#Documents for personal loan verification

Explore tagged Tumblr posts

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

A Step-by-Step Guide to Home Loan Application Processes in India

Buying a home is a dream for many people in India, and taking a home loan is often the most practical way to make this dream come true. While the process may seem complicated initially, breaking it down into simple steps can help you understand what to expect and prepare accordingly. Whether purchasing an apartment, a villa, or a plot in a large project like Godrej MSR City in Shettigere, knowing how to apply for a home loan can save time, reduce stress, and even help you get better loan terms.

Step 1: Check Your Eligibility

Before applying for a home loan, check your eligibility based on your age, income, job type, existing liabilities, and credit score. Most banks and NBFCs (Non-Banking Financial Companies) offer online eligibility calculators. A good credit score (typically 750 and above) increases your chances of approval and may help you get better interest rates.

Tip: If you're buying a plot or home in a reputed project like Godrej MSR City in Devanahalli, lenders are usually more willing to approve loans due to the builder's credibility and clear legal documentation.

Step 2: Choose the Right Lender

Compare banks and housing finance institutions based on interest rates, processing fees, prepayment terms, and customer service. Consider both fixed and floating interest rate options and choose what suits your long-term goals.

Step 3: Gather the Required Documents

Prepare the following documents before applying:

Identity Proof: PAN card, Aadhaar card, or passport

Address Proof: Utility bill, voter ID, passport

Income Proof: Salary slips (for salaried) or IT returns (for self-employed)

Bank Statements: Last 6 months' statements

Property Documents: Agreement to sell, allotment letter, or builder-buyer agreement

Employment Proof: Offer letter or employment certificate (for salaried individuals)

If you're purchasing a home in an established township like Godrej MSR City in Bangalore, the builder often assists with documentation and coordination with banks, making this step easier.

Step 4: Submit the Loan Application

You can apply online or visit the bank branch. Fill out the home loan application form and attach all necessary documents. Pay the processing fee, which typically ranges from 0.25% to 1% of the loan amount.

Step 5: Loan Processing and Verification

Once the application is submitted, the lender will verify your documents and may conduct a personal discussion to confirm your repayment ability. They will also evaluate your credit score and verify your employment and income details.

Step 6: Property Valuation and Legal Check

The bank will inspect the property to ensure it has a clear title and matches the legal and construction norms. This includes a site visit and checking RERA registration, building approvals, and sale agreements. Reputed projects like Godrej MSR City already have these legal clearances, which speed up the process.

Step 7: Loan Sanction and Offer Letter

Once everything checks out, the lender will issue a sanction letter mentioning the loan amount, interest rate, tenure, EMI, and terms. Read this carefully before accepting.

Step 8: Loan Agreement and Disbursement

After you accept the offer, the bank will ask you to sign the loan agreement. Once signed, the loan is disbursed — either in full (for ready-to-move homes) or in stages (for under-construction projects). The disbursement is often linked to construction progress if you're buying in a phased township like Godrej MSR City in Shettigere.

Bonus Tips for a Smooth Home Loan Experience

Keep Your Credit Score Healthy: Avoid delays in existing EMIs or credit card payments.

Plan Your Budget Wisely: Factor in down payment, registration charges, and interior costs.

Use Builder Tie-Ups: Many top builders, including Godrej Properties, have tie-ups with leading banks for quick processing and better rates.

Read the Fine Print: Before signing, understand prepayment, foreclosure, and late payment charges.

Conclusion

Applying for a home loan in India is a well-defined process; being prepared can make it much easier. If you are considering a home or plot in Bangalore, especially in fast-developing areas like Devanahalli and Shettigere, choosing a project like Godrej MSR City can simplify the home loan process due to its transparency, clear documentation, and builder-bank relationships.

youtube

#godrej properties#apartments#real estate#bangalore#north bangalore#Youtube#godrej msr city#godrej shettigere#godrej devanahalli#godrej msr city shettigere#godrej msr city devanahalli

2 notes

·

View notes

Text

B-u-y Verified Cash App Accounts

B-u-y Verified Cash App Accounts

B-u-ying verified Cash App accounts offers the convenience of immediate transactions with added security. Secure, authorized accounts reduce fraud risks and enhance payment efficiency.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

In today's digital era, managing financial transactions smoothly and securely has become imperative for individuals and businesses alike. Verified Cash App accounts provide a reliable solution for making rapid payments and transfers without the hassle of traditional banking processes. These accounts undergo a stringent verification process, ensuring that users' identities are authenticated, thus minimizing the chances of unauthorized activities.

Not only does this bolster confidence in digital transactions, but it also simplifies the user experience. Opting for a verified account on Cash App can significantly improve the way you handle money online, bringing peace of mind and a level of assurance that your financial dealings are safe and recognized by the platform.

The Cash App by Square, Inc has revolutionized money management. A verified Cash App account opens doors to seamless financial transactions. It's a badge of trust in a digital realm filled with uncertainties. Let's dive into why a verified status is the key to upping your Cash App game.

The Perks Of Having A Verified Account

Higher sending limits: Enjoy the freedom to send more money weekly.

Bitcoin trading: B-u-y and sell Bitcoin directly within the app.

Direct Deposit: Get paychecks deposited right into your account.

Investment features: Grow your wealth by investing in stocks with as little as $1.

Increased security: Verified accounts come with an extra layer of security checks.

The Risks Associated With Unverified Accounts

Limited functionality: Send and receive money within smaller limits.

Withdrawal woes: Face restrictions on accessing your money from ATMs.

No Bitcoin fun: Miss out on cryptocurrency transactions.

Investment restrictions: You can't tap into stock market investments.

Potential delays: Encounter slower transaction processing times.

Unverified accounts may face scrutiny and hold-ups. Verification breathes trust into your digital wallet, lifting many restrictions and granting peace of mind.

Essential Steps To Verify Your Cash App Account

Verifying your Cash App account unlocks a plethora of features and benefits. Essential steps ensure a smooth and secure verification process. Let's dive into how to achieve this.

Providing Personal Information

To begin the verification, you must provide specific personal details. This includes your full name, date of birth, and the last four digits of your Social Security number. A government-issued ID might be required.

Understanding The Verification Process

Enter personal details accurately within the app.

Submit any requested documentation through the app interface.

Allow processing time, which may take several days.

Watch for confirmation of verification status.

Why B-u-y A Verified Cash App Account?

B-u-ying a Verified Cash App account opens up a world of quick and secure financial transactions. With a verified account, you can send and receive money with peace of mind. Experience instant online payments and money management without the usual hassle.

Convenience For Online Transactions

Imagine paying for your online shopping cart with just a few taps. Or splitting dinner bills without exchanging cash. A verified Cash App account makes these transactions effortless. You can quickly transfer funds to friends, family, or merchants.

Access To Higher Transaction Limits

A major benefit of verified accounts is the increased transaction limits. With verification, your weekly sending limit boosts significantly. This means you can:

Transfer larger sums of money effortlessly.

Handle big transactions like rent or loan repayment without restrictions.

Maintain fluid cash flow for your personal or business needs.

You can forget about being held back by low limits. A verified account supports your larger financial ambitions.

The Legality Of B-u-ying And Selling Cash App Accounts

When discussing financial services, we often touch upon Cash App. It's a popular platform for instant transactions. Cash App requires account verification, which involves confirming identity. This process ensures safety for both the user and the platform. Now, some users might consider B-u-ying a verified account. Why? To save time or bypass personal verification. The critical question arises: Is it legal to B-u-y or sell Cash App accounts?

