#How to Find HSN Code

Explore tagged Tumblr posts

Text

SS Pipe Supplier in Delhi with Ready Stock – Udhhyog Trusted Quality

In the bustling industrial capital of North India, finding a trusted SS pipe supplier in Delhi with verified stock and competitive rates is crucial for businesses in infrastructure, construction, fabrication, and more. From power plants to pharmaceutical facilities, stainless steel (SS) pipes form the backbone of modern engineering systems.

Udhhyog, one of India’s most respected names in the steel supply industry, brings you ready stock of SS pipes in Delhi, covering all major grades and specifications, supported by unbeatable quality assurance and end-to-end service.

🌐 Why Udhhyog Is a Leading SS Pipe Supplier in Delhi

Delhi’s demand for stainless steel pipes spans across public sector undertakings, private infrastructure projects, high-rise builders, OEM manufacturers, and large-scale fabricators. Udhhyog is among the top-rated SS pipe suppliers thanks to:

✅ In-house stock availability in multiple grades

✅ PAN India logistics support

✅ Certified SS pipes with MTC

✅ Quick dispatch from Delhi NCR warehouse

✅ Custom processing (cutting, threading, bending)

Our deep industry experience, vast inventory, and commitment to standards make Udhhyog the first choice for stainless steel pipe procurement in Delhi.

📦 Stainless Steel Pipe Grades Available at Udhhyog

We stock a complete range of SS pipes to meet varied industry demands:GradeDescriptionCommon UseSS 202Economical & corrosion-resistantFurniture, railings, fabricationSS 304Most widely used; general-purposePlumbing, dairy, pharmaSS 316Marine-grade; high corrosion resistanceChemical plants, seawater linesSS 310High-temperature resistantBoilers, furnaces, heat exchangers

📐 Technical Specifications – Udhhyog SS Pipes

SpecificationRangeSize (OD)½��� to 24” NB (15mm – 600mm)Wall ThicknessSCH 5 / 10 / 20 / 40 / 80 / 160Length1m to 6m standard (custom cuts available)FinishMill, polished, brushed, mirrorTypeSeamless, ERW, WeldedStandardASTM A312 / A213 / IS 1239 / IS 3589End OptionsPlain / Beveled / Threaded

We maintain ready stock across all these categories, ensuring immediate dispatch for urgent project requirements.

🏭 Industries Served in Delhi NCR

Delhi is home to a variety of industrial verticals, all of which rely on SS pipes for durability, strength, and corrosion resistance. Udhhyog regularly supplies to:

🧪 Chemical & Petrochemical Plants

🏗️ Construction & Infrastructure Projects

🥫 Food & Beverage Manufacturing Units

🧴 Pharmaceutical & Biotech Facilities

🛢️ Oil Refineries & Fuel Stations

🔥 Boiler Rooms & Thermal Power Plants

🌊 Water Treatment & STP Systems

🛠️ Fabrication & Welding Workshops

🛠️ Value-Added Services by Udhhyog

Unlike standard traders, Udhhyog adds exceptional value with in-house processing and logistics:

✂️ Cut-to-length Services

🔩 Threading & Socketing

📦 Bundled Dispatch & Labeling

📄 Third-Party Inspection (TPI) Assistance

🚛 Fast Delivery Within Delhi NCR

📍 Udhhyog – Local Expertise in Delhi NCR

With strong logistics and a stocked warehouse in Delhi NCR, Udhhyog ensures faster turnarounds than national suppliers.

✔️ On-site delivery within 24–72 hours

✔️ Verified stock updates with real-time dispatch status

✔️ Technical advisory for project-specific SS pipe selection

From Connaught Place to Faridabad, Okhla to Bawana, Udhhyog serves all of Delhi's industrial zones.

🧾 Compliance and Documentation

Every order from Udhhyog includes:

✅ Mill Test Certificate (MTC)

✅ ISI & ASTM standards mentioned

✅ HSN Code and GST-ready Invoice

✅ Load Test and Pressure Test on Request

📊 SS Pipe Price List Per Meter (Approx.) – 2025

GradeSize (NB)Price Per Meter (₹)SS 3041”₹280 – ₹350SS 3161”₹390 – ₹480SS 2021”₹220 – ₹270SS 3101”₹520 – ₹650

Prices are indicative and vary by quantity, grade, and delivery terms. Contact Udhhyog for updated quotes.

📞 How to Place Your Order with Udhhyog

Buying SS pipes in Delhi is now simple and reliable:

📩 Send an enquiry via udhhyog.com

📃 Receive an instant quote with weight and pricing

✅ Confirm purchase & share delivery location

🚛 Receive your consignment within 2–5 business days

❓ Frequently Asked Questions (FAQ)

Q1: What sizes of SS pipe are available in ready stock in Delhi?

A: Udhhyog maintains ready stock from ½” to 12” NB in SS 202, 304, and 316. Larger diameters are available on order.

Q2: Do you offer cut-length and customization in SS pipes?

A: Yes, Udhhyog provides custom-length cutting, socketing, threading, and polishing as per customer requirements.

Q3: Is Udhhyog an authorized distributor of Jindal SS pipes?

A: Yes, we are a recognized stockist and supplier of Jindal SS pipes along with other certified brands.

Q4: What are the benefits of buying SS 316 pipes from Udhhyog?

A: SS 316 pipes offer excellent chemical and saltwater resistance. Udhhyog ensures original MTC-certified material with full traceability and fast delivery in Delhi.

Q5: Can Udhhyog supply for government and tender-based projects?

A: Absolutely. We supply to government contractors and offer all required documentation, including GST invoices and E-Way Bills.

0 notes

Text

Understanding HSN/SAC Codes for Indian Businesses

For any business working in the Goods and Services Tax regime in India, understanding HSN codes and SAC codes or applying them correctly is not merely a matter of fulfilling a legal requirement-it is an important aspect of ensuring bills are correctly prepared, that the right amount of tax is calculated, and GST has been properly complied with.

At first glance, these codes can appear complicated, but that is far from the truth-just like everything is based on common sense—these codes were developed with the intention that they provide uniformity and clarity in respect of classification of goods and services. Any other form of misclassification may have various consequences like levy of wrong tax, imposition of penalties, and reconciliation problems.

Tririd Biz, your trusted accounting and billing software in India, believes that GST compliance can be a little less challenging if it is clear upfront. This comprehensive guide will clarify HSN and SAC codes, show why these matters are of significance to your business, and even walk you through how our software makes managing HSN and SAC codes quite simple.

What are HSN Codes and SAC Codes?

Briefly:

HSN Code (Harmonized System of Nomenclature): These are internationally accepted classification codes for goods. The codes were evolved by the World Customs Organisation (WCO) to classify traded goods the world over systematically. In India, these codes are used in GST to assess the rate of tax applicable to different products.

Structure: While HSN codes remain international only till 6-digits, India in reality uses an HSN code of 2, 4, 6, or 8 digits depending on the turnover of the business. The more digits the code has, the finer the classification.

SAC Code (Service Accounting Code): In the same manner HSN is structured for goods, SAC codes are used to classify services. These codes are restricted to India and were developed by the Central Board of Indirect Taxes & Customs (CBIC) for service tax purposes, which were subsequently taken over by GST.

Structure: The SAC code is of 6 digits only; the initial two digits are '99' for services, and the next four digits specify the exact nature of service.

Why are HSN/SAC Codes Necessary for GST Compliance in India?

The primary reasons HSN/SAC codes are mandatory under GST are:

Uniform Classification: They ensure that goods and services are classified uniformly across India, preventing ambiguity and disputes regarding tax rates.

Tax Rate Determination: Every HSN/SAC code is linked to a specific GST rate. Using the correct code ensures you charge and pay the right amount of tax.

Invoice Generation: It is mandatory to mention the HSN/SAC code on GST-compliant invoices, especially for B2B transactions, if your turnover exceeds certain limits.

GST Return Filing: HSN/SAC-wise summary of outward supplies (sales) is required in GSTR-1, providing granular detail to the tax authorities.

Data Analysis & Policy Making: The government uses these codes to analyze trade data, understand consumption patterns, and formulate economic policies.

How Many Digits of HSN/SAC Code Do You Need to Use?

