#How to apply for an EIN Number

Explore tagged Tumblr posts

Text

Huh. Actually -- since I'm stuff home sick and my brain refuses to shut up and let me sleep -- apropos of reblogging @superhelltubedotsys' post citing Barbatos Lupus Rex's status as a werewolf Gundam, I'm now thinking about the significance that has within Iron-Blooded Orphans (some spoilers follow).

Because Barbatos the demon has no association with wolves in the Ars Goetia. The nearest applicable part is "He giveth understanding of the singing of Birds, and of the Voices of other creatures, such as the barking of Dogs", which is fitting for Mikazuki and plays into the comparison between mobile armour Hashmal and a bird, but pointedly does not imply 'appears as a giant fuck-off wolf monster with a knife-tail'. That description would seem more appropriately applied to Amon, the immediately prior demon, number seven: "He appeareth like a Wolf with a Serpent’s tail, vomiting out of his mouth flames of fire . . ."

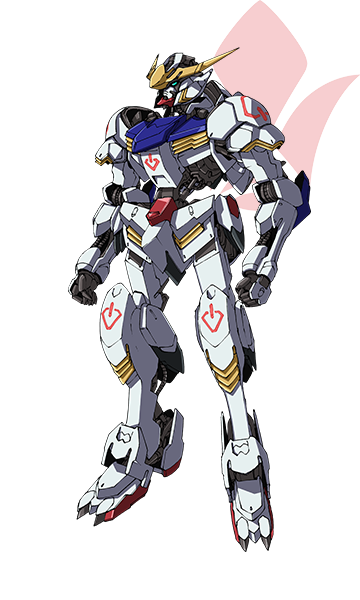

But of course, Gundam Barbatos' steady revision towards the Lupus Rex form is a drift away from its initial design. Exactly how much influence the Ars Goetia descriptions had on the Gundam project and how much they were just used as a naming convention is a little up in the air. Some do seem to be applicable (Zagan being a 'bull with gryphon wings', Flauros switching between the forms of a leopard and a man, etc.). Others . . . well, Bael is supposed to appear as either a toad, a cat, or a man, or all three at once, and while that has some applicability to McGillis' whole deal, it's not really a match for Gundam Bael's angelic form. Nor do the Gundam's abilities evoke demon!Bael's power to render someone invisible. However, I think we can safely conclude that, in-universe at least, the goetic demons are only pertinent to the Gundams' initial appearances and capabilities.

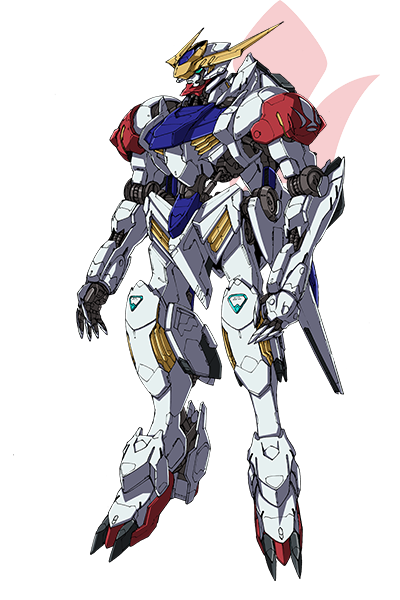

Barbatos' revisions throughout Season 1 are instead a gradual cannibalisation of various different sources of technology and weapons to get it back into fighting shape (Teiwaz technically restores it to its original appearance, but that doesn't last past the Dort arc; thereafter, we're back to bolting on any spare armour going). Barbatos Lupus then represents a significant step towards redefining it in line with the Chief's goal of creating an 'ultimate' version based on Mika's battle data, with Barbatos Lupus Rex being the end-point for that progression.

Put simply, Barbatos gradually becomes more and more tailored to Mikazuki, specifically. To digress for a moment, this forms a big part of my reasoning that Mika being able to use the katana properly at the climax of Season 1 represents the influence of Barbatos' original pilot; after this, he ditches that kind of weapon entirely. Even while fighting Hashmal, he reaches for the biggest club available (technically, a broad-sword, but so ridiculously huge nobody could call it a precision weapon). It's another interesting detail that Mika can't beat Ein in their final face-off by fighting like himself, which comes back around again as the back half of Season 2 kicks into gear.

Anyway, my point is this: being a werewolf is not inherently part of Barbatos' deal. Rather it represents Mikazuki's growing influence -- as you might thematically expect for a union with a character named after the moon (crescent moon, specifically, though I can't imagine the association wasn't intended given Tekkadan are wolf-coded in the text). And that's fascinating because as I've written about before, Barbatos and Mikazuki are the most blatant example of a devil's bargain in the show. The kid literally sells and arm and a leg (and an eye) for the power Barbatos can give him. And yet, the bestial aspects Barbatos takes on are rooted in Mika.

There's an echo of Gundam Wing's 'Gundams are a curse' refrain in IBO. These machines bring bad luck to everyone who pilots them, as a function of representing humanity subsumed by war. The inherent gamble of the Alaya-Vijnana, the overwhelming nature of the conflict they were built to end, the fact Gundams are never sufficient on their own to change the world -- it forms an unspoken counter-argument to McGillis' zealous faith in their status as symbols of transformation that is actually very in keeping with the demonological tradition from which they take their names. What they offer is costly and potentially damning, while also largely illusory when it comes to anything other than utter destruction. Indeed, Mikazuki is a living testament to how 'cursed' their pilots are.

It just happens that he was able to curse Barbatos back.

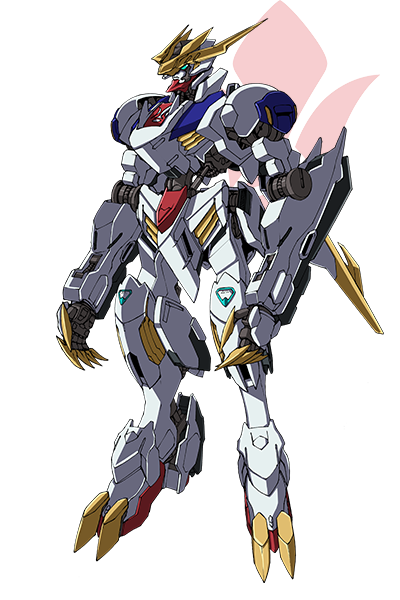

Because that's what Barbatos Lupus Rex is, isn't it? Put side by side with its original form, this is a clear degradation of a proud warrior into a savage beast. The same design elements persist, of course, yet by the end, it's near impossible to picture Barbatos as an elegant fighter making precision strikes with a honed sword. It has become a true berserker, tearing into its opponents with teeth and claws (well, claws and knife tail). As Tekkadan in general tend to, Mikazuki strips away the affectations of nobility and 'honourable' warfare in favour of brutal reality.

The detail of the Lupus Rex form merging parts of a mobile armour into a Gundam only heightens this. Weapons are weapons, whoever they serve and whatever guise they wear. Mikazuki is always honest about that. His awed response to Hashmal is of a piece with how easily he fits within Barbatos. He sees himself as equivalent to them -- has, in fact, constructed his entire identity around being so.

Thus, the lycanthropy he inflicts on Barbatos is of a kind that merely reveals the truth lurking under the skin. It was always an instrument of devastation. Now it looks the part.

#gundam iron blooded orphans#gundam ibo#tekketsu no orphans#g tekketsu#gundam#gundam barbatos#barbatos#more rambling#at some point I will get around to finishing that essay about the meaning of Gundams in this show#and putting that in context of the rest of the franchise

51 notes

·

View notes

Text

To register #DearDearestBrands LLC in California, you'll need to complete and submit the Articles of Organization (Form LLC-1) with the California Secretary of State. Below is a general outline of how your details will fit into the documentation:

California LLC Formation Details for #DearDearestBrands

LLC Name: #DearDearestBrands LLC

State of Formation: California

Business Structure: Limited Liability Company (LLC)

Owners (Members):

Claire Jorif Valentine (Primary Owner)

Bambi Valentine Prescott (Co-Owner)

Business Purpose:

To operate and manage an art, fashion, and digital media brand encompassing multiple creative and entertainment ventures.