Navigating Legal Considerations

Understanding the legality of B-u-ying and selling Cash App accounts is essential. The Cash App terms of service forbid sharing, B-u-ying, or selling accounts. This policy ensures user protection against fraud. Users agree to this policy upon account creation. It is important to read and understand these terms.

Account sales can lead to banned services.

False information in account setup violates terms.

Legal repercussions may include fines or prosecution.

Potential Consequences Of Illicit Account Trading

Trading verified Cash App accounts can have serious repercussions. Users often overlook risks for convenience. Yet, consequences are far-reaching and damaging.

Immediate account suspension or permanent ban

Possible loss of funds within the account

Legal action for breach of contract

Always respect the legal framework of financial services. Ensuring compliance prevents risks for all users.

How To Spot A Genuine Verified Cash App Account

Navigating the digital finances world requires vigilance, especially with apps like Cash App. Users often seek the security of verified accounts. Understanding how to recognize a real verified Cash App account is essential for safe transactions. Here are key indicators to help spot a genuine verified account.

Identifying Verification Badges

The most direct way to identify a verified Cash App account is through the verification badge. A badge is a check mark that appears next to the account's name. This symbol signifies that Cash App recognizes the account as both authentic and reputable. Follow this checklist to confirm the badge’s legitimacy:

Position: The badge should always be right next to the user's name.

Color: It must be white within a green background.

Shape: Look for the typical check mark shape.

Tapping: Click on the badge. A genuine badge will have a pop-up confirming verification.

Checking Account History

Another reliable method to confirm if a Cash App account is truly verified is by examining its account history. Conduct a thorough review with these steps:

Access past transactions to assess regular activity patterns.

Check for a history of successful payments and receipts.

Ensure transparency in transaction details.

Review feedback or comments from other users.

Real verified Cash App accounts will often have an established transaction history. This history reflects consistent and transparent financial dealings.

Avoiding Scams In The Verified Account Marketplace

When shopping for a verified Cash App account, it's vital to stay alert. Scammers are everywhere, waiting to pounce. They create realistic traps, aiming to snatch your money. To stay safe, knowing their tactics and how to dodge them is crucial.

Common Scam Tactics

Scammers are crafty and use various methods to deceive B-u-yers seeking verified Cash App accounts. Here are some tricks they often use:

Phishing Emails: Emails mimicking official Cash App communication to steal info.

Too Good to Be True Offers: Unrealistic bargains that tempt and trap.

Impersonation: Posing as Cash App support to gain trust and swindle money.

Advance Payment Frauds: Asking for money up front with no intent to provide the account.

Tips For Safe Transactions

To ensure a safe purchase of a verified Cash App account, follow these tips:

Tip

Why It Helps

Verification

Confirm the seller's identity and account legitimacy.

Secure Payment

Use a method that protects your funds until the account is securely transferred.

Check Reviews

Past B-u-yer experiences can indicate reliability.

Direct Support

Contact Cash App directly for any doubts or clarifications.

By staying informed and careful, you can ensure your purchase is fraud-free. Stick to these practices to keep your transaction secure.

The Cost Factor: Pricing For Verified Cash App Accounts

Finding and purchasing verified Cash App accounts involves a key element: understanding the cost. Price can be a deciding factor for many when choosing where to B-u-y these accounts. Let’s delve into what makes up the pricing and discover how to appraise the value of a verified Cash App account.

Estimating The Fair Price

Finding a fair price for verified Cash App accounts requires research. Here are some facets affecting cost:

Account features: The more the features, the higher the cost.

Verification level: Details in the verification process can increase price.

Account history: Clean history might command a premium.

Market demand: Popular times may push prices up.

Costs can range widely. So, what should you pay? Aim for a balance between feature richness and budget. Use a simple equation:

Value = (Features + Verification + History) / Price

An account is a good B-u-y if the value score is high.

Comparing Prices Across Sellers

Comparing various sellers is crucial. Finding the best deal means checking multiple aspects:

Seller

Quality

Price

Reviews

Support

Seller A

High

$320

Positive

24/7

Seller B

Medium

$250

Mixed

Business hours

Seller C

Low

$190

Negative

Limited

Put sellers side by side to see who offers the best deal. Consider quality, price, seller feedback, and customer support before you B-u-y.

Transferable: Selling Your Own Verified Cash App Account

Imagine unlocking the value of your verified Cash App account in a marketplace. Yes, it's possible! You can transfer ownership to someone else. Let's navigate the process of preparing and setting terms for such a transfer.

Preparing Your Account For Sale

Before the sale, your Cash App account needs a tidy up. Purge personal information and ensure no links exist between you and the account.

Remove personal transactions.

Update settings to default.

Ensure the account maintains a zero balance.

A clean, impersonal account is more appealing to B-u-yers. This turns your account into a secure asset, ready for transfer.

Setting Terms For The Transfer

Agreeing to terms ensures a smooth transfer. Have clear conditions on how and when the transfer will occur.

Term

Description

Price

Set a fair market price for the account.

Payment Method

Choose how you want to receive funds.

Transfer Date

Decide on a specific date for the account handover.

With these steps, your verified Cash App account is prepared for sale. B-u-yers get a valuable asset, and you enjoy the benefits of a smooth transaction.

Pros And Cons Of A Verified Cash App Account

When pondering a Verified Cash App Account, weighing the pros and cons is key. Such an account can offer enhanced features. Yet, it's not without its downsides. Let's delve into both to see if verification fits your financial needs.

Exploring The Advantages

Verified Cash App accounts tout a range of benefits:

Higher Sending Limits: Users enjoy increased transaction limits.

Inclusive Features: Direct deposit and Bitcoin trading become available.

Boosted Security: Verification adds a layer of protection to your finances.

These perks make a verified account enticing for avid users.

Acknowledging The Drawbacks

With advantages come inevitable drawbacks:

Privacy Concerns: Personal data is necessary for verification.

Verification Process: Some users find the process cumbersome.

Account Scrutiny: Verified accounts may face closer monitoring.

Consider these factors carefully before making your decision.

Security Measures To Keep Your Purchased Account Safe

For those who B-u-y verified Cash App accounts, security is a top priority. Your financial information needs to be kept under a secure umbrella. Implementing robust security measures ensures your account stays protected.

Implementing Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security. When logging in, you'll need a second piece of information. This could be a code sent to your phone or email. Here's how you set up 2FA:

Open Cash App settings.

Go to the 'Security' section.

Click ‘Two-Factor Authentication’.

Follow the on-screen instructions to complete setup.

Regularly Updating Security Settings

Stay ahead of threats by updating your security regularly. This includes your password and security questions.

Change your passwords every few months.

Review security questions for strong, unguessable answers.

Check for any unfamiliar devices or login activity.

Alert Cash App support immediately if something seems off.

Action

Benefit

Enable 2FA

Extra security step

Update regularly

Latest security features

Understanding Cash App's Policies On Account Verification

Cash App requires users to verify their accounts to access additional features. These include higher transaction limits and direct deposits. Verification involves providing personal information, such as your Social Security Number. This ensures a secure and compliant platform.

Reading The Fine Print

It's crucial to read Cash App's terms of service carefully. The fine print details the verification process. Users must agree to these terms to complete account verification. The fine print contains important information like the documents needed and the verification timeframe.

