#EMI Installment Calculator

Explore tagged Tumblr posts

Text

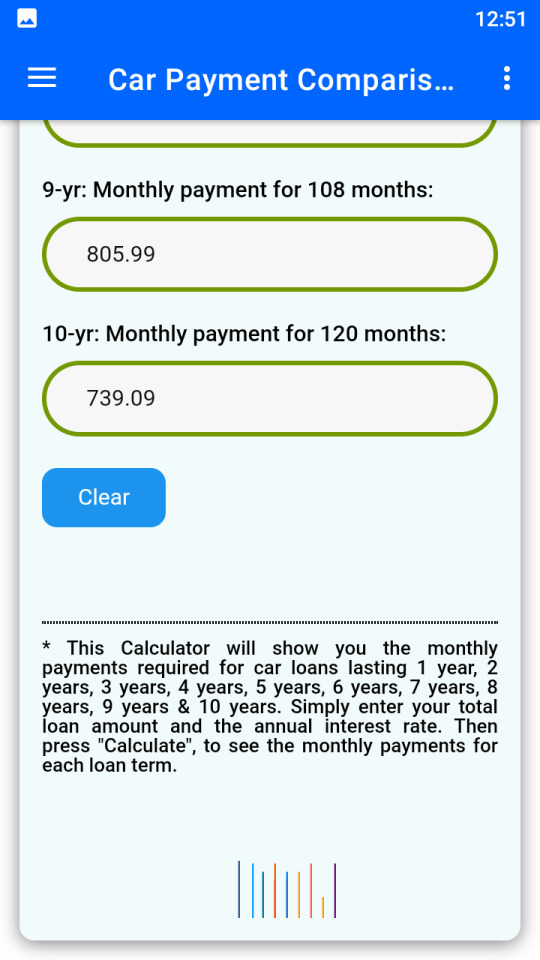

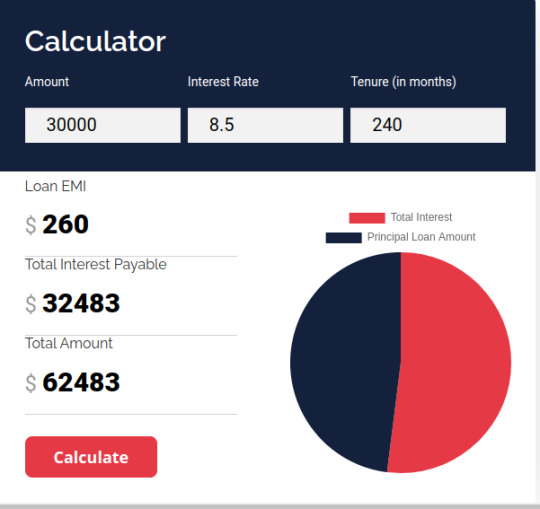

EMI Installment Calculator – Calculate Your EMIs Instantly

Managing your loan repayments smartly starts with knowing your EMI (Equated Monthly Installment). Whether you're planning to take a personal loan, home loan, or car loan, calculating your EMI in advance helps you stay financially prepared.

✅ What is an EMI Installment Calculator?

An EMI Installment Calculator is an online tool that helps you estimate your monthly loan repayments based on:

Loan Amount

Interest Rate

Tenure (in months or years)

This helps you understand how much you’ll need to pay each month, making it easier to plan your budget without surprises.

🔗 Use Our Free EMI Calculator Online

Want to calculate your EMI in seconds? 👉 Try our fast and easy-to-use EMI Installment Calculator now.

Just enter your loan amount, interest rate, and tenure — and get your monthly installment instantly!

💡 Why Use Our EMI Installment Calculator?

100% Free & Online

No personal details required

Instant & accurate results

User-friendly mobile and desktop experience

Our tool is perfect for anyone planning a loan, comparing lenders, or just checking repayment possibilities.

📊 Plan Better, Borrow Smarter

Before you apply for a loan, always calculate your EMI. It reduces financial stress and helps in better decision-making.

