#DigitalWallets

Explore tagged Tumblr posts

Text

Wearable Payments Market Challenges and Solutions Transforming Consumer Behavior in Digital Financial Transactions

he wearable payments market has been gaining significant momentum over the past few years, driven by advancements in technology, increasing consumer demand for convenience, and the global shift towards cashless payments. Wearable payment devices, such as smartwatches, fitness bands, smart rings, and even clothing embedded with payment chips, are transforming the way consumers interact with their finances. This article explores the current state of the wearable payments market, its growth drivers, challenges, key players, and future prospects.

Growth Drivers of the Wearable Payments Market

One of the primary factors propelling the wearable payments market is the rapid adoption of contactless payment technology. Near Field Communication (NFC) has become the standard for enabling secure, fast, and convenient transactions without the need to carry physical wallets or cards. The COVID-19 pandemic further accelerated contactless payments as consumers and merchants preferred touch-free payment options to reduce the risk of virus transmission.

Another driver is the increasing penetration of smartphones and wearable devices globally. As more consumers adopt smartwatches and fitness trackers equipped with payment capabilities, the demand for wearable payments naturally increases. Additionally, the tech-savvy younger generation prefers seamless and instant payment methods, fueling market growth.

The rise of digital wallets and mobile payment platforms, such as Apple Pay, Google Pay, and Samsung Pay, has also played a pivotal role in supporting wearable payment adoption. These platforms integrate with wearable devices, making it easier for consumers to pay for goods and services anytime, anywhere.

Market Segmentation and Key Players

The wearable payments market can be segmented based on device type, technology, and end-user industry. Smartwatches dominate the device segment due to their widespread popularity and multifunctionality. Fitness bands and smart rings are emerging as alternatives, offering users more options based on style and functionality preferences.

Technologically, NFC remains the most widely used method for wearable payments, but biometric authentication (such as fingerprint and facial recognition) is being integrated to enhance security and user experience. Some advanced wearables are also experimenting with QR code-based payments, expanding the options available for users.

In terms of geography, North America and Europe are leading markets due to high smartphone penetration, strong infrastructure for contactless payments, and greater consumer willingness to adopt new technology. However, Asia-Pacific is witnessing rapid growth, propelled by large populations, increasing smartphone users, and rising e-commerce activities.

Key players in the wearable payments market include tech giants like Apple, Samsung, Fitbit (owned by Google), Garmin, and Huawei. Financial institutions and payment processors such as Visa, Mastercard, and PayPal are also actively collaborating with device manufacturers to expand wearable payment ecosystems. Furthermore, startups specializing in wearable fintech solutions are contributing innovation and diversification.

Challenges in the Wearable Payments Market

Despite its promising growth, the wearable payments market faces several challenges. Security concerns remain at the forefront, as wearable devices are susceptible to hacking, data breaches, and loss or theft. Ensuring robust encryption and secure authentication methods is crucial to building consumer trust.

Battery life and device compatibility are additional issues. Wearable devices require frequent charging, and not all payment terminals support every wearable payment technology. This can limit consumer convenience and adoption.

Another hurdle is the regulatory environment. Different countries have varying rules regarding digital payments, data privacy, and financial transactions. Navigating these regulations adds complexity for manufacturers and payment providers looking to scale globally.

Finally, consumer awareness and education about wearable payments are still evolving. Many users remain unfamiliar with the technology or skeptical about its safety, requiring ongoing efforts to increase adoption.

Future Prospects and Innovations

The future of the wearable payments market looks promising, with continuous innovations aimed at enhancing user experience and expanding functionality. Integration of Artificial Intelligence (AI) and machine learning can personalize payment experiences, detect fraudulent transactions, and improve security.

The emergence of blockchain technology may also influence wearable payments by providing decentralized and tamper-proof transaction records. This can build greater trust and transparency in payment systems.

Furthermore, wearable payment devices are likely to become more diverse and embedded in everyday accessories such as rings, glasses, and clothing. This evolution will make payments even more seamless and unobtrusive.

Partnerships between technology companies, financial institutions, and retailers will be critical in expanding acceptance points for wearable payments globally. Enhanced interoperability and universal standards could make wearable payments ubiquitous.

