehbaren Ereignissen geprägt sind, scheint sich eine neue Geschichte zu entfalten, die selbst die kühnsten Vorstellungen übertrifft. Neue Beweise legen nahe, dass die Bank of Japan (BOJ) am Montag eingegriffen hat, als der japanische Yen plötzlich abgestürzt ist.

Am Sonntagabend, um 21:30 Uhr Eastern Time, erlebte der japanische Yen einen dramatischen Rückgang und schwächte sich zum ersten Mal seit 1990 auf 160 gegenüber dem US-Dollar ab. Doch was noch bemerkenswerter ist, ist die Tatsache, dass genau 2,5 Stunden nach den ersten Meldungen der Kurs von 160,20 auf 156,50 einbrach.

Heute, nachdem der Staub sich etwas gelegt hat, gibt die BOJ bekannt, dass ihr laufendes Konto einen Rückgang von 7,56 BILLIONEN Yen oder 48,2 Milliarden US-Dollar verzeichnen wird – mehr als das DREIFACHE der bisherigen Erwartungen.

Die Frage drängt sich auf: Hat die BOJ kurz nach dem Zusammenbruch ihrer Währung künstlich interveniert? Einige Marktbeobachter und Analysten hegen den Verdacht, dass hinter den Kulissen ungewöhnliche Maßnahmen ergriffen wurden, um den Yen zu stabilisieren.

Einige Stimmen äußerten Zweifel an der plötzlichen Natur des Zusammenbruchs des Yen-Kurses. Es scheint merkwürdig, dass die Währung nur Minuten nach Erreichen der kritischen Schwelle von 160 so stark abgestürzt ist. Dies weckt Spekulationen über mögliche Interventionen seitens der BOJ oder anderer involvierter Parteien.

Die jüngsten Daten deuten darauf hin, dass die BOJ tatsächlich am Montag intervenierte. In einer Erklärung am Dienstag gab die BOJ bekannt, dass der unerwartet hohe Rückgang des laufenden Kontos auf "fiskalische Faktoren, einschließlich der Ausgabe von Staatsanleihen und Steuerzahlungen am Mittwoch", zurückzuführen sei.

Die Höhe dieses Rückgangs, der mit mehr als dem Dreifachen der vorherigen Schätzungen übereinstimmt, wirft jedoch weitere Fragen auf. Es wird spekuliert, dass die BOJ wahrscheinlich zum ersten Mal seit 2022 mit einem beträchtlichen Betrag von 5,5 BILLIONEN Yen interveniert hat. Diese Maßnahme signalisiert nicht nur eine erhöhte Besorgnis seitens der japanischen Behörden über die Stabilität ihrer Währung, sondern könnte auch die Glaubwürdigkeit zukünftiger Interventionen beeinträchtigen, da das Vertrauen in die Maßnahmen der Zentralbank abnimmt.

Doch welche Auswirkungen könnte diese Entwicklung auf den globalen Devisenmarkt haben, insbesondere auf den Euro und den US-Dollar?

Ein plötzlicher Absturz des japanischen Yen könnte dazu führen, dass Anleger ihr Vertrauen in die Währung verlieren und ihre Vermögenswerte in andere Währungen verlagern, darunter auch den Euro und den US-Dollar. Dies könnte zu einer Aufwertung des Euro und des Dollars führen, was wiederum Auswirkungen auf die wirtschaftliche Entwicklung im Euro- und Dollarraum haben könnte.

Eine starke Aufwertung des Euro und des Dollars könnte die Exporte in diesen Regionen verteuern und die Wettbewerbsfähigkeit der exportorientierten Unternehmen beeinträchtigen. Gleichzeitig könnte eine Aufwertung des Euro und des Dollars die Importe verbilligen und die Kaufkraft der Verbraucher erhöhen, was positive Auswirkungen auf das Wirtschaftswachstum haben könnte.

