#GstSoftware

Explore tagged Tumblr posts

Text

Discover the top 5 benefits of using GST accounting software for small businesses. File returns, manage invoices, and stay tax-compliant.

#GSTSoftware#AccountingMadeEasy#GSTBilling#SmallBusinessTools#TriridBiz#BillingSoftwareIndia#GSTReady#TaxFilingSimplified#InvoiceSoftware#BusinessGrowth

0 notes

Text

GST Compliance Made Easy: Must-Have Software for E-commerce Sellers!

🚀 E-commerce Entrepreneurs!

Are GST compliance tasks bogging you down? Managing multiple GST registrations, diverse transactions, and strict deadlines can be overwhelming. But there's a solution! 🌟

Why You Need GST Software:

Automated GST Return Filing: Say goodbye to manual data entry; let the software handle GSTR-1, GSTR-3B, and more. E-Way Bill Generation: Effortlessly generate e-way bills directly from your sales data. GST Reconciliation: Ensure your sales data aligns with GST portal records to avoid mismatches and penalties. Multi-Platform Integration: Seamlessly connect with platforms like Amazon, Flipkart, Shopify, and accounting tools like Tally or Zoho Books. Real-Time Reporting and Analytics: Stay updated on your GST liabilities, ITC claims, and filing status with intuitive dashboards.

Implementing the right GST software can transform your compliance process, allowing you to focus on scaling your business. Don't let GST obligations hold you back!

Ready to Simplify Your GST Compliance?

Discover how GST software can be a game-changer for your e-commerce business. Read our comprehensive guide here: https://www.suvit.io/post/gst-software-for-ecommerce-sellers

Empower your business with the tools it needs to thrive in the digital marketplace! 🌐📈

#GSTSoftware#EcommerceSellers#GSTCompliance#TaxAutomation#OnlineBusiness#EcommerceGrowth#SmallBusinessIndia#GSTFiling#AccountingTech#Suvit#BusinessAutomation

0 notes

Text

🚀 Nammabilling: Smart & Intuitive GST Billing Software 💼📊 Simplify invoicing, manage taxes & boost productivity! 💡 #Nammabilling #GSTSoftware #BillingMadeEasy

#Nammabilling#EffortlessBilling#GSTSolutions#SmartBilling#InvoicingSimplified#TaxCompliance#BusinessTools#BillingMadeEasy#GSTSoftware#ProductivityBoost

0 notes

Text

0 notes

Text

Customization Features in GST E-invoice Software to Suit Different Industries

The way businesses handle their invoicing procedures has been completely transformed in India with the implementation of GST e-invoicing. However, since every industry is different and has various needs, universal solutions frequently don't work. This is where GST e-invoice software that can be customised comes into play, providing capabilities that are specifically designed to meet the needs of different industries. Here are some examples of how various sectors profit from these customisation features.

1. Industry-Specific Templates

The ability to customise GST e-invoice software with industry-specific templates is one of its most notable advantages. For instance, whereas the service industry would be more concerned with service descriptions and SAC codes, the retail sector might need detailed line items with product descriptions and HSN numbers. With customizable templates, companies may create invoices that precisely capture all pertinent data while also satisfying the industry's unique compliance requirements.

2. Multi-Currency and Multi-Language Support

Multi-currency and multi-language support are crucial for sectors involved in international trade, such as export enterprises. Businesses may create invoices that comply with local and international requirements by using customizable GST e-invoice software, which supports several currencies and languages. This function ensures smooth cross-border transactions, which is especially helpful for sectors that deal with international clients.Accurate acquisition of pertinent data is made.

3. Integration with Industry-Specific ERP Systems

Specialized ERP (Enterprise Resource Planning) systems are frequently used by many businesses to manage their operations. These industry-specific ERP systems can be coupled with customizable GST e-invoice software to provide smooth data flow between invoicing and other corporate operations like accounting, procurement, and inventory management. This integration guarantees that all financial data is consistent across platforms, minimises errors, and decreases the need for manual data entry.

