#FinancialAssurance

Text

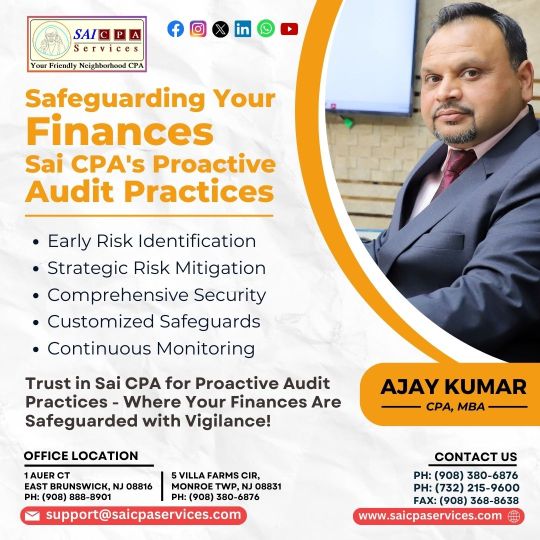

Audit Excellence: SAI CPA Services Pioneering Financial Precision and Transparency

At SAI CPA Administrations, our Review Administrations rethink monetary confirmation. With a tradition of trust traversing 25 years, our master group fastidiously inspects your monetary records, guaranteeing precision and consistence. Past a standard check, we convey bits of knowledge that enable your essential independent direction. As the principal CPA firm in Middlesex Region, New Jersey, our obligation to accuracy and greatness is unequaled. Pick SAI CPA Administrations for reviews that go past the numbers, offering a safeguard of monetary trustworthiness and unwavering quality for your business.

#AuditServices#FinancialIntegrity#CPAFirm#PrecisionAccounting#FinancialAssurance#ComplianceExcellence#ExpertFinancialServices#MiddlesexCountyCPA#BusinessTrust#SAICPAServices#TopCPAFirm#AccountingExcellence

1 note

·

View note

Text

Understanding Non-fund Based Financing: Financial Guarantees for Business Growth

In business finance, non-fund-based financing stands out as a unique and strategic tool that offers businesses a way to secure and guarantee transactions without the immediate need for a direct cash infusion. This type of financing provides essential financial assurances that can help companies manage risk, enhance credibility, and facilitate smoother operations.

What is Non-fund Based Financing?

Non-fund-based financing does not involve the actual disbursement of money to the borrower. Instead, it provides financial guarantees or commitments on behalf of the borrower to third parties. The most common instruments in this category are letters of credit (LC) and bank guarantees.

Key Instruments of Non-fund Based Financing

Letters of Credit (LC): A letter of credit is a financial document issued by a bank that guarantees a buyer's payment to a seller will be made on time. If the buyer fails to pay, the bank steps in to cover the payment. This tool is widely used in domestic and international trade to reduce risks and facilitate secure transactions.

Bank Guarantees: A bank guarantee is a commitment by a bank to cover a loss if the borrower defaults on a financial obligation. This type of guarantee can be used in various scenarios, such as securing loans, leases, or contractual agreements. It provides the beneficiary with confidence that the bank will fulfil the financial obligation if the borrower fails to do so.

Benefits of Non-fund Based Financing

Risk Mitigation: By providing financial guarantees, non-fund-based financing helps reduce the risk for both the borrower and the third party. This assurance can make business transactions more secure and reliable.

Enhanced Credibility: Businesses that use letters of credit or bank guarantees often find it easier to establish trust with suppliers, customers, and partners. The backing of a reputable financial institution can significantly boost a company's credibility.

How Non-fund Based Financing Works

When a business opts for non-fund-based financing, the lender issues a guarantee on behalf of the borrower. If the borrower meets their obligations, the guarantee remains unused, and the only cost incurred is the fee paid to the lender. However, if the borrower defaults, the lender steps in to fulfil the commitment, ensuring that the third party is not financially impacted.

Conclusion

Non-fund-based financing serves as a crucial tool for businesses looking to secure transactions and enhance their credibility without the immediate need for cash. By offering financial guarantees, it mitigates risks and fosters trust in business relationships. Whether through letters of credit or bank guarantees, this form of financing plays a vital role in facilitating trade and ensuring smoother operations in the business world.

Understanding and leveraging non-fund-based financing can provide businesses with the confidence and security needed to expand their operations and enter new markets, making it an indispensable part of modern financial strategies.

