#FTSE 100 Chart Update

Explore tagged Tumblr posts

Text

How Does the FTSE 100 Chart Reflect Market Activity?

Highlights

Visual tool used to observe FTSE 100 stock movements

Covers sector fluctuations across listed companies

Helps track the index over different time frames

FTSE 100 CHART The FTSE 100 chart is a graphical representation of price changes for companies listed on the UKX index. It reflects the daily, weekly, or long-term movements of stocks across sectors such as energy, financials, healthcare, and industrials. The chart provides a visual overview of how the top UK-listed firms perform relative to the broader market.

Key Components of the FTSE 100 Chart

The chart typically includes candlestick or line formats displaying price fluctuations during specific periods. Indicators such as volume, open-high-low-close data, and moving averages may also be integrated. It offers an at-a-glance method for understanding how the index is trending without relying on narrative commentary.

Sectoral Insights Through Chart Trends

The chart reflects market sentiment across various sectors represented in the index. Sudden peaks or dips may correspond with events impacting specific industries like oil, pharmaceuticals, or banking. Observing sector performance through the chart assists in recognizing broad patterns, such as cyclicality or relative stability, based solely on visible data.

Time Frame and Frequency Settings

Chart views can be customized to show intraday shifts, weekly performance, or long-term movements over months or years. This allows for flexible observation, whether for short-term tracking or for viewing extended patterns of listed FTSE 100 firms. The ability to isolate periods helps in understanding specific economic cycles or corporate response timelines.

Chart as a Monitoring Tool

The chart supports objective observation of the index’s performance over time. Paired with index summaries and sector distribution tables, it presents data visually rather than through subjective interpretation. While not predictive in nature, it serves as a structured view into the performance trajectory of companies on the UKX list.

1 note

·

View note

Text

FTSE 100 Share Price and FTSE 100 Chart: Current Trends and Market Insight | Kalkine

The FTSE 100 share price remains a critical reference point for tracking the performance of the largest listed companies on the London Stock Exchange. This index includes major multinational firms across various sectors, offering a snapshot of the broader UK economy and its global reach. As economic conditions evolve, monitoring the FTSE 100 share price provides valuable insight into how external and internal factors are influencing corporate performance and investor sentiment.

The FTSE 100 chart illustrates how the index has moved over time, enabling readers to identify short-term fluctuations and long-term trends. From daily price shifts to yearly performance cycles, the chart is essential for those looking to analyse historical movements, market corrections, or periods of recovery. Observing the FTSE 100 chart alongside economic data releases and global developments can help interpret how the market reacts to events such as interest rate decisions, geopolitical tensions, or corporate earnings updates.

Over recent months, the FTSE 100 share price has seen periods of volatility, largely driven by macroeconomic news. Data from major economies such as the US, the Eurozone, and China continue to affect sentiment in London markets. Inflation figures, GDP updates, and central bank policy have had notable effects on trading volumes and price action. Companies in the index that are closely linked to sectors like energy, mining, and finance have often led these movements.

A closer look at the FTSE 100 chart reveals several key patterns. For example, cyclical sectors tend to show stronger momentum when economic outlooks improve. Defensive stocks, such as those in healthcare or consumer staples, may maintain stability during downturns. Technical analysis of the FTSE 100 chart—including moving averages, support and resistance levels—adds another layer of interpretation for those examining how the index might behave in the short term.

The index's composition plays a role in how the FTSE 100 share price performs. Given the heavy weighting towards energy companies, global oil prices can cause significant changes. Additionally, the currency markets also influence the index. When the British pound weakens, the overseas revenues of international companies in the FTSE 100 become more valuable, often resulting in an upward shift in the FTSE 100 share price.

To access real-time and historical performance, the FTSE 100 chart on Kalkine provides detailed visualisations. Users can analyse day-to-day movements, track changes over weeks or months, and assess broader economic trends through the lens of the FTSE 100’s historical performance. The tool is particularly useful for understanding how events such as earnings season or fiscal updates affect market performance.

With the global economy navigating through varied challenges, the FTSE 100 share price continues to reflect the collective outlook on UK-listed corporates. Market participants closely observe sectors like financials, commodities, and consumer services, as they often guide broader movements in the index. Earnings results, mergers and acquisitions, and sector-specific developments feed into ongoing changes in share prices.

Meanwhile, the FTSE 100 chart is also instrumental in comparing the UK’s main index to international benchmarks like the S&P 500 or Euro Stoxx 50. Correlations between markets help indicate whether a move is driven by local fundamentals or part of a broader global trend. This comparative view can be vital in interpreting index movement across different geographies.

In conclusion, regular updates on the FTSE 100 share price and detailed views from the FTSE 100 chart offer a comprehensive understanding of the London equity market's direction. Interested readers can stay informed via Kalkine’s interactive tools and updates available. These tools support deeper examination of market shifts and provide timely context for those following the performance of UK-listed firms.

0 notes

Text

Tracking Market Trends with the FTSE 100 Chart

Visualises real-time and historical price movements of the index

Aids in understanding sector shifts and market sentiment

Used to interpret fluctuations in listed blue-chip stocks

FTSE 100 CHART FTSE 100 CHART provides a graphical representation of the FTSE 100 index, which includes leading UK-listed firms like LON:HSBA and LON:AZN. These firms span sectors such as finance, pharmaceuticals, energy, and consumer goods, making the chart a central reference for market direction.

Purpose and Utility

The chart illustrates changes in the index's value over various time frames. It displays price points that correspond to trading activity, reflecting intraday shifts, weekly patterns, or long-term movements.

Sectoral Interpretation

Movements on the FTSE 100 chart often correlate with sector-specific developments. For example, fluctuations in the financial or healthcare sectors can significantly influence the chart’s trajectory due to their substantial index weight.

Market Sentiment Indicator

The chart serves as a tool to gauge broader market sentiment. Rapid shifts or consistent trends may indicate changes in corporate earnings, macroeconomic data, or geopolitical updates affecting the UK economy.

Time Interval Selection

Users can view the chart over multiple intervals ranging from minutes to years. This feature supports a comprehensive understanding of both short-term volatility and long-term stability in index components.

Inclusion of Historical Data

The FTSE 100 chart often includes comparative historical data to contextualise current performance. This helps track shifts in price levels over time, tied to specific sector or global economic trends.

1 note

·

View note

Text

Forex #UK100Cash +900 Pips profits running showing last 3 signals. 2025V Update Version. Official Website: wWw.ForexCashpowerIndicator.com

The UK 100 Cash is a derivative product based on the FTSE 100 index, which tracks the performance of the 100 largest companies in the United Kingdom: What it is. The UK 100 Cash is a tradeable asset that can be used to monitor the UK equity market and gain insight into the health of the UK economy. . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes. . ✅ NO Monthly Fees/ New 2025 Version ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#UK100cash

#UK100cash#indicatorforex#forexsignals#forexindicators#forexindicator#cashpowerindicator#forex#forextradesystem#forexprofits#forexvolumeindicators#forexchartindicators#metatrader4 indicators#metatrader4 trade system#forex brokers#forex ebook

1 note

·

View note

Text

Stay Updated with Live Market Trends Using WikiStock

Stay Updated with Live Market Trends Using WikiStock In the ever-evolving world of finance, staying updated with live market trends is crucial for making informed investment decisions. WikiStock, a comprehensive platform for global stock market data, offers real-time updates and detailed insights into market movements. This article delves into the features and benefits of using WikiStock to stay ahead in the financial markets.To get more news about WikiStock, you can visit our official website.

