#Derivative Markets and Instruments Project Help

Explore tagged Tumblr posts

Text

FTSE Futures Index: Key Trends and Insights for FTSE Futures Today

The FTSE Futures Index plays a significant role in shaping the market outlook for the UK. This financial instrument is a popular tool for traders and investors who are looking to gauge the future performance of the UK stock market. The index reflects the expectations of traders about the direction of the FTSE 100, a key benchmark that tracks the performance of the top 100 companies listed on the London Stock Exchange. Understanding the FTSE Futures Index and the dynamics of FTSE Futures today is essential for those looking to participate in the UK equity market.

FTSE futures are derivative contracts that allow traders to speculate on the future value of the FTSE 100 index. These futures contracts are standardized agreements to buy or sell the underlying index at a predetermined price at a future date. Traders use these instruments to hedge against potential risks or to capitalize on expected market movements. FTSE futures can be particularly useful during periods of market volatility, as they provide a mechanism to manage risk while also allowing for potential profit opportunities.

The FTSE Futures Index represents the projected value of the FTSE 100 based on trading in futures contracts. It reflects the combined sentiment of market participants, indicating their expectations regarding the UK stock market's performance. As a forward-looking indicator, it provides valuable insight into how investors perceive the potential movement of the FTSE 100. Traders often rely on the FTSE Futures Index as a signal to make informed decisions about their investments, especially in the lead-up to key economic events or corporate earnings reports.

FTSE Futures today offer a snapshot of the market sentiment at any given moment. They are updated throughout the trading day, providing real-time data on how the market is likely to open the next day. For traders and investors, monitoring FTSE Futures today can be a useful tool in anticipating market trends and making informed decisions. These futures contracts can give an indication of whether the FTSE 100 is expected to rise or fall when the market opens, helping investors prepare their strategies accordingly.

The FTSE Futures Index is influenced by various factors, including global economic conditions, geopolitical events, and corporate earnings reports. Economic indicators such as GDP growth, inflation, and interest rates can have a significant impact on the performance of the FTSE 100, which in turn affects the FTSE Futures Index. Additionally, news events or political developments, both within the UK and internationally, can create fluctuations in the futures market.

Today, as with any other day, the FTSE Futures Index continues to be influenced by multiple external factors. Economic data from major economies such as the United States, China, and the Eurozone can have an immediate effect on market sentiment. Moreover, developments related to trade, regulation, and political events can lead to changes in market expectations. For example, any unexpected news related to Brexit or UK domestic policies can impact the FTSE Futures today, as market participants adjust their positions accordingly.

For those seeking to stay updated on the latest developments regarding the FTSE Futures Index, resources like Kalkine Media (https://kalkinemedia.com/uk) offer valuable insights and analysis. The website provides real-time updates on market trends, including comprehensive coverage of the FTSE 100 and its futures market. With timely information at hand, investors can make better-informed decisions based on the current sentiment in the market.

In conclusion, understanding the FTSE Futures Index is crucial for anyone involved in trading or investing in UK equities. By tracking FTSE Futures today, traders can gain valuable insights into potential market movements and adjust their strategies accordingly. With the right information and tools, participants in the financial markets can better navigate the complexities of the FTSE 100 and make more informed decisions. The FTSE Futures Index remains an essential tool for gauging the direction of the UK stock market and is a key element of the global financial landscape.

0 notes

Text

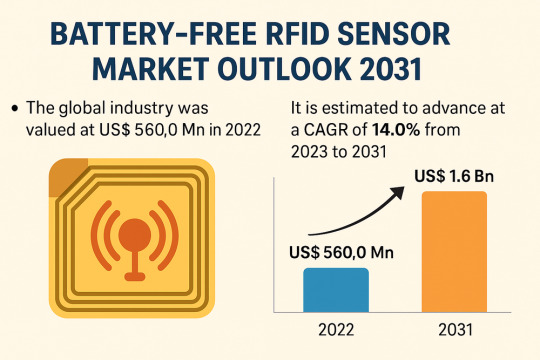

Battery-free RFID Sensor Market Rides 14% CAGR Wave Through 2031

The global battery-free RFID sensor market is projected to grow significantly over the next decade, with valuation expected to rise from USD 560.0 Mn in 2022 to an estimated USD 1.6 Bn by 2031, expanding at a compound annual growth rate (CAGR) of 14.0% from 2023 to 2031. Increasing reliance on advanced supply chain monitoring, wireless automation, and industrial digitalization is steering this upward trajectory.

Market Overview: Battery-free RFID (radio frequency identification) sensors are transforming traditional data collection and tracking systems by removing the need for external power sources. These innovative devices derive energy from electromagnetic fields emitted by RFID readers, enabling a low-maintenance, sustainable alternative to battery-powered devices.

With growing application across logistics, automotive, food safety, retail, aerospace, and healthcare, battery-free RFID sensors are revolutionizing how businesses monitor assets, inventory, and environmental conditions in real-time.

Market Drivers & Trends

1. Expansion of the logistics sector is a primary growth engine. As the global economy becomes increasingly digitized and logistics chains more complex, RFID-based sensing provides a contactless, automated, and real-time solution to inventory and shipment tracking. By eliminating manual intervention, RFID sensors help minimize errors and improve operational efficiency.

2. Surge in automotive manufacturing innovations, particularly in quality assurance, is another critical driver. Battery-free RFID tags embedded in vehicles’ metal chassis detect temperature fluctuations and moisture leakage parameters that are otherwise difficult to monitor manually and may result in damage worth thousands of dollars.

3. Shift toward sustainability and energy efficiency continues to stimulate the adoption of battery-free technologies across industries. As organizations look to reduce waste and energy consumption, passive RFID systems offer a long-term, maintenance-free alternative.

Latest Market Trends

Recent advancements in tag design and energy harvesting are enabling more compact, durable, and multi-functional RFID sensors. There’s a noticeable trend toward integrating temperature, light, strain, and humidity sensing capabilities into a single unit, broadening the use cases in harsh or remote environments.

Additionally, miniaturization of components and improvements in on-metal sensor performance are paving the way for deployments in challenging industrial environments, such as aerospace and defense sectors.

Key Players and Industry Leaders

The global battery-free RFID sensor market features a mix of established players and emerging innovators. Notable companies include:

ON Semiconductor

Microsemi

Infineon Technologies Ag

Inductosence Ltd.

RFMicron, Inc.

Texas Instruments Incorporated

Farsens

Powercast Corp

Phase IV

General Electric

These firms are investing heavily in R&D and product differentiation, focusing on enhancing energy harvesting capabilities, increasing tag sensitivity, and expanding application-specific sensor portfolios.

Access an overview of significant conclusions from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=54252

Recent Developments

One of the key developments shaping the industry occurred in 2022, when Tageos launched the EOS-840 Sensor line, a battery-free sensor inlay series built on Asygn’s AS321x chips. This product family delivers next-generation RAIN RFID (UHF) sensing for temperature, strain, and ambient light. The launch marks a major milestone, opening up new application domains in retail, supply chain, and industrial automation.

Market Opportunities

Several untapped and emerging sectors offer strong growth prospects:

Food Quality Monitoring: RFID sensors ensure food integrity during storage and transportation, an increasingly vital concern amid rising food safety regulations.

Structural Health Monitoring: Passive RFID sensors are being integrated into infrastructure such as bridges and tunnels to track stress, corrosion, and fatigue.

Healthcare: Battery-free sensors enable cold-chain monitoring of vaccines and biologics, as well as patient asset tracking in hospitals.

