#Financial API Gateway

Explore tagged Tumblr posts

Text

#SMS Marketing for Banking and Financial Services#sms gateway#bulk sms provider#sms marketing#bulk sms service provider#sms api

0 notes

Text

What Are the Key Factors to Consider When Choosing a Payment Solution Provider?

The rapid growth of digital transactions has made choosing the right payment solution provider a crucial decision for businesses. Whether you operate an e-commerce store, a subscription-based service, or a financial institution, selecting the right provider ensures secure and efficient payment processing. With the increasing demand for fintech payment solutions, businesses must evaluate providers based on security, compatibility, scalability, and cost-effectiveness.

1. Security and Compliance

Security is the top priority when selecting a payment solution provider. Since financial transactions involve sensitive customer data, businesses must ensure that their provider follows strict security protocols. Look for providers that comply with PCI DSS (Payment Card Industry Data Security Standard) and offer encryption, tokenization, and fraud prevention measures.

A reputable provider should also offer real-time fraud detection and risk management tools to safeguard transactions. Compliance with regional regulations such as GDPR, CCPA, or PSD2 is also crucial for businesses operating in multiple locations.

2. Integration and Compatibility

Seamless Payment gateway integration is essential for a smooth transaction experience. Businesses should assess whether the provider’s APIs and SDKs are compatible with their existing platforms, including websites, mobile apps, and POS systems. A well-documented API enables easy customization and enhances the overall customer experience.

Additionally, businesses should consider whether the provider supports multiple payment methods such as credit cards, digital wallets, cryptocurrencies, and bank transfers. The ability to integrate with accounting, CRM, and ERP software is also beneficial for streamlining financial operations.

3. Cost and Pricing Structure

Understanding the pricing structure of payment solution providers is crucial for managing operational costs. Different providers offer various pricing models, including:

Flat-rate pricing – A fixed percentage per transaction

Interchange-plus pricing – A combination of network fees and provider markup

Subscription-based pricing – A fixed monthly fee with lower transaction costs

Businesses should evaluate setup fees, transaction fees, chargeback fees, and any hidden costs that may impact profitability. Opting for a transparent pricing model ensures cost-effectiveness in the long run.

4. Scalability and Performance

As businesses grow, their payment processing needs will evolve. Choosing a provider that offers scalable fintech payment solutions ensures seamless expansion into new markets and accommodates higher transaction volumes without downtime or slow processing speeds.

Look for providers with a robust infrastructure that supports high uptime, fast transaction processing, and minimal payment failures. Cloud-based payment solutions often offer better scalability and reliability for growing businesses.

5. Customer Support and Service Reliability

Reliable customer support is essential when dealing with financial transactions. Payment-related issues can result in revenue loss and customer dissatisfaction. Businesses should opt for providers that offer 24/7 customer support via multiple channels such as phone, email, and live chat.

Additionally, a provider with dedicated account management services can offer personalized solutions and proactive issue resolution, ensuring minimal disruptions to business operations.

6. Multi-Currency and Global Payment Support

For businesses targeting international markets, multi-currency support is a key consideration. The ability to accept payments in different currencies and offer localized payment methods enhances customer satisfaction and expands the business’s global reach.

Providers that support cross-border transactions with competitive exchange rates and minimal conversion fees are ideal for businesses operating in multiple countries.

7. Fintech Payment System Compatibility

A modern fintech payment system should be adaptable to emerging financial technologies. Businesses should evaluate whether the provider supports innovations like blockchain payments, real-time payment processing, and artificial intelligence-driven fraud prevention.

The ability to integrate with open banking solutions and provide seamless transaction experiences across various fintech ecosystems is becoming increasingly important in the digital payment landscape.

8. Reputation and Industry Experience

The credibility of a payment solution provider is another critical factor. Researching customer reviews, case studies, and testimonials can provide insights into the provider’s reliability and performance.

Established providers with years of experience and partnerships with reputable financial institutions are more likely to offer stable and secure payment processing services. Collaborations with fintech leaders, such as Xettle Technologies, demonstrate a provider’s commitment to innovation and excellence in payment solutions.

Conclusion

Choosing the right payment solution provider requires careful consideration of security, integration, pricing, scalability, customer support, and industry experience. Businesses must align their choice with long-term growth objectives and ensure that the provider offers secure, seamless, and cost-effective fintech payment solutions.

With the rise of digital transactions, businesses that invest in a robust fintech payment system with seamless payment gateway integration will gain a competitive edge and enhance customer trust. By partnering with reputable payment solution providers, businesses can ensure secure and efficient transaction experiences for their customers while maximizing operational efficiency.

3 notes

·

View notes

Text

Which Payment Gateways Are Compatible for Dynamic Websites - A Comprehensive Guide by Sohojware

The digital landscape is constantly evolving, and for businesses with dynamic websites, staying ahead of the curve is crucial. A dynamic website is one that generates content on the fly based on user input or other factors. This can include things like e-commerce stores with shopping carts, membership sites with customized content, or even online appointment booking systems.

For these dynamic websites, choosing the right payment gateway is essential. A payment gateway acts as a secure bridge between your website and the financial institutions that process payments. It ensures a smooth and safe transaction experience for both you and your customers. But with a plethora of payment gateways available, selecting the most compatible one for your dynamic website can be overwhelming.

This comprehensive guide by Sohojware, a leading web development company, will equip you with the knowledge to make an informed decision. We’ll delve into the factors to consider when choosing a payment gateway for your dynamic website, explore popular options compatible with dynamic sites, and address frequently asked questions.

Factors to Consider When Choosing a Payment Gateway for Dynamic Websites

When selecting a payment gateway for your dynamic website in the United States, consider these key factors:

Security: This is paramount. The payment gateway should adhere to stringent security protocols like PCI DSS compliance to safeguard sensitive customer information. Sohojware prioritizes security in all its development projects, and a secure payment gateway is a non-negotiable aspect.

Transaction Fees: Payment gateways typically charge transaction fees, which can vary depending on the service provider and the type of transaction. Be sure to compare fees associated with different gateways before making your choice.

Recurring Billing Support: If your website offers subscriptions or memberships, ensure the payment gateway supports recurring billing functionalities. This allows for automatic and convenient payment collection for your recurring services.

Payment Methods Supported: Offer a variety of payment methods that your target audience in the US is accustomed to using. This may include credit cards, debit cards, popular e-wallets like PayPal or Apple Pay, and potentially even ACH bank transfers.

Integration Complexity: The ease of integrating the payment gateway with your dynamic website is crucial. Look for gateways that offer user-friendly APIs and clear documentation to simplify the integration process.

Customer Support: Reliable customer support is vital in case you encounter any issues with the payment gateway. Opt for a provider with responsive and knowledgeable customer service representatives.

Popular Payment Gateways Compatible with Dynamic Websites

Here’s a glimpse into some of the most popular payment gateways compatible with dynamic website:

Stripe: A popular and versatile option, Stripe offers a robust suite of features for dynamic websites, including recurring billing support, a user-friendly developer interface, and integrations with various shopping carts and platforms.

