#Fintech API Platform

Explore tagged Tumblr posts

Text

Identity fraud and theft are the serious concern for every financial business in Canada. With the increase in fraudulent schemes, companies in Canada are under constant threat from various types of economic crime. KYC Software is one of the most effective fraud prevention tools that assist in combating these threats. KYC software helps Canadian businesses for KYC verification of their client and ensures whether they are genuine or not.

#kyc canada#kyc solution#kyc providers#kyc api#kyc software#kyc platform#business#fintech#insurance#kyc verification#KYC Company

1 note

·

View note

Text

#video kyc solution providers#video kyc platform#video kyc providers#video kyc services#KYC UK#kyc solution#kyc api#fintech#banks#finance#kyc companies#banking

1 note

·

View note

Text

#API Banking India#bank api provider#banking api provider#banking api provider india#banking api providers india#fintech api providers in india#banking api india#open banking api india#fintech api india#open banking api providers#api banking solutions#api service provider#api banking services#api platform

0 notes

Text

🎯 The Future of Payments is Here – And It’s Powered by Itio Innovex! 🚀

As the digital economy evolves, businesses need to stay ahead with secure, compliant, and scalable Crypto Payment Gateways that also support fiat transactions and neo-banking integrations.

At Itio Innovex, we have built a full-stack solution that not only meets global compliance standards like FATF, PCI-DSS, GDPR, and SOC 2, but also comes with developer-friendly APIs and ready-to-integrate source code.

✅ Accept multi-chain crypto payments ✅ Convert seamlessly to fiat currencies ✅ Ensure KYC/AML compliance by design ✅ PCI-DSS secure for fiat handling ✅ Embedded fraud detection & risk monitoring

🔗 Explore our detailed technical article here: (Insert your article link here)

💻 Developers can also access the full source code and API structure to integrate our solution into any SaaS or Fintech platform.

🔒 Why Itio Innovex? Because payment technology deserves to be secure, compliant, and future-proof.

#crypto#cybersecurity#digital banking licenses#digitalbanking#fintech#investors#white label crypto exchange software#bitcoin#digital marketing#financial advisor#payment gateway#gdprcompliance#digital licences#cyber security#social security#cryptoinvesting#digitalcurrency#blockchain#altcoin#saas#saas development company#saas technology#b2b saas#saas platform

2 notes

·

View notes

Text

What Are the Key Factors to Consider When Choosing a Payment Solution Provider?

The rapid growth of digital transactions has made choosing the right payment solution provider a crucial decision for businesses. Whether you operate an e-commerce store, a subscription-based service, or a financial institution, selecting the right provider ensures secure and efficient payment processing. With the increasing demand for fintech payment solutions, businesses must evaluate providers based on security, compatibility, scalability, and cost-effectiveness.

1. Security and Compliance

Security is the top priority when selecting a payment solution provider. Since financial transactions involve sensitive customer data, businesses must ensure that their provider follows strict security protocols. Look for providers that comply with PCI DSS (Payment Card Industry Data Security Standard) and offer encryption, tokenization, and fraud prevention measures.

A reputable provider should also offer real-time fraud detection and risk management tools to safeguard transactions. Compliance with regional regulations such as GDPR, CCPA, or PSD2 is also crucial for businesses operating in multiple locations.

2. Integration and Compatibility

Seamless Payment gateway integration is essential for a smooth transaction experience. Businesses should assess whether the provider’s APIs and SDKs are compatible with their existing platforms, including websites, mobile apps, and POS systems. A well-documented API enables easy customization and enhances the overall customer experience.

Additionally, businesses should consider whether the provider supports multiple payment methods such as credit cards, digital wallets, cryptocurrencies, and bank transfers. The ability to integrate with accounting, CRM, and ERP software is also beneficial for streamlining financial operations.

3. Cost and Pricing Structure

Understanding the pricing structure of payment solution providers is crucial for managing operational costs. Different providers offer various pricing models, including:

Flat-rate pricing – A fixed percentage per transaction

Interchange-plus pricing – A combination of network fees and provider markup

Subscription-based pricing – A fixed monthly fee with lower transaction costs

Businesses should evaluate setup fees, transaction fees, chargeback fees, and any hidden costs that may impact profitability. Opting for a transparent pricing model ensures cost-effectiveness in the long run.

4. Scalability and Performance

As businesses grow, their payment processing needs will evolve. Choosing a provider that offers scalable fintech payment solutions ensures seamless expansion into new markets and accommodates higher transaction volumes without downtime or slow processing speeds.

Look for providers with a robust infrastructure that supports high uptime, fast transaction processing, and minimal payment failures. Cloud-based payment solutions often offer better scalability and reliability for growing businesses.

5. Customer Support and Service Reliability

Reliable customer support is essential when dealing with financial transactions. Payment-related issues can result in revenue loss and customer dissatisfaction. Businesses should opt for providers that offer 24/7 customer support via multiple channels such as phone, email, and live chat.

Additionally, a provider with dedicated account management services can offer personalized solutions and proactive issue resolution, ensuring minimal disruptions to business operations.

6. Multi-Currency and Global Payment Support

For businesses targeting international markets, multi-currency support is a key consideration. The ability to accept payments in different currencies and offer localized payment methods enhances customer satisfaction and expands the business’s global reach.

