#F&O loss in ITR

Text

Everything to Know About Reporting F&O Losses in Income Tax Returns!

Learn how to report F&O losses in income tax returns effectively with our comprehensive guide. Discover the best F&O trading account with the lowest brokerage charges in India. Choose top stock market broker for managing F&O losses in your ITR. For more information on F&O loss in ITR, visit the blog!

#lowest brokerage charges in India for trading#top stock market broker in India#F&O Losses in ITR#F&O loss in income tax return#F&0 trading account#F&O loss in ITR

0 notes

Text

Everything to Know About Reporting F&O Losses in Income Tax Returns!

Declaring F&O losses on the income tax return (ITR) is considered to be of immense prominence in terms of financial compliance. Knowing the taxation regulations governing these transactions is essential due to the popularity of derivative trading and futures.

In this tutorial in this guide, we'll take a look at how to report F&O loss in ITR, offering valuable insight to Indian investors who are navigating the world of tax filing for income and how derivatives are taxed.

What are Futures and Options?

Futures and Options (F&O) are financial instruments that permit investors to purchase or sell assets at a specific date and price at a future date. In the F&O market in India, F&O facilitates price detection and helps in hedging against the market's volatility.

You should know its risks when you open an F&0 trading account. For purchasing or selling an asset in the Future & Options contracts, it allows the option, however, not the obligation, to purchase and sell assets. F&O trading is risky, with inherent dangers such as market volatility and the risk of sustaining large losses.

Understanding F&O Losses in ITR

Understanding F&O loss in income tax return procedure is essential. F&O losses are caused by trading derivatives, particularly those involving options and futures. To be used for income tax return (ITR) reasons, F&O losses are considered non-speculative business losses.

Tax implications for F&O losses within Indian circumstances are unique from other investment losses.

As opposed to losses or capital gains resulting from selling stock and equity mutual funds, F&O losses aren't classified in the same way as losses from capital. They are instead treated as losses of business under the category "Profits and Gains of Business or Profession" on the ITR format.

Selecting the Right Form for F&O Losses in ITR

The right choice in the Income Tax Return (ITR) format is essential for Futures and Options (F&O) traders who must declare F&O losses. The form of selection is based on the nature and scope of the trading activity.

1. Knowing ITR Forms: It's crucial to know that various ITR forms are available to cater for different types of income, such as salary, property for sale capital gains, and professional earnings.

2. ITR-3 for Business Activity: It is for individuals and Hindu Undivided Families who engage in F&O trading as a commercial activity; ITR-3 is the appropriate type of form. The form was designed to record business-related earnings and losses, including those incurred by F&O trading.

3. ITR-3's Scope ITR-3: ITR-3 is comprehensive and contains sections on reporting the gains and profits earned from the profession or work, income from pension or salary or house properties or other sources, earnings from different sources, and income from capital gains.

4. ITR-2 for Investment: When F&O trading is viewed as an investment by individuals and HUFs, they must select ITR-2. The form was designed to track income and losses from investments, in addition to other categories of income.

5. ITR-2's Scope ITR-2: ITR-2 covers various income sources, like pension and salary income, multi-house properties, capital gains/losses, agriculture income, foreign assets/income that exceeds Rs.5000 and others.

6. Professional Guidance: Due to the difficulty of tax laws and the grave consequences of wrong decisions, seeking professional assistance in deciding on the ITR form is generally recommended. Aaditya Wealthon is a top stock market broker in India that offers exceptional taxation services. If you want to help how to save tax using your demat account, feel free to call us today.

7. Be Aware of Deadlines: It's essential to be mindful that the tax return deadline in India is typically on the 31st of July each year. Extensions may be granted in specific circumstances.

8. Be Well-Informed. Keep Up-to-date: Tax rules and laws may vary from year to year. So, being aware of the changes in tax laws is crucial for avoiding compliance problems.

Conclusion

Taxpayers must report F&O losses on their tax returns to avoid discrepancies and penalty charges. By following the appropriate rules and working with a tax professional, taxpayers can efficiently and precisely file their F&O loss and remain in compliance with the tax laws.

Aaditya is a leading stock brokerage firm offering a comprehensive range of services, including opening demat accounts, IOP accounts, trading accounts, stock advisory services, etc. We offer the lowest brokerage charges in India for trading. So, whether you are looking to invest in SIP or gold or simply want to learn to improve your investment portfolio, contact us today.