1 note

·

View note

Text

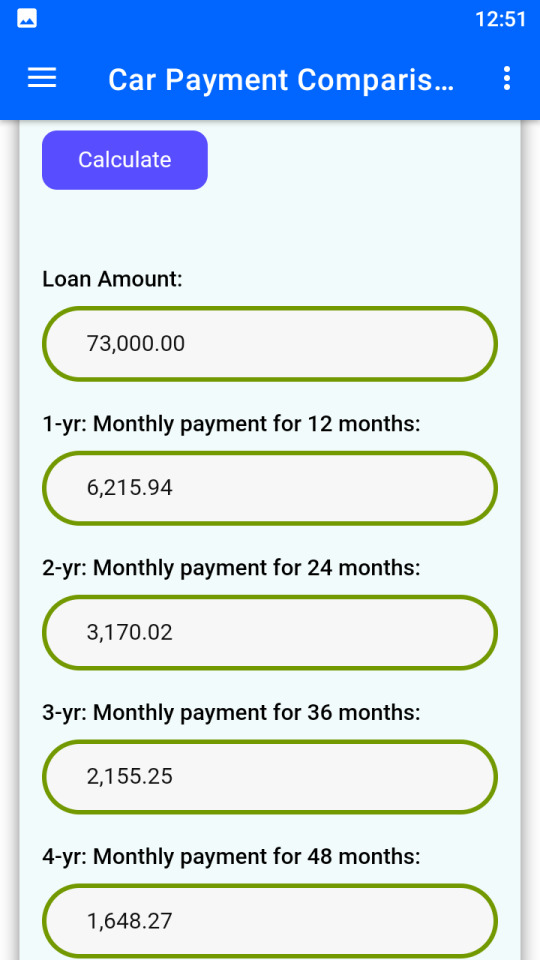

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

Decoding your Dream Home: A Simple Guide to Calculating Your Home Loan EMI

Owning a home - it's the cornerstone of Indian dreams, a symbol of stability and success. But navigating the financial intricacies of a home loan can feel like deciphering hieroglyphics. Enter the Home Loan EMI Calculator, your trusty decoder ring in this financial adventure.

What's this magical calculator, you ask? Imagine a genie who grants your wish to know your monthly payment (EMI) before you even sign on the dotted line. That's the Home Loan EMI Calculator! But to truly wield its power, let's crack the code on a few key terms:

EMI (Equated Monthly Installment): The fixed amount you pay towards your loan every month, like a delicious bite-sized piece of your dream home pie.

Interest Rate: The cost of borrowing the money, like the sprinkles on your pie - some like it sweet, some prefer less!

So, how does this EMI magic work? Buckle up, we're going on a formula field trip!

The EMI Formula: P x R x (1 + R)n / ((1 + R)n - 1)

Don't faint! We'll break it down:

P: Loan amount - Your desired palace size.

R: Interest rate - Sweet or not-so-sweet sprinkles.

n: Loan tenure - How many years to savor your pie.

Steps to Master the EMI Spell:

1. Gather your Loan Details: Know your desired loan amount and preferred tenure.

2. Uncover the Interest Rate: Consult lenders or use online resources to compare rates.

3. Channel your Inner Mathematician: Plug your details into the formula, or use the magic of online EMI calculators.

4. Embrace the Amortization Schedule: This table unveils how your payments chip away at the principal and interest over time.

Beyond the EMI Spell:

1. Home Loan Insurance: Shield your loved ones with this protective charm.

2. Tax Benefits: Enjoy tax deductions on your EMIs - like finding extra sprinkles in your pocket!

3. Refinancing Options: If interest rates dip, consider recasting your spell for a sweeter deal.

Remember, SRG Housing, your friendly neighborhood housing finance wizards, are here to guide you through every step. We specialize in empowering the underserved to turn their dream homes into reality. Contact us today and let's unlock your EMI magic together!

We are committed to empowering individuals in rural and semi-urban areas of India to realize their dream of owning a home. Explore your possibilities with SRG Housing.

Visit www.srghousing.com to unlock your dream home's EMI magic!

#home loan emi calculator#Equated Monthly Installment#Interest rate#Loan amount#Loan tenure#EMI formula#Home loan insurance#Tax benefits#Refinancing options#SRG Housing#Housing finance

0 notes

Text

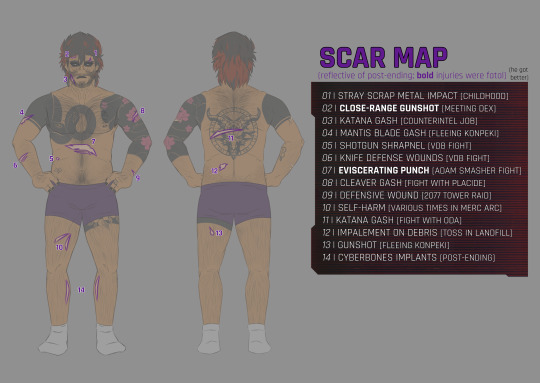

𝕍𝕀𝕂𝕋.