Providers that support cross-border transactions with competitive exchange rates and minimal conversion fees are ideal for businesses operating in multiple countries.

7. Fintech Payment System Compatibility

A modern fintech payment system should be adaptable to emerging financial technologies. Businesses should evaluate whether the provider supports innovations like blockchain payments, real-time payment processing, and artificial intelligence-driven fraud prevention.

The ability to integrate with open banking solutions and provide seamless transaction experiences across various fintech ecosystems is becoming increasingly important in the digital payment landscape.

8. Reputation and Industry Experience

The credibility of a payment solution provider is another critical factor. Researching customer reviews, case studies, and testimonials can provide insights into the provider’s reliability and performance.

Established providers with years of experience and partnerships with reputable financial institutions are more likely to offer stable and secure payment processing services. Collaborations with fintech leaders, such as Xettle Technologies, demonstrate a provider’s commitment to innovation and excellence in payment solutions.

Conclusion

Choosing the right payment solution provider requires careful consideration of security, integration, pricing, scalability, customer support, and industry experience. Businesses must align their choice with long-term growth objectives and ensure that the provider offers secure, seamless, and cost-effective fintech payment solutions.

With the rise of digital transactions, businesses that invest in a robust fintech payment system with seamless payment gateway integration will gain a competitive edge and enhance customer trust. By partnering with reputable payment solution providers, businesses can ensure secure and efficient transaction experiences for their customers while maximizing operational efficiency.

3 notes

·

View notes

Text

What Web Development Companies Do Differently for Fintech Clients

In the world of financial technology (fintech), innovation moves fast—but so do regulations, user expectations, and cyber threats. Building a fintech platform isn’t like building a regular business website. It requires a deeper understanding of compliance, performance, security, and user trust.

A professional Web Development Company that works with fintech clients follows a very different approach—tailoring everything from architecture to front-end design to meet the demands of the financial sector. So, what exactly do these companies do differently when working with fintech businesses?

Let’s break it down.

1. They Prioritize Security at Every Layer

Fintech platforms handle sensitive financial data—bank account details, personal identification, transaction histories, and more. A single breach can lead to massive financial and reputational damage.

That’s why development companies implement robust, multi-layered security from the ground up:

End-to-end encryption (both in transit and at rest)

Secure authentication (MFA, biometrics, or SSO)

Role-based access control (RBAC)

Real-time intrusion detection systems

Regular security audits and penetration testing

Security isn’t an afterthought—it’s embedded into every decision from architecture to deployment.

2. They Build for Compliance and Regulation

Fintech companies must comply with strict regulatory frameworks like:

PCI-DSS for handling payment data

GDPR and CCPA for user data privacy

KYC/AML requirements for financial onboarding

SOX, SOC 2, and more for enterprise-level platforms

Development teams work closely with compliance officers to ensure:

Data retention and consent mechanisms are implemented

Audit logs are stored securely and access-controlled

Reporting tools are available to meet regulatory checks

APIs and third-party tools also meet compliance standards

This legal alignment ensures the platform is launch-ready—not legally exposed.

3. They Design with User Trust in Mind

For fintech apps, user trust is everything. If your interface feels unsafe or confusing, users won’t even enter their phone number—let alone their banking details.

Fintech-focused development teams create clean, intuitive interfaces that:

Highlight transparency (e.g., fees, transaction histories)

Minimize cognitive load during onboarding

Offer instant confirmations and reassuring microinteractions

Use verified badges, secure design patterns, and trust signals

Every interaction is designed to build confidence and reduce friction.

4. They Optimize for Real-Time Performance

Fintech platforms often deal with real-time transactions—stock trading, payments, lending, crypto exchanges, etc. Slow performance or downtime isn’t just frustrating; it can cost users real money.

Agencies build highly responsive systems by:

Using event-driven architectures with real-time data flows

Integrating WebSockets for live updates (e.g., price changes)

Scaling via cloud-native infrastructure like AWS Lambda or Kubernetes

Leveraging CDNs and edge computing for global delivery

Performance is monitored continuously to ensure sub-second response times—even under load.

5. They Integrate Secure, Scalable APIs

APIs are the backbone of fintech platforms—from payment gateways to credit scoring services, loan underwriting, KYC checks, and more.

Web development companies build secure, scalable API layers that:

Authenticate via OAuth2 or JWT

Throttle requests to prevent abuse

Log every call for auditing and debugging

Easily plug into services like Plaid, Razorpay, Stripe, or banking APIs

They also document everything clearly for internal use or third-party developers who may build on top of your platform.

6. They Embrace Modular, Scalable Architecture

Fintech platforms evolve fast. New features—loan calculators, financial dashboards, user wallets—need to be rolled out frequently without breaking the system.

That’s why agencies use modular architecture principles:

Microservices for independent functionality

Scalable front-end frameworks (React, Angular)

Database sharding for performance at scale

Containerization (e.g., Docker) for easy deployment

This allows features to be developed, tested, and launched independently, enabling faster iteration and innovation.

7. They Build for Cross-Platform Access

Fintech users interact through mobile apps, web portals, embedded widgets, and sometimes even smartwatches. Development companies ensure consistent experiences across all platforms.

