#DealStructuring

Explore tagged Tumblr posts

Text

𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐌𝐨𝐝𝐞𝐥𝐢𝐧𝐠 𝐟𝐨𝐫 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐋𝐨𝐚𝐧 𝐁𝐫𝐨𝐤𝐞𝐫𝐬!

In the fast paced world of commercial lending, financial modeling is no longer just a technical skill it’s a powerful strategic tool. For commercial loan brokers, it can completely transform how deals are assessed, structured, and closed. Whether you're helping a business secure funding or analyzing complex proposals, mastering financial modeling allows you to deliver more value, reduce risk, and gain trust from both clients and lenders.

What is Financial Modeling?

At its core, financial modeling is the practice of building a detailed, dynamic representation of a business’s financial situation. It involves using spreadsheets and data inputs to forecast future performance, simulate different financial outcomes, and analyze the impact of various strategic decisions. Think of it as a financial roadmap it gives clarity, insight, and direction to both brokers and borrowers.

Why It Matters for Loan Brokers:

1. Informed Decision Making Financial models allow you to evaluate a client’s financial health with precision. You can present proposals that are realistic, tailored, and backed by data. Instead of relying on surface level numbers, you’ll be able to dig deep into cash flow patterns, debt service coverage ratios, and profitability trends resulting in stronger, smarter decisions.

2. Risk Assessment & Mitigation A good financial model helps you simulate various scenarios what happens if revenue drops by 15%? What if expenses rise unexpectedly? By analyzing different what if situations, you’re able to identify and prepare for potential risks, giving you an edge in both structuring deals and advising your clients.

3. Streamlined Loan Structuring With a well built model, you can structure loans that align with the borrower’s needs while satisfying the lender’s criteria. Whether it’s determining optimal loan amounts, repayment schedules, or interest structures, financial modeling ensures you’re not guessing you’re calculating. This can lead to quicker approvals and more sustainable loan terms.

4. Increased Client Trust Clients want to work with brokers who bring insight, not just options. When you walk in with a clear, data driven model that outlines their financial position and opportunities, it builds confidence. You’re seen as a knowledgeable partner, not just a facilitator.

5. Stronger Lender Relationships Lenders appreciate brokers who come prepared. A financial model presents a professional, transparent snapshot of the borrower’s situation, reducing ambiguity and making underwriting easier. It also shows that you’ve done your homework something lenders never overlook.

Key Takeaways

Financial modeling is an essential skill for today’s commercial loan brokers. It goes beyond spreadsheets it enables you to present credible, customized loan proposals based on real data. This helps you make informed decisions, mitigate risk, and structure smarter deals. More importantly, it builds trust with clients and strengthens your relationships with lenders. In a competitive marketplace, brokers who can model effectively stand out, close faster, and grow their business more sustainably.

#CommercialLoans#FinancialModeling#LoanBrokers#BusinessGrowth#FinancialAnalysis#BrokeringSuccess#RiskManagement#ClientRelationships#CommercialLending#BusinessLoans#FinancialForecasting#DealStructuring#CashFlowModeling#FinanceStrategy#CloseMoreDeals#TrustedAdvisor#LoanOrigination#FinanceForBrokers#ProfessionalEdge#ClientSuccess

1 note

·

View note

Text

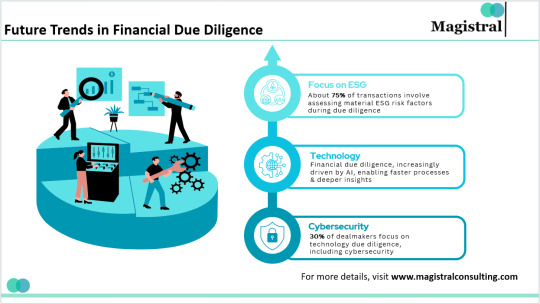

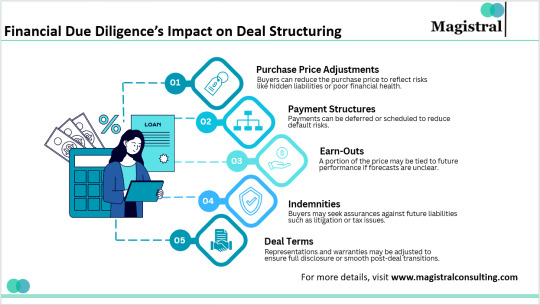

How Financial Due Diligence Shapes M&A Deal Structures

#financialduediligence#Dealstructure#finance#MagistralConsulting#mergerandacquisition#DueDiligence#Audit

