#How to Transfer Walmart Gift Card to Cash App

Explore tagged Tumblr posts

Text

Winning Real Money with Cash App

Easily

👉 Get Extra Money On Cash App!

Participating in Cash App's various promotions and contests presents an opportunity to win real money. Whether it's through cash giveaways or rewards for completing tasks, users can capitalize on these incentives to boost their earnings.

#buy cash app gift card#cashapp#cash app#gift#gift card#paypal#giftcard#giftcash#us#United States#apple gift card#can i add a gift card to cash app#can i add a visa gift card to cash app#can i use a visa gift card on cash app#Can You Transfer Money From Gift Card to Cash App#How to Transfer Walmart Gift Card to Cash App

1 note

·

View note

Text

Unveiling the Convenience: Claim Your $750 Cash App Gift Card

Click Now

#Win $500 Cash App Gift Card#cashapp gift card#cash app gift cards#cash app gift card code#buy cash app gift card#cashapp#cash app#gift#gift card#paypal#giftcard#giftcash#us#United States#apple gift card#can i add a gift card to cash app#can i add a visa gift card to cash app#can i use a visa gift card on cash app#Can You Transfer Money From Gift Card to Cash App#How to Transfer Walmart Gift Card to Cash App#How to Use a Gift Card on Cash App

1 note

·

View note

Photo

Thank you to FreeShipping.com for sponsoring this post. FreeShipping.com is a rewards program where members earn 10% cash back at over 1,000 retailers every day. Get paid to shop. Earn money on purchases you were going to make anyway. These are the promises of cash back and online shopping rewards programs. Do they deliver? Yes. Are the payouts enough to warrant changing your shopping habits? Yes, if you work the system right. Cash back and online shopping rewards programs pay you cash, gift cards, shopping credits, or free product in return for purchases you make. Based on personal experience, the value of these rewards is commonly 1% or 2% of your purchase totals. But you can earn far more with the right programs and strategies. Source: Canva. 1% cash back may not be motivating, especially if you must shop differently to get it. But how about a 10% or 12% payback on your purchases? That’s a more compelling number. So let’s explore how cash back programs work, which types pay the best, and strategies to maximize rewards and earn 10% or more every time you shop online. Understanding cash back programs Cash back programs reward you for buying things. Often, the reward is calculated as a percentage of your shopping total. When you complete a qualifying purchase, your rewards account is credited according to the program’s terms. Some programs use reward points which can be redeemed for cash, store credit, account credit, gift cards, or merchandise. Other programs reward you directly in cash, which can be sent to you as a check, PayPal payment, or bank transfer. Types of cash back programs The type of cash back program often dictates what purchases qualify for rewards, how much you can earn, and how fast you can redeem your rewards. Five primary types are online shopping portals, data apps, credit card programs, store loyalty programs, and hybrid programs. Pro-tip: Understanding the types of rewards programs helps you identify opportunities to earn multiple rewards on the same purchase. Additionally, online shopping rewards can be paid memberships or free to join. Paid memberships typically have richer benefits than free programs. Amazon Prime, Walmart+, and FreeShipping.com are popular paid programs. The table below summarizes how different types of cash back programs work. A more detailed discussion of each follows. Program Type How to Earn Typical Earnings Online shopping portal Make purchases with partner retailers through the portal to earn a percentage-based cash back. 1% to 15% cash back on purchases made through portal. Paid memberships offer higher, more consistent rewards. Data apps Share purchase data to earn small rewards. Up to $0.01 to $0.025 per purchase. Cash back credit cards Use the credit card to earn rebates of 1% to 5%. Some cards offer a flat percentage on all purchases, while others have higher percentages for certain types of purchases, such as hotel stays. 1% to 5% of purchases made with the card Store loyalty programs Shop in a specific store to earn rebates on your purchases. Varies. Some programs offer perks like free shipping and gifts. Others have a point system with earnings usually amounting to 1% to 2% of purchases.Hybrid Hybrid programs may require you to shop a specific retailer while using a specific credit card. 1% to 5% of purchase value, often along with other perks. Online shopping portals Online shopping portals reward you for making purchases with their network retailers. To earn rewards, you must access the portal’s application before completing the transaction. This usually involves visiting the portal’s website and clicking through to the retailer or using a browser extension to link your transaction to your account with the portal. FreeShipping.com is an online shopping portal featuring 10% cash back and rebates at more than 1,000 retailers, including budget shopping favorites Asos, Chico’s Off the Rack, and J. Crew Factory. What to consider when evaluating free and paid online shopping portals: Speed and timing of rewards payouts. Paid memberships will offer faster purchase approvals and quicker payouts. FreeShipping.com pays rewards monthly via check or PayPal. Free programs can wait 45 days or more before approving rewards. Some sent payouts automatically each quarter. Others make no automatic payments, but instead require you to redeem rewards. Reward type. You can earn cash payments or points redeemable for gift cards. Cash is the more versatile option. Quantity and quality of retailers. You can maximize your earnings with a portal that partners with your favorite stores. Process for reporting missed transactions. Sometimes transactions made through the portal don’t appear in your account or are declined for rewards. This is problematic if you made a purchase decision because you expected a big reward. Before joining an online portal, verify there is a process for reporting missed purchases. Consistency and value of rewards. FreeShipping.com pays a minimum 10% cash back on all qualified purchases – sometimes up to 20% cash back during seasonal shopping holidays! Free providers typically have fluctuating rewards of 1% or more. Data apps Data apps reward you for sharing your purchase data. They collect the data by connecting to your bank accounts or accepting receipt uploads. Some offer other earning opportunities, such as shopping portals and rewards-based games. What to consider when evaluating data apps: Ease of use. Look for apps that make earning easy. Your time is too valuable to spend three hours playing a game or watching ads to earn $0.01. Minimum payout and redemption fees. Payouts should be low — say, $10. And you should not pay redemption fees. Data privacy. Data apps collect a lot of information from you. They might encourage you to link your bank accounts and your shopping accounts. Some offer to maximize your earnings by tracking your location. Consider how much information you want to share and if the earnings are worth it. Use of advertising. Data apps have a heavy advertising component, which can be mind-numbing. For example, you may need to watch an ad to upload a receipt or request a payout. Credit card cash back Cash back credit cards rebate a percentage of your purchases. Some cards offer a flat percentage, such as 1% or 2%, on every purchase. Others have a tiered structure. For example, you might earn 1% on grocery purchases, but 3% on gas. What to consider when evaluating cash back credit cards: Annual fees. Opt for cards with no annual fee. Cash back percentage and structure. Flat-rate reward structures tend to produce the highest earnings, especially when the rate is 2% or 2.5%. Ease and speed of redemption. Ideally, the card will allow you to apply your earnings as statement credits. Some also allow you to deposit your earnings as cash in a linked bank account. If the card offers other redemption methods, check the conversion rate before you proceed. As an example, Citi will prompt you to use your rewards for purchases at Walgreens and certain gas stations. However, the value assigned to the points in this application is less than if you redeemed for a statement credit. Store loyalty programs Store loyalty programs offer rewards based on your shopping activity with that store. Some programs offer flat-rate rewards, while others give you perks without disclosing an earnings formula. The loyalty program for athleisure brand Athleta earns 1%. You get 1 point for every $1 you spend, and each point is worth $0.01. The rewards are shopping credits, redeemable at Athleta and sister stores Gap, Banana Republic, and Old Navy. The rewards program for bakery chain Panera offers occasional free bagels or beverage discounts, without telling you exactly how you earn them. Once you meet some unknown threshold, the rewards appear in your account. What to consider when evaluating store loyalty programs: How often you shop at that store. You cannot accumulate measurable rewards at stores you only shop occasionally. Earnings structure. Clear earnings formulas help you make better purchase and budgeting decisions. On the other hand, the Panera model can be more fun because each reward is a new surprise. Rewards expiration. Rewards should be active for an extended period, so you have time to use them. Hybrid Hybrid shopping rewards programs have broader rewards and redemption opportunities. They are usually paid memberships or require you to use a specific credit card. Examples include Amazon Prime, Walmart+, and Macy’s Star Rewards Silver, Gold, or Platinum. What to consider when evaluating hybrid rewards programs: Cost vs. value. Amazon Prime gives you free shipping and streaming content — but these are only valuable to the extent you use them. If the program has a membership fee, evaluate the fee next to the value you expect to receive. Ease of redemption. Cash, statement credits, and gift card rewards are the easiest to redeem. Avoid programs that require you to buy something to redeem rewards. How to maximize your online shopping rewards Three strategies can maximize your online shopping rewards: consolidate purchases, stack rewards, and optimize your payouts. Consolidate purchases Prioritize your rewards memberships as you shop. For example, if you are a FreeShipping.com member, use that membership for every online purchase you can. Stack rewards You can earn rewards from your online shopping portal, credit card, and store loyalty program at the same time. For example, you can shop Athleta via FreeShipping.com and pay for the purchase with your Citi Double Cash Card. Here are the numbers on a $500 purchase: You may earn $50 from FreeShipping.com or 10%. You earn 500 points, worth $5, from Athleta. You earn $10 cash back from your Citi card or 2%. Your cash rewards from FreeShipping.com and Citi total $60 or 12%. The $5 Athleta credit is only valuable if you use it on something you would have bought anyway. Include that and your total earnings are $65 or 13% of the original $500 purchase. One risk to note is that stacking certain coupons or multiple cash back programs may cause one or more of your rewards not to track. Optimize payouts The way you collect cash back rewards can affect how much value you get. Some strategies to maximize your reward value include: If you have a choice, opt for cash rewards or credit card statement credits. You can use cash and statement credits to reduce the cost of your purchases. Redeem for gift cards cautiously. Some retailers don’t allow you to combine a gift card payment and a credit card payment for the same purchase. That means you can only use a gift card when its balance covers your entire purchase. Worse, you often up with a small, random balance on the card that never gets used. Don’t redeem to buy. Rewards that require you to make another purchase are less valuable. Old Navy Super Cash is an example. Save 10% on online purchases Routinely saving 10% or more on your online purchases is one way to manage inflation and a slowing economy. To do it, join the right programs, consolidate your purchases, stack your rewards, and choose cash redemptions whenever possible. As a last step, track your rewards across programs. It’s surprising and motivating to see how much you can earn over time. About FreeShipping.com FreeShipping.com is a paid membership program that pays consistent 10% cash back on purchases made through the FreeShipping.com network of 1,000-plus merchants. During special seasonal promotions, members can even earn as much as 20% cash back on their purchases. FreeShipping.com members also have built-in price protection on their network purchases and earn cash rebates on their costs for shipping, return shipping, and food delivery. Source link