The number of digits you need to declare depends on your business's aggregate annual turnover in the preceding financial year:

For Goods (HSN):

Turnover up to ₹5 Crore: 4-digit HSN code (mandatory for B2B invoices)

Turnover exceeding ₹5 Crore: 6-digit HSN code (mandatory for all invoices)

Exports & Imports: 8-digit HSN code is generally required.

For Services (SAC):

All Turnovers: 6-digit SAC code is generally required.

(Always refer to the latest notifications from the GST portal for the most accurate and up-to-date requirements, as these thresholds can be revised.)

How to Find Your HSN/SAC Codes

Finding the right HSN/SAC code relevant to your goods or services is extremely important. Some good ways include:

GST Portal: The GST portal at times has search methods or links to official HSN/SAC code lists.

CBIC Website: Lists of HSN codes for goods and SAC codes for services are available on the Central Board of Indirect Taxes & Customs (CBIC) website.

Industry Associations: Your industry association might have compiled lists or issued guidelines for your particular industry.

Tax Consultants: A professional tax consultant will assist in determining the correct codes for your particular offerings.

Through Your Accounting Software: A good smart GST accounting software like Tririd Biz will take away a lot of these worries.

Common Mistakes to Avoid with HSN/SAC Codes

Using Wrong Codes: It is the commonest mistake, and these wrong codes can lead to wrong tax calculations, penalties, and problems for the customers in claiming ITC.

Not Updating Codes: As products or services change, or as GST rules change, always ensure your codes are up to date.

Ignoring Compulsory Requirements: Not mentioning the HSN/SAC code in the invoice, when it is required to do so, or putting in lesser digits than required, with respect to the turnover.

Confusing Goods with Services: Remember to use the HSN for goods and SAC for services.

Lack of Documentation: Failure to maintain documentation explaining the basis for assigning a certain HSN/SAC code, especially in the case of complex items.

How Tririd Biz Accounting & Billing Software Simplifies HSN/SAC Management

Managing HSN/SAC codes manually for every product and service can be tedious and error-prone, especially for businesses with diverse offerings. Tririd Biz is designed to take this burden off your shoulders:

Product/Service Master Data: Easily store and manage your products and services, each tagged with its correct HSN/SAC code and corresponding GST rate, within our software.

Automated Tax Calculation: When you create an invoice in Tririd Biz, the software automatically picks up the HSN/SAC code and applies the correct GST rate based on your master data. This minimizes manual errors.

Invoice Printing: Your GST-compliant invoices generated by Tririd Biz will automatically include the required HSN/SAC codes, ensuring you meet legal requirements.

GSTR-1 Summary: Tririd Biz helps in generating HSN/SAC-wise summaries for your GSTR-1, streamlining your return filing process.

Seamless Data Management: Update codes centrally, and the changes reflect across all relevant transactions, ensuring consistency.

By leveraging Tririd Biz, you can focus on growing your business, knowing that your GST billing and accounting are accurate and compliant with the latest HSN/SAC regulations.

Ensure Compliance, Embrace Simplicity

Understanding HSN/SAC codes is a fundamental aspect of GST compliance for Indian businesses. By dedicating time to correctly classify your goods and services and utilizing smart tools like Tririd Biz, you can ensure accuracy, avoid penalties, and simplify your entire GST filing process.

Ready to streamline your GST compliance with intelligent HSN/SAC management?

Get a Free Demo of Tririd Biz Today! Learn More About Tririd Biz GST Software Explore Tririd Biz Features

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Tririd Biz Accounting Software#HSN SAC codes India#GST codes for goods and services#Understanding HSN code#What is SAC code in GST#GST invoice HSN SAC

0 notes

Text

Discover insights on India's growing vermicompost export market, including export data, top exporters, and key tips for successful international trade. Learn about the vermicompost HSN code and how to find global buyers for eco-friendly farming solutions.

#vermicompost export from india#vermicompost hsn code#vermicompost exporters#vermicompost exporters in india#vermicompost export data from india

0 notes

Text

Explore Global Trade with Real-Time Data Access

Access up-to-date import-export data from 100+ countries. Discover new markets, monitor competitors, and analyze global trade trends with our advanced platform designed for smarter business decisions. Visit here more information- https://vanesight.com/blog/how-to-find-buyers-for-export-from-india-top-import-export-companies/

0 notes

Text

How Does GST Audit Advisor in Chennai Prevent Filing Errors?

If you run a business, you already know how important it is to stay on top of financial regulations. But one area that often creates confusion is GST filing. Dealing with GST returns can feel like walking through a maze, especially when you’re trying to do everything right to avoid penalties. Whether you’re a small business owner or an investor trying to maintain clean books. This is why more and more businesses are opting for GST filing services in Chennai to stay worry-free. Having expert support means fewer errors and better compliance.

But even if you're getting help, understanding the basics and common mistakes in GST filing can give you a clearer view of your financials. In this article, we’ll walk you through the most common errors people make while filing GST returns and how to avoid them.

1. Manual Data Entry Errors

Let’s face it: Typing numbers manually always leaves room for mistakes. A small typo in GSTIN, invoice amount, or date can create major problems. These errors can trigger notices or rejections during audits. Always double-check your entries or use digital accounting tools to reduce the chances of these errors.

2. Confusion with Tax Slabs

Every product or service is taxed under a specific GST slab. If you don’t apply the correct rate, it can lead to underpayment or overpayment of tax. This can result in a mismatch when the department cross-verifies your returns, leading to delays or penalties. Always refer to the HSN (Harmonised System of Nomenclature) codes and GST slab list before filing.

3. Skipping NIL Returns

Just because you didn’t make any sales in a particular month doesn’t mean you can skip the GST return. Many investors and startups make this mistake. You must file a NIL return to stay compliant, even when there’s no activity. Ignoring this can attract fines and freeze your GSTIN.

4. Zero-Rated vs Nil-Rated Confusion

Zero-rated supplies (like exports) and nil-rated supplies (like certain essential goods) are not the same. Be sure to understand this distinction clearly before filing your returns.

If you find these processes overwhelming, it might be time to get help from a GST Audit advisor in Chennai. They can help review your filing practices and make sure you're not missing anything important.

5. Incorrect Reverse Charge Filing

Some transactions fall under the Reverse Charge Mechanism (RCM), where the buyer pays the GST instead of the seller. Failing to identify and declare these transactions correctly can lead to interest and penalties. Always check whether a transaction falls under RCM and file it accordingly.

6. Misclassification under GST Heads

Many businesses end up paying GST under the wrong tax heads — CGST, SGST, or IGST. This mistake can affect your returns and lead to notices or demands from the tax department. Knowing which tax head applies to each transaction type is key to staying compliant.

7. Documentation and Bookkeeping Gaps

Maintaining clean and organized records is a must. Inadequate documentation can make audits a nightmare. Make sure to save every invoice, payment proof, and ledger detail. Good documentation helps not just during audits but also while claiming ITC and preparing financial reports.

Conclusion

Whether you're a business owner or an investor, understanding the basics of GST compliance is crucial. It’s not just about avoiding fines, it’s also about building trust, keeping your operations smooth, and staying stress-free during audits. A little help can go a long way for your business or investment portfolio to grow without unnecessary hiccups.

#tax planning services in Chennai#best tax planning company in Chennai#tax on capital gains from mutual funds in Chennai#gst filing services in Chennai#GST Audit advisor in Chennai#tax filing consultants in Chennai#tax filing advisor in Chennai#income tax filing consultant in Chennai#tax consultant in Chennai#gst return filing online in Chennai#Tax preparation services in chennai#Income tax filing assistance in chennai

0 notes

Text

HSN Code for Installation Charges

The HSN is a crucial part of getting the tax classification rights for any goods or services in India. So, if you are into installation services, knowing which HSN code to apply on your invoices and in your GST filings turns out to be quite important. This blog will break down everything you need to know about the HSN code for installation charges and how to find it. What is the HSN Code for…

0 notes

Text

Can a GST Bill Generator Boost Your Business Efficiency? Find Out!

In today’s fast-paced business world, managing time and efficiency is more important than ever. For businesses, creating GST-compliant invoices can sometimes be a tedious task, especially if done manually. However, with tools like GST Bill Generators, this process becomes not only quicker but also more accurate.

What is a GST Bill Generator?

