#How to start Poultry Farm Business

Explore tagged Tumblr posts

Text

How to Start a Profitable Chicken Feed Manufacturing Business

🐔 Ready to start your Poultry Feed Manufacturing Business? Learn the secrets to success and create high-quality chicken feed that boosts profits! 🚀 #PoultryFeedBusiness #ChickenFeedProductionFeedManufacturing #EntrepreneurJourney #ProfitableIdeas

Poultry products such as eggs and meat contribute to a significant percentage of the world’s food demand. Chicken feed generally refers to the food of chickens, ducks, pigeons, quails, and so on. Usually, when they are free, they arrange their own food. But when they are raised commercially, they need chicken feed as their food. Because, commercial chicken feed is rich in protein, minerals,…

#business ideas 2025#chicken farming business#chicken feed business#chicken feed business in india#chicken feed business plan#chicken feed machine#chicken feed making business#chicken feed manufacturing business#chicken feed pellets business#chicken feed processing business#how to build a chicken feed business#manufacturing business ideas#poultry farming#poultry farming business plan#poultry feed#start chicken feed farming business#startups

0 notes

Text

1333 – Day 4 – Wozny Farm

Theodora and Balwin have planned their elopement well. Watcher knows they’ve had the time to consider it.

They settle in a hut hidden deep in the hills, on the shore of a lake that will offer Balwin ample opportunity to fish while Theodora tends to their house and the animals. There won’t be much trade in their home, so to support themselves, they have bought some chickens on the way here, along with a kitten to keep away rodents from their food stores, which Theodora is most delighted by.

It had been the only bright spot in their journey, once her excitement had worn off somewhat. Of course she hadn’t expected it to be a joyride, but trekking through the mountains with only a pony to carry their things has been uncomfortable, and exhausting, and cold. She still remembers almost weeping with relief when she had spotted the lake that was their goal. Balwin had learned about it at market a long time ago and made a deal with a shepherd for the hut. It suits their purposes well: no one will think to look for them here, and only a handful of people, mostly shepherds, travel this far into the hills, so they are unlikely to be discovered.

After enjoying finally sleeping in a bed again – although it is nothing but a lumpy straw mattress – Theodora can even appreciate the beauty of the place, especially when she sees the early morning light glinting on the lake. It’s tranquil. Maybe not the perfect place to start a family with how far from civilization they are, but at least one where they won’t be disturbed.

The problem is, of course, that aside from Balwin's fishing, neither of them has much practical experience in what they are doing. Theodora has read about poultry and husbandry – her visits to the abbey to drop off their charitable donations have been an excellent excuse to avail herself of its library – and watched the maids’ cleaning at home, but she has never done any of it. She counts it as a triumph that her chickens are still alive after a fortnight. And Balwin is a good, hardworking man, but he is no farmer.

What Theodora also realizes, rather quickly, is that manual labour is exhausting, much more so than she had anticipated. She is constantly tired, her hands start to blister from the cold and from her continual scrubbing, her back and knees soon begin to ache, and the worst thing is that she can’t even complain because she chose this.

It’s just so much more difficult than she ever imagined.

While she busies herself with those domestic duties, Balwin works outside. Their plan had been for him to fish – not to trade in any great scope, but to provide food for themselves. With how quickly fish goes bad, catching more than they need wouldn’t be practical. There aren’t many families around, so while they can exchange fish for other things, they couldn’t possibly sell it at market.

But a sudden onset of frost that freezes the edges of the lake makes it impossible for Balwin to do that now, so he instead takes over planting the seeds they bought. Since the task requires overturning the soil, Theodora isn’t too sad to hand over that duty. Balwin also notices that there are many rocks of interesting materials lying around, which he gathers, to sell the next time a trader comes by, or when they next visit the market at Tovar.

Due to the cold, Theodora mostly spends the time she is not caring for the animals or scrubbing or doing some other kind of yard- or housework huddled by the fire, knitting or sewing. Some of this she means to put aside to sell or trade, but they will also need clothing and blankets. Truth be told, she is just glad to be doing something she feels capable at.

Unlike Theodora, Balwin seems to be excited about the new possibilities their life holds, despite the setback the frost represents. But then again, that is not too surprising. Unlike her, he is used to demanding physical work.