0 notes

Photo

Thank you to FreeShipping.com for sponsoring this post. FreeShipping.com is a rewards program where members earn 10% cash back at over 1,000 retailers every day. Get paid to shop. Earn money on purchases you were going to make anyway. These are the promises of cash back and online shopping rewards programs. Do they deliver? Yes. Are the payouts enough to warrant changing your shopping habits? Yes, if you work the system right. Cash back and online shopping rewards programs pay you cash, gift cards, shopping credits, or free product in return for purchases you make. Based on personal experience, the value of these rewards is commonly 1% or 2% of your purchase totals. But you can earn far more with the right programs and strategies. Source: Canva. 1% cash back may not be motivating, especially if you must shop differently to get it. But how about a 10% or 12% payback on your purchases? That’s a more compelling number. So let’s explore how cash back programs work, which types pay the best, and strategies to maximize rewards and earn 10% or more every time you shop online. Understanding cash back programs Cash back programs reward you for buying things. Often, the reward is calculated as a percentage of your shopping total. When you complete a qualifying purchase, your rewards account is credited according to the program’s terms. Some programs use reward points which can be redeemed for cash, store credit, account credit, gift cards, or merchandise. Other programs reward you directly in cash, which can be sent to you as a check, PayPal payment, or bank transfer. Types of cash back programs The type of cash back program often dictates what purchases qualify for rewards, how much you can earn, and how fast you can redeem your rewards. Five primary types are online shopping portals, data apps, credit card programs, store loyalty programs, and hybrid programs. Pro-tip: Understanding the types of rewards programs helps you identify opportunities to earn multiple rewards on the same purchase. Additionally, online shopping rewards can be paid memberships or free to join. Paid memberships typically have richer benefits than free programs. Amazon Prime, Walmart+, and FreeShipping.com are popular paid programs. The table below summarizes how different types of cash back programs work. A more detailed discussion of each follows. Program Type How to Earn Typical Earnings Online shopping portal Make purchases with partner retailers through the portal to earn a percentage-based cash back. 1% to 15% cash back on purchases made through portal. Paid memberships offer higher, more consistent rewards. Data apps Share purchase data to earn small rewards. Up to $0.01 to $0.025 per purchase. Cash back credit cards Use the credit card to earn rebates of 1% to 5%. Some cards offer a flat percentage on all purchases, while others have higher percentages for certain types of purchases, such as hotel stays. 1% to 5% of purchases made with the card Store loyalty programs Shop in a specific store to earn rebates on your purchases. Varies. Some programs offer perks like free shipping and gifts. Others have a point system with earnings usually amounting to 1% to 2% of purchases.Hybrid Hybrid programs may require you to shop a specific retailer while using a specific credit card. 1% to 5% of purchase value, often along with other perks. Online shopping portals Online shopping portals reward you for making purchases with their network retailers. To earn rewards, you must access the portal’s application before completing the transaction. This usually involves visiting the portal’s website and clicking through to the retailer or using a browser extension to link your transaction to your account with the portal. FreeShipping.com is an online shopping portal featuring 10% cash back and rebates at more than 1,000 retailers, including budget shopping favorites Asos, Chico’s Off the Rack, and J. Crew Factory. What to consider when evaluating free and paid online shopping portals: Speed and timing of rewards payouts. Paid memberships will offer faster purchase approvals and quicker payouts. FreeShipping.com pays rewards monthly via check or PayPal. Free programs can wait 45 days or more before approving rewards. Some sent payouts automatically each quarter. Others make no automatic payments, but instead require you to redeem rewards. Reward type. You can earn cash payments or points redeemable for gift cards. Cash is the more versatile option. Quantity and quality of retailers. You can maximize your earnings with a portal that partners with your favorite stores. Process for reporting missed transactions. Sometimes transactions made through the portal don’t appear in your account or are declined for rewards. This is problematic if you made a purchase decision because you expected a big reward. Before joining an online portal, verify there is a process for reporting missed purchases. Consistency and value of rewards. FreeShipping.com pays a minimum 10% cash back on all qualified purchases – sometimes up to 20% cash back during seasonal shopping holidays! Free providers typically have fluctuating rewards of 1% or more. Data apps Data apps reward you for sharing your purchase data. They collect the data by connecting to your bank accounts or accepting receipt uploads. Some offer other earning opportunities, such as shopping portals and rewards-based games. What to consider when evaluating data apps: Ease of use. Look for apps that make earning easy. Your time is too valuable to spend three hours playing a game or watching ads to earn $0.01. Minimum payout and redemption fees. Payouts should be low — say, $10. And you should not pay redemption fees. Data privacy. Data apps collect a lot of information from you. They might encourage you to link your bank accounts and your shopping accounts. Some offer to maximize your earnings by tracking your location. Consider how much information you want to share and if the earnings are worth it. Use of advertising. Data apps have a heavy advertising component, which can be mind-numbing. For example, you may need to watch an ad to upload a receipt or request a payout. Credit card cash back Cash back credit cards rebate a percentage of your purchases. Some cards offer a flat percentage, such as 1% or 2%, on every purchase. Others have a tiered structure. For example, you might earn 1% on grocery purchases, but 3% on gas. What to consider when evaluating cash back credit cards: Annual fees. Opt for cards with no annual fee. Cash back percentage and structure. Flat-rate reward structures tend to produce the highest earnings, especially when the rate is 2% or 2.5%. Ease and speed of redemption. Ideally, the card will