PayPal: A widely recognized brand, PayPal allows customers to pay using their existing PayPal accounts, offering a familiar and convenient checkout experience. Sohojware can integrate PayPal seamlessly into your dynamic website.

Authorize.Net: A secure and reliable gateway, Authorize.Net provides a comprehensive solution for e-commerce businesses. It supports various payment methods, recurring billing, and integrates with popular shopping carts.

Braintree: Owned by PayPal, Braintree is another popular choice for dynamic websites. It offers a user-friendly API and integrates well with mobile wallets and other popular payment solutions.

2Checkout (2CO): A global payment gateway solution, 2Checkout caters to businesses of all sizes. It offers fraud prevention tools, subscription management features, and support for multiple currencies.

Sohojware: Your Trusted Partner for Dynamic Website Development and Payment Gateway Integration

Sohojware possesses extensive experience in developing dynamic websites and integrating them with various payment gateways. Our team of skilled developers can help you choose the most suitable payment gateway for your specific needs and ensure a seamless integration process. We prioritize user experience and security, ensuring your customers have a smooth and secure checkout experience.

1. What are the additional costs associated with using a payment gateway?

Besides transaction fees, some payment gateways may charge monthly subscription fees or setup costs. Sohojware can help you navigate these costs and choose a gateway that fits your budget.

2. How can Sohojware ensure the security of my payment gateway integration?

Sohojware follows best practices for secure development and adheres to industry standards when integrating payment gateways. We stay updated on the latest security protocols to safeguard your customer’s financial information.

3. Does Sohojware offer support after the payment gateway is integrated?

Yes, Sohojware provides ongoing support to ensure your payment gateway functions smoothly. Our team can address any issues that arise, troubleshoot problems, and provide updates on the latest payment gateway trends.

4. Can Sohojware help me choose the best payment gateway for my specific business needs?

Absolutely! Sohojware’s experts can assess your business requirements, analyze your target audience, and recommend the most suitable payment gateway based on factors like transaction volume, industry regulations, and preferred payment methods.

5. How long does it typically take to integrate a payment gateway with a dynamic website?

The integration timeline can vary depending on the complexity of the website and the chosen payment gateway. However, Sohojware’s experienced team strives to complete the integration process efficiently while maintaining high-quality standards.

Conclusion

Choosing the right payment gateway for your dynamic website is crucial for ensuring a seamless and secure online transaction experience. By considering factors like security, fees, supported payment methods, and integration complexity, you can select a gateway that aligns with your business needs. Sohojware, with its expertise in web development and payment gateway integration, can be your trusted partner in this process. Contact us today to discuss your requirements and get started on your dynamic website project.

2 notes

·

View notes

Text

What Web Development Companies Do Differently for Fintech Clients

In the world of financial technology (fintech), innovation moves fast—but so do regulations, user expectations, and cyber threats. Building a fintech platform isn’t like building a regular business website. It requires a deeper understanding of compliance, performance, security, and user trust.

A professional Web Development Company that works with fintech clients follows a very different approach—tailoring everything from architecture to front-end design to meet the demands of the financial sector. So, what exactly do these companies do differently when working with fintech businesses?

Let’s break it down.

1. They Prioritize Security at Every Layer

Fintech platforms handle sensitive financial data—bank account details, personal identification, transaction histories, and more. A single breach can lead to massive financial and reputational damage.

That’s why development companies implement robust, multi-layered security from the ground up:

End-to-end encryption (both in transit and at rest)

Secure authentication (MFA, biometrics, or SSO)

Role-based access control (RBAC)

Real-time intrusion detection systems

Regular security audits and penetration testing

Security isn’t an afterthought—it’s embedded into every decision from architecture to deployment.

2. They Build for Compliance and Regulation

Fintech companies must comply with strict regulatory frameworks like:

PCI-DSS for handling payment data

GDPR and CCPA for user data privacy

KYC/AML requirements for financial onboarding

SOX, SOC 2, and more for enterprise-level platforms

Development teams work closely with compliance officers to ensure:

Data retention and consent mechanisms are implemented

Audit logs are stored securely and access-controlled

Reporting tools are available to meet regulatory checks

APIs and third-party tools also meet compliance standards

This legal alignment ensures the platform is launch-ready—not legally exposed.

3. They Design with User Trust in Mind

For fintech apps, user trust is everything. If your interface feels unsafe or confusing, users won’t even enter their phone number—let alone their banking details.

Fintech-focused development teams create clean, intuitive interfaces that:

Highlight transparency (e.g., fees, transaction histories)

Minimize cognitive load during onboarding

Offer instant confirmations and reassuring microinteractions

Use verified badges, secure design patterns, and trust signals

Every interaction is designed to build confidence and reduce friction.

4. They Optimize for Real-Time Performance

Fintech platforms often deal with real-time transactions—stock trading, payments, lending, crypto exchanges, etc. Slow performance or downtime isn’t just frustrating; it can cost users real money.

Agencies build highly responsive systems by:

Using event-driven architectures with real-time data flows

Integrating WebSockets for live updates (e.g., price changes)

Scaling via cloud-native infrastructure like AWS Lambda or Kubernetes

Leveraging CDNs and edge computing for global delivery

Performance is monitored continuously to ensure sub-second response times—even under load.

5. They Integrate Secure, Scalable APIs

APIs are the backbone of fintech platforms—from payment gateways to credit scoring services, loan underwriting, KYC checks, and more.

Web development companies build secure, scalable API layers that:

Authenticate via OAuth2 or JWT

Throttle requests to prevent abuse

Log every call for auditing and debugging

Easily plug into services like Plaid, Razorpay, Stripe, or banking APIs

They also document everything clearly for internal use or third-party developers who may build on top of your platform.

6. They Embrace Modular, Scalable Architecture

Fintech platforms evolve fast. New features—loan calculators, financial dashboards, user wallets—need to be rolled out frequently without breaking the system.

That’s why agencies use modular architecture principles:

Microservices for independent functionality

Scalable front-end frameworks (React, Angular)

Database sharding for performance at scale

Containerization (e.g., Docker) for easy deployment

This allows features to be developed, tested, and launched independently, enabling faster iteration and innovation.

7. They Build for Cross-Platform Access

Fintech users interact through mobile apps, web portals, embedded widgets, and sometimes even smartwatches. Development companies ensure consistent experiences across all platforms.

They use:

Responsive design with mobile-first approaches

Progressive Web Apps (PWAs) for fast, installable web portals

API-first design for reuse across multiple front-ends

Accessibility features (WCAG compliance) to serve all user groups

Cross-platform readiness expands your market and supports omnichannel experiences.

Conclusion

Fintech development is not just about great design or clean code—it’s about precision, trust, compliance, and performance. From data encryption and real-time APIs to regulatory compliance and user-centric UI, the stakes are much higher than in a standard website build.

That’s why working with a Web Development Company that understands the unique challenges of the financial sector is essential. With the right partner, you get more than a website—you get a secure, scalable, and regulation-ready platform built for real growth in a high-stakes industry.

