Don't wanna be here? Send us removal request.

Text

What is a Citizenship by Investment Program?: A Complete Guide to CBI Programs

Citizenship by Investment (CBI) programs are becoming increasingly popular among individuals looking to obtain a second citizenship. These programs offer a pathway to citizenship through investment in the country's economy, real estate, or government bonds. The concept of CBI programs has been around for many years, but they have become more prevalent in recent times due to increased globalization and the desire for mobility and access to international markets. This blog post will provide a detailed explanation of what Citizenship by Investment Programs are and how they work and key factors to consider while choosing a Citizenship by Investment Program.

0 notes

Text

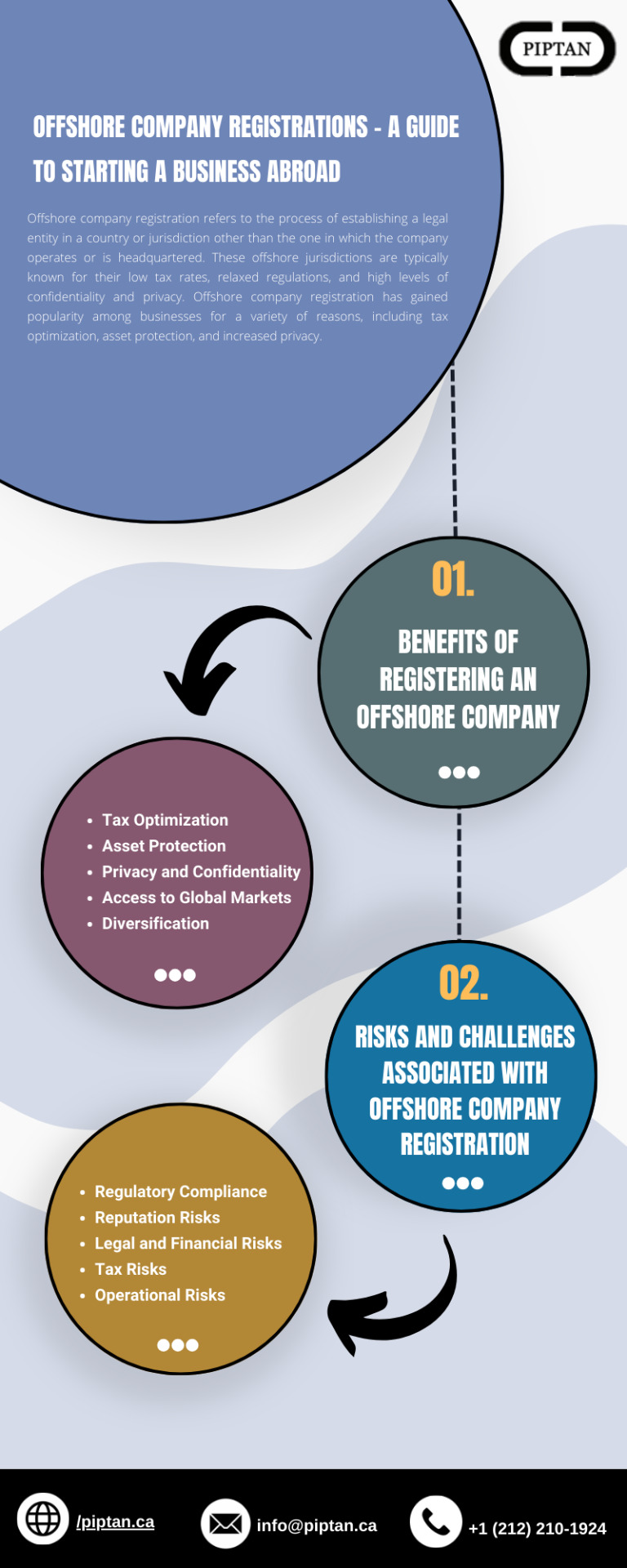

Offshore Company Registrations - A Guide to Starting a Business Abroad

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered. These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. The process of registering an offshore company typically involves hiring a professional service provider, such as a law firm or corporate services provider, to assist with the incorporation process. The service provider will typically guide the client through the process of selecting the most appropriate offshore jurisdiction, based on the client's specific needs and objectives, and then assist with the necessary documentation and filings to establish the company.

1 note

·

View note

Text

Top 5 cities of the world with the most number of millionaires.

Wealth is concentrated in the hands of a few, and cities around the world play a crucial role in determining where these wealthy individuals reside. While there are numerous measures of wealth, the number of millionaires in a city is often used as a benchmark to determine its affluence.

Millionaires are those individuals with a net worth of at least $1 million, excluding the value of their primary residence. In this blog, we will explore the 5 cities with the highest number of millionaires and examine the factors that contribute to their wealth. Understanding these trends can provide insights into the global economy and inform investment strategies for those seeking to capitalize on the wealth of these cities.

0 notes

Text

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered.

These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. In the second part of this blog, we will explore the best countries for offshore company formation in 2023.

0 notes

Text

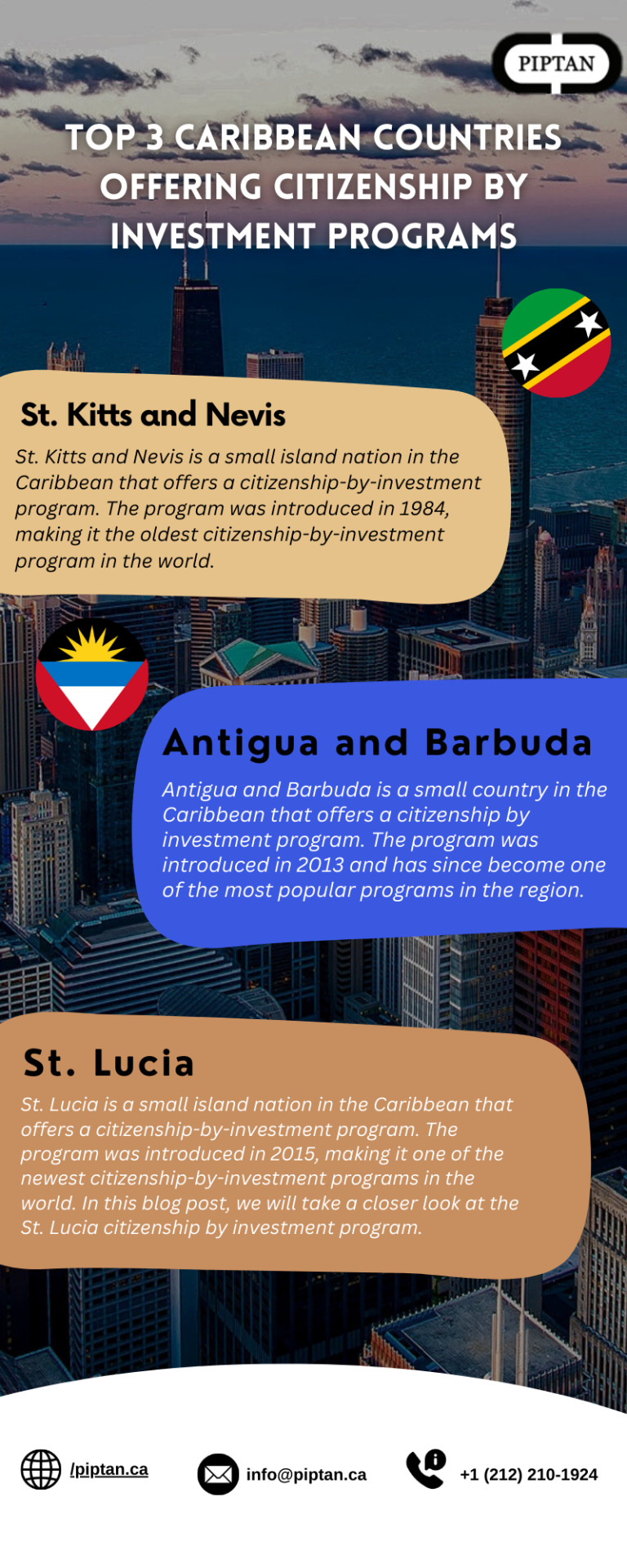

Top 3 Caribbean Countries Offering Citizenship by Investment Programs

Citizenship by investment (CBI) programs have become an increasingly popular way for countries to attract foreign investment and talent. These programs allow individuals to obtain Citizenship by Investment Program in a country by making a significant investment in that country, often in the form of real estate or other approved investment options. In return, individuals are granted access to the benefits and privileges that come with citizenship, such as the right to live, work, and travel freely in the country. Many countries around the world offer CBI programs, each with its own unique requirements and investment options. These programs can be an attractive option for high-net-worth individuals seeking to gain citizenship in a new country and take advantage of the opportunities that come with it. In this blog post, we will take a closer look at the Citizenship by Investment Programs offered by the top 3 Caribbean countries.

