#Data Center Structured Cabling Market

Explore tagged Tumblr posts

Text

Single Mode Laser Diode Market: Growth and Opportunities by 2025-2032

MARKET INSIGHTS

The global Single Mode Laser Diode Market size was valued at US$ 1.45 billion in 2024 and is projected to reach US$ 2.23 billion by 2032, at a CAGR of 6.3% during the forecast period 2025-2032.

Single mode laser diodes are semiconductor devices that emit coherent light through the recombination of electrons and holes in a p-n or p-i-n junction structure. These components operate with a single transverse mode, ensuring precise beam quality ideal for applications requiring high spectral purity. The wavelength range for single-mode blue laser diodes (400-483nm) makes them particularly valuable in scientific and industrial applications where accuracy is paramount.

Market growth is driven by increasing demand in metrology, spectroscopy, and life sciences applications. While Japan dominates consumption with 56% market share, Europe follows with 17%, indicating strong regional adoption patterns. The industry remains concentrated, with top manufacturers including Sony, Nichia, and Osram Opto Semiconductors collectively holding over 90% market share. Recent technological advancements in fiber-coupled and free-space laser diode designs are further expanding application possibilities across multiple sectors.

MARKET DYNAMICS

MARKET DRIVERS

Expansion in Telecommunications and Data Center Applications Accelerates Market Growth

The global single mode laser diode market is experiencing robust growth driven by escalating demand from telecommunications networks and hyperscale data centers. With internet traffic projected to grow at 25-30% annually through 2030, network operators are rapidly deploying fiber optic infrastructure requiring high-performance single mode laser diodes. These components enable efficient transmission over long distances with minimal signal loss – a critical advantage for backbone networks and undersea cables. Recent technological advancements have increased transmission capacities to 400G and beyond while reducing power consumption, making them indispensable for next-generation networks.

Medical Laser Systems Adoption Creates New Demand Channels

Healthcare applications represent one of the fastest-growing segments for single mode blue laser diodes, with the medical laser market expected to surpass $12 billion by 2025. These precision light sources are increasingly used in surgical systems, diagnostic equipment, and therapeutic devices due to their excellent beam quality and wavelength stability. Dermatology applications alone account for over 28% of medical laser usage, where blue wavelength lasers enable treatments for vascular lesions and pigmentation disorders. The trend toward minimally invasive procedures and the development of novel photodynamic therapies are driving double-digit growth in this sector.

Industrial Processing Innovations Fuel Specialty Applications

Advanced materials processing applications are creating significant opportunities for single mode laser diode manufacturers. Unlike multimode lasers, single mode variants provide the ultra-fine focus required for precision micro-machining, semiconductor lithography, and additive manufacturing. The industrial laser market has grown consistently at 7-9% annually since 2020, with laser diodes accounting for an increasing share due to their compact size and energy efficiency. Emerging applications in green energy technologies, particularly photovoltaic cell production and battery welding, are expected to drive nearly $150 million in annual demand by 2026.

MARKET RESTRAINTS

Complex Manufacturing Processes Increase Production Costs

The sophisticated fabrication requirements for single mode laser diodes present significant cost barriers to market expansion. Producing the <1nm spectral width devices requires expensive molecular beam epitaxy or metalorganic chemical vapor deposition systems, with cleanroom facilities costing $50-100 million to establish. Yield rates for high-performance blue laser diodes rarely exceed 60-65% even for leading manufacturers, driving up unit costs. These economic factors currently preclude adoption in price-sensitive applications, limiting market penetration to premium segments where performance justifies the expense.

Other Restraints

Supply Chain Vulnerabilities The industry faces persistent challenges in sourcing key raw materials including gallium nitride substrates and specialty dopants. Japan controls over 75% of gallium production capacity, creating geographic concentration risks. Recent trade disputes have caused 8-10 week delays in substrate deliveries, forcing manufacturers to carry 25-30% higher inventory buffers.

Thermal Management Challenges Maintaining wavelength stability requires sophisticated thermal control systems that add complexity and cost. Thermal resistance below 10°C/W is necessary for many telecom applications, requiring expensive thermoelectric coolers and precision heat sinks that account for 15-20% of total component cost.

MARKET OPPORTUNITIES

Emerging Quantum Technologies Create Revolutionary Applications

The quantum technology sector presents transformative growth potential for single mode laser diode providers. Quantum computing systems require ultra-stable single frequency lasers for ion trapping and qubit manipulation, with each installation using 50-100 precision laser sources. The quantum market is projected to exceed $5 billion by 2028, with lasers representing 18-22% of system costs. Several governments have committed over $3 billion in quantum research funding since 2021, accelerating commercial development timelines.

Automotive Lidar Expansion Drives New Volume Demand

Advanced driver assistance systems (ADAS) and autonomous vehicles are creating substantial opportunities in the 905nm and 1550nm single mode laser diode segments. While current systems predominantly use pulsed multimode lasers, next-generation FMCW lidar requires coherent single mode sources for superior ranging accuracy. The automotive lidar market is forecast to grow at 33% CAGR through 2030, potentially consuming over 2 million laser diode units annually by 2025. Tier 1 suppliers have already begun qualifying single mode solutions from leading Japanese and German manufacturers.

MARKET CHALLENGES

Intellectual Property Barriers Constrain Market Participation

The single mode laser diode industry faces significant challenges from aggressive intellectual property protection, particularly around blue laser technology. Over 1,200 active patents cover critical aspects of gallium nitride laser diode design and fabrication, with Nichia Corporation alone holding 487 fundamental patents. This creates substantial barriers to entry for new competitors and has led to several high-profile legal disputes involving potential royalty payments exceeding $50 million. Smaller manufacturers risk being locked out of key application segments due to licensing restrictions.

Other Challenges

Standardization Fragmentation The lack of unified industry standards creates compatibility issues across different manufacturer’s products. While telecommunications applications have well-defined MSAs (multi-source agreements), other segments like medical and industrial lasers suffer from proprietary interfaces that increase system integration costs by 15-20%.

Technical Workforce Shortages Designing and manufacturing single mode laser diodes requires specialized knowledge spanning semiconductor physics, thermal engineering, and optical design. The global photonics industry currently faces a 28% gap in qualified engineers versus demand, with the shortage most acute in the Asia-Pacific region outside Japan. Training programs have yet to scale sufficiently to meet projected workforce needs.

SINGLE MODE LASER DIODE MARKET TRENDS

Rising Demand for Precision Optics in Medical and Industrial Applications

The global single-mode laser diode market is experiencing significant growth driven by increasing demand for high-precision optical components across medical, industrial, and scientific applications. Recent advancements in blue laser diode technology (400-483nm wavelength range) have enabled breakthroughs in fluorescence microscopy, DNA sequencing, and semiconductor inspection systems. The market, valued at approximately $270 million in 2024, is projected to grow at a 9.1% CAGR through 2032, reaching nearly $489 million. Optical communication networks are also adopting single-mode diodes due to their superior beam quality and energy efficiency compared to multi-mode alternatives.

Other Trends

Miniaturization and Power Efficiency Improvements

Component miniaturization is reshaping product development strategies across the industry. Manufacturers are achieving 30-40% size reductions in latest-generation diodes while simultaneously improving wall-plug efficiency by 15-20%. This trend directly responds to requirements from portable medical devices and embedded industrial sensors where space constraints previously limited adoption. Emerging packaging technologies like flip-chip bonding and advanced heat dissipation materials enable these simultaneous improvements in both form factor and performance.

Emerging Applications in Quantum Technologies

Quantum computing and quantum communication systems are creating new demand vectors for single-mode laser diodes with exceptionally narrow spectral linewidths. These applications require wavelength stability below 1 pm (picometer) and coherence lengths exceeding 100 meters – specifications that only specialized single-mode diodes can achieve. Several photonics companies have recently introduced products specifically targeting quantum research labs, with Japan currently accounting for 56% of global consumption in this segment. The European market follows at 17%, benefiting from strong government investments in quantum technology programs.

