#GST Invoice format in Excel

Explore tagged Tumblr posts

Text

Excel Mastery: Crafting The Perfect GST Tax Invoice Format For Your Business

Managing GST invoices effectively is a cornerstone of business success in today’s tax-compliant world. By creating a structured and professional Excel GST Invoice Format, you can streamline your invoicing process, reduce errors, and ensure compliance with GST regulations. Let’s explore how to create the perfect GST invoice in Excel that saves time and adds professionalism to your business operations.

What is a GST Invoice?

A GST invoice is a legal document that outlines the sale of goods or services, complete with GST details. It includes essential elements like the seller's and buyer's information, invoice number, product or service description, GST rates, and the total payable amount. The GST Invoice Format in Excel makes it easier to comply with regulations while presenting a professional image to clients.

This invoice acts as proof of the transaction, ensuring that businesses can claim input tax credits and maintain accurate financial records.

Why Choose Excel for GST Invoices?

Excel is an excellent tool for creating GST invoices due to its simplicity, flexibility, and automation capabilities. Here’s why the Excel GST Invoice Format stands out:

Automation: Use formulas to calculate GST amounts, subtotals, and totals automatically.

Customization: Tailor your invoice template with business-specific branding elements like logos and colors.

Ease of Use: Excel’s user-friendly interface ensures that anyone can create and manage invoices without hassle.

Cost-Effective: Excel is an accessible and affordable solution compared to dedicated invoicing software.

How to Create a GST Invoice Format in Excel

Follow these steps to design a professional and compliant GST Invoice Format in Excel:

Step 1: Set Up the Template

Open Excel and create a new spreadsheet. Divide the sheet into sections for:

Business name and logo

Invoice number and date

Buyer and seller details (including GSTIN)

Product or service description

Quantity, price, and total amount

GST details (CGST, SGST, or IGST)

Grand total

Step 2: Automate Calculations

Leverage Excel formulas to calculate GST automatically. For instance:

GST Amount = (Subtotal × GST Rate) ÷ 100

Grand Total = Subtotal + GST Amount

This automation minimizes errors and saves time.

Step 3: Apply Formatting

Enhance readability by applying professional formatting. Use bold fonts for headings, add borders to separate sections, and choose a clean font style.

Step 4: Specify GST Details

Clearly differentiate between CGST, SGST, and IGST based on the transaction type and location. This ensures compliance and transparency in tax reporting.

Step 5: Save and Share

Save the completed invoice in Excel format or export it as a PDF for secure sharing with clients.

Features of an Excel GST Invoice Format

Automated Calculations: Avoid manual errors with pre-built formulas.

Customizable Layout: Personalize the template to align with your business branding.

GST Compliance: Includes all required fields like GSTIN, tax breakdowns, and invoice numbers.

User-Friendly Interface: Intuitive design for easy navigation and data entry.

Secure and Reliable: Safeguard your financial data with password protection.

Benefits of Using a GST Invoice Format in Excel

Efficiency: Automate repetitive tasks and save time on invoicing.

Accuracy: Eliminate errors in tax and total calculations.

Professionalism: Present well-structured invoices to impress clients.

Cost Savings: Use Excel instead of investing in expensive invoicing tools.

Data Insights: Analyze trends and gain insights using Excel’s data tools.

Conclusion

Creating a professional and compliant GST Invoice Format in Excel is a simple yet effective way to streamline your invoicing process. Excel’s versatility allows you to design a template that meets your business’s unique needs while ensuring accuracy and compliance with GST regulations.

Switch to Excel for your GST invoices and experience the benefits of automation, customization, and professionalism. With a properly crafted Excel GST Invoice Format, you can focus on growing your business while Excel handles the heavy lifting of invoicing.

Now’s the time to upgrade your billing process. Start using the GST Invoice Format in Excel today and take the first step toward hassle-free financial management.

0 notes

Text

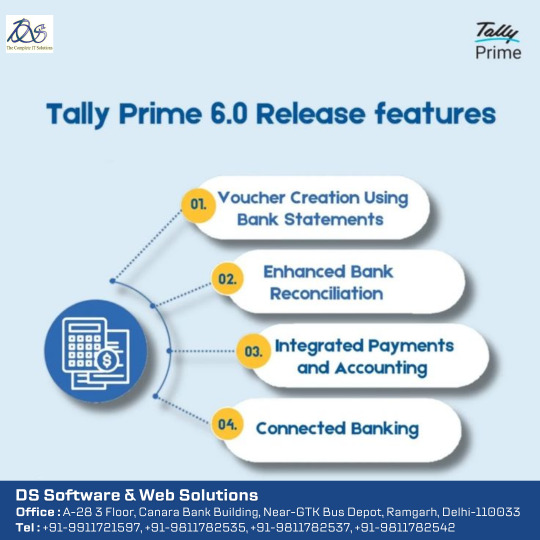

TALLY PRIME 6.0 RELEASE FEATURES

Here’s a comprehensive overview of the new capabilities in TallyPrime 6.0, officially released on 9 April 2025

1. Connected Banking & Automation:-

Real‑time bank integration: Connect securely to your bank using Tally.NET credentials to view live balances and statements inside Tally.

Auto‑voucher creation: Import bank statements to automatically generate payment/receipt vouchers with full details (narration, instrument no/date), in bulk or merged.

Smart reconciliation & e‑payments: One-click matching with rule-based and bulk options; create and track NEFT/IMPS payment files via e-Payment module supporting 18+ Indian banks.

