#ESG compliance consultants

Text

Environmental, Social, and Governance (ESG) Compliance for SMBs: A Strategic Necessity

Learn how ESG compliance consultants help SMBs navigate evolving regulations, manage risks, and build scalable ESG frameworks to ensure sustainable growth and stakeholder trust. Go here https://justpaste.it/esg-compliance-consultants

0 notes

Text

#ESG Consultant#environmental consulting firms#environmental compliance audit#environmental consultant#environmental consultants

0 notes

Text

The Ultimate Guide to ESG Investing: Strategies and Benefits

Socio-economic and environmental challenges can disrupt ecological, social, legal, and financial balance. Consequently, investors are increasingly adopting ESG investing strategies to enhance portfolio management and stock selection with a focus on sustainability. This guide delves into the key ESG investing strategies and their advantages for stakeholders.

What is ESG Investing?

ESG investing involves evaluating a company's environmental, social, and governance practices as part of due diligence. This approach helps investors gauge a company's alignment with humanitarian and sustainable development goals. Given the complex nature of various regional frameworks, enterprises and investors rely on ESG data and solutions to facilitate compliance auditing through advanced, scalable technologies.

Detailed ESG reports empower fund managers, financial advisors, government officials, institutions, and business leaders to benchmark and enhance a company's sustainability performance. Frameworks like the Global Reporting Initiative (GRI) utilize globally recognized criteria for this purpose.

However, ESG scoring methods, statistical techniques, and reporting formats vary significantly across consultants. Some use interactive graphical interfaces for company screening, while others produce detailed reports compatible with various data analysis and visualization tools.

ESG Investing and Compliance Strategies for Stakeholders

ESG Strategies for Investors

Investors should leverage the best tools and compliance monitoring systems to identify potentially unethical or socially harmful corporate activities. They can develop customized reporting views to avoid problematic companies and prioritize those that excel in ESG investing.

High-net-worth individuals (HNWIs) often invest in sustainability-focused exchange-traded funds that exclude sectors like weapon manufacturing, petroleum, and controversial industries. Others may perform peer analysis and benchmarking to compare businesses and verify their ESG ratings.

Today, investors fund initiatives in renewable energy, inclusive education, circular economy practices, and low-carbon businesses. With the rise of ESG databases and compliance auditing methods, optimizing ESG investing strategies has become more manageable.

Business Improvement Strategies

Companies aiming to attract ESG-centric investment should adopt strategies that enhance their sustainability compliance. Tracking ESG ratings with various technologies, participating in corporate social responsibility campaigns, and improving social impact through local development projects are vital steps.

Additional strategies include reducing resource consumption, using recyclable packaging, fostering a diverse workplace, and implementing robust cybersecurity measures to protect consumer data.

Encouraging ESG Adoption through Government Actions

Governments play a crucial role in educating investors and businesses about sustainability compliance based on international ESG frameworks. Balancing regional needs with long-term sustainability goals is essential for addressing multi-stakeholder interests.

For instance, while agriculture is vital for trade and food security, it can contribute to greenhouse gas emissions and resource consumption. Governments should promote green technologies to mitigate carbon risks and ensure efficient resource use.

Regulators can use ESG data and insights to offer tax incentives to compliant businesses and address discrepancies between sustainable development frameworks and regulations. These strategies can help attract foreign investments by highlighting the advantages of ESG-compliant companies.

Benefits of ESG Investing Strategies

Enhancing Supply Chain Resilience

The lack of standardization and governance can expose supply chains to various risks. ESG strategies help businesses and investors identify and address these challenges. Governance metrics in ESG audits can reveal unethical practices or high emissions among suppliers.

By utilizing ESG reports, organizations can choose more responsible suppliers, thereby enhancing supply chain resilience and finding sustainable companies with strong compliance records.

Increasing Stakeholder Trust in the Brand

Consumers and impact investors prefer companies that prioritize eco-friendly practices and inclusivity. Aligning operational standards with these expectations can boost brand awareness and trust.

Investors should guide companies in developing ESG-focused business intelligence and using valid sustainability metrics in marketing materials. This approach simplifies ESG reporting and ensures compliance with regulatory standards.

Optimizing Operations and Resource Planning

Unsafe or discriminatory workplaces can deter talented professionals. A company's social metrics are crucial for ESG investing enthusiasts who value a responsible work environment.

Integrating green technologies and maintaining strong governance practices improve operational efficiency, resource management, and overall profitability.

Conclusion

Global brands face increased scrutiny due to unethical practices, poor workplace conditions, and negative environmental impacts. However, investors can steer companies towards appreciating the benefits of ESG principles, strategies, and sustainability audits to future-proof their operations.

As the global focus shifts towards responsible consumption, production, and growth, ESG investing will continue to gain traction and drive positive change.

5 notes

·

View notes

Text

ESG Consultancy In Dubai | ESG Investment Management

AJMS Global is a boutique consulting firm specializing in providing niche consulting proposition to its clients in the area of Tax, Risk, Compliance, IFRS advisory and Digital Transformation Advisory.

#esg consultancy in dubai#esginvestmentmanagement#esg analyst#tax managed services#esg consulting firms#esg data providers#data management strategy

2 notes

·

View notes

Text

Welcome to Vastasys: Elevate Your Business with Dynamics 365

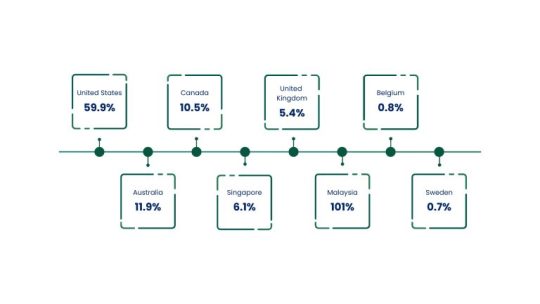

🚀At Vastasys, we specialize in harnessing the power of Microsoft Dynamics 365 to drive efficiency and growth for businesses across Canada, the US, and Europe.

Since 2013, our cost-effective solutions and expert consulting services have helped companies enhance productivity, improve customer engagement, and accelerate sales cycles. Discover how we can transform your business today!