Associated Brands and Projects:

DearDearestBrands WordPress

PlayStation 7 Vogue

enXantingXMEN

MarvelKeys

Crown And Noble

#TheeForestKingdom

Baroquenheart Art Gallery

Registered Agent: (Must be a California resident or a registered agent service)

Business Address: (A physical address in California is required; P.O. boxes are not accepted.)

Management Structure: (Specify whether it will be member-managed or manager-managed.)

Filing Fee: $70 (Payable to the California Secretary of State)

Next Steps to Officially Register #DearDearestBrands LLC

Check Name Availability:

Ensure "#DearDearestBrands" is available in California’s business name database: Business Search

File Articles of Organization:

Online: California Secretary of State Website

By Mail: Print and submit Form LLC-1 to the Secretary of State with a $70 filing fee.

Appoint a Registered Agent:

You can designate yourself, another individual, or a service.

Obtain an EIN (Employer Identification Number):

Apply for free on the IRS website: EIN Application

File Statement of Information (Form LLC-12) within 90 Days:

Required in California and must be updated every two years ($20 filing fee).

Register for State Taxes (If Applicable):

Sales tax permit if selling goods

Franchise tax ($800 annual fee in California)

Open a Business Bank Account:

Use your EIN and Articles of Organization to set up a separate business account.

Would you like assistance filing the LLC-1 form, finding a registered agent, or checking name availability in California? Let me know how you'd like to proceed!

#DearDearestBrands LLC#DearDearestBrands#Claire Jorif Valentine#BambiPrescott#WOD#The government#PlayStation7#Sony#Marvel#SquareEnix#Binance

2 notes

·

View notes

Text

Answer the questions and tag five fanfiction authors you know!

tagged by the terrifyingly talented @kvetchinglyneurotic and the impossibly incredible @sighonaraa

1. How many fandoms have you written in?

One! Uno! Eins! All of the ridiculously emotionally evocative writers in the Ted Lasso fandom completely broke my brain and launched me into the undiscovered country (fic writing).

2. How many years have you been writing fanfiction?

Since January, so about .3 years 🤗

3. Do you read or write more fanfiction?

Definitely read. I am perpetually mentally exhausted in my free time and usually can't concentrate enough to write. That being said I also haven't had much time to READ fic lately. So. Help???

4. What is one way you've improved as a writer?

Hmmmm. I'd say embracing the draft process? When I started writing fic (OH SO LONG AGO I KNOW) I was very 'this needs to be good' and now I'm appreciating the 'this needs to be FUNCTIONAL' mindset more.

5. What's the weirdest topic you researched for a writing project?

Definitely not weird BUT I did accidentally fall down a research spiral for ONE WORD in 'i learned to walk while he was away'. For context: I am not Jewish, but I head-canon Roy as Jewish and there is ONE LINE that references this in that fic. I wanted to double check if there was any significance to the different spellings of Hanukkah, lest I accidentally step on a cultural landmine. Cut to a day later where I'd fallen deep, deep down an equally enjoyable and educational rabbit hole about Jewish holidays, (fostered my ongoing vendetta against the English language,) and found a Jewish bakery that's local to me because I wanted to try Challah very badly. (It was great.) (There is not a large Jewish population where I live [in case that wasn't obvious] I'm blaming my now-semi-remedied culture blindness on that. But Em, you took an elective on world religion in University? SHUT UP I KNOW.)

6. What's your favourite type of comment to receive on your work?

ANY COMMENT. I made an ao3 account last year because I wanted to not lurk quite so much, stop being a 'consumer' of fan-creations, and LEAVE SOME COMMENTS. And I'd seen authors talk about how great getting them was but holy guacamole nothing could have prepared me for the feeling of people liking something I wrote enough to leave a comment or a heart or an 'ah'.

7. What's the most fringe trope/topic you write about?

Errrrrrrr. I guess just gen-fic? Looking at the numbers of ship-fic in the archive, it certainly feels fringe-esque to write gen.

8. What is the hardest type of story for you to write?

I was going to say 'short' because things just keep happening when I try to write succinct outlines (somehow NONE OF THOSE 'THINGS' ARE PLOT), but after applying a bit more scrutiny to anything I've ever written; it's action. Fast-paced action. I don't know her.

9. What is the easiest type?

Assorted emotional whacks! When I was writing original fiction a solid decade ago as a teen-bean I favoured physical-whump, me now has found it a lot easier to write emotional-whump. Not sure why??? But here we are. (Either way someone's suffering.)

10. Where do you do your writing? What platform? When?

Okay this is actually a very involved story that I might tell later, but I just changed what platform I was using. SO! As of about a week ago I've been writing on google docs. Beyond that, it's a laptop/couch combo whenever I have the brain power (which is almost never 😭).

11. What is something you've been too nervous/intimidated to write, but would love to write one day?

OOOF. There are a few wips in the assorted-mountainous-pile of non-active development that are. Heavy. Heavier than the various fics/wips I've published/am actively poking at. I'd like to write them one day but I am also very 'hmm' when I look at them.

12. What made you choose your username?

So 'Em' is a real-life nickname, smash that together with my love of the colour green and tada! You get 'emerald'. 'Cats' is about... cats. I am obsessed with the little creatures, despite never owning one. (Initially I spelt it as 'kat'- no idea why??? I think I just like the letter 'k'???? Potassium?????????? B A N A N A???????????????) And 'thirteen' is my favourite number, just because I find the concept of a number being considered 'unlucky' hysterical and the idea that some airlines genuinely leave out a row thirteen because of superstition always makes me grin like an idiot. The order is purely because I like the image of a bunch of green cats running around together.

I have done a quick investigation and everyone I know has either already done this or already been tagged. (I have once again shown up two days late with iced-coffee to a tag-game. [At least I showed up, I forgot to do like three of these things despite loving them, I'M SORRY 😭])

If anyone sees this and they HAVEN'T been tagged, consider this your green-for-go flag and feel free to tag me as your tagger.

#THANK YOU BELOVEDS#feel very lucky to have stumbled onto this corner of the internet/fandom/world(??) full of such amazing people#always grateful for you all#tag game#writing tag

8 notes

·

View notes

Text

How to Open a Company in the US for Non-Citizens in 2024

Starting a business in the United States as a non-citizen might seem like a daunting task, but it's more accessible than you might think. Whether you're an entrepreneur with a groundbreaking idea or a small business owner looking to expand into new markets, the US offers a wealth of opportunities. This guide will walk you through the process of company registration in the US, breaking it down into simple steps that anyone can follow. By the end of this article, you'll feel confident in your ability to navigate the US business landscape and take your first step toward success.

Why Start a Business in the US?

It is true that the US market is among the largest and most active worldwide, which makes it a desirable location for entrepreneurs. Why should non-citizens think about establishing a business with a company in the US? In the first place it is because the US provides a steady economic climate, solid legal protections for companies as well as access to an extensive population of consumers. Furthermore the majority of investors prefer dealing with US-registered businesses, and incorporating within the US can boost your business's standing on the international scene.

Understanding the Legal Structure

Before you begin how to register, it's important to be aware of the different kinds of legal structures that are available to companies within the US. These structures will define the legal obligations of your business as well as tax and personal responsibility. Most commonly used options include:

Sole Proprietorship

Partnership

Limited Liability Company (LLC)

Corporation (C-Corp or S-Corp)

Each structure comes with pros and cons, based on your specific business requirements and requirements. It's important to select the one that is most suitable for your needs.

Choosing the Right Business Structure

The right structure for your business is akin to laying the groundwork for a structure. It must be strong and well-suited for the future plans you have. For the majority of non-citizens, creating an LLC is a common option because of its flexibility, a lower liability and management ease. However C-Corps are more suitable C-Corp could be more appropriate for those who plan to raise funds through investors.

LLC offers the flexibility, ease of use and security from personal responsibility.