A GST Bill Generator is a software tool designed to help businesses create GST-compliant invoices easily and quickly. These tools ensure that your invoices include all necessary details such as:

GSTIN (Goods and Services Tax Identification Number)

HSN (Harmonized System of Nomenclature) code

Tax breakup (CGST, SGST, or IGST)

Invoice date and number

Customer and business details

How Does a GST Bill Generator Improve Business Efficiency?

Let’s take a closer look at how this tool can benefit your business:

Saves Time: One of the biggest benefits of a GST Bill Generator is that it helps you save time. Manually creating invoices can be a slow process, especially if you handle multiple customers daily. With a GST Bill Generator, you can generate invoices within minutes.

Reduces Errors: Manual billing increases the risk of errors in calculations or missing details. A Best GST Bill Generator ensures that all calculations are accurate and compliant with GST regulations, reducing the chance of penalties.

Improves Billing Processes: Automating invoicing with a Bill Generator streamlines your billing process. You can easily manage customer data, generate recurring invoices, and track payments—all from one place.

Increases Business Productivity: With efficient billing processes and reduced manual effort, you can focus more on growing your business rather than worrying about paperwork. This is how business efficiency tools like GST Bill Generators contribute to productivity.

Why Should You Switch to the Best GST Bill Generator?

If you are still wondering whether a GST Bill Generator is the right choice for your business, consider these additional benefits:

Cost-Effective: Many GST Bill Generators come with affordable pricing or even free plans for small businesses.

Customization: Create professional invoices tailored to your brand with custom logos and layouts.

Compliance Assurance: Stay updated with the latest GST rules and ensure your invoices always meet regulatory standards.

Data Insights: The Impact of Using GST Bill Generators

According to a recent survey:

75% of small businesses using GST Bill Generators reported significant time savings in invoicing.

68% of businesses reduced billing errors by switching to automated invoicing tools.

Businesses using billing software saw a 40% improvement in payment collection time.

85% of users found that automated GST invoicing tools simplified tax compliance and filing.

Companies with recurring invoicing needs saved an average of 20 hours per month using such tools.

Key Features to Look for in a GST Bill Generator

When selecting the Best GST Bill Generator, consider these essential features:

User-Friendly Interface: Look for software that is easy to use, even for beginners.

Mobile Accessibility: A tool with a mobile app ensures you can generate invoices on the go.

Tax Calculation Automation: Automatic calculation of CGST, SGST, and IGST saves time.

Multi-User Access: If you have a team, choose software that allows multiple users to access and create invoices.

Customer Support: Reliable customer support can be a lifesaver if you encounter any issues.

Top GST Bill Generators in India (2025)

Here’s a list of some of the most popular GST Bill Generators that you can explore:

Zoho Invoice: Offers a free plan for small businesses and robust features.

TallyPrime: A trusted name with extensive GST compliance tools.

Vyapar: Best suited for small and medium businesses with an easy-to-use mobile app.

Marg ERP: A comprehensive solution for invoicing and accounting.

Gimbook: A user-friendly tool tailored for efficient GST billing and compliance.

Gimbook: The Smarter Choice for GST Billing

Gimbook is an emerging player in the world of GST Bill Generators, offering an intuitive platform designed to simplify GST invoicing for businesses of all sizes. With features like automated tax calculations, customizable invoice templates, and seamless integration with accounting tools, Gimbook ensures accurate and efficient billing. Its user-friendly interface makes it a top choice for small and medium enterprises looking to streamline their billing processes and enhance compliance.

Let us help you streamline your GST billing process. Get started with Gimbook today! https://gimbooks.com/

Conclusion

Using a GST Bill Generator is no longer a luxury but a necessity for businesses that aim to stay competitive and efficient. These tools not only improve billing processes but also ensure compliance, save time, and enhance productivity. Whether you are a small business owner or manage a large enterprise, the Best GST Bill Generator can be a game-changer for your business efficiency.

0 notes

Text

Common GST Terms Every Business Owner Should Know

For every business owner in India, understanding GST (Goods and Services Tax) is essential. While GST has simplified taxation, it comes with its own set of terms and jargon that can be confusing.

In this blog, we’ll explain some of the most common GST terms in simple words and also discuss how GST registration consultants in Delhi can help you.

1. GSTIN (Goods and Services Tax Identification Number)

GSTIN is a unique 15-digit number assigned to every business registered under GST. This number is used for all GST-related activities, including filing returns and paying taxes.

2. Input Tax Credit (ITC)

Input Tax Credit allows businesses to reduce the tax they’ve already paid on purchases (input) from the tax they need to pay on sales (output). It ensures that tax is paid only on the value added at each stage of the supply chain.

3. GST Returns

GST returns are documents that businesses must file to report their income, expenses, and tax liability. Common returns include GSTR-1 (sales), GSTR-3B (summary), and GSTR-9 (annual).

4. HSN (Harmonized System of Nomenclature) Code

HSN codes classify goods under GST, ensuring consistency in tax rates. Each product has a specific HSN code, which must be mentioned in invoices.

5. SAC (Services Accounting Code)

SAC codes are similar to HSN codes but are used for services instead of goods. They help identify and classify different services under GST.

6. Composition Scheme

The Composition Scheme is designed for small businesses with a turnover below a specific threshold. It simplifies compliance by allowing businesses to pay a fixed percentage of their turnover as tax instead of calculating GST on each transaction.

7. Reverse Charge Mechanism (RCM)

Under RCM, the recipient of goods or services pays the GST instead of the supplier. This typically applies to certain goods and services specified under GST laws.

8. E-Way Bill

An E-Way Bill is a document required for the movement of goods worth more than ₹50,000. It ensures transparency and prevents tax evasion during transportation.

9. Taxable Person

A taxable person is any individual or entity engaged in business activities that are subject to GST. This includes sole proprietors, companies, partnerships, and freelancers.

10. GST Threshold Limit

The GST threshold limit is the turnover amount above which a business must register for GST. Currently, the limit is ₹20 lakh for most states and ₹10 lakh for special category states.

How GST Registration Consultants Can Help

Navigating GST terms and compliance can be challenging, especially for new business owners. GST registration consultants in Gurgaon can simplify the process by providing:

Expert Advice: They explain GST rules and terms in a way that’s easy to understand.

Hassle-Free Registration: Consultants handle all the paperwork and ensure smooth registration.

Compliance Support: From filing returns to managing ITC, they ensure you stay compliant with GST laws.

Tailored Solutions: They offer services tailored to your business needs, saving you time and effort.

Why Choose GST Consultants in Gurgaon, Delhi, or Noida?

These cities are thriving business hubs with access to experienced consultants. Whether you’re starting a new venture in Gurgaon, scaling up in Delhi, or running a business in Noida, you’ll find experts who can guide you every step of the way.

Conclusion

Understanding common GST terms like GSTIN, ITC, and HSN codes is crucial for running a business in India. However, you don’t have to navigate the complexities of GST alone. With the help of GST registration consultants in Noida, you can ensure smooth compliance and focus on growing your business. Reach out to an expert today to make GST management hassle-free!

#GST registration in Gurgaon#GST registration in Noida#GST registration in Delhi#GST Registration Services#GST registration consultants in Delhi#GST registration consultants in Gurgaon#GST registration consultants in Noida#GST consultant in Delhi#GST consultant in Noida#GST consultant Gurgaon

0 notes

Text

"Eximate: Your Best way to connect Foreign Importers"

Finding reliable international buyers is important for businesses developing in the huge world of global trade. It can be difficult to know where to look with so many platforms out there offering assistance. That's where Eximate comes in. It's like a guiding light, they helping businesses connect with reliable Foreign importers. Let's take a closer look at why Eximate is the go-to platform for linking exporters with foreign buyers.

The Power of Eximate: Simplifying International Trade: Eximate isn't like any other online marketplace. It's a dynamic platform that revolutionizes how exporters link up with international buyers. With its easy-to-use interface and powerful features, Eximate is the top choice for businesses looking for real trade chances worldwide. Trust Eximate to help you find genuine trade opportunities and take your export business to new heights.