Conclusion

The wearable payments market is revolutionizing how consumers make financial transactions, offering convenience, speed, and a futuristic approach to cashless payments. While challenges remain, ongoing technological advancements, consumer shifts towards contactless options, and strong collaboration among key industry players are set to drive robust market growth.

As wearable devices continue to evolve in design and capability, the wearable payments market is poised to become a cornerstone of the digital economy, transforming everyday purchases into effortless, secure experiences.

#WearablePayments#ContactlessPayments#DigitalWallets#CashlessFuture#SmartwatchPayments#FintechInnovation

0 notes

Text

📲 Mobile Money 2025: Empowering a Cashless, Inclusive Financial Future

In 2025, mobile money has become a driving force behind financial inclusion and digital transformation, especially in emerging markets. With smartphones in nearly every pocket, users now rely on mobile wallets and payment apps for everything from peer-to-peer transfers and utility payments to savings, loans, and merchant transactions. Fintech innovation, biometric security, and real-time transaction capabilities are making mobile money faster, safer, and more accessible than ever before. Governments and central banks are also integrating mobile platforms into digital ID and tax systems, fostering transparency and economic growth. As cashless ecosystems expand, mobile money is reshaping the way people manage, move, and multiply their finances

#MobileMoney#DigitalWallets#FintechInnovation#CashlessEconomy#FinancialInclusion#MCommerce#MobileBanking#PayTech#FutureOfFinance#MobilePayments2025

0 notes

Text

Top Money Transfer Apps USA with Lowest Fees (2025)

At present, it is very important to find a fast, safe and low cost medium for money transactions. Especially if you live in United States and transfer money inside the country or internationally, it is important to choose the right app. On this blog we will discuss some of the best Money Transfer Apps USA of 2021, which provide low cost and Real-Time Transfer.

Why use Money Transfer Apps USA?

The conventional banking system in the United States can often be slow. So the current generation is looking for Lean & Fast Financial Solutions, where mobile apps are the most popular choice. Money Transfer Apps USA is now reached in unique popularity for the following reasons:

Fasten Money Facility (Real-Time Transfer)

Minimum transfer fee

User-Friendly Interface

International transfer facility

Secure encryption system

1. Zelle-the fastest and bank-engaged app

Zelle is an app that is integrated with most banks in the United States. This is one of the fastest money sending apps to the Money Transfer Apps USA category.

Zelle’s Features:

The Real-Time Transfer Facility, that is, the recipient immediately gets the money.

No transfer fee — completely free.

Transfer can be done with mobile number or email address.

Why zelle popular:

In addition to United States, it can also be effective for those who use US-based accounts from Canada, UK or Australia.

1. What will change in these apps in the coming days?

Answer: Money Transfer Apps USA will become smarter and AI-based after 2021 and then. Fraud Detection AI, Crypto Integration, International Transfer Support and Multi-Currency Wallet will continue to increase. This will be more convenient for users.

READ MORE

#TopMoneyTransferApps#MoneyTransferUSA#LowestFees2025#TransferMoney#BestAppsUSA#MoneyTransferOptions#FinanceTips#SendMoney#SavingOnFees#CostEffectiveTransfers#FinancialApp#2025Savings#DigitalWallets#MoneyManagement#CheapTransfers#InstantMoneyTransfer#FintechSolutions#VirtualBanking#MoneyTransferGuide#BudgetSmart

0 notes

Link

#androiddigitalwallet#builddigitalwallet#builddigitalwalletapp#createdigitalwallet#creditcardvsdigitalwallet#cryptowallet#developdigitalwallet#digitalwallet#digitalwalletapp#digitalwalletdefinition#digitalwalletvsdebitcard#digitalwallets#howdoiuseadigitalwallet#howtobuildadigitalwallet#howtomakeadigitalwallet#whatisadigitalwallet#whatisdigitalwallet?

1 note

·

View note

Text

The Future of Fintech: How Embedded Finance is Leading the Way

Embedded finance is gaining global momentum among businesses. One notable example is the growing preference for 'buy now, pay later' options among consumers. Traditional financial services are known for their extensive paperwork, complex procedures, and limited accessibility, which can hinder efficient financial management and service access for individuals and businesses alike. Integrating financial services into non-financial platforms has historically been costly and time-consuming. However, embedded finance is revolutionizing this process by seamlessly integrating financial services into everyday tasks and platforms. This article provides insights into this emerging niche.