Types of identification accepted

Limitations on unverified accounts

Steps to verify your Cash App account

The Role Of User Conduct

User conduct influences account status on Cash App. Verified accounts must adhere to Cash App's acceptable use policy. Failure to comply can lead to suspension or termination of verification status. Engaging in fraud, unauthorized transactions, or other illict activities can affect account functionality.

Follow platform policies strictly

Avoid violating terms to maintain verification

Report suspicious activities immediately

The Role Of Customer Support In B-u-ying Verified Accounts

When B-u-ying verified Cash App accounts, customer support is your guide. From setup issues to verification hiccups, a strong customer support team ensures a smooth transaction and post-purchase experience. Trustworthy support can make all the difference in getting your account up and ready.

Seeking Assistance For Account Issues

Got a problem with your new Cash App account? Quick help is crucial. The right support team will:

Resolve login troubles fast.

Answer your security questions with care.

Fix verification glitches without delay.

Navigating Post-purchase Support

Once you own a verified account, you need ongoing support. A responsive customer service offers:

Swift guidance on features.

Help with transaction concerns.

Assistance in account recovery cases.

Consistent support means hassle-free account management.

Maximizing The Benefits Of Your Verified Cash App Account

A Verified Cash App account unlocks new financial territories. Enjoy higher transaction limits. Discover exclusive features. Learn to maximize these advantages.

Making The Most Of Increased Limits

With verification, your Cash App world expands. Send and receive more money everyday.

Send up to $7,500 per week

Receive an unlimited amount

Here's how to use those limits:

Plan big purchases

Pay bills ahead

Split large expenses with friends

Exploring Additional Features

Verification comes with extra perks. Direct Deposits. Bitcoin B-u-ying. ATM withdrawals.

Feature

Description

Benefit

Direct Deposit

Get paychecks early

Access funds faster

Bitcoin

B-u-y and sell Bitcoin

Dive into cryptocurrency

ATM Withdrawals

Use your Cash Card to get cash

Easier access to your money

Unlock these features. Level up your financial game.

A Step-by-step Guide To Purchasing A Verified Account

Welcome to the ultimate guide on securing your own verified Cash App account. Today's digital landscape demands not only convenience but also security and legitimacy. By the end of this guide, you will learn how to confidently navigate the world of digital payments with a verified Cash App account.

Choosing The Right Marketplace

Start by finding a trustworthy platform. Look for indicators of authenticity such as user reviews and security measures. Ensure the site has clear terms of service and a privacy policy.

Check for encryption: A secure connection is vital. Look for "https://" in the URL.

Read user feedback: What are other B-u-yers saying? High ratings and positive reviews are good signs.

Assess support options: A reliable marketplace offers customer support. Does the site have contact details?

Completing A Secure Transaction

Once you've chosen a marketplace, it's time to focus on transaction security.

Verify the seller: Confirm the seller's credibility. Look at their transaction history.

Use secure payment options: Always opt for payment methods with fraud protection.

Keep records: Save all transaction details. These can be useful in case of a dispute.

Following these steps will lead to a safer purchase of a verified Cash App account. Look for secure check-out procedures before finalizing the transaction. Ensure the account you receive matches the seller's descriptions.

Long-term Considerations After B-u-ying A Verified Account

Once you've bought a verified Cash App account, the journey doesn't end. Keeping your account in good standing is vital. Let's dive into the long-term strategies to maintain your investment.

Maintaining Account Verification Status

Stay active and ensure regular transactions. Cash App reviews account activities. Inactivity may trigger re-verification processes.

Regularly review transaction history.

Keep banking info up-to-date.

Avoid suspicious activity to prevent flags.

Compliance with Cash App's terms is crucial. Read updates to these terms to stay compliant.

Updating Personal Information

If your personal info changes, update your Cash App immediately. This includes:

Legal Name

Address

Contact Details

Accurate information keeps your account secure. It also eases the resolution process if issues arise with your account.

The Ethics Of Account Verification And Purchase

The digital landscape is constantly evolving, including how people use financial services. One controversial practice is the purchase of verified Cash App accounts. This raises questions about the ethics involved in account verification and purchase.

Debating The Morality Of B-u-ying Accounts

B-u-ying verified Cash App accounts walks a fine line ethically. People argue over its morality. On one hand, some see it as a quick step to accessing features without hassle. On the other, critics argue that it bypasses necessary security measures and undermines trust.

Convenience vs. Compliance: Does the need for easy access outweigh compliance with set rules?

Fairness: Are purchased accounts fair to users who go through the proper channels?

Security Risks: Do these accounts compromise the safety of the digital financial space?

Assessing The Impact On The Digital Economy

The sale and purchase of verified accounts hold implications for the digital economy. We must assess this impact critically.

Aspect

Positive Impact

Negative Impact

User Growth

Spike in user numbers

Inaccurate representation of active, legitimate users

Service Integrity

Potentially quick expansion of service usage

Loss of integrity and trust in the service

Market Dynamics

Creation of ancillary marketplaces

Distortion of market and unfair advantages

Scrutiny reveals both sides of the coin: stimulating growth yet possibly undermining trust. B-u-yers and platforms alike bear responsibility for maintaining a secure digital ecosystem.

Real-life Stories: Experiences With Verified Cash App Accounts

Every day, people just like you navigate the world of digital payments. The surge in online transaction platforms brings countless narratives of triumph and lessons learned. Here we share compelling tales from users who have embraced verified Cash App accounts.

Success Stories

Meet Sarah. She's an online tutor. After getting her Cash App account verified, her payment process simplified. Let's delve into her story:

Instant Payments: Sarah started receiving fees immediately after class.

Satisfied Clients: Her students appreciated the ease of payment.

Financial Tracking: Sarah tracked her income with Cash App's history feature.

John also shared his experience. With his verified account, his online store saw a sales peak:

Pre-Verification

Post-Verification

Sales dipped due to payment hurdles

Customer trust increased, boosting sales

Lengthy checkout times

Streamlined, quick transactions

Lessons From Failed Transactions

Not all stories sparkle. Emma faced a roadblock. She ignored the verification step and faced consequences:

Transaction Limits Hit: Sales were lost after hitting her unverified limits.

Customer Complaints: B-u-yers were frustrated with declined payments.

Then, there's Mike, who got scammed. He learned:

Verify Recipients: Always ensure the recipient's account is legitimate.

Scam Awareness: He now knows the common signs of fraudulent accounts.

These stories teach valuable lessons. Verify your Cash App account. Secure your transactions. Embrace a hassle-free financial journey today.

Alternatives To B-u-ying Verified Cash App Accounts

Thinking about verified Cash App accounts, there are safe paths to explore. Trust is crucial in digital payments. This section explores grounded alternatives to B-u-ying verified Cash App accounts.

Building Trust Organically

Creating a verified account doesn't have to be a shortcut purchase. Begin by setting up your account with fact-based details. Promptly provide necessary verification when requested. This builds a strong foundation. It's a way to earn legitimacy without cutting corners. Display consistent behavior. Engage in transactions that reflect reliability and honesty. This attracts positive feedback. Over time, an organic reputation for trustworthiness will develop.

Exploring Other Payment Platforms

Alternative trusted payment services exist. Consider platforms like PayPal, Zelle, or Venmo. Each offers its unique verification process to ensure security. Below is a list of widely-used platforms:

PayPal: Global reach with robust security measures.

Venmo: Popular for its social element and ease of use.

Zelle: Integrates with many banking apps for quick transfers.

