#GreenFinance

Text

youtube

The Truth About Green Fintech's $540 Billion Future

We talk about the potential and problems associated with investments in climate tech and green fintech today. It investigates why, in spite of advantageous regulatory tailwinds, many asset-heavy companies are unable to secure traditional venture capital and private equity funding. The significance of government incentives, the protracted path to profitability, and the unpredictability of green premiums are all emphasized in the video. It highlights the need of properly evaluating these investments and warns investors about the hazards associated with investing in green tech ETFs.

0 notes

Text

The Evolution of ESG Screening: From Exclusion to Inclusion

In its contemporary form, ESG screening involves evaluating companies based on various parameters such as their products and services, ESG controversies, and alignment with global regulations and frameworks. All sustainability data can be effectively utilized for screening based on different priorities by simply setting the relevant thresholds. This evaluation can lead to either exclusion or inclusion in investment portfolios, depending on the investor’s objectives and the nature of the company’s ESG profile.

Inrate has provided various clients with screening capabilities based on UNGC compliance, SDG Impact, ESG Controversies, Product Involvement and more in order to align with varying sustainability priorities.

Impact ratings also act as a positive screening tool, enabling FMPs to identify top performers in various sectors and select them in a portfolio or specific fund accordingly. Such ratings can be utilized for Best-In-Class portfolios and Impact Investing strategies.

Conclusion

As sustainable investing continues to evolve, ESG screening has transformed from a simple exclusionary tool into a sophisticated instrument for portfolio construction. Its ability to support both negative and positive screening makes it particularly valuable in today’s market, where investors increasingly seek to create thematic portfolios that not only avoid harm but actively contribute to sustainable development.

Positive screening, in particular, offers a powerful means to build portfolios with enhanced sustainability profiles. It’s especially useful for thematic strategies and impact investing, allowing investors to concentrate their capital on companies and sectors that are considered leaders in ESG performance.

By leveraging customized ESG screening, investors and fund managers can create more targeted, impactful, and differentiated sustainable investment products. This evolution in screening reflects the broader shift in sustainable investing — from merely avoiding negative impacts to proactively seeking positive change through investment decisions.

#SustainableInvesting#ESG#ResponsibleInvesting#ImpactInvesting#ESGScreening#GreenFinance#EthicalInvesting#Sustainability#InvestmentStrategies#ClimateChange

0 notes

Text

A Guide to ESG Active Ownership: What Investors Need to Know

In the realm of sustainable investing, ESG Active Ownership has emerged as a powerful tool for investors aiming to influence corporate behavior and promote sustainable business practices. But what exactly does ESG active ownership entail, and why is it so impactful?

What is ESG Active Ownership?

ESG Active Ownership involves the use of shareholder power to influence corporate behavior through direct engagement and proxy voting. Investors who practice active ownership work closely with companies to improve their ESG performance, address specific issues, and encourage sustainable business practices. For a detailed overview, you can refer to Inrate’s ESG Active Ownership.

The Importance of ESG Active Ownership

Enhancing Corporate Accountability: By actively engaging with companies, investors can hold them accountable for their environmental, social, and governance practices. This can lead to more transparent and responsible business operations.

Mitigating Risks: Companies that are proactive in addressing ESG issues are often better positioned to manage risks related to environmental and social factors, leading to more stable long-term returns.

Driving Positive Change: Active ownership allows investors to push for changes that can lead to significant improvements in a company’s ESG performance, benefiting both the company and society at large.

How Does ESG Active Ownership Work?

ESG active ownership typically involves:

Engagement: Investors engage in dialogue with company management to discuss ESG issues and encourage improvements.

Proxy Voting: Investors use their voting rights to influence corporate policies and practices.

Collaboration: Investors may collaborate with other stakeholders to amplify their influence and drive broader industry changes.

For more details on how ESG active ownership works, check out Inrate’s methodology.