record manager, master of martial arts, bodyguard | mercenary, Arasaka agent

birth name: Victor André Montoya previous aliases: NC548082: Viper (corp designation) | V (mercenary tag (still goes by this by Us Cracks girls and when taking the stage with Kerry)) gender: male date of birth | birthplace: 2035 November 3 | Boise, Idaho signs: sun: Scorpio | moon: Aquarius | rising: Gemini heritage: Spanish (father is an immigrant from Spain) family: Andrés Montoya (father) | Emy Walsh (mother) | Johnny Silverhand (brother figure) | Rogue Amendiares (mother figure) | Mamá Welles (mother figure) sexuality: demigay spoken languages: English (fluent) | Japanese (fluent) | Spanish (relatively proficient) love interest: Kerry Eurodyne claims: voice: Default Male V, though a bit raspier and with a little country twang | singing voice: Lajon Witherspoon (Sevendust) | face: Miguel Angel Silvestre

physical build: 6'2" (188cm), a force to be reckoned with. Tall, muscular, and broad; easily fills an empty doorway. Upper torso and legs are especially sculpted from many years of vigorous training in swordsmanship and martial arts. Begins to plump up slightly in the tummy area after retiring from the merc life, though that musculature maintains thanks to frequent spars with Goro or Vik and morning exercises/jogs. hair: Black (natural color) with a red gradient that's more pronounced at the nape. Undercut. Usually slicked back--or is attempted to be, though it's hard to wrangle; locks tend to stray away. eyes: Sky blue naturally, though no longer applicable. Now bright off-white/pallid blue optic implants that pierces through darkness. Sclera are black and bold. Always framed by hard lines and heavy bags. cyberware: Kiroshi Optics Mk. III | Syn-Lungs | Pain Editor | Optical Camo | Memory Boost (defective) | R3APER behavioral chip (defective) - installed after Mikoshi: Blood Pump | Biomonitor (replacement) | Grafted Muscle & Muscle Lace in torso

personality: Analytical, callous, stubborn. Loyal to a fault, protective. Molded to be cold and calculating, off-putting to most as a result. Maintains a pretty solid, firm emotional wall, though behind it is someone a bit romantic, sarcastic, snarky and humorous. He was one of Arasaka's most treasured weapons, notorious for how efficient and vicious he was; when he has a job to do, he gets it done... no matter what that entails. It's rumored that he becomes the Reaper itself... likes: thunderstorms | listening to Kerry practice | fresh coffee | blaring phonk out of the open windows of his car | gin--straight dislikes: early meetings... or, frankly, meetings in general | migraines/feeling ill | being forced to socialize with strangers | clutter

notable game choices: Didn't decrypt shard from Meredith, didn't warn Maelstrom. Kept Evelyn's involvement from Dex. Sent Jackie to his family. Became friends with Johnny. Didn't side with the Voodoo Boys, eliminated them. Spared Oda. Saved Goro Takemura. Told Jefferson the truth of his condition. Tattoo choice: Together Forever. (Don't Fear) the Reaper ending, though heavily modified. Returned to body.

30 notes

·

View notes

Text

SBI Personal Loan EMI Calculator

There are many online EMI (Equated Monthly Installment) calculators available that can help you determine the monthly payments for a loan or mortgage. To use one, you can follow these general steps:

Open your web browser and go to a search engine like Google. In the search bar, type "serviceplusemi.com" and press Enter.

2 notes

·

View notes

Text

#accounting#branding#commercial#economy#finance#investing#business#ecommerce#entrepreneur#founder#loans#emi#banking#india#indian#india love#mumbai#delhi#hyderabad

3 notes

·

View notes

Text

Best EMI Calculator for Personal Loan in India – Find Your Ideal Repayment Plan

In today’s fast-paced digital world, choosing the Best EMI calculator for personal loan in India is essential for anyone seeking financial clarity before applying for a loan. Whether you're salaried, self-employed, or a freelancer, calculating your monthly obligations in advance can help you make smarter financial decisions.

An EMI (Equated Monthly Installment) calculator is a free online tool that helps borrowers estimate how much they will need to repay every month, based on the loan amount, interest rate, and tenure. It also breaks down each EMI into principal and interest components, giving full transparency to the repayment structure.

Why Use an EMI Calculator for Personal Loans in India?

✔️ Instant results based on current interest rates

✔️ Helps plan budget before taking a loan

✔️ Includes options to simulate prepayments and see their impact

✔️ Works with all loan amounts and durations

✔️ Supports real-time updates and amortization tables

Using the Personal loan EMI calculator India 2025, you can compare various loan offers available from banks, NBFCs, and fintech platforms. Many platforms also include a personal loan interest rates comparison chart India 2025, which lets you analyze rates side-by-side before making a decision.

If you're planning to repay your loan earlier than the scheduled term, then opt for an online personal loan EMI calculator with prepayment option. This feature shows how much you can save on interest by making a lump sum payment before your tenure ends.

Top Benefits of Using an EMI Calculator:

Saves time by eliminating manual calculations

Avoids surprises by showing the full cost of borrowing

Lets you customize variables for different loan plans

Works across devices—laptop, tablet, or mobile

Finding the right tool means ensuring it is accurate, updated, user-friendly, and includes flexible options like prepayment simulation and multiple interest rate inputs.