1 note

·

View note

Text

The Top 3 European Countries Offering Citizenship by Investment Programs

Citizenship by investment (CBI) programs have become an increasingly popular way for countries to attract foreign investment and talent. These programs allow individuals to obtain citizenship in a country by making a significant investment in that country, often in the form of real estate or other approved investment options. In return, individuals are granted access to the benefits and privileges that come with citizenship, such as the right to live, work, and travel freely in the country. Many countries around the world offer CBI programs, each with its own unique requirements and investment options. These programs can be an attractive option for high-net-worth individuals seeking to gain citizenship in a new country and take advantage of the opportunities that come with it. In this blog post, we will take a closer look at the Citizenship by Investment Programs offered by the top 3 countries of Europe.

1 note

·

View note

Text

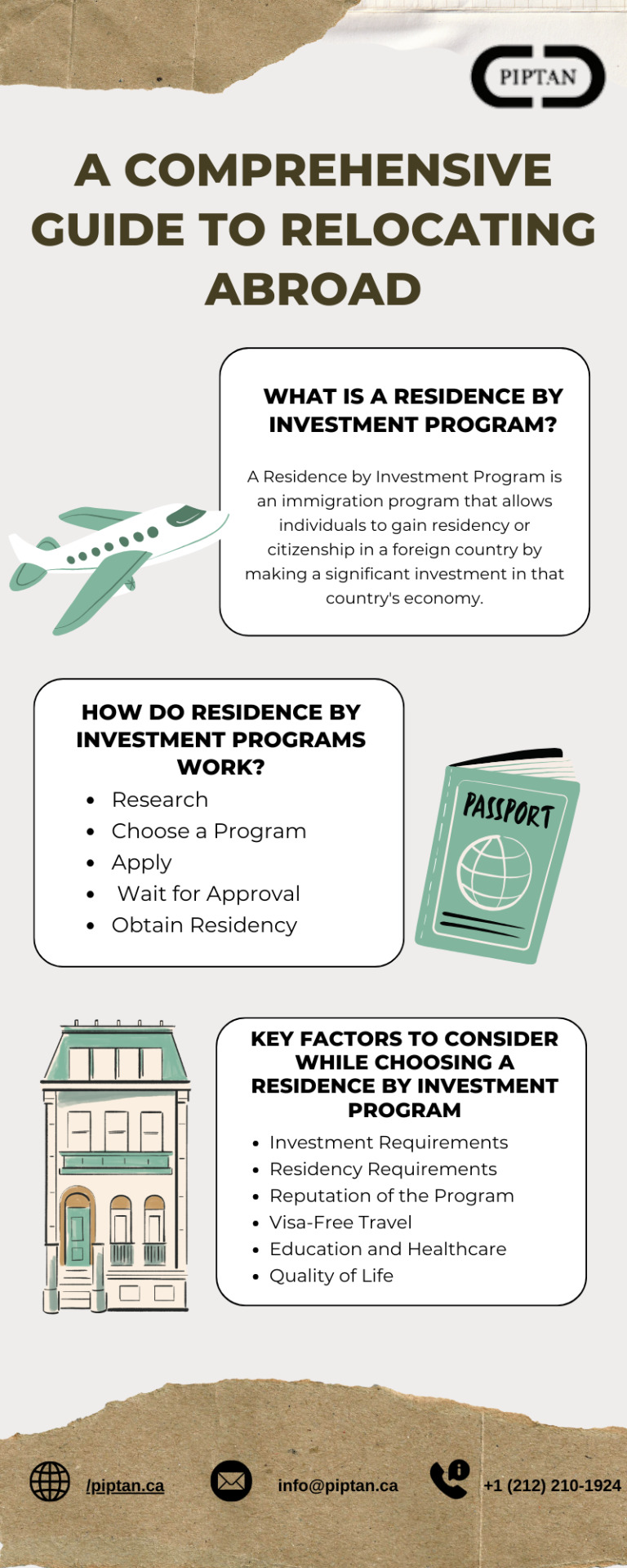

A Comprehensive Guide to Relocating Abroad.

In recent years, an increasing number of people have been exploring options for obtaining residency in foreign countries through investment. This has led to the rise of Residence by investment programs, also known as investor visas or golden visas. These programs allow individuals to gain residency in a foreign country by making a significant investment in the country's economy. The investment requirements and benefits vary by country, but the general idea is that the country grants residency or citizenship in exchange for the investment. In this article, we will delve deeper into what a residence by investment program is, how it works, and the benefits it can offer. In this blog post, we will delve deeper into what Residence by Investment programs are, how they work, and the key factors to consider while choosing a Residence by Investment Program.

#Golden Visa Program#Financial Advisory Firm#Residency by Investment#Residency by Investment Programs

1 note

·

View note

Text

The Top 3 First World Countries Offering Residency by Investment Programs

Over the past few years, there has been a growing trend of individuals seeking residency in foreign nations through investment avenues. This surge has given rise to programs commonly known as Residence by Investment, Investor Visas, or Golden Visas. These initiatives enable individuals to acquire residency in a foreign country by making substantial investments in the host country's economy.

1 note

·

View note

Text

Piptan International Inc. is committed to supporting individuals and families on their journey to becoming Global Citizens through investments in global second residency and citizenship options.

1 note

·

View note

Text

The Top 3 European Countries Offering Citizenship by Investment Programs

Citizenship by investment (CBI) programs have become an increasingly popular way for countries to attract foreign investment and talent. These programs allow individuals to obtain citizenship in a country by making a significant investment in that country, often in the form of real estate or other approved investment options. In return, individuals are granted access to the benefits and privileges that come with citizenship, such as the right to live, work, and travel freely in the country. Many countries around the world offer CBI programs, each with its own unique requirements and investment options. These programs can be an attractive option for high-net-worth individuals seeking to gain citizenship in a new country and take advantage of the opportunities that come with it. In this blog post, we will take a closer look at the Citizenship by Investment Programs offered by the top 3 countries of Europe.

Austria

Citizenship by Investment Program in Austria: Austria's citizenship by investment program was launched in 2011 and is officially known as the "Austrian Citizenship Act Amendment." The program is designed to attract wealthy individuals who can contribute to the Austrian economy and society. To be eligible for the program, individuals must make a significant investment in Austria, have a clean criminal record, and meet other requirements.

The investment options for the program are as follows:

Investment in a business: An individual can invest a minimum of €3 million in an Austrian business that creates new jobs or maintains existing ones. Investment in real estate: An individual can invest a minimum of €10 million in real estate in Austria. Investment in government bonds: An individual can invest a minimum of €3.5 million in Austrian government bonds.

Investment in a charitable project: An individual can invest a minimum of €2 million in a charitable project that benefits the Austrian people.

Combination of investment options: An individual can combine investment options to reach the required investment amount.

Once an individual has made the required investment, they must then meet additional requirements to obtain citizenship. These include passing a German language test and demonstrating knowledge of Austrian culture and history. Additionally, applicants must have a clean criminal record and be able to prove that their investment funds are legitimate.

