#FinancialForecasting

Explore tagged Tumblr posts

Text

𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐌𝐨𝐝𝐞𝐥𝐢𝐧𝐠 𝐟𝐨𝐫 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐋𝐨𝐚𝐧 𝐁𝐫𝐨𝐤𝐞𝐫𝐬!

In the fast paced world of commercial lending, financial modeling is no longer just a technical skill it’s a powerful strategic tool. For commercial loan brokers, it can completely transform how deals are assessed, structured, and closed. Whether you're helping a business secure funding or analyzing complex proposals, mastering financial modeling allows you to deliver more value, reduce risk, and gain trust from both clients and lenders.

What is Financial Modeling?

At its core, financial modeling is the practice of building a detailed, dynamic representation of a business’s financial situation. It involves using spreadsheets and data inputs to forecast future performance, simulate different financial outcomes, and analyze the impact of various strategic decisions. Think of it as a financial roadmap it gives clarity, insight, and direction to both brokers and borrowers.

Why It Matters for Loan Brokers:

1. Informed Decision Making Financial models allow you to evaluate a client’s financial health with precision. You can present proposals that are realistic, tailored, and backed by data. Instead of relying on surface level numbers, you’ll be able to dig deep into cash flow patterns, debt service coverage ratios, and profitability trends resulting in stronger, smarter decisions.

2. Risk Assessment & Mitigation A good financial model helps you simulate various scenarios what happens if revenue drops by 15%? What if expenses rise unexpectedly? By analyzing different what if situations, you’re able to identify and prepare for potential risks, giving you an edge in both structuring deals and advising your clients.

3. Streamlined Loan Structuring With a well built model, you can structure loans that align with the borrower’s needs while satisfying the lender’s criteria. Whether it’s determining optimal loan amounts, repayment schedules, or interest structures, financial modeling ensures you’re not guessing you’re calculating. This can lead to quicker approvals and more sustainable loan terms.

4. Increased Client Trust Clients want to work with brokers who bring insight, not just options. When you walk in with a clear, data driven model that outlines their financial position and opportunities, it builds confidence. You’re seen as a knowledgeable partner, not just a facilitator.

5. Stronger Lender Relationships Lenders appreciate brokers who come prepared. A financial model presents a professional, transparent snapshot of the borrower’s situation, reducing ambiguity and making underwriting easier. It also shows that you’ve done your homework something lenders never overlook.

Key Takeaways

Financial modeling is an essential skill for today’s commercial loan brokers. It goes beyond spreadsheets it enables you to present credible, customized loan proposals based on real data. This helps you make informed decisions, mitigate risk, and structure smarter deals. More importantly, it builds trust with clients and strengthens your relationships with lenders. In a competitive marketplace, brokers who can model effectively stand out, close faster, and grow their business more sustainably.

#CommercialLoans#FinancialModeling#LoanBrokers#BusinessGrowth#FinancialAnalysis#BrokeringSuccess#RiskManagement#ClientRelationships#CommercialLending#BusinessLoans#FinancialForecasting#DealStructuring#CashFlowModeling#FinanceStrategy#CloseMoreDeals#TrustedAdvisor#LoanOrigination#FinanceForBrokers#ProfessionalEdge#ClientSuccess

1 note

·

View note

Text

Strategy & Forecasting | Insight Business Solutions

Here at Insight Business Solutions, we empower businesses to navigate uncertainties, capitalise on opportunities, and achieve growth.

0 notes

Text

Why Businesses Benefit from Outsourced FP&A Services

Managing finances effectively is crucial for any business, but handling Financial Planning & Analysis (FP&A) in-house can be complex and costly. Many companies now turn to outsourced FP&A services to streamline operations, improve decision-making, and enhance financial performance.

Cost-Effective Expertise

Building an internal FP&A team requires hiring skilled professionals, investing in technology, and maintaining ongoing training. Outsourcing provides access to experienced financial analysts at a lower cost, allowing businesses to get high-quality insights without the expense of a full-time team.

Better Financial Insights & Reporting

Outsourced FP&A firms use advanced tools to deliver real-time reports and financial forecasts. These insights help businesses understand their cash flow, track key performance indicators (KPIs), and plan for future growth with confidence.