Supply Chain Diversification Challenges

While demand grows, the industry faces concentration risks with 90% market share controlled by just seven manufacturers including Sony, Nichia, and Osram. Recent geopolitical tensions have accelerated efforts to develop alternative supply chains, particularly for the GaN-based substrates essential for blue laser production. Several Western manufacturers are now investing in captive epitaxial growth capabilities to reduce dependence on traditional Asian suppliers. This strategic shift may lead to 15-20% cost premiums initially but could stabilize long-term pricing by mitigating regional supply disruptions.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Innovation to Secure Market Position

The global single mode laser diode market is highly concentrated, with Japanese and German manufacturers dominating the competitive landscape. Sony Corporation and Nichia Corporation collectively command over 45% of the market share in 2024, leveraging their strong foothold in blue laser diode technology and extensive patent portfolios.

While these industry giants maintain leadership through vertical integration and economies of scale, specialized players like TOPTICA Photonics and Osram Opto Semiconductors are gaining traction by focusing on niche applications in spectroscopy and bioanalytics. The market witnesses particularly intense competition in wavelength precision and power efficiency improvements, where even incremental advancements can translate into significant commercial advantages.

Recent developments show companies are increasingly adopting hybrid strategies – Sharp Corporation expanded its production capacity by 30% in 2023, while Coherent Inc. acquired two smaller laser technology firms to bolster its single-mode diode offerings. This dual approach of organic growth and strategic acquisitions is becoming vital in a market projected to reach $489 million by 2032.

Emerging competition comes from Chinese manufacturers like CNI Laser who are aggressively improving product quality while maintaining cost advantages. However, established players maintain edge through proprietary manufacturing processes and established distribution networks across key markets in North America and Europe, which accounted for 38% of global demand in 2024.

List of Key Single Mode Laser Diode Companies Profiled

Sony Corporation (Japan)

Nichia Corporation (Japan)

Sharp Corporation (Japan)

Osram Opto Semiconductors (Germany)

TOPTICA Photonics (Germany)

Egismos Technology Corporation (Japan)

Ondax (U.S.)

Sheaumann (U.S.)

QPhotonics (U.S.)

Innolume (Germany)

Laser Components (Germany)

Lasertack (Germany)

ROHM (Japan)

Eagleyard (Germany)

CNI laser (China)

Ushio (Japan)

Coherent (U.S.)

OSI Laser Diode (U.S.)

Segment Analysis:

By Type

Fiber-Coupled Laser Diodes Dominate Due to Superior Beam Quality and Ease of Integration

The market is segmented based on type into:

Fiber-Coupled Laser Diode

Free Space Laser Diode

Others

By Application

Spectroscopy Applications Lead the Market Owing to Precision Requirements in Analytical Instruments

The market is segmented based on application into:

Metrology

Spectroscopy

Bioanalytics

Life Sciences

Others

By Wavelength

405-450nm Segment Holds Major Share for Blu-ray and Medical Applications

The market is segmented based on wavelength into:

405-450nm

451-483nm

By End-User Industry

Industrial Manufacturing Shows Strong Demand for Material Processing Applications

The market is segmented based on end-user industry into:

Industrial Manufacturing

Healthcare

Telecommunications

Research & Development

Others

Regional Analysis: Single Mode Laser Diode Market

North America North America holds a significant share in the global single-mode laser diode market due to its advanced technological infrastructure, particularly in the U.S. and Canada. The region benefits from strong R&D investments from leading manufacturers such as Coherent, TOPTICA Photonics, and Newport Corporation, who focus on high-precision laser applications in metrology, spectroscopy, and life sciences. The U.S. remains the largest market within the region, driven by demand from healthcare, telecommunications, and defense sectors. Government initiatives supporting photonics research and increasing adoption of single-mode blue laser diodes for medical diagnostics further boost market growth. However, stringent regulatory standards and high production costs pose challenges.

Europe Europe, the second-largest consumer of single-mode laser diodes globally, thrives on industrial automation, semiconductor manufacturing, and advanced healthcare applications. Germany leads the market due to its strong focus on photonics and laser technologies, followed by France and the U.K. The region’s emphasis on precision engineering and compliance with EU regulations regarding laser safety and environmental considerations ensures steady demand for high-quality single-mode laser diodes. Key contributors include companies like Osram Opto Semiconductors and Laser Components, who innovate compact, energy-efficient laser solutions. Growing applications in biotechnology and autonomous systems contribute to sustained market expansion.

Asia-Pacific Asia-Pacific dominates the single-mode laser diode market, accounting for over 50% of global consumption, primarily driven by Japan, China, and South Korea. Japan remains the epicenter due to the presence of industry giants like Sony, Nichia, and Sharp, which collectively hold a majority market share. China’s rapid expansion in telecommunications and industrial laser processing accelerates demand, while India shows potential growth in medical and defense applications. The region benefits from cost-efficient manufacturing and increasing adoption of fiber-coupled laser diodes for spectroscopy applications. However, price sensitivity and fluctuating raw material costs create challenges for premium single-mode laser diode adoption.

South America South America represents a developing market for single-mode laser diodes, with Brazil and Argentina emerging as key players due to their expanding industrial and healthcare sectors. While the market remains niche compared to North America and Asia-Pacific, rising investments in laser-based manufacturing and biomedical research present growth opportunities. Limited local manufacturing capabilities result in reliance on imports, causing higher costs and supply chain inefficiencies. Despite economic volatility, Brazil’s growing telecommunications infrastructure and Argentina’s focus on medical laser applications signal long-term potential.

Middle East & Africa The Middle East & Africa exhibit gradual growth in single-mode laser diode adoption, primarily in Israel, UAE, and Saudi Arabia due to their investments in defense, healthcare, and oil & gas industries. Israel stands out with its strong laser technology ecosystem, supported by companies like SCD (SemiConductor Devices), specializing in infrared and blue laser diodes. The UAE shows promise in telecommunications and smart manufacturing, while Africa’s progress remains slow due to limited infrastructure. While regulatory hurdles and funding constraints hinder rapid adoption, strategic partnerships with global suppliers could unlock future opportunities.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Single Mode Laser Diode markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Single Mode Laser Diode market was valued at USD 270 million in 2024 and is projected to reach USD 489 million by 2032, growing at a CAGR of 9.1%.

Segmentation Analysis: Detailed breakdown by product type (Fiber-Coupled Laser Diode, Free Space Laser Diode, Others), application (Metrology, Spectroscopy, Bioanalytics, Life Sciences), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific (dominant region with 56% market share), Latin America, and the Middle East & Africa, including country-level analysis.

Competitive Landscape: Profiles of leading market participants including Sony, Nichia, Sharp, Osram Opto Semiconductors, TOPTICA Photonics, covering their product portfolios, market share (top 5 companies hold over 90% share), and strategic developments.

Technology Trends & Innovation: Assessment of emerging semiconductor laser technologies, wavelength optimization (400-483nm range), and manufacturing advancements in p-i-n structures.

Market Drivers & Restraints: Evaluation of factors driving market growth including demand for precision optics, along with challenges like supply chain constraints in semiconductor materials.

Stakeholder Analysis: Strategic insights for component suppliers, OEMs, and investors regarding the evolving photonics ecosystem and growth opportunities.