2. Enhanced Banking Reports & Dashboards:-

New Banking Activities dashboard tile: shows pending reconciliations, balances, e‑payment statuses with drill-down reports.

Improved reporting in vouchers/day‑books, capturing bank account, instrument and reconciliation status; detailed Edit Log now tracks changes to UPI, bank date/instrument.

3. Streamlined Data Split & Verification:-

Simplified Data Split: new interface with enhanced options—single or dual company splits, progress bar, and robust pre‑split verification.

Resolves memory glitches and errors during large data operations .

4. Profile Management & Notifications:-

In‑app Profile section: modify contact info tied to serial number directly in Tally.

Semi‑annual reminders ensure your contact details stay current.

5. GST, TDS, VAT & Tax Enhancements:-

GSTR‑1 improvements: smarter filing with Excel Utility v5.4 for GSTR‑3B and breakup of B2B/B2C HSN summaries (Phase III from 1 April 2025).

Enhanced TDS/VAT reporting: precise calculations and correct state-wise reporting.

GCC compliance: bilingual (English/Arabic) invoicing, Arabic numerals, VAT formats for Kuwait/Qatar.

6. Income‑Tax & Regulatory Updates:-

Updated support for Income-Tax slabs under the 2025–26 Finance Bill, including rebate (87A), marginal relief, revised Form 16/24Q annexures.

7. Developer (TDL) Enhancements:-

New attributes & functionality: Skip-Forward, Disable Period on Tile, Multi‑Objects, IsPatternMatch, and Recon Status collection filter.

Internal optimization: Opening BRS details moved out of bank master to improve performance.

#tallyprime#tally on cloud#accountingsoftware#tallysoftware#cloud accounting software#cloudcomputing

0 notes

Text

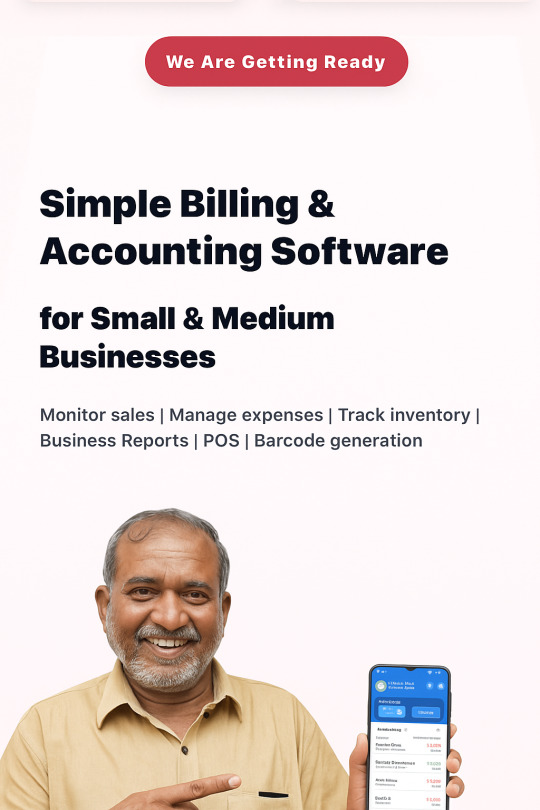

Khaata Pro 🚀: How It Simplifies Your Billing

In today’s fast-paced business environment, managing finances manually or using outdated tools can slow down growth. That’s where Khaata Pro comes in, a next-generation billing and accounting software built specifically for small and medium-sized businesses in India. With its streamlined workflow, Khaata Pro empowers business owners to focus on scaling up rather than managing paperwork.

Let’s explore how Khaata Pro works step-by-step, from customer onboarding to real-time reporting.

🔁 Step-by-Step Workflow of Khaata Pro

1️⃣ Customer Onboarding

Start by adding your business details and GST information (if applicable).

Create multiple user roles (owner, accountant, staff) with access restrictions.

Add your company logo and choose from pre-built invoice templates.

✅ Why it matters: Sets up a secure, branded system for smooth daily operations.

2️⃣ Product & Inventory Setup

Enter your product catalog with SKU, pricing, and tax details.

Add stock levels, reorder thresholds, and supplier info.

Optionally use barcode generation and printing.

✅ Why it matters: Real-time stock tracking ensures better inventory management and order fulfillment.

3️⃣ Sales & Billing

Generate GST-compliant invoices (B2B, B2C, retail, or wholesale).

Choose the invoice template and customize terms.

Accept payments in cash, UPI, cheque, or digital wallets.

Share invoices via print, email, or WhatsApp.

✅ Why it matters: Enables quick and professional billing, boosting customer satisfaction.

4️⃣ Expense & Purchase Tracking

Record daily expenses (rent, utilities, vendor payments, etc.).

Upload and scan receipts for automated entry.

Generate and approve purchase orders for inventory restocking.

✅ Why it matters: Keeps your cash flow in check and helps forecast expenses.

5️⃣ Inventory Movement & POS

Use the Point of Sale (POS) module for walk-in customers.

Automatically update stock after each sale.

Get alerts for low-stock and out-of-stock items.

✅ Why it matters: Helps you maintain optimal inventory levels and avoid lost sales.

6️⃣ Payment Reminders & Collection

Track unpaid invoices and overdue payments.

Send automated WhatsApp/email reminders to clients.

Offer digital payment options linked with invoices.

✅ Why it matters: Improves payment cycles and reduces manual follow-up effort.