C-Corp is a great option for companies that want to grow dramatically and draw investors.

Think about your goals for the business as well as the degree of control you would like to maintain, and also the tax implications in making the decision.

Registering Your Business Name

After you've decided on your business's structure The next step is to register your business name. Your company name is more than an identifier for your brand. It's your identity. Make sure that it's unique and memorable. For registration of your business name:

Do a search for names: Make sure your business's name isn't already used.

Register Your Name If you're not yet ready to sign up You can reserve your name for a certain time.

Create Your Own Business Name Name: Register your name with appropriate authorities of the state. The process is slightly different from state to state.

This ensures that your business name is legally recognized.

Obtaining a Federal Employer Identification Number (EIN)

An EIN is a type of identification number used by your business. It's vital to use for tax purposes, when hiring employees or opening a company bank account. Non-citizens are able to easily get an EIN through the IRS without the need for an Social Security Number (SSN). Here's how:

Apply online Apply Online: Visit the IRS website and fill out the EIN application form.

Apply via Mail Alternately, you could send Form SS-4 through either fax or mail.

After you've obtained your EIN You'll be officially acknowledged by the IRS and then you're able to proceed to the next steps.

Opening a US Business Bank Account

A US corporate bank account can be essential to control finances, accepting payments, and establishing credibility with clients and partners. Non-residents are able to create an US commercial bank account relatively easily and with the aid of fintech solutions such as Mercury, Wise, Relay Financial and Payoneer. What you'll need to do:

EIN The reason for this is that, as we mentioned earlier it is necessary to create the bank account.

Documentation of Business Registration Documentation proving that your company is registered legally within the US.

Personal Identification Passport or any other type of ID issued by the government.

Selecting the best bank for you will be based on your specific business needs So, look into your options thoroughly.

Navigating Taxes and Compliance

US Tax laws are a bit shady However, staying on top of tax laws is not a matter of choice. If you're a non-citizen owner of a business it is essential to know the federal and state tax regulations. Generally speaking, you'll need to comply with:

Annual Reports in HTML0 Based on your business's structure and your location.

pay federal taxes This includes tax on income, taxes for employment and perhaps excise taxes.

State taxes The tax rates vary state-by-state and some states don't have a tax on income.

A tax professional that specializes in taxation for non-residents can be an investment that will ensure that you're fulfilling all your obligations.

Hiring Employees in the US

If you're planning to employ employees from the US There are many legal procedures you'll need comply with. They include:

Registration to State Employment Agencies: For unemployment insurance as well as workers' compensation.

Conforming to Labor Laws: Including minimum wage, overtime and laws on non-discrimination.

Payment Taxes Payroll Taxes: You'll have to withhold these taxes and pay them on behalf of employees.

Knowing these rules is essential to avoid legal problems and penalty.

Managing Your Business Remotely

Being able to run a business from outside of the US is now possible thanks to the advancement of technology. Tools for project management, communication as well as financial administration make it much easier than ever before to run your company remotely. Consider using:

Cloud-based Accounting Software to keep on top of tax and financial obligations.

Tool for Project Management to coordinate with your team in the US or your partners.

Virtual Offices If you require an office in the US for business or legal reasons.

These tools will help you keep control of your business, regardless of where you are located in the world.

Maintaining good standing with US Authorities

When your business is established in operation, it's important to remain in good relations with the state or federal agencies. This includes:

Annual Reports and Filing as legally required in the jurisdiction in which your company is registered.

Renewal of Licenses and Permits Based on your sector, this could be a requirement that is ongoing.

Documenting exact Records for both tax and legal compliance.

Being on top of your obligations will allow you to avoid penalties and fines.

Establishing a business operating in the US as a non-citizen might be a daunting task, but by following the steps laid out in this article to help you make it through the process confidently. From choosing the appropriate company structure and understanding your tax obligations, and running your enterprise remotely every stage is vital to your success. The US provides a wide array of opportunities. If you have the right planning your business will be able to thrive in this competitive market.

FAQs

1. Can a non-US citizen own an enterprise inside the US? non-US citizens can also run a business within the US. There are no limitations on foreign ownership and you can select between various business structures such as LLC and C-Corp.

2. Do I require an US address for registering a business? You'll require an US address to register your business. It could be an actual address or a virtual office address, based on the requirements of your business.

3. What's the price to establish a company within the US? The cost is determined by the state and the business structure. In general, the cost is between $100 and $800 for registration costs.

4. Can I create an account with a US commercial bank account with out going to the US? Yes, a lot of fintech companies such as Mercury, Wise, and Payoneer permit non-US citizens to open US business bank accounts online.

5. What tax do I have in order to be a business owner? You'll be liable for state and federal taxes such as the tax on income, employment as well as excise tax in accordance with your business design and its location.

6. Do I require an authorization to begin an enterprise within the US? You do not require a visa in order to establish or run a business in the US. If you intend to work and live in the US then you'll need to get a visa.

7. What is the ideal business structure for non-citizens? A lot of non-citizens choose to form an LLC because of its flexibility and management ease. If you are planning to raise a significant amount of capital it is suggested that a C-Corp might be better suited.

8. Can I employ employees from the US as an owner of a business that is not a citizen? Yes, you are able to employ workers within the US. It is necessary to follow all state and federal employment laws, such as paying payroll taxes and offering workers with 'comp insurance.

9. What is the time frame to register a business to the US? The length of time varies according to state and business structure. It could take between a few days up to several weeks to finish your registration.

10. Can I run my US business remotely from a different country? Yes, you are able to manage your US company remotely by using online tools for project management, communication as well as financial administration. Many business owners who are not citizens successfully manage their US-based enterprises via their home countries.

#travel#usa#travkes#startusacompany#registeryourcompanyintheusa#businessconsultant#businessconsulting#companyformation#usacompanyregistration#uscompanyregistration#uscompanyformation#growyourbusiness#companyformationservices#companyformationservice#businessconsultingservices#uscompanyformationfornonresident

2 notes

·

View notes

Text

🚀 How to Start a 501(c)(3) Nonprofit Organization

Define Your Mission and Vision 🎯

Clearly articulate the purpose and goals of your nonprofit organization. Conduct Market Research 📊

Research similar organizations, community needs, and potential supporters to validate your mission. Form a Board of Directors 🧑🤝🧑

Assemble a group of dedicated individuals to serve as your board of directors, providing governance and oversight. Draft Your Bylaws 📋

Create the governing document that outlines your nonprofit's structure, roles, and operating procedures. Incorporate Your Nonprofit 🏢

Register your nonprofit with your state by filing articles of incorporation and paying the required fees. Obtain an Employer Identification Number (EIN) 🔢

Apply for an EIN from the IRS, which will be used for tax purposes and hiring employees. Apply for 501(c)(3) Status with the IRS 📄

Complete and submit Form 1023 (or Form 1023-EZ for smaller organizations) to apply for federal tax-exempt status. Develop a Fundraising Plan 💰

Plan how you will raise funds, including donations, grants, and fundraising events. Establish Financial Systems 💹

Set up a bank account, accounting system, and financial policies to manage your nonprofit’s finances responsibly. Comply with Ongoing Requirements 🔄

Stay compliant with federal, state, and local regulations, including annual reporting, tax filings, and board meetings. Start your journey to making a positive impact by establishing your 501(c)(3) nonprofit organization with these essential steps! 🌟 #Nonprofit #501c3 #Charity #CommunityImpact #NonprofitOrganization

6 notes

·

View notes

Text

Setting up a corporation in USA

The United States is a land of opportunity, and many entrepreneurs dream of starting a business there. If you're one of them, you'll need to choose the right business structure. One popular option is to incorporate as a corporation. MAS LLP can help you with the process of setting up a corporation in USA. We have a team of experienced professionals who can guide you through every step of the way, from choosing a business name to filing your articles of incorporation. Why Choose to Setting up a corporation in USA? There are many reasons why entrepreneurs choose to Setting up a corporation in USA. Some of the most common benefits include: Limited liability protection: This means that your personal assets are protected from business debts and liabilities. Pass-through taxation: Corporations are not taxed on their profits. Instead, the profits are passed through to the shareholders, who are taxed on them at their individual rates. Access to capital: It is easier for corporations to raise capital than other types of businesses.

