#Finance Valuation Training

Text

Boost Your Earning Potential: Top Courses in New York for Financial Success

New York, the bustling hub of business, technology, and creativity, offers myriad opportunities for those looking to enhance their skill set and increase their earning potential. Whether you’re looking to break into the financial district, scale the corporate ladder, or jump into the start-up scene, the city that never sleeps has something for everyone. Here is a curated list of top courses to…

View On WordPress

#Culinary Arts Education#Cybersecurity Bootcamp#Data Science with Python#Digital Marketing Bootcamp#Entrepreneurship Development#Finance Valuation Training#Full-Stack Web Development#Graphic Design Skills#New York professional courses#Project Management Certification#Real Estate License NY

0 notes

Text

Startup Valuation

Startup Valuation is one of the challenging tasks often required by financial. We will discuss how to value startups through some of the more popular valuation methods. In the most general sense, these are new business ventures created by an entrepreneur. Startups usually focus on developing ideas or technologies, and the market valuation is required in the form of a new product or service.

#Aswath Damodaran#Business Valuation Training#Startup Valuation#Corporate Finance Training#Mergers and Acquisitions courses#Mergers and Acquisitions Training#Best finance courses#Negotiation training#Negotiation workshop#Private Equity Deals#Deal Negotiation#Financial modeling workshops#Fundraising training

0 notes

Text

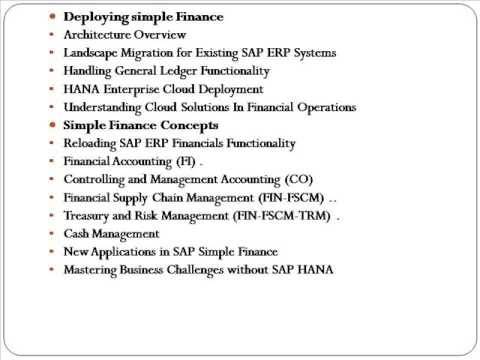

Thirteen Sap Simple Finance Training Ideas Finance, Sap, On-line Coaching

Learn new key ideas of Simple Finance like Integrated enterprise planning for Finance, Universal journal, changes to controlling-COPA, and information migration process. SAP S/4HANA Finance is the trail to simplify finance which is a complete set of financial administration and account options powered by SAP HANA in-memory database which can be deployed in the cloud or on-premise. Our in-depth information, trade area experience and business processes are effectively used to supply innovative training solutions that end in measurable worth for our shoppers. Learn SAP Simple Finance overview at SAPVITS in USA and everywhere in the globe. Also provide SAP Simple Finance coaching material, SAP Simple Finance videos, SAP S4 hana Simple Finance PDF, PPT. Visit us for SAP S4 HANA Simple Finance on-line coaching course particulars & SAP Simple Finance tutorial.

youtube

Clarkston Consulting attracts expertise by shelling out the biggest paychecks within the space — the median in that office is $141K. These professionals are among the many prime paid software professionals and one of the sought-after designations in the IT trade. The median salary provided to SAP S/4HANA Simple Finance professionals are round $117,000 to $153,000.

Project Management

Create and keep charts of depreciation and the depreciation areas, asset classes, asset grasp data, and configure and carry out FI-AA business processes within the SAP system. Set up valuation and depreciation, carry out periodic and year-end closing processes, and clarify and configure parallel accounting. SAP S/4HANA Logistics is essential SAP ERP utility tool which deals with the real time analysis and reporting of all logistic operations like flow of materi... #SAPSimpleFinance is an entire finance solution based on #SAPHANA, which may be utilized within the cloud or on-premise. SAP Simple Finance can be known as #SAPS4HANASimpleFinance.

After the course completion, your coach will present all details about the certification you can seem for the skills of every.

They access the assignments and supplies through the LMS system.

Business lovers and aspiring professionals on the lookout for top-rated SAP training programs should have a session with us.

We use top of the range paid coaching software that has premium tools and features.

“I find the recruitment course of and CV assistance assembly very informative helpful and most significantly gives a clear give consideration to my profession aspirations and objectives.

We will work with students who has valid work permit in USA and who're residing in USA. As of now, we solely have purchasers in USA and don’t provide providers in Mexico/Canada. It is kind of a problem for us to get First Project for you, hence we propose you focus in the direction of working hard and aiming for the primary project as an alternative of worrying concerning the pay.

Sap S/4hana Finance 2021 Coaching

Due to the value added by ERP’s to medium and large sized companies by method of enabling them to turn into ever more environment friendly, the expansion in the implementation of ERP’s is inevitable. SAP is likely certainly one of the world’s largest ERP software program brand, supporting various industries worldwide. Every day lot of organisations proceed to implement it everywhere in the world.

An endorsed course is a abilities based course which has been checked over and permitted by an unbiased awarding physique. Endorsed programs usually are not regulated so do not result in a qualification - nonetheless, the coed can normally buy a certificates showing the awarding body’s emblem if they want. Certain awarding our bodies - corresponding to Quality Licence Scheme and TQUK - have developed endorsement schemes as a method to help students choose one of the best expertise primarily based courses for them. A regulated qualification is delivered by a learning institution which is regulated by a authorities physique. In England, the government physique which regulates courses is Ofqual. Ofqual regulated skills sit on the Regulated Qualifications Framework , which might help college students understand how different skills in different fields examine to each other.

Uplatz is UK-based main supplier of SAP training, Oracle coaching, Big Data & Machine Learning courses, Program... Uplatz presents comprehensive coaching on Salesforce system administration. sap abab course uk of this Salesforce coaching is to supply the necessary abilities on the core co... Accelerate finance transformation with SAP S/4HANA Finance. Discover the 5 easy steps to drive fast time-to-value with this ..SAP S/4HANA Finance.

The Place We Serve Sap S/4 Hana Finance Coaching

Hi Pradeep, Today I have cleared my skilled certification right now, thanks for your help and documents. You can E-mail your question to the assist Email-ID which we'd share with you. It would assist to resolve your question related to your training topic. You might be privileged to get skilled from the best faculty across the globe which would otherwise not potential in the classroom coaching. We conduct classes on premium coaching software program which presents a lot of user-friendly features.