They use:

Responsive design with mobile-first approaches

Progressive Web Apps (PWAs) for fast, installable web portals

API-first design for reuse across multiple front-ends

Accessibility features (WCAG compliance) to serve all user groups

Cross-platform readiness expands your market and supports omnichannel experiences.

Conclusion

Fintech development is not just about great design or clean code—it’s about precision, trust, compliance, and performance. From data encryption and real-time APIs to regulatory compliance and user-centric UI, the stakes are much higher than in a standard website build.

That’s why working with a Web Development Company that understands the unique challenges of the financial sector is essential. With the right partner, you get more than a website—you get a secure, scalable, and regulation-ready platform built for real growth in a high-stakes industry.

0 notes

Text

✅ PAN-Aadhaar Verification API: Streamline Compliance & Prevent Fraud

In today's digital landscape, verifying user identity quickly and accurately is essential for businesses operating in financial services, fintech, lending, insurance, and beyond. One key regulatory requirement in India is the linkage and verification of PAN (Permanent Account Number) with Aadhaar. The PAN-Aadhaar Verification API helps businesses meet this requirement with ease, speed, and security.

🔍 What is PAN-Aadhaar Verification API?

The PAN-Aadhaar Verification API allows businesses to verify whether a user's PAN is linked with their Aadhaar in real-time. This verification is conducted using government-approved data sources and ensures compliance with the latest KYC (Know Your Customer) and AML (Anti-Money Laundering) norms.

🚀 Key Advantages

1. Real-Time Verification

No more delays in manual checks. Get instant confirmation of PAN-Aadhaar linkage status for seamless user onboarding and transaction processing.

2. Government-Compliant

The API is aligned with regulatory standards, ensuring your business stays compliant with the latest income tax and KYC rules.

3. Bulk Verification Support

Need to verify thousands of users? The API supports high-volume, batch verification to save time and operational effort.

4. Fraud Prevention

Prevent identity fraud by verifying the authenticity of PAN-Aadhaar linkage before processing loans, payouts, or registrations.

5. Easy API Integration

The API is designed for fast integration with your platform—whether it's a mobile app, web portal, or internal system.

6. Cost-Efficient & Scalable

Automating verification reduces operational costs and scales effortlessly with your growing customer base.

💼 Who Should Use It?

NBFCs & Banks: For customer onboarding & loan disbursals

Fintech Platforms: For KYC and fraud checks

Insurance Providers: For policy issuance & verification

Payment Gateways: For user validation before transactions

HR & Payroll Firms: For employee onboarding & compliance

🔐 Why It Matters

The Indian government has made PAN-Aadhaar linkage mandatory for most financial and legal processes. Businesses that fail to comply risk penalties and operational disruptions. Automating this verification using a reliable API not only saves time but ensures regulatory compliance and data accuracy.

🌐 Conclusion

The PAN-Aadhaar Verification API is an essential tool for any digital-first business looking to streamline verification, reduce fraud, and ensure compliance. Whether you handle thousands of users or just a few, this API can greatly enhance your onboarding and KYC workflows.

Power your compliance with NifiPayments – Simple, Secure, Scalable. #DigitalIndia #PANVerification #AadhaarVerification #FintechSolutions #RegulatoryCompliance #NifiPayments #KYCAPI #APISolutions

0 notes

Text

Is Generative AI Training in Bengaluru Worth the Investment in 2025?

In 2025, Generative AI is no longer just a buzzword—it's a transformative technology driving innovation across industries like healthcare, finance, education, media, and software development. As India’s leading tech hub, Bengaluru is at the forefront of this AI revolution. This has given rise to a wave of Generative AI training in Bengaluru, targeted at professionals, students, and entrepreneurs alike.

But the critical question remains: Is investing in Generative AI training in Bengaluru truly worth it? Let’s break it down in terms of value, ROI, career prospects, curriculum relevance, and market demand.

Understanding Generative AI and Its Potential

Generative AI refers to algorithms that can create new content, from text to images, videos, music, and even code. Think ChatGPT, Midjourney, and GitHub Copilot—these tools have made AI accessible and productive.

In Bengaluru, tech companies, startups, and R&D centers are actively hiring talent with Generative AI skills. Whether it’s building chatbots, AI-driven content tools, or autonomous systems, the demand for trained professionals is growing exponentially.

Why Bengaluru for Generative AI Training?

1. India’s AI Capital

Bengaluru, often dubbed the Silicon Valley of India, is home to:

Over 10,000 tech startups

Major AI R&D units of Google, Microsoft, Infosys, and Wipro

A booming ecosystem of accelerators, coworking spaces, and AI meetups

2. Rich Talent and Training Ecosystem

From IISc and IIIT-B to private training providers like the Boston Institute of Analytics, the city offers a range of programs tailored to different levels—from beginner to advanced enterprise AI applications.

3. Industry Integration

Courses in Bengaluru often feature:

Capstone projects in collaboration with startups

Internship opportunities

Direct placement assistance with tech firms in the city

Course Investment: What's the Cost?

Typical Costs in Bengaluru

Short-term bootcamps (4–8 weeks): ₹25,000 – ₹50,000

Comprehensive diploma programs (3–6 months): ₹60,000 – ₹1,50,000

Executive or certification courses with global affiliations: ₹1,50,000 – ₹2,50,000+

Boston Institute of Analytics, for instance, offers:

A hands-on, globally certified Generative AI course

Expert-led live classes

Real-world projects & placement support

EMI options for affordable learning

Considering Bengaluru’s cost of living and competition in the training market, many institutes now provide value-driven pricing without compromising quality.