What Is Embedded Finance?

Embedded finance refers to integrating financial services such as payments, lending, insurance, and more into non-financial businesses or platforms, eliminating the need to redirect to traditional financial institutions. This allows businesses to offer tailored financial products and services within their existing platforms, enhancing customer experience and streamlining transactions. While the concept isn't new, as non-banks have offered financial services through private-label credit cards and sales financing for decades, the technology and ease of integration into digital interfaces like apps, digital wallets, and rewards programs are groundbreaking. Embedded finance enables businesses to provide convenient financial services without relying on traditional banks. For instance, e-commerce platforms can offer instant financing at the point of purchase, and SaaS companies can integrate invoicing or payment processing to simplify financial management.

Top 5 Use Cases of Embedded Finance

1. Digital Wallets One of the most practical aspects of embedded finance is the development of digital wallets. These user-friendly smartphone apps securely store digital copies of debit and credit cards, protecting account numbers and other sensitive information. Mobile payment options like Google Pay, Apple Pay, and Samsung Pay have set the standard by enabling users to make payments at contactless terminals and online, streamlining and securing transactions.

2. Oil and Gas Industry The oil and gas industry relies on specialized personnel and equipment at every stage. Marketplaces tailored to this sector allow buyers and suppliers to connect and compare items like heat exchangers, drill bits, and pipes, meeting the specific needs of the industry.

3. Construction Sector Similar to oil and gas, the construction industry has unique requirements. Finding replacement parts for specific equipment can be challenging, even with Google. B2B marketplaces for construction provide more choices for buyers and opportunities for suppliers, simplifying the procurement process.

4. Insurance Embedded finance is transforming the insurance sector by streamlining administration, claims processing, and payments for both firms and clients. Automation reduces manual operations, offering clients convenient payment options for premiums, coinsurance, and deductibles, ultimately improving customer satisfaction and operational efficiency.

5. Grocery and Food Service If you’ve ever paid for grocery pickup or delivery through an app, you’ve encountered embedded finance. This trend is growing in the B2B food and beverage sector, with marketplaces offering a wide range of products, from organic foods to wholesale items, providing flexibility and choice for grocers and restaurateurs.

Healthcare

Embedded finance holds significant potential in the healthcare industry, especially with high out-of-pocket costs in the U.S. In 2022, healthcare spending surpassed $4.5 trillion, averaging $13,493 per person. Major hospitals and health systems now offer payment services and financial solutions through desktop and mobile apps, enabling patients to pay medical bills seamlessly. Innovations like PayZen provide no-interest, no-fee payment plans, potentially reducing costs for insurers, doctors, patients, and hospitals.

Future of Embedded Finance

Embedded finance is poised to shape the future of fintech by merging non-financial service providers with financial services like payment processing, lending, and insurance. This integration offers numerous benefits, including improved customer experiences and engagement. Businesses can provide a seamless and convenient user experience by embedding financial services into non-financial platforms, eliminating the need for customers to switch between different platforms or institutions.

Additionally, embedded finance opens new revenue streams for businesses through transaction fees, interest charges, and other financial products. This diversification can help companies grow and maintain sustainability in the long run.

0 notes

Text

Exciting Upgrades and New Product Launches: What's Next in Fintech?

The fintech industry has always been a hotbed of innovation, continuously evolving to meet the demands of consumers and businesses alike. The pace of change has only accelerated in recent years, driven by advancements in technology, increasing consumer expectations, and a global push towards digital transformation. As we move further into 2024, several exciting upgrades and new product launches are set to revolutionize the way we handle financial transactions, manage investments, and interact with our money.

The impact of fintech extends beyond mere convenience; it is fundamentally altering the landscape of financial services. From mobile payments and robo-advisors to blockchain and decentralized finance, fintech is empowering individuals and businesses with tools that offer greater control, transparency, and efficiency. Moreover, the integration of artificial intelligence and machine learning is making financial services more personalized and accessible than ever before.

