Experienced finance professional with a strong background in financial analysis, investment strategies, and risk management. Skilled in managing financial portfolios, forecasting market trends, and providing insights that drive business growth. Adept at optimizing financial operations, improving profitability, and leveraging data to make informed investment decisions. With a keen eye for detail and a passion for staying ahead of market shifts, I bring strategic financial solutions to clients and organizations, ensuring long-term sustainability and success. Dedicated to delivering high-quality financial services with integrity and expertise.

Don't wanna be here? Send us removal request.

Text

Home Loan Made Easy in 2025 – Apply Online for Quick Approval, Low EMIs & No Heavy Paperwork

Tired of Renting? Here's How You Can Get a Home Loan in 2025 Without Any Hassles

Imagine this: You’re scrolling through property listings, dreaming of your perfect home. However, the biggest obstacle is getting a home loan approved. Documents, bank visits, long waits... feels like a nightmare, right?

Well, not anymore.

In 2025, you can apply for a home loan online, get instant approval, and enjoy low interest rates — all without stepping into a bank.

Welcome to the world of instant home loan online – fast, paperless, and designed for your busy life.

Why More People Are Choosing Online Home Loans in 2025

Applying for a home loan has never been this easy. Thanks to digital lending platforms, you can now:

Apply online for a home loan from anywhere

Get approval in minutes

Submit only the minimum documentation

Access the lowest home loan interest rates in India

Compare lenders instantly

Track your loan status live

If you're wondering how to get a home loan instantly, or typing quick home loans online into Google, this guide is made for you.

Online vs Traditional Home Loan – 2025 Comparison Table

How to Apply Online for an Instant Home Loan in 2025 – Step-by-Step

Step 1: Choose a Trusted Platform

Use digital platforms like Investkraft, KreditBee, or your preferred bank's app for a home loan online.

Step 2: Fill in Basic Details

Enter your PAN, Aadhar, income, location, and property details.

Step 3: Upload Minimum Documents

Aadhaar Card

PAN Card

3–6 months' bank statements or salary slips (if asked)

Many NBFCs also offer home loans with minimum documentation, so approval is easier even if you're self-employed or have a low income.

Step 4: Use EMI Calculator

Use tools like the Pre-EMI Loan EMI Calculator to know your expected EMI, interest, and repayment timeline.

Step 5: Get Instant Approval

Once submitted, most lenders will send you a home loan instant approval within minutes to 24 hours.

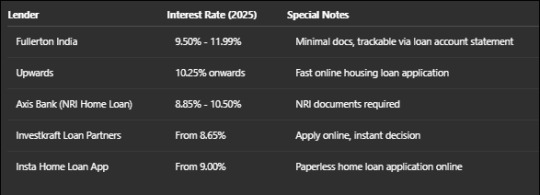

Present Home Loan Interest Rates in India (2025)

Interest rates depend on your credit profile and loan amount

What Are Incidental Charges in Home Loan?

Incidental charges are additional one-time fees charged by lenders for services like:

Legal verification of the property

Technical property valuation

Document processing & courier

Always ask your lender for a complete breakdown of incidental charges before signing the loan agreement.

Who Can Apply for an Online Housing Loan in 2025?

You can apply even if:

You earn ₹15,000 or above

You're a freelancer or self-employed

You don’t have ITR but have consistent bank transactions

You're a first-time buyer

You’ve taken a personal loan via Investkraft or KreditBee before

Real User Story: How Ravi Got His Loan in Just 2 Days

I work in a small digital agency and earn ₹25,000/month. I tried SBI and HDFC but faced delays. Then I applied through Investkraft. The application took 7 minutes. I got instant pre-approval for ₹18 lakhs — and within 48 hours, the funds were ready. All with just my PAN, Aadhaar, and 6-month bank statement. Unreal, but true!

That’s the power of online home loan applications in 2025.

Best Platforms to Apply Online for a Quick Home Loan in 2025

Here are some trusted portals offering quick home loan solutions with minimum hassle:

Investkraft – User-friendly platform, great support, trusted reviews

KreditBee – Great for young salaried applicants

mPokket – Now offers housing finance too

SBI YONO – Ideal for existing SBI customers

ICICI iLoans – Paperless with competitive rates

FAQs – People Also Ask

1. Can I apply for a home loan online without salary slips or ITR?

Yes! Many NBFCs now offer home loans with minimum documentation. Strong bank statements or co-applicants can boost your approval chances.

2. Is an online home loan safe in India?

Absolutely. Platforms like Investkraft and top bank portals offer encrypted, verified services with 100% safety.

3. What is the fastest way to get a home loan approved?

Apply online, choose NBFC or Investkraft-like platforms, and submit clean KYC with active bank statements — you can get instant approval.

4. How can I know which bank has the lowest home loan interest rate in India today?

Use comparison tools or visit platforms like KreditBee, ICICI, SBI, or the Pre-EMI loan EMI calculator to see live interest rates.

5. What’s the difference between a personal loan and a home loan?

A home loan is secured and used for buying property, often with lower interest rates. A personal loan (like Investkraft personal loan) is unsecured and can be used for multiple purposes, including home improvements.

Final Words: Don’t Just Dream It – Own It

Why wait when your dream home is just a few clicks away?

With online home loans in 2025, the process is faster, easier, and smarter than ever before. No paperwork chaos, no long waits, and no confusing terms.

Apply now Get approved instantly Lock the lowest home loan interest rates in India

Your perfect home is waiting. All you have to do is click “Apply Now” and take the first step toward homeownership.

#apply for home loan online#home loan online#instant home loan#online home loan#online home loan application#quick home loan#online housing loan#home loan application online#instant home loan online#online home loan apply#quick home loans#home loans online#home loan application#home loan interest rates india#personal loan interest rate#sbi home loan rate of interest#home loan instant approval#investkraft reviews#investkraft personal loan#present home loan interest rate#what is incidental charges in home loan#prefr loan emi calculator#kreditbee home loan interest rate#home loan easy#online housing loan application#housing loan finance#mpokket loan application process#home loan online apply#home loan with minimum documentation

1 note

·

View note

Text

10 Best Term Loans for Small & Medium Businesses in India – Compare Rates, Tenure & Eligibility (2025 Guide)

Are you looking to expand your business but lacking sufficient funds? A long-term business loan might be the strategic solution to fuel your growth. Whether you're a startup, SME, or an established enterprise, choosing the right business term loan can help you manage large expenses like equipment purchase, infrastructure, working capital, or even acquisitions.

In this guide, we'll walk you through the top 15 long-term business loans in India (2025), compare interest rates, tenures, eligibility, and explain key features so that you can make an informed financing decision.

What is a Long-Term Business Loan?

A long-term business loan is a type of term loan for business purposes with repayment periods typically ranging from 3 to 10 years. It is structured for long-term financial needs such as business expansion, asset acquisition, or infrastructure development.

Key Characteristics of Term Loans for Business:

Fixed or floating term loan interest rates

Pre-defined business loan tenure (up to 10-15 years)

EMI-based repayment schedule

Available as secured business loans or unsecured loans

Loan amounts typically range from ₹5 lakhs to ₹50 crores, depending on the lender

These loans are a reliable option compared to short-term business loans, which have higher EMIs and shorter repayment cycles.

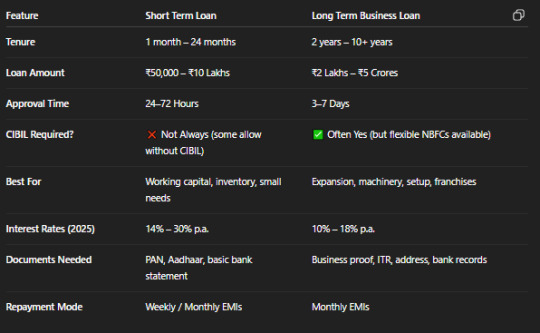

Short-Term vs Long-Term Business Loans

Top 15 Long-Term Business Loans in India (2025)

Here are the best term business loans for 2025, specially curated based on interest rates, tenure flexibility, documentation ease, and funding speed:

