#Global Camera Module Market

Explore tagged Tumblr posts

Text

#Global Thermal Camera Module Market Size#Share#Trends#Growth#Industry Analysis#Key Players#Revenue#Future Development & Forecast

0 notes

Text

The global camera modules market size is projected to reach USD 58.5 billion by 2026, growinmg at a compound annual growth rate (CAGR) of 10.5% during the forecast period.

0 notes

Text

Why are headlights so expensive for cars?

The high cost of modern car headlights is driven by a convergence of advanced technology, complex design, stringent regulations, and market factors. Here's a breakdown of the key reasons:

Advanced Technology & Complexity:

LED/Laser/Matrix Systems: Modern headlights use multi-element LED arrays, adaptive projectors, laser elements (on high-end models), or matrix/pixel technology that individually dims segments of the beam. This requires sophisticated control units, sensors, and wiring.

Adaptive Functionality: Features like auto-leveling, cornering beams, glare-free high beams, and dynamic light projections require motors, cameras, complex software, and extra wiring harnesses.

Integrated Components: Headlights now house DRLs (Daytime Running Lights), turn signals, position lights, and often front-facing sensors (radar/camera for ADAS) all in one sealed unit, driving up complexity.

Precision Engineering & Materials:

Optical Precision: Lenses and reflectors are molded with extreme precision to meet strict beam pattern regulations and avoid glare. Molds for these optics are incredibly expensive to design and manufacture.

Materials: High-performance polycarbonate lenses resist yellowing and cracking, while complex aluminum or magnesium heat sinks efficiently dissipate heat from powerful LEDs/Lasers. Seals must be perfect to prevent moisture and corrosion. Internal reflectors use specialized coatings.

Durability Requirements: Headlights must withstand extreme temperatures, UV radiation, road debris impacts, vibrations, and chemical exposure (car washes, road salt) for the vehicle's lifespan. This requires high-grade materials and construction.

Regulation & Testing Overhead:

Global Standards: Headlights must comply with strict global regulations (SAE, ECE, etc.) regarding beam pattern, intensity, cutoff sharpness, and aiming. Developing, testing, and certifying each headlight design for different markets adds significant cost.

Complex Testing: Extensive lab and road testing is required to ensure compliance, durability, and performance in all conditions, adding R&D costs.

Design and Manufacturing Integration:

Styling Demands: Headlights are critical styling elements. Aggressive shapes, intricate lighting signatures ("light jewelry"), and seamless integration with body panels require complex, unique housings for each model.

Custom Manufacturing: Headlights are model-specific (often even trim-level specific). Low-volume production runs compared to simple bulbs mean costs aren't spread over millions of identical units. Assembly involves delicate electronics and precise calibration.

Module Design: Modern headlights are typically sold as sealed assemblies ("modules"). If anything fails inside (LED chip, driver, ballast, motor, wiring), you often have to replace the entire 800+ unit, not a 10 bulb.

Supply Chain & Market Factors:

OEM vs. Aftermarket: Dealers charge high prices for genuine OEM parts, covering their overhead and profit margins. While quality aftermarket options exist (often significantly cheaper), OE parts command a premium.

Insurance Influence: Since insurance often pays for replacements after collisions (which frequently damage headlights), manufacturers have less pressure to minimize headlight costs compared to components owners pay for directly.

Low Price Elasticity: Headlights are essential safety items. Consumers need them to drive legally and safely, reducing the incentive for manufacturers/dealers to compete heavily on price for replacements.

Supplier Profit: Tier-1 suppliers (like Valeo, Bosch, Magna, Koito) design and build these complex units and need to recoup their substantial R&D and tooling investments per unit sold to the automaker.

Labor Cost (Hidden): Installation is often complex, requiring bumper/fender removal and sometimes electronic calibration/reprogramming. While the part cost is high, labor adds significantly to the total replacement expense perceived by the owner.

Comparison to Older Designs:

Simple Halogen Reflectors: Used cheap bulbs (10-50), simple reflectors, and a basic lens. Easy to manufacture replaceable bulbs. Entire assembly replacement was relatively inexpensive (100-300).

HID Projectors: Introduced cost via ballasts and specialized bulbs (50-150 per bulb), but the projectors and housings were less complex than modern LED units. Assemblies cost more than halogens but less than LEDs.

Modern LED/Adaptive Units: Represent a quantum leap in technology, integration, and complexity, hence the price jump.

In essence: You're paying for high-tech electronics, extreme precision optics, complex software integration, advanced materials built for durability, significant R&D/testing/regulatory costs, custom low-volume manufacturing of a styling-critical safety component, and market dynamics where insurers often foot the bill. It's a far cry from swapping out a simple bulb in a basic reflector housing.

#led lights#car lights#led car light#youtube#led auto light#led headlights#led light#led headlight bulbs#ledlighting#young artist#led light bulbs#led strip lights#car rental#electric cars#classic cars#car#cars#truck#porsche#suv#lamborghini#sabrina carpenter#bmw#carlos sainz#autonomous vehicle headlights#overtake another vehicle#older vehicles#vehicle#auto mode#automobiles

