#Extract Foreclosure Data

Explore tagged Tumblr posts

Text

Vegas REIT Dump: Firm Sells $200M Inventory

Key Takeaways A leading REIT has placed $200 million worth of Las Vegas housing inventory on the market, raising concerns across the real estate sector. The sudden influx of listings is putting downward pressure on housing values and shaking investor confidence. Regulatory bodies are increasing scrutiny as uncertainty and anxiety spread among market participants. Unprecedented Inventory Surge Challenges Las Vegas Market Las Vegas stands on the brink of chaos as reports surface of a dominant REIT unloading a staggering $200 million in housing inventory, sending shockwaves through the market. Investors eye the sudden surge in listings with dread, fearing a tidal wave of plunging values and evaporating confidence. Regulatory scrutiny intensifies, housing supply shrinks, and panic pulses through industry circles. The city’s fragile real estate ecosystem now hangs by a thread—will this be the trigger that unravels it all? Institutional Investors Reshape Las Vegas Housing Market A monstrous shadow looms over Las Vegas real estate as institutional tremors threaten to ignite chaos across the valley. In the grip of rising uncertainty, market speculation reaches a fever pitch. Reports swirl of a $200 million REIT inventory dump, casting dread over homeowners, renters, and investors alike. Across manicured subdivisions and echoing luxury towers, fear spreads—what if the pillars holding the market aloft finally give way? Although no direct evidence confirms a single $200 million sell-off in Q1 filings, anxiety remains unyielding. Investors and analysts scour every transaction, parsing data for signals of impending disaster. Institutional buyers, particularly hedge funds, now dominate the South Nevada market, their purchases extracting inventory from the hands of would-be homeowners. The pool of available homes shrinks, not because of new buyers, but because vast quantities are rerouted into corporate rental strategies. This aggressive posture solidifies the grip of Wall Street firms over neighborhoods once ruled by individual owners. The resulting scarcity drives price inflation, infuriating local families frozen out of the dreams of ownership. A relentless surge in single-family rental (SFR) inventory—jumping 10% in a single month—stirs more distress. The numbers climb relentlessly, with active SFR listings swelling to 6,350 by April 2025. The absorption rate holds stable, camouflaging the tightening noose. Institutional liquidity acts as a floor beneath home prices, sparing the market from collapse, but stifling hope for affordable entry. The median non-luxury home stabilizes near $450,000–$485,000, an unyielding barrier for those endeavoring to buy. Meanwhile, the luxury segment defies gravity, with a 7.5% year-over-year jump and a widening gap from the national average, luring even more speculative capital from California and beyond. VICI Properties, a dominant local REIT, exits Q1 with a $1.3 billion senior notes deal and a $510 million casino loan—not a clear harbinger of an imminent residential asset purge but evidence of the colossal leverage powering these entities. Strategic debt financing, focused on casinos and experiential properties, separates the institutional class from the average homebuyer. Since 2000, approximately 131,710 homes have been purchased in the Las Vegas Valley, charting a sharp rise in the post-2008 era by corporations and institutional investors. Yet, the horror remains. Month after month, corporate buyers remove properties from the resale pipeline, depriving Las Vegas of much-needed inventory relief. New construction, lagging, and unable to fill demand, ensure no rescue is in sight. Rumbles spread: Redfin ranks Las Vegas #1 for institutional investor home purchases. Corporate landlords, fixated on rental strategies rather than community stewardship, fuel nightmarish scenarios among locals. Delayed foreclosures offer no consolation, failing to supply additional inventory. Regulatory risks mount as lawmakers awaken to the swelling tide of corporate ownership.

The valley sits on a knife’s edge, obsessed with every institutional trade, every rental listing, every data point that could signal the market's breaking point. Investors and residents alike wait for the next catastrophe, haunted by the monstrous shadow that refuses to dissipate. Assessment Dark clouds may be gathering over the Las Vegas real estate market, as institutional investors make swift and bold moves, like the recent $200 million inventory offload that's grabbing headlines. While such a significant dump certainly stirs anxiety about market stability and future values, it’s important to maintain perspective. Every new property that hits the listings sounds an alarm, but it could also signal opportunities for those willing to look deeper, not just danger for those already invested. The city’s housing market is facing real uncertainty, but the full story is still being written. If you’re a homeowner, an investor, or thinking about entering the market, don’t react out of fear—get informed. Monitor trends, seek expert opinions, and consider how shifts like this $200 million sale could impact your own real estate goals. Now’s the time to dig beneath the headlines and take proactive steps, rather than letting uncertainty make decisions for you.

0 notes

Text

Generate Free Lead List using AI & County Public Data: Property, Tax liens, Permit, Code Violations & Foreclosure Records

Real estate investors, home improvement contractors, and businesses can build robust prospect lists for free by leveraging public data from local county or city websites. Here’s a simple guide to help you get started:

1: Gather Public Data

Most counties and cities update their public records regularly. Look for these key data categories:

Property Ownership & Deed Records

Deeds & Titles: Get details on ownership history, transfers, and any liens.

Tax Records & Assessments

Property Tax Assessments: Review assessed values, tax histories, and delinquency data.

Tax Sale Listings: Identify properties overdue on taxes that might be available at a discount.

Permit Applications & Building Data

Permit Applications: Track projects like roof replacements, solar panel installations, pool additions, or other major improvements.

Code Violations

Code Enforcement Records: Find properties with safety or maintenance issues.

Condemnation & Rehabilitation Notices: Spot properties needing significant repairs, potentially ripe for investment.

Foreclosure, Eviction, & Legal Records

Foreclosure Listings: Locate properties in pre-foreclosure or those heading to auction.

Eviction Records & Legal Filings: Discover data on eviction cases, bankruptcies, or probate proceedings that might signal distressed properties.

2. Export and Format the Data

Depending on the county or city, data may be available in different formats:

CSV Exports: Some websites offer a direct download option.

Online Records: Others display records in batches (e.g., 50-100 per page).

PDF Files: Certain data like tax liens or auction details might be provided as PDFs.

3. Transform Raw Data into Actionable Insights with AI

Instead of manually copying records, use AI tools like ChatGPT to structure your data efficiently:

Direct Extraction: Supply the website URL, and let the AI scrape key details (owner name, address, property status, etc.) into a clean CSV or Excel file.

Manual Upload: Alternatively, copy-paste data or upload PDFs into the AI tool and prompt it to organize the information.

4. Enhance Your Prospect List with Data Append Services

Once you’ve compiled your leads, you might want to add contact details like phone numbers or email addresses. datazapp.com offers a quick and reliable solution to append this crucial information, saving you time and ensuring your lead data is complete.

By following these steps, you can efficiently generate a targeted prospect list from free public records. Whether you choose to harness AI for data extraction or opt for ready-to-use solutions from datazapp.com, you'll be well on your way to smarter, cost-effective lead generation.

#Property Tax#peroperty#tax#foreclosure#foreclosure data#foreclosure list#foreclosure append#Code Violations

0 notes

Text

Income and property fraud risk handling

Income and property fraud are significant challenges facing the mortgage industry, leading to financial losses and regulatory issues. Fraudulent activities such as falsifying income documents or inflating property values not only harm lenders but also impact the stability of the housing market. In this context, the integration of ‘Artificial Intelligence’ (AI) technologies presents a promising solution to mitigate these risks and enhance security measures.

The Problem

Income and property fraud significantly affect the mortgage industry, causing numerous challenges. Financial losses directly impact profitability and undermine investor confidence. Non-compliance with regulations due to fraud can result in hefty penalties. There’s also a heightened risk of borrower default and loan delinquencies, further straining financial stability. Trust among stakeholders erodes as fraud becomes more prevalent, and detecting sophisticated fraud schemes adds complexity to the industry. Additionally, the manipulation and exploitation of sensitive borrower information pose severe data security risks. To combat these issues, robust fraud prevention measures and advanced technologies are essential to maintain the mortgage market’s integrity and stability.