2 notes

·

View notes

Text

13 Sap Simple Finance Training Ideas Finance, Sap, On-line Coaching

Learn new key ideas of Simple Finance like Integrated enterprise planning for Finance, Universal journal, changes to controlling-COPA, and knowledge migration course of. SAP S/4HANA Finance is the trail to simplify finance which is a comprehensive set of monetary administration and account options powered by SAP HANA in-memory database which could be deployed within the cloud or on-premise. Our in-depth knowledge, industry area experience and enterprise processes are successfully used to offer revolutionary training solutions that end in measurable worth for our clients. Learn SAP Simple Finance overview at SAPVITS in USA and everywhere in the globe. Also provide SAP Simple Finance training materials, SAP Simple Finance videos, SAP S4 hana Simple Finance PDF, PPT. Visit us for SAP S4 HANA Simple Finance on-line training course particulars & SAP Simple Finance tutorial.

youtube

Clarkston Consulting attracts talent by shelling out the largest paychecks within the area — the median in that workplace is $141K. These professionals are among the top paid software professionals and one of the most sought-after designations in the IT industry. The median salary offered to SAP S/4HANA Simple Finance professionals are round $117,000 to $153,000.

Project Administration

Create and maintain charts of depreciation and the depreciation areas, asset courses, asset master data, and configure and carry out FI-AA enterprise processes in the SAP system. Set up valuation and depreciation, carry out periodic and year-end closing processes, and clarify and configure parallel accounting. SAP S/4HANA Logistics is essential SAP ERP software tool which deals with the true time evaluation and reporting of all logistic operations like move of materi... #SAPSimpleFinance is a complete finance answer based mostly on #SAPHANA, which may be utilized within the cloud or on-premise. SAP Simple Finance is also known as #SAPS4HANASimpleFinance.

After the course completion, your trainer will provide all details concerning the certification you possibly can seem for the skills of each.

They entry the assignments and supplies through the LMS system.

It would possibly take serious influence on candidature, due to duplicate resume submission by totally different consulting companies to identical consumer.

We use top of the range paid coaching software program that has premium tools and options.

“I find the recruitment process and CV assistance assembly very informative helpful and most importantly provides a transparent concentrate on my career aspirations and objectives.

We will work with college students who has legitimate work permit in USA and who're dwelling in USA. As of now, we only have shoppers in USA and don’t provide providers in Mexico/Canada. It is type of a problem for us to get First Project for you, hence we suggest you focus towards working hard and aiming for the first project as a substitute of worrying concerning the pay.

Sap S/4hana Finance 2021 Training

Due to the value added by ERP’s to medium and big sized companies in phrases of enabling them to turn out to be ever extra efficient, the expansion in the implementation of ERP’s is inevitable. SAP is one of the world’s largest ERP software program brand, supporting numerous industries worldwide. Every day lot of organisations continue to implement it all over the world.

sap simple finance training uk "/>

An endorsed course is a skills based course which has been checked over and accredited by an impartial awarding physique. Endorsed programs usually are not regulated so do not end in a qualification - nevertheless, the student can often buy a certificates displaying the awarding body’s brand if they wish. Certain awarding our bodies - similar to Quality Licence Scheme and TQUK - have developed endorsement schemes as a method to help college students choose the most effective skills primarily based programs for them. A regulated qualification is delivered by a learning establishment which is regulated by a authorities physique. In England, the federal government physique which regulates courses is Ofqual. Ofqual regulated skills sit on the Regulated Qualifications Framework , which can help students perceive how different skills in different fields examine to one another.

Uplatz is UK-based main supplier of SAP training, Oracle coaching, Big Data & Machine Learning programs, Program... Uplatz offers complete coaching on Salesforce system administration. The goal of this Salesforce training is to supply the required expertise on the core co... Accelerate finance transformation with SAP S/4HANA Finance. Discover the 5 simple steps to drive quick time-to-value with this ..SAP S/4HANA Finance.

Where We Serve Sap S/4 Hana Finance Coaching

Hi Pradeep, Today I even have cleared my professional certification at present, thanks in your help and paperwork. You can E-mail your question to the assist Email-ID which we would share with you. It would help to resolve your question related to your training subject. You might be privileged to get skilled from the most effective college throughout the globe which might otherwise not possible in the classroom training. We conduct lessons on premium training software program which provides lots of user-friendly options.

#sap simple finance training uk#sap simple finance course uk#sap simple finance training london#sap simple finance course london

2 notes

·

View notes

Text

Fixed-asset Accounting Fundamentals

A SAP Accounting resolution enables you to accelerate the month-end shut process. Having all your monetary and operational data in a single place, and out there in the cloud removes the challenge of compiling month-end knowledge. SAP Business One additionally allows you to assign tasks to individuals or create reminders to complete every aspect of your shut process. SAP is a multinational software improvement and consulting corporation, which offers enterprise software applications and assist to companies of all sizes globally... Graduation from this training program will present you with valuable, verified CPD points. As an accountant, you will want to gain CPD points to keep your accounting membership and to cooperate with professional accounting our bodies' (such as ACCA, AAT, CIMA, ICAEW, etc.) necessities.

Also called writing down, represents the period during which the market worth of an asset is lower than the valuation entered on an organization’s stability sheet.

Thus, lowering the data latency of SAP Business Warehouse reporting.

It is the world's largest and fastest-growing skilled qualification, with over 500,000 members and students in one hundred seventy countries.

In this video tutorial, you'll be getting an outline on what is Asset Accounting, a picturesque diagram on the life cycle of mounted assets and why Asset Accounting is considered as sub ledger in SAP system. You may even be succesful of cope with the essential features of SAP Asset Accounting that cowl the entire lifespan of the process from the initial requisition to all the best way to asset requirement. You will also find out how this method calculates routinely and produces the depreciation values, interest rate, and different required info using the business course of Information System. Here, you will also have the ability to study with special valuations using SAP Asset Accounting that includes processing leased property and the preparation for consolidation for group monetary statements. Under this udemy SAP FICO course, you will learn to find the co-product value by way of the “by-period method”. Using the by-period situation technique, you analyze the cost over an prolonged interval.

Finest Udemy Sap Fico Courses In 2022 || Udemy Sap Fico Certifications And Reviews

The instructor advises you to undergo the “SAP Co- Product Costing-By Order Scenario in S4 HANA 1909” course before understanding the product costing course of better. With information captured, processed and reported on in real-time, your accounting manages the ‘now’ bettering cash-flow administration, inventory administration and control of budgets. CPD accounting coaching is an inclusive, practical accounting coaching program created to build the bridge between data and sensible areas of accounting and tax.

youtube

Depreciation by models of manufacturing writes off an asset based on how much that asset produces. This possibility spreads the depreciation evenly over the useful lifetime of an asset. The new asset is exclusive, will get a new ID and represents 25% of the original asset.

Sap Po (process Orchestration) Training

With these options, you get constantly connected stay together with your trainer and different members. This makes online coaching even better and comfortable, as you presumably can attend the training being at your own location without wasting time on travelling. SAP S/4HANA Finance, earlier known as SAP Simple Finance is a standard product for SAP ERP. sap asset accounting training uk rising options for Financial Management & Accounting, are extremely demanded by high monetary organizations worldwide. Major organizations are now adopting the cloud know-how supplied by SAP within the form of S/4HANA.