0 notes

Text

Trusted Data Cable Manufacturers in India: Why NexTik Stands Out

Data Cables Manufacturers | Data Cable supplier | Data cable Manufacturers in india

In today's technologically driven world, the need for seamless connection and high-speed data transfer is increasing at an unprecedented rate. Data cables are a crucial component of every communication system, from business networks and smart homes to data centers and industrial settings. NexTik, one of the top data cable manufacturers, has built a solid reputation in the Indian and worldwide networking markets by providing long-lasting, high-performance, and cost-effective cable solutions.

The Importance of High-Quality Data Cables

With the rising use of cloud computing, 5G, IoT, and big data technologies, the demand for dependable and fast data transfer has never been greater. High-quality data connections guarantee that:

Low signal loss

Minimal interference

Faster transmission speeds

Long-term durability

Choosing the correct data cable manufacturers is crucial for attaining these objectives. Inferior cables can cause interruptions, signal decline, and increased maintenance expenses. That's why businesses rely on established industry leaders like NexTik to handle their structured cabling needs.

NexTik – A Leader Among Data Cable Manufacturers

NexTik is one of India's fastest-growing data cable producers, with a diverse line of networking cables designed to meet current infrastructure requirements. NexTik continues to set the standard for data cabling technology by focusing on innovation, quality, and client happiness.

Here’s what sets NexTik apart from other data cable manufacturers:

1. Extensive Product Range

NexTik provides a wide array of data cabling solutions, including:

Cat5e, Cat6, and Cat6A Ethernet cables

Shielded and unshielded twisted pair (STP/UTP) cables

High-frequency LAN cables

Custom length and color-coded data cables

Every product is made with stringent quality control and meets international standards like ISO, RoHS, and CE.

2. State-of-the-Art Manufacturing Facilities

NexTik, an innovative data cable maker, uses cutting-edge technology and automated procedures in its manufacturing plants. From raw material procurement to final packing, every stage is optimized for precision, performance, and consistency.

3. Custom Cable Solutions

NexTik, an innovative data cable manufacturer, employs cutting-edge technology and automated processes in its manufacturing facilities. Every stage, from raw material acquisition to final packing, is designed to maximize precision, performance, and consistency.

4. Focus on Durability and Performance

NexTik cables are engineered to deliver great performance even in harsh environments. Whether it's heat resistance, moisture protection, or electromagnetic shielding, the firm promises long-term operation with little signal degradation—qualities that only the best data cable manufacturers can provide.

5. Affordable and Scalable Offerings

Affordability is an important aspect when selecting data cable manufacturers, particularly for large-scale installations. NexTik provides low pricing while maintaining high quality standards. Their scalable solutions are suited for small, medium, and big firms equally.

Applications of NexTik’s Data Cables

As one of India’s top data cable manufacturers, NexTik serves a variety of sectors, such as:

Telecommunication and ISPs

Enterprise IT Networks

Smart Homes and IoT Systems

Data Centers

Educational and Government Institutions

Security and Surveillance Systems

NexTik's cabling solutions are the preferred choice for any company that requires strong data communication due to their flexibility and high trustworthiness.

Commitment to Sustainability

NexTik stands apart from other data cable producers due to its dedication to sustainable methods. NexTik prioritizes environmental responsibility while providing high-quality networking devices, from employing eco-friendly materials to reducing carbon emissions during manufacture.

Unmatched Customer Support

NexTik believes in developing long-term partnerships with its clients. That's why their after-sales service is as dependable as their products. Their devoted staff of technical specialists and customer service representatives assures prompt help, seamless installation, and troubleshooting—qualities that are seldom equaled by other data cable manufacturers.

Why NexTik is the Right Partner for Your Cabling Needs

When choosing among the many data cable manufacturers available in the market, it's important to consider:

Proven track record

Technological capabilities

Certification and compliance

Customization options

Competitive pricing

NexTik checks all of these boxes and more. NexTik remains a market leader in data cable manufacturing in India, focusing on innovation, quality, and customer-centricity.

Conclusion

As digital infrastructure expands throughout sectors, the demand for high-quality data connections will increase. Choosing the proper data cable manufacturers, such as NexTik, provides peak network performance, future preparedness, and long-term savings. Whether you're developing a new IT infrastructure or upgrading an existing one, NexTik's skilled solutions can fuel your digital connectivity. Contact us

Explore NexTik’s complete range of networking cables today and partner with one of the most reliable data cable manufacturers in India.

0 notes

Text

Eco-Friendly Acoustic Insulation Materials: Meeting Demand with Sustainability

As the global push toward digitization intensifies, data centers have become the nerve centers of modern life. From powering cloud storage to enabling artificial intelligence and streaming services, these facilities are growing exponentially in size, complexity, and energy demand. While significant focus is placed on their energy efficiency, security, and uptime, one crucial factor often goes unnoticed—acoustic insulation. Typically associated with residential, automotive, or industrial applications, acoustic insulation in data centers remains an underexplored yet essential component in ensuring performance, safety, and sustainability.

Emerging Demand in Digital Infrastructure

The world’s data centers are rapidly expanding, both in scale and number. According to Synergy Research Group, there are now over 800 hyperscale data centers globally, with hundreds more planned in the coming years. These facilities house tens of thousands of servers, cooling equipment, and backup generators, all operating around the clock. The cumulative effect of these systems generates continuous ambient noise, often reaching decibel levels above 80 dB—equivalent to the sound of city traffic.

𝐌𝐚𝐤𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐞𝐝 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬 – 𝐀𝐜𝐜𝐞𝐬𝐬 𝐘𝐨𝐮𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐈𝐧𝐬𝐭𝐚𝐧𝐭𝐥𝐲! https://www.futuremarketinsights.com/reports/sample/rep-gb-14503

This noise is not just a comfort issue. In environments where technical precision and constant monitoring are vital, excessive noise can hinder operational efficiency. Maintenance personnel working near loud cooling fans or HVAC systems face difficulties in communicating or identifying abnormal sounds that could indicate equipment faults. In some cases, high-frequency noise from devices has even interfered with vibration and acoustic monitoring sensors used to detect anomalies in rotating equipment. Thus, the application of noise control materials is no longer optional but increasingly essential for seamless operations.

Unique Acoustic Challenges in Data Centers

Unlike traditional commercial buildings, data centers present a complex acoustic profile. Equipment generates not only airborne sound but also structure-borne vibrations that can travel through floors and walls. Additionally, the widespread use of raised flooring systems—designed for cabling and airflow—can inadvertently amplify sound if not properly insulated.

Another challenge lies in echo and reverberation. Large, open spaces with minimal furniture or absorbent materials create ideal conditions for sound waves to bounce freely. This can elevate stress for onsite technicians and compromise speech intelligibility, which becomes critical during emergency communication or system checks.

Furthermore, noise is not confined to interior spaces. Exterior noise from cooling towers and emergency diesel generators can lead to compliance issues with local environmental regulations, particularly in urban installations. In this context, soundproofing technology in data centers becomes not just a comfort measure but an operational and regulatory necessity.

Types of Acoustic Insulation Materials in Use

The requirements for acoustic insulation in data centers go beyond simple noise reduction. Materials must meet stringent standards for fire resistance, low particulate emissions, and thermal stability. This makes certain insulation types particularly suitable.

𝐔𝐧𝐥𝐨𝐜𝐤 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 – 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.futuremarketinsights.com/reports/acoustic-insulation-market

Melamine foam, known for its open-cell structure and fire resistance, is often installed in server rooms and cooling ducts to absorb high-frequency noise. Mineral wool panels, used in walls and ceilings, provide both thermal and acoustic insulation synergy, reducing noise while also managing the heat load. Polyester fiber composites, which are low in VOC emissions and highly durable, are preferred in spaces where clean air standards must be maintained.

Some facilities have adopted modular acoustic enclosures around particularly noisy systems, such as generators or HVAC units. These enclosures can incorporate a combination of mass-loaded vinyl barriers and fiberglass batting to deliver multi-layered sound absorption without compromising ventilation.