Key Features to Look For:

Real-time rate updates

Clean and responsive interface

Graphical amortization charts

Prepayment and part-payment modules

Loan comparison support

Choose wisely and use the Best EMI calculator for personal loan in India to take full control of your financial future.

#BestEMICalculatorIndia#PersonalLoanEMICalculator2025#LoanRepaymentIndia#LoanInterestCalculator#CompareLoanEMIs#FinancialToolsIndia#OnlineLoanCalculator#loans#fast cash loans online#banking#insurance#student loans#personal loans#home loans#dsa loan agent#finance#business

0 notes

Text

Is IVF Accessible for Everyone? Discussing Affordability & Inclusion

Becoming a parent is a dream for many. But for some, it doesn’t happen easily. If you're having trouble getting pregnant, in vitro fertilization (IVF) is a medical option that can help you conceive. It has given hope to millions. But one big question remains: Is IVF something everyone can afford and access? This blog explores that question.

What is IVF and Why Do People Choose It?

IVF stands for In Vitro Fertilization. IVF entails taking a woman's eggs and a man's sperm and allowing them to fertilize outside the human body. After successful fertilization, the developed embryo is placed back into the woman's womb.

Many people choose IVF when:

The woman has blocked fallopian tubes

The man has low sperm count or quality

The couple faces unexplained infertility

The woman is above 35 years old and natural pregnancy becomes harder

Couples are of the same gender or single parents by choice

How Much Does IVF Cost in India?

In India, the average cost of one IVF cycle can be between ₹1,20,000 to ₹2,50,000. In some cities or special cases, it might even go higher.

What Does This Cost Cover?

Doctor consultation

Hormone injections to stimulate egg growth

Ultrasound and blood tests

Egg retrieval (taking eggs out of the ovaries)

Lab fertilization process

Embryo transfer into the uterus

Pregnancy test after embryo transfer

Sometimes, more than one cycle is needed. This can make IVF more expensive.

What Makes IVF More Expensive?

Advanced Techniques: Using ICSI (injecting sperm into an egg), PGT (genetic testing), or assisted hatching.

Egg or Sperm Donor: If a couple needs a donor, it adds to the cost.

Embryo Freezing: Some couples freeze extra embryos for future use.

Surrogacy: If the woman cannot carry the baby, a surrogate is needed.

Is IVF Affordable for All?

For many families, IVF costs can feel heavy. Traditionally, most health insurance policies in India did not cover IVF expenses. That means people pay from their own pocket. But now, some clinics try to help:

Offering easy monthly installment (EMI) plans

Giving all-inclusive packages for one price

Providing free first consultation

Having cost calculators on their websites

Running awareness and subsidy programs

Does Everyone Have Equal Access to IVF?

Access is not the same for everyone. People living in big cities like Ahmedabad, Mumbai, or Delhi have more IVF centers. But those in villages or small towns may need to travel far.

Also, not all people are treated equally. Some face challenges because of:

Their economic condition

Their marital status

Their sexual orientation

Lack of family support

Good News: IVF is Becoming More Inclusive

Times are changing. More clinics are opening doors to:

Single adults on their journey to becoming parents

LGBTQ+ couples looking for fertility options

People with health conditions like cancer survivors who froze their eggs earlier

Working couples who need flexible appointments

These steps are making IVF more inclusive for all kinds of families.

How Eye and IVF Hospital Supports Accessibility

Eye and IVF Hospital in Ahmedabad is committed to making IVF more affordable and inclusive. Here’s how:

Transparent pricing with no hidden charges

Receive a treatment plan that's just right for you, considering your health and your budget

Free first consultation and expert counseling

Availability of financial planning support and EMI options

Trained doctors who understand the emotional and physical journey of infertility

Serving people from Ahmedabad, Gandhinagar, and nearby areas with easy access

Their team ensures that every couple or individual receives equal respect, support, and attention throughout the fertility journey.

Government Schemes and NGO Help

While India is still working on offering public support for IVF, some non-profit groups and government hospitals are starting to:

Offer low-cost IVF

Create awareness programs

Promote early fertility health checks

Build mobile clinics to reach rural areas

These efforts help bridge the gap for people who could not otherwise afford or access treatment.

Conclusion: IVF Should Be for Everyone

IVF is not just science—it’s a chance at life, a chance to hold a baby and call it your own. But cost, location, and societal attitudes still stop many people from choosing it. Making IVF more affordable and inclusive is not just a medical task, but a social responsibility. With better awareness, more support, and caring hospitals like Eye and IVF Hospital, more people can chase the dream of parenthood—without fear or judgment.

