#FinProConsulting

Explore tagged Tumblr posts

Text

The time for action is NOW. You have postponed enough; it's time to hit play on your success story. Whether it's a new certification, skill upgrade, or career leap, FinPro Consulting is here to make it happen. Register today and start building the future you deserve! Contact Us now;- 84214 38047

#RegisterNow#TakeAction#CareerGoals#SuccessMindset#FinProConsulting#FutureReady#InvestInYourself#NoMoreExcuses#UnlockYourPotential

0 notes

Text

ACCA DipIFR Online Certification by Industry Experts

Elevate your finance career by becoming an IFRS specialist. Join our comprehensive ACCA DipIFR online course, designed and taught by practicing Chartered Accountants and industry experts with years of real-world IFRS implementation experience. Our structured program is focused on one thing: helping you pass the DipIFR exam on your first attempt.

Why Choose Us? ✅ Live Interactive Classes: Learn directly from experts, not just from pre-recorded videos. ✅ Exam-Focused Approach: We cover the entire syllabus with a focus on exam questions and case studies. ✅ Practical Knowledge: Go beyond theory with real-world examples from seasoned professionals. ✅ Comprehensive Mock Exams: Get exam-ready with tests that simulate the actual DipIFR paper. ✅ Dedicated Doubt-Clearing Sessions: Get all your questions answered. ✅ Flexible Weekend/Weekday Batches

Perfect for: CAs, ACCAs, Finance Managers, Auditors, and Accounting Professionals.

Enroll in our upcoming batch and take the next step in your global finance career. ➡️ Request a FREE Demo Class & Course Brochure! Contact Us now:- +91 8421438047

#diploma in ifrs#accounting#dipifr course#dipifrs#ifrs online classes#finpro consulting#ifrs#finproconsulting#diplomainifrs#acca

0 notes

Text

Let IFRS certification be your ultimate passport to international work opportunities! Equip yourself with the globally recognized standard in financial reporting and open doors worldwide. Contact us Now;-84214 38047

#IFRS#InternationalOpportunities#GlobalFinance#CareerBoost#FinProConsulting#FinanceEducation#WorkAbroad#CFO#Accountant#FutureProofYourCareer

0 notes

Text

In our previous blog, we discussed ACCA DipIFR exam utility interface & answer writing tips which will help students to get comfortable with CBE interface and to be familiar with the examination pattern and face it with confidence.

0 notes

Text

In our previous blog, we discussed ACCA DipIFR exam utility interface & answer writing tips which will help students to get comfortable with CBE interface and to be familiar with the examination pattern and face it with confidence.

#diploma in ifrs#accounting#dipifrs#dipifr course#ifrs#finpro consulting#diplomainifrs#finproconsulting#ifrs online classes#acca

0 notes

Text

ACCA DipIFR Remote Exam: Requirement, Set-up & Tips

In our previous blog, we discussed ACCA DipIFR exam utility interface & answer writing tips which will help students to get comfortable with CBE interface and to be familiar with the examination pattern and face it with confidence.

This blog is especially for the students who chose Remote examination session i.e., who would appear from home or office instead of centre-based examination. This blog will guide you about technical requirements of the allowed devices and necessary care to be taken before and during the remote examination session.

System Requirements:

Operating System

• Windows 11 and 10 (64-bit) – (excluding ‘S Mode’) • macOS 13 and above – (excluding beta versions)

Note: • Mac OS, starting with Mojave, now requires permission from the user to allow any hardware access to an application, which includes OnVUE (proctorapp). Candidates should be prompted to allow this application • Windows Operating Systems must pass Genuine Windows Validation.

Unsupported operating systems

• Windows 8/8.1, Windows 7, Windows XP, and Windows Vista • Linux/Unix and Chrome based Operating Systems

Firewall

• Corporate firewalls should be avoided as they often cause this delivery method to fail. • VPNs and proxies should not be used. • We recommend testing on a personal computer. Work computers generally have more restrictions that may prevent successful delivery.

