#FCRA Documentation

Text

Foreign Contribution Regulation Act

FCRA का मतलब Foreign Contribution Regulation Act, जो भारत के भीतर होने वाले विदेशी योगदानों को नियंत्रित करता है। सरकारी प्राधिकरण द्वारा जारी एफसीआरए पंजीकरण प्रमाणपत्र किसी भी पंजीकृत ट्रस्ट, सोसायटी, संस्था, एसोसिएशन और गैर-सरकारी संगठनों द्वारा किसी विदेशी अंशदान या विदेशी अनुदान को प्राप्त करने या प्राप्त करने के लिए एक अनिवार्य दायित्व है।

The minimum requirement for FCRA Registration

A) Obligations for Proper FCRA Registration:

• आवेदक(applicant) एक पंजीकृत संस्था होगी और उसका न्यूनतम 5 साल तक संचालन होना चाहिए।

• आवेदक इकाई को अपनी मुख्य वस्तुओं की प्राप्ति के लिए पिछले तीन वर्षों में कम से कम INR 10 लाख खर्च करना चाहिए, जिसके लिए इकाई को प्रशासनिक व्यय को छोड़कर पंजीकृत किया गया था।

• एक योग्य चार्टर्ड एकाउंटेंट द्वारा लेखा परीक्षित पिछले तीन वर्षों का वित्तीय विवरण एक आवेदक द्वारा प्रस्तुत किया जाएगा।

B) The Obligation for Prior Permission FCRA Registration:

• यदि नव पंजीकृत संस्था (newly registered entity) विदेशी अंशदान foreign contributions प्राप्त करने के लिए तैयार है या विदेशी अनुदान पूर्व अनुमति के लिए आवेदन करेगा |

• उसी के लिए आवेदन करने के दौरान, यह एक विदेशी मालिक से संबंधित विवरण देगा जो निधि में योगदान दे रहा है

• प्राप्त फंड का उपयोग केवल निर्दिष्ट उद्देश्य के लिए किया जाएगा

Following documents shall be annexed with the online application:

• Self-certified copy of incorporation certificate, trust deed, or any other certificate hold by such entity.

• PAN of NGO

• Copy of MOA & AOA of associations and institutions

• Signature of the chief judiciary in JPG format

• A detailed report on activities of the preceding three years.

• Audited copy of financial statement, P&L account, Income-Expenditure details, and cash flow statement of the preceding three years.

• CTC of the resolution passed by a governing body authorized by NGO

• Certificate obtained under section 80G and 12A of Income Tax. Section 80G and 12A provide tax exemption to NGOs under the Income-tax Act.

FCRA Registration Process

• FCRA की आधिकारिक वेबसाइट https://fcraonline.nic.in पर उपलब्ध ऑनलाइन फॉर्म एफसी -3 भरने के माध्यम से ऑनलाइन आवेदन करें

• FCRA के तहत पंजीकरण के लिए विकल्प "एफसीआरए ऑनलाइन फॉर्म" पर क्लिक करें।

• आवेदक को कई विकल्पों के लिए अगले पृष्ठ पर पुनर्निर्देशित किया जाएगा जैसे कि केंद्र सरकार की अनुमति लेने के लिए आवेदन, विदेशी रसीद सूचना, एफसीआरए पंजीकरण के लिए आवेदन आदि।

एफसीआरए पंजीकरण (एफसी -3) के लिए आवेदन के तहत "ऑनलाइन आवेदन करें" विकल्प चुनें

• नए उपयोगकर्ता को आवेदन पत्र पूरा करने के लिए साइन अप करना होगा

• फॉर्म भरें और सभी अनिवार्य विवरणों को पूरा करें

• फॉर्म पूरा हो जाने के बाद, सेव बटन पर क्लिक करें जिसके बाद “यूजरआईडी”अपने आप जेनरेट हो जाएगी।

• फिर आवेदक को उपरोक्त प्रक्रिया पर स्वचालित रूप से उत्पन्न लॉगिन क्रेडेंशियल का उपयोग करके साइन अप करना होगा।

• कदम पंजीकरण द्वारा कदम शुरू करना जारी रखें।

• पूरा फॉर्म पूरा हो जाने के बाद, आवेदक को पीडीएफ प्रारूप में दस्तावेजों को स्कैन और संलग्न करना होगा।

• ऑनलाइन भुगतान गेटवे के माध्यम से ऑनलाइन भुगतान करके ऑनलाइन पंजीकरण को पूरा करें।

Renewal of FCRA License

FCRA registration पांच साल के लिए वैध रहता है, जिसे नवीकरण के लिए आवेदन करके नवीनीकृत किया जा सकता है। निम्नलिखित समयसीमा के भीतर नवीकरण के लिए एक इकाई लागू होगी:

• लाइसेंस रद्द होने की तारीख से कम से कम छह महीने पहले।

• पंजीकरण से कम से कम 12 महीने पहले जब पंजीकरण में कमी होती है, तो इस मामले में इकाई बहु-वर्षीय परियोजना पर काम कर रही है।

Cancellation/Suspension of FCRA Registration

1. एनजीओ विदेशी अंशदान (विनियमन) अधिनियम के प्रावधानों का पालन करने में विफल रहता है।

2. यदि इकाई नियत तारीख के भीतर वार्षिक रिटर्न जमा करने में विफल रहती है

3. यदि किसी संगठन द्वारा परिचालन में किसी गलत काम के लिए लगाए गए किसी भी आरोप के लिए कोई जाँच की जाती है, और ऐसा आरोप सही साबित हुआ है

4. प्राप्त अंशदान का उपयोग FCRA पंजीकरण आवेदन के दौरान बताए गए उद्देश्य को प्राप्त करने के लिए न तो इकाई के मुख्य उद्देश्य की प्राप्ति के लिए किया जाता है।

0 notes

Text

NGO Registration in Gurgaon: Your Complete Guide Understanding NGO Registration in Gurgaon

Creating a Non-Governmental Organization (NGO) is a noble endeavor that will help improve society. However, creating an NGO requires knowing the regulatory environment and overcoming legal processes. The goal of Adya financial' s guide is to offer thorough information about NGO registration in Gurgaon, guaranteeing a simple and hassle-free procedure.

What is an NGO?

With an emphasis on social, cultural, environmental, or humanitarian reasons, an NGO, or non-governmental organization, functions autonomously from the government. The Societies Registration Act, 1860, the Indian Trusts Act, 1882, and the Companies Act, 2013 (Section 8 company) are among the Acts in India that allow non-governmental organization's to register. Because it dictates how your organization will operate and be run, selecting the appropriate structure is crucial.