Scalability & Flexibility

Every business experiences financial fluctuations. With outsourced FP&A, companies can scale services up or down based on their needs, ensuring they receive the right level of support without long-term commitments.

Improved Decision-Making

Accurate financial analysis is essential for strategic planning. By outsourcing FP&A, businesses receive unbiased insights and data-driven recommendations, helping them make better financial decisions and minimize risks.

Focus on Core Business Goals

Financial analysis is time-consuming and requires continuous monitoring. Outsourcing allows business leaders to concentrate on growth and operations while experts handle financial planning, forecasting, and reporting.

Ensuring Compliance & Reducing Risk

Financial regulations can be complex and ever-changing. Outsourced FP&A professionals ensure that businesses remain compliant with industry standards, reducing the risk of financial mismanagement.

Conclusion

Outsourcing FP&A services helps businesses optimize financial performance, reduce costs, and gain expert insights for better decision-making. With flexible, scalable, and cost-effective solutions, companies can focus on growth while ensuring financial stability.

0 notes

Text

AI and Budgeting Automation: The Future of Financial Management

👤 Admin | 📅 December 19, 2024

1. Introduction to AI and Financial Management

Artificial Intelligence (AI) is not just transforming industries; it’s also revolutionizing how we manage our finances. AI-powered budgeting tools are rapidly becoming essential for individuals and businesses who want to take control of their financial future. By automating tedious tasks like tracking expenses, categorizing transactions, and predicting future costs, AI offers a smarter and more efficient approach to financial management.

Read More: Artificial Intelligence in Healthcare: Revolutionizing the Future of Medicine

How AI is Transforming Budgeting:

Expense Categorization: AI algorithms automatically categorize transactions, allowing users to see where their money goes each month without manually entering data.

Budget Predictions: Machine learning models analyze past spending patterns to predict future costs, offering personalized budget recommendations.

Financial Insights: AI tools provide actionable insights into spending habits, helping users adjust their budget to avoid overspending.

Automated Alerts: Set notifications to alert users when they’re nearing their budget limits, helping them stay on track.

Read More: AI-Powered Personal Finance Tools (2025 Edition)

2. The Advantages of AI in Budgeting Automation

Integrating AI into budgeting offers several key benefits:

Time-Saving: Automates routine tasks like categorizing expenses and calculating totals, saving users hours every month.

Accuracy: AI reduces human error, ensuring that all transactions are categorized correctly and budgets are accurate.

Cost-Effective: With AI tools, businesses and individuals can manage their finances more efficiently without the need for expensive financial advisors.

Customization: AI tools adapt to individual or business financial behavior, providing personalized advice and recommendations.

Read More : How Artificial Intelligence is Revolutionizing Budgeting and Savings

3. Challenges and Considerations in AI-Based Budgeting

While AI offers numerous advantages, there are some challenges and considerations to keep in mind:

Data Privacy: AI tools collect and analyze a lot of personal financial data, which raises privacy concerns. Users must ensure they use secure platforms with strong data protection policies.

Dependence on Technology: Relying heavily on AI for financial management might result in reduced human oversight, which could be problematic if the AI makes incorrect predictions.

Learning Curve: Some users may find it difficult to adjust to new AI-driven budgeting tools, especially if they’re not tech-savvy.

4. The Future of AI in Financial Management

The future of AI in financial management looks promising. As technology advances, AI-powered budgeting tools will become even more sophisticated, offering greater personalization, better prediction models, and more seamless integration with other financial platforms. In the near future, AI will not only automate budgeting but also provide deep insights into investment management, savings, and financial planning.

Conclusion

AI is revolutionizing the way we approach financial management by offering more personalized, efficient, and automated solutions. While challenges such as data privacy and reliance on technology exist, the benefits of AI-driven budgeting tools far outweigh these risks. As AI continues to evolve, it is poised to make financial management more accessible and manageable for both individuals and businesses alike. Whether you’re looking to save time, reduce costs, or gain deeper insights into your financial habits, AI can be a game-changer in achieving financial success.