Steps to Incorporating in the USA

The process of Setting up a corporation in USA can vary depending on the state in which you choose to incorporate. However, the general steps are as follows:

Choose a business name: Your business name must be unique and comply with all state and federal laws. Appoint a registered agent: A registered agent is a person or entity that will receive legal documents on behalf of your business. File articles of incorporation: Articles of organization are a legal document that states the basic information about your business, such as its name, address, and purpose. Apply for an employer identification number (EIN): An EIN is a tax identification number that you will need to file your taxes. Develop bylaws: Bylaws are the rules that govern the internal operations of your corporation. Hold your first board of directors meeting: At this meeting, the board of directors will elect officers and make other important decisions. MAS LLP Can Help

MAS LLP can help you with every step of the Setting up a corporation in USA process. We can:

Help you choose a business name and check for availability. Appoint a registered agent for you. File your articles of incorporation and other necessary paperwork. Apply for an EIN. Draft bylaws for your corporation. Help you hold your first board of directors meeting. We can also provide you with ongoing legal and compliance support.

Contact MAS LLP Today If you're thinking about Setting up a corporation in USA, contact MAS LLP today. We can help you make sure that your business is set up correctly and that you are in compliance with all state and federal laws. In addition to the services listed above, MAS LLP can also help you with: Obtaining business licenses and permits Setting up your accounting and corporation. Filing your taxes We are committed to helping our clients succeed. Contact us today to learn more about how we can help you set up your corporation in the USA.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

4 notes

·

View notes

Text

How to Stay Legally Compliant as a New Entrepreneur: Key Essentials

Starting a new business is an exciting and challenging endeavor, but it also entails a host of legal obligations that every entrepreneur must comply with. Navigating the complexities of legal compliance is essential for the long-term success and sustainability of your business. Failing to comply with the law can lead to costly fines, penalties, or even the closure of your business. In this article, we’ll explore the key legal essentials that new entrepreneurs must consider to stay compliant.

Understand the Business Structure

One of the first steps in starting a new business is choosing the proper legal structure. The type of structure you select—such as a sole proprietorship, limited liability company (LLC), corporation, or partnership—will affect how your business is taxed, your liability, and other critical aspects of your operations. Each structure has its pros and cons, and it’s essential to understand the implications of each.

For example, a sole proprietorship is the simplest form of business structure. Still, it offers no protection from personal liability, meaning your assets could be at risk if your business faces a lawsuit or debt. On the other hand, forming an LLC or corporation offers protection from personal liability, ensuring that your assets are separate from the business. Consider consulting with a legal professional to determine the best structure for your business.

Register Your Business and Obtain Necessary Licenses

Once you’ve decided on your business structure, the next step is to officially register your business with the appropriate state or local authorities. This process typically involves filing paperwork with the Secretary of State’s office or a similar agency, and it will allow you to obtain the necessary permits and licenses required for your specific industry.

In addition to state registration, many businesses are required to obtain federal and local licenses. These licenses can vary widely depending on the nature of your business. For instance, if you’re opening a restaurant, you’ll need health department permits, food handling certifications, and alcohol licenses if you plan to serve alcohol. Ensuring that you have all the necessary permits will prevent you from facing legal issues down the road.

Comply with Tax Requirements

Tax compliance is one of the most critical aspects of running a business. As a new entrepreneur, you must understand your business’s tax obligations to avoid penalties. The type of taxes you need to pay will depend on your business structure, location, and the nature of your business.

At the federal level, you will likely need an Employer Identification Number (EIN), which is used to identify your business for tax purposes. Even if you don’t plan to hire employees immediately, an EIN is required for opening a business bank account. You will also need to determine whether your business is subject to income tax, payroll tax, sales tax, or excise tax. Each of these taxes has different filing and payment deadlines, so it’s crucial to stay organized and compliant.

State and local tax obligations also vary, and some states impose their own income or sales tax on businesses. You should research your state’s tax laws to ensure that you are filing and paying the appropriate taxes. To simplify your tax compliance, consider hiring a certified public accountant (CPA) to help you navigate the complexities of business taxes.

Protect Your Intellectual Property

As a new entrepreneur, your intellectual property (IP) is one of your most valuable assets. Protecting your IP—such as trademarks, copyrights, and patents—will help prevent others from using your creations without your permission. Intellectual property laws are complex, but understanding how they apply to your business can save you from future legal disputes.

Trademarks are used to protect brand names, logos, and slogans. If you have a unique business name or logo, consider registering it with the U.S. Patent and Trademark Office (USPTO). This will give you exclusive rights to use that trademark in connection with your products or services. Copyrights protect creative works such as writing, music, and art, while patents protect new inventions or discoveries. Depending on your business, you may need to file for one or more types of IP protection.

Follow Employment Laws

If you plan to hire employees, it’s essential to understand and comply with employment laws. These laws encompass a broad range of topics, including wages, working hours, discrimination, employee benefits, and other related matters. For example, the Fair Labor Standards Act (FLSA) dictates minimum wage requirements and overtime rules for employees.

Additionally, businesses must comply with anti-discrimination laws under the Equal Employment Opportunity Commission (EEOC). It’s essential to create policies that prevent workplace discrimination and harassment and ensure fair treatment of all employees. As an employer, you also need to maintain accurate records, pay the correct wages, and withhold taxes from employee paychecks. Consulting with an employment lawyer or HR expert can help ensure that you’re compliant with these laws.

Maintain Proper Contracts and Agreements

Contracts are an essential part of business operations, and they help protect your interests in legal disputes. Whether you’re working with suppliers, clients, employees, or business partners, having well-drafted contracts is critical. These agreements should outline the terms and conditions of the business relationship, including payment terms, deliverables, timelines, and any other essential provisions.

A solid contract can prevent misunderstandings and minimize the risk of disputes. As a new entrepreneur, you should work with a business attorney to ensure that your contracts are legally sound and enforceable. In particular, you’ll want to create contracts for employees, independent contractors, clients, and vendors to ensure that everyone’s responsibilities are clear.

Staying legally compliant as a new entrepreneur requires careful planning and attention to detail. From selecting the proper business structure and registering your business to understanding your tax obligations and protecting your intellectual property, there are many legal considerations to keep in mind. By staying informed and seeking legal guidance when needed, you can avoid costly mistakes and build a strong foundation for your business.

1 note

·

View note

Text

How to Create a Consulting Company?

Are you an expert in your field and wondering how to start a consulting business? Whether you’re a marketing guru, IT wizard, HR strategist, or financial advisor, launching your own consulting company in 2025 could be your smartest career move yet. The global consulting market continues to boom, offering lucrative opportunities for professionals who want to monetize their knowledge.

In this comprehensive guide, you’ll learn exactly how to create a consulting company, from idea to execution—optimized with the latest strategies for building a scalable and successful business.

Step 1: Define Your Niche

The first step to start a consulting business is identifying your consulting niche. This is crucial because clients want experts, not generalists.

Popular consulting niches in 2025:

Business Strategy Consulting

Digital Marketing Consulting

IT and Cybersecurity Consulting

Financial Advisory Consulting

HR and Talent Management Consulting

Sustainability and ESG Consulting

Step 2: Create a Solid Consulting Business Plan

Every successful consulting company begins with a well-structured business plan. It outlines your goals, target audience, pricing strategy, and marketing approach.

Your consulting company business plan should include:

Executive Summary

Market Analysis

Competitive Positioning

Service Offerings

Revenue Model

Marketing Strategy

Financial Projections

Download our free consulting business plan template to get started.

Step 3: Register Your Business

To legally operate your consulting firm, you'll need to:

Choose a business structure (LLC, S-Corp, etc.)

Register your company name

Get a business license

Apply for an EIN (Employer Identification Number)

Make sure your business name is unique and includes words like “Consulting,” “Advisors,” or “Solutions” for brand clarity and SEO benefit.