Jedoch könnte eine zu starke Aufwertung des Euro und des Dollars auch negative Auswirkungen haben, wie zum Beispiel eine Verringerung der Wettbewerbsfähigkeit der exportorientierten Unternehmen und eine Verschlechterung der Handelsbilanz. Daher werden die Zentralbanken und Regierungen im Euro- und Dollarraum die Entwicklungen auf dem Devisenmarkt genau beobachten und möglicherweise Maßnahmen ergreifen, um eine übermäßige Aufwertung ihrer Währungen zu verhindern.

Insgesamt bleibt die Situation um den Yen und die möglichen Auswirkungen auf den globalen Devisenmarkt und die wirtschaftliche Entwicklung im Euro- und Dollarraum ein faszinierendes Kapitel in der Geschichte der Finanzmärkte, das die Welt der Wirtschafts- und Finanzanalysten weiterhin in Atem hält.

#BankofJapan#Intervention#Währungsabsturz#Devisenmarkt#JapanischerYen#Euro#USDollar#Finanzmärkte#Zentralbanken#Wirtschaftsentwicklung#Export#Import#Wettbewerbsfähigkeit#Handelsbilanz#Währungsaufwertung

0 notes

Text

Emerging Markets Battle Weak Currencies As Dollar Crushes Peers

Emerging economies, particularly in Asia, are struggling with a strengthening US dollar. This has forced central banks to take various measures to protect their currencies.

Central Banks Step Up Intervention

The recent surge in the dollar’s value is putting pressure on emerging market currencies. Several central banks have signaled their readiness to intervene. Malaysia’s central bank stands ready to support the ringgit, while South Korea, Thailand, and Poland are closely monitoring currency volatility. Indonesia has actively intervened by selling dollars, and China has used its yuan fixing mechanism to maintain stability.

This intervention stems from concerns about the Federal Reserve’s monetary policy. Stronger-than-expected US inflation data has dampened hopes of interest rate cuts, which would weaken the dollar. This, in turn, would alleviate pressure on emerging market currencies. Additionally, rising tensions in the Middle East could further increase demand for the dollar as a safe haven asset.

Verbal Intervention and Direct Action

Some central banks are resorting to verbal warnings to influence currency markets. Thailand, for example, is emphasizing its commitment to managing volatility. Similarly, Poland has warned of potential intervention to bolster the zloty. South Korea is also keeping a close eye on the won’s movements.

Other central banks are taking more direct action. Indonesia has intervened by buying rupiah to limit losses. Peru has surprised markets by cutting interest rates while also reportedly selling dollars to support the sol. Notably, Israel also sold dollars to protect the shekel after a recent conflict.

China’s Balancing Act

China faces a unique challenge. Weakening the yuan could encourage capital flight, while propping it up could worsen the economic slowdown. The People’s Bank of China has prioritized stability by keeping the yuan fixing within a tight range. However, continued dollar strength may force them to deploy additional tools.

Investment Opportunities?

While the dollar’s dominance shows no signs of immediate abating, some analysts see this as a potential buying opportunity for beaten-down emerging market currencies. The delay in expected Fed rate cuts creates headwinds for these currencies, but it could also present a chance to “buy the dip” in regional assets. This article highlights the ongoing battle between emerging market central banks and the strengthening US dollar. It explores the various intervention strategies used and the challenges faced by policymakers in these economies.

Also Read: Shimao Group Faces Liquidation Petition Amidst China’s Property Sector Turmoil

0 notes

Photo

Unglaublicher Lottogewinn in den USA | CeBoz.com

Ein glücklicher Gewinner aus den USA erlebt einen unvergesslichen Moment, als er den Jackpot knackt.

0 notes

Text

Positive Economic Boost as US Inflation Shows Signs of Deceleration!

Logic Finance- In November, prices in the United States experienced a notable decline, marking the first decrease in over three and a half years. This downturn contributed to a reduction in the annual inflation rate, pushing it further below the 3% threshold. Consequently, financial markets are increasingly anticipating a potential interest rate cut by the Federal Reserve in the coming March.

The recent report released by the Commerce Department on Friday revealed a persistent easing of underlying inflation pressures. This moderation in inflation not only alleviates economic concerns but also leaves households with more disposable income. This surplus income is expected to bolster consumer spending, providing crucial support to the overall economy as we approach the end of the year.

