#ESGInvestments

Text

Investing in Tomorrow: Navigating Emerging Trends for Financial Growth

The financial world is ever-evolving, presenting investors with new opportunities and challenges. In this era of rapid change, understanding and capitalizing on emerging investment trends can be the key to unlocking unprecedented financial growth. Let’s embark on a journey through the latest and most promising trends that savvy investors are keeping a close eye on.

Embracing ESG Investing

As…

View On WordPress

#CleanEnergyRevolution#ESGInvestments#ImpactfulInvesting#InvestingInTheFuture#TechInnovationInvesting

0 notes

Text

Green Loans: Companies Raise Over 180 Billion Know It All

Green Loans: Companies Raise Over 180 Billion Know It All.

Introduction: Green Loans

In recent years, the financial world has witnessed a significant shift towards sustainability and environmental responsibility. This shift is most evident in the realm of corporate finance, where companies are increasingly turning to Green Loans and Sustainability-Linked Loans (SLLs) to fund their…

View On WordPress

#CorporateSustainability#ESGBestPractices#ESGFinancing#ESGGrowth#ESGInvestments#ESGPrinciples#FinancialSustainability#GreenBonds#GreenFinanceTrends#GreenLoans#SustainabilityMetrics#SustainabilityReporting#SustainabilityStrategy#Sustainablebusiness#SustainableFinance

1 note

·

View note

Text

0 notes

Text

Exploring the Role of Fintech in ESG (Environmental, Social, Governance) Investing

In recent years, Environmental, Social, and Governance (ESG) investing has shifted from a niche interest to a mainstream movement. Investors are no longer solely focused on financial returns; they're increasingly interested in how their investments impact the world. As ESG considerations become central to investment decisions, fintech is playing a pivotal role in shaping this new era of sustainable finance.

What is ESG Investing?

ESG investing refers to the integration of environmental, social, and governance factors into investment strategies. It’s about aligning financial goals with broader values—such as reducing carbon emissions, promoting social justice, and ensuring ethical governance practices. ESG investors seek to generate positive, measurable impact alongside financial returns.

Traditionally, ESG investing was the domain of large institutional investors who had the resources to conduct in-depth analyses. However, fintech innovations are democratizing access to ESG data and making it easier for everyday investors to align their portfolios with their values.

How Fintech is Revolutionizing ESG Investing

1. Enhanced Access to ESG Data

One of the key challenges in ESG investing has been the lack of standardized, reliable data. Fintech companies are addressing this by developing platforms that aggregate and analyze ESG data from a variety of sources. These platforms provide investors with insights into the ESG performance of companies, enabling them to make informed decisions.

AI and machine learning are also being used to process vast amounts of unstructured data, such as news articles and social media posts, to assess a company’s ESG practices. This provides a more comprehensive view of a company’s impact and allows for real-time updates.

2. Personalized ESG Portfolios

Fintech platforms are making it easier for investors to create personalized ESG portfolios. Using robo-advisors and AI-driven tools, investors can customize their portfolios based on their specific values and priorities. Whether an investor is passionate about clean energy, gender equality, or corporate transparency, fintech allows them to tailor their investments accordingly.

These platforms often include tools for tracking the impact of investments, providing transparency and accountability. This not only empowers investors but also encourages companies to improve their ESG performance.

3. Blockchain for Transparency and Accountability

Blockchain technology is another fintech innovation that is enhancing ESG investing. By providing a transparent and immutable ledger of transactions, blockchain can be used to track the ESG credentials of assets and verify the authenticity of sustainability claims.

For example, blockchain can be used to track the supply chain of a product, ensuring that it is ethically sourced and produced. This level of transparency is particularly important for investors who want to avoid “greenwashing,” where companies exaggerate or falsify their ESG credentials.

4. Green Fintech and Sustainable Finance

Fintech is also driving the growth of green finance, which focuses on funding projects that have positive environmental impacts. Platforms that facilitate peer-to-peer lending, crowdfunding, and micro-investing are being used to support renewable energy projects, sustainable agriculture, and other environmentally friendly initiatives.

These platforms make it easier for individuals and small investors to participate in sustainable finance, broadening the impact of ESG investing and directing more capital toward projects that address global challenges like climate change.

5. Socially Responsible Investing (SRI) and Fintech

Socially responsible investing, a subset of ESG, is also benefiting from fintech advancements. Fintech platforms are providing tools for investors to screen companies based on specific social criteria, such as labor practices, human rights, and community impact.