#lowest brokerage charges in India for trading#top stock market broker in India#F&O Losses in ITR#F&O loss in income tax return#F&0 trading account#F&O loss in ITR

0 notes

Text

Gain/Loss On Futures And Options – Income Tax Treatment

Derivative trading, or the trading of futures and options, has increased dramatically in the last few years. Usually referred to as F&O. People who had previously been involved in it on a part-time basis are now pursuing it full-time. Along with their jobs, people are earning extra money through trading. Through F&O investment, investors can forecast the price of stocks or commodities and earn substantial returns. However, there is a significant risk involved.

Investors are talking a lot about trading futures and options, or F&O, on stocks, currencies, and commodities, but they need to know how this is taxed. Allow us to better understand how to handle your taxes.

What is F&O, or futures and options?

Financial derivatives instruments traded on stock exchanges are called futures and options, or F&O. These are contracts that let investors guess or hedge their bets on how the prices of underlying assets—like stocks, commodities, currencies, or indexes—will change in the future. This is a quick summary of options and futures:

Futures:

A standardised contract for the purchase or sale of an underlying asset at a fixed price and future date is known as a futures contract.

Regardless of the market price at the time the contract expires, it requires the seller to sell the asset at the agreed-upon price and the buyer to buy it.

Futures are highly standardised with respect to contract size, expiration date, and settlement method. They are traded on organised exchanges.

Options:

The buyer of an options contract is granted the right, but not the responsibility, to purchase (call option) or sell (put option) an underlying asset at a strike price on or before a specific date (expiry date) at a given price.

For the option, the buyer gives the seller a higher price.

If the buyer chooses to exercise the option, the seller is required to comply with the terms of the agreement.

Options come in a variety of forms, including index options, stock options, and commodity options, and are also traded on organised exchanges.

Future and Option Trading.

Options & Futures Trading is the act of exchanging derivatives for an underlying asset at a fixed price. A currency, equity shares, or a commodity could be this underlying asset.

With futures, a trader purchases or sells a contract at a fixed price and on a fixed future date.

Options provide the buyer the right, not the obligation, to purchase or sell, so he can terminate the agreement if he suffers any losses.

Treatment of Futures and Options in the ITR along with the adjustment of Losses?

Trades of futures and options are reported under Profit and Gains from Business or Profession. Net of all the trades whether positives or negatives are considered as Business Income. Whereby for reporting purposes Turnover is considered as Absolute amount of ( Selling Amount – Purchase Amount). While Profits are reported under Profit and Gains from Business and Profession and taxed as per the slab rate of the assessee.

Trading in futures and options is regarded as non-speculative activity under Section 43(5). This implies that the taxation of any income derived from F&O trading is comparable to that of business transactions.

Transactions can be offset against all other sources of income (salary excluded) in the event of a F&O loss. This is a main advantage. These sources of income could come from a business or occupation, real estate, or other sources. For instance, if you are paying Rs 100,000 in rent each month, you will receive Rs 12,00,000 a year. If you have any loss on F&O for the year, which let’s say is Rs. 200,000, you can deduct this loss from your rental income. Your taxable income will drop to Rs. ((1200000- (30%*1200000)- 200000)= 640,000 as a result.

In this instance, the loss may be carried forward over the following eight years if it could not be set off in the current year. But for the next eight years, nothing will change; but you can only deduct it from your business income.

When reporting F&O income, which ITR form should I file?

To file an ITR, there are various forms available. Given that F&O income and losses are regarded as typical business income and losses, selecting the appropriate option is crucial depending on the nature of your revenue. Therefore, the appropriate form to report this income is ITR-4. To guarantee accurate reporting of your income and prevent any discrepancies, it is imperative that you choose the appropriate ITR form.

What variables are considered and how is F&O turnover calculated?

Calculating trading turnover is crucial to determining whether or not the tax audit is relevant.

Total Profit (the absolute total of the gains and losses on all of the transactions that were made during the year) is the turnover for futures and options trading.

Here, the sum of the positive and negative differences equals the profit or loss.

Let’s use an example to better understand this:-

On 07/09/2023, Mr. X purchases 400 Nifty Futures contracts at a price of Rs. 50. On October 20, 2023, he sells these contracts for Rs. 30. Additionally, on October 5, 2022, Mr. X purchases 200 Sensex Futures contracts for Rs. 100. On December 9, 2023, he sells these contracts for Rs. 150.