Challenges Faced by the Mortgage Industry from Income and Property Fraud:

Financial Losses: Fraudulent activities such as falsifying income documents or inflating property values can result in significant financial losses for mortgage lenders. These losses impact profitability, investor confidence, and overall market stability.

Regulatory Compliance: Mortgage lenders must adhere to strict regulatory guidelines and compliance standards. Income and property fraud can lead to regulatory penalties and legal consequences if not detected and addressed promptly.

Risk of Default: Loans based on fraudulent information are more likely to result in borrower default. This increases the risk exposure for lenders and can lead to a higher rate of loan delinquencies and foreclosures.

Loss of Trust: Instances of fraud erode trust between lenders, borrowers, and investors. This loss of trust can lead to reluctance in lending, reduced investment in mortgage-backed securities, and a general decline in confidence in the mortgage industry.

Complex Fraud Schemes: Fraudsters continuously evolve their tactics, challenging fraud detection and prevention. Sophisticated schemes often involve multiple layers of deception, requiring advanced technologies and strategies to uncover.

Data Security Concerns: The collection and storage of sensitive borrower information pose data security risks. Fraudsters may exploit vulnerabilities in systems to access and manipulate data, increasing the likelihood of fraudulent activities going undetected.

The Solution

Addressing challenges stemming from income and property fraud requires a multi-faceted approach that combines robust security measures, advanced technologies like AI, and ongoing collaboration between industry stakeholders and regulatory bodies.

Alone ‘Artificial Intelligence’ (AI) is revolutionizing the mortgage industry by enhancing fraud detection capabilities, particularly in income and property fraud. Here’s how AI is making a significant impact:

Leveraging AI for Detecting Income Fraud in Mortgages –

Intelligent Document Processing (IDP) is transforming income fraud detection in the mortgage industry by automating and enhancing the accuracy of document analysis. Traditional methods of verifying income involve manual processes prone to human error and manipulation. IDP leverages advanced technologies like Optical Character Recognition (OCR), Machine Learning (ML), and Natural Language Processing (NLP) to efficiently extract and validate information from income documents.

IDP systems can quickly scan and interpret various formats of income-related documents, such as pay stubs, tax returns, and bank statements, identifying inconsistencies or anomalies that may indicate fraud. By cross-referencing data from multiple sources, IDP ensures that the information provided by applicants is accurate and consistent. This reduces the risk of fraudulent activities and improves the reliability of the mortgage approval process.

Moreover, IDP enhances the speed and efficiency of processing mortgage applications, allowing lenders to make faster, more informed decisions. By automating routine tasks, IDP frees up human resources to focus on more complex cases and customer service, ultimately leading to a more streamlined and secure mortgage lending process. As a result, IDP plays a crucial role in mitigating income fraud and safeguarding the integrity of the mortgage industry.

Leveraging AI for Detecting Property Fraud in Mortgages –

Intelligent document processing (IDP) significantly improves property fraud detection in the mortgage industry by automating the extraction, validation, and analysis of document data. By leveraging machine learning and natural language processing, IDP quickly identifies inconsistencies, anomalies, and fraudulent information across various documents such as title deeds, income statements, and property appraisals. This technology ensures data accuracy, reduces manual errors, and flags suspicious activities for further investigation. Additionally, IDP enhances compliance with regulatory standards and speeds up the verification process, making fraud detection more efficient and reliable, ultimately protecting lenders and borrowers from potential financial losses.

Conclusion

In the dynamic landscape of the mortgage industry, the integration of ‘Artificial Intelligence’ (AI) is proving to be a game-changer in combating income and property fraud. AI algorithms analyze vast data sets with unparalleled speed and accuracy, flagging anomalies and patterns that signify potential fraudulent activities.

By leveraging AI technologies like intelligent document processing, the mortgage industry can proactively detect and prevent income and property fraud, minimize financial losses, maintain regulatory compliance, reduce the risk of default, preserve trust among stakeholders, counter complex fraud schemes, and enhance data security measures.

Experience intelligent automation in income and property fraud detection for the mortgage industry, with DocVu.AI.

0 notes

Text

Scraping RealtyTrac Real Estate Listings

Unlock Real Estate Insights with RealtyTrac Listings Scraping by DataScrapingServices.com. In the ever-evolving world of real estate, having access to accurate and comprehensive data is crucial for making informed decisions. RealtyTrac is one of the leading sources for real estate information, providing detailed property listings, foreclosure data, and market trends. DataScrapingServices.com offers a cutting-edge solution for extracting valuable information from RealtyTrac, allowing real estate professionals to gain a competitive edge.

At DataScrapingServices.com, we understand the importance of data in driving successful real estate strategies. Our RealtyTrac Real Estate Listings Scraping service is designed to help real estate investors, agents, and analysts gather essential data efficiently and accurately. By automating the extraction process, we provide our clients with up-to-date information that is crucial for market analysis, investment decisions, and strategic planning.

List of Data Fields

Our RealtyTrac Real Estate Listings Scraping service covers a wide range of data fields, ensuring that you have access to all the information you need. Some of the key data fields we extract include:

Property Details: Address, property type, size, number of bedrooms and bathrooms, and other relevant details.

Listing Information: Listing price, listing date, and status (e.g., for sale, sold, pending).

Foreclosure Data: Foreclosure status, auction dates, and lender information.

Market Trends: Price trends, market activity, and neighborhood statistics.

Owner Information: Owner names and contact details (where available).

Tax Information: Property tax assessments and historical tax data.

Sales History: Previous sales data, including sale dates and prices.

Property Features: Amenities, renovation history, and special features.

Geographic Data: Coordinates, zoning information, and nearby landmarks.

School Information: Details about nearby schools and school district ratings.

Benefits of Scraping RealtyTrac Real Estate Listings

1. Enhanced Decision-Making: Access to comprehensive and accurate data enables real estate professionals to make well-informed decisions, from property investments to pricing strategies.

2. Time Efficiency: Automating the data extraction process saves valuable time, allowing you to focus on analyzing data and formulating strategies rather than gathering information manually.

3. Competitive Advantage: Stay ahead of the competition by leveraging detailed and up-to-date information on properties, market trends, and foreclosure data.

4. Cost-Effective: Our realtytrac real estate listings scraping services reduce the need for manual data collection and minimize errors, leading to cost savings and more efficient operations.

5. Customized Solutions: We tailor our RealtyTrac real estate listingsscraping services to meet your specific needs, ensuring that you get the most relevant and useful data for your business.

6. Scalable: Our RealtyTrac real estate listingsscraping services can scale with your business, accommodating growing data needs and larger volumes of information.

Best Business Directory Scraping Services Provider

Ezlocal Business Directory Data Scraping

Scrape Verified Business Data from Europages.co.uk

Google Map Businesses Data Scraping

Yellow Pages Business Listings Scraping

Canpages Business Listings Scraping

Scraping Handyman Services from Thumbtack

Scrape Australian Businesses Listing from Truelocal

Scrape Business Listings from FreeIndex

Goldenpages.bg Data Extraction

Google Business Reviews Extraction

Best Scraping RealtyTrac Real Estate Listings Services in USA:

Fort Worth, Kansas City, Orlando, Sacramento, San Francisco, Austin, Philadelphia, Houston, Chicago, Indianapolis, Omaha, Mesa, San Francisco, San Diego, Raleigh, New Orleans, Washington, Bakersfield, Long Beach, Nashville, Jacksonville, Virginia Beach, Albuquerque, Wichita, Tulsa, Las Vegas, Denver, Colorado, Fresno, El Paso, Atlanta, Memphis, San Antonio, Columbus, Milwaukee, Colorado, Louisville, Seattle, Sacramento, Dallas, Orlando, Charlotte, Oklahoma City, San Jose, Boston, Long Beach, Fresno, Tucson and New York.