Step 4: Build a Professional Online Presence

Your website is your #1 lead generation tool.

Essentials for a consulting business website:

Clear value proposition

Client testimonials

Case studies

Service breakdowns

Blog for SEO traffic

Easy contact form

Include keywords like “how to become a consultant,” “business consulting services,” and “small business advisor” to rank on Google.

Step 5: Set Your Pricing Model

How much should you charge as a consultant?

Common pricing models:

Hourly rate

Retainer packages

Project-based fees

Value-based pricing

Research your industry rates and position yourself as a premium consultant by highlighting unique expertise and proven results.

Step 6: Market Your Consulting Company

Marketing is where many consultants struggle, but in 2025, the opportunities are endless.

Top marketing strategies:

LinkedIn lead generation

Guest blogging

Webinars and virtual workshops

Email marketing funnels

Google Ads and SEO

Focus on high-converting keywords like:

“Start a consulting company”

“Consulting firm for startups”

“How to launch a consulting business”

Step 7: Deliver Results and Scale

Once you land your first clients, your focus should shift to delivering value and building long-term relationships. Happy clients mean referrals, testimonials, and recurring revenue.

Scale your consulting business by:

Hiring subcontractors or junior consultants

Automating processes with CRM tools

Offering group coaching or digital courses

Creating proprietary frameworks

Final Thoughts

Starting a consulting company in 2025 doesn’t require a massive investment—just your expertise, clarity of vision, and the right strategy. Follow these steps to build a profitable, scalable business and position yourself as a go-to expert in your industry.

#consulting#staffingsolutions#consultant#it staffing company#staffing services#recruitment#contract staffing#staffing agency

0 notes

Text

How to Register a Company in Miami: Step-by-Step Guide

Starting a business in Miami can be an exciting and rewarding endeavor, thanks to its thriving economy, business-friendly climate, and diverse opportunities. Whether you're launching a startup or expanding an existing brand, registering your company correctly is the first crucial step. This guide walks you through the entire process of company registration in Miami in a clear, straightforward way. By the end, you'll have a solid understanding of the legal steps, required documentation, and how to stay compliant from day one. Let's make your entrepreneurial dream in Miami a legal reality.

Choose the Right Business Structure

Before beginning the registration process, it’s essential to decide on the structure of your business. In Miami, the most common types include sole proprietorships, limited liability companies (LLCs), corporations, and partnerships. Each type comes with different legal implications, tax obligations, and personal liability levels. LLCs are particularly popular due to their flexibility, pass-through taxation, and protection of personal assets. Make sure to evaluate your business goals and consult a legal or financial advisor if you’re unsure which structure fits your needs.

Name Your Business and Check Availability

Naming your business is more than just choosing something catchy—it must also comply with Florida naming laws. You’ll need to ensure your business name is unique and distinguishable from others already registered in the state. Start by checking the name availability through the Florida Division of Corporations website. Once confirmed, consider reserving the name to avoid it being taken while you prepare the rest of your registration documents. Also, check for available domain names if you plan to establish an online presence.

Register with the Florida Division of Corporations

All businesses operating in Miami must register with the Florida Division of Corporations. You can do this online through the Sunbiz portal. The forms you’ll need depend on your business structure. For example, registering an LLC requires filing the Articles of Organization and paying a filing fee. Once completed, the state will issue a document confirming your business's legal formation, which you should keep in a secure place for future reference. This is the official step that makes your business legally recognized in Florida.

Apply for an EIN from the IRS

An Employer Identification Number (EIN) is required for most businesses, even if you don’t have employees. It’s used for federal tax filings, opening a business bank account, and applying for certain licenses. You can apply for an EIN directly from the IRS website at no cost. The process is quick and straightforward—once submitted, you’ll usually receive your EIN immediately. Keep this number safe, as you’ll use it frequently when managing your business finances and operations.

Register for State and Local Taxes

Depending on your type of business, you may need to register for specific taxes at both the state and local levels. In Florida, this includes sales tax, reemployment tax, and corporate income tax. If you’re selling taxable goods or services, you’ll need to register with the Florida Department of Revenue to collect and remit sales tax. Miami-Dade County may also require local business taxes. Make sure to research and fulfill all tax obligations to avoid penalties and stay compliant.

Obtain Necessary Business Licenses and Permits

Licensing requirements vary widely depending on your industry. Some businesses in Miami need professional licenses, health permits, or zoning approvals before they can legally operate. For instance, restaurants require health department clearance, and construction companies need contractor licenses. Check with the City of Miami and Miami-Dade County regulatory agencies to determine the specific permits applicable to your business. It’s wise to obtain all required licenses before launching to ensure a smooth and legal operation.

Open a Business Bank Account

Once your company is registered and you have your EIN, opening a business bank account is your next logical step. A dedicated business account helps separate personal and company finances, making bookkeeping easier and providing more credibility with clients. Most banks in Miami offer tailored business account packages, so shop around for one that meets your financial needs. Bringing your registration documents and EIN will streamline the process during your bank visit.

Draft an Operating Agreement or Corporate Bylaws

While not always legally required, having an operating agreement (for LLCs) or corporate bylaws (for corporations) is highly recommended. These documents outline the structure, roles, and responsibilities of members or shareholders. They help prevent conflicts and provide clear guidelines for decision-making and dispute resolution. In the event of legal disputes or audits, having these agreements in place demonstrates responsible management and can be used to protect your interests.

Set Up Your Accounting and Record-Keeping Systems

Good financial management starts with organized and accurate record-keeping. Setting up your accounting systems early helps you stay compliant with tax regulations and monitor your business’s performance. Many Miami-based entrepreneurs use software like QuickBooks or hire local accountants to manage their books. Be sure to track all income, expenses, employee payrolls, and tax payments. If you're not confident handling this yourself, professional accounting services can ensure that nothing falls through the cracks.

Promote Your Business and Stay Compliant

Once your company is officially registered and ready to operate, it's time to promote it. Build a website, launch social media accounts, and register with online directories. While you focus on growth, don’t forget to maintain compliance. This includes filing annual reports with the Florida Division of Corporations, renewing licenses, and staying current with taxes. Failure to meet these requirements could result in penalties or administrative dissolution of your business. Stay informed and proactive to keep your business in good standing.

Consider Professional Help When Needed

While it’s possible to handle all aspects of registration yourself, many entrepreneurs opt for professional support to avoid costly errors and streamline the process. Using company registration services Miami businesses rely on can save time and ensure compliance. These services typically handle paperwork, filings, and even provide reminders for ongoing compliance deadlines. It’s an excellent option if you’re launching your first company or want to focus on other areas of business development.

Final Thoughts

Registering a company in Miami involves several steps, but each is essential to building a legal and sustainable business. From choosing the right structure and registering with the state to securing licenses and staying compliant, taking the time to do it right from the start will pay off in the long run. Miami’s vibrant business environment offers plenty of opportunities—and now, you’re well on your way to making the most of them.

At Greenlight Financial, we offer personalized accounting support that helps small and medium-sized businesses thrive. Our focus is on delivering expert guidance through trusted relationships and innovative solutions that support your business’s growth with clarity and confidence.

#companyregistrationmiami#startabusinessinmiami#registerllcmiami#floridabusinessregistration#businesslicensemiami#miamistartupguide#howtoopenacompanyinmiami#miamientrepreneurtips#companyformationflorida#smallbusinessmiami

1 note

·

View note

Text

IBO reference notes on . . . mobile suit designations

And now for some deeply useless observations on how mobile suits are labeled in Iron-Blooded Orphans.

(I’m purely looking at this ‘in fiction’; I know most of these are in fact in-jokes based on the mecha designers’ names.)

Starting with the titular Gundam frames, these are each designated ASW-G-XX, where XX is a number between 01 and 72 (or literally XX for Vidar). We have no canonical explanation for what ‘ASW’ means, but all other types of mobile suit have a similar letter string in their codes. I personally favour the idea it references the manufacturer, and that each frame family represents the work of a different group, but there’s nothing backing that up.