0 notes

Text

emi education loan calculator:- Financial planning for education with Auxilo's EMI education loan calculator. Calculate EMIs effortlessly, assess repayment options, and make well-informed decisions about your educational financing.

Visit:-

1 note

·

View note

Text

How to Choose the Right Solar Panels for Your Home in Hyderabad

As the demand for renewable energy continues to rise, more homeowners in Hyderabad are turning to solar power. With abundant sunshine throughout the year, Hyderabad offers ideal conditions for solar energy generation. However, choosing the right solar panels for your home in Hyderabad can be challenging if you don’t know where to start. From efficiency and durability to pricing and installation, several factors must be considered before making an informed decision.

In this article, we guide you through the essential steps to help you choose the perfect solar solution for your home.

1. Understand Your Home's Energy Needs

Before selecting a solar panel system, assess your household’s average electricity consumption. Review your past electricity bills to determine your monthly and yearly usage. A typical Indian household consumes anywhere between 200 and 500 units of electricity per month, depending on usage patterns and appliances.

By knowing how much energy you use, you can calculate how many solar panels you'll need to meet your daily requirements without overspending.

2. Choose the Right Type of Solar Panel

There are mainly two types of solar panels commonly used in residential setups:

Monocrystalline Solar Panels: These are highly efficient and ideal for homes with limited roof space. They work well in high-temperature conditions like Hyderabad.

Polycrystalline Solar Panels: Slightly less efficient than monocrystalline but more cost-effective. These are suitable if you have ample rooftop area.

If you’re installing solar panels for home in Hyderabad, monocrystalline panels might be a better option due to their higher efficiency and better performance in hot climates.

3. Evaluate Panel Efficiency and Durability

Solar panel efficiency refers to how well a panel converts sunlight into electricity. Higher efficiency panels may cost more initially but can generate more power in the same space.

Also, consider the durability and warranty of the panels. Most quality panels come with a 25-year performance warranty. Since Hyderabad experiences intense summer heat, choose panels that are weather-resistant and certified for high-temperature operation.

4. Compare Solar Panel Price in Hyderabad

One of the most important considerations is the solar panel price in Hyderabad. The cost can vary depending on the brand, capacity (kW), panel type, and installation services.

As of 2025, solar panel systems for homes typically cost around ₹40,000 to ₹55,000 per kW (including installation and GST).

A 3 kW system (sufficient for small to medium homes) can cost approximately ₹1.2 to ₹1.5 lakh.

Some companies also offer EMI options and government subsidies, especially for rooftop solar installations.

Always compare quotes from multiple vendors and check for hidden charges in installation, wiring, or after-sales service.

5. Choose a Trusted Solar Provider in Hyderabad

When installing solar panels for home in Hyderabad, it’s essential to choose a reliable solar company with a good track record. Look for installers who offer:

Site inspection and custom design

Transparent pricing

Installation by certified professionals

After-sales service and AMC (Annual Maintenance Contract)

Ask for references or reviews from previous customers in Hyderabad to gauge their service quality.

6. Check Government Subsidies and Net Metering

The Indian government, through the Ministry of New and Renewable Energy (MNRE), offers subsidies for residential rooftop solar systems. Check with your installer if your system qualifies for the subsidy.

Additionally, Hyderabad homes can benefit from net metering, which allows you to sell excess electricity back to the grid and reduce your power bill even further.

Conclusion

Choosing the right solar panels can significantly reduce your electricity bills and your carbon footprint. By considering your energy needs, comparing the solar panel price in Hyderabad, and partnering with a trustworthy installer, you can enjoy a hassle-free and efficient solar experience.

If you’re ready to go green, now is the perfect time to invest in solar panels for home in Hyderabad—where the sun works for you all year round.

#solar panels for home in Hyderabad#solar power in Hyderabad#solar panel installation in Hyderabad#solar panel price in Hyderabad

1 note

·

View note

Text

Take Control of Your Home Loan with Smart EMI Planning

Take control of your financial future with smart EMI planning using the powerful tools provided by Loan Quantum. Whether you're purchasing your first home or investing in a second property, it’s essential to understand your repayment capacity in advance. The Home Loan EMI Calculator helps you estimate your monthly installments accurately based on the loan amount, interest rate, and tenure. By using this tool, you gain a clear understanding of your financial obligations, allowing you to plan your budget more effectively. With Loan Quantum, you’re empowered to make informed decisions, minimize risks, and select a repayment strategy that supports your long-term financial goals.

0 notes

Text

Solar Installation Nawada / Gaya: Powering Bihar Homes with Clean Energy

As the demand for renewable energy rises across India, Bihar is witnessing a strong shift toward solar power—especially in regions like Nawada and Gaya. With increasing electricity costs and growing awareness about sustainable living, homeowners and businesses are now actively exploring solar energy solutions. If you're searching for reliable and cost-effective solar installation in Nawada or Gaya, Ghar Ghar Solar is here to lead the way.