0 notes

Text

✅ PAN-Aadhaar Verification API: Streamline Compliance & Prevent Fraud

In today's digital landscape, verifying user identity quickly and accurately is essential for businesses operating in financial services, fintech, lending, insurance, and beyond. One key regulatory requirement in India is the linkage and verification of PAN (Permanent Account Number) with Aadhaar. The PAN-Aadhaar Verification API helps businesses meet this requirement with ease, speed, and security.

🔍 What is PAN-Aadhaar Verification API?

The PAN-Aadhaar Verification API allows businesses to verify whether a user's PAN is linked with their Aadhaar in real-time. This verification is conducted using government-approved data sources and ensures compliance with the latest KYC (Know Your Customer) and AML (Anti-Money Laundering) norms.

🚀 Key Advantages

1. Real-Time Verification

No more delays in manual checks. Get instant confirmation of PAN-Aadhaar linkage status for seamless user onboarding and transaction processing.

2. Government-Compliant

The API is aligned with regulatory standards, ensuring your business stays compliant with the latest income tax and KYC rules.

3. Bulk Verification Support

Need to verify thousands of users? The API supports high-volume, batch verification to save time and operational effort.

4. Fraud Prevention

Prevent identity fraud by verifying the authenticity of PAN-Aadhaar linkage before processing loans, payouts, or registrations.

5. Easy API Integration

The API is designed for fast integration with your platform—whether it's a mobile app, web portal, or internal system.

6. Cost-Efficient & Scalable

Automating verification reduces operational costs and scales effortlessly with your growing customer base.

💼 Who Should Use It?

NBFCs & Banks: For customer onboarding & loan disbursals

Fintech Platforms: For KYC and fraud checks

Insurance Providers: For policy issuance & verification

Payment Gateways: For user validation before transactions

HR & Payroll Firms: For employee onboarding & compliance

🔐 Why It Matters

The Indian government has made PAN-Aadhaar linkage mandatory for most financial and legal processes. Businesses that fail to comply risk penalties and operational disruptions. Automating this verification using a reliable API not only saves time but ensures regulatory compliance and data accuracy.

🌐 Conclusion

The PAN-Aadhaar Verification API is an essential tool for any digital-first business looking to streamline verification, reduce fraud, and ensure compliance. Whether you handle thousands of users or just a few, this API can greatly enhance your onboarding and KYC workflows.

Power your compliance with NifiPayments – Simple, Secure, Scalable. #DigitalIndia #PANVerification #AadhaarVerification #FintechSolutions #RegulatoryCompliance #NifiPayments #KYCAPI #APISolutions

0 notes

Text

How Address Verification APIs Help Prevent Fraud and Reduce Failed Deliveries

Inaccurate addresses are more than just logistical problems—they’re gateways to financial loss, fraud, and customer dissatisfaction. Address verification APIs are the silent workhorses behind successful shipping, billing, and identity verification. This article explores how they safeguard your business.

What Is an Address Verification API?

An Address Verification API automatically checks and validates addresses during data entry or prior to shipment. It corrects typos, standardizes formats, and flags incomplete or fraudulent addresses.

How Fraud Happens Without Address Validation

Fake Addresses Used for Promotions

Stolen Credit Cards with Mismatched Addresses

Synthetic Identities for Loan or Benefit Fraud

Shipping to Abandoned Warehouses

Fraud Prevention Benefits

Address Matching with Payment Methods

Geolocation Cross-Checks

Instant Blacklist Notifications

Reduced Chargebacks and Identity Fraud

Failed Deliveries: Hidden Costs

Every failed delivery incurs:

Reshipment fees

Wasted materials

Customer support time

Lower satisfaction scores

How Address Verification APIs Reduce Delivery Failures

Autocorrect Minor Typos

Suggest Valid Alternatives

Ensure Address Completeness

International Format Normalization

Address Verification vs. Address Autocomplete

FeatureVerification APIAutocomplete APIPurposeValidate + CorrectSuggest + CompleteBest ForShipping, ComplianceCheckout UXPrevents Fraud?YesNo

Popular Address Verification API Providers

Lob

Smarty

PostGrid

Loqate

Melissa

Compliance and Security Benefits

PCI DSS Alignment

HIPAA for Healthcare

GDPR for European Data

Data Encryption and Logging

Industry Use Cases

E-commerce: Reduces return-to-sender rates

Banking: Validates KYC (Know Your Customer) addresses

Insurance: Ensures property address accuracy

Logistics: Reduces routing and delivery errors

Integration Workflow

Capture Address

Call API

Receive Standardized + Validated Address

Update CRM or Proceed to Checkout

Sample API Call

jsonCopy

Edit

{ "address_line1": "742 Evergreen Ter", "city": "Springfield", "country": "USA", "zip": "62704" }

Output Response

jsonCopy

Edit

{ "status": "verified", "suggested_correction": "742 Evergreen Terrace, Springfield, IL 62704" }

Best Practices for Implementation

Validate before checkout

Offer user overrides only if confidence score is high

Show real-time correction suggestions

Measuring API Effectiveness

Failed Delivery Rate

Fraud Detection Rate

Customer Satisfaction Score

Cost Per Delivery

Conclusion: Protecting Your Bottom Line

Address Verification APIs are not just optional—they’re essential. Preventing fraud, reducing delivery errors, and enhancing customer trust starts with clean, validated data. Integrate it right, and you’ll avoid the costs of wrong addresses and bad actors.

youtube

SITES WE SUPPORT

Check Postcard With API – Wix

0 notes

Text

API Banking – Simplifying Financial Innovation

The fintech revolution is built on one key enabler: APIs. API Banking allows businesses and developers to connect with bank services quickly and securely. At Bharat Inttech, our API Banking platform delivers a powerful, plug-and-play gateway to modern financial services.

What is API Banking?

API Banking enables third-party applications to access bank data and functionalities—like account details, transactions, fund transfers, or KYC—via secure APIs. This technology helps banks and fintechs offer tailored solutions without rebuilding core infrastructure.

Key Offerings:

Account Access APIs: View balances, fetch statements, and validate account details.

Payment APIs: Enable UPI, IMPS, NEFT, and other fund transfer options.

Onboarding APIs: Perform eKYC and link bank accounts.

Lending APIs: Automate loan disbursement and repayment tracking.

Use Cases:

Neo-banks building full banking experiences

Lending apps integrating automated payments

Merchant platforms enabling real-time settlements

ERP tools integrating banking within dashboards

Why Inttech’s API Banking?

Quick Integration: Our SDKs and sandbox environment simplify the process.

Customizable APIs: Tailor workflows to match your business logic.

Secure & Compliant: Follows ISO, PCI-DSS, and RBI standards.

Technical Support: From onboarding to production, we support your journey.

Benefits for Businesses:

Faster go-to-market

Reduced development cost

Streamlined user experience

Real-time financial data access

Conclusion:

API Banking is no longer a tech trend—it’s the foundation of fintech. Whether you’re launching a digital bank or integrating payment services into your app, Bharat Inttech provides the tools you need to innovate confidently.

For More Information Visit Us:

0 notes

Text

End-to-End Crypto Card Development for Growing Payment Businesses

As digital currencies reshape the way the world handles transactions, payment businesses are rapidly exploring new-age solutions to stay competitive. One of the most powerful solutions available for entrepreneurs in the financial and blockchain space is the crypto card. With seamless integration of cryptocurrencies into traditional financial ecosystems, a well-developed crypto card solution—especially a Master Crypto Card or Visa Crypto Card—can bridge the gap between blockchain technology and everyday transactions.

