#lamf api

Explore tagged Tumblr posts

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF)��allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

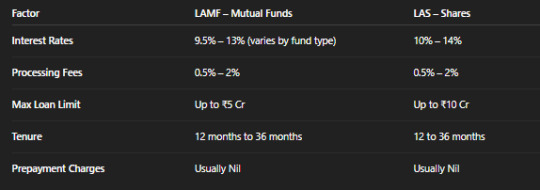

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

باہمی فنڈز کے خلاف قرض: باہمی فنڈ کی سرمایہ کاری کے خلاف ٹاٹا کیپیٹل کا ڈیجیٹل قرض کیسے حاصل کریں؟

باہمی فنڈز کے خلاف قرض: باہمی فنڈ کی سرمایہ کاری کے خلاف ٹاٹا کیپیٹل کا ڈیجیٹل قرض کیسے حاصل کریں؟

ٹاٹا کیپیٹل نے اپنا ڈیجیٹل لانچ کیا ہے۔ باہمی فنڈز کے خلاف قرض. صارفین فائدہ اٹھا سکتے ہیں۔ قرض 5 لاکھ سے 2 کروڑ روپے کے درمیان۔

ٹاٹا کیپیٹل ڈیجیٹل قرض فنڈ ہاؤسز میں ایکویٹی اور ڈیوٹ میوچل فنڈ اسکیموں کے خلاف پیشکش کی جاتی ہے۔ ٹاٹا کیپیٹل کی ایک پریس ریلیز میں کہا گیا ہے کہ صارفین میوچل فنڈ یونٹس پر قرض کا نشان لگا کر قرض کی رقم حاصل کرسکتے ہیں۔ پریس ریلیز میں کہا گیا ہے کہ “ٹیکنالوجی اور تجزیات کی مدد سے ، LAMF کسٹمر کی متنوع فنڈ کی ضروریات کو پورا کرنے کے لیے ایک ذاتی نوعیت کی مصنوعات ہے۔

پریس ریلیز میں کہا گیا ہے کہ کسٹمر کو پورٹ فولیو کو چھڑانے کی ضرورت نہیں ہے اور صرف لاگو قرض کی رقم پر سود ادا کرتا ہے۔

صارفین باہمی فنڈز کے خلاف قرضوں کے لیے لاگ ان کرکے درخواست دے سکتے ہیں: https://www.las.tatacapital.com/online/loans/las/apply-now-las-loan

ٹاٹا کیپیٹل پریس ریلیز کے مطابق ، یہ ڈیجیٹل ایل اے ایم ایف کے کچھ اہم فوائد ہیں:

آن لائن سے اختتامی سفر: آن بورڈنگ ٹو ڈسبرسمنٹ۔

قرض کو اوور ڈرافٹ سہولت کے طور پر یا ٹرم لون کے طور پر لاگو کیا جا سکتا ہے۔

ایک سال سے زائد مدت کے لیے آٹو تجدید کی سہولت دستیاب ہے (باہمی فنڈ پورٹ فولیو کے جائزے سے مشروط)

CAMS API کے ذریعے باہمی فنڈز کی آن لائن لائین مارکنگ۔

سروس پورٹل میں تقسیم ، ڈرا ڈاؤن ، اضافی عہد اور ڈی پلیجنگ کی خصوصیات شامل ہیں۔

دستاویزات پر آن لائن عملدرآمد۔

کسٹمر MF پورٹ فولیو سے حاصل ہونے والی ترقی اور منافع کے فوائد حاصل کرسکتا ہے۔

باہمی فنڈز کے خلاف قرض کیا ہے؟ میوچل فنڈ سرمایہ کار اپنی میوچل فنڈ کی سرمایہ کاری کے خلاف کریڈٹ حاصل کر سکتے ہیں۔ میوچل فنڈ یونٹس کے خلاف قرض ایک اوور ڈرافٹ سہولت کی شکل میں ہے اور سود صرف کریڈٹ کے طور پر حاصل کی گئی رقم پر وصول کیا جاتا ہے۔

. Source link

0 notes