Why Go Solar in Nawada and Gaya?

Nawada and Gaya receive ample sunlight throughout the year, making them ideal for rooftop solar panel setups. By switching to solar, you not only reduce electricity bills but also contribute to a cleaner environment. Solar energy is especially beneficial for households and commercial setups in semi-urban and rural Bihar, where power cuts and high tariffs are common concerns.

Ghar Ghar Solar – Your Local Solar Expert

Ghar Ghar Solar offers affordable, efficient, and hassle-free solar installation in Nawada and Gaya. Whether you're a homeowner, shopkeeper, or run a small-scale business, our tailored solar solutions are designed to match your energy needs and budget.

Affordable solar installation in Nawada with Ghar Ghar Solar Our expert team ensures cost-effective rooftop systems with quality components and installation services. Benefit from subsidy support and EMI options that make solar adoption easier than ever.

Calculate your solar savings for Gaya homes here Curious about how much you can save by going solar? Use Ghar Ghar Solar’s easy online calculator to estimate your monthly and yearly savings based on your current electricity usage.

Book a rooftop survey for solar setup in Nawada or Gaya Start your solar journey with a free onsite survey. Our team will assess your rooftop, recommend the optimal system size, and guide you through the entire installation process.

Key Services Offered by Ghar Ghar Solar

Free solar consultations and surveys

Customized rooftop solar systems

Government subsidy and documentation support

On-time installation by certified professionals

System monitoring and maintenance support

Solar Benefits for Nawada & Gaya Residents

Lower electricity bills by up to 90%

Increase in property value

Reduce dependence on grid electricity

Access to net metering and state subsidies

Long-term savings with low maintenance

Conclusion

Solar energy is the future—and it’s already making a big impact in Nawada and Gaya. With Ghar Ghar Solar as your trusted partner, transitioning to clean energy is now simpler and more affordable. Take the first step toward sustainable living today.

Affordable solar installation in Nawada with Ghar Ghar Solar

Calculate your solar savings for Gaya homes here

Book a rooftop survey for solar setup in Nawada or Gaya

0 notes

Text

Simplifying Financial Planning with EMI and SIP Calculators

Though often daunting, managing money becomes much simpler with the right tools, helping individuals make informed decisions. The EMI Calculator and the SIP Calculator are two essential financial tools that can greatly assist in this process. These calculators help users plan and manage their finances by offering a clear picture of their financial commitments, empowering them to take control. Understanding how these calculators work is crucial for anyone looking to manage debts or invest in mutual funds. Understanding the EMI Calculator Functionality An EMI Calculator is designed to help individuals determine their Equated Monthly Installments (EMIs) on loans. Whether it's a personal loan, auto loan, or home loan, the EMI Calculator gives a clear estimate of the monthly installment amount. It calculates the EMI based on factors such as the loan amount, interest rate, and loan tenure. This tool enables users to quickly assess how much they will need to pay each month, allowing for better budgeting and planning. How the SIP Calculator Helps Investors For those looking to invest in mutual funds through Systematic Investment Plans (SIPs), the SIP Calculator is a powerful tool. SIPs make investing more accessible by allowing individuals to contribute a fixed amount regularly to a mutual fund of their choice. Based on factors such as the monthly contribution, expected rate of return, and investment duration, the SIP Calculator helps forecast potential investment returns. This gives investors a clearer understanding of how their investments may grow over time and allows them to set realistic financial goals. Benefits of Using an EMI Calculator The EMI Calculator offers several benefits, especially for loan applicants. It allows individuals to compare multiple loan options to find the most suitable one for their financial condition. It also enables users to adjust the loan tenure or interest rate to see how these changes affect monthly payments. This flexibility helps borrowers make informed decisions regarding loan repayments. Additionally, by eliminating the need for complex manual calculations, the EMI Calculator simplifies the entire loan process, saving time and effort. Maximizing Returns with the SIP Calculator Similarly, the SIP Calculator helps investors maximize returns by showing how their regular contributions compound over time. In addition to estimating potential returns based on monthly contributions and expected interest rates, it illustrates thepower of compounding. For anyone serious about long-term wealth creation, the SIP Calculator is an essential tool, as the interest accrued over time can significantly boost the total investment value. By regularly investing in SIPs and tracking their progress using this calculator, investors can stay on course to achieve their financial goals. Managing Debt and Investments Effectively with These Calculators Both the EMI and SIP Calculators play crucial roles in helping individuals manage their financial responsibilities effectively. While the EMI Calculator assists in tracking and managing loan repayments, the SIP Calculator helps monitor and plan investments. Utilizing these tools not only improves financial discipline but also supports smart decision-making around loans and investments. Balancing debt and investment strategically ensures financial stability and growth, enabling individuals to reach their goals with ease. Conclusion In conclusion, personal financial management heavily relies on tools like the SIP Calculator and the EMI Calculator. For more detailed insights and resources on using these tools effectively, visit agssl.in. Whether you're planning for a loan or investing for the future, these calculators provide the clarity needed to make informed decisions and ensure long-term financial well-being.

