#Golden Visa Program

Text

Investors are increasingly drawn to Greece for its Golden Visa program. Last week, Prime Minister Kyriakos Mitsotakis revealed in the Greek Parliament that the real estate investment route for the Golden Visa program will undergo price hikes.

0 notes

Text

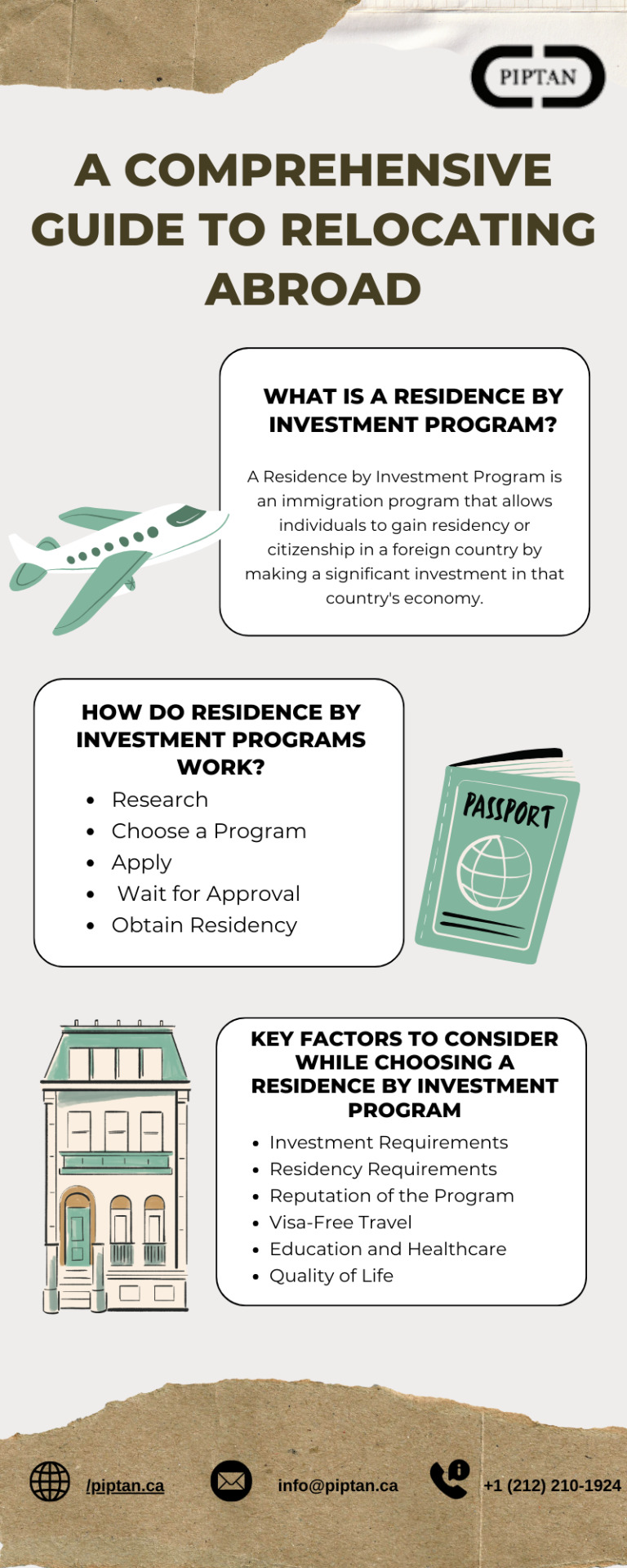

A Comprehensive Guide to Relocating Abroad.

In recent years, an increasing number of people have been exploring options for obtaining residency in foreign countries through investment. This has led to the rise of Residence by investment programs, also known as investor visas or golden visas. These programs allow individuals to gain residency in a foreign country by making a significant investment in the country's economy. The investment requirements and benefits vary by country, but the general idea is that the country grants residency or citizenship in exchange for the investment. In this article, we will delve deeper into what a residence by investment program is, how it works, and the benefits it can offer.

In this blog post, we will delve deeper into what Residence by Investment programs are, how they work, and the key factors to consider while choosing a Residence by Investment Program.

#Golden Visa Program#Financial Advisory Firm#Residency by Investment#Residency by Investment Programs

1 note

·

View note

Text

The increase in the worth of real estate throughout the countries that make up the European Union has led to the raising of investment thresholds as well as the discontinuation of the Golden Visa program, which was previously made available to individuals of significant wealth.

Read more here-

0 notes

Text

Golden Visa of The United Arab Emirates is Proving to be a Game-Changer for Affluent Indians

The increase in the worth of real estate throughout the countries that make up the European Union has led to the raising of investment thresholds as well as the discontinuation of the Golden Visa program, which was previously made available to individuals of significant wealth. As a direct result of this, Indian investors are increasingly focusing their attention on the possibilities offered by the United Arab Emirates (UAE) to obtain residency in that country. High-net-worth individuals (HNIs) in the United Arab Emirates have the opportunity to acquire a residency visa that is valid for ten years if they invest 2 million dirhams (approximately 21.5 crores) in a real estate asset.