The Future of ESG Active Ownership

As the focus on sustainability continues to grow, ESG active ownership will play an increasingly important role in shaping the future of corporate governance. Investors who prioritize active ownership are likely to see long-term benefits, both in terms of financial performance and societal impact.

Conclusion

Understanding and implementing ESG active ownership is essential for investors who want to drive sustainable change and make a positive impact. By leveraging their influence, investors can help create a more sustainable and ethical business environment. To learn more, visit Inrate’s ESG Active Ownership.

#ESG#Sustainability#ActiveOwnership#ImpactInvesting#CorporateGovernance#SocialResponsibility#GreenFinance#EthicalInvesting#SustainableInvesting#ESGEngagement

0 notes

Text

Voluntary Carbon Credit Market: Opportunities, Challenges, and the Path Toward a Low-Carbon Economy

The global voluntary carbon credit market size is anticipated to reach USD 24.00 billion by 2030 and is anticipated to expand at a CAGR of 34.6% during the forecast period, according to a new report by Grand View Research, Inc. The voluntary carbon credit market (VCM) refers to the trading of carbon credits on a voluntary basis outside of any legal or regulatory requirements. In this market, companies, individuals, and other entities purchase carbon credits to offset their greenhouse gas emissions and meet self-imposed sustainability goals.

Voluntary Carbon Credit Market Report Highlights

Based on project, renewable energy dominated the market and accounted for a revenue share of 39.08% in 2023. Wind and solar farms generate credits by reducing emissions compared to traditional sources. This creates financial incentives for clean energy development, as companies can earn revenue while tackling climate change

Industrial dominated the component segment with more than 32.5% share in 2023. Industries like manufacturing and heavy production are driving growth in the market. These high-emitting sectors purchase credits from renewable projects to offset their footprint, fueling clean energy development while meeting sustainability goals

Private Companies dominated the end use segment. Private companies are a growing force in the voluntary carbon credit market. They purchase credits generated by emissions-reducing projects, like renewable energy, to offset their own footprint. This trend benefits both sides: companies achieve sustainability goals, and green projects gain vital funding

Asia Pacific is expected to witness significant growth in the market owing to factors such as supportive policies and growing environmental concerns

For More Details or Sample Copy please visit link @: Voluntary Carbon Credit Market Report

The VCM is facilitated by a variety of independent certification programs, such as the Verified Carbon Standard, Gold Standard, and Climate Action Reserve, which establish accounting rules, project eligibility criteria, and verification procedures for carbon credit projects. These projects span a range of activities, including renewable energy, forestry, and carbon capture and storage. However, the VCM has faced criticism over the quality and integrity of some carbon credits, leading to calls for greater standardization and transparency.

Governments are increasingly engaging with the VCM, using it to help meet their national climate goals under the Paris Agreement. For instance, Japan's GX League requires companies to offset any emissions they fail to reduce directly, using the VCM as a complementary mechanism. Policymakers see the VCM as a way to mobilize private capital for climate action, particularly in developing countries where the potential for cost-effective emissions reductions is high. At the same time, there are concerns that the VCM could undermine efforts to achieve deep, economy-wide decarbonization if not properly regulated and integrated with broader climate policy. The voluntary carbon credit market represents a growing and evolving landscape, with the potential to play a significant role in the global transition to a low-carbon economy

Gain deeper insights on the market and receive your free copy with TOC now @: Voluntary Carbon Credit Market Analysis Report

We have segmented the global voluntary carbon credit market report based on project, application, end-use, and region.

#VoluntaryCarbonMarket#CarbonCredits#Sustainability#CarbonOffset#ClimateAction#CarbonFootprint#NetZero#GreenFinance#ClimateChange#EnvironmentalImpact#CarbonReduction#SustainableBusiness#CarbonNeutral#EcoFriendly#CarbonTrading#ClimateMitigation#RenewableEnergy#SustainableDevelopment#CarbonEconomy#ClimateFinance

0 notes

Text

What to expect from union budget 2024?