3 notes

·

View notes

Text

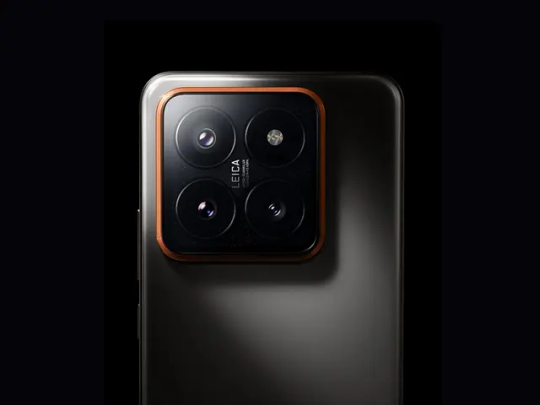

Forget Samsung: Xiaomi 14 Series Ready to Dethrone Galaxy S24 as King of Android

The Xiaomi 14 series has been officially unveiled in China, and it looks like it will be the Android flagship series to beat in 2023. The new Xiaomi 14 and Xiaomi 14 Pro come with improvements across the board, including bright displays, the latest Snapdragon 8 Gen 3 chipset, upgraded cameras, super-fast charging, and a titanium frame option for the Pro model. While we wait to get the Xiaomi 14 and Xiaomi 14 Pro in for full reviews, here is a preview of the key specs and features to expect from Xiaomi's latest flagships. We'll update this preview once we have the devices in hand and can provide more details from our hands-on testing. Xiaomi 14 Series Key Specs Xiaomi 14Xiaomi 14 ProSize, Weight152.8 x 71.5 x 8.2 mm, 188 g161.4 x 75.3 x 8.5 mm, 223 gDisplay6.36" OLED, 120Hz, 3,000 nits6.7" OLED, 120Hz, 3,000 nitsProcessorSnapdragon 8 Gen 3Snapdragon 8 Gen 3RAM, Storage8/256GB, 12/256GB, 12/512GB, 16/1TB LPDDR5X12/256GB, 16/512GB, 16/1TB LPDDR5XCameras50MP main (f/1.6), 50MP ultra-wide f/2.2, 50MP 3.2X telephoto f/2.0, 32MP front50MP main (f/1.42-4.0), 50MP ultra-wide f/2.2, 50MP 3.2X telephoto f/2.0, 32MP frontBattery4,610 mAh4,880 mAhCharging90W wired, 50W wireless120W wired, 50W wireless The highlights include the latest Snapdragon 8 Gen 3 chip, fast LPDDR5X RAM, bright 3,000 nit displays, and extremely fast charging speeds. The Pro model also introduces a variable aperture main camera and titanium frame option. We'll need to thoroughly test out these phones to see how all these specs translate to real-world performance and experience. Stay tuned for our full reviews! Xiaomi 14 Series Design The Xiaomi 14 series retains the premium design identity of the previous generation, with curved displays and backs, rectangular camera modules, and slim profiles. The Pro model introduces an eye-catching new titanium frame option. Both phones also utilize Xiaomi's new proprietary Ceramic Glass material on the front and back for added durability.

Xiaomi 14 Pro Color options include: - Xiaomi 14: Jade Green, Black, White, Pink - Xiaomi 14 Pro: Titanium, Black, White, Green

Xiaomi 14 Xiaomi 14 Series Cameras The Leica-tuned cameras on the Xiaomi 14 series bring some exciting upgrades. The main 50MP sensor on the Pro model features a variable f/1.4-f/4.0 aperture for more flexibility. The new 50MP ultrawide camera promises improved quality. The telephoto camera uses a floating lens element for better edge-to-edge sharpness. New AI tricks like eye tracking autofocus and Night OIS should also help boost photography. We look forward to putting these new camera systems through their paces.

Xiaomi 14 Series Software The latest Xiaomi 14 series introduces an exciting shift from MIUI to the new HyperOS. Running on Android 14 out of the box, HyperOS promises an improved user experience focused on four key areas: performance optimization, seamless connectivity, predictive intelligence, and robust security. While full details on HyperOS are yet to come, early reports suggest substantial AI and on-device neural processing. This enables advanced contextual awareness and personalization. Software support remains unconfirmed, but if last year's models are any indication, the Xiaomi 14 line should receive major OS updates for at least four years. Xiaomi 14 Series Availability The Xiaomi 14 and 14 Pro launched first in China, but global availability typically follows a couple months later. Pricing is also usually a bit lower for global markets. We expect the Xiaomi 14 series to compete head-to-head with the Galaxy S23 series in many regions later this year. The Xiaomi 14 in particular looks like excellent value if they can hit a competitive price point. In summary, the Xiaomi 14 and 14 Pro bring some exciting upgrades and look very promising on paper. We can't wait to get them in hand for full reviews. They have a good chance of being the top Android flagships of 2023 if their real-world performance lives up to the hype. Stay tuned for our detailed analysis. Read the full article

12 notes

·

View notes

Text

Genio 510: Redefining the Future of Smart Retail Experiences

Genio IoT Platform by MediaTek

Genio 510

Manufacturers of consumer, business, and industrial devices can benefit from MediaTek Genio IoT Platform’s innovation, quicker market access, and more than a decade of longevity. A range of IoT chipsets called MediaTek Genio IoT is designed to enable and lead the way for innovative gadgets. to cooperation and support from conception to design and production, MediaTek guarantees success. MediaTek can pivot, scale, and adjust to needs thanks to their global network of reliable distributors and business partners.

Genio 510 features

Excellent work

Broad range of third-party modules and power-efficient, high-performing IoT SoCs

AI-driven sophisticated multimedia AI accelerators and cores that improve peripheral intelligent autonomous capabilities

Interaction

Sub-6GHz 5G technologies and Wi-Fi protocols for consumer, business, and industrial use

Both powerful and energy-efficient

Adaptable, quick interfaces

Global 5G modem supported by carriers

Superior assistance

From idea to design to manufacture, MediaTek works with clients, sharing experience and offering thorough documentation, in-depth training, and reliable developer tools.

Safety

IoT SoC with high security and intelligent modules to create goods

Several applications on one common platform

Developing industry, commercial, and enterprise IoT applications on a single platform that works with all SoCs can save development costs and accelerate time to market.