Dappsfirm offers Custom Crypto Card Development solutions tailored to match the unique demands of growing payment businesses. Whether you're building a fintech brand from scratch or scaling an existing operation, Dappsfirm’s Crypto Card Development Services empower entrepreneurs to launch cutting-edge card programs that blend crypto capabilities with traditional finance usability.

Why Crypto Cards are Gaining Momentum

Crypto cards are not just a tech novelty—they are becoming a mainstream financial product. These cards allow users to spend digital currencies like Bitcoin, Ethereum, and stablecoins at any merchant that accepts Mastercard or Visa. Instead of converting crypto manually, the card handles conversions in real-time, making crypto as spendable as fiat.

For payment businesses, offering a Visa Crypto Card or Master Crypto Card means tapping into a growing user base of crypto holders seeking convenient spending options. By integrating these services into your business model, you can attract a tech-savvy audience while expanding your brand presence in the blockchain ecosystem.

Custom Crypto Card Development by Dappsfirm

Dappsfirm specializes in Custom Crypto Card Development, delivering full-scale, end-to-end infrastructure that powers next-generation payment solutions. From user wallets and card issuing platforms to real-time crypto-fiat conversions and global KYC/AML integration, Dappsfirm handles every technical layer with precision and compliance in mind.

Entrepreneurs can expect a branded card program, including custom features like:

Multi-asset crypto wallets

Automated conversion engines

Advanced user dashboards

Integration with Visa and Mastercard networks

Global and region-specific KYC compliance

Secure payment gateways and transaction tracking

Each crypto card platform is designed for scalability, enabling payment businesses to serve global users without compromising speed, security, or regulatory requirements.

Benefits of Partnering with a Crypto Card Development Company

Working with an experienced Crypto Card Development Company like Dappsfirm ensures not only rapid development but also a robust foundation built to handle evolving market dynamics. Entrepreneurs gain:

Access to blockchain experts

Ongoing technical support

Security audits and compliance integration

Custom branding and UI/UX flexibility

Scalable API architecture

Dappsfirm’s proven approach reduces time-to-market, allowing you to launch your Master Crypto Card or Visa Crypto Card solution efficiently without reinventing the wheel.

Driving New Revenue Streams with Crypto Card Services

Crypto Card Development Services offer more than just a spending mechanism. They serve as a gateway to multiple monetization channels. As an entrepreneur, you can integrate features like:

Card issuance and activation fees

Crypto-to-fiat conversion spreads

ATM withdrawal fees

Subscription-based premium cards

Loyalty and cashback rewards in crypto

These value-added offerings not only drive user retention but also position your brand as a forward-thinking leader in the digital finance space.

Future-Proof Your Payment Business with Dappsfirm

Launching a crypto card requires deep technical knowledge, regulatory insights, and secure blockchain integration. Dappsfirm brings all of these elements together into a cohesive, ready-to-deploy solution. Whether you're interested in issuing a globally accepted Visa Crypto Card, or creating a private Master Crypto Card for your community, Dappsfirm helps you take the leap from concept to execution.

For entrepreneurs focused on the next evolution of digital payments, investing in Custom Crypto Card Development is a strategic move. With the right technology partner, you can build a scalable, secure, and future-ready crypto card system that serves both your business goals and your users' expectations.

Reach out to Dappsfirm and start building your crypto-powered financial brand today.

#Crypto Card Development Company#Crypto Card Development#Crypto Card Development Services#Crypto Card Development Solutions

0 notes

Text

Bahrain’s App Developers Are Changing the Game.

In the Gulf’s rapidly evolving tech landscape, Bahrain stands out as a growing hub for mobile app development, where innovation meets execution, and businesses thrive. Across Manama, Muharraq, Isa Town, and beyond, local developers are elevating user experiences and breaking new ground. In this wave of digital transformation, Bahrain’s app developers are not just building software—they’re sculpting the future of mobile interaction.

In this article, we explore how these tech experts are shaping industries, empowering startups and enterprises, enabling real user engagement, and why partnering with firms like Five Programmers can help your business win.

🚀 New Norms in App Development: Bahrain Sets the Bar

Several trends are driving Bahrain’s innovation in mobile apps:

Hybrid & Native Excellence Developers in Bahrain expertly combine native (Swift, Kotlin) and hybrid (Flutter, React Native) frameworks to craft apps that balance performance, speed, and cost.

User-Centric Design Beyond mere visuals—apps are built with regional aesthetics, Arabic/English language support, and UX that streamlines tasks in banking, healthcare, and retail.

AI & Personalization From smart chatbots to predictive product suggestions, Bahraini apps are harnessing AI to offer more contextual and personalized experiences.

Secure Fintech and E-commerce Developers are delivering encrypted, payment-ready apps fully compliant with Bahrain’s financial regulations and consumer expectations.

Cross-Border Expansion Regional scalability is key—apps developed in Bahrain now serve users across the GCC, thanks to localization and smart architecture.

These advancements show why mobile app development company in Bahrain is rewriting the rulebook for digital products in the region.

📈 Why Businesses Are Embracing Bahrain-Based Development

Working locally offers clear advantages:

Cultural Fluency Bahrain’s app developers understand Arabic/English nuances, payment habits, and regional UX preferences.

Agile Collaboration Same timezone, in-person collaboration, and fast iteration cycles lead to clearer communication and better outcomes.

Value Without Compromise High-quality apps at competitive rates—offering a stronger ROI compared to Western or Southeast Asian equivalents.

Full-Cycle Support From design and development to analytics and updates, Bahrain teams, including Five Programmers, deliver complete solutions.

💡 Case Studies: Game‑Changing Apps Built in Bahrain

1. Healthcare On-the-Go

A digital clinic app built in Manama offers telehealth appointments, reminders, patient records, and prescription ordering. The result: improved retention and reduced no-show rates.

2. App-First Retail Experience

A boutique retail app lets customers book appointments, explore AR try-ons, and redeem loyalty offers in real time—blending digital with in-store experience.

3. Smarter Logistics

A startup in Muharraq built a mobile app for real-time delivery tracking and rating, boosting fleet efficiency and customer satisfaction.

These successes highlight how Bahrain-based mobile app developers enable diverse industries to harness digital transformation.

🧭 The Bahrain Advantage: How Local Developers Lead the Pack

Rapid MVP Execution

Top Bahrain firms run user research and workshops, then build launch-ready MVPs in 8–12 weeks to validate ideas before investing heavily.

Bilingual User Flow

Apps now switch between Arabic and English seamlessly—vital in a multilingual society.

Secure Tech Stack

Developers use secure frameworks and libraries, integrate local payment gateways like BenefitPay, and keep data compliant with REST APIs and encryption.

Ongoing Engagement

Post-launch plans include analytics monitoring, feature updates, performance tuning, and marketing support.

These capabilities are why startups and enterprises prefer Bahrain when building mobile products—driven by quality, speed, and aftercare.