Image by freepik

The Union Budget 2024 in India is expected to focus on a variety of sectors with a strong emphasis on growth and inclusion. Here are some key expectations:

Tax Reforms and Reliefs: There are calls for tax relief on interest earnings from deposits, home loans, and rationalizing the taxation of Employee Stock Ownership Plans (ESOPs). Simplifying tax compliance processes and…

#Budget2024#DigitalIndia#EconomicGrowth#ElectricVehicles#Fintech#GreenFinance#HealthcareBudget#IndiaBudget2024#InfrastructureInvestment#JobCreation#MakeInIndia#SkillIndia#Startups#TaxReforms#UnionBudget2024

0 notes

Text

Climate-Driven Capital Relocation

Bangkok's capital must move in response to climate change, signifying adaptability, cooperation, and resilience for a sustainable future in the face of rising sea levels.

Climate change is one of the few phenomena that directly and significantly affects both the natural world and human society. Every element of our lives, including the places we live in and the air we breathe, is impacted by it. Bangkok is the most notable example of this, as the city's core faces an existential threat from the sea's unceasing climb in elevation.

Climate projections indicate that flooding is impending, making consideration of a capital relocation necessary. This acts as a somber symbol of how we are all coming to terms with the consequences of the decisions we have made. Pavich Kesavawong's dire forecast that Bangkok will be submerged by the end of the century if we carry on in the same direction serves as a wake-up call to take preventive measures to mitigate the impending issue.

The crux of this dilemma is how to strike a compromise between the need to preserve significant centers of government and business and the irreversible advance of climate change. Relocating to a capital city is a challenging endeavor that involves numerous logistical challenges as well as socio-political, economic, and environmental aspects.

It is critical to comprehend how urbanization and climate resilience are related in order to have a meaningful discussion on capital relocation. Bangkok is a huge, bustling metropolis that is a testament to human ingenuity and adaptation. But as sea levels rise, even the most resilient cities will eventually reach their breaking point.

The recommended courses of action, which include building dikes akin to those found in the Netherlands, emphasize the need for innovative solutions tailored to the unique needs of each site. However, as Mr. Pavich correctly notes, these measures may prove insufficient to halt the oncoming waves. Consequently, thinking about a capital shift becomes a sensible response to a danger to one's life itself.

Relocating to a capital city has a big impact on socioeconomic dynamics, government, and identity. Bangkok, a thriving center of trade and culture, encapsulates the intricacy and ambitions of modern-day Thailand. Moving its capital would signal a major shift in the direction of the nation, with implications that extended well beyond the realm of urban planning.

Furthermore, even outside of Thailand, the debate over capital relocation is relevant to broader global conversations about climate adaptation and mitigation. The example of Indonesia, which is set to establish Nusantara as its new capital, emphasizes how critical it is to address low-lying coastal cities' vulnerabilities to climate change.

But even in the face of the approaching flood, revolutionary change is possible. Given the potential for capital migration, rethinking urban settings via the prisms of sustainability, equality, and resilience is essential. It presents an opportunity to support inclusive development strategies that prioritize environmental and public health.

Above all, the concept of capital flight underscores the criticality of nations cooperating to confront the existential risks posed by climate change. Bangkok's situation is a microcosm of a worldwide issue that transcends national borders and calls for hitherto unheard-of levels of collective action.

While taking into account the lessons learned from the past and charting a course for the future, policymakers must accept the demands of the present. Moving to a capital city is one way to demonstrate the adaptability and foresight needed to handle an uncertain future. For the legacy to be preserved for future generations, it requires courage, vision, and unrelenting dedication.

Ultimately, the necessity of climate-driven capital mobility is fundamental to our shared humanity and goes well beyond the domains of geopolitics and economics. It is proof of humankind's capacity to persevere in the face of adversity, forge new paths in the face of uncertainty, and protect the environment for future generations. In response to the call to action, let's embark on a more resilient and long-term course toward a future that can withstand increasing seas.

For other information>>

0 notes

Video

youtube

Carbonomics: Rethinking and accelerating Carbon supply chain finance wit...