#NonFundBasedFinancing #LettersOfCredit #BankGuarantees #RiskMitigation #EnhancedCredibility #SecureTransactions #BusinessFinance #FinancialAssurances #TradeFinance #BusinessOperations

0 notes

Text

Navigating Assurance with SAI CPA Services: Your Guide to Audit and Review Excellence

Embarking on an audit or review process can be a daunting task for businesses, but with SAI CPA Services by your side, it becomes a journey of assurance and excellence. Our dedicated team of experts specializes in providing meticulous Audit and Review Services to ensure the integrity of your financial statements.

At SAI CPA Services, we understand the importance of transparent financial reporting. Our thorough audit processes delve deep into your financial records, offering a comprehensive examination for accuracy and compliance. For businesses seeking a lighter touch, our review services provide a detailed analysis without the extensive scrutiny of an audit.

Rest assured, with SAI CPA Services, your financial statements are in capable hands. Our commitment to precision and professionalism sets us apart, making us your trusted partner in navigating the complexities of audits and reviews. Experience peace of mind with SAI CPA Services, where assurance meets excellence.

#SAICPAServices#AuditExcellence#FinancialIntegrity#ReviewServices#FinancialAssurance#CPAExperts#TransparentReporting#FinancialAccuracy#BusinessAssurance#CPAInsights#AuditReview#FinancialCompliance#AssuranceExcellence#TrustedAdvisors#BusinessIntegrity

1 note

·

View note

Text

Differences between Fund-based and Non-fund-based Financing

When it comes to financing options, businesses often find themselves weighing the merits of fund-based versus non-fund-based financing. Understanding the differences between these two can help businesses make informed decisions based on their specific financial needs and goals.

Fund-based Financing

Fund-based financing involves the direct disbursement of funds from the lender to the borrower. This traditional form of lending includes:

Loans: Borrowers receive a lump sum amount that must be repaid with interest over a predetermined period.

Overdraft Facilities: Allows businesses to withdraw more money than is available in their account, up to a certain limit, to cover short-term needs.

Cash Credit: Provides access to funds for day-to-day operations, usually backed by inventory or receivables.

Term Loans: Long-term financing for purchasing assets, business expansion, or significant projects.

In fund-based financing, the borrower receives a direct inflow of money that can be used for various purposes like working capital, purchasing assets, or funding business expansions. The primary obligation for the borrower is to repay the principal amount along with interest within the specified period.

Non-fund-based Financing

Non-fund-based financing, on the other hand, does not involve the actual disbursement of funds. Instead, it provides financial guarantees or commitments on behalf of the borrower to third parties. Key instruments include:

Letters of Credit (LC): A promise from the lender that ensures the seller receives payment from the buyer, provided the terms of the agreement are met.

Bank Guarantees: Assures the beneficiary that the lender will fulfill the borrower’s obligations if the borrower defaults.

Non-fund-based financing is more about providing assurance or a promise of payment rather than a direct transfer of funds. The borrower benefits from the enhanced credibility and the ability to undertake transactions that might otherwise be risky. The lender charges a fee or commission for these services, but the borrower does not receive any actual funds unless a specific event triggers the need for payment.

Key Differences

Nature of Disbursement:

Fund-based Financing: Direct disbursement of funds to the borrower.

Non-fund-based Financing: No actual funds are disbursed; instead, financial guarantees are provided.

Usage of Funds:

Fund-based Financing: Borrower uses the funds for various business needs like working capital, purchasing assets, or expansion.

Non-fund-based Financing: Used to provide assurance to third parties about the borrower’s financial commitments.

Cost:

Fund-based Financing: Involves interest payments on the principal amount borrowed.

Non-fund-based Financing: Involves fees or commissions for the guarantees provided.

Risk:

Fund-based Financing: Borrower bears the risk of repaying the principal amount with interest.

Non-fund-based Financing: Risk is more on the lender, as they assure the payment in case of the borrower’s default.

Flexibility:

Fund-based Financing: Offers more flexibility in terms of usage of funds.

Non-fund-based Financing: Limited to providing financial assurances.

In summary, fund-based financing is ideal for businesses that need immediate access to cash for operations, growth, or asset acquisition, with a clear repayment plan. Non-fund-based financing suits businesses that need to bolster their credibility and secure transactions without needing direct funds, providing a safety net for their financial commitments. Both play crucial roles in the financial ecosystem, addressing different aspects of a business’s financing needs.

#FinanceOptions #BusinessFunding #FinancialStrategy #LendingChoices #CapitalManagement #CreditFacilities #RiskManagement #BusinessGrowth #FinancialAssurance #FundingSolutions

0 notes

0 notes