What You Learn: Core Topics Covered

Here’s what a well-structured Generative AI training in Bengaluru typically covers:

Foundations of AI and ML

Neural Networks and Deep Learning

Natural Language Processing (NLP)

Transformer Models (BERT, GPT, etc.)

Image and Text Generation Techniques

Prompt Engineering & Fine-Tuning

Ethics & Bias in Generative AI

Deployment using Cloud Platforms (AWS, GCP, Azure)

Practical Projects using tools like:

OpenAI APIs

Hugging Face

LangChain

Stability AI

These are not just theoretical concepts but directly tied to real-world applications—making the training industry-relevant.

Additional Value Beyond the Paycheck

✅ Future-Proof Skillset

Generative AI is reshaping software development, design, marketing, and even education. Training now prepares you for tomorrow’s roles.

✅ Entrepreneurial Edge

Want to build the next ChatGPT for fintech or an AI-powered learning app? Generative AI training equips you with the tools to innovate.

✅ Global Relevance

With AI becoming borderless, certifications from Bengaluru-based institutes are often globally recognized, especially if affiliated with international boards or platforms.

Challenges to Consider Before Investing

While the benefits are many, it’s important to assess:

Your learning background: Some courses expect basic programming or ML knowledge.

Time commitment: Weekend vs full-time batches—choose one that fits your schedule.

Course credibility: Choose institutes with strong placement records and industry tie-ups.

Curriculum relevance: Make sure the syllabus includes cutting-edge tools (like GPT-4, DALL·E, etc.).

Who Should Definitely Consider It?

Working IT professionals looking to upskill

Fresh graduates in CS, IT, or data science

Startup founders building AI-powered products

Freelancers and content creators wanting to use AI tools more effectively

Product managers who need AI know-how for decision-making

Final Thoughts: Is It Worth It?

Absolutely. If you’re looking to future-proof your career, enhance your technical credibility, or simply tap into the rapidly expanding AI job market, investing in Generative AI training in Bengaluru in 2025 is a smart and timely decision.

With the city’s dynamic ecosystem, competitive programs, and access to global tech giants, Bengaluru offers more than just learning—it offers transformation.

#Generative AI courses in Bengaluru#Generative AI training in Bengaluru#Agentic AI Course in Bengaluru#Agentic AI Training in Bengaluru

0 notes

Text

Power Your Fintech Stack with the UPI Collection API

Build stronger, faster, and more intelligent payment infrastructures with our UPI Collection API. Whether you're launching a new app, scaling your payment platform, or just need a reliable collection layer — we’ve got you covered. Benefit from seamless UPI integration, industry-grade security, and scalable design. A developer-friendly API built for merchants who demand more from fintech.

0 notes

Text

#kyc canada#kyc solution#kyc providers#business#kyc api#kyc software#kyc platform#kyc verification#insurance#fintech#canada

1 note

·

View note

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

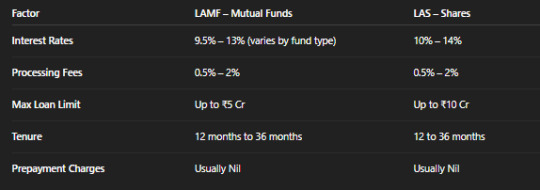

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

Best Custom Software Development in the USA: Top 5 Companies in 2025

Introduction

In today’s digital era, off-the-shelf software can only take a business so far. When your goals are unique, your systems must be, too. That’s why custom software development is a top priority for businesses across the United States in 2025. From automating operations to launching scalable products, companies are turning to specialized development partners to create high-performance, tailored solutions.

Among the industry’s most trusted names, The HubOps stands out as the premier custom software development company in the USA. This article explores the top 5 firms redefining custom software—and why The HubOps sits firmly at the top of the list.

Top 5 Custom Software Development Companies in the USA (2025)

1. The HubOps – New York, NY - A leading custom software development company known for delivering innovative, scalable, and client-focused digital solutions.

2. BairesDev – San Francisco, CA - A top nearshore custom software development company offering agile solutions for fast-growing businesses.

3. Intellectsoft – Palo Alto, CA - Intellectsoft is a premier custom software development company specializing in digital transformation for enterprises.

4. Simform – Orlando, FL - Simform is a technology partner that helps businesses build and scale custom software solutions with a focus on agility and innovation.

5. DockYard – Boston, MA - DockYard is a digital product agency specializing in custom software development with a strong emphasis on user experience and modern design.

1. The HubOps – New York, NY

Overview: The HubOps is setting the standard for custom software development in 2025. Based in New York, the company is known for building powerful, scalable, and fully customized software that adapts to each client’s needs. With a proven track record across industries, The HubOps delivers solutions that drive innovation, reduce costs, and enable long-term growth.

Core Competencies:

End-to-end custom software solutions

Web & mobile application development

AI/ML integration & data-driven systems

SaaS and cloud-native platforms

Automation & enterprise toolkits

Why Choose The HubOps:

High client retention and satisfaction

Future-proof tech stack (AI, cloud, blockchain)

Transparent, agile development process

Expert teams with cross-industry experience

24/7 support and continuous maintenance

Industries Served: Healthcare, fintech, logistics, eCommerce, education, and startups.