#AI#budgetingautomation#financialmanagement#AIinfinance#automatedbudgeting#smartfinance#futureoffinance#financialtechnology#AItools#personalfinanceAI#businessfinanceAI#machinelearningforbudgeting#financialforecasting#AIfinanceapps#budgetingsoftware#expensetracking#financialplanning#financialanalytics#automationinfinance#budgetmanagementtools#moneymanagement#predictivebudgeting#AIdrivenfinance#AIsavings#AIbudgetingapps#futureofbudgeting#automatedfinancialplanning#financialmanagementtools#financialinsights#costprediction

0 notes

Text

Master Financial Forecasting in 30 Days: Strategies for Precision and Growth

Financial forecasting is crucial for effective budgeting, cash flow management, and identifying growth opportunities in today's fast-paced business environment. Yet, achieving accuracy is often a challenge. Learn how to enhance your forecasting precision in 30 days with actionable strategies like leveraging historical data, using AI-powered tools, and incorporating qualitative insights. Whether planning for growth or navigating uncertainty, these tips will help you make informed business decisions. Need expert guidance? Discover how VLC Solutions can empower your forecasting process with advanced tools and tailored solutions.

0 notes

Text

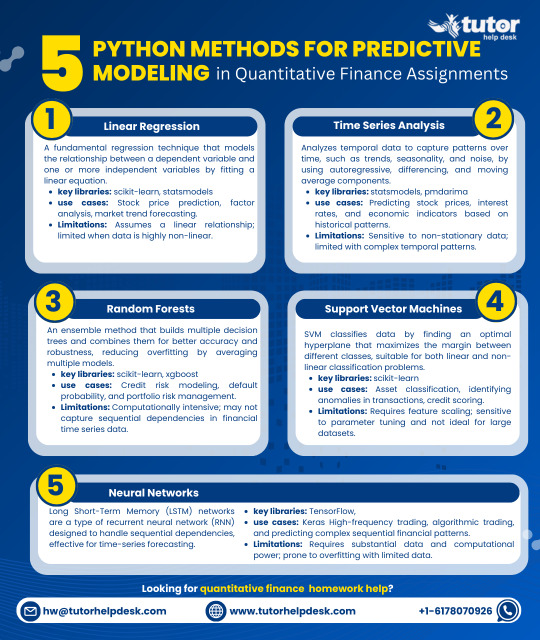

5 Python Programming Techniques to use for Predictive Modeling in Quantitative Finance Homework 🐍

Learning the syntax of Python is crucial when it comes to handling operative quantitative finance tasks and creating sound financial predictive models. In particular, the regression approach is known to be an effective tool in predictive modeling and Python offers quite a number of these.

Interested in knowing the 5 best Python methods that can assist you in solving quantitative finance homework faster?

👉 Read the full guide here

#AccountingHelp#AccountingHomework#Finance#FinancialMath#PythonForFinance#PredictiveModeling#DataAnalysis#FinancialForecasting#FinanceTutoringmodeling

0 notes

Text

How Accounting Firms Can Help Your Business Navigate Financial Challenges During Economic Downturns

Economic downturns can be challenging for businesses of all sizes. When the economy takes a hit, companies often face financial stress, fluctuating revenue, and uncertain market conditions. In such times, having a trusted partner by your side can make all the difference. Accounting firms in Abu Dhabi are uniquely positioned to provide crucial support during these difficult periods. Here’s how these firms can help your business navigate financial challenges and emerge stronger.

1. Financial Analysis and Forecasting

During an economic downturn, understanding your financial situation is paramount. Accounting firms in Abu Dhabi offer comprehensive financial analysis and forecasting services to help you:

Assess Cash Flow: Accurate cash flow analysis helps you understand your current liquidity position and plan for future cash needs. This is critical for managing day-to-day operations and avoiding liquidity crises.

Develop Financial Projections: By analyzing market trends and your business’s historical data, accounting firms can help you create realistic financial projections. These forecasts assist in budgeting and planning for different scenarios, ensuring you’re prepared for potential fluctuations.

2. Cost Management and Efficiency

Managing costs effectively is crucial when facing economic challenges. Accounting firms in Abu Dhabi can assist with:

Expense Review: Conducting a thorough review of your expenses to identify areas where cost-cutting is possible without compromising essential operations. This might include renegotiating contracts or finding more cost-effective suppliers.