#youtube#Carbonomics#CarbonSupplyChain#ClimateAction#Sustainability#GreenFinance#CarbonNeutral#SupplyChainManagement#ClimateFinance#RenewableEnergy#EcoFriendly

0 notes

Text

Mastering Material Data Management: A Cornerstone for Sustainable Decision-Making in Green Finance

In today's world, sustainability isn't just a buzzword - it's a driving force for businesses and investors alike. And at the heart of it all lies ESG data. This critical information paints a picture of a company's environmental, social, and governance performance, but gathering it can be a real challenge.

Imagine sifting through mountains of spreadsheets, deciphering cryptic reports, and chasing down data scattered across departments. It's enough to give even the most sustainability-minded individual a headache.

That's where Master Data Management (MDM) steps in, playing a crucial role in ensuring accurate, reliable, and consistent ESG reporting.

Understanding ESG Data:

At the heart of sustainable finance lies ESG data, providing information about a company or investment's environmental, social, and governance (ESG) attributes. This data is used by a wide range of stakeholders, including investors, analysts, companies, policymakers, and more, to understand and make informed decisions about business effectiveness, risk, and sustainability.

Sustainable data management is the responsible management and handling of data throughout its lifecycle. This includes the collection, processing, storage, and disposal of data. Sustainable data management aims to minimize the environmental impact of data management practices, reduce energy consumption, and optimize the use of resources. Sustainable data management also focuses on ensuring that data is used in a socially responsible and ethical way.

Why is Sustainable Data Management Important?

Sustainable data management is essential for several reasons. Firstly, it helps to minimize the environmental impact of data management practices. Data centres and other IT infrastructure consume significant amounts of energy and produce a considerable amount of carbon emissions. Sustainable data management practices aim to reduce energy consumption and carbon emissions by optimizing data centre design, improving energy efficiency, and using renewable energy sources.

88% of publicly traded companies have ESG initiatives in place followed by 79% of venture and private equity-backed companies and 67% of privately-owned companies. (Src:Navex)

Data Collection for ESG Reporting

ESG reporting demands transparency on a company's environmental, social, and governance practices. The first step is choosing the relevant metrics based on your industry, reporting framework (e.g., GRI, SASB, TCFD), and stakeholder interests.

Each framework defines specific metrics for different ESG categories like:

Environment: Greenhouse gas emissions, water usage, waste generation, resource consumption, etc.

Social: Labor practices, diversity and inclusion, employee health and safety, community engagement, etc.

Governance: Board composition, executive compensation, shareholder rights, anti-corruption practices, etc.

Gathering the data to tell this story is crucial, but it can be a complex process. Once the metrics are identified, you need to gather data from various sources:

Internal Data: This includes energy consumption, waste generation, employee diversity, community engagement, and governance policies. Data may reside in various systems like energy meters, HR databases, and financial records, etc.

External Data: Suppliers, industry groups, and governmental agencies provide data on things like raw material sourcing, labor practices, and regulatory compliance, etc.

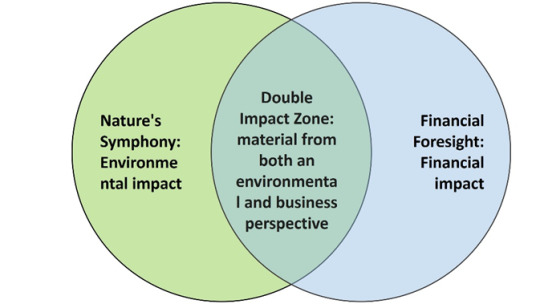

Prioritizing your Data Collection with Double Materiality

Before diving into data mountains, it's crucial to define your Everest. Enter double materiality, the guiding compass for prioritizing the most impactful ESG and sustainability data your organization needs to collect.

Double materiality emphasizes matters that are significant:

From an ESG perspective: How your operations and actions affect the environment, society, and governance.

From a financial perspective: How ESG issues can impact your business risks and opportunities.