RAM Required

Recommended Minimum RAM of 4 GB or more

Display

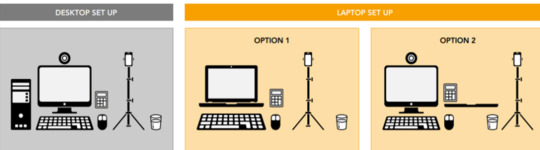

Minimum Resolution: 1024 x 768 in 16-bit col Recommended Resolution: 1920 x 1080 or higher in 32-bit color • If using an external monitor, you must close your laptop and use an external keyboard, mouse, and webcam. • Multiple monitors are forbidden. • Touch screens are strictly forbidden.

Webcam

• The webcam may be internal or external. It must be forward-facing and at eye level to ensure your head and shoulders are visible within the webcam. • The webcam must remain in front of you and cannot be placed at an angle. • Webcam filters are not allowed (for example, Apple’s ‘Reactions’). • Webcam must have a minimum resolution of 640x480 @ 10 fps.

Note: • Mobile phones are strictly prohibited as a webcam for exam delivery. • Mac OS users may need to allow OnVUE within their System Preferences: Security & Privacy: Privacy settings for camera & microphone.

Speakers and microphone

Speakers: • Speakers must be built-in or wired. • Bluetooth speakers or the use of headphones* as speakers are not allowed. Headphones: • Headphones and headsets are not allowed unless explicitly approved by your test sponsor. • If allowed, headphones must be wired – Bluetooth are not allowed.

Browser settings

Internet Cookies must be enabled.

Device

All tablets are strictly prohibited, unless they have a physical keyboard and meet the operating system requirements mentioned earlier.

Power

Make sure you are connected to a power source before starting your exam to avoid draining your battery during the exam.

Internet Browser

The newest versions of Microsoft Edge, Safari, Chrome, and Firefox, for web registrations or downloading the secure browser.

Internet Connection

• For better performance, a reliable and stable connection speed of 12 Mbps download and 3 Mbps upload required. • We recommend testing on a wired network as opposed to a wireless network. • If testing from home, ask others within the household to avoid internet use during your exam session.

We strongly recommend using equipment that meets or exceeds the Recommended Specifications. The minimum requirements will change periodically based on the needs of exam sponsors.

Mobile phone: You may have the option to use your mobile phone to complete the check-in process. The mobile must meet the following requirements:

• Android (11+, Chrome) or IOS (15+, Safari) operating systems • A functioning camera with a stable internet connection

A mobile phone is used only for completing admission steps and must not be used during the exam. After completing the check-in steps, please place the mobile phone where it is not accessible to you during the exam. As a reminder, phones are a prohibited item and should not be within your reach or visible to you while sitting in front of your computer.

Pre-exam requirements

Passing the Mandatory system test

• You MUST pass mandatory system test prior to your check-in for exam. • When taking the test, use same device and the same location you we’ll use on exam day. • Make sure your last test run is a pass, so that you are eligible for all post-exam options. • Go to Exam Planner & hit the Run System Test button.

Practice using the scratch pad

Remember, you cannot use scratch paper for remote exam session. So, it’s important to get used to using the scratch pad on the Practice Platform before your live exam.

Exam set-up

Your room setup

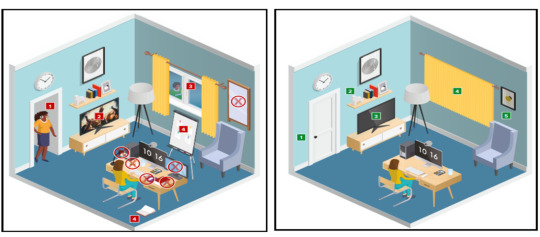

You will be under exam conditions and monitored by an invigilator throughout. Make sure below conditions are being followed: • A private and quite room with solid walls and doors. • No other person can be visible or heard for full duration of exam. • Use curtains or blinds to cover windows if anyone can be seen through them. • Switch all other unnecessary electrical equipment off. • Refer below images to have an idea about ideal exam environment.

Prohibited Permitted

Your desk setup

Your desk must be setup in a way that meets the rules and regulations of the exam: • No scrap paper• Only one monitor • A glass/bottle of water with label removed permitted • No headphones / earbuds / earphones • No watches

The check-in process

• Check in to your exam by going the exam planner and click launch exam button. • You can launch your exam 30 minutes prior your scheduled time. • If you are more than 15 minutes late you will miss your exam attempt and be marked as Absent.