Operational Efficiency: Providing insights into streamlining processes and improving operational efficiency. They can recommend changes that reduce waste and enhance productivity, helping you maintain profitability even in tough times.

3. Strategic Financial Planning

Strategic planning becomes even more important during economic downturns. Accounting firms can help by:

Developing Contingency Plans: Creating contingency plans to prepare for various financial scenarios. This includes strategies for managing reduced revenue, handling increased expenses, and navigating potential financial pitfalls.

Assessing Financial Risks: Identifying and evaluating financial risks specific to your industry and business. Accounting firms help you understand these risks and develop strategies to mitigate them.

4. Tax Planning and Compliance

Economic downturns often lead to changes in tax regulations and policies. Accounting firms in Abu Dhabi provide:

Tax Optimization: Advising on tax strategies to minimize liabilities and maximize deductions. They can help you take advantage of any available tax relief or incentives designed to support businesses during economic hardships.

Regulatory Compliance: Ensuring that your business complies with all relevant tax laws and regulations. This helps avoid penalties and ensures that your financial statements accurately reflect your situation.

5. Access to Financing

Securing financing can be challenging during economic downturns, but accounting firms can assist by:

Preparing Financial Statements: Helping prepare accurate and compelling financial statements required for loan applications or investor pitches. Well-prepared documents increase your chances of securing necessary funding.

Advising on Funding Options: Providing advice on various funding options, including traditional loans, government grants, or alternative financing solutions. They can help you choose the best option based on your business’s needs and situation.

6. Business Valuation

Understanding the value of your business is essential, especially if you’re considering restructuring or seeking investment. Accounting firms offer:

Accurate Valuation Services: Performing detailed business valuations to determine the fair market value of your company. This information is crucial for making informed decisions about selling, merging, or attracting investors.

7. Financial Reporting and Monitoring

Regular financial reporting and monitoring are essential for staying on top of your financial health. Accounting firms in Abu Dhabi provide:

Detailed Reports: Generating regular financial reports to track performance, monitor key metrics, and identify any emerging issues early. Timely reports enable you to make informed decisions and address problems proactively.

Performance Analysis: Analyzing financial performance against industry benchmarks and historical data to gauge your company’s standing and make necessary adjustments.

8. Expert Advice and Support

During uncertain times, having expert advice is invaluable. Accounting firms offer:

Strategic Consultation: Providing expert advice on navigating economic challenges and implementing effective strategies. Their insights can guide you through difficult decisions and help you find opportunities for growth.

Ongoing Support: Offering continuous support and guidance to help you adapt to changing circumstances and maintain financial stability.

Conclusion

Economic downturns present significant challenges, but partnering with a skilled accounting firm in Abu Dhabi can provide the support and expertise needed to navigate these difficulties successfully. From financial analysis and cost management to strategic planning and compliance, accounting firms offer essential services that help businesses stay resilient and thrive despite economic adversity. By leveraging their expertise, you can better manage your financial situation, optimize operations, and position your business for long-term success.

If you’re facing financial challenges and need expert guidance, consider reaching out to a trusted accounting firm in Abu Dhabi. Their professional support can make a crucial difference in steering your business through uncertain times and emerging stronger on the other side.

#AccountingFirmsAbuDhabi#FinancialChallenges#EconomicDownturn#BusinessFinancialPlanning#CostManagement#TaxPlanning#FinancialForecasting#StrategicPlanning#CashFlowManagement#BusinessValuation#FinancialSupport#AbuDhabiAccountants#BusinessResilience#FinancialConsulting#ExpenseReview#FundingOptions#RegulatoryCompliance#FinancialMonitoring#ExpertAdvice#BusinessRecovery

0 notes

Text

Financial Astrology Outlook: July 12, 2024

#FinancialAstrology#AstroFinance#AstrologyInvesting#AstroTrading#AstroFinanceInsights#WealthAstrology#MarketAstrology#AstrologyAndFinance#InvestmentAstrology#AstrologyStocks#AstrologyMarkets#AstroWealth#FinancialForecasting#AstroEconomics#AstrologyPredictions#AstroMoney#AstroTradingTips#AstroFinanceTrends#InvestmentHoroscope#AstrologyInvestments