Moreover, the integration of IoT platforms and cloud-based analytics with RFID sensors creates real-time data ecosystems that empower predictive maintenance and smart logistics.

Future Outlook

The future of the battery-free RFID sensor market is anchored in sustainable innovation and digital transformation. As more industries shift toward autonomous operations and Industry 4.0, demand for maintenance-free, wireless, and smart sensing solutions is set to surge.

By 2031, the market is expected to triple in value, driven by advancements in semiconductor materials, increased affordability, and widespread digitization initiatives across the globe.

Market Segmentation

The market is segmented based on frequency, application, and end-use industry:

By Frequency:

Low Frequency (LF)

High Frequency (HF) and Near-Field Communication (NFC)

Ultra High Frequency (UHF)

By Application:

Food Quality Monitoring

Supply Chain Management

Condition Monitoring

Structural Health Monitoring

Others

By End-use Industry:

Automotive

Aerospace & Defense

Commercial

Food

Logistics

Others (Agriculture, Industrial, etc.)

Regional Insights

North America held the largest market share in 2022, driven by advanced industrial infrastructure, stringent regulatory frameworks, and booming e-commerce and logistics sectors. The U.S. and Canada are front-runners in adopting RFID technologies for food traceability, product authentication, and asset tracking.

Asia Pacific is anticipated to register strong growth through 2031, bolstered by digitization programs, smart city projects, and the emergence of Industry 4.0 in countries like China, India, Japan, and South Korea. The region is also home to a large number of electronics manufacturers and logistics providers, creating ripe ground for RFID applications.

Europe, Latin America, and Middle East & Africa are also making strategic investments in RFID solutions for both industrial and consumer applications.

Why Buy This Report?

This comprehensive report provides:

Detailed market sizing and forecasts from 2023 to 2031

In-depth analysis of key market drivers, challenges, and opportunities

Profiles of major players, including strategic initiatives and product pipelines

Insights into market segmentation by frequency, application, and end-use industry

Regional outlook and country-level analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa

Recent technological developments and industry trends

Porter’s Five Forces and value chain analysis

Customizable Excel data sheets and visual dashboards

Whether you're an investor, manufacturer, policymaker, or technology provider, this report offers valuable insights to make informed decisions and stay competitive in a rapidly evolving global landscape.

Explore Latest Research Reports by Transparency Market Research: Piezoelectric Devices Market: https://www.transparencymarketresearch.com/piezoelectric-device-market.html

Energy Harvesting for Small Sensors Market: https://www.transparencymarketresearch.com/energy-harvesting-for-small-sensors-market.html

Commercial Security Systems Market: https://www.transparencymarketresearch.com/commercial-security-systems-market.html

Dissolved Oxygen Sensors Market: https://www.transparencymarketresearch.com/dissolved-oxygen-sensor-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

0 notes

Text

Array Instruments Market Drivers Enhancing Healthcare and Pharmaceutical Diagnostic Capabilities Rapidly

The Array Instruments Market in Healthcare and Pharmaceuticals is witnessing significant transformation, driven by a combination of technological evolution and growing healthcare demands. These instruments, essential in genomics and proteomics, are crucial for high-throughput analysis, gene expression profiling, and biomarker discovery. Below are the primary drivers influencing the expansion and modernization of this market.

Rising Demand for Precision and Personalized Medicine One of the most influential drivers of the array instruments market is the global shift towards precision medicine. With increasing awareness of genetic variability and its impact on disease manifestation and drug response, healthcare systems are rapidly incorporating genomics-based diagnostics. Array instruments, especially DNA and protein microarrays, are vital in identifying genetic mutations, facilitating targeted therapies. In the pharmaceutical sector, this technology supports companion diagnostics, ensuring that medications are matched accurately to individual genetic profiles, thereby enhancing treatment efficacy.

Surge in Chronic and Genetic Disorders A global rise in chronic diseases such as cancer, cardiovascular disorders, and genetic conditions is accelerating the demand for array-based diagnostics. Cancer diagnostics, for instance, often rely on gene expression arrays to detect mutations or abnormal expressions. In 2023, over 20 million new cancer cases were reported worldwide. The use of array instruments helps clinicians and researchers understand disease at a molecular level, making them indispensable tools in modern healthcare.

Technological Advancements and Automation The integration of automation and AI into array-based platforms has greatly improved the accuracy, efficiency, and reproducibility of results. Automated systems minimize manual errors, reduce turnaround time, and allow the processing of thousands of samples simultaneously. Additionally, the rise of bioinformatics and cloud computing is enhancing the analytical capabilities of array instruments, enabling researchers to derive meaningful insights from vast datasets. This technological growth is encouraging pharmaceutical companies to invest heavily in array technologies for drug discovery and development.

Increased Government and Private Funding Government initiatives and private investments in genomics research and biotechnology are key drivers for the array instruments market. National genome projects, healthcare modernization programs, and funding from agencies like NIH and WHO have created robust infrastructure and encouraged the adoption of genomic technologies. Pharmaceutical companies are also increasing their R&D budgets, especially in genomics and precision drug development, thereby pushing the demand for sophisticated array tools.

Widespread Adoption in Drug Discovery and Development Array instruments play a pivotal role in the pharmaceutical industry, especially in the early stages of drug discovery. They are employed to study gene expression patterns, identify potential drug targets, and analyze drug response mechanisms. This helps in accelerating the drug development process and reducing the costs and time associated with traditional trial-and-error methods. As drug pipelines grow more complex and patient-specific, array instruments are becoming essential tools for pharmaceutical R&D labs.

Emerging Applications in Infectious Disease Management Infectious diseases, particularly emerging and re-emerging viruses, are another significant driver. Array instruments have been used in recent years for pathogen identification, especially during the COVID-19 pandemic. Their ability to provide rapid, multiplexed analysis made them crucial for tracking viral mutations and understanding immune responses. This has increased their value in epidemiological research and public health diagnostics, with healthcare systems worldwide investing in these technologies for preparedness and monitoring.

Growing Utility in Academic and Clinical Research Universities, research institutes, and clinical laboratories are increasingly adopting array instruments for various applications, including gene mapping, mutation detection, and tissue-specific gene expression analysis. As academic collaborations with pharmaceutical companies intensify, the demand for reliable and scalable array platforms continues to rise. This has created a mutually beneficial ecosystem, where innovation in academia feeds the practical applications in clinical and pharmaceutical settings.

Conclusion The array instruments market is underpinned by a robust set of drivers, ranging from the rise of personalized medicine and chronic diseases to technological innovation and funding support. As both healthcare and pharmaceutical industries lean more on genetic and proteomic insights, the relevance and demand for array instruments are only expected to increase. Stakeholders in this market are positioned for growth, especially those that prioritize innovation, automation, and clinical integration.

0 notes

Text

Unlock Your Future with Data: Why a Data Analytics Course in Coimbatore is a Smart Move for Students

In modern world governed by data, analytical ability and use of data are capital assets. Learning data analytics transforms both professional wanting to increase employability and new students eager to start college. With a great data analytics course in Coimbatore, Xploreitcorp helps students to welcome the digital avalanche.

We want to overcome the knowledge gap between the classroom and the workplace by means of basic ideas and advanced tools with Power BI. Let's explore for students stepping into the field of data analytics the significance of the present.

Definition of Data Analytics: Value

Interpreting enormous volumes of unstructured data to derive actionable patterns, insights, trends, and intelligence is essential component of data analytics. Regarding decision-making, projection of specific outputs, and relative position in the competitive market, this helps companies. But this service is not limited to big businesses; analytics is now needed in retail markets, healthcare, even the education sector to run more wisely.