Regulatory and Design Considerations

Data center designers are increasingly integrating acoustic considerations into early-stage planning, particularly as occupational safety standards become more stringent. The U.S. Occupational Safety and Health Administration (OSHA) limits workplace exposure to continuous noise above 85 dB, which can be easily breached in poorly insulated equipment rooms. By incorporating industrial acoustic panels into design plans, operators not only reduce noise pollution but also avoid potential health violations and improve worker productivity.

From a sustainability standpoint, certifications such as LEED (Leadership in Energy and Environmental Design) encourage the use of materials that enhance both energy efficiency and indoor environmental quality. Acoustic insulation that doubles as thermal insulation supports these objectives, contributing to overall green building performance.

Market Opportunity and Innovation Outlook

While acoustic insulation currently makes up a relatively small percentage of overall data center construction costs, its strategic value is rising. According to a report by Future Market Insights, the acoustic insulation market size is projected to reach USD 16.8 billion in 2025. The industry is likely to expand to USD 29.6 billion by 2035, reflecting a CAGR of 5.8% during the forecast period.

Innovations such as smart acoustic panels that integrate sensors for noise monitoring, or active noise cancellation systems for targeted zones, are beginning to surface. While still in their infancy, these technologies point to a future where acoustic control is dynamically managed in response to real-time conditions.

General & Advanced Materials Industry Analysis: https://www.futuremarketinsights.com/industry-analysis/general-and-advanced-materials

Case studies from leaders in the field offer promising insight. Google’s data center in Hamina, Finland, features advanced sound-dampening architecture using a combination of internal wall insulation and exterior barriers to comply with strict local noise ordinances while maintaining energy efficiency. Similarly, Equinix has implemented acoustic foam insulation in high-density colocation environments to create quieter, technician-friendly zones within its facilities.

Key Segments Covered in the Acoustic Insulation Market Survey

By Type:

Glass Wool

Rock Wool

Foamed Plastic

Elastomeric Foam

By End Use Industry:

Building and Construction

Transportation

Oil & Gas and Petrochemicals

Energy & Utilities

Industrial & OEM

By Region:

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc. Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, USA T: +1-347-918-3531 For Sales Enquiries: [email protected] Website: https://www.futuremarketinsights.com LinkedIn| Twitter| Blogs | YouTube

0 notes

Text

All Ordinaries Chart Watch: Telstra Group (ASX:TLS) Drives Telecommunications Growth

Highlights:

Telstra Group Limited delivers nationwide mobile and fixed broadband services in the telecommunications sector

The company holds a place in the ASX 200 and contributes to the broader view represented in the All Ordinaries Index

Network expansion and service infrastructure improvements remain key features of Telstra’s operational roadmap

Telecommunications Sector Overview with All Ordinaries Chart Context Telstra Group Limited (ASX:TLS) operates in the telecommunications sector, delivering broadband, mobile, and data services across Australia. As a long-standing constituent of both the ASX 200 and All Ordinaries Index, the company represents a substantial share of the country’s communication infrastructure. The All Ordinaries chart is often used as a broad indicator of Australian market activity, capturing the performance of companies across diverse sectors, including telecommunications, energy, and finance.

Telstra provides services through retail, wholesale, and enterprise channels, with operations stretching across metropolitan and remote regions. The company’s network infrastructure includes fibre-optic cables, mobile towers, satellite facilities, and data centers that support voice and digital traffic for both personal and commercial use.

Infrastructure and Network Capabilities Telstra continues to expand its infrastructure footprint, focusing on mobile coverage, fixed-line enhancements, and next-generation connectivity platforms. The company operates a substantial mobile network, which includes long-term evolution (LTE) and fifth-generation (5G) capabilities. Its tower footprint covers extensive geographic areas, including remote and regional locations, offering wide-area connectivity for mobile voice and data services.

Fibre networks form the core of Telstra’s fixed-line internet offerings. These high-speed lines support business operations, home broadband, and institutional services. International subsea cable systems also link Australia with global networks, providing bandwidth for enterprise, media, and wholesale needs. The integration of cloud-based traffic management and advanced data routing ensures stable service delivery under high-demand scenarios.

Enterprise Solutions and Service Diversification The enterprise division of Telstra Group supports corporate and government clients with specialised communication solutions. These services include data hosting, network security, private cloud access, and secure voice systems. The company operates dedicated business hubs and account management structures to serve organisations with tailored telecommunications packages.

Product diversification extends into areas such as unified communications, video conferencing systems, and digital collaboration platforms. With dedicated business infrastructure, Telstra enables seamless connectivity across public institutions, education networks, healthcare services, and corporate entities. Managed service offerings combine software with physical infrastructure, allowing clients to streamline digital workflows through a single provider.

Technology Partnerships and Digital Evolution Telstra partners with technology vendors and infrastructure providers to enhance its product suite and digital service delivery. These collaborations enable upgrades to core networks, including improvements in latency, scalability, and resilience. The company’s investment in software-defined networking supports automation and virtualisation within its service layers.

The group’s focus on cybersecurity solutions aligns with broader digital trends, offering detection and prevention services through dedicated platforms. Telstra’s data centers and cloud environments support enterprise continuity, while real-time diagnostics help manage performance across its network ecosystem. The company’s integration of Internet of Things (IoT) solutions supports remote monitoring and machine-to-machine communications across various sectors.

Financial Position and Index Representation Telstra maintains a stable position in the Australian share market, appearing in both the ASX 200 and the All Ordinaries Index. Its listing in these indexes reflects its market capitalisation and relevance across the Australian economy. The All Ordinaries Index captures the performance of hundreds of companies, offering a wider view beyond top-cap stocks, and Telstra’s inclusion underscores its scale and footprint in national infrastructure.

Revenue streams are drawn from both consumer services and enterprise divisions, with network usage, product subscriptions, and managed services contributing to earnings. The company maintains a consistent operational approach, aligned with national digital initiatives and infrastructure rollout plans.

0 notes

Text

Powering the Future: U.S. Battery Energy Storage Market Trends & Insights

The U.S. battery energy storage system market is witnessing substantial growth, with its estimated valuation reaching USD 711.9 million in 2023 and projected to expand at a compound annual growth rate (CAGR) of 30.5% from 2024 to 2030. This surge is fueled by the rising adoption of battery storage solutions across industries to support critical equipment in emergencies, including grid failures and power trips. Additionally, the increasing need for uninterruptible power supply (UPS) in data centers and telecommunications is driving further demand, as businesses prioritize operational efficiency and productivity.

Market Structure and Key Components

The U.S. battery energy storage market is characterized by a structured value chain, consisting of equipment suppliers, battery energy storage manufacturers, and various end-use markets. The storage systems incorporate essential components, including batteries, module packs, connectors, cables, and bus bars, with batteries serving as a critical element in the storage process.

Integration with Renewable Energy and Regulatory Influence

The large-scale deployment of renewable energy sources is expected to boost battery storage adoption, addressing power intermittency issues from solar and wind installations. Strict government regulations promoting environmental sustainability have accelerated the shift toward solar and wind energy, necessitating off-grid power storage systems for energy reliability.

Battery energy storage solutions play a pivotal role in:

Emergency power supply systems,

Wind power output fluctuation management,

Stand-alone photovoltaic (PV) systems.

Favorable attributes such as cost efficiency, high performance ratios, ease of charging, and recyclability further strengthen market demand.

Technological Innovations and Alternative Battery Solutions

The market is also driven by continuous advancements in energy storage technology. Leading industry players, such as U.S.-based Power Electronics, are developing dual solar-inverter-plus-storage solutions alongside enhancements in solar charging technology.

There is growing interest in alternatives to lithium-ion batteries, particularly zinc-based technologies, which are gaining traction in fire-sensitive environments where lithium-ion is considered higher risk.