Think of it like Venn diagram of "sustainability is good for the planet" and "sustainability is good for business." The overlapping area forms your double materiality sweet spot, focusing data collection efforts on topics that matter most, both ethically and economically.

Practically, focus your data collection laser! By identifying the most critical ESG topics and risks, you ensure your efforts aren't scattered. Take for example the rising threat of extreme weather events for an energy and utility company – a double materiality double whammy for both sustainability and the bottom line! Now, let's turn the screws: what are the key climate risk data points and KPIs this company needs to track? Where's this data hiding, internally or externally? And how can they grab it efficiently? Prioritization isn't just about sorting – it's about taking targeted action for maximum impact.

The Challenges of Data Cleansing and Management:

Gathering the valuable information isn't always a picnic. Here are some common hurdles:

Data Silos: ESG data often gets trapped in isolated pockets across different departments and systems.

Inconsistent Formats: Metrics may be measured and reported differently, making comparisons difficult.

Data Quality Issues: Missing or inaccurate data can undermine the entire reporting process.

Lack of Resources: Companies may struggle to dedicate time and expertise to data collection.

Inaccurate or missing data can undermine the credibility of your ESG report. MMDM solution providers like Verdantis offers data cleansing, validation, and enrichment tools, enhancing data quality and minimizing errors.

Your ESG materiality should be a mirror reflecting your unique identity, values, and business model. Sustainability and ESG initiatives should build upon this foundation, not replace it.

By prioritizing data management, you ensure your focus remains on the issues that truly matter, driving both environmental progress and financial success.

MDM: The Powerhouse for ESG Data:

As ESG reporting requires accurate and comprehensive data across multiple dimensions, MDM provides the necessary framework to ensure data integrity and consistency.

MDM (Master Data Management) provides the foundation for effective management of ESG data, offering several key benefits:

Single Source of Truth: MDM establishes a single, centralized repository for all ESG data, eliminating inconsistencies and streamlining access for various stakeholders.

Data Quality and Integrity: MDM ensures data accuracy, completeness, and consistency, mitigating risks associated with poor data quality.

Improved Reporting and Compliance: By centralizing and standardizing ESG data, MDM facilitates efficient reporting and compliance with evolving ESG regulations.

Enhanced Decision-Making: Accurate and reliable ESG data empowers companies to make informed decisions about sustainable investments, operations, and stakeholder engagement.

Planting the Seeds for a Sustainable Future:

In our data-driven future, sustainable finance practices are no longer optional but imperative. Robust Master Data Management (MDM) solutions like Verdantis unlock the full potential of ESG data, fostering informed decision-making and transparency. Empower your organization in sustainable finance with MDM, navigating the complex financial landscape one well-governed data point at a time.

Mastering material data management is not just a business necessity but a strategic advantage in our evolving world. Prioritizing accurate material data helps companies navigate green finance, meet ESG standards, and reduce carbon footprints. Integrating sustainability into core decision-making processes contributes to a more resilient and environmentally conscious global economy.

To embark on a data led ESG strategy, organizations require internal support and guidance from consulting partners like Verdantis to craft a blueprint. Considering the vast amount of data involved, the right technology becomes essential.

Remember, MDM is not just about managing data, it's about managing your organization's journey towards a sustainable and responsible future.

Get In Touch Today To Embrace A Sustainable Future: [email protected]/

www.verdantis.com/contact

#ESG#Sustainability#SustainableFinance#GreenFinance#ImpactInvesting#ClimateAction#CorporateSocialResponsibility#CSR#DataDrivenDecisions#FutureProofing#MasterDataManagement#MaterialDataManagement#DataGovernance#GreenInvesting#SustainableInvesting#ESGInvesting#FinTech#ClimateTech#CleanTech#CircularEconomy#Datacleansing

0 notes

Text

Northvolt Secures Record $5 Billion in Debt Financing for Expansion and Recycling Facility

Europe’s Leading Battery Manufacturer Readies For Possible Stock Market Listing

In a significant development, Northvolt, the Swedish battery manufacturer, has solidified its status as Europe’s best-funded start-up by securing a groundbreaking $5 billion in debt financing. The funding, acknowledged as the largest green loan in Europe to date, is poised to fuel the expansion of the company’s inaugural gigafactory and the construction of a state-of-the-art recycling facility on the same site. This move highlights the insatiable demand for capital in the region’s burgeoning battery sector and positions Northvolt for potential stock market listing, pending improved market conditions.