allow you to apply your earnings as statement credits. Some also allow you to deposit your earnings as cash in a linked bank account. If the card offers other redemption methods, check the conversion rate before you proceed. As an example, Citi will prompt you to use your rewards for purchases at Walgreens and certain gas stations. However, the value assigned to the points in this application is less than if you redeemed for a statement credit. Store loyalty programs Store loyalty programs offer rewards based on your shopping activity with that store. Some programs offer flat-rate rewards, while others give you perks without disclosing an earnings formula. The loyalty program for athleisure brand Athleta earns 1%. You get 1 point for every $1 you spend, and each point is worth $0.01. The rewards are shopping credits, redeemable at Athleta and sister stores Gap, Banana Republic, and Old Navy. The rewards program for bakery chain Panera offers occasional free bagels or beverage discounts, without telling you exactly how you earn them. Once you meet some unknown threshold, the rewards appear in your account. What to consider when evaluating store loyalty programs: How often you shop at that store. You cannot accumulate measurable rewards at stores you only shop occasionally. Earnings structure. Clear earnings formulas help you make better purchase and budgeting decisions. On the other hand, the Panera model can be more fun because each reward is a new surprise. Rewards expiration. Rewards should be active for an extended period, so you have time to use them. Hybrid Hybrid shopping rewards programs have broader rewards and redemption opportunities. They are usually paid memberships or require you to use a specific credit card. Examples include Amazon Prime, Walmart+, and Macy’s Star Rewards Silver, Gold, or Platinum. What to consider when evaluating hybrid rewards programs: Cost vs. value. Amazon Prime gives you free shipping and streaming content — but these are only valuable to the extent you use them. If the program has a membership fee, evaluate the fee next to the value you expect to receive. Ease of redemption. Cash, statement credits, and gift card rewards are the easiest to redeem. Avoid programs that require you to buy something to redeem rewards. How to maximize your online shopping rewards Three strategies can maximize your online shopping rewards: consolidate purchases, stack rewards, and optimize your payouts. Consolidate purchases Prioritize your rewards memberships as you shop. For example, if you are a FreeShipping.com member, use that membership for every online purchase you can. Stack rewards You can earn rewards from your online shopping portal, credit card, and store loyalty program at the same time. For example, you can shop Athleta via FreeShipping.com and pay for the purchase with your Citi Double Cash Card. Here are the numbers on a $500 purchase: You may earn $50 from FreeShipping.com or 10%. You earn 500 points, worth $5, from Athleta. You earn $10 cash back from your Citi card or 2%. Your cash rewards from FreeShipping.com and Citi total $60 or 12%. The $5 Athleta credit is only valuable if you use it on something you would have bought anyway. Include that and your total earnings are $65 or 13% of the original $500 purchase. One risk to note is that stacking certain coupons or multiple cash back programs may cause one or more of your rewards not to track. Optimize payouts The way you collect cash back rewards can affect how much value you get. Some strategies to maximize your reward value include: If you have a choice, opt for cash rewards or credit card statement credits. You can use cash and statement credits to reduce the cost of your purchases. Redeem for gift cards cautiously. Some retailers don’t allow you to combine a gift card payment and a credit card payment for the same purchase. That means you can only use a gift card when its balance covers your entire purchase. Worse, you often up with a small, random balance on the card that never gets used. Don’t redeem to buy. Rewards that require you to make another purchase are less valuable. Old Navy Super Cash is an example. Save 10% on online purchases Routinely saving 10% or more on your online purchases is one way to manage inflation and a slowing economy. To do it, join the right programs, consolidate your purchases, stack your rewards, and choose cash redemptions whenever possible. As a last step, track your rewards across programs. It’s surprising and motivating to see how much you can earn over time. About FreeShipping.com FreeShipping.com is a paid membership program that pays consistent 10% cash back on purchases made through the FreeShipping.com network of 1,000-plus merchants. During special seasonal promotions, members can even earn as much as 20% cash back on their purchases. FreeShipping.com members also have built-in price protection on their network purchases and earn cash rebates on their costs for shipping, return shipping, and food delivery. Source link

0 notes

Text

Introducing "My Free App": Earn Money Playing Simple and Engaging Games!

In today's fast-paced world, finding ways to earn extra income while having fun can feel like a challenge. But what if you could make money by simply playing games on your phone? Sounds too good to be true, right? Well, it's time to think again! Introducing "My Free App"—a newly launched, free-to-download app exclusively available for U.S. citizens. With "My Free App," you can earn real cash rewards by playing simple and engaging games right from the comfort of your home. Don’t miss out on this exciting opportunity—download "My Free App" today and start earning!

What is "My Free App"?

"My Free App" is an innovative, user-friendly app that allows you to earn money just by playing games on your phone. The app is packed with a variety of fun, simple games that cater to all kinds of interests, from puzzle lovers to action enthusiasts. Whether you have a few minutes to spare or want to spend hours enjoying your favorite games, "My Free App" has something for everyone.

And the best part? You earn real cash rewards for every game you play. There are no hidden costs, no in-app purchases—just pure entertainment with the added bonus of earning money. Ready to start? Download "My Free App" now for free and turn your gaming into earning!

Click here to download "My Free App" now!

How Does It Work?

Getting started with "My Free App" is incredibly simple. Here's how it works:

1. Download the App:

Head over to the App Store or Google Play Store and search for "My Free App." Or simply click here to download directly. Within seconds, you’ll have access to a world of fun and rewarding games.