Austria's CBI program has several advantages for investors. First, Austria is a member of the European Union, which means that Austrian citizens have the right to live and work in any EU member state. This can be a significant advantage for individuals who are looking to do business or invest in Europe. Second, Austria is known for its stable economy and high standard of living, which can make it an attractive destination for individuals looking to relocate or invest. However, the program also has some drawbacks. The investment amount required for the program is high, which may make it inaccessible for many individuals. Additionally, the application process for the program can be lengthy and complex, which may deter some potential investors.

In conclusion, Austria's Citizenship-by-investment program offers wealthy individuals the opportunity to obtain Austrian citizenship in exchange for a significant investment in the country. While the program has several advantages, including the ability to live and work in the European Union, it also has some drawbacks, including a high investment amount and a complex application process. As with any investment, individuals should carefully consider the costs and benefits of the program before making a decision.

Benefits of the CBI Program Austria

Austria does not have a formal citizenship-by-investment program. However, Austria does offer a residency by investment program called the Austrian Investor Program (AIP), which can lead to citizenship over time. Here are some potential benefits of participating in the AIP:

Access to the European Union: Austria is a member of the European Union, which means that obtaining residency in Austria through the AIP can provide visa-free travel to all EU countries.

Quality of life: Austria is consistently ranked among the top countries in the world in terms of quality of life, thanks to its strong economy, excellent healthcare, and beautiful natural environment.

Education: Austria is home to many renowned universities and educational institutions, including the University of Vienna, the Vienna University of Technology, and the Vienna University of Economics and Business. Residency in Austria can provide opportunities for educational advancement for you and your family.

Business opportunities: Austria is a hub for business and trade in Central Europe, with a highly skilled workforce and a favorable business environment. Obtaining residency in Austria through the AIP can provide access to these business opportunities.

Citizenship eligibility: Although the AIP is a residency program, after a certain period, you may be eligible to apply for Austrian citizenship. Austrian citizenship can provide access to all the benefits of being an EU citizen, including the right to live and work in any EU country.

It's important to note that the AIP has strict eligibility requirements, and the process can be lengthy and complex. It's always a good idea to consult with a qualified immigration lawyer before pursuing a residency in Austria through the AIP or any other program.

Malta

Citizenship by Investment Program in Malta: Malta's citizenship by investment program, also known as the Malta Individual Investor Programme (MIIP), was launched in 2014. The program is designed to attract high-net-worth individuals who can contribute to the Maltese economy and society. To be eligible for the program, individuals must make a significant investment in Malta, have a clean criminal record, and meet other requirements.

The investment options for the program are as follows:

Contribution to the National Development and Social Fund: An individual can make a non-refundable contribution to the National Development and Social Fund of Malta. The contribution amount varies depending on the size of the applicant's family, but it starts at €650,000 for a single applicant. Investment in government-approved financial instruments: An individual can invest a minimum of €150,000 in government-approved financial instruments, which must be held for a minimum of five years. Investment in real estate: An individual can invest a minimum of €350,000 in real estate in Malta. The property must be held for a minimum of five years. Investment in a Maltese company: An individual can invest a minimum of €700,000 in a Maltese company. The company must be actively trading in Malta and have a physical presence in the country.

Once an individual has made the required investment, they must then meet additional requirements to obtain citizenship. These include passing a due diligence check and a background check, demonstrating knowledge of Maltese culture and history, and proving that their investment funds are legitimate.

Malta's CBI program has several advantages for investors. First, Malta is a member of the European Union, which means that Maltese citizens have the right to live and work in any EU member state. This can be a significant advantage for individuals who are looking to do business or invest in Europe. Second, Malta has a stable economy and a high standard of living, which can make it an attractive destination for individuals looking to relocate or invest.

However, the program also has some drawbacks. The investment amount required for the program is high, which may make it inaccessible for many individuals. Additionally, the due diligence process for the program is rigorous, which may deter some potential investors.

In conclusion, Malta's citizenship by investment program offers high-net-worth individuals the opportunity to obtain Maltese citizenship in exchange for a significant investment in the country. While the program has several advantages, including the ability to live and work in the European Union, it also has some drawbacks, including a high investment amount and a rigorous due diligence process. As with any investment, individuals should carefully consider the costs and benefits of the program before making a decision.

Benefits of CBI Program Malta

The Maltese Citizenship by Investment Program, also known as the Individual Investor Program (IIP), provides foreign investors with the opportunity to obtain Maltese citizenship by making a significant investment in the country. Here are some potential benefits of the program:

Access to the European Union: Maltese citizenship provides access to the European Union, which means that citizens can live and work in any EU country without a visa.

Travel benefits: Maltese citizens can travel visa-free or with a visa-on-arrival to over 180 countries, making it easier to explore the world.

Business opportunities: Malta has a growing economy with a favorable business environment, and obtaining Maltese citizenship can provide access to business opportunities in the country and the wider EU.

Education: Malta has a highly regarded education system, with many reputable universities and educational institutions. Citizenship in Malta can provide opportunities for educational advancement for you and your family.

Quality of life: Malta is known for its beautiful weather, stunning coastline, rich history and culture, and high quality of life.

It's important to note that the Maltese Citizenship by Investment Program has strict eligibility requirements and significant investment requirements, and the process can be lengthy and complex. It's always a good idea to consult with a qualified immigration lawyer before pursuing Maltese citizenship through this program or any other program.

Montenegro

Citizenship by Investment Program in Montenegro: Citizenship by investment (CBI) programs have become increasingly popular in recent years as more countries seek to attract foreign investment and talent. These programs offer individuals the opportunity to obtain citizenship in a country by investing a certain amount of money in that country. One country that offers a CBI program is Montenegro.

Montenegro's citizenship by investment program, also known as the Montenegro Citizenship by Investment Program (MCBI), was launched in 2019. The program is designed to attract foreign investment to the country and boost its economic growth. To be eligible for the program, individuals must make a significant investment in Montenegro and meet other requirements.

The investment options for the program are as follows:

Investment in real estate: An individual can invest a minimum of €250,000 in real estate in Montenegro. The property must be held for a minimum of five years.

Investment in a development project: An individual can invest a minimum of €450,000 in a development project in Montenegro. The project must be approved by the government and create a minimum of ten jobs.

Investment in government bonds: An individual can invest a minimum of €350,000 in Montenegro government bonds. The bonds must be held for a minimum of three years.

Once an individual has made the required investment, they must then meet additional requirements to obtain Citizenship by investment. These include passing a due diligence check and a background check, demonstrating knowledge of Montenegrin culture and history, and proving that their investment funds are legitimate. Montenegro's CBI program has several advantages for investors. First, Montenegro is a candidate country for membership in the European Union, which means that Montenegrin citizens may have the opportunity to become EU citizens in the future. Second, Montenegro has a growing economy and a high potential for growth, which can make it an attractive destination for individuals looking to invest in emerging markets. However, the program also has some drawbacks. The investment amount required for the program is high, which may make it inaccessible for many individuals. Additionally, the due diligence process for the program is rigorous, which may deter some potential investors. In conclusion, Montenegro's citizenship by investment program offers individuals the opportunity to obtain Montenegrin citizenship in exchange for a significant investment in the country. While the program has several advantages, including the potential for EU membership and a growing economy, it also has some drawbacks, including a high investment amount and a rigorous due diligence process. As with any investment, individuals should carefully consider the costs and benefits of the program before making a decision.

Benefits of CBI Program Montenegro

The Montenegro Citizenship by Investment Program, also known as the Montenegro Economic Citizenship Program (MECP), provides foreign investors with the opportunity to obtain Montenegrin citizenship by making a significant investment in the country. Here are some potential benefits of the program: Access to the European Union: Montenegro is a candidate country for EU membership, and Montenegrin citizens enjoy visa-free travel to the Schengen area for up to 90 days in any 180-day period. Once Montenegro joins the EU, Montenegrin citizens will have access to all the benefits of being EU citizens, including the right to live and work in any EU country. Travel benefits: Montenegrin citizens can travel visa-free or with a visa-on-arrival to over 120 countries, making it easier to explore the world. Business opportunities: Montenegro has a developing economy with a favorable business environment, and obtaining Montenegrin citizenship can provide access to business opportunities in the country and the wider EU. Real estate investment: The Montenegro Citizenship by Investment Program requires a significant investment in real estate in the country, which can provide a valuable asset for the investor. Quality of life: Montenegro is known for its stunning natural beauty, warm Mediterranean climate, and rich cultural heritage, making it a desirable place to live and visit.