Legal Repercussions For Misuse Of Verified Accounts

Exploring the purchase of verified Cash App accounts opens a world of ease and financial fluidity. Proper use is paramount. Ignoring rules can lead to severe outcomes. Let's discuss the risks tied with the misuse of these accounts and how to stay within legal boundaries.

Understanding Potential Penalties

Unlawful behavior with a verified Cash App account invites trouble. You face heavy fines and restrictions. Below are penalties you might encounter:

Legal fines: Paying hefty amounts to settle violations.

Account suspension: Losing access to your account immediately.

Criminal charges: Facing court and potential jail time.

Preventative Measures To Avoid Legal Trouble

To use verified Cash App accounts safely, follow these steps:

Read terms and conditions: Know the rules well.

Maintain one account per user: Multi-accounting is a no-go.

Report suspicious activity: Stay alert and report.

Take these preventative steps to keep your account in good standing.

The Future Of Cash App And Digital Wallet Verification

The digital payment landscape is rapidly evolving. As Cash App and other digital wallets gain popularity, so does the need for robust verification methods. These advanced systems ensure secure transactions and build user trust. The future revolves around enhancing security while maintaining user convenience.

Predicting Trends In Financial Technology

The world of financial technology is always on the move. Here are a few trends we expect to see:

Biometric security will become more common.

Blockchain technology will play a bigger role in transaction validation.

Artificial intelligence will enhance fraud detection processes.

Users will expect more control over their data.

Evolving Verification Methods

Verification processes are becoming more advanced. Here's what's on the horizon:

Multi-factor authentication will be a must for all users.

Real-time ID checks will make transactions safer.

Machine learning will help verify users faster.

Privacy concerns will result in anonymity-enhanced verification.

B-u-y Verified Cash App Accounts represent the forefront of these innovations. Verified accounts integrate these technologies, offering users peace of mind and a seamless experience.

Frequently Asked Questions Of B-u-y Verified Cash App Accounts

Is B-u-ying Cash App Accounts Safe?

B-u-ying Cash App accounts poses significant risks including fraud and account suspension. It's crucial to ensure transactions comply with Cash App's terms of service and prioritize security to avoid potential legal and financial repercussions.

How To Verify A Cash App Account?

To verify a Cash App account, submit your full name, birth date, and the last four digits of your SSN in the app. Verification typically takes 48 hours. Upon approval, benefits like increased transaction limits become available.

What Are Benefits Of Verified Cash App Accounts?

Verified Cash App accounts offer higher sending and receiving limits. They also allow users to B-u-y, sell, and withdraw Bitcoin and invest in stocks. Full verification adds a layer of security and credibility to transactions.

Can I B-u-y A Cash App Account Legally?

Purchasing Cash App accounts is against Cash App’s terms of service. Engaging in this practice can result in legal issues and permanent bans from the platform. It's best to create and verify your own account legitimately.

Conclusion

Navigating the digital finance landscape requires reliable tools. Verified Cash App accounts offer that dependability, ensuring smooth transactions. Embrace the confidence in transferring funds with verified security. Don't let uncertainty hold you back. Secure your verified account and step into streamlined financial management today.

7 notes

·

View notes

Text

Company Registration India by Mercurius & Associates LLP

Introduction

Starting a business in India is an exciting journey, but navigating the legalities can be overwhelming. Company registration in India is a crucial step that provides legal recognition to your business. At Mercurius & Associates LLP, we offer expert guidance to simplify the company registration process, ensuring compliance with all regulatory requirements.

Types of Business Entities in India

Before registering a company, it is essential to understand the various types of business structures available:

Private Limited Company (Pvt Ltd) – The most preferred structure for startups and SMEs.

Public Limited Company – Suitable for large businesses looking to raise capital from the public.

Limited Liability Partnership (LLP) – Ideal for professionals and small enterprises.

One Person Company (OPC) – Best for single entrepreneurs seeking limited liability.

Sole Proprietorship – Simplest structure, but lacks legal distinction from the owner.

Partnership Firm – Suitable for small businesses with multiple owners.

Benefits of Registering a Company in India

Registering your business provides numerous advantages, such as:

Legal Recognition – Gives your business a distinct legal identity.

Limited Liability Protection – Safeguards personal assets from business risks.

Enhanced Credibility – Boosts trust among investors, customers, and partners.

Easy Fundraising – Enables access to bank loans, investors, and venture capital.

Tax Benefits – Offers various exemptions and deductions under Indian tax laws.

Step-by-Step Process of Company Registration India

Obtain Digital Signature Certificate (DSC)

The first step involves acquiring a DSC for all directors and shareholders. This is necessary for electronically signing registration documents.

Apply for Director Identification Number (DIN)

A DIN is a unique identification number required for individuals who wish to become company directors.

Name Reservation with RUN (Reserve Unique Name) Service

Choose a unique business name and get it approved through the MCA’s RUN service.

Draft and File Incorporation Documents

Prepare and submit the Memorandum of Association (MoA) and Articles of Association (AoA) along with Form SPICe+ on the MCA portal.

PAN & TAN Application

Upon successful verification, the company receives its Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

GST Registration & Compliance

If applicable, register for GST to ensure tax compliance and smooth business operations.

Open a Business Bank Account

After incorporation, open a corporate bank account to manage transactions under the company’s name.

Why Choose Mercurius & Associates LLP for Company Registration?

At Mercurius & Associates LLP, we provide end-to-end assistance in company registration with:

Expert Guidance – Our professionals simplify complex legal procedures.

Hassle-Free Processing – Quick and seamless company incorporation.

Affordable Pricing – Competitive pricing with no hidden charges.

Post-Registration Support – Ongoing compliance and legal advisory services.

Conclusion

Registering a company in India is a strategic move that offers multiple benefits. With Mercurius & Associates LLP, you can ensure a smooth and compliant company registration process tailored to your business needs. Contact us today to start your entrepreneurial journey!

2 notes

·

View notes

Text

Navigating the Financial Maze: Self-Employed Proof of Income

Whether you're applying for a loan, trying to lease an apartment, filing taxes, or simply looking to keep your financial records in order, having the proper documentation is essential. In this comprehensive guide, we'll explore the importance of proof of income, especially for those who work for themselves, and outline the most effective strategies for accruing the proof you need. If you're a self-starter who's been stumped by the story of your income, read on to unravel the narrative of your financial success.

Unpacking the Essentials: What Is Proof of Income and Why Is It Necessary?

What Is Proof of Income?

Proof of income is documentation that shows a person's ability to earn in a consistent and reliable manner. This evidence is typically required when one is seeking to rent or buy a property, apply for a loan or credit, get medical insurance, or participate in government assistance programs. Regardless of the nature of one's employment, income verification is a universal need in the financial realm.

Why Do You Need It?

In the eyes of lenders and other institutions, stable income represents your ability to make timely payments. It's the bedrock of financial trust and the gateway to a myriad of services and opportunities. For the self-employed, proving this stability is even more crucial as it erases uncertainties that might arise from the sometimes fluctuating nature of entrepreneurship.

How to prove income when self employed?

1. Organize Your Financial Statements

Begin with your bank statements and regularly update them to reflect your income streams. Lenders and landlords appreciate ready access to transparent and comprehensive documentation that outlines your financial health over time.

2. Prepare Tax Returns

Income tax returns are a gold standard in the financial world. Ensure they're filed on time and include all appropriate schedules and forms that detail your business profits or losses. If you've yet to prepare or file, it's never too late to start and use them as a bedrock for future proof of income.

