#DataManagementTools

Explore tagged Tumblr posts

Text

The Role of Fitment Data Management Tools :

Fitment Data Management Tools are crucial for modern businesses. Here’s how they can benefit you:

Centralized Organization 📊 – Keep all your data in one place for easy access.

Real-Time Updates 🔄 – Stay up-to-date with automatic data refreshes.

Seamless Distribution 📡 – Distribute data smoothly across multiple channels.

Supports Expansion 🌍 – Scale effortlessly as your business grows.

Enhanced Decision-Making 💡 – Make informed decisions with accurate, real-time data.

Integration Capabilities 🔗 – Easily integrate with other tools and systems.

Discover more at www.pcfitment.com

#FitmentData#DataManagementTools#RealTimeUpdates#SeamlessIntegration#BusinessExpansion#DecisionMaking#DataDriven#CentralizedData#TechSolutions#EfficientBusiness#DataDistribution#BusinessGrowth#IntegrationCapabilities

1 note

·

View note

Text

Top Tools and Techniques for Effective Data Management Planning

In today’s digital age, data is at the heart of decision-making for businesses. However, managing large volumes of data effectively requires proper data management planning and the right tools. Whether you're a business owner or Google Analytics consultants, having a solid strategy ensures accurate, actionable insights. Here are the top tools and techniques to streamline data management and boost efficiency.

1. Data Integration Tools

Platforms like Talend and Informatica simplify the integration of data from multiple sources. These tools ensure your data management planning is seamless, helping you consolidate and organize data efficiently.

2. Cloud-Based Storage Solutions

Solutions such as Google Cloud and AWS offer scalable, secure storage for your data. These platforms allow for easy access, ensuring your team can collaborate and analyze data in real-time.

3. Advanced Analytics Platforms

Google Analytics is a vital tool for understanding website performance and user behavior. A Google Analytics consultant can leverage its powerful features to identify trends, track performance metrics, and enhance your marketing strategies.

4. Data Quality Assurance Techniques

Data quality is critical for effective decision-making. Regular audits, validation tools, and cleansing processes ensure your data is accurate, reliable, and actionable.

5. Automated Reporting Tools

Power BI and Tableau are excellent for creating automated, interactive dashboards. These tools allow businesses to visualize data trends and track performance metrics, making it easier to align decisions with goals.

Conclusion

Effective data management planning requires the right mix of tools and techniques. By integrating platforms like Google Analytics with other advanced tools, businesses can unlock the full potential of their data. Partnering with Kaliper.io ensures expert guidance for accurate insights and better results. Start planning your data strategy today!

0 notes

Text

How Microfinance Banking Software Can Improve Client Data Management

In the dynamic world of financial services, microfinance institutions play a vital role in bridging the gap between underserved populations and essential financial resources. As the sector continues to grow, the need for efficient client data management has become paramount. Enter Microfinance Banking Software — a game-changing tool designed to enhance operations, streamline workflows, and improve the accuracy of client data management.

Why Client Data Management Matters in Microfinance

Client data management forms the backbone of any microfinance institution. Accurate, accessible, and well-organized data empowers organizations to:

Provide Tailored Services: Understanding client needs allows institutions to offer products that meet their specific financial goals.

Reduce Operational Errors: A centralized system minimizes the risk of duplicate or inaccurate entries.

Enhance Client Trust: Securely managing personal and financial information builds long-term client relationships.

Given the criticality of these factors, adopting reliable Microfinance Banking Software becomes a necessity.

Also read: How Advanced Microfinance Software is Transforming Financial Services

Key Features of Microfinance Banking Software for Data Management

Modern Microfinance Banking Software comes equipped with advanced functionalities designed to simplify client data handling. Below are some standout features:

1. Centralized Database Management

Microfinance software provides a unified platform where client information is stored securely. This ensures all data is up-to-date and eliminates the challenges of maintaining multiple, disjointed records.

2. Automated Data Entry and Validation

Gone are the days of manual record-keeping. Automated systems minimize human error and ensure that data is accurate and consistent across all platforms.

3. Real-Time Data Access

With cloud-based solutions, field officers and branch staff can access and update client information in real time, improving decision-making and reducing turnaround times.

4. Data Analytics and Reporting

Advanced reporting tools allow institutions to analyze client behavior, repayment trends, and demographic insights. This data-driven approach helps in creating better strategies and products.

5. Security Protocols

Microfinance software incorporates encryption, multi-factor authentication, and regular system audits to safeguard sensitive client information.

Benefits of Improved Client Data Management

Adopting Microfinance Banking Software for client data management yields numerous benefits that directly impact operational efficiency and customer satisfaction:

Streamlined Workflows

Automating routine processes such as loan application reviews and account updates frees up staff to focus on strategic tasks.

Enhanced Client Experience

Faster processing times and personalized services ensure a superior client journey from onboarding to loan disbursement.

Regulatory Compliance

Financial institutions must adhere to strict regulatory frameworks. Reliable software ensures compliance by maintaining detailed, audit-ready records.

Scalability

As microfinance organizations expand, having a robust system that scales with the business is invaluable.

Cost Efficiency

Streamlined operations translate into reduced administrative costs, which can be redirected towards client-centric initiatives.

Also read: Benefits of Advanced Microfinance Software for Financial Efficiency

How Microfinance Software Supports Data Management

While Microfinance Banking Software takes center stage in managing client data, the broader category of Microfinance Software also offers support in related areas such as:

Loan tracking and monitoring

Financial reporting and accounting

Customer relationship management (CRM)

Together, these tools create a cohesive ecosystem where client data is not just managed but actively leveraged to drive organizational growth.