Learning data analytics is as demanding as a new language for pupils, but with valuable knowledge, they might be part of an intellectual revolution always present in all spheres. As it happens in real time, the change might generate possibilities and employment.

Considered the "Manchester," Coimbatore has gained popularity in industry language for South India Technological Center. It's a perfect location to learn and apply data analytics when combined with the entrepreneurial energy of different companies and corporatives. The demand for experts in data analytics and related disciplines is continuously rising as companies realize their clients depend on data and highlight their capabilities.

Emerging skills taught in the Data Analytics Course in Coimbatore are highly valued in other industries including banking, healthcare, IT, logistics, childcare, and even e-commerce. The candidates gradually have the chance to work as Consultants, Engineers, Senior Analysts, Data Managers as they ascend the levels.

Choosing a data analytics degree in Coimbatore enables students to have a decent education at a cost more reasonable than in metropolitan locations. Moreover, the given internships and actual projects with nearby businesses offer chances for practical education that support theoretical knowledge.

Utilizing Power BI in Data Analytics

Among the most sought-after instruments available in the data analytics scene nowadays is Microsoft Power BI. It lets users create interactive dashboards and reports that help to share and comprehend data. Learning Power BI gives students a useful capacity to increase their employability so they will not be left out in the job market.

Xploreitcorp offers a customized Power BI course in Coimbatore stressing data visualization, business intelligence, and real-time analytics. Using functional dashboards and project work, the course comprises in practical training sessions that equip students for real-world situations. Whether your field of work is business, engineering, or IT, including Power BI on your CV will make a big difference.

What In a Data Analytic Course You Will Learn

Our goal at Xploreitcorp is to reason with the future; your data analytics course in Coimbatore most certainly covers the following subjects:

Data type introductions, sources and structural explanations

Preprocessing and data cleaning

Interpretation and statistical analysis

Visualization of data on Power BI

database and SQL management

Machine learning and predictive analysis: foundations

working on industry data real time projects

Every idea is taught to build on the one before it so motivates students of various academic backgrounds to grow in knowledge confidence.

Data Analytic Course in Coimbatore Employment Prospectures

A course in data analytics course in Coimbatore lets students pursue many job routes. Based on their additional education, they could be intrigued in playing the following roles:

Analyst in data science

An Analyst in Business Intelligence

Engineer in Data Analytics

Analyst of Data

Accountant for Reporting

Marketing Analyst

Consultant in Finance Data

As more and more businesses rely on data as a basic component, there are plenty of chances present. Starting pay for entry-level positions are reasonable, and combined with fast expansion in other areas, encouragement from experience makes this profession rather desirable.

Furthermore, people enrolled in a Coimbatore Power BI training would have more opportunities during business intelligence job interviews involving dashboard development, data modeling, and dynamic reporting.

Why should you choose Xploreitcorp for your path of data analytics?

Xploreitcorp thinks kids need immersive experiences rather than only intellectual understanding. Our differences stem from these:

Industry Ready Trainers: We have professors that have been actively working in business intelligence and analytics.

Every one of our students works practically on projects, homework, and case studies.

We help students in Power BI and data analytics be ready for international certification tests.

Students receive assistance for professionally produced resumes, practice interviews, and placement services in career development.

Convenience for most college students allows evening and weekend courses to be accessible.

Xploreitcorp's data analytics course in Coimbatore is a dedication to your professional growth rather than just a set of lectures.

Suggestive Projects To Improve Self-Esteem

Application of the ideas in the real world distinguishes a superb course from an ordinary one. Like the professionals, at Xploreitcorp we equip our students to work on real-time datasets and challenges. Projects like sales forecasting and customer segmentation help to develop confidence and work readiness.

In our Power BI training in Coimbatore, where students learn to design interactive dashboards, construct KPIs, and visualize them as well as become competent in data storytelling, such practical exposure is also given.

India's Data Analytics Outlook

Data is lifeblood for the growing digital economy India is building. To run best, artificial intelligence, IoT, and automation depend on data insights. Like anything, the demand for data specialists is going to rise; early adopters will have a major benefit.

Through data analytics training in Coimbatore, students are not only preparing for the current market but also actively defending their profession for long terms. For many years, critical thinking, data structure management, and analysis skills—which will help one obtain insights related to the company—will be in much demand.

Your Data Journey Begins Here: Take the First Step

Everything in our modern society revolves on data; those who grasp it will bring about world change. Learning data analytics is the next best professional choice for you or something that will set you apart as a student.

Our data analytics course in Coimbatore at Xploreitcorp provides hands-on exposure and practical training required for a competitive employment market, therefore arming students. Our Power BI coursemin coimbatore offers deeper knowledge and more work options; our skilled instructors guarantee mastery of the most sought-after analytics technologies.

FAQs:

1. Who can join the course? Students from any background with basic math skills can enroll—no coding experience needed.

2. How long is the course? It typically lasts 3 to 6 months, with flexible batch options.

3. Is Power BI included? Yes, Power BI basics are included. For deeper learning, we offer a separate Power BI course in Coimbatore.

4. Will I get a certificate? Yes, you'll receive a completion certificate from Xploreitcorp.

5. Are placements available? Yes, we provide placement assistance and interview training after course completion.

0 notes

Text

Emulsifying the Future: Exploring the Expanding Global Food Emulsifiers Market

Food Emulsifiers Market Size & Forecast The global food emulsifiers market is poised for sustained growth, driven by rising demand for convenience foods, an increasing appetite for innovative baked goods, and a growing health-conscious consumer base. With advancements in food processing technologies and the push for customization, new growth avenues are opening up across regions. The shift in consumer eating habits and preferences, combined with technological progress, continues to shape the market landscape for food emulsifiers.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=6067?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=28-05-2025

Key Findings in the Food Emulsifiers Market By 2025, the Mono, Di-glycerides & Derivatives segment is expected to dominate the emulsifiers market, owing to their effectiveness in stabilizing emulsions in a wide range of food applications. From a sourcing perspective, plant-based emulsifiers are projected to lead the market, aligning with clean-label trends and the rising preference for plant-derived ingredients. In terms of application, bakery products will likely remain the largest segment, fueled by innovations in baked goods and consumer demand for variety and longer shelf life. North America is forecast to hold the largest share geographically, thanks to its mature food industry and growing focus on clean-label formulations.

Food Emulsifiers Market Trends

Increasing Demand for Convenience and Processed Food The growing popularity of convenience and processed food continues to significantly influence the food emulsifiers market. Today’s consumers increasingly prefer ready-to-eat meals, baked snacks, cereals, confectioneries, and beverages due to their convenience and time-saving benefits. The shift in eating habits, particularly in urban settings, reflects a deeper lifestyle transformation where time constraints and changing family dynamics necessitate quick food solutions. The rapid pace of urbanization is also a key factor. According to the United Nations World Urbanization Prospects, around 56.6% of the global population lived in urban areas as of 2021, a number projected to reach 68% by 2050. This urban migration typically brings higher incomes and improved standards of living, which in turn supports greater consumption of processed and convenience foods.

Food emulsifiers play a pivotal role in this market by enhancing texture, extending shelf life, and ensuring product consistency. These functional properties make emulsifiers indispensable in the development of high-quality, tasty, and healthier processed foods. Moreover, emulsifiers help reduce the content of fats and sugars without sacrificing the taste or appeal of food products, making them highly valuable to manufacturers focused on creating healthier product lines. The steady consumer shift towards convenience continues to drive demand for food emulsifiers globally.