As we look to the future, it’s clear that fintech will continue to drive significant changes in how we manage our financial lives. This blog will explore some of the most exciting upgrades and new product launches on the horizon, highlighting how these innovations will shape the future of finance. Whether you’re a tech enthusiast, a financial professional, or simply curious about the next big thing in fintech, these developments promise to transform our relationship with money in profound ways.

Here’s a sneak peek into what’s next in the world of fintech:

1. Digital Identity Solutions

The rise of digital identity solutions is revolutionizing how individuals and businesses verify their identities online. Fintech companies are developing secure and user-centric identity verification platforms that leverage biometric data, blockchain technology, and advanced encryption techniques. These solutions not only enhance security and privacy but also streamline customer onboarding processes for financial institutions and facilitate seamless digital interactions across various platforms.

2. Instant Payments and Real-Time Settlements

The demand for faster and more efficient payment solutions is driving the development of instant payment systems and real-time settlement networks. Fintech companies are collaborating with banks and payment processors to implement instant payment solutions that enable near-instantaneous transfer of funds between individuals and businesses. Real-time settlements are also gaining traction in the world of securities trading, allowing for faster and more transparent transactions in the financial markets.

3. Augmented Reality (AR) and Virtual Reality (VR) in Banking

The integration of augmented reality (AR) and virtual reality (VR) technologies is transforming the way we interact with banking and financial services. Fintech companies are leveraging AR and VR to create immersive banking experiences, such as virtual branch visits, interactive financial education modules, and personalized investment simulations. These technologies enhance customer engagement, improve financial literacy, and provide innovative ways to visualize and manage personal finances.

4. Quantum Computing in Financial Services

The advent of quantum computing holds immense potential for revolutionizing financial services, particularly in areas such as risk management, portfolio optimization, and algorithmic trading. Fintech companies and financial institutions are exploring the use of quantum computing algorithms to solve complex mathematical problems at speeds that were previously unimaginable. While still in the experimental stage, quantum computing has the power to unlock new frontiers in financial analysis and decision-making.

5. Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer lending platforms are gaining popularity as alternative sources of financing for individuals and small businesses. Fintech companies are leveraging technology to create P2P lending platforms that connect borrowers directly with investors, bypassing traditional financial intermediaries. These platforms offer competitive interest rates, streamlined loan application processes, and greater flexibility for both borrowers and investors, disrupting the traditional lending landscape and expanding access to credit for underserved populations.

Conclusion

The future of fintech is incredibly promising, with innovations aimed at making financial services more accessible, secure, and efficient. From digital identity solutions and instant payments to augmented reality banking and quantum computing, these developments are poised to transform the way we interact with money and financial institutions. Stay tuned as these exciting upgrades and new product launches unfold, bringing us closer to a more integrated and intelligent financial future.

#Fintech#Innovation#DigitalFinance#Technology#Blockchain#AI#MachineLearning#DigitalWallets#RoboAdvisors#RegTech#SustainableFinance#FinancialInclusion#AR#VR#QuantumComputing#P2PLending#InstantPayments#RealTimeSettlements#EmbeddedFinance

0 notes

Text

In this digital age, don't forget to protect your online assets too! From social media accounts to digital wallets, make sure they're included in your estate plan this spring.

Contact us today to learn how we can help safeguard your digital legacy. tinyurl.com/book20westlegal

0 notes

Text

🌟💼 Entering the Era of Digital Wallets: What's Next? 💳📲

Hey Tumblr fam, let's talk about the exciting realm of digital wallets and what the future holds for this game-changing technology! 🚀

🌐 The Digital Wallet Revolution: Digital wallets have completely transformed the way we handle money and make transactions. With just a few taps on our smartphones, we can pay bills, split expenses, and even shop online seamlessly. It's like having our entire wallet stored conveniently in our pocket!

🔍 What's on the Horizon: As we step into this new era of digital finance, what can we expect next? Here are a few things to ponder:

Enhanced Security Measures: With the rise of digital transactions, ensuring the security of our financial data becomes paramount. We can anticipate the development of even more robust security measures, such as biometric authentication and advanced encryption technologies, to safeguard our digital wallets from potential threats.

Integration of Cryptocurrencies: As cryptocurrencies gain mainstream acceptance, digital wallets are likely to integrate support for various digital assets. This opens up exciting possibilities for seamless crypto transactions and portfolio management within our digital wallets.