4. Custom Reporting and Analytics

Every industry has different reporting requirements, whether it's the retail sector tracking sales by product category or the IT sector keeping an eye on service delivery schedules. Advanced reporting and analytics tools are available in customizable GST e-invoice software, and they can be adjusted to match these particular requirements. Custom reports that offer information about an organization's invoicing procedures can be generated by businesses to assist them optimise their operations and make well-informed decisions.

5. Compliance with Sector-Specific Regulations

Pharmacies and the healthcare sector are two examples of businesses with strict regulations. It is possible to set up customizable GST e-invoice software to guarantee compliance to these industry-specific rules. It may have functions for keeping track of batch numbers, expiration dates, and other crucial data that regulatory agencies demand. This enhances an organisation's billing procedures while verifying compliance.

Ginesys One: Tailored GST E-Invoice Solutions

Ginesys One is a flexible platform for companies looking for a GST e-invoice software solution that can be tailored to the requirements of their sector. With support for industry-specific templates, and smooth ERP connectivity, Ginesys One guarantees that your invoicing procedures are effective, compliant, and customised to meet your particular needs.

0 notes

Text

Transform your billing process with our GST Billing Software! 💻 Designed to automate and simplify, our solution ensures your business stays compliant and efficient under the Goods and Services Tax (GST) system. Whether you’re a small business or a large enterprise, our software adapts to your needs, providing seamless billing and reporting. , 🔍 Explore more about how we can streamline your operations! , 📞 Contact Us Today! , 📲 𝐂𝐚𝐥𝐥 𝐨𝐫 𝐖𝐡𝐚𝐭𝐬𝐀𝐩𝐩: +91 76960 66625 📧 Email: [email protected] 🌐 Website: www.skvaishjeet.in ,

#GSTSoftware#BillingSolutions#BusinessEfficiency#Automation#SoftwareDevelopment#TechForBusiness#GSTReady#GSTBilling#BusinessSoftware#TaxCompliance#Efficiency#billingsolutions#retailsoftware#billingsoftware

0 notes

Text

0 notes

Text

Easy to Generate Bulk E-way Bills

Under the GST era, generation of E-Way bill has been made compulsory which in turn has also become a time-consuming or tedious process.

To simplify the process of generating E-Way Bill, BUSY has introduced Auto Generation of E-Way Bill. With this option, you can automatically create E-Way Bill No. from BUSY at the time of saving the voucher. E-Way Bill No. will be then automatically updated in the corresponding voucher, and you can print the Invoice from there only.

#gst software#accounting software#inventory software#small business accounting services#gst accounting software for retail#billing software#financial planning#gst registration#EwayBill#Business#AccountingSoftware#GSTSoftware#GST

0 notes

Text

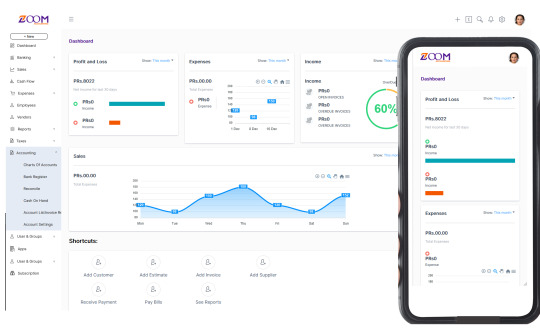

Best Accounting Software for all Businesses

When it comes to managing finances effectively, choosing the best accounting software is crucial for businesses of all sizes. Zoom SaaS Accounting Software stands out as the ideal solution, offering comprehensive features such as streamlined bookkeeping, invoicing, expense tracking, and financial reporting. With user-friendly interfaces, customizable options, and seamless integrations, this Accounting Software empowers businesses to simplify their financial processes, increase efficiency, and make informed decisions for long-term success.

0 notes

Photo

Having different parties in different cities with different pricing becomes hard to manage. To manage different parties manually can cause huge mistakes, and it’s hard to manage.

Use Our online accounting software that makes it easy for you to manage party-wise detailed reports.