Using your mobile phone:

• You may use your mobile phone during the check-in process – On-screen instruction will guide you.• You’ll be asked to take and upload photos of your exam environment, yourself and your ID. • Once completed this process place your mobile phone on silent and out of arm’s reach. • Do not use your mobile phone for any other purpose during exam (exception if invigilator calls you) • Taking photos of your screen or making calls during the exam is strictly prohibited.

Under exam conditions:

In addition to the desk/room requirements you should be aware that the following is also prohibited:

• Talking aloud during your exam. • People being audible outside your room. • Leaving the exam early – DO NOT end your exam early, you must stay supervised for the full-time duration.

Contacting the invigilator

• To start a chat with your invigilator, select the chat button. • Your invigilator will be with you as soon as they are available. • Unlikely they can assist you, but you should inform your invigilator if you are experiencing any technical difficulties. • You must inform your invigilator if you wish to use your permitted bathroom break.

Bathroom breaks

You can take one bathroom break during your exam of up to 5 minutes: • Notify your invigilator when you are leaving and returning from bathroom break. • You do not have to wait for the invigilator to give you their permission before taking your bathroom break. • The exam timing will continue to run – if you exceed 5 minutes your exam may be terminated.

Post-exam options: In the event of technical issue disrupting your exam, you may wish to use post-exam options which can be accessed on exam planner or under Contact Us on ACCA’s website.

Minimise the risk of the technical issue by: • Performing your equipment and connectivity test. • Accessing troubleshooting resources.

Using post exam options

To use rebook or withdrawal option you must have: • attempted to check-in your exam • experienced a technical issue impacting your ability to complete exam.

Additional withdrawal eligibility criteria

• The mandatory system test must be taken ahead of each exam session. • Student must have passed the mandatory system test in their last attempt prior to checking in for your exam.

Make sure that your device / other equipment’s are compatible as per the provided requirements and you are availed with the environment requisite for the exam purpose. Everyone should make sure to follow fair practices during exam to avoid any disqualification or disciplinary action.

We hope, this blog about ACCA DipIFR Remote Exam Requirement, Set-up & Tips shall assist in making the necessary arrangements.

Further, please watch video related to the remote examination on the below link: https://youtube.com/playlist?list=PLRYOefFr48S0apGK6f0kw0sX7fC6uSzsx&feature=shared

Best wishes from Team FinPro!

#finproconsulting#diploma in ifrs#accounting#dipifrs#ifrs#ifrs online classes#finpro consulting#dipifr course#diplomainifrs#acca

0 notes

Text

Nothing makes us prouder than seeing our students thrive and achieve their goals. This amazing feedback fuels our passion to keep delivering top-notch education. Ready to write your own success story? Contact Us Now:-84214 38047

#StudentSuccess#Testimonial#HappyLearners#FinProConsulting#CareerGoals#EducationExcellence#FutureLeaders#SuccessStories

0 notes

Text

Our IFRS training equips you to adapt and thrive. Register Now! Contct Us Now:-+91 8421438047

0 notes

Text

Examinations are set for June 5th & 6th, 2025

Here's what you need to know:

Format: 3 hours 15 minutes, 100 marks total (50% to pass). No MCQs!

Questions: Four compulsory 25-mark questions. Expect consolidation in Q1, with detailed scenario-based IFRS case studies for Q2-4 (numerical answers need explanations!).

Action: Don't forget to download your exam docket via your ACCA login!

Ready to ace it? FinPro's got you covered!

#ACCA#DipIFR#IFRSEmExams#FinProConsulting#FinanceProfessionals#ExamPrep#Accounting#IFRS#June2025#StudyTips#ComputerBasedExam#FinancialReporting#CareerGoals#Auckland

0 notes

Text

The ACCA Diploma in International Financial Reporting (Dip-IFRS) is a globally recognized qualification, where the syllabus is rich and practical, however, many students find the mode of examination (Computer Based Examination – CBE) and time pressure to be challenging hurdles. Further, per the examiners’ report over past many years, it is an observation of examination team that frequently students lack in understanding the question or what is expected in the answer. Also, students do not explain their numeric answers adequately.