These platforms often include educational resources that help investors understand the social implications of their investments, promoting greater awareness and engagement.

The Future of ESG Investing and Fintech

As ESG investing continues to grow, the role of fintech will become even more significant. Fintech innovations are not only making ESG investing more accessible and efficient but also driving the development of new products and services that cater to the growing demand for sustainable investments.

We can expect to see further advancements in AI, blockchain, and data analytics, all of which will enhance the ability of investors to assess and track ESG performance. Additionally, fintech will likely play a key role in the development of new financial instruments, such as green bonds and sustainability-linked loans, that align with ESG principles.

Outcome: A Sustainable Future with Fintech

The integration of fintech and ESG investing is creating a powerful synergy that is transforming the financial industry. By making ESG data more accessible, enabling personalized portfolios, and promoting transparency, fintech is empowering investors to align their financial goals with their values.

As the world faces pressing challenges like climate change and social inequality, the role of fintech in ESG investing will only become more crucial. Investors are no longer content with just financial returns; they want their money to make a difference. With fintech at the forefront, the future of investing is not only profitable but also sustainable and responsible.

#Fintech#ESGInvesting#EnvironmentalSocialGovernance#SustainableFinance#FinancialInnovation#ImpactInvesting

0 notes

Text

#PensionRealEstate#InstitutionalInvestment#RealEstateInvesting#SustainableInvesting#ESGInvesting#GreenRealEstate#CommercialRealEstate#RealEstateTrends#AlternativeAssets#GlobalRealEstate#UrbanDevelopment#SmartBuildings#RealEstateMarkets#PensionFunds#InvestmentStrategies

0 notes

Text

The Importance of ESG (Environment, Social & Governance) in Modern Finance.

The Importance of ESG (Environment, Social & Governance) in Modern Finance.

In recent years, the financial industry has seen a tremendous change toward sustainability and responsible investing. Environmental, social, and governance (ESG) considerations have become critical in determining the long-term value and impact of investments. As organizations and investors become more aware of the relevance of ESG, it is critical to understand how these factors contribute to sustainable finance.

ESG is a new paradigm in finance.

Environmental factors determine a company's impact on the earth. This covers its carbon footprint, waste management practices, and utilization of renewable resources. Companies that promote environmental sustainability not only benefit the earth but also minimize the risks connected with the regulation of the environment and climate change.

Social considerations concern a company's interactions with employees, customers, suppliers, and the communities in which it operates. This includes labor practices, diversity and inclusion, and human rights. Companies that prosper in social responsibility typically have better reputations, more employee satisfaction, and stronger consumer loyalty.

Governance parts evaluate a company's leadership, CEO compensation, audits, internal controls, and shareholder rights. Good governance makes sure that businesses are governed ethically and transparently, lowering the danger of fraud and misconduct.

The Effects of ESG on Sustainable Finance

Incorporating ESG criteria into investing decisions is more than a trend; it is crucial to sustainable finance. ESG investment identifies companies that are not only financially sound but also socially and ecologically responsible. These businesses are better positioned to succeed in the long run, making ESG investing an excellent option for forward-thinking investors.

Task Academy acknowledges the growing importance of ESG in modern finance. Our specialist courses provide financial professionals with the information and skills required to examine and incorporate ESG factors into investing strategies. Our comprehensive program covers the most recent trends, best practices, and regulatory requirements for ESG investment.

Benefits of ESG Investing-

ESG investing benefits companies by mitigating legal, regulatory, and reputational concerns. They are more equipped to deal with environmental calamities, societal unrest, and governance crises.

Long-term Returns: Companies that prioritize ESG issues frequently outperform in the long run. Sustainable practices can result in cost savings, innovation, and increased operational efficiency, boosting overall profitability.

Attracting Capital: Investors are increasingly looking for ESG-compliant organizations. Companies that prioritize ESG factors can attract more cash from both institutional and individual investors.

Regulatory Compliance: As governments and regulatory organizations around the world prioritize sustainability, companies that have strong ESG practices are better positioned to comply with changing legislation and requirements.

Task Academy's dedication to ESG education

Task Academy is committed to advancing sustainable finance through high-quality education. Our ESG courses are designed to equip financial professionals with extensive information and practical skills. Whether you are an investor, financial analyst, or business executive, Task Academy's ESG programs will help you make more educated and responsible investing decisions.

By incorporating ESG principles into your investment plan, you may help to create a more sustainable and fair society while meeting your financial objectives. Task Academy's professional teachers and extensive curriculum ensure that you keep current in the ever-changing subject of sustainable finance.