Future Growth and Expanding Applications

Battery energy storage systems are anticipated to experience high penetration rates, supported by:

Easy charging properties,

Re-energization of electrolyte liquid, resulting in low wastage,

Expanding applications in backup power, portable power, and stationary energy solutions.

As demand for efficient and scalable energy storage systems continues to grow, the U.S. battery storage market is expected to play a critical role in shaping the future of renewable energy integration and power stability across industries.

Detailed Segmentation:

Product Insights

The lithium-ion battery segment led the market in 2023, securing a 54.9% revenue share due to its widespread use across multiple applications. Lithium-ion battery storage systems play an essential role in communication base stations, commercial and industrial buildings, grid frequency modulation, household energy storage, and ensuring stable renewable energy output. The segment’s high efficiency, energy density, and long lifespan contribute to its strong market positioning.

The lead-acid battery segment accounted for a significant 18.57% revenue share in 2023, owing to its cost-effectiveness, simple manufacturing process, durability, and reliability. Lead-acid batteries also offer low maintenance costs and high discharge rate capabilities, which enhance their competitiveness against Li-ion and NiCd alternatives. Their application in backup power systems and stationary storage solutions continues to drive demand in various industries.

Application Insights

The grid storage segment held the largest revenue share of more than 44.0% in 2023, driven by the increasing need for reliable energy storage solutions to facilitate the integration of renewable energy sources. Grid storage systems play a critical role in balancing electricity supply, ensuring stable operations by storing excess power generated during peak production periods and delivering stored energy during high-demand intervals. As more renewable energy projects are deployed, the demand for efficient battery storage solutions will continue to grow, reinforcing the importance of grid storage technologies in energy management.

Key U.S. Battery Energy Storage System Companies:

General Electric

Hitachi Ltd.

GS YuasaBeckett Energy Systems

Exide Technologies

Samsung SDI

Enersys

AES Energy Storage

Imergy Power Systems Inc.

Altair Nanotechnologies Inc.

U.S. Battery Energy Storage System Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. battery energy storage system market report based on application, and product:

Application Outlook (Revenue, USD Million, 2018 - 2030)

Transportation

Grid Storage

UPS

Telecom

Others

Product Outlook (Revenue, USD Million, 2018 - 2030)

Flywheel Battery

Lead Acid Battery

Lithium-ion Battery

Others

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

0 notes

Text

Structured Cabling Market: Untapped Potential in Emerging Economies

Structured Cabling Industry Overview

Valued at $10.46 billion in 2022, the global Structured Cabling Market is projected to grow at a robust compound annual growth rate (CAGR) of 10.7% over the forecast period. Structured cabling systems, comprising essential hardware and cables, form the backbone of telecommunication infrastructure for managing various systems. This infrastructure facilitates the seamless transfer of video, voice, and data signals across communication networks, relying on diverse connecting devices and cables for smooth network operation. The surge in internet users and the widespread adoption of digital services have led to an explosive growth in the volume of sensitive data handled by organizations. Structured cabling systems, by enabling high-speed data transmission, have been instrumental in driving market expansion. The increasing demand for automated business processes, the proliferation of IoT data, a strong focus on time and cost efficiency, and intensifying competition have significantly boosted the need for these systems.

Moreover, structured cabling systems facilitate faster data transmission, empowering businesses to enhance the efficiency of their decision-making processes and ultimately maximize profitability. However, the high cost associated with fiber optic cables, their incompatibility with older communication infrastructure, and the volatility of copper prices pose potential challenges to industry growth.

Detailed Segmentation:

Product Type Insights

The fiber optic cables segment is estimated to register the highest CAGR over the forecast period. Fiber optics serve as the internet's backbone, and optical fiber cables serve as the medium for transporting data from one location to another. These cables are used in various verticals, including telecommunication, residential and commercial, government, utilities, aerospace, and private data networks. Increasing demand for high-speed Internet services is expected to be the key growth factor for the fiber optic cables segment. The growing use of new telecommunication technologies, such as 5G mobile and FTTX (Fiber-to-the-X) applications, is also expected to drive the growth of this segment.

Application Insights

The data center segment is expected to exhibit a high CAGR of over 11.3% from 2023 to 2030. The growth of structured cabling in data centers is due to the increasing use of IoT devices, mobile data, and smart applications. A significant amount of data is generated through digital devices, necessitating more storage, thus driving demand for data centers. This, in turn, increases demand for high data transmission speeds. Data center market competitors are increasing their foothold in previously untapped locations. Consequently, demand for structured cabling systems is anticipated to grow over the forecast period.

Vertical Insights

The IT and telecommunications segment dominated the market in 2022 with a share of around 35%. Technological innovations in the telecommunications sector, such as the 5G network, require high bandwidth and low latency provided by structured cabling systems. This drives the market over the forecast period.

Regional Insights

Asia Pacific is expected to emerge as the fastest-growing regional market, with a CAGR of 12.5% over the forecast period. The major factors such as government initiatives to promote advanced infrastructure, digitization, accelerated adoption of smart devices, rising population, and investments in cloud and IoT technologies are expected to contribute to the regional market's growth. Developing economies such as China and Japan are leading the APAC region. The increasing Internet use in these countries is resulting in a rising number of broadcast activities. This, in turn, is expected to drive the regional market's growth over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Structured Cabling Market

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of various prominent players. Players have adopted strategies such as agreements, expansions, collaborations, and joint ventures. They are engaging in developing new products with high speed and improved features to enhance their product portfolio and hold a strong position in the market. For instance, in February 2021, Legrand announced the acquisition of the Champion ONE (C1) family of brands, one of the prominent suppliers for optical networking components and solutions for the data center, enterprise, and telecommunication markets.

In another instance, In September 2021, Nexans SA announced that it had agreed to the acquisition of Centelsa, the manufacturer of premium cable in Latin America active in producing cables for Building and utility applications.

Companies have also obtained approvals from different governments to launch products that can provide high speed and security. Some prominent players in the global structured cabling market include:

ABB Ltd

Belden Inc.

CommScope Holding Company, Inc.

Corning Incorporated

Furukawa Electric Co., Ltd.

Legrand SA

Nexans

Schneider Electric

Siemens AG

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

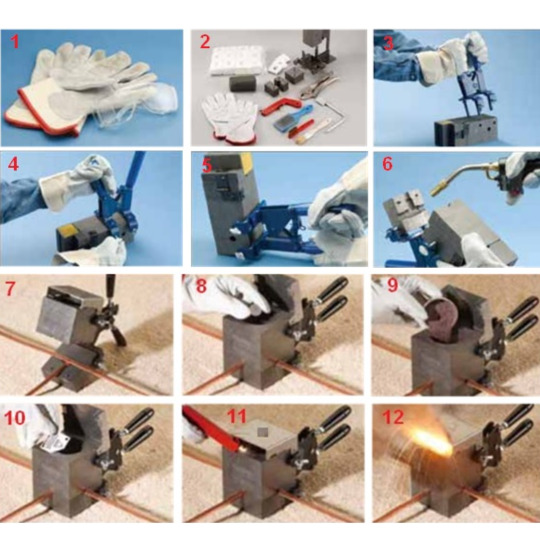

Exothermic Welding Mould: The Foundation of Reliable Grounding Joints

When it comes to permanent electrical connections in critical grounding systems, the role of the Exothermic Welding Mould cannot be overstated. It's the essential component that ensures precision, control, and safety during every weld.

At Amiable Impex, we specialize in high-quality Exothermic Welding Moulds that meet the highest industry standards. Whether you are working on electrical substations, solar plants, or railway grounding systems, using the right mould is key to successful exothermic bonding.

What is an Exothermic Welding Mould?