Real-Time Market Data One of the most significant advantages of WikiStock is its provision of real-time market data. The platform covers major global indices, including the DOW JONES, NASDAQ, S&P 500, FTSE 100, and many others. This real-time data includes points and percentage changes, enabling investors to track market performance accurately.

For example, as of the latest update, the DOW JONES index showed a positive change of 0.24%, while the NASDAQ and S&P 500 indices increased by 0.21% and 0.20%, respectively. On the other hand, the Nikkei 225 index in Japan experienced a significant drop of 1.77%. Such detailed information helps investors understand the performance of different markets and adjust their strategies accordingly.

Comprehensive Coverage WikiStock provides extensive coverage of global stock markets, including the United States, China, Japan, Germany, and many other regions1. This comprehensive coverage allows investors to diversify their portfolios and explore opportunities in various markets. For instance, the SSE Index in China showed a positive change of 0.49%, while the SZSE Component Index increased by 0.08%1. By offering data on multiple international markets, WikiStock helps investors identify potential growth areas and mitigate risks associated with investing in a single market.

User-Friendly Interface Navigating the vast amount of data on WikiStock is made easy with its user-friendly interface. The platform is designed to be intuitive, allowing users to quickly find the information they need. Whether you are looking for specific stock indices, trading volumes, or historical data, WikiStock’s interface ensures a seamless experience.

Additionally, the platform offers customizable charts and graphs, enabling users to visualize market trends and patterns. This visual representation of data helps investors better understand market dynamics and make more informed decisions.

Real-Time Updates WikiStock’s real-time updates are invaluable for active traders and long-term investors alike. The platform continuously refreshes its data to reflect the latest market movements. This feature ensures that users have access to the most current information, which is essential for making timely investment decisions.

For example, the Hang Seng Index in Hong Kong showed a notable increase of 0.80%, while the FTSE 100 in the United Kingdom experienced a slight decline of 0.08%. By providing up-to-the-minute data, WikiStock enables investors to react quickly to market changes and capitalize on emerging opportunities.

Analytical Tools In addition to real-time data, WikiStock offers a range of analytical tools to help investors make informed decisions. These tools include technical analysis indicators, historical data comparisons, and market sentiment analysis. By leveraging these tools, investors can gain deeper insights into market trends and develop more effective trading strategies.

For instance, technical analysis indicators such as moving averages and relative strength index (RSI) can help investors identify potential entry and exit points for trades. Historical data comparisons allow investors to analyze past market performance and predict future trends. Market sentiment analysis provides insights into the overall mood of the market, helping investors gauge the potential impact of news and events on stock prices.

Conclusion In conclusion, WikiStock is an invaluable resource for investors seeking comprehensive and real-time stock market data. Its extensive database, real-time updates, user-friendly interface, and global coverage make it a powerful tool for navigating the complexities of the global stock market. Whether you are an active trader or a long-term investor, WikiStock provides the information you need to make informed decisions and achieve your financial goals.

0 notes

Text

Markets Week Ahead: S&P 500, US Dollar, Fed, Stimulus, British Pound, Brexit, Gold

This past week ended with the VIX ‘fear gauge’ rising the most since the end of October as global equities experienced a cautious pullback. The S&P 500, DAX 30 and Nikkei 225 aimed lower. Could this be setting a sour tone for financial markets heading into 2021? Treasury yields on the longer-dated spectrum declined, signaling fading optimism on longer-term growth prospects.

Looking at currencies, the growth-linked Australian Dollar still managed to outperform, likely boosted by Chinese demand for iron ore from Down Under. This is as the British Pound declined, experiencing the worst week on average since early September. Sterling’s woes can be traced to dimming prospects of a Brexit deal, as made apparent by UK Prime Minister Boris Johnson.

The US Dollar continues to weaken, and that has been a boon to commodities such as copper and crude oil. Covid vaccine prospects are likely benefiting the latter with anticipation of a steady increase in general travel. Yet, anti-fiat gold prices are struggling to capitalize on greenback declines, signaling underlying weakness despite a parallel drop in US real yields.

After the UK became the first western nation to begin rolling out a coronavirus vaccine, the US was poised to follow after the FDA recommended the approval of Pfizer’s and BioNTech’s product. The anticipation of immunization may have kept US consumer sentiment upbeat this past week, despite ongoing roadblocks to a $900 billion bipartisan fiscal package.

Republicans push for employer liability protections continued to clash with Democrat wishes for state and local government aid. Outside of fiscal affairs, keep a close eye on central banks such as the Fed, BoE and BoJ for their economic outlooks and views on unconventional policy. New Zealand releases third-quarter GDP, Australia reports the latest jobs report. What else is ahead?

Fundamental Forecasts:

Crude Oil Prices May Extend Gains as Investors Eye OPEC JMMC Meeting

Crude oil prices may continue to push higher on the back of positive vaccine news, a pickup in global demand and the moderate easing of OPEC+ output cuts.

Gold Price Boosted by Risk-Off Move, US Dollar May Hinder XAUUSD Rally Next Week

Gold is currently pushing ahead as financial markets take a sharp risk-off turn ahead of the weekend. Next week, the US dollar may weigh on this move.

US Dollar Outlook Hinges on Federal Reserve Interest Rate Decision

The Federal Reserve’s last meeting for 2020 may shake up the near-term outlook for the US Dollar with the bank slated to update the Summary of Economic Projections (SEP).

Dow Jones, Nasdaq 100, DAX 30, FTSE 100 Forecasts for the Week Ahead

The Dow Jones and Nasdaq 100 remain near record levels ahead of next week’s Fed meeting where slight modifications to the current framework are expected. The FTSE 100 will look to Brexit news.

GBP/USD Weekly Forecast: Sterling on High Alert for Sunday Showdown

GBP Implodes, Option Volatility Explodes. No-Deal Brexit Risks Heightened.

Technical Forecasts:

British Pound Forecast: Sterling Slammed – GBP/USD Seeks Support

Dollar was weak but Sterling was even weaker with a massive weekly reversal in GBP/USD off multi-year highs. Here are the levels that matter on the Pound weekly chart.

Nasdaq 100 Bullish Trend Remains Intact Despite Short-Term Pullback

The Nasdaq 100 appears to have entered a brief technical correction after hitting an all-time high. The overall bullish trend remains intact but upward momentum appears to be fading.