1 note

·

View note

Text

Classe365's finance and accounting management system is a comprehensive solution for educational institutions, encompassing budgeting, forecasting, and reporting. It enables efficient budget creation and management, with forecasting tools based on historical data and trends. The system offers robust reporting capabilities, generating financial statements and providing insights into financial performance. Seamlessly integrated with Classe365's platform, it ensures streamlined financial data flow and assists in adhering to financial regulations and reporting standards

#EducationFinance#SchoolBudgeting#FinancialForecasting#FinancialReporting#EducationTechnology#EdTech#Classe365#FinanceManagement#AccountingTools

0 notes

Text

The Role of Financial Advisors in Business Growth 🚀

In today’s dynamic business landscape, financial advisors play a crucial role in driving business growth and ensuring long-term success. Here's how partnering with a skilled financial advisor can benefit your business:

Strategic Planning and Analysis:

Financial advisors bring expertise in developing strategic plans tailored to your business goals. They conduct thorough financial analysis to identify growth opportunities and mitigate risks, helping you make informed decisions that propel your business forward.

Optimizing Cash Flow Management:

Efficient cash flow management is vital for any business. Financial advisors help optimize cash flow by analyzing your financial statements, identifying inefficiencies, and recommending actionable strategies to improve liquidity and ensure smooth operations.

Investment Guidance:

Navigating the complex world of investments can be challenging. Financial advisors provide insights into investment opportunities, helping you diversify your portfolio, manage risks, and maximize returns to support business expansion and stability.

Tax Planning and Compliance:

Staying compliant with tax regulations while minimizing tax liabilities is crucial for business growth. Financial advisors offer expert tax planning services, identifying deductions and credits, and developing strategies to reduce your tax burden and enhance profitability.

Financial Forecasting and Budgeting:

Accurate financial forecasting and budgeting are essential for setting realistic growth targets. Financial advisors use advanced tools and techniques to create detailed financial models, helping you anticipate future trends, allocate resources effectively, and achieve your business objectives.

Risk Management:

Identifying and managing financial risks is critical for sustainable growth. Financial advisors assess potential risks, implement robust risk management strategies, and ensure your business is prepared to handle uncertainties and market fluctuations.

Access to Funding:

Securing the right funding at the right time is vital for expansion. Financial advisors assist in evaluating funding options, preparing compelling business cases, and connecting you with potential investors or lenders, facilitating access to capital needed for growth initiatives.

Partnering with a financial advisor can transform your business, providing the expertise and strategic insights necessary to navigate challenges, capitalize on opportunities, and achieve your long-term vision.

Ready to take your business to the next level? Connect with us today to explore how our financial advisory services can drive your business growth.

0 notes

Text

How to improve Financial Forecasting?

Improving the accuracy of financial forecasting is crucial for any business aiming for long-term success. Here are some strategies to enhance your financial forecasting:

1. Leverage Historical Data

Analyze Past Trends: Look at historical data to identify patterns and trends. This can provide a solid foundation for future projections.

Clean Data: Ensure that your historical data is accurate and free of anomalies which could skew your forecasts.

2. Use Advanced Analytics

Statistical Models: Employ statistical methods such as regression analysis to predict future financial outcomes based on historical data.

Machine Learning: Implement machine learning algorithms that can handle large datasets and identify complex patterns.

3. Incorporate Market Analysis

Economic Indicators: Keep an eye on key economic indicators like GDP growth rates, interest rates, and inflation.

Industry Trends: Understand trends specific to your industry and factor these into your forecasts.

4. Scenario Planning

Multiple Scenarios: Develop best-case, worst-case, and most likely scenarios. This helps prepare for various potential outcomes.

Sensitivity Analysis: Assess how changes in key assumptions affect your forecasts.

5. Regular Updates

Frequent Reviews: Update your forecasts regularly to reflect new data and changing circumstances.

Continuous Improvement: Use feedback from actual performance versus forecasts to refine your methods.