These mounted belongings are any additions and upgrades you make to leased assets or rental property. Such assets embrace built-in cupboards, inside partitions, ceilings and any electrical and plumbing upgrades. The new SAP S4 HANA Finance Builds enterprise rules within the platform, together with embedded analytics, to create new optimized and revolutionary enterprise processes. Learning Tree is the premier international supplier of studying options to help organizations’ use of expertise and effective business practices. SAP HANA is a sport altering and greatest promoting product in the historical past of SAP.

Best Accounting Programs To Get Essentially The Most Of Your Accounting Profession

Conveying the outcomes of information evaluation is far simpler when the results are visualized using graphs, charts and other graphical formats. This enables analysts and business decision-makers to more simply visualize and communicate tendencies and patterns to stakeholders to help in efficient decision-making. In this course, you'll be launched to Python packages corresponding to Matplotlib and Seaborn which can allow you to create straightforward to learn and perceive graphs, charts and other visual representations of data using Python.

#sap asset accounting training uk#sap asset accounting course uk#sap asset accounting training london#sap asset accounting course london

2 notes

·

View notes

Text

13 Sap Simple Finance Training Concepts Finance, Sap, On-line Training

Learn new key ideas of Simple Finance like Integrated enterprise planning for Finance, Universal journal, adjustments to controlling-COPA, and data migration process. SAP S/4HANA Finance is the path to simplify finance which is a complete set of financial administration and account options powered by SAP HANA in-memory database which may be deployed within the cloud or on-premise. Our in-depth knowledge, business area expertise and business processes are successfully used to offer progressive coaching options that end in measurable value for our shoppers. Learn SAP Simple Finance overview at SAPVITS in USA and all over the globe. Also offer SAP Simple Finance training material, SAP Simple Finance videos, SAP S4 hana Simple Finance PDF, PPT. Visit us for SAP S4 HANA Simple Finance online training course details & SAP Simple Finance tutorial.

youtube

Clarkston Consulting attracts talent by shelling out the biggest paychecks within the area — the median in that workplace is $141K. These professionals are among the prime paid software program professionals and one of the most sought-after designations in the IT industry. The median wage provided to SAP S/4HANA Simple Finance professionals are round $117,000 to $153,000.

Project Management

Create and keep charts of depreciation and the depreciation areas, asset courses, asset grasp information, and configure and perform FI-AA enterprise processes in the SAP system. Set up valuation and depreciation, carry out periodic and year-end closing processes, and clarify and configure parallel accounting. SAP S/4HANA Logistics is essential SAP ERP utility tool which deals with the true time analysis and reporting of all logistic operations like flow of materi... #SAPSimpleFinance is a complete finance resolution primarily based on #SAPHANA, which could be utilized in the cloud or on-premise. SAP Simple Finance can be called #SAPS4HANASimpleFinance.

They entry the assignments and supplies through the LMS system.

We use high quality paid training software that has premium instruments and features.

“I discover the recruitment course of and CV assistance assembly very informative useful and most significantly gives a transparent concentrate on my career aspirations and targets.

We will work with students who has legitimate work allow in USA and who're living in USA. As of now, we solely have purchasers in USA and don’t provide providers in Mexico/Canada. It is type of a problem for us to get First Project for you, therefore we advise you focus towards working exhausting and aiming for the primary project as a substitute of worrying in regards to the pay.

Sap S/4hana Finance 2021 Coaching

Due to the value added by ERP’s to medium and big sized companies in phrases of enabling them to become ever extra efficient, the expansion in the implementation of ERP’s is inevitable. SAP is probably certainly one of the world’s largest ERP software program model, supporting varied industries worldwide. Every day lot of organisations proceed to implement it all round the world.

sap simple finance training uk "/>

An endorsed course is a skills primarily based course which has been checked over and accredited by an impartial awarding physique. Endorsed courses aren't regulated so don't lead to a qualification - nonetheless, the student can usually buy a certificates exhibiting the awarding body’s brand if they need. Certain awarding bodies - such as Quality Licence Scheme and TQUK - have developed endorsement schemes as a method to help college students choose the best abilities primarily based courses for them. A regulated qualification is delivered by a learning institution which is regulated by a authorities physique. In England, the government physique which regulates programs is Ofqual. Ofqual regulated skills sit on the Regulated Qualifications Framework , which can help college students understand how different skills in several fields evaluate to one another.

Uplatz is UK-based leading supplier of SAP coaching, Oracle coaching, Big Data & Machine Learning programs, Program... Uplatz provides comprehensive coaching on Salesforce system administration. The objective of this Salesforce training is to supply the mandatory expertise on the core co... Accelerate finance transformation with SAP S/4HANA Finance. Discover the 5 simple steps to drive quick time-to-value with this ..SAP S/4HANA Finance.

Hi Pradeep, Today I even have cleared my professional certification at present, thanks in your help and documents. You can E-mail your query to the help Email-ID which we might share with you. It would assist to resolve your question associated to your training topic. You shall be privileged to get trained from the most effective school throughout the globe which might in any other case not possible in the classroom coaching. We conduct classes on premium coaching software which provides a lot of user-friendly features.

#sap simple finance training uk#sap simple finance course uk#sap simple finance training london#sap simple finance course london

2 notes

·

View notes

Text

How to Successfully Transition Your Business to New Ownership

Transitioning a business to new ownership can be a daunting task. It's a critical process that requires careful planning and execution. Whether you're passing the reins to a family member, selling to an outside party, or merging with another company, the key is to ensure a smooth transition that maintains business continuity. This guide will help you navigate the complexities of this process.

Understanding Business Succession Planning

What is business succession planning? In simple terms, it’s the process of identifying and developing new leaders who can replace old leaders when they leave, retire, or pass away. This plan ensures that the business continues to operate smoothly without any disruptions.

Identifying the Right Successor

Choosing the right person to take over your business is crucial. Think about who has the necessary skills, experience, and vision to lead the company into the future. This could be a family member, a trusted employee, or an external candidate.

Family Members vs. External Candidates

Consider the pros and cons of each option. Family members may have a personal stake in the business, but external candidates might bring fresh perspectives and new ideas.

Valuing Your Business

Determining the value of your business is a critical step in the transition process. This involves evaluating your company's assets, earnings, market position, and future prospects. A professional appraiser can provide an objective valuation.

Methods of Valuation

Asset-Based Approach: Calculates the net asset value of the business.