Conclusion

The value of ESG in modern finance cannot be emphasized. As the globe faces environmental concerns, socioeconomic disparities, and governance issues, the financial industry must play a critical role in promoting constructive change. Finance professionals may ensure long-term success and profitable development by including ESG elements in their investment decisions.

Enroll in Task Academy's ESG courses today to stay competitive in the field of sustainable finance. Learn from industry professionals, receive practical insights, and take the lead in ESG investment.

#TaskAcademy#ESGImportance#SustainableFinance#ESGInvestment#FinancialEducation#EnrollNow#FinanceSuccess

0 notes

Text

Understanding ESG Strategy is crucial for modern business growth. By integrating Environmental, Social, and Governance (ESG) practices, companies not only enhance their brand image and attract investors but also drive sustainable growth. Learn how ESG can add value to your business with the right strategies and best practices.

#ESGStrategy#SustainableBusiness#EnvironmentalImpact#SocialResponsibility#CorporateGovernance#BusinessGrowth#SustainableFinance#InvestorAttraction#BrandReputation#ESGIntegration#ComplianceRegulations#GreenBusiness#CorporateSustainability#ESGInvesting#LongTermSuccess#RiskManagement#EthicalBusiness#SustainableDevelopment#ESGImplementation#MarketExpansion

0 notes

Text

Have you ever wondered how your investment choices could shape the world? The rise of ESG (Environmental, Social, and Governance) investing is turning traditional finance on its head, offering us a way to influence the future of business practices while pursuing profitability.

What’s ESG All About?

Environmental considerations are no longer just about compliance; they're about innovation. Companies that proactively reduce their carbon footprints and embrace sustainable practices are not only mitigating risks but are also enhancing their competitiveness and market position. They are proving that what's good for the planet can also be good for the bottom line.

On the social front, how a company treats its employees, the communities it operates in, and how it manages supplier relationships are increasingly under the spotlight. Firms that excel in these areas often enjoy enhanced customer loyalty, more engaged employees, and a stronger brand reputation—all of which contribute to financial performance.

Governance, the often overlooked aspect of ESG, involves the systems of practices and controls that a company uses to govern itself, make effective decisions, manage risks, and ensure accountability. Good governance can prevent scandals, fraud, and mismanagement—all factors that can destroy shareholder value overnight.

Why This Matters Now More Than Ever

We are at a pivotal moment where our financial decisions as investors, or as professionals in the field, can drive real change. The demand for greater transparency and accountability is moving from a niche preference to a mainstream demand. This shift is not just creating opportunities for investors to align their portfolios with their values; it’s also opening doors to new careers in fields driven by principles of sustainability and ethical governance.

As we look to the future, the implications of ESG for career paths in finance, sustainability, and corporate roles are profound. The demand for professionals who can navigate this new landscape—understanding both the financial and ethical dimensions—is skyrocketing.

So, what are your thoughts on the rise of ESG investing? Do you see it influencing your career choices or investment decisions? Are businesses that prioritize strong ESG practices paving the way for a new standard in corporate success? Share your views and let's discuss how we can be part of shaping a sustainable, equitable future.

0 notes

Text

Navigating Investment Portfolio Management with IMF Pvt Ltd Financial Consultants

Investing can be a daunting task, especially when it comes to managing a diverse portfolio of assets. With so many investment options available, it's easy to feel overwhelmed and unsure of where to start. That's where IMF Pvt Ltd Financial Consultants come in. Our team of experienced advisors specializes in helping clients navigate the complexities of investment portfolio management, offering expert guidance and personalized strategies to help you achieve your financial objectives. In this guide, we'll delve into the world of investment portfolio management and explore how our consultants can help you optimize your investment portfolio for long-term success.

Understanding Investment Portfolio Management

Investment portfolio management is the process of strategically allocating assets to achieve specific financial objectives while minimizing risk. It involves carefully selecting a mix of investments, such as stocks, bonds, mutual funds, and alternative assets, and periodically rebalancing the portfolio to maintain the desired asset allocation.

Developing a Personalized Investment Strategy

One of the key roles of IMF Pvt Ltd Financial Consultants is to help clients develop a personalized investment strategy tailored to their unique financial goals, risk tolerance, and time horizon. By taking the time to understand your individual needs and objectives, our consultants can recommend a diversified portfolio mix designed to maximize returns while minimizing volatility.