An Exothermic Welding Mould is typically made from high-grade graphite and designed to contain the exothermic reaction during a welding process. It holds the conductors (such as cable to cable, cable to rod, or cable to flat bar) in place and directs the molten metal precisely where it’s needed.

These moulds are reusable, durable, and manufactured in various shapes and sizes to suit different connection types. Every weld starts with a quality mould — and that’s why it’s such a crucial part of the process.

Why is the Mould So Important?

The mould is where the magic happens. It ensures:

Proper alignment of conductors

Controlled flow of molten metal

Consistent weld size and strength

Safety by containing the high-temperature reaction

With a poorly designed or low-quality mould, the risk of failed connections, leakage, or even fire hazards increases significantly. That’s why trusted suppliers like Amiable Impex provide precision-engineered Exothermic Welding Moulds to ensure flawless execution every time.

Applications of Exothermic Welding Mould

Exothermic Welding Moulds are used in a variety of industries where grounding and bonding are critical. These include:

Power generation and transmission

Oil & gas refineries

Petrochemical plants

Data centers

Telecom towers

Railway signaling systems

Lightning protection setups

Each application requires a different mould design, and Amiable Impex offers a full range of options to suit every configuration.

Why Choose Amiable Impex for Welding Moulds?

As a leader in the field, Amiable Impex provides:

High-quality graphite moulds with excellent heat resistance

Compatibility with a wide range of Exothermic Welding Powder

Long life span with up to 50–70 welds per mould

Custom moulds designed for specific project needs

Affordable Exothermic Welding Kit Price with complete accessories

We’re not just a Exothermic Welding Powder Manufacturer — we’re your one-stop solution for all things exothermic welding. Explore our products atexothermic-welding.com.

Types of Exothermic Welding Moulds

Here are some common types of Exothermic Welding Moulds offered by Amiable Impex:

Cable to cable (parallel or cross)

Cable to rod

Cable to ground rod

Cable to plate

Ground rod to structure

Each mould type is designed for a specific use case, ensuring optimal flow of molten copper and creating a strong, permanent bond.

Exothermic Welding Kit Price – What’s Included?

A typical Exothermic Welding Kit includes:

Exothermic Welding Mould

Exothermic Welding Powder

Cleaning brushes and tools

Ignition tools and flint igniter

Metal disks for reaction

The Exothermic Welding Kit Price varies depending on the number of connections and type of mould required. But when you choose Amiable Impex, you’re guaranteed value for money and the highest quality materials in the market.

What About Exothermic Welding Cost?

While the Exothermic Welding Cost may seem higher initially than mechanical connections, it's a one-time investment that brings lifelong value. No corrosion, no maintenance, and zero electrical resistance issues.

Think long-term — no recurring costs, no replacements, and no failures. That’s what makes exothermic welding a smart choice, especially for critical infrastructure.

Handling and Maintenance Tips

To extend the life of your Exothermic Welding Mould, follow these simple tips:

Clean thoroughly after every weld

Store in a dry place

Do not expose to moisture

Avoid rough handling to prevent surface cracks

Always use the correct amount of Exothermic Welding Powder

Taking good care of your mould not only ensures more welds but also guarantees better and safer performance.

FAQs

Q1. How many times can I reuse an Exothermic Welding Mould? A1. A well-maintained mould can last up to 50–70 welds, depending on the type and usage.

Q2. Can I use the same mould for different cable sizes? A2. No. Moulds are designed for specific conductor sizes and shapes. Always match the mould to your application.

Q3. What makes Amiable Impex a trusted supplier? A3. Our commitment to precision, quality materials, and full customer support has made us a preferred supplier across industries worldwide.

Conclusion

A high-quality Exothermic Welding Mould is the foundation of every successful weld. It ensures alignment, safety, and strength — three pillars of any reliable electrical connection. When paired with premium Exothermic Welding Powder and used properly, these moulds produce lifetime joints that can withstand even the harshest environments.

For all your exothermic welding needs — moulds, powders, kits, and accessories — trust Amiable Impex, your global partner in quality and performance.👉 Learn more atexothermic-welding.com and take the first step toward safer, stronger connections today.

0 notes

Text

North America Structured Cabling Market Set for Strong Growth with Increasing Demand for High-Speed Networks

The North American structured cabling market is witnessing significant growth, fueled by the escalating demand for high-speed networks and the proliferation of data-driven technologies across industries. As businesses and consumers demand faster, more reliable connectivity, structured cabling systems are becoming the backbone of modern IT infrastructures, providing the physical foundation necessary to support the digital age.

0 notes

Text

The Role of a Cable Ladder Supplier & manufacturer in Industrial Infrastructure Projects

In industrial infrastructure, cable management is key to the smooth flow of electrical and communication systems. Cable ladder is an important element that plays an integral part in this process. Cable ladders are necessary to manage, support, and shield electrical cables in manufacturing, power plants, and construction industries. Having developed itself into a trusted name, Parco Engineers is one of the foremost suppliers and manufacturers of cable ladders, ensuring they are highly durable and effective products customized according to varied industrial needs.

Cable Ladder Introduction and Application

A cable ladder is a building system used for supporting electrical cables in industrial, commercial, and utility applications. In contrast to other systems, a ladder-type cable tray has improved ventilation and cable accessibility that are critical in heat dissipation and maintenance efficiency.

Cable ladders are perfectly suitable for the handling of heavy cables over extensive runs. Equipped with features such as high carrying capacity, high strength construction, and versatility, ladder cable trays are utilized universally in industries that demand reliability and durability.

The Role of a Reliable Cable Ladder Supplier

A reliable cable ladder supplier such as Parco Engineers is responsible for providing industries with high-quality products that are optimized for performance. Through customized solutions and strict quality control, good suppliers are able to fulfill the stringent demands of industrial infrastructure projects.

Most Important Advantages of Selecting the Right Cable Ladder Supplier:

Quality Guarantee: Parco Engineers guarantees that all GI ladder type cable trays and galvanized cable trays are up to industry standards.

Customization: Being a leading cable ladder manufacturer, Parco Engineers provides customized solutions according to project requirements.

Material Excellence: Right from hot dip galvanized products to long-lasting galvanized materials, excellence is the focus to ensure longevity and performance.

Manufacturing Expertise in Cable Ladders

A skilled cable ladder producer uses modern methods and high-quality materials to create long-lasting cable management systems. Parco Engineers is skilled in producing high-quality ladder trays from top-class galvanized iron metal and other corrosion-resistant materials.

Why Galvanized Cable Ladders?

Resistance to Corrosion: Hot dip galvanized coatings shield the metal against corrosion and environmental attacks.

Strength and Longevity: Galvanized iron increases the strength and longevity of GI ladder cable trays.

Low Maintenance: Galvanized steel items are low on maintenance, saving costs in the long run.

Industrial Applications of Cable Ladders

Multiple sectors use cable ladders in different industries to achieve structured cabling in both indoor and outdoor conditions. Industries that find application for cable ladders include:

Power Plants: High temperature and difficult situations are endured by heavy-duty ladder type cable trays.

Oil & Gas Industries: Hot dip galvanized trays that are corrosion-resistant ensure durability in harsh environments.

Construction Sites: Ladder trays make cable routing easier across massive sites.

Data Centers: Keeping cables organized to prevent overheating and signal loss.

Parco Engineers has established itself as a leading cable ladder supplier, providing unparalleled experience in the production of GI perforated cable trays, ladder trays, and hot dip galvanized sheet products. Their emphasis on precision engineering and quality control makes them stand out in the market.

Key Features of Parco Engineers’ Cable Ladders:

Strong Design: Heavy-duty construction with reinforced side rails for stability.

Range of Sizes: Customizable sizes to suit various project requirements.

Superior Protection: Hot dip galvanized coatings for corrosion protection.