Income Approach: Looks at the company’s potential to generate future income.

Market Approach: Compares the business to similar companies that have been sold recently.

Preparing Legal Documents

Legal documentation is essential to formalize the transfer of ownership. This includes drafting a buy-sell agreement, updating the business structure, and ensuring all contracts are in order.

Key Legal Documents

Buy-Sell Agreement: Outlines the terms and conditions of the sale.

Non-Disclosure Agreement (NDA): Protects sensitive information during negotiations.

Employment Contracts: For key employees to ensure continuity.

Financial Planning and Funding

Proper financial planning ensures that the new owner has the necessary funds to take over and run the business. This might include securing loans, lines of credit, or seeking investors.

Securing Funding

Bank Loans: Traditional funding option with specific repayment terms.

Private Investors: Can provide significant capital in exchange for equity.

Seller Financing: The seller finances part of the purchase price, paid back over time.

Communication with Stakeholders

Effective communication is key to a successful transition. Keep your employees, customers, suppliers, and other stakeholders informed about the changes and how it will affect them.

Transparent Communication

Employees: Reassure them about job security and future prospects.

Customers: Ensure them that the quality of products or services will remain the same.

Suppliers: Inform them about any changes in procurement or payment processes.

Training and Transitioning the New Owner

Training the new owner is essential for a smooth transition. This includes transferring knowledge about daily operations, introducing them to key contacts, and involving them in strategic planning.

Training Plan

Shadowing: New owner spends time observing current operations.

Workshops: Focused on specific aspects of the business.

Mentorship: Continuous guidance from the outgoing owner.

Maintaining Business Continuity

Maintaining continuity is crucial to avoid disruptions. Develop a plan that ensures business operations run smoothly during the transition period.

Strategies for Continuity

Temporary Management Team: A team to oversee operations during the transition.

Contingency Plans: Plans to address potential issues that could arise.

Regular Check-Ins: Frequent meetings to address any concerns.

Common Challenges and How to Overcome Them

Transitioning a business comes with its own set of challenges. Recognizing these potential hurdles can help you prepare and address them effectively.

Potential Challenges

Resistance to Change: From employees or customers.

Financial Strain: High costs associated with the transition.

Cultural Differences: Between outgoing and incoming owners.

Overcoming Challenges

Engagement: Involve all stakeholders early in the process.

Financial Planning: Detailed budgeting and securing adequate funds.

Cultural Integration: Team-building activities and open communication.

The Role of Advisors and Mentors

Advisors and mentors play a vital role in the transition process. They offer valuable insights, support, and guidance to both the outgoing and incoming owners.

Types of Advisors

Financial Advisors: Assist with valuation and funding.

Legal Advisors: Ensure all legal aspects are covered.

Business Consultants: Provide strategic advice and operational support.

Evaluating the Transition Plan

After the transition, it’s important to evaluate the process and outcomes. This helps identify areas for improvement and ensures the business is on the right track.

Evaluation Metrics

Performance Metrics: Sales, revenue, and profit margins.

Employee Feedback: Satisfaction and engagement levels.

Customer Feedback: Retention rates and satisfaction scores.

Celebrating the Transition

Finally, don’t forget to celebrate the successful transition. This is a significant milestone for your business and deserves recognition.

Celebration Ideas

Company-Wide Event: Celebrate with all employees and stakeholders.

Public Announcement: Share the news with the wider community.

Personal Recognition: Thank individuals who played a key role in the transition.

Conclusion

Transitioning your business to new ownership is a complex but rewarding process. With proper planning, effective communication, and the right support, you can ensure a smooth and successful transition. Remember, the key is to start early, be transparent, and stay focused on the future success of your business.

0 notes

Text

Navigating the Valuation Process: Understanding Commercial Real Estate Appraisal Services

commercial real estate appraisal servicesIntroduce the significance of commercial real estate appraisal services in determining the market value of commercial properties.Highlight the importance of accurate appraisals for various purposes, including financing, sales, acquisitions, and property tax assessments.

The Role of Commercial Real Estate Appraisal: commercial real estate appraisal services

Define commercial real estate appraisal as the process of determining the fair market value of commercial properties based on various factors. Discuss the primary objectives of commercial appraisals, including providing unbiased opinions of value and supporting informed decision-making.

Types of Commercial Properties Appraised: commercial real estate appraisal services

Explore the diverse range of commercial properties that may require appraisal services, including office buildings, retail centers, industrial warehouses, multi-family apartment complexes, and special-purpose properties.Discuss the unique considerations and methodologies involved in appraising different types of commercial properties.

Factors Influencing Property Value: commercial real estate appraisal services

Outline the key factors that influence the value of commercial real estate, such as location, size, condition, rental income, occupancy rates, comparable sales, and market trends.Discuss how appraisers analyze these factors to arrive at an accurate valuation.

Appraisal Process Overview: commercial real estate appraisal services

Provide an overview of the commercial real estate appraisal process, including data collection, property inspection, market analysis, valuation methods, and report generation.Discuss the importance of thorough due diligence and compliance with industry standards and regulations.

Purpose of Appraisal Services: commercial real estate appraisal services

Discuss the various purposes for which commercial real estate appraisals are conducted, including financing, investment analysis, property tax assessment, litigation support, estate planning, and feasibility studies.Highlight the importance of selecting appraisers with expertise in the specific purpose of the appraisal.

Importance of Accredited Appraisers: commercial real estate appraisal services

Emphasize the importance of hiring accredited and certified appraisers with recognized credentials, such as those designated by the Appraisal Institute (AI) or other professional appraisal organizations.Discuss the rigorous education, training, and ethical standards required for accreditation.

Appraisal Report and Documentation: commercial real estate appraisal services

Explain the components of a typical commercial real estate appraisal report, including property descriptions, valuation methods, comparable sales data, market analysis, and the appraiser’s conclusions and recommendations.Discuss the importance of clear and concise documentation to support the appraisal’s findings.

Choosing Appraisal Services: commercial real estate appraisal services

Provide guidance on selecting reputable commercial real estate appraisal services, including researching credentials, reviewing past work, and obtaining multiple quotes.Emphasize the importance of transparency, communication, and collaboration throughout the appraisal process.

Conclusion: commercial real estate appraisal services

Summarize the role of commercial real estate appraisal services in determining property value and supporting informed decision-making.Encourage property owners, investors, lenders, and other stakeholders to prioritize accurate and reliable appraisals to mitigate risks and maximize opportunities in the commercial real estate market.