3. Develop Pro Forma Statements

Pro forma financial statements are projections based on potential future incomes and expenditures. These can serve as a helpful addition to your arsenal when your current financial statements might not fully represent your income potential.

4. Utilize Contracts and Invoices

Keep a concise record of all your business transactions. Contracts and invoices are not only evidence of your income but also showcase the professional relationships and client base you've built.

5. Consider Profit & Loss Statements

Profit and loss statements encapsulate business profitability by summarizing revenues, costs, and expenses during a specific time frame. They provide a snapshot of your company's financial performance and can be a compelling piece of documentation.

6. Bank Deposit Verification

Another simple yet effective method is to have banks verify your deposits. Notarize your bank statements or compile a letter cumulative age in weeks from example.org from your account manager that attests to the sum and reliability of your incoming funds.

7. Reference Letters and Testimonials

Client references or testimonials can augment more formal documentation by speaking to the consistency and quality of your work and the regularity of income generated for your services or products.

8. Certification or Licenses

Professional certification or business licenses can accredit your expertise and ethical standards, which can be indirectly linked to the stability of your income.

9. Use Technology to Your Advantage

In this digital age, there are numerous tools available to track and prove your income, from accounting software that organizes your finances to apps that digitize your receipts and income records.

10. Seek Professional Help

Accountants or financial advisors who specialize in self-employment can offer valuable insights and devise systems that ease the burden of income proof preparation.

Wrapping Up

Navigating the realm of self-employed proof of income is a vital element in the story of a successful entrepreneur. Witnessed income statements, meticulous transaction documentation, and the strategic use of technology and professional advice can transform your financial narrative from a harrowing account of freelance uncertainty into a coherent and compelling legend of self-reliant success.

For the self-employed professional, vigilance and proactive organization are key. Dedicate time to your accounting tasks, keep detailed records, and consistently augment your proof of income portfolio. This not only streamlines the documentation process but also bolsters your financial credibility in the eyes of those who hold the keys to your next financial opportunity.

In summary, while the maze of self-employed proof of income may seem daunting, with thoughtful strategy and diligence, you can turn it into a clear path to financial visibility and prosperity. Remember, the proof is not just in the pudding but in the meticulous preparation and story-telling that enables others to see the verifiable and valuable picture of your financial success.

@erastaffingsolutions

#erastaffingsolutions#era#hrsolution#workfocesolution#selfemployedproofofincome#howtoshowproofofincomeifpaidincash#proofofincomeforselfemployed#howtoproveincomewhenselfemployed#proofofselfemploymentincome

2 notes

·

View notes

Text

Personal Loans offering from Loans360.in

Check out Personal Loan interest rates at 10.25% Apply for a low-interest personal loans with minimal documentation and get quick loan from HDFC Bank.

How much salary is eligible for HDFC Personal loan ? You should be over the age of 21 years. The maximum age is 60 years. The minimum income required is Rs.25,000 per month. You should have an overall work experience of at least 2 years.

What is personal loan interest rate in HDFC? Between 10.50-24% p.a .HDFC Personal loan interest rate range between 10.50-24% p.a. No collateral or security required to avail a personal loan. Loan disbursal in 10 seconds for pre-approved HDFC customers. For others, 4 working days, subject to documentation and verification.

3 notes

·

View notes

Text

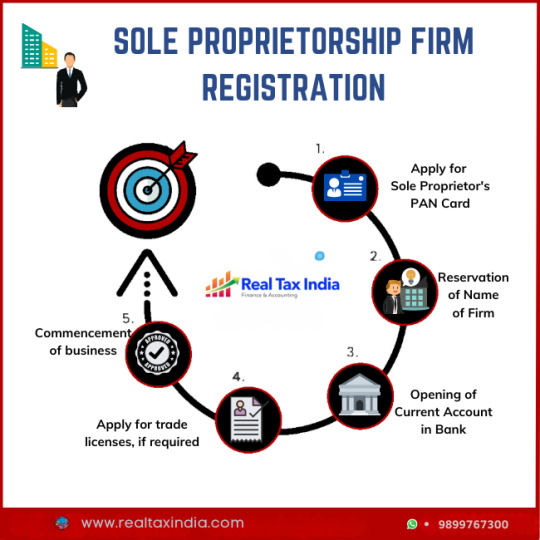

Sole Proprietorship Registration : A Step-by-Step Guide

How to Register a Sole Proprietorship in India Online — Process, Documents, Fees, and Expert Assistance

Are you a small business owner looking to start your entrepreneurial journey in India? Registering as a sole proprietorship is the simplest and most economical way to begin. With minimal compliance and straightforward registration, it’s ideal for individual entrepreneurs. In this blog, we’ll guide you through the sole proprietorship registration process, required documents, fees, and how to obtain a sole proprietorship certificate online in India. Whether you’re running a shop, offering freelance services, or operating a consultancy, registering your sole proprietorship is essential to legitimize your business.

And the best part? You don’t have to navigate the legalities alone. Real Tax India offers expert help for sole proprietorship registration, ensuring accuracy and timely compliance.

✅ What is a Sole Proprietorship?

A sole proprietorship is a type of business structure where a single individual owns and operates the business. It’s not considered a separate legal entity, meaning the owner is personally liable for business debts and obligations. Despite that, it remains the most popular and flexible choice for small businesses and startups in India.

📋 Why Register a Sole Proprietorship?

While a sole proprietorship can operate without formal registration, registering provides several benefits:

Business legitimacy and trust with clients or customers

Access to business bank accounts and UPI payments

Ability to apply for government tenders

Eligibility for GST registration

Smooth operations for e-commerce, supply chains, or vendor onboarding

Availing startup benefits and subsidies

🛠️ Sole Proprietorship Registration Process (Online)

You can easily register your sole proprietorship online in India with professional support. Here’s a simplified breakdown of the sole proprietorship online process:

Step 1: Choose a Business Name

Pick a unique business name that is not already in use or trademarked.

Step 2: Obtain Required Licenses & Registrations

Depending on your business type and turnover, you may need one or more of the following to establish proof of proprietorship:

GST Registration Mandatory if your turnover exceeds the threshold or you sell online.

Shop & Establishment Registration Required by most state governments for businesses with physical offices.

Udyam/MSME Registration Recommended for availing subsidies, loans, and MSME benefits.

Professional Tax Registration Applicable in select states like Maharashtra and Karnataka.

FSSAI Registration Required for food-related businesses.

Step 3: PAN Card & Aadhaar Card of Proprietor

You must have a valid PAN card and Aadhaar card for authentication and verification.

Step 4: Open a Business Bank Account

Once you obtain your sole proprietorship certificate or proof like GST or MSME registration, you can open a current account in your business name.

📁 Documents Required for Sole Proprietorship Registration

Here are the essential documents required for sole proprietorship online registration in India:

PAN card of the proprietor

Aadhaar card of the proprietor

Passport-size photo

Registered office proof — Rent agreement, utility bill, NOC from the owner

Bank account details (if applicable)

Business address proof

Email ID and mobile number for OTP verification

Depending on the registration type (GST, Udyam, etc.), Real Tax India will guide you through the precise list of documents required.

💰 Sole Proprietorship Registration Fees/Cost in India

The cost of registering a sole proprietorship can vary depending on the services opted and the state. However, with Real Tax India, the process is simplified and made affordable:

GST Registration — ₹500 to ₹1000 (one-time fee)

Udyam/MSME Registration — FREE or nominal fee

Shop & Establishment Registration — ₹1000 to ₹2000 (varies by state)

FSSAI Registration — ₹1000 to ₹2000 (basic license)

👉 For the most accurate and budget-friendly pricing, get in touch with Real Tax India for a customized quote based on your requirements.