6. Collaborative Approach

Involve Key Stakeholders: Engage with different departments to get a comprehensive view of potential future events.

Transparent Communication: Ensure that all stakeholders understand the assumptions and methodologies behind the forecasts.

7. Technology Utilization

Financial Forecasting Software: Invest in robust financial forecasting tools that can automate and enhance the accuracy of your projections.

Data Integration: Integrate data from various sources to get a holistic view of the financial landscape.

By implementing these strategies, businesses can significantly improve the accuracy and reliability of their financial forecasts.

For tailored financial forecasting solutions and expert advice, visit Virtual CFO Hub. With over 20 years of experience, they provide the best comprehensive virtual CFO services to help businesses make informed financial decisions and achieve their financial goals.

0 notes

Text

Smooth out Your Funds with Master Bookkeeping Administrations from SAI CPA Administrations

Open true serenity and monetary clearness with SAI CPA Services' expert bookkeeping arrangements. Our carefully prepared group in Middlesex Region, New Jersey, offers fastidious accounting, exact budget summary readiness, and vital determining. With more than 25 years of experience, we assure you that we can deal with your records. From new companies to laid-out organizations, our custom-fitted administrations guarantee consistency and enable informed independent direction. Experience greatness in bookkeeping — join forces with SAI CPA Administrations today.

Connect Us: https://www.saicpaservices.com/contact-us/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#saicpaservices#AccountingServices#Bookkeeping#FinancialManagement#TaxPlanning#BusinessStartups#FinancialForecasting#Compliance#MiddlesexCounty#NewJerseyCPA#Expertise

1 note

·

View note

Text

Financial Analysis: A Comprehensive Guide!

Check out our least article:

#FinancialAnalysis#FinanceTips#InvestmentStrategies#FinancialPlanning#EconomicAnalysis#FinancialDecisions#Investing101#MoneyManagement#FinancialEducation#FinanceSkills#Budgeting#InvestmentOpportunities#FinancialForecasting#ROI#BusinessFinance#PersonalFinance#FinancialLiteracy#SavingsGoals#FinancialHealth#EthicalFinance#FinancialTools#FinancialStatements#Toronto#Canada

1 note

·

View note

Text

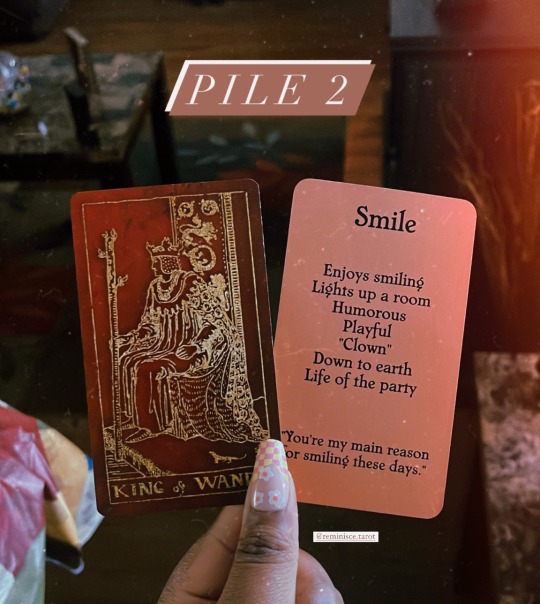

💘 What’s Coming Towards You in Love? Pick a Card 💘

Choose a pile to see what you may expect when it comes to your love life. Take what resonates; leave what doesn’t. The messages can be used upon your interpretation as well. This applies to you and the other person’s energy ~ regardless of relationship status.

Choose 1, 2, or 3

If you chose Pile 1 -

Listen to that inner voice when you are connecting with someone. Take the “Instagram filter” off someone and really see what’s happening in that moment. There’s a need for vulnerability and to take things to the heart. Does someone loves you for being you, or their own idea of you? 😘

If you chose Pile 2 -

You are clear about what you truly want from the start. You are the main attraction when you walk in the room. Smiling and laughing! Behind that smile is hiding secrets and feelings from the world. Don’t be a prisoner of your own mind. 🧡

If you chose Pile 3 -

Trust the process in your healing journey. Things are changing for the better. Life is really a roller coaster ride. If you want to make this work, keep an open mind and heart toward acceptance and love ~ nothing is really set in stone. 💘

Let me know which pile do you choose and if it resonates.