People who are employed in the financial services sector and have stockpiles of investable capital that are greater than but do not quite surpass 5 crores are referred to as “high net worth individuals” (HNIs). The term “high net worth individuals” (HNIs) refers to this group of people. Due to the fact that these investors have a comparatively low net worth, the financial industry categorizes them as private investors. According to the CBRE Dubai Market Report, the total transaction volumes in Dubai’s residential market reached 9,229 in January 2023, indicating an increase of 69.2% from a year earlier. This information was obtained from the report.

According to Akash Puri, director of international operations for India Sotheby’s International Realty, modifications to the Golden Visa program in some EU countries have resulted in an increase in interest from Indian high-net-worth individuals in the UAE Golden Visa program. This increase in interest has led to an increase in the number of applications for the UAE Golden Visa. The United Arab Emirates Golden Visa allows its holders to become residents and comes with enticing financial advantages.

Because of the COVID-19 outbreak and the subsequent restrictions imposed on travel, the capacity to move about freely has evolved into an essential component that must be met in order to qualify for residency status. This led to an increase in demand for Golden Visas or residency by investing in real estate in EU nations, specifically among the wealthy who were looking for a path that allowed for more mobility. This demand was driven primarily by wealthy individuals who were searching for a path that allowed for more mobility. On the other hand, as a consequence of this, real estate prices in EU countries increased, which prompted those countries to either increase the minimum investment necessary or discontinue the Golden Visa route.

Realiste, a property technology company with headquarters in Dubai, has observed, over the course of the past few months, an increase in the number of investors hailing from India and conducting business in Dubai. This is probably due to the fact that a lot of people in India are trying to find ways to safeguard their riches because the value of the rupee has been going down. The growth of the real estate market in Dubai is projected to reach as high as 46% in the year 2023, according to data that was supplied by Realiste and published by The Economic Times. This growth is expected to occur in the city of Dubai.

According to comments made by Arjun Sahay, an adviser to India Sotheby’s International Realty, as reported by ET, Indians living in London and the United States have also been investing in real estate in countries of the European Union. However, due to the recent closure of Golden Visas for real estate investors, it is likely that they will turn their attention to purchasing second homes in the United Arab Emirates.

0 notes

Text

Portuguese Citizenship - Here Are the Top 3 Ways to Get It

Many people have their reasons for wanting to travel and immigrating to another country. The usual reasons for wanting to move and immigrate are for better job opportunities or a place that can offer an improvement to their lives. Europe has always been a hotspot of families and individuals immigrating and looking for permanent residence as job opportunities not only pay a reasonable amount but living conditions are significantly improved.

If you’ve been thinking of moving to Europe, we have you covered as we have here different ways to secure Portuguese citizenship. Portugal is an incredibly good place to move in as it offers the lowest crime rates along with a low basic cost of living compared to other countries in Europe.

Claiming Citizenship through Ancestry or Marriage

It is not uncommon for any country to grant citizenship to foreigners who get married to local citizens of the country. Marriage is perhaps the most straightforward way for anyone to obtain citizenship but isn’t very practical if you are doing it for any other reason. Similar to marriage, it is also possible to get citizenship by proving your relations to a Portuguese in your ancestry. Grandchildren of Portuguese citizens for example can claim their citizenship through the right of ancestry.

Both of these methods have their share of unique paperwork and requirements you need to accomplish such as living in the country for a certain amount of time.

5-Year Residency (Naturalization)

Naturalization into a country is the most common way for people to secure citizenship in any country. In Portugal’s case, immigrants are required to stay at least 5 years within 15 years to become eligible for Portuguese citizenship. This 5-year requirement includes things such as academic studies or work in the country counts as part of it as it involves staying in the country.

Once the 5 years are accomplished, additional documents and requirements are needed such as being proficient in a certain level of Portuguese for example which you can accomplish before or after the 5 years have passed. Only your records of staying in Portugal are needed for this process as you don’t need to be necessarily employed in a full-time position or own property in the country. Furthermore, you also need to have a clean record and any legal obligations from your previous country that restricts you from moving.

Portugal Golden Visa Program

Created back in 2012, the Portugal Golden Visa is a program by the government that aims to grant immigrants Portuguese citizenship with a more lenient outtake on the 5-year requirement for naturalization. The 5-year wait cannot be removed as it is a mandatory requirement but with, the Golden Visa you only would need to stay 7 days each year during the 5 years.

There are several options available in the Golden Visa program that you can accomplish during the 5 years as well as certain criteria you need to fall under to become eligible for them. The program and the criteria can be explored more with the help of an agency or the official program page.

0 notes

Text

The Portuguese Golden Visa program allows you to travel Europe without any additional visa. You can work, study, and live in Portugal with your family, and you can even apply for Portugal citizenship after 5 years.

#Portuguese Golden Visa#Portugal New Golden Visa Rules#Golden Visa Scheme#Portugal Golden Visa Program#Golden Visa Work Permit

1 note

·

View note

Text

Comprehensive Guide to the Portugal Golden Visa

Portugal isn't just about wine and music; it offers one of the best EU Golden Visa programs. Portugal attracts many with a high standard of living, excellent healthcare, and more. Their Golden Visa program grants residency to non-EU citizens who invest in the country. This Visa can lead to citizenship later. Remember, this isn't legal advice; use it to see if Portugal's program suits your needs.