7️⃣ Reporting & Analytics

View dashboard summaries: revenue, profit, top-selling products, and more.

Generate GST reports (GSTR-1, GSTR-3B), sales summaries, and P&L statements.

Export reports in Excel or PDF formats.

✅ Why it matters: Makes it easy to stay compliant and make informed decisions.

8️⃣ Multi-Company & Multi-User Support

Manage multiple business branches under one account.

Give access to different users with assigned roles and permissions.

Switch between companies without logging out.

✅ Why it matters: Scales with your growing business structure and staff needs.

💡 Bonus Tools in the Workflow

Tool

Purpose

WhatsApp Integration

Send invoices and reminders instantly

Offline Billing

Continue operations without internet access

Rental Scheduling

Manage recurring billings like equipment rent

Cloud Backup

Secure your data with auto-sync and restore

✅ Real-Life Use Case

A retail shop owner can use Khaata Pro to:

Sell items using the POS module

Automatically reduce inventory

Generate GST bills for each customer

Receive payments via UPI or cash

Send follow-up messages on WhatsApp for unpaid bills

Download monthly reports and file taxes

All this in a matter of minutes without hiring a full-time accountant!

🎯 Final Thoughts

The beauty of Khaata Pro’s workflow lies in its simplicity. Each feature is built to reduce manual effort, save time, and make complex accounting easy for Indian business owners.

Whether you're a trader, wholesaler, freelancer, or service provider, this workflow ensures you're always in control of your finances and operations anywhere, anytime.

Coming Soon: Khaata Pro Launch on June 26, 2025 Stay tuned to experience the power of modern billing with Indian business needs at its heart.

0 notes

Text

Billing Software in Navi Mumbai

Managing finances in today’s fast-paced business environment can be overwhelming without the right tools. That’s where TSP Group comes in with its advanced Billing Software in Navi Mumbai, designed to meet the evolving needs of businesses of all sizes and industries.

Our billing software offers an intuitive interface and smart automation features, enabling you to generate accurate invoices, track payments, and maintain clear financial records. Whether you're a startup, retailer, wholesaler, or service provider, TSP Group’s billing solutions simplify your operations by reducing manual errors and improving efficiency.

The Billing Software in Navi Mumbai by TSP Group supports multiple billing formats, customizable templates, tax compliance (including GST), and seamless integration with accounting systems. Businesses benefit from real-time data access, enabling better decision-making and enhanced cash flow management.

In a competitive market like Navi Mumbai, staying ahead means embracing technology that saves time and money. With TSP Group’s billing software, you eliminate paperwork, streamline inventory tracking, and get detailed financial reports—all in a few clicks.

Security and reliability are at the core of our solution. Your financial data is encrypted and stored securely, giving you peace of mind. Additionally, TSP Group provides ongoing support and updates to ensure that your billing system runs smoothly and stays compliant with the latest regulations.

What sets us apart is our local expertise and commitment to customer satisfaction. We understand the specific needs of Navi Mumbai businesses and offer tailored billing solutions that deliver real value. Our team works closely with clients to customize the software as per their workflow, ensuring smooth onboarding and maximum usability.

If you're looking for reliable and feature-rich Billing Software in Navi Mumbai, TSP Group is your trusted partner. We help you transform your billing process into a streamlined, error-free, and fully automated experience, so you can focus more on growth and less on paperwork.

Get in touch with TSP Group today and take a step toward smarter financial management. Our scalable billing software is ready to grow with your business and empower you to achieve operational excellence.

0 notes

Text

From HQ to Outlet: How FMS Ensures Franchisee Success at Every Step

In today’s fast-paced and highly competitive franchise landscape, running a successful franchise business requires more than just brand recognition and product consistency. It requires real-time coordination, data transparency, and seamless operations from head office to every individual outlet.

That’s where Franchise Management Software (FMS) plays a game-changing role. FMS isn't just a digital tool—it's the backbone of operational excellence, ensuring franchisees are empowered, informed, and aligned with the brand vision every step of the way.

Why Traditional Franchise Management Falls Short

Without a centralized system, franchise networks often face:

Communication breakdowns between HQ and outlets

Delayed order processing and approvals

Inconsistent inventory tracking

Manual billing and reporting errors

Lack of performance visibility

These inefficiencies can lead to customer dissatisfaction, revenue leakage, and strained relationships with franchisees.

Enter FMS: A Unified System for Unified Growth

Franchise Management Software bridges the gap between HQ and outlets, ensuring a smooth, efficient, and scalable operational model. Here’s how FMS ensures franchisee success at every stage:

1. Order Management & Invoicing

FMS enables franchisees to place orders directly from the outlet through a mobile app or web platform. Orders are instantly visible to HQ or the warehouse team for processing. No delays No manual errors Auto-generated invoices with real-time tracking

2. Inventory and Stock Control

The software provides complete visibility into stock levels at each outlet.

Auto-replenishment triggers based on minimum stock thresholds

Real-time stock updates post sales or returns

Wastage tracking for loss prevention

Franchisees can focus on selling, while HQ ensures the shelves are always stocked.

3. Sales and CRM Integration

Every sale, return, or customer interaction is captured and analyzed.

Track outlet-wise sales trends

Monitor fast-moving items

Run loyalty programs and promotional campaigns with ease

FMS keeps franchisees connected to customer expectations and brand strategies.

4. Expense and Petty Cash Management

With built-in tools to manage petty cash and local expenses, franchisees can maintain financial discipline.