Conclusion

DataScrapingServices.com's RealtyTrac Real Estate Listings Scraping service is an invaluable tool for anyone involved in the real estate industry. By providing detailed and accurate data, we empower our clients to make smarter decisions, stay competitive, and maximize their investment returns. Whether you are a real estate investor, agent, or analyst, our scraping services can provide the insights you need to succeed. Partner with DataScrapingServices.com and transform raw data into actionable intelligence for your real estate business.

Website: Datascrapingservices.com

Email: [email protected]

#scrapingrealtytracrealestatelistings#realtytracpropertydatascraping#usabusinessdirectoryscraping#usabusinessdatascraping#businessdirectorydatascraping#businessdirectoryscraper#datascrapingservices#webscrapingexpert#websitedatascraping

0 notes

Text

SunTec Data offers specialized mortgage data entry services to real estate, financial, and mortgage-related businesses. They extract and process information from various sources, including PDFs, images, and handwritten documents. The team ensures data accuracy, categorization, and quick turnaround. Services also include data indexing, foreclosure entry, and property record management.

0 notes

Text

How Web Scraping is used to Extract Foreclosure Data from Real Estate Websites?

You will be easily able to scrape property details from foreclosure listings such as – Address, Price, Area, Estimated Mortgage, Property Type, Availability, Images, and more.

Get the Foreclosure Listings link for your desired location.

A foreclosure happens when a homeowner fails to make mortgage payments. If the owner is unable to pay off the remaining debt or sell the property, it will be auctioned off during a foreclosure auction. If the property does not sell there, the loan institution seizes it.

Here you will learn to get Foreclosure links from Trulia, Zillow, Realtor, and Redfin.

How to Search for Foreclosure Data on Trulia?

Visit Trulia.com and search for the city, neighborhood, zip code, or country of your interest.

Copy the URL of the page to deliver this as an input to the Trulia Scraper. Below given is the demonstration of what the foreclosure homes listed on Trulia will look like:

https://www.trulia.com/for_sale/Washington,DC/foreclosure_lt/

After you've applied any further criteria (price, kind of property, etc.) based on your requirements, copy and paste the URL(s) into the Trulia Scraper. The crawler must be in Advanced Mode to add additional URLs.

How to Search for Foreclosure Data on Zillow?

Visit Zillow.com and look for real estate listings in your desired area. The real estate listings will be displayed on the results page. Similarly, to Trulia, you may pick Remove Map Boundary to enhance the number of listings or search area.

The For Sale tab is located to the right of the search bar. Select the dropdown menu adjacent to the tab.

Select the Foreclosures and Pre-Foreclosures checkbox. You may also use the Foreclosed option if you like. Check that all the other options are unchecked. After you save the filters, you will be able to examine the list of foreclosures.

https://www.zillow.com/washington-dc/foreclosures/

After you've applied all of the necessary criteria according to your requirements, copy and paste the URL(s) into the Zillow Crawler. The crawler must be in Advanced Mode to add additional URLs. You may also specify how many pages to scrape. If you leave this field empty, the system will gather all of the data.

Please keep in mind that the Zillow Crawler can only retrieve a maximum of 800 entries per input URL. We recommend using different filters on the website to narrow down the search results and providing them as multiple-input URLs.

Since January 2021, Zillow and Trulia have changed the way they display listings. You may read more about the changes here and see whether you need to update your inputs.

How to Search for Foreclosure Data on Realtor?

Visit Realtor.com and look for real estate listings in the area you want to live. The real estate listings will be displayed on the results page.

Here's an example of a Realtor link for Foreclosed Homes:

https://www.realtor.com/realestateandhomes-search/Washington_DC/show-foreclosure

You may pick the Map and create your boundaries to enhance the number of listings or the region searched.

After you've applied all of the necessary criteria based on your requirements, copy and paste the URL(s) into the Realtor Crawler. The crawler must be in Advanced Mode to add additional URLs. You may also specify how many pages to scrape. If you leave this field empty, the system will gather all of the data.

How to Search for Redfin Foreclosure Data?

Visit Redfin.com and look for real estate listings in the area you want. The real estate listings will be displayed on the results page.

Select the dropdown next to 'More Filters' on the listing page.

The options are listed under the heading Listing Type (Make sure the Listing Status is For Sale). Except for Foreclosures, uncheck all of the other choices.

Below is an example of the link of how foreclosed homes look like:

https://www.redfin.com/city/12839/DC/Washington-DC/filter/include=foreclosed

You can delete the Map outline and set your own boundaries to enhance the number of listings or the region searched.

Once you have added all the desired filters based on your needs, copy and paste the URL(s) into the Redfin Crawler. The crawler must be in Advanced Mode to add additional URLs. You may also specify how many pages to scrape. If you leave this field empty, the system will gather all of the data.

3i Data Scraping Custom Solutions

The most significant advantage of foreclosed properties is that the majority of foreclosures are sold at a significant discount below market value. Buyers may be able to save even more money by taking advantage of features such as lower down payments and cheaper charges. Websites like Zillow, Trulia, and Realtor can assist you in locating foreclosure leads and homes. You can detect these indicators and make smarter investing selections with foreclosure data.

Using web scraping to extract foreclosure data can help you obtain structured, concise datasets in the format you prefer. You may obtain data on a specified schedule by using a web scraping service like 3i Data Scraping. We can give reliable real estate data if you want to collect real estate data on a wide scale across various websites.

For any other web scraping services, contact 3i Data Scraping today!

Request for a quote!

#Web Scraping Service#Extract Foreclosure Data#Foreclosure Data Scraping#Foreclosure Data Extraction#Real Estate Data Scraping#3i Data Scraping

0 notes

Text

Possible occupations

9-1-1 dispatcher

Abortion clinic worker

Actor

Aeronautical engineer brother (once tested fighter jet windshields by shooting dead turkeys at them which had to be sanctioned by PETA)

Airplane mechanic

Amusement park worker

Answering service employee

Apartment maintenance. (And it's kind of a cool job cause people leave things behind all the time when they move.)

App developer

Appliance store sales clerk

Architect

Architectural lighting designer

Army criminal investigator

Art professor

Artist

Attorney

Auto parts clerk

B&B owner

Bakery worker

Ballet dancer

Banker,

Barrista

Bartender

Bead store clerk/stocker

Bee Keeper

Bicycle shop employee

Biofeedback therapist

Biogas plant builder

Biomedical engineer (Interesting side note, you can kill an entire surgical suite of medical professionals with a faulty anesthesia machine. Quite the murder weapon.)

Black Jack dealer

Blackhawk pilot

Boat canvases maker

Book collator (assembling books page by page)

Bookstore clerk

Border patrol

Bridge painter

Bus driver

Business/Financial News network reporter/producer/anchor

College baseball director of operations

Cabinet maker

Cake decorator

Cannery worker

Car wash attendant

Carpenter

Carpet layer

Cartoonist

Caterer’s assistant

Cello maker

CEO of a high tech company

Chain restaurant pre-employment/set-up team (they travel from town to town to help 'set-up', stock and hire the employees that will ultimately work there. After a month of two, they go onto the next franchisee location and get THAT restaurant set-up, etc.)

Charter/private airline flight attendant.

Chef

Chemical engineer (does research on paper recycling, bioenergy, and fungi that digest wood)

Chemical scientist

Childcare worker

Chimney sweep

Chinook Helicopter Mechanic US Army

Chiropractor

Christmas Around the World sales person

Civil/structural engineer.