It's important to note that the Montenegro Citizenship by Investment Program has strict eligibility requirements and significant investment requirements, and the process can be lengthy and complex. It's always a good idea to consult with a qualified immigration lawyer before pursuing Montenegrin citizenship through this program or any other program.

Conclusion

In conclusion, citizenship by investment programs has become an increasingly popular way for countries to attract foreign investment and talent. These programs offer individuals the opportunity to obtain citizenship in a country by making a significant investment, often in the form of real estate or other approved investment options. While the benefits of these programs can be significant, including access to the privileges and opportunities that come with citizenship, it is important for individuals to carefully consider the costs and requirements of each program before making a decision. Piptan in Each country offering a citizenship-by-investment program has its own unique set of requirements and investment options, and individuals should carefully evaluate each option to determine which program best meets their needs and goals. Ultimately, citizenship by investment programs can be an attractive option for high-net-worth individuals seeking to gain citizenship in a new country and take advantage of the opportunities that come with it.

#Citizenship by Investment#citizenship by investment 2023#cheapest Citizenship by Investment#Citizenship by Investment europe#Fastest Citizenship by Investment

0 notes

Text

The Top 3 European Countries Offering Citizenship by Investment Programs

Citizenship by investment (CBI) programs have become an increasingly popular way for countries to attract foreign investment and talent. These programs allow individuals to obtain citizenship in a country by making a significant investment in that country, often in the form of real estate or other approved investment options. In return, individuals are granted access to the benefits and privileges that come with citizenship, such as the right to live, work, and travel freely in the country. Many countries around the world offer CBI programs, each with its own unique requirements and investment options. These programs can be an attractive option for high-net-worth individuals seeking to gain citizenship in a new country and take advantage of the opportunities that come with it. In this blog post, we will take a closer look at the Citizenship by Investment Programs offered by the top 3 countries of Europe.

Austria

Citizenship by Investment Program in Austria: Austria's citizenship by investment program was launched in 2011 and is officially known as the "Austrian Citizenship Act Amendment." The program is designed to attract wealthy individuals who can contribute to the Austrian economy and society. To be eligible for the program, individuals must make a significant investment in Austria, have a clean criminal record, and meet other requirements. The investmentoptions for the program are as follows: Investment in a business: An individual can invest a minimum of €3 million in an Austrian business that creates new jobs or maintains existing ones.

Investment in real estate: An individual can invest a minimum of €10 million in real estate in Austria. Investment in government bonds: An individual can invest a minimum of €3.5 million in Austrian government bonds. Investment in a charitable project: An individual can invest a minimum of €2 million in a charitable project that benefits the Austrian people. Combination of investment options: An individual can combine investment options to reach the required investment amount.

Once an individual has made the required investment, they must then meet additional requirements to obtain citizenship. These include passing a German language test and demonstrating knowledge of Austrian culture and history. Additionally, applicants must have a clean criminal record and be able to prove that their investment funds are legitimate. Austria's CBI program has several advantages for investors. First, Austria is a member of the European Union, which means that Austrian citizens have the right to live and work in any EU member state. This can be a significant advantage for individuals who are looking to do business or invest in Europe. Second, Austria is known for its stable economy and high standard of living, which can make it an attractive destination for individuals looking to relocate or invest. However, the program also has some drawbacks. The investment amount required for the program is high, which may make it inaccessible for many individuals. Additionally, the application process for the program can be lengthy and complex, which may deter some potential investors. In conclusion, Austria's Citizenship-by-investment program offers wealthy individuals the opportunity to obtain Austrian citizenship in exchange for a significant investment in the country. While the program has several advantages, including the ability to live and work in the European Union, it also has some drawbacks, including a high investment amount and a complex application process. As with any investment, individuals should carefully consider the costs and benefits of the program before making a decision.

Benefits of the CBI Program Austria:

Austria does not have a formal citizenship-by-investment program. However, Austria does offer a residency by investment program called the Austrian Investor Program (AIP), which can lead to citizenship over time. Here are some potential benefits of participating in the AIP:

Access to the European Union: Austria is a member of the European Union, which means that obtaining residency in Austria through the AIP can provide visa-free travel to all EU countries. Quality of life: Austria is consistently ranked among the top countries in the world in terms of quality of life, thanks to its strong economy, excellent healthcare, and beautiful natural environment. Education: Austria is home to many renowned universities and educational institutions, including the University of Vienna, the Vienna University of Technology, and the Vienna University of Economics and Business. Residency in Austria can provide opportunities for educational advancement for you and your family. Business opportunities: Austria is a hub for business and trade in Central Europe, with a highly skilled workforce and a favorable business environment. Obtaining residency in Austria through the AIP can provide access to these business opportunities. Citizenship eligibility: Although the AIP is a residency program, after a certain period, you may be eligible to apply for Austrian citizenship. Austrian citizenship can provide access to all the benefits of being an EU citizen, including the right to live and work in any EU country. It's important to note that the AIP has strict eligibility requirements, and the process can be lengthy and complex. It's always a good idea to consult with a qualified immigration lawyer before pursuing a residency in Austria through the AIP or any other program.

Malta

Citizenship by Investment Program in Malta: Malta's citizenship by investment program, also known as the Malta Individual Investor Programme (MIIP), was launched in 2014. The program is designed to attract high-net-worth individuals who can contribute to the Maltese economy and society. To be eligible for the program, individuals must make a significant investment in Malta, have a clean criminal record, and meet other requirements.

The investment options for the program are as follows: Contribution to the National Development and Social Fund: An individual can make a non-refundable contribution to the National Development and Social Fund of Malta. The contribution amount varies depending on the size of the applicant's family, but it starts at €650,000 for a single applicant. Investment in government-approved financial instruments: An individual can invest a minimum of €150,000 in government-approved financial instruments, which must be held for a minimum of five years. Investment in real estate: An individual can invest a minimum of €350,000 in real estate in Malta. The property must be held for a minimum of five years. Investment in a Maltese company: An individual can invest a minimum of €700,000 in a Maltese company. The company must be actively trading in Malta and have a physical presence in the country. Once an individual has made the required investment, they must then meet additional requirements to obtain citizenship. These include passing a due diligence check and a background check, demonstrating knowledge of Maltese culture and history, and proving that their investment funds are legitimate. Malta's CBI program has several advantages for investors. First, Malta is a member of the European Union, which means that Maltese citizens have the right to live and work in any EU member state. This can be a significant advantage for individuals who are looking to do business or invest in Europe. Second, Malta has a stable economy and a high standard of living, which can make it an attractive destination for individuals looking to relocate or invest. However, the program also has some drawbacks. The investment amount required for the program is high, which may make it inaccessible for many individuals. Additionally, the due diligence process for the program is rigorous, which may deter some potential investors. In conclusion, Malta's citizenship by investment program offers high-net-worth individuals the opportunity to obtain Maltese citizenship in exchange for a significant investment in the country. While the program has several advantages, including the ability to live and work in the European Union, it also has some drawbacks, including a high investment amount and a rigorous due diligence process. As with any investment, individuals should carefully consider the costs and benefits of the program before making a decision.

Benefits of CBI Program Malta: The Maltese Citizenship by Investment Program, also known as the Individual Investor Program (IIP), provides foreign investors with the opportunity to obtain Maltese citizenship by making a significant investment in the country.

Here are some potential benefits of the program: Access to the European Union: Maltese citizenship provides access to the European Union, which means that citizens can live and work in any EU country without a visa. Travel benefits: Maltese citizens can travel visa-free or with a visa-on-arrival to over 180 countries, making it easier to explore the world. Business opportunities: Malta has a growing economy with a favorable business environment, and obtaining Maltese citizenship can provide access to business opportunities in the country and the wider EU. Education: Malta has a highly regarded education system, with many reputable universities and educational institutions. Citizenship in Malta can provide opportunities for educational advancement for you and your family.