Daily, weekly, or monthly expense tracking

Budget compliance monitoring

Expense approvals through HQ workflows

This transparency builds trust and reduces misuse.

5. Accounts and Reporting

From GST-compliant invoices to outlet-wise P&L statements, FMS automates financial reporting.

Tally integration or standalone reporting

Digital audit trails

Custom reports for both franchisee and franchisor

Finance teams save hours in reconciliation and analysis.

6. Real-Time Communication

Franchisees and HQ can exchange messages, documents, feedback, and updates in a structured format. This promotes faster decision-making, better alignment, and eliminates the dependency on informal communication channels like WhatsApp or email.

7. Performance Monitoring and Business Intelligence

Franchisees can track their performance via built-in dashboards:

Sales vs Targets

Outlet profitability

Expense trends

Customer satisfaction metrics Meanwhile, HQ gains a bird’s eye view of the entire franchise network, enabling data-driven decisions.

The FMS Advantage: Why It Matters

A well-implemented Franchise Management System:

Reduces operational friction

Ensures standardization across outlets

Enables franchisee autonomy with oversight

Enhances brand control and consistency

Accelerates growth through performance visibility

In essence, FMS helps transform the franchise model from a decentralized network of units into a well-oiled, synchronized business engine—where every outlet feels supported and every decision is backed by data.

Conclusion: Empowering Franchisees, Strengthening Brands

From the moment a franchisee places an order to the moment a customer receives their product, Franchise Management Software ensures that every step is smooth, accountable, and efficient.

For brands looking to scale without compromising on quality, transparency, or partner satisfaction, FMS is not just an option—it’s an essential foundation for long-term success.

From HQ to outlet—BETs FMS keeps every link in the chain strong.

To know more,

Visit Us : https://www.byteelephants.com/

0 notes

Text

GST-Integrated Billing Software That Simplifies Your Financial Processes

Go GST Bill is revolutionizing the way businesses manage their finances by offering innovative and easy-to-use accounting and billing solutions. Designed with user experience in mind, their products cater to businesses of all sizes, from startups to established enterprises. With a focus on simplifying complex financial tasks, Go GST Bill ensures that companies can focus on growth instead of grappling with accounting intricacies.

At the core of their offerings is software that seamlessly integrates key accounting functions, streamlining operations while maintaining accuracy and compliance. Whether it’s billing, inventory management, or financial reporting, Go GST Bill provides comprehensive solutions tailored to meet varying business demands. Their user-friendly interfaces and powerful features have set a new standard in the accounting software market. Many clients appreciate their free business accounting software, enabling businesses to access essential tools without financial strain.

Go GST Bill - All-in-One Financial Solutions for Businesses

Go GST Bill also simplifies the often-complicated process of generating professional business documents. Their intuitive systems offer a pre-designed purchase order format to help businesses efficiently manage procurement processes and maintain robust vendor communication.

For businesses dealing with the Goods and Services Tax (GST), Go GST Bill proves to be a valuable partner. Their smart software includes customizable templates, such as an accurate and professional GST invoice template, ensuring compliance with tax regulations. Additionally, they offer a detailed GST challan format that aids businesses in managing their tax records with precision and ease.

Go GST Bill’s commitment to empowering businesses reflects in every aspect of their service. By offering tools that simplify, streamline, and enhance financial processes, they’ve established themselves as a trusted partner for businesses aiming to achieve financial efficiency. Explore Go GST Bill’s innovative solutions today and take the first step toward smarter accounting and business management. With Go GST Bill, financial excellence is within reach.

0 notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] Book Keeper is most simplified accounting software for Micro and Small businesses. With over 1 Lac Users worldwide and 4.5 rating on Play Store/ App Store, Book Keeper is one of the leading accounting software in India. Works Offline Create GST invoices, file GST returns Complete Inventory Management + Warehouse + Barcode Sync Across Devices + User Management Generate Quotation/Orders Track Receivable/Payable Supports Windows, Android, iOS devices No Hidden Charges Get 3 months FREE subscription with this package Book Keeper is a product of Just Apps Pvt Ltd. Made in India specially for Indian businesses. Fully GST compatible - GST Invoicing se GST Filing tak. Book Keeper Accounting is Tally compatible. Sync your company accounts with Tally by importing existing Tally Masters into Book Keeper, and exporting Masters and Transactions from Book Keeper to Tally Works on Windows desktop, Android/iOS devices Generate and print invoices as per GST format Generate GST returns (GSTR1, 2, 3B, 4) in either JSON format or Excel offline utility Generate and manage e-Way Bills easily Track and maintain the right stocks at the right time, manage raw material and finished goods [ad_2]

0 notes

Text

Advance Course on GST in Delhi- IFDA Institute

Goods and Services Tax (GST) is one of the most crucial tax reforms in India, and understanding its complexities is essential for professionals, business owners, and students aspiring to build a career in finance and taxation. If you are looking to enhance your expertise in GST, enrolling in an advanced GST course in Delhi can be an excellent choice.

Why Opt for an Advanced GST Course?

An advanced GST course provides in-depth knowledge of the legal, practical, and compliance aspects of GST. Whether you are a tax professional, accountant, or entrepreneur, this course will equip you with:

A comprehensive understanding of GST laws and regulations

Hands-on training on GST return filing and compliance

Insights into tax planning and litigation aspects

Real-world case studies and expert guidance

Who Should Enroll?