History of Portugal's Golden Visa

Portugal faced economic challenges in the early 2000s. To recover, they launched the Golden Visa program on October 8, 2012, attracting foreign investors to boost their economy. Over 12,000 investors joined, investing over seven billion dollars. Most got their Portugal residence permit by buying real estate, which is the program's top choice.

Recent Changes in the Visa

In October 2023, new rules stopped the path to Portuguese citizenship through property investment. However, the Golden Visa program itself is still open. The government said the time it takes to apply (6–18 months) now counts towards the five years needed for citizenship. Real estate investment is no longer an option, leaving some investors unsure. However, good choices exist, like starting a company, donating to research, or investing in funds.

Golden Entrepreneur Visa

Entrepreneurs have an often-overlooked option with the Portugal Golden Investment Visa. To qualify, you need to start a company and create at least ten jobs in Portugal (or eight in less populated areas). Each employee must be registered with the Portuguese Social Security system. You have the opportunity to inject €500,000 into an established business in Portugal, generating and sustaining five new full-time positions for three years. Corporate tax is 21%, and personal income tax ranges from 14.5% to 48%.

Benefits of Portugal Golden Visa Program

Portugal's Tier A passport is among the best, granting visa-free access to 191 countries in 2024, making it the third most powerful passport as mentioned by the Nomad Passport Index. While investing in a residency permit won't automatically make you a citizen, it's a step towards it. The naturalization process in Portugal is relatively quick, just five years. You can enjoy visa-free travel within the Schengen Area and many other countries during this time. You also gain the right to work and live in Portugal and other EU/EEA nations. Portugal's investment visa is considered stable, and Portugal offers tax benefits for crypto investors.

Capital Contributions with Portugal's Golden Visa

For those not taking the entrepreneur route, simpler options like capital contributions are available. Due to recent changes, this route has become more appealing but is pricier.

Investment options for Portugal's Golden Visa include:

€500,000 in Venture Capital/Private Equity Fund

€500,000 as a Donation to Research Activities

€250,000 for Donations to Arts These investments must be maintained for five years of residence.

Specific funds are set up for Portugal visa Golden investors, offering shorter terms and lower risks. However, due to FATCA regulations, not all funds are available to US applicants. All applicants must provide proof of investment to the government, so keep a detailed paper trail.

Golden Visa: Requirements, Documents and Fees

1. Fulfill the minimum residence requirement

To maintain your residency in Portugal, you must spend at least fourteen days there during your first two years. Then, when you renew your permit for the next three years, you'll need to pay a total of 21 days in Portugal. After that, you only need to spend a minimum of seven days per year in the country to keep your residency.

2. Provide proper documentation

Applying for the Portugal Golden Investment Visa is more straightforward than applying for other citizenship programs. You can apply online through their Immigration and Borders Services portal or have a legal representative do it. However, it's essential to understand the process to avoid mistakes. You must submit personal documents, proof of investment, and other paperwork like a background check, health insurance, and evidence of tax compliance. All documents must be recent.

3. Be a third-country national

This requirement means you can't already be a citizen of Portugal or any EU or EEA country. While over half of the applicants are from China, others from countries like Russia, Turkey, South Africa, Brazil, and more are also applying.

4. Maintain a qualified investment for five years

As the principal applicant, you must keep the investment if you and your family have a Portugal visa and Golden residency status. Once you attain permanent residency or Portuguese citizenship, you are no longer required to maintain the investment.

5. Pay all related fees

The Portuguese government offers a Tier A passport for wealthy investors seeking EU access. Alongside your investment, applicants pay a €5,000 ($5,364) fee, which is reduced by half upon renewal. A processing fee of €533 (US$571) for the principal applicant and €83 (US$89) for each family member, payable with the initial application and renewals. Spouses, children under 18, unmarried children over 18 in school, and retirement-aged parents are eligible.

Portugal's Golden Investment Visa presents a compelling opportunity for investors seeking residency and potential citizenship in Europe. With various investment options, streamlined application processes, and the allure of visa-free travel, it remains an attractive pathway for individuals and families looking to establish roots in Portugal and the broader European Union. For more, visit Acquest Advisors' official page today.

0 notes

Text

Unlock European Elegance with Portugal's Golden Visa Program by TVG Investments!

Dreaming of a life in Europe? Discover the charm of Portugal and unlock a world of opportunities with the Portugal Golden Visa by Investment Program offered by TVG Investments. This prestigious program is your gateway to not only residing in one of Europe's most enchanting countries but also to potential citizenship or permanent residence within just five years.

Why Choose Portugal's Golden Visa Program?

Visa-Free Travel: Enjoy visa-free access to 26 European countries in the Schengen Area and 114 countries worldwide.

Investment Options: Diverse investment options starting from €280,000, including real estate in high-potential areas.

Quality of Life: Experience Portugal's rich culture, beautiful landscapes, and high standard of living.

Why TVG Investments?

Expert Guidance: Our team of experts provides personalized guidance, helping you navigate through the investment process smoothly.