1. State Bank of India (SBI) Business Term Loan

Interest Rate: 9.00% p.a. onwards

Tenure: Up to 15 years

Loan Amount: Up to ₹100 crore

Collateral: Required

2. InvestKraft Business Term Loan (via investkraft.com)

Interest Rate: 10.00% to 16.25%

Tenure: Up to 7 years

Loan Amount: Up to ₹50 lakhs

Online application available

3. ICICI Bank Long-Term Business Loan

Interest Rate: Starting from 10.50%

Tenure: Up to 10 years

Secured and unsecured options

4. Axis Bank Term Loan for Business

Interest: 11.50% onwards

Tenure: Up to 10 years

Best for manufacturing and service industries

5. Kotak Mahindra Bank Business Term Loan

Interest Rate: 10.25% - 17%

Tenure: Up to 5 years

Ideal for SMEs and startups

6. IDFC FIRST Bank Long-Term Loan

Interest Rate: 11.00% onwards

Tenure: 3 to 7 years

Collateral-free options available

7. Punjab National Bank (PNB) Business Loan

Interest Rate: 9.35% onwards

Tenure: Up to 10 years

Term loan features: Flexible repayment, low processing fee

8. Tata Capital Business Loan

Interest Rate: 12% onwards

Tenure: Up to 6 years

Apply for unsecured business loan online

9. Bajaj Finserv Business Loan

Interest: 13% to 20%

Tenure: 1 to 7 years

Best for quick disbursal and minimal paperwork

10. LendingKart Online Business Loan

Interest: 15% onwards

Tenure: 1 to 5 years

Best suited for startups and small businesses

11. Fullerton India Business Term Loan

Interest: Starting from 17%

Tenure: Up to 7 years

Flexible repayment

12. Indifi Long-Term Loan

Interest Rate: Varies

Tenure: Up to 5 years

Digital-first and startup-friendly

13. NeoGrowth Business Loan

Interest: 18% - 24%

Tenure: 1 to 5 years

Based on card swipe or digital revenues

14. FlexiLoans Term Loan

Interest: 14% onwards

Tenure: Up to 5 years

Easy application & eligibility check

15. Hdfc Term LoanHDFC

Interest: Competitive rates

Tenure: Customizable from 1 to 10 years

Apply for a long-term loan with minimal paperwork

Eligibility Criteria & Requirements

To apply for a long-term business loan, here are the standard requirements:

Basic Eligibility:

Age: 21 to 65 years

Business should be operational for 1-3 years (or more)

Satisfactory credit history (CIBIL score above 700)

Business turnover as per the lender's minimum criteria

Required Documents:

KYC documents (Aadhaar, PAN, GST)

Business proof (registration certificate, licenses)

Income proof (bank statements, ITRs)

Financial statements for the last 2-3 years

When Should You Opt for a Term Loan for Business?

Choose a long-term business loan when:

You're planning a major business expansion

You want to purchase high-cost equipment or commercial property

Your business has a consistent cash flow for regular EMI payments

You want to lower monthly outgo vs a short-term loan

FAQs on Long-Term Business Loans in India (2025)

1. Which banks offer the lowest interest rates on long-term business loans?

SBI and PNB typically offer the lowest term loan interest rates starting from 9% p.a. for secured loans.

2. Is a term loan better than a working capital loan?

Yes, if you are looking for long-term capital investment. Working capital loans are better for day-to-day operations.

3. Can startups apply for long-term business loans?

Yes, many banks and NBFCs now offer startup business loans with flexible eligibility. You can apply for a startup loan for a new business with minimal documentation.

4. Are long-term business loans secured or unsecured?

Both options are available. Secured business loans offer lower interest rates, while unsecured loans offer faster approval.

5. Can I apply for a business loan online?

Absolutely! You can apply for a business loan online through platforms like InvestKraft, HDFC, Axis Bank, LendingKart, and more.

Final Words: Choose Wisely to Grow Sustainably

Long-term funding plays a vital role in business sustainability and scalability. From term loans for new businesses to expansion funding for MSMEs, today's market offers customized solutions for all needs. Remember to compare loan terms based on interest rates, features, and tenure before making your move.

If you're looking to grow your venture, visit InvestKraft.com to apply for long-term loans, get guidance, and secure the funding your business truly deserves.

#long term business loans#business term loan#term loan for business#loan term loans#short and long term loans#interest on term loan#term business loan#term loan for new business#long term business loan#term loans for business#term loans features#term loan interest#long-term business loans#site:investkraft.com#term business loans#term loan characteristics#long-term business loan#apply for long term loan#term loan requirements#short term business loan#business term loans#business loan tenure#business loan maximum tenure#business loans long term#business loan long term#term loan business#short term loan for business#term loan rate of interest#term loan apply#business loan term

0 notes

Text

Home Loan 2025: 100% Digital Application, No Branch Visit, Instant Eligibility & Same-Day Approval

Imagine Getting a Home Loan Without Leaving Your Couch

In 2025, buying a house has become more achievable than ever, not just because of better loan options, but because of the ease of applying online. Gone are the days of long queues, endless paperwork, and repeated branch visits. Today, applying for a home loan online is fast, paperless, and just a few clicks away.

Whether you're a first-time buyer or upgrading to a bigger space, a digital home loan application can save you time, money, and stress. This guide is your one-stop solution to understand everything about home loan applications, from instant approval to minimum documentation, and comparing interest rates across leading banks.

Let’s dive right in.

Why Apply for a Home Loan Online in 2025?

Benefits You Can't Ignore:

100% Digital Application Process

Zero or Minimal Documentation Required

Instant EMI & Eligibility Check

Compare Today’s Best Home Loan Interest Rates in One Place

Apply from Anywhere, Anytime – No Branch Visit Needed

Home Loan Application Online: A Step-by-Step Guide

Visit the lender’s official website or app

Click on "Apply for Home Loan Online" or "Online Housing Loan Application."

Fill in your personal, income, and property details

Upload digital copies of the required documents

Get real-time eligibility & EMI calculation

Get instant or same-day approval (if eligible)

Comparison Table: Top Home Loan Interest Rates in India (2025)

Note: These are indicative rates as of July 2025. Always check today's home loan rate on the Investkraft website.

Online Home Loan Eligibility and Documents – What Do You Need?

Basic Eligibility Criteria:

Indian citizen aged 21–60

Salaried or self-employed

Stable income source

Good credit score (preferably 700+)

Documents (Minimum Required):

PAN & Aadhaar (for KYC)

Income Proof (salary slips / ITR)

Property documents (if already identified)

Bank statements (past 6 months)

Thanks to digitization, many banks offer home loans with minimum documentation, especially for pre-approved customers.

Understanding Other Loan Terms Users Search

What Is "Application for House Loan"?

It simply refers to your formal request to the bank to provide you with a home loan. With the digital home loan application route, it’s seamless and takes less than 15 minutes.

Common Add-ons & Charges You Must Know

Processing Fee for Home Loan ICICI: Usually 0.50% or fixed ₹3,000+

What Are Incidental Charges in a Home Loan? These are extra charges incurred for legal verification, field investigation, or document handling.

Faircent EMI Calculator: A great tool to pre-check your EMI based on amount, tenure, and rate.

Special Mentions – What Users Search That You Must Know

Indian Bank Home Loan EMI – Use their EMI calculator before applying.

L&T Housing Finance Home Loan Interest Certificate Online – Downloadable from their portal for ITR & tax proof.

MPokket Loan Extension Charges – Applies to microloans, unrelated to home loans, but often searched.

Mpokket Grievance Email ID – Relevant if you're dealing with Mpokket separately.

KreditBee Maximum Tenure – Mostly short-term personal loans, not home loans.

Real Human Talk: Why You’ll Love Online Home Loan Application in 2025

Let’s be honest — nobody wants to waste their weekends hopping from one bank to another. With the online home loan application, you don’t just save time, you avoid frustration.

Imagine sipping chai on your balcony while the bank updates you via SMS that your home loan is approved — that’s 2025 convenience for you.

Don’t Forget EMI Planning – It’s Key

Before you hit “Apply for Home Loan Online”, check your EMI:

Use tools like the Pre-EMI Loan EMI Payment calculator

Know your monthly budget

Don’t forget to compare bank home loan interest rates before finalizing

Apply Now with These Leading Platforms

Indian Bank Home Loan Online Apply

ICICI Online Housing Loan Application

Fullerton India Instant Home Loan Online

L&T Housing Finance Digital Home Loan Application

5 Most Asked FAQs (With Real Answers)

1. Can I apply for a home loan completely online in 2025?

Yes! Most major banks now offer 100% digital home loan application with eKYC, digital document upload, and instant eligibility checks.

2. Is zero documentation really possible?

For pre-approved customers and salaried applicants with a credit history, minimal documentation is enough. Some banks offer home loans with zero paperwork via fintech partnerships.

3. Which bank has the lowest home loan interest rate in 2025?

As of now, Indian Bank and HDFC Ltd are offering competitive rates starting at 8.35% – 8.50%. Always compare today’s home loan rate before applying.

4. How long does online approval take?

If you're eligible, you can get instant or same-day approval. Disbursal may take 2–5 working days, depending on the bank and property verification.

5. Is it safe to apply for a home loan online?

Absolutely. As long as you apply via official websites or trusted apps, the entire process is encrypted and secure.

Final Thoughts: Don’t Wait for Your Dream Home

2025 is the year to stop waiting and start living. With digital home loan application processes, competitive bank home loan interest rates, and instant EMI approval, your dream home is now just a few clicks away.

Whether it’s an Indian Bank home loan application, ICICI’s seamless portal, or Fullerton India’s instant offer, choose what fits your needs best.