2. Sign Up:

Once the app is installed, create a free account. Just provide some basic details like your name and email, and you're all set!

3. Play Games:

Browse through a wide selection of games, choose the ones that interest you, and start playing. Each game comes with clear instructions, so you can dive in and start earning immediately.

4. Earn Rewards:

For every game you play, you'll earn points that can be converted into real money. The more you play, the more you earn! Points are awarded based on your performance and the time spent playing, so there’s always a chance to boost your earnings.

5. Cash Out:

Once you reach the minimum payout threshold, you can easily transfer your earnings to your PayPal account or redeem them for gift cards from popular retailers like Amazon, Walmart, and more. Imagine earning cash just by playing your favorite games!

Ready to start earning? Don’t wait—download "My Free App" now and turn your game time into cash! Get the app for free here.

Why Choose "My Free App"?

If you're wondering why "My Free App" is the best choice for earning money while playing games, here are a few compelling reasons:

Completely Free:

"My Free App" is 100% free to download and use. There are no hidden fees, and you won’t be asked to make any in-app purchases. This is a risk-free opportunity to earn real money.

Wide Range of Games:

With a diverse selection of games, there’s something for everyone. Whether you enjoy brain-teasing puzzles, action-packed adventures, or simple card games, you’ll find it all here.

Real Cash Rewards:

Unlike many other apps that offer points or virtual currency, "My Free App" lets you earn actual cash. It’s a great way to make extra money while having fun!

Easy to Use:

The app is designed to be user-friendly, with easy navigation and simple instructions for each game. No technical skills are required—just download, play, and earn!

Exclusively for U.S. Citizens:

If you're living in the U.S., you're eligible to start earning with "My Free App" today.

Don’t miss out—download "My Free App" and start enjoying fun games while making extra money on the side! Get started here!

Earn While You Play: The Future of Gaming

With "My Free App," the future of gaming is here. No longer do you have to play games just for entertainment; now, you can earn real money while having fun. "My Free App" turns your leisure time into a rewarding experience, allowing you to make the most of every moment.

Why spend hours playing games without a return? "My Free App" brings you the perfect blend of enjoyment and financial rewards. Whether you're waiting in line, commuting, or relaxing at home, you can turn your downtime into an opportunity to earn extra cash.

Don't wait—download "My Free App" today and start earning money with every game you play! Click here to get the app for free!

A Limited-Time Opportunity

Remember, "My Free App" is available exclusively for U.S. citizens, and this opportunity won't last forever. Be among the first to experience this groundbreaking app and start earning money while you play. Don’t miss out on this unique chance to combine entertainment with financial gain.

“Take action now!” Visit the App Store or Google Play Store and search for "My Free App," or simply click here to download it for free. Create your account, choose your favorite games, and start playing today. The more you play, the more you earn—it’s that simple!

Conclusion

"My Free App" is revolutionizing the way U.S. citizens use their phones to earn money. With an array of engaging games, a user-friendly interface, and real cash rewards, it's the perfect app for anyone looking to make some extra income while having fun. Don’t let this opportunity pass you by.

Download "My Free App" now and start earning money with every tap! Join the "My Free App" community here!

Your next paycheck is just a game away. Get started today!

#make money online#make money#how to earn money#passive income#earn money online#make money home#make money fast

0 notes

Text

How to Get Money from Venmo Without a Bank Account?

In today’s digital age, where financial transactions are increasingly moving online, Venmo has emerged as a popular payment platform thanks to its simplicity and user-friendly interface. For many users, the ability to send and receive money with just a few taps is a game-changer. However, not everyone wants to link their bank account to Venmo for various reasons, ranging from privacy concerns to the lack of a bank account altogether. In this comprehensive guide, we will explore several practical ways to access your Venmo funds without a bank account.

Using a Venmo Card

One of the most straightforward methods to get your Venmo balance is by obtaining a Venmo Card. This debit card works like any other bank debit card but is connected directly to your Venmo balance. Here’s how you can use it:

Apply for the Venmo Card: You can apply directly through the Venmo app. The process is quick and typically requires you to verify your identity.

Activate the Card: Once received, activate your Venmo Card using the Venmo app.

Use Your Card: You can use the Venmo Card for online and in-store purchases anywhere Mastercard is accepted. Additionally, it allows you to withdraw cash from ATMs, including MoneyPass ATMs without a withdrawal fee.

Transferring Venmo Balance to Gift Cards

Another innovative way to utilize your Venmo funds without a bank account is by purchasing gift cards. Venmo allows users to buy gift cards from a wide array of retailers directly through the app. This method not only enables you to spend your money on goods and services but also makes an excellent gift option. Here’s how to proceed:

Select the Gift Card Feature: Inside your Venmo app, navigate to the gift card section.

Choose Your Card: Select from an extensive list of retailers such as Amazon, Starbucks, Walmart, and many more.

Purchase and Use: Follow the prompts to purchase your desired gift card. You’ll receive an electronic gift card that can be used online or in the respective stores.

Using Venmo with Trusted Friends or Family

If you prefer not to have a Venmo Card or gift cards, another option is to utilize trusted friends or family members to access your funds:

Send Funds to a Trusted Person: Transfer the amount you need to a friend or family member who agrees to help.

Have Them Withdraw or Spend: They can withdraw the funds using their bank account or Venmo Card, or spend the money on your behalf.

Important Considerations

While the options listed provide various ways to withdraw money from Venmo without a bank account, it’s crucial to consider the following:

Fees and Limits: Some methods may incur fees or have specific limits. Always check the latest terms and conditions in the Venmo app.

Security: Only transact with trusted individuals and reputable businesses to avoid scams or fraud.

Conclusion

Venmo provides several flexible options for accessing your funds without the need for a traditional bank account. Whether through a Venmo Card, buying gift cards, or collaborating with trusted friends and local vendors, you have multiple ways to enjoy your money how and when you want it. By understanding and utilizing these methods, you can maximize the benefits of your Venmo account, ensuring convenience and accessibility to your funds at all times.

0 notes

Text

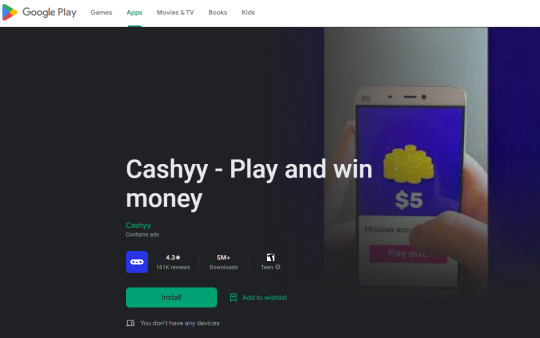

Install and Register in the Cashyy App!

Play games, complete missions & fetch gifts

Cashyy is a completely free app which will top up your PayPal account.

Discover free games, accomplish missions and win coins to exchange with gift cards

All you have to do is play, complete missions and you will receive free money. The more you play the more money you earn.

Download Cashyy for free (no advertising, no deposit, no in-app purchases) ✅

Choose a mission and play your favorite game from our list 🎮

Fetch rewards 🎁🎉🏆

Are you searching for cash games on Google Play to make extra money while having fun?