Easy Installation: Quick and easy to install, reducing labor and time.

Benefits of Using Galvanized Cable Ladders

In harsh industrial environments, it is critical to use galvanized materials in order to guarantee long-lasting durability. Parco Engineers excels in offering:

GI perforated cable trays for improved airflow and ventilation.

GI ladder type cable trays where strength is coupled with versatility.

Hot dip galvanized products that provide superior corrosion resistance.

Why Galvanized Products Shine in Industrial Environments:

Increased Lifespan: Resistant to environmental stresses and high temperatures.

Increased Safety: Eliminates the risk of electrical failures and fire safety hazards.

Sustainability: Galvanizing prolongs product lifespan, lowers replacement rates, and decreases environmental footprint.

Select Parco Engineers for Your Cable Ladder Requirement

Parco Engineers isn’t merely a steel trader or a manufacturer but they’re industry leaders specializing in providing cutting-edge products for empowering industrial infrastructure projects. Keeping their promise for quality and innovations, they keep their GI ladder cable tray, perforated cable tray, as well as the hot dip galvanized steel at par with industrial standards.

Through the integration of advanced manufacturing techniques with high-quality materials, Parco Engineers is continually raising the bar as a reliable cable ladder manufacturer and cable ladder supplier in Mumbai and worldwide.

In industrial infrastructure development, effective cable management is essential for successful operations. Selecting a trusted cable ladder supplier such as Parco Engineers ensures high-performance, long-lasting solutions for different industries. From GI ladder cable trays to hot dip galvanized products, Parco Engineers provide unparalleled quality to power your projects with stability, efficiency, and longevity.

For top-of-the-line cable ladders, galvanized steel plates, and innovative cable management products, rely on Parco Engineers for your industrial success.

#cable ladder supplier#cable ladder manufacturer#ladder type cable tray#ladder cable tray#ladder tray#cable ladder#gi ladder type cable tray

1 note

·

View note

Text

Top Copper Cables Supplier in India – Why NexTik Leads the Way in Networking Solutions.

Copper cables Supplier in India | Copper cables manufacturers in India | Copper cables.

In today's hyper-connected digital world, uninterrupted data transmission is critical for businesses, service providers, and people alike. Whether it's setting up a local area network (LAN), guaranteeing consistent data transfer in a data center, or allowing high-definition video surveillance, the quality of networking cables is the cornerstone of all communication systems. Copper cables are one of the most dependable and extensively used solutions, thanks to their stability, performance, and cost-effectiveness.

As a trusted Copper Cables Supplier in India, Nextik stands out as a market leader, offering a diverse range of high-quality copper networking cables designed for optimal performance and long-term durability. With a strong focus on innovation, quality, and customer satisfaction, Nextik continues to support India's growing infrastructure needs through reliable copper cable solutions.

Why Copper Cables Still Dominate Networking Infrastructure

Despite the growing use of fiber optics, copper networking cables remain the backbone of many small to medium-sized networks. Their low cost, simplicity of installation, and compatibility with existing infrastructure make them an excellent alternative for both business and domestic use.

As a leading Copper Cables Supplier in India, Nextik offers a wide selection of copper cable types—such as Cat5e, Cat6, and Cat6A—that ensure consistent transmission rates, low crosstalk, and excellent interference resistance. Choosing high-quality cables from a trusted name like Nextik enables smooth communication, reliable data transmission, and strong network stability to meet today’s digital demands.

NexTik – A Reliable Copper Cables Supplier in India

NexTik, an important producer and Copper Cables Supplier in India, combines modern technology, strict quality control, and local manufacturing expertise to deliver industry-grade solutions. Our copper cables are engineered to meet international standards and are ideal for a wide range of applications, including LAN, CCTV surveillance, VoIP, structured cabling, and data centers.

Here’s why NexTik is the favored Copper Cables Supplier for many businesses across the country:

1. Wide Range of Copper Networking Cables

NexTik offers a comprehensive portfolio of copper cables to cater to diverse networking needs. Our product range includes:

Cat5e Cables – Ideal for basic networking applications with speeds up to 1 Gbps and 100 MHz bandwidth.

Cat6 Cables – Suitable for high-speed networks, supporting up to 10 Gbps and 250 MHz bandwidth.

Cat6A Cables – Built for advanced data centers and enterprise-grade applications, providing up to 10 Gbps over longer distances with 500 MHz bandwidth.

All of our copper cables are offered in UTP (Unshielded Twisted Pair) and STP (Shielded Twisted Pair) configurations, allowing clients to select based on their installation environment and disturbance levels.

2. Made-in-India Manufacturing Excellence

NexTik is satisfied to manufacture its copper cables domestically as part of the "Make in India" program. Our in-house production ensures:

High-quality materials and precision engineering

Faster delivery timelines

Affordable pricing without compromising on performance

Tailored solutions for Indian networking environments

Customers that choose NexTik not only support local production, but also benefit from goods built exclusively for the Indian climate and operational requirements.

3. Unmatched Quality and Performance

Every NexTik copper cable undergoes stringent testing to ensure high electrical performance, minimal signal loss, and compliance with international safety and performance standards such as TIA/EIA and ISO/IEC. Our cables offer excellent resistance to electromagnetic interference (EMI) and crosstalk, enabling clear and uninterrupted data transmission.

As a trusted Copper Cables Supplier in India, NexTik’s dedication to innovation, consistency, and customer satisfaction has made us a reliable partner for IT infrastructure installers, system integrators, and telecom businesses across the country.

4. Customized Solutions and Technical Support

We recognize that each networking arrangement is unique. That is why NexTik provides bespoke cable lengths, packaging, and combinations based on your project specifications. Our team of professionals is always available to give technical consulting, installation help, and after-sales support, ensuring that your copper cable infrastructure runs smoothly and efficiently for the long term.

5. Applications Across Diverse Industries

Our copper networking cables are used in a wide range of industries, including:

Corporate offices and enterprises

Educational institutions

Smart cities and government infrastructure

Retail and hospitality

Surveillance and security systems

Residential and commercial complexes

From simple LAN setups to high-density data transmission, NexTik’s copper cables deliver dependable results every time.

Choose NexTik – Your Trusted Partner in Networking Cables

In an era where connection drives development, selecting a trustworthy Copper Cables Supplier in India is more critical than ever. NexTik combines cutting-edge manufacturing, premium materials, and extensive industry expertise to deliver best-in-class copper networking cables across the country.

Whether you're setting up a small office network or a large-scale infrastructure, NexTik provides scalable, efficient, and dependable copper cable solutions tailored to your needs.

explore our complete range of copper networking cables and discover how NexTik, a leading Copper Cables Supplier in India, can support your digital growth. Contact Us

0 notes

Text

Dedicated Server Hosting Netherlands

Why Buy a Netherlands Dedicated Server for Business Growth and High-Speed Hosting?

The Amsterdam Internet Exchange (AMS-IX) processes an incredible 8.3TB of data each second, with peaks hitting 11.3TB per second. This makes dedicated server hosting Netherlands a smart choice for companies that need strong hosting solutions. The country stands third in Europe for data center facilities, with almost 300 data centers operating in 2024. Only Germany and the UK have more facilities.

Netherlands dedicated server services let you handle up to 30 times your website's normal daily traffic. This capacity works perfectly to manage promotional events and unexpected traffic spikes. The country's advanced fiber optic network provides smooth connectivity, and its strict GDPR compliance will give you solid data protection. Amsterdam's data centers boast a 99.97% uptime guarantee. The Netherlands ranks seventh worldwide for reliable power supply, creating an infrastructure that excels in both performance and reliability.

This piece will help you learn about how Netherlands dedicated servers can stimulate your business growth. We'll get into the infrastructure capabilities and explore budget-friendly aspects of this hosting solution.