Why Register an NGO in Gurgaon?

Before we dive into the steps, let’s understand why NGO registration in Gurgaon is important:

Legal Recognition: Registration gives your organization a legal identity, enabling it to open a bank account, own property, and sign contracts in its name.

Access to Funding: Registered NGOs are eligible for government grants, tax exemptions, and can apply for foreign donations under FCRA (Foreign Contribution Regulation Act).

Tax Exemptions: NGOs registered under certain sections can enjoy tax benefits under the Income Tax Act.

Credibility: A registered NGO holds more trust and credibility among donors, beneficiaries, and the public.

Types of NGO Registration in Gurgaon

In Gurgaon, you can register your NGO in three main forms:

Society: A society is a group of people working together towards a common goal. It is registered under the Societies Registration Act, 1860. This type of NGO requires a minimum of seven members from different states.

Trust: NGOs registered as trusts are governed by the Indian Trusts Act, 1882. A trust can be created by a group of individuals or even a family. Trusts are ideal for charitable and religious purposes.

Section 8 Company: A Section 8 company is a non-profit organization registered under the Companies Act, 2013. It operates as a corporate body, providing greater transparency and professional governance.

Steps to NGO Registration in Gurgaon

The process of NGO registration in Gurgaon varies slightly depending on the type of NGO you choose. Below are the steps for each type:

Society Registration:

Step 1: Prepare the Documents: You’ll need a memorandum of association, rules, and regulations of the society, identity proofs of all members, and address proof of the office.

Step 2: Draft the Memorandum of Association (MoA): The MoA outlines the objectives and activities of the NGO. It must be signed by all founding members.

Step 3: Submit the Application: Submit the signed MoA along with supporting documents to the Registrar of Societies in Gurgaon. The Registrar will verify the documents and, if everything is in order, issue a certificate of registration.

Step 4: Get the Society Registered: Upon approval, you’ll receive a certificate of registration, making your NGO legally recognized.

Trust Registration:

Step 1: Create a Trust Deed: A trust deed is a legal document that outlines the name of the trust, its objectives, and details of the trustees. It is drafted on non-judicial stamp paper.

Step 2: Appoint Trustees: Trustees are the individuals responsible for managing the trust. Usually, there’s no minimum or maximum number of trustees required.

Step 3: Submit the Deed to the Registrar: Submit the trust deed along with identity proofs of the trustees to the Registrar of Trusts in Gurgaon. After verification, the Registrar will issue a certificate of registration.

Section 8 Company Registration:

Step 1: Obtain Digital Signature Certificates (DSC): The first step is to obtain DSCs for all directors. DSCs are essential for e-filing the registration documents.

Step 2: Apply for Director Identification Numbers (DIN): Directors need DINs to register a Section 8 company.

Step 3: File INC-12: File Form INC-12 to the Registrar of Companies (RoC) along with necessary documents like the Memorandum of Association and Articles of Association.

Step 4: Get the Company Registered: Once the RoC approves the application, you’ll receive a certificate of incorporation. Your NGO is now registered as a Section 8 company.

Documents Required for NGO Registration in Gurgaon

For a smooth registration process Documents Required for NGO Registration in Gurgaon, you need to have the following documents ready:

For Society: Memorandum of Association, rules and regulations, identity proof of members, address proof of the registered office.

For Trust: Trust deed, identity proof of trustees, address proof of the trust’s office.

For Section 8 Company: Memorandum of Association, Articles of Association, identity proof of directors, DSCs, and DINs.

Cost of NGO Registration in Gurgaon

The cost of NGO registration in Gurgaon can vary depending on the type of NGO you are registering:

Society Registration: Typically ranges from ₹5,000 to ₹10,000.

Trust Registration: The cost for trust registration varies but can range between ₹4,000 and ₹8,000.

Section 8 Company: Registering a Section 8 company is more expensive, ranging from ₹10,000 to ₹25,000, depending on legal fees and documentation.

Time Taken for NGO Registration in Gurgaon

The time taken to register an NGO depends on the type of registration:

Society Registration: It usually takes 1-2 months for society registration.

Trust Registration: The process can take up to 1 month.

Section 8 Company: Registration typically takes 2-3 months.

Post Registration Compliances for NGOs

After registering your NGO, there are several post-registration compliances to ensure its smooth functioning:

Annual Filings: NGOs must file annual reports, including financial statements, with the relevant authority.

Income Tax Registration: You need to register under Section 12A and 80G to avail of tax exemptions and allow donors to claim deductions.

FCRA Registration: If you plan to accept foreign contributions, you must apply for FCRA registration.

How Adya Financial Can Help

We at Adya Financial offer comprehensive help with NGO registration in Gurgaon. Our team of professionals will assist you at every step of the way, from choosing the best kind of NGO to making sure all legal criteria are met. We guarantee that the registration is finished quickly and in accordance with the applicable laws.

Conclusion

If you have the proper counsel, ngo registration in gurgaon is a simple process. It's important to adhere to the proper legal processes whether you decide to register as a society, trust, or Section 8 corporation. Adya Financial is available to guide you through the procedure and make sure your NGO gets off to a good start.

0 notes

Text

Knoxville Criminal Records Search: Tips and Tricks for Accurate Results

Searching for criminal records can seem tough, but it doesn't have to be. Whether you’re a landlord checking on a tenant, an employer hiring someone new, or just curious about your own records, this guide will help you find what you need.

Let’s break down some simple tips to get accurate results when searching for criminal records search in Knoxville.

What Are Criminal Records?

Criminal records are documents that show a person’s history with the law. This can include arrests, trials, and jail time. In Knoxville, these records are kept by different groups, such as the local police, the county courthouse, and state agencies.

Tip 1: Know Where to Look

Start by knowing the right places to search for criminal records:

Knoxville Police Department (KPD):

They have records of arrests and incidents in Knoxville. You can ask them for copies of reports.

Knox County Court Clerk:

They keep records of court cases, including criminal trials. You can visit their office to get this information.

Tennessee Bureau of Investigation (TBI):

This agency has a large database of criminal records from all over the state. You can search online on its website.

Tip 2: Make Sure You Have the Right Person

Ensuring the records you find are for the right person is important. Here’s how:

Full Name and Birth Date:

Always use the person’s full name and birth date to narrow your search. Middle names and initials help, too.

Other Names:

Check if the person has used different names before. This can help you find all the records.