Rising Demand for Low-fat Food An increasing number of consumers are adopting health-conscious diets, focusing on nutrition, weight management, and overall well-being. This growing trend is compelling food manufacturers to reformulate their products to reduce fat content while maintaining the desired taste and texture. Emulsifiers are instrumental in this transformation, helping blend ingredients effectively and preserve the creamy, indulgent mouthfeel consumers expect from traditionally high-fat foods. They allow producers to meet market demand for healthier products without compromising on quality.

Additionally, as the low-fat trend overlaps with the clean-label movement, manufacturers are under pressure to develop products using natural and functional ingredients. This dynamic has led to a surge in the popularity of plant-based emulsifiers, which not only support fat reduction but also align with consumer demands for ingredient transparency and natural sourcing. The move towards cleaner ingredient labels is stimulating innovation in the emulsifier segment, encouraging the development of products that balance health benefits with functional performance. The demand for low-fat and clean-label food items is therefore expected to remain a significant driver in the global food emulsifiers market.

Food Emulsifiers Market Opportunities

Technological Advancements in Food Processing The evolving landscape of food technology is opening new doors for food emulsifiers through innovations like high-pressure processing, microencapsulation, and advanced mixing techniques. These methods are improving the functional performance of emulsifiers across a range of applications. They not only boost the texture and stability of emulsified products but also enable the formulation of new products that respond to changing consumer preferences, including healthier options with reduced sugar and fat content.

Manufacturers are increasingly leveraging digital tools and data analytics to refine formulations and optimize product development. This tech-driven approach helps ensure consistency and supports the inclusion of high-performance emulsifiers that deliver reliable results across diverse processing conditions. These innovations are crucial for developing next-generation food products that align with both evolving consumer expectations and regulatory standards. As the food industry continues to embrace these technological advancements, the demand for versatile, clean-label, and efficient emulsifiers is expected to rise accordingly.

Get Full Report @ https://www.meticulousresearch.com/product/food-emulsifiers-market-6067?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=28-05-2025

Food Emulsifiers Market Analysis: Top Market Opportunity

Mono, Di-glycerides & Derivatives Segment to Dominate in 2025 Among the various types of food emulsifiers, mono, di-glycerides & derivatives are expected to maintain their dominance in the market by 2025. Their ability to effectively stabilize emulsions makes them indispensable in the production of products such as margarine, salad dressings, and bakery items. These emulsifiers help prevent ingredient separation, ensuring consistent texture and mouthfeel, which are vital attributes in consumer-oriented food products.

Meanwhile, lecithin is projected to experience the fastest growth during the forecast period. Sourced naturally and widely regarded as a multifunctional ingredient, lecithin acts as an emulsifier, stabilizer, and texturizer in products like chocolates, baked goods, and salad dressings. Its popularity stems from its clean-label appeal, non-allergenic nature, and versatility across a wide range of applications. As the food industry shifts toward cleaner ingredient decks and more natural formulations, lecithin’s growth is expected to accelerate rapidly, reinforcing its position as a sought-after emulsifier in both conventional and health-focused product segments.

Geographical Analysis

North America Dominates the Food Emulsifiers Market in 2025 North America is anticipated to hold the largest share of the global food emulsifiers market in 2025. This dominance is primarily due to the region’s well-established food and beverage sector, the presence of major global food manufacturers, and a growing consumer demand for processed and convenience foods. In addition, a strong emphasis on clean-label and organic food products is reshaping the regional market. Consumers are increasingly scrutinizing product ingredients, driving demand for emulsifiers derived from natural sources that comply with transparent labeling standards.

The clean-label trend is gaining traction across the U.S. and Canada, with health-conscious consumers gravitating toward minimally processed products that are free from artificial additives. These preferences are prompting manufacturers to adopt plant-based and naturally derived emulsifiers, thereby supporting market growth. The emphasis on healthier eating habits and ingredient awareness is fueling innovation and encouraging the development of new emulsifier formulations tailored to consumer expectations.

In contrast, the Asia-Pacific region is set to experience the highest compound annual growth rate during the forecast period. Several factors are contributing to this momentum, including increased consumption of processed and convenience foods, a rapidly growing population, urbanization, and rising disposable incomes. Countries such as China, India, and Japan are witnessing significant shifts in dietary habits, with consumers embracing western-style diets and veganism. These changes are boosting demand for emulsifiers used in plant-based and processed food products. Moreover, the expansion of the regional food and beverage industry, along with an evolving retail landscape, is further accelerating the adoption of emulsifiers across various product categories.

Food Emulsifiers Market: Key Companies The competitive landscape of the food emulsifiers market comprises leading global and regional players that have adopted strategic developments such as product launches, partnerships, and technological advancements. Key players in this market include Cargill, Incorporated (U.S.), Archer-Daniels-Midland Company (U.S.), BASF SE (Germany), DSM-Firmenich AG (Switzerland), DuPont de Nemours, Inc. (U.S.), International Flavors & Fragrances Inc. (U.S.), Kerry Group plc (Ireland), Ingredion Incorporated (U.S.), Givaudan SA (Switzerland), Wilmar International Limited (Singapore), Stepan Company (U.S.), Tate & Lyle PLC (U.K.), Foodchem International Corporation (China), and Palsgaard A/S (Denmark). These companies continue to play a pivotal role in shaping the global emulsifiers market through innovation, sustainable sourcing, and customer-centric product development.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=6067?utm_source=Blog&utm_medium=Product&utm_campaign=SB&utm_content=28-05-2025

0 notes

Text

Cholesteatoma Treatment Market Size, Share & Trends Analysis Report By Product ,By End-use, And Segment Forecasts (2023-2030)

Cholesteatoma Treatment Market Overview & Estimation

The Cholesteatoma Treatment Market Size was valued at approximately USD 200 million in 2023 and is projected to grow to around USD 246 million by 2030, representing a compound annual growth rate (CAGR) of 3% over the 2023–2030 forecast period. Cholesteatoma—a destructive and expanding growth of keratinizing squamous epithelium in the middle ear—requires specialized surgical intervention to prevent hearing loss, recurrent infections and life-threatening complications such as intracranial abscesses. Rising patient awareness, improvements in diagnostic imaging and growing access to advanced otologic surgical technologies are steadily expanding the market’s addressable base.

Cholesteatoma Treatment Latest News & Trends

In the last 12–18 months, several key developments have shaped cholesteatoma management:

Endoscopic Ear Surgery Gains Traction Leading otolaryngology centers report increased adoption of transcanal endoscopic techniques, which allow for more complete removal of disease with reduced morbidity and shorter hospital stays. A multi-center study published in early 2024 found that endoscopic approaches reduced residual disease rates by 15% compared to traditional microscopic surgery.

3D‐Printed Surgical Guides Hospitals in North America and Europe are piloting patient-specific, 3D-printed mastoidectomy guides that streamline bone removal and help surgeons navigate complex anatomy. Early adopters cite a 20% reduction in operative time and enhanced preservation of critical structures such as the facial nerve.

Advanced Imaging for Early Detection High-resolution diffusion-weighted MRI protocols have become more widely available, improving sensitivity for small or hidden cholesteatoma foci. Radiology departments in Japan have started integrating automated image-analysis software that flags possible lesions on routine scans, expediting referral to ENT surgeons.

Focus on Minimally Invasive Implants Innovations in bioresorbable ossicular replacement prostheses and antibiotic-loaded mastoid packing materials are under clinical evaluation. These technologies aim to reduce postoperative infection rates and eliminate the need for secondary implant removal procedures.

Cholesteatoma Treatment Market Segmentation

The cholesteatoma treatment market can be characterized by treatment type, technology, and care setting, each contributing distinct revenue streams.