Looking to build scalable, secure, and smart software for your business? Get in touch with The HubOps now.

2. BairesDev – San Francisco, CA

Overview: A top-tier nearshore custom software development company, BairesDev helps U.S. companies access elite development talent in Latin America. They specialize in rapid scaling and cost-effective engineering for growing businesses.

Strengths:

Agile nearshore teams

MVP development and scaling

Reliable for fast-paced product cycles

Best For: Startups, mid-size tech companies, and businesses seeking cost-effective offshore models.

3. Intellectsoft – Palo Alto, CA

Overview: Intellectsoft is a long-standing name in enterprise software development, offering tailored solutions to Fortune 500 clients and large-scale businesses. Their deep expertise in enterprise transformation sets them apart.

Specializations:

Blockchain & AI-based enterprise tools

Legacy modernization

Custom platform development

Industries Focused: Healthcare, travel, construction, and financial services.

4. Simform – Orlando, FL

Overview: Simform delivers flexible engineering services designed for organizations scaling quickly. Known for its team augmentation services, Simform supports both startups and enterprises with custom platforms and API integrations.

Key Services:

Dedicated software teams

Cloud-native application development

DevOps and microservices architecture

Ideal For: Businesses seeking scalable teams and long-term development support.

5. DockYard – Boston, MA

Overview: DockYard is a digital product agency that blends user-centric design with custom software engineering. With strong roots in Elixir and Ember.js, they offer highly maintainable and future-ready applications.

Core Capabilities:

Custom software with UX-first approach

Web app development

Full-stack product strategy and design

Industries Served: Education, media, government, and early-stage ventures.

The HubOps Advantage: More Than Just Software

While many companies provide great code, The HubOps delivers complete, business-aligned solutions. Here's why they continue to top the charts:

🔹 Tailored to Fit

No two businesses are the same—and The HubOps knows it. Every project begins with deep discovery to understand your processes, challenges, and growth targets.

🔹 Innovation at Its Core

From AI-driven platforms to blockchain-secured systems, The HubOps is fluent in the technologies shaping tomorrow’s digital landscape.

🔹 Enterprise Power with Startup Agility

Whether you’re an enterprise or an agile startup, The HubOps adapts to your pace, offering flexibility without compromising on quality.

🔹 End-to-End Partnership

The HubOps stays with you beyond launch. Expect ongoing support, performance optimization, and iterative upgrades based on your business evolution.

Conclusion

In 2025, investing in custom software isn’t optional—it’s essential. Companies need digital tools built around their unique workflows, customer needs, and long-term goals. Generic software can’t provide the edge needed to compete in today’s market.

That’s where the top players in custom software development shine. While firms like BairesDev, Intellectsoft, Simform, and DockYard bring unique strengths to the table, The HubOps sets itself apart by consistently going above and beyond.

With a combination of technical depth, innovation, and customer obsession, The HubOps has earned its reputation as the #1 custom software development company in the USA for 2025.

FAQs

1. What makes The HubOps the best custom software company in 2025?

The HubOps blends innovation, industry expertise, and a user-first mindset to deliver secure, scalable, and high-performing custom software tailored to business goals.

2. Can the HubOps work with both startups and large enterprises?

Absolutely. The HubOps serves clients of all sizes, offering flexible project models for startups, SMBs, and Fortune 500 companies.

3. How long does it take to develop custom software?

Project timelines vary, but The HubOps typically delivers MVPs within 8–12 weeks, with full projects depending on scope and complexity.

4. Is post-launch support included?

Yes. The HubOps offers continuous maintenance, performance monitoring, and future enhancements to ensure your product evolves with your needs.

5. How do I get started with The HubOps?

Simply visit www.thehubops.com, fill out the consultation form, and a product expert will guide you through your custom software journey.

1 note

·

View note

Text

Cloud Platforms Testing at GQAT Tech: Powering Scalable, Reliable Apps

In today's digital world, most companies use the cloud to host their software, store their data, and provide users with seamless experiences and interactions, meaning their cloud-based systems have to be fast and secure (it could be an e-commerce site, a mobile app, or corporate software platform) and be able to provide a robust reliable level of service that does not fail. All this hard work to develop a cloud-based application means nothing if the application is not subjected to testing and verification to work properly in different cloud environments.

Credit should be given to GQAT Tech for making cloud platform testing a core competency, as the entire QA team tests applications in the cloud, on cloud-based platforms, i.e., AWS, Azure, Google Cloud, or Private Cloud, while testing for performance, security, scalability, and functionality.

Now, let's explore the definition of cloud platform testing, what it is, why it is important, and how GQAT Tech can help your company be successful in the cloud.

What Is Cloud Platform Testing?

Cloud platform testing provides validation of whether a web or mobile application will function correctly in a cloud-based environment (as compared to on a physical server).

It involves testing how well your app runs on services like:

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud Platform (GCP)

IBM Cloud

Private/Hybrid cloud setups

The goal is to ensure your app is:

Scalability - Will it support more users over time with no performance degradation?