Monitoring and Adjusting Your Portfolio

Effective investment portfolio management doesn't end with the initial allocation of assets. It requires ongoing monitoring and periodic adjustments to ensure that your portfolio remains aligned with your objectives and market conditions. IMF Pvt Ltd Financial Consultants provide regular portfolio reviews and recommendations to help you stay on track and adapt to changing market dynamics.

In conclusion, effective investment portfolio management is essential for achieving long-term financial success. With the guidance of IMF Pvt Ltd Financial Consultants, you can navigate the complexities of investing with confidence and peace of mind. Whether you're saving for retirement, funding your child's education, or building wealth for the future, our team is here to help you develop a personalized investment strategy that aligns with your goals and aspirations. Contact us today to schedule a consultation and take the first step towards optimizing your investment portfolio.

#InvestmentPortfolioManagement#FinancialConsultants#IMFPvtLtd#AssetAllocation#InvestmentStrategy#Diversification#TaxEfficiency#EconomicTrends#ESGInvesting

0 notes

Text

ESG Investing and Passive Investing: What You Need to Know

#ESGinvesting #passiveinvesting

0 notes

Text

Mastering Material Data Management: A Cornerstone for Sustainable Decision-Making in Green Finance

In today's world, sustainability isn't just a buzzword - it's a driving force for businesses and investors alike. And at the heart of it all lies ESG data. This critical information paints a picture of a company's environmental, social, and governance performance, but gathering it can be a real challenge.

Imagine sifting through mountains of spreadsheets, deciphering cryptic reports, and chasing down data scattered across departments. It's enough to give even the most sustainability-minded individual a headache.

That's where Master Data Management (MDM) steps in, playing a crucial role in ensuring accurate, reliable, and consistent ESG reporting.

Understanding ESG Data:

At the heart of sustainable finance lies ESG data, providing information about a company or investment's environmental, social, and governance (ESG) attributes. This data is used by a wide range of stakeholders, including investors, analysts, companies, policymakers, and more, to understand and make informed decisions about business effectiveness, risk, and sustainability.

Sustainable data management is the responsible management and handling of data throughout its lifecycle. This includes the collection, processing, storage, and disposal of data. Sustainable data management aims to minimize the environmental impact of data management practices, reduce energy consumption, and optimize the use of resources. Sustainable data management also focuses on ensuring that data is used in a socially responsible and ethical way.

Why is Sustainable Data Management Important?

Sustainable data management is essential for several reasons. Firstly, it helps to minimize the environmental impact of data management practices. Data centres and other IT infrastructure consume significant amounts of energy and produce a considerable amount of carbon emissions. Sustainable data management practices aim to reduce energy consumption and carbon emissions by optimizing data centre design, improving energy efficiency, and using renewable energy sources.

88% of publicly traded companies have ESG initiatives in place followed by 79% of venture and private equity-backed companies and 67% of privately-owned companies. (Src:Navex)

Data Collection for ESG Reporting

ESG reporting demands transparency on a company's environmental, social, and governance practices. The first step is choosing the relevant metrics based on your industry, reporting framework (e.g., GRI, SASB, TCFD), and stakeholder interests.

Each framework defines specific metrics for different ESG categories like:

Environment: Greenhouse gas emissions, water usage, waste generation, resource consumption, etc.

Social: Labor practices, diversity and inclusion, employee health and safety, community engagement, etc.

Governance: Board composition, executive compensation, shareholder rights, anti-corruption practices, etc.

Gathering the data to tell this story is crucial, but it can be a complex process. Once the metrics are identified, you need to gather data from various sources:

Internal Data: This includes energy consumption, waste generation, employee diversity, community engagement, and governance policies. Data may reside in various systems like energy meters, HR databases, and financial records, etc.

External Data: Suppliers, industry groups, and governmental agencies provide data on things like raw material sourcing, labor practices, and regulatory compliance, etc.

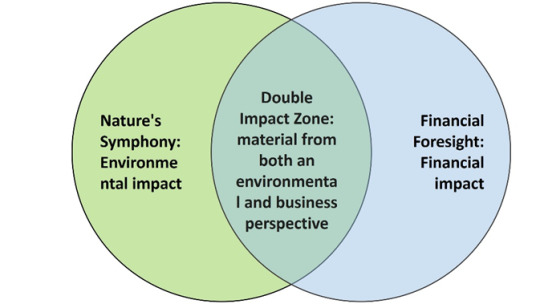

Prioritizing your Data Collection with Double Materiality

Before diving into data mountains, it's crucial to define your Everest. Enter double materiality, the guiding compass for prioritizing the most impactful ESG and sustainability data your organization needs to collect.