Cross-Border Payments: Say goodbye to hefty transfer fees and lengthy processing times! Digital wallets are poised to streamline cross-border payments, enabling faster and more cost-effective transactions across the globe. This could have profound implications for international trade and remittance services.

Personalized Financial Management: Imagine having a digital wallet that not only tracks your spending but also offers personalized financial advice tailored to your goals and preferences. With advancements in artificial intelligence and machine learning, such capabilities could soon become a reality, empowering users to make smarter financial decisions.

🚀 The Future Looks Bright: As we embrace the era of digital wallets, one thing is clear: the future of finance is digital, dynamic, and full of possibilities! Whether it's harnessing the power of blockchain technology or revolutionizing the way we interact with money, the journey ahead promises to be nothing short of exhilarating.

So buckle up, fellow explorers, as we embark on this exciting voyage into the digital frontier of finance! 💫💼

#FutureOfFinance#FintechRevolution#DigitalWallets#finance#thefinrate#payment gateway#fintech#financialinsights#financetalks

1 note

·

View note

Text

How to Build a Digital Banking Platform?

Over the last two years, your workplace may have undergone significant digitization. But have your banking services kept pace? For the 78% of Americans who prefer banking online, navigating financial tasks through various apps has become the norm.

Financial giants are already adapting to this change, with a 2022 survey revealing that over half of consumers use their bank or credit union’s mobile app for banking activities. However, creating these digital platforms is challenging without the necessary infrastructure for data collection, integration with other software, secure communication, and fraud detection.

To mitigate risks and delays, many banks utilize Digital Banking Platforms, ensuring a smooth transition for employees and customers to online services across diverse channels and market sectors. But how do you choose the right Online banking solutions for your needs? This article will guide you through everything you need to consider.

What Is a Digital Banking Platform?

Digital banking platforms are utilized by banks, credit unions, and financial institutions to offer customers online access for carrying out conventional banking tasks and operations. With the appropriate partner, most banking services can be transformed into digital formats. Different Online banking solutions cater to various needs; some focus on loan and wealth management, while others are tailored towards everyday banking activities, such as transferring funds, managing savings and checking accounts, and tracking transactions.

Additionally, these platforms can enhance a bank's core systems with new features through API integrations, automation, and the use of no-code or low-code tools for developing pages and functionalities. Financial institutions of all sizes leverage these platforms, from smaller banks aiming to attract more customers, to large international banks streamlining processes into automated workflows.

Features of Digital Banking Platforms

Digital banking platforms provide financial institutions with a suite of comprehensive features. Based on specific needs, you can choose the financial products and services that best serve your customers.

These platforms offer the flexibility for banks to create specialized services through API integrations with fintech partners, allowing customers to expand their online and mobile applications with additional functionalities beyond what the platform originally offers.

Key features commonly found in Online banking solutions include:

Opening and managing financial accounts

Dashboards for financial management

Processes for online applications and approvals

Security measures and fraud prevention

Conducting money transfers

Facilitating bill payments

Providing budgeting tools

Sending alerts and notifications

Enabling third-party integrations

Offering options for customizable branding

Best Digital Banking Platforms

Selecting the best digital banking platform is crucial for financial institutions aiming to meet the evolving demands of modern banking. The ideal platform combines seamless user experience with robust security features, extensive financial management tools, and flexible integration capabilities. Here are some leading Digital payment platforms known for their comprehensive functionalities and adaptability:

nCino Bank Operating System

The nCino Bank Operating System is a comprehensive digital solution adopted by financial institutions to enhance the digital handling of loans and deposits for their customers. It is equipped with a suite of tools designed to streamline loan processing times and improve efficiency in managing customer relationships, content, workflows, and reporting. Positioning itself as an all-encompassing platform, nCino addresses a wide range of banking requirements, including asset finance and leasing, customer engagement, treasury management, and portfolio analysis, offering an end-to-end solution for modern banking needs.

Finacle Digital Engagement Suite

The Finacle Digital Engagement Suite caters to banks seeking to offer their customers comprehensive support across multiple channels, including customer onboarding, engagement, product sales, and the delivery of ongoing banking services. This platform is designed to enhance the banking experience for customers, employees, and external partners alike, featuring a range of solutions that span core banking functionalities, trade finance, liquidity management, blockchain-based payments, and beyond.