Quality of life: Malta is known for its beautiful weather, stunning coastline, rich history and culture, and high quality of life.

It's important to note that the Maltese Citizenship by Investment Program has strict eligibility requirements and significant investment requirements, and the process can be lengthy and complex.

It's always a good idea to consult with a qualified immigration lawyer before pursuing Maltese citizenship through this program or any other program.

Montenegro

Citizenship by Investment Program in Montenegro: Citizenship by investment (CBI) programs have become increasingly popular in recent years as more countries seek to attract foreign investment and talent. These programs offer individuals the opportunity to obtain citizenship in a country by investing a certain amount of money in that country. One country that offers a CBI program is Montenegro.

Montenegro's citizenship by investment program, also known as the Montenegro Citizenship by Investment Program (MCBI), was launched in 2019. The program is designed to attract foreign investment to the country and boost its economic growth. To be eligible for the program, individuals must make a significant investment in Montenegro and meet other requirements.

The investment options for the program are as follows: Investment in real estate: An individual can invest a minimum of €250,000 in real estate in Montenegro. The property must be held for a minimum of five years. Investment in a development project: An individual can invest a minimum of €450,000 in a development project in Montenegro. The project must be approved by the government and create a minimum of ten jobs. Investment in government bonds: An individual can invest a minimum of €350,000 in Montenegro government bonds. The bonds must be held for a minimum of three years.

Once an individual has made the required investment, they must then meet additional requirements to obtain Citizenship by investment. These include passing a due diligence check and a background check, demonstrating knowledge of Montenegrin culture and history, and proving that their investment funds are legitimate.

Montenegro's CBI program has several advantages for investors. First, Montenegro is a candidate country for membership in the European Union, which means that Montenegrin citizens may have the opportunity to become EU citizens in the future. Second, Montenegro has a growing economy and a high potential for growth, which can make it an attractive destination for individuals looking to invest in emerging markets.

However, the program also has some drawbacks. The investment amount required for the program is high, which may make it inaccessible for many individuals. Additionally, the due diligence process for the program is rigorous, which may deter some potential investors.

In conclusion, Montenegro's citizenship by investment program offers individuals the opportunity to obtain Montenegrin citizenship in exchange for a significant investment in the country. While the program has several advantages, including the potential for EU membership and a growing economy, it also has some drawbacks, including a high investment amount and a rigorous due diligence process. As with any investment, individuals should carefully consider the costs and benefits of the program before making a decision.

Benefits of CBI Program Montenegro: The Montenegro Citizenship by Investment Program, also known as the Montenegro Economic Citizenship Program (MECP), provides foreign investors with the opportunity to obtain Montenegrin citizenship by making a significant investment in the country. Here are some potential benefits of the program: Access to the European Union: Montenegro is a candidate country for EU membership, and Montenegrin citizens enjoy visa-free travel to the Schengen area for up to 90 days in any 180-day period. Once Montenegro joins the EU, Montenegrin citizens will have access to all the benefits of being EU citizens, including the right to live and work in any EU country. Travel benefits: Montenegrin citizens can travel visa-free or with a visa-on-arrival to over 120 countries, making it easier to explore the world. Business opportunities: Montenegro has a developing economy with a favorable business environment, and obtaining Montenegrin citizenship can provide access to business opportunities in the country and the wider EU.

Real estate investment: The Montenegro Citizenship by Investment Program requires a significant investment in real estate in the country, which can provide a valuable asset for the investor. Quality of life: Montenegro is known for its stunning natural beauty, warm Mediterranean climate, and rich cultural heritage, making it a desirable place to live and visit.

It's important to note that the Montenegro Citizenship by Investment Program has strict eligibility requirements and significant investment requirements, and the process can be lengthy and complex. It's always a good idea to consult with a qualified immigration lawyer before pursuing Montenegrin citizenship through this program or any other program.

Conclusion

In conclusion, citizenship by investment programs has become an increasingly popular way for countries to attract foreign investment and talent. These programs offer individuals the opportunity to obtain citizenship in a country by making a significant investment, often in the form of real estate or other approved investment options. While the benefits of these programs can be significant, including access to the privileges and opportunities that come with citizenship, it is important for individuals to carefully consider the costs and requirements of each program before making a decision. Piptan in Each country offering a citizenship-by-investment program has its own unique set of requirements and investment options, and individuals should carefully evaluate each option to determine which program best meets their needs and goals. Ultimately, citizenship by investment programs can be an attractive option for high-net-worth individuals seeking to gain citizenship in a new country and take advantage of the opportunities that come with it.

#Citizenship by Investment Program#citizenship by Investment Countries#cheapest citizenship by investment#citizenship by investment 2023#cheapest citizenship by investment in europe#fastest citizenship by investment#cheapest second passport

0 notes

Text

Best Countries for Offshore Company Formation in 2023

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered. These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company formation has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. In this blog, we will explore the best countries for offshore company formation in 2023.

Singapore

Singapore has long been a popular destination for offshore company formationdue to its favorable tax system, political stability, and a strong economy. Singapore offers a wide range of business structures, including the private limited company (Pte Ltd), which provides limited liability protection and greater credibility with customers and suppliers.

In addition to its tax advantages, Singapore offers a highly developed financial infrastructure, a skilled workforce, and a business-friendly regulatory environment. Setting up a company in Singapore is relatively straightforward, with a minimum paid-up capital requirement of just SGD 1. Moreover, the government offers various incentives for new businesses, such as tax breaks and funding programs.

How to Register an Offshore Company in Singapore?

Step 1: Choose a company name and business activity The first step in setting up an offshore company in Singapore is to choose a unique name for your business. The name must not be identical or similar to any existing registered company name in Singapore, and it must comply with the relevant regulations. You will also need to decide on the nature of your business activity, which will determine the relevant business license or permit requirements Step 2: Engage a professional services firm To register an offshore company in Singapore, you will need to engage the services of a professional services firm, such as a corporate service provider (CSP) or a law firm. These firms can provide expert guidance on the registration process, assist with the necessary paperwork and documentation, and ensure compliance with local regulations. Step 3: Choose a business structure The next step is to decide on the most appropriate business structure for yourcheapest offshore company formation offers several business structures, including sole proprietorship, partnership, limited liability partnership (LLP), and private limited company (Pte Ltd). Most offshore companies in Singapore opt for the Pte Ltd structure, which offers limited liability protection and greater credibility with customers and suppliers. Step 4: Register your company with the Accounting and Corporate Regulatory Authority (ACRA) Once you have chosen your company name, engaged a professional services firm, and decided on your business structure, you can register your company with the Accounting and Corporate Regulatory Authority (ACRA). The registration process involves submitting the necessary paperwork and documentation, such as the Memorandum and Articles of Association, details of the company's shareholders and directors, and the company's registered address. Step 5: Apply for business licenses and permits Depending on the nature of your business activity, you may need to apply for one or more business licenses or permits. Some common licenses and permits required in Singapore include a business license, employment pass, and goods and services tax (GST) registration. Your professional services firm can guide you on the necessary licenses and permits and assist with the application process. Step 6: Open a corporate bank account Finally, you will need to open a corporate bank account in Singapore. Singapore offers a wide range of local and international banks, and it is advisable to shop around to find the best account for your business needs. To open a corporate bank account, you will need to provide the necessary documentation, such as your company's registration certificate, a copy of the company's Memorandum and Articles of Association, and proof of identity and address for the company's directors and shareholders.

In Conclusion, registering an offshore company in Singapore certainly could be a straightforward and streamlined process if you follow the necessary steps and meet the relevant requirements. By engaging a professional services firm, choosing the right business structure, and complying with local regulations, you can establish a successful offshore company in Singapore and take advantage of its favorable tax system, political stability, and a strong economy.

Benefits of Registering an Offshore Company in Singapore?