Record-Breaking Financing

Northvolt’s recent announcement validates earlier reports from the Financial Times in March, indicating the company’s intent to raise $5 billion in debt. The funds were sourced from a consortium of 23 banks, alongside significant contributions from the European Investment Bank and the Nordic Investment Bank. This financing, which encompasses the refinancing of a $1.6 billion debt package from July 2020, brings the company’s total raised capital to over $13 billion, facilitating its ambitious plan to establish four major factories across Sweden, Germany, and Canada by the decade’s end.

Challenges and Milestones at Northvolt Ett

The financing will play a pivotal role in realizing the full potential of Northvolt Ett, the company’s inaugural gigafactory situated below the Arctic Circle in northern Sweden. Although the company Ett commenced battery production in late 2021, it faced delays and setbacks, impacting overall production. Notably, the Swedish truckmaker Scania, among other customers, has been awaiting deliveries from Northvolt Ett, contributing to the company’s losses, which surged eight-fold to nearly SKr11 billion ($1.1 billion) for the first three quarters of 2023 compared to the previous year.

Focus on Sustainability and Circular Practices

Peter Carlsson, Northvolt’s CEO and co-founder, emphasized the financing as a milestone for the European energy transition. The funds will not only support the gigafactory but also finance the adjacent recycling plant, Revolt Ett. This marks the first instance of a company outside Asia placing a recycling facility next to battery manufacturing. According to Northvolt, recycled battery materials boast a 70% lower carbon footprint than mined minerals, reinforcing the company’s commitment to sustainable and circular business practices.

Environmental Recognition and Future Challenges

Northvolt received a commendable “dark green” rating from Cicero, a Norwegian consultancy assessing the environmental quality of debt offerings. Emma Nehrenheim, Chief Environmental Officer at Northvolt, expressed pride in attracting top-tier financial partners, noting that global capital is increasingly keen on investing in electrification and climate change mitigation. Despite the challenges faced by the company, executives remain optimistic, anticipating that future gigafactories will necessitate their own multibillion-dollar financing packages.

Northvolt received advisory support from BNP Paribas, Allen & Overy, and Mannheimer Swartling, underscoring the strategic collaboration behind this monumental financing endeavor. As Northvolt navigates its expansion and sustainability initiatives, the battery manufacturer is positioned as a trailblazer in Europe’s transition towards greener energy solutions.

Also Read: Pallet Jacks: The Backbone of Efficient Warehousing and Logistics

#Northvolt#GreenFinance#BatteryTechnology#Sustainability#EuropeanStartups#DebtFinancing#RecyclingFacility#Gigafactory

0 notes

Text

0 notes

Text

0 notes

Text

ESG Screening: A Dynamic Tool for Modern Sustainable Investing

ESG screening has evolved into a vital and versatile component in the toolkit of responsible investors looking to align their investment portfolios with Environmental, Social, and Governance (ESG) principles. While it originated primarily as an exclusionary practice, ESG screening has transformed into a customized, sophisticated tool for both exclusion and inclusion, particularly relevant in today’s market for creating thematic sustainable portfolios and funds.

It helps investors achieve a variety of objectives, including but not limited to:

Mitigating ESG risks

Developing Article 8 or 9 funds

Supporting business models that address ESG issues

Developing regulatory-aligned portfolios

Improving or maximizing a portfolio’s overall ESG rating

The Evolution of ESG Screening

Initially, ESG screening was primarily used as a negative screening tool, allowing investors to systematically exclude companies that conflicted with their ethical standards or sustainability goals. This approach has deep roots in responsible investing, dating back to faith-based investment strategies.