Why Eximate Stands Out:

Extensive Global Network: Eximate has a huge network of foreign importers covering many different industries and parts of the world. Whether you're export electronics, textiles, metal, brass, wooden or agricultural products, they connect you with potential buyers from all over the world. No matter what you're export, Eximate has got you covered, making it easier than ever to find the right buyers for your products wherever they may be.

Verified Foreign Buyers: With Eximate, you can trust that you're dealing with genuine on our platform is reliable and trustworthy. Focus on building successful business relationships with confidence, knowing that they are there to support you every step of the way.

Verified Contact Details: They know how crucial it is to communicate reliably with potential buyers. That's why they verify all email addresses and phone numbers, ensuring you reach the right people in the purchasing department. With verified contact details, you can reach out confidently, knowing your mails will land in the right hands. No more wasted time or frustration trying to connect—trust Eximate to put you in touch with the key contacts for your business success.

HSN Code Conformance: They Follow to HSN Code standards, so you can trust that our buyer data meets the highest industry standards. They are dedicated to following rules and regulations, so you can trust that our data is accurate and dependable. With Eximate, you can feel confident knowing that you're getting trustworthy buyer data that meets all the standards. This reliable information will be a key factor in boosting your export business.

Real-Time Accessibility: In the fast-moving world of international trade, being up-to-date is important. That's why Eximate gives you real-time updates, so you always have the latest buyer data exactly when you need it. With this info, you can outshine your competitors and make smart choices to expand your export business. Trust Eximate to keep you in sync with the freshest buyer data, guiding you through the ever-changing world of global trade with confidence.

Dedicated Support: Questions or need assistance? They can assist you with our dedicated team members. Whether you need help understanding HSN Code details or navigating the acquisition process, they’re here for you with timely and dependable support.

Long-Term Success: Their goal is to support your long-term success in addition to offering buyer data offering exact, fast, and compliant information for long-term success.

0 notes

Text

How to Start a Furniture Export Business from India

The need for one-of-a-kind, handcrafted furniture is growing worldwide, and India is well-positioned to supply this demand thanks to its talented artisans and rich design legacy. India's furniture sector, which is currently ranked 12th in the world for furniture exports, is renowned for the elegance, robustness, and ethnic appeal that are preserved via the use of traditional crafting tools.

History and Evolution of Indian Furniture

In the past, floor seating and sleeping arrangements were the only options available to the common people in India, who lived in palaces, temples, and public places. Following their conquest, the Portuguese, Dutch, Mughals, and British all began making furniture for their own use. As a result, Indian furniture design became a fusion of several cultural elements.

Indian Furniture Production and Market Overview

India is the world's fifth-largest manufacturer and fourth-largest consumer of furniture. Leading producers in the industry include Godrej Interio, Woodenstreet, Durian Furniture, Nilkamal Furniture, and Hometown. By 2026, the around $30 billion Indian furniture market is expected to grow to above $32 billion.

Furniture Export Trends and Facts

India's furniture industry brought nearly $5 billion in revenue in FY 2022–2023. From 2023 to 2028, the market is projected to expand at a compound annual growth rate (CAGR) of 7.77%. By 2024, it is expected that the worldwide furniture business would bring in $765 billion, with the Indian market alone expected to grow by 12% to $20 billion. With a projected $223.60 billion in revenue by 2024, living room furniture is the most popular market sector.

Furniture Export Data (2023-2024)

In 2023, 2,440 exporters served 13,164 consumers with 681.5K shipments of furniture export from India. The major markets for Indian furniture exports are the USA, France, and the Netherlands. For furniture that is exported, the main HSN codes are 94036000, 94016900, and 94032090. India's furniture exports were estimated to be worth $3.5 billion in 2022, despite a notable 36% drop in imports over the previous three years. More than one-third of India's furniture exports go to the USA, which continues to be the biggest market.

Top Export Destinations for Indian Furniture

Germany: $18,269

UK: $11,418.3

France: $10,807.7

USA: $72,815.9

Types of Furniture Commonly Exported

Wooden Furniture: Renowned for its traditional craftsmanship and use of quality woods like shesham, teak, and rosewood.

Cane Furniture: Lightweight, easy to maintain, and suitable for both indoor and outdoor use.

Upholstered Furniture: Comfortable and aesthetically pleasing, including beds, sofas, ottomans, and room dividers.

Steps to Start a Furniture Export Business from India

Starting a furniture export from India involves market research, legal compliance, product quality, logistics management, and establishing international trade connections.

Proper Planning: Ensure your product has global demand using export-import data.

Competitive Pricing: Leverage India's cheap labor to maintain competitive pricing.

Locate Genuine Suppliers: Use platforms like Seair Exim Solutions to find verified suppliers.

Engage a Professional Import Agent: Navigate legal requirements and logistics with professional assistance.

Required Documentation for Exporting Furniture

Export Promotion Council's certification

Bank statement

Shipping bills

Commercial invoice or packing list

Bill of lading or airway bill

Importer Exporter Code (IEC)

Address proof

Standard goods certificate

Report from a certified engineer

Product manual

Obtaining a Furniture Importer List

Use systems such as Seair Exim Solutions to obtain current and precise transaction data. Reliable sources of data are essential to the success of trade activities.

Conclusion

The global furniture business offers enormous possibilities for India's furniture sector. This is an opportunity for entrepreneurs to grow their business by launching unique, premium furniture items. Speak with data specialists to learn more about chances to grow your Indian furniture export company.

#furniture#exporters#seaireximsolutions#exportfromindia#furniture design#top furniture exporters#exporters from india

0 notes

Text

Search HS Codes by product name of 5000+ goods across 60+ countries at Exim Trade Data. Find potential buyers and sellers in the global market using our valuable global import export trade data. To understand better, visit our website www.eximtradedata.com or email us at [email protected]

#Free Search HS Codes#Indian Hs Code List#ITC Harmonised System Code#HS Classifications#Search HS Code in Chapter 1 to 98#Custom Tariff Head#Search HS Codes by Product Name#Search Indian HS Code#Search HS Code#How to Find HSN Code#HS Codes by Product Name#HS Code Search#HSN Code Finder#hs code finder

0 notes

Link

One of the best ways to find Indian Port Data; you can visit the Seair Exim Solutions platform to obtain accurate export import data and port data suppliers. We provide authentic Import Export Data and the most updated US Customs Data; HS Codes and you can obtain HSN code search country-wise also.

0 notes

Text

How to Find a Profitable Product for Online Selling ?

What to sell on online market place: – This is one of the most imperative factors in creating a successful e-Commerce business to know for a seller and the person who has desire to sell their products on ecommerce platform, because analyzing the ideal products to sell is the most important step in creating a profitable and growing business.

But you don’t worry, ecommerce guru is here to make this process easier with some innovative ideas & suggestion which will help you to choose right product to sell online by few simple steps.

Select the Items that are not Gated & Don’t need Category Approval

For selling the items there is a process to categorize the products before listing on market place, where sellers need to take category approval from the panels, but you can also establish your business on the panels by taking the products which is not gated & do not require category approval on most of the panels.

Below are Some Examples:-

Mobile Accessories: screen guards, back covers, headphones, data cable, charges, etc.

Disposables

Ladies Footwear

Kids Toys

Fashion Jewelry

Stationary

Goggles

Wallets

Belts

Watches

Daily Use: foil paper, napkins, hanky, socks, mufflers, caps, hats

2. Basic Taxation Concept

Before organizing your business you should be more aware of the taxes which you will pay for selling product online, with the correct tax information you can compare the low and high tax products as well.

GST (Goods and Service Tax) Percentage Rate & HSN Code

GST -Whether you’re someone who wants to sell your items online, there are a few artefact that you need to figure out before your next step. You should be aware of the different kinds of taxes which apply in online sales, and ensure that you do not get into trouble because you didn’t know regarding tax which you’re going to pay.

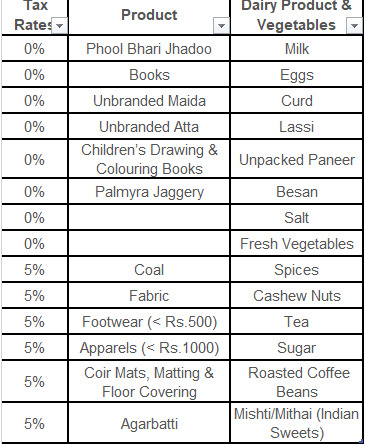

Below are some tax rate examples or you can click on the below link to know more information:

https://cleartax.in/s/gst-rates

HSN – “Harmonized System of Nomenclature” this is a multifunction global product nomenclature expanded by the (WCO) World Customs Organization. It first came into action in 1988.