Interestingly, the mobile armours are *not* given identification codes. Given that they bear the same symbol as the Gundams on key components, however, we might suppose that using ASW-A or something like that would make sense, in a ‘underlining the obvious connection’ fashion. (Well, now I’ve said that, this might only apply to Hashmal and Harael; Ananel and Nemamiah look distinct enough to have come from different manufacturers.)

Valkyrja frames, meanwhile, follow a slightly more impenetrable logic:

V03-0907 Oltlinde

V04-0630 Waltraute

V07-0126 Sigrún

V08-1228 Grimgerde

We can presumably add V0_-0526 Helmwige, based on the V08Re-0526 Helmwige Reincar (AKA the Grimgerde in new clothes), although we don’t know what its prefix number is supposed to be.

Graze frame codes, by contrast, run thus:

EB-05s Schwalbe Graze

EB-06 Graze

EB-06j Graze Ground Type

EB-06N Graze Stachel

EB-06Q Graze Schild

EB-06r Graze Ritter

EB-06rs Graze Ritter Commander Type

EB-06s Graze Commander Type

EB-06t Graze Trainer Type

I don’t know if the capitalisation is meant to be meaningful. I would assume not since there’s nothing particularly special about the Stachel and Schild that would make them stand out from the pack (they’re basically different equipment sets on a standard Graze. The Schwalbe is the prototype for the frame, and is numbered straight on from the Geirail, EB-04. Currently, no model has been designated EB-07 but based on the above, we can assume it was the prototype for the Reginlaze.

The AEB-06L Hloekk Graze has a modified numbering convention, presumably because it is a modified Graze. But I’m not sure what to do with the EB-AX2 Graze Ein. It’s not really a custom (more on which later), nor does it have a proper place in this lineage, though design elements would be incorporated into the Reginlaze Julia. It’s just this weird outlier monster prototype thing.

Regardless, the two mainline Reginlaze variants follow the same schema as Grazes:

EB-08 Reginlaze

EB-08s Reginlaze Commander Type

Moving out of Gjallarhorn, the standard configuration for the Hexa frame has two versions,

IPP-0032 Gilda

IPP-0032S Gilda SAU

Which are basically the same thing with differing load-outs. We see IPP-0032 in the context of construction models hijacked for the purposes of insurrection, and the IPP-0032S fielded by the SAU military. Then we get:

IPP-18875 Enzo

IPP-66305 Hugo

The Hugo is the most prominent Hexa in IBO proper, since ‘suits of this type are used by the Dawn Horizon Corps and JPT Trust. An Enzo, meanwhile, shows up as Range’s first machine in IBO:Urdr Hunt - and I’m saying ‘an Enzo’ because while the descriptions implies it’s fairly rare/unique, the numbering suggests it’s a type rather than a custom model.

This assumption is based on the pattern that continues with the Rodi frames, where standard mass-production models have simple ‘letter string hyphen alphanumerical’ codes:

UGY-R38 Spinner Rodi

UGY-R41 Man Rodi

UGY-R41 Landman Rodi

UGY-R45 Garm Rodi

No code has been given for the Monkey Rodis used by 598′s human debris crew, though they appear to be another Man Rodi variant. Perhaps oddly, there is no distinction between Man and Landman Rodis. Most other equipment swaps see some update to the numbering, leaving this an oddity. Then again, why would Tekkadan have bothered registering them under a new classification when they redid the legs?

Then we have the Teiwaz/Io frame mobile suits:

STH-05 Hyakuren

STH-05R Rouei

STH-14s Hyakuri

STH-16 Shiden

STH-20 Hekija

All of this essentially leaves us with two ‘genres’ of base mobile suit IDs: mass production types that have a consistent form like (ABC)-(ABC123), and lines of unique ‘suits where each is identified individually: ASW-G-XX, V0X-(1234).

Conclusions? Not many, but I would propose the machine specific codes for the mass-production types (that is, say, Crank Zent’s particular Graze) might follow the Valkyrja form of ID in having an addition numerical string. There’s no obvious reason for the Valkyrjas to be numbered so precisely since the implication in various materials is that there’s only nine of them, but if it is in fact following common practice (Ahab reactor number, maybe?) we might infer a more precise machine code running ‘ EB-06-0505′ or ‘IPP-18875-7007′.

What we don’t have to infer is the convention for custom models based on mass-production ‘suits, which is usually to append a string including the letter ‘c’ to the end of the ID. Thus we have:

EB-06/tc Graze Custom

EB-06/tc2 Ryusei-Go

EB-06/tc3 Ryusei-Go (repaired)

STH-16/tc Shiden Custom (Ryusei-Go III/Riden-Go)

STH-16/tc2 Orga's Shiden (The King’s Throne)

EB-08jjc Reginlaze Julia

MPM02/AC Triaina

STH-05/AC Amida's Hyakuren

UGY-R41/H Hakuri Rodi

EB-06/T2C Regal Lily

STH-14/T2C Kallisto

UGY-R41/T2C Labrys

To take these in sets -- ‘tc’ obviously stands for ‘Tekkadan Custom’. We have one based on Crank’s Graze getting up to ‘tc3′ before being retired in favour of a customised Shiden, and the King’s Throne as the second Shdien custom commissioned for Tekkadan.

The Julia is a ‘Julieta Juris Custom’. Given this is something being produced by the R&D division, we could label it a prototype ala the Graze Ein, but since the Julia is decidedly built with Julieta in mind, custom is the better term.

I didn’t include the Triaina previously because we only ever see one of them and it’s labelled the same way as Amida’s Hyakuren (AC), which we know is ‘custom built’ in the sense of being a pseudo-prototype made with better materials. So this might be a case of a limited run rather than unique unit.

The Hakuri Rodis are scrap-heap Man Rodis with cobbled-together armour (literally Brewers’ cast-offs found in a debris zone). It’s not surprising they break the pattern.

Tanto Tempo’s customs (T2C) make a pattern of labelling by organisation. Descriptions confirm the Labrys are customised by Tanto Tempo, so they’re not a sub-type in their own right, just a made-to-order variant of the Landman Rodi. Curiously, the Kallisto suggests the existence of a STH-14 model as distinct from the STH-14s Hyakuri. Or the ‘s’ just got dropped when Gianmarco ripped off the backpack.

From all of this, we might therefore conclude that the EB-04jc4 Geirail Scharfrichter is also a custom model. Its profile describes it as a sister machine to the normal Geirail, but it being unique to the mercenary company Mossa employs feels more sensible than it being some kind of standard variant (honestly, I usually forget it even exists).

Finally, there’s the matter of customised Gundams. These don’t generally see an addition to the number codes when they are updated, which might reflect an expectation they will be reconfigured semi-regularly (Kimaris certainly came with a lot of optional extras and it’s Dantalion’s whole gimmick). But nevertheless, common practice appears to be to add extra words to the name:

ASW-G-08 Gundam Barbatos Lupus

ASW-G-08 Gundam Barbatos Lupus Rex

ASW-G-11 Gundam Gusion Rebake

ASW-G-11 Gundam Gusion Rebake Full City

ASW-G-29 Gundam Astaroth Rinascimento

Gundam Hajiroboshi Alector

ASW-G-47 Gundam Vual Yuhana

ASW-G-66 Gundam Kimaris Trooper

ASW-G-66 Gundam Kimaris Vidar

Going back to V08Re-0526 Helmwige Reincar, we see this applied here as well, so theoretically, were there another line of individually IDed mobile suits, the same thing would apply to that.

And there you have it. I have no idea why I thought this was something I should write about but I did.