However, as sustainable investing has matured, so has the application of ESG screening. Today, it serves not only as a method for exclusion but also as a powerful tool for positive screening, enabling investors to actively select companies aligned with specific sustainability themes or goals.

The positive screening itself can be utilized for various investment strategies:

1. Best-in-Class: This approach focuses on companies that outperform their peers in ESG measures within their respective sectors.

2. ESG Improvers: This strategy targets companies that are improving their ESG measures more rapidly than their peers, capitalizing on positive change.

3. Thematic Investing: This involves selecting companies that are actively addressing specific ESG challenges, such as climate change or gender diversity.

4. Impact Investing: Selecting specific companies that have a positive sustainability impact

The Essence of Modern ESG Screening

In its contemporary form, ESG screening involves evaluating companies based on various parameters such as their products and services, ESG controversies, and alignment with global regulations and frameworks. All sustainability data can be effectively utilized for screening based on different priorities by simply setting the relevant thresholds. This evaluation can lead to either exclusion or inclusion in investment portfolios, depending on the investor’s objectives and the nature of the company’s ESG profile.

Inrate has provided various clients with screening capabilities based on UNGC compliance, SDG Impact, ESG Controversies, Product Involvement and more in order to align with varying sustainability priorities.

Impact ratings also act as a positive screening tool, enabling FMPs to identify top performers in various sectors and select them in a portfolio or specific fund accordingly. Such ratings can be utilized for Best-In-Class portfolios and Impact Investing strategies.

Conclusion

As sustainable investing continues to evolve, ESG screening has transformed from a simple exclusionary tool into a sophisticated instrument for portfolio construction. Its ability to support both negative and positive screening makes it particularly valuable in today’s market, where investors increasingly seek to create thematic portfolios that not only avoid harm but actively contribute to sustainable development.

Positive screening, in particular, offers a powerful means to build portfolios with enhanced sustainability profiles. It’s especially useful for thematic strategies and impact investing, allowing investors to concentrate their capital on companies and sectors that are considered leaders in ESG performance.

By leveraging customized ESG screening, investors and fund managers can create more targeted, impactful, and differentiated sustainable investment products. This evolution in screening reflects the broader shift in sustainable investing — from merely avoiding negative impacts to proactively seeking positive change through investment decisions.

#SustainableInvesting#ESG#ResponsibleInvesting#GreenFinance#Sustainability#ESGScreening#ImpactInvesting#EthicalInvesting#ClimateAction#ESGTrends#esginvesting#esgdata

0 notes

Text

#ESG#Sustainability#ImpactInvesting#ResponsibleInvestment#CorporateResponsibility#ESGRatings#SustainableFinance#ESGImpact#SustainableInvesting#GreenFinance

0 notes

Text

🌍 Startling UN report at #COP28 reveals a staggering $7 trillion annually fuels activities harming our planet, overshadowing investments in nature-based solutions. It's time to #GreenFinance and redirect these funds towards a sustainable future. The call for action is louder than ever! 🌿💰

#ClimateAction#NaturePositive#COP28UAE#sustainablefuture#climatecrisis#netzero#biodiversity#GlobalGoals#geohoney

6 notes

·

View notes

Text

Buy Flats in Ajmera Greenfinity by IndexTap

Ajmera Greenfinity is a high-end residential complex in Mumbai located in the heart of Wadala (East). This upcoming project, which is being developed by the eminent Ajmera Group, will be ready for possession in January 2024. This gated community promises a luxurious living experience with an emphasis on sustainability.

The budget-friendly housing society, which is spread across a generous land parcel, offers 1, 2 and 3 BHK apartments in a variety of configurations. Ajmera Greenfinity consists of a single 22-floor tower. The apartments in the complex are spacious and well-ventilated, with plenty of natural light and cross-ventilation.

0 notes

Text

0 notes