Play new mobile games and win gift cards!

Discover missions and play new games every day from our list

➡ spend time playing them, achieve your missions

➡ earn coins

➡ exchange your coins for gift cards such as Amazon gift cards, Google Play coupons, PlayStation cards, Zalando vouchers, or you can simply get your cash directly on your PayPal account.

How to start using our cash app?

Cashyy is very easy to use:

✓📱 Get Cashyy now

✓🎮 Choose a mission

✓💎 Earn coins for every mission you complete

✓💲 Trade your coins for any gift cards or receive your money on your Paypal account

That’s it 😊

Why Cashyy?

✓ A completely free app (⛔no advertising, ⛔no in-app purchases)!

✓ Easy to use!

✓ Fast and guaranteed payouts and rewards!

✓ Different ways to collect your prize (PayPal money transfer, Amazon gift cards, Google Play gift cards, PSN cards, Nintendo cards, Steam vouchers, Walmart coupons, Xbox gift card and many more)!

✓ Huge selection of different game types from Google Play to fit any preference!

✓ Invite your friends to Cashyy and you will both receive extra bonuses! 🤝

Currently, our offer wall contains various game types such as Casual, Strategy, Action, Puzzle, Adventure, Arcade, and many more. You can play ANY game you like and start collecting coins!

If you already like playing mobile games, Cashyy is the cash app for you as it pays you to play games!

So, what are you waiting for? Start now and fetch your first gift card! 🏆

#app#freeoffer#appinstalltion#offerings#install#offersale#special offers#final offer#appinstall#Cashyyapp#cashyyappinstall#cashyyapregister#cashyyapinstallandregister

1 note

·

View note

Text

Learn How to Add a Gift Card to the Cash App? Transfer Money From Gift Card?

Are you wondering can you transfer money from a gift card to your Cash App wallet? If so, you are not alone. While the service does not support direct transfers from store gift cards, you can use several other methods. Fortunately, some are free and don’t cost you a cent.

The first step to add a gift card to your Cash App account is to sign up for PayPal. You will then need to link your PayPal account to your bank. You may also want to sign up for Venmo. While both services allow you to transfer your gift card balances to your bank, they offer different features and require separate steps.

In addition to the above, you can transfer funds from your Visa gift card to your PayPal account. However, it’s unlikely that you will see any improvement in your balance from this simple step. One alternative is to use a prepaid debit card. This works by automatically deducting the purchase amount from your balance. However, some prepaid cards may charge a monthly fee. You can then reload your card for additional money.

As a final option, you can also check out the other options on the Venmo website. This service offers many other valuable features, including sending and receiving money via phone. If you want to transfer a large sum of money from your gift card to your PayPal account, you will need to do it correctly. This means that you will need to make sure you have the correct credentials, such as your PayPal username and password and your bank account information.

How to Transfer Money From Gift Card to Cash App?

Cash App is an innovative mobile payment service that allows you to receive and send cash using multiple methods. It’s an excellent tool for anyone looking to cash in on their gift card tidbits, and the process isn’t as complex as you might think. Several methods are available if you’re looking to transfer money from a gift card to your bank account. Some are free, and others may incur a small fee.

For example, you can transfer money from your Walmart gift card to your Cash App account without a visit to your local Walmart store. However, if you don’t have one nearby, you’ll need to buy a money order from your local grocery store or post office.

Alternatively, you can use the services of a third-party service that will send your funds directly to your bank account. These services may charge a small fee but are more convenient, and the transfer process is usually instant.

The best way to transfer money from a gift card to a bank account is to link the two using PayPal. If you don’t have a PayPal account, you can sign up for one in as little as a few minutes. In addition, you can use general-purpose gift cards in the checkout process, and some stores even offer e-gift cards.

Another way to transfer money from a gift card is to sell your unused card for cash. Fortunately, plenty of sites will do the legwork for you, like Card Cash. Once you have your card, you’ll need to visit their website and select the best offers. You’ll need to provide your gift card details and agree to exchange rates before you’re paid.

Can You Transfer Money From Walmart Gift Card to Cash App?

The Cash App can be downloaded for free from the App Store. However, there is no direct way to transfer money from a gift card to your Cash App account. Instead, you must buy a Gift Card using your Cash App credit card. Then, you can transfer the Gift Card balance to your Cash App account. If you want to make a quick buck, you might consider selling your unused gift cards. Several platforms on the web will let you instantly trade in your new gift cards for cash. But you’ll need to find a site that pays you the most for your unused gift card.

The Cash App also provides a valuable shopping service. It can be used to purchase Apple and Starbucks gift cards in stores and online. If you’re looking for a gift, consider buying a Vanilla Visa Gift Card. These prepaid debit cards can be redeemed at most online and offline retailers.

If you still need to download Cash App, you’re missing out on one of the most popular mobile payment apps. This peer-to-peer mobile payment system allows users to send and receive money and buy and sell stock. If you have a Visa Gift Card, you can use it to make purchases online and at Cash App-enabled ATMs. You can also use it to make purchases in-store. Aside from Cash App’s official website, you can also download it from Google Play. Once you’ve downloaded it, you’ll need to sign up for an account by email or phone. The process is easy enough.

#can you add a gift card to cash app#can you add a visa gift card to cash app#how to transfer walmart gift card to cash app#transfer money from gift card to cash app#cash app gift card

4 notes

·

View notes

Text

Get Your $750 Cash App Gift Card 2024 Now — A Real Deal!

How to Get Your $750 Cash App Gift Card

👉Get a Cash App Gift Card For Free!

Ready to claim your $750 Cash App Gift Card? Simply follow these steps:

Download the Cash App from the App Store or Google Play Store.

Sign up for an account and verify your identity.

Once your account is set up, navigate to the "Gift Cards" section.

Enter the promo code to claim your $750 gift card.

Start using your gift card to make purchases and enjoy the rewards!

#cash app gift card#cash app gift cards#cash app gift card code#buy cash app gift card#cashapp#cash app#gift#gift card#paypal#giftcard#giftcash#us#United States#apple gift card#can i add a gift card to cash app#can i add a visa gift card to cash app#can i use a visa gift card on cash app#Can You Transfer Money From Gift Card to Cash App#How to Transfer Walmart Gift Card to Cash App

1 note

·

View note

Text

The Ultimate Guide to Transferring Gift Card Balance to Cash App

Gift cards are a popular form of payment, especially during the holiday season or for special occasions like birthdays or weddings. However, if you have received a gift card and would like to transfer the balance to your Cash App account, you might wonder if it's possible. This blog post will explore whether you can transfer money from a gift card to Cash App and how you can do it.

Can You Transfer Money from a Gift Card to Cash App?

The short answer is yes, you can transfer gift card money to Cash App. However, the process is not straightforward and requires some extra steps.

Here are the steps you need to follow to transfer money from a gift card to Cash App:

Check the Gift Card Balance

Before transferring the money from your gift card to the Cash App, you need to check the balance on your gift card. To do this, look for the balance on the back of the card or call the customer service number provided on the card.