Clerk at candy store

Closet organizer

Coat check girl

College admissions counselor

College professor

Computer guy for a wine company

Computer programmer

Computer repair person

Consumer columnist.

Contract analyst

Cook

Copywriter

Counselor in the Juvenile Detention Center

Couture cat collar maker sold through Internet boutique

Crab shaker/crab cooker

Custom hat embroidery business owner

Custom racing bicycles designer and airbrusher.

Cytogenetic technologist

Dairy farmer

Dam operator

Data analyst

Deli worker

Dental assistant

Dental office practice manager

Development work for an art and history museum

Dialysis technician

Dietary aide at a nursing home,

Director of study abroad program

Disc jockey

Dishwasher

DJ

DMV clerk

Dog breeder/trainer

Dog walker

Drafting work for architecture firms

Egg farm worker

EMT

ESL teacher

Event specialist (sets up events at hotels)

Excavator bulldozer & crane operator

Executive assistant

Exterminator

Extreme sports videographer

FAA tower controller.

Factory assembly line

Field biologist specializing in insectivores. (Shrews are insane.)

Financial advisor

Fire chaplain

Firefighter

Fish physiologist

Fisheries biologist

Flight attendant

Florist

Foreclosure/default analyst/investigator.

Freelance wedding/event/aerial photographer/videographer

Funeral director

Game creator

Geek squad

General contractor

General counsel for a phone company

Geologist

Geophysicist

Glass blower

Golf pro shop employee

Grant writer

Graphic designer

Graphic novelist

Green building consultant

Grocery store cashier

Groundskeeper at a major league ball park

Group home worker

Guard at an art museum

Guy who cleans out the vacuum tubes once a year at the bank/hospital/Costco.

Hair stylist

Handyman

Head Start Teacher.

Heath care aide

Herbarium archivist

High school history teacher

High school teacher at an alternative school for near-dropouts.

Highway flag person

Historical remodeler (carpenter)

Home help for families with special needs children. (help out around the house, help out with the kids, babysit when the parents need time to themselves.

Horse groomer (in the competitive horse world the equivalent of a golfer's caddy)

Horticulturist

Hostess at a café.

Hot tub sales person

Hotel employee

House inspector.

House painter

Housekeeper.

Human resources

Human resources for the research and marketing arm of a pet food company

Information (411) operator

Instructor at a college

Insurance adjuster

Insurance salesman

Interior designer

Investigate allegations of abuse and neglect of people with disabilities

IRS worker

Jail Commander

Jewelry design/repair

Journalist

Judo instructor

Juvenile Detention worker

Kindergarten teacher

Landscape architect

Lawn service/snowplow operator

Librarian

Life guard

Logger

Magazine editor

Mail carrier (mail carriers know A LOT about the people on their streets.)

Management consultant

Map editor/producer for a navigation systems company.

Marine biologist

Math professor

Mechanic

Mechanic

Mechanical designer

Mechanical engineer

Mediator

Medical examiner

Medical information sales

Medical records scanner

Medical social worker

Mental health therapist

Microbiologist

Mill worker

Model

Montessori teacher

Morgue attendant

Motel clerk

Movie critic

Nail technician

Nanny

Neon sign repair in the LED age

Night club worker "working door"

Nighttime office maintenance/property manager (which gives access to all kinds of offices!)

Nonprofit administrator

Nurse

Nursery owner

Nursing home worker

Occupational therapist

Office building cleaner

Office Manager/Bookkeeper

Oncology nurse

Organic farmer

Otter tech for the Department of Conservation

Pastor

Patient finances at hospital

Personal trainer business owner

Pet shop worker

Pet transport business (takes puppies to and from the vet or groomers, or gets rescue dogs to new families across the country.)

Pharmaceutical salesman (we affectionately say "drug dealer" haha),

Phone banker

Phone nurse

Photographer

Physicist

Pizza chef

Planer operator at a mill

Police Academy cadet trainer

Police dispatcher

Pool maintenance person

Preloader for long haul trucks

Preschool dance teacher

Preschool teacher

Printers

Prison guard

Professional genealogist

Proofreader

Psychiatric nurse

Psychic

Psychologist

Public radio producer

Quality control inspector for commercial construction

Ranch hand,

Real estate agenT

Real estate management.

Receptionist at a naturopathic (or any) clinic

Recycling equipment engineer.

Reporter

Research assistant

Retired radio on-air personality.

Road crew supervisor

Roofer

Sand pit owner/operator

Sandblaster

School secretary

Scientists that work on lab animals

Seamstress

Security officer

Senior Theatre materials publisher

Shelving assembler (assembling and disassembling shelves in a warehouse as stock changed)

Shoe store employee

Sides of beef and other freezer meat seller

Singer in small clubs

Ski lift repair tech

Social worker

Software analyst

Software engineer

Soldier

Songwriter

Spanish teacher

Speech language pathologist

Spider researcher (extracts venom from deadly spiders)

State safety radio network monitor

Stock market trader

Stock photographer

Storage facility owner

Submarine engineer

Substitute teacher

Summer camp counselor

Surgeon

Systems programmer

Tattoo artist

Tea shop owner

Teach art to very senior citizens at a residential retirement home. (fascinating mix of humor and pathos)

Teach teachers how to use technology in their classrooms

Tech writer

Teflon coater

Telephony installer

Therapist

Tie-dye artist.

Tile setter

Time share seller

Tour director

Toy inventor

Translator

Trouble shooter for a college

Truck driver

TV weatherman

Urban planner

Usher for the Opera

Varsity soccer coach

Veterinarian assistant,

Volunteer reader for SMART

Warehouse worker

Warehouse worker (forklift operator)

Water therapy swimming for injured dogs.

Waterfront engineer who also does wind power

Web designer

Weight Watchers Weigher

Welder in residential home construction (does design work, like railings and structural pieces for houses built into rocks on a mountain.)

Wildlife photographer

Window trimmer (designed windows for shoe stores)