Ready to Begin?

Click. Apply. Move In. Your dream home loan online application starts now. No paperwork. No delays. Just you and your future home.

#home loan application#apply for home loan online#online home loan application#home loan online apply#home loan application online#online housing loan application#home loan with minimum documentation#indian bank home loan online apply#online home loan eligibility and documents#application for house loan#bank home loan interest rates#processing fee for home loan icici#mpokket loan extension charges#faircent emi calculator#what is incidental charges in home loan#mpokket grievance email id#kreditbee maximum tenure#l & t housing finance home loan interest certificate online#prefr loan emi payment#indian bank home loan emi#indian bank home loan apply#digital home loan application#apply for housing loan online#today's home loan rate#fullerton india home loan interest rate#home loan apply#instant home loan online

1 note

·

View note

Text

Personal Loan for Education Purpose in India – Get Upto ₹10 Lakhs for School, College & Abroad Study

Need Funds for Education? Here's a Smarter Way to Get Quick Loans Without Hassles

Education in India is evolving fast, and so are the costs. Whether it's school fees, college admissions, study material, coaching, or even going abroad for higher education, financial pressure is real. Not every student or parent has enough savings to cover everything.

That's where a personal loan for education steps in.

Unlike traditional education loans that require collateral, co-signers, or long approval times, personal loans for students in India offer instant disbursal, minimal paperwork, and complete freedom to use the funds for any educational purpose—from school tuition to visa processing.

In this 2025 guide, we’ll explain everything you need to know about getting a personal loan for education in India—whether you're a student, parent, teacher, or even planning to study abroad.

What Is a Personal Loan for Educational Purposes?

A personal loan for education is an unsecured loan you can use to fund various education-related expenses. Unlike a traditional education loan, which can only be used for tuition at recognized institutions, a personal education loan gives you more freedom. You can use it for:

School or college fees

Books, laptops, or coaching

Student visa processing

Education travel costs

Exam fees

Accommodation or hostel expenses

Skill development or part-time courses

Whether you're a higher secondary teacher, parent, or student, a personal loan can offer immediate support.

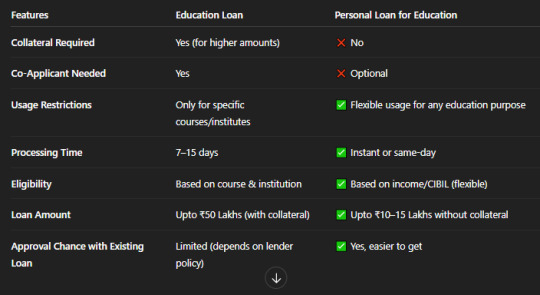

Why Choose a Personal Loan Over a Traditional Education Loan?

Who Can Apply for a Personal Education Loan in India (2025)?

If you're wondering, "Can I get an education loan if I have a personal loan?", the answer is YES. Most NBFCs and fintechs allow students or parents to apply if their repayment capacity is strong.

You can apply if you are:

A student (18+ age) with part-time income or a guarantor

A salaried parent or guardian

A self-employed person funding a child's education

A higher secondary teacher or school staff

An individual applying for a student visa abroad

Even if you already have a loan, you may still be eligible depending on your repayment history.

Best Use Cases of a Personal Loan for Students in India

Many people think loans are only for tuition, but the reality is broader. Here’s how students and parents are using them today:

School Admissions: Use a personal loan for school fees, uniforms, books, and transport

College Studies: Fund your college education, hostel, and semester fees with a personal loan for college

Study Abroad: Cover visa, flight tickets, or living costs with a personal loan for student visa holders

Competitive Exams: Need money for coaching, travel or test fees? Get a student personal loan in India instantly

Online Courses & Certifications: Short-term skills are expensive—use a student loan for personal use

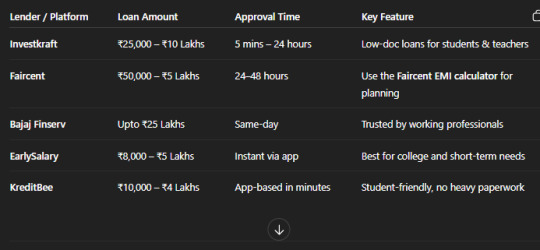

Top Platforms & Lenders Offering Personal Loans for Education in 2025

Here are some trusted platforms offering instant personal loans for higher education and general education purposes:

Education Loan Up to 50 Lakhs Without Collateral – Myth or Reality?

Yes, it’s possible to get education loans up to ₹50 lakhs without collateral, but mostly through government-backed schemes like:

Vidya Lakshmi Portal

SBI Global Ed-Vantage (for abroad studies)

Axis Bank or ICICI higher education plans

But these are traditional education loans, and approval takes longer. If you want speed and flexibility, a personal loan for education might be more practical—even if the amount is slightly lower.

Planning to Study Abroad? Get Personal Loan for Student Visa & More

Getting a personal loan for student visa holders is a rising trend in India. These loans help students fund:

IELTS/GRE coaching

Application & document fees

Visa charges

Airfare and accommodation

Insurance & laptop purchases

Lenders like Investkraft, KreditBee, and Faircent are helping Indian students bridge the gap when education loans aren’t enough.

Faircent EMI Calculator – Know Your Repayment Before You Borrow

Before applying, always calculate your EMI to avoid surprises. Use the Faircent EMI calculator or Investkraft’s loan calculator to:

Choose a tenure that suits your budget

Plan monthly EMIs

Check how interest affects the total cost

For example:

Loan Amount: ₹1,00,000 Interest Rate: 14% Tenure: 24 months EMI: ₹4,800 approx.

5 Most Asked FAQs on Personal Loan for Education in India (2025)

1. Can I get a personal loan for education if I already have one?

Yes, if your credit score and repayment history are good. Many lenders offer top-up or new personal loans for education, even if you have existing loans.

2. Is a personal loan better than an education loan in India?

For quick, flexible funding with no restrictions or collateral, personal loans are better. But for large-ticket overseas education, traditional education loans are ideal.

3. How much personal loan can a student get in India?

Students with a part-time income or a guarantor can get ₹25,000 to ₹5 lakhs, depending on lender policies.

4. Can a higher secondary teacher apply for a personal loan for education?

Yes, many banks and NBFCs offer dedicated personal loans to teachers and educators with quick approval.

5. Is collateral required for a personal education loan?

No. Personal loans for education are unsecured—no need to mortgage property or show security.

Final Words – Should You Get a Personal Loan for Education in 2025?

If you're looking for a fast, flexible, and simple way to fund your or your child’s education—whether in school, college, or abroad—a personal loan for educational purposes might be your best solution.

Unlike rigid education loans, they don’t tie you down with usage restrictions, co-applicants, or long wait times.

Platforms like Investkraft, Faircent, and others are making it easier than ever to get started, with instant personal loans for higher education, school expenses, or even student visa funding.

Don’t let money delay your dreams. Apply smart, compare options, and use loan calculators to make informed decisions.

#personal loan for education#personal loan for education purpose#personal loan for students in india#personal loan for study#can i get education loan if i have personal loan#personal loan for school#personal loans for school expenses#personal loan education loan#personal loans for students#education personal loan#personal loan for educations#personal loans for student loans#personal loan for education loan#faircent emi calculator#personal loan for higher education#personal loans for educational purposes#personal loan for college#student personal loan#education loan upto 50 lakhs without collateral#personal loan for student#personal loan for higher secondary teachers#instant personal loan for higher education#personal education loan#student loan for personal use#get personal loan for students#student loan personal loan#investkraft personal loan#personal loan for student visa holders#student personal loan in india

1 note

·

View note

Text

Top Travel Loan Apps in India – Get Instant Tour Loan with Low Interest & No Documents in 2025

Want to Travel Without Worrying About Finances? Now You Can

We all dream of exploring scenic mountains, pristine beaches, or vibrant international cities. However, travel often comes with a hefty price tag, including flights, hotels, food, sightseeing, and more. If financial limitations are holding you back, an instant travel loan in India can be the perfect solution in 2025. Whether it's a personal loan for a vacation, a trip with family, or a solo tour abroad, you can now get a travel loan online in minutes.

In this guide, we’ll help you understand everything: from interest rates to eligibility, documents required, and the best travel loan apps in 2025 — so you can travel stress-free and smart.

What is a Travel Loan?

A travel loan is a type of unsecured personal loan for travel purposes, allowing you to finance your domestic or international trips without using your savings. It covers expenses like:

Airfare and train tickets

Accommodation and hotel stays

Visa and travel insurance

Tour packages

Food and local transportation

Sightseeing and activities

The best part? No collateral or security is required. You can apply for a travel loan online with just a few basic documents and get instant approval in many cases.

Why People in India Prefer Travel Loans in 2025?