Explore Our Dynamics 365 Solutions

Dynamics 365 for Small & Medium Businesses (SMBs) 🌟

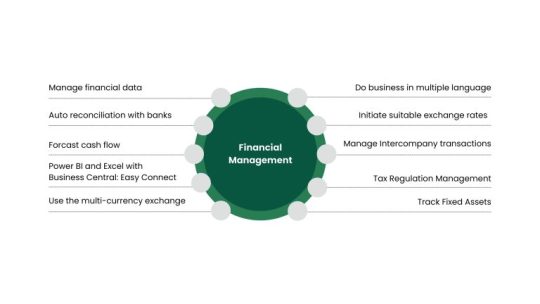

Business Central: Streamline your operations with a unified system that integrates finance, sales, service, and operations into one seamless solution.

Ideal for SMBs looking to boost efficiency and accuracy. Explore more about our solutions and services on our website Vastasys.

Uncover Insights with Dynamics 365 Customer Insights 📊

Customer Insights: Gain a deeper understanding of customer behaviors and preferences. Use Copilot for personalized content, lead nurturing, and compliance with privacy regulations to make informed decisions.

Accelerate Sales with Dynamics 365 Sales 🚀

Sales: Enhance your sales processes with automation, real-time insights, and advanced AI. Improve customer interactions and speed up your sales cycles with our cutting-edge tools.

Transform Customer Service with Dynamics 365 🛠️

Customer Service: Deliver exceptional customer support with optimized operations and automated workflows. Empower your team to handle every customer interaction efficiently.

Optimize Financial Operations with Dynamics 365 Finance 💰

Finance: Automate and digitize your financial processes to boost productivity, enhance decision-making, and reduce your ESG footprint. Our solution provides comprehensive financial management.

Enhance Field Service Management with Dynamics 365 ⚙️

Field Service: Improve service delivery with AI-powered field service management. Optimize your operations and enhance the efficiency of your field service teams.

Why Choose Vastasys?

Our Cost-Effective Blended Model 💡

Benefit from our unique approach that combines onsite and offsite resources. Our blended cost model ensures:

Top-Quality Solutions

Affordable Pricing

Rapid Delivery

Smooth Communication

Dedicated Project Managers

This model delivers the best value and performance for your investment.

Our Comprehensive Service Offerings

Seamless Implementation 🚀

We offer a full suite of implementation services for Microsoft Dynamics CRM, including strategy development, data management, security, and integration with your existing systems.

Smooth Upgradation 🔄

Transition effortlessly from legacy systems to Dynamics 365. Our upgradation services ensure minimal disruption and lower maintenance costs.

Tailored Customization 🎨

Customize Dynamics 365 to fit your unique business needs. Our services include secure data transfer, custom entities, functions, workflows, and branded UI to enhance performance and scalability.

Expert Training and Support 🎓

Ensure your team is fully equipped to use Dynamics 365 with our comprehensive training and support services. We provide ongoing assistance to address any issues and maximize your investment.

Grow Your Business with Vastasys

Analyze & Design 🔍

We start by understanding your specific needs and challenges to design a solution tailored to your business goals.

Develop & Deploy ⚙️

Our development and deployment process ensures that your Dynamics 365 solution is implemented effectively and aligns with your operational requirements.

Continuous Training & Support 💬

Ongoing training and support keep your team skilled and ready to utilize Dynamics 365 efficiently, ensuring smooth operations.

Get in Touch

Address: 1001 1st St SE, Calgary AB, T2G 5G3

For more information or to schedule a consultation, visit our Contact Us page.

Explore how Vastasys can elevate your business with Microsoft Dynamics 365. Partner with us to achieve greater efficiency and success! 🌟

#Dynamics365#MicrosoftDynamics#microsoft dynamics 365 consultant#dynamics crm consulting services#dynamics 365 customer insights#microsoft dynamics 365 support services

1 note

·

View note

Text

SUSTAINABILITY REPORT CONSULTANT

In the contemporary business environment, sustainability has shifted from being a mere buzzword to an integral constituent of corporate strategy. Organizations increasingly prioritize environmental, social, and governance (ESG) factors, so the demand for detailed and accurate sustainability reporting has surged. This is where a Sustainability Report Consultant comes into play, offering critical expertise in shaping, crafting, and giving sustainability reports that align with global standards and stakeholder expectations.

The Growing Importance of Sustainability Reporting

Sustainability reporting has become more than just a regulatory requirement; it is now a strategic tool that reflects a company's commitment to responsible practices and transparent governance. It provides stakeholders—from investors and customers to employees and regulators—with insights into the company's environmental impact and social aids, and governance practices.

A well-prepared sustainability report enhances corporate credibility, fosters trust, and can significantly impact a company's reputation and market performance. This makes the role of a Sustainability Bang Consultant crucial in ensuring that reports are comprehensive, accurate, and strategically aligned with the company's goals and stakeholder expectations.

What Does a Sustainability Report Consultant Do?

A Sustainability Report Consultant is an expert who assists organizations in developing and presenting their sustainability reports. This role involves several key responsibilities:

Understanding and Alignment: The consultant begins by understanding the company's operations, goals, and stakeholder expectations. This includes deep diving into the company's sustainability practices and reporting standards.

Framework and Standards: Sustainability Report Consultants are well-versed in various reporting frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). They help organizations choice the most appropriate framework that aligns with their sustainability goals and industry requirements.

Data Collection and Analysis: Accurate data is crucial for a credible sustainability report. Consultants guide companies in collecting and analyzing relevant data related to their environmental impact, social practices, and governance issues.

Report Development: With the data in hand, the consultant assists in drafting and structuring the sustainability report. This includes writing explicit and engaging content that accurately reproduces the company's performance and strategies while adhering to the chosen reporting standards.

Stakeholder Engagement: Engaging with stakeholders is vital to address their concerns and expectations. Consultants help integrate stakeholder feedback into the report and ensure that the report communicates effectively with its intended audience.

Compliance and Verification: Ensuring the report meets all regulatory requirements and industry standards is another dangerous task. A Sustainability Report Consultant often collaborates with third-party verification services to provide credibility and assurance.