Yet another dataset underscores the robustness of the ongoing economic expansion, a resilience attributed to a steadfast labor market. Contrary to dire predictions of a recession by economists and certain business leaders since late 2022, the economy has demonstrated impressive endurance.

According to Sal Guatieri, a senior economist at BMO Capital Markets in Toronto, "Fed Chairman Jerome Powell couldn't have asked for a better present this year." The current economic scenario surpasses expectations, defying initial projections. While the Federal Reserve, under Powell's leadership, is not hastily considering rate cuts, it seems increasingly inevitable, becoming more a matter of when than if, as the economic landscape continues to evolve positively.

The latest report from the Commerce Department's Bureau of Economic Analysis reveals a 0.1% decrease in inflation, as measured by the personal consumption expenditures (PCE) price index, for the previous month. This marks the first monthly decline in the PCE price index since April 2020, following an unchanged reading in October.

Notable decreases were observed in both food prices, which edged down by 0.1%, and energy prices, which experienced a significant 2.7% drop. Over the 12 months leading up to November, the PCE price index showed a 2.6% increase, slightly lower than the 2.9% rise observed in October. Remarkably, October marked the first time since March 2021 that the annual PCE price index was below the 3% threshold. This data highlights noteworthy shifts in inflation trends, impacting various sectors of the economy.

Economists surveyed by Reuters had predicted no change in the PCE price index for the month, with a year-on-year increase of 2.8%.

Excluding the volatile food and energy elements, the PCE price index experienced a 0.1% uptick in November, mirroring the gain seen in October.

The core PCE price index, which excludes food and energy, showed a year-on-year increase of 3.2% in November, marking the smallest rise since April 2021, following a 3.4% increase in October. The Federal Reserve closely monitors PCE price measures to gauge progress toward its 2% inflation target.

In a government report on Thursday, core PCE inflation for the third quarter was reported to have increased at a 2.0% annualized rate. Combined with the mild gain in November, this resulted in a six-month core PCE inflation rate of 1.9%.

Also Read | Global Banks Predict Smooth Sailing, But U.S. Companies Sound the Alarm! The Shocking Twist You Didn’t See Coming!

Economists suggest that monthly inflation readings of 0.2% on a sustainable basis are necessary to bring inflation back to the Fed's target. According to CME Group's FedWatch Tool, financial markets indicate a roughly 75% chance of a rate cut at the Fed's March 19-20 policy meeting.

The trend of subsiding inflation is positively impacting consumer sentiment, as indicated by a separate report from the University of Michigan, which showed a significant increase in December, reversing declines from the previous four months.

President Joe Biden, facing challenges related to the high cost of living, welcomed the news, attributing it to collective efforts in addressing supply chain issues and boosting workforce participation.

In response to the developments, stocks on Wall Street were trading higher, and the dollar weakened against a basket of currencies, while U.S. Treasury prices rose.

Read the full article

0 notes

Text

Naira Surges Against the US Dollar, Reaches N1113/$ in Peer-to-Peer Market

In a surprising turn of events, the naira strengthened by N166 against the US dollar in the P2P market within just a few hours, leaving currency traders to rethink their strategies. What had initially peaked at N1279/$ on Thursday evening has now settled at a more favorable rate of N1113/$ at the time of this report.

Market observations suggest that this surge might be attributed to a lack of buyers, as few are willing to pay the higher rate of around N1300/$. This hesitation may reflect the growing optimism about the naira's future stability.

Finance Minister Wale Edun has also revealed that the country is poised to receive a substantial $10 billion in foreign currency inflows over the next few weeks. This influx is expected to bolster liquidity in the foreign exchange market, which has been a hindrance to the growth of Africa's largest economy. President Tinubu has signed two executive orders to facilitate the issuance of domestic financial instruments in foreign currencies and encourage the transfer of cash from outside the banking system into banks.

ALSO READ: Interesting stories

Traders, especially speculators, are now contemplating the likelihood of further Naira appreciation against the dollar in the coming days. Consequently, they find themselves compelled to sell at lower rates.

