#Expert Advisors

Explore tagged Tumblr posts

Text

#stock market#investing#forex#cfd#crypto#casino#binaryoptions#expert advisors#xauusd#xagusd#aus200#eu50#fra40#ger40#it40#jp225#neth25#spain35#swi20#uk100#us30#us100#us500

4 notes

·

View notes

Text

AI-Powered Trading Systems: The Future of Forex Trading in 2025

Hey there, fellow traders! If you’ve been in the forex game for a while or you’re just starting to explore the wild world of currencies, you’ve probably heard the hype about AI-powered trading systems. It’s like the markets got a shiny new sidekick, and trust me, it’s shaking things up. As someone who’s seen forex evolve over the years, I’m pumped to break down what these systems are, why they’re…

0 notes

Text

🌀📉 Market Moving Sideways? Don’t Sleep on It!

Consolidation means tight, low-volatility price action… and often, a breakout is coming! 💥📊

Learn how to spot these quiet zones before the storm — and prepare to strike when the move hits! 🎯🚀

👉 Master the setup here:

#kraitos#forexsignals#expert advisors#expert advisor#forexindicator#gearbox#forexstrategy#forextrading#forex#auvoriaprime

0 notes

Text

Discover how leading portfolio management services stay ahead of market trends and adapt strategies to meet evolving financial landscapes for better returns and risk management.

#portfolio management#market trends#financial services#asset management#investment strategies#risk management#market adaptation#financial growth#portfolio strategies#wealth management#market analysis#investment tips#financial planning#portfolio diversification#market fluctuations#financial success#investment solutions#expert advisors#investment portfolio#economic changes

0 notes

Text

Telegram Signal Copier: Is Good For Beginners?

If you're new to trading and have come across Telegram Signal Copier, you might be wondering if they're a good fit for beginners. Telegram Signal Copiers are tools designed to automate trade signals from Telegram channels to your trading platform, potentially making the trading process easier and more efficient.

But is this tool suitable for someone just starting out? Let’s explore the pros and cons to help you make an informed decision.

What is Telegram to MT4 copier?

Telegram Signal copier is also known as telegram to mt4 copier. It has variable names. So, do not get confused! Suppose, you follow a telegram channel where you receive quality forex signals. Now, you want those signals to get copied and executed into your Metatrader account automatically. Telegram to mt4 copier is the tool that helps you copy and execute the trades into your account.

Why is TSC Good for Beginners?

Easy to Use:

Telegram Signal Copiers are designed with simplicity in mind. They often feature user-friendly interfaces and straightforward setup processes, making them accessible even for those who are new to trading. You don’t need to have advanced technical knowledge to get started; most of the work is done for you once the copier is set up.

Real-time trades:

One of the significant advantages of using a Telegram Signal Copier is its ability to execute trades in real time. This ensures that you can act on signals immediately as they are received, which is crucial in the fast-moving world of forex trading. Real-time execution helps you capitalize on market opportunities without delay.

Access to Expert Insights:

By using a Telegram Signal Copier, you can tap into the expertise of experienced traders who provide signals through Telegram channels. This allows you to benefit from professional insights and strategies without needing to be an expert yourself. It’s like having a knowledgeable mentor guiding your trades.

Time Efficiency:

Managing trades manually can be time-consuming, especially for beginners who are still learning the ropes. A Telegram Signal Copier automates this process, saving you time and effort. You can spend less time on trade execution and more time focusing on other aspects of your trading strategy or personal life.

Trade Anytime, Anywhere:

Telegram Signal Copiers work seamlessly across various devices and locations. Whether you’re at home, at work, or on the go, you can stay connected to your trades and make adjustments as needed. This flexibility ensures that you can manage your trades effectively no matter where you are.

Tips for Beginners Using TSC:

Choose reliable signal providers with a proven track record.

Start with a demo account to practice.

Don’t set unrealistic expectations as trading involves risks and fluctuations.

Manage your risk using SL and TP features to protect your investment.

Stay informed about market news and conditions.

Regularly monitor and analyze the performance of the trades.

Avoid overtrading; focus on quality trades rather than excessive trading.

Use the opportunity to learn from signals and improve your trading.

Customize the copier’s settings to match your trading style and risk tolerance.

Seek support if you encounter issues or have questions.