#accounting#dipifr course#dipifrs#ifrs online classes#ifrs#finpro consulting#diplomainifrs#diploma in ifrs#careergrowth#finproconsulting

0 notes

Text

ACCA Dip-IFRS Exam Structure & Time Management Tips

The ACCA Diploma in International Financial Reporting (Dip-IFRS) is a globally recognized qualification, where the syllabus is rich and practical, however, many students find the mode of examination (Computer Based Examination – CBE) and time pressure to be challenging hurdles. Further, per the examiners’ report over past many years, it is an observation of examination team that frequently students lack in understanding the question or what is expected in the answer. Also, students do not explain their numeric answers adequately.

To overcome the above hurdles or challenges, first important step is to understand the exam structure or structure of the question paper. Second step is to understand how the examination utility looks on a computer machine and how to navigate through the various exhibits in question scenario and how to answer without losing time in navigation. The third most important and last step is to practice on such platform in order to reduce time required to solve the question paper. In this blog, we’ll focus on the first step to overcome the hurdles i.e. understanding structure of the exam.

Let us break down and analyse the exam paper pattern and try to understand what ACCA on a broad level expects from the students of Diploma IFRS examination. This will help students to plan their revision based on the expectations of examiner and more importantly to plan 3 hours of examination. Student has 3 hours and 15 minutes at his disposal. Student can use it as per his own convenience for reading questions and writing answers. However, our suggestion is to keep total 15 minutes for reading and planning the question paper and another 10 minutes as a buffer. Thus, out of 195 minutes, remaining 170 minutes can be utilised to solve the question paper. Thus, 1.7 minutes per mark can be used as a very broad level guideline for the time management. However, considering the level of difficulty of a particular question, this time may be revised.

Exam consists of 100 marks with 4 questions, each attracting 25 marks. All questions are compulsory, and no alternative is available for any question.

Question One

This question will involve the preparation of a consolidated financial statement, as examinable within the syllabus. This question will often include issues that will need to be addressed prior to performing the consolidation procedures for e.g. procedures mentioned in IFRS 3 – Business Combinations viz. calculation of purchase consideration, NCI, goodwill etc. Generally, these issues will relate to the financial statements of the parent entities prior to their consolidation. A key purpose of this question is to assess technical consolidation skills. However, the question may also require candidates to adjust for transactions that have been incorrectly or incompletely accounted for in the financial statements of group entities (usually the parent entity). In order to make these adjustments candidates will need to apply the provisions of relevant IFRS Standards. In Question one, the focus will primarily on application rather than explanation. No explanations are expected in the question number

Question Two

This question will often be related to a scenario in which questions arise regarding the appropriate accounting treatment and/or disclosure of a range of issues. In this question candidates may be asked to comment on management’s chosen accounting treatment and determine a more appropriate one, based on circumstances described in the question. This question will also contain an ethical and professional component related to the accounting treatment that is being examined.

Question Three

This question will usually deal with one or two IFRS Standards in some detail. Such a question would require candidates to describe key features of the IFRS Standard and apply it to two or more situations that the question describes. In contrast with Question 1, there will be a limited number of marks available for technical preparation of financial statements extracts and the majority of marks are available for identifying and quantifying the appropriate adjustments. However, it is expected that students can explain how these adjustments will affect line items in the financial statements.

Question Four

This question will often present candidates with a scenario or a range of scenarios for which the correct financial reporting treatment is complex or uncertain. Often the question will place the candidate in a ‘real-life’ role, for example chief accountant reporting to the chief executive officer or senior accountant supervising an assistant. The question frequently requires candidates to address a series of questions that have been posed by the other party in the scenario. The question will often ask candidates to present a reply or report that deals with the appropriate financial reporting of the issues raised in the scenario. The primary skill in this question is identifying and describing the issues, rather than the detailed computation of numbers. Questions 2, 3 and 4

will be more about identification and explanation of financial reporting issues rather than of financial statements preparation. Practicing these questions from the past exam questions is very good exam preparation as generally candidates find the narrative style questions more challenging than the numerical style of question one. These past papers continue to be relevant, but students should bear in mind that sometimes additional query or explanation of an additional IFRS Standard can be demanded.We hope knowing the ACCA Dip-IFRS exam structure will help you approach the exam with a clear plan. Understanding the types of questions, marks distribution, and how the paper is set will make it easier for you to focus on your study and manage your time during the exam.