President Tinubu, in his recent summit address, has assured attendees that he is committed to clearing the backlog and resolving liquidity issues in the foreign exchange market. He emphasized stringent monitoring of all transactions within the foreign exchange market, signaling a crackdown on arbitrage practices.

The government acknowledges that liquidity challenges have hindered the efficiency of Nigeria's foreign exchange market. However, it is determined to take all necessary steps to rectify this situation. Plans are underway to streamline and restructure the foreign exchange market, ensuring that all legitimate transactions occur in the official market. Any unregulated activities will be penalized and deemed illegal.

LEARN MORE: Read blogs and articles here!!!

Meanwhile, on the global front, the US dollar has reached a near one-week high against a basket of currencies. This rise is attributed to a decrease in investor appetite for riskier currencies following disappointing corporate results, which have raised concerns about the state of the economy. Additionally, rising US Treasury bond yields have contributed to the shift in risk sentiment.

Federal Reserve Chairman Powell's recent speech also had an impact on the markets. While he concurred with other officials that policy may need to be tightened further, his remarks did not definitively suggest a rate hike in December, leaving room for uncertainty.

The Fed's intention is to convince the market that more rate increases are possible, contingent on a significant decline in inflation.

ALSO CHECK: Affordable products

Read the full article

#Currency#CurrencyExchange#CurrencyStrength#EconomicNews#ExchangeRate#ExchangeRateMovement#FinancialMarkets#ForeignExchange#Forex#ForexMarket#ForexTrading#ForexUpdate#Naira#NairaAppreciation#NairaValue#NigerianCurrency#Peer-to-PeerMarket#Reaches#Surges#USDollar

0 notes

Text

Geopolitische Spannungen und Finanzmärkte: Warum Anleger von Bitcoin in Gold und US-Dollar wechseln

Bitcoin ETF. Analyse der Anlegerströme in Zeiten geopolitischer Unsicherheit

Inmitten verschärfter geopolitischer Spannungen haben sich die Zuflüsse in Bitcoin-Fonds spürbar verringert. Die 4-Wochen-Durchschnittszuflüsse sind um 1 Milliarde US-Dollar von ihrem Höchststand auf etwa 700 Millionen US-Dollar gesunken.

Dennoch liegen die aktuellen Zuflüsse immer noch deutlich über den Niveaus der letzten 2 Jahre.

Eine interessante Beobachtung ist, dass trotz der dezentralen Natur von Bitcoin in Zeiten geopolitischer Unsicherheit Anleger Bitcoin verkaufen. Diese Nachfrage scheint sich größtenteils in Richtung Gold und US-Dollar zu verlagern.

Bitcoin: Bedeutung und Sicherheitsaspekte

Bitcoin ist eine Kryptowährung, die als Alternative zu traditionellen Währungen und als Absicherung gegen wirtschaftliche Unsicherheiten betrachtet wird. Als dezentralisierte Währung unterliegt Bitcoin nicht der Kontrolle von Regierungen oder Zentralbanken, was ihm eine gewisse Unabhängigkeit verleiht.

Die Sicherheit von Bitcoin steht jedoch zur Debatte, insbesondere in Bezug auf seine Volatilität und die Reaktion der Anleger auf geopolitische Ereignisse. Obwohl einige Bitcoin als sicheren Hafen betrachten, ziehen es andere vor, in Zeiten der Unsicherheit auf traditionelle Anlagen wie Gold und den US-Dollar umzusteigen.

Warum verlagern Anleger ihre Investments in Krisenzeiten?

Die Entscheidung von Anlegern, Bitcoin in einer geopolitischen Krise zu verkaufen, kann aus verschiedenen Gründen erfolgen. Eine mögliche Erklärung ist die Volatilität von Bitcoin, die viele Investoren dazu veranlasst, auf stabilere Anlagen umzusteigen, um Risiken zu minimieren.

Darüber hinaus könnten einige Anleger Bitcoin nicht als bewährten sicheren Hafen betrachten, da es im Vergleich zu traditionellen Anlagen wie Gold und dem US-Dollar noch relativ neu und unerprobt ist.