MediaTek Genio 510

Smart retail, industrial, factory automation, and many more Internet of things applications are powered by MediaTek’s Genio 510. Leading manufacturer of fabless semiconductors worldwide, MediaTek will be present at Embedded World 2024, which takes place in Nuremberg this week, along with a number of other firms. Their most recent IoT innovations are on display at the event, and They’ll be talking about how these MediaTek-powered products help a variety of market sectors.

They will be showcasing the recently released MediaTek Genio 510 SoC in one of their demos. The Genio 510 will offer high-efficiency solutions in AI performance, CPU and graphics, 4K display, rich input/output, and 5G and Wi-Fi 6 connection for popular IoT applications. With the Genio 510 and Genio 700 chips being pin-compatible, product developers may now better segment and diversify their designs for different markets without having to pay for a redesign.

Numerous applications, such as digital menus and table service displays, kiosks, smart home displays, point of sale (PoS) devices, and various advertising and public domain HMI applications, are best suited for the MediaTek Genio 510. Industrial HMI covers ruggedized tablets for smart agriculture, healthcare, EV charging infrastructure, factory automation, transportation, warehousing, and logistics. It also includes ruggedized tablets for commercial and industrial vehicles.

The fully integrated, extensive feature set of Genio 510 makes such diversity possible:

Support for two displays, such as an FHD and 4K display

Modern visual quality support for two cameras built on MediaTek’s tried-and-true technologies

For a wide range of computer vision applications, such as facial recognition, object/people identification, collision warning, driver monitoring, gesture and posture detection, and image segmentation, a powerful multi-core AI processor with a dedicated visual processing engine

Rich input/output for peripherals, such as network connectivity, manufacturing equipment, scanners, card readers, and sensors

4K encoding engine (camera recording) and 4K video decoding (multimedia playback for advertising)

Exceptionally power-efficient 6nm SoC

Ready for MediaTek NeuroPilot AI SDK and multitasking OS (time to market accelerated by familiar development environment)

Support for fanless design and industrial grade temperature operation (-40 to 105C)

10-year supply guarantee (one-stop shop supported by a top semiconductor manufacturer in the world)

To what extent does it surpass the alternatives?

The Genio 510 uses more than 50% less power and provides over 250% more CPU performance than the direct alternative!

The MediaTek Genio 510 is an effective IoT platform designed for Edge AI, interactive retail, smart homes, industrial, and commercial uses. It offers multitasking OS, sophisticated multimedia, extremely rapid edge processing, and more. intended for goods that work well with off-grid power systems and fanless enclosure designs.

EVK MediaTek Genio 510

The highly competent Genio 510 (MT8370) edge-AI IoT platform for smart homes, interactive retail, industrial, and commercial applications comes with an evaluation kit called the MediaTek Genio 510 EVK. It offers many multitasking operating systems, a variety of networking choices, very responsive edge processing, and sophisticated multimedia capabilities.

SoC: MediaTek Genio 510

This Edge AI platform, which was created utilising an incredibly efficient 6nm technology, combines an integrated APU (AI processor), DSP, Arm Mali-G57 MC2 GPU, and six cores (2×2.2 GHz Arm Cortex-A78& 4×2.0 GHz Arm Cortex-A55) into a single chip. Video recorded with attached cameras can be converted at up to Full HD resolution while using the least amount of space possible thanks to a HEVC encoding acceleration engine.

FAQS

What is the MediaTek Genio 510?

A chipset intended for a broad spectrum of Internet of Things (IoT) applications is the Genio 510.

What kind of IoT applications is the Genio 510 suited for?

Because of its adaptability, the Genio 510 may be utilised in a wide range of applications, including smart homes, healthcare, transportation, and agriculture, as well as industrial automation (rugged tablets, manufacturing machinery, and point-of-sale systems).

What are the benefits of using the Genio 510?

Rich input/output choices, powerful CPU and graphics processing, compatibility for 4K screens, high-efficiency AI performance, and networking capabilities like 5G and Wi-Fi 6 are all included with the Genio 510.

Read more on Govindhtech.com

#genio#genio510#MediaTek#govindhtech#IoT#AIAccelerator#WIFI#5gtechnologies#CPU#processors#mediatekprocessor#news#technews#technology#technologytrends#technologynews

2 notes

·

View notes

Text

Global Metalens Market: Trends, Applications, and Forecast (2024–2034)

What are metalens?

Metalenses, which are ultra-thin, planar optical components created using sub-wavelength nanostructures, are replacing traditional bulky, multi-element lenses with compact, high-performance metasurfaces. Their adoption is accelerating across multiple industries due to their ability to drastically reduce the size and weight of optical systems while maintaining or improving performance.

Frequently Asked Questions(FAQ’s):

What major trends are shaping the metalens market?

Rapid shift to wafer-level nano-imprint lithography (NIL) for mass production, demand for ultra-thin optics in smartphones and XR headsets, emergence of multifunctional metasurfaces (focusing + polarization/spectral control), and convergence with silicon-photonics and quantum-optics platforms.

Which regions will witness the fastest growth in global metalens market?

Asia-Pacific in shipment volume (driven by Chinese and Korean handset OEMs), while North America and Europe lead early adoption in automotive LiDAR and medical imaging thanks to strong R&D funding and supportive regulations.

What challenges could impede adoption of metalens?

High up-front CAPEX for NIL toolsets, yield losses at sub-50 nm features, fragmented IP/licensing landscape and export controls, plus stringent reliability qualifications for automotive and aerospace applications.

Where lie the biggest opportunities in global metalens market?

High-volume smartphone/XR camera design wins, compact automotive LiDAR modules, disposable medical endoscopes and OCT probes, and strategic partnerships linking metalens start-ups with large CMOS/MEMS foundries to scale production.

Market Opportunities

Integration with AR/VR & Holographic Displays: Metalenses offer compact, high-performance optics ideal for AR/VR and holographic displays. By replacing bulky multi-element lenses with flat metasurfaces, metalenses enable smaller, lighter devices with improved image quality and clarity, enhancing user experience in immersive technologies.