Comprehensive Support: From choosing the right investment to completing all the legal procedures, we're with you every step of the way.

Proven Track Record: We pride ourselves on a history of helping clients successfully achieve their residency and citizenship goals.

Embrace the Portuguese Lifestyle: The Portugal Golden Visa by Investment Program is more than just a residency program; it's a lifestyle choice. Whether you're looking to retire in a serene environment, expand your business horizons, or provide your family with access to world-class education and healthcare, Portugal offers it all.

Ready to embark on your journey to Portugal? Learn more about our services and how we can help: Portugal Citizenship by Investment

Begin your journey to a new life filled with European charm and global mobility with TVG Investments!

0 notes

Text

Top 2024 Investment Programs: Experts Recommend the Best Second Passports for Offshore Investment

In today’s globalized world, the concept of investing offshore and obtaining a second passport has become increasingly popular among savvy investors. As we step into 2024, certain investment programs have risen to the top, highly recommended by experts for those seeking to diversify their portfolios while gaining the flexibility and benefits of a second citizenship. Here are the top investment…

View On WordPress

#Antigua & Barbuda#Citizenship by Investment#citizenship investment program#Cyprus#Cyprus Investment Programme#Grenada#Investment Programs#Malta Individual Investor Programme#MIIP#Montenegro#Portugal Golden Visa#second passport#Second Passport Investment Programs#Vanuatu

0 notes

Text

Exploring the Array of Benefits Offered by the Golden Visa

Introduction

In an increasingly interconnected world, international travel and global citizenship have gained paramount importance. Many individuals aspire to explore new horizons, access better opportunities, and secure their future in foreign lands. The concept of a Golden Visa has emerged as a pathway to achieving these dreams. This blog delves into the benefits of the Golden Visa programs, highlighting its advantages for those seeking to obtain guaranteed citizenship and a second passport.

Ease of International Travel:

A Golden Visa often grants holders the privilege of visa-free or visa-on-arrival access to multiple countries. This facilitates seamless international travel, eliminating the hassles and uncertainties associated with obtaining visas for various destinations. This newfound freedom opens doors to a world of business, leisure, and cultural experiences.

Diverse Investment Opportunities:

One of the key requirements of a Golden Visa program is the investment in the host country's economy. This investment can take various forms, such as real estate, business ventures, or government bonds. By engaging in these investments, individuals not only secure their eligibility for the Golden Visa but also gain exposure to potentially lucrative financial opportunities.

Access to Better Education and Healthcare:

Many Golden Visa programs extend the benefits of world-class education and healthcare systems to the visa holders and their families. This is particularly appealing to parents seeking top-quality education for their children and families looking for comprehensive healthcare services.

Business Expansion and Investment:

For entrepreneurs and investors, a Golden Visa can serve as a gateway to new markets and business opportunities. By establishing a presence in a foreign country, individuals can tap into local networks, access a skilled workforce, and expand their business horizons on an international scale.

Enhanced Quality of Life:

Golden Visa programs often lead to an improved quality of life for visa holders and their families. From living in safe and well-developed environments to enjoying cultural diversity and a high standard of living, these programs offer a chance for a better lifestyle overall.

Long-Term Residency and Citizenship Options:

Many Golden Visa programs eventually offer a pathway to permanent residency and even citizenship. This opens up a range of opportunities for individuals who wish to fully integrate into their new country, contributing to its society and reaping the benefits of being a citizen.

Conclusion

The concept of the Golden Visa has transformed the way individuals think about global citizenship and mobility. From enhanced travel freedom to diverse investment opportunities and a higher quality of life, the benefits offered by these programs are undeniably attractive. As with any significant decision, it's essential to thoroughly research and understand the specific terms and conditions of the Golden Visa program you're considering. Consulting with legal and financial experts can help you navigate the complexities and make an informed choice that aligns with your aspirations and goals.

0 notes

Link

The Portugal Golden Residence Permit Program, which is also famous as the Portugal Golden Visa Program, is offered by the Portugal Government. It is a five-year residence and investment program that permits non-EU nationals to live, study, and work in the country.

#Portugal golden visa#Portugal golden visa program#golden residence permit program#Portugal golden visa requirements#Portugal golden visa benefits#Portugal golden visa processing time

1 note

·

View note

Text

Best Countries for Offshore Company Formation in 2023

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered.

These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. In the second part of this blog, we will explore the best countries for offshore company formation in 2023.

Anguilla

When it comes to establishing an Best Offshore Company formation service, Anguilla has emerged as a highly desirable destination. This beautiful Caribbean island offers a range of benefits and advantages that make it an attractive option for individuals and businesses seeking to register an offshore company

Registering an offshore company in Anguilla can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. Let’s delve into the numerous advantages of choosing Anguilla as the jurisdiction for your offshore company.

Best Country To Set Up An Offshore Company Register :

How to Register an Offshore Company in Anguilla?

Step 1: Choose a company nameThe first step in registering an offshore company in Anguilla is to choose a unique company name that is not already registered in the jurisdiction. The name should not be similar to any existing Anguillan company and should comply with the relevant regulations. It's advisable to conduct a name search to ensure availability.