Finflux

Finflux is a cloud-based platform dedicated to lending services, supporting more than four million borrowers with a variety of needs such as loan management, origination, debt collection, and liability management, among others. Its extensive suite of API integrations allows financial institutions to effortlessly gather and analyze data from diverse sources, enabling the customization of digital experiences for customers across various loan categories.

Alkami Platform

The Alkami Platform offers a comprehensive digital banking solution designed to assist banks and credit unions in attracting and maintaining relationships with both retail and business clientele. It has successfully introduced innovative digital experiences for major credit unions, including the Idaho Central Credit Union, which boasts over 400,000 members. This platform provides lenders with a user-friendly mobile application experience, enabling users to manage payments, open new accounts, and interact virtually with customer support representatives with ease.

NCR Digital Insight

NCR Digital Insight offers an all-encompassing platform for digital transformation initiatives, encompassing a wide range of applications from digital banking to point-of-sale systems and the virtualization of stores. Its technology is utilized by banks and credit unions to integrate various banking services — such as consumer, retail, or business banking — into a unified application accessible on both desktop and mobile devices.

When it comes to choosing the best digital banking platform, the Market Intelligence Report by Quadrant Knowledge Solutions proves invaluable. This report offers deep insights into market trends, competitor analysis, and emerging technologies, assisting institutions in making informed decisions. It highlights the importance of adopting platforms with low-code application development capabilities, given their significant market share and growth potential. According to the report, the "Market Share: Digital banking platforms, 2022, Worldwide" indicates a robust and expanding market, while the "Market Forecast: Digital banking platforms, 2022-2027, Worldwide" predicts substantial growth over the next five years. This growth underscores the shift towards platforms that enable rapid development and deployment of digital banking services, making it easier for institutions to adapt to market changes and customer needs. By leveraging such market intelligence, financial institutions can strategically choose a Digital payment platform that not only meets their current requirements but also positions them for future growth and innovation.

Conclusion

This guide is the culmination of our extensive experience in crafting mobile banking solutions. As highlighted in the article, initiating with thorough research and setting clear strategic objectives for your business are crucial first steps. These foundational actions guarantee that your approach to creating a digital banking platform is aligned with your business goals. Once you've established a comprehensive overview and a blueprint for the forthcoming application, collaboration with DevOps, DevSecOps, and other relevant teams can commence. The development process is intricate and often lengthy. Therefore, we advise partnering with IT firms that offer a full range of services and oversee every phase of fintech software development.

#OnlineBanking#MobileBanking#Fintech#DigitalFinance#InternetBanking#DigitalPayments#VirtualBanking#DigitalWallets#BankingTechnology

0 notes

Text

इस महीने बंद हो जाएगा PAYTM? आरबीआई ने लिया सख्त एक्शन, अब आगे कैसे कर सकेंगे पेमेंट, जानिए आपके सभी सवालों के जवाब

#PaytmShutdown#RBIAction#PaymentRegulations#DigitalPayments#FintechNews#FinancialRegulations#TechUpdates#IndianFinance#BusinessNews#PaymentSolutions#DigitalWallets#TechRegulations

0 notes

Text

Unlocking the Future of Finance with Digital Wallets

Digital wallets have revolutionised the way we handle money; it has changed the way the financial industry works. Your finances are now at your fingertips—with a few taps, you can send money, pay bills, and do all types of financial transactions. The next generation of financial app services, digital wallets, use technology to improve workflow, security, and analytics. In this article, we will look at the development of digital wallets, their impact on transactions, and their transformational role in fintech. Know more: https://www.ficode.co.uk/blog/the-future-of-money-mobile-payments-and-digital-wallets