Partnerships between Start-ups and Semiconductor Giants: Collaborations between start-ups and established semiconductor companies are accelerating metalens adoption. These partnerships combine innovative metasurface technology with manufacturing expertise, allowing for scaled production and expansion into industries like consumer electronics, automotive, and healthcare.

Emerging Use in Photonic Computing & Quantum Optics: Metalenses have strong potential in photonic computing and quantum optics by enabling efficient light manipulation. In photonic computing, metalenses can improve speed and energy efficiency, while in quantum optics, they can enhance the performance of sensors and other quantum devices, opening doors to new applications.

What are the main technical challenges in metalenses?

Complex Fabrication: Metalenses require highly precise nanostructuring, which is difficult and costly to maintain at scale. Low production yields can also drive up costs.

High Capital Investment: Advanced fabrication tools like nanoimprint lithography (NIL) require significant capital, making it challenging for smaller companies to enter the market.

Material and Integration Issues: Limited material options and challenges in integrating metalenses into existing optical systems can slow adoption. Compatibility with CMOS processes is a key hurdle.

Regulatory and IP Barriers: Intellectual property complexities and regulatory restrictions, especially in defense applications, may hinder the widespread use and commercialization of metalenses.

Excited to learn more about Metalens Market, Click Here!

Learn more about Automotive Vertical by clicking here!

Conclusion

The Metalens Market is experiencing rapid growth, driven by advancements in nanoimprint lithography (NIL) and increasing demand for miniaturized, high-performance optics across industries such as consumer electronics, automotive, healthcare, and aerospace. Metalenses are replacing traditional bulky lenses with compact, efficient alternatives, enhancing applications in smartphone cameras, AR/VR headsets, LiDAR systems, and medical imaging. While challenges like fabrication complexity and high capital investment exist, ongoing innovations and industry collaborations are overcoming these obstacles. With emerging opportunities in AR/VR displays, photonic computing, and quantum optics, metalenses are poised to play a key role in the future of optical systems.

0 notes

Text

Pallet Rack Market Report 2025–2031: Trends, Growth, and Forecast

"

The Global Pallet Rack Market is set for steady growth from 2025 to 2031. This detailed report provides valuable insights into market trends, key players, regional analysis, and future opportunities. It is designed to help businesses, investors, and stakeholders make informed decisions backed by data.

Get the full report here https://marketsglob.com/report/pallet-rack-market/665/

What This Report Covers:

Recent innovations in Pallet Rack product development

Trends in synthetic sourcing and their impact on production

Focus on cost-saving manufacturing methods and new applications

Industry Developments:

Focus on new Pallet Rack product innovations and R&D activities

Highlights the industry's move toward synthetic sourcing methods

Includes case studies of leading players and their cost-effective production strategies

Key Companies in the Market:

Averys

SSI SCHAEFER

Unarco Material Handling

Ridg-U-Rak

KION Group

Steel King

Mecalux

Elite Storage Solutions

Daifuku

Advance Storage Products

AR Racking

Inform

Hannibal Industries

Nedcon

JINGXING

TKSL

Frazier Industrial

Top-tiger

Murata Machinery

Rack Builders

North American Steel

Speedrack Products

Constructor Group

Ouyade

Sanshin Metal Working

Nanjing Kingmore

Tianjin Master Logistics

Jiangsu NOVA

This report features leading companies in the Pallet Rack industry, highlighting their strategies, recent developments, and future plans. It provides a clear view of the competitive environment to support better business planning.

Product Types Covered:

Selective Pallet Rack

Drive-In and Drive-Through Pallet Rack

Push-Back Pallet Rack

Pallet Flow Rack

Others

Applications Covered:

Distribution Centers

Manufacturing Facilities

Large-Scale Retail

Others

Sales Channels Covered:

Direct Channel

Distribution Channel

Regional Insights:

North America (United States, Canada, Mexico)

Europe (Germany, United Kingdom, France, Italy, Russia, Spain, Benelux, Poland, Austria, Portugal, Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, Australia, Taiwan, Rest of Asia Pacific)

South America (Brazil, Argentina, Colombia, Chile, Peru, Venezuela, Rest of South America)

Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt, Nigeria, Rest of Middle East & Africa)

Key Takeaways:

Market size, share, and CAGR projections through 2031

Strategic insights into new market opportunities

Demand analysis for both generic and premium products

Company profiles, pricing structures, and revenue forecasts

Trends in licensing, co-development, and partnerships

The Global Pallet Rack Market report delivers a comprehensive look at where the industry is today and where it’s going next. Whether you're planning to enter the market or grow your share, this report offers the insights you need.

" Sports Apparel & Footwear Surge Arresters MV and HV Surge Arrester Hookah Flavors Portable Bridge Monomer Casting Nylon Medium Density Fiberboard (MDF) Automotive Camera Lens Automotive Camera Module Wafer Stages Wafer Inspection Equipment Chromatic Confocal Sensors Anti-Rust Oil Raw Cashew Nuts Fluff Pulp Cream Cheese Electric Insulators Air Brake Chamber Viscose Staple Fiber Pallet Acetophenone

0 notes

Text

Voice Coil Motor Driver Chips Market 2025-2032

The global Voice Coil Motor Driver Chips Market size was valued at US$ 678 million in 2024 and is projected to reach US$ 1.12 billion by 2032, at a CAGR of 7.3% during the forecast period 2025-2032

Voice Coil Motor Driver Chips Market Overview

After a strong growth of 26.2% in 2021, the World Semiconductor Trade Statistics (WSTS) revised its forecast to single-digit growth in 2022, due to rising inflation and weakening demand in end markets—particularly those linked to consumer spending.