Tip 3: Get Help from a Professional in Sevierville

Sometimes, you might need records from nearby places like Sevierville. Hiring a professional process server in Sevierville can be very helpful in such cases. They know how to get legal documents and can quickly help you find accurate records.

Tip 4: Double-Check Multiple Sources

To make sure the information is correct, check multiple sources. Here’s why:

Mistakes:

Different places might have different information. By comparing, you can find the most accurate records.

Complete Search:

One place might not have all the records. Checking multiple sources ensures you don’t miss anything important.

Tip 5: Know the Legal Rules

When you search for criminal records, you have to follow some rules, especially about privacy and fairness:

Fair Credit Reporting Act (FCRA):

If you’re using the information for hiring or renting, make sure you follow FCRA rules, which say how you can use the information.

Permission:

Often, you need the person’s permission to do a criminal records search in Knoxville, especially for jobs.

Tip 6: Be Careful with Online Tools

Many websites say they can find criminal records. Some are good, but be careful:

Accuracy:

Not all online services give correct or updated information. Always check with official sources to confirm.

Cost:

Some websites charge a lot for information you can get for free. Make sure you’re not overpaying.

Final Statement

Searching for criminal records in Knoxville doesn’t have to be hard. You can find accurate records by knowing where to look, making sure you have the right person, double-checking information, understanding the rules, and using online tools carefully.

If you need help, a professional process server in Sevierville can make the search easier. Whether you’re looking for yourself or someone else, these tips will help you get the information you need without any trouble.

0 notes

Text

4 Growth-Focused Strategies for Credit Repair Specialists

Are you struggling with repairing your credit score in Washington? Don’t worry, you are not alone. Many people face this problem due to various reasons such as missed payments, bankruptcy, or identity theft. But the good news is that there are ways to improve your credit score. In this blog, we will discuss five expert tips that can help you transform your credit repair journey in Washington.

1. Know Your Credit Score Inside Out:

The journey to credit repair in Washington begins with a deep understanding of your current financial standing. Request a copy of your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion. Under federal law, you’re entitled to one annual free credit report from each bureau. Once you have your reports, scrutinize them for inaccuracies, discrepancies, or signs of identity theft. Consider factors like late payments, outstanding debts, and derogatory marks. Understanding the intricacies of your credit report will empower you to formulate a targeted strategy for improvement.

2. Dispute Inaccuracies with Precision:

Inaccurate information on your credit report can drag down your score and hamper your financial prospects. Fortunately, the Fair Credit Reporting Act (FCRA) empowers consumers to challenge erroneous data. If you spot any discrepancies during your review, don’t hesitate to file a dispute with the relevant credit bureau. In Washington, credit bureaus must investigate disputes within 30 days and rectify errors. Craft a clear and concise letter outlining the inaccuracies and provide supporting documentation wherever possible. By taking proactive steps to dispute inaccuracies, you can expedite the credit repair process and set the stage for improvement.

3. Adopt Responsible Debt Management Practices:

High debt levels can act as a millstone around your financial neck, dragging down your credit score and limiting your financial flexibility. To kick start your credit repair journey in Washington, prioritize responsible debt management. Begin by crafting a detailed budget for your income, expenses, and debt obligations. Identify areas where you can trim expenses and redirect funds toward debt repayment. Consider leveraging debt consolidation or negotiation strategies to streamline your repayment process and potentially reduce your debt burden. By taking control of your debt and adhering to a disciplined repayment plan, you can gradually chip away at outstanding balances and improve your creditworthiness.

4. Cultivate Positive Credit Habits:

Building a solid credit history is a marathon, not a sprint. As you work to repair your credit in Washington, focus on cultivating positive credit habits that will stand the test of time. Start by paying your bills on time, every time. Late payments can wreak havoc on your credit score, so set up automatic reminders or scheduled payments to stay on track. Additionally, strive to keep your credit card balances low relative to your available credit limit – ideally below 30%. Avoid opening multiple new accounts quickly, which can signal financial instability to lenders. Demonstrating responsible credit behavior over time’ll gradually rebuild your credit profile and unlock access to better financial opportunities.

Conclusion:

Transforming your credit repair journey in Washington requires patience, persistence, and a proactive mindset. By familiarizing yourself with your credit report, disputing inaccuracies, managing debt responsibly, cultivating positive credit habits, and seeking professional guidance, you can chart a course toward financial empowerment and independence. Remember, credit repair is a gradual process that requires consistent effort and dedication. Celebrate small victories along the way, and stay focused on achieving a healthier credit score and brighter financial future. With the right strategies and mindset, you can overcome obstacles, conquer challenges, and unlock the doors to financial freedom in the Evergreen State.

Contact Us :

Address - 3409 Chandler Pkwy Bellingham, WA 98226

Phone - (360) 312-7164

Email - [email protected]

Website - Whatcom Credit Restoration

Blog - 4 Growth-Focused Strategies for Credit Repair Specialists

#credit score#credit restoration#credit restoration services#credit card#credit report#bad credit#credit restoration company#Credit Repair Specialists

0 notes

Text

A comprehensive guide on FCRA registration for NGOs in India, detailing the importance of FCRA registration, eligibility criteria, types of registration, application process, required documents, and post-registration compliance. Learn how to legally receive foreign contributions and ensure transparency and accountability in your organization’s operations with this step-by-step overview.

0 notes

Text

Social Web Activity Checks Are Important for Employee Selection

In today's digital age, social media has become a fundamental part of our lives. Platforms like Facebook, Twitter, LinkedIn, and Instagram allow individuals to share personal and professional milestones. For employers, these platforms provide a valuable resource to understand the behavior and character of potential hires, offering insights that traditional background checks might miss. As a result, social media behavior checks have become an essential aspect of the employee screening process.

Why Conduct Social Media Behavior Checks?

Assessing Cultural Fit: A person's personality, interests, and values can be inferred a lot from their social media presence. Employers can assess if a candidate will blend well with the company culture by observing their online behavior. Do they engage professionally and respectfully? Does their shared content reflect the company’s values?

Spotting Red Flags: These checks can uncover issues that standard background checks might miss, such as inappropriate content, discriminatory comments, or evidence of illegal activities. Identifying these concerns early can prevent potential reputational damage and legal issues for the company.

Verifying Information: Candidates often enhance their resumes to appear more attractive to employers. Social media profiles can help verify the information provided. For instance, LinkedIn endorsements or posts about professional achievements can validate a candidate’s work history and skills.

How to Conduct Effective Social Media Behavior Checks?