Convert the Gift Card to Cash

Once you know the balance on your gift card, you need to convert it to cash. There are a few ways to do this:

Sell the gift card online: You can sell your gift card on websites such as Cardpool, Gift Card Granny, or Raise. These websites will buy your gift card for cash, although they typically charge a fee for their services.

Use a gift card exchange kiosk: Some stores have kiosks to exchange your gift card for cash. Examples include Coinstar kiosks and the Walmart Gift Card Exchange.

Use a prepaid debit card: You can use your gift card to purchase a prepaid debit card that can be used like cash.

Add Cash to Cash App

After you have converted your gift card to cash, you can add the cash to your Cash App account by following these steps:

Open the Cash App and tap on the "Balance" tab at the bottom of the screen.

Tap "Add Cash" and enter the amount of cash you want to add.

Choose the source of the funds (e.g., bank account or debit card) and follow the prompts to complete the transaction.

Once the cash is added to your Cash App account, you can send money to friends, pay bills, or buy Bitcoin.

FAQs

Can I transfer the balance of a gift card to my bank account?

No, you cannot transfer the balance of a gift card to your bank account directly. You need to convert the gift card to cash first and then transfer the cash to your bank account.

How long does it take for the money to appear in my Cash App account?

The time it takes for the money to appear in your Cash App account depends on the source of the funds. The money should be available immediately if you use a debit card to add cash to your Cash App account. If you use a bank account, it can take a few days for the funds to appear.

Can I add a gift card to my Cash App account?

You cannot add a gift card to your Cash App account. You need to convert the gift card to cash first and then add the cash to your Cash App account.

Is there a fee to add cash to my Cash App account?

No, adding cash to your Cash App account is free if you use a debit card. However, you will be charged a fee if you use a credit card.

Conclusion

Transferring money from a gift card to a Cash App is possible but requires some extra steps. You need to convert the gift card to cash first and then add the cash to your Cash App account. Following the steps outlined in this blog post, you can successfully transfer the balance from your gift card to the Cash App and use it to send money to friends or purchase goods and services.

#transfer money from gift card to cash app#Can you add a gift card to Cash App#how to add gift card to cash app#can i add a visa gift card to cash app#can you put a gift card on cash app#how to transfer walmart gift card to cash app

0 notes

Text

How to Get Cash from Your Walmart Gift Card and Transfer It to Cash App

Walmart gift cards are a popular form of gifting, and many users may want to transfer the funds to their Cash App account. Here is how to transfer money from a Walmart gift card to Cash App:

Step 1: Launch the Walmart website and select the option to check the balance on your gift card.

Step 2: Write down the gift card number, PIN, and balance.

Step 3: Visit the Walmart store and purchase an item using the gift card. Make sure to purchase an item equal to or less than the balance on the gift card.

Step 4: After the purchase, ask the cashier to provide you with a "money order" for the remaining balance on the gift card.

Step 5: Once you have the money order, launch the Cash App on your mobile device and tap on the balance icon on the home screen.

Step 6: Next, click on the "Add Cash" option and select the option to add funds via money order.

Step 7: Enter the amount on the money order and the reference number provided on the money order.

Step 8: Finally, click the "Add Money" option, and the funds will instantly be transferred to your Cash App account.

It is essential to note that Walmart gift cards may have restrictions, such as expiration dates or limitations on the amount you can transfer. Additionally, you may need to pay a fee for the money order, which may vary depending on the store's policy. Therefore, it is always best to read the terms and conditions before transferring the funds.

In conclusion, transferring funds from a gift card to a Cash App is a simple process, and it can be done in a few easy steps. However, it is important to check if Cash App supports the gift card and to read the terms and conditions before transferring the funds to avoid complications.

#transfer money from gift card to cash app#Can you add a gift card to Cash App#can you add a visa gift card to cash app#how to transfer walmart gift card to cash app#how to add gift card to cash app

0 notes

Text

How to Use a Gift Card on Cash App? (Step by Step Guide)

Adding a Visa gift card to the Cash App is not possible. However, you can use PayPal to transfer funds to the Cash App. You will need to have a PayPal account and a bank account that you can link to your PayPal account. Once you have linked your Visa gift card to PayPal, you can use the balance to pay for purchases on the Cash App. This can be a great way to use your Visa gift card to pay for purchases or send funds to another PayPal user.

You will have several associated fees when you first purchase a Visa gift card. These fees are based on the card’s value and the location of the purchase. If you plan to use your Visa gift card on a Cash App, it is essential to know these fees. You will also have to pay a small fee to upload the card to the Cash App.

If you plan to add your Visa gift card in a Cash App, it is best to purchase items on sale. You can also sell your gift card to another Cash App user. However, you should remember that this is a prepaid card, and you cannot use it to pay for recurring services like subscriptions. You can, however, use it to pay for groceries or other purchases that are not on sale.

How to Use a Gift Card on Cash App?

The Cash App is one of the most popular mobile payment apps. You can send money, buy and sell gift cards, and receive money from peers. If you want to know how to use gift card on Cash App, know it is a simple process. However, it requires some work. The first step is to create a PayPal account. Afterwards, you can transfer money from your PayPal balance to your Cash App balance. You can also send converted balances to others.

You can also add prepaid cards to your PayPal account. However, you will need to first delete your current debit card. This is because the Cash App only allows you to use one debit card simultaneously. You can also sell gift cards to get cash. You can do this through websites such as CardSell. Or, you can use sites like Venmo.

You can also add gift cards to PayPal through the PayPal Express payment method. This is a fast way to send money. It takes about a business day for the funds to deposit into your PayPal account. You can also link Visa gift cards to your PayPal account. You will need to provide your Visa gift card information, which includes your card number and expiration date. You can also add American Express gift cards.

Can I Transfer Money from a Visa gift card to Cash App?

Using Card Cash, you can transfer funds from Visa gift card to your Cash App account. CardCash is a payment processor that works with PayPal to transfer funds from your PayPal account to your Cash App account. You will first have to create a PayPal account to link a Visa gift card to your Cash App account. You will need to log into your PayPal account and click on the “Link a card” option. This will bring you to a page where you will enter the card’s information. Then, you will have to select a Cash App bank account to which you wish to transfer the funds. Before moving the funds to your Cash App account, you must confirm this bank account.

You can also use PayPal to add money to your Cash App balance from a Visa gift card. To do this, you will need to create a PayPal account and then log into your PayPal account. You will then have to enter the information for your Visa gift card. Once you have entered all the necessary information, you must select “Link a card” and follow the instructions.

You can also sell your Visa gift card using CardCash. However, this is only an option for some merchant prepaid cards. You should consider purchasing items on sale before you sell your Visa gift card. It is also important to note that if you plan to use your Visa gift card in stores, it is best to buy items that are on sale rather than items that are not on sale.

How to Transfer Walmart Gift Card to Cash App?

The Cash App has several methods to transfer your gift card to your account. You can do so in person, over the phone, or online. You will have to make a few changes depending on how your Walmart gift card is tied to your account. Getting cash back for your Walmart gift card can be easy. There is an app called Cash App, which allows users to transfer money from one account to another. Whether you want to sell your card to a friend or family member or you want to put your profit into your Cash App account, you can do it.