Here’s why travel loans in India are booming:

Rising cost of international travel

Flexible repayment options

Instant approvals through travel loan apps

Special offers for vacations (festive, honeymoon, family tours)

Easy access even for salaried people with low income

Whether you need a small loan for a vacation or a bigger amount for a tour abroad, travel loans can help you explore the world without delaying your dream.

Best Use Cases of Travel Loans

Honeymoon in Europe or the Maldives

Family trip to Goa, Manali, or Kerala

International tour to Dubai, Thailand, Singapore

Student travel or study-related trips

Pilgrimage tour (Char Dham, Vaishno Devi, etc.)

Solo or group adventure trips

Travel Loan Comparison Table (Top Lenders in India – 2025)

How to Apply for a Travel Loan Online in 2025?

Getting a personal loan for travel has never been easier. Just follow these steps:

Step-by-Step Process:

Choose your lender or travel loan app

Fill out the travel loan online application

Upload basic documents (Aadhaar, PAN, salary slips, etc.)

Get approval in real-time or within 1-2 days

The amount is credited directly to your bank account

Platforms like Navi, Investkraft, KreditBee, and Tata Capital offer instant travel loans through their apps.

Documents Required for Travel Loan

To get a travel loan, you’ll need:

PAN Card & Aadhaar Card

Last 3–6 months’ bank statements

Income proof (salary slips or ITR)

Photograph

Travel itinerary (optional)

Don't worry — some small travel loans or app-based lenders might approve with just basic KYC and bank data.

Eligibility Criteria for Travel Loan in India

To be eligible for a tour loan, here’s what lenders usually look for:

Indian resident aged 21–58

Minimum monthly income: ₹12,000 – ₹20,000

Stable job or business continuity of 2+ years

Good credit score (above 650 ideal, but some approve with lower too)

Clean repayment history (no defaults)

Pro Tip: Even if your credit score is low, many fintech lenders offer personal loans for travel without CIBIL checks.

Travel Loan Interest Rates in 2025

Interest rates for travel loans vary depending on:

Your income & credit score

Loan amount & repayment period

Lender’s policy

Typical travel loan interest rates in India in 2025 range between 9.9% to 25% per annum.

To save money, compare offers using a travel loan EMI calculator before you apply.

Why Taking Out a Loan to Travel is Smart (When Done Right)

Many hesitate when it comes to getting a loan to travel, but here’s why it’s a smart financial move if planned well:

You get to enjoy the experience now and pay over time

No need to disturb your emergency savings

EMIs can be tailored as per your budget

Many lenders offer no-cost EMI options for tours

It builds a positive credit history if paid on time

Always borrow within limits and only from trusted travel loan lenders in India.

Top Travel Loan Apps in 2025

These apps are trending in India for quick travel financing:

Navi – Paperless and fastest approval

MoneyTap – Credit line for repeat travelers

KreditBee – Ideal for students and first-time loan users

PaySense – Personalized vacation loans

CASHe – For small tour loans without income proof

Pro Tips Before You Apply for a Travel Loan

Compare multiple lenders online

Calculate the total repayment, including interest

Use a travel loan EMI calculator

Avoid borrowing more than necessary

Keep your documents ready for faster approval

Check for hidden fees or prepayment charges

5 Most Asked FAQs About Travel Loans in India

Q1. Can I get a personal loan for international travel in India?

Yes, most banks and NBFCs offer personal loans for international vacations, including coverage for visas and airfare.

Q2. What is the minimum salary to apply for a travel loan?

Usually, ₹12,000 – ₹20,000/month is enough. Some apps offer loans even to low-income earners with a clean bank history.

Q3. Which is the best travel loan app in India?

Navi, MoneyTap, and KreditBee are top-rated for their instant approval and easy-to-use apps in 2025.

Q4. Can I get a small travel loan for a weekend trip?

Absolutely! Many platforms offer small loans for vacation starting from ₹10,000 with flexible tenure.

Q5. Is it safe to take a loan for a trip or tour?

Yes, it’s safe if borrowed from RBI-approved lenders. Just ensure you repay EMIs on time and don’t overspend.

Final Words: Make Memories, Not Worries

In 2025, traveling will no longer be a luxury only for the rich. Whether it's a long-awaited honeymoon, a quick trip to the hills, or an international tour, a travel loan in India can help turn your dream into reality — instantly.

Take that break you deserve. With the right personal loan for travel, you won’t have to put your plans on hold anymore.

#travel loan#personal loan for travel#travel loan online#instant travel loan#personal loan for vacation#travel loan interest rate#loan for travel#tour loan#tourist loan#travel loan in india#travel loans in india#travel loans#apply for travel loan#trip loan#best loan for travelling#interest rate for travel loan#loan for vacation trip#personal loans for travel#loan for trip#getting a loan to travel#travel loan rate of interest#taking out a loan to travel#travel loan app#eligibility criteria for travel loan#get travel loan#documents required for travel loan#travel loan india#get personal loan for travel#travel loan interest rates#small loan for vacation

0 notes

Text

Loan Against SIP & ELSS in 2025 – Get Funds in Minutes Without Breaking Investments

Fresh Start: Unlock the Power of Your Investments – Without Selling Them

In 2025, money problems can knock on your door anytime—be it a medical emergency, a wedding, a home renovation, or business needs. But what if you could unlock instant funds without disturbing your SIP or ELSS investments?

Yes, it’s possible! Thanks to the Loan Against Mutual Funds (LAMF) facility, you can borrow money by pledging your mutual fund units and get cash instantly, without selling a single unit.

Let’s dive deep into this digital loan revolution, understand the benefits, the process, and how you can apply for a loan against mutual funds online, especially when you need it the most.

What Is a Loan Against Mutual Funds (LAMF) in 2025?

A Loan Against Mutual Funds (LAMF) is a secured loan where you pledge your mutual fund investments—like equity mutual funds, debt funds, SIPs, or ELSS—as collateral. You don’t need to sell your units; you retain ownership and still enjoy market returns.

Banks and NBFCs provide instant loans against mutual funds online, typically through digital APIs (LAMF API), offering fast processing and minimal documentation.

Features of Loan Against Mutual Funds – 2025 Highlights

Note: Use an updated Loan Against Mutual Funds Eligibility Calculator to check how much loan you can get on your current holdings.

Why Choose a Loan Against SIP or ELSS Mutual Funds?

Let’s break down why more investors in India are choosing LAMF loans in 2025:

1. No Need to Sell Your Investments

You can get a loan on mutual funds without selling your ELSS, SIP, or equity units. Your long-term goals stay intact while you solve your short-term needs.

2. Fast Digital Processing

Thanks to the rise of mutual fund loan apps in India, you can apply digitally and get instant cash in your bank account—no physical visits, no hassles.

3. Low Interest Rates Compared to Personal Loans

The mutual fund loan interest rate in 2025 starts from as low as 9.5%*, making it more affordable than credit cards or personal loans.

4. Flexible Repayment

You can choose interest-only EMI, full repayment options, or even opt for overdraft-style accounts—perfect for short-term liquidity gaps.

Who Can Apply for a Loan Against a Mutual Fund Online?

To apply for a digital loan against a mutual fund, you need:

Valid and active mutual fund folio

KYC-verified PAN and Aadhaar

Investment in eligible AMCs

Age above 18 years

Indian resident status

How to Apply for a Loan Against Mutual Funds in 2025?

Here’s how you can apply for a LAMF loan via trusted apps like Investkraft Loan platform or bank portals:

Step-by-Step Process:

Choose a lender (bank/NBFC/mutual fund loan app like Investkraft)

Log in with PAN or an Aadhaar-linked MF account

Select mutual funds to pledge (ELSS, SIP, debt/equity)

Use their LAMF eligibility calculator to check the max loan value

Submit documents (minimal – KYC only)

The loan is disbursed instantly or within 24 hours

How Does a Loan Against a Mutual Fund Work?

Once you apply for LAMF, your chosen units are lien-marked (pledged) but not sold.

The lender holds the right to sell only if you default.

Until then, you continue earning market returns.

When you repay, the lien is removed and you regain full access to your investments.

Use Cases: When Should You Take a Mutual Fund Loan?

Loan Against Mutual Funds for Financial Needs – Urgent medical, travel, or short-term cash.

Loan Against Mutual Funds for Wedding – Plan your dream wedding without disturbing long-term wealth.

Loan Against Mutual Funds for Financial Planning – Bridge gaps in business, tuition fees, etc.

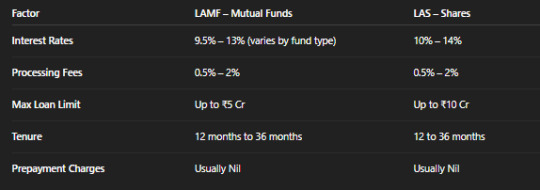

Mutual Fund Loan Interest Rate & Fees – 2025

Tip: Always compare loans against mutual funds processing fees and interest rates across multiple lenders before applying.