Other reference posts include:

IBO reference notes on … Gjallarhorn (Part 1)

IBO reference notes on … Gjallarhorn (Part 2)

IBO reference notes on … Gjallarhorn (corrigendum) [mainly covering my inability to recognise mythical wolves]

IBO reference notes on … three key Yamagi scenes

IBO reference notes on … three key Shino scenes

IBO reference notes on … three key Eugene scenes

IBO reference notes on … three key Ride scenes

IBO reference notes on … the tone of the setting

IBO reference notes on … character parallels and counterpoints

IBO reference notes on … a perfect villain

IBO reference notes on … Iron-Blooded Orphans: Gekko

IBO reference notes on … an act of unspeakable cruelty

IBO reference notes on … original(ish) characters [this one is mainly fanfic]

IBO reference notes on … Kudelia’s decisions

IBO reference notes on … assorted head-canons

IBO reference notes on … actual, proper original characters [explicit fanfic – as in, actually fanfic. None of them have turned up in the smut yet]

IBO reference notes on … the aesthetics of the mobile frame

11 notes

·

View notes

Text

What Do Truck Owners Need to Know About IRS 2290 Filing in 2025?

The trucking industry is the backbone of the American economy, delivering goods across states and keeping supply chains moving. But behind every long haul and heavy-load trip, there are important regulations and tax obligations that every truck owner must follow. One such requirement is the annual filing of IRS 2290 — a crucial step that keeps vehicles legally on the road and businesses compliant with federal law.

For both new and seasoned truckers, understanding the details of this form can be the difference between smooth operations and costly penalties. Whether you manage a single vehicle or a fleet, this form applies to anyone operating heavy vehicles weighing 55,000 pounds or more on public highways.

What Is IRS 2290 and Why Is It Required?

IRS 2290, also known as the Heavy Vehicle Use Tax (HVUT), is a federal tax form used to report and pay taxes on heavy highway vehicles. The funds collected go toward maintaining and improving the roads and highways these vehicles use frequently.

If your truck meets the weight requirement and is registered in your name, you must file this form annually. The filing season begins July 1st, and the deadline to file and pay the tax is August 31st. If you purchase a new vehicle, the deadline is the last day of the month following the month you first use the vehicle.

Filing this form is more than a legal obligation — it’s necessary for vehicle registration. Without a stamped Schedule 1 (proof of payment), you cannot register your truck or renew its plates with the Department of Motor Vehicles (DMV).

Who Must File?

You must file IRS form 2290 if:

Your vehicle weighs 55,000 pounds or more.

It travels on public highways.

It’s registered in your name.

Even if your vehicle does not exceed the annual mileage use limit (5,000 miles or 7,500 miles for agricultural vehicles), you are still required to file — although you may qualify for tax suspension.

What Information Is Needed to File?

Before filing, you need to gather the following:

Employer Identification Number (EIN) – SSNs are not accepted.

Vehicle Identification Number (VIN) for each vehicle.

Taxable Gross Weight of each vehicle.

The date you first used the vehicle on a public highway during the current tax period.

Having these details ready will ensure a faster and smoother filing process.

Where and How to File IRS 2290

There are two main ways to file:

Electronically (e-File): Highly recommended, especially if filing for 25 or more vehicles. Many IRS-approved e-filing providers offer instant confirmation and simplified filing.

By Paper: You can mail a completed paper form to the IRS, though processing times may be longer.

E-filing is not only faster but also helps reduce errors, making it a preferred method for most truck owners and tax professionals.

Key Benefits of E-Filing

Immediate access to your stamped Schedule 1.

Automatic error checks before submission.

Secure and encrypted data transmission.

Save time with bulk VIN import options.

Common Mistakes to Avoid

Filing mistakes can delay your Schedule 1 or lead to penalties. Here are common errors and how to avoid them:

Incorrect EIN: Make sure it’s valid and registered with the IRS.

Wrong VIN: Double-check each VIN before submission.

Missed Deadline: Late filings result in penalties and interest.

Underreported Gross Weight: Leads to underpayment and future issues.

Bullet Points: Filing Tips for Truck Owners

File early to avoid deadline pressure.

Use only EINs (not SSNs) for all filings.

Verify all vehicle information before submitting.

Use IRS-approved e-file providers for speed and convenience.

Keep your stamped Schedule 1 safe — it is required for vehicle registration.

How IRS Form 2290 Affects Your Trucking Business

Proper tax compliance through irs form 2290 filing ensures uninterrupted operations, especially when it comes time for vehicle registration or renewals. It also builds credibility and professionalism in your business. Clients and partners are more likely to work with carriers who operate within legal and regulatory frameworks.

Aside from legal compliance, staying current with IRS requirements helps in financial planning. Knowing your tax obligations in advance allows you to budget accordingly, avoiding any last-minute financial strain or delays in paperwork.

Final Thoughts

Filing IRS 2290 may seem like just another administrative task, but it plays a crucial role in the trucking business. It keeps your operations compliant, helps maintain national infrastructure, and supports smoother workflow when it’s time to register or renew your vehicle.

For truck owners and fleet managers, understanding and staying up to date with tax obligations is part of running a successful business. Make sure to file before the deadline each year, use trusted e-filing services, and double-check your data to ensure everything is accurate. In the fast-paced world of trucking, staying compliant means staying on the road — and that starts with timely and accurate filing of IRS 2290.

#2290 2025#2290 2025 online#2290 form online#2290 online#2290 tax#form 2290 2025#irs 2290#irs form 2290

0 notes

Text

Small Business Setup: Resources and Guidance

Key Takeaways

Choosing the appropriate type of business entity and an original business name helps to ensure that you are laying a solid groundwork. What you choose will affect both your legal obligations and your brand image.

Register your business as soon as possible! Get the required tax ID numbers to avoid hassles with local tax authorities and make doing business easier.

Learn more about different types of funding available, such as government grants or other industry-specific grant programs, to find the financial resources you need for your venture.

Use smart strategies, digital tools, and resources to save costs and create your business presence online.

Create a cost-effective marketing plan Consider a multi-channel approach by combining local and online marketing techniques to get the word out without breaking the bank.

Connect with local networks and community resources for support, and consider participating in events to build relationships and grow your business.

Small business setup refers to the guidance and resources available for entrepreneurs looking to start their own ventures. Knowing the steps you need to take, from selecting the right business structure to registering with your local government, can make things easier.

Some of the biggest obstacles for new business owners include learning how to budget, developing a solid business plan, and meeting legal requirements. Having reliable information and access to trusted technical advice helps make these tasks a lot less intimidating.

From locating funding opportunities and learning about tax requirements to creating successful marketing plans, help is needed every step of the way. This post will outline practical steps and tips to assist you in establishing your small business and achieving your entrepreneurial goals.

Essential Steps to Start Your Business

The first steps in starting a small business enterprise require executing each step with a keen eye, understanding how it will impact your business checking account and overall financial health.

1. Choose Your Business Structure

Deciding on a business structure like a sole proprietorship, partnership or corporation is very important. This decision has major implications for taxes, liability and ownership.

For example, a sole proprietorship may provide ease and immediate authority, yet it puts personal property at risk for business obligations. A corporation provides a greater shield from personal liability, but it comes with increased regulation and administrative burden.

2. Select a Unique Business Name

A unique business name can help establish your identity and give you an edge in a competitive industry. Make sure the name you choose has positive connotations and associations with your target audience.

Additionally, be sure to check trademark availability to prevent future legal entanglements.

3. Register Your Business Officially

In fact, registering your business with your Secretary of State is required by law. This step officially establishes your business, providing it with a distinct legal identity and entity so you can conduct business legally.

Creating a business checking account is the easiest way to start keeping everything separate and make it clearer which expenses go where.

4. Obtain Necessary Tax Identification Numbers

You’ll need to obtain a federal employer identification number (EIN) to be used for tax purposes. This is a free number, easily acquired from your state department of revenue.

It is required for hiring employees and filing taxes.

5. Apply for Required Licenses and Permits

You’ll need to check with state and local authorities to see what types of licenses and permits you need. Fulfilling requirements by registering with the Department of Revenue and getting local permits protects your business.

This ensures you can operate without disruption.

Securing Funding and Financial Support

Clearly securing funding through options like a small business checking account is going to be key for small business success. Understanding these financing options will allow small business owners to navigate their financial landscape and position themselves for success in the small business community.