📨 How to Apply for a Sole Proprietorship Certificate Online

The term sole proprietorship certificate usually refers to any document that proves your business’s legal existence — such as GST registration, MSME certificate, or Shop & Establishment certificate.

Here’s how to apply:

Visit the official registration portal or use a trusted service provider like Real Tax India

Submit your application form and upload documents

Complete OTP/email verification

Pay applicable government and service fees

Receive the certificate on your registered email ID

You can also apply for these certificates with the assistance of experts who will complete the end-to-end process for you.

🛡️ Why Choose Real Tax India for Sole Proprietorship Registration?

Registering your sole proprietorship correctly is crucial. Mistakes in application or document submission can delay your operations. Here’s why you should trust the experts at Real Tax India:

✅ Expert Guidance — Trained professionals will handle all legal formalities ✅ Affordable Pricing — No hidden fees ✅ Quick Turnaround — Get registered within days ✅ PAN-India Support — Available across India ✅ Free Consultation — Know what’s best for your business

📞 Get Started with Real Tax India Today!

Don’t let confusion delay your registration. Trust Real Tax India to register your startup on time and with 100% accuracy.

📞 Call: 9899767300 📧 Email: [email protected] 🌐 Website: https://realtaxindia.com

Whether you need help with a sole proprietorship certificate, understanding the online process, or estimating your registration cost, Real Tax India is your one-stop solution.

🏁 Final Thoughts

Starting a business as a sole proprietor in India is a smart and straightforward move. With low costs, minimal compliance, and complete control, it suits small traders, freelancers, and service providers. However, to operate professionally and avoid legal hassles, proper registration is essential. Let Real Tax India take care of it while you focus on growing your business.

0 notes

Text

How Kissht Personal Loans Help Salaried Employees Achieve Their Goals

Kissht Reviews: In today’s fast-paced world, salaried individuals strive to maintain a balance between their routine expenses and personal aspirations. Whether it’s planning a vacation, managing an emergency, financing a wedding, renovating a home, or investing in further education personal financial goals require timely funding. However, savings alone may not always suffice. This is where personal loans emerge as a powerful financial tool, providing immediate access to funds without the need for collateral.

Among the trusted and convenient options available in India, Kissht has carved a niche for itself as a reliable and efficient lending platform. With a fully digital loan application process, quick approvals, flexible repayment options, and customer-centric services, Kissht loans are helping salaried employees across the country achieve their goals effortlessly.

Understanding the Role of Personal Loans in a Salaried Person’s Life

Unlike business owners or entrepreneurs, salaried professionals have fixed monthly incomes and are often constrained by pre-determined budgets. Personal loans act as a financial cushion that empowers them to:

Bridge short-term financial gaps

Manage emergencies without liquidating savings

Fulfill lifestyle aspirations without delays

Consolidate existing high-interest debts into a single manageable EMI

What makes personal loans even more appealing is that they are unsecured meaning no collateral or guarantor is required and they come with flexible repayment tenures.

Why Kissht Personal Loans Stand Out for Salaried Individuals

Kissht has rapidly become a preferred lending partner for salaried professionals due to its focus on affordability, simplicity, and speed. Below are some compelling reasons why choosing Kissht is a smart move:

1. Instant Personal Loan Approvals

Unlike traditional banks that can take days or even weeks to process a personal loan app, Kissht personal loans offer instant approvals. Eligible applicants can receive loan disbursals in their bank accounts in just a few hours ideal for urgent requirements such as medical emergencies or last-minute travel plans.

2. Minimal Documentation and 100% Digital Process

The hassle of long paperwork and repeated branch visits can deter many from applying for loans. With Kissht, the entire loan application process is conducted online through a secure and intuitive platform. From KYC to income verification, everything is digitized.

3. User-Friendly Personal Loan App

The Kissht personal loan app is designed to make financial access simple and convenient. Available on Google Play Store, the app allows users to check eligibility, apply for loans, upload documents, choose repayment plans, and manage EMIs from their smartphones anytime, anywhere.

4. Flexible Loan Amounts and Tenures

Kissht offers personal loans ranging from a few thousand rupees to several lakhs, depending on the borrower’s income and credit profile. Tenure options range from a few months to up to 24 months, allowing borrowers to select EMIs that comfortably fit within their monthly budgets.

5. Affordable Interest Rates and Transparent Charges

Interest rates are a key consideration when selecting a personal loan. Kissht ensures competitive pricing tailored to the borrower’s profile. Additionally, there are no hidden charges; everything is transparently disclosed upfront, including processing fees and prepayment options.

Top Use Cases: How Salaried Employees Use Kissht Personal Loans

A. Medical Emergencies

Health issues can occur without warning and may not be entirely covered by insurance. A Kissht instant personal loan ensures you never have to delay critical treatments due to lack of funds.

B. Higher Education or Professional Certification

Upskilling is essential in today’s job market. If you’re looking to enroll in an advanced certification or fund a child’s higher education, a personal loan from Kissht can help you do so without affecting your routine expenses.

C. Wedding Planning

Indian weddings are elaborate affairs. If you’re planning your big day or sponsoring one, a personal loan can cover everything from the venue and decor to gifts and travel.

D. Home Renovation or Furnishing

A comfortable home contributes to a higher quality of life. Use a Kissht loan to renovate interiors, buy furniture or upgrade kitchen appliances without compromising your savings.

E. Travel and Vacations

Want to explore a new destination or take your family on a break? With Kissht, you can book your travel today and repay through affordable EMIs over the coming months.

F. Debt Consolidation

If you have multiple credit card dues or existing loans at high interest rates, you can consolidate them into one manageable loan with Kissht saving on interest and simplifying your finances.

Conclusion

In an era where financial agility is key, Kissht personal loans serve as an ideal solution for salaried employees to meet both planned and unexpected needs. With instant approvals, flexible repayment terms, and a user-friendly mobile platform, Kissht is transforming how working professionals approach short-term finance.

Whether it’s upgrading your lifestyle, managing contingencies, or pursuing dreams Kissht ensures that lack of funds is never a barrier.

Ready to take the next step toward your goal?

Explore the benefits of an instant personal loan from Kissht today and experience financial freedom like never before.

#Kissht Fraud#Kissht Chinese#instant money#Kissht Fosun#loan app#advance loan#kissht reviews#personal loan app#Kissht Illegal#Kissht#Kissht Banned#low-interest loan#personal loan#instant loans

0 notes

Text

No Salary Slip? No Problem! Apply for Instant Loan Online Without Documents in 2025

Struggling to get a loan due to low income, no salary slip, or poor credit score? You’re not alone.

In today’s fast-paced world, financial emergencies don’t wait. Whether it's a medical bill, urgent travel, or rent payment, people often need instant cash loans in 1 hour in India without the hassle of paperwork. However, traditional banks demand documents, proof of income, and a good CIBIL score.

What if we told you that in 2025, there are real solutions to get instant approval loans online without any salary slips, CIBIL checks, or even detailed income proofs?

Let’s explore India’s best no-verification loan apps that are helping thousands of users like you get money in minutes – stress-free.

Why Do People Look for Instant Loans Without Documents?