The Benefits of Hiring a Sustainability Report Consultant

Expertise and Knowledge: Sustainability reporting involves complex standards and frameworks that require specialized knowledge. A consultant brings expertise in these areas, ensuring the report is compliant and strategically effective.

Efficiency and Focus: Developing a sustainability report can be time-consuming. By hiring a consultant and companies can emphasis on their core business activities while the consultant handles report preparation and presentation intricacies.

Enhanced Credibility: A professionally prepared report, guided by a consultant, enhances the credibility and reliability of the information presented. This is crucial for maintaining trust with stakeholders and meeting regulatory requirements.

Improved Communication: Consultants are skilled in translating complex data into clear and compelling narratives. This recovers the overall readability and impact of the sustainability report.

Strategic Insights: Beyond reporting, consultants offer valuable insights into how sustainability practices can be enhanced and aligned with corporate strategy, providing a roadmap for future initiatives.

Choosing the Right Sustainability Report Consultant

Selecting the right consultant is pivotal for achieving effective and impactful sustainability reporting. Here are some factors to consider:

Experience and Track Record: Look for consultants with a proven track record in sustainability reporting, especially within your industry.

Knowledge of Standards: Ensure the consultant is knowledgeable in your business's reporting frameworks and standards.

Consultative Approach: The consultant should adopt a consultative approach, working closely with your team to understand your sole needs and objectives.

Reputation and References: Check the consultant's reputation and seek references from previous clients to gauge their reliability and effectiveness.

Cost vs. Value: While cost is a factor and the value provided by the consultant in terms of expertise and quality of reporting should be the primary consideration.

Conclusion

In an era where sustainability is integral to business success, the role of a Sustainability Report Consultant is more critical than ever. By leveraging their expertise and organizations can develop comprehensive and trustworthy sustainability reports that meet regulatory requirements and enhance their reputation and strategic position. Investing in a Sustainability Report Consultant is not just about compliance—it's about showcasing a genuine promise to sustainability and positioning your organization for long-term success in a rapidly evolving business landscape.

#Sustainabilityreportconsultantinindia#Sustainabilityreportingconsultantinindia#Sustainability#Sustainabilityreportconsultancy

0 notes

Text

Why Green Building Consultants Are Key to Achieving ESG Goals

In today's fast-paced world, achieving Environmental, Social, and Governance (ESG) goals has become a top priority for organizations worldwide. Businesses increasingly adopt sustainable practices to meet regulatory requirements and attract environmentally conscious investors. One of the most effective ways to align with ESG goals is by embracing green building practices, and that's where Green Building Consultants play a vital role.

Understanding the Role of Green Building Consultants

A Green Building Consultant helps organizations design, build, and operate sustainable structures that minimize environmental impact. Their expertise extends beyond energy efficiency; it includes areas such as water conservation, waste reduction, indoor air quality, and eco-friendly materials. By guiding businesses through sustainable construction and operational practices, green building consultants are instrumental in achieving ESG targets.

Green Building Consultancy services go beyond providing recommendations; they help businesses meet international certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and other global sustainability standards. Green building consultants ensure that a building meets the environmental criteria necessary to fulfil ESG mandates.

Green Building Consultancy in UAE

The UAE has been at the forefront of sustainable development in the Middle East. With its ambitious Vision 2030, the nation is committed to reducing its carbon footprint and promoting sustainability across industries. As part of this vision, Green Building Consultancy in the UAE has seen a significant rise in demand. Businesses looking to align with the UAE's sustainability goals are increasingly seeking the services of Green Building Consultants to ensure their projects meet the required green building standards.

Whether a commercial skyscraper in Dubai or a residential development in Abu Dhabi, Green Building Consultancy in Dubai and across the UAE is essential to minimizing environmental impact and improving social responsibility metrics, consultants' expertise helps organizations meet national regulations, attract investors, and gain a competitive edge in a rapidly evolving market.

Achieving ESG Goals with Agile Advisors

One of the leading firms in the sustainability space is Agile Advisors, a company dedicated to providing comprehensive green building consultancy services. Agile Advisors guides organizations in the UAE and beyond through the intricacies of sustainable construction and operational practices. Their team of experts works closely with businesses to help them meet their green building goals and their broader ESG objectives.

Agile Advisors provides customized solutions that address energy efficiency, water conservation, waste management, and compliance with local and international green building standards. Organizations can enhance their ESG credentials by leveraging their services while minimizing their environmental footprint.

How Green Building Consultants Drive ESG Success

Environmental Impact: The "E" in ESG is often the most visible, and green building consultants are critical players in reducing a company's environmental impact. By recommending energy-efficient designs, renewable energy sources, and sustainable construction materials, they help reduce carbon emissions, which is central to ESG goals.

Social Responsibility: Green building consultants also influence the "S" in ESG by improving indoor environmental quality ensuring building occupants' health and well-being. Buildings designed with sustainable materials and optimized energy systems create safer, more comfortable environments for employees and tenants, enhancing social responsibility.

Governance: From a governance perspective, adhering to green building standards demonstrates a company's commitment to sustainability and transparency. Green building consultants guide businesses in obtaining certifications and meeting regulatory requirements, which reflects positively on the organization's governance practices.

Conclusion

In a world where ESG goals are becoming increasingly important, Green Building Consultants are crucial in helping organizations achieve their sustainability objectives. For businesses in the UAE, partnering with a Green Building Consultancy like Agile Advisors is an intelligent move toward building a sustainable future. By doing so, they can meet regulatory requirements and gain a competitive edge, attract investors, and contribute to global sustainability efforts.

Incorporating sustainable practices into your building projects isn't just about being eco-friendly; it's about driving long-term value for the environment and your organization. As ESG standards continue to shape the business landscape, working with a green building consultant is essential to staying ahead.

#green building consultancy in uae#green building consultant#green building consultancy#green building consultancy in dubai#green building consultant in uae

0 notes

Text

assurance services Singapore

Comprehensive Audit and Assurance Services in Singapore

Navigating the complex landscape of financial regulations and compliance in Singapore requires expertise, precision, and a commitment to excellence. At PWCO, we offer a wide range of Audit and Assurance Services in Singapore to help businesses meet regulatory standards, enhance transparency, and build stakeholder confidence. Our team of highly skilled auditors delivers services tailored to your business needs, ensuring you stay compliant and focused on growth.