0 notes

Text

Creative Business School's Founder Akshay Varma: The Surge of Tech Stocks in the Current Market Landscape

The Surge of Tech Stocks in the Current Market Landscape

Creative Business School's founder Akshay Varma believes that the current state of the U.S. stock market provides a significant opportunity for investors to reassess their portfolios, particularly with an eye on technology and cyclical stocks. Varma asserts that understanding the underlying trends and financial conditions is crucial for making informed investment decisions.

Creative Business School, established in 2023, is a premier training academy in India dedicated to financial traders and entrepreneurs. The institution offers comprehensive courses in investing, finance, and market analysis, catering to investors and entrepreneurs at various stages. Their curriculum spans multiple specialized areas, including stock trading, venture capital, blockchain, and business model analysis.

The Importance of Trend Analysis and Quantitative Trading

Creative Business School's founder Akshay Varma emphasizes the importance of trend analysis in stock trading. He explains that trend analysis is a crucial aspect of technical analysis, which determines the overall direction of a security. Once a trend is established, stock prices tend to follow the trend's direction. "Following the trend is essential," says Varma, highlighting that it allows investors to capitalize on market movements.

In addition to trend analysis, Varma advocates for quantitative trading. He points out that most market participants make decisions based on subjective judgment without relying on data. This gives quantitative trading a significant edge. "The key to quantitative trading is not just creating a good strategy on a particular day, but the ability to consistently develop new strategies over a long period," says Varma.

Analysis of the Current Market Situation

According to Creative Business School's founder Akshay Varma, the U.S. stock market has experienced notable shifts since the beginning of the year. The market has seen a rotation from growth stocks outperforming to a simultaneous rise in cyclical growth and growth stocks, and back to growth stocks regaining momentum. This prompts the question: should investors return to technology stocks or continue focusing on cyclical stocks?

Varma explains that technology stocks have strong earnings support and are not solely reliant on valuations. However, the earnings improvement in cyclical sectors is limited and based more on expectations of future macroeconomic cycles. The key to determining the balance between growth and cyclical stocks lies in the financial conditions and whether they can ease. At present, the market has limited room for growth; short-term leadership in technology stocks persists, while cyclical stocks have not yet begun a significant recovery trend.

The Role of AI in Supporting Tech Stocks

Akshay Varma highlights that the support for tech stocks comes from the demand for AI, which boosts earnings and investment. Ample cash flow has increased buyback scales, further supporting tech stocks. In contrast, cyclical stocks are driven by expectations rather than actual earnings, especially in the current inflationary environment where financial conditions still constrain their recovery potential.

Sectoral Performance and Financial Conditions

Varma notes that the first quarter of the year witnessed a clear rotation in global assets, driven primarily by the financial conditions in the U.S. This rotation was evident in the tech sector, which saw robust performance due to strong earnings, particularly from companies like Nvidia and Microsoft. These tech giants benefited significantly from the AI industry trend, contributing to the overall market performance.

On the other hand, cyclical sectors such as energy, industrials, and materials showed mixed results. While these sectors benefited from a broader economic recovery, their performance was primarily driven by valuation expansions rather than substantial earnings improvements. Varma points out that financial conditions and their reflexivity will continue to play a critical role in determining the recovery pace of cyclical stocks.

Investment Strategies Moving Forward

Creative Business School's founder Akshay Varma advises investors to closely monitor financial conditions and the broader economic environment. He suggests that a balanced approach, with a focus on both technology and cyclical stocks, could be beneficial. However, the emphasis should be on companies with strong earnings potential and robust cash flows.

Varma emphasizes the need for caution in the current market environment, noting that while tech stocks may offer short-term gains due to their strong earnings and buyback capabilities, cyclical stocks require more time for their earnings to catch up with valuations. He advises investors to remain vigilant and adjust their portfolios in response to changing financial conditions and market dynamics.

Conclusion

In conclusion, Creative Business School's founder Akshay Varma provides a nuanced perspective on the current state of the U.S. stock market. He underscores the importance of trend analysis, quantitative trading, and a balanced investment strategy that considers both technology and cyclical stocks. By understanding the underlying financial conditions and market trends, investors can make informed decisions and navigate the complexities of the stock market more effectively.

0 notes

Text

Beparr: Empowering Small and Medium Businesses Across India

Beparr, a pioneering B2B platform based in Surat, Gujarat, has rapidly emerged as a transformative force in the landscape of small and medium businesses (SMBs) in India. Founded by Akash Dubey and co-led by Neha Shukla, Beparr is dedicated to addressing the unique challenges faced by SMBs, providing them with the tools and resources they need to thrive in a competitive market.

The Vision Behind Beparr

The inception of Beparr stemmed from a deep understanding of the struggles faced by small and medium-sized enterprises in India. Akash Dubey, hailing from a background of financial hardship, witnessed firsthand the hurdles that businesses face in terms of resource limitations and lack of connectivity. With a vision to empower these businesses, Akash, along with Neha Shukla, set out to create a platform that would bridge the gap between small retailers and the larger business ecosystem.

What Beparr Offers

Beparr offers a comprehensive suite of services designed to streamline business operations and enhance market reach. Key features of the platform include:

Market Connectivity: Beparr connects retailers with a vast network of suppliers, enabling them to source products more efficiently and at competitive prices. This connectivity helps reduce supply chain disruptions and ensures a steady flow of goods.

Digital Tools: The platform provides a range of digital tools that help businesses manage their inventory, track sales, and analyze market trends. These tools are designed to be user-friendly, making it easy for even the most technologically inexperienced users to harness their benefits.

Financial Services: Recognizing that access to finance is a critical issue for many SMBs, Beparr offers financial solutions such as microloans and credit facilities. These services help businesses manage their cash flow and invest in growth opportunities.

Educational Resources: Beparr is committed to the continuous growth and development of its users. The platform offers educational resources, including webinars and training sessions, to help business owners enhance their skills and knowledge.

Impact and Growth

Since its launch, Beparr has seen remarkable growth and adoption. The platform currently serves over 400,000 retailers across India, making it one of the most widely used B2B platforms in the country. The success of Beparr can be attributed to its user-centric approach and the dedication of its founders.

Under the leadership of Akash Dubey and Neha Shukla, Beparr has not only achieved significant milestones in terms of user base and revenue but has also garnered a valuation exceeding $4 million. This impressive growth is a testament to the platform's effectiveness in addressing the needs of small and medium businesses.

The Future of Beparr

Looking ahead, Beparr aims to expand its services and reach even more businesses across the country. The platform plans to introduce new features that will further enhance the user experience and provide additional support to businesses in their growth journey.

Beparr is also exploring opportunities to expand internationally, bringing its successful model to other emerging markets. By continuing to innovate and adapt to the changing needs of its users, Beparr is poised to remain at the forefront of the B2B sector.