To get a free demo of our accounting software, contact us today at https://bit.ly/3fwzn3H

#accountingsoftware#onlineaccountingsoftware#gstaccountingsoftware#bestaccountingsoftware#freeaccountingsoftware#gstsoftware

2 notes

·

View notes

Text

🚀 Nammabilling: Smart & Intuitive GST Billing Software 💼📊 Simplify invoicing, manage taxes & boost productivity! 💡 #Nammabilling #GSTSoftware #BillingMadeEasy

#Nammabilling#SmartBilling#GSTSoftware#InvoicingMadeEasy#BillingSolutions#BusinessTools#TaxManagement#EfficiencyBoost#SoftwareForBusiness#SimplifyBilling

0 notes

Link

2 notes

·

View notes

Photo

Hitech Services is a 5 Star Tally Certified Partner in Dehradun. We provide Tally support that include installation, training, migration, customization, integration and also a complete enterprise solution on TallyPrime. For more details, Visit https://www.facebook.com/hitechservicesindia/

#tallyservices#tallycertifiedpartner#tallysoftware#tallysupport#tally#accountingsoftware#gstaccountingsoftware#accounting#tallyprime#gstsoftware#tallyproducts#tallysolutions

1 note

·

View note

Text

Small Business Online Accounting Software for Accountants

Online accounting software is a wise investment for every CPA firm. It is an efficient way of making your business work smarter and faster. It improves collaboration within your team and with your clients.

The desktop-based accounting software for small business may not be useful to you if your team is located at multiple locations. It can lead to data redundancy. It may also involve managing paper-files and bulky storage.

What an Accountant can do with Online Accounting System

As an accountant working in a modern CPA firm or a small company, your best bet is accounting software that can be accessed from anywhere, at any time and using any devices. Online accounting software for accountants fits the bill as it frees your accountants from the workstations in the office.

Online GST Invoicing

After you have delivered your goods or services, it is time to get paid. How do you do it? It matters as it can affect your cash flow. Use online accounting software to prepare customised GST invoice and to email it to your customer instantly.

Online Storage Management

These systems store data on web servers. It is guarded with the use of a security matrix. Only authorised users can access it. Moreover, even they get to access the data based on the need to know basis.

It puts the data at your fingertips or a mouse-click away. Your accountants can access it anytime. There is no need to maintain bulky paper-files. Storing data on the web servers keep clients’ financial data safe from any hazards.

Charts for Cash Flow Management

Do your clients expect you to advise them? Can your accountants rely on the accounting software for actionable data?

Online accounting software comes with a Dashboard. It gives charts based on latest data. They show accountants Cash In/ Out of the client’s company for the last 6-month, Invoices owed to and Bills owed by it. Your accountants can on latest info for giving data-driven advise.

Bank Reconciliation

The accountants can play an important role in maintaining positive cash flow for your clients. They can do so by doing the bank reconciliation regularly for the clients.

The accountants can track bank entries and match them against the clients’ financial records available to them. In fact, some of the small business accounting software enables them to reconcile any accounts.

5 Benefits of Online Accounting SoftwareReal-Time Data

The online accounting system provides real-time data to give your accountants a clear understanding of clients’ current financial position.

Multi-user

It allows multi-user access and promotes collaboration between accountants and clients.

Focus on Your Clients

The software is hosted on web servers. Your CPA firm does not have to worry about its upgrading or maintenance. It leaves you completely free to spend your time doing things important for your business.

Use Latest Version

The software is updated online. You always have access to its latest version. You do not have to install it. Your accountants access it by using its URL in the internet browser on their devices.

Auto-save

These software records drafts and asks whether to save it or not. They auto-save sessions data. Each bit of data is stored online.

Costs of using online accounting software

You need to pay for a monthly subscription to use online accounting system. And that’s it.

Using a small business accounting software for an accountant is a worry-free option. You do not have to take care of version upgrades, IT team for software maintenance, costs for system administration costs or server failures. These issues are taken care of by online accounting software provider, leaving you to do your best work for your clients.

1 note

·

View note

Text

See my video about GST Solution 👇

KNOWLEDGE WATT

https://www.youtube.com/watch?v=ruEGhI_y27Y

youtube

1 note

·

View note

Text

"Transform your accounting experience with TallyPrime! 🚀 Streamline your financial operations and boost productivity like never before."

0 notes