While she doesn’t dare voice her discomfort now that the uncomfortable reality of the life she chose settles in for her, they still discuss their plans for the future very often. They are married now, before the eyes of witnesses – meaning the congregation of a small church they stopped at – and have consummated their marriage, so there may be children to take care of in the foreseeable future. They will have to build up proper food stores for that, and they need to decide what to plant in the next few seasons, they need to figure out how to do certain things neither of them has experience in, build relationships with their few neighbours, and gather as much knowledge from them as they can.

Theodora fears that there will be many other challenges they aren’t even considering yet, but she’ll do her best to be a good wife and to face her life with determination and hope.

There is, after all, no going back now.

Previous: 1333, Day 4, Part 2/6 <--> Next: 1333, Day 4, Part 4/6

#townsend legacy#ultimate decades challenge#the ultimate decades challenge#the sims 3#ts3#udc: wozny family#1330s#udc: gen 2

8 notes

·

View notes

Text

small town AU where:

Scott and Melissa moved there after losing the house during the divorce and she's working at the rural clinic while he's working under Dr. Deaton.

Stiles is still the kid of a sheriff and the sheriff's department takes care of beacon hills as well as the surrounding other small towns in the county :)

Four words, Livestock Veterinarian Alan Deaton! Four more bonus words Livestock Veterinary Assistant Scott!!! A bunch of more words Deaton and Scott with cute little baby farm animals!!!!!!!!

(if i truly had the energy to do so, i would love to continue writing my livestock vet Scott + farmhand Stiles fic, but that's a different AU)

Derek Hale is a city kid turned farmhand on an old man's farm (the old man in question is Elias, Stiles' grandfather)(and to the question why is Stiles or his father working at the farm is because 1. Elias lets his son work as a sheriff because whatever and 2. Stiles is a walking disaster no way is he letting that boy in charge of farm chores nuh uh not even on a lazy almost fall summer day where there's not much than the usual morning feeding also 3. Derek was only hired after Elias accepted that he was not as young and capable as he used to be and Noah and Stiles put themselves in charge of finding a farmhand)(Derek was the only one to send in a reply to their job ad) and the farm primarily raises sheep for meat and wool but I'd like to think that after Derek started working there a few years back he'd regularly add in new animals every summer or so. Sometimes he'd raise poultry, sometimes it's a small drove of pigs, sometimes it's not even animals but just a crop of pumpkins and squash and tomatoes and cucumbers!!

Derek loves the sheep. He's a shepherd through and through.

Jackson is not a whittemore but a miller, except his parents just died a bit later into his life and he lives with the whittemores on their large scale hay farm where there's an added bonus (to me)! h o r s e s !!!!

(all of this is just a way for me to write my fav characters interacting with my longest running obsession of all time, horses)

Lydia's mother owns the town's bistro/bar, her father owns the lodge built next to it. It used to be a whole business but it split with the divorce but there's still the whole B&B package deal to this day as it's wayyyyy too popular to risk losing business by stopping it.

Allison moved there pretty recently and the guns business her family owns fits in pretty well with the need for safety of the farmer and their livestock from predators and also for the wild game hunters in the late summer through fall hunting season.

Scott and Lydia bonding over being two kids from a divorced family. Scott and Lydia bonding over having pet dogs (Roxy is alive and Prada and her are absolute besties). Scott and Lydia being partners in science projects. Scott and Lydia spending wayy too long staring into each others eyes than how much friends would. Scott and Lydia realizing they want to be more than friends.

Stiles spouting off cool animal facts that Scott 100% already knew but acts like he didn't because both of them are stupidly in love with each other.

Scott meeting Derek when on the job. He can't help but crush over Derek and his enthusiasm over regenerative agricultural practices.

Jackson trying to impress Scott and Stiles by trotting up and down the main street on his horse. (I live laugh love by my Scott/Stiles/Jackson agenda) He also gets his dad to bring his horse over to school so he can just ride on it back home, in hopes of impressing Scott and Stiles but Scott is too invested in Stiles animal facts that they only way Jackson really has a chance was when Scott came over with Deaton for an emergency check up on a rogue cow on their property that was limping bad. Jackson straight up embarasses himself because he's a loser :P but Scott finds the attempt endearing and asks if he'd want to hang out with him and Stiles. It's the beginning of a slippery slope of 'Oh. Oh.' realizations for the three of them.

Scott and Allison meeting each other at the bistro and it starts a blossoming relationship that tugs at the heartstrings. It's cute little notes during class and hanging out at the bistro over hot chocolate even on hot days and going over to each others house to watch TV to cuddle under the same blanket and quick glances at each other and it's so goshdarn cute.