This course is ideal for:

Chartered Accountants (CAs) and Company Secretaries (CSs)

Finance and taxation professionals

Business owners and entrepreneurs

MBA and commerce students

Lawyers specializing in taxation

Course Curriculum

The advanced GST course in Delhi typically covers:

Introduction to GST – Basics, structure, and framework

GST Registration Process – Eligibility, application, and amendments

GST Return Filing – GSTR-1, GSTR-3B, annual returns, and reconciliation

Input Tax Credit (ITC) Mechanism – Rules, restrictions, and practical scenarios

E-Invoicing and E-Way Bill System – Compliance and challenges

GST Audits and Assessments – Practical insights into audits and litigation

Recent Amendments and Case Studies – Real-world applications and updates

Benefits of Taking an Advanced GST Course

Enhances career prospects in taxation and finance

Helps businesses ensure GST compliance and avoid penalties

Provides industry-recognized certification for professional growth

Develops practical skills in GST software and filing tools

Course Duration and Fees

The duration of an advanced GST course varies from a few weeks to a few months, depending on the institute and course format (online or offline). The fees range from ₹5,000 to ₹50,000, based on the level of expertise and certification offered.

Conclusion

An advanced GST course in Delhi is an excellent investment for anyone looking to master GST and excel in taxation. Whether you are a working professional or a business owner, this course will equip you with the knowledge and skills needed to navigate the complex GST framework efficiently. Choose a reputed institute and take your career or business to new heights with expert GST training.

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee

1 note

·

View note

Text

Why Choose Bharat Bills: The Best Cloud-Based GST Billing Software?

In today's fast-paced business environment, managing invoices, taxes, and accounts efficiently is crucial for growth. A cloud-based GST billing software streamlines these processes while ensuring compliance with Indian tax regulations. Whether you're a small business owner or managing multiple locations, an advanced billing solution like Bharat Bills can help you automate operations, save time, and improve financial accuracy.

Key Features of Bharat Bills Software: The Ultimate Cloud-Based GST Billing Solution

Bharat Bills offers a robust suite of features designed to simplify business operations:

1. E-Way Bill Integration for Seamless Transport Compliance

Generate e-way bills with a single click and ensure compliance with transport regulations without hassle.

2. WhatsApp Integration with Automated Payment Reminders

Keep customers informed with automated reminders for due payments via WhatsApp, reducing overdue invoices.

3. E-Invoice Integration for Faster GST Compliance

Directly generate and manage e-invoices, reducing tax compliance complexities.

4. Advanced Reporting & Analytics

Access multiple informative reports to gain insights into sales, expenses, and tax summaries, enhancing decision-making.

5. Recurring Invoice Generation for Subscription-Based Billing

Automate recurring invoices and streamline billing cycles for subscription-based businesses.

6. Multi-User & Role-Based Access

Assign different access levels to multiple users, ensuring secure and controlled data management.

7. Multi-Company & Multi-Location Support

Manage multiple businesses and branches from a single cloud platform.

8. GSTR-1 JSON Download for Easy GST Filing

Export GST returns in JSON format, ensuring hassle-free tax compliance.

9. Export All Reports to Excel

Generate and export all reports in Excel format for easy data analysis and record-keeping.

10. Free Android Application for On-the-Go Access

Manage billing, invoices, and reports from your mobile device using the Bharat Bills app.

11. UPI Integration for Instant Payments

Allow customers to make quick and secure payments via UPI, reducing transaction delays.

12. Track Supplier’s GST Return Status

Monitor suppliers' GST filing status to ensure compliance and maintain smooth business operations.

Future-Proof Your Business with Bharat Bills

A cloud-based GST billing software like Bharat Bills simplifies business operations, reduces compliance burdens, and enhances financial efficiency. Whether you manage a single company or multiple locations, Bharat Bills ensures smooth invoicing, tax reporting, and payment tracking.

For a detailed insight into how a cloud-based billing solution can benefit your business, read this article.

Get Started Today

Upgrade your billing process with Bharat Bills. For inquiries and a free demo, contact us today!

0 notes

Text

Best Printable Receipt Invoice Templates in PDF

A printable receipt invoice template in PDF is a vital tool for businesses, freelancers, and service providers. It helps maintain financial records, streamline payment processes, and ensure professionalism in transactions. Using a well-designed printable receipt invoice templates in pdf makes it easy to create, send, and store receipts in a universally accessible format.

Why Use a Printable Receipt Invoice Template in PDF?

1. Professional and Consistent Formatting

PDF templates maintain consistent formatting across all devices, ensuring that invoices look professional regardless of where they are viewed. Unlike Word or Excel files, PDFs preserve design elements and prevent unintentional modifications.

2. Easy Accessibility and Printing

A printable receipt invoice template allows businesses to quickly generate invoices that can be printed or shared digitally. This is especially useful for retail stores, consultants, and freelancers who need to issue receipts on the go.

3. Secure and Tamper-Proof

PDF invoices are more secure than other formats, as they cannot be easily edited without specialized software. This ensures authenticity and prevents unauthorized modifications.

4. Compliance with Legal and Tax Requirements

Using structured PDF invoice templates helps businesses comply with tax regulations by including essential details such as transaction date, tax amounts, and total payments.

Key Features of the Best Printable Receipt Invoice Templates

1. Clear Business and Client Details

A high-quality template should include:

Business name, logo, and contact information

Client’s name, address, and contact details

2. Unique Invoice and Receipt Numbering

Every invoice should have a unique identifier to ensure proper record-keeping and easy tracking.