Loss from Trade 1 = (30-50) * 400 = Rs. -8,000

Profit from Trade 2 = (150-100) * 200 = Rs. 10,000

Turnover = 8000+10,000=Rs.18,000

Profit/ Loss from Business and Profession = Rs. 2000

The Advantages of Reporting Your F&O Loss

There are various advantages Futures and Options (F&O) loss when submitting your income tax return. These advantages include:

Tax Deduction: One of the main advantages of proving the loss is that it can be deducted from any other money you have received. You can deduct a loss on a F&O trade from all sources of income other than your salary. This could come from a job work, a business, a house property, or any other source of income. It lowers your total amount of owed taxes. This may assist in reducing your tax obligation.

Carry Forward: You may carry forward unabsorbed losses to subsequent fiscal years if your F&O losses in a given year surpass your total income. Your tax obligation in later years can be decreased by deducting these losses from your F&O gains. Carry Forward of losses would only be available if the return is filed timely as per Section 139(1)

Documentation for Future Use: When you accurately report your F&O losses, you get a record of your financial transactions that you can use for future financial planning or loan applications.

Adjustment against F&O Gains: Declaring the losses enables you to offset them against the gains, lowering the total tax obligation on F&O transactions, if you have both F&O gains and losses in a financial year.

Preparation of Books of Accounts and Audit Requirements

It is significant to note that once your account is classified as a business, appropriate books of accounts must be kept if the income exceeds Rs 2,50,000 or the turnover exceeds Rs 25,00,000 in any of the preceding three years, or in the first year in the case of a new business. Individuals conducting business, such as F&O trading, are subject to the same rules. Under Section 44AA of the Income Tax Act, the trader would have to prepare regular books of accounts. However, a tax audit under Section 44AB will be carried out if the turnover surpasses Rs. 10 crore or the profit declared is less than 8%. This implies that you must have a Chartered Account audit your accounts, and you must file your tax return and the audit report by the deadline set by the act.

Under Section 271A, there is a penalty for failing to keep accounting records. The fine is Rs 25,000. Furthermore, failing to have books audited in accordance with Section 44AB may result in a fine under Section 271B equal to the lesser of Rs 1.5 lakhs or 0.5% of gross receipts or turnover.

In what situations and with whom is a F&O trading tax audit permissible?

Case 1: Up to $2 Cr in trading turnover.

Tax Audit is not applicable if the profit is greater than or equal to 6% of Trading Turnover and presumptive taxation has been chosen.

If the taxpayer’s income exceeds the exemption limit and they have lost money or made money that is less than 6% of trading turnover, a tax audit is necessary.

Case 2: Trading Turnover Exceeds $2Cr and May Reach $10Cr

A tax audit is necessary if the taxpayer has lost money or made a profit that is less than 6% of trading turnover.

The Tax Audit is relevant if the profit exceeds or equals 6% of Trading Turnover and presumptive tax has not been chosen.

The Tax Audit is not relevant if the profit is greater than or equal to 6% of Trading Turnover and presumptive tax has been chosen.

Case 3: The trading turnover exceeds $10 billion.

Tax Audit is relevant in every situation, regardless of trading volume.

0 notes

Text

Taxation of Derivatives Income - Futures & Options (F&O)

Income from derivative transactions are taxed as business income irrespective of the volume or turnover. If you’ve traded in derivatives, ITR 3 (the form for reporting business income) needs to be filled. Even if you’re a salaried person, you’ll still need to fill ITR-3 if you’ve engaged in any F&O trades in the last FY.

Under Section 43(5), a business is categorized as speculative or non-speculative.

Speculative business income: Income from intraday equity trading is considered as speculative.

Non-speculative business income: Income from trading F&O (both intraday and carryforward) on is considered as non-speculative business. F&O is also considered as non-speculative as these instruments are used for hedging and also for taking/giving delivery of underlying contract.

Maintenance of Books of accounts

All the transaction carried out need to be recorded. This includes buy/sell transactions, expenses like electricity bills, demat charges, phone bills, advisory fee etc. In case a trader is involved in multiple forms of trading in shares like intraday trading, F&O, making investments in MFs, holding shares for more than twelve months from the date of purchase, the business income from each of these must be declared separately since the tax treatment differs based on the type of dealing. The common expenses can be bifurcated depending on the proportion of time spent on the various types of trades.

How do you calculate your trading turnover?

For every trade, contract notes are issued which show the value of assets bought or sold. While for the recording purpose only the difference between is used. Take this example:

Anurag bought one lot of Maruti ports at 2.0 lakhs and sold it for 2.8 lakhs (Profit = Rs 80,000)

Anurag bought one lot of SBI at 3.5 lakhs and sold it for 3.00 lakhs (Loss= Rs 50,000)

The turnover shall be calculated as Rs 80,000 + Rs 50,000 = Rs. 1.30 lakhs. [3]Also, any premium received when you’re writing a option must be added to the turnover value.