BASICALLY, SCOTT/EVERYONE because I can't choose which ship to go with this au because Scott DESERVES everyone and everyones ALSO DESERVES Scott :D

#this is just a bunch ive thought about this AU#more characters would also be in this au but i havent thought so thoroughly about them being in this au yet#Scott McCall#Stiles Stilinski#Derek Hale#Jackson Whittemore#Lydia Martin#Allison Argent#Scott/everyone#Scydia#Sciles#Scerek#Scackson#Scott/Stiles/Jackson#Scallison#Teen Wolf#feral says things#myfic#I THINK ABOUT THIS FIC AND THEN I GO AND PLAY NEED FOR SPEED INSTEAD OF WRITING AAAAAA#honestly tho i should write a street racing au oneshot again those are soooo fun

61 notes

·

View notes

Text

Bloc Québécois Leader Yves-François Blanchet laid out a list of demands Wednesday he said the government must fulfil by the end of October if it wants to avoid the risk of an early election. Speaking to reporters on Parliament Hill, Blanchet said the Bloc wants the government to push through a bill, C-319, that would hike Old Age Security (OAS) payouts by 10 per cent for seniors between the ages of 65 and 74. The government topped up OAS payments for seniors aged 75 and older in 2022. Blanchet also said he wants the government to agree to pass a Bloc private member's bill, C-282, that exempts the supply-managed farm sectors — dairy, poultry and eggs — from any future trade negotiations. He said those demands must be met by October 29. If they're not, he said, the Bloc will start negotiations with the Conservatives and the NDP on toppling Prime Minister Justin Trudeau's government. If the Liberals come through on those two priorities, Blanchet said, the Bloc won't vote against the government before Christmas. That would all but guarantee the government's survival into the new year. ********** It's not clear how the government could meet the Bloc's demands, given some parliamentary realities. C-319, the OAS top-up bill, is up for debate later today in the Commons. It also would have to clear the Senate before it could become law. Because it directs the government to spend money, it would need a "royal recommendation" from the government before it could be enacted. In the normal course of business, all of that would take months to accomplish. The Parliamentary Budget Officer (PBO) has said the Bloc's 10 per cent boost would have a net cost of $16.1 billion over five years — a pricey commitment as the federal government is trying to find money to expand new social programs and build up Canada's military to meet NATO spending targets. The top-up also raises questions about generational fairness — something the government has said it cares about. Elderly benefits, including OAS and the Guaranteed Income Supplement (GIS) for low-income seniors, are expected to cost the federal treasury roughly $80 billion this fiscal year — a budget line item much larger than other major programs, such as Employment Insurance (EI), the Canada Child Benefit and federal health-care transfers. The Canada Pension Plan (CPP) is funded by employee and employer contributions, not through general tax revenues like the other two federal retirement benefits. As for C-282 — which would tie the hands of future trade negotiators — the legislation is before a Senate committee. The government has little, if any, control over how long the Red Chamber takes to debate, amend or pass legislation through a committee.

*muffled screaming*

#oh fuck you#YOU SHOULDN'T EVEN BE THERE#YOU'RE NOT A FEDERAL PARTY#forever angry that the BQ loopholed themselves into parliament#canada#politics

5 notes

·

View notes

Text

The plight of Kenya's jobless youth: A story of hope and despair.

By Emmanuel Okiru, 17 November 2023

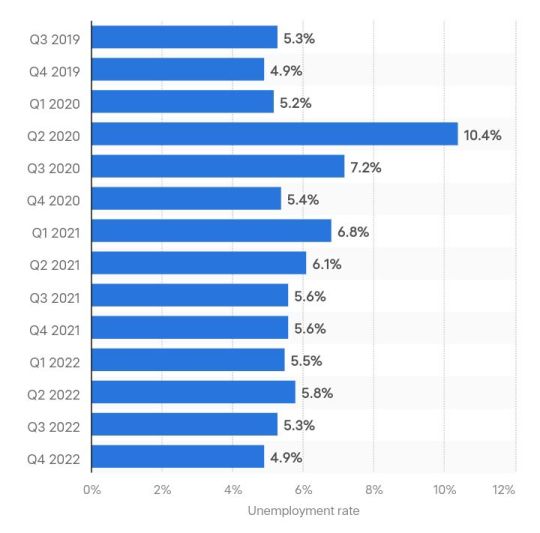

Kenya is facing a serious challenge of youth unemployment, which affects millions of young people who are either out of work or stuck in low-quality and informal jobs