0 notes

Photo

Looking forward to participating on this panel with a great group of colleagues at the TEDC 2020 Annual Conference. The second PGR will be on "Deal Structuring for Economic Development Projects: Type A, Type B and Non A/B Economic Development Organizations" with Kent Sharp of Sherman Economic Development Corporation as moderator and Diana Blank-Torres of City of Kyle Economic Development, Amy Madison, CEcD EDFP of Pflugerville Community Development Corp., and Josh Schneuker of Seguin Economic Development Corporation as panelists. Make sure you register for our 2020 Annual Conference so you don't miss out! https://lnkd.in/gksW6cK #TEDC #TEDC2020AnnualConference #EconomicDevelopment #KyleTexas #MoreThanHome #DealStructuring #innovationcorridor https://www.instagram.com/p/CEb8V1dlzqU/?igshid=1lpcq1ml8lsbp

#tedc#tedc2020annualconference#economicdevelopment#kyletexas#morethanhome#dealstructuring#innovationcorridor

0 notes

Text

Successful Deal Structuring: Tips for Commercial Loan Brokers!

Introduction:

Deal structuring is a crucial aspect of commercial loan brokerage, enabling brokers to design transactions that align with the needs and objectives of both borrowers and lenders. Effective deal structuring requires a deep understanding of financial principles, risk management, and negotiation techniques. By employing proven strategies and techniques, brokers can craft win-win deals that facilitate successful outcomes for all parties involved. Here are tips for successful deal structuring as a commercial loan broker. 1. Understand Client Objectives:

Begin by understanding the objectives, priorities, and constraints of your client. What are their financing needs? What are their long-term goals and risk tolerance? By gaining insight into your client's objectives, you can tailor the deal structure to meet their specific needs and preferences. 2. Analyze Financial Metrics:

Conduct a thorough analysis of the client's financial metrics, including cash flow, profitability, liquidity, and leverage. Assess the client's ability to service debt and generate sufficient returns on investment. Consider factors such as industry benchmarks, market conditions, and economic forecasts when evaluating financial metrics. 3. Mitigate Risk:

Identify potential risks associated with the deal and develop strategies to mitigate them effectively. This may involve structuring the loan with appropriate collateral, guarantees, covenants, or insurance provisions to protect the interests of the lender. Consider the borrower's creditworthiness, market risk, and operational risk when assessing risk factors. 4. Negotiate Terms and Conditions:

Negotiate loan terms and conditions that are favorable for both borrowers and lenders. Balance the interests of both parties by seeking win-win solutions that address key concerns and priorities. Be prepared to compromise and explore alternative options to reach mutually beneficial agreements. Focus on building rapport and trust with lenders to facilitate constructive negotiations. 5. Optimize Capital Structure:

Optimize the capital structure of the deal to maximize returns and minimize costs for the borrower. Consider factors such as interest rates, loan-to-value ratios, amortization schedules, and prepayment penalties when structuring the financing. Evaluate alternative financing options and sources of capital to determine the most cost-effective and flexible solution for the borrower. 6. Provide Value-Added Services:

Offer value-added services to enhance the attractiveness of the deal for both borrowers and lenders. This may include financial advisory services, strategic planning, market analysis, or introductions to potential investors or partners. By providing comprehensive support and guidance, brokers can differentiate themselves and add significant value to the deal. 7. Ensure Compliance and Documentation:

Ensure compliance with regulatory requirements and industry standards when structuring the deal. Prepare thorough and accurate documentation, including loan agreements, security documents, and disclosures, to formalize the terms of the deal. Work closely with legal counsel and other professionals to ensure that the deal is executed properly and in accordance with applicable laws and regulations.

Conclusion:

Successful deal structuring is a combination of art and science, requiring brokers to leverage their expertise, creativity, and negotiation skills to craft win-win solutions for borrowers and lenders. By understanding client objectives, analyzing financial metrics, mitigating risk, negotiating terms, optimizing capital structure, providing value-added services, and ensuring compliance, brokers can achieve successful outcomes and drive positive results in the competitive landscape of commercial loan brokerage.

#DealStructuring#CommercialLoanBrokers#LoanBrokerTips#FinancialDealMaking#LoanNegotiation#CommercialLoans#FinancialStrategy#RiskManagement#LoanTerms#ClientObjectives#CapitalStructure#LoanAnalysis#DealMaking#BrokerSuccess

1 note

·

View note