Mexican Peso Technical Forecast: USD/MXN Takes a Breather, Path of Least Resistance Still Lower

USD/MXN manages to push above the 20-mark but finds strong resistance at key Fibonacci level

AUD/USD Technical Outlook – Australian Dollar May Experience Setback vs US Dollar

The move higher in Aussie may at the least pause in the coming week as the trend becomes extended; short-term technical structure to wat

Crude Oil Price Outlook: Will WTI Rise into 2021? Technical Signals Mixed

Crude oil prices pushed higher this past week, but conflicting technical signals hint to proceed with caution. What is the technical road ahead for WTI into the end of this year?

Euro Technical Analysis: EUR/USD, EUR/JPY Battle at Big Resistance

The Euro was in the spotlight for Thursday’s ECB rate decision. But both EUR/USD and EUR/JPY put in Dojis for the week after running into big areas of resistance.

Weekly US Dollar Technical Forecast: DXY Index Bears Down Major Technical Damage

The DXY Index has sustained major technical damage in recent weeks, having broken through the rising trendline from the April 2011 and February 2018 lows.

Gold Technical Forecast: XAU/USD Approaches Key Chart Levels

Gold ended the week nearly unchanged after bulls failed to break through descending channel resistance. Now, XAU/USD finds itself between two key levels as longer-term technicals move into focus.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD

The post Markets Week Ahead: S&P 500, US Dollar, Fed, Stimulus, British Pound, Brexit, Gold appeared first on Forex Trader Post.

from WordPress https://ift.tt/3gMYlec via IFTTT

1 note

·

View note

Text

Stock Market Today: Live Updates

2 hours ago European stocks open higher European stocks opened higher on Tuesday, with the benchmark Stoxx 600 up 0.45% at 8:30 AM GMT. Technology stocks rose 1.7% as global investors expect a pause in rate hikes from the US Federal Reserve. France’s CAC 40 rose 0.73% as Germany’s DAX rose 0.55% and Britain’s FTSE 100 rose 0.22%. see chart… Stoxx 600 index. 6 hours ago The People’s Bank of…

View On WordPress

0 notes

Text

What Can Be Seen Through the Lens of FTSE Live Market Movement?

Highlights

FTSE live data reflects real-time updates from the United Kingdom's equity market.

Key movements in the FTSE indices often align with trends across sectors like finance, energy, and consumer goods.

FTSE live streaming enables continuous visibility into index changes throughout the trading session.

Overview of the FTSE Market Segment

FTSE live updates offer insight into companies listed on the London Stock Exchange across sectors such as energy, finance, and telecommunications. This data captures continuous index fluctuations, offering a reflection of overall equity sentiment in the United Kingdom market.

The FTSE indices cover a wide range of entities, with the FTSE 100 and FTSE 250 being among the most tracked. These indices include entities from multiple sectors, offering broad market representation. The live data stream reflects movements during the active trading session, allowing market participants to stay informed about real-time performance shifts.

FTSE Live in the Financial Sector

The financial sector has a significant weighting in the FTSE indices. FTSE live updates often reflect market responses within this segment, particularly from large banking and insurance entities. Movements in this space may align with macroeconomic themes or sector-specific developments.

Entities in this category contribute heavily to the daily variation observed in the FTSE charts. As FTSE live data updates minute-by-minute, financial sector entities often drive noticeable spikes or declines across the board.

Energy Sector Visibility via FTSE Live

Energy is another prominent sector represented in the FTSE indices. Entities engaged in oil exploration, refining, and distribution often show marked activity in FTSE live streams. These fluctuations can be associated with commodity prices or regional developments impacting global supply and demand.

Live tracking captures the shifts occurring across energy-linked stocks. These dynamics can lead to broader index variation, especially when several key entities show synchronous movement.

Consumer Goods Impact Seen on FTSE Live

The consumer goods sector plays a vital role in the FTSE landscape. FTSE live coverage highlights changes in retail-focused or product-based entities. These include sectors such as food production, household goods, and luxury items.

Daily live movements help reflect how market sentiment reacts to developments within this space. FTSE live feeds display real-time progressions, including price adjustments that align with overall market flow in the consumer category.

Telecommunications and Technology in FTSE Live Updates

Telecommunications and technology continue to shape part of the FTSE index composition. FTSE live allows real-time monitoring of firms providing communication services, broadband infrastructure, and software solutions.

Entities in this category often demonstrate change during trading hours based on market activity or broader sector themes. The consistent updating mechanism in FTSE live helps visualize these movements across the trading timeline.

How FTSE Live Supports Real-Time Monitoring

FTSE live serves as a comprehensive stream of performance metrics during open market hours. This data includes price changes, market cap shifts, and volume surges across listed entities. By observing the index in real-time, sectoral momentum becomes visible as market movement unfolds.

The data is continuously refreshed, making FTSE live a central reference for understanding what is happening in the equity landscape across the London Stock Exchange.

1 note

·

View note

Photo

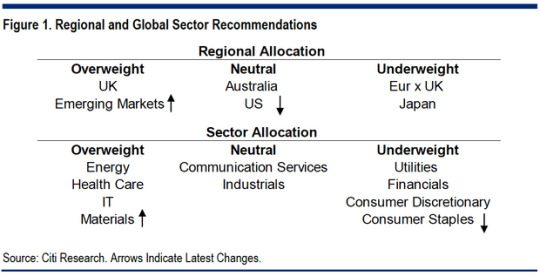

Citi downgrades U.S. stocks, predicting that global equities will be flat in 2021

Financial markets have shrugged off the violence and chaos on Capitol Hill, with both the Dow DJIA and S&P 500 SPX hitting new highs on Wednesday and the Nikkei 225 notching another 30-year record on Thursday.

But investor optimism could be tempered as we continue into 2021, as Citi’s global strategy team said that global stocks will be flat over the year, in our call of the day.

The investment bank’s strategists have predicted just a 2% increase in the benchmark MSCI All Countries World Index XX:892400 over 2021, and have neutralized their inclination for growth sectors in favor of a rotation into value stocks.

Lowering the temperature on their long-held bias toward growth stocks, which has historically kept their rating on the U.S. market overweight, is part of the rationale behind downgrading the U.S. market to neutral.

They also viewed the U.S. fiscal deficit as a threat to the dollar, which they expected to weaken this year, boosting emerging markets and commodity stocks.

But bond yields could be lifted, helped by a recovery in the global economy, with Citi projecting that the 10-year U.S. Treasury yield (currently at 1%) will hit 1.25% in coming months and 1.45% by the end of the year. They said this should help financial and energy companies, which are value stock stalwarts.

The best returns are expected in the U.K., where Citi forecasts 7% growth for the FTSE 100 UK:UKX, and Australia, where they expect the S&P/ASX 200 AU:XJO to rise 6%. Emerging markets, notably China, Korea, and Russia, are singled out by the strategists for growth.

Their “mildly optimistic” view on global equities hinges on the success of COVID-19 vaccines in restarting the world economy. Citi’s economists are predicting a 5% increase in global gross domestic product in 2021, after 2020’s 3.9% contraction.