more for info:- calculating cagr online mastering trading cagr calc hdfc cagr calculator

0 notes

Text

How to Choose the Right AC Dealer in Ahmedabad for Your Home or Office

Mitsubishi AC dealers in Ahmedabad who offer genuine products, expert advice, and dependable service? Whether you're outfitting your home or upgrading your office cooling system, choosing the right air conditioner dealer is essential. At S A Air Conditioning, customers in Ahmedabad get access to the latest Mitsubishi air conditioners, including energy-efficient inverter models and powerful split ACs. From transparent pricing and professional installation to excellent after-sales service, they offer a complete solution under one roof. Visit their Mitsubishi AC showroom in Ahmedabad to explore top-rated models and experience unmatched customer service. When you're ready to buy Mitsubishi AC in Ahmedabad, make sure you're choosing a dealer that delivers value, reliability, and long-term support.

Understanding the Importance of a Reliable AC Dealer

Choosing the right air conditioner is just one part of the equation — the more critical factor is selecting a reliable AC dealer who can offer genuine products, expert advice, and trustworthy services . Especially in Ahmedabad, where the summer heat can be unbearable, having a dependable air conditioning system for your home or office is a must. When you decide to buy Mitsubishi AC Ahmedabad, the dealer you choose can significantly impact your experience — from selecting the right model to enjoying consistent after-sales service.

Wide Range of AC Options to Match Your Needs

One of the key advantages of working with top Mitsubishi AC dealers inAhmedabad is the availability of a wide range of models. Whether you're looking for a powerful air conditioner for your office or a compact and stylish unit for your bedroom, a professional dealer will have various options readily available. Products like the Mitsubishi split AC Ahmedabad are ideal for individual rooms, while the Mitsubishi inverter AC Ahmedabad range is perfect for energy-efficient and silent operation. A reliable dealer ensures that you can compare features, cooling capacities, and energy ratings before making a purchase.

Expert Advice Makes the Difference

It’s not just about selling the product — a good dealer takes the time to understand your requirements and recommends the most suitable unit accordingly. At a professional Mitsubishi AC showroom Ahmedabad, you'll find staff who are knowledgeable about different models, their ideal use cases, and how to calculate the correct tonnage based on room size. Their guidance is invaluable, especially for first-time buyers or those upgrading from older systems. This customer-first approach ensures you don't just buy any AC — you buy the right one.

Transparent Pricing and Affordability

Affordability plays a major role in choosing the right AC dealer. A trusted dealer will always maintain price transparency, explaining installation costs, optional add-ons, warranty inclusions, and any promotional offers available. When you look for an affordable Mitsubishi AC in Ahmedabad, you should never have to sacrifice quality for cost. The best dealers often provide great deals, EMI options, and festive discounts — helping you get value without hidden charges. Clear and upfront pricing builds trust and helps you plan your budget efficiently.

After-Sales Service You Can Rely On

The service you receive after buying the AC is just as important as the purchase itself. An experienced dealer will typically have their own Mitsubishi AC service center Ahmedabad or work closely with authorized service providers. This ensures timely installation, annual maintenance, emergency repairs, and the availability of genuine spare parts. Consistent service keeps your Mitsubishi air conditioners Ahmedabad running at peak efficiency and increases their lifespan. When a dealer provides hassle-free service and fast support, you know you're in safe hands.

Trust, Reviews, and Reputation

Before choosing a dealer, it’s always a good idea to check their reviews, reputation, and years of experience. A well-reviewed dealer in Ahmedabad is likely to offer better service, more product knowledge, and professional conduct throughout the process. Customer testimonials reveal how dealers handle everything — from inquiries and deliveries to installations and support. A great local reputation is often earned by delivering consistent, trustworthy service and ensuring complete customer satisfaction. That's why it's wise to rely on word of mouth and online reviews when deciding where to buy Mitsubishi AC Ahmedabad.

Your One-Stop Destination for Cooling Solutions If you're looking for all these qualities in one place, SA Air Conditioning is among the best Mitsubishi AC dealer Ahmedabad has to offer. With an impressive selection of Mitsubishi air conditioners Ahmedabad customers trust, they bring together product variety, affordability, expert advice, and exceptional after-sales service — all under one roof. Whether it’s a Mitsubishi split ACAhmedabad unit for your home or a commercial cooling solution, they make the buying process seamless and stress-free.