When is an audit mandatory?

When the turnover from F&O trading exceeds Rs 2 crore (Section 44AD) or if profits are less than 8% of the trading turnover (and your other income is above taxable limit), the accounts need to be audited by a practicing Chartered Accountant.

Tax Computation for Anurag

Let’s say Anurag works for Minance and has earned a salary of Rs 15 lakhs in FY 2018-19 (yeah, I wish!)

Anurag opened a trading account with a brokerage firm by paying Rs 5,000 as account opening charges. He has to pay 0.02% as brokerage charges for each F&O trade and paid a total of Rs 98,000 as brokerage charges during the year. He also attended a workshop for F&O beginners and paid the organizers Rs 7,000 for it.

Anurag has mobile expenses of Rs 36,000 (because he talks a lot) for the whole year and a review of his past bills indicates about 50% of his bill is towards his F&O trade. His monthly internet bill is Rs 1,200. He met a consultant who specializes in F&O and had a dinner worth Rs 2,000 with him.

His total turnover is Rs. 1.2 crores and since he’s a horrible trader, his losses are Rs 3 lakhs. Here’s what happened next:

His F&O trades is treated as a business. He will have to file ITR-3 instead of ITR-1 (form for income from salaries, house property, interest and other sources) that he files normally

Anurag can claim expenses of F&O from his income (or loss), which are directly related to F&O his trading

Losses have tax benefits (they can be offset with certain other incomes and can be carry forwarded for 8 succeeding years)

Since Anurag’s turnover is less than Rs 1 crore, but he has losses from FnO business (ie Profit is less than 8% of FnO Turnover) he must get an audit done from his CA. He also has to maintain books of accounts for his trading activity.

Table 1: List of expenses incurred for F&O trading by Anurag.

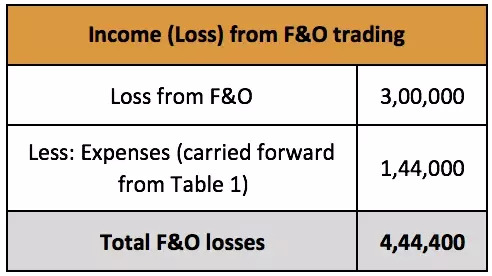

Table 2: Net income from Anurag’s F&O trading business. Remember I made a loss of Rs 3 lakhs because I’m a horrible trader? That’s the first item. The second team is the net expenses brought forward from the grand total of Table 1.

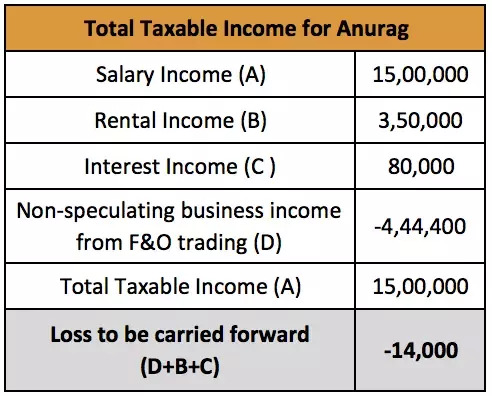

Table 3: F&O trading is considered as a non-speculative business, can be set off with other incomes such as rental income, interest income. Any loss which is unadjusted here (the Rs 14,000 portion) can be carried forward to 8 succeeding years. In these 8 years it can only be set off against non-speculative business income.

Treatment of losses from the F&O trading business and how it affects tax liability?

Reporting losses can help you bring down the tax liability. Since F&O trading is counted as a non-speculative business, loss from F&O trading is allowed to be adjusted against income from any other source (except salary income).

Note: Losses from a speculative business such as day trading cannot be set off against any income other than income from a speculative business.

If the loss is not fully adjusted it can be set off against income under any other source like Income from House Property, Income from Capital Gains etc, except under the head Salaries. If the loss still couldn't be adjusted fully in the year in which it was incurred, the unadjusted loss can be carried forward for next eight years immediately succeeding the year in which it was incurred and be set off only against the head Profit and gains of business and profession for non-speculative business.

Consequences of non-compliance

Penalty of amount upto Rs. 25,000 for not maintaining proper books of accounts.

Penalty of 1.5 % of the turnover or maximum penalty of Rs. 1.5 lakhs for not auditing accounts before the specified date (Relevant date was 31st Oct 2019 for the FY 2018-19).

0 notes