Download the Beparr App Today!

If you are a retailer or a business owner in the clothing industry or any other sector, Beparr is your go-to platform for growth and success. Join the thriving community of over 400,000 retailers who are leveraging Beparr to enhance their operations and expand their market reach. Download the Beparr app today from the Google Play Store and start your journey towards business excellence.

For more information, visit our website.

Join the revolution with Beparr and take your business to new heights! #Beparr #BusinessGrowth #B2BPlatform #SmallBusiness #RetailSuccess #KurtiWholesaleAhmedabad #SareeWholesaleSurat #EmpowerSMBs #BusinessTools #MarketConnectivity

1 note

·

View note

Text

How to Select Course in Option Trading and Equity Research?

With the immensely sophisticated technologies of today, trade has taken center stage in every civilization. As a result, interest in options trading and equities research is rising. So, how do I select the Equity research course in Delhi? Come study with me.

What is Equity Research?

Equity research specialists are responsible for creating recommendations, analysis, and reports on investment prospects that investment banks, institutions, or their clients may find intriguing. The Equity Research Division is a group of analysts and associates who work for an institution, an independent organization, or an investment banking firm.

The main objective of equity research is to give investors comprehensive financial analysis and recommendations on whether to buy, hold, or sell a particular investment. In order to "support" their clients in sales, trading, and investment banking by providing them with quick access to reliable information and analysis, banks commonly use equities research.

How Are Options Traded?

An option is a written contract from the seller that, in the case of a call option, gives the buyer the right—but not the obligation—to purchase or sell, at a future predetermined price (also known as the striking price or exercise price) a specific asset.

In exchange for offering the choice, the seller receives payment from the buyer (sometimes known as a premium).

How Can I Choose the Best Option Trading Course in Delhi?

When choosing an option trading course in Delhi, there are several considerations to weigh. You may now access some of the best option trading courses offered in India thanks to social media networks. Not everyone, though, is to your liking. Let's talk about the key characteristics that beginners should search for.

Extensive Curriculum: A comprehensive education in options trading in India will cover a wide range of topics, such as spread making, complex techniques, risk management, time concepts, and the fundamentals of options.

A well-balanced curriculum should give more advanced principles to experienced traders while still offering a strong basis for novices.

Expert Teachers: Seek out courses given by experts who have a history of success in the options trading industry. Because they have firsthand market expertise, instructors with real-world trading skills may provide enlightening guidance, practical tips, and direction.

Captivating Instruction: Choose from the best options trading schools in India that offer interactive learning resources, live trading demonstrations, case studies, and simulations. Gaining real-world experience can help students grasp concepts more fully and improve their comprehension, enabling them to use what they've learned in real-world trading situations.

Tools and Resource Accessibility: The finest options trading courses provide its students with trading platforms, research materials, analytical tools, and trading communities.

Delhi's Finest Course for Equity Research

One of top 10 stock market training institutions in Delhi is Stock Vidyapeeth. The course facilitates understanding different corporation valuation approaches. By completing this module, you can improve your chances of getting hired in the corporate finance sector and help your company or one of your investors make smarter investment decisions. It also acts as a manual for writing and evaluating the equity research report.

Original Source: https://penzu.com/p/99d63f00de3f25f5

#Online Stock Market Courses in delhi#equity research course in delhi#option trading course in delhi#share market classes in delhi#technical analysis training in delhi#best online stock trading courses for beginners#best stock market courses in delhi#stock market course for job#live classes for stock market#best stock market courses online in delhi#top 10 stock market training institutes in delhi

0 notes

Text

#Aswath Damodaran#Business Valuation Training#Corporate Finance Training#Startup Valuation#Mergers and Acquisitions courses#Mergers and Acquisitions Training#Best finance courses#Negotiation training

1 note

·

View note

Text

Discover the Best Finance Courses in Hyderabad at Smart Steps Training Academy

In today's dynamic financial landscape, staying ahead requires a solid foundation in finance and the skills to navigate complex financial markets. Whether you’re an aspiring finance professional or looking to enhance your current skills, Smart Steps Training Academy in Hyderabad offers a comprehensive suite of finance courses in Hyderabad tailored to meet your needs.

Why Choose Smart Steps Training Academy?

Industry-Relevant Curriculum:

Smart Steps Training Academy ensures that its courses are aligned with current industry standards and practices. Our curriculum is designed by experts who bring a wealth of experience from various sectors of finance. This means you’ll learn the latest techniques and tools used by professionals in the field.

Experienced Instructors:

Our instructors are seasoned professionals with extensive backgrounds in finance. They bring practical insights and real-world knowledge to the classroom, bridging the gap between theory and practice. Their expertise will provide you with a deep understanding of complex financial concepts and how they apply in real-world scenarios.

Hands-On Learning:

At Smart Steps, we believe in learning by doing. Our courses are designed to provide ample opportunities for practical application of the concepts learned. Through case studies, simulations, and projects, you’ll gain hands-on experience that prepares you for the challenges of the finance industry.

Flexible Learning Options:

Understanding the varied needs of our students, we offer flexible learning options. Whether you prefer in-person classes, live online sessions, or self-paced learning, we have a solution that fits your schedule and learning style.

Career Support:

Our commitment to your success doesn’t end with the course completion. We offer robust career support services, including resume building, interview preparation, and job placement assistance. Our network of industry contacts and alumni can open doors to exciting career opportunities.

Our Top Finance Courses

Certified Financial Analyst (CFA) Preparation Course:

The CFA designation is one of the most respected and recognized investment management certifications globally. Our CFA preparation course is designed to help you pass all three levels of the CFA exams. You’ll receive comprehensive study materials, practice exams, and guidance from CFA charter holders.

Financial Modeling and Valuation:

This course covers the essentials of financial modeling and valuation, key skills for anyone working in finance. You’ll learn how to build robust financial models from scratch, conduct valuations using different methods, and make informed financial decisions based on your analyses.

Corporate Finance:

Our Corporate Finance course delves into the principles of corporate financial management. Topics include capital budgeting, cost of capital, capital structure, and working capital management. This course is ideal for those looking to enhance their strategic decision-making skills.

Investment Banking:

Learn the intricacies of investment banking with our comprehensive course. Covering areas such as mergers and acquisitions, IPOs, and private equity, this course prepares you for a career in one of the most lucrative fields in finance.

Risk Management:

Understand the various types of financial risks and how to manage them effectively. This course covers market risk, credit risk, operational risk, and regulatory frameworks. You’ll learn how to use risk management tools and techniques to protect your organization from potential financial losses.

Enroll Today!