Step 2: Engage a Registered AgentTo register an offshore company in Anguilla, it is mandatory to engage a registered agent licensed by the Anguillan Financial Services Commission (FSC). A registered agent will assist you in navigating the registration process, ensuring compliance with local regulations, and acting as a liaison between your company and the authorities.

Step 3: Determine the Company StructureAnguilla offers various company structures for offshore businesses, including companies limited by shares (Ltd.), companies limited by guarantee (Guarantee Ltd.), and limited duration companies (LLC). Choose the most suitable structure based on your specific needs, considering factors like liability protection, ownership, and operational flexibility.

Step 4: Prepare the Required DocumentationTo register an offshore company in Anguilla, you will need to gather and prepare the necessary documentation. This typically includes:

Articles of Incorporation:This document outlines the company's regulations and internal workings.

Memorandum of Association:It provides details about the company's purpose, structure, and activities.

Consent of Directors and Officers:The consent of all directors and officers should be obtained and documented.

Declaration of Compliance:This document certifies that the company meets all legal requirements.

Step 5: Submit the Application to the Registrar of CompaniesOnce you have prepared the required documentation, you will need to submit the application to the Registrar of Companies in Anguilla. Your registered agent will assist you in submitting the application along with the necessary fees.

Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the requisite fees to the Anguillan authorities. The fees will vary based on the type of company and the services provided by your registered agent.

Step 7: Obtain a Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Registrar of Companies. This document serves as legal proof of the existence of your offshore company in Anguilla.

Step 8: Fulfill Ongoing Compliance RequirementsAfter the registration process is complete, you must fulfill the ongoing compliance requirements for your Anguillan offshore company. This may include annual filings, maintaining proper accounting records, and adhering to any other obligations outlined by the Anguillan authorities.

In Conclusion, registering an Offshore company registration can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. By following the step-by-step guide outlined above, you can successfully navigate the process of registering an offshore company in Anguilla. Remember to consult with a registered agent or legal professional to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a thriving offshore company in Anguilla and reap the benefits it offers.

Benefits of Registering an Offshore Company in Anguilla

Privacy and ConfidentialityAnguilla is renowned for its strong commitment to privacy and confidentiality. The jurisdiction has strict laws in place to protect the privacy of individuals and businesses. When you register an Offshore Company in Anguilla, you can enjoy enhanced privacy protection, ensuring that your personal and financial information remains secure and confidential.

Tax AdvantagesOne of the primary reasons individuals and businesses opt to register an offshore company is to enjoy tax advantages. Anguilla offers a favorable tax environment for offshore entities. There are no income taxes, capital gains taxes, inheritance taxes, or wealth taxes imposed on offshore companies registered in Anguilla. This allows you to retain a larger portion of your profits and optimize your tax planning strategies.

Easy Company FormationAnguilla boasts a streamlined and efficient company formation process. Setting up an offshore company in Anguilla is relatively straightforward and requires minimal bureaucracy. The jurisdiction offers user-friendly procedures and a supportive regulatory framework, making it hassle-free for individuals and businesses to establish their offshore entities.

Asset Protection:Asset protection is a crucial consideration for many individuals and businesses. Registering an offshore company in Anguilla provides a layer of protection for your assets. The jurisdiction's legislation is designed to safeguard your assets from potential legal threats, creditors, and lawsuits. By establishing an offshore company in Anguilla, you can mitigate risks and shield your assets effectively.

Flexibility and Operational Ease:Anguilla offers significant flexibility and operational ease for offshore companies. There are no requirements for minimum capitalization, and you have the freedom to structure your company according to your specific needs. Additionally, there is no mandatory requirement for annual general meetings or the disclosure of beneficial owners, further enhancing the operational ease and convenience of running an offshore entity in Anguilla.

Proximity to North America and Europe:Anguilla's strategic location in the Caribbean region provides easy access to both North American and European markets. This proximity makes it an ideal choice for businesses looking to expand globally and establish a presence in these lucrative markets. The well-developed infrastructure and connectivity of the island further facilitate trade and communication with international partners.

Professional Support and Services:Anguilla has a well-established network of professional service providers, including lawyers, accountants, and company formation agents, who specialize in assisting with the registration and ongoing management of offshore companies. These experienced professionals can provide expert guidance, ensuring compliance with local regulations and maximizing the benefits of your offshore company.

Panama

Panama is renowned for being a favorable jurisdiction for offshore company formation due to its strategic location, robust economy, and attractive tax regulations. Setting up an offshore company in Panama can offer numerous benefits, such as tax optimization, asset protection, and enhanced privacy.

Panama has gained a reputation as one of the most attractive jurisdictions in the world. Known for its business-friendly environment, and strategic location, Panama offers numerous benefits for individuals and businesses seeking to establish an offshore company. In this guide, we will walk you through the process of registering an offshore company in Panama.

How to Register an Offshore Company in Panama?

Step 1: Choose a company nameThe first step in registering an offshore company in Panama is selecting a unique company name that is not already registered. The chosen name should not be similar to any existing Panamanian company and must comply with the regulations set by the Public Registry of Panama.

Step 2: Engage a Registered AgentTo register an offshore company in Panama, it is mandatory to engage the services of a registered agent. A registered agent will facilitate the registration process, assist with the necessary documentation, and act as a liaison between your company and the Panamanian authorities.