Digital Loan Against Mutual Fund – Peace of Mind in a Tap

Platforms like Investkraft Loan, Groww, Paytm Money, or even ICICI Direct now offer fully digital mutual fund loans. The digital loan against mutual fund trend is exploding in 2025 because of:

LAMF APIs are integrated directly with fund houses

Real-time pledge & approval system

Same-day credit disbursal

Transparent eligibility criteria & instant tracking

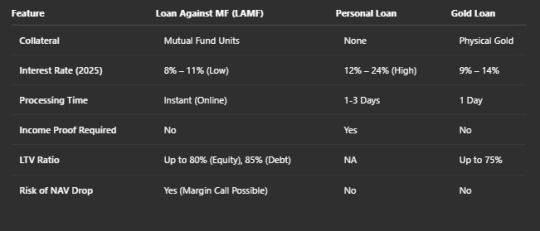

Comparison Table – Mutual Fund Loan vs Personal Loan

5 Most Asked FAQs on Loan Against Mutual Funds

1. Can I get a loan on mutual funds without selling them?

Yes! That’s the biggest benefit—you pledge but don’t sell, keeping your long-term growth on track.

2. What’s the maximum loan I can get on my SIP or ELSS?

Usually up to 50%-70% of your fund value. Use a loan against mutual funds eligibility calculator for exact figures.

3. How soon is the loan disbursed?

Most digital lenders offer instant loans against mutual fund disbursal within minutes to 24 hours.

4. Is my CIBIL score affected?

No, unless you default. Timely repayment even helps your credit score grow.

5. Which apps offer the best LAMF loan in 2025?

Some top apps include Investkraft Loan, Zerodha, Paytm Money, ICICI Direct, and Groww.

Final Thoughts – Don’t Break, Just Borrow!

In 2025, it’s smarter to borrow against your mutual funds than break them. Whether it’s your ELSS tax-saver fund or a 3-year SIP you don’t want to redeem, LAMF loans are your perfect bridge between long-term wealth and short-term needs.

So next time life throws you a financial curveball, don’t panic—just apply for a loan against mutual fund online and unlock the power of what you already own.

Ready to get started?

Use your PAN, check your eligibility, and get instant cash within hours—without selling even a rupee of your SIP or ELSS.

#loan against mutual funds#instant loan against mutual fund#loan against ELSS mutual funds#loan against SIP investment#loan against mutual fund online#Digital#get loan on mutual funds without selling#mutual fund loan interest rate 2025#how to get loan on mutual fund#mutual fund loan apps India#lamf#loan against mutual funds explained#digital loan against mutual fund#lamf eligibilty & documents#what is a loan against mutual fund#investkraft loan#lamf loan#how does a loan against mutual fund work#features of loan against mutual funds#lamf api#loan against mutual funds features#lamf eligibility#loan against mutual funds eligibility calculator#loan against mutual funds for financial needs#loan against mutual funds for wedding#loan against mutual funds eligibility and documents#apply for loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds processing fees and interest rates#loan against mutual funds for financial planning

0 notes

Text

Why Let Property Sleep? Get Fast LAP Loan Online Without Salary Slip or Heavy Docs (2025 Update)

What if the home you’re living in could unlock ₹10–50 Lakhs without needing your salary slip, CIBIL score, or even ITR?

Yes, in 2025, it’s possible. Thousands of Indians are waking up to this powerful reality – their property isn't just real estate, it's ready-made capital.

If you’re struggling with loan approvals due to low income, poor credit, or lack of documents, a Loan Against Property (LAP) might be your golden solution.

Let’s break it down.

What is LAP Loan & Why Is Everyone Talking About It in 2025?

LAP (Loan Against Property) is a secured loan where you use your residential or commercial property as collateral to borrow a significant amount of money. Unlike personal loans, LAP loans offer higher limits, lower interest rates, and flexible tenures.

And here’s the big relief — many lenders in 2025 are offering LAP loans without income proof or heavy documentation, making it a practical route for self-employed, freelancers, and even homemakers.

Who Can Apply for a Loan Against Property Online?

Whether you're salaried, self-employed, or have minimal formal income proof, you can still apply for a loan against property online in 2025. Leading NBFCs and digital lenders now use alternative checks (bank statements, property valuation) instead of asking for ITR or salary slips.

Ideal for:

Salaried individuals without payslips

Self-employed without ITR

People with low CIBIL

Those needing urgent funds for business, education, marriage, etc.

Residential vs Commercial Property: What Works Better for LAP?

You can pledge either type. But each comes with different risk profiles and loan amounts.

Fast Loan Against Property – Even Without Documents?

Yes! Thanks to fintech, it’s now possible to get an instant loan against property with minimal to no documentation. Lenders now allow you to:

Upload basic property docs online

Skip income proof if the property value is high

Use digital EMI calculators & eligibility tools instantly

So even if you’re asking: “How to get LAP loan without documents?” – the answer is YES, it’s doable.

Check Eligibility in Minutes – No Salary Required

Before applying, you can use any property loan eligibility calculator to see how much LAP you qualify for. Most tools check:

Property market value

Age and condition of the property

Applicant's age & basic profile

Repayment capacity or alternate income sources

Even if you don’t have a fixed salary, alternate income like rent or small business income is enough to qualify.

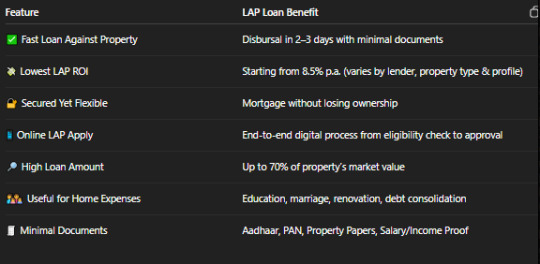

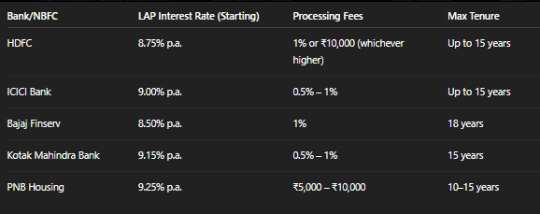

LAP Loan Interest Rates in 2025 – What to Expect?

As of mid-2025, the best LAP loan interest rate ranges from 8.25% to 11.5%, depending on lender type and risk score. Here's a quick comparison:

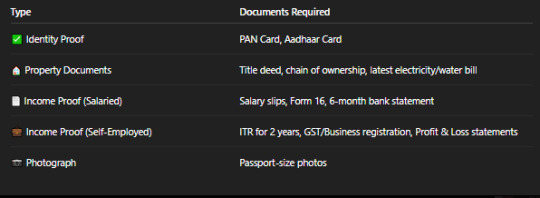

What Documents Are Really Required in 2025?

Forget piles of paperwork. Here's what most lenders want today:

Property papers (sale deed, tax receipts)

Basic KYC (PAN, Aadhaar)

Bank statements (last 3–6 months)

And that’s it. For many, no income tax returns, no salary slips, no employer letter.

Lenders are now trusting the value of your property, not your paper trail.

How to Apply for LAP Online – Quick Steps

Applying is now as easy as ordering a pizza.

Visit the lender/NBFC/fintech site

Fill in basic property & personal details

Upload property documents & KYC

Get an instant loan estimate via the EMI calculator

Receive offer → eSign → Get funded within 24–72 hours

Why LAP Loans Are a Lifeline in 2025

With India’s growing credit rejection rate (due to low CIBIL, unstable jobs, or informal incomes), LAP is becoming the #1 funding solution for middle-class and self-employed individuals.

You’re not borrowing blindly — you’re unlocking money you already own.

And that’s financial wisdom.

Frequently Asked Questions (FAQs)

1. What is the minimum income required for a LAP loan?

Most lenders don’t need income proof if the property value is high. Alternative income, like rent or business transactions, is accepted.

2. Can I get a loan against property with a low CIBIL?

Yes. Since LAP is a secured loan, lenders focus more on property value than on your credit score.

3. How fast can I get an instant loan against property online?

You can get same-day approvals and disbursals in 24–72 hours from fintech or NBFC platforms.

4. Which is better – a loan against residential or commercial property?

Both are accepted. Residential property usually gets a higher LTV (loan-to-value) and better interest rates.

5. How to calculate LAP EMI before applying?

Use a free EMI calculator for LAP available on most lender websites. It gives you monthly repayment, total interest, and tenure options instantly.

Final Words: Don’t Let Your Gold Sleep

Your property isn’t just a home or shop – it’s your personal finance engine. With no income proof, no CIBIL, and no heavy documents, you can now get the money you need in 2025 — faster, smarter, and completely online.

So don’t let it sit idle. Use it to grow, build, or overcome financial roadblocks.