Explore Government Grant Opportunities

Federal government grants can be some of the most overlooked opportunities. Unlike loans, they don’t have to be paid back, which makes them an appealing prospect. There are programs such as the Small Business Innovation Research (SBIR) that provide money to support R&D.

Entrepreneurs are encouraged to investigate the wide array of local and national grant opportunities that best match with their business objectives.

Understand Contract Assistance Programs

Contract assistance programs help smaller firms get government contracts. These programs help small businesses navigate the bidding process, educating them on what they need to know, eligibility, and requirements.

For instance, the 8(a) Business Development Program enables socially and economically-disadvantaged entrepreneurs to better compete for federal contracts.

Investigate Industry-Specific Funding Options

Funding options that are specific to industry sectors can be used to meet the specialized needs of businesses. For instance, a new technology startup will likely be drawn to venture capital, whereas an ag-tech startup would seek out cooperative grants.

Every sector maintains its own unique funding sources that can offer tremendous monetary support.

Navigate the Funding Landscape in Today's Economy

While the current economic environment is undeniably tough, it opens many doors. Credit score less than 680 can be a challenge for many entrepreneurs. For people with a credit score below 680, traditional lending options start to dry up.

Particularly microloans, which can be as small as $50,000 or less, are good alternatives. Bootstrapping demonstrates commitment, while timely payments on business credit cards build creditworthiness.

Mature businesses pay competitive interest rates with a proven record of generating more than $100,000 in yearly revenue.

Minimizing Startup Costs Effectively

Minimizing startup costs effectively is a key practice for small business owners who want to get their business up and running in a sustainable manner. This section dives into a few strategies, including utilizing free resources and understanding financing options, to minimize costs without sacrificing quality or efficiency.

1. Implement Cost-Effective Strategies for Setup

Explore virtual offices or shared office spaces to sidestep the expensive burden of leased offices. These options allow for greater flexibility and even less overhead during those start-up days.

Buying quality, professionally refurbished office furniture and equipment can save a bundle on startup costs while still providing a great atmosphere. Develop a detailed spreadsheet of possible costs.

Everything from legal fees to office supplies, get specific about where you can cut costs!

2. Leverage Digital Tools for Operations Management

Taking advantage of free or low-cost software solutions can save time, improve efficiency, and reduce operational costs. Open-source tools or cloud-based applications frequently provide the level of functionality you need without all the startup sticker shock.

Having a clear budget and financial plan is essential. By focusing on only what’s needed to start, businesses can save on cash flow and cut out the waste.

3. Establish a Professional Online Presence on a Budget

Creating a professional online presence on the cheap is crucial. Specifically, entrepreneurs can take advantage of social media platforms and website builders that have low-cost or no-cost solutions.

This strategy gives companies a chance to connect with a wider customer base at little to no cost. With consistent monitoring of financial strategies, you can guarantee that you’re continuously streamlining costs, supporting sustainable practices for the future.

Marketing Strategies for Small Businesses

Marketing strategies are key to small business owners looking to establish their presence in their communities. By focusing on targeted planning, utilizing various channels, and implementing cost-effective tactics, these small business enterprises can optimize their marketing efforts and achieve sustainable growth.

1. Create a Targeted Marketing Plan

A targeted marketing plan is essential. A clear marketing plan outlines who your small business is trying to reach. This means doing the necessary market research to determine your target customers’ demographics, preferences, and pain points.

For example, a new local coffee shop may want to focus on attracting young professionals who are looking for convenient lunch-time options. By customizing communications and promotions to this demographic, the café will improve engagement and increase conversion rates.

2. Utilize Local and Online Marketing Channels

Finding the right balance between local and online marketing channels is key to maximizing your reach. Local marketing might be sponsoring community events, putting up flyers in local businesses, or joining forces with other local businesses.

You can establish a digital footprint using social media channels. Beyond that, you can take advantage of email newsletters and search engine optimization (SEO).

For instance, a small boutique could organize a pop-up shop. Simultaneously, it can use Instagram to market its goods to further entice local shoppers, as well as online followers.

3. Develop Budget-Friendly Promotional Tactics

We know that small businesses usually don’t have much money to play with. However, developing budget-friendly promotional tactics is crucial. Even small investments can have a powerful impact!

Tactics such as referral programs, social media contests, and partnerships with local influencers can create excitement and awareness without expensive outlays. A small gym could offer a discount for every new member referred by an existing member, effectively leveraging word-of-mouth marketing.

Common Mistakes to Avoid During Setup

Running a small business enterprise is challenging enough without stepping on preventable land mines that are often hidden in the grass. Understanding these frequent pitfalls can help small business owners focus their efforts on successfully launching, then scaling their business.

1. Identify Critical Pitfalls in Business Launch

The biggest mistake of all is skipping on market research. Without a clear picture of what customers need, businesses can easily launch a product or service that misses the mark. For instance, a startup might release a new tech device without considering whether anyone wants it, resulting in lackluster sales due to lacking market demand.

Not having a well-defined business model right off the bat leads to disarray and uncertainty. Entrepreneurs need to be clear on their revenue model, if it’s direct sales, subscription, advertising, etc.

Failing to accurately estimate startup expenses is another common mistake. Too many new entrepreneurs estimate costs with pie-in-the-sky expectations, creating a cash crunch. It’s important to have a detailed budget created for all startup expenses, such as permitting, inventory, and grand opening marketing.

2. Learn How to Mitigate Risks Effectively

Effective risk mitigation starts with a solid business plan. A comprehensive plan includes goals, tactics, and risk response. For instance, if a product launch does not meet sales targets, having an alternative strategy can help pivot the business quickly.

In addition, building a strong network of supporters is essential. Involving mentors or experienced industry colleagues can help inform your decisions and set you on the right path.

The small business success stories you hear all share one thing in common; they’ll tell you how the advice of seasoned professionals helped them get there.

Leveraging Community and Local Resources

Beyond the individual, the journey to building a successful small business enterprise takes much more than just individual grit and determination. Engaging with the small business community can offer learning experiences, relationship building, and crucial support to help you along the way.

Connect with Local Networks for Support

Local business networks are essential resources for emerging entrepreneurs. By joining these organizations, as well as your local chamber of commerce or industry-specific associations, you open yourself up to collaboration and mentorship.

These networks sometimes organize pitch competitions, in which budding business owners can learn from other entrepreneurs, share ideas, and discover partners or backers. A local restaurant owner would have a much easier time finding a local supplier at a networking event.

This makes it a win-win situation for everyone involved.

Access Assistance from SBA Partners

The U.S. Small Business Administration (SBA) has many free and low-cost resources available to small businesses. Their local district offices and resource partner network offer no-cost workshops, advising, and funding opportunities.

Leveraging these resources can help business owners learn how to develop a business plan, marketing plan, and how to manage finances. A business seeking startup capital may go to an SBA borrower’s workshop to learn about their options.

This type of information can be key in getting that first funding!

Participate in Community Events for Growth

Community events, whether fairs, markets or other gatherings, offer natural opportunities for small businesses to highlight their goods and services. Beyond boosting exposure, these events provide invaluable opportunities for building relationships with new customers as well as other business owners.

For a seller of handmade goods, a single well-attended local craft fair could introduce them to a much wider audience. This promotion almost always translates into increased sales and brand visibility.

The Role of Technology in Business Efficiency

Technology has become the great equalizer when it comes to improving efficiency in small businesses. By implementing technology and utilizing data, such as with advanced traffic management systems, businesses can operate in a more efficient manner, saving time and money.

This section dives into how the power of automation and digital technology can make or break a small business’s success.

1. Integrate Automation for Streamlined Processes

Automation makes managing recurring tasks a breeze, so business owners can spend less time on operations and more on the business’s future. For example, deploying software to manage invoicing can reduce human error in data entry and shorten time from service delivery to payment.

Platforms like Zapier help businesses to connect and integrate various applications, automating repetitive tasks like data entry or email marketing. This method is a huge time saver.

It further improves operational consistency, delivering consistent work product and on-time completion of tasks.

2. Explore Digital Tools for Enhanced Productivity