Step 3: Determine the Company StructurePanama offers several company structures for offshore businesses, including Private Interest Foundations (PIFs) and International Business Corporations (IBCs). Consider the advantages and characteristics of each structure to determine the most suitable option based on your business objectives and needs.

Step 4: Prepare the Required DocumentationTo register an offshore company in Panama, you will need to gather and prepare the necessary documentation. The typical documentation includes:

Articles of Incorporation: This document outlines the company's purpose, share capital, and internal regulations.

Certificate of Good Standing: If incorporating a company that already exists, you may need to provide a certificate of good standing from the jurisdiction where the company is currently registered

Passport Copies and Proof of Address: Provide passport copies and proof of address for all directors, officers, and shareholders.

Notarized Power of Attorney: This document authorizes your registered agent to act on your behalf during the registration process.

Step 5: Submit the Application to the Public Registry of PanamaOnce you have prepared the necessary documentation, your registered agent will submit the application to the Public Registry of Panama. The application includes the company's Articles of Incorporation, along with the required fees and supporting documents.

Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the Public Registry of Panama. The fees vary depending on the type of company and the services provided by your registered agent.

Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Public Registry of Panama. This certificate serves as legal proof of your offshore company's existence in Panama.

Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in Panama, it is crucial to comply with ongoing obligations and requirements. This includes maintaining proper accounting records, filing annual tax returns, and adhering to any other obligations outlined by the Panamanian authorities.

In Conclusion, registering an offshore company in Panama can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and enhanced privacy. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in Panama.

It is essential to consult with legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in Panama and capitalize on the benefits it offers.

Benefits of Registering an Offshore Company in Panama

Favorable Tax EnvironmentOne of the key advantages of registering an offshore company in Panama is the favorable tax environment it offers. Panama operates on a territorial tax system, which means that offshore companies are only taxed on income derived from Panamanian sources. Income generated outside of Panama is exempt from local taxation, providing significant tax planning opportunities and potential tax savings for businesses.

Asset ProtectionPanama offers robust asset protection laws that make it an ideal jurisdiction for individuals seeking to safeguard their assets. By registering an offshore company in Panama, you can separate your personal assets from those of your company, reducing the risk of personal liability. The country's legal framework provides strong asset protection, making it more challenging for creditors or litigants to seize assets held within your offshore company.

Privacy and ConfidentialityPanama has strict laws and regulations in place to protect the privacy and confidentiality of individuals and businesses. The country's corporate laws ensure that the identities of beneficial owners, directors, and shareholders remain confidential and are not part of the public record. This level of privacy protection is highly sought after and provides individuals and businesses with peace of mind.

Simplified Company Formation ProcessSetting up an offshore company in Panama is relatively simple and straightforward. The process involves minimal bureaucracy and paperwork compared to other jurisdictions. The government has streamlined the company formation procedures, allowing for quick and efficient registration. This enables entrepreneurs and businesses to establish their offshore entities with ease and start operating swiftly.

Political and Economic StabilityPanama has long been regarded as a politically and economically stable country. It boasts a robust economy, a well-developed banking system, and a favorable business climate. The country's stable political environment ensures a secure and predictable investment climate, attracting businesses and entrepreneurs from around the world.

Strategic Geographical LocationSituated at the crossroads of the Americas, Panama enjoys a strategic geographical location. It serves as a vital international trade and logistics hub, connecting North and South America. This strategic position provides businesses with easy access to markets in both continents, making Panama an ideal base for expanding into the Americas.

International Banking and Financial ServicesPanama is home to a thriving banking and financial sector. The country has a well-established reputation as an international financial center, offering a wide range of banking services, including asset management, private banking, and offshore banking. Access to reputable and internationally recognized financial institutions can enhance the credibility and operational capabilities of your offshore company.

British Virgin Islands

The British Virgin Islands (BVI) has long been recognized as one of the premier offshore jurisdictions for company registration. Known for its favorable tax laws, robust legal framework, and business-friendly environment. The BVI offers numerous benefits for individuals and businesses seeking to establish an offshore company.

In this guide, we will delve into the advantages of choosing the British Virgin Islands as the jurisdiction for your offshore company.

How to Register an Offshore Company in the British Virgin Islands?

Step 1: Engage a Registered AgentTo register an offshore company in the BVI, it is mandatory to engage the services of a registered agent. A registered agent will guide you through the registration process, assist with the required documentation, and act as a liaison between your company and the BVI Financial Services Commission.

Step 2: Choose a Company NameThe next step is to select a unique company name that is not already in use. The chosen name should comply with the regulations set by the BVI Registrar of Corporate Affairs and should not be misleading or similar to existing companies in the jurisdiction.

Step 3: Determine the Company StructureThe BVI offers various company structures for offshore businesses, with the most common being the BVI Business Company (BVIBC). Consider the company structure that best suits your business objectives, taking into account factors such as liability protection, ownership flexibility, and ease of administration.

Step 4: Prepare the Required DocumentationTo register an offshore company in the BVI, you will need to gather and prepare the necessary documentation, including:

Memorandum and Articles of Association: These documents outline the company's purpose, activities, and internal regulations.