Conclusion:

In summary, a Telegram Signal Copier simplifies trading by automating the process, providing real-time trade execution, and offering access to expert insights, all while saving you time and allowing you to trade from anywhere. These features make it an excellent tool for beginners looking to streamline their trading experience.

1 note

·

View note

Text

FREE eBOOK (.PDF) -This eBook includes general information and educational resources for explaining the modern use of automated trading, plus some practical information and advice on how to create a proprietary automated trading system. The optimization of a trading strategy through sophisticated backtesting and walk-through steps is maybe the most difficult part of strategy building. This eBook contains information on how to successfully backtest and optimize automated strategies using advanced commercial software.

0 notes

Text

Automated Forex Trading: Benefits and Risks of Using Trading Robots

Automated forex trading has revolutionized the way traders engage with the forex market. By utilizing trading robots, also known as expert advisors (EAs), traders can execute trades automatically based on pre-defined criteria. While automated forex trading offers numerous benefits, it also comes with inherent risks. This article explores the advantages and disadvantages of using trading robots…

View On WordPress

#Automated Forex Trading#Backtesting#Expert Advisors#Forex Diversification#Forex Indicators#Forex Market#Forex Security#Forex Trading#Forex Trading Plan#Market Analysis#Market Efficiency#Risk Management#Technical Analysis#Trading Automation#Trading Costs#Trading Performance#Trading Robots#Trading Strategies#Trading Technology

0 notes

Text

Unlock Success With The Expert Insight: Your Premier Destination For Written Consultation Expert Advisors

Gain a competitive edge with personalized insights from industry leaders. Our expert advisors offer in-depth analysis, helping you navigate complexities and make informed decisions. Whether it's phone consultations, market surveys, or written consultations, we connect you with top-tier professionals. Accelerate your research, strengthen strategies, and drive success. Join our global network of advisors and be part of dynamic projects. Contact us now to elevate your business with precision and expertise. The Expert Insight – Where Knowledge Meets Solutions!

0 notes

Text

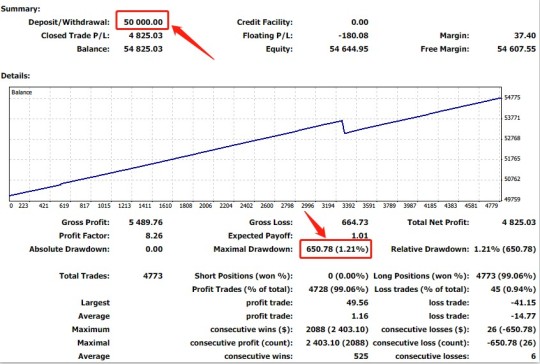

DARK Algo V2 Backtest

#forex#ea bot#ea robot#expert advisor#expert advisors#forex education#forexmarket#forexsignals#forextrading#passive income

0 notes

Text

Ultra Signal Ver2.100

後編をアップしたら、リリースします!

Once I upload the second part, I will release it!

youtube

1 note

·

View note

Text

Get expert broker home loan services and wealth management from FinPrestige.

FinPrestige is a trusted name in broker home loan services and wealth management for Singapore's elite. Their expert advisors craft tailored solutions to elevate wealth and ensure it thrives in a dynamic market. FinPrestige offers competitive rates and personalized options for home loan services, ensuring integrity, reliability, and discretion. Their trust is their capital, and their financial matters are handled with care. FinPrestige provides a global perspective and local expertise, offering clients exclusive benefits like priority services and tailored investment opportunities. With a focus on excellence beyond financial transactions, FinPrestige offers concierge-level service that anticipates needs and exceeds expectations. Join the financial elite and experience a journey where financial success meets prestige.

#finprestigeconsultancy#bank loans for startups#investment opportunities#financial transactions#expert advisors#home loan services

0 notes

Text

🧠💻 Expert Advisor Developer = The Brain Behind the Bot!

