#GSTreturnfiling

Explore tagged Tumblr posts

Text

#GSTCompliance#GSTReturnFiling#DSCIntegration#TallyReconciliation#DashboardAnalytics#BulkReturnProcessing#MultiUserAccess#ErrorValidation#ITCReconciliation#AutoGSTR3B

0 notes

Text

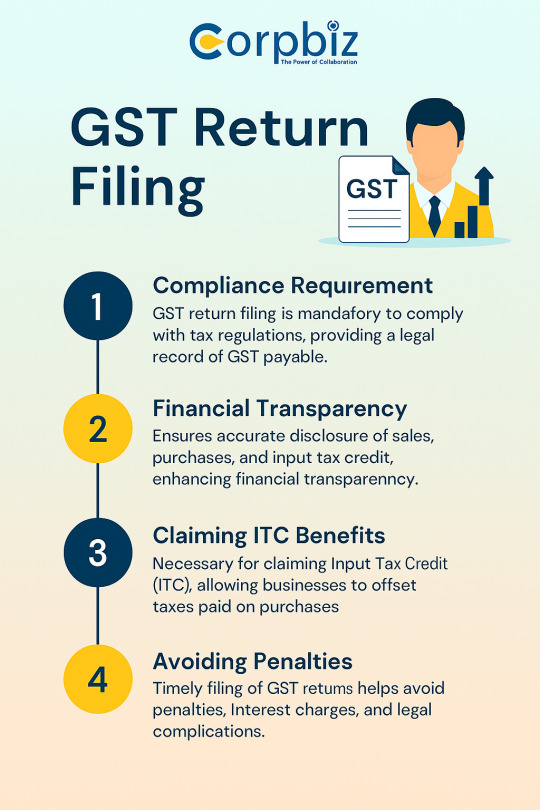

GST Return Filing Simplified for Small Businesses in India

GST Return Filing is a process where businesses report their monthly, quarterly, or annual GST transactions to the government. For small businesses, timely gst return filing ensures legal compliance and helps avoid penalties. The gst return filing process includes collecting sales and purchase data, reconciling invoices, and filing via the GST portal. Understanding the gst return filing procedure can reduce stress and save costs. Whether you're a startup or MSME, choosing the right filing frequency and keeping accurate records is key to smooth GST compliance.

#GSTReturnFiling#SmallBusinessIndia#GSTFilingProcess#TaxCompliance#CorpbizIndia#GSTReturnProcedure#MSMETaxSupport#GSTMadeSimple

0 notes

Text

Expert GSTR-9C Late Fee Waiver Guide: Key Dates & Eligibility

Struggling with GSTR-9C filing? Taxgoal’s GST Return Filing Services in Delhi offers expert guidance on GSTR-9C late fee waivers. Learn the key dates, eligibility criteria, and step-by-step instructions for filing your GST return. Stay compliant and save on penalties with our efficient, hassle-free services. Contact us (+91 9138531153) today for GST Return Filing Services Near Me.

#Taxgoal#GSTR-9C#GSTReturnFiling#LateFeeWaiver#FilingGuide#KeyDates#Eligibility#GSTCompliance#DelhiGSTServices#TaxFiling#GSTR-9CLateFee

0 notes

Text

Guide to GST Services by the LegalDost

Businesses may find it challenging to keep up with the complicated rules of the Goods and Services Tax (GST). At the LegalDost, we make it easier by providing a full range of GST-related services. This way, you can focus on growing your business while we ensure you stay compliant. The LegalDost is your reliable partner for all your GST needs, whether you must register for GST, file your GST report, or file your GSTR-9 annually.

GST Registration: Your Gateway to Compliance

Businesses need to first register for GST to comply with the framework. It gives your company a distinct identity and allows you to legally collect and remit GST.

Key Aspects of GST Registration

Turnover Limit for GST Registration: Companies that generate more revenue than the specified threshold must register for GST. The cost is ₹40 lakh for the majority of goods and ₹20 lakh for services.

Types of GST Registration: Depending on your company plan, you might require casual taxable person registration, composition scheme registration, or ordinary GST registration.

Documents Required for GST Registration: Completing the process requires a PAN card, proof of business, address proof, and identity proof.

New GST Registration Fees: We at the LegalDost offer hassle-free online GST registration with transparent charges.

GST Registration Portal: Throughout the GST registration process, we help you with everything from filing to receiving your GST registration certificate.

Check GST Registration Status: The LegalDost can help you keep track of your application on the GST registration portal.

Why the LegalDost?