Both of these factors should boost the recovery in corporate profits, with earnings per share in the most battered sectors rebounding the most.

The Citi strategists said that much of their forecast on recovery may already be priced into the market, because the MSCI All Countries World Index is trading at 20 times consensus earnings per share — far higher than the long-term median of 15 times. By that measure, the U.S. is the most expensive of the major markets, and the U.K. the cheapest.

As for sentiment, Citi said we’re deep into euphoria territory in the U.S. Panic/Euphoria index, indicating that corrections may be coming. Their suggestion? Buy the dip.

The buzz

President Donald Trump acknowledged defeat in the U.S. presidential election, saying there will be an “orderly transition” of power. His concession came after Congress certified Joe Biden and Kamala Harris’ win, voting into the night after a violent pro-Trump mob stormed Capitol Hill on Wednesday.

Also: Why the stock market rallied even as a violent mob stormed the Capitol

Technology giants Facebook FB and Twitter TWTR took steps to limit Trump’s ability to communicate with supporters during the siege of Capitol Hill, temporarily locking his accounts amid the violence that claimed four lives.

Plus: World leaders Boris Johnson, Justin Trudeau and others condemn ‘shocking’ and ‘disgraceful scenes’ at U.S. Capitol

Senior members of Trump’s administration have discussed the possibility of invoking the 25th Amendment of the Constitution, according to CBS. If invoked — for the first time in history — it would remove Trump as president and make Vice President Mike Pence the commander-in-chief.

Read more: Re-impeach? 25th Amendment? Various ideas floated to end the Trump era now

U.S. officials are considering banning Americans from investing in Alibaba and Tencent, China’s two most valuable publicly-listed companies. That would mark an expansion of the Trump administration’s late-stage effort to blacklist investments in Chinese companies linked to the country’s military.

Sports betting stocks like DraftKings DKNG, Caesars CZR, and MGM Resorts MGM, surged in Wednesday trading through to Thursday’s premarket, after New York Gov. Andrew Cuomo changed his tune on legalizing the practice. Cuomo said that New York had the potential to be the “largest sports-wagering market in the United States.”

The market cap of all cryptocurrencies has topped $1 trillion, with bitcoin BTCUSD trading at fresh highs above $37,000.

Bed Bath & Beyond shares are down close to 14% in the premarket, after the retailer posted worse-than-expected sales and profit figures for its fiscal third quarter ending Nov. 29.

The markets

Stock markets are up DJIA

SPX, continuing from the record highs reached by Wednesday’s rally. Asian markets JP:NIK

HK:HSI

CN:SHCOMP ticked up while European stocks XX:SXXP

UK:UKX

DX:DAX

FR:PX1 traded higher.

The market is reacting positively to the Democratic sweep ushered in by the two Senate runoff wins in Georgia, which improve the chances of more fiscal stimulus, as Vice President-elect Harris would cast tiebreaking votes.

In economic news, initial state jobless claims dropped by 3,000, to 787,000, during the week ended Jan. 2, and the U.S. trade deficit widened in November.

Read more: Democrats win Georgia’s runoff elections, giving their party control of U.S. Senate

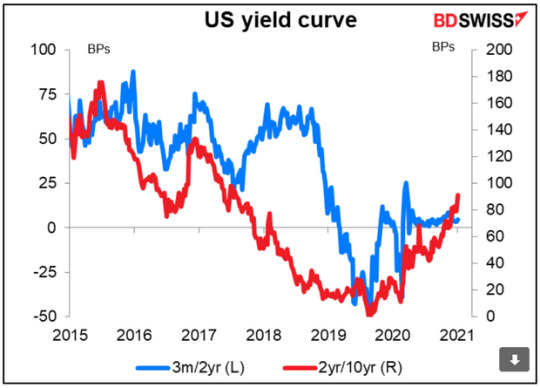

The chart

U.S. Treasury yields, shown in our chart of the day from Marshall Gittler at BDSwiss, rose sharply as the two Senate runoff races in Georgia were called for Democrats. 10-year yields BX:TMUBMUSD10Y rose 8 basis points to 1.04%—the first time they have been above 1% since mid-March 2020.

The tweet

Research from YouGov found that one in five voters approved the storming of Capitol Hill, and that a majority of Republicans blamed President-elect Biden for it.

Random reads

New pub does roaring trade during lockdown after opening in a care home.

On the llam: ‘Very chill’ llama found wandering off highway in Massachusetts.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

0 notes

Text

GBP/USD, EUR/GBP and FTSE 100 Latest Outlooks

GBP/USD, EUR/GBP and FTSE 100 Latest Outlooks

[ad_1]

GBP/USD, EUR/GBP and FTSE 100 – Prices, Charts and Analysis:

EU/UK trade talks and Chancellor Sunak’s budget update on Wednesday key.

Sterling flat and rangebound, FTSE 100 pushing tentatively higher.

Recommended by Nick Cawley

Brand New Q3 Sterling Guides

View On WordPress

#Euro/UK Pound Sterling FX Cross Rate#FX Cross Rate#THOMSON REUTERS#Foreign exchange market#FTSE 100 INDEX#Schooling Centre#Twitter#United Kingdom

0 notes

Text

Stocks could fall a further 7% after last week’s correction. But here’s why Morgan Stanley says that’s ‘healthy’

Need to Know

Published: June 15, 2020 at 7: 54 a.m. ET

Bangladesh police officers attending a yoga session in a bid to stay healthy during the Covid-19 pandemic

Getty Images

It looks set to be another damaging Monday for U.S. stocks.

The three major benchmark indexes suffered their biggest weekly losses since March 20 last week, as the Federal Reserve’s downbeat economic outlook and rising coronavirus cases unsettled investors. Fears of a second wave grew over the weekend and U.S. stock futures pointed lower early on Monday.

However, in our call of the day, Morgan Stanley said last week’s correction was overdue and “healthy” and that the bull market would soon “resume in earnest.”

“We maintain our positive view for U.S. equity markets because it’s early in a new economic cycle and bull market. Last week’s correction was overdue and likely has another 5-7% downside. It’s healthy and we are buyers into weakness with a small/mid-cap and cyclical tilt,” the investment bank’s strategists said.

The team, led by equity strategist Michael Wilson, said corrections were “normal” after rapid moves higher and that last week’s correction was overdue in what they described as a new cyclical bull market.

The S&P 500 SPX, -2.16% could fall to 2,800, and the Nasdaq COMP, +1.01% to 8,500 “before the bull market resumes in earnest,” they added.

Morgan Stanley’s economists see this recession as being “the steepest but also one of the shortest on record,” and its strategists agree there will be a V-shaped recovery.

“The V-shaped recovery in markets is foreshadowing a V-shaped recovery in the economy and earnings. It’s also following the 2009 pattern almost identically in many ways,” they said.