Tax Benefits One of the most significant benefits of registering an offshore company in Singapore is the favorable tax system. Singapore has a territorial tax system, which means that only income earned within Singapore is taxed. Offshore companies that are registered in Singapore are exempted from paying taxes on foreign-sourced income that is not remitted to Singapore. The tax rate for companies is also relatively low, with the current rate being 17%. 2) Political Stability Singapore is known for its political stability and sound governance. This creates a favorable environment for businesses to operate in. The government is supportive of foreign investment and has implemented policies to attract businesses to the country. This means that offshore companies registered in Singapore can operate without any political instability or interference. Easy Company Registration Process The process of registering an offshore company in Singapore is straightforward and efficient. The government has streamlined the registration process, and it can be completed within a few days. The process involves submitting the necessary documents, such as the company's memorandum and articles of association, and the appointment of a local director. Singapore's business-friendly policies make it an attractive destination for entrepreneurs looking to start a business quickly. Strategic Location Singapore's strategic location in Southeast Asia makes it an ideal location for businesses looking to expand their operations in the region. The country is well-connected to major Asian markets, such as China and India, and has excellent air and sea links. This makes it easy for offshore companies registered in Singapore to access markets and customers in the region. Protection of Intellectual Property Singapore has a robust legal system that protects intellectual property rights. The country is a signatory to several international conventions, such as the World Intellectual Property Organization (WIPO) and the Paris Convention for the Protection of Industrial Property. This means that offshore companies registered in Singapore can benefit from strong protection of their intellectual property. Access to Skilled Labor Singapore has a highly skilled and educated workforce. The country's education system is world-renowned, and many of its graduates are sought after by multinational companies. Offshore companies registered in Singapore can tap into this pool of skilled labor, which can help them operate efficiently and effectively. Excellent Infrastructure Singapore has world-class infrastructure, including modern transportation, telecommunications, and utilities. This makes it easy for offshore companies to conduct their business operations smoothly and efficiently.

Hong Kong

Hong Kong is another popular offshore company formation destination due to its low tax rates, strategic location, and open economy. Hong Kong has a simple and transparent tax system, with a corporate tax rate of just 16.5% and no tax on foreign-sourced income. Hong Kong also has a highly developed financial system, making it an attractive location for businesses in the financial sector.

Hong Kong has a reputation for being one of the easiest places to do business, with a highly efficient and transparent regulatory environment. The incorporation process is relatively straightforward, and the government offers various support services for new businesses, such as funding and mentorship programs.

How to Register an Offshore Company in Hong Kong?

Step 1: Choose a Company Name The first step in registering an offshore company in Hong Kong is to choose a company name. The name must not be identical to any existing Hong Kong company name, and it must not be offensive or misleading. You can check the availability of your desired company name on the Hong Kong Companies Registry website. Step 2: Choose the Type of Company Hong Kong offers several types of companies, including limited liability companies (LLCs) and branch offices. LLCs are the most common type of offshore company in Hong Kong and provide limited liability protection to shareholders. Step 3: Choose a Registered Agent and Address All Hong Kong companies are required to have a registered agent and address in Hong Kong. The registered agent will handle all official correspondence on behalf of the company, while the registered address will be the official address for the company's correspondence. Step 4: Prepare the Required Documents To register an offshore company in Hong Kong, you will need to prepare the following documents: Certificate of Incorporation Articles of Association Business registration certificate Memorandum of Association Incorporation form Identity proof and address proof of directors and shareholders Step 5: Submit the Documents to the Companies Registry Once you have prepared all the required documents, you can submit them to the Hong Kong Companies Registry. The registration process typically takes around 5-7 working days. Step 6: Open a Corporate Bank Account Once your offshore company is registered in Hong Kong, you will need to open a corporate bank account. Hong Kong offers a wide range of banks, including international banks, making it easy to find a bank that meets your business needs. Step 7: Fulfill the Ongoing Compliance Requirements After registering your offshore company in Hong Kong, you will need to fulfill ongoing compliance requirements, including filing annual tax returns, maintaining proper accounting records, and holding annual general meetings.

In Conclusion, registering an offshore company in Hong Kong can be a highly effective strategy for entrepreneurs looking to take advantage of Hong Kong's business-friendly environment and favorable tax system. By carefully following the registration processand fulfilling ongoing compliance requirements, you can establish a successful offshore company in Hong Kong and reap the benefits of increased profitability and growth.

Benefits of Registering an Offshore Company in Hong Kong?

Favorable Tax System Hong Kong has a simple and transparent tax system, with a low tax rate of 16.5%. Hong Kong's tax system is also territorial, which means that companies are only taxed on income generated within Hong Kong. This makes Hong Kong an attractive destination for offshore companies looking to minimize their tax liabilities. Strategic Location Hong Kong's location in the heart of Asia makes it an ideal location for companies looking to expand their business in the region. It is well-connected to other major Asian markets, including China, Japan, South Korea, and Taiwan, making it a gateway to these markets. Business-Friendly Environment Hong Kong is known for its business-friendly policies, which make it easy to do business in the country. The government has implemented measures to simplify company registration and reduce bureaucracy, making it easy for companies to set up and operate in Hong Kong. Efficient Banking System Hong Kong has a highly efficient and stable banking system, which is an essential factor for offshore companies. The city is home to some of the world's largest banks and has an excellent reputation for financial stability. Protection of Intellectual Property Hong Kong has a robust legal system that protects intellectual property rights. The city has enacted laws to protect trademarks, copyrights, patents, and other forms of intellectual property, making it an ideal location for companies that rely on intellectual property. Skilled Workforce Hong Kong has a highly educated and skilled workforce, with a large pool of talent from diverse backgrounds. This makes it easy for companies to find the right talent for their business needs. Access to Funding Hong Kong is a hub for venture capital and private equity investment, with a thriving startup ecosystem. This makes it easy for offshore companies to access funding and grow their business. United Arab Emirates The United Arab Emirates (UAE) has emerged as a leading offshore company formation destination in recent years due to its favorable tax system, business-friendly environment, and strategic location. The UAE does not impose a corporate tax, and there are no personal income taxes, making it an attractive location for businesses and entrepreneurs.

Dubai and Abu Dhabi, the two main commercial centers of the UAE, have modern infrastructure, excellent connectivity, and a highly skilled workforce. The UAE also has a stable political environment and a transparent regulatory framework, making it an easy place to do business.

How to Register an Offshore Company in UAE?

Step 1: Choose a Business Activity and Company Name The first step in registering an offshore company in UAE is to choose a business activity and company name. The business activity must be approved by the UAE government and the company name must not be identical to any existing UAE company name. Step 2: Choose a Registered Agent and Address All UAE offshore companies are required to have a registered agent and address in the UAE. The registered agent will handle all official correspondence on behalf of the company, while the registered address will be the official address for the company's correspondence. Step 3: Prepare the Required Documents To register an offshore company in UAE, you will need to prepare the following documents: Memorandum and Articles of Association Certificate of Incorporation Copy of the passport and address proof of directors and shareholders Power of Attorney Board Resolution Step 4: Submit the Documents to the Appropriate Authority Once you have prepared all the required documents, you can submit them to the appropriate authority in the UAE. The authority will review your application and may request additional documents or information. Step 5: Obtain Necessary Licenses and Permits Depending on your business activity, you may need to obtain additional licenses and permits from the UAE government. These may include a trade license, industrial license, or professional license. Step 6: Open a Corporate Bank Account Once your offshore company is registered in UAE and you have obtained the necessary licenses and permits, you can open a corporate bank account. UAE offers a wide range of banks, including international banks, making it easy to find a bank that meets your business needs. Step 7: Fulfill the Ongoing Compliance Requirements After registering your offshore company in UAE, you will need to fulfill ongoing compliance requirements, including filing annual tax returns, maintaining proper accounting records, and holding annual general meetings.

In Conclusion, registering an offshore company in UAE can be a highly effective strategy for entrepreneurs looking to take advantage of UAE's business-friendly environment and favorable tax system. By carefully following the registration process and fulfilling ongoing compliance requirements, you can establish a successful offshore company in UAE and reap the benefits of increased profitability and growth. It is recommended to consult with a professional advisor to ensure that you meet all the requirements and comply with all the laws and regulations of the UAE.