Establish Clear Guidelines: Before starting social media checks, it’s crucial to define what constitutes acceptable and unacceptable online behavior. This guarantees a consistent and equitable evaluation process for every candidate.

Respect Privacy: It’s important to gather information ethically by only reviewing publicly available content and not asking candidates for passwords or access to private accounts.

Focus on Relevance: Concentrate on behaviors relevant to the job role and company values. Refrain from passing judgement on things based on your own beliefs or unrelated actions.

Be Consistent: Apply the same criteria to all candidates to maintain fairness and avoid potential discrimination claims. Documenting the process and standards can also enhance accountability and transparency.

Legal and Ethical Considerations

Compliance with Laws: Different regions have varying laws regarding social media checks. Employers must ensure their practices comply with relevant laws, such as the Fair Credit Reporting Act (FCRA) in the United States.

Avoid Discrimination: Employers must not base hiring decisions on protected characteristics like race, gender, religion, or age, which may be visible on social media profiles.

Transparency: Informing candidates that social media checks will be part of the screening process helps maintain transparency and build trust.

Conclusion

Social media behavior checks are a powerful tool for employers to gain deeper insights into potential employees. By understanding how candidates present themselves online, companies can make more informed hiring decisions, ensuring a better fit for their teams. But it's imperative that these checks be carried out morally and legally, striking a balance between the need for information and privacy protection.

Implementing a well-structured social media behavior check process can enhance your company’s ability to select candidates who align with your values and contribute positively to your organizational culture. As social media continues to play a significant role in our lives, integrating these checks into your screening process will become increasingly important for successful hiring practices.

#background screening#employee verification#background verification#background verification company#social media

0 notes

Text

What Role Does Bookkeeping Play In The Financial Sustainability Of Non-Profit Organizations In India?

In India, non-profit organizations (NPOs) are essential for tackling social, cultural, and environmental problems. These groups frequently have little revenue and rely largely on donations, grants, and other sources of income to run. For nonprofit organizations to fulfill their purposes and continue operating, they must be financially stable. The methodical documentation of financial transactions known as bookkeeping is essential to the long-term financial viability of nonprofit organizations. This essay examines the vital roles that bookkeeping plays in improving the financial stability of nonprofit organizations in India.

Maintaining Accountability and Transparency:-

In non-profit organizations, maintaining accountability and transparency is one of bookkeeping's main responsibilities. NPOs have a variety of stakeholders to answer to, such as funders, recipients, governmental organizations, and members of the public. Financial documents that are clear and accurate show that the company is handling money ethically and responsibly. Transparency fosters confidence and trust, both of which are essential for drawing in and keeping supporters and donors.

Adherence to Legal and Regulatory Mandates:-

In India, nonprofit organizations must comply with a number of legal and regulatory obligations. NPOs must adhere to the Foreign Contribution (Regulation) Act (FCRA) if they receive foreign donations, file annual returns, and retain accurate records for audits. Accurate bookkeeping ensures that these criteria are met. Penalties, legal issues, and even the loss of the organization's nonprofit status are possible outcomes of non-compliance. NPOs can stay out of trouble with the law and minimize these risks by keeping careful financial records.

Facilitating Informed Decision-Making:-

Accurate and current financial information is essential for non-profit organizations to make well-informed decisions, and this is provided through efficient bookkeeping. Nonprofit organizations (NPOs) use financial reports derived from bookkeeping records to monitor cash flow, analyze program and initiative effectiveness, and assess their overall financial health. Organizations can use this information to plan for future initiatives, allocate resources effectively, and make strategic decisions that support their mission and objectives.

Improving Your Fundraising Attempts:-

A vital component of keeping non-profit organizations alive is fundraising. Grantmakers and donors want confirmation that their funds are being utilized wisely and for the intended goals. Thorough bookkeeping records show the impact of donations and how money is used. Nonprofit organizations can become more successful in their fundraising endeavors, draw in more donors, and obtain larger grants by exhibiting fiscal prudence and efficient fund management.

Financial Planning and Budgeting:-

For non-profit organizations, bookkeeping is essential to financial planning and budgeting. Nonprofits can produce accurate financial predictions and budgets by maintaining thorough records of their revenue and expenses. This aids groups in planning for upcoming expenses, identifying possible financing gaps, and setting realistic financial targets. For non-profits to remain viable over the long term and increase their influence, they must practice sound financial planning and budgeting.

Monitoring Financial Performance:-

Non-profit organizations can regularly assess their financial performance with the help of regular bookkeeping. Nonprofit organizations (NPOs) can pinpoint areas where they are failing or overspending by monitoring income, expenses, and financial patterns. Organizations can swiftly take corrective action, optimize their operations, and make sure they are using resources efficiently thanks to continuous financial monitoring. It also aids in recognizing financial hazards and creating plans to lessen them.

Developing Financial Strength:-

An organization's financial resilience refers to its capacity to endure financial shocks and uncertainty. By giving a clear view of their cash flow and financial status, bookkeeping assists non-profit organizations in developing financial resilience. NPOs are better equipped to create reserves, prepare for emergencies, and handle unforeseen difficulties when they have precise financial records. The sustainability of non-profits depends heavily on their ability to withstand financial setbacks and unstable funding sources.

Increasing the Efficiency of Programs:-

Nonprofit organizations need to show the efficacy of their initiatives to all relevant parties, such as sponsors and recipients. Data on the financial resources allotted to different programs and their results can be found in bookkeeping records. Nonprofit organizations can use this data to evaluate the projects' cost-effectiveness, make the required modifications, and enhance program delivery. Through the integration of financial data with program outcomes, organizations can exhibit their worth and influence to relevant parties.

Strengthening Donor Relationships:-

Sustaining long-term relationships with contributors is critical to non-profit organizations' viability. Because bookkeeping guarantees the efficient and transparent management of donor finances, it plays a critical role in fostering these partnerships. Donors can feel certain that their gifts are having an impact because of the regular financial reports and updates on the use of funds. Long-term partnerships result from this transparency's ability to build confidence and motivate contributors to continue their support.

Supporting Grant Applications:-

Grants from foundations, governmental organizations, and other financial sources are essential to the operations of many non-profit organizations. Preparing grant applications and proving the organization's financial soundness requires accurate bookkeeping. A grant application procedure generally includes the requirement for comprehensive financial records and reports. Nonprofit organizations can strengthen their funding case and improve their chances of receiving grants by keeping well-organized and current financial records.