Simplified GST Registration Process: Your GST registration number will be sent to you quickly because we take care of everything.

Affordable Fees: Our GST registration fees are affordable and come with no additional charges.

GST Return Filing: Stay Ahead of Deadlines

The LegalDost provides comprehensive assistance for accurate and fast GST return filing.

Everything You Must Know About GST Return Filing

How to File GST Return Online: Our team streamlines the GST return filing process, ensuring accuracy and compliance with regulations.

GST Return Filing Due Dates: Missing deadlines may result in penalties. Allow us to help you with paying your taxes before the GST return filing due date.

File GST Return Online: We support all return types, including the GSTR-1, GSTR-3B, as well as others.

GST Return Filing Fees: Cost-effective GST return filing is made possible by our affordable prices.

How to File GSTR-9 Annual Return: The LegalDost ensures that all regulations are followed when submitting your GSTR-9 annual return.

Due Date for Filing GSTR-9 Annual Return: Stay updated about the GSTR-9 annual return filing due date with the help of our experts.

GSTR-9 Annual Return Filing Format, Eligibility & Rules: We make it simple for you to file your annual returns.

GST Return Filing Status: We provide real-time post-filing updates on the GST return filing status.

GST LUT Filing: Simplifying Export Processes

A Letter of Undertaking (LUT) needs to be filed by exporters for zero-rated supplies that do not include integrated tax payment.

Key Aspects of GST LUT Filing

Who Can File LUT Under GST? Exporters that fulfill certain requirements are qualified.

How to File LUT Under GST Online: Our professionals guarantee a smooth GST portal experience.

Time Limit for Filing LUT in GST: Timelines are managed by us to prevent delays in LUT filing in GST.

GST Amendment: Keeping Your Details Updated

Maintaining compliance requires updating your GST registration details. The LegalDost offers GST amendments assistance to effectively update your company's data.

Why Amend GST Details?

GST Amendment Process: Update information, such as authorized signatories, addresses, as well as contact information.

Recent Amendments in GST: Know what the most recent amendments in GST mean and how they affect you.

Why Choose the LegalDost for GST Compliance?

The LegalDost has everything you need for GST services in one place:

Comprehensive Support: Our services include new GST registration and GSTR-9 annual return filing.

Expert Guidance: Our team ensures the correct execution of the GST registration procedure and filing processes.

Affordable Pricing: We offer competitive fees for services like filing a GST return or a GST LUT.

Summary

The LegalDost makes it easier to obey GST requirements. Whether you need help with new GST registration, GST registration status, or GSTR-9 annual returns, we will make the procedure simple.

Partner with the LegalDost today and simplify your GST compliance journey!

0 notes

Text

GST Return Filing Due Date

GST return filing doesn't have to be a daunting task. By following the expert tips and guidelines outlined in this article, you can streamline the process, ensure compliance with the law, and avoid costly mistakes.

0 notes

Text

Effortless GST Compliance: Leveraging Legal Terminus for Seamless Return Filing | Legal Terminus

Legal Terminus can assist you with GST return filing in India for your organization in a hassle-free manner, ensuring that it is submitted within the due date. We provide our services within a reasonable time span and at a competitive professional fee. To learn more about how we can help with your GST return filing, please book a free telephonic appointment with one of our consultants.

0 notes

Text

GST Return Filing Services by Tax4India

GST Return Filing Services

Get your GST Return Filing with Tax4India expert team

Call Now: +91 92516 54050

Visit our website: www.tax4india.org

.

.

.

.

.

.

.

1 note

·

View note

Text

MVAT Audit Report in Form e-704

Introduction

Regular audits are essential to ensure compliance and transparency in taxation. The new VAT Audit Form — 704 has brought out many major changes that are important for companies operating under the Sales Tax Act. The Maharashtra Value Added Tax Rules introduced this complete form with the objective of reducing the audit procedure and improving the effectiveness of tax administration. In this article, we’ll go into detail about the new VAT Audit Form 704, including its deadline, important clauses, and the significance of the audit report under MVAT.

What is VAT Audit Form-704?

The new VAT Audit Form 704 shows an important change in the tax audit system. It is easy to collect accurate information on a company’s financial dealings, tax obligations, and compliance status. The form provides auditors with important insights into the company’s tax position by serving as an organized structure to evaluate the correctness and completeness of a taxpayer’s VAT information.

What is the importance of the MVAT Audit Report?