Netherlands Server Infrastructure Analysis 2024

The Netherlands is an excellent place for hosting dedicated servers due to the high-quality streaming and adaptable solutions that are available there.

The Netherlands' data center market reached USD 1.20 Billion in 2023. We invested heavily in reliable infrastructure to achieve this growth. AMS-IX Network Architecture runs on a distributed exchange system that connects multiple independent colocation facilities in Amsterdam. The network uses MPLS/VPLS infrastructure and supports connections through 10GE, 100GE, and 400GE interfaces. Traffic peaked at an impressive 11.92 Tb/s in January 2024.

A reliable power grid forms the life-blood of dedicated server hosting in the Netherlands. The grid operator TenneT maintains 99.99% availability, making it one of the world's most dependable power systems. The network's exceptional reliability comes from its 265,000 km of underground cables. These cables make up 97% of the infrastructure and protect it from bad weather.

New fiber-optic connections grew by 250,000 in Q1 2024. The network now serves 7.38 million households, with 2.92 million subscribers using fiber-optic plans. Some areas still lack fiber coverage, including parts of Groningen, Noord-Holland, Zuid-Holland, Zeeland, and Limburg.

Server Configuration Options for Business Growth

The right server configuration is crucial to business growth in the Netherlands' hosting environment.

Enterprise-Grade Hardware Specifications

Today's dedicated servers in the Netherlands come with multi-core processors that offer 4 to 64 cores. Businesses can pick between Intel Xeon or AMD EPYC processors. AMD's latest EPYC "Turin" processors support up to 192 cores. RAM options start at 16GB and go up to 1536GB. These specifications work perfectly for high-demand applications and virtual machine setups.

Storage options include SATA drives, SSDs, and NVMe drives. SSDs run 5-10 times faster than standard drives, which makes them perfect for data-heavy operations. Servers usually have 4 to 12 drive slots. This setup allows businesses to add more storage when needed.

Scalable Resource Allocation Systems

The Netherlands' dedicated server hosting infrastructure supports both vertical and horizontal scaling. Businesses can upgrade RAM and storage with minimal downtime through vertical scaling. This approach works best for applications that have predictable resource needs.

Horizontal scaling with extra servers works better for changing workloads. This setup allows:

Resource distribution across multiple servers

Automated provisioning based on needs

Pay-per-use resource allocation

This scalable structure supports automated backend services and gives control over reboots, OS reloads, and IP management. Private network options help create secure hybrid cloud setups that ensure continuous resource allocation across different infrastructure parts.

Performance Benchmarks and Metrics

The current implementation of the AMS-IX peering platform uses an MPLS/VPLS infrastructure. This setup allows for a resilient and highly scalable infrastructure inherent to MPLS, while at the same time the interface towards the members and customers is still the common shared Layer 2 Ethernet platform.

Speed and reliability tests show that Netherlands-based servers have major advantages over others.

Latency Comparison: EU vs Global Locations

Network tests show impressive low latency results within European connections. Servers in Amsterdam can reach UK locations in just 11ms, which helps European users the most. Our largest longitudinal study shows that cross-Atlantic connections take 90-100ms. This makes Dutch server hosting a smart choice for European markets.

Connection Route

Netherlands-UK

Netherlands-US

Local (AMS-IX)

Average Latency

11ms

90-100ms

<10ms

Bandwidth Throughput Analysis

Dutch infrastructure delivers outstanding bandwidth performance through the AMS-IX network. Recent tests confirm that servers reach 40 Gbit backbone connectivity, which ensures stable throughput for demanding applications. Dutch networks keep speeds consistent thanks to direct backbone connections.

Load Testing Results

Load testing services showcase these servers' reliable capabilities:

Support for up to 100,000 concurrent users

Up-to-the-minute data analysis from multiple global points

Clear insights into server response under peak loads

Dutch dedicated server options excel at handling sudden traffic spikes. Stress tests prove that servers stay stable even under very heavy loads. Businesses get detailed metrics about their setup's performance and practical suggestions to optimize it.

Cost-Benefit Analysis for Business Investment

Financial analysis shows dedicated server hosting in Netherlands costs USD 80.00 monthly. This is higher than shared hosting at USD 10.00.

Total Cost of Ownership Calculator

The TCO covers several essential components. Direct costs include hardware procurement while indirect expenses relate to maintenance and operations. A detailed TCO analysis should consider:

Hardware maintenance and repairs

Power consumption (USD 731.94 annually per server)

Technical support and staffing

Software licensing fees

Physical space requirements

These factors help businesses save 79% on their IT budget when they choose Netherlands dedicated servers instead of on-premises infrastructure over five years.

ROI Projections: 3-Year Analysis

We calculated the three-year ROI by comparing operational costs with the original investment. Standard configurations (2 vCPUs, 8GB RAM, 512GB storage) cost USD 313.90 monthly to operate. This is significantly lower than on-premises solutions at USD 1476.31.

buy Netherlands dedicated server shows a 155% ROI over three years. The benefits grow through lower maintenance costs and no hardware refresh cycles. Annual subscriptions provide extra savings by reducing monthly costs from USD 130.00 to about USD 80.00.

Conclusion

Netherlands dedicated servers are a compelling choice for businesses that want to build a strong digital presence in Europe. The state-of-the-art infrastructure uses AMS-IX's remarkable 11.92 Tb/s peak capacity. These servers provide exceptional performance for demanding applications.

Enterprise-grade hardware specifications and flexible expandable solutions let businesses adapt their resources when they just need to grow. The performance advantages become clear in European markets. Businesses can expect low latency rates of 11ms to UK locations and reliable bandwidth throughput with 40 Gbit backbone connectivity.

The numbers show most important long-term benefits with a 155% ROI over three years and 79% savings compared to on-premises solutions. Netherlands' reliable power infrastructure keeps 99.99% grid availability. These factors make dedicated servers an affordable choice for businesses that prioritize performance and value.

Netherlands dedicated servers support up to 100,000 concurrent users while prices start at just USD 80.00 monthly. Businesses don't have to choose between quality and value anymore. This combination of capabilities and affordable pricing makes Netherlands dedicated hosting an ideal solution for businesses looking for reliable, high-performance hosting services.

FAQs

Q1. What are the main advantages of using a dedicated server in the Netherlands? Dedicated servers in the Netherlands offer improved performance, enhanced security, and increased reliability. They provide exclusive access to server resources, allowing for optimal performance during traffic spikes and the ability to handle up to 100,000 concurrent users.

Q2. How does the Netherlands' server infrastructure compare to other European countries? The Netherlands boasts exceptional internet infrastructure, with the AMS-IX network handling up to 11.92 Tb/s of traffic. The country ranks third in Europe for data center facilities and offers low latency connections, making it an ideal choice for businesses targeting European markets.

Q3. What server configuration options are available for business growth? Businesses can choose from a range of enterprise-grade hardware specifications, including multi-core processors (4 to 64 cores), RAM configurations up to 1536GB, and various storage solutions like SSDs and NVMe drives. Scalable resource allocation systems support both vertical and horizontal scaling approaches.

Q4. How cost-effective are dedicated servers in the Netherlands? While dedicated servers start at a higher price point than shared hosting, they offer significant long-term benefits. Businesses can expect a 155% ROI over three years and 79% savings compared to on-premises solutions. Monthly costs can be as low as $80 with annual subscriptions.

Q5. What performance metrics can businesses expect from Netherlands dedicated servers? Netherlands servers demonstrate remarkably low latency within European connections, achieving round-trip times of 11ms to UK locations. They offer 40 Gbit backbone connectivity, ensuring stable throughput for high-demand applications. Load testing shows support for up to 100,000 concurrent users with maintained stability under heavy loads.

0 notes

Text