The global semiconductor market reached a total size of USD 580 billion in 2022, marking a year-over-year (YoY) growth of 4.4%.

Segment-Wise Performance (YoY Growth in 2022)

Analog: +20.8%

Sensors: +16.3%

Logic: +14.5%

Memory: -12.6%

Regional Sales Performance in 2022

Americas:

Sales: USD 142.1 billion

Growth: +17.0% YoY

Europe:

Sales: USD 53.8 billion

Growth: +12.6% YoY

Japan:

Sales: USD 48.1 billion

Growth: +10.0% YoY

Asia Pacific (Largest Region):

Sales: USD 336.2 billion

Decline: -2.0% YoY

We have surveyed the Voice Coil Motor Driver Chips manufacturers, suppliers, distributors, and industry experts on this industry, involving the sales, revenue, demand, price change, product type, recent development and plan, industry trends, drivers, challenges, obstacles, and potential risks This report aims to provide a comprehensive presentation of the global market for Voice Coil Motor Driver Chips, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Voice Coil Motor Driver Chips. This report contains market size and forecasts of Voice Coil Motor Driver Chips in global, including the following market information:

Global Voice Coil Motor Driver Chips market revenue, 2020-2025, 2026-2032, ($ millions)

Global Voice Coil Motor Driver Chips market sales, 2020-2025, 2026-2032, (K Units)

Global top five Voice Coil Motor Driver Chips companies in 2024 (%)

Request Your Free Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=97520

Voice Coil Motor Driver Chips Key Market Trends :

Growing Demand in Mobile Devices Increasing integration of voice coil motor (VCM) drivers in smartphones and tablets is driving market growth.

Shift Towards Optical Anti-Shake Technology The adoption of optical image stabilization (OIS) is pushing demand for optical anti-shake VCM driver chips.

Focus on Energy-Efficient Designs Manufacturers are innovating to deliver low-power VCM driver chips for battery-sensitive devices.

Increasing Use in Compact Camera Modules Miniaturization trends in electronics are expanding applications for VCM drivers in slimmer camera modules.

Geographical Shift in Production & Demand Though Asia-Pacific leads manufacturing, regions like North America and Europe are seeing higher adoption in consumer devices.

Voice Coil Motor Driver Chips Market Segmentation :

Global Voice Coil Motor Driver Chips market, by Type, 2020-2025, 2026-2032 ($ millions) & (K Units) Global Voice Coil Motor Driver Chips market segment percentages, by Type, 2024 (%)

Open-loop Voice Coil Motor Driver Ic

Closed-loop Voice Coil Motor Driver Chip

Optical Anti-shake Voice Coil Motor Driver Chip

Global Voice Coil Motor Driver Chips market, by Application, 2020-2025, 2026-2032 ($ Millions) & (K Units) Global Voice Coil Motor Driver Chips market segment percentages, by Application, 2024 (%)

Mobile Phone

Tablet Computer

Others

Competitor Analysis The report also provides analysis of leading market participants including:

Key companies Voice Coil Motor Driver Chips revenues in global market, 2020-2025 (estimated), ($ millions)

Key companies Voice Coil Motor Driver Chips revenues share in global market, 2024 (%)

Key companies Voice Coil Motor Driver Chips sales in global market, 2020-2025 (estimated), (K Units)

Key companies Voice Coil Motor Driver Chips sales share in global market, 2024 (%)

Further, the report presents profiles of competitors in the market, key players include:

DONGWOON

ZINITIX

ROHM Semiconductor

AKM

ON Semiconductor

Fitipower

Giantec Semiconductor

Chipsemicorp

Claim Your Free Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=97520

FAQs

Q1. What are the key driving factors and opportunities in the Voice Coil Motor Driver Chips market? A: Key drivers include smartphone growth, camera enhancements, and energy-efficient designs. Opportunities lie in wearables, automotive systems, and IoT imaging devices.

Q2. Which region is projected to have the largest market share? A: Asia-Pacific holds the largest share due to high manufacturing capacity and smartphone demand, despite a slight decline in recent years.

Q3. Who are the top players in the global Voice Coil Motor Driver Chips market? A: Leading companies include ON Semiconductor, Texas Instruments, Rohm Semiconductor, Analog Devices, and Samsung Electro-Mechanics.

Q4. What are the latest technological advancements in the industry? A: Advances include optical anti-shake chips, closed-loop control systems, and ultra-low power ICs for compact camera modules.

Q5. What is the current size of the global Voice Coil Motor Driver Chips market? A: The market was valued at US$ 678 million in 2024 and is forecasted to reach US$ 1.12 billion by 2032, growing at a CAGR of 7.3%.

0 notes

Text

Global Voice Coil Motor Driver Chips Market to Reach US$ 1.12 Billion by 2032 at 7.3% CAGR

Voice Coil Motor Driver Chips Market Analysis:

The global Voice Coil Motor Driver Chips Market size was valued at US$ 678 million in 2024 and is projected to reach US$ 1.12 billion by 2032, at a CAGR of 7.3% during the forecast period 2025-2032

Voice Coil Motor Driver Chips Market Overview

After a strong growth of 26.2% in 2021, the World Semiconductor Trade Statistics (WSTS) revised its forecast to single-digit growth in 2022, due to rising inflation and weakening demand in end markets—particularly those linked to consumer spending.

The global semiconductor market reached a total size of USD 580 billion in 2022, marking a year-over-year (YoY) growth of 4.4%.