While there are many payment apps out there, there is one that is sure to get your money. You can check the balance of your Walmart gift card on the Cash App website, which can save you a trip to the store.

The Cash App has a walk-around that will allow you to see how to transfer your Walmart gift card. However, you will need to download the app before you can use it. The Walmart Cash App is only available at some stores, so you may not be able to find it. The app will also require that you have an iOS device. The best way to transfer your Walmart gift card to your Cash App account is to go to the Cash App website, click on the My Cash tab, and follow the instructions. Sometimes, you may have to wait up to 24 hours for the funds to appear.

#can i add a gift card to cash app#can i add a visa gift card to cash app#can i use a visa gift card on cash app#Can You Transfer Money From Gift Card to Cash App#How to Transfer Walmart Gift Card to Cash App#How to Use a Gift Card on Cash App#cash app gift card

0 notes

Text

How to send money from a Visa gift card to your Cash App account?

If you've purchased a gift card, you may wonder how to add money from gift card to Cash App. The answer depends on your card type and whether the app supports such cards. For example, if you have a Visa or Mastercard, you can add the money to the Cash App.

Can I Add a Gift Card to the Cash App?

With the Cash App, you can use gift cards to purchase products. This process is fast and free. Once you've linked your gift card to your PayPal account, you can use the card just like cash in the Cash App. To get started, go to your PayPal account and select "Link Your Gift Card". You can also use your gift card in stores and online.

Cash App currently supports most gift cards and some government-enabled prepaid cards. Unfortunately, it does not accept Visa gift cards. However, using your Cash App balance, you can add gift cards from other providers. There are many other gift card options, such as Apple gift cards.

A few methods exist to add money from a gift card to Cash App. One way is to sell the gift card on CardCash, but this is not an official feature. Besides using your PayPal account, you can use Apple Pay and Google Pay to add money to your gift card.

Can You Send Gift Card Money to Cash App?

If you want to use gift cards on Cash App, you must have a PayPal account. This way, you can load the money from your card and use it on the app. The process is easy and fast. You can even link your PayPal balance to your Cash App balance.

If you want to send money from a Visa gift card to your Cash App account, you can do so through PayPal. To do this, you need to create a PayPal account or log in to your existing PayPal account. Click on the 'Send Money' tab on PayPal's website. Then, enter the gift card amount and verify the card details. Once you're done, the money will be transferred to your Cash App wallet.

While Cash App does not currently support gift cards, it does support other gift-based cards. The app supports debit and credit cards from American Express, MasterCard, Visa, and Discover. You can also add gift cards through PayPal.

How to Transfer Money from Gift Card to Cash App?

If you use the Cash App to make payments, you may wonder how to transfer money from a gift card. There is a simple way to do this. You need to take the below-mentioned steps to transfer money from gift card to Cash App:

First, you need to link the card to the Cash App. Once linked, enter the card number and PIN. Then, tap the Transfer option.

Once the information has been verified, you can transfer the money from your gift card to your Cash App account. You can also use your gift card in stores or online.

Next, you should sign into your Cash App account. Click "My Cash" and find the "+ Add Credit Card" option.

You will be asked to enter the information from your gift card.

After you complete this step, you will receive a confirmation email.

You can use the money in your Cash App account within a few minutes.

#how to add a gift card to cash app#how to add gift card to cash app#can you send gift card money to cash app#transfer gift card to cash app#can you put a gift card on cash app#can you use gift cards on cash app#how to transfer walmart gift card to cash app

0 notes

Text

Can You Transfer Money From Gift Card to Cash App (Update Guide 2022)

Walmart does not offer any direct way for customers to withdraw cash from their gift cards. Instead, they place money on them and request that customers spend the money at Walmart. However, this is not possible at all stores. These are the methods you can use to transfer your gift card balance into your Cash App. This is the easiest method to withdraw cash from your gift card balance. This option is only available online.

First, the Walmart MoneyCard money can buy another gift card. You can also use the Walmart MoneyCard to buy other gift cards, including a Wal-Mart MoneyCard, once used at Walmart. Walmart even allows you to break up large gift cards into smaller denominations to use them in different locations. It's that simple! You can then transfer the money to any application that supports a prepaid debit card.

To transfer your Walmart MoneyCard balance, you will need to link it with your PayPal account. This can be done at the checkout stage of your online order. Walmart MoneyCard can be purchased at other stores that take prepaid cards. You can also split the gift cards into smaller denominations as cash in other shops.

Can I Transfer Walmart Gift Card To Cash App?

Your Walmart gift card cannot be given to anyone. It cannot be exchanged for cash. It would help if you went to the store to exchange it for cash. This information is available on the website. You can find the law in your state if you are unsure. It is possible to get your money back. It would help if you always read the rules, so you don't violate them.

If you want to purchase a product using a Walmart gift certificate, your Walmart gift card can be used to pay. If you have an existing account, you can also use your debit or credit card to pay. You can buy items without fees if you don't have a PayPal account. You can also link your Walmart MoneyCard account with your PayPal account. Also, you should have your ACH number and your routing number.

You can exchange your Walmart gift card with Cash App anytime you like. You can sell your gift cards for cash at some stores. You'll need to pay the full retail price, but you will receive your cash within a few days. You can also sell any leftover money to another person for a higher amount. These cards are in high demand online and can be purchased from resellers via the internet.

How do I transfer money from a gift card to a cash app?

How can I transfer money from a gift card to the Cash App? You have two options for adding the gift card balance to the Cash app: First, you can use PayPal Express to add funds. You can then use your Gift Card balance from PayPal Wallet to pay for purchases. You can use PayPal Express to transfer the gift-card balance to your Cash App account once you have it.

You can't transfer your Visa gift card balance to the Cash App directly if you have a Visa gift card. However, you can add funds to your Cash App account using another method. You can add funds to your Cash App account using a PayPal account. This is the easiest way to add money to your Cash App account using a gift card.

You can link your gift card with your PayPal account as the first option. You can then receive the money from your gift card and send it to you. After that, you can transfer money to your Cash App account. You can then use the cash to make Cash App purchases. This is the best option for those who don't own a bank account or don't want to use a debit or credit card.

#Transfer Walmart Gift Cards To Cash App#transfer a Gift card to Cash App card#send Walmart gift card money to Cash App#can you use gift cards on cash app#what cards does cash app accept#does cash app take gift cards#how to transfer walmart gift card to cash app

1 note

·

View note

Text

Cricut Ideas: Get Inspired To Make Best Craft Projects

Looking for inspiration to start your projects using the Cricut cutting machines and devices? Then look no further; you are at the right place. This blog is hand-crafted to give you the best money-making Cricut Ideas. Every Cricut cutting machine and device can give you the best professional-looking results in no time.

Here, we have provided the steps to get started with the Cricut Ideas. Then you get to know what you can create with various Cricut machines, presses, and tools. So, keep reading to find out everything about Cricut ideas and much more.

Cricut Ideas: How To Get Started?

Before you look into all the Cricut Ideas, I have broken down the whole process of creation into a few simple steps. These steps are basic and will act as a mini guide before you embark on your journey of creating and selling crafts using your Cricut machines.