DING! DING! DING!

Financial Forecast Email Reading Special (Limited Time) 💸💰

This financial forecast reading touches upon what’s happening with your money and your career. This reading includes the HUSTLE Money/Career Advice Oracle Cards. I will send your reading through your email address. It is $10 per submission.

HOW TO SECURE YOUR SPOT ~ 💰💸

- Please include your full name and email address along with your payment via CashApp or PayPal in the notes section at checkout.

Cashapp - $KekeWin23

PayPal - @reminiscetarot

- Make sure that you are giving the correct information. If you made an error, please email me at [email protected]. Don’t forget to send me your proof of payment, your full name and email address.

Submissions will be closed on Sunday 09/10/2023.

REMINDER: Use your own interpretation of the cards and the message that I give you as well. Please be patient with my time and energy.

Look is what your reading will look like!

#spirituality#black tarot readers#dreamnreminisce#healing#reminiscetarot#tarot reader#divination#intuitive#pac#pick a card#pick an image#love reading#love#loveyourself#financialforecast#firesigns#water signs#astrology#tarot reading#oracle reading#tumblr fyp#blacktarotreaders

97 notes

·

View notes

Text

New York Stock Market Index in 2025

The New York Stock Market Index, one of the world’s leading financial markets, plays a pivotal role in global economics. Its indices, such as the Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ Composite, serve as barometers of the financial health and investor sentiment in the United States. In 2024, the performance and dynamics of these indices have garnered significant attention, not only within the U.S. but also globally, including their impact on the Indian market. This comprehensive overview explores the current state of the New York Stock Market, its live updates, and its influence on the Indian economy.

New York Stock Market Index

Key Indices and Their Performance:

NASDAQ Composite: Known for its high concentration of technology and biotech companies, the NASDAQ Composite has shown significant volatility in 2024. The performance of major tech giants and innovative startups has heavily influenced this New York stock market index.

Dow Jones Industrial Average (DJIA): The DJIA, consisting of 30 major companies, is one of the oldest and most well-known stock market indices. In 2024, the DJIA has experienced fluctuations due to various factors, including economic data releases, corporate earnings, and geopolitical events.

S&P 500: New York stock market index includes 500 of the largest companies listed on the NYSE and NASDAQ. The S&P 500 is widely regarded as one of the best representations of the U.S. stock market. Its performance in 2024 has been closely monitored, reflecting the overall economic conditions and investor confidence.

New York Stock Market Now

Current Trends and Influences:

Corporate Earnings: Quarterly earnings reports from major corporations provide insights into New York stock market now financial health and future prospects. In 2024, mixed earnings results across sectors have led to varied market reactions, with technology and healthcare sectors showing notable performances.

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation figures have a direct impact on New York stock market index performance. In 2024, the U.S. economy has shown signs of resilience with steady GDP growth, though concerns about inflation have persisted, influencing investor behavior.

Monetary Policy: The Federal Reserve’s monetary policy, including interest rate decisions and quantitative easing measures, plays a crucial role in shaping market dynamics. In 2024, the Fed’s stance on interest rates has been a focal point for investors, impacting both equity and bond markets.

Geopolitical Events: Geopolitical tensions, trade relations, and international conflicts can lead to market volatility. In 2024, events such as trade negotiations, diplomatic developments, and regional conflicts have contributed to fluctuations in the New York Stock Market Now.

New York Stock Market Live

Real-Time Updates and Market Movements:

Investor Behavior: The behavior of retail and institutional investors significantly influences New York stock market index trends. In 2024, the rise of retail investors, facilitated by online trading platforms, has added a new dimension to New York stock market index dynamics, often leading to unexpected price movements.

Market Sentiment: Real-time market sentiment, driven by news events, analyst reports, and social media trends, can cause immediate market reactions. In 2024, platforms providing live updates and market sentiment analysis have become invaluable tools for investors.

Technological Advancements: Advances in trading technology, including algorithmic trading and high-frequency trading, have increased the speed and volume of transactions. These technological developments have contributed to greater market liquidity and efficiency in 2024.