Segment-Wise Performance (YoY Growth in 2022)

Analog: +20.8%

Sensors: +16.3%

Logic: +14.5%

Memory: -12.6%

Regional Sales Performance in 2022

Americas:

Sales: USD 142.1 billion

Growth: +17.0% YoY

Europe:

Sales: USD 53.8 billion

Growth: +12.6% YoY

Japan:

Sales: USD 48.1 billion

Growth: +10.0% YoY

Asia Pacific (Largest Region):

Sales: USD 336.2 billion

Decline: -2.0% YoY

We have surveyed the Voice Coil Motor Driver Chips manufacturers, suppliers, distributors, and industry experts on this industry, involving the sales, revenue, demand, price change, product type, recent development and plan, industry trends, drivers, challenges, obstacles, and potential risks This report aims to provide a comprehensive presentation of the global market for Voice Coil Motor Driver Chips, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Voice Coil Motor Driver Chips. This report contains market size and forecasts of Voice Coil Motor Driver Chips in global, including the following market information:

Global Voice Coil Motor Driver Chips market revenue, 2020-2025, 2026-2032, ($ millions)

Global Voice Coil Motor Driver Chips market sales, 2020-2025, 2026-2032, (K Units)

Global top five Voice Coil Motor Driver Chips companies in 2024 (%)

Voice Coil Motor Driver Chips Key Market Trends :

Growing Demand in Mobile Devices Increasing integration of voice coil motor (VCM) drivers in smartphones and tablets is driving market growth.

Shift Towards Optical Anti-Shake Technology The adoption of optical image stabilization (OIS) is pushing demand for optical anti-shake VCM driver chips.

Focus on Energy-Efficient Designs Manufacturers are innovating to deliver low-power VCM driver chips for battery-sensitive devices.

Increasing Use in Compact Camera Modules Miniaturization trends in electronics are expanding applications for VCM drivers in slimmer camera modules.

Geographical Shift in Production & Demand Though Asia-Pacific leads manufacturing, regions like North America and Europe are seeing higher adoption in consumer devices.

Voice Coil Motor Driver Chips Market Regional Analysis :

North America:Strong demand driven by EVs, 5G infrastructure, and renewable energy, with the U.S. leading the market.

Europe:Growth fueled by automotive electrification, renewable energy, and strong regulatory support, with Germany as a key player.

Asia-Pacific:Dominates the market due to large-scale manufacturing in China and Japan, with growing demand from EVs, 5G, and semiconductors.

South America:Emerging market, driven by renewable energy and EV adoption, with Brazil leading growth.

Middle East & Africa:Gradual growth, mainly due to investments in renewable energy and EV infrastructure, with Saudi Arabia and UAE as key contributors.

Voice Coil Motor Driver Chips Market Segmentation :

Global Voice Coil Motor Driver Chips market, by Type, 2020-2025, 2026-2032 ($ millions) & (K Units) Global Voice Coil Motor Driver Chips market segment percentages, by Type, 2024 (%)

Open-loop Voice Coil Motor Driver Ic

Closed-loop Voice Coil Motor Driver Chip

Optical Anti-shake Voice Coil Motor Driver Chip

Global Voice Coil Motor Driver Chips market, by Application, 2020-2025, 2026-2032 ($ Millions) & (K Units) Global Voice Coil Motor Driver Chips market segment percentages, by Application, 2024 (%)

Mobile Phone

Tablet Computer

Others

Competitor Analysis The report also provides analysis of leading market participants including:

Key companies Voice Coil Motor Driver Chips revenues in global market, 2020-2025 (estimated), ($ millions)

Key companies Voice Coil Motor Driver Chips revenues share in global market, 2024 (%)

Key companies Voice Coil Motor Driver Chips sales in global market, 2020-2025 (estimated), (K Units)

Key companies Voice Coil Motor Driver Chips sales share in global market, 2024 (%)

Further, the report presents profiles of competitors in the market, key players include:

DONGWOON

ZINITIX

ROHM Semiconductor

AKM

ON Semiconductor

Fitipower

Giantec Semiconductor

Chipsemicorp

Drivers

Rise in Smartphone Penetration Growing smartphone usage worldwide is boosting demand for camera modules using VCM driver chips.

Increased Camera Quality Expectations Consumer demand for high-resolution imaging is fueling the need for advanced focus and stabilization solutions.

Advancements in Semiconductor Technologies Miniaturization and enhanced chip performance are enabling more compact and efficient driver solutions.

Restraints

Volatility in Raw Material Prices Fluctuating prices of semiconductor materials can impact production costs and pricing strategies.

High Competition and Price Wars A crowded market with multiple players often results in pricing pressure and reduced profit margins.

Supply Chain Disruptions Geopolitical tensions and logistic challenges can affect the global supply of critical components.

Opportunities

Emergence of Wearable and IoT Devices Increasing integration of miniature camera systems in wearables offers new market opportunities.

Rising Demand in Automotive Applications Advanced driver-assistance systems (ADAS) and in-car monitoring systems are adopting VCM drivers.

Expanding Adoption in Industrial Imaging Use of high-precision cameras in industrial inspection and robotics is a growing market segment.

Challenges

Technological Complexity Designing chips that are compact, efficient, and compatible with various sensors is challenging.

Intellectual Property Issues Patent wars and IP infringement risks may create legal and financial hurdles for market players.

Dependence on Limited Suppliers Relying on a few semiconductor fabricators can pose supply risks during high-demand periods.

0 notes

Text

top camera module manufacturers

Here are some of the top camera module manufacturers listed. For more information, please refer to this article.

1.Muchvision

Founded in 2009, Shenzhen Muchvision Technology Co., Ltd. initially specialized in the production of mobile phone cameras. After undergoing two industrial transformations and upgrades, the company shifted its focus to the research, development, manufacturing, production, and sales of advanced CMOS camera modules, accumulating extensive industry experience and a large customer base both domestically and internationally.

The company has cultivated a research and development, design, and production team with robust professional expertise and a strong innovative spirit. It strictly adheres to international quality management system standards and technical specifications, using these as a reference to establish a set of rigorous internal quality management processes. This ensures efficient, stable, and high-quality product production and service delivery, thereby meeting diverse market demands.