Women’s clothes sales person

Wood worker

Yoga instructor

3 notes

·

View notes

Link

Analysis: Impeachment complicates Biden's efforts to unify After four exhausting years of Trump that left this country deeply divided and democracy hanging by a thread, the nation breathed easier when Trump decamped Wednesday to Mar-a-Lago, his slashing vitriol silenced by a permanent suspension on Twitter. Next month’s trial will bring the outcast former President back to center stage, giving him yet another chance to claim that he is a victim in a never-ending partisan witch hunt and handing him a platform to rally his supporters at a time when he might have otherwise had none. Biden is caught in an almost impossible vise as the nation reengages in the most polarizing kind of proceeding that exists in Washington. He has insisted that Trump must be held accountable for the attempted insurrection at the Capitol on January 6, but he has been notably cool to the prospect of impeachment as he tries to unravel Trump’s legacy with more than two dozen executive orders in his first three days in office, while simultaneously working the phones to build broader legislative consensus. The looming trial — which has the potential to inflame partisan divisions just as quickly as Biden was trying to squelch them — offers no visible upside to a President who was elected on his promise to bring the warring parties of Washington together and forge compromise in a Capitol that has been defined by strife. The hopes that Biden could bring a different tone to Washington — which were so bright on Inauguration Day — were complicated by Senate Majority Leader Chuck Schumer and House Speaker Nancy Pelosi’s announcement that the House would deliver the impeachment article charging Trump with “incitement of insurrection” to the Senate on Monday evening. Senators will be sworn in for the trial the next day, according to the calendar outlined by Schumer, with trial arguments slated to start on February 9. The delay in the trial’s start will be helpful to Biden because only two of his Cabinet nominees have been approved by the Senate so far — a much slower pace than his predecessors. Biden underscored that point Friday when asked whether he favored Senate Minority Leader Mitch McConnell’s timeline for a mid-February impeachment trial. “The more time we have to get up and running and meet these crises, the better,” Biden replied at the end of a White House event about executive actions on the economy. Senate unlikely to convict Biden has been circumspect on whether he believes there is any point to holding a Senate impeachment trial for a President who has already left office, answering virtually every question by stating that he will leave the timing and mechanics of a trial up to Senate leaders. White House press secretary Jen Psaki crisply shut down questions about Biden’s more substantive views on impeachment — and whether Trump should be barred from holding federal office in the future — by pointing out that the President ousted Trump from the White House through the electoral process. “He ran against him because he thought he was unfit to serve, and he’s no longer here because President Biden beat him,” Psaki said during the White House news briefing Friday. “We’ll leave the steps — the accountability steps — to Congress to determine.” The question of the futility of an impeachment trial at this point is even more salient now given that the Senate looks increasingly unlikely to convict Trump, according to reporting by CNN’s Manu Raju, Ted Barrett and Jeremy Herb. Convicting Trump would require 17 Republican senators to vote with the 50 Democrats in the Senate, a tall order on any legislative matter, let alone one as fraught as this one. Though there is disagreement among rank-and-file Republicans about how Trump should be punished for his role in the riot — with conviction dangling the possibility that Trump could be barred from holding federal office in the future — many Republicans are now also questioning whether it is constitutional to try a president who has already left office. The argument about constitutionality is serving as a useful dodge for GOP senators who are wary of Trump’s punishing instincts — allowing them to avoid alienating his base voters, while potentially getting them off the hook with more moderate constituents who were angered by Trump’s role in the Capitol riot, seeded by the blizzard of lies he told about the November election results. “I don’t know what the vote will be, but I think the chance of two-thirds is nil,” Sen. John Cornyn, a Texas Republican, told CNN. ‘Americans are going hungry’ Through almost all of his other actions this week, Biden signaled that he was trying to move Americans beyond the Trump era, not just in policy but also in tone. Swearing in his new employees, Biden told them that if he heard them disrespecting or talking down to another colleague, he would fire them on the spot — underscoring that he believes everyone deserves to be treated with the dignity and decency that has been “missing in a big way the past four years.” Aside from that comment, when given the chance to take a shot at Trump, he has generally avoided it — describing the letter the former President left him, for example, as “generous.” Biden alienated some Republicans this week by seeking to undo some of Trump’s most controversial policies through executive actions — halting construction of the wall at the US-Mexico border, canceling the Keystone XL pipeline, rejoining the Paris climate accord and rescinding Trump’s ban on travel from predominantly Muslim countries. But the new President also placed great emphasis on actions he was taking that could garner support from both parties: measures to speed up vaccine distribution like invoking the Defense Production Act to produce more supplies like needles or specialized syringes that could extract more vaccine from each vial; plans to accelerate the reopening of schools; an extension of moratoriums on evictions and foreclosures; and policies aimed at curbing food insecurity in the midst of the pandemic, which has been a concern for both Democrats and Republicans. Pointing to the road ahead as he outlined some of the economy-focused executive actions that he was taking on Friday, Biden underscored that there were constraints on what he could do alone with the stroke of his pen — and made another urgent plea to members of Congress to come to the negotiating table on his $1.9 trillion coronavirus relief package. With the US Senate divided 50-50, Schumer and McConnell are still wrangling over a power-sharing agreement in the Senate that will determine the number of seats each party controls the chamber’s committees. Talks have stalled over McConnell’s demand that Schumer preserve the filibuster. While Biden is already facing significant resistance among Republicans about the cost of the package, National Economic Council Director Brian Deese warned that Americans may tumble into an even deeper medical crisis and “economic hole” without it. Biden noted that another 900,000 Americans have joined the ranks of the unemployed, according to economic data this week, while many families are still being forced to drive up to food banks just to feed their children. In an argument for his legislative package attuned to Republican concerns, he said there is a “growing economic consensus that we must act decisively and boldly to grow the economy,” and that it is “a smart fiscal investment” that will help America retain its competitive edge around the world. (He noted at one point that Trump’s former economic adviser, Kevin Hassett, has spoken in favor of the proposal that he has outlined). “This almost doesn’t have a partisan piece to it,” Biden said plaintively. “I don’t believe the people of this country just want to stand by and watch their friends and their neighbors, coworkers, fellow Americans go hungry, lose their homes, or lose their sense of dignity and hope and respect,” he said Friday. “I don’t believe Democrats or Republicans are going hungry and losing jobs; I believe Americans are going hungry and losing their jobs.” “We have the tools to fix it.” But Biden still has a great deal of persuading to do as he tries to drum up the political will for another bipartisan piece of legislation using those tools. As he reaches out, there are signs that the two camps are retreating back to their familiar corners — with impeachment standing as the biggest obstacle in the new President’s way. Source link #Analysis #Bidens #Complicates #efforts #impeachment #ImpeachmentcomplicatesBiden'seffortstounify-CNNPolitics #Politics #unify

0 notes

Text

Analysis: Impeachment complicates Biden's efforts to unify

New Post has been published on https://appradab.com/analysis-impeachment-complicates-bidens-efforts-to-unify/

Analysis: Impeachment complicates Biden's efforts to unify

After four exhausting years of Trump that left this country deeply divided and democracy hanging by a thread, the nation breathed easier when Trump decamped Wednesday to Mar-a-Lago, his slashing vitriol silenced by a permanent suspension on Twitter. Next month’s trial will bring the outcast former President back to center stage, giving him yet another chance to claim that he is a victim in a never-ending partisan witch hunt and handing him a platform to rally his supporters at a time when he might have otherwise had none.

Biden is caught in an almost impossible vise as the nation reengages in the most polarizing kind of proceeding that exists in Washington. He has insisted that Trump must be held accountable for the attempted insurrection at the Capitol on January 6, but he has been notably cool to the prospect of impeachment as he tries to unravel Trump’s legacy with more than two dozen executive orders in his first three days in office, while simultaneously working the phones to build broader legislative consensus.

The looming trial — which has the potential to inflame partisan divisions just as quickly as Biden was trying to squelch them — offers no visible upside to a President who was elected on his promise to bring the warring parties of Washington together and forge compromise in a Capitol that has been defined by strife.

The hopes that Biden could bring a different tone to Washington — which were so bright on Inauguration Day — were complicated by Senate Majority Leader Chuck Schumer and House Speaker Nancy Pelosi’s announcement that the House would deliver the impeachment article charging Trump with “incitement of insurrection” to the Senate on Monday evening. Senators will be sworn in for the trial the next day, according to the calendar outlined by Schumer, with trial arguments slated to start on February 9.

The delay in the trial’s start will be helpful to Biden because only two of his Cabinet nominees have been approved by the Senate so far — a much slower pace than his predecessors. Biden underscored that point Friday when asked whether he favored Senate Minority Leader Mitch McConnell’s timeline for a mid-February impeachment trial. “The more time we have to get up and running and meet these crises, the better,” Biden replied at the end of a White House event about executive actions on the economy.

Senate unlikely to convict

Biden has been circumspect on whether he believes there is any point to holding a Senate impeachment trial for a President who has already left office, answering virtually every question by stating that he will leave the timing and mechanics of a trial up to Senate leaders.

White House press secretary Jen Psaki crisply shut down questions about Biden’s more substantive views on impeachment — and whether Trump should be barred from holding federal office in the future — by pointing out that the President ousted Trump from the White House through the electoral process.

“He ran against him because he thought he was unfit to serve, and he’s no longer here because President Biden beat him,” Psaki said during the White House news briefing Friday. “We’ll leave the steps — the accountability steps — to Congress to determine.”

The question of the futility of an impeachment trial at this point is even more salient now given that the Senate looks increasingly unlikely to convict Trump, according to reporting by Appradab’s Manu Raju, Ted Barrett and Jeremy Herb. Convicting Trump would require 17 Republican senators to vote with the 50 Democrats in the Senate, a tall order on any legislative matter, let alone one as fraught as this one.