Conclusion: Choose Smart, Stay Cool

In a city like Ahmedabad, investing in a reliable air conditioning system is not optional — it’s essential. But beyond just choosing a quality brand, selecting the right dealer ensures you get expert advice, affordable pricing, and dependable service for years to come. The right AC dealer will help you every step of the way — from choosing the ideal Mitsubishi inverter AC Ahmedabad to ensuring smooth installation and ongoing support. Make a smart choice and stay cool all year round with the help of a trusted AC partner like S A Air Conditioning.

Ready to enjoy premium cooling comfort with a trusted dealer? Don’t wait! Reach out to S A Air Conditioning today to get expert help selecting the perfect Mitsubishi AC for your home or business. Whether you need a Mitsubishi inverter AC Ahmedabad, a classic split AC, or reliable servicing, they have you covered. Call Now: + 91-968-7675-771 or Email: [email protected]

#Mitsubishi AC dealers in Ahmedabad#Mitsubishi air conditioners Ahmedabad#buy Mitsubishi AC Ahmedabad#Mitsubishi AC showroom Ahmedabad#Mitsubishi split AC Ahmedabad#Mitsubishi inverter AC Ahmedabad#best Mitsubishi AC dealer Ahmedabad#Mitsubishi AC service center Ahmedabad

0 notes

Text

0 notes

Text

Everything You Need to Know About Debt Consolidation in India

Introduction

Especially when juggling several interest rates, payment dates, and lenders, managing several debts can be taxing and perplexing. For those trying to streamline their financial responsibilities, debt consolidation is becoming a really popular fix in India. It aggregates several loans under one, presumably with better terms and a reduced interest rate. This page investigates debt consolidation in India, its advantages, and when it could be the best choice for you.

What Is Debt Consolidation?

Combining several outstanding debts—such as credit card debt, personal loans, or payday loans—into one loan is made possible by debt consolidation as a financial plan. Usually at a cheaper interest rate, you repay one consolidated loan instead of juggling several installments every month. This can assist your monthly payments be more reasonable and aid to lower your whole financial load.

How Debt Consolidation Works in India

Debt consolidation in India usually entails paying off all of your current loans by means of a personal loan, top-up loan, or secured loan—that is, a loan against property. Offering these services are banks, NBFCs, and digital lenders. You will have to send evidence including credit records, loan bills, pay stubs, and identification verifications. Once accepted, you can pay back just the new loan and close all outstanding high-interest debt using the money.

Benefits of Debt Consolidation

Debt consolidation offers primarily simplicity as its benefit. Tracking several EMIs is significantly more difficult than managing one loan. Should the new loan arrive at a reduced rate, it could also help you minimise your interest load. Timeliness in repayments helps your credit score to rise too. When handling personal funds, it provides generally improved control and peace of mind.

Types of Debt That Can Be Consolidated

One can apply debt consolidation to several secured and unsecured loans. These cover personal loans, consumer durable loans, payday loans, credit card liabilities, even corporate loans. Simplifying your financial life requires grouping all of them under one roof.

Best Options for Debt Consolidation in India

Consolidation can be aided with several financial instruments. Balance transfer credit cards let you move your debts for a limited period to a low-interest or zero-interest card. The most often chosen option because of its adaptability are personal loans. If you can pledge assets, borrowing against gold or property offers reduced rates. One other handy choice are top-up loans from your current lender.

Things to Consider Before Consolidating Debt

Although debt consolidation has benefits, you should consider the whole cost of the new loan—including interest rates and processing fees. See if you over time are saving money. Know prepayment policies, and exercise caution if you intend to extend the payback period since this will cause more interest paid over time.

When Debt Consolidation May Not Be a Good Idea

Not always the best fix is debt consolidation. Should your spending patterns remain the same, you may find yourself in even greater debt. Should the new loan's overall cost or rate be larger than those of your existing debt, it could aggravate your circumstances. Moreover, you might not be eligible for good conditions if your credit score is low.

How to Choose the Right Consolidation Method

Always check several lenders and consolidation choices. Review interest rates, term, fees, and flexibility. Plan your repayments using EMI calculators, and review and rate the lender to verify their credibility. If not sure, before moving forward see a qualified financial advisor.

Conclusion

In India, debt consolidation provides a methodical approach for recovering financial control. Replacing several high-interest loans with a single reasonable loan will help you to simplify repayments and maybe save money. Still, you should evaluate your financial behaviour, weigh alternatives, and move deliberately. A tool rather than a cure, debt consolidation should be used carefully with a good repayment schedule in place.

0 notes