3. Itemized Breakdown of Goods or Services

Description of products or services provided

Quantity, unit price, and total amount

Discounts or additional charges (if applicable)

4. Taxes and Final Amount

Clear mention of VAT, GST, or any applicable tax

Grand total, including all charges

5. Payment Methods and Terms

Accepted payment options (bank transfer, PayPal, credit card)

Payment due date and late fee policy (if applicable)

6. Notes and Business Policies

A section for additional notes, refund policies, or a thank-you message enhances professionalism.

Where to Find the Best Printable Receipt Invoice Templates in PDF

There are various online platforms that offer free and premium PDF invoice templates, such as:

Luzenta

Invoice Home

Zoho Invoice

Microsoft Office Templates

Conclusion

A printable receipt invoice template in PDF is a must-have for businesses looking for professional, well-structured, and secure invoicing solutions. It ensures clarity, compliance, and ease of use, making transactions smoother and more efficient.

1 note

·

View note

Text

GST Billing Software in India

Managing finances and keeping track of GST bills can often feel overwhelming, especially for businesses of all sizes. However, with the help of GST billing software in India, this process becomes faster, easier, and more efficient. Let’s dive into why GST billing software is a must-have for businesses in India.

What is GST Billing Software?

GST billing software is a tool designed to simplify the creation, management, and tracking of invoices while ensuring compliance with the Goods and Services Tax (GST) regulations. This software automates billing tasks, making it easier for businesses to manage their taxes and finances.

Benefits of Using GST Billing Software in India

Simplifies Billing Process

Automatically calculates GST rates for your products or services.

Generates GST-compliant invoices quickly.

Ensures Accuracy

Minimizes human errors in tax calculations.

Keeps records error-free and compliant.

Saves Time

Speeds up the billing and tax filing processes.

Reduces time spent on manual calculations.

Tracks Financial Records

Helps monitor sales, expenses, and tax liabilities.

Provides detailed financial reports for better decision-making.

Improves Compliance

Ensures all invoices meet GST regulations.

Simplifies GST return filing.

User-Friendly Features

Easy-to-use interfaces for small and large businesses.

Supports multiple billing formats and customizations.

Cost-Effective Solution

Reduces dependency on external accountants.

Saves money by avoiding penalties due to tax errors.

Who Can Benefit from GST Billing Software?

Small businesses looking to streamline their billing process.

Medium-sized enterprises managing multiple transactions.

Large corporations handling high volumes of invoices daily.

Freelancers and self-employed professionals who need accurate GST billing.

Why is GST Billing Software Essential in India?

In India, adhering to GST regulations is mandatory for businesses. GST billing software ensures compliance and simplifies tax filing. Moreover, it boosts efficiency, reduces errors, and helps businesses focus on growth rather than administrative hassles.

Conclusion

Incorporating GST billing software into your business operations is a smart move that saves time, improves accuracy, and ensures compliance with Indian tax laws. For businesses seeking reliable and user-friendly solutions, Optech Software provides excellent options to make billing effortless and efficient.

#billingsoftware#gstbillingsoftware#businesssolutions#gstcompliance#accountingtools#optechsoftware#billing software#invoicing#taxfiling#softwareforbusiness

0 notes

Text

Online Expense Tracking

Most of the times cashiers, consumers, owners, contractors and businessmen prefer to work from their own locations and as per their flexibility. They always require a reliable and effective expense tracking software to record the expenses they are spending on projects. TRIRID-Billing software helps owners/Businessmen to maintain all expenses in proper way and fulfil this entire requirement accurately.

TRIRID-Billing online invoice software with GST offers:

Easy and simple user-friendly expense tracking software.

Efficient Timesheet and Expense approval workflow.

Save employees/customers details and expenses as needed and excess later.

Customers based bill, payments and receipts.

Online billing access from anywhere.

Powerful Dashboards and reports for owners and Businessmen.

Powerful dashboard view of purchased, sales, expense, invoices and outstanding stock for future predictions etc.

TRIRID-Billing software is cloud-based expense software in which you can manage all your purchases, expenses and stock data are stored in cloud and users can access all the data from anywhere anytime. This allows businessmen/consumers to access all expenses from any convenient source while roaming or surfing.

With the help of TRIRID-Billing GST based invoice is auto generated. Also when you click to GST Report Column you can able to see the GST Sale and GST Purchase report including party name, GST, voucher date, Sub Total, Shipping etc. You can see month wise report by clicking on Date Picker button. You can download GST purchased/Sale or export as CSV files in your local device.

TRIRID-Billing software smooth expense submission and approval processes make expense tracking less time consuming and error free. TRIRID-Billing software has a separate Expenses page where owners/consumers can create their weekly, quarterly, monthly, yearly expense sheet or manipulate later.

TRIRID-Billing software can analyse expenses to identify and removing errors, like duplicates and overpayments while done manually. This detailed data analysis is extremely useful for small, medium and large enterprises that deal in multiple taxes as VAT, GST etc.

TRIRID-Billing dashboard helps to analyse all your expense data and generate online reports for documentation and sharing purposes. Also you can download/export this report to Excel and PDF formats.

TRIRID-Billing Software is deal with the bill payment of Purchases, Sales and other transactions that can be easily achieved by using our TRIRID-Billing software.

With TRIRID-Billing software you can store your invoices in the form of data files on your Computer/Mobile/Tablet etc. Now you have rights to access to them without use of any paper.