Supporting Audits:-

An essential component of guaranteeing non-profit organizations' financial integrity and accountability is auditing them. By giving auditors thorough and precise financial records, bookkeeping makes the audit process easier. Frequent audits assist NPOs in maintaining regulatory compliance, strengthening internal controls, and pinpointing opportunities for improvement. Nonprofits can show their dedication to financial responsibility and transparency by becoming audit-ready.

Conclusion

Bookkeeping is essential to Indian non-profit organizations' capacity to maintain a stable financial position. It facilitates compliance with legal and regulatory obligations, guarantees accountability and transparency, and offers precise financial data to support well-informed decision-making. Bookkeeping facilitates continuous financial performance monitoring, budgeting, and financial planning. It also helps with fundraising. Additionally, it strengthens donor connections, increases program efficacy, and fosters financial resiliency. Non-profit organizations may demonstrate their influence, obtain funding, and establish long-term sustainability by keeping accurate financial records. This helps the organizations fulfill their purposes and improve society.

#nonprofits_organizations#india_nonprofits_organization#bookkeeping_for_nonprofits_organization#solutions_for_nonprofits_organization

0 notes

Text

FCRA (Foreign Contribution Regulation Act) registration online involves submitting required documents and details such as organization information, sources of foreign funding, and compliance with government norms. This process ensures legal authorization for NGOs and other entities to receive foreign contributions in India.

0 notes

Text

Statement Printing and Mailing Fulfillment

In an age where digital communication is prevalent, the demand for statement printing and mailing fulfillment remains significant. This article delves into the importance, processes, and advancements in statement printing and mailing services.

Importance of Statement Printing and Mailing Fulfillment

Regulatory Compliance: Many industries, especially financial services and healthcare, are required by law to provide printed statements to their clients. Printed statements ensure compliance with regulations such as the Fair Credit Reporting Act (FCRA) and Health Insurance Portability and Accountability Act (HIPAA).

Accessibility: Not all clients prefer or have access to digital statements. Printed statements cater to those who may not be tech-savvy or who prefer physical documents for record-keeping. This inclusivity ensures that all clients receive the information they need in their preferred format.

Professionalism and Trust: Physical statements often convey a sense of professionalism and trust. Clients may perceive printed statements as more official and reliable compared to their digital counterparts. This perception can enhance the company's reputation and client relationships.

Marketing Opportunities: Printed statements provide an additional touchpoint for customer engagement. Companies can include marketing materials, promotional offers, or personalized messages in their mailings, adding value to the client while promoting services or products.

Process of Statement Printing and Mailing Fulfillment

Data Collection and Preparation: The process begins with collecting the necessary data from various sources such as transaction records, account information, and client details. This data is then organized and formatted into statement templates.

Printing: Once the statements are prepared, they are sent to high-speed printers. Modern printing technologies ensure high-quality, clear, and accurate prints. Variable data printing allows for personalization, where each statement can be tailored to the individual recipient.

Insertion and Packaging: After printing, statements are inserted into envelopes along with any additional inserts such as marketing materials or informational leaflets. Automated insertion machines ensure accuracy and efficiency in this step.

Mailing and Distribution: The final step involves mailing the packaged statements to the recipients. Mailing fulfillment services handle the logistics, ensuring timely and accurate delivery. This includes sorting, addressing, and working with postal services to ensure compliance with mailing regulations.

Advancements in Statement Printing and Mailing Fulfillment

Automation and Efficiency: Automation has significantly improved the efficiency and accuracy of statement printing and mailing. From data collection to printing and packaging, automated systems minimize errors and speed up the process, ensuring timely delivery of statements.

Sustainability: There is a growing emphasis on sustainability in the printing and mailing industry. Many companies are adopting eco-friendly practices such as using recycled paper, eco-friendly inks, and optimizing packaging to reduce waste. Sustainable practices not only help the environment but also appeal to environmentally conscious clients.

Enhanced Security: Security is paramount in statement printing and mailing. Advances in technology have led to better data encryption, secure printing facilities, and tamper-evident packaging. These measures protect sensitive client information and maintain confidentiality.

Integrated Services: Many service providers now offer integrated solutions that combine printing, mailing, and digital services. Clients can choose to receive both printed and digital statements, providing flexibility and convenience. Integration also allows for better tracking and reporting, giving companies insights into their statement distribution processes.

Choosing a Statement Printing and Mailing Fulfillment Provider

When selecting a provider, consider the following factors:

Experience and Reputation: Choose a provider with a proven track record in statement printing and mailing. Check for client testimonials and reviews to gauge their reliability and service quality.

Technology and Capabilities: Ensure that the provider uses advanced technology for printing, automation, and security. Their capabilities should align with your specific needs, whether it's large-volume printing or personalized statements.

Compliance and Security: Verify that the provider adheres to industry regulations and has robust security measures in place. This is especially crucial for industries dealing with sensitive information, such as finance and healthcare.

Customer Service: Good customer service is essential for addressing any issues that may arise during the printing and mailing process. Choose a provider known for responsive and helpful customer support.

Cost and Value: While cost is a significant factor, consider the overall value provided. A provider offering high-quality, reliable, and secure services may be worth the investment.

In conclusion, both tracking your statements in real-time and statement printing and mailing fulfillment are vital components of modern financial management. Real-time tracking offers immediate access, security, and improved budgeting capabilities, while statement printing and mailing fulfillment ensures compliance, accessibility, and professional engagement. By leveraging advanced technology and best practices, individuals and businesses can enhance their financial operations and client relationships.

youtube

SITES WE SUPPORT

Print HIPAA Direct Mail – Wix

0 notes

Text

Challenges and Solutions in Pre-Employment Vetting

Pre-employment vetting is a crucial part of the hiring process, ensuring that candidates are thoroughly evaluated before being offered a position. However, many employers face significant challenges during pre employment vetting. In my opinion, understanding these challenges and implementing effective solutions is essential for a smooth and successful hiring process.

Common Challenges in Pre-Employment Vetting

Incomplete or Inaccurate Information

One of the biggest challenges in pre-employment vetting is dealing with incomplete or inaccurate information provided by candidates. This can lead to hiring decisions based on false premises.

Legal and Compliance Issues

Navigating the legal landscape of pre-employment vetting can be complex. Employers must comply with various laws and regulations, such as the Fair Credit Reporting Act (FCRA) and anti-discrimination laws.

Time-Consuming Processes

Pre-employment vetting can be time-consuming, especially when dealing with large volumes of candidates. This can delay the hiring process and impact business operations.