Though there is disagreement among rank-and-file Republicans about how Trump should be punished for his role in the riot — with conviction dangling the possibility that Trump could be barred from holding federal office in the future — many Republicans are now also questioning whether it is constitutional to try a president who has already left office.

The argument about constitutionality is serving as a useful dodge for GOP senators who are wary of Trump’s punishing instincts — allowing them to avoid alienating his base voters, while potentially getting them off the hook with more moderate constituents who were angered by Trump’s role in the Capitol riot, seeded by the blizzard of lies he told about the November election results.

“I don’t know what the vote will be, but I think the chance of two-thirds is nil,” Sen. John Cornyn, a Texas Republican, told Appradab.

‘Americans are going hungry’

Through almost all of his other actions this week, Biden signaled that he was trying to move Americans beyond the Trump era, not just in policy but also in tone. Swearing in his new employees, Biden told them that if he heard them disrespecting or talking down to another colleague, he would fire them on the spot — underscoring that he believes everyone deserves to be treated with the dignity and decency that has been “missing in a big way the past four years.” Aside from that comment, when given the chance to take a shot at Trump, he has generally avoided it — describing the letter the former President left him, for example, as “generous.”

Biden alienated some Republicans this week by seeking to undo some of Trump’s most controversial policies through executive actions — halting construction of the wall at the US-Mexico border, canceling the Keystone XL pipeline, rejoining the Paris climate accord and rescinding Trump’s ban on travel from predominantly Muslim countries.

But the new President also placed great emphasis on actions he was taking that could garner support from both parties: measures to speed up vaccine distribution like invoking the Defense Production Act to produce more supplies like needles or specialized syringes that could extract more vaccine from each vial; plans to accelerate the reopening of schools; an extension of moratoriums on evictions and foreclosures; and policies aimed at curbing food insecurity in the midst of the pandemic, which has been a concern for both Democrats and Republicans.

Pointing to the road ahead as he outlined some of the economy-focused executive actions that he was taking on Friday, Biden underscored that there were constraints on what he could do alone with the stroke of his pen — and made another urgent plea to members of Congress to come to the negotiating table on his $1.9 trillion coronavirus relief package.

With the US Senate divided 50-50, Schumer and McConnell are still wrangling over a power-sharing agreement in the Senate that will determine the number of seats each party controls the chamber’s committees. Talks have stalled over McConnell’s demand that Schumer preserve the filibuster.

While Biden is already facing significant resistance among Republicans about the cost of the package, National Economic Council Director Brian Deese warned that Americans may tumble into an even deeper medical crisis and “economic hole” without it.

Biden noted that another 900,000 Americans have joined the ranks of the unemployed, according to economic data this week, while many families are still being forced to drive up to food banks just to feed their children. In an argument for his legislative package attuned to Republican concerns, he said there is a “growing economic consensus that we must act decisively and boldly to grow the economy,” and that it is “a smart fiscal investment” that will help America retain its competitive edge around the world. (He noted at one point that Trump’s former economic adviser, Kevin Hassett, has spoken in favor of the proposal that he has outlined).

“This almost doesn’t have a partisan piece to it,” Biden said plaintively.

“I don’t believe the people of this country just want to stand by and watch their friends and their neighbors, coworkers, fellow Americans go hungry, lose their homes, or lose their sense of dignity and hope and respect,” he said Friday. “I don’t believe Democrats or Republicans are going hungry and losing jobs; I believe Americans are going hungry and losing their jobs.”

“We have the tools to fix it.”

But Biden still has a great deal of persuading to do as he tries to drum up the political will for another bipartisan piece of legislation using those tools. As he reaches out, there are signs that the two camps are retreating back to their familiar corners — with impeachment standing as the biggest obstacle in the new President’s way.

0 notes

Text

Mortgage Equity Withdrawal Increased in Q2

Note 1: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures). For Q2 2020, the Net Equity Extraction was $28 billion, or a 0.60% of Disposable Personal Income (DPI) .

Click on graph for larger image. This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method. Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago. MEW has been mostly positive for the last four years. The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $81 billion in Q2. For reference: Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method). For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here. from Calculated Risk http://www.calculatedriskblog.com/2020/09/mortgage-equity-withdrawal-increased-in.html

0 notes

Text

Housing Is The Business Cycle (Leamer, 2007)

Not a book, but figured I’d publish my notes anyway -- I wanted to type this all out to really make it stick in my head, because I found it fascinating. Original paper is available here and worth a close read. Takeaways are pretty simple: the cycle is about consumer spend rather than business spend, housing is the best leading indicator, and housing is influenceable via monetary policy. (Recommended by: Elliot Turner)

Housing is an obvious way that monetary policy affects the economy but is not studied or even acknowledged in most macroeconomic literature.

Advocating for a modified Taylor Rule that depends on a LT measure of inflation but uses housing starts and change in housing starts in place of the output gap. Starts are the best leading indicator he’s aware of. Doing this would create preemptive anti-inflation in the middle of expansions making anti-inflation policy less necessary at the ends of cycles. Idea is to make recessions less frequent & less severe.

This is empirical data -- temporal, not causal since it can’t be measured in experiments.

“Economics... is a self-consciously interventionist discipline. We think we are designing the best way for our governments to influence the outcomes.”

Of 10 recessions since WWII, 8 have been “consumer recessions” and 2 have not been - namely the “DoD downturn” in 1953 (end of Korean War led to massive contraction of defense spend) and “Internet comeuppance” of 2000-2001 driven by collapse in biz investment (software/equipment) as Internet profitability disappointed.

Sectors with most volatile employment are construction and manufacturing. If you exclude these from total employment, employment flattens out but doesn’t decline perceptibly in recessions. Manufacturing always recovered in a “V” out of a recession except in 1990 when it was a “U” and after 2001 it didn’t recover (”L”).

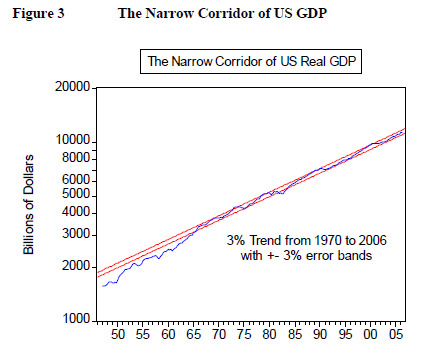

From 1970 onward, economy has grown at a surprisingly steady 3% real rate, almost always within a +/-3% band (”3-3 rule”). Shows policy has not had a demonstrable effect on LT growth. Shows us policy should be focused on "ironing out” the cycle and keeping real GDP growth within the corridor.

Resi investment is a very small part of LT growth, like 4% or 13 bps of 3.10% -- consumer services leads, followed by nondurables and durables. Equipment & software has become more important, and inventories/structures hardly contribute at all. Interestingly, inventory contributes volatility but less volatility in inventories has been a big contributor to increased stability of GDP growth post-1984. Hard to know if that’s improved inventory management or greater stability of sales. Volatility of every component declines after 1985 -- esp resi investment, durables and nondurables, which are all inventory-intensive.