The team raised its base case S&P 500 price target through June 2021 to 3,350 from 3,000, also shifting its bull and bear cases higher — from 3,250 to 3,700 and from 2,500 to 2,900 respectively.

High quality and growth stocks would still do well as the economy recovers but would struggle to keep up with more cyclical pockets of the markets, including automobiles and consumer durables, they said.

The chart

This chart from the U.K.’s Office for National Statistics shows that anxiety levels among people in Britain are higher than at the end of 2019 but have improved in recent months.

Office for National Statistics.

The markets

After a partial rebound on Friday at the end of the biggest weekly losses for U.S. stocks since March 20, the Dow Jones Industrial Average DJIA, -2.59% was set to open lower on Monday. Dow futures ES00, -1.93% are 2.6%, or 674 points, down, S&P 500 SPX, -2.16% futures fell 2.3% and Nasdaq NQ00, -1.15% futures were also 1.7% lower. Fears of a second wave, with rising infections in a number of countries, also sent European stocks lower in early trading. The pan-European Stoxx 600 index SXXP, -0.87% dropped 1%, having fallen nearly 6% last week. The German DAX DAX, -1.16%, French CAC PX1, -1.11% and U.K. FTSE 100 UKX, -1.36% also lost between 1% and 2%.

The buzz

Oil major BP BP, -4.51% said it was taking up to $17.5 billion in charges and write-offs as it cut long-term forecasts for oil prices and said the COVID-19 pandemic would have an “enduring impact” on the global economy.

Swedish fashion retailer Hennes & Mauritz (known as H&M) HM.B, -1.56% said sales fell 50% in the second quarter, a smaller drop than expected as many countries began easing coronavirus restrictions.

The Federal Reserve Bank of New York will release its Empire State Manufacturing Survey for June on Monday — economists are looking for a -27.5 reading, an improvement on May’s -48.5 score.

A number of companies are due to release results this week, including home builder Lennar LEN.B, +4.17% and technology company Oracle ORCL, +1.07% on Tuesday and retailer Kroger KR, -1.34% on Thursday. Lyft LYFT, +4.44% and Slack WORK, +1.71% will both host virtual annual shareholder meetings on Friday.

British drugmaker AstraZeneca AZN, +1.11% has reached an agreement with Europe’s Inclusive Vaccine Alliance to supply up to 400 million doses of the University of Oxford’s potential COVID-19 vaccine.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7: 30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Read More

from Job Search Tips https://jobsearchtips.net/stocks-could-fall-a-further-7-after-last-weeks-correction-but-heres-why-morgan-stanley-says-thats-healthy/

0 notes

Text

What is the FTSE 100 and Why it Matters to Investors?

The FTSE 100, one of the most widely recognized indices globally, serves as a benchmark for the overall performance of major UK-listed companies. Representing the top 100 companies listed on the London Stock Exchange by market capitalization, the FTSE 100 index plays a pivotal role in gauging the health of the UK economy and guiding investment strategies.

Investors, analysts, and economists closely monitor the FTSE 100 share price movements as they reflect the broader market sentiment and economic conditions. Understanding how the index works and the factors influencing it can help investors make more informed financial decisions.

What is the FTSE 100 Index?

The FTSE 100 index, often referred to simply as the "Footsie," was established in 1984 by the Financial Times and the London Stock Exchange (LSE). It is a capitalization-weighted index, meaning that larger companies have a greater influence on the index’s overall performance. The index includes blue-chip companies from a range of sectors, including energy, finance, healthcare, consumer goods, and technology.

Some well-known companies in the FTSE 100 include BP, Unilever, HSBC, and GlaxoSmithKline. Since these companies generate significant revenues both domestically and internationally, the FTSE 100 share price trends can be influenced by global market events as well as local economic factors.

Factors Affecting FTSE 100 Share Price Movements

The FTSE 100 index is dynamic, with its share price movements influenced by a wide array of factors. Here are some key drivers:

Economic Data and Interest RatesEconomic indicators such as GDP growth, inflation rates, and employment data can significantly impact the FTSE 100. If the Bank of England raises or lowers interest rates, it may also affect the index. Higher interest rates can dampen market sentiment, while lower rates tend to boost investor confidence.

Global Market TrendsSince many FTSE 100 companies operate on a global scale, international events like geopolitical tensions, trade disputes, or changes in commodity prices can have a ripple effect on the index. For instance, fluctuations in the oil market can directly impact companies like BP and Shell.

Currency FluctuationsThe value of the British pound relative to other currencies can influence FTSE 100 share prices. A weaker pound often benefits exporters in the index, as their overseas earnings translate into higher profits when converted back into sterling.

Corporate Earnings and NewsQuarterly earnings reports and major corporate announcements can trigger sharp movements in individual stock prices, thereby affecting the broader index. Positive earnings surprises tend to lift share prices, while disappointing results may lead to declines.

Investor Sentiment and Market TrendsBroader market trends, including bull and bear markets, impact the FTSE 100 index. During times of economic uncertainty, investor sentiment may become cautious, leading to lower share prices. Conversely, periods of economic optimism often drive the index higher.

How to Track the FTSE 100 Index

Tracking the FTSE 100 is essential for investors who want to stay updated on market trends and the performance of key UK-listed companies. There are several ways to monitor the index:

Live Updates and Real-Time Data: Investors can access live FTSE 100 share prices and index updates through financial news websites, brokerage platforms, and mobile apps.

Market Reports: Daily and weekly market reports provide valuable insights into the FTSE 100’s performance, including information on top gainers and losers.

Technical Analysis Tools: For those who rely on technical analysis, charting tools can help identify trends, support and resistance levels, and potential trading opportunities.

FTSE 100 vs. Other Global Indices

While the FTSE 100 is the leading index in the UK, it is often compared to other major global indices, such as the S&P 500 in the United States, the DAX in Germany, and the Nikkei 225 in Japan. Understanding how the FTSE 100 performs relative to these indices can offer valuable context for investors.

During periods of global market turmoil, the FTSE 100 may exhibit resilience due to its diversified composition and the international operations of its constituent companies. On the other hand, the index can also be vulnerable to global downturns, especially if there are sharp declines in commodity prices or significant disruptions in international trade.

Investment Strategies for the FTSE 100

Investors have several options when it comes to gaining exposure to the FTSE 100. Here are some popular strategies:

Buying Individual Shares:Investors can purchase shares of individual FTSE 100 companies based on their research and investment goals. For example, those seeking dividend income may focus on blue-chip companies with a history of stable payouts.

Investing in FTSE 100 ETFs:Exchange-traded funds (ETFs) that track the FTSE 100 index offer a convenient way to gain diversified exposure to the entire index. These funds can be traded like individual stocks and often have lower fees compared to actively managed mutual funds.

Using Derivatives for Trading:Experienced traders may use derivatives such as futures and options to speculate on the direction of the FTSE 100 or hedge against potential losses. However, these instruments carry higher risks and may not be suitable for all investors.