The primary concept of HSN is to classify goods from all over the World in a systematic and logical manner.

What are the tax rates for different product categories?

Here is the complete guide to understand the tax rate in brief, Click on below link:

http://www.cbic.gov.in/resources//htdocs-cbec/gst/goods-rates-booklet-03July2017.pdf

You can also click on attached below link to find current and exact GST rate with HSN

https://www.indiafilings.com/find-gst-rate#stq=footwear&stp=1

3. Referral Fee of Online Market Place

Referral fee is the charges which is included each time when you sell a product on the market place or it’s a fee amount which is charged by the panels, basically it is a percentage of the total sales price. The percentage varies based on the product category.

You can also get the referral fee information and understanding of the exact fee which require for any of the product category before selling on line.

As Amazon have the panel to seek the information of the referral fee by its amazon service page. Click here – AMAZON SERVICES

4. Trending Ecommerce Niche Product

If you already planned that what to sell on panels (Amazon, Flipkart, Shopclues, Paytm, Snapdeal and more), then start searching how equitable your idea is already performing on the market places. Or if you are not sure about selling product, then you can look at new trends to help inspire your decision. Keeping your eye on the marketplace which helps you to recognize the various needs of your product for listing on account.

Here are some resources to begin your research:

Product directories

Other stores

Newspapers & magazines

Product Advised:-

Natural beauty products

Portable LED projectors

Bags

Phone accessories

Men’s Watches

Shoes

Kid’s Trending Products

5. Competitive Products and Landscape

There will be similar products on other websites, this means that you need to have a firm understanding of your competition, that way you can stand in between the crowd, by making your product price more competitive and categorize your competitors, for this you need to visit the market places/websites.

Target audience: –

Once you have selected reasonable product to sell online, then you need to consider that who you’re selling to, also known as target audience. Having an understanding of your customer needs and requirement can help you to form the price decisions, for this you can plan your marketing strategies and establish your brand and try to figure out the following information about your audience:

Price sensitivity

Basic demographics

Customer motivation

Daily Used Product

This will help to increase your business value and revenue eventually.

NOTE: – Our motive to provide you the basic information regarding online selling product and all provided information are subjective & could be changed by the time, and depends on the individual software/Application company’s terms and polices.

#Online Ecommerce Expert#Internet Marketing#Online Marketing#Selling Product online#Daily used Product

0 notes

Text

Best Indian Medicine Database provider company: DataRequisite

World’s largest source of clinical and descriptive drug knowledge that’s been integrated into healthcare information systems. We are having a complete Indian database medicine as well as other healthcare products.

Best leading market of an Indian Medicine database, integrated medication and medical device. We maintain data base management with Strong imagination and conceptualization capabilities

We are having a complete Indian database medicine as well as other healthcare products, having more than 1.3lac products. We provide high end solutions which can help you size your market. Providing database since more than 10 years.

Find the best assembled health care database medication for research. Moreover, expertise in Digital transformation of the businesses and consultation for the implementation of a healthcare environments for the businesses to get the new perspective of the business and to generate the revenue.

We’re providing a new medical device knowledge platform to change how healthcare identifies, tracks, and analyses everything from stents and catheters to medical supplies, beyond our previous focus on medication knowledge. Our mission is to reduce the information confusion and inefficiencies that now governs the entire hospital supply chain.

All of this leads us to our final point—call it the thread that connects our experience from its humble beginnings more than decades ago to our bright future together. We will gladly provide the essential information that supports healthcare IT systems and the decision-makers who utilise them, no matter that you are or your goal. We have a purpose and a vision for a better world founded on a single conviction

The impossible becomes possible as knowledge grows more powerful. An essential source of business list & lead.

Most extensive & crucial Indian database. In today’s business, it is not only good to have business database, but also it is absolutely necessary. There are tons of business directory listings and advertisement everywhere, finding the correct customer or supplier will be burden. We think database is here to help you and your business to minimize expenses and time. Discover your prospects & supplier. Envision the amount of time you will save and utilise into productively to generate more revenue.

We recognise the market well. We employ the best and the legal methods to obtain the essential data. We emphasize on identifying, obtaining and retaining profitable database for our clients.

Our DataBase List

MEDICINE DATABASE FIELDS

1. Product ID

2. Product Name

3. MRP

4. Name of Manufacturer

5. Compositions

6. Packing Type

7. Packaging

8. Drug Schedule

9. Usage

10. About Salt

11. Mechanism of Action

12. Pharmacokinetics

13. Onset of Action

14. Duration of Action

15. Half Life

16. Side Effects

17. Contra-indications

18. Special Precautions while taking

19. Pregnancy Related Information

20. Product and Alcohol Interaction

21. Old Age-Related Information

22. Breastfeeding Related Information

23. Children Related Information

24. Indications

25. Interactions

26. Typical Dosage

27. Storage Requirements

28. Effects of Missed Dosage

29. Effects of Overdose

30. Expert Advice

31. How to Use

32. FAQs

33. HSN Code

0 notes

Text

Seair Exim Solutions is one of the best sources for the exporters and importers to know how to find HSN code using the HSN Code Search. Over 98 % of world trade is classified in terms of the HSN code and around 200 countries search HSN codes.

Visit us : HSN Code Search

#hsn 2021#globaltradedata#export data#import export#importexportdata#trade data#importexport#global#importers#exporters#export#hsncode#worldtrade#world trade data

0 notes

Text

Best 4th of July sales from across the web 2021

New Post has been published on https://tattlepress.com/lifestyle/best-4th-of-july-sales-from-across-the-web-2021/

Best 4th of July sales from across the web 2021

Yahoo Life has received compensation to create this article, and receives commission from purchases made via links on this page. Pricing and availability are subject to change.

Stand up and salute! The biggest sales of the summer are here — and we’ve gathered all the best deals for you. (Photo: Getty Images)

It’s 4th of July weekend — a time to celebrate freedom. This year, it has a special meaning, as we all emerge to hang with friends and family, exchange hugs and high-fives, and launch a summer of appreciation and joy.

Before you fire up the grill or head to the beach, take a minute to benefit from the celebratory sales. No need to open a thousand tabs and peruse sites of countless retailers — we did the legwork for you, combing through the options and pulling together one list of can’t-miss opportunities below.

As for the sales themselves? They’re absolutely massive. You’ll find amazing discounts on tech, small appliances, home goods, and more. There’s no shortage of steals and deals this holiday weekend.

So let’s get to it: Here are the July 4th sales you absolutely can’t afford to miss, from across the web.

Best TV sales

We have seen the future, and it’s this Sony 4K TV. (Photo: Amazon)

This Sony X80J 65-inch 4K Ultra HD LED Smart Google TV is the latest from a manufacturer that’s long been at the forefront of top-notch home video. No shocker, then, that the display on this set is dazzlingly vivid and detailed. Originally $1,000, this beauty is available for only $898 for the 4th of July.

Sony’s state-of-the-art Processor X1 is the power behind its true-to-life visuals, while HDR (High Dynamic Range) settings make sure colors stay bright and black levels are dark. Get ready: It’s going to feel like you’re sitting in the middle of all the action.

This 4K TV includes Google TV with instant access to hundreds of popular streaming apps like Netflix, Hulu, Disney+, HBO Max, Paramount+, Peacock and much, much more. It even has built-in Chromecast for slinging videos and music from your phone or tablet to the TV. Also: The remote has a microphone that lets you use Google Assistant for voice search and hands-free navigation. And shoppers just love it too.