Consent Forms: Obtain consent forms from all directors, officers, and shareholders, confirming their agreement to act in their respective roles.

Registered Office Address: Provide a registered office address in the BVI where the company's official correspondence will be sent.

Identity Documents: Submit certified copies of passports or other identity documents for all directors, officers, and shareholders.

Step 5: Submit the Application to the BVI Financial Services CommissionOnce the required documentation is prepared, your registered agent will submit the application to the BVI Financial Services Commission. The application should include the necessary forms, fees, and supporting documents.

Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the BVI Financial Services Commission. The fees vary depending on the type of company and the services provided by your registered agent.

Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the BVI Financial Services Commission. This certificate serves as legal proof of your offshore company's existence in the British Virgin Islands.

Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in the BVI, it is important to fulfill the ongoing compliance requirements. This includes maintaining proper accounting records, filing annual returns, and adhering to any other obligations outlined by the BVI authorities.

In Conclusion, registering an offshore company in the British Virgin Islands can offer significant advantages for entrepreneurs, including tax benefits, asset protection, and confidentiality. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in the BVI.

It is essential to seek advice from legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in the British Virgin Islands and enjoy the benefits it offers.

Benefits of Registering an Offshore Company in the British Virgin Islands

Tax AdvantagesOne of the key benefits of registering an offshore company in the BVI is the favorable tax environment. The jurisdiction does not impose taxes on offshore companies' profits, capital gains, dividends, or inheritance. This means that your offshore company can benefit from significant tax savings and optimization of your global tax planning strategies.

Privacy and ConfidentialityThe British Virgin Islands places a strong emphasis on privacy and confidentiality. The jurisdiction has strict laws and regulations in place to protect the identities of company directors, shareholders, and beneficial owners. Registering an offshore company in the BVI allows you to maintain confidentiality, as these details are not available to the public.

Asset ProtectionThe BVI offers robust asset protection laws, making it an attractive destination for individuals seeking to safeguard their assets. By establishing an offshore company in the BVI, you can separate your personal assets from those held within the company. This separation reduces the risk of personal liability and provides a layer of protection against potential lawsuits or creditors.

Simple and Efficient Company FormationSetting up an offshore company in the BVI is a relatively straightforward process. The jurisdiction has a well-established company formation framework, with streamlined procedures and minimal bureaucracy. This allows for quick and efficient registration, enabling you to establish your offshore entity promptly and start conducting business.

Flexibility and Operational EaseThe BVI provides considerable flexibility and operational ease for offshore companies. There are no requirements for minimum capitalization, and you have the freedom to structure your company according to your specific needs. Additionally, the BVI allows for the appointment of corporate directors and offers simplified reporting requirements, making it convenient to run your offshore company.

International Recognition and CredibilityThe British Virgin Islands has gained international recognition as a reputable offshore jurisdiction. The jurisdiction's legal system is based on English common law, providing familiarity and credibility to international investors and business partners. This recognition enhances your offshore company's reputation and instills confidence in your stakeholders.

Professional Service ProvidersThe BVI has a well-developed network of professional service providers, including lawyers, accountants, and corporate service providers, who specialize in assisting with the registration and ongoing management of offshore companies. These experienced professionals can provide expert guidance, ensuring compliance with local regulations and optimizing the benefits of your offshore company.

Conclusion

In conclusion, Piptan offshore company registration can offer significant benefits to businesses seeking to optimize their tax liabilities, protect their assets, and increase their privacy. However, this process also carries several risks and challenges that businesses must carefully consider before pursuing offshore registration. Regulatory compliance, reputation risks, legal and financial risks, tax risks, and operational risks are among the most significant challenges associated with Best Offshore Company formation service. Businesses must ensure that they comply with all relevant laws and regulations, carefully manage their reputation, mitigate legal and financial risks, carefully evaluate tax implications, and effectively manage their offshore operations to successfully navigate these challenges. Despite these challenges, many businesses have successfully established offshore companies and taken advantage of the benefits associated with this process. However, businesses must carefully evaluate the potential benefits and challenges of offshore company registration and seek professional advice to ensure that they make informed decisions. Overall, Offshore Company Registration online can be a complex and challenging process, but with careful planning and execution, businesses can successfully navigate these challenges and reap the benefits of offshore company registration.

#Citizenship by Investment#Residency by Investment#Citizenship by Investment Program#Residency by Investment Programs#Offshore Company Registration#international business service#Citizenship programs#Residency Programs#Second Passport#Golden Visa#Economic Citizenship#Setting up a company in Singapore#offshore company formation#LLC Formation#Dual Citizenship#Offshore Banking#Pitan#Immigration by Investment#Golden Visa Program#Financial Advisory Firm#Offshore Company Incorporation Dubai#business setup consultants

0 notes

Text

Immigrate to Cyprus and Apply for Investment Residency Program

Ajmera Law Group is a reputed immigration law firm that helps you to get Cyprus citizenship by investment. Under the Cyprus investment residency program, non-EU nationals can obtain a residence permit in Cyprus by investing in or purchasing a residential property for their personal use in Cyprus. Visit us today to learn more about the Cyprus investment residency program.