Why Choose Our Audit Services in Singapore?

As a leading Audit Company in Singapore, we provide comprehensive audit services designed to meet the unique needs of your business. Our audit approach is both thorough and insightful, aimed at understanding your business dynamics and providing valuable advice beyond mere compliance. We conduct statutory audits, internal audits, and special purpose audits, ensuring that every aspect of your business’s financial reporting is accurate and compliant with the Singapore Financial Reporting Standards (SFRS).

Expert Assurance Services in Singapore

In addition to our audit services, we specialize in offering Assurance Services in Singapore that provide an independent and objective evaluation of financial information. Our assurance services encompass various areas such as financial statement reviews, risk management assessments, and regulatory compliance checks. By engaging us for assurance services, businesses can achieve greater credibility in their financial reporting and gain the trust of investors and stakeholders.

Leading Provider of Corporate Tax Services in Singapore

Navigating Singapore’s corporate tax landscape can be challenging without professional guidance. Our team at PWCO offers expert Corporate Tax Services in Singapore that cover tax planning, compliance, and advisory services. We ensure that businesses optimize their tax positions while adhering to local tax regulations. Whether you need assistance with corporate income tax filing, tax dispute resolution, or international tax planning, our experienced tax advisors are here to help.

Business Consulting Services for Enhanced Growth

As businesses strive to innovate and grow, strategic consulting becomes crucial. We offer Business Consulting Services in Singapore tailored to different industries and business sizes. From financial advisory and business restructuring to operational efficiency enhancement, our consultants provide insights and strategies that drive sustainable growth. Our approach is to work closely with you to understand your business challenges and provide practical solutions that deliver measurable results.

Blockchain and Cryptocurrency Accounting Expertise

The rise of digital assets like blockchain and cryptocurrencies has revolutionized the financial sector, and proper accounting for these assets is essential. At PWCO, we provide specialized Blockchain and Cryptocurrency Accounting in Singapore to help businesses navigate this complex field. Our team is well-versed in the latest regulations and reporting standards related to digital assets, ensuring accurate financial reporting and compliance for businesses involved in blockchain technology and cryptocurrencies.

Top Audit Company in Singapore for ESG Services

Environmental, Social, and Governance (ESG) factors are becoming increasingly critical for businesses today. As a Top Audit Company in Singapore, we offer comprehensive ESG Services in Singapore to help businesses integrate sustainability into their strategies and operations. Our services include ESG reporting, sustainability strategy development, and stakeholder engagement. By leveraging our expertise, businesses can enhance their ESG performance and create long-term value.

Risk Advisory Services for a Secure Future

In an ever-changing business environment, managing risks effectively is crucial for success. Our Risk Advisory Services in Singapore help businesses identify, assess, and mitigate risks to safeguard their operations and reputation. We provide tailored risk management solutions that align with your business goals and regulatory requirements. From cyber risk management to internal controls and governance frameworks, our risk advisory team provides proactive strategies to manage uncertainties.

Choose PWCO for Reliable and Comprehensive Services

At PWCO, our mission is to provide reliable, comprehensive, and high-quality services that help businesses succeed in today's competitive landscape. Whether you need Audit and Assurance Services, Corporate Tax Services, Business Consulting, or Blockchain Cryptocurrency Accounting in Singapore, our team is here to assist you. Contact us today to learn more about how we can support your business growth and compliance needs.

0 notes

Text

Renewable Energy Consultants

Energy consultants play a vital role in Australia’s journey towards sustainable development. They help businesses and individuals reduce their energy costs and ensure compliance with environmental laws. They also provide expertise in energy efficiency and renewable energy solutions.

A career as a Renewable energy consultants Sydney requires extensive knowledge of energy markets and regulations. You should also be able to stay updated with new technologies and trends in the industry.

RK Solar and Consulting Services

RK Solar and Consulting Services is an energy business that offers residential and commercial solar system installation and energy consultancy. Their experienced team of engineers and technicians provide customised solutions for every customer. They also offer a five-year workmanship warranty. They have been operating in NSW for more than 11 years and are a CEC approved solar retailer.

The sales process was quick and hassle free. Installers arrived on time and worked efficiently. They took care of everything, including organising a smart meter with our energy provider. I’m pleased with the overall experience and would recommend them.

However, I’m not happy with the placement of the panels on the roof, it looks like they were just slapped on the roof and wont return calls to discuss. I will have to find a new electrician to get them moved for best sun exposure. The installers were polite and courteous though, and went over and above to ensure their safety.

WolfPeak

WolfPeak knows that Australia has the resources and technical abilities to develop a Renewable energy Sydney industry and export green power around the world. Its experts are devoted to addressing climate change and promoting sustainable energy independence, and they offer advanced systems engineering analyses for wind, solar, tidal, and hydro power projects.

They also help their clients mitigate risks and connect new technologies to the grid, including assessing whether the project’s design and controls coordinate with Grid Code and interconnection requirements. They can also assist with navigating the complex planning, assessment and compliance requirements that are associated with renewable energy projects.

In addition to their comprehensive renewable energy assessments and strategic advisory services, they also provide specialized expertise in areas like battery storage and resilience planning. Their ESG integration services improve sustainability and corporate responsibility, while their system integration and risk management services streamline the procurement process. This helps businesses save time and resources while achieving their renewable energy goals.

YZ Consulting

YZ Consulting provides value-add consulting services for renewable energy ventures. Based in Newcastle, Australia, the company helps companies establish their business in the Australian clean energy industry and grow to scale. Its specialised consultants are knowledgeable in the dynamic Australian market, which can be volatile and difficult to predict. They also assist clients with their business plans and risk assessments.

The company’s founder, Yannick Zapf, has extensive experience in the solar and renewable energy sector across Europe, South Africa, and Australia. He previously served as the Head of C&I solar PV for specialist engineering consultancy, Clean Technology Partners. He now combines his commercial and technical knowledge of the renewable energy sector to help develop businesses in this field.

The company has a total of 4 employees. Its management team includes Shahram Salek-Ardakani (President), and Yannick Zapf (Director). YZ Consulting is a private limited liability partnership. It was incorporated on 8 May 2019. Its current status is Active.