Improve security - Is my data protected from being compromised/attacked?

Stability - Is it repeatably functioning (no crashing or errors)?

Speed - Is the load time fast enough for users worldwide?

Cost - Is it utilizing cloud resources efficiently?

GQAT Tech’s Cloud Testing Services

GQAT Tech employs a hybrid process of manual testing, automated scripts, and real cloud environments to validate/applications in the most representative manner. The QA team manages real-time performance, availability, and security across systems.

Services Offered:

Functional Testing on Cloud

Validates that your app will behave in an appropriate way while hosted on different cloud providers.

Performance & Load Testing

Validates how your app behaves when 10, 100, or 10,000 users are accessing it at the same time.

Scalability Testing

Validates whether your app is capable of scaling up or down based on usage.

Security Testing

Validates for vulnerabilities specific to clouds: data leak vulnerabilities, misconfigured access, and DDoS risks.

Disaster Recovery & Backup Validation

Validates whether systems can be restored after failure or downtime.

Cross-Platform Testing

Validates your application's performance across AWS, Azure, GCP, and Private Cloud Systems.

Why Cloud Testing Is Important

By not testing your application in the cloud, you expose yourself to significant risks such as:

App crashes when usage is highest

Data loss because of inadequate backup

Cloud bills that are expensive due to inefficient usage

Security breaches due to weaker settings

Downtime that impacts customer frustration

All of these situations can be prevented and you can ensure your app runs smoothly every day with cloud testing.

Tools Used by GQAT Tech

GQAT Tech uses advanced tools for cloud testing:

Apache JMeter – Load testing and stress testing

Postman – API testing for cloud services

Selenium / Appium – Automated UI testing

K6 & Gatling – Performance testing

AWS/Azure/GCP Test Environments – Real cloud validation

CI/CD Pipelines (Jenkins, GitHub Actions) – Continuous cloud-based testing

Who Needs Cloud Platform Testing?

GQAT Tech works with startups, enterprises, and SaaS providers across industries like:

E-commerce

Healthcare

Banking & FinTech

Logistics & Travel

IoT & Smart Devices

Education & LMS platforms

If your product runs in the cloud, you need to test it in the cloud—and that’s exactly what GQAT does.

Conclusion

Cloud computing provides flexibility, speed, and power—but only if your applications are tested and validated appropriately. With GQAT Tech's cloud platform testing services, you can be confident that your application will work as required under all real-world environments.

They will help eliminate downtime, enhance app performance, protect user data and help optimize cloud expenditure—so you can expand your business without concern.

💬 Ready to test smarter in the cloud? 👉 Explore Cloud Platform Testing Services at GQAT Tech

#Cloud Platform Testing#AWS Testing#Azure Testing#Google Cloud QA#Cloud Application Testing#Performance Testing on Cloud#Cloud Scalability Testing#Functional Testing on Cloud#Cloud Security Testing#Cloud-Based QA#GQAT Cloud Services#CI/CD in Cloud#Real-Time Cloud Testing#Cloud QA Automation#SaaS Testing Platforms

0 notes

Text

App Development Services,

App Development Services,

In today's digital-first world, mobile applications have become essential for businesses looking to enhance customer engagement, streamline operations, and drive growth. At codezenithtech, we specialize in delivering innovative and customized App Development Services that align with your business goals and user needs.

Why Choose Codezenithtech for App Development?

At codezenithtech, we believe in building apps that are not just functional but also intuitive, scalable, and future-ready. Whether you're a startup aiming for a strong launch or an enterprise looking to optimize internal processes, our team of experienced developers is here to bring your ideas to life.

Our App Development Services Include:

iOS & Android App Development Native and cross-platform mobile solutions tailored for maximum performance on both platforms.

UI/UX Design Stunning, user-centered designs that ensure exceptional user experience.

Custom App Solutions We build apps from scratch to meet unique industry needs—be it eCommerce, healthcare, education, or fintech.

API Integration & Backend Development Powerful backend systems and seamless third-party API integrations for enhanced functionality.

Testing & Quality Assurance Rigorous testing ensures bug-free and high-performing applications.

Post-launch Support & Maintenance We offer continuous updates, improvements, and technical support after deployment.

What Sets Codezenithtech Apart?

Client-Centric Approach: Your vision drives our development process.

Latest Technologies: We use cutting-edge frameworks like Flutter, React Native, Swift, and Kotlin.

Timely Delivery: We adhere to strict deadlines without compromising quality.

Affordable Pricing: Our App Development Services are competitively priced to suit all business sizes.

Industries We Serve

From logistics to lifestyle, codezenithtech has delivered impactful mobile solutions to a wide range of industries including:

Healthcare

Education

Real Estate

eCommerce

Travel & Hospitality

Finance

Get Started with Codezenithtech Today!

If you're looking to transform your business idea into a robust mobile app, codezenithtech is your trusted partner. Our App Development Services are designed to help you succeed in a mobile-first world. Contact us today to discuss your project and discover how we can turn your vision into a powerful application.

Visit www.codezenithtech.com to learn more and schedule a free consultation.

0 notes

Text

What Are the Costs Associated with Fintech Software Development?