🌟 Why Five Programmers Is a Leading Choice in Bahrain

Among Bahrain’s top-tier app developers, Five Programmers stands out for:

End-to-End Solutions: Strategy, design, development, launch, and optimization covered

Cross-Platform Mastery: From Flutter MVPs to native iOS/Android apps

Brand-Aligned UX: UI/UX that works in both Arabic and English while reflecting your brand identity

Technical Reliability: Secure code, cloud architecture, CI/CD pipelines

Scalable Models: Apps that grow with features, user base, and integration needs

By choosing Five Programmers, you're opting for a partner that truly understands Bahrain’s market dynamics and future requirements.

🔍 FAQs: How Bahrain’s App Ecosystem Benefits You

Q1: Can Bahrain app developers handle complex systems like fintech or ERP? Absolutely. Top agencies are experienced in secure transaction flows, real-time data synchronization, and regional compliance.

Q2: How long does it take to launch a full-featured app from Bahrain? Mid-size apps launch in 12–18 weeks; enterprise-level apps may take up to 5–6 months depending on scope and integrations.

Q3: What budget should I set for a quality Bahrain-built app? Expect projects ranging from US$25,000 to $120,000 based on complexity and required integrations.

Q4: Do Bahrain firms support marketing and analytics? Yes—most provide analytics setup, ASO, print campaigns, and performance monitoring as standard.

🏁 Final Word: Bahrain’s App Developers Have Arrived

Bahrain’s app developers are not just building software—they’re building relationships, business value, and digital futures. With local expertise, bilingual interfaces, cost-effective models, and world-class skill, they stand out as regional leaders in mobile innovation.

If you’re ready to turn a great idea into a powerful mobile presence, reach out to Five Programmers—your trusted partner for building game-changing apps that truly matter.

📞 Contact Us | Get a Quote Take the leap with Bahrain’s mobile expertise. Build smarter, scale faster, and lead the game in 2025.

#mobile app development companies in Bahrain#Mobile app developers in Bahrain#app development companies in Bahrain#Technology#Tech

0 notes

Text

A Short Guide to Fintech Software Development Services

In today's dynamic business landscape, the intersection of finance and technology has given rise to innovative solutions that drive efficiency, security, and growth. At the forefront of this revolution are FinTech software development services, which empower organizations to harness the power of technology to revolutionize financial processes. In this short guide, we delve into the essential aspects of FinTech software development services, highlighting the expertise of industry leader Xettle Technologies.

Understanding FinTech Software Development Services

FinTech software development services encompass a wide range of offerings aimed at addressing the unique needs and challenges of the financial industry. From custom application development to integration services and ongoing support, these services cater to businesses seeking to enhance their operations, improve customer experiences, and stay ahead of the competition.

The Role of Xettle Technologies

Xettle Technologies stands out as a trusted provider of FinTech software development services, offering a comprehensive suite of solutions tailored to meet the diverse needs of businesses worldwide. With a proven track record of delivering cutting-edge software fintech solutions, Xettle Technologies combines technical expertise, industry knowledge, and a customer-centric approach to drive digital transformation and business success.

Custom Application Development

One of the core offerings of FinTech software development services is custom application development. Xettle Technologies collaborates closely with clients to understand their unique requirements and objectives, leveraging their expertise in software development to design and build bespoke solutions that address specific business challenges.

Whether it's developing a mobile payment app, a blockchain-based trading platform, or a risk management system, Xettle Technologies has the capabilities and experience to deliver tailored solutions that meet the evolving needs of the financial industry.

Integration Services

In today's interconnected world, seamless integration with existing systems and third-party applications is crucial for the success of FinTech solutions. Xettle Technologies offers integration services that enable businesses to connect disparate systems, streamline workflows, and enhance interoperability.

Whether it's integrating with banking APIs, payment gateways, or regulatory compliance tools, Xettle Technologies ensures that clients' FinTech solutions seamlessly integrate with their existing infrastructure, maximizing efficiency and ROI.

Security and Compliance

Security and compliance are paramount considerations in FinTech software development. Xettle Technologies employs rigorous security measures and adheres to industry best practices to safeguard against cyber threats and ensure compliance with regulatory requirements.

From encryption and access controls to data privacy and regulatory compliance, Xettle Technologies prioritizes security at every stage of the development lifecycle, instilling confidence in clients and end-users alike.

Ongoing Support and Maintenance

The journey doesn't end with the deployment of a FinTech solution. Xettle Technologies offers ongoing support and maintenance services to ensure that clients' software fintech solutions remain secure, reliable, and up-to-date.

Whether it's troubleshooting issues, implementing updates, or providing technical assistance, Xettle Technologies' dedicated support team is on hand to address clients' needs promptly and effectively, allowing them to focus on their core business activities with peace of mind.

Conclusion

In conclusion, FinTech software development services play a pivotal role in driving innovation, efficiency, and growth in the financial industry. By leveraging the expertise of trusted providers like Xettle Technologies, businesses can unlock the full potential of technology to transform their operations, enhance customer experiences, and achieve their strategic objectives in today's fast-paced digital economy.

2 notes

·

View notes

Text

Secure E-Commerce: SSL, PCI Compliance & Beyond with Jurysoft

In the age of digital commerce, e-commerce security is no longer a luxury—it’s a business-critical necessity. With data breaches, fraud, and privacy concerns on the rise, consumers expect secure and transparent online shopping experiences. At Jurysoft, a leading e-commerce development company in Bangalore, we deliver end-to-end secure e-commerce solutions that align with the latest global security standards—SSL, PCI DSS, GDPR, and more.

🔐 Why Secure E-Commerce Development Matters

Every online transaction involves the exchange of sensitive data: credit card numbers, login credentials, shipping addresses. One weak link in your security infrastructure could result in irreparable brand damage and significant financial penalties. That’s why businesses across industries trust Jurysoft to build secure and scalable e-commerce websites.

✅ SSL Encryption: Your First Layer of Trust

Secure Socket Layer (SSL) certificates encrypt the communication between a user’s browser and your server. This is what activates the “HTTPS” protocol and the padlock icon, both of which signal safety to your shoppers.

Our approach at Jurysoft:

We implement 2048-bit SSL certificates for maximum encryption strength.

Configure HTTPS site-wide to ensure secure data transmission.

Integrate SSL monitoring and automatic renewal to avoid certificate expiration issues.

📚 Learn more about how SSL works

💳 PCI DSS Compliance: Secure Payment Gateways

PCI DSS (Payment Card Industry Data Security Standard) is required for any business that processes credit card transactions. Non-compliance can lead to fines or even suspension of your merchant account.

Jurysoft ensures PCI compliance by:

Using certified PCI-compliant payment gateways like PayPal, Razorpay, and Stripe.

Implementing tokenization and encryption for cardholder data.

Following secure coding practices and data access controls.

📖 Official PCI DSS documentation

🌍 GDPR Compliance: User Privacy First

If your business serves users in the EU, GDPR (General Data Protection Regulation) compliance is mandatory. Even for global stores, GDPR compliance builds customer trust and transparency.

Jurysoft’s GDPR strategy includes:

Consent banners and user opt-in for cookies.