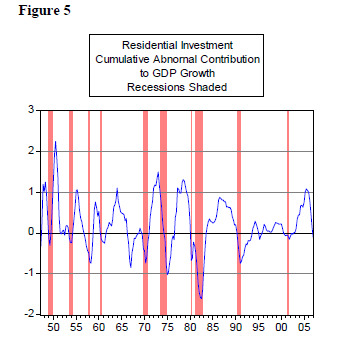

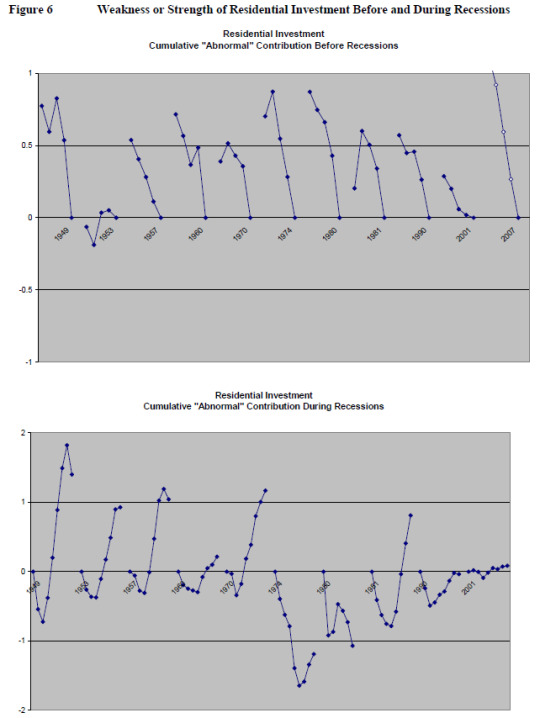

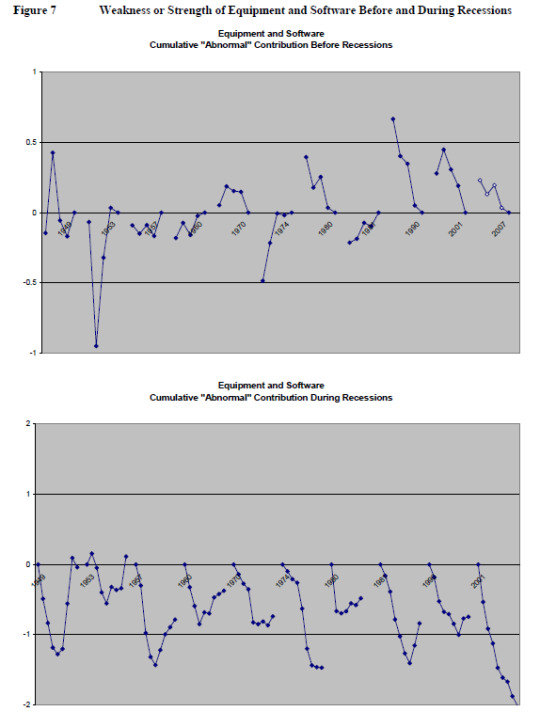

Leamer extracts abnormal contribution of each component relative to its smoothed normal contribution (complicated process but good methodology given) and measures that around recessions, setting value at cycle peak = 0.

Because these lines show cumulative abnormal contribution to GDP growth:

flat line = contribution each Q is normal

declining line = contribution less than normal, contributing to weakness

rising line = contribution greater than normal, contributing to strength

Resi investment subtracts from GDP growth before recessions but contributes > normal soon after recession starts (2nd or 3rd quarter). Equipment & software is very different, less and less consistent negative contribution prior to recessions (though seemingly growing over time) and a clear contribution to weakness *after* recession has begun. Biz capex clearly contributed more than normal to weakness before and during recession in 2001 because of its abnormal nature (truly a biz recession). As a rule: weakness in housing precedes recessions; weakness in equipment/software is coincident. The cycle is a consumer cycle, not a business cycle.

On average, housing contributes 20-25% of the weakness in growth prior to a recession and is the biggest and most consistent contributor. Only two recessions where it wasn’t a significant contributor were, again, 1953 & 2001

Equipment & software is the largest contributor of weakness during a recession, averaging ~20% of the weakness contributed. It’s only the 6th-largest when measuring prior to recessions.

Timing the path of a recession goes: homes, durables, nondurables, services. Average paths of biggest components are shown in Figs 8 & 9 (consumer recessions only)

Significant portion of weakness in demand is exported via weaker imports, which makes imports’ abnormal contribution positive during recessions (as opposed to its normal drag on GDP). This is offset by substantial negative abnormal contribution of exports -- possibly because foreign GDP is weaker due to lower US imports.

When has a recession happened without housing predicting it (ie housing has given a false negative signal)? The years already covered, 1953 & 2001 (though ‘01 had some weakening in home values).

When has housing predicted a recession but it hasn’t occurred (ie housing has given a false positive signal)? 1951-2 and 1966-7. Lack of recession attributable to ramp of defense spending on Korean War and Vietnam War, respectively.

If we include defense spending’s abnormal contribution, we get 90% of the cycle story of the last 60 years.

Uses multivariate approach to proving this out, doing a regression of GDP growth vs. one-quarter-lagged contribution. Here, the t-stats measure independent contribution of each GDP component, controlling for all others. Top 4 contributions are resi investment, consumer services, consumer nondurables and consumer durables.

Coefficient on resi investment implied by this exercise is 2.0, meaning an abnormal contribution to GDP growth from housing implies twice as much contribution the next quarter. Consumer services at 1.7 is the only other component with coefficient >1, implying a multiplicative effect. Coefficient on consumer durables is negative -- controlling for strength in the economy (as this exercise does), an abnormal surge in sales of durables in one quarter steals from the next.

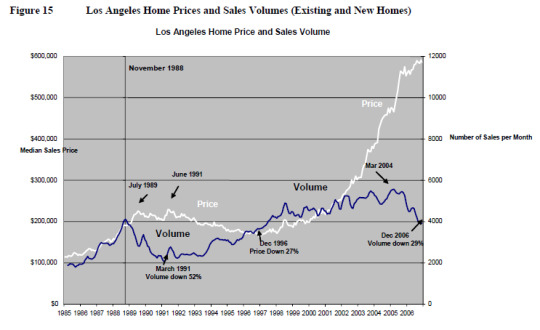

Housing is a fairly unique asset in that prices are inflexible downwards, which means volumes are crushed when in a downturn because bid-ask widens. The impact on GDP is from volume, not price (simple appreciation does not impact “production”, which is what GDP measures) -- especially when you consider jobs in construction, finance, real estate.

Another way to think about price not moving GDP is that any appreciation in land value that’s booked as an asset for homeowners needs to be booked with an exactly offsetting liability for future homebuyers Price weakness in housing makes the effective interesting rate high even at low nominal interest rates --> it’s highly leveraged and thus small price declines can kill off building. Makes it hard for stimulative rate cut to move the needle once volumes are declining.

Normal sales volumes in houses happen when buyers are confident that home prices should increase at normal rates or at least not decline. Otherwise, buyer waits to get a better deal. If prices were able to recalibrate quickly when the cycle turned down, normal prospective appreciation and thus normal sales volumes could reappear quickly. But sluggish downward price adjustments leads to a more extreme volume cycle. This is the core of *why* housing is so important to recessions. There are empirical examples like in LA in the 90s.

Builders are more motivate sellers than homeowners (who can just decide to stay put), but this is also observe in new home sales.

Argues that new home volumes best observed via +/-20% bands vs. prices which normal fit within +/-10% bands when considered on a real basis.

Basically, homeowners who won’t sell into a weak market sit on a house while the price erodes on a real basis due to general inflation. So while nominal price stays steady, house becomes cheaper with time. This is to say that price cycle is even less pronounced in nominal terms than in real terms and supports argument that it’s a volume cycle.

Trend in real price by geography shows (negative) correlation between new building (LT trend of new home sales growth) and real appreciation rate. E.g., South (lots of building) real appreciation is +1.1%, Northeast (little building) +2.0%. Where buildable land is plenty, response to increased demand is more building, but where there is little, the response is price increase which discourages buyers and reequilibrates supply & demand.

Several reasons for seller unwillingness to adjust prices down.