The fintech industry is experiencing exponential growth, driven by advancements in technology and increasing demand for innovative financial solutions. As organizations look to capitalize on this trend, understanding the costs associated with fintech software development becomes crucial. Developing robust and secure applications, especially for fintech payment solutions, requires significant investment in technology, expertise, and compliance measures. This article breaks down the key cost factors involved in fintech software development and how businesses can navigate these expenses effectively.

1. Development Team and Expertise

The development team is one of the most significant cost drivers in fintech software development. Hiring skilled professionals, such as software engineers, UI/UX designers, quality assurance specialists, and project managers, requires a substantial budget. The costs can vary depending on the team’s location, expertise, and experience level. For example:

In-house teams: Employing full-time staff provides better control but comes with recurring costs such as salaries, benefits, and training.

Outsourcing: Hiring external agencies or freelancers can reduce costs, especially if the development team is located in regions with lower labor costs.

2. Technology Stack

The choice of technology stack plays a significant role in the overall development cost. Building secure and scalable fintech payment solutions requires advanced tools, frameworks, and programming languages. Costs include:

Licenses and subscriptions: Some technologies require paid licenses or annual subscriptions.

Infrastructure: Cloud services, databases, and servers are essential for hosting and managing fintech applications.

Integration tools: APIs for payment processing, identity verification, and other functionalities often come with usage fees.

3. Security and Compliance

The fintech industry is heavily regulated, requiring adherence to strict security standards and legal compliance. Implementing these measures adds to the development cost but is essential to avoid potential fines and reputational damage. Key considerations include:

Data encryption: Robust encryption protocols like AES-256 to protect sensitive data.

Compliance certifications: Obtaining certifications such as PCI DSS, GDPR, and ISO/IEC 27001 can be costly but are mandatory for operating in many regions.

Security audits: Regular penetration testing and vulnerability assessments are necessary to ensure application security.

4. Customization and Features

The complexity of the application directly impacts the cost. Basic fintech solutions may have limited functionality, while advanced applications require more extensive development efforts. Common features that add to the cost include:

User authentication: Multi-factor authentication (MFA) and biometric verification.

Real-time processing: Handling high volumes of transactions with minimal latency.

Analytics and reporting: Providing users with detailed financial insights and dashboards.

Blockchain integration: Leveraging blockchain for enhanced security and transparency.

5. User Experience (UX) and Design

A seamless and intuitive user interface is critical for customer retention in the fintech industry. Investing in high-quality UI/UX design ensures that users can navigate the platform effortlessly. Costs in this category include:

Prototyping and wireframing.

Usability testing.

Responsive design for compatibility across devices.

6. Maintenance and Updates

Fintech applications require ongoing maintenance to remain secure and functional. Post-launch costs include:

Bug fixes and updates: Addressing issues and releasing new features.

Server costs: Maintaining and scaling infrastructure to accommodate user growth.

Monitoring tools: Real-time monitoring systems to track performance and security.

7. Marketing and Customer Acquisition

Once the fintech solution is developed, promoting it to the target audience incurs additional costs. Marketing strategies such as digital advertising, influencer partnerships, and content marketing require significant investment. Moreover, onboarding users and providing customer support also contribute to the total cost.

8. Geographic Factors

The cost of fintech software development varies significantly based on geographic factors. Development in North America and Western Europe tends to be more expensive compared to regions like Eastern Europe, South Asia, or Latin America. Businesses must weigh the trade-offs between cost savings and access to high-quality talent.

9. Partnering with Technology Providers

Collaborating with established technology providers can reduce development costs while ensuring top-notch quality. For instance, Xettle Technologies offers comprehensive fintech solutions, including secure APIs and compliance-ready tools, enabling businesses to streamline development processes and minimize risks. Partnering with such providers can save time and resources while enhancing the application's reliability.

Cost Estimates

While costs vary depending on the project's complexity, here are rough estimates:

Basic applications: $50,000 to $100,000.

Moderately complex solutions: $100,000 to $250,000.

Highly advanced platforms: $250,000 and above.

These figures include development, security measures, and initial marketing efforts but may rise with added features or broader scope.

Conclusion

Understanding the costs associated with fintech software development is vital for effective budgeting and project planning. From assembling a skilled team to ensuring compliance and security, each component contributes to the total investment. By leveraging advanced tools and partnering with experienced providers like Xettle Technologies, businesses can optimize costs while delivering high-quality fintech payment solutions. The investment, though significant, lays the foundation for long-term success in the competitive fintech industry.

2 notes

·

View notes

Text

Eko API Integration: A Comprehensive Solution for Money Transfer, AePS, BBPS, and Money Collection

The financial services industry is undergoing a rapid transformation, driven by the need for seamless digital solutions that cater to a diverse customer base. Eko, a prominent fintech platform in India, offers a suite of APIs designed to simplify and enhance the integration of various financial services, including Money Transfer, Aadhaar-enabled Payment Systems (AePS), Bharat Bill Payment System (BBPS), and Money Collection. This article delves into the process and benefits of integrating Eko’s APIs to offer these services, transforming how businesses interact with and serve their customers.

Understanding Eko's API Offerings

Eko provides a powerful set of APIs that enable businesses to integrate essential financial services into their digital platforms. These services include:

Money Transfer (DMT)

Aadhaar-enabled Payment System (AePS)

Bharat Bill Payment System (BBPS)

Money Collection

Each of these services caters to different needs but together they form a comprehensive financial toolkit that can significantly enhance a business's offerings.