Challenges in Client Data Management and How Software Solves Them

1. Data Fragmentation

Many microfinance institutions struggle with scattered client data across various systems or spreadsheets. Microfinance banking software integrates all information into a single, secure platform, making access and updates seamless.

2. Human Error

Manual data entry often leads to inaccuracies that can impact decision-making. Automation within the software minimizes these errors and ensures data reliability.

3. Data Security Concerns

Handling sensitive client information comes with its risks. With advanced security measures, including encryption and access controls, microfinance software ensures that client data remains confidential and protected from breaches.

4. Difficulty in Generating Insights

Raw data is of little use without analysis. Microfinance software’s analytics capabilities turn raw data into actionable insights, aiding in strategy formulation and decision-making.

Steps to Implement Microfinance Banking Software Successfully

1. Assess Organizational Needs

Identify specific pain points in your current data management processes and list the must-have features for your software.

2. Choose the Right Vendor

Partner with a trusted provider like Gtech Web Solutions PVT. LTD., renowned for delivering the best microfinance software tailored to business needs.

3. Train Your Team

Ensure that your staff is well-versed in the new system through comprehensive training programs.

4. Monitor and Optimize

Continuously track software performance and make adjustments as needed to align with evolving business goals.

Future Trends in Microfinance Banking Software

The landscape of microfinance is ever-evolving, and the tools supporting it are no different. Here are some trends shaping the future:

Artificial Intelligence (AI)

AI-powered tools can predict client behavior, assess credit risk, and automate customer interactions, making data management even more efficient.

Blockchain Technology

Blockchain can enhance transparency and security in data handling, offering tamper-proof records and streamlined verification processes.

Mobile Integration

With increasing smartphone penetration, mobile-friendly software solutions allow clients to access services and update their details conveniently.

Green Initiatives

Eco-friendly software solutions focus on reducing paper usage by digitizing documents and records, aligning with sustainability goals.

Also read: Features to Look For In The Best Microfinance Software in India

Conclusion

In today’s fast-paced financial landscape, the importance of robust client data management cannot be overstated. Microfinance Banking Software offers an all-encompassing solution, enabling institutions to manage data efficiently, enhance client relationships, and achieve sustainable growth. By addressing challenges such as data fragmentation and security concerns, this software ensures microfinance institutions remain competitive and client-focused.

For microfinance institutions looking to make a meaningful impact, partnering with a reliable software provider is key. Gtech Web Solutions PVT. LTD. offers cutting-edge Microfinance Software and banking solutions designed to elevate your operations and ensure long-term success. Explore their offerings today and take the first step toward transforming your business.

#MicrofinanceBankingSoftware#MicrofinanceSoftware#ClientDataManagement#FinancialTechnology#FinTechSolutions#DigitalBanking#BankingSoftware#DataManagementTools#LoanManagement#FinancialInclusion#BusinessGrowth#SecureBanking#CloudBasedBanking#SoftwareForMicrofinance#OperationalEfficiency#RegulatoryCompliance#CustomerExperience#DataSecurity#FinTechInnovation#BankingSolutions

0 notes

Text

Anchor Software provides top-notch Data Quality Software Solutions and Customer Data Management Tools to keep your data accurate and organized. Their Advanced Address Validation Software ensures real-time address verification, reducing errors and improving customer satisfaction. Learn more at anchorcomputersoftware.com.

#DataQualitySolutions#CustomerDataManagement#AddressValidationSoftware#DataAccuracy#BusinessEfficiency#AnchorSoftware#AdvancedAddressValidation#CleanCustomerData#DataManagementTools#UndeliverableMailReduction

0 notes

Text

Leveraging Data Analytics As A Key Business Success Factor

With the data management services of EnFuse Solutions, businesses can easily leverage data analytics to their advantage in today’s data-centric world. Their commitment extends to recognizing and maximizing the value of underutilized data assets.

#DataManagement#DataManagementServices#DataManagementSystem#DataAnalytics#DataManagementTools#EnFuseSolutions

1 note

·

View note

Text

Choose the best data management tool available in India-HOICKO

Choose the top data management tool in India to complete your work so that you may view your data graphically and take use of the best work features for your data.

If you would like to learn more about hoicko visit us at:

https://www.hoicko.com/

Connect us at: +91-7627029423

1 note

·

View note

Photo

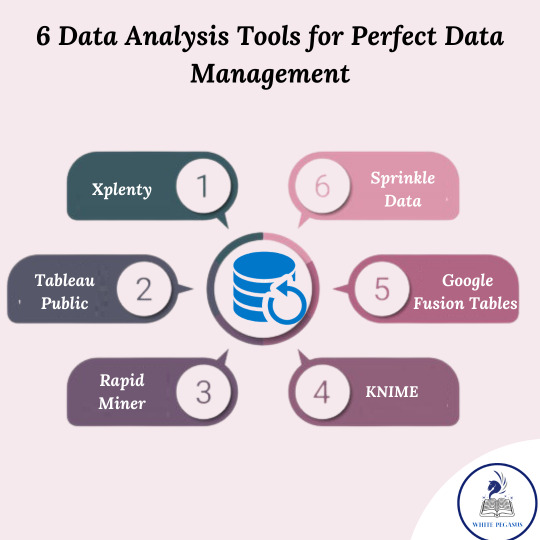

6 Data Analysis Tools for Perfect Data Management

• Xplenty • Tableau Public • RapidMiner • KNIME • Google Fusion Tables • Sprinkle Data

Learn More

0 notes