Best wishes from Team FinPro!

Thank you for reading our blog, stay tuned for such insightful tips.

Thank you for reading our blog. Stay tuned for more such insightful tips. If you have any questions or need assistance, feel free to contact us.

#finproconsulting#diploma in ifrs#accounting#dipifr course#dipifrs#finpro consulting#ifrs#ifrs online classes#diplomainifrs#careergrowth

0 notes

Text

Looking to clear the ACCA DipIFR exam in June 2025?

If you're short on time or need a solid revision strategy, check out this DipIFR Fast Track / Revision Course. It's a recorded course in English that covers the entire syllabus (except 6 small topics) — perfect for working professionals or repeat candidates.

📌 What’s included:

Recorded Sessions – study at your own pace

Cloud + Mobile App Access

Hard copy books available at 50% discount*

Affordable price: ₹4,000 + 18% GST

This course is designed to help you focus, revise smartly, and boost your chances of success in the June 2025 exam.

If anyone needs details or wants to enroll, feel free to connect here or visit: [https://finproconsulting.in/acca-dipifr/dipifr-recorded-sessions/] 📞 WhatsApp for quick queries: +91 8421438047 +91 8329119908

#ifrs#accounting#dipifr course#dipifrs#ifrs online classes#diploma in ifrs#finpro consulting#diplomainifrs#careergrowth#finproconsulting

0 notes

Text

If you're short on time or need a solid revision strategy, check out this DipIFR Fast Track / Revision Course. It's a recorded course in English that covers the entire syllabus (except 6 small topics) — perfect for working professionals or repeat candidates.

📌 What’s included:

Recorded Sessions – study at your own pace

Cloud + Mobile App Access

Hard copy books available at 50% discount*

Affordable price: ₹4,000 + 18% GST

This course is designed to help you focus, revise smartly, and boost your chances of success in the June 2025 exam.

If anyone needs details or wants to enroll, feel free to connect here or 📞 WhatsApp for quick queries: +91 8421438047 +91 8329119908

#finproconsulting#diploma in ifrs#dipifr course#dipifrs#accounting#finpro consulting#ifrs online classes#diplomainifrs#careergrowth#ifrs

0 notes

Text

Maximize your time and boost your career with FinPro Consulting’s on-demand IFRS courses. Learn at your own pace with expert-recorded sessions designed for busy professionals. Save time, cut costs, and gain globally recognized financial reporting knowledge. Start your IFRS journey today with FinPro! Contact Us Now:- +91 8421438047

#IFRSOnDemand#FinProConsulting#LearnIFRSOnline#FlexibleLearning#AccountingCourses#InvestInYourself#OnlineIFRSCourse#SelfPacedLearning#FinanceEducation#CAPreparation#ElearnAccounting#IFRSIndia

0 notes

Text

Join Our Certificate Course in IFRS – Learn from Expert CA | 98% Success Rate

FinPro Consulting offers globally accessible Certificate Courses in IFRS, led by expert Chartered Accountants. With a proven 98% passing rate, our comprehensive, exam-focused training is trusted by finance professionals worldwide. Whether you're preparing for the ACCA DipIFR or looking to enhance your IFRS knowledge, our online courses are designed for flexible, effective learning—anytime, anywhere.

#finproconsulting#accounting#dipifr course#dipifrs#diploma in ifrs#finpro consulting#ifrs online classes#careergrowth#diplomainifrs

0 notes

Text

Don't let them hold you back! Join our FREE live online query resolution sessions for the Diploma IFRS June 2025 exam. Limited spots available – register now and ace your prep! On image- update Contact Us Now:-+91 8421438047

#IFRSQueries#ExamPrep#LiveSession#FreeWebinar#AccountingHelp#FinanceExam#DiplomaIFRS#June2025Exam#FinProConsulting#RegisterNow#DontMissOut

0 notes