Why the FTSE 100 Remains Relevant

Despite changing market dynamics, the FTSE 100 remains a key barometer of the UK’s economic performance and a valuable tool for investors. Its diversified composition, global reach, and historical significance make it an important index to watch.

By keeping an eye on FTSE 100 share prices, staying informed about economic developments, and employing sound investment strategies, investors can better navigate the complexities of the financial markets. Whether you are a long-term investor seeking stability or a short-term trader looking for opportunities, understanding the FTSE 100 is essential for achieving your financial goals.

1 note

·

View note

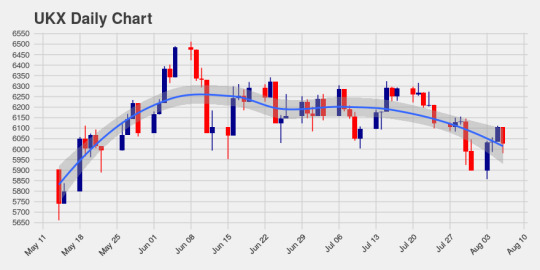

Photo

FTSE 100 (UKX) Up $22.99 On 4 Hour Chart, Fares the Worst Out of 8 major Global Equity Indices; 3 Day Up Streak Broken FTSE 100 4 Hour Price Update Update...#free_analysishttps://biedex.markets/ftse-100-ukx-up-22-99-on-4-hour-chart-fares-the-worst-out-of-8-major-global-equity-indices-3-day-up-streak-broken/?feed_id=10259&_unique_id=5f2cfc2f48b12

0 notes

Text

Brexit Briefing: GBP Ignores the Noise, Benefits from Weak USD

New Post has been published on http://forex-info.info/main/brexit-briefing-gbp-ignores-the-noise-benefits-from-weak-usd.html

Brexit Briefing: GBP Ignores the Noise, Benefits from Weak USD

: they’re free and have been updated,with several new ones now available including Forex for Beginners, Building Confidence and Traits of Successful Traders

The UK media have been full of stories this week about the Brexit timetable, UK access to EU research and development, immigration and the free movement of labor, efforts to lure businesses from London to other EU capitals and the divorce bill.

Yet the British Pound and London stocks have sailed serenely through the noise, affected more by geopolitical tensions, global risk and monetary policy. In particular the Pound, while not generally seen as a haven currency, is being helped by the growing belief that tighter monetary settings in the US and the Euro-Zone are being pushed further and further into the future.

Mario Draghi, the President of the European Central Bank, is unlikely to set out a timetable for tightening policy at his press conference tomorrow after the latest meeting of the ECB’s Governing Council.

Watch out for our live webinar covering the ECB’s policy decisions. You can sign up here

Meanwhile, the latest comments from US Federal Reserve officials have been distinctly dovish, benefiting the Pound at the expense of the Dollar.

Chart: GBP/USD One-Hour Timeframe (August 24 – September 6, 2017)

Chart by IG

From a technical perspective, GBPUSD has climbed back above the psychologically important 1.30 level and faces little resistance ahead of the July 18 high at 1.3120, then the August 3 high at 1.3265. EURGBP is easing back, has fallen below 0.92 and has dropped under the two-month support line joining the previous rising lows. Potentially it could decline as far as the four-month support line currently close to 0.90.

Chart: EUR/GBP Daily Timeframe (April 24 – September 6, 2017)

Chart by IG

As for IG Client Sentiment, that is currently sending out a bullish signal for GBPUSD, with 42% of retail traders long and 58% short.

Markets

Index / Exchange Rate

Change (Exchange Hours/GMT Session Rollover)

Market Close/Last

FTSE 100

-0.55%

7,332

DAX

-0.14%

12,106

GBP/USD

+0.07%

1.3042

EUR/USD

+0.25%

1.1944

EUR/GBP

+0.19%

0.9158

Upcoming UK/EU Event Risk

Events

Date, Time (GMT)

Forecast

Previous

German Industrial Production s.a. (MoM) (Jul)

Sep7, 0600

0.6%

-1.1%

German Industrial Production n.s.a. and w.d.a. (YoY) (Jul)

Sep7, 0600

4.6%

2.4%

Euro-Zone GDP s.a. (QoQ) (2Q F)

Sep7, 0900

0.6%

0.6%

Euro-Zone GDP s.a. (YoY) (2Q F)

Sep7, 0900

2.2%

2.2%

ECB Rate Decision

Sep 7, 1145

0.0%

0.0%

ECB Marginal Lending Facility

Sep 7, 1145

0.25%

0.25%

ECB Deposit Facility Rate

Sep 7, 1145

-0.4%

-0.4%

ECB Asset Purchase Target

Sep 7, 1145

€60b

€60b

— Written by Martin Essex, Analyst and Editor

To contact Martin, email him at [email protected]

Follow Martin on Twitter @MartinSEssex

You can learn more by listening to our regular trading webinars; here’s a list of what’s coming up

Like to know about the Traits of Successful Traders? Just click here

Or New to Forex? That guide is here

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

DISCLOSURES SOURCE

0 notes

Text

New Post has been published on Forex Blog | Free Forex Tips | Forex News

!!! CLICK HERE TO READ MORE !!! http://www.forextutor.net/gbpusd-heading-lower-after-opinion-poll-revised-gdp-data/

GBP/USD Heading Lower After Opinion Poll, Revised GDP Data

Talking Points

– A YouGov poll has put the ruling UK Conservative Party’s lead over Labour at just five percentage points, down from 20ppts only 11 days ago.

– Alongside Thursday’s news of downward revisions to UK Q1 GDP, the British Pound has fallen and could yet fall further.

– Check out the DailyFX Economic Calendar and see what live coverage of key event risk impacting FX markets is scheduled for next week on the DailyFX Webinar Calendar.

GBPUSD has again rejected the psychologically important 1.30 level and is weakening; a trend that will likely continue after Thursday’s downward revisions to UK Q1 GDP and Friday’s release of an opinion poll showing a huge drop in the lead the ruling Conservative Party has over Labour in the runup to the UK General Election on June 8.

The poll by YouGov, the first since the Manchester bombing, puts the Conservatives just five percentage points ahead of the opposition Labour Party, down from a 20ppts lead in two polls published only 11 days earlier. The center-right Conservatives are widely seen as more market-friendly than center-left Labour.

The poll follows revised data Thursday showing UK Q1 GDP grew by just 0.2% quarter/quarter and 2.0% year/year, both down a tenth of a percentage point from earlier flash estimates.

In response, GBP/USD has fallen and is now in a well-defined downward channel on the charts, suggesting more losses to come – particularly if further polls confirm the setback for Prime Minister Theresa May’s party. The pair is also now below the 20-, 50- and 100-day moving averages.

Chart: GBP/USD 30-Minute Timeframe (Week to Date)

Chart by IG

Electioneering has restarted today after the Manchester suicide bombing, with Labour leader Jeremy Corbyn giving a speech linking wars abroad with “terrorism here at home”.