Join the ranks of successful finance professionals who have benefitted from our expert training. With our industry-relevant courses, experienced instructors, and comprehensive career support, Smart Steps Training Academy is your partner in achieving your finance career goals.

0 notes

Text

Navigating the New Scheme for Education and Training in CA Final Course

It's important to stay updated with resources and educational programs in the continuously changing rule of chartered accountancy (CA). The updated syllabus brought forth by the New Scheme for Education and Training aims to equip aspiring chartered accountants for the evolving demands of the business. In this blog post, we'll go over the key components of the new strategy, discuss recommended reading lists, and provide tips on how to perform well on the CA Entrance Exam.

Understanding the New Scheme for Education and Training

The New Scheme for Education and Training in CA represents a strategic shift towards a more practical and application-oriented approach. It emphasizes real-world scenarios, case studies, and hands-on learning to prepare candidates for the complexities of modern accounting and finance practices. The scheme comprises three levels: Foundation, Intermediate, and Final.

Navigating the CA Entrance Exam Successfully

The CA Entrance Exam serves as the gateway to the profession, assessing candidates' aptitude and readiness to pursue the CA course. Here are some tips for navigating the entrance exam successfully:

Understand the Exam Pattern: Familiarize yourself with the format and structure of the entrance exam, including the number of questions, duration, and marking scheme.

Create a Study Plan: Develop a structured study plan that allocates sufficient time for each subject. Prioritize areas of weakness while ensuring comprehensive coverage of all topics.

Practice Regularly: Regular practice is key to mastering the concepts tested in the entrance exam. Solve sample papers, attempt mock tests, and utilize CA Entrance Exam books to enhance your preparation.

Seek Guidance: Don't hesitate to seek guidance from experienced mentors, tutors, or fellow aspirants. Joining a coaching institute or online study group can provide valuable insights and support.

Stay Updated: Stay informed about any modifications or revisions to the ICAI's syllabus or test design. For the most recent information, subscribe to relevant publications or internet forums for discussion.

Latest Updates on ICAI New Scheme

The Institute of Chartered Accountants of India (ICAI) has released the updated syllabus for the CA Final course, applicable from May 2024. This new syllabus, under the new scheme of education and training, aims to better equip aspiring Chartered Accountants with the skills and knowledge needed in the dynamic field of accounting and finance.

Overview of the New CA Final Syllabus

The updated syllabus for the CA Final course consists of six papers, streamlined from the previous eight. This change aims to focus on core areas and eliminate redundancy. Each paper is designed to cover a comprehensive range of topics essential for the professional competence of future CAs.

Group I

Paper1:FinancialReporting

Focuses on Indian Accounting Standards (Ind AS), group financial statements, and financial instruments.

Key topics include Business Combinations, Consolidation, and Ind AS specific requirements.

Paper2:Advanced Financial Management

Covers strategic financial management, risk management, security valuation, and portfolio management.

Includes topics like derivatives, foreign exchange exposure, and mergers and acquisitions.

Paper3:Advanced Auditing and Professional Ethics

Deals with comprehensive direct tax laws including recent amendments and international taxation principles.

Topics include transfer pricing, BEPS, tax treaties, and taxation of digital transactions.

Group II

Paper4:Direct Tax Laws & International Taxation

Deals with comprehensive direct tax laws including recent amendments and international taxation principles.

Topics include transfer pricing, BEPS, tax treaties, and taxation of digital transactions.

Paper5:Indirect Tax Laws

Focuses on GST and Customs Law.

Key areas include supply, charge of GST, input tax credit, and procedures for import and export under GST.

Paper6:Integrated Business Solutions

A multi-disciplinary case study paper that includes strategic management and business solutions.

This paper requires the application of knowledge from all other subjects in practical scenarios.

Recommended Study Materials for CA Final Exam

Preparing for the CA Final examination requires access to high-quality study materials that cover the entire syllabus comprehensively. Here are some recommended resources

CA Final Books: A curated selection of textbooks authored by renowned experts in the field. These books provide in-depth coverage of each subject and serve as essential reference materials for exam preparation.

Scanner CA Final Books: Scanners are invaluable tools for CA aspirants, offering a collection of past exam questions categorized topic-wise. Practicing with scanners helps candidates familiarize themselves with the exam pattern and refine their problem-solving skills.

Study Material for CA Final Books: The Institute of Chartered Accountants of India (ICAI) provides official study materials for CA Final aspirants. These materials are meticulously crafted to align with the exam syllabus and often include case studies, illustrations, and practice questions to aid comprehension.

CA Entrance Exam Books: For candidates preparing for the CA entrance exam, a comprehensive guidebook covering mathematics, logical reasoning, and General Awareness is essential. These books help build a strong foundation in the subjects tested, ensuring thorough preparation and enhancing the chances of success in the exam.

Conclusion

The New Scheme for Education and Training in CA provides a modern way to prepare future Chartered Accountants for their professional challenges. By using the recommended study materials and effective study strategies, students can confidently and ability to navigate their CA journey. With hard work and dedication to success in the CA Entrance Exam and beyond is achievable.

#ca entrance exam#scanner for ca intermediate books#books for ca exam#ca entrance exam books#study material for ca#ca intermediate books#ca foundation books#ca final books

0 notes

Text

Monetary Displaying Administrations: A Comprehensive Guide

In today's fast-paced and complex business environment financial modelling services in hyderabad, it is essential for any organization's success and sustainability to make well-informed financial modelling service provider in Hyderabad decisions. Businesses now rely on financial modeling services to help them forecast future financial performance, assess project viability, and make strategic decisions. This article examines the significance, applications, and essential components of effective financial models of financial modeling services.

What are Monetary Demonstrating Administrations?

The creation of abstract representations (models) of a financial situation is a component of financial modeling services. These models financial modelling services for startups in hyderabad are utilized to re-enact the monetary presentation of a business, task, or speculation under different situations.

Significance of Monetary Displaying Administrations

Informed Navigation: A data-driven foundation for making strategic decisions is provided by financial models. They help in assessing the monetary financial modeling companies in hyderabad ramifications of different business techniques and functional changes.

Management of risk: By mimicking various situations, monetary models empower organizations to distinguish likely dangers and devise systems to alleviate them.

Analyses of Investing: For financial backers and financial modelling consulting services in hyderabad partners, monetary models offer bits of knowledge into the likely returns and dangers related with various venture open doors.

Planning and Anticipating: Monetary demonstrating help outsourced financial modeling services in hyderabad. organizations in making point by point spending plans and figures, guaranteeing they are ready for future monetary circumstances.

Key Uses of Monetary Displaying Administrations

Corporate Money: Monetary models are utilized to assess financial modeling consultant in hyderabad organization execution, plan capital design, and survey the monetary effect of key drives like consolidations and acquisitions.