NUS

NUS offers energy management solutions to help companies achieve their cost and sustainability objectives. Its services include invoice processing, cloud-based energy information systems, analysis and optimization, procurement, risk management, and carbon tracking/reporting. NUS was founded in 1933 and is headquartered in Park Ridge, New Jersey.

NUS’s Australian team provides commercial and industrial businesses with professional energy procurement services. Its market expertise, price monitoring tools, management processes, and supplier relationships ensure a successful outcome for any energy tender. The NUS Australia team also assists clients with their renewable energy and sustainability initiatives. These include corporate power purchase agreements (PPAs) that enable a business to buy low emissions energy from local and regional wind or solar farms. This energy helps businesses meet their greenhouse gas emissions reduction targets and supports national policy initiatives towards net zero emissions. This is a very important step in the shift to a low-carbon economy. This can be achieved by a combination of energy efficiency, renewable generation and demand response.

#Solar energy Sydney#Renewable energy Sydney#Renewable energy consultants Sydney#Solar power systems Sydney#Business solar solutions Sydney#Energy-efficient home solutions Sydney#Energy-efficient homes Sydney#Sustainable energy solutions Sydney

0 notes

Text

Elevating Business Value with ESG Services: A Strategic Imperative

In today's rapidly evolving business landscape, organizations are increasingly recognizing the importance of integrating Environmental, Social, and Governance (ESG) factors into their operations. As stakeholders become more conscious of the ethical and sustainable dimensions of business practices, ESG has transitioned from a peripheral concern to a core component of corporate strategy. ESG services, encompassing consulting, reporting, and strategy development, are vital tools for businesses aiming to enhance their sustainability, mitigate risks, and create long-term value.

The Growing Importance of ESG in Business

The demand for ESG services is growing as businesses across industries acknowledge that their long-term success is intertwined with their ability to operate sustainably and ethically. ESG consulting services provide businesses with the expertise needed to navigate complex regulatory landscapes, identify opportunities for improvement, and build resilient strategies that align with global sustainability goals.

At the heart of ESG lies the principle of accountability—businesses are no longer evaluated solely on their financial performance. Investors, customers, and other stakeholders are increasingly scrutinizing how companies impact the environment, how they treat their employees and communities, and how they govern themselves. ESG services help organizations address these concerns, ensuring that they operate responsibly while also achieving their business objectives.

The Role of ESG Consulting Services

ESG consulting services play a crucial role in guiding companies through the intricacies of ESG integration. These services offer tailored strategies that align with an organization's specific goals and industry requirements. ESG consultants assist businesses in assessing their current practices, identifying gaps, and developing actionable plans to enhance their ESG performance.

One of the primary benefits of ESG consulting services is their ability to provide an objective analysis of a company's operations. This includes evaluating environmental impact, social responsibility, and governance practices. By doing so, ESG consultants help organizations identify areas where they can make meaningful improvements, such as reducing carbon emissions, enhancing diversity and inclusion efforts, and strengthening corporate governance structures.

Moreover, ESG consulting services assist companies in setting measurable goals and tracking progress over time. This is particularly important in today's regulatory environment, where companies are increasingly required to disclose their ESG performance to stakeholders. ESG consultants can help organizations develop robust reporting frameworks that meet these requirements and demonstrate their commitment to sustainability.

The Business Case for ESG Integration

Integrating ESG factors into business strategy is not just about compliance—it's about creating value. Companies that embrace ESG principles are better positioned to manage risks, seize opportunities, and build stronger relationships with stakeholders. This, in turn, can lead to enhanced financial performance and long-term sustainability.

For instance, companies that prioritize environmental stewardship through ESG services can reduce their operational costs by optimizing resource use and minimizing waste. This not only benefits the environment but also improves the bottom line. Similarly, businesses that focus on social responsibility are more likely to attract and retain top talent, foster customer loyalty, and build a positive brand reputation.

Governance, the third pillar of ESG, is equally critical. Strong corporate governance practices, including transparent decision-making, ethical conduct, and accountability, are essential for building trust with investors and other stakeholders. ESG consulting services help companies strengthen their governance structures, ensuring that they are well-equipped to navigate challenges and capitalize on opportunities in an increasingly complex business environment.

ESG Reporting and Disclosure

One of the key components of ESG services is reporting and disclosure. Transparent and accurate ESG reporting is essential for building trust with stakeholders and demonstrating a company's commitment to sustainability. ESG consulting services provide businesses with the tools and expertise needed to develop comprehensive ESG reports that meet regulatory requirements and stakeholder expectations.

ESG reporting involves disclosing a company's performance across various ESG metrics, such as carbon emissions, energy use, diversity and inclusion, and board composition. These reports provide stakeholders with valuable insights into a company's sustainability practices and help them make informed decisions about their investments, partnerships, and purchasing choices.

In addition to meeting regulatory requirements, ESG reporting can also enhance a company's reputation and attract socially responsible investors. Companies that are transparent about their ESG performance are more likely to build trust with stakeholders, which can lead to increased investment and business opportunities.

The Impact of ESG on Investor Relations

ESG services are increasingly influencing investor decisions, as more investors prioritize sustainability and ethical considerations in their portfolios. ESG consulting services help companies align their strategies with investor expectations, enhancing their appeal to socially responsible investors and improving access to capital.

Investors are increasingly using ESG criteria to assess the long-term viability and risk profile of companies. Companies with strong ESG performance are viewed as lower-risk investments because they are better equipped to manage environmental and social challenges, as well as regulatory changes. As a result, these companies are more likely to attract investment from ESG-focused funds and institutional investors.

Moreover, ESG consulting services can help companies engage with investors on ESG issues, providing them with the information and insights needed to address investor concerns and build stronger relationships. This proactive approach to investor relations can lead to increased shareholder value and long-term financial success.

The Future of ESG Services

As the importance of ESG continues to grow, so too will the demand for ESG services. Companies that invest in ESG consulting services are better positioned to navigate the challenges of the future and capitalize on emerging opportunities. Whether it's adapting to new regulations, responding to stakeholder demands, or addressing global sustainability challenges, ESG services will play a critical role in shaping the future of business.