Meanwhile, there are mixed messages from the latest IG Client Sentiment data. The figures show 40.3% of traders are net-long, with the ratio of traders short to long at 1.48 to 1. In fact, traders have remained net-short since Apr 12, when GBPUSD traded near 1.23717; the price has moved 4.1% higher since then. The number of traders net-long is 7.8% higher than yesterday and 6.9% higher from last week, while the number of traders net-short is 2.6% higher than yesterday and 11.5% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a mixed GBPUSD trading bias.

Elsewhere, the FTSE 250 index of mid-cap London-listed companies hit a new record high Friday, climbing above the 20,000 level for the first time.

— Written by Martin Essex, Analyst and Editor

To contact Martin, email him at [email protected]

Follow Martin on Twitter @MartinSEssex

If you’re looking for trading ideas, check out our Trading Guides; they’re free and updated for the second quarter of 2017

GBP/USD Heading Lower After Opinion Poll, Revised GDP Data GBP/USD Heading Lower After Opinion Poll, Revised GDP Data https://rss.dailyfx.com/feeds/all $inline_image

0 notes

Text

Forex Tester For Mac

Hi all,

Forex Simulator. Simple and intuitive, highly customizable, multi-currency multi-timeframe real-time stand-alone Forex trading simulator for Windows and Mac.Download 130 GB of high-quality historical tick data, drag-drop orders, SL and TP.

Forex Tester 4 has a lot of the look and feel of Forex Tester (which is good). The software is very customizable and includes features like Hotkeys for almost any action and quick buy or sell orders all of which allow for quick action for fast testing. The ability to use fixed fractional position sizing is the most exciting feature.

Oct 02, 2020 MT4 on Mac OS - Working guide! (mac os Catalina MT4) 0 replies. MT4 (Metatrader) installation instruction for Snow Leopard 10.6 Mac 101 replies. Will Metaquotes ever develop MT4 for MAC? Mac OS X and MT4? MT4 on MAC (working and tested) 2 replies.

Forex Tester 3 Mac And Forex Trader Pro Tutorial is best in online store. I will call in short name as Forex Tester 3 Mac And Forex Trader Pro Tutorial For peop.

I hope someone here can help I have just reinstalled FT on Mac via Crossover. At first everything seemed to go well, the program started very smoothly and I could run a test in the testing mode that went perfectly well. However, when I tried to update the data from the data center, the program freezed and gave me a 'can not download data from server' message. I then tried to import the data manually and received a 'can not import data' error.

Forex Tester For Mac Shortcut

I have no clue on how to solve this issue. Is someone here running FT on Mac via an emulated windows? I should add that MT4 is running perfectly well on this installation. I expected the same from FT but that's not the case.. Thank you for your help. Nikki (/img)

Software >> Forex Simulator

Key to Success in Forex

Trading Forex requires practice, but it takes a lot of time.

Our Forex trading simulator lets you train much faster, without taking any risk.

No more waiting for certain market conditions or price movements.

No more having to watch the charts all day long.

With our simulation software you can control the time and focus on most important moments.

Trade historical data and save your time

Forex Simulator lets you move back in time and replay the market starting from any selected day. It shows you charts, indicators and economic news as if it was happening live. You are able to place your orders, modify them or close them, just like you were trading live.

Trading historical data saves a lot of time compared to demo trading and other forms of paper trading. It also allows to adjust the speed of simulation, so you can skip less important periods of time and focus on the most important ones.

How it works

Forex Simulator works as Expert Advisor for Metatrader 4. It combines great charting capabilities of MT4 with quality tick-by-tick data and economic calendar to create a powerful trading simulator. It uses offline charts, which let you use indicators, templates and drawing tools available in Metatrader.

However, it is not limited to using historical data offered by Metatrader, which is usually low-quality data. It also lets you download and use high-quality tick data from Dukascopy and TrueFX.

60 Forex pairs, gold, silver, oil and 12 stock indexes

The software gives you access to all Forex major pairs plus XAUUSD and XAGUSD. You can also run simulations on oil and main stock indexes. Choose your favourite instrument and trade it.

Currency pairs - Dukascopy

EURUSDAUDNZDAUDUSDAUDJPYEURCHFEURGBPEURJPYGBPCHFGBPJPYGBPUSDNZDUSDUSDCADUSDCHFUSDJPYCADJPYEURAUDCHFJPYEURCADEURNOKEURSEKUSDNOKUSDSEKUSDSGDAUDCADAUDCHFCADCHFEURNZDGBPAUDGBPCADGBPNZDNZDCADNZDCHFNZDJPYXAGUSDXAUUSDAUDSGDCHFSGDEURCZKEURDKKEURHKDEURHUFEURPLNEURRUBEURSGDEURTRYHKDJPYSGDJPYTRYJPYUSDCNHUSDCZKUSDDKKUSDHKDUSDHUFUSDILSUSDMXNUSDPLNUSDRONUSDRUBUSDTHBUSDTRYUSDZARZARJPY

Commodities - Dukascopy

Brent crude oilWTI light crude oil

Indexes - Dukascopy

ASX 200SMI 20DAX 30IBEX 35STOXX 50CAC 40FTSE 100HSIDow Jones 30S&P 500NASDAQ 100Nikkei 225

Currency pairs - TrueFX

EURUSDAUDNZDAUDUSDAUDJPYEURCHFEURGBPEURJPYGBPJPYGBPUSDNZDUSDUSDCADUSDCHFUSDJPYCADJPYCHFJPY

Real tick-by-tick data

Unlike other trade simulators, our software lets you use as much as 10 years of real tick data with real variable spread. The simulator can download historical data from Dukascopy*, which is considered one of the best free data sources, and from TrueFX*.

* High quality tick data is offered for free by Dukascopy and TrueFX at their websites. Make sure you read their terms of use before using it. Please note that we have no connection with these providers. Soft4FX Forex Simulator simply lets you download and use their tick data in convenient way.

Forex Tester For Mac

Use broker's data

Starting from version 1.7 of Forex Simulator it is possible to import historical data from Metatrader and use it in simulations. Now, you can run simulations on all instruments offered by any MT4 broker. All you need is a demo account. Read more about importing data from MT4.

Multiple timeframes

You can open several charts at once and follow price action on several timeframes. You can also create custom timeframe charts, like 10-minute chart or 2-day chart. All charts are synchronized and updated tick-by-tick.

More charting capabilities

All types of charts you ever needed in one place:

Standard Metatrader charts: M1, M5, M15, M30, H1, H4, Daily, Weekly and Monthly

Custom timeframes: M2, M10, H2, H3, 2 days, ..

Second charts: 30 sec, 45 sec, ..

Renko charts

Range charts

Tick charts

As you can see, our simulator offers you many more timeframes and types of charts than MT4.

Built-in economic calendar

You have access to current economic news releases at any time during the simulation. You can display them on your charts as well. Economic calendar is downloaded from Forex Factory and contains events starting from 2007. Other news providers may be available in the future.

News can filtered by their importance and by currencies, so you can easily display events that really affect your trading.