Muchvision has consistently adhered to the company philosophy of "innovative products, customer service, and quality assurance," focusing on producing products that closely align with customer needs. The company is committed to enhancing the quality of camera modules and providing the most cost-effective solutions to address customers' most significant challenges.

2.Sony Corporation

As a global leader in the camera industry, Sony has always been at the forefront of innovation and is renowned for its advanced image sensors, which are the core of high-performance camera modules. Sony's camera modules feature advanced functions such as high resolution, ultra-low light, and fast focusing. Its leading technology has set the standard for the entire camera module industry and is not only popular in the consumer electronics field but also highly sought after in medical imaging and aerospace fields.

3.OmniVision Technologies

OmniVision Technologies specializes in providing digital imaging solutions and is known for its compact, innovative camera modules. Its camera modules feature advanced sensor technology and a focus on miniaturization, enabling the development of smaller, more efficient camera devices. These are widely used in security cameras, automotive applications, and wearable devices.

4.LG Innotek

LG Innotek, a subsidiary of LG Electronics, is a trusted supplier of camera modules and a major player in the smartphone camera module market. The company's camera modules offer advanced image processing capabilities, with products featuring dual-lens or even multi-lens configurations, widely used in iPhones and iPads.

5.Sinoseen

Sinoseen has grown into a key player in the camera module industry. The company specializes in the R&D, manufacturing, and sales of CMOS camera modules, known for their efficiency, stability, and high quality. It offers cost-effective solutions suitable for both small and large manufacturers, widely used in smartphones, security cameras, and other fields.

6.Samsung Electronics

Samsung Electronics holds a significant position in the camera module sector and is one of the leading manufacturers in the field. It specializes in producing advanced camera modules for smartphones and other consumer electronics devices. Samsung Electronics' camera modules typically feature high-resolution sensors, advanced optical image stabilization (OIS), and multi-lens configurations. Its ISOCELL technology enhances light sensitivity and reduces noise, thereby improving overall image quality.

0 notes

Text

The global camera modules market size is projected to reach USD 58.5 billion by 2026, growinmg at a compound annual growth rate (CAGR) of 10.5% during the forecast period.

#The global camera modules market size is projected to reach USD 58.5 billion by 2026#growinmg at a compound annual growth rate (CAGR) of 10.5% during the forecast period.

0 notes

Text

Smartphone Camera Lens Market to Rise on Growing Demand

The Global Smartphone Camera Lens Market is estimated to be valued at US$ 6.34 Bn in 2025 and is expected to exhibit a CAGR of 4.2 % over the forecast period 2025 to 2032. The smartphone camera lens market encompasses precision-engineered optical modules designed to enhance image quality, stability, and zoom performance in mobile devices. These lenses integrate advanced aspheric elements, multi-layer coatings, and autofocus mechanisms to deliver high-resolution photography and video capabilities. As social media engagement, content creation, and video conferencing proliferate, there is a pressing need for miniature yet powerful imaging components that blend seamlessly with sleek smartphone designs. Key advantages include improved low-light sensitivity, reduced distortion, compact form factors, and compatibility with AI-driven image processing. Smartphone Camera Lens Market Insights are manufacturers leverage market research and cutting-edge materials—such as low-dispersion glass and plastic hybrids—to balance cost-effectiveness with performance. Growing consumer appetite for professional-grade imaging on handheld devices is driving continuous innovation in lens architectures, from periscope telephoto assemblies to ultra-wide-angle optics. Integration with depth-sensing modules and optical image stabilization further expands the market scope, catering to both flagship and mid-tier segments. As OEMs vie for differentiation through camera-centric features, R&D investments are reshaping market dynamics and enhancing overall business growth prospects. Get more insights on,Smartphone Camera Lens Market

#Coherent Market Insights#Smartphone Camera Lens#Smartphone Camera Lens Market#Smartphone Camera Lens Market Insights#Megapixel

0 notes

Text

Light Sensor Market Is Driven by Rapid IoT Adoption

Light sensors, including photodiodes, phototransistors, CCDs and CMOS image sensors, detect ambient illumination and convert light into electrical signals. These devices are integral to smartphones, tablets, laptops, digital cameras, automotive infotainment systems, and industrial automation equipment. Advantages such as low power consumption, high sensitivity, miniaturization and rapid response time enable dynamic backlight adjustment, energy savings and enhanced user experience.

The growing need for adaptive lighting in smart homes, wearable devices and healthcare monitoring systems further fuels demand. Manufacturers are innovating multi-spectral and proximity sensing solutions to support gesture recognition, AR/VR headsets and advanced driver-assistance systems (ADAS). As consumer electronics companies and OEMs seek to optimize battery life and performance, Light Sensor Market�� have become critical components in product roadmaps. Continuous advancements in MEMS fabrication and integration with IoT platforms underscore emerging market opportunities. Global research initiatives and strategic partnerships are accelerating product differentiation and market penetration.

The light sensor market is estimated to be valued at USD 5.24 Bn in 2025 and is expected to reach USD 11.66 Bn by 2032. It is estimated to grow at a compound annual growth rate (CAGR) of 12.1% from 2025 to 2032. Key Takeaways

Key players operating in the Light Sensor Market are:

-ams-OSRAM AG

-Analog Devices, Inc.

-Broadcom Inc.

-ELAN Microelectronics Corp.

-Everlight Electronics Co., Ltd.