Treatment Type. Surgical resection remains the cornerstone, accounting for roughly 70% of expenditures in 2023. Within surgery, canal wall–up and canal wall–down mastoidectomies dominate, but a growing share—about 25% of surgical procedures—is now performed endoscopically. The remaining 30% of market value derives from adjunctive therapies and postoperative care products, including antibiotic-loaded dressings and bioresorbable packing materials designed to stabilize the middle ear space and reduce recurrence.

Technology. Traditional microscopic instruments and drills still represent the bulk of device spend, amounting to about 60% of 2023 revenues. However, advanced technologies—endoscopes, high-speed pneumatic drills with navigation capability, and 3D-printing services for patient-specific guides—are the fastest-growing segment at an estimated 8% CAGR, capturing roughly 40% of market value as clinics invest in minimally invasive platforms and personalized tools.

Care Setting. Hospital otolaryngology departments account for 65% of total market value, driven by complex disease presentations and multidisciplinary perioperative services. Ambulatory surgery centers make up 20%, leveraging streamlined endoscopic workflows for straightforward cholesteatoma cases. The balance—15%—resides with specialized ENT clinics that offer diagnostic imaging, office-based endoscopic debridement and postoperative follow-up, often in conjunction with tertiary-care referral networks.

Cholesteatoma Treatment Regional Analysis: USA & Japan

United States

The U.S. market represents approximately 40% of global revenues, equating to USD 80 million in 2023, and is forecast to grow at a CAGR of 3.2% to reach about USD 100 million by 2030. Growth is driven by:

Rising Procedure Volumes. An aging population and greater awareness of chronic ear disease have increased referrals for cholesteatoma surgery at major academic and community hospitals.

Technological Leadership. Many U.S. centers are early adopters of navigation-assisted mastoidectomy and endoscopic-only corridors, supported by CPT codes that reimburse advanced visualization tools.

Favorable Reimbursement. The Centers for Medicare & Medicaid Services (CMS) provide add-on payments for endoscopic ear procedures and intraoperative monitoring, encouraging hospitals to invest in related equipment.

Japan

Japan accounts for roughly 15% of the market, or USD 30 million in 2023, and is projected to grow at a CAGR of 2.8% to about USD 36 million by 2030. Key growth factors include:

National Otology Guidelines. The Ministry of Health, Labour and Welfare updated its otologic surgery guidelines in 2023 to recommend endoscopic removal for limited cholesteatoma cases, accelerating equipment adoption across both public and private hospitals.

Advanced Imaging Coverage. Japan’s national health insurance reimburses high-resolution diffusion-weighted MRI protocols at a premium rate when used for recurrent ear disease, leading to earlier detection and referral.

Surgeon Training Initiatives. Government-sponsored training programs in partnership with leading otolaryngology societies have increased the number of certified endoscopic ear surgeons, expanding capacity beyond major urban centers.

Key Report Highlights

Primary Drivers: Increasing global incidence of chronic ear disease; technological advancements in minimally invasive surgery; favorable reimbursement for advanced diagnostic and surgical tools.

Restraints: High capital costs for endoscopic towers and navigation systems; limited specialized surgeon availability in emerging regions; risk of residual disease requiring revision surgery.

Opportunities: Expansion of tele-mentoring programs to train surgeons in developing markets; use of AI-driven image analysis for routine otoscopic screening; growth of bioresorbable implantable materials to reduce reoperation rates.

Cholesteatoma Treatment Key Players & Competitive Landscape

The competitive landscape blends major medical-device manufacturers with niche ENT innovators. The top five players by market share are:

Olympus Corporation, a leader in rigid endoscopes and imaging platforms for otologic surgery.

Karl Storz SE & Co. KG, known for high-definition endoscopic towers and navigation-integrated drills.

Stryker Corporation, which supplies pneumatic mastoid drills and ENT surgical instrumentation kits.

Medtronic plc, offering intraoperative nerve-monitoring systems and powered drill consoles.

SEWERIN GmbH, a specialist in custom-printed surgical guides and ENT-specific 3D planning software.

Recent M&A/Research: In 2024, Karl Storz acquired an AI-imaging startup to embed automated cholesteatoma-detection algorithms into its endoscopic suite. Olympus announced a partnership with a leading U.S. academic center to trial a bioresorbable ossicular prosthesis in recurrent disease cases, with clinical data expected in early 2025.

Conclusion

The cholesteatoma treatment market is poised for steady, sustainable growth through 2030, underpinned by demographic trends, evolving clinical best practices and continuous technological innovation. While traditional microscopic surgery will remain prevalent—particularly in regions with limited resources—the shift toward endoscopic techniques, personalized surgical guides and advanced imaging will redefine standards of care. The United States and Japan are leading this transformation, but efforts to democratize surgeon training and expand tele-mentoring could unlock significant opportunities in emerging economies. Overall, as otolaryngologists strive to reduce recurrence, improve functional outcomes and streamline patient pathways, the market is well positioned to exceed USD 246 million by 2030, offering robust prospects for device makers, software innovators and healthcare providers alike.

0 notes

Text

Fueling a Nutritional Renaissance: How Food Fortification is Reshaping Global Health Through 2035

In a world where wellness trends and health crises collide, one unsung hero is quietly transforming global nutrition — food fortifying agents. DataString Consulting’s latest market research reveals a remarkable trajectory for this sector, projecting the market to skyrocket from $90.9 billion in 2024 to a staggering $264.6 billion by 2035. This is no fleeting fad; it’s a full-blown nutritional revolution.

The Nutrient-Enhanced Future of Food

At its core, food fortification is the strategic enrichment of everyday staples with essential vitamins, minerals, amino acids, and healthy fats. It’s a deceptively simple concept with profoundly global implications. Major players like DSM, BASF, and Nestlé are leading this charge, delivering fortifying solutions that help bridge micronutrient gaps in populations worldwide. The beauty of this innovation? People get healthier without having to dramatically alter their eating habits.

A Sensory Evolution, Not Just a Health Play

But it’s not only about nutrition anymore — it’s about experience. Today’s fortifying agents do double duty, enhancing both the health benefits and sensory appeal of foods. Imagine cereals that stay crispy longer, dairy products that are creamier without added fat, or plant-based milks with a silkier finish. Companies like DuPont and ADM are riding this wave, ensuring fortified products delight consumers on every level.

The Organic and Clean Label Revolution

Consumers have become increasingly label-savvy, steering away from synthetic additives and seeking natural, plant-based alternatives. This has spurred a significant shift toward organic fortifiers derived from herbs, fruits, and botanical extracts. The result? Cleaner, more transparent ingredient lists and formulations that resonate with modern wellness values.

Why It Matters

This isn’t just good news for individual health — it’s a strategic play for governments and health organizations combating nutrient deficiencies on a global scale. Fortified foods can address public health crises like anemia, rickets, and iodine deficiency disorders in a sustainable, cost-effective manner.

Final Thought

As tradition meets innovation, food fortifying agents are no longer just ingredients — they’re instruments of global well-being. The coming decade will see these agents fortify not just our plates, but the very future of nutrition itself.

Curious about the brands and trends fueling this growth? Dive into the full market intelligence at datastringconsulting.com.

0 notes

Text

Planning to Sell Your NJ Business? Here’s the Role Private Capital Markets Play in Your Valuation

When you're planning to sell your New Jersey-based business, the process can be both exciting and daunting. The idea of moving on from something you’ve built often comes with a mix of emotions, but it also presents an opportunity for financial success if handled properly. One of the most critical components of the sale process is understanding your business’s value, which will directly impact the sale price. This is where private capital markets play an important role in shaping your business valuation.