Benefits of Registering an Offshore Company in UAE?

Tax Benefits One of the most significant benefits of registering an offshore company in UAE is the favorable tax system. Offshore companies registered in the UAE are exempt from corporate and personal income tax, as well as value-added tax (VAT). This makes the UAE an attractive destination for companies looking to minimize their tax liabilities. Strategic Location The UAE is strategically located between Europe, Asia, and Africa, making it an ideal location for companies looking to expand their business in these regions. The country is well-connected to major global markets, with excellent air and sea links, making it easy for offshore companies to access markets and customers. Business-Friendly Environment: The UAE is known for its business-friendly policies, which make it easy for companies to set up and operate in the country. The government has implemented measures to simplify company registration and reduce bureaucracy, making it easy for companies to establish their business in the UAE. Stable Political Environment The UAE has a stable political environment, which is an essential factor for companies looking to establish their business in the country. The government is supportive of foreign investment and has implemented policies to attract businesses to the country. Access to Skilled Labor The UAE has a highly skilled and diverse workforce, with talent from different parts of the world. The country's education system is world-renowned, and many of its graduates are sought after by multinational companies. Offshore companies registered in the UAE can tap into this pool of skilled labor, which can help them operate efficiently and effectively. Modern Infrastructure The UAE has modern infrastructure, including world-class transportation, telecommunications, and utilities. This makes it easy for offshore companies to conduct their business operations smoothly and efficiently. Free Trade Zones The UAE has several free trade zones that offer several benefits for offshore companies. These zones offer 100% foreign ownership, no corporate tax, no import or export duties, and streamlined customs procedures. This makes it easy for offshore companies to conduct their business operations and access markets. Access to Global Markets The UAE has a diversified economy and is home to several industries, including oil and gas, manufacturing, and finance. This provides offshore companies with access to global markets and business opportunities.

Conclusion

In conclusion, Piptan offshore company registration can offer significant benefits to businesses seeking to optimize their tax liabilities, protect their assets, and increase their privacy. However, this process also carries several risks and challenges that businesses must carefully consider before pursuing offshore registration. Regulatory compliance, reputation risks, legal and financial risks, tax risks, and operational risks are among the most significant challenges associated with offshore company registration. Businesses must ensure that they comply with all relevant laws and regulations, carefully manage their reputation, mitigate legal and financial risks, carefully evaluate tax implications, and effectively manage their offshore operations to successfully navigate these challenges. Despite these challenges, many businesses have successfully established offshore companies and taken advantage of the benefits associated with this process. However, businesses must carefully evaluate the potential benefits and challenges of offshore company registration and seek professional advice to ensure that they make informed decisions. Overall, offshore company registration can be a complex and challenging process, but with careful planning and execution, businesses can successfully navigate these challenges and reap the benefits of offshore company registration.

#Offshore Company Registration online#Best Offshore Company formation service#Offshore Company formation With Bank account#Best Country To Set Up An Offshore Company#Offshore company List#Best country For Offshore Company

0 notes

Text

Best Countries for Offshore Company Formation in 2023

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered.

These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. In the second part of this blog, we will explore the best countries for offshore company formation in 2023.

Anguilla

When it comes to establishing an Best Offshore Company formation service, Anguilla has emerged as a highly desirable destination. This beautiful Caribbean island offers a range of benefits and advantages that make it an attractive option for individuals and businesses seeking to register an offshore company

Registering an offshore company in Anguilla can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. Let’s delve into the numerous advantages of choosing Anguilla as the jurisdiction for your offshore company.

Best Country To Set Up An Offshore Company Register :

How to Register an Offshore Company in Anguilla?

Step 1: Choose a company nameThe first step in registering an offshore company in Anguilla is to choose a unique company name that is not already registered in the jurisdiction. The name should not be similar to any existing Anguillan company and should comply with the relevant regulations. It's advisable to conduct a name search to ensure availability.

Step 2: Engage a Registered AgentTo register an offshore company in Anguilla, it is mandatory to engage a registered agent licensed by the Anguillan Financial Services Commission (FSC). A registered agent will assist you in navigating the registration process, ensuring compliance with local regulations, and acting as a liaison between your company and the authorities. Step 3: Determine the Company StructureAnguilla offers various company structures for offshore businesses, including companies limited by shares (Ltd.), companies limited by guarantee (Guarantee Ltd.), and limited duration companies (LLC). Choose the most suitable structure based on your specific needs, considering factors like liability protection, ownership, and operational flexibility.

Step 4: Prepare the Required DocumentationTo register an offshore company in Anguilla, you will need to gather and prepare the necessary documentation. This typically includes:

Articles of Incorporation:This document outlines the company's regulations and internal workings. Memorandum of Association:It provides details about the company's purpose, structure, and activities. Consent of Directors and Officers:The consent of all directors and officers should be obtained and documented. Declaration of Compliance:This document certifies that the company meets all legal requirements. Step 5: Submit the Application to the Registrar of CompaniesOnce you have prepared the required documentation, you will need to submit the application to the Registrar of Companies in Anguilla. Your registered agent will assist you in submitting the application along with the necessary fees. Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the requisite fees to the Anguillan authorities. The fees will vary based on the type of company and the services provided by your registered agent. Step 7: Obtain a Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Registrar of Companies. This document serves as legal proof of the existence of your offshore company in Anguilla. Step 8: Fulfill Ongoing Compliance RequirementsAfter the registration process is complete, you must fulfill the ongoing compliance requirements for your Anguillan offshore company. This may include annual filings, maintaining proper accounting records, and adhering to any other obligations outlined by the Anguillan authorities.

In Conclusion, registering an Offshore company registration can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and privacy. By following the step-by-step guide outlined above, you can successfully navigate the process of registering an offshore company in Anguilla. Remember to consult with a registered agent or legal professional to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a thriving offshore company in Anguilla and reap the benefits it offers.

Benefits of Registering an Offshore Company in Anguilla

Privacy and ConfidentialityAnguilla is renowned for its strong commitment to privacy and confidentiality. The jurisdiction has strict laws in place to protect the privacy of individuals and businesses. When you register an Offshore Company in Anguilla, you can enjoy enhanced privacy protection, ensuring that your personal and financial information remains secure and confidential. Tax AdvantagesOne of the primary reasons individuals and businesses opt to register an offshore company is to enjoy tax advantages. Anguilla offers a favorable tax environment for offshore entities. There are no income taxes, capital gains taxes, inheritance taxes, or wealth taxes imposed on offshore companies registered in Anguilla. This allows you to retain a larger portion of your profits and optimize your tax planning strategies. Easy Company FormationAnguilla boasts a streamlined and efficient company formation process. Setting up an offshore company in Anguilla is relatively straightforward and requires minimal bureaucracy. The jurisdiction offers user-friendly procedures and a supportive regulatory framework, making it hassle-free for individuals and businesses to establish their offshore entities. Asset Protection:Asset protection is a crucial consideration for many individuals and businesses. Registering an offshore company in Anguilla provides a layer of protection for your assets. The jurisdiction's legislation is designed to safeguard your assets from potential legal threats, creditors, and lawsuits. By establishing an offshore company in Anguilla, you can mitigate risks and shield your assets effectively. Flexibility and Operational Ease:Anguilla offers significant flexibility and operational ease for offshore companies. There are no requirements for minimum capitalization, and you have the freedom to structure your company according to your specific needs. Additionally, there is no mandatory requirement for annual general meetings or the disclosure of beneficial owners, further enhancing the operational ease and convenience of running an offshore entity in Anguilla. Proximity to North America and Europe:Anguilla's strategic location in the Caribbean region provides easy access to both North American and European markets. This proximity makes it an ideal choice for businesses looking to expand globally and establish a presence in these lucrative markets. The well-developed infrastructure and connectivity of the island further facilitate trade and communication with international partners. Professional Support and Services:Anguilla has a well-established network of professional service providers, including lawyers, accountants, and company formation agents, who specialize in assisting with the registration and ongoing management of offshore companies. These experienced professionals can provide expert guidance, ensuring compliance with local regulations and maximizing the benefits of your offshore company.