User data export, correction, and deletion features.

End-to-end data encryption and restricted access policies.

🔗 What is GDPR? - A Simple Guide

🛡️ Regular Security Audits & Penetration Testing

Security is a continuous effort, not a one-time investment. Our team performs regular vulnerability assessments, code audits, and penetration testing to ensure your store remains protected against the latest threats.

Our ongoing security services include:

OWASP-based code reviews and penetration testing.

Automated vulnerability scans and patch management.

Real-time monitoring with alert-based incident response.

🧪 Related keyword: e-commerce website vulnerability testing services

🧭 Jurysoft’s Secure E-Commerce Development Process

From consultation to deployment, Jurysoft’s custom e-commerce development services are designed with security at the core:

Discovery & Planning Define security goals, data flow, and compliance requirements.

Secure Architecture & Design Build with HTTPS, secure APIs, and encrypted storage.

Secure Coding & QA Apply static code analysis and penetration testing.

Launch & Maintenance Continuous security monitoring and updates post-launch.

Whether you're building a B2B platform, multi-vendor marketplace, or a high-performance D2C store, we provide secure, compliant, and future-proof digital experiences.

🚀 Start Building a Secure Online Store with Jurysoft

At Jurysoft, we believe that security builds trust, and trust drives conversions. That’s why our team integrates SSL encryption, PCI DSS standards, GDPR compliance, and continuous security audits into every e-commerce platform we develop.

🔗 Talk to our e-commerce security experts

0 notes

Text

Streamline Onboarding with Business Verification API by NifiPayments

In today’s fast-paced digital ecosystem, businesses are under constant pressure to verify entities quickly, accurately, and in compliance with regulations. Manual verification processes are time-consuming, error-prone, and often lead to onboarding delays or security risks.

To tackle this, NifiPayments offers a powerful solution — the Business Verification API, designed to simplify and automate the process of verifying business identities in real-time.

🔍 What is the Business Verification API?

The Business Verification API by NifiPayments enables businesses, fintech platforms, lending companies, and marketplaces to instantly validate the authenticity of business entities. This includes confirming business registration details, legal status, GST information, and more — directly from authoritative data sources.

✅ Key Features

Real-Time Business Lookup Access up-to-date business data in seconds using just a PAN, GSTIN, or registration number.

Compliance-Ready Ensure that your onboarding process adheres to KYC, AML, and RBI regulatory guidelines.

Seamless API Integration Plug-and-play API that can be easily integrated into your onboarding workflows or existing systems.

Bulk Verification Support Need to verify hundreds or thousands of businesses? No problem — our API supports bulk processing for scale.

Fraud Prevention Detect and block fraudulent or shell companies before they enter your ecosystem.

🚀 Benefits for Your Business

Faster Onboarding: Reduce manual checks and approve legitimate businesses instantly.

Better Risk Management: Access verified data from trusted sources to reduce financial and compliance risks.

Operational Efficiency: Free up internal teams from repetitive verification tasks.

Improved User Experience: Deliver a smoother onboarding process that builds trust from the first interaction.

Scalability: Whether you’re a startup or enterprise, the API grows with your needs.

💼 Who Can Use It?

Fintech companies

Payment gateways

NBFCs & banks

Marketplaces & aggregators

SaaS platforms

Insurance & lending firms

🔗 Why Choose NifiPayments?

At NifiPayments, we combine cutting-edge technology with regulatory compliance to empower digital businesses. Our Business Verification API is not only fast and secure but also tailored to meet the evolving demands of modern finance and commerce.

📝 Final Thoughts

In a world where speed, accuracy, and security define success, the Business Verification API by NifiPayments is your ally in building a trusted, compliant, and scalable business ecosystem. Make smarter decisions with verified data — instantly.

📞 Ready to automate your business verification process? Connect with NifiPayments today and get started!

0 notes

Text

How to Build a FinTech Mobile App | A Complete Guide

In today’s fast-digital world, financial services aren’t just online — they’re in your pocket. From mobile banking and digital wallets to robo-advisors and crypto apps, FinTech solutions are reshaping how we manage money. If you’ve ever dreamt of launching your own FinTech app, this guide walks you through what FinTech app development involves, the pros and cons, and how companies like SMT Labs are making it happen.

What Is FinTech App Development?

FinTech app development refers to building mobile (and often paired web) applications that offer financial services digitally. These apps may include:

Banking: Checking balances, making transfers, depositing checks

Payments: Mobile wallets, UPI/QR payments, peer-to-peer transfers

Lending: Digital loan origination, credit scoring, repayment

Investments: Trading, robo-advisors, portfolio tracking

Insurance (InsurTech): Policy management, automated claims

Blockchain & crypto: Wallets, DeFi platforms, smart contracts

It’s not just programming — it combines security, compliance, UX design, backend systems, and often AI/ML and blockchain integration to deliver seamless, trusted experiences.

Worldwide accessibility – After development, your app can be used by users across the globe.

Why You Should Develop a FinTech App

1. Massive market opportunity FinTech is exploding. With rising smartphone usage and demand for digital finance, people expect instant, sleek, and secure services. Whether you’re targeting underserved markets or niche segments — there’s room to grow.

2. Customer-centric innovation FinTech apps let you offer services tailored to real user needs — instant payments, personal finance insights, automated savings. Delight users with convenience and personalization.

3. High scalability potential Apps can expand features, support more users, integrate APIs — scaling your tech and revenue without scaling costs linearly.

4. Data-driven capabilities Leverage user behavior data with AI/ML for smart features like predictive budgeting, fraud detection, and robo-advice.

5. Strategic partnerships Embedded finance — banking-as-a-service, APIs, payment processors — opens doors for collaboration and revenue-sharing.

Worldwide accessibility – After development, your app can be used by users across the globe.

Key Features of a FinTech Mobile App

To build a robust FinTech app, consider these essential components:

Feature

Description

Strong security

End‑to‑end encryption, MFA, biometric login, fraud detection

Fast payments

Support UPI, QR code scans, wallets, card/net banking

Real-time data

Live balance updates, transaction tracking, trading feeds

User-friendly UI

Intuitive navigation, visual dashboards, seamless onboarding

Cross‑platform support

Native iOS/Android or hybrid solutions (Flutter, React Native)

Integration

Connect with banks, KYC/CDD, payment gateways, credit bureaus

Analytics & AI

Personalized insights, budgeting tools, credit scoring, risk checks

Compliance

Adhere to regulations (PCI DSS, GDPR, RBI, ISO standards)

Support

Chatbots, in-app support, notifications, alerts

Worldwide accessibility – After development, your app can be used by users across the globe.

Step‑by‑Step FinTech App Development Process

A typical roadmap looks like this:

1. Requirement Analysis

Define goals, target users, core features, and regulatory constraints. This stage guides your development plan.

2. Design & Prototyping

Create wireframes, mockups, interactive prototypes. Prioritize simplicity, transparency, and trust.

3. Development & Integration

Choose your tech stack: e.g. React Native or Flutter for mobile; Node.js, Python, Java for backend; databases, cloud infrastructure. Integrate APIs: banking, KYC, payments, credit, crypto/blockchain as needed.