1) Ego -- we love our houses, don’t want to sell our loved ones for less than we think they’re worth (different from a stock), especially not if we’re anchoring off what a neighbor got for their house

2) Sellers look backward (what they paid), buyers look forward (what house might be worth in near future). In a rising market, this causes bid-ask to cross (buyer sees higher future value and seller sees lower past value) and a transaction occurs, but in a falling market it’s the opposite, bid-ask spread remains wide and no transaction occurs

3) Aversion to crystallizing the loss

Makes an argument for why we need to attenuate the cycle anyway -- unemployment and foreclosure does damage to working people’s ability to budget for their lifetime, and unemployment and foreclosure disproportionately impacts the poor and the young.

Hypothesizes that financial cycle is experienced disproportionately by low-income first-time homebuyers and that idiosyncratic risk is greatest for homes bought at the top of the cycle, usually by those same buyers. Finds greatest appreciation in LA from 2003-2005 was in low-priced zip codes and for smaller homes. Meanwhile, idiosyncratic risk hypothesis was not right -- buying/selling acumen explains the idio risk, which is surprisingly large with a stdev of 30%

Paul McCully (2007) applied Hyman Minsky’s 1986 theory of financial cycle to housing. Three types of loans

hedge finance -- supports acquisition of assets with current profits sufficient to cover interest and amortization

Speculative finance -- supports acquisition of assets with current profits sufficient to cover only interest and relies on future appreciation or income growth to pay down the debt

Ponzi finance -- current profits won’t even cover interest.

Through the cycle, progress through these as lending standards ease and tighten

Studies price appreciation between homes priced in the 10th percentile and 90th percentile. 10th percentile had higher appreciation when underwriting standards were relaxed (2004-2005). This differs from 1988-1989 when 90th percentile homes saw the most appreciation.

Two important facts:

early warning signs of recession are weakness in homes and consumer durables;

most of the job loss in US recessions comes in construction and durables manufacturing.

Special features of durable manufacturing and residential contstruction

Previous product (new homes, cars) creates a stock of existing assets that compete with current production -- long periods of unsustainably high levels of sales/production that increases stock beyond equilibrium levels gives rise to long periods of low sales/production to reequilibrate. Conversely, recessions create pent-up demand that is met by high levels of sales/production after recessions. I.e., it’s cyclical.

Services flow from existing stock is very elastic and ability to postpone acquisition of new car or home is great. I.e., you can always keep driving it or not move for another year or two

Price of durability = real rate of interest. When real interest is low, equilibrium stock of homes/cars is high. If this is a permanent shift in real interest, fine. If it’s impermanent, creates problems due to longevity of the assets. I.e., equilibrium demand is rate-sensitive.

Asset prices of homes/new cars suffer from downward rigidity. This causes production to stay low even if rental market is strong. Deflation in asset prices of existing durable stocks in the fact of strong rental markets is a real problem.

Due to longevity, creates an intertemporal control problem -- i.e. stimulus today steals from the future. In 2001 recession, sales of homes and durable held up well. There were no lost-sales to transfer forward in time, so Fed easing in 2002-2004 instead transferred sales backward in time (i.e. stole from the future, 2006-2009). That’s why cutting rates won’t help.

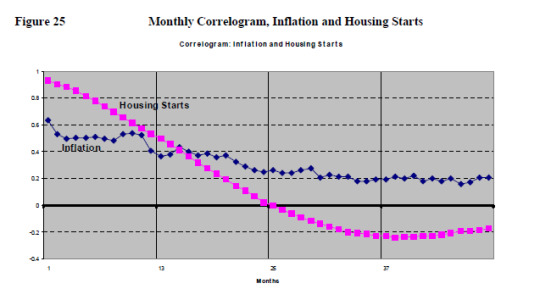

Uses correlograms (moving correlation) to study inflation vs. housing:

Inflation is persistent -- correlation of CPI inflation with CPI inflation prior month is 0.63. After 4 years, it’s still 0.2. Once it gets going it’s hard to stop, this is why monetary policy takes it so seriously.

For housing, it’s the cycle that’s persistent -- correlation of housing starts to housing starts prior month is 0.93. That goes to 0 after 24 months, and is significantly negative (-0.2) within 36 months.

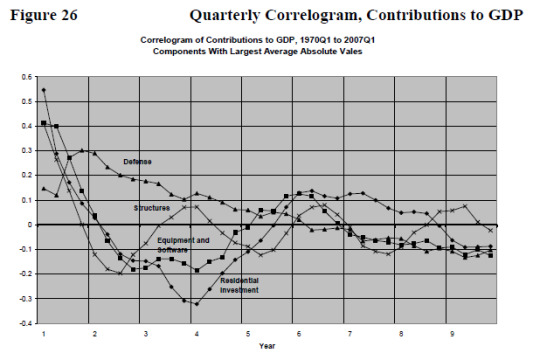

Of all the GDP components, resi investment has the largest correlogram (i.e. it’s the most cyclical). Other 3 that are significant are defense, business structures and business equipment & software.

Defense has a long string of negatives at 8-9 years, implying buildups are followed by cutbacks or vice-versa.

Studies where and how housing conflicts with explicit Fed targets of inflation and unemployment (e.g. weak housing calling for a rate cut while high inflation is calling for a hike). Conflict between housing and UE are not great, conflict with inflation is more significant.

Regresses a bunch of indicators to see which most explains changes in Fed funds rate --> 10Y Tsys win (on t-stat and coefficient). Housing starts is last, implying it’s least-watched by Fed.

Studies whether historical policy has amplified or attenuated housing cycle, even though this is not what Fed was targeting -- does this across a bunch of cycle periods with interesting results. He uses slope of yield curve (10s - FFR)/10s to measure monetary tightness. Goes through predictive (market signal) and causal (credit crunch) narratives for yield curve inversion.

Not much info available on Great Depression, but housing starts turned down in 1925, 3+ years ahead of industrial production (July’29) and DJIA peak (Oct’29). In total, starts went from 900k at peak to <100k at 1933 trough.

There is potentially a relationship between durables and housing -- they are complementary (you buy dishwashers, furniture, etc to fill your house), housing wealth may help finance durables spending and the same interest rates may drive both cycles. However, most of the amplitude in durables comes from autos, not furniture, which hurts the complementarity argument. Given that prices adjust slowly and thus the wealth effect seems like a weak argument, he argues it’s interest rates & employment that are the common drivers between the housing & durables cycles.

Negative wealth effect (price-driven) is different from recessions (volume-driven) -- it’s an argument for sluggish growth, not contraction.

Conclusion: Housing is a small contributor to normal economic growth, but while unimportant in normal periods, it’s critical in US recessions: the first thing to soften and the first to turn back up.

His personal monetary to-do list -- he believe Fed watching housing can contribute to all:

Smooth business cycle -- attenuate collective unwanted idleness of recessions. We are better off if recessions are less frequent and less severe.

Keep us working productively -- limit speculative bubbles that absorb labor time and divert savings into low-yielding investments.

Limit re-distribution of wealth caused by financial disruptions

Keep consumer balance sheets accurately reflecting reality -- improves ability to plan for retirement realistically which informs how and how much we work. “We want our measured asset values to increase when our investments and discoveries make us confident that future GDP will be greater than we had originally thought. We do not want a monetary system that allows us to put phantom assets on our balance sheets and that signals to us that hard work and savings are not needed to prepare for our retirements.”

0 notes

Text

Can You Trust TruthFinder?

With today’s technology, there is no doubt that information flies around with somehow the speed of light. Moreover, nowadays it’s pretty easy to find out even personal information about a certain individual. In this article we’re going to reveal what information we gathered regarding TruthFinder. Ever heard of it? Actually, the website promises to provide you with personal information about people if you make a monthly subscription.

Getting a better understanding of how TruthFinder works