Die Rotation der Nachfrage von Bitcoin in Richtung Gold und US-Dollar könnte auch auf das Verlangen nach physischen Vermögenswerten zurückzuführen sein, die in Krisenzeiten als zuverlässiger angesehen werden.

Bitcoin ETF vs. Bitcoin Fonds: Was ist der Unterschied?

Ein weiterer wichtiger Aspekt sind die Anlegerpräferenzen zwischen Bitcoin ETFs (Exchange-Traded Funds) und Bitcoin Fonds. Ein ETF ist ein Investmentfonds, der wie eine Aktie an einer Börse gehandelt wird und den Preis von Bitcoin nachbildet. Im Gegensatz dazu investieren Bitcoin Fonds direkt in die Kryptowährung selbst.

Anleger könnten in unsicheren Zeiten dazu neigen, ETFs vor Fonds zu bevorzugen, da sie möglicherweise eine breitere Marktabdeckung und Liquidität bieten. Zudem könnten ETFs als weniger volatil und riskant angesehen werden als der direkte Besitz von Bitcoin.

Fazit

Die aktuellen Entwicklungen in Bezug auf Bitcoin und geopolitische Unsicherheiten werfen wichtige Fragen über die wahrgenommene Sicherheit und den sicheren Hafenstatus von Bitcoin auf. Während Bitcoin als innovative und dezentralisierte Währung gefeiert wird, entscheiden sich viele Anleger in Zeiten der Krise für traditionellere Anlagen wie Gold und den US-Dollar.

Es bleibt abzuwarten, wie sich diese Dynamik weiterentwickelt und ob Bitcoin langfristig als Absicherung gegen geopolitische Risiken an Bedeutung gewinnt. In jedem Fall ist es wichtig, die Rolle von Bitcoin im Kontext der globalen Finanzmärkte und als Teil eines breiteren Portfolios kritisch zu analysieren.

#Bitcoin#GeopolitischeSpannungen#Kryptowährung#Sicherheit#Anlegerverhalten#Gold#USDollar#Volatilität#BitcoinETF#BitcoinFonds

0 notes

Text

USA und Katar einigen sich darauf, das an Teheran gezahlte Lösegeld in Höhe von 6 Milliarden US-Dollar erneut einzufrieren

Mehrere Pressestellen in den Vereinigten Staaten berichteten, dass die Biden-Regierung eine „stille Vereinbarung“ mit Katar getroffen habe, die den Iran daran hindern würde, auf die 6 Milliarden US-Dollar zuzugreifen, die Amerika letzten Monat freigegeben hatte, um die Freilassung mehrerer iranischer Geiseln sicherzustellen.

Berichten zufolge sagte ein stellvertretender Finanzminister, Wally…

View On WordPress

#darauf#das#einigen#einzufrieren#erneut#gezahlte#hohe#Katar#Lösegeld#Milliarden#sich#Teheran#und#USA#USDollar#von

0 notes

Text

The U.S. Debt Ceiling and Its Global Implications

Every country’s financial structure houses various integral concepts that dictate its economic narrative. One such pivotal yet complex concept is the ‘debt ceiling.’ Frequently appearing in U.S. financial news, the term ‘debt ceiling’ refers to the maximum limit set by Congress on the amount of national debt that the U.S. government can accrue to meet its financial obligations. The term ‘ceiling’ signifies a limit beyond which the national debt cannot extend.

What is the Debt Ceiling

The debt ceiling functions as a regulatory limit on the amount of national debt the U.S. Treasury can accrue to pay for the expenditures that Congress has already approved. It acts as a checkpoint to monitor and control government spending.