Panama

Panama is renowned for being a favorable jurisdiction for offshore company formation due to its strategic location, robust economy, and attractive tax regulations. Setting up an offshore company in Panama can offer numerous benefits, such as tax optimization, asset protection, and enhanced privacy.

Panama has gained a reputation as one of the most attractive jurisdictions in the world. Known for its business-friendly environment, and strategic location, Panama offers numerous benefits for individuals and businesses seeking to establish an offshore company. In this guide, we will walk you through the process of registering an offshore company in Panama.

How to Register an Offshore Company in Panama?

Step 1: Choose a company nameThe first step in registering an offshore company in Panama is selecting a unique company name that is not already registered. The chosen name should not be similar to any existing Panamanian company and must comply with the regulations set by the Public Registry of Panama. Step 2: Engage a Registered AgentTo register an offshore company in Panama, it is mandatory to engage the services of a registered agent. A registered agent will facilitate the registration process, assist with the necessary documentation, and act as a liaison between your company and the Panamanian authorities. Step 3: Determine the Company StructurePanama offers several company structures for offshore businesses, including Private Interest Foundations (PIFs) and International Business Corporations (IBCs). Consider the advantages and characteristics of each structure to determine the most suitable option based on your business objectives and needs. Step 4: Prepare the Required DocumentationTo register an offshore company in Panama, you will need to gather and prepare the necessary documentation. The typical documentation includes: Articles of Incorporation: This document outlines the company's purpose, share capital, and internal regulations. Certificate of Good Standing: If incorporating a company that already exists, you may need to provide a certificate of good standing from the jurisdiction where the company is currently registered Passport Copies and Proof of Address: Provide passport copies and proof of address for all directors, officers, and shareholders. Notarized Power of Attorney: This document authorizes your registered agent to act on your behalf during the registration process. Step 5: Submit the Application to the Public Registry of PanamaOnce you have prepared the necessary documentation, your registered agent will submit the application to the Public Registry of Panama. The application includes the company's Articles of Incorporation, along with the required fees and supporting documents. Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the Public Registry of Panama. The fees vary depending on the type of company and the services provided by your registered agent. Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the Public Registry of Panama. This certificate serves as legal proof of your offshore company's existence in Panama. Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in Panama, it is crucial to comply with ongoing obligations and requirements. This includes maintaining proper accounting records, filing annual tax returns, and adhering to any other obligations outlined by the Panamanian authorities.

In Conclusion, registering an offshore company in Panama can provide entrepreneurs with significant advantages, including tax benefits, asset protection, and enhanced privacy. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in Panama.

It is essential to consult with legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in Panama and capitalize on the benefits it offers.

Benefits of Registering an Offshore Company in Panama

Favorable Tax EnvironmentOne of the key advantages of registering an offshore company in Panama is the favorable tax environment it offers. Panama operates on a territorial tax system, which means that offshore companies are only taxed on income derived from Panamanian sources. Income generated outside of Panama is exempt from local taxation, providing significant tax planning opportunities and potential tax savings for businesses. Asset ProtectionPanama offers robust asset protection laws that make it an ideal jurisdiction for individuals seeking to safeguard their assets. By registering an offshore company in Panama, you can separate your personal assets from those of your company, reducing the risk of personal liability. The country's legal framework provides strong asset protection, making it more challenging for creditors or litigants to seize assets held within your offshore company. Privacy and ConfidentialityPanama has strict laws and regulations in place to protect the privacy and confidentiality of individuals and businesses. The country's corporate laws ensure that the identities of beneficial owners, directors, and shareholders remain confidential and are not part of the public record. This level of privacy protection is highly sought after and provides individuals and businesses with peace of mind. Simplified Company Formation ProcessSetting up an offshore company in Panama is relatively simple and straightforward. The process involves minimal bureaucracy and paperwork compared to other jurisdictions. The government has streamlined the company formation procedures, allowing for quick and efficient registration. This enables entrepreneurs and businesses to establish their offshore entities with ease and start operating swiftly. Political and Economic StabilityPanama has long been regarded as a politically and economically stable country. It boasts a robust economy, a well-developed banking system, and a favorable business climate. The country's stable political environment ensures a secure and predictable investment climate, attracting businesses and entrepreneurs from around the world. Strategic Geographical LocationSituated at the crossroads of the Americas, Panama enjoys a strategic geographical location. It serves as a vital international trade and logistics hub, connecting North and South America. This strategic position provides businesses with easy access to markets in both continents, making Panama an ideal base for expanding into the Americas. International Banking and Financial ServicesPanama is home to a thriving banking and financial sector. The country has a well-established reputation as an international financial center, offering a wide range of banking services, including asset management, private banking, and offshore banking. Access to reputable and internationally recognized financial institutions can enhance the credibility and operational capabilities of your offshore company.

British Virgin Islands

The British Virgin Islands (BVI) has long been recognized as one of the premier offshore jurisdictions for company registration. Known for its favorable tax laws, robust legal framework, and business-friendly environment. The BVI offers numerous benefits for individuals and businesses seeking to establish an offshore company.

In this guide, we will delve into the advantages of choosing the British Virgin Islands as the jurisdiction for your offshore company.

How to Register an Offshore Company in the British Virgin Islands?

Step 1: Engage a Registered AgentTo register an offshore company in the BVI, it is mandatory to engage the services of a registered agent. A registered agent will guide you through the registration process, assist with the required documentation, and act as a liaison between your company and the BVI Financial Services Commission. Step 2: Choose a Company NameThe next step is to select a unique company name that is not already in use. The chosen name should comply with the regulations set by the BVI Registrar of Corporate Affairs and should not be misleading or similar to existing companies in the jurisdiction. Step 3: Determine the Company StructureThe BVI offers various company structures for offshore businesses, with the most common being the BVI Business Company (BVIBC). Consider the company structure that best suits your business objectives, taking into account factors such as liability protection, ownership flexibility, and ease of administration. Step 4: Prepare the Required DocumentationTo register an offshore company in the BVI, you will need to gather and prepare the necessary documentation, including: Memorandum and Articles of Association: These documents outline the company's purpose, activities, and internal regulations. Consent Forms: Obtain consent forms from all directors, officers, and shareholders, confirming their agreement to act in their respective roles. Registered Office Address: Provide a registered office address in the BVI where the company's official correspondence will be sent. Identity Documents: Submit certified copies of passports or other identity documents for all directors, officers, and shareholders. Step 5: Submit the Application to the BVI Financial Services CommissionOnce the required documentation is prepared, your registered agent will submit the application to the BVI Financial Services Commission. The application should include the necessary forms, fees, and supporting documents. Step 6: Pay the Required FeesAs part of the registration process, you will need to pay the applicable fees to the BVI Financial Services Commission. The fees vary depending on the type of company and the services provided by your registered agent. Step 7: Obtain the Certificate of IncorporationUpon successful completion of the registration process and payment of the fees, you will receive a Certificate of Incorporation from the BVI Financial Services Commission. This certificate serves as legal proof of your offshore company's existence in the British Virgin Islands. Step 8: Fulfill Ongoing Compliance RequirementsAfter registering your offshore company in the BVI, it is important to fulfill the ongoing compliance requirements. This includes maintaining proper accounting records, filing annual returns, and adhering to any other obligations outlined by the BVI authorities.

In Conclusion, registering an offshore company in the British Virgin Islands can offer significant advantages for entrepreneurs, including tax benefits, asset protection, and confidentiality. By following the step-by-step guide outlined above and working with a reputable registered agent, you can successfully navigate the process of registering an offshore company in the BVI.

It is essential to seek advice from legal and tax professionals to ensure compliance with all applicable laws and regulations. With the right guidance, you can establish a successful offshore company in the British Virgin Islands and enjoy the benefits it offers.

Benefits of Registering an Offshore Company in the British Virgin Islands