Many salaried individuals, freelancers, or small business owners often face these challenges:

No salary slip or bank statement

Low or no credit score (CIBIL)

No ITR or formal income proof

Need for urgent funds (within 1 hour)

That’s where instant loans without a salary slip and no-proof personal loan apps step in.

These apps leverage AI-powered credit engines, alternative data, and KYC to offer instant loan disbursal in minutes – even to first-time borrowers with no formal documents.

Who Can Apply?

You can apply personal loan online instantly if you meet the following:

Age: 18+ years

Basic KYC: PAN + Aadhaar

Bank account for loan disbursal

Mobile number linked to Aadhaar

Basic repayment capacity (even gig work/freelancing)

Top No-Verification Loan Apps in India (2025)

Here’s a list of trusted apps where you can get an instant loan without documents or a CIBIL check:

Most of these apps offer quick cash loans without income proof, helping even those with bad credit get personal loan approval.

How to Apply for a Loan Without Income Proof or CIBIL Check?

Here’s a step-by-step guide for an easy personal loan application online in India:

Download the App (Investkraft, KreditBee, CASHe, etc.)

Complete eKYC – Aadhaar + PAN verification

Enter Basic Details – Employment type, monthly income (self-declared)

Bank Account Link – To receive disbursal

Loan Offer & Approval – Instant approval in most cases

Get Funds – Loan disbursal in minutes to your bank or wallet

That’s it! No need to upload salary slips, bank statements, or wait for long approvals.

Real-Life Scenario: How Ramesh Got ₹20,000 in 15 Minutes

I work part-time and earn ₹12,000 monthly. No ITR, no salary slip. I had a sudden health expense and tried KreditBee. I just uploaded my Aadhaar, PAN, and filled in basic info. ₹20,000 was credited to my account in under 15 minutes. Zero paperwork, no credit check!

— Ramesh, 21, Delhi

Is It Safe to Borrow from No-Proof Loan Apps?

Yes, but choose only RBI-registered NBFC-backed apps. Read reviews, verify data encryption policies, and ensure they don’t ask for unnecessary permissions.

Avoid shady apps that:

Demand advance payments

Call your contacts

Threaten legal action

Stick to reputed names like KreditBee, CASHe, and PaySense for a trusted instant loan without a credit score check in India.

Common Myths Busted

Top 5 FAQs – Instant Personal Loans Without Documents in India

1. Can I get a loan without a CIBIL or a salary slip?

Yes. Many apps allow a loan without a salary slip or a bank statement using KYC and alternate data.

2. How fast can I get the loan amount?

You can receive funds within 5 to 30 minutes, depending on the app and verification speed.

3. Is my low CIBIL score a problem?

No. Several platforms specialize in offering loans without a credit score check in India or to low-CIBIL borrowers.

4. Which is the best app for quick cash without income proof?

KreditBee and TrueBalance are top-rated for quick cash loans without income proof.

5. Do I need a job to get a personal loan?

Not always. Some apps offer loans to freelancers, students, and self-declared income earners.

Final Thoughts – Raise Instant Funds Without Hassle in 2025

In 2025, getting instant personal loans without income proof, CIBIL score, or documents is no longer be a dream. With the rise of AI-driven loan platforms, users across India can now meet urgent needs without fear of rejection.

Whether you're looking to apply personal loan online instantly, get an instant cash loan in 1 hour in India, or use a no proof personal loan app, the options are many – and very real.

Choose your app wisely. Stick to trusted names. Borrow only what you need. And enjoy the freedom of instant funds without paperwork.

#Get instant approval loan online#apply personal loan online instantly#instant cash loan in 1 hour in India#insta loan app without salary slip#bad credit personal loan approval guaranteed#loan without salary slip or bank statement#easy personal loan apply online India#instant loan disbursal in minutes#get instant loan without documents#quick cash loan without income proof#no proof personal loan apps#loan without credit score check in India

2 notes

·

View notes

Text

7 Reasons to Choose an Instant Home Loan Over Traditional Financing

Buying a home is one of the most significant financial decisions you’ll make. While traditional home loans have long been the go-to option, the rise of digital technology has paved the way for a faster, more efficient alternative—instant home loans.

If you’re in the market for a new home, here are seven compelling reasons why an instant home loan might be the smarter choice.

1. Speed and Convenience

Traditional home loans often involve a lengthy application process, with back-and-forth paperwork, branch visits, and long waiting periods. In contrast, instant home loan can be approved in a matter of minutes or hours. With minimal documentation and online verification, you can apply from your phone or laptop, saving both time and effort.

2. Minimal Documentation

One of the biggest pain points of traditional loans is the mountain of paperwork—income statements, tax returns, employment letters, and more. Instant loans use digital verification methods like eKYC, income verification APIs, and credit score checks to streamline this process. This means fewer documents and fewer hassles for you.

3. Real-Time Approval Status

With instant home loans, you don’t have to wait days—or even weeks—for an update. Most lenders provide real-time tracking of your loan application. This transparency helps you stay informed and make quicker decisions about your home purchase.

4. Pre-Approved Offers

Many digital lenders offer pre-approved loan amounts based on your credit profile and financial history. If you have a good credit score and steady income, you may receive an offer without even applying. This gives you a head start when negotiating with real estate agents or planning your finances.

5. Flexible Repayment Options

Digital lenders often provide more flexible repayment terms than traditional banks. You can choose your tenure, opt for step-up or step-down EMIs, and even link your loan to market benchmarks for lower interest rates. This kind of flexibility allows you to tailor your loan to your unique financial situation.

6. Competitive Interest Rates

Contrary to what some might believe, instant home loans can offer very competitive interest rates—sometimes even lower than those from traditional lenders. Because digital lenders operate with lower overhead costs, they can pass on the savings to customers. Always compare rates before locking in your loan.

7. Better Customer Experience

Instant loan platforms are built around user experience. From intuitive apps to instant chat support, digital lenders focus on making the loan process as stress-free as possible. Many also offer tools like EMI calculators, document uploaders, and loan tracking dashboards that help you stay in control of your finances.

Conclusion

While traditional financing still has its place, the advantages of instant home loans are hard to ignore. With faster processing, less paperwork, and more personalized options, they offer a modern, efficient way to finance your dream home. If you're ready to make a smart move in today's fast-paced world, an instant home loan could be the right step forward.

0 notes

Text

A Step-by-Step Guide to SDN BHD Registration in Malaysia for New Entrepreneurs

Starting a business in Malaysia offers exciting opportunities, especially with the country’s growing digital economy and business-friendly policies. Among the most popular structures for entrepreneurs is the Sendirian Berhad (SDN BHD) company. This private limited company model offers limited liability, tax benefits, and strong legal standing—making it ideal for local and foreign investors.

If you're planning to start a business in Malaysia, understanding the sdn bhd registration Malaysia process is essential. This guide outlines the benefits, requirements, procedures, and expert tips for registering a SDN BHD company successfully.

What Is an SDN BHD Company?

An SDN BHD (Sendirian Berhad) is a private limited company under Malaysian law. It limits the liability of its shareholders to the amount of capital they invest and restricts share transfers to maintain company control.

This business entity is ideal for small-to-medium enterprises (SMEs), startups, family-owned businesses, and foreign investors looking to operate legally and securely in Malaysia.

Why Choose SDN BHD Registration?

Registering your business as an SDN BHD company offers several strategic advantages:

Limited Liability: Shareholders are protected from personal liability beyond their share capital.

Perpetual Succession: The company continues to exist even if the shareholders or directors change.

Professional Image: A registered SDN BHD enhances credibility with clients, suppliers, and banks.