You’re sitting on gold. It’s time to unlock it.

#apply for loan against property online#best lap loan interest rate#loan against property without income proof#lap loan for salaried person#fast loan against property#property loan eligibility calculator#low interest loan against property#how to get lap loan without documents#loan against residential property#loan against commercial property#emi calculator for loan against property#instant loan against property#lap loan#loan against property#personal loan against property#online loan against property#instant property loan#fnb loan against property requirements#lap loan against property#lap interest rate#loan against property for salaried person#lap roi#loan against property eligibility#lap loan meaning#what is lap loan

1 note

·

View note

Text

Overdraft Loan Apply Online (2025): Eligibility, OD Charges, Limit & Instant Approval Tips

Discover the Overdraft Loan Hack Most People Don't Know About in 2025

In today’s fast-moving world, having a little extra cash in your account when you need it most can make a big difference. Whether you're a salaried professional stuck with mid-month expenses or a business owner dealing with delayed client payments, an overdraft loan in India could be your smartest financial fallback in 2025.

But what exactly is an overdraft loan? How does it differ from a personal loan? What are the eligibility rules, interest rates, and OD limits for salaried and business users?

In this guide, you’ll get everything you need to know — including how to apply online without collateral.

What is an Overdraft Facility in Banks?

An overdraft facility is a short-term credit option provided by banks where you can withdraw money even when your account balance is zero, up to a certain limit approved by the bank.

Think of it like a credit line attached to your savings or current account, which you can use when required and pay interest only on the amount used, not the full limit.

Overdraft Loan vs Personal Loan: What’s the Difference?

Many confuse overdraft loans with personal loans, but both serve different purposes.

So if you’re looking for instant liquidity without long approval processes or rigid EMIs, overdraft loans win the race in most real-life scenarios.

Overdraft Loan Eligibility in India (2025)

Every bank has slightly different norms, but here are the general eligibility criteria for getting an OD loan approved:

For Salaried Professionals:

Minimum income: ₹25,000–₹35,000 per month

Minimum 6 months in current job

Clean repayment history (CIBIL 700+ preferred)

Salary should be credited in the linked bank account

For Business Owners/Self-Employed:

Minimum 1–2 years of business vintage

Audited financials or ITRs

Active current account (preferably with the same bank)

GST registration (optional but helps)

So, whether you need a bank overdraft loan for a salaried individual or a business loan, having a steady income flow and a trusted bank relationship increases your chances.

What is OD Limit & How It’s Calculated?

The OD limit refers to the maximum amount you can overdraw from your bank account. It depends on:

Your monthly income or average account balance

Business turnover (for current account holders)

Past repayment history

Relationship with the bank

Example OD Limits:

OD Loan Interest Rate & Charges in 2025

Banks usually offer competitive OD loan interest rates, ranging between 10% to 18% per annum, depending on your risk profile.

Common OD Loan Charges:

You’ll find that the OD loan interest rate is often lower than credit card interest and more manageable than some high-interest personal loans.

Best Banks for Overdraft Facility in India (2025)

Here are some of the top banks offering overdraft loans without collateral:

HDFC Bank Overdraft Facility – Instant OD for salaried & business

ICICI OD Against Salary Account – OD Limit up to 5x monthly salary

SBI Overdraft Loan – For both savings & current accounts

Axis Bank Business OD – Competitive rates for MSMEs

Kotak OD Against FD/Salary – Flexible for young earners

Always check which bank gives you the best overdraft facility based on your existing relationship, interest rate, and documentation requirements.

How to Apply for an Overdraft Loan Online in India

Applying online for an OD loan has become super easy:

Step-by-Step Process:

Visit your bank’s website or net banking portal

Navigate to "Loans" > "Overdraft Facility"

Enter your details & select account

Upload basic documents (ID, income proof)

Get instant OD approval (for pre-approved users)

Many banks allow instant OD loan approval for eligible customers with minimal documentation.

Overdraft Facility for Businesses & Current Accounts

If you own a business or have a current account overdraft facility, banks often give:

Higher OD limits based on turnover

Custom overdraft repayment cycles

Dedicated RM support for MSMEs

These business overdraft loans are ideal for short-term working capital, vendor payments, inventory restocking, and seasonal cash flow needs.

Overdraft Loan Without Collateral – Is It Possible?

Yes, many private and public sector banks now offer overdraft loans without collateral. Especially if:

You're a salaried individual with a good income

Or a business with stable transactions & clean credit

This makes OD loans an excellent choice for zero-collateral financing in urgent situations.

Common FAQs on Overdraft Loans in India

1. What is an overdraft loan, and how does it work?

An overdraft loan lets you withdraw more than your account balance, up to a set limit. Interest is charged only on what you use.

2. How to get an overdraft facility for the first time?

You can apply through your bank's online portal or visit your branch. Approval depends on your income, credit score, and relationship with the bank.

3. What is the OD limit for salaried account holders?

Usually 2x to 5x of your net monthly salary, depending on the bank's policy.

4. Is an overdraft better than a personal loan?

Yes, if you need flexible short-term funds. You pay interest only on the amount used — not the full limit like personal loans.

5. Are there any overdraft charges or penalties?

Yes, banks may charge processing fees, renewal charges, and penalty fees for delayed payments or exceeding the OD limit.

Final Words: Should You Choose an Overdraft Loan in 2025?

If you're looking for flexible funds without long paperwork, an overdraft facility in banks is a smart and fast option in 2025.

Whether you're salaried, self-employed, or a business owner, OD loans offer quick liquidity, no fixed EMIs, and often no collateral. With the right bank, right planning, and proper usage, this facility can become your financial safety net when you need it most.

#overdraft facility in banks#overdraft loan eligibility#overdraft vs personal loan#how to get overdraft facility#overdraft loan interest rate#bank overdraft loan for salaried#overdraft facility for business#best bank for overdraft facility#overdraft loan apply online#overdraft loan without collateral#overdraft facility#overdraft loan#what is overdraft facility#overdraft loans#business overdraft loan#overdraft limit#what is overdraft loan#business overdraft#personal loan overdraft facility#od limit#current account overdraft facility#best overdraft facility#od loan interest rate#od loan#od charges#how to apply for overdraft loan#od limit for salaried

1 note

·

View note

Text

Need Instant Funds? Get Same-Day Online Loan in India Without Income Proof – Apply in 5 Minutes (2025)

I Just Needed 3000, But No Bank Helped Me – The Story of Millions of Indians in 2025

Riya, a 24-year-old gig worker from Jaipur, needed ₹3000 urgently for her mom’s medical prescription. She had no fixed income, no credit history, and no one to borrow from. She searched online:

3000 instant loan without documents

Instant fund app without CIBIL

Within 5 minutes, ₹5000 was transferred to her account, without income proof or paperwork. Welcome to 2025, where insta loans and instant funds are helping lakhs of Indians get quick money.

Why Are Millions Searching for “Instant Loan” or “Instant Funds” in India?

People search terms like:

need an instant loan

Instant cash loan now

loan instant approval in 5 mins

Best instant loan website in India

Because they face:

Salary delays

Emergency travel/weddings

Rent or bills due

Gadget breakdowns

Business cash flow issues

Banks ask for paperwork and CIBIL scores. But people need money now. That’s where instant loan apps help.

What Are Instant Loans or Insta Funds in 2025?

An instant loan or insta fund is a short-term loan:

Approved within minutes

Requires only Aadhaar + PAN

Amount: ₹3000 to ₹2 lakh

100% online, paperless

EMI: 3 to 24 months

Ideal for:

Freelancers

Students

Housewives

Salaried (10K+/month)

People without CIBIL

Real Problems These Loans Solve

"I searched ‘insta credit loan 5000 urgent’. KreditBee helped instantly." – Mohan, Bangalore

"I’m a student. Got ₹3000 via TrueBalance. No papers." – Priya, Lucknow

"Lost my job. MoneyTap gave ₹50K. Repaid in 6 months." – Rajiv, Delhi NCR

How to Get an Instant Loan or Fund in 5 Minutes

Step-by-Step Process

Download Investkraft, NIRA, LazyPay, etc.

Register with your phone number

Complete KYC: Aadhaar + PAN + selfie

Enter the loan amount

Select EMI (3-24 months)

Submit and wait 3-5 minutes

Money gets transferred to the bank

No salary slip or CIBIL needed for small instant personal loans.

Best Instant Loan Apps in India (2025 Comparison)

Instant Loan with EMI Option

Apps allow:

EMI options (3, 6, 12, 24 months)

Auto-debit & reminders

Pre-closure with low fees

Flexible repayment with less pressure.

How to Choose the Right Insta Fund App

Small loan like 3000? ➔ TrueBalance / KreditBee

Bigger loan? ➔ Investkraft / NIRA

Buy now, pay later? ➔ LazyPay / Investkraft

Always Check:

RBI-registered app?