Use MT4 indicators and templates

Since this trading simulator is an add-on for Metatrader 4, it allows you to use all built-in MT4 indicators as well as many custom ones. You can also use MT4 templates to prepare your charts quickly.

We cannot guarantee that all non-standard indicators will work fine with Forex Simulator, but there is a good chance that many of them will. Please use our free demo to test your favourite indicators before purchasing our simulation software.

New York Close 5-day charts

The simulator is capable of drawing charts in one of two modes:

GMT - all charts are based on Greenwich Mean Time (UTC+0)

New York Close - all charts are aligned with New York trading session close

The difference between these modes can easily be seen on daily charts. GMT charts will render 6 days in a week, including Sunday bar. New York Close charts will render only 5 days in a week. Also, all daily bars will look a bit different as time is shifted by a few hours.

Many traders believe that New York Close charts are essential in trading Forex. The importance of NY Close charts is better described in Nial Fuller's article.

Save your simulation at any time

The simulation can be saved to a file and loaded at a later time. All your trades, pending orders, stop losses, take profits, trailing stops and other settings will be restored.

Fully control the speed

You can pause and resume the simulation whenever you like. You can speed it up and slow it down. You can also step forward candle-by-candle on any chart you like, including tick, renko and range charts.

Moreover, there are 2 possible speed modes:

The Mac version of Ctrl-Alt-Delete: Mac computers have a similar three-key keyboard shortcut for. On a Windows PC the CTRL-ALT-END key combination can be used to send the CTRL-ALT-DEL sequence to the remote session. As you rightly point out this is not possible on a MAC keyboard. For a MAC the key sequence to use is actually CTRL-ALT-DEL. https://foxholidays732.tumblr.com/post/653074583967121408/ctrl-alt-for-mac.

Ticks per second - ticks are uniformly distributed in time, for example 2 ticks per second or 10 ticks per second.

Real-time - ticks are distributed in the same way as they were distributed in real life. Of course, you can also speed it up, just like a video recording.

You can also tell the program to pause the simulation automatically on certain events:

Hitting SL or TP

Execution of pending order

Reaching a defined price level

Rewind the simulation

Starting from version 1.6 of the simulator you can easily go back in time if you need to. Every chart is now equipped with a button which lets you move back bar by bar. All your trades, pending orders, stop losses, take profits, trailing stops, account details and even statistics will be restored.

If you miss the opportunity or you simply increase the speed too much, it is not a problem. The simulation can be rewound by a minute, an hour, a day or by any other timeframe you choose.

Risk-based position sizing

The simulator lets you use either lot-based position sizing or risk-based position sizing. For example, you can set it to risk no more than 2% of your balance or no more than $100 per trade. Risk-based position sizing requires setting a stop loss to work properly.

Automatic trade management

Following automatic rules can be applied to any trade:

Stop Loss and Take Profit

Trailing stop

Automatic break-even

One-cancels-other (OCO) rule for pending orders

Moreover, you can use order templates to work faster and avoid repeating the same steps. A template can be used to save your trade management settings and load them at any time.

Visual trading

Forex Simulator lets you place pending orders, stop losses and take profits by simply dragging lines on the chart. You can also modify existing orders in the same way.

Save as HTML report

With Soft4FX simulator you can save the history of your trading as an HTML report. It is formatted in exactly the same way as Metatrader account statements, so it is very easy to import it to any third-party tool for further analysis. An example of such tool is Quant Analyzer. It offers quite a lot of useful statistics and features, even in a free version.

Export to Excel

It is possible to save your trading history as an Excel sheet, allowing you to study and analyze it in more depth.

Detailed statistics

The simulator displays statistics similar to ones offered by Metatrader, including:

Balance/Equity graph

Profit/Loss

Absolute, relative and maximum drawdown

Maximum, minimum and average spread

Profit factor

Expected profit

Largest winning and losing trades

Longest/Largest winning streak

Longest/Largest losing streak

..

You can access your current statistics at any time during the simulation, not only after it ends.

Hotkeys

Basic operations can be done very quickly using hotkeys:

Ctrl + Space - Pause/Play

Ctrl + Up Arrow - Increase speed

Ctrl + Down Arrow - Decrease speed

Ctrl + Right Arrow - Next bar

Ctrl + Left Arrow - Previous bar

Ctrl + B - Buy

Ctrl + S - Sell

Ctrl + C - Close last trade

Ctrl + A - Close all trades

Hotkeys work only in the main window of the simulator, so this window must be currently active (must be the last clicked window).

Free updates

Updates are free. All you have to do is to download and install a new version. Your activation code will still work with new versions.

There is no special procedure of updating. You can install the new version in the same way as you installed the program for the first time.

Current version is: 1.89 (Download)

Requirements

Windows 7 / 8 / 10 (will not work on Mac)

Installed Metatrader 4 (not Metatrader 5)

4 GB of RAM

Internet connection (the faster the better - downloading tick data may be time-consuming)

Microsoft .NET Framework 4.5 (Check and install)

Recommended: a few GB of free hard disk space for storing downloaded tick data

Recommended: Full HD screen

Download Forex Simulator

The simulator is not a standalone application. It is an add-on for Metatrader 4, so you need to have Metatrader 4 platform installed in your system. Metatrader 5 is not supported yet.

By default the software is locked and works in demo more. Demo mode has two limitations:

You can take only 5 trades per simulation.

You can not load saved simulations.

You need to buy the license to unlock the software.

(EX4 file, approx. 1.5 MB -> see installation)

Demo - test the program for free

You can test our software for free as long as you want. The download button is just above.

When starting the program please leave both e-mail and activation code empty. It will start the simulator in demo mode.

Buy the license

Payments can be made by PayPal and Skrill (MoneyBookers). Most credit and debit cards are accepted.

License is lifetime.

It lets you use the software on 2 Metatrader accounts (demo or real).

There is no limit for the number of computers in use. What limits the use of software is the number of Metatrader accounts.

More information about payments and the license can be found in License, payments and refunds section.

We strongly suggest to test the demo version of the simulator with your favourite indicators before buying it. All standard MT4 indicators work fine, but not every custom indicator works correctly on the simulator. Read more about known problems with custom indicators and possible solutions in Troubleshooting section.

Buy Forex Simulator

99 USD

One-time payment

Lifetime license for 1 person

2 Metatrader accounts (with transfer possibility)

14 day money back guarantee

Analysis toolpak for excel mac. Follow these steps to load the Analysis ToolPak in Excel 2016 for Mac: Click the Tools menu, and then click Excel Add-ins. In the Add-Ins available box, select the Analysis ToolPak check box, and then click OK. To install Analysis toolpak in Excel for Mac, follow below steps. Goto tools or Insert menu. Locate Add-Ins and Click on it. You’ll be prompted to choose from available add-ins. Select Analysis Toolpak. Analysis Toolpak is added.

Requires Microsoft Windows and Metatrader 4

More information

Forex Simulator

0 notes