Private capital markets consist of financial institutions, investors, and funds that deal with the buying and selling of private equity, debt, and other financial instruments outside of the public markets. For small and mid-market businesses, like many in New Jersey, private capital markets provide the infrastructure and support for both raising capital and determining business valuations during a sale. Understanding how these markets influence your company’s value can ensure that you make informed decisions throughout the process.

What is Private Capital and How Does it Relate to Your Business?

Private capital refers to the investment of capital in a business or project that is not listed on the public stock exchange. In the context of a business sale, private capital markets typically involve private equity firms, venture capitalists, family offices, and institutional investors who are seeking to acquire or invest in businesses. These investors play a pivotal role in determining the value of your company when you decide to sell.

Unlike public markets, where companies' valuations are determined by stock prices and market forces, private markets involve more nuanced assessments. Investors in the private capital market are often more focused on the company’s fundamentals—such as revenue, profit margins, growth potential, and market position—than on short-term price fluctuations. This allows for a deeper and often more stable valuation process, but it also introduces complexities in how these values are determined.

Valuation Metrics in Private Capital Markets

Private capital investors use a range of metrics and methodologies to assess the value of your business. These methods differ significantly from public market valuations because private businesses don’t have easily accessible financial data, such as stock prices or public disclosures. Here are some common approaches to valuation in the private capital markets:

1. EBITDA Multiples

One of the most widely used valuation methods in private markets is the application of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples. Investors look at your company’s earnings potential by assessing its operating performance without considering tax structures or financing costs. The EBITDA multiple is a ratio derived from comparing the company’s historical or projected EBITDA with the sale price. In the New Jersey market, businesses in certain industries—like healthcare, tech, and manufacturing—can command higher multiples due to their growth potential.

2. Comparable Company Analysis (Comps)

This method involves comparing your business to similar companies that have been sold recently or are publicly traded. The comparable company analysis helps establish a fair market range for the sale price by looking at metrics like revenue, EBITDA, and industry benchmarks. Investors in private capital markets will often use comps to determine how your company stacks up against others in the same industry, size, and geographical region. This is particularly helpful in New Jersey, where the local market dynamics can significantly influence a company’s worth.

3. Discounted Cash Flow (DCF)

The discounted cash flow (DCF) method estimates the value of a business based on its future cash flows. In simple terms, it determines what your business will be worth in the future, taking into account projected revenues, operating costs, and expected profits. A discount rate is then applied to account for the time value of money. The DCF method is often used by investors who are focused on long-term growth potential, and it can be particularly useful when selling a business that has predictable cash flows or is in a growth phase.

4. Asset-Based Valuation

For some businesses, especially those that are asset-heavy or operate in industries such as real estate, manufacturing, or construction, an asset-based valuation may be used. This method determines a company’s value by assessing the worth of its tangible and intangible assets, including real estate, equipment, intellectual property, and goodwill. This approach can be beneficial if your business has significant assets but may not be generating large profits yet.

The Impact of Private Capital Markets on Your Sale Price

The role of private capital markets in your sale is not just about determining the right valuation; these markets can also help you find the right buyers who will pay the price your business is worth. Here are a few key ways private capital markets influence the final sale price:

1. Investor Appetite

The current appetite for investment in certain sectors or industries can drive up valuations in private capital markets. For instance, New Jersey has a thriving healthcare and life sciences sector, and if your business operates within these areas, private capital investors may be willing to offer higher multiples due to the perceived growth potential. Similarly, industries such as technology, clean energy, and logistics are also attracting attention from private equity firms and venture capitalists. A favorable market for your industry can push your valuation higher.

2. Competitive Bidding

Private capital markets are often structured around competitive bidding, where multiple investors or firms vie for ownership of your business. This competition can drive up the price of the business, as potential buyers are motivated to outbid each other. A competitive auction-style sale often results in higher valuations than those found through direct negotiations with a single buyer. A well-structured sale process leveraging private capital markets can create this competitive dynamic.

3. Deal Structures and Terms

Private capital investors may also influence the structure of the deal itself. For example, private equity firms might offer you a mix of cash upfront and equity in the buying company, allowing for a higher overall sale price. In such cases, the long-term potential of your business within the new ownership structure could increase the perceived value. Additionally, private capital markets provide liquidity options that can make a business more attractive to potential buyers, further enhancing the sale price.

4. Market Trends and Timing

The overall conditions in the private capital markets at the time of your sale can also affect your valuation. If the market is experiencing a liquidity boom, such as during periods of economic expansion or low-interest rates, private equity firms may be more inclined to offer higher prices to secure investments. Conversely, during periods of market uncertainty, valuations may contract. Timing the sale of your business with favorable market conditions can make a significant difference in the ultimate price.

How to Leverage Private Capital Markets for Your Sale

Selling a business is a complicated process, and you’ll want to work with professionals who understand both your industry and the intricacies of private capital markets. Here are a few ways to leverage these markets when planning your business sale:

1. Work with an M&A Advisor or Investment Banker

To navigate the private capital markets effectively, you should consider engaging with an M&A (mergers and acquisitions) advisor or investment banker who specializes in your industry. These professionals can help you understand the nuances of valuation, identify potential buyers, and run a competitive bidding process to maximize your sale price.

2. Prepare Thorough Financials

Private capital investors rely heavily on financial data to assess your company’s value. Having well-prepared financial statements, a solid business plan, and projected cash flows will make your business more attractive to buyers in private capital markets. The more transparent and organized your business is, the easier it will be for investors to determine its worth.

3. Understand Industry-Specific Trends

Private capital markets are influenced by trends within specific industries. Make sure you understand how these trends impact the valuation of your business. For example, if you’re in the tech space, understand how market demand, innovation, and competition might affect your company’s potential for growth. Keep up with market developments and adjust your expectations accordingly.

Conclusion

The role of private capital markets in your New Jersey business sale is immense. From determining the right valuation to finding the right buyers, these markets provide the necessary tools, infrastructure, and financial backing to ensure a successful transaction. By understanding the factors that influence your company’s value, leveraging investor appetite, and working with professionals who specialize in private capital markets, you can maximize your business’s sale price and ensure a smooth transition to the next phase of your life or business venture.

0 notes

Text

The fundamental role of knowledge management is to extract tacit knowledge and make it available for others to use2. Explicit knowledge exists in the form of words, documents, data, computer programs or software and other explicit forms. Knowledge management involves planning, organizing, motivating and controlling of workers and arrangements in the firm to make sure that knowledge related assets are improved and effectively employed. By motivating the creation, dissemination and application of knowledge, KM initiatives help organizations embed knowledge and learning into organizational processes so that it can improve its practices and behaviors to achieve its goals. Organizational learning helps the organization sustainably improve its utilization of knowledge. OL is the capability that enables organizations to practice the most suitable and precise management practices, structures and actions to facilitate and encourage learning. Recruitment and Selection Recruitment is the process of hiring a pool of people who are capable of working in an organization. Selection involves the use of specific instruments to choose from a pool of applicants the persons who are most likely to excel in a job relative to the management’s goals and legal requirements3. . When organizations hire workers who possess relevant knowledge, skills and aptitudes, the process plays a pivotal role in shaping an organizations effectiveness and performance. The organization recruitment process should be modified to accommodate knowledge management practices. The most innovative organizations in knowledge management select individuals with the appropriate skills and attitudes as such employees have the ability to assimilate knowledge from various sources.4 Traditional approaches to selection may be revised to capture unpredictable knowledge flows especially in innovation projects. This is because it may be difficult to specify the requisite knowledge and expertise in advance for such projects. The social process model of recruitment and selection derived from social psychology has been adopted by different firms. This model assumes that people change constantly in the course of their careers and that subjective self-perceptions are critical to their work motivation and performance. Self-perceptions are influenced by assessment selection procedures, and that modern jobs involve interaction, negotiation and mutual influence, which take place in multi-skilled, flexible and self-directed work teams. 5 Firms use the social model to recruit persons who are most likely to share and acquire knowledge. Some researchers have argued that traditional recruitment and selection practices obstruct knowledge sharing among groups or departments in firms organized in accordance to the functional principle. For instance, in one pharmaceutical company, the assessment centers for selection of graduates were functionally focused with sales assessment centers and marketing assessment Read the full article

0 notes

Text

Alternative Investment Funds (AIFs): Understanding the Basics.