The future of ESG is likely to be characterized by increased integration of ESG factors into all aspects of business operations, from strategy and governance to supply chain management and product development. ESG consulting services will be essential in helping companies navigate this transition, providing the guidance and expertise needed to succeed in a rapidly changing business environment.

In conclusion, ESG services are no longer a "nice-to-have" but a strategic imperative for businesses aiming to thrive in the 21st century. By leveraging ESG consulting services, companies can enhance their sustainability, mitigate risks, and create long-term value for their stakeholders. As the world continues to evolve, businesses that prioritize ESG will be better equipped to lead the way toward a more sustainable and equitable future.

0 notes

Text

Understanding Sustainability and Its Benefits to the Environment

Understanding Sustainability and Its Benefits to the Environment

In an era of escalating environmental challenges, sustainability has emerged as a critical component in shaping the future of our planet. Sustainability is not just a buzzword but a comprehensive approach that seeks to balance economic growth, social well-being, and environmental protection. The core idea of sustainability is to meet the needs of the present without compromising the ability of future generations to meet their own needs. This philosophy has far-reaching implications, particularly regarding environmental protection and the role of sustainability consultants in driving this change.

What is Sustainability?

all while supporting economic stability and improving quality of life. Sustainable practices are designed to be socially equitable, economically viable, and environmentally sound.

Benefits of Sustainability to the Environment

Reduction in Environmental Impact:

Sustainable practices help in minimizing pollution, reducing carbon footprints, and conserving natural resources. This leads to a decrease in harmful emissions and pollutants that contribute to climate change and environmental degradation.

Conservation of Natural Resources:

Sustainability emphasizes the efficient use of resources such as water, energy, and raw materials. By adopting sustainable methods, industries can reduce their consumption of non-renewable resources, ensuring their availability for future generations.

Protection of Biodiversity:

Sustainable practices promote the preservation of ecosystems and wildlife habitats. This helps in maintaining biodiversity, which is crucial for the resilience of natural systems and the provision of ecosystem services.

Long-term Economic Stability:

By integrating sustainability into business models, companies can achieve long-term economic stability. Sustainable businesses are more resilient to environmental risks and are better positioned to adapt to regulatory changes and market demands.

Social and Community Benefits:

Sustainability initiatives often involve local communities, improving social equity and fostering economic development. Sustainable practices ensure that communities have access to clean water, clean air, and other essential resources.

The Role of Sustainability Report Consultants

Sustainability consultants play a vital role in guiding organizations toward adopting sustainable practices. These professionals help businesses, governments, and NGOs design and implement strategies that reduce environmental impact while enhancing economic and social outcomes.

Sustainability Consultants in India:

In India, the demand for sustainability consultants has been rising as businesses increasingly recognize the importance of sustainable practices. These consultants assist organizations in understanding and managing their environmental footprint, ensuring compliance with regulations, and improving their overall sustainability performance.

Sustainability Reporting Consultant:

Sustainability reporting consultants in India specialize in helping companies communicate their sustainability efforts transparently. They guide organizations in preparing sustainability reports that adhere to global standards, such as the Global Reporting Initiative (GRI). These reports are crucial for stakeholders, including investors, customers, and regulators, who increasingly demand greater transparency in environmental and social governance (ESG) practices.

Sustainability Reporting Consultant in India:

In India, sustainability reporting consultants are pivotal in helping companies navigate the complex landscape of sustainability reporting requirements. With the introduction of mandatory ESG disclosures and sustainability reporting in various sectors, these consultants provide expertise in data collection, analysis, and report preparation, ensuring that companies meet regulatory requirements and build trust with stakeholders.

#SustainabilityReportingconsultant#Sustainability#Sustainability Consultant in India#Sustainability Reporting consultant in India

0 notes

Text

ESG Consultants: Preparing for the Future of ESG Requirements

Explore the evolving landscape of ESG requirements. Learn about emerging regulations, enforcement actions, and strategies for SMEs to strengthen ESG frameworks and ensure compliance. Go here https://www.regulatoryrisks.com/blog-details/esg-consultants-future-requirements-business-preparation

0 notes

Text

Understanding the Importance of WBCSD PACT Conformant Certification

In today's business environment, companies are increasingly focused on sustainability and ethical practices. One way to demonstrate this commitment is by adhering to globally recognized standards, such as the WBCSD PACT Conformant certification. This certification, offered by the World Business Council for Sustainable Development (WBCSD), plays a crucial role in ensuring that companies operate responsibly, particularly in managing and reporting on their climate actions.

What is WBCSD PACT Conformant Certification?

The WBCSD PACT Conformant certification is a framework that ensures businesses align with the PACT (Pathway to Action) standards, developed to help companies effectively measure and manage their environmental impact. The certification ensures that companies adhere to best practices in sustainability, focusing on climate, nature, and equity. Being WBCSD PACT Conformant is not just about ticking a box; it's about embedding sustainability into the core of a company's operations.

The Importance of Being WBCSD PACT Conformant

Achieving WBCSD PACT Conformant certification offers multiple benefits to companies. First and foremost, it enhances a company’s credibility in the eyes of stakeholders, including customers, investors, and regulatory bodies. In a world where sustainability is increasingly becoming a key factor in decision-making, having this certification can set a company apart from its competitors.

Moreover, being WBCSD PACT Conformant helps companies reduce risks associated with environmental, social, and governance (ESG) factors. By following the PACT standards, companies are better equipped to handle challenges such as climate change, resource scarcity, and social inequalities. This proactive approach not only mitigates risks but also opens up new opportunities for innovation and growth.

How to Achieve WBCSD PACT Conformant Status

To achieve WBCSD PACT Conformant status, companies need to follow a series of steps. The first step involves understanding the PACT framework and how it applies to their specific industry. This may require working with consultants or experts in sustainability to ensure that all aspects of the framework are adequately addressed.

Next, companies must implement the necessary changes to align their operations with the PACT standards. This could involve adopting new technologies, rethinking supply chains, or improving data collection and reporting processes. The goal is to ensure that every aspect of the business is operating in a manner that is consistent with the principles of sustainability.

Finally, companies must undergo an audit or assessment by an accredited body to verify that they meet the requirements of the WBCSD PACT Conformant certification. Once certified, companies must continue to monitor and report on their sustainability efforts to maintain their status.