New York Stock Market Index Impact on Indian Market

Interconnected Global Economy:

Capital Flows: The interconnectedness of global financial markets means that movements in the New York Stock Market Index can influence capital flows to emerging markets, including India. In 2024, shifts in investor sentiment in the U.S. have led to changes in foreign portfolio investments in Indian equities and bonds.

Exchange Rates: The performance of the U.S. dollar, influenced by the New York Stock Market Now impacts exchange rates. In 2024, fluctuations in the dollar have affected the Indian rupee, influencing trade dynamics and foreign exchange reserves.

Commodity Prices: The U.S. stock market’s performance can impact commodity prices globally. In 2024, changes in oil prices, driven by market sentiment and economic conditions in the U.S., have had ripple effects on India’s import costs and inflation.

Sectoral Impacts:

Automotive Sector: The automotive sector, particularly electric vehicles (EVs), has seen significant developments in the U.S. market. In 2024, the growth of the EV market in the U.S. has spurred investments and innovations in India’s automotive industry, promoting sustainability and technological advancement.

Technology Sector: The technology sector’s performance in the New York Stock Market Index has direct implications for Indian IT companies, many of which derive a significant portion of their revenue from the U.S. In 2024, strong performances by U.S. tech giants have been positive for Indian tech firms.

Pharmaceutical Sector: The healthcare and pharmaceutical sectors are closely linked between the U.S. and India. In 2024, advancements and investments in U.S. biotech and pharma companies have opened opportunities for Indian counterparts, enhancing collaborations and market access.

Challenges and Opportunities

Navigating Market Volatility:

Investment Opportunities: Despite market volatility, 2024 has presented numerous investment opportunities. Sectors such as renewable energy, healthcare, and technology have shown promise, attracting both domestic and international investors.

Risk Management: Investors in both the U.S. and India need to adopt robust risk management strategies to navigate market volatility. In 2024, diversification across asset classes and geographical regions has become essential to mitigate risks associated with New York stock market index fluctuations.

Policy Responses: Government and regulatory policies play a critical role in stabilizing markets. In 2024, coordinated policy responses between the U.S. and India, focusing on trade, investment, and economic reforms, have been crucial in addressing market challenges.

CONCLUSION

The New York Stock Market Index in 2024 has been a focal point for global investors, reflecting broader economic trends, technological advancements, and geopolitical developments. Its real-time performance and market movements have had far-reaching implications, influencing not only the U.S. economy but also global markets, including India. Understanding the dynamics of the New York Stock Market Index and its interconnectedness with the Indian market is crucial for investors, policymakers, and businesses seeking to navigate the complexities of the global financial landscape in 2024.

Stay updated with ISMT latest insights New York Stock Market Index in 2024, real-time analysis New York Stock Market Now live data, expert commentary.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#financeblog#economicoutlook#marketupdate#stockpredictions#useconomy2025#wallstreet#investmentstrategies#financialforecast#nyse2025#stockmarkettrends#stockmarketindex#newyorkstockmarket

0 notes

Text

🚀📈 Neural Finance Is Redefining Stock Market Predictions!

💻 Neural finance investment platforms 🤖 are transforming how we predict 📊 stock market trends—using artificial intelligence 🧠 to uncover hidden patterns 🔍, reduce risks ⚠️, and supercharge 💥 portfolio returns 💰!

Wondering how it all works? 🧐

We explain everything: from how neural networks 🕸️ forecast market moves 🔄 to best practices for smart investing 💼.

👉 Read the full article now and stay ahead of the game! 🏁 https://thinquer.com/financial/neural-finance-investment-platforms-stock-market-predictions/

💬 Drop a comment & 📅 check back daily for more insights!

#NeuralFinance#StockMarketPredictions#AIInvesting#FintechRevolution#SmartInvesting#DeepLearning#PortfolioOptimization#QuantTrading#FinancialForecast#PredictiveAnalytics#MachineLearning#InvestmentPlatform#FinanceNews#AIDriven#StockTrends#DataScience#InvestorsCommunity#TradingTools#MarketInsights#FutureOfFinance

0 notes