#Digital Accounting

Text

cant tell you how bad it feels to constantly tell other artists to come to tumblr, because its the last good website that isn't fucked up by spoonfeeding algorithms and AI bullshit and isn't based around meaningless likes

just to watch that all fall apart in the last year or so and especially the last two weeks

there's nowhere good to go anymore for artists.

edit - a lot of people are saying the tags are important so actually, you'll look at my tags.

#please dont delete your accounts because of the AI crap. your art deserves more than being lost like that #if you have a good PC please glaze or nightshade it. if you dont or it doesnt work with your style (like mine) please start watermarking #use a plain-ish font. make it your username. if people can't google what your watermark says and find ur account its not a good watermark #it needs to be central in the image - NOT on the canvas edges - and put it in multiple places if you are compelled #please dont stop posting your art because of this shit. we just have to hope regulations will come slamming down on these shitheads#in the next year or two and you want to have accounts to come back to. the world Needs real art #if we all leave that just makes more room for these scam artists to fill in with their soulless recycled garbage #improvise adapt overcome. it sucks but it is what it is for the moment. safeguard yourself as best you can without making #years of art from thousands of artists lost media. the digital world and art is too temporary to hastily click a Delete button out of spite

#not art#but important#please dont delete your accounts because of the AI crap. your art deserves more than being lost like that#if you have a good PC please glaze or nightshade it. if you dont or it doesnt work with your style (like mine) please start watermarking#use a plain-ish font. make it your username. if people can't google what your watermark says and find ur account its not a good watermark#it needs to be central in the image - NOT on the canvas edges - and put it in multiple places if you are compelled#please dont stop posting your art because of this shit. we just have to hope regulations will come slamming down on these shitheads#in the next year or two and you want to have accounts to come back to. the world Needs real art#if we all leave that just makes more room for these scam artists to fill in with their soulless recycled garbage#improvise adapt overcome. it sucks but it is what it is for the moment. safeguard yourself as best you can without making#years of art from thousands of artists lost media. the digital world and art is too temporary to hastily click a Delete button out of spite

23K notes

·

View notes

Text

boop!! :3

#unfortunately i can't boop back from here bc this is a side account. sad!#my art#artists on tumblr#digital sketch#cat#april fools

20K notes

·

View notes

Text

Adapting to the Future: How Accountants Can Thrive by Embracing Digital Skills

In an era where technology is rapidly reshaping industries, the accounting profession is no exception. Traditional accountants who once relied on paper-ledgers and manual calculations are finding themselves at a crossroads. The advent of digital accounting has ushered in a new age of efficiency, accuracy, and opportunity.

The shift towards digital accounting is not merely a trend but a…

View On WordPress

#Artificial Intelligence in Accounting#Big Data Analytics#Career Advancement#Cloud Computing#Digital Accounting#Financial Technology#Professional Development#Skill Upgrade#Traditional Accountants

0 notes

Text

The Future of Accounting: Embracing Technology with E-Accounting

Introduction

In the ever-evolving domain of finance, the traditional foundations of accounting are undergoing a radical metamorphosis, spurred on by the relentless march of technology. As we stride boldly into the future, the adoption of cutting-edge tools and methodologies has become an imperative for professionals in the field. At the forefront of this evolution stand two formidable pillars: E-Accounting and the integration of Data Analytics in accounting processes.

E-Accounting: Revolutionizing Financial Management

E-Accounting, a succinct term for Electronic Accounting, signifies a departure from conventional manual bookkeeping methods towards a realm of digitalization and automation. The advent of cloud computing and sophisticated software solutions is reshaping accountants' workspaces from once paper-cluttered desks to virtual dashboards and intuitive platforms.

Efficiency through Streamlined Processes

E-Accounting introduces a streamlined approach to financial management, eliminating the need for physical ledgers and laborious data entry. With a few clicks, accountants gain access to real-time financial data, enabling them to generate reports and collaborate seamlessly with clients and colleagues.

Accuracy and Compliance at the Forefront

A standout feature of E-Accounting lies in its ability to reduce errors and ensure compliance. Automated calculations and built-in error-checking mechanisms contribute to heightened accuracy, while compliance features assist in navigating the intricate web of regulations governing financial reporting.