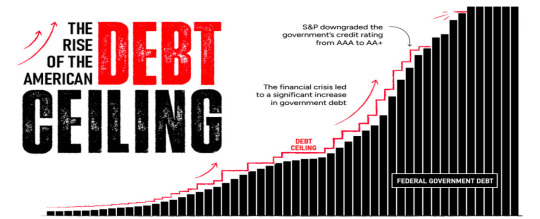

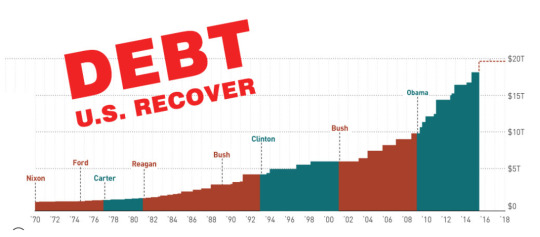

Over the past century, the debt ceiling has been raised or suspended multiple times, each change reflecting the evolving realities and necessities of government spending and borrowing. It’s an interesting dance between policy, spending, and repayment, and an essential cog in the wheel of U.S. financial mechanisms.

Why is the U.S. in Debt and Unable to Repay It?

Over the years, the U.S. has built up a colossal national debt, a daunting figure that’s largely the outcome of varied factors such as heavy government spending, enduring economic crises like the 2008 financial meltdown, the COVID-19 pandemic, and certain tax policies that have influenced the debt scenario.

The complex challenge of repaying this debt is deeply intertwined with the global economic structure’s complexities. While it’s easy to assume that the trade deficit, characterized by a higher import volume than export, contributes to the debt, it doesn’t directly add to the national debt. However, it does play a role in influencing the overall economic health of the nation and indirectly impacts the debt situation.

But, what are the reasons that the U.S. has hit the debt ceiling and is not able to overcome it?

Government Spending: The U.S. government spends substantially on various programs such as defence, healthcare, social security, and interest payments on the national debt. This spending often exceeds the government’s revenues, resulting in a deficit that adds to the national debt.

Economic Crises: Economic downturns often necessitate increased government spending to stimulate the economy and provide relief.

Tax Policies: Tax policies also play a role in the debt scenario. Tax cuts, while potentially stimulating economic growth, can decrease government revenue, thus increasing the deficit if not accompanied by corresponding reductions in government spending.

Interest Payments: As the national debt grows, so does the interest the government must pay on that debt. These interest payments can become a significant part of the budget, leaving less room for other spending priorities and creating a cycle that can cause the debt to grow even further.

Managing and repaying the U.S. debt is a complex issue that involves a careful balance of government spending and revenue, fiscal policy decisions, and managing the country’s economy in the context of a global economic system.

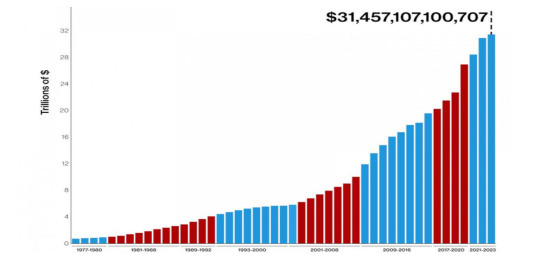

The Size and Scope of U.S. Debt

As of 2023, the U.S. national debt stands at a staggering $31.4 trillion, earning the country the status of being the world’s largest debtor.

Where Does the U.S. Borrow From?

The United States acquires debt by issuing Treasury securities like Treasury bonds, notes, and bills. These financial instruments are bought by a wide array of investors, including individuals, corporations, and foreign governments.

Who Are Its Biggest Lenders?

The U.S.’s most substantial debt holders on the international front are Japan and China. Other countries, including the United Kingdom, Brazil, and Ireland, also hold significant portions of U.S. debt. The United States owes Japan approximately $1.28 trillion, while China holds around $1.06 trillion of U.S. debt. The amounts owed to other lenders vary, typically falling into the range of billions of dollars.

Consequences of Hitting the Debt Ceiling

The U.S. hitting its debt ceiling can have significant global implications due to the interconnectedness of today’s global economy.

Here are some potential global consequences:

Impact on Global Markets: The U.S. Treasury market is the largest and most liquid bond market in the world. If the U.S. defaults on its debt obligations, it could cause widespread volatility in global markets. Investors, both domestic and foreign, might start doubting the creditworthiness of the U.S., causing a sell-off of U.S. Treasury securities that could disrupt financial markets worldwide.