For More Information:

Call @ +91 8980010210

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#Benefits of Billing Software#Online Expense Tracking#Time Tracking & Billing Software#TRIRID-Billing in Bopal-Ambli road-ahmedabad#TRIRID-Billing in ISCON-Ambli road-ahmedabad

0 notes

Text

Unlock Your Potential with an Accounting GST Course: A Comprehensive Guide

In today's dynamic business environment, staying updated with the latest accounting and taxation practices is crucial for both professionals and businesses. One such critical area is the Goods and Services Tax (GST), which has revolutionized the taxation system in many countries, including India. Pursuing an accounting GST course can be a game-changer for your career, providing you with the necessary skills and knowledge to excel in this field. This comprehensive guide will explore the benefits, curriculum, and career prospects associated with an accounting GST course, and how it can lead to a diploma in GST accounting and taxation.

Why Opt for an Accounting GST Course?

1. High Demand for GST Professionals

Since the implementation of GST, the demand for skilled professionals who understand the intricacies of this tax system has surged. Businesses need experts to handle GST compliance, filings, and audits. By completing an accounting GST course, you position yourself as a valuable asset to potential employers.

2. Comprehensive Knowledge

An accounting GST course provides in-depth knowledge of GST laws, regulations, and procedures. You'll learn about GST registration, return filing, input tax credit, and more. This comprehensive understanding is crucial for ensuring compliance and avoiding penalties.

3. Career Advancement

A diploma in GST accounting and taxation can significantly enhance your career prospects. It opens up opportunities for roles such as GST consultant, tax analyst, accounts manager, and compliance officer. These positions often come with attractive salaries and growth potential.

Curriculum of an Accounting GST Course

A well-structured accounting GST course covers various aspects of GST, ensuring that you gain a thorough understanding of the subject. Here’s a glimpse of what you can expect:

1. Introduction to GST

History and evolution of GST

Key concepts and definitions

Benefits of GST for businesses and the economy

2. GST Registration

Eligibility criteria for GST registration

Online registration process

Types of GST registrations

3. GST Invoicing

Format and contents of a GST invoice

Time and value of supply

Debit and credit notes

4. Input Tax Credit (ITC)

Concept of ITC and its importance

Conditions for availing ITC

Reversal of ITC

5. GST Returns Filing

Types of GST returns

Filing process and due dates

Common errors and how to avoid them

6. GST Payment and Refunds

Modes of GST payment

Interest and penalties for late payment

Procedure for claiming refunds

7. GST Audit and Assessment

Types of GST audits

Audit procedures and documentation

Assessment and adjudication process

Benefits of a Diploma in GST Accounting and Taxation

Pursuing a diploma in GST accounting and taxation offers several advantages:

1. Specialized Knowledge

A diploma course delves deeper into GST laws and regulations, providing specialized knowledge that is highly valued in the job market.

2. Practical Training

Many diploma courses include practical training sessions, workshops, and case studies. This hands-on experience is invaluable for understanding real-world applications of GST.

3. Industry Recognition

A diploma from a reputed institute adds credibility to your resume. It signals to employers that you have undergone rigorous training and possess the skills required to excel in GST-related roles.

4. Networking Opportunities

Diploma courses often provide opportunities to network with industry professionals, alumni, and faculty. These connections can be beneficial for career growth and job placements.

Career Prospects after Completing an Accounting GST Course

Completing an accounting GST course or a diploma in GST accounting and taxation opens up a wide range of career opportunities. Here are some potential career paths:

1. GST Consultant

As a GST consultant, you'll advise businesses on GST compliance, help with registration, filing returns, and resolve GST-related issues. This role requires a deep understanding of GST laws and excellent analytical skills.

2. Tax Analyst

Tax analysts are responsible for preparing and reviewing tax returns, ensuring compliance with GST regulations, and analyzing tax-related data. This role is crucial for businesses to optimize their tax liabilities and ensure accurate reporting.

3. Accounts Manager

Accounts managers handle the financial records of an organization, including GST compliance. They oversee invoicing, payments, and reconciliations, ensuring that all transactions adhere to GST guidelines.

4. Compliance Officer

Compliance officers ensure that a company adheres to all legal and regulatory requirements, including GST laws. They conduct audits, review policies, and implement compliance programs to mitigate risks.

Choosing the Right Accounting GST Course

When selecting an accounting GST course, consider the following factors:

1. Accreditation and Recognition

Ensure that the course is accredited by a recognized body and is well-regarded in the industry. This adds value to your qualification and enhances your employability.

2. Curriculum and Faculty

Review the course curriculum to ensure it covers all essential topics. Check the qualifications and experience of the faculty members to ensure you receive quality education.

3. Practical Training

Choose a course that offers practical training through case studies, workshops, and internships. Practical experience is crucial for understanding the real-world applications of GST.

4. Placement Assistance

Many institutes offer placement assistance to help you secure a job after completing the course. Check if the institute has tie-ups with reputed companies and a good placement track record.

Conclusion

An accounting GST course is an excellent investment for anyone looking to build a successful career in accounting and taxation. It equips you with the necessary skills and knowledge to navigate the complexities of GST and opens up a plethora of career opportunities. Whether you’re a fresh graduate or a working professional, pursuing a diploma in GST accounting and taxation can significantly enhance your career prospects and help you stay ahead in the competitive job market.

By choosing the right course and dedicating yourself to learning, you can unlock your potential and achieve professional success in the field of GST accounting and taxation. So, take the first step towards a rewarding career and enroll in an accounting GST course today!