Story continues

“In one word: Awesome….,” raved a five-star reviewer of this Sony. “It can be adjusted to give you absolute black even in a dark room; 4K and HDR are amazing…”

Check out more 4th of July TV sales below:

Insignia NS-32DF310NA19 32-inch Smart HD TV — Fire TV, $150 (was $200), amazon.com

Insignia 55-inch NS-55F301NA22 F30 Series LED 4K Ultra HD Smart Fire TV, $400 (was $500), amazon.com

Toshiba 32-inch Smart HD TV — Fire TV Edition, $160 (was $200), amazon.com

Toshiba 43-inch 43C350KU C350 Series LED 4K Ultra HD Smart Fire TV, $320 (was $370), amazon.com

Sony 55-inch Class X80J Series LED 4K Ultra HD Smart Google TV, $750 (was $950), bestbuy.com

Sony 65-inch Class X80J Series LED 4K Ultra HD Smart Google TV, $900 (was $1,150), bestbuy.com

LG 65-inch Class 4K Ultra HD NanoCell Smart TV, $997 (was $1,200), walmart.com

LG 65-inch Class CX Series OLED 4K Ultra HD Smart webOS TV, $1,900 (was $2,200), bestbuy.com

LG C1 65-inch Class 4K Smart OLED TV, $2,100 (was $2,500), qvc.com

Samsung 70-inch Class 7 Series LED 4K Ultra HD Smart Tizen TV, $680 (was $750), bestbuy.com

Best headphone and earbud sales

Save over 40 percent on these Beats beauties. (Photo: Amazon)

On sale for $199 — an incredible $151 off! — the Beats Studio3 Wireless Noise Cancelling Headphones (in Matte Black) mix style and performance in one sleek design. These are Beats’ premium noise-canceling headphones that work seamlessly with just about any Apple device, including the iPhone, iPad and MacBook. The way they sync to your Apple products, thanks to Apple’s W1 chip for instant pairing, is magical. And Amazon shoppers are hooked.

“These are the best headphones I’ve ever had,” shared a delighted Amazon shopper. “I travel 99 percent of the time for work and am on planes twice a week. I am exhausted and don’t want to talk to people. These are perfect for when you’re feeling anti-social on the plane, in the airport….hell, anywhere! The 22-hour battery life and noise cancellation are mind-blowing. Definitely worth the money!”

Check out more 4th of July headphone and earbud sales below:

Beats Solo3 Wireless On-Ear Headphones, $145 (was $200), amazon.com

Beats Solo Pro Headphones, $149 (was $300), walmart.com

Beats Flex Wireless Earbuds, $39 (was $50), amazon.com

Bietrun Wireless Bluetooth Earbuds, $26 (was $130), walmart.com

Apple AirPods (wireless charging case), $160 (was $199), amazon.com

Apple AirPods Max, $490 (was $549), amazon.com

Philips Wireless In-Ear Headphones, $30 (was $60), walmart.com

JBL Tune 115TWS True Wireless Headphones, $50 (was $60), kohls.com

Beats Flex All-Day Wireless Earphones, $40 (was $50), target.com

Samsung Galaxy Buds+, $100 (was $150), bestbuy.com

Meidong Bluetooth Noise-Canceling Over-Ear Headphones, $35 (was $70), walmart.com

Best smart-home sales

Start building the smart home of your dreams with this bundle — save nearly 35 percent! (Photo: Lowe’s)

For the 4th of July, Lowe’s is giving you a chance to score the Google Nest Mini (second generation) and GE Smart Plug for just $40 (was $60).

The next-gen Nest Mini packs the Google Assistant into a sleek design with really great sound. Enjoy crisp vocals and balanced bass while you stream songs from Spotify, YouTube Music, SiriusXM, Pandora, Apple Music and more. Want a smart home? Now’s the time! If you have a phone in your pocket and a Wi-Fi network at home, you’re well on your way to building a smart home.

Plus, the bundle includes the GE Smart Plug (a $15 value), which can easily pair with the Google Nest Mini. Simply plug into a wall outlet, then plug in anything like a lamp, a TV or even a coffeemaker.

Then connect the plug to your Wi-Fi network and use your phone to sync to the Google Home app (for Android smartphones and Apple iPhones). That’s it! Now you can control just about anything in your home with your phone or just the sound of your voice via the Google Assistant. Fun!

“I am amazed at how much sound can come out of this little bitty device,” said a five-star Lowe’s reviewer. “The ease of setting it up via Wi-Fi was a breeze…I would recommend this little device for not only sound, but also ease of use. It can make your life simple and up-to-date if you carry a busy workload. Set a reminder and it will remind you even with a little music.”

Check out more 4th of July smart-home sales below:

Kamep Wireless Wi-Fi Video Doorbell Camera, $65 (was $130), amazon.com

TP-Link N300 WiFi Extender (TL-WA855RE), $17 (was $30), amazon.com

Moen 7594BL Arbor One-Handle Pulldown Kitchen Faucet, $289 (was $500), amazon.com

Govee Smart Light Bulbs, $11 with on-page coupon (was $22), amazon.com

Google Nest Mini, $35 (was $49), lowes.com

Google Nest Learning Smart Thermostat, $199 (was $249), lowes.com

Google Nest Hello, $149 (was $229), lowes.com

Google Nest Cam Indoor Security Camera, $130 (was $200), walmart.com

Honeywell RLV4300A1005 5-2 Day Programmable Thermostat (renewed), $10 (was $35), eBay.com

TP-Link Wi-Fi Mini Smart, $10 (was $18), target.com

Beats Pill+ Wireless Bluetooth Speaker, $140 (was $230), kohls.com

Philips Neopix Ultra Projector with Wi-Fi Screen Mirroring, Bluetooth & Built-in Media Player, $380 (was $400), kohls.com

Lenovo Smart Clock Essential, $30 (was $50), lowes.com

eufy Security eufy Wireless Smart, $170 (was $200), lowes.com

Brookstone PhotoShare Digital Picture Frame, $110 (was $130), lowes.com

Fitbit Charge 4 Fitness & Activity Tracker, $100 (was $130), kohls.com

Defender Ultra HD 4K Wired Outdoor Security System (1TB), $260 (was $450), walmart.com

Monoprice Wireless Smart Outdoor Dual Socket, $25 (was $38), target.com

XODO Smart Wi-Fi HD Video Doorbell, $90 (was $150), walmart.com

DHcamera Wired Spotlight Cam HD Security Camera, $150 (was $230), walmart.com

Garmin Vivosport Fitness Tracker (renewed), $70 (was $200), eBay.com

Love Spotify and Pandora, but still want to play your beloved CDs? Bose is here to keep physical media alive. (Photo: HSN)

If you can’t let go of your old CDs and love listening to the radio, the Bose Wave Music System IV is the ticket. And for the 4th of July, HSN has temporarily dropped the price of this gem from $500 to just $300. That’s the lowest price we’ve found on the web right now — a savings of 40 percent.

This Bose speaker system projects crisp sound, and comes equipped with a Bluetooth receiver add-on, so you can wirelessly sync your smartphone or laptop to it. The design is elegant, minimal and slim, making it a seamless addition to your entertainment center or on its own in a bedroom, kitchen or living room. It also comes with a remote. If you enjoy waking up to the sound of music or the radio, you can program the system’s timer to sync up to your preferences too.

“Perfect sound system for the home,” wrote a five-star Bose reviewer. “The sound is simply stunning and fills the entire room. The radio reception is superb and the ability to play Internet radio via TuneIn brings this product firmly in the 2020s!”

New to HSN? Score an additional $20 off with promo code HSN2021 at checkout — and bring the price down to just 460 bucks. And if you’d rather not pay all at once (we get it), HSN lets you opt for five “FlexPays” of just $60, with no interest at all. Plus, free shipping!

Best smartphone and tablet sales

Forget the Apple iPad! This Samsung Galaxy Tab A7 is a better bargain — and it can do more too. (Photo: Amazon)

On sale for $170 (was $230), the Samsung Galaxy Tab A7 weighs just over a pound and features 32GB of storage (expandable up to 1TB via microSD card). That’s got it all over Apple’s entry level tablet, which isn’t expandable. And unlike the iPad, the Tab A7’s 10.4-inch display has a full HD widescreen for immersive viewing.

Also out-Apple-ing Apple? The A7’s camera set is better than the one that comes with the iPad. It has an eight-megapixel selfie cam with a five-megapixel rear shooter on the front for video calls. “Mostly use for mobile gaming. Tried to play PS4 remote play, and it worked,” reported a satisfied gamer. “Sound is great and build quality is better than iPad. Speed is seamless.”