4. Security & Compliance Testing

Perform rigorous testing: pen-testing, code reviews, encryption verification. Also run compliance audits with legal/finance experts.

5. Deployment & Launch

Publish in app stores, roll out phased user adoption, set up backend monitoring and support.

6. Maintenance & Upgrades

Continuously improve through feature releases, security patches, performance tuning, regulatory compliance.

Worldwide accessibility – After development, your app can be used by users across the globe.

Benefits of Developing a FinTech App

Superior user experience – Fast, intuitive, and 24/7 accessible.

Operational efficiency – Automates paper-based processes.

New monetization paths – From fees, subscription models, embedded finance.

Real-time insights – Data helps you refine offerings.

Worldwide accessibility – After development, your app can be used by users across the globe.

Worldwide accessibility – After development, your app can be used by users across the globe.

Challenges & Drawbacks to Consider

Security & trust – Financial apps are prime hacking targets; failure means massive reputational risk.

Complex compliance – Different countries require different legal adherence.

High cost & complexity – Security, integrations, audits, and scalability drive up costs.

Regulatory hurdles – Approvals like banking licenses add time and cost.

User trust & retention – People are cautious with money apps — UX, privacy, and reliability are critical.

Worldwide accessibility – After development, your app can be used by users across the globe.

Why Choose a FinTech App Development Company?

If you're not a development house, partnering with a specialized FinTech software development company is smart:

They have domain expertise — security, compliance, integrations, performance.

They provide end-to-end support — design, development, QA, deployment, maintenance.

They know how to avoid pitfalls, having built multiple similar products.

Worldwide accessibility – After development, your app can be used by users across the globe.

Pros & Cons of Working with a Specialist Firm like SMT Labs

✅ Pros

⚠️ Cons

Domain expertise in financial tech

Higher rate compared to generalists

Robust security and compliance

Some remote coordination may be needed

Faster development with reusable components

US/regulatory support might need local partners

Scalability through proven architecture

Custom projects still require your strong input

24/7 support & continuous updates

Long-term contracts may apply

Worldwide accessibility – After development, your app can be used by users across the globe.

How to Get Started with FinTech App Development

Clarify your idea Define your app’s niche, target users, monetization, must-have features, and compliance requirements.

Plan your budget & timeline Simple apps: ~$50K to build; advanced platforms: $200K+. Set realistic timelines (3–12+ months).

Shortlist vendors Look for companies with FinTech experience, security credentials, and relevant case studies — like SMT Labs.

Draft requirements doc Include user journeys, features (KYC, payments, analytics), supported platforms, key integrations, security needs, and regulatory context.

Get proposals & sign NDA Invite selected vendors to pitch, including scope, pricing, timeline, tech stack, and project milestones.

Commence development Start with prototyping and iterative sprints. Include regular demos and testing cycles.

Beta testing Launch to a pilot group, gather feedback on performance, UX, Bugs, security.

Launch & market Release on App Stores, support users, monitor usage, iterate based on behavior analytics.

Maintain & scale Continuous upgrades — security patches, new features, evolving regulations, user support.

Worldwide accessibility – After development, your app can be used by users across the globe.

Final Thoughts

Building a FinTech mobile app is a rewarding but complex journey — security, compliance, integrations, cloud infrastructure, UX — there’s a lot to get right. A specialist partner like SMT Labs can help you avoid pitfalls, accelerate delivery, and focus on your core vision.

By combining:

Strategic planning

Secure, user-friendly design

Modern tech stack

Ongoing support

…you’ll be set to launch a compelling FinTech app that not only powers digital finance today, but adapts and grows for tomorrow’s needs.

Conclusion

FinTech app development is a dynamic mix of finance, tech, security, and compliance — offering massive growth and impact opportunities. Whether you're building a payment wallet, a digital bank, a robo-advisor, or a blockchain platform, partners like SMT Labs provide the expertise and full-stack development support to help you build, launch, and scale confidently.

#fintech software development services#fintech software development#fintech software development company#fintech app development company#financial software development#financial software development company#mobile app developers#mobile app development#fintechtrends#fintech

0 notes

Text

How White-Label Payment Solutions Ensure PCI Compliance

As digital commerce becomes the norm, businesses are under increasing pressure to secure financial transactions and protect customer data. Implementing white-label payment solutions has become a strategic choice for many, helping companies streamline operations while ensuring compliance with global standards—particularly PCI DSS.

At Payomatix, we help businesses build branded payment experiences backed by robust security infrastructure. In this document, we’ll explore how white-label solutions ensure PCI compliance while supporting scalable business growth.

What Are White-Label Payment Solutions?

White-label payment solutions allow companies to use a third-party payment infrastructure under their own brand. These platforms come pre-equipped with essential features like:

Payment gateway integrations

Fraud detection mechanisms

Multi-currency support

PCI compliance tools

Instead of developing a payment system from the ground up, businesses save time and reduce costs—focusing instead on growth, product development, and customer experience.

Understanding PCI Compliance and Why It Matters

What is PCI DSS?

PCI DSS (Payment Card Industry Data Security Standards) is a set of guidelines created by major credit card companies to protect cardholder information. It includes 12 key requirements such as:

Maintaining secure firewalls

Encrypting cardholder data

Implementing strong access control measures

Monitoring and testing network systems regularly

Why It’s Crucial

Non-compliance with PCI standards can lead to:

Financial penalties

Legal liabilities

Customer trust issues

Data breaches

White-label platforms provide built-in PCI compliance tools that ease the burden on businesses.

How White-Label Payment Solutions Support PCI Compliance

1. Pre-Certified Payment Infrastructure

White-label providers often offer pre-certified PCI-compliant systems. This allows businesses to bypass the complex and expensive certification process.

2. Tokenization & Encryption

Sensitive payment data is replaced with tokens and encrypted to prevent unauthorized access, ensuring cardholder information is never stored in raw format.

3. Regular Security Audits

Providers perform ongoing penetration testing and vulnerability scans to meet evolving PCI DSS requirements.

4. PCI-Compliant Hosting

The platforms are hosted in secure, PCI-compliant environments, covering storage, transmission, and processing of data.

5. Compliance Reporting Tools

White-label services include dashboards and real-time alerts for monitoring and documenting compliance status.

Benefits of PCI-Compliant White-Label Solutions

Faster Go-to-Market

Launch payment offerings quickly without the delays of building and certifying infrastructure.

Increased Customer Trust

Secure transactions build confidence, leading to higher customer retention and conversion.

Lower Risk Exposure

Reduce the chances of data breaches, fraud, and fines with built-in security protocols.

Cost-Efficient Compliance

Avoid the high costs of independent PCI certification with turnkey white-label solutions.

Scalable Infrastructure

Grow locally or internationally with a secure and compliant system that scales with your business.

How Payomatix Ensures PCI Compliance

Payomatix offers end-to-end white-label solutions built for compliance and security. Key features include:

PCI-DSS certified infrastructure

Real-time fraud detection

Secure APIs with live monitoring

Advanced chargeback management

24/7 technical support

Whether you're an online store, SaaS business, or digital marketplace, Payomatix ensures your payments remain secure and compliant.