Introduction

Traditional investments like stocks, bonds, and mutual funds have been popular choices for years. However, as financial markets evolve, investors are exploring Alternative Investment Funds (AIFs) to diversify their portfolios. AIFs provide access to asset classes beyond conventional markets, such as private equity, venture capital, hedge funds, real estate, and infrastructure.

At Zebu, we help investors navigate complex financial instruments like AIFs. This guide explores what AIFs are, their types, benefits, risks, and key factors to consider before investing.

1. What is an Alternative Investment Fund (AIF)?

An Alternative Investment Fund (AIF) is a privately pooled investment vehicle that collects funds from investors to invest in non-traditional asset classes. Regulated by SEBI (Securities and Exchange Board of India), AIFs differ from mutual funds in their investment strategies and risk-return profiles.

Key Characteristics of AIFs:

Managed by professional fund managers with expertise in specialized markets.

Typically have higher minimum investment requirements and lower liquidity than mutual funds.

Designed for high-net-worth individuals (HNIs) and institutional investors.

Follow structured regulatory guidelines under SEBI.

At Zebu, we offer insights into AIF structures, helping investors evaluate whether these funds align with their financial goals.

2. Categories of AIFs in India

SEBI classifies AIFs into three broad categories based on their investment strategy.

Category I AIFs – Focused on Economic Growth Sectors

These funds invest in businesses that contribute to economic and social development. SEBI encourages investments in this category by offering incentives and tax benefits.

Types of Category I AIFs:

Venture Capital Funds (VCFs): Invest in early-stage startups with high growth potential.

Social Venture Funds: Support businesses with a social impact, such as education and healthcare.

Infrastructure Funds: Invest in infrastructure projects like highways, energy, and urban development.

Angel Funds: Pool capital from angel investors to finance startups at their initial stages.

At Zebu, we help investors assess startup investment opportunities and the potential of impact-driven funds.

Category II AIFs – Private Equity, Debt, and Fund of Funds

These funds do not qualify under Category I or III but do not use leverage beyond permitted limits.

Types of Category II AIFs:

Private Equity Funds (PEFs): Invest in established businesses for expansion or restructuring.

Debt Funds: Provide capital to companies via structured debt instruments.

Fund of Funds (FoFs): Invest in multiple AIFs instead of directly in companies.

Zebu’s research tools assist investors in evaluating private equity opportunities and debt-based investment strategies.

Category III AIFs – Hedge Funds and Complex Trading Strategies

These funds aim to generate high returns through sophisticated strategies, including leverage, derivatives, and arbitrage.

Types of Category III AIFs:

Hedge Funds: Use aggressive trading techniques such as short-selling and derivatives.

Quant Funds: Employ algorithm-driven models to execute investment strategies. Zebu’s advisory team can guide investors in understanding risk-adjusted returns and the complexities of hedge fund strategies.

3. Key Benefits of AIFs

Portfolio Diversification

AIFs provide exposure to non-traditional asset classes, reducing dependence on stock market fluctuations.

Potential for Higher Returns

Many AIFs target high-growth sectors or employ advanced strategies to optimize returns.

Professional Fund Management

AIFs are managed by experienced professionals with deep expertise in niche markets.

Access to Exclusive Investment Opportunities

AIFs allow investors to participate in private equity, venture capital, and other alternative markets that are typically unavailable to retail investors.

Regulatory Oversight

As AIFs are regulated by SEBI, they follow structured compliance guidelines, enhancing investor protection.

At Zebu, we provide investors with detailed analysis and comparison tools to evaluate different AIFs.

4. Risks and Considerations

Lower Liquidity

AIFs often have a lock-in period, limiting early withdrawals.

Higher Investment Threshold

AIFs require a minimum investment of ₹1 crore, making them more suitable for HNIs and institutions.

Market and Business Risks

Alternative investments are exposed to market fluctuations, economic downturns, and sector-specific risks.

Complex Fee Structures

AIFs typically have management fees and performance-linked fees, which may impact net returns.

Regulatory and Tax Considerations

Changes in SEBI regulations or tax structures can influence AIF performance.

Zebu’s insights help investors navigate these risks and structure their investment strategies accordingly.

5. AIFs vs. Mutual Funds: Key Differences

At Zebu, we offer comparative insights to help investors decide between AIFs and mutual funds based on their risk tolerance and investment objectives.

6. Who Should Consider Investing in AIFs?

AIFs are designed for investors who:

Have a high-risk tolerance and a long-term investment horizon.

Seek portfolio diversification beyond traditional stocks and bonds.

Can meet the ₹1 crore minimum investment requirement.

Are comfortable with limited liquidity and lock-in periods.

Want exposure to private equity, venture capital, hedge funds, or debt funds.

At Zebu, we provide investment research and expert advisory services to help investors make informed decisions about AIFs.

Conclusion

Alternative Investment Funds (AIFs) offer a diverse range of opportunities for investors seeking exposure beyond traditional markets. Whether it's venture capital, private equity, hedge funds, or debt-based investments, AIFs provide a structured approach to alternative assets. However, they require a higher risk appetite, longer investment horizon, and larger capital commitments.

Understanding different AIF categories, evaluating risk factors, and selecting funds based on financial goals are essential steps for investors. Zebu’s research-driven approach helps investors explore, compare, and invest in AIFs with confidence.

For those interested in AIFs, conducting thorough research and consulting Zebu’s financial experts can assist in making well-informed investment choices.

Disclaimer:

This article is for informational purposes only and should not be considered financial or investment advice. Please consult a SEBI-registered financial advisor before making any investment decisions.

Would you like any modifications, such as specific fund examples or a deeper focus on regulatory changes?

#zebu#finance#investment#investwisely#financialfreedom#mutual funds#investing#investors#makemoney#investmentgoals#AIF

0 notes

Text

Understanding Capital Markets and Real Estate Services

Capital markets play a crucial role in the global economy, facilitating the flow of capital between investors and businesses. They provide a platform for trading financial assets, raising capital, and managing risks. Within the real estate sector, capital markets serve as a bridge between property owners, developers, and investors, helping them achieve their financial and investment objectives. Capital markets real estate services are essential for businesses looking to optimize their real estate portfolios, access funding, and maximize returns on investment.

For more information on capital markets real estate services, visit Cushman & Wakefield.

What Are Capital Markets?

Capital markets are financial markets where long-term securities such as stocks, bonds, and real estate investment products are bought and sold. These markets help businesses raise capital by issuing shares or debt instruments to investors. Capital markets are broadly divided into two categories:

Primary Market — Where new securities are issued and sold directly to investors.

Secondary Market — Where existing securities are traded among investors.