The VAT Audit Form — 704 audit report is a crucial document for both businesses and tax authorities. It provides an in-depth review of a business’s VAT compliance, indicating potential risk factors and areas of non-compliance. Businesses can improve their understanding of their tax positions and correct any inaccuracies or irregularities by carefully reviewing the audit report. The report can also be used by tax authorities to evaluate a taxpayer’s compliance status, promoting efficient tax administration and enforcement actions.

What are the Important Clauses of VAT Audit Form — 704?

The new VAT Audit Form — 704 has multiple sections that cover important details of a company’s VAT requirements. These comprise of:

1. General Information: Under this section, businesses must submit basic information such as their name, address, tax identification number, and the financial year that is being audited.

2. Turnover Information: To allow auditors to assess the correctness of VAT calculations, businesses are required to provide their taxable turnover, export turnover, exempt turnover, and turnover subject to the composition scheme.

3. Input Tax Credit (ITC) Reconciliation: The objective of this section is to reconcile up the input tax credit claims made by the company with the appropriate supporting documents. It helps auditors in verifying the validity and eligibility of claims for input tax credits made during the financial year.

4. Comply with Filing Standards: Companies must provide information on VAT returns, tax payments, and the submission of the necessary documents to complete their compliance with filing standards.

5. Tax Obligation and Payments: The tax liability of the taxpayer is calculated in this section by taking into account multiple factors, including output tax, input tax credit, composition tax, and penalties, if any.

What is the due date of VAT Audit?

Businesses need to be aware of the VAT audit deadline in order to ensure timely compliance. The VAT Audit Form — 704 must be submitted in accordance with the rules within nine months after the conclusion of the financial year for which the audit applies. This due date shows how important it is to have correct and current financial documents all year long in order to ensure a smooth and effective audit process.

The GST return filing online facilitates the tax process by providing businesses with a convenient and accessible method to submit their GST returns digitally. This streamlined and transparent process eliminates the need for traditional paperwork, thus streamlining the reporting process and ensuring accuracy in terms of sales, purchases and tax credits. Adopting the digital era, GST return filing online provides a convenient and accessible solution for businesses to fulfill their tax obligations.

Summary

The new VAT Audit Form — 704 is an important step toward improving tax accountability and transparency. Businesses need to be aware of every element of this detailed form, such as the deadline, important clauses, and the importance of the audit report as it involves the Maharashtra Value Added Tax. Businesses may speed the audit process, reduce possible risks, and contribute to a more effective tax ecosystem by keeping accurate records and guaranteeing compliance. Businesses will be better prepared to deal with the VAT audit environment and will experience a smoother tax compliance journey if they keep up with the changing tax regulations.

0 notes

Text

Process of GST Return Filing in Auckland:

In the ever-evolving realm of taxation, it's crucial for organizations of all sizes to maintain compliance with the latest guidelines. For businesses operating in Auckland, New Zealand having a deep understanding of the Goods and Services Tax (GST) Return Filing procedure is indispensable. In this blog post, we, at Accountrix, take pride in offering the finest GST Return Filing Service in Auckland. We will guide you through the process of filing GST returns, outlining the key steps and providing valuable insights to streamline the process.

Click Here to Know More About our Blog:

https://accountrix.co.nz/process-of-gst-return-filing-in-auckland/

0 notes

Text

Simplify your GST return filing process with our expert GST Return Filing Services. Check it out here: https://pioneerone.in/gst-return-filing-services/

✔ Hassle-Free Filing: Let our professionals handle your GST return filing, ensuring accuracy and compliance, while you focus on growing your business.

✔ Timely Submissions: Say goodbye to missed deadlines! We'll ensure your GST returns are filed promptly, avoiding any late fees or penalties.

✔ Expert Guidance: Our experienced team will guide you through the complex GST regulations, ensuring you understand your filing requirements and obligations.

✔ Error-Free Filing: Minimize the risk of errors in your GST returns. Our professionals will review and cross-verify your data, ensuring a smooth and error-free filing process.

✔ Stay Compliant: Don't stress about staying up-to-date with ever-changing GST rules. Our experts will keep you informed, ensuring your filings are in full compliance.

Simplify your GST return filing and stay compliant! Visit our website now to explore our GST Return Filing Services and experience a seamless filing process. https://pioneerone.in/gst-return-filing-services/

For any inquiries or assistance, our dedicated team is ready to support you. Let's make your GST return filing hassle-free and efficient!