These market companies leverage strong R&D capabilities and extensive patent portfolios to maintain market share in a competitive landscape. Strategic mergers and acquisitions, along with collaborative alliances, enable these firms to expand their technology roadmap across photometric, color and proximity sensing. Advanced signal-conditioning ICs and application-specific sensor modules introduced by these key players support diverse end-use segments. Continuous capital investments and rigorous market research empower them to anticipate industry trends and regulate supply chain dynamics. As recognized market players, they also focus on supply consistency and quality certification to meet stringent automotive and medical standards, solidifying their leading positions in global and regional markets.

‣ Get More Insights On: Light Sensor Market

‣ Get this Report in Japanese Language: 光センサー市場

‣ Get this Report in Korean Language: 광센서시장

0 notes

Text

In the world of aerial photography, there is only one name that is always in the lead: DJI. With its cutting-edge drones and industry-leading camera technology, DJI has established the gold standard for what everyone needs from flying cameras. So when rumors first began circulating about the highly anticipated DJI Mavic 4 Pro, drone enthusiasts and tech experts alike perked up and took special interest.But with excitement came something more unexpected: delay and secrecy. As rumors mount and unofficial rumors make the rounds, let's dive deep into what we believe we know about the Mavic 4 Pro—and why DJI appears to be playing the long game.

A Legacy to Be Lived Up To

To put into perspective the hype surrounding the Mavic 4 Pro, it's worth knowing the heritage it's stepping into. The Mavic 3 Pro, launched in 2023, featured a three-lens camera system, a huge leap for drone photography. It had wide-angle, telephoto, and medium-telephoto lenses, so it was a utility camera for film creators and content producers. DJI demonstrated that drones were not merely airborne cameras—they were proper cinematography equipment.

The expectation is high, and the bar is even higher for Mavic 4 Pro.

The Leak Heard Round the Web

At the beginning of 2025, there was a storm brewing within drone communities and tech forums on the internet. A trusted leak suggested the Mavic 4 Pro will have a dual 8K camera system—a major departure from the triple-lens system of the earlier model. Instead of three separate lenses, DJI may be heading towards an interchangeable or hybrid lens setup, easier for the user and further enhancing image quality.

And here was what the leak revealed—or at least hinted at:

8K support for increased frame rates, maybe 60 fps

A larger main sensor, maybe in the 1-inch or even 4/3-inch range

An excellent zoom lens with enhanced digital and optical stabilization

New artificial intelligence-powered intelligent features, like enhanced subject following and obstacle evasion

Though none of this has been documented, the leak seemed to come from solid insider sources and aligned with the product trajectory of DJI.

What Could Be Holding Back DJI

For the majority, the larger question isn't what's in the Mavic 4 Pro—but why it isn't here yet.

The following are some plausible explanations:

Supply Chain Disruptions

Like other tech manufacturers, DJI has also faced global chip shortages and logistics delays. Higher-end components such as image processors, camera sensors, and flight control modules have been more difficult to find.

Product Refining

DJI has a reputation for quality products. Perhaps the company is taking the time to get its software just right, beta-test new features, and make sure the final product lives up to expectations. Who knows? The release of the Mavic 3 was sort of marred by unfinished firmware and absent features on release day—a mistake DJI likely doesn't want to make again.

Competition and Market Strategy

With players like Autel Robotics, Skydio, and even Sony moving into the drone market with aggressive innovation, DJI might be changing its release strategy. Instead of hurrying the Mavic 4 Pro to market, it might be making sure the product provides sufficient paradigm shift to keep pace for another product cycle.

Potential Game-Changing Features

If rumor is correct—and experience has indicated that it often is—the Mavic 4 Pro is perhaps the most advanced consumer drone to be made. The most hotly debated features are these:

1. Dual 8K Camera System

Picture shooting so crisp that even pro movie cameras can't keep pace. The shift to two 8K cameras isn't just a function of resolution but also promises the possibility of doing post-filming zoom, frame cropping, and cinematic stabilization without compromising image quality.

2. AI Flight Modes

DJI has been increasingly incorporating AI into its drones, and the Mavic 4 Pro may do so even more. From real-time recognition of the scene to more intelligent detection and avoidance of obstacles, the drone may be able to make intelligent decisions on where and how to fly while maintaining its subject in focus.

3. Longer Flight Times

There are rumors that the new battery system can give as much as 50 minutes of flight time, which is longer than the standard in the industry. That would be a significant benefit for professional users who often need extended air time for complicated shoots.

4. Advanced OcuSync Transmission

A future update of OcuSync 4.0 or 5.0 could bring even stronger signal strength, better quality live feeds, and even greater control range-even in very interference-heavy environments such as a city or forest.

5. Interchangeable Lens Modules

We also hear whispers of modular lenses, which will allow users to change optics based on their requirements—wide-angle for landscapes, telephoto for wildlife, and cinematic lenses for shooting films.

What It Means for Content Creators To commercial drone pilots, vloggers, and filmmakers, the Mavic 4 Pro could be game-changing. If it does meet the specifications rumored, it has the ability to render larger and more expensive drone configurations like the DJI Inspire series or FPV rigs obsolete for some use cases.

XBoom provides great service in case you want to purchase the drone , you can access the link here https://www.xboom.in/shop/drone-guide/cinema/dji-mavic-4-pro-flymore-combo/

The portability of the Mavic series and professional-grade imaging features render it the ideal middle ground between consumer and professional-grade drones. Final Thoughts: Worth the Wait? There is no confirmed release date at the time of mid-2025. DJI has just kept things close to its vest, though. That's no surprise. Previous models had releases publicized with little warning, typically after months of speculation. In spite of the delays, anticipation for the Mavic 4 Pro is still high. As the drone market matures and content creation is increasingly professionalized, there is more demand than ever for hardware that is both capable and affordable. If you are a weekend pilot and a hobbyist or pro aerial photographer, the DJI Mavic 4 Pro is hyped as one to wait for—assuming the final product is as good as all the building buzz. Until then, all eyes (and cameras) are directed skyward.

0 notes