Step One:

If you have not yet purchased your Cricut cutting machine, then the first thing you need to do is get one. You can either buy it from famous stores like Walmart, or you can get it from famous online websites, including Amazon and Cricut’s very own online shop. I would recommend you do thorough research on the features that are offered by the machine you are opting for. Make sure that it matches your requirements. You can also buy important tools and add-on devices like a knife blade, heat press, scoring tools, and rotary blades.

Step Two:

Download the Cricut Design Space application on your system or mobile device. It has a library with many pre-designed projects, images, graphics, and fonts. It will not only inspire you to create beyond any limits but also save your time. Once you have your own Cricut ID and login credentials, you can join various Cricut communities on the app that will help you further.

Step Three:

Start creating your projects for yourself and selling your craftsmanship to earn some extra cash. You can host a sale in your backyard and really create a small business overnight. The Cricut machines are user-friendly and quick machines that can help you personalize stuff for your clients. Make sure to take as many pictures as possible to post your work online to gain popularity and a good client base.

Cricut Ideas: For Beginners

Here are some interesting Cricut ideas that you can get inspired from:

Make Greeting Cards/Invitation Cards/Drawn Cards/ Welcome Cards etc.

To make cards, be they real-life-looking drawn cards, invitation cards, adhesive vinyl cards, welcome cards, birthday cards, customized cards, or cards for any occasion, you will either need a Cricut Maker, Explore, or Joy machine. You can sell it to people who are looking for personalized gifts cards options. By adding a scoring stylus or wheel, you can customize the envelopes to go along with the cards. Cricut also has its own range of colorful pens that can be used to add beautiful aesthetics to your cards.

Create A Personalised Vase

Flowers are everyone’s favorite; people gift them to each other normally as well as on special occasions. A great companion of flowers is a beautiful vase. You can actually brighten up any corner of your home or workplace with a customized vase. You can use fonts, graphics, and designs that are already pre-made in your Cricut Design Space Application. Then cut them out using Cricut cutting machines. You will need adhesive vinyl as a base material to cut out designs that can easily stick to the surface of the vase.

Personalize Storage And Boxes To Organize

One of the best among all Cricut ideas is using your Cricut cutting machine to declutter and organize your home, craft room, workspace, or kitchen. You can organize many areas of your home by making stylish labels from adhesive vinyl. All you will have to do is cut the labels and, with the help of a tool, transfer them to your carts, boxes, bags, etc. For creating small labels, I would highly recommend the Cricut Joy machine. You can get many beautiful fonts on the Cricut Design Space application.

Make Customized Mugs

The best way to create customized mugs is by combining the technologies of your Cricut cutting machine, Cricut Mug Press, and Cricut Design Space. You can create a beautiful collection of mugs or sell customized mugs. The mug making is one of the best among all the Cricut ideas, as they are high-in-demand products. You can work with infusible inks or heat transfer vinyl.

Visit: cricut.com/setup learn cricut.com/setup cricut setup www.cricut.com learn

Source: https://learn-cricut.com/cricut-ideas/

3 notes

·

View notes

Text

How to add credit card to cash app without bank account?

We all know that it is important to add a payment method to Cash App for a hassle-free payment experience. To ensure the best payment experience, Cash App supports three types of payment methods: bank account, debit card, and credit card. As we have already discussed how to add a bank account and debit card to the Cash App in one of our last posts, today we will show you how to add a credit card to Cash App.

In this helpful post, you will also learn about Cash App credit card fees and troubleshooting steps to follow when you can't add a credit card on Cash App. If your concern is about any failed credit card payment then you can contact us to learn how a cash App refund works. So, let's get started.

How to add a credit card to Cash App?

Thankfully, Square Cash App has kept in place a very simple method to add a credit card on Cash App. To link a credit card to your Cash App wallet, you need to use your credit cards details such as card number, expiration date, and secret code. One must be careful while entering the card details on Cash App as even one small mistake can prevent you from adding your card to Cash App. However, there might be a few more reasons that result in being not able to link a credit card in Cash App. We will discuss them later but first, learn the steps to add a credit card on Cash App.

So, as a first step, open the Cash App.

Tap the banking or my cash button with a $ sign.

On the next screen just below the cash and bitcoin tab, you will find an additional credit card option.

Select the add credit card option.

Now enter your credit card number, expiration date, and CVV code.

After that tap the add card button.

As you have added your credit to Cash App now you can make payment with ease of mind.

Can't add a credit card to Cash App? Fix it now

So, you can't add a credit card to Cash App. If you are sure that you are entering the right card details but still unable to link your credit card on Cash App then it might be possible that Cash App does not support your credit card. What credit cards does Cash App support? It might be your next question. Here below is the answer.

Cash App supports almost all debit and credit cards of the authorized banks by the US Government. One good to know information is that Cash App does not support gift or prepaid cards. Let's not forget that different banks apply different terms and conditions for using credit cards. And sometimes these terms and conditions make or break the compatibility of your credit card to Cash App.

Note that if your bank applies a fee to set up a credit card on Cash App then your card will not be allowed to be linked and used as a payment method on Cash App. When someone tries to add an unsupportive credit card to Cash App an error message pops up that reads "This card is not supported because the issuing bank charges cardholders additional fees. Please add another card".

According to the reports, the Citibank credit card does not work on Cash App. Why? Because Citi Bank charges an additional fee to be used on Cash App. While on the other hand, Chase Bank credit cards always work seamlessly on Cash App as it does not charge an additional fee on Cash App. For more information, get in touch with your credit card issuer bank.

Add credit card option is not available

What to do when there is no option available to add a credit card? Good question! Here is the answer. It happens when one tries to add a credit card without adding a debit card on the Cash App. Be informed that it is mandatory to first add a debit card. After that, you will be allowed to add a bank account and credit card. So, read this informative post: How to add a debit card on Cash App?

How to use a credit card on Cash App?

Can you send money through Cash App with a credit card? Yes, you definitely can send money but think twice before you send money to someone using a credit card on Cash App. Why? Because Cash App charges a hefty fee for using a credit card on Cash App. More specifically, Cash App charges a 3% fee for sending money using a credit card. In addition to that, your bank or Credit Card Company might also charge a transaction fee and interest. That's why avoid using a credit card on Cash App if you can. In case you have no other option but to use a credit card on Cash App then follow these steps to send money.

Open Cash App and select send money.

Now enter the amount and tap next.

By default, Cash App selects the Cash App balance or debit card to send money.

You need to change the payment method. And to do so, tap the amount.

Now select a credit card as a payment method.

Finally, tap the send button and scan your touch id to complete the payment.

Can you add money to the Cash App card from a credit card?

No, it is not possible. You can't add money to a Cash App card from a credit card. A piece of good news is that there are three possible ways to add money to a Cash App card. You can request money from family and friends on Cash App or transfer money from a debit card. If these methods are not suitable then you can visit the store and reload your Cash App card. Here is more information about how to add money to Cash App card at Walmart?

How to activate cash app card | Cash transfer failed | Cash app account closed | Cash app refund | Cash app direct deposit | Cash app cash out failed | Where can I load my cash app card

#Can't add credit card to cash app#Can I use a credit card on cash app | Add cash to credit card#Can't add cash to credit card to cash app

4 notes

·

View notes