1. Money Transfer API Integration

Eko’s Money Transfer API allows businesses to offer domestic money transfer services directly from their platforms. This API is crucial for facilitating quick, secure, and reliable fund transfers across different banks and accounts.

Key Features:

Multiple Transfer Modes: Support for IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer), and RTGS (Real Time Gross Settlement), ensuring flexibility for various transaction needs.

Instant Transactions: Enables real-time money transfers, which is crucial for businesses that need to provide immediate service.

Security: Strong encryption and authentication protocols to ensure that every transaction is secure and compliant with regulatory standards.

Integration Steps:

API Key Acquisition: Start by signing up on the Eko platform to obtain API keys for authentication.

Development Environment Setup: Use the language of your choice (e.g., Python, Java, Node.js) and integrate the API according to the provided documentation.

Testing and Deployment: Utilize Eko's sandbox environment for testing before moving to the production environment.

2. Aadhaar-enabled Payment System (AePS) API Integration

The AePS API enables businesses to provide banking services using Aadhaar authentication. This is particularly valuable in rural and semi-urban areas where banking infrastructure is limited.

Key Features:

Biometric Authentication: Allows users to perform transactions using their Aadhaar number and biometric data.

Core Banking Services: Supports cash withdrawals, balance inquiries, and mini statements, making it a versatile tool for financial inclusion.

Secure Transactions: Ensures that all transactions are securely processed with end-to-end encryption and compliance with UIDAI guidelines.

Integration Steps:

Biometric Device Integration: Ensure compatibility with biometric devices required for Aadhaar authentication.

API Setup: Follow Eko's documentation to integrate the AePS functionalities into your platform.

User Interface Design: Work closely with UI/UX designers to create an intuitive interface for AePS transactions.

3. Bharat Bill Payment System (BBPS) API Integration

The BBPS API allows businesses to offer bill payment services, supporting a wide range of utility bills, such as electricity, water, gas, and telecom.

Key Features:

Wide Coverage: Supports bill payments for a vast network of billers across India, providing users with a one-stop solution.

Real-time Payment Confirmation: Provides instant confirmation of bill payments, improving user trust and satisfaction.

Secure Processing: Adheres to strict security protocols, ensuring that user data and payment information are protected.

Integration Steps:

API Key and Biller Setup: Obtain the necessary API keys and configure the billers that will be available through your platform.

Interface Development: Develop a user-friendly interface that allows customers to easily select and pay their bills.

Testing: Use Eko’s sandbox environment to ensure all bill payment functionalities work as expected before going live.

4. Money Collection API Integration

The Money Collection API is designed for businesses that need to collect payments from customers efficiently, whether it’s for e-commerce, loans, or subscriptions.

Key Features:

Versatile Collection Methods: Supports various payment methods including UPI, bank transfers, and debit/credit cards.

Real-time Tracking: Allows businesses to track payment statuses in real-time, ensuring transparency and efficiency.

Automated Reconciliation: Facilitates automatic reconciliation of payments, reducing manual errors and operational overhead.

Integration Steps:

API Configuration: Set up the Money Collection API using the detailed documentation provided by Eko.

Payment Gateway Integration: Integrate with preferred payment gateways to offer a variety of payment methods.

Testing and Monitoring: Conduct thorough testing and set up monitoring tools to track the performance of the money collection service.

The Role of an Eko API Integration Developer

Integrating these APIs requires a developer who not only understands the technical aspects of API integration but also the regulatory and security requirements specific to financial services.

Skills Required:

Proficiency in API Integration: Expertise in working with RESTful APIs, including handling JSON data, HTTP requests, and authentication mechanisms.

Security Knowledge: Strong understanding of encryption methods, secure transmission protocols, and compliance with local financial regulations.

UI/UX Collaboration: Ability to work with designers to create user-friendly interfaces that enhance the customer experience.

Problem-Solving Skills: Proficiency in debugging, testing, and ensuring that the integration meets the business’s needs without compromising on security or performance.

Benefits of Integrating Eko’s APIs

For businesses, integrating Eko’s APIs offers a multitude of benefits:

Enhanced Service Portfolio: By offering services like money transfer, AePS, BBPS, and money collection, businesses can attract a broader customer base and improve customer retention.

Operational Efficiency: Automated processes for payments and collections reduce manual intervention, thereby lowering operational costs and errors.

Increased Financial Inclusion: AePS and BBPS services help businesses reach underserved populations, contributing to financial inclusion goals.

Security and Compliance: Eko’s APIs are designed with robust security measures, ensuring compliance with Indian financial regulations, which is critical for maintaining trust and avoiding legal issues.

Conclusion

Eko’s API suite for Money Transfer, AePS, BBPS, and Money Collection is a powerful tool for businesses looking to expand their financial service offerings. By integrating these APIs, developers can create robust, secure, and user-friendly applications that meet the diverse needs of today’s customers. As digital financial services continue to grow, Eko’s APIs will play a vital role in shaping the future of fintech in India and beyond.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko India#Eko API Integration#api integration developer#api integration#aeps#Money transfer#BBPS#Money transfer Api Integration Developer#AePS API Integration#BBPS API Integration

2 notes

·

View notes