Double materiality emphasizes matters that are significant:

From an ESG perspective: How your operations and actions affect the environment, society, and governance.

From a financial perspective: How ESG issues can impact your business risks and opportunities.

Think of it like Venn diagram of "sustainability is good for the planet" and "sustainability is good for business." The overlapping area forms your double materiality sweet spot, focusing data collection efforts on topics that matter most, both ethically and economically.

Practically, focus your data collection laser! By identifying the most critical ESG topics and risks, you ensure your efforts aren't scattered. Take for example the rising threat of extreme weather events for an energy and utility company – a double materiality double whammy for both sustainability and the bottom line! Now, let's turn the screws: what are the key climate risk data points and KPIs this company needs to track? Where's this data hiding, internally or externally? And how can they grab it efficiently? Prioritization isn't just about sorting – it's about taking targeted action for maximum impact.

The Challenges of Data Cleansing and Management:

Gathering the valuable information isn't always a picnic. Here are some common hurdles:

Data Silos: ESG data often gets trapped in isolated pockets across different departments and systems.

Inconsistent Formats: Metrics may be measured and reported differently, making comparisons difficult.

Data Quality Issues: Missing or inaccurate data can undermine the entire reporting process.

Lack of Resources: Companies may struggle to dedicate time and expertise to data collection.

Inaccurate or missing data can undermine the credibility of your ESG report. MMDM solution providers like Verdantis offers data cleansing, validation, and enrichment tools, enhancing data quality and minimizing errors.

Your ESG materiality should be a mirror reflecting your unique identity, values, and business model. Sustainability and ESG initiatives should build upon this foundation, not replace it.

By prioritizing data management, you ensure your focus remains on the issues that truly matter, driving both environmental progress and financial success.

MDM: The Powerhouse for ESG Data:

As ESG reporting requires accurate and comprehensive data across multiple dimensions, MDM provides the necessary framework to ensure data integrity and consistency.

MDM (Master Data Management) provides the foundation for effective management of ESG data, offering several key benefits:

Single Source of Truth: MDM establishes a single, centralized repository for all ESG data, eliminating inconsistencies and streamlining access for various stakeholders.

Data Quality and Integrity: MDM ensures data accuracy, completeness, and consistency, mitigating risks associated with poor data quality.

Improved Reporting and Compliance: By centralizing and standardizing ESG data, MDM facilitates efficient reporting and compliance with evolving ESG regulations.

Enhanced Decision-Making: Accurate and reliable ESG data empowers companies to make informed decisions about sustainable investments, operations, and stakeholder engagement.

Planting the Seeds for a Sustainable Future:

In our data-driven future, sustainable finance practices are no longer optional but imperative. Robust Master Data Management (MDM) solutions like Verdantis unlock the full potential of ESG data, fostering informed decision-making and transparency. Empower your organization in sustainable finance with MDM, navigating the complex financial landscape one well-governed data point at a time.

Mastering material data management is not just a business necessity but a strategic advantage in our evolving world. Prioritizing accurate material data helps companies navigate green finance, meet ESG standards, and reduce carbon footprints. Integrating sustainability into core decision-making processes contributes to a more resilient and environmentally conscious global economy.

To embark on a data led ESG strategy, organizations require internal support and guidance from consulting partners like Verdantis to craft a blueprint. Considering the vast amount of data involved, the right technology becomes essential.

Remember, MDM is not just about managing data, it's about managing your organization's journey towards a sustainable and responsible future.

Get In Touch Today To Embrace A Sustainable Future: [email protected]/

www.verdantis.com/contact

#ESG#Sustainability#SustainableFinance#GreenFinance#ImpactInvesting#ClimateAction#CorporateSocialResponsibility#CSR#DataDrivenDecisions#FutureProofing#MasterDataManagement#MaterialDataManagement#DataGovernance#GreenInvesting#SustainableInvesting#ESGInvesting#FinTech#ClimateTech#CleanTech#CircularEconomy#Datacleansing

0 notes

Text

Sustainable and Responsible Investing (SRI): Building Wealth with a Conscience

In a world where social and environmental concerns are at the forefront, Sustainable and Responsible Investing (SRI) has emerged as a powerful strategy that not only aligns investment goals but also contributes to positive global change. This blog post will delve into the principles of SRI, its impact on financial markets, and how investors can integrate these strategies into their…

View On WordPress

0 notes

Text

0 notes