#GSTReturnFiling#GSTCompliance#ExpertAssistance#HassleFreeFiling#BusinessSuccess#GrowWithGST#StayCompliant#CustomizedSolutions#Compliance#FocusOnYourBusiness#accountingfirm#accountingservices#auditingfirm#pioneerone#taxconsultant#auditservices#taxation#businesssupport

0 notes

Text

youtube

youtube

0 notes

Text

Top 7 Mistakes to Avoid When Filing GST Annual Return

Avoid common errors when filing your GST Annual Return & Audit in Delhi with Taxgoal. Key mistakes include incorrect data entry, missing deadlines, improper reconciliation, failing to claim eligible credits, inadequate documentation, errors in turnover calculation, and neglecting audit requirements. Learn how to navigate these pitfalls for a smooth process. Contact us (+91 9138531153) today for GST Annual Return & Audit Near Me.

#Taxgoal#GSTAnnualReturn#GSTAudit#TaxFilingMistakes#GSTDelhi#GST#GSTCompliance#GSTReturnFiling#TaxAuditTips#DelhiGST#GSTFilingErrors

0 notes

Text

Streamlining Your Business with the Ultimate GST Software Solution

Introduction:

In today's fast-paced business landscape, keeping up with the ever-changing tax regulations and maintaining seamless operations can be daunting. However, embracing technology can streamline your business and lead to remarkable growth. If you're seeking a game-changer to revolutionize your company's tax management and overall efficiency, look no further than the ultimate GST software solution.

In this blog, we'll explore how this cutting-edge software can transform your business operations, ensuring compliance and maximizing productivity.

Simplified GST Filing Process:

The hallmark of a robust GST software solution lies in its ability to simplify the GST filing process. Instead of grappling with complex spreadsheets and manual calculations, the software automates the entire process, eliminating the risk of human errors. With a user-friendly interface and step-by-step guidance, preparing and filing GST returns becomes a breeze, saving valuable time and resources.

Real-Time Data Management:

Efficient data management is crucial for making informed business decisions. The ultimate GST software enables real-time tracking of sales, purchases, and tax liabilities. With up-to-date insights, you can gain a comprehensive view of your financial position and take proactive measures to optimize cash flow and profitability.

Seamless Integration with Existing Systems:

Worried about disrupting your current business setup? Fear not! The right GST software seamlessly integrates with your existing ERP or accounting systems. This integration not only ensures a smooth transition but also enhances data accuracy and prevents duplication of efforts.

Stay Compliant with Regular Updates:

Tax laws are continuously evolving, and non-compliance can lead to penalties and reputation damage. The ultimate GST software solution keeps you up-to-date with the latest regulatory changes, ensuring that your business is always compliant. Automated updates and timely reminders guarantee that you never miss a deadline.

Advanced Report Generation:

From comprehensive financial reports to insightful analytics, the software's reporting capabilities offer a wealth of valuable information. Access detailed tax summaries, expense analysis, and sales trends at your fingertips, enabling you to make data-driven decisions and seize growth opportunities.

Enhanced Security and Data Privacy:

Security breaches can cripple a business's reputation and financial stability. The ultimate GST software prioritizes data security, employing robust encryption and secure cloud storage to safeguard your sensitive information. Rest assured that your financial data remains confidential and protected.

Exceptional Cost Savings:

Investing in a powerful GST software solution is not an expense but a strategic investment. By streamlining your tax management and automating various processes, you can significantly reduce operational costs. Additionally, the increased efficiency allows your team to focus on more strategic tasks, enhancing overall productivity.

Conclusion:

Embracing the ultimate GST software solution is a transformative step towards streamlining your business operations, boosting compliance, and achieving unprecedented growth. By simplifying the GST filing process, providing real-time data insights, ensuring seamless integration, and enhancing security measures, this cutting-edge software empowers your organization to stay ahead of the competition.

As you embark on this journey of digital transformation, choose a reputable software provider with a proven track record and a commitment to customer support. The future of your business is in your hands – embrace the power of technology today and unlock a world of possibilities.

0 notes

Text

GST Registration in India

Easily apply for GST Registration in India online with our step-by-step guide. Get your GST number in just a few days and start your business operations without delays.

#gstupdates#gstreturns#GSTRegistration#GSTReturnFiling#gstcancellation#gstnotice#GoodsandServicesTax

0 notes

Text

Understanding the Timeframe for Submitting GST Returns | Legal Terminus

The process of GST return filing in India can take anywhere from 1 to 2 working days. This timeline is contingent upon the submission of correct information and complete documentation. Ensuring that all necessary details are accurate and all required documents are provided in a timely manner will facilitate a smooth and efficient filing process.

Legal Terminus provides the best GST return filing services in India and also in Bhubaneswar. To know more visit Legal Terminus.

0 notes