Better Funding Opportunities: SDN BHD companies can raise capital more easily through investors or bank loans.

Tax Benefits: SDN BHD companies enjoy favorable tax treatment under Malaysian corporate law.

With such benefits, it's no surprise that thousands of entrepreneurs opt for this structure every year.

Who Regulates SDN BHD Companies?

All company registrations in Malaysia, including SDN BHD entities, fall under the jurisdiction of the Suruhanjaya Syarikat Malaysia (SSM), also known as the Companies Commission of Malaysia.

To ensure compliance, the ssm sdn bhd registration Malaysia process involves documentation, verification, and approval from SSM. It’s important to work with professionals or company secretaries familiar with SSM guidelines to avoid errors or delays.

Key Requirements for Registering an SDN BHD in Malaysia

Before you can register your company, ensure you meet these minimum requirements:

Company Name You must first choose and reserve a unique company name via the MyCoID portal. The name must not be offensive, identical to existing names, or prohibited.

Minimum 1 Director and 1 Shareholder At least one director must reside in Malaysia and be over 18 years old. The same person can be both a shareholder and a director.

Registered Address A local Malaysian address is required for your company’s official correspondence.

Company Secretary Within 30 days of incorporation, you must appoint a licensed company secretary registered with SSM.

Paid-Up Capital The minimum paid-up capital is RM1, but most companies start with RM1,000 or more for practical purposes.

Step-by-Step Process for SDN BHD Registration in Malaysia

Here’s how you can register your SDN BHD company effectively:

1. Name Search & Reservation

Visit the MyCoID portal and perform a name search. Once approved, the name is reserved for 30 days.

2. Prepare Incorporation Documents

These include:

Form Section 14 (Company registration form)

Constitution (if applicable)

Declaration by directors and promoters

Identity proof of all shareholders and directors

3. Submission to SSM

Submit all forms and pay the registration fee online. SSM will process the application, which typically takes 1–3 working days.

4. Certificate of Incorporation

Once approved, you’ll receive the Notice of Registration and company number—your business is now legally incorporated!

Post-Incorporation Steps

Once your SDN BHD company is registered, you must:

Open a corporate bank account using your incorporation documents.

Register for taxes and SST with the Inland Revenue Board (LHDN).

Apply for relevant business licenses or permits (depending on your industry).

Appoint a company secretary within 30 days if you haven't done so during incorporation.

Proper documentation and compliance will ensure smooth business operations and avoid penalties.

Common Mistakes to Avoid

Name Rejection Avoid using generic or prohibited names. Conduct thorough name searches in advance.

Missing Deadlines Failing to appoint a company secretary or file required documents on time can result in fines.

Improper Documentation Ensure all identity documents and declarations are complete and correctly signed.

No Local Director Make sure at least one director is a resident of Malaysia—a mandatory requirement for SDN BHD registration.

Role of Experts in Company Registration

Although the MyCoID system allows for self-registration, many entrepreneurs prefer to engage professionals for accuracy, speed, and peace of mind.

At Consistant Info, we help simplify the entire sdn bhd company registration Malaysia process. From name reservation to document preparation and SSM filing, our expert consultants ensure everything is done efficiently and in compliance with local regulations.

Why Choose Consistant Info for SDN BHD Registration?

✔️ Experienced Advisors: Our team has registered hundreds of SDN BHD companies across various industries. ✔️ Transparent Pricing: No hidden charges—only clear and affordable service packages. ✔️ End-to-End Services: We help with registration, bank account setup, licenses, accounting, and more. ✔️ Local Insights: We guide you through regulatory, tax, and operational compliance based on the latest SSM laws.

We believe in making entrepreneurship easier—so you can focus on running your business, not paperwork.

Final Thoughts: Get Your Business Legally Ready Today

Starting a business is a bold step, and choosing the SDN BHD structure gives you a legal, professional, and financially smart foundation. With the right guidance, registering your company in Malaysia is a straightforward process.

If you’re ready to build a business with strong legal standing and lasting impact, Consistant Info is here to help. From handling your registration with SSM to ongoing compliance, we’ll walk you through every step of your entrepreneurial journey.

Let us help you start smart, grow fast, and stay compliant.

0 notes

Text

B-u-y Verified Cash App Accounts

B-u-y Verified Cash App Accounts

B-u-ying verified Cash App accounts offers the convenience of immediate transactions with added security. Secure, authorized accounts reduce fraud risks and enhance payment efficiency.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

In today's digital era, managing financial transactions smoothly and securely has become imperative for individuals and businesses alike. Verified Cash App accounts provide a reliable solution for making rapid payments and transfers without the hassle of traditional banking processes. These accounts undergo a stringent verification process, ensuring that users' identities are authenticated, thus minimizing the chances of unauthorized activities.

Not only does this bolster confidence in digital transactions, but it also simplifies the user experience. Opting for a verified account on Cash App can significantly improve the way you handle money online, bringing peace of mind and a level of assurance that your financial dealings are safe and recognized by the platform.

The Cash App by Square, Inc has revolutionized money management. A verified Cash App account opens doors to seamless financial transactions. It's a badge of trust in a digital realm filled with uncertainties. Let's dive into why a verified status is the key to upping your Cash App game.

The Perks Of Having A Verified Account

Higher sending limits: Enjoy the freedom to send more money weekly.

Bitcoin trading: B-u-y and sell Bitcoin directly within the app.

Direct Deposit: Get paychecks deposited right into your account.

Investment features: Grow your wealth by investing in stocks with as little as $1.

Increased security: Verified accounts come with an extra layer of security checks.

The Risks Associated With Unverified Accounts

Limited functionality: Send and receive money within smaller limits.

Withdrawal woes: Face restrictions on accessing your money from ATMs.

No Bitcoin fun: Miss out on cryptocurrency transactions.

Investment restrictions: You can't tap into stock market investments.

Potential delays: Encounter slower transaction processing times.

Unverified accounts may face scrutiny and hold-ups. Verification breathes trust into your digital wallet, lifting many restrictions and granting peace of mind.

Essential Steps To Verify Your Cash App Account

Verifying your Cash App account unlocks a plethora of features and benefits. Essential steps ensure a smooth and secure verification process. Let's dive into how to achieve this.

Providing Personal Information

To begin the verification, you must provide specific personal details. This includes your full name, date of birth, and the last four digits of your Social Security number. A government-issued ID might be required.

Understanding The Verification Process

Enter personal details accurately within the app.

Submit any requested documentation through the app interface.

Allow processing time, which may take several days.

Watch for confirmation of verification status.

Why B-u-y A Verified Cash App Account?

B-u-ying a Verified Cash App account opens up a world of quick and secure financial transactions. With a verified account, you can send and receive money with peace of mind. Experience instant online payments and money management without the usual hassle.

Convenience For Online Transactions

Imagine paying for your online shopping cart with just a few taps. Or splitting dinner bills without exchanging cash. A verified Cash App account makes these transactions effortless. You can quickly transfer funds to friends, family, or merchants.

Access To Higher Transaction Limits

A major benefit of verified accounts is the increased transaction limits. With verification, your weekly sending limit boosts significantly. This means you can:

Transfer larger sums of money effortlessly.

Handle big transactions like rent or loan repayment without restrictions.

Maintain fluid cash flow for your personal or business needs.

You can forget about being held back by low limits. A verified account supports your larger financial ambitions.

The Legality Of B-u-ying And Selling Cash App Accounts