The Role of PACT Conformant Software

In achieving and maintaining WBCSD PACT Conformant certification, technology plays a critical role. PACT Conformant software solutions are specifically designed to help companies track their sustainability metrics, ensure compliance with PACT standards, and generate the necessary reports for certification. These software tools streamline the process, making it easier for companies to manage their sustainability initiatives and demonstrate their commitment to responsible business practices.

Conclusion

In an era where sustainability is no longer optional, the WBCSD PACT Conformant certification represents a significant step forward for companies committed to making a positive impact on the world. By aligning with the PACT standards, businesses can not only enhance their reputation but also contribute to a more sustainable and equitable future. Whether through adopting PACT Conformant software or undergoing rigorous certification processes, companies that strive to be WBCSD PACT Conformant are setting themselves up for long-term success in a rapidly changing world.

0 notes

Text

What is ESG Controversy, and How Does It Impact Business?

Social media has augmented the power multimedia coverage has over public perception. The positive aspects of this situation include a rising demand for accountability and transparent corporate communication. However, the potential misuse of modern media, third-party firms’ intelligence, and news platforms can threaten the brand you develop through fake news. For instance, an ESG controversy, whether real or not, can impact a business. And this post explains how.

What is an ESG Controversy?

An ESG controversy encompasses all events concerning actual or alleged adverse impact assessments, sustainability non-compliance, data theft, etc. The environmental, social, and governance (ESG) factors help analysts create comprehensive reports and financial disclosures, highlighting potentially controversial business aspects.

Controversial events can decrease your company’s reputation, increase legal liabilities, and alienate the stakeholders. Besides, brand-related risks have long-term consequences. Therefore, corporations leverage ESG controversy analysis to identify the activities that can undermine their strategic vision, financial performance, and stakeholder interests.

What Causes an ESG Controversy?

Advanced technology empowers today’s world, empowering researchers, non-governmental organizations (NGOs), industry bodies, regional authorities, and consumers. They can quickly investigate if a brand has engaged in ESG non-compliant activities.

Employing child labor, discriminating against employees, polluting the environment, or engaging in corruption can affect your company’s relationships. Sometimes, old norms become obsolete, and new legal frameworks replace them. However, specific organizations might miss such dynamics or willfully postpone compliance.

Through ESG consulting, businesses can acquire thematic insights into sustainability compliance and controversy exposure. Themes include energy transition, labor rights, social good, carbon emissions, and waste disposal. So, investors, authorities, businesses, NGOs, and consumers can decide which brands to support or ignore.

How Does an ESG Controversy Impact a Business?

1| It Can Discourage Investors

Ethical and impact investors want to focus on enterprises working on socio-economically beneficial projects. They also employ exclusion strategies when building portfolios based on sustainable development goals (SDGs). Investors are less likely to include a brand with a controversial background in their portfolios.

2| ESG Controversy Can Lead to Consumer Boycott

Launching a new product or service will become more challenging if a company is part of a controversy. Consumers believe in buying from brands that share their values. Suppose they learn about a brand’s ESG controversy. They will deliberately avoid its products, events, and services. Simultaneously, social media and news platforms can accelerate the brand boycott trends.

3| Legal Processes Will Impact the Business

Addressing non-compliance issues can involve fulfilling legal requirements like account audits, independent inquiries, or financial penalties. These activities can make specific business operations inefficient for a while. Otherwise, the managers might get trade restrictions for an indefinite period.

4| ESG Controversy Makes Supply Chain Management Riskier

Consider a business that procures critical components from a supplier that employs child labor and releases untreated industrial effluent into water bodies. Therefore, the brand is at risk. After all, ESG controversy analysis does not stop at the company level. It inspects whether a few supplier relations can damage your stakeholder goodwill due to questionable practices.

Steps of Controversy Monitoring and Reporting

Recognizing the vulnerable aspects across the environmental, social, and governance pillars helps companies and investors streamline risk assessment. Think of the deforestation risks that will be higher in the case of construction projects. However, water resources will be more vulnerable to pollution from the heavy chemicals industry.

Later, you want to create a consolidated statistical method to rate the adverse impact according to ESG controversy risks. It will allow companies to benchmark their compliance.

Finally, investors must determine whether they want to buy or sell an asset using the final reports. Likewise, business leaders must explore opportunities to make their organizations more resilient to controversies.

Conclusion

Several possibilities affect how everyone essential to your business development perceives you. Their faith in your brand shakes once your organization becomes the focus of global and regional media coverage for the wrong reasons.

Still, every ESG controversy analyst will follow a unique system to evaluate the risks that business leaders must mitigate to have a positive impact. As a result, corporations must select analysts with an established track record of sustainability compliance and risk assessment.

3 notes

·

View notes

Text

Leaders in Bank Consulting: Driving Innovation and Excellence

The Hallmarks of Top Bank Consultants

The leaders in bank consulting are distinguished by a few critical qualities:

Deep Industry Knowledge: The best consultants possess a profound understanding of the banking sector, including its regulatory frameworks, market dynamics, and technological trends. Their expertise allows them to anticipate challenges and opportunities, providing banks with strategies that are both innovative and compliant.

Technological Expertise: With the banking industry increasingly reliant on technology, leaders in bank consulting are at the forefront of digital transformation. Leaders In Bank Consulting They understand the intricacies of fintech integration, cybersecurity, and data analytics, ensuring that banks not only adopt new technologies but do so in a way that adds value and mitigates risk.

Strategic Vision: Successful bank consultants combine industry knowledge with a forward-thinking approach. They help financial institutions align their operations with long-term goals, whether that means expanding into new markets, optimizing existing processes, or navigating mergers and acquisitions. Their strategic guidance ensures that banks are not just reacting to market changes but are proactively shaping their future.

Client-Centric Approach: The top consultants prioritize their clients’ needs, understanding that every bank has unique challenges and objectives. By offering tailored solutions rather than one-size-fits-all strategies, they build strong, trust-based relationships that enable long-term success.