Transparent interest & fees?

Good app ratings?

Mistakes to Avoid

Don’t apply to 5 apps at once

Never pay advance fees

Don’t fake income or a job

Always read EMI terms

When Should You Use Instant Loans?

Emergency hospitalization

School/college fees

Rent, bills

Urgent gadget/mobile purchase

Business shortfall

Why Trust Investkraft?

Investkraft verifies:

RBI-registered NBFC apps

Safe platforms with real reviews

Paperless and secure loan options

We help you avoid scams & choose the best fit.

FAQs on Instant Loans (2025)

Q1: Can I get a loan without income proof?

Yes. Most apps just need Aadhaar + PAN + selfie.

Q2: Which app gives ₹3000 instantly?

TrueBalance and KreditBee offer 3000 - 10,000 without CIBIL.

Q3: How fast is approval?

Between 2 to 10 minutes, depending on the app.

Q4: Can students or freelancers apply?

Yes, many apps offer to students, gig workers, and housewives.

Q5: Is repayment flexible?

Yes. EMIs + prepayment options available.

Final Words: Get 3000 to 2 Lakh in Minutes

No income proof? Low CIBIL? Salary delayed?

Use verified apps like:

KreditBee

NIRA

Investkraft

LazyPay

TrueBalance

Get money in 5 minutes, no excuses. Investkraft helps you choose trusted apps with safe, fast, and paperless approval.

Apply now. Get funded fast.

#instant loan#instant funds#insta loans#instant loan online#instant cash loan#investkraft#instant loans#loan instant#instant loan website#get instant loan#instant loan website in india#instant personal loan online#insta personal loan#instant fund app#instant personal loan#insta fund#personal loan in 5 minutes#insta funds#loan instant approval#need instant loan#3000 instant loan#insta credit loan#5 minutes loan#get instant money#insta loan app#loan app instant#instant personal loan moneytap#instant personal loan with emi#same day loans#short-term loans without credit check

1 note

·

View note

Text

Get Quick Digital Loan Against Mutual Funds in 2025 – No CIBIL, Instant Approval, Low Interest!

In 2025, managing financial emergencies or funding major life goals has become faster and easier, thanks to the growing popularity of Loan Against Mutual Funds (LAMF). Whether you need funds for a wedding, a medical emergency, or to start a small business, your investments in mutual funds can help unlock instant liquidity without selling them.

But how does it work? What is the LAMF interest rate in 2025? What documents are required? How does LAMF compare to personal loans or gold loans? In this guide, you’ll find everything you need to know to make an informed decision.

What Is a Loan Against Mutual Fund (LAMF)?

A Loan Against a Mutual Fund is a type of secured loan where your mutual fund units are pledged as collateral. It’s one of the smartest ways to raise quick funds without selling your investments.

When you pledge mutual fund units, lenders assign a certain Loan-To-Value (LTV) ratio and disburse funds instantly. The units stay in your demat account but cannot be redeemed unless the loan is repaid.

Key Features of Loan Against Mutual Funds in 2025

Instant Online Approval via LAMF API integration

No income proof or credit score required

Flexible repayment tenure

Zero foreclosure charges with top lenders

Loans are available on both equity & debt mutual funds

Apply Loan Against Mutual Fund Online Instantly

With platforms like Investkraft, Volt Money LAMF, and Bajaj Finserv mutual fund loan options, applying online is seamless. You can complete the entire loan process in under 5 minutes with just your PAN and folio number.

No paperwork. No branch visits. Purely digital loan against mutual fund access.

LAMF vs Personal Loan vs Gold Loan: A Real Comparison

Understanding LTV in Loan Against Mutual Funds

Loan-to-Value (LTV) is the percentage of your mutual fund’s current value that can be disbursed as a loan.

LAMF LTV for Equity Mutual Funds: Up to 80%

LAMF LTV for Debt Mutual Funds: Up to 85%

This means if your equity mutual fund value is ₹1,00,000, you can get a loan up to ₹80,000.

What Is the Interest Rate for a Loan Against Mutual Funds in 2025?

Interest rates are much lower than personal loans and depend on your mutual fund type and the lender.

LAMF interest rate 2025 (Equity Funds): 9% – 11.5%

LAMF interest rate 2025 (Debt Funds): 8% – 10.5%

Some top digital lenders offer rates as low as 7.99% for salaried investors.

Who Can Apply for a Loan Against Mutual Funds?

Eligible Individuals:

Salaried professionals

Self-employed individuals

Retirees with mutual fund holdings

LAMF Eligibility Requirements:

KYC-verified PAN

Active mutual fund folio in demat form

No need for income proof or CIBIL score

Use any LAMF eligibility calculator online (Investkraft, Volt, Bajaj) to check your loan limit.

Loan Against Mutual Funds: Documents Required

You’ll be surprised how minimal it is:

PAN card

Linked mobile number for OTP

Demat account login or mutual fund folio number

There is no need to upload salary slips, income proof, or ITR, unlike personal loans.

How Does a Loan Against a Mutual Fund Work?

Apply online on any LAMF platform (e.g., Investkraft, Bajaj Finserv)

Enter your PAN and validate your folio

The lender checks your eligible mutual fund units

The loan amount is calculated using the loan against mutual fund calculator

Get instant disbursal into your bank account

Your units are pledged, and you can unpledge anytime by repaying the loan.

Risks of LAMF: What You Must Know

Loan Against Mutual Fund Margin Call: If the NAV drops significantly, the lender may ask you to repay a portion or add more units

Risk of LAMF NAV Drop: Equity markets are volatile, so equity funds carry higher risk

Redemption Blocked: You can’t sell your pledged units until the loan is cleared

However, for debt mutual funds, risks are minimal, and LTV is higher.

Best Banks & Platforms for Loan Against Mutual Funds in 2025

Check recent loan against mutual fund reviews on Reddit or Google before choosing a platform.

Why Choose LAMF in 2025 for Financial Needs?

No EMI burden upfront

You stay invested while getting liquidity

Much cheaper than personal loans

Great for short-term or mid-term funding: weddings, emergencies, travel, education

Whether you're a young investor or a salaried individual, a digital loan against mutual fund is the smartest way to raise money today.

FAQs on Instant Loan Against Mutual Funds in 2025

Q1. What is the loan against mutual fund interest rate in 2025? Interest rates range from 8% to 11.5% based on the fund type and lender.

Q2. How much loan can I get against mutual funds? You can get up to 80% LTV on equity funds and up to 85% on debt mutual funds.

Q3. Are there any risks of taking LAMF? Yes, if NAV drops drastically, a margin call may be triggered. However, with proper planning, this can be managed.

Q4. Can I apply for LAMF without income proof or CIBIL? Yes. LAMF is completely collateral-based. No CIBIL or income proof is needed.

Q5. Which is better – LAMF or a personal loan? LAMF is cheaper, faster, and requires no documents. It’s ideal for mutual fund investors.

Final Words: Tap Your Investments, Not Your Savings

Why liquidate your funds when you can use them as leverage? In 2025, LAMF loans are empowering investors with easy access to capital, be it for a personal emergency, funding a wedding, or growing a side business.

If you have mutual funds, it’s time to make them work for you. Explore LAMF with trusted lenders like Investkraft, Volt Money, or Bajaj Finserv and unlock a world of digital, instant, low-interest funding.

Apply loan against a mutual fund online now – no income proof, no stress, only smart financing.

#loan against mutual fund interest rate#LAMF interest rate 2025#loan against mutual fund LTV#LAMF LTV equity vs debt mutual fund#loan against mutual fund calculator#LAMF eligibility calculator#loan against mutual fund documents required#apply loan against mutual fund online#LAMF vs personal loan#loan against mutual fund vs gold loan#loan against mutual fund margin call#risk of LAMF NAV drop#best banks for loan against mutual funds#Volt Money LAMF#Bajaj Finserv mutual fund loan#loan against mutual fund review#LAMF experiences reddit#lamf#loan against mutual funds limit#loan against mutual funds features#lamf eligibility#lamf loan#digital loan against mutual fund#investkraft loan#loan against mutual funds for financial needs#what is a loan against mutual fund#who can apply for loan against mutual funds#loan against mutual funds explained#loan against mutual funds processing fees and interest rates#lamf api

1 note

·

View note

Text

Turn Property into Power: Top LAP Loans for Salaried & Self-Employed in India – 2025 Approval Guide

Are you sitting on a piece of property while struggling to raise funds for urgent needs? If yes, your real estate could be your gateway to immediate liquidity. In 2025, more Indian borrowers are turning to Loan Against Property (LAP) — a smart way to use your immovable assets without selling them. Whether you're salaried or self-employed, LAP gives you the financial freedom you didn’t know was already in your name.