Currency Fluctuations: The U.S. dollar is the world’s primary reserve currency, meaning many countries hold it in large quantities to carry out international trade. A U.S. debt default could weaken the dollar, leading to currency fluctuations and economic instability globally.

Global Economic Slowdown: The U.S. economy plays a vital role in driving global growth. Any economic disruption in the U.S., like a recession triggered by a debt default, could have a domino effect on the world economy, potentially leading to a global economic slowdown or recession.

Impact on Foreign Debt Holders: Countries like China and Japan, which hold significant amounts of U.S. debt, could face losses if the U.S. were to default. This could impact their economic stability.

Reduced Confidence in Global Financial System: The U.S. is seen as a global economic leader, and its debt is considered one of the safest investments. A debt default could shake confidence in the global financial system, leading to economic uncertainty and reduced investment.

Potential for Increased Borrowing Costs: If a U.S. default leads to a downgrade in its credit rating, borrowing costs for the U.S. could increase, which could then impact borrowing costs globally. This could make it more expensive for governments, businesses, and individuals worldwide to borrow money.

Here are some potential individual consequences:

In short, the U.S. hitting its debt ceiling and potentially defaulting on its debt repayments could have serious, far-reaching consequences for the global economy. It highlights the need for prudent fiscal policy not only for the U.S. but for economies around the globe. But, what will the citizens of the U.S. face because of hitting its debt ceiling?

The wrangling over the debt ceiling can create economic uncertainty, negatively impacting consumer and business confidence. This can lead to reduced business investments, job cuts, and slower economic growth.

The government might have to make tough choices about which bills to pay. This could put programs like Social Security, Medicare, and military pensions at risk, directly affecting the citizens dependent on these programs.

The uncertainty and the potential for increased government borrowing costs can trickle down to the public in the form of higher interest rates for mortgages, auto loans, student loans, and credit cards.

The debate and uncertainty surrounding the debt ceiling often lead to stock market volatility. This can affect the retirement savings and investment portfolios of everyday Americans.

The Domino Effect: Recession and Layoffs

The repercussions of the U.S. hitting its debt ceiling can go far beyond its own borders, owing to the country’s significant role in the global economy. A notable concern is the potential for a worldwide economic recession and the dreaded consequence – mass layoffs.

As the keystone of global markets, the U.S. economy’s health directly influences financial currents worldwide.

Imagine this: the U.S., unable to lift its debt ceiling, defaults on its debt. This scenario would unsettle financial markets and could seriously undermine investors’ confidence. The ensuing decline in investments can ripple through economies, leading businesses to scale back or shut down, manifesting the dire reality of layoffs.

A U.S. default could also send shockwaves through economies heavily reliant on exporting to the U.S. A debt default could trigger a contraction in the U.S. economy, causing a slump in demand for imports. As a result, these export-dependent economies may see their growth slow down, potentially leading to job cuts in various sectors.

A U.S. debt default could create a ripple effect in global interest rates. As investors’ confidence shakes, they may demand higher returns to compensate for the increased risk, causing a surge in global interest rates. This increase in borrowing costs can hurt businesses and households, leading to a decline in spending, further slowing economic growth, and potentially driving more layoffs.

How Will the U.S. Recover from This Debt?

Recovering from such an overwhelming amount of debt is a long-term and complex process. It requires the implementation of severe cost-cutting measures, comprehensive tax reforms, and strategies to stimulate economic growth.

An integral part of this process is maintaining fiscal discipline to prevent uncontrolled debt accumulation. However, these measures must be carefully balanced to ensure that they don’t hinder economic growth or place an unfair burden on the nation’s citizens.

Read more at: https://dsb.edu.in/the-us-debt-ceiling-and-its-global-implications/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+us+debt

#USDebtCeiling#GlobalImplications#EconomicImpact#FinancialMarkets#USFiscalPolicy#DebtCrisis#EconomicOutlook#FinancialStability#GovernmentShutdown#GlobalEconomy#USDollar#TradeTensions#MonetaryPolicy#BudgetDeficit#EconomicForecast#india#fintech#jobs#banking#education#google#ai#blockchain

0 notes