0 notes

Text

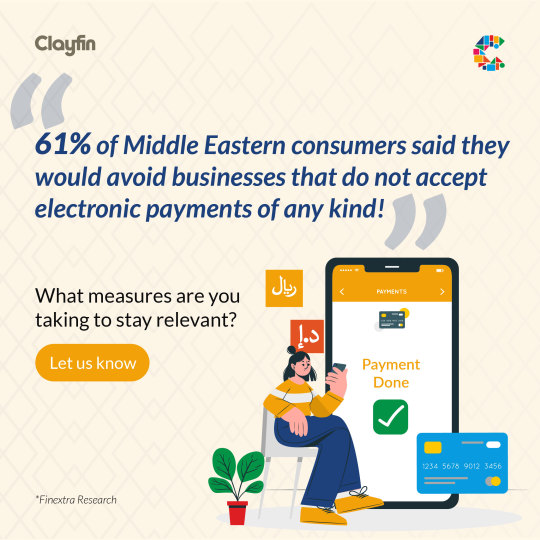

If you’re a business owner in the Middle East and if you believe that your business can maintain its competitive edge without integrating digital payment methods, think again! A recent study conducted by Finextra revealed that digital wallets are poised to become the preferred mode of payment in the near future, with credit cards following closely.

Saudi Arabia's Financial Sector Development Programme has aimed to increase non-cash transactions to 70% by 2030, and it is imperative now more than ever for businesses to adopt digital technology to cater to their customers. Have you adopted digital payments yet? Facing challenges in doing so? Let us hear you out.

Learn how we've enabled one of Bangladesh's biggest bank digitally transform with QR payments.

#digitalpayments#digitalwallets#digitaltechnology#qrpayments#digitalbanking#retailbanking#corporatebanking

0 notes

Text

Visa and Mastercard Tap into Africa's Digital Wallet Boom for Online Shopping! #africa #digitalwallets #Ecommerce #Mastercard #visa

0 notes

Text

📲💼 mobilepaymentscenter.com is available!

A premium, trustworthy domain for a mobile payment platform, fintech startup, or digital transaction hub. Clear, credible, and commerce-ready.

🔗 Grab it now: www.godaddy.com/en-uk/domainsearch/find?domainToCheck=mobilepaymentscenter.com

0 notes

Text

Your Crypto. Your Control.

With PRI Pay Wallet, you: 💳 Manage all crypto in one place 🔁 Swap between BTC, PRI & others 💸 Use EU-wide ATMs for cash 🔒 Stay fully on-chain Real-time actions. Transparent portfolio. No surprises.

#CryptoFreedom#PRIpay#CryptoATMs#FinancialControl#DigitalWallet#privateumglobal#priwallet#pricoin#privateumecosystem

0 notes

Text

Best Budgeting Apps of 2025

In today’s fast-paced digital world, managing your money wisely is more important than ever. Whether you’re saving for a vacation, trying to reduce debt, or simply aiming for better financial control, having the best budgeting apps at your fingertips can make all the difference. These modern personal finance tools simplify everything from expense tracking to financial planning, putting you in charge of your financial future.

Why Budgeting Apps Matter in 2025

As the global economy becomes increasingly unpredictable, more people are turning to money management solutions to help stay on top of their spending. The best budgeting apps in 2025 are smarter, more intuitive, and packed with features that cater to users from all financial backgrounds. They not only help track income and expenses but also provide insights and forecasts that aid in smarter financial planning.

Let’s take a look at the best budgeting apps of 2025 that can help transform the way you manage your money.

1. Mint

A classic favorite that remains strong in 2025, Mint continues to dominate the world of personal finance tools. With real-time expense tracking, bill reminders, and customizable budgets, it’s perfect for beginners and experienced budgeters alike.

Key Features:

Automatic syncing with bank accounts

Visual budget breakdowns

Credit score monitoring

Mint excels in money management by giving a full overview of your financial picture in one place. It’s simple, effective, and free.

2. YNAB (You Need A Budget)

If you want to take control of your finances proactively, YNAB is one of the best budgeting apps to consider. It follows a zero-based budgeting approach, ensuring every dollar has a job.

Key Features:

Real-time syncing across devices

Detailed reports for smarter financial planning

Debt payoff and savings goal tracking

YNAB is ideal for those looking for disciplined money management and structured expense tracking.

#BestBudgetingApps2025#BudgetingApps#PersonalFinance#FinTech#MoneyManagement#BudgetSmart#ExpenseTracker#FinanceTips#SavingsGoals#FinancialFreedom#BudgetingForBeginners#SmartSpending#InvestInYourself#WealthBuilding#2025Finance#DigitalWallet#FinancialPlanning#AppRecommendations#MoneySavvy

0 notes