High Costs

Comprehensive vetting processes can be expensive. Costs associated with background checks, drug testing, and other screening methods can add up, particularly for small businesses.

Data Security and Privacy Concerns

Handling sensitive candidate information during the vetting process raises concerns about data security and privacy. Ensuring that this data is protected from breaches is a significant challenge.

Inconsistent Screening Procedures

Inconsistencies in screening procedures can lead to biases and unreliable results. It’s crucial for employers to maintain uniform vetting standards across all candidates.

Practical Solutions and Best Practices

Automating the Vetting Process

Automation can help address the challenge of incomplete or inaccurate information. Automated systems can quickly verify candidate details, ensuring accuracy and completeness. In my opinion, investing in reliable HR software can streamline this process significantly.

Staying Compliant with Laws and Regulations

To navigate legal complexities, employers should stay updated on relevant laws and regulations. Partnering with legal experts or HR consultants can ensure compliance. Regular training for HR staff on legal requirements is also beneficial.

Efficient Time Management

Implementing technology can speed up the vetting process. Using online platforms for background checks and electronic submissions of documents can save time. Additionally, pre-employment vetting can start early in the recruitment process to avoid delays.

Cost-Effective Screening Methods

To manage costs, employers can prioritize essential checks based on the role’s requirements. Bulk screening packages offered by vetting service providers can also reduce expenses. In my experience, negotiating with service providers for better rates can lead to significant savings.

Enhancing Data Security

Employers should use secure, encrypted systems to handle candidate information. Regular audits and updates to security protocols can protect against data breaches. Educating employees on data privacy best practices is crucial for maintaining security.

Standardizing Screening Procedures

Establishing standardized screening procedures ensures consistency and fairness. Clear guidelines and checklists for the vetting process help maintain uniformity. Regular reviews and updates to these procedures can keep them effective and unbiased.

The Role of Technology

Technology plays a pivotal role in addressing many challenges associated with pre-employment vetting. Automated background checks, AI-driven data analysis, and secure cloud-based storage are just a few technological advancements enhancing the vetting process. In my opinion, leveraging these technologies can lead to more efficient, accurate, and secure vetting practices.

Wrap Up

Pre-employment vetting is a vital process that comes with its own set of challenges. By understanding these challenges and implementing practical solutions, employers can ensure a more effective and efficient vetting process. In my opinion, staying proactive and adopting best practices in pre-employment vetting not only helps in hiring the right candidates but also protects the company from potential risks. Investing in technology, staying compliant with laws, and maintaining data security are key steps towards successful pre-employment vetting.

0 notes

Text

Comprehensive Employment Education Background Checks - Sure Screening LLC

Sure Screening LLC is a company specializing in employment background checks, including education verification. This process is crucial for employers to ensure the accuracy and legitimacy of a candidate’s educational qualifications. Here’s an overview of how Sure Screening LLC handles employment education background checksemployment education background checks:

1. Verification Process

Document Collection: Sure Screening collects relevant documents from the candidate, such as diplomas, transcripts, and certificates.

Institutional Contact: The company contacts the educational institutions directly to verify the authenticity of the documents and the candidate’s attendance and graduation details.\

Database Searches: Sure Screening may also utilize various educational databases to cross-check the information provided by the candidate.

2. Key Features

Comprehensive Checks: The service includes verification of high school diplomas, GEDs, college degrees, professional certifications, and trade school qualifications.

Global Reach: Sure Screening can verify educational credentials from institutions worldwide, which is crucial for employers hiring candidates with international education backgrounds.

Fast Turnaround: The company aims to complete the verification process promptly to not delay the hiring process.

3. Compliance and Security

Regulatory Compliance: Sure Screening ensures that their processes comply with relevant regulations, such as the Fair Credit Reporting Act (FCRA) in the United States, ensuring that candidates’ rights are protected.

Data Security: The company employs robust security measures to protect sensitive information during the verification process.

4. Benefits for Employers

Accuracy: Ensures that the candidate’s educational background is accurately represented, reducing the risk of hiring based on falsified credentials.

Confidence: Provides employers with the confidence that they are hiring qualified individuals.

Risk Mitigation: Helps in mitigating risks associated with hiring unqualified personnel, which can lead to financial and reputational damage.

5. Candidate Experience

Transparency: Candidates are informed about the verification process and are required to provide consent.

Fairness: The process is designed to be fair and non-discriminatory, ensuring that all candidates are treated equally.

Summary

Sure Screening LLC Sure Screening LLC offers a reliable and thorough education background check service for employers. By verifying candidates' educational qualifications, they help ensure that the hiring process is based on accurate and verified information, ultimately aiding in making informed hiring decisions.

0 notes

Text

EPF Registration in kolkata

EPF registration in Kolkata is a straightforward process essential for employers and employees alike. It entails obtaining an Employer Identification Number (EIN), submitting necessary documents, and adhering to statutory requirements to ensure legal compliance and access to employee benefits.

0 notes

Text

The Role of Financial Services Expert Witnesses in Consumer Protection Cases

Consumer protection is a cornerstone of the financial services industry, ensuring fair treatment and safeguarding the interests of consumers. In cases involving disputes or allegations of misconduct, financial services expert witnesses play a vital role in providing impartial analysis, expert opinions, and insights to assist the court in reaching fair and just decisions. In this article, we explore the indispensable role of Banking Expert Witness and financial services expert witnesses in consumer protection cases, examining their contributions and the impact they have on ensuring accountability and upholding consumer rights.

The Role of Financial Services Expert Witnesses:

Financial services expert witnesses bring specialized knowledge, expertise, and experience to consumer protection cases, offering valuable insights and analysis on a wide range of financial matters. Their role encompasses various aspects, including:

Assessing Compliance with Regulations: Financial services expert witnesses evaluate whether financial institutions have complied with relevant regulations and industry standards in their dealings with consumers. This may involve assessing the implementation of consumer protection laws, such as the Truth in Lending Act (TILA), the Fair Credit Reporting Act (FCRA), or the Consumer Financial Protection Bureau (CFPB) regulations.

Analyzing Financial Products and Services: Expert witnesses analyze the features, terms, and suitability of financial products and services offered to consumers. This includes assessing the risks, costs, and benefits associated with loans, investments, insurance policies, and other financial instruments to determine whether they meet consumer needs and expectations.

Investigating Allegations of Misconduct: Financial services expert witnesses conduct thorough investigations into allegations of misconduct, fraud, or deceptive practices by financial institutions. They examine relevant documentation, transactions, and communications to identify any breaches of fiduciary duty, negligence, or unfair business practices that may have harmed consumers.