This guide is your all-in-one resource for understanding what LAP means, applying for it, checking eligibility, comparing rates, and utilizing it for various needs, such as weddings, medical bills, or business expansion. And yes, it’s written in a human-first tone, with Google-friendly clarity and freshness so it gets indexed faster and ranks stronger.

Start Here: What is a LAP Loan in 2025?

LAP or Loan Against Property is a secured loan where you keep your property (residential, commercial, or industrial) as collateral and raise funds for personal or business needs.

LAP loan full form: Loan Against Property.

Unlike selling, you retain ownership while unlocking funds from your existing asset. It’s becoming a popular choice in India in 2025 due to lower interest rates, flexible tenure, and high approval chances.

For Salaried People: How LAP Can Fuel Your Dreams

If you're a working professional earning a fixed income, a loan against property for salaried individuals can help you cover big-ticket expenses without draining your savings or taking a high-interest personal loan.

Key Benefits:

Borrow up to 60-70% of your property’s market value

Long repayment tenure (up to 15-20 years)

Lower EMI burden compared to unsecured loans

Real Example: If you earn ₹40,000/month, you may qualify for a LAP worth ₹30 lakhs, depending on property value and other debts.

Salaried LAP Meaning: A loan sanctioned to salaried individuals against owned property, with easy documentation and fast approval.

Self-Employed? Here’s How LAP Makes Business Expansion Easier

For entrepreneurs and freelancers, traditional loans often come with limitations. But with a loan against property for self-employed individuals, your business can raise capital without disrupting operations.

Why It Works for You:

Multiple properties can be pledged

Income proof flexibility (ITR, GST returns)

Larger loan amounts for longer tenure

Whether you're planning a store expansion or managing wedding costs, a private loan against property or a bank LAP can bridge your financial gap effectively.

Who Can Avail a Loan Against Property in 2025?

You qualify for a LAP loan if:

You're aged between 21 and 65

You own property (self-occupied or rented)

You're salaried or self-employed with a stable income

Lenders now evaluate both salaried and business incomes, especially if you're applying for a loan against property for home expenses or business-related funding.

LAP Eligibility Criteria (Salaried + Self-Employed)

Note: Use online LAP eligibility calculators to pre-check your loan limits before applying.

How to Apply for LAP Loan Online (Step-by-Step in 2025)

Getting a fast loan against property in 2025 is easy if you follow this path:

Visit your preferred lender’s website

Fill in the LAP loan apply online form with your income and property details

Upload scanned documents

Wait for verification and valuation

Receive approval and disbursal in 48-72 hours

LAP Loan Documents Required

For Salaried Persons:

Aadhaar/PAN

Salary slips (last 3 months)

Form 16 or ITR

Property ownership papers

For Self-Employed:

Business registration

GST returns/ITR (last 2 years)

Bank statements (last 6 months)

Property documents

Best LAP Interest Rates in India (2025 Comparison Table)

Use this loan against property ROI comparison table to select the lender best suited to your income and repayment capacity.

Loan Against Property Charges You Must Know

Loan against property fees and charges for salaried individuals:

Processing fee: 0.5% to 2% of the loan amount

Valuation/legal fee: ₹1000 to ₹15,000

Foreclosure charges: NIL for floating, up to 4% for fixed rate

Check hidden charges before signing your agreement to avoid surprises.

Property Type You Can Use to Raise LAP

You can raise funds via:

Loan against residential property (self or rented)

A loan against immovable property, such as plots

Loan against property mortgage (registered under your name)

All must be free from legal disputes and be located in lender-approved zones.

Real Use Cases: LAP for Medical, Wedding & More

Meet Shalini, a Pune-based salaried executive. When her father needed urgent surgery, she used a LAP loan to raise ₹40 lakhs in 3 days without touching her savings or PF.

A loan against property for self-employed individuals, such as for a wedding or urgent business cash flow, is also common. It’s reliable, secure, and way cheaper than credit cards or personal loans.

Procedure of Loan Against Property

Property eligibility check

Application submission (online/offline)

Document collection and verification

Site visit and property valuation

Loan sanction & agreement signing

Disbursal to your bank account

5 FAQs on LAP in 2025

1. Is a LAP loan better than a personal loan? Yes. LAP loans have lower interest rates, higher amounts, and longer tenures.

2. What documents are needed for LAP if I’m self-employed? GST returns, ITR, business proof, property papers, and bank statements.

3. Can I apply for LAP if my credit score is low? Yes, especially with co-applicants or additional property as security.

4. What is LAP in a loan context? LAP refers to using your property as collateral to get a secured loan.

5. Can I get an immediate LAP loan online? Many fintechs and banks now offer instant LAP loans with digital verification.

Final Word: Make Your Property Earn for You

Your property doesn’t just provide shelter — it can secure your future. Whether you're planning your child's education or fueling your startup, a Loan Against Property (LAP) is your key to unlocking hidden wealth.

Explore your options, compare LAP loan interest rates in India, and apply for a loan against property online today. Because your assets should work as hard as you do.

#loan against property for salaried person#loan against property lap#what is lap loan#lap loan#fast loan against property#lap eligibility#salaried lap meaning#loan against property comparison#loan against property fees and charges for salaried individuals#lap rates india#loan against property for salaried individuals#how to apply for loan against property for salaried individuals#how to raise loan against property#loan against property features for salaried individuals#lap in loan#lap loan apply online#lap loan against property#lap loan full form#apply for loan against property online#who can avail a loan against property#loan against property features for self employed individuals#loan against property roi comparison#loan against property for salaried individuals for home expenses#loan against property eligibility and documents for self employed individuals#procedure of loan against property#loan against residential property#lap loan documents required#bank gives loan against property#private loan against property#loan against immovable property

1 note

·

View note

Text

Apply Online for Working Capital Loan Without Income Proof – Best Business Loan Options in India 2025

Running a business in India isn’t easy — rent, salaries, inventory, marketing… the bills don’t wait. And if clients delay payments or sales dip, it gets tougher.

That’s why many small business owners — from Kirana stores to D2C brands — are turning to working capital loans to keep things moving without breaking the bank.

But here’s the good news: You don’t need to visit a bank, pledge property, or wait weeks anymore. In 2025, you can apply online, get approved instantly, and receive funds without collateral — all while sitting at your desk.

Let’s break it down like a real friend would — no jargon, just straight answers.

What Exactly Is a Working Capital Loan?

A working capital loan is like a short-term fuel tank for your business. It's not for buying new machinery or expanding — it's for everyday needs like:

Paying staff salaries

Restocking inventory

Clearing supplier dues

Handling marketing or rent

Think of it as temporary oxygen when cash is stuck.

And the best part? Many platforms offer working capital loans without collateral, which means no need to mortgage your shop, house, or gold.

Why Choose a Working Capital Loan in 2025?

Because business speed matters. Traditional banks are slow. Fintech lenders now offer:

Instant loan disbursal (within 24–48 hours)

Apply online in just 10 minutes

No collateral required (for loans up to ₹25 lakhs)

Lower interest rates than credit cards

Tailored for MSMEs & new startups

Whether you're a small bakery owner in Jaipur or running an Instagram fashion store in Delhi, these loans are built for you.

Are You Eligible?

Most lenders don’t need 10 years of history or a 900 CIBIL score. Here’s the basic working capital loan eligibility:

Tip: Even if you’re new, many NBFCs and fintech lenders offer working capital loans for new businesses in India. UPI income, Swiggy/Zomato payouts, even Shopify sales help!

What’s the Interest Rate in 2025?

Let’s be real: Interest rates depend on your profile, business, and lender. But here's a general idea

Use a working capital loan calculator online to get an idea of your EMI.

How to Apply Online (Without Getting Scammed)

Gone are the days of waiting in bank queues. Here's how you can apply for a working capital loan online:

Step-by-Step:

Go to the lender’s official website (e.g., LendingKart, Razorpay Capital, Indifi).

Click on “Apply for Business Loan.”

Enter basic details – Name, Business Type, Turnover, PAN, Aadhaar.

Upload documents – Just a few (bank statement + KYC).

Get approval – If all is good, you’ll get instant business loan approval.

Loan Disbursal – Money hits your account within 24 to 48 hours.

No agents. No under-the-table dealings. 100% transparent.

Business Loan vs Overdraft vs Working Capital Loan

Still confused? Here's how these options compare:

How Much Can I Get?

The loan amount depends on your income, cash flow, and lender policies.

Rough ballpark:

New biz → ₹50,000 to ₹2 lakh

Growing SME → ₹2 to ₹10 lakh

Established firm → ₹10 to ₹25 lakh+

Many platforms now use AI to check your UPI/gateway/bank data and approve even without ITR. Yes, you read that right!

Real Story (Human Touch)

“I run a tiffin service in Pune. After Diwali, orders dropped, but expenses didn’t. I applied for a working capital loan through Indifi, uploaded my UPI records, and boom — ₹1.5 lakh in my account in 24 hours. No property, no tension.”