Finance for Projects: These models aid in determining the viability of large projects, particularly those in the energy, real estate, and infrastructure industries.

Securities Trading: Monetary models are essential for value research, Initial public offering estimating, and portfolio the board.

Confidential Value and Investment: They help in assessing new businesses financial modeling consulting firms in hyderabad and development stage organizations, assisting financial backers with settling on informed venture choices.

Real property: Models aid property valuation, income investigation, and speculation achievability studies.

Parts of a Hearty Monetary Model

Input Information: The groundwork of any monetary model is precise and complete information, including authentic fiscal reports, market investigation, and financial pointers.

Assumptions: It's critical to make assumptions about future conditions like interest rates, cost inflation, and revenue growth rates. These ought to be based on premises that are both plausible and plausible.

Analysis of Scenarios: To comprehend the effect of various factors, models ought to incorporate different situations (best case, assuming the worst possible scenario, and base case). Stress testing the financial outcomes is made easier by this.

Methods of Valuation: Methods like Limited Income (DCF), Practically identical Organization Investigation (CCA), and point of reference exchanges are frequently consolidated to gauge the worth of the business or task.

Innovation and Apparatuses: To guarantee accuracy and effectiveness, the provider ought to make use of cutting-edge modeling software and tools.

Backing and Preparing: Your team can make the most of the financial model and modify it as needed over time with ongoing support and training.

End

Monetary displaying administrations are vital for organizations expecting to explore the intricacies of monetary preparation and navigation. By giving an organized and information driven approach, these models engage associations to go with informed choices, oversee gambles, and accomplish their monetary targets. Whether for corporate money, speculation examination, or undertaking assessment, powerful monetary models are a foundation of fruitful monetary system.

0 notes

Text

Navigating Business Sales: Expert Tips for Entrepreneurs

Selling a business can be a daunting task, especially for entrepreneurs who have invested significant time and resources into building their venture. Whether you're planning to retire, move on to a new project, or simply capitalize on your investment, understanding the ins and outs of selling a business is crucial. This guide will walk you through the process of how to sell a business in Canada, offering expert tips and practical advice to ensure a smooth and successful transaction.

Introduction

Selling a business isn't just about putting a "For Sale" sign up and waiting for offers. It's a complex process that requires careful planning, strategic decision-making, and a clear understanding of the market. In this article, we'll break down the steps involved in selling a business in Canada, providing you with expert insights to help you navigate the process effectively.

Understanding Your Business Value

Before you can sell your business, you need to know what it's worth. This involves more than just looking at your balance sheet. Consider factors like market trends, your business's unique selling points, and potential for future growth. Hiring a professional appraiser can provide an objective valuation and help set a realistic asking price.

Factors Influencing Business Valuation

Market Conditions: Economic climate and industry trends can significantly impact your business's value.

Financial Performance: Consistent revenue and profit margins are attractive to buyers.

Assets and Liabilities: A thorough audit of your business’s financial health is essential.

Brand and Reputation: Strong brand recognition and a positive reputation can increase value.

Preparing Your Business for Sale

Preparation is key to a successful sale. Think of it like staging a home: the better presented it is, the more appealing it will be to potential buyers.

Organize Financial Records

Ensure your financial statements are up-to-date, accurate, and detailed. Potential buyers will scrutinize these documents to assess the viability of your business.

Streamline Operations

Demonstrate that your business can run smoothly without you. This might involve creating manuals for procedures, training staff, or even appointing a temporary manager.

Enhance Curb Appeal

Just like selling a house, first impressions matter. Invest in minor improvements and ensure your business premises are clean and well-maintained.

Finding the Right Buyer

Not all buyers are created equal. Finding the right buyer involves more than just accepting the highest offer. You want someone who shares your vision and has the resources to continue your business’s success.

Types of Buyers

Strategic Buyers: Often from the same industry, looking to expand their operations.

Financial Buyers: Interested in the potential return on investment.

Individual Buyers: Entrepreneurs or investors looking to own and operate a business.

Marketing Your Business

Create a compelling business listing highlighting your business’s strengths. Use multiple channels, including online business marketplaces, industry networks, and business brokers.

Negotiating the Sale

Negotiation is where the art of the deal comes into play. It’s crucial to remain flexible yet firm on your key terms.

Key Negotiation Points

Price: Be prepared to justify your asking price with solid data.

Payment Terms: Decide whether you’ll accept all cash, seller financing, or earn-outs.

Transition Period: How long will you remain involved post-sale to ensure a smooth transition?

Tips for Successful Negotiation

Be Prepared: Know your minimum acceptable terms.

Stay Professional: Keep emotions in check and focus on business.

Consult Experts: Engage lawyers and accountants to ensure all legal and financial aspects are covered.

Legal Considerations

Selling a business involves numerous legalities. From drafting the sale agreement to transferring licenses and permits, legal oversight is essential.

Drafting the Sales Agreement

Ensure the sales agreement covers all critical aspects, including price, terms of payment, and transition arrangements. This document protects both parties and minimizes future disputes.

Due Diligence

Buyers will conduct a thorough examination of your business. Be transparent and provide all requested documents promptly.

Closing the Deal

The final stage involves signing the agreement, transferring ownership, and receiving payment. Ensure all paperwork is complete and all conditions met.

Checklist for Closing

Finalise Agreements: Confirm that all contracts and agreements are in place.

Transfer Assets: Ensure the transfer of assets, including physical and intellectual property.

Notify Stakeholders: Inform employees, customers, and suppliers about the change in ownership.

Post-Sale Transition

A smooth transition is vital for maintaining business continuity. Agree on a handover period where you’ll be available to guide the new owner.

Transition Plan

Training: Offer training sessions for the new owner and key employees.

Customer Relations: Introduce the new owner to major clients and suppliers.

Operational Handover: Ensure the new owner understands daily operations.

Common Mistakes to Avoid

Avoiding common pitfalls can save you time, money, and stress.

Overpricing the Business

Setting an unrealistic price can deter serious buyers. Ensure your valuation is based on comprehensive data.

Neglecting Due Diligence

Failure to provide complete and accurate information can lead to delays or failed negotiations.

Ignoring Tax Implications

Consult a tax advisor to understand the tax consequences of the sale. Proper planning can help minimize your tax burden.

Conclusion

Selling your business in Canada requires careful planning, thorough preparation, and strategic execution. By understanding your business’s value, preparing meticulously, and navigating the sales process with care, you can achieve a successful and profitable sale. Remember, the right buyer is out there, and with the right approach, you can find them and close the deal with confidence.

0 notes