Providing Expert Opinions and Testimony: Expert witnesses provide expert opinions and testimony based on their analysis and findings, helping the court understand complex financial matters and implications. Their testimony may cover a wide range of topics, including industry practices, regulatory compliance, risk management, and the standard of care expected from financial institutions.

Assisting in Settlement Negotiations: Financial Services Expert Witness play a critical role in settlement negotiations by providing objective analysis and advice to parties involved in consumer protection cases. Their insights help parties assess the strengths and weaknesses of their positions and reach mutually acceptable resolutions that protect the interests of consumers.

Case Examples:

Mortgage Fraud: In cases involving mortgage fraud, financial services expert witnesses may analyze loan documents, underwriting practices, and appraisal reports to determine whether borrowers were misled or deceived by lenders. They may identify red flags indicating fraudulent activities, such as inflated appraisals, undisclosed fees, or predatory lending practices, and provide expert testimony to support their findings.

Consumer Credit Disputes: Financial services expert witnesses may assist in resolving consumer credit disputes by evaluating credit reports, billing statements, and correspondence between consumers and creditors. They may identify inaccuracies, errors, or violations of consumer protection laws, such as the Fair Credit Billing Act (FCBA) or the Fair Debt Collection Practices Act (FDCPA), and provide expert opinions on the appropriate remedies or damages owed to consumers.

Investment Fraud: In cases involving investment fraud, financial services expert witnesses may analyze investment portfolios, prospectuses, and communications between investors and financial advisors. They may identify instances of misrepresentation, omission of material facts, or unsuitable investment recommendations that have harmed investors and provide expert testimony to assist the court in holding responsible parties accountable.

Conclusion:

Financial services expert witnesses play a crucial role in consumer protection cases, serving as impartial experts who provide valuable analysis, insights, and testimony to assist the court in reaching fair and just outcomes. Their specialized knowledge, expertise, and objectivity are essential for evaluating compliance with regulations, analyzing financial products and services, investigating allegations of misconduct, and providing expert opinions and testimony. By leveraging the expert witness financial services, consumers can seek accountability and justice in cases involving financial wrongdoing and ensure that their rights and interests are protected in the complex world of financial services.

0 notes

Text

How Professional Shredding Can Help Protect Your Business

Why should all businesses shred out-of-date, unneeded, or no longer relevant documents? Why not simply throw them in the trash bin?

While most of us know that it's essential to protect ourselves from online identity theft, it's easy for people to forget that the threat of paper identity theft is still accurate. You should shred if you want to avoid your business taking any chances!

However, if you still need to learn about the threat of hoarding old documents in your office, here are some common reasons why you should consider hiring a professional paper shredding service to take care of your documents today!

It Helps Prevent Identity Theft.

All documents containing PII (personally identifiable information) and PHI (protected health information) must be shredded as soon as they are no longer needed. Working with a professional shredding service is the best way to do this. Suppose you consider buying an office shredder for your in-house shredding needs. In that case, you must know that these shredders are generally limited to cutting basic strips, enabling users to reassemble the document by hand or using software. If you can do it, so can the thief.

Fortunately, you can ensure you get ideal results by outsourcing your document destruction to a professional shredding service. Professionals will use state-of-the-art destruction equipment to ensure all your documents are destroyed perfectly.

Let's Remember That It's The Law!

Many businesses are legally required to dispose of all sensitive information securely. If your business handles a lot of customer and employee data, it's critical that you shred those records as soon as they are no longer in use.

These documents could include standard information like name, email address, and address and other data that could create apparent privacy issues like credit card numbers, social security numbers, and medical records. Depending on your industry type, there could be a few additional regulations you must follow.

For instance, the Health Insurance Portability and Accountability Act (HIPAA), the Fair Credit Reporting Act (FCRA), and the Payment Card Industry Data Security Standard, sometimes called PCI compliance. No matter what regulations guide your business, professional shredding companies will have all the expertise and knowledge to guide your process efficiently.

It Protects Your Business And Gives You More Space.

All business owners agree that their data is vital. But have you wondered how careful you and your employees are when handling financial, customer, or client information? At best, a data breach can be an embarrassing mention in your local news. At worst, it could easily lead to loss of business, generate expensive fines, and even result in your competition stealing your business ideas and customers. By shredding all expired documents vigilantly, you can easily ensure your tricks of the trade are safe.

Shredding old documents can also help you clear out some space in your office. Why keep stacks of documents in your office when they are never going to be used again? With professional shredding services, you can enjoy a clean, uncluttered work area. It will also make room for extra supplies and spare equipment in your office.

Once a shredding company destroys your documents, it will give you a certificate of destruction, which can be used as proof that you did your best to prevent data breaches in your firm. If you have any more questions or would like to learn more about the process, feel free to speak with a professional shredding service today.

0 notes

Text

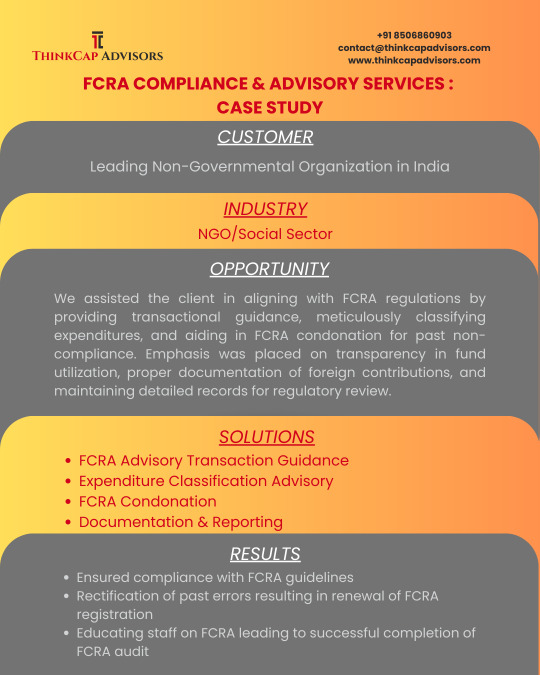

FCRA Case Study: We worked with the client on multiple facets of FCRA compliance & advisory including FCRA Transaction Guidance, Expenditure Classification, FCRA Condonation Advisory, & FCRA documentation.