Key PCI Features to Look for in White-Label Solutions

When selecting a provider, ensure the platform offers:

Tokenization and encryption

2FA (Two-Factor Authentication)

Role-based access control

Regular vulnerability scanning

Real-time fraud detection

Cloud-based PCI-compliant hosting

Payomatix includes all of the above, offering a secure foundation for your business operations.

The Future of Payment Security

As cyber threats evolve, payment platforms must stay a step ahead. Emerging trends in white-label security include:

AI-powered fraud detection

Biometric authentication

Blockchain verification systems

By choosing a forward-looking provider like Payomatix, your business remains protected against current and future threats.

Final Thoughts

White-label payment solutions offer more than branding—they deliver a secure, scalable, and PCI-compliant pathway to online transactions. With Payomatix’s Security & Compliance Suite, you can:

Launch quickly

Stay secure

Scale globally

Take Action

Want to secure your payments the smart way? 👉 [Talk to our experts at Payomatix] and explore white-label PCI-compliant solutions tailored to your business.

FAQs

1. What is PCI compliance in white-label payment solutions?

It ensures the payment infrastructure meets strict standards for securing cardholder data, protecting against fraud and breaches.

2. How do these platforms secure customer data?

Through encryption, tokenization, and secure, monitored hosting environments.

3. Can using white-label providers help avoid PCI penalties?

Yes. Providers like Payomatix manage PCI requirements, helping you avoid fines and regulatory issues.

4. What services are included in PCI compliance?

Tokenization, encryption, access controls, regular security scans, and reporting tools.

5. Are white-label solutions safe for online payments?

Absolutely. They use the latest security technologies to ensure safe, branded, and seamless transactions.

0 notes

Text

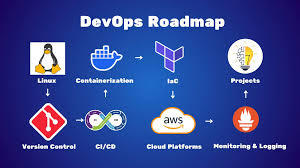

Mastering AWS DevOps in 2025: Best Practices, Tools, and Real-World Use Cases

In 2025, the cloud ecosystem continues to grow very rapidly. Organizations of every size are embracing AWS DevOps to automate software delivery, improve security, and scale business efficiently. Mastering AWS DevOps means knowing the optimal combination of tools, best practices, and real-world use cases that deliver success in production.

This guide will assist you in discovering the most important elements of AWS DevOps, the best practices of 2025, and real-world examples of how top companies are leveraging AWS DevOps to compete.

What is AWS DevOps

AWS DevOps is the union of cultural principles, practices, and tools on Amazon Web Services that enhances an organization's capacity to deliver applications and services at a higher speed. It facilitates continuous integration, continuous delivery, infrastructure as code, monitoring, and cooperation among development and operations teams.

Why AWS DevOps is Important in 2025

As organizations require quicker innovation and zero downtime, DevOps on AWS offers the flexibility and reliability to compete. Trends such as AI integration, serverless architecture, and automated compliance are changing how teams adopt DevOps in 2025.

Advantages of adopting AWS DevOps:

1 Faster deployment cycles

2 Enhanced system reliability

3 Flexible and scalable cloud infrastructure

4 Automation from code to production

5 Integrated security and compliance

Best AWS DevOps Tools to Learn in 2025

These are the most critical tools fueling current AWS DevOps pipelines:

AWS CodePipeline

Your release process can be automated with our fully managed CI/CD service.

AWS CodeBuild

Scalable build service for creating ready-to-deploy packages, testing, and building source code.

AWS CodeDeploy

Automates code deployments to EC2, Lambda, ECS, or on-prem servers with zero-downtime approaches.

AWS CloudFormation and CDK

For infrastructure as code (IaC) management, allowing repeatable and versioned cloud environments.

Amazon CloudWatch

Facilitates logging, metrics, and alerting to track application and infrastructure performance.

AWS Lambda

Serverless compute that runs code in response to triggers, well-suited for event-driven DevOps automation.

AWS DevOps Best Practices in 2025

1. Adopt Infrastructure as Code (IaC)

Utilize AWS CloudFormation or Terraform to declare infrastructure. This makes it repeatable, easier to collaborate on, and version-able.

2. Use Full CI/CD Pipelines

Implement tools such as CodePipeline, GitHub Actions, or Jenkins on AWS to automate deployment, testing, and building.

3. Shift Left on Security

Bake security in early with Amazon Inspector, CodeGuru, and Secrets Manager. As part of CI/CD, automate vulnerability scans.

4. Monitor Everything

Utilize CloudWatch, X-Ray, and CloudTrail to achieve complete observability into your system. Implement alerts to detect and respond to problems promptly.

5. Use Containers and Serverless for Scalability

Utilize Amazon ECS, EKS, or Lambda for autoscaling. These services lower infrastructure management overhead and enhance efficiency.

Real-World AWS DevOps Use Cases

Use Case 1: Scalable CI/CD for a Fintech Startup

AWS CodePipeline and CodeDeploy were used by a financial firm to automate deployments in both production and staging environments. By containerizing using ECS and taking advantage of CloudWatch monitoring, they lowered deployment mistakes by 80 percent and attained near-zero downtime.

Use Case 2: Legacy Modernization for an Enterprise

A legacy enterprise moved its on-premise applications to AWS with CloudFormation and EC2 Auto Scaling. Through the adoption of full-stack DevOps pipelines and the transformation to microservices with EKS, they enhanced time-to-market by 60 percent.

Use Case 3: Serverless DevOps for a SaaS Product

A SaaS organization utilized AWS Lambda and API Gateway for their backend functions. They implemented quick feature releases and automatically scaled during high usage without having to provision infrastructure using CodeBuild and CloudWatch.

Top Trends in AWS DevOps in 2025

AI-driven DevOps: Integration with CodeWhisperer, CodeGuru, and machine learning algorithms for intelligence-driven automation

Compliance-as-Code: Governance policies automated using services such as AWS Config and Service Control Policies

Multi-account strategies: Employing AWS Organizations for scalable, secure account management

Zero Trust Architecture: Implementing strict identity-based access with IAM, SSO, and MFA

Hybrid Cloud DevOps: Connecting on-premises systems to AWS for effortless deployments

Conclusion

In 2025, becoming a master of AWS DevOps means syncing your development workflows with cloud-native architecture, innovative tools, and current best practices. With AWS, teams are able to create secure, scalable, and automated systems that release value at an unprecedented rate.

Begin with automating your pipelines, securing your deployments, and scaling with confidence. DevOps is the way of the future, and AWS is leading the way.

Frequently Asked Questions

What distinguishes AWS DevOps from DevOps? While AWS DevOps uses AWS services and tools to execute DevOps, DevOps itself is a practice.

Can small teams benefit from AWS DevOps

Yes. AWS provides fully managed services that enable small teams to scale and automate without having to handle complicated infrastructure.

Which programming languages does AWS DevOps support

AWS supports the big ones - Python, Node.js, Java, Go, .NET, Ruby, and many more.

Is AWS DevOps for enterprise-scale applications

Yes. Large enterprises run large-scale, multi-region applications with millions of users using AWS DevOps.

1 note

·

View note