0 notes

Text

Creating Professional Invoice Templates in Excel and Word

A) Invoice template Excel

An invoice template in excel is a document plan that assists the user in creating professional invoices with ease and in a short span of time. These often contain data about the customer, items and services, subtotal and total, taxes, and payment method. It can be formatted according to the requirements of the company with other options like conditional formatting, formulas, as well as data validation for purposes of enhancing the accuracy of the operations. In creating an invoice using Excel, you can produce several invoices in the shortest time possible and in the most efficient way; this way, there are little to no mistakes when typing the invoice number, date, product description, quantity, and price, yet the invoice reflects professionalism by incorporating the image of the company’s logo at the back of the invoice.

Elements of Invoice template Excel

1. Header:

The heading part of the invoice that contains information such as the name, logo, number, physical and email address of the business.

2. Invoice number:

A document number through which the invoice can be specifically identified may contain alphabets and/or numerals.

3. Date:

The specific point of time at which the invoice was prepared or sent by the invoicing company to the buyer.

4. Billing information:

The name of the customer as well as his or her address among the other detailed information.

5. Itemized list:

This is a record of products or services that are offered which may include:

● Description:

A short description of the good.

● Quantity:

The quantity of the products is the number of items that are to be bought.

● Unit price:

The cost for each unit of the good.

● Amount:

It is the total amount of money that has been spent on the item of concern, thus quantity multiplied by the unit price.

6. Subtotal:

A figure prior to Tax computation; that is a Gross figure.

7. Taxes:

The taxes that are charged on the subtotal or the total sales for instance; the sales tax, value added tax-VAT or goods and services tax-GST.

8. Total:

This is the total figure owed in sum with all the subtotals.

9. Payment terms:

Details of the acceptable modes of payment, the required amount of time for making payment, and any other point that pertains to a delayed payment.

10. Footer:

Extra information relevant to the company, for instance, the return-policies, ways which consumers can reach the company or even a simple note of thanks.

B) Invoice Template word

An example of an invoice in Word format contains a professional heading where you may find the business logo, name, address, and phone/fax numbers/email addresses; the central region containing basic details of the sale/service, such as date, invoice number, buyer’s name and address, goods and services sold and purchased, quantities, unit prices, and totals; the last section may involve payment terms, payment options and due dates; and the footer usually consists an area to write the customer’s full name, payment receipt stamp and also for any extra remarks about the order.

Step-by-step process for creating an invoice template in Word

Step 1: Open a new document in word.

Click on the Microsoft Word application and go to the “File” option next select “New”.

Select the templates or begin Type with a clean slate.

Name the page as landscape and most importantly arrange the margins to your desired setting.

Step 2: Company Information Booth

Include a formal table of two columns in which to place the logo and name of the company as well as the address and phone numbers.

The font style as well as the font size that one will be using should correspond to the company’s theme.

Step 3: The next step is to add Invoice Header.

To elaborate this, you need to construct a table having the columns such as invoice number, the date, and invoice details that might include Invoice, Date, Bill To, etc.

Make use of a larger font size that will be visible enough so that it can easily attract the attention of the reader.

Step 4: Get more information about the Product/Service.

To present multiple items, use a table that can help list down the products/s or services offered.

Columns can include:

Item description

Quantity

Unit price

The amount arrived at after multiplications of total quantity by unit price are summed up.

It is recommended that a consistent font style and formatting has to be included in the text.

Step 5: Total and Payment Info

Deduct quantity discount if the given parameter is set and then sum up all the extended totals to get the subtotal.

Append the tax rate (if any) and sum them to obtain the collective.

These should be written in three different headings; payment terms, payments acceptable and the due date.

If there are any specifics that need to be emphasized, then it should be done in a properly sized bold font.

Step 6: Add Footer

To the right of its partner this element should be supplemented with a footer section to place the customer’s signature and payment receipt stamp

It is also possible to described here any additional notes or comments

Step 7: Save for later and Choose options

Additional or deletion of sections may be done by the user depending on his/her needs, the user may also change the templates’ fonts and its margins.

Use a different name to save the template when creating the new invoice with an example being “Invoice Template. Docx”.

Step 8: Instead of forcing such skills on learners, educationists can endeavor to use the template.

Copy and paste the contents of the template in a new sheet or if you want to start with a new fresh document.

Make adjustments to the header section for the line item, including the new invoice number, as well as the date if you have to make the changes frequently for the items listed as products and services provided to the buyer.

0 notes

Text

Which accounting applications are the best in India?

While searching for the best accounting software, usually SMEs look out for those that serve their business purposes. Selecting the best business accounting software is important for business growth.

Currently, you'll find a lot of accounting software in India, and being an SME you wouldn't take much time to finalize.

Well, you can have a look at some of the options below: - Busy Accounting Software - ZohoBooks - Marg - TallySolutions

BUSY is the #1 GST, billing and accounting software for micro, small & medium enterprises. It is powerful, easy to use, and scalable as per your business needs.

Key features of BUSY Accounting Software:

- Validate HSN/SAC & GSTIN - Automatic Generation of E-Invoice & E-Way Bill - GST e-returns in JSON format - Ledger Reconciliation - Automatic Data Backup on Google Drive - Reports Export (Plain File / HTML / PDF / MS-Excel)

However, it would be a great idea if you try BUSY for 30 days and then make the right choice.

#small business accounting services#accounting software#gst accounting software for retail#inventory software#financial planning

0 notes