Key Areas of Impact

Leaders in bank consulting make a significant impact across various areas within financial institutions:

Regulatory Compliance: Navigating the complex regulatory landscape is a significant challenge for banks. Top consultants assist in ensuring that institutions remain compliant with ever-changing regulations, reducing the risk of fines and legal issues while also streamlining compliance processes to improve efficiency.

Digital Transformation: As banks embrace digital solutions, leaders in consulting guide them through the process of integrating new technologies, from mobile banking platforms to AI-driven customer service tools. They help banks harness the power of data analytics to better understand customer behavior, improve decision-making, and personalize services.

Risk Management: With financial markets becoming more volatile, effective risk management is critical. Leading consultants provide strategies to identify, assess, and mitigate risks, helping banks protect their assets and maintain stability even in uncertain times.

Operational Efficiency: Enhancing efficiency is a key focus area for many banks. Fintech Management Consulting Firm Consultants bring in best practices and innovative solutions that streamline operations, reduce costs, and improve productivity, ensuring that banks can do more with less.

The Future of Bank Consulting

As the banking industry continues to evolve, the role of bank consulting leaders will become even more critical. The future will likely see an increased focus on sustainability, with consultants helping banks to not only achieve financial success but also to meet environmental, social, and governance (ESG) goals. Additionally, as customer expectations continue to rise, consultants will play a key role in helping banks deliver exceptional, personalized experiences through the smart use of technology.

0 notes

Text

ESG CONSULTANT

In todays business world, the emphasis on environmental, social, and governance (ESG) factors is more pronounced than ever. Companies are increasingly expected to demonstrate their commitment to sustainable practices and responsible management. As a result, ESG reporting has become a critical aspect of corporate slide and strategy. Many organizations are turning to an ESG Consultant for expert guidance and support to navigate this complex terrain.

Understanding the Significance of ESG Reporting

ESG reporting involves disclosing a companys environmental impact, social practices, and governance policies. This reporting helps businesses meet regulatory requirements, enhances their reputation, and builds trust with stakeholders. It provides valuable visions into how a company manages risks and opportunities related to ESG factors, which can influence investment decisions and customer loyalty, and general corporate performance.

Given the growing importance of ESG factors, businesses recognize the need for professional expertise to ensure their reporting is accurate, comprehensive, and aligned with best practices. An ESG Consultant offers specialized knowledge and strategic support in crafting and presenting ESG reports.

The Role of an ESG Consultant

An ESG Consultant plays a pivotal role in guiding organizations through the intricacies of ESG reporting. Their know-how encompasses a range of responsibilities, including:

Assessment and Strategy Development: An ESG Consultant begins by assessing a companys current ESG practices and identifying areas for improvement. They work with organizations to develop a strategic approach that aligns with their business goals and stakeholder expectations. This includes setting quantifiable ESG objectives and identifying key performance indicators (KPIs).

Framework Selection and Implementation: ESG reporting is governed by various frameworks and standards, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). An ESG Consultant helps organizations select the most appropriate framework and ensures their reporting meets the supplies.

Data Collection and Analysis: Accurate and reliable data is crucial for effective ESG reporting. An ESG Consultant guides businesses in collecting and analyzing relevant data related to their environmental impact, social initiatives, and governance practices. They help establish robust data management systems and processes.

Report Preparation and Presentation: With the data collected and the ESG Consultant assists in drafting and structuring the ESG report. This involves creating explicit, engaging content that effectively connects the companys ESG performance and strategies. The consultant also ensures that the report adheres to the selected reporting framework and meets stakeholder expectations.

Stakeholder Engagement and Communication: Engaging with stakeholders is essential for understanding their concerns and expectations. An ESG Consultant helps organizations integrate stakeholder feedback into their ESG reporting and develop communication plans that resonate with their audience.

Compliance and Verification: Ensuring compliance with regulatory requirements and industry standards is another critical task. An ESG Consultant often collaborates with third-party verification services to provide credibility and assurance for the ESG report.

Why Hire an ESG Consultant?

Expertise and Knowledge: ESG reporting involves complex standards and evolving regulations. An ESG Consultant brings specialized knowledge and expertise to navigate these complexities, ensuring accurate and compliant reports.

Efficiency and Focus: Preparing an ESG report can be laborious and resource-intensive. By engaging an ESG Consultant, organizations can streamline the process and focus on their core business activities while the consultant handles the intricacies of ESG reporting.

Enhanced Credibility: A professionally prepared ESG report, guided by a consultant, enhances the credibility and reliability of the information presented. This is crucial for maintaining trust with investors and meeting regulatory requirements.

Strategic Insights: Beyond reporting, an ESG Consultant offers valuable insights into how ESG practices can be improved and integrated into the companys overall strategy. This can drive long-term sustainability and competitive advantage.

Risk Management and Opportunity Identification: An ESG Consultant helps organizations identify potential risks and opportunities related to ESG factors. This proactive method can mitigate risks and capitalize on opportunities that align with sustainable business practices.

Choosing the Right ESG Consultant

Selecting the right ESG Consultant is essential for achieving effective and impactful ESG reporting. Here are some factors to consider:

Experience and Track Record: Look for consultants with a proven track record in ESG reporting, particularly within your industry. Their experience will be instrumental in navigating specific challenges and requirements.

Knowledge of Frameworks: Ensure the consultant is well-versed in the relevant ESG reporting frameworks and standards applicable to your business and This know-how is crucial for compliance and effective reporting.

Consultative Approach: The consultant should adopt a consultative approach, working closely with your team to understand your unique needs and objectives. This collaboration ensures that the ESG report aligns with your companys strategy and goals.

Reputation and References: Check the consultants reputation and seek references from previous clients and This will provide insights into their reliability, efficiency, and overall client satisfaction.

Cost vs. Value: While cost is a consideration, the value the consultant offers in terms of expertise, quality of reporting, and planned insights should be the primary focus.

Conclusion

As the emphasis on ESG factors continues to grow, the role of an ESG Consultant is becoming progressively vital. By leveraging their expertise and organizations can develop comprehensive and credible ESG reports that meet regulatory requirements and enhance their reputation and strategic position. Investing in an ESG Consultant is not just about obedienceits about demonstrating a genuine commitment to sustainability and positioning your organization for long-term success in a rapidly evolving business landscape.

0 notes