Check out more 4th of July smartphone and tablet sales below:

Apple iPad (10.2-inch, Wi-Fi, 32GB), $299 (was $329), amazon.com

Apple iPad Air (10.9-inch, Wi-Fi, 256GB), $699 (was $749), amazon.com

Linsay Android 10 Tablet with Marble Case, $98 (was $325), macys.com

Moto G Stylus Smartphone, $180 (was $218), qvc.com

Linsay 10.1-inch New Quad Core 32GB Tablet Android, $100 (was $169), macys.com

Core Innovations 7-inch, $54 (was $70), bhphotovideo.com

onn. 8-inch Tablet Pro, $79 (was $99), walmart.com

Samsung Galaxy A11 (Net10), $99 (was $149), walmart.com

Lenovo Tab M10 Plus, $170 (was $200), bestbuy.com

Visual Land Prestige Elite 10QL 10-Inch 16GB Android Tablet, $90 (was $120), kohls.com

Best gaming sales

Half price: The Last of Us Part II for PlayStation 4. (Photo: Walmart)

On sale for $30 (was $60), The Last of Us Part II for PlayStation 4 is set five years after the first game and follows Ellie and Abby as they continue to survive in a post-apocalyptic United States. This is one of the best games of 2020 and it’s half off at Walmart.

“I have played it three times now,” shared a delighted gamer. “On each play through, I found something new, which I most likely missed because of the insane attention to detail in this game. It all started to make sense after my second play through. I think that The Last of Us Part II is one of the best storytelling masterpieces out there.”

Check out more 4th of July gaming sales below:

BioShock: The Collection, $19 (was $50), amazon.com

NBA 2K21 (Xbox Series X), $20 (was $70), amazon.com

Mafia: Definitive Edition (PS4), $20 (was $40), amazon.com

Call of Duty: Infinite Warfare (PS4), $15 (was $40), amazon.com

The Sims 4 (Xbox One), $5 (was $50), cdkeys.com

Tom Clancy’s Rainbow Six Siege (Xbox One), $13 (was $35), cdkeys.com

Minecraft (Xbox One), $10 (was $30), cdkeys.com

Outriders: Day One Edition (PS4), $40 (was $60), walmart.com

Microsoft Xbox Series S 512GB with Xbox Game Pass and Accessories, $636 (was $700), qvc.com

Grand Theft Auto V: Premium Edition (PS4), $20 (was $60), walmart.com

Madden NFL 21 (Xbox One), $20 (was $60), walmart.com

Star Wars Jedi: Fallen Order (Xbox One), $30 (was $60), walmart.com

The Pillars of The Earth (PS4), $29 (was $45), walmart.com

Crash Team Racing: Nitro Fueled (PS4), $34 (was $40), walmart.com

PlayStation Plus Membership (12 months), $38 (was $60), cdkeys.com

Playstation Plus Membership (three months), $20 (was $25), cdkeys.com

Best vacuum sales

This vacuum sucks…and that’s a very good thing — save nearly 30 percent! (Photo: Walmart)

Do you have hair-shedding pets? Do you want to keep a clean home but are just too busy during your week to make sure it stays neat and tidy? If your answer is yes, then you need the EcoVacs Deebot U2 Robot Vacuum Cleaner. It’s on sale for an impressive $179, a sweet $71 off at Walmart.

The robovac makes it easy to keep your hardwood floors or carpet clean, even if you’re not at home. Just sync the vacuum to your smartphone via the Ecovacs app and let the Deebot do the rest. This vacuum uses “Smart Navi 2.0” technology to map your space, so it can keep your home free from crumbs, debris, pet hair and other icky things.

“Meet my new maid,” chirped a savvy Walmart shopper. “This mop and vac saves me a precious hour each evening I spend with my family after work instead of cleaning my floors. Easy to fill and I hand wash the mop attachment each night and air dry it for the next evening. Attractive design. Thorough cleaning. Can’t beat the price. It holds a charge for at least 110 mins. I’m completely satisfied.”

Check out more 4th of July vacuum sales below:

Dyson V8, $350 (was $450), dyson.com

Lefant M210 Robot Vacuum Cleaner, $140 with on-page coupon (was $400), amazon.com

OKP Life K2 Robot Vacuum Cleaner, $124 (was $300), amazon.com

roborock E4 Robot Vacuum Cleaner, $210 (was $300), amazon.com

Kenmore 31510 Robot Vacuum Cleaner, $150 with on-page coupon (was $259), amazon.com

iHome AutoVac Eclipse G 2-in-1 Robot Vacuum and Mop, $179 (was $400), walmart.com

Shark RV2001WD AI Robot VacMop Pro, $480 (was $799), macys.com

Shark ION Robot Vacuum RV750, $149 (was $299), walmart.com

Trifo Maxs Robot Vacuum, $400 (was $667), macys.com

iRobot Roomba E6 Vacuum Cleaning Robot E6198, $200 (was $380), eBay.com

Eureka Groove 4-Way Control Robotic Vacuum, $129 (was $200), walmart.com

Simplicity Sport Portable Canister Vacuum Cleaner, $109 (was $277), macys.com

Mighty Rock Robot Vacuum and Mop, $73 (was $130), walmart.com

Best home office sales

Take note of the Samsung Chromebook Plus V2 — and save $164 during 4th of July weekend! (Photo: Amazon)

For the 4th of July, the Samsung Chromebook Plus V2 convertible laptop is on sale for just $386 — that’s 30 percent off for a model so popular, over 800 reviewers gave it five stars.

The sleek, incredibly thin Samsung Chromebook is actually more than just a laptop. It has a brilliant 12.2-inch HD touchscreen display (at 1900×1200 resolution) and flexible 360-degree hinge, so it can rotate to any angle for use as a tablet.

“I wanted both a tablet and a computer. I love that you can download apps and use them for both the computer and the tablet form,” reported a delighted five-star reviewer. “The stylus makes using Lightroom and other creative apps a breeze. Being able to use the cloud is a must because the storage would fill up pretty quickly…The large screen is also a good thing for activities like editing photos, drawing, and taking notes. Start up, web browsing, and apps are quick. The battery life is really great for everyday use…”

Check out more 4th of July home office sales below:

Cloud Massage Shiatsu Foot Massager Machine, $240 with on-page coupon (was $340), amazon.com

Renpho Neck Shoulder Massager, $30 with on-page coupon (was $50), amazon.com

Vybe Percussion Massage Gun, $150 with on-page coupon (was $200), amazon.com

DamKee Massage Gun, $69 with on-page coupon for Prime members only (was $110), amazon.com

WorkEZ Rise Aluminum Laptop Stand, $30 (was $33), qvc.com

Samsung 27-inch Smart Monitor, $300 (was $329), qvc.com

HP OfficeJet Pro 8035e All-in-One Printer, $220 (was $249), qvc.com

Asus Chromebook C223, $265 (was $340), hsn.com

Bell & Howell Adjustable Laptop Desk, $32 (was $50), hsn.com

Embassy NanoShred 8-Sheet Paper Shredder, $100 (was $124), hsn.com

OttLite Wireless Charging Desk Lamp, $35 (was $61), hsn.com

Apple MacBook Pro (mid-2020), $1,099 (was $1,299), bhphotovideo.com

Microsoft Surface Pro 5 (renewed), $540 (was $800), eBay.com

Ousgar 47-inch White Desk, $100 (was $266), walmart.com

Hemu Fashion Bamboo Laptop Lap Tray, $38 (was $80), walmart.com

Best kitchen sales

Make smoothies, soups and more. (Photo: Amazon)

When anything Instant Pot goes on sale for over 50 percent off, it’s time to take notice. The Instant Pot blender is a kitchen hero you’ll love at first sight. It easily whips up smoothies and soups, plus it can make delectable chunky dips and salsas, too. Love nut butters? This machine will turn out the creamiest toppings ever. It has over 10 presets, so you’ll find no shortage of uses for this whip-smart blender.

“This is, by far, the nicest blender we’ve ever owned,” one shopper shared. “Motor is powerful and blades have perfectly blended everything we’ve thrown in it. Almond nut butter was creamy and smoothies were the smoothest. Glass pitcher is, as advertised, professional quality. Big fan of the tamper as I have ruined more than my fair share of spoons with other blenders.”