In the real estate sector, capital markets enable property owners and developers to secure funding through various financial instruments, including real estate investment trusts (REITs), mortgage-backed securities, and direct property investments.

The Role of Capital Markets in Real Estate

The intersection of capital markets real estate services allows businesses and investors to leverage financial strategies for real estate transactions. These services are critical for structuring deals, raising capital, and ensuring liquidity in the property market. Here’s how capital markets impact real estate:

1. Investment and Financing Solutions

Capital markets provide real estate developers and investors with access to equity and debt financing.

Companies can secure funding through institutional investors, private equity firms, and financial institutions.

Various financing instruments, such as commercial mortgage-backed securities (CMBS) and real estate funds, help in raising capital for large-scale developments.

2. Real Estate Investment Trusts (REITs)

REITs allow individual investors to invest in real estate assets without directly owning properties.

They provide a liquid investment option while offering dividends and long-term capital appreciation.

Publicly traded REITs contribute to the secondary capital market by enabling investors to buy and sell shares on stock exchanges.

3. Mergers and Acquisitions (M&A)

Many real estate firms engage in mergers and acquisitions to expand their portfolios.

Capital markets play a vital role in structuring and financing these transactions, ensuring smooth transitions and maximizing shareholder value.

4. Risk Management and Market Liquidity

The presence of active capital markets enhances liquidity in the real estate sector.

Investors can diversify risks by investing in various real estate asset classes.

Financial instruments like hedging and derivatives help mitigate risks associated with market fluctuations.

Capital Markets Real Estate Services

Professional firms like Cushman & Wakefield provide specialized capital markets real estate services to investors, developers, and corporate clients. These services include:

1. Investment Advisory Services

Assisting clients in making informed investment decisions.

Providing market insights, risk analysis, and strategic planning for real estate investments.

2. Debt and Equity Financing

Structuring and sourcing financing solutions for real estate projects.

Accessing debt and equity markets to raise capital for acquisitions and developments.

3. Valuation and Due Diligence

Conducting property valuations to determine fair market value.

Performing due diligence to assess financial risks and investment feasibility.

4. Real Estate Portfolio Management

Optimizing asset performance and maximizing returns on investment.

Diversifying portfolios by investing in multiple real estate segments

5. Dispositions and Acquisitions

Assisting clients in buying and selling real estate assets.

Identifying lucrative investment opportunities in domestic and international markets.

For expert guidance on real estate investments, visit Cushman & Wakefield Capital Markets.

Future Trends in Capital Markets and Real Estate

The capital markets real estate sector is constantly evolving due to technological advancements, economic shifts, and changing investor preferences. Some emerging trends include:

Sustainable and ESG Investments

Investors are increasingly focusing on environmental, social, and governance (ESG) factors.

Sustainable real estate investments, such as green buildings, are gaining popularity.

2. Digital Transformation

Blockchain technology and digital platforms are streamlining real estate transactions.

Tokenization of real estate assets is making property investments more accessible.

3. Increased Institutional Investment

Pension funds, insurance companies, and sovereign wealth funds are allocating more capital to real estate.

Institutional investors prefer commercial and industrial real estate sectors due to their stable returns.

4. Flexible Workspaces and Mixed-Use Developments

The demand for flexible office spaces and mixed-use developments is rising.

Capital markets support such projects through innovative financing solutions.

Conclusion

Capital markets are essential for the growth and stability of the real estate sector. They provide businesses and investors with the financial tools needed to acquire, develop, and manage real estate assets effectively. Capital markets real estate services help clients navigate the complexities of real estate investments, secure funding, and optimize asset performance. By staying informed about market trends and leveraging professional advisory services, investors can make strategic decisions that yield long-term success.

1 note

·

View note

Text

Offer Is Here Go And Grab The Jaltest V9 At Discount shop now

Jaltest Diagnostics is offering a limited-time Spring sale until March 31 and the sale is going on with a free one-year software update. It is a multi-brand and multi-system diagnostic tool developed to carry out the most advanced tasks of diagnostics and vehicle maintenance simply and intuitively.

Coverage is provided for all brands, models, and systems of commercial vehicles, agricultural equipment, special equipment, material handling equipment, and vessels, Jaltest Diagnostics is divided into different projects:

• Jaltest CV: truck, bus, trailer, light commercial vehicle, or pickup truck.

• Jaltest AGV: tractors, harvesters, forage harvesters, grape harvesters, or telescopic arms, among others.

• Jaltest OHW: cranes, excavators, dumpers, stationary engines, cleaning machines, or road maintenance equipment, among others.

• Jaltest MHE: forklifts, telescopic handlers, lift platforms, and derivatives.

• Jaltest Marine: vessels, jet skis, outboard and inboard engines, and stationary engines.

Key features:

1. INTERACTIVE WIRING DIAGRAMS.

While navigating over the wiring diagrams, the components are outlined and the technical information including, relevant documents, technical data, comments, and location, can be directly accessed.

2. SYSTEM OPERATING DIAGRAM.

Understanding how systems work can be a complex task. Jaltest provides the pneumatic, electrical, and fuel schematics with their corresponding technical values, images, locations, and much more to speed up the technician’s work.

3. SYSTEM DISPLAY.

Real-time live data display on vehicle schematics. It enables a fast assessment of the functioning of the system.

4. VIRTUAL INSTRUMENTS / GRAPHS.

Visual aid for the technician to check values and understand the actual status of any system available in the vehicle.

5. SYSTEM SCAN.

This function allows the user to auto-detect the available systems in the selected model. During the Auto-detection, an error reading of every available system takes place including their identification data. Later, every error found can be cleaned.

6. FLEET CUSTOMISATION.

This function will allow customize your fleet. Create new brands specific to your market by selecting the systems included in the vehicle. Add connectors, location, images, and comments.

7. DIAGNOSIS BY NUMBER PLATE.

Once the customers and vehicles portfolio has been created, access by number plate is fast and easy.

8. SHORTCUT TO SPECIAL FUNCTIONS.

Optimize repair times at the shop with direct access to relevant repair processes.

9. TECHNICAL DATA AND PROCEDURES.

The experience of Cojali’s Technical Assistance team has allowed the classification of the most relevant technical data of the vehicle.

10. REPAIR TIMES.

To help improve the workshop's time management and productivity, a time estimation function has been created.

grab the deal

+91 92053 23885

+91 99580 57547

Watch Our Videos for More Details:

Automax Tools India YouTube

Topdon India YouTube

Available at Automax Tools India – Trusted by professionals nationwide!

For more details visit: www.automaxtools.co.in

#carscanner#OBD#Multicarscanner#multitruckscanner#Truckscanner#keyprogrammer#multikeyprogrammer#multikeytool#carandtruck#heavydutyscanner#OBDscanner#lightcommercialscanner#diagnostictool#carjumstarter#carbatteryjumper#carbatteryscanner#carbatterytester#carbatterycharger#carbatterymaintainer#Jaltestv9#Automaxtools#newdelhi#india

1 note

·

View note

Text

Unlocking the Potential of Cell-Free Systems for Rapid Protein Production

The global cell-free protein expression market size is expected to reach USD 475.1 million in 2030 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. Growing demand for novel biologic products for the treatment of severe chronic diseases such as, cancer, multiple sclerosis, and anemia is a major factor contributing to the market growth. For instance, as reported by the world health organization (WHO) in 2020, there were 10 million deaths or about 1 in 6 deaths due to cancer making it to be one of the major causes of death worldwide. Such rising cancer incidences are increasing the adoption of protein biologics as an alternative treatment option due to their target-specific treatment with fewer side effects compared to other treatments which is positively impacting the market growth.