Ever wondered who creates those powerful trading bots that run 24/7? 🤖💹

Meet the Expert Advisor Developer — the mastermind behind automated forex strategies! 🛠️📊 They design, code, test, and optimize EAs to help you trade smarter (and hands-free). 🙌

🚀 Dive into the world of EA developers and see how they make automation work for YOU:

#kraitos#expert advisor#expert advisors#forexsignals#forexindicator#gearbox#forexstrategy#forextrading#auvoriaprime#forex

0 notes

Text

How Top Portfolio Management Services Adapt to Changing Markets

Financial markets by no means sleep. They shift, evolve, and once in a while transform entirely—leaving traders scrambling to alter their strategies. This consistent flux explains why Top Portfolio Management Services has become essential gear for extreme buyers searching for stability amid chaos. These specialized services don't just react to market modifications; they anticipate them, creating resilient investment frameworks that weather monetary storms.

Modern Strategies Backed by Advanced Risk Assessment

The best portfolio management services distinguish themselves through state-of-the-art hazard evaluation fashions. Gone are the times of simplistic bull-bear market strategies. Portfolio management services in India employ multi-dimensional evaluation frameworks that take into account macroeconomic signs, quarter-precise disruptions, and even geopolitical tensions. This comprehensive method allows them to identify potential trouble spots before they emerge on maximum buyers' radars.

Technology Meets Human Judgment

What's specifically amazing is how those offerings have embraced information analytics without dropping the human contact. Algorithms might pick out styles, but seasoned portfolio managers interpret what those styles imply for unique customer conditions. This balance between technological insight and human judgment represents the brand-new gold well-known in investment management.

Personalization and Investor-Specific Strategies

Personalization has emerged as every other crucial model. While portfolio management services in India once presented relatively standardized programs, present-day first-rate corporations recognize that investor needs vary dramatically. Some clients prioritize boom, others are searching for earnings technology, and nonetheless others cognizance on capital protection. Top-tier offerings now build, without a doubt, bespoke techniques aligned with personal desires, timelines, and risk tolerances.

Responsive Portfolio Rebalancing and Agile Execution

Portfolio rebalancing—as soon as it is done quarterly or yearly—has developed right into a continuous, responsive procedure among industry leaders. This agility lets portfolio control services in India capitalize on short-term opportunities while retaining a long-term strategic course. The ability to pivot quickly but thoughtfully separates exceptional offerings from simply adequate ones.

Transparency Through Real-Time Communication

Communication practices have converted as well. The fine portfolio management services now provide clients with real-time insights via secure platforms, offering unprecedented transparency. This openness builds trust and facilitates investors recognizing why certain choices make sense inside broader marketplace contexts.

Navigating Regulations with Precision

Regulatory navigation represents every other region wherein premier services prove their real worth. As financial policies develop increasingly complex throughout global markets, portfolio control offerings in India have developed specialized expertise in compliance. This understanding protects buyers from capability prison complications while maximizing opportunities within regulatory frameworks.

Incentive-Based Fee Structures

Fee systems have additionally developed, with overall performance-primarily based additives becoming more commonplace. This alignment of pastimes ensures that portfolio managers prevail most effectively whilst their clients do—an effective incentive for excellence that wasn't constantly found in conventional management models.

Stability in Times of Market Extremes

For investors considering expert help, the distinction between common and excellent portfolio control will become most apparent at some point of market extremes. When volatility spikes, the high-quality portfolio control offerings hold composure, following hooked-up protocols in place of making panic-driven choices. This disciplined approach frequently preserves wealth that might in any other case evaporate during turbulent intervals.

Integrating Ethical Investment Principles

The panorama continues evolving, with top portfolio management services incorporating sustainability metrics and ethical issues into their funding frameworks. This variation displays converting investor priorities and acknowledges that long-time-period overall performance increasingly correlates with accountable company conduct.

Final Thoughts

For those searching for guidance in these complex surroundings, choose topics carefully. The satisfactory portfolio management services integrate technological sophistication with human perception, offering personalized strategies that adapt to each marketplace situation and individual situation. This winning aggregate gives you what each investor in the end seeks: monetary security amid uncertainty and opportunity amid change.

#portfolio management#market trends#financial services#asset management#investment strategies#risk management#market adaptation#financial growth#portfolio strategies#wealth management#market analysis#investment tips#financial planning#portfolio diversification#market fluctuations#financial success#investment solutions#expert advisors#investment portfolio#economic changes

0 notes

Text

If you have $10K, try it to control the Maximum Drawdown within 25% and earn an annual return of over 100%.

Every time 0.01 lots are traded, a monthly profit of 1K US dollars is easily achievable.

0 notes