0 notes

Text

Understanding the Foreign Contribution Regulation Act: A Comprehensive Overview

In the modern world where everything is connected, globalization makes it easier to share resources, ideas, and money between different countries. This has many advantages, but it also makes people worry about whether things are open and honest, and if money from other countries might be used the wrong way. To deal with these worries, governments make rules to keep an eye on and control money coming from abroad. In India, the Foreign Contribution Regulation Act (FCRA) is an important set of rules for this purpose.

What Is the Foreign Contribution Regulation Act? (Purpose of Foreign Contribution Regulation Act?)

The Foreign Contribution Regulation Act, commonly known as FCRA, is legislation enacted by the Indian government to regulate the acceptance and utilization of foreign contributions or donations by individuals, associations, and organizations within India. The primary purpose of FCRA law is to ensure that such contributions are not utilized for activities detrimental to the national interest or for any activities that may compromise the sovereignty and integrity of the nation.

Why Is an FCRA Certificate Required?

A Foreign Contribution Regulation Act (FCRA) certificate is required in India for any entity (organization, association, etc. ) that wants to receive or utilize foreign contributions, even if they're well-intentioned. There are several key reasons for this:

1. Transparency and Accountability:

The Foreign Contribution Regulation Act (FCRA) ensures clear and open records of foreign funds entering India. This helps to prevent:

Money laundering: Illegally obtained funds being disguised as donations.

Foreign interference: Unwanted influence on Indian entities and activities.

Misuse of funds: Ensuring donations are used for their intended purposes.

2. National Security:

Tracking foreign contributions helps authorities monitor potential threats to national security. This could involve:

- Funding of extremist groups or activities harmful to India's interests.

- Attempts to influence elections or policy through foreign funding.

3. Fairness and Public Trust: The Foreign Contribution Regulation Act (FCRA) promotes a level playing field for organizations receiving donations. It prevents:

-Unfair advantages gained by those receiving unregulated foreign funds.

- Erosion of public trust in non-profit organizations due to lack of transparency.

4. Compliance with International Agreements:India is a signatory to various international treaties against money laundering and terrorism financing. The Foreign Contribution Regulation Act (FCRA) helps fulfill these obligations.

Overall, the FCRA (Foreign Contribution Regulation Act) certificate acts as a gatekeeper, ensuring foreign contributions are used legally, ethically, and for the benefit of India.

Who Is Eligible for Fcra?

Under the provisions of the Foreign Contribution Regulation Act (FCRA) law, certain categories of entities are eligible to apply for an FCRA certificate. These include:

1. Non-profit organizations (NGOs): Non-profit organizations, commonly known as NGOs, are entities that operate for the public benefit or the betterment of society without the primary goal of making a profit.

2. Societies: Societies are voluntary associations of individuals united by common interests or goals, such as promoting art, culture, education, sports, or charitable activities. They are typically governed by a set of rules and regulations and are registered under the Societies Registration Act, 1860.

3. Trusts: Trusts are lawful organizations formed to hold possessions for the advantage of particular people or groups, called beneficiaries, as outlined in a document known as a trust deed. Trusts are often set up for charitable, religious, educational, or philanthropic aims.

4. Section 8 companies: Section 8 companies, also known as non-profit companies, are entities incorporated under the Companies Act, 2013, with the primary objective of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, or any other charitable purpose.

5. Registered associations: Registered associations refer to any group or organization that has been formally registered under relevant laws or regulations governing associations or clubs.

6. Individuals seeking foreign contributions: Individuals who seek foreign contributions for specific purposes such as social, educational, religious, or cultural activities are also eligible to apply for an FCRA certificate.

Who Is Exempt From Fcra?

The Foreign Contribution Regulation Act (FCRA) applies to most organizations that receive foreign contributions, but there are some exceptions. These exceptions include government organizations, organizations funded by the government, organizations that receive contributions from family members living abroad, and organizations that have obtained specific prior permissions or clearances from the government.

What Documents Are Required For the Foreign Contribution Regulation Act?

The documents required for the Foreign Contribution Regulation Act (FCRA) vary depending on whether you're applying for registration or seeking prior permission for a specific foreign contribution. Here's a breakdown:

Registration:

Mandatory:

Registration certificate of your organization (Society Registration Act, Trust Act, etc.)

Memorandum of Association/Trust deed

Activity report for the past three years

Audited financial statements for the past three years

Bank details of designated FC receipt-cum-utilisation account

Details of key members of the organization

Optional (may enhance application):

Proof of experience in utilizing foreign contributions

Letters of support from credible organizations

Detailed project proposal if requesting specific project-based registration

Prior Permission:

Mandatory:

FC-3B application form filled and signed

Details of the foreign contribution (source, amount, purpose)

Project proposal (if applicable)

Bank details of designated FC receipt-cum-utilisation account

Details of key members involved in the project

Additional Points:

All documents must be in English or Hindi, or translated into these languages.

File size limits may apply for online submissions.

Consider seeking legal counsel to ensure complete compliance and understand specific requirements for your situation.

Remember, complying with the Foreign Contribution Regulation Act (FCRA) ensures transparency and ethical handling of foreign contributions, contributing to a trustworthy system.

To Know More Information About Fcra, Contact M&M Law Partners

Navigating the complexities of the Foreign Contribution Regulation Act (FCRA) compliance can be challenging for individuals and organizations alike. For expert guidance and assistance with the FCRA registration process, compliance, and enforcement, consider reaching out to experienced FCRA attorneys such as M&M Law Partners. They can provide important assistance in guaranteeing your compliance with the law due to their extensive understanding and knowledge of FCRA laws.

FAQ

Is Fcra Mandatory?Yes, Foreign Contribution Regulation Act (FCRA) compliance is mandatory for entities seeking to receive foreign contributions in India.

Who Manages Fcra? Foreign Contribution Regulation Act (FCRA) is managed and regulated by the Ministry of Home Affairs, Government of India.

What Are the Government Fees for Fcra?

The government fee for FCRA prior permission is ₹5000, while the Government fee for Fresh FCRA registration is ₹10000.

What Is the Validity Period of an Fcra Certificate?An FCRA (Foreign Contribution Regulation Act) certificate is typically valid for five years from the date of issue.

What Is the Time Limit for Fcra Renewal?

Entities holding an FCRA certificate must apply for renewal at least six months before the expiry date of the current certificate to ensure continuity of foreign funding eligibility.

In simpler terms, any group or organization in India wanting to receive foreign donations must fully understand the Foreign Contribution Regulation Act (FCRA). Following the FCRA Act rules and getting legal advice when needed helps them stay compliant, operate transparently, and contribute to a fair and trustworthy system overall.

0 notes