Check out more 4th of July kitchen sales below:

Vitamix 5200 Blender, $390 (was $550), amazon.com

Farberware Millennium Stainless Steel Cookware Pots and Pans Set, $104 (was $260), amazon.com

Staub Pure Grill, 10.5″, $120 (was $243), surlatable.com

PowerXL 5.3 Quart Power Air Fryer, $91 (was $180), wayfair.com

Cuisinart Cordless Rechargeable Mini Chopper, $64 (was $80), bedbathandbeyond.com

Kalorik 26 Quart Digital Air Fryer Oven, Stainless Steel, $200 (was $280), wayfair.com

15 percent off orders over $100, ninjakitchen.com

Lodge Enameled Cast Iron, $57 (was $93), wayfair.com

CRUX Artisan Series 7-Speed Blender, $40 (was $100), bedbathandbeyond.com

Ninja FD401 Foodi 8-Quart 9-in-1 Deluxe XL Pressure Cooker, $150 (was $250), amazon.com

SodaStream Sparkling Water Maker (Rose Gold) Bundle, $88 (was $111), walmart.com

Three-Piece Heart Cake Pan Set, $20 (was $30), walmart.com

The Pioneer Woman Sweet Rose 3.2 Quart Baker with Tote, $19 (was $26), walmart.com

Best beauty sales

Reveal your megawatt smile! (Photo: QVC)

Dreaming of white teeth but don’t want to invest hundreds of dollars into getting them professionally whitened? This kit will help. It comes with two toothpastes — one charcoal coconut and one packed with B12 — to eradicate stains and leave your pearly whites…white.

You’ll get 28 whitening strips (that’s two weeks’ worth of treatments!) for just 50 bucks. Simply leave the strips on for 30 minutes, then remove and brush away the gel. Check out incredible before-and-after photos here.

Check out more 4th of July beauty sales below:

Obagi Medical 360 Retinol Moisturizer Cream, $40 (was $74), amazon.com

Tan-Luxe Hydra Mousse Self-Tan Mousse Duo, $55 (was $98), hsn.com

Up to 50 percent off select items and free shipping on all orders with code FREESHIP, sephora.com

Up to 20 percent off select items and kits, charlottetilbury.com

Calista Perfecter Pro Heated Round Brush with Embellish Spray, $94 (was $131.50), qvc.com

Clinique Almost Lipstick Black Honey Duo, $20 (was $32.50), qvc.com

Korres Body Firming Serum Spray, $20 (was $36.50), hsn.com

20 percent off NuFace, skinscarerx.com

Items up to 60 percent off, nordstrom.com

Beauty finds starting at just $9.50, marcjacobsbeauty.com

Up to 75 percent off clearance, skincarerx.com

BaBylissPRO Nano Titanium Lightweight Ionic Hair Dryer, $65 (was $85), walmart.com

Elizabeth Arden Red Door Eau De Toilette, $38 (was $72), walmart.com

Better Not Younger Lift Me Up Hair Thickener, $25 (was $34), hsn.com

Olay Regenerist Retinol 24 Max Moisturizer, $43 (was $53), amazon.com

Living Proof Perfect Hair Day Dry Shampoo, $20 (was $24), walmart.com

Best style sales

You’ll never want to take these off. (Photo: Amazon)

Whether your summer plans include traveling, hikes, or strolling around town, comfy shoes are a must. Pick up Amazon’s No. 1 bestselling sneakers while they’re on sale, and you’ll be good to go. Adored by podiatrists and nurses alike, the slip-ons have a chunky, supportive sole and feel absolutely divine on your feet. Choose from 28 colors and sizes 5.5 to 11.

“These shoes are so great for nurses who stand on their feet for long periods of time,” a shopper declared. “Better than my $150 pair of shoes…medical professional healthcare providers, these are worth trying! They are like walking on bubble bouncing cushions.”

Check out more 4th of July style sales below:

Up to 50 percent off sitewide, oldnavy.com

Extra 40 percent off markdowns, gap.com

Up to 50 percent off styles, stuartweitzman.com

60 percent off apparel with code GEARUP60, reebok.com

30 percent off select styles, vionic.com

1/10 Carat Diamond Solitaire Necklace, $28 (was $300), walmart.com

Extra 30 percent off sale items, spanx.com

Extra 15 percent off, coachoutlet.com

Skechers GOwalk Joy Washable Slip-On Sneakers, $52 (was $63.50), qvc.com

Dresses starting at $10, target.com

Tees and tanks, two for $14, target.com

Avia Women’s Summer Romper, $7 (was $14), walmart.com

Athletic Works Women’s Active Racerback Tank, $9 (was $15), walmart.com

10 percent off select styles and free shipping, newbalance.com

Up to 70 percent off sale, jcrew.com

Extra 25 percent off sale with code EXTRA, toryburch.com

HUE Short Sleeve Tee & Modern Classic Skimmer PJ Set, $38 (was $46), hsn.com

OURS Women’s Summer Dress, $22 (was $40), amazon.com

Up to 50 percent off hundreds of styles, adidas.com

Leggings Depot High Waisted Solid Yoga Leggings, $13 (was $20), amazon.com

Up to 50 percent off summer collection, aerosoles.com

Up to 50 percent off select styles plus extra 20 percent off, colehaan.com

Best mattress and bedding sales

If your mattress alone isn’t doing it for you, this topper might help. (Photo: HSN)

If your mattress is feeling a bit blah but you don’t want to invest in a brand new one just yet, try this Concierge Collection topper on for size! The high loft fill is dreamy, and it’s quilted, which keeps it from bunching up — plus a stretchy skirt ensures the topper stays nice and snug. Can it get any better? It can! The moisture-wicking fabric stays cool on even the hottest nights. And it’s treated with an antimicrobial coating, which inhibits the growth of bacteria and other nasties.

Check out more 4th of July mattress and bedding sales below:

Rest Haven 2 Inch Gel Memory Foam Mattress Topper, $55 (was $80), walmart.com

2 Pack Plixio Shredded Memory Foam Pillow, $40 (was $50), walmart.com

4earth 2-Pack Eco-Friendly Organic Cotton Standard Bed Pillows, $15 (was $25), bedbathandbeyond.com

Farm to Home Organic Cotton Waffle Knit Comfy-let with Shams-Full/Queen, $100 (was $170), qvc.com

Scott Living HygroCotton and Tencel 400TC Sheet Set with FlexiFit, $62 (was $99), qvc.com

Casper Original Mattress, $931 (was $1,095), casper.com

beegod Pillows for Sleeping, $33 (was $58), amazon.com

Casper Sleep Pillow for Sleeping, $55 (was $65), amazon.com

AllerEase Cotton Euro Pillow, $13 (was $19), walmart.com

Extra 25 percent off select home items, nordstromrack.com

25 percent off sitewide plus $250 gift set, bearmattress.com

Best pet sales

Your cat is going to love this scratching tower. (Photo: Walmart)

Tired of pleading with your cat to stop scratching the sides of your couch? This pole just might be the temptation she needs to stay away. It’s covered in thick sisal rope, and has a wide base so it won’t topple over as she digs her claws in. At the very top, a rotating feather (or mouse, or ball — the scratcher comes with plenty of options) ensures she’s fully engaged. You can even adjust the height of the pole, so smaller cats and kittens can get in on the fun.

“Our cats have been obsessed with this thing since I set it up!” a shopper shared. “They immediately went crazy for the toys it came with and are now scratching the post instead of my furniture! Amen!”

Check out more 4th of July pet sales below:

Buy three, get one free — toys, grooming and more, chewy.com

WAG Dental Dog Treats, $10 (was $23), amazon.com

Up to 50 percent off food, treats, furniture and more, petco.com

Animals Favorite New Rectangle Pet Bed, $33 (was $45), amazon.com

EMME Dog Bed for Small Dogs, $35 (was $55), amazon.com

Morpilot Pet Travel Carrier Bag, $31 (was $40), walmart.com

Kadell Professional Quiet Electric Pet Hair Clipper, $27 (was $54), walmart.com

Read More from Yahoo Life:

Follow us on Instagram, Facebook, Twitter and Pinterest for nonstop inspiration delivered fresh to your feed, every day.

Want daily pop culture news delivered to your inbox? Sign up here for Yahoo Entertainment & Life’s newsletter.

Source link

0 notes