#Cyprus residency#Cyprus investment residency#Cyprus investment residency program#Cyprus golden visa lawyer in India

1 note

·

View note

Text

Golden Visa Programs for Europe- Invest for your Citizenship

Will I ultimately be granted citizenship? is the one question that will unavoidably come up when you begin looking into European Golden Visas or Permanent Residency Programs.

The ability to live and work in another EU nation, learn there, and start a business there, just like any other EU citizen, is one of the potential rights granted by the EU. You can also transfer your status to future generations, buy real estate, cast your ballot, and visit some nations without a visa. Possessing citizenship enables you to get a visa.

In this article, we'll outline concrete methods to acquire these rights, which accrue over time.

The "Illusion of a Golden Visa Program" is what? Why is it crucial to comprehend this idea?

Most of the time, you think—or are led to think—that by buying some property and travelling there for a few weeks each year, your citizenship application will be automatically approved. Several or no more inquiries were made!

Unfortunately, the majority of Golden Visa Programs are short-term and must be renewed every five years. The majority of programs require kids to reapply once they're old enough and autonomous. The people who stand to gain from this "misunderstanding" are most often the ones who write vague pieces to the contrary.

Being physically present in a developed nation for at least ten years is typically required to become naturalized. Citizenship is not assured even then. The same advocates would also like you to think that you can bypass the Long-Term Residency and Permanent Residency phases and proceed directly to citizenship. A free upgrade to EU membership is improbable, though.

A person can file for permanent residency and then be naturalized, or become a citizen, after a certain period of time in many European countries. While the circumstances differ from nation to nation, they typically have a number of solid connections, including:

-Being a decent and fit individual

-Being able to support your family and yourself

-Being physically, continuously, and lawfully present in the nation for a long time.

Although it can differ in Europe, the minimum is five years.

It is unlikely that someone who has not physically lived in the nation for a number of years will be qualified to apply for citizenship, let alone permanent residency.

Let's presume that a person has earned the right to apply and that they have met the necessary requirements. The problem is this: The state is not required to accept an application just because one has the right to submit it.

How is EU Citizenship obtained through a Golden Visa Program? Here Is the Actual Price

Rich people can obtain EU citizenship through the use of golden visas by investing in real estate or companies in EU member states for the money they invested.

All of the privileges of EU citizenship, including the freedom to move around and travel, access to healthcare and education, and the ability to reside and work in any member state, are available to those who possess a Golden Visa. Golden Visas Program do have a price, though.

For example:-

Malta encourages clear-path citizenship by investment through its initiative called Malta Citizenship by Naturalisation for Exceptional Services by Direct Investment (Malta Citizenship by Naturalisation for Exceptional Services by Direct Investment). Investors can choose between two different opportunities provided by the initiative:

After having a residency status in Malta for one year, a person may petition for citizenship by making a contribution of 750,000 euros (a non-refundable expenditure) to the National Development and Social Fund, which was established by the Government of Malta.

Apply for Maltese citizenship after three years with a smaller non-refundable expenditure of €600,000.

In the application, the primary candidate must set aside €50,000 for each family member. Additionally, you must lease a home for a minimum of €16,000 per year and give €10,000 to any Malta-registered non-governmental organization.

As an alternative, you may spend a minimum of €700,000 on a home in Malta and keep it for a minimum of five years after receiving your certificate of naturalization.

Depending on the make-up of the household, administrative and due diligence fees will be charged. No matter the applicant's decision, the lifetime rewards will not change.

What happens if you don’t have enough money for the golden visa program?

There is already a legal provision in place to let citizens of third countries profit from citizenship in the same ways as other European citizens without having to pay a million euros.

The Long-Term Residents Directive, also known as EU Council Directive 2003/109/E, contains the solution. The remaining 25 members of the European Union, with the exception of three, have all signed this regulation. The price? Nearly naught.

You have the opportunity to obtain Long-Term Residency status once you have been a resident for four years and two months over five years and have met other necessary requirements. Furthermore, the nation has a duty to handle it.

The advantages of this legislation are substantial because it bestows privileges usually reserved for citizens. These include the freedom to work for others or for oneself, schooling, and access to social services in all 25 member states of the European Union. One is more likely to acquire citizenship and a national passport if one remains in that country for even longer.

Golden visa Programs are more and more common because they provide routes to European citizenship. Golden Visas additionally offer a variety of advantages. Golden Visas do, however, have a price, including expensive investment requirements and stringent eligibility requirements. Golden Visas are still a good choice for people who want to reside and work in Europe. Golden Visa applications and approvals are not without difficulty. For this reason, it's crucial to search for immigration specialists who can help you realize your dream of becoming a citizen of Europe.

0 notes

Text

0 notes

Text

Why the Portugal Golden Visa Investment Programme is Still Relevant?

Explore unparalleled opportunities with the Portugal Golden Visa program! Unlock European access, diverse investment options, and stability in a culturally rich environment. Your pathway to residency by investment begins here.

#Portugal Immigration Visa#Portugal Golden Visa Program#Portugal National Visa#Residency by Investment#Portugal Golden Visa#National Visa#Golden Visa#Golden Visa Portugal

0 notes