Global Reach and Collaborative Dynamics

Cloud-based E-Accounting systems offer unparalleled accessibility, enabling accountants to work from anywhere in the world. This not only fosters collaboration but also facilitates real-time updates and communication with clients, cultivating a dynamic and responsive financial management process.

Unleashing the Potential of Data Analytics in Accounting

Hand in hand with E-Accounting, Digital Accounting harnesses the power of data analytics to transform financial data into a strategic asset for businesses.

Informed Decision-Making through Big Data

The integration of data analytics tools empowers accountants to navigate vast datasets and extract meaningful patterns. By tapping into the potential of Big Data, businesses can make informed decisions, identify trends, and predict future financial scenarios with unparalleled precision.

Fortifying Financial Integrity

Digital accounting, fortified by data analytics, stands as a vigilant guardian against financial irregularities. Advanced algorithms can detect anomalies, flag suspicious transactions, and provide an additional layer of security to safeguard the financial integrity of organizations.

Proactive Financial Planning with Predictive Analytics

Predictive analytics in accounting enables organizations to shift from reactive strategies to proactive financial planning. By forecasting future trends and scenarios, businesses can position themselves strategically, mitigating risks and capitalizing on emerging opportunities.

The Convergence of E-Accounting: Shaping Tomorrow's Vision

As E-Accounting and Digital Accounting converge, the synergy between these technological pillars is set to redefine the future of accounting. The seamless integration of automated processes, real-time collaboration, and data-driven insights will not only enhance efficiency but also empower accountants to assume a more strategic advisory role within organizations.

In Conclusion

Standing at the threshold of this transformative era, embracing the fusion of E-Accounting and Digital Accounting, with a keen focus on data analytics, is imperative for navigating the ever-evolving landscape of financial management. The future of accounting extends beyond numbers; it's about harnessing technology to unlock the full potential of financial data, driving informed decisions, and propelling businesses toward unprecedented success.

#future of finance#digital accounting#digital transformation#data analytics in accounting#Technology

0 notes

Text

study 🏇

#ukrart#artists on tumblr#ukrainian art#арткозацтво#украрт#український tumblr#укртамблер#укртумбочка#original art#digital art#sketch#illustration#digital aritst#digital sketch#digital drawing#draweveryday#drawing#my art#small art account#small artist#artwork#art

19K notes

·

View notes

Text

Since I've seen it I couldn't stop thinking about it (please don't kill me x,,d)

Ironically I think Doofenshmirtz and Perry's dynamic kinda could work with Mike and William

#actually mike would take perry's place#but taking into account how alike william and mike looked doof would make more sense to be compared with william#'cuz you know... mad scientist doing evil plans and all that lol#anyways they would be so silly and it's so fun to imagine them like that jhasjshs XD#oh- the wonders you can do as an artist x'd#fnaf#five nights at freddy's#michael afton#william afton#springtrap#fnaf fanart#art#my art#artwork#my artwork#drawing#illustration#digital art#digital artwork#digital drawing#digital illustration#artists on tumblr#fanart#videogame fanart#fnaf art#mike afton#scooped michael#purple guy#fnaf 3#heinz doofenshmirtz

5K notes

·

View notes

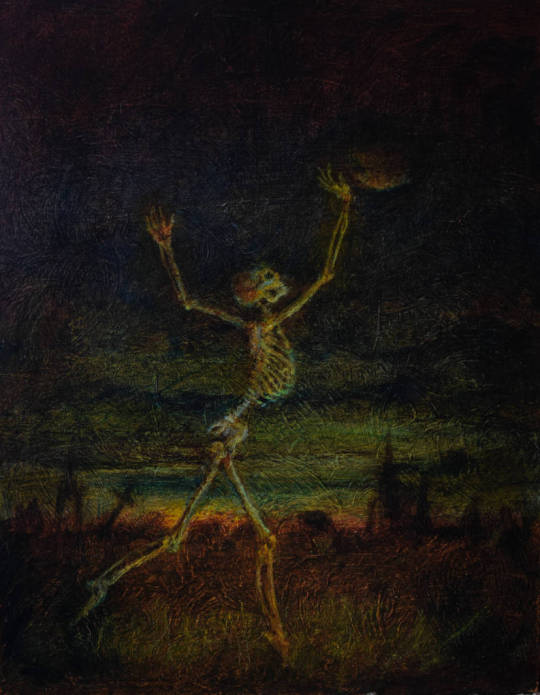

Photo

Works by octonimoes

#art#illustration#dark art#horror#fantasy#macabre#surreal#skeleton#could not find anything on if these are digital or traditional or what#deviant has had an account for 8 years but no other social media linked?#so idk

8K notes

·

View notes

Text

Took a break from my final projects long enough to finish up The Pantheon! A year in the making lol!

#art#digital art#fanart#star wars#character art#character design#digital artist#star wars fanart#sw fanart#art account#sw art#sw prequels#sw au#star wars prequels#star wars art#star wars au#medieval fantasy au#star wars padme#sw padme#padme amidala#padme#padme fanart#character redesign#character concept#characterart#star wars medieval au#sw medieval au

8K notes

·

View notes

Text

"Oh Caine can't kiss Pomni" WRONG

Hello, this is my contribution to the showtime community

I say they're both not big on PDA, Pomni herself isn't one to melt but Caine is the romantic of the two! He stares at her longingly and she just smiles at him. Pomni is trying real hard to be more romantic and Caine is trying very hard to understand how humans show affection TwT

#the amazing digital circus#Pomni#Caine#PEOPLE WHO DONT FOLLOW MY REBLOG ACCOUNT DONT UNDERSTAND MY PURE INDULGENCE WITH THIS SHIP#the amazing digital circus pomni#the amazing digital circus caine#TADC#tadc pomni#tadc caine#the amazing digital circus fanart#tadc fanart#art#showtime#Caine x Pomni

4K notes

·

View notes

Text

#digital art#new account#beginner artist#drawdrawdraw#support the artist#digital painting#digital portrait#art school#cats of tumblr#cute cats#cat#sunset#sunsets#cozycore#cozy aesthetic#cozy#stars#my ocs#ocs#oc art#oc

3K notes

·

View notes

Text

it’s almost ready! 🍽️

#senshi ily#senshi#dungeon meshi#dunmeshi#dungeon meshi senshi#delicious in dungeon#senshi of izganda#digital art#digital drawing#digital painting#illustration#art account#drawing#artwork#small artist#character art#dungeon meshi fanart#fanart#wafercone

2K notes

·

View notes

Text

Harvey stans gather around! I bring food!!!

This man is so cute it hurts, that or I just love himbos, either way, I love him.

#drawing#sketch#fanart#painting#stardew valley#stardew valley fanart#digital art#harvey stardew fanart#harvey stardew valley#sdv harvey#stardew harvey#stardew#stardew valley fandom#sdv art#sdv fanart#sdv fandom#digital artist#digital drawing#digital painting#digital illustration#artists on tumblr#artwork#my art#female artists#small artist#women artists#small art account

1K notes

·

View notes

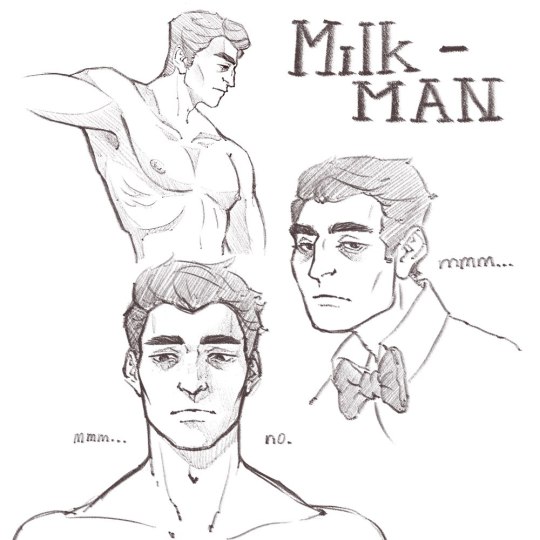

Text

well my drawing itch is done

no colors because i am a pussy and don't like them

#milkman#that's not my neighbor#francis mosses#small art account#digital art#game fanart#art#mmmm... just no you know#i have two options of where the milk comes from tbh#someone sedate me pls

1K notes

·

View notes

Text

The Future of Accounting: Embracing Technology with E-Accounting

Introduction

In the dynamic landscape of finance, the traditional realms of accounting are undergoing a revolutionary transformation, driven by the relentless march of technology. As we step into the future, the integration of cutting-edge tools and methodologies is becoming increasingly essential for professionals in the field. Two key pillars propelling this evolution are E-Accounting and the utilization of Data Analytics in accounting processes.

E-Accounting: A Paradigm Shift in Financial Management

E-Accounting, short for Electronic Accounting, marks a departure from traditional manual bookkeeping methods towards a digitalized and automated system. With the advent of cloud computing and advanced software solutions, the once paper-laden desks of accountants are being replaced by virtual dashboards and intuitive platforms.

Streamlining Processes with E-Accounting

E-Accounting offers a streamlined approach to financial management, eliminating the need for physical ledgers and tedious data entry. With just a few clicks, accountants can access real-time financial data, generate reports, and collaborate seamlessly with clients and colleagues.

Enhancing Accuracy and Compliance

One of the standout features of E-Accounting is its ability to reduce errors and ensure compliance. Automated calculations and built-in error-checking mechanisms contribute to greater accuracy, while compliance features help navigate the complex web of regulations governing financial reporting.

Global Accessibility and Collaboration

Cloud-based E-Accounting systems provide unparalleled accessibility, allowing accountants to work from anywhere in the world. This not only enhances collaboration but also facilitates real-time updates and communication with clients, fostering a more dynamic and responsive financial management process.

The Power of Data Analytics

In tandem with E-Accounting, Digital Accounting leverages the potential of data analytics to unlock valuable insights, transforming financial data into a strategic asset for businesses.

Harnessing Big Data for Informed Decision-Making

The integration of data analytics tools allows accountants to sift through vast datasets and extract meaningful patterns. By harnessing the power of Big Data, businesses can make informed decisions, identify trends, and predict future financial scenarios with a level of precision previously unattainable.

Detecting Fraud and Anomalies

Digital accounting, fortified by data analytics, acts as a vigilant guardian against financial irregularities. Advanced algorithms can detect anomalies, flag suspicious transactions, and provide an additional layer of security to safeguard the financial integrity of organizations.

Strategic Planning with Predictive Analytics

Predictive analytics in accounting enables organizations to move beyond reactive strategies and embrace proactive financial planning. By forecasting future trends and scenarios, businesses can position themselves strategically, mitigating risks and capitalizing on emerging opportunities.

The Synergy of E-Accounting : A Vision for Tomorrow

As the realms of E-Accounting and Digital Accounting converge, the synergy between these two technological pillars is poised to redefine the future of accounting. The seamless integration of automated processes, real-time collaboration, and data-driven insights will not only enhance efficiency but also empower accountants to assume a more strategic advisory role within organizations.

In conclusion,

As we stand on the cusp of this transformative era, embracing the amalgamation of E-Accounting and Digital Accounting with a focus on data analytics is imperative for staying ahead in the ever-evolving landscape of financial management. The future of accounting is not just about numbers; it's about leveraging technology to unlock the full potential of financial data, driving informed decisions and propelling businesses towards unprecedented success.

#future of finance#digital accounting#digital transformation#data analytics in accounting#Technology

0 notes

Text

besties 💥💥

#ukrart#artists on tumblr#ukrainian art#арткозацтво#украрт#український tumblr#укртамблер#укртумбочка#original art#digital art#small art account#small artist#fan art#my art#artwork#art#soul eater#maka albarn#death the kid#digital fanart#fanart#artist on tumblr#digital artist#digital sketch#digital drawing#character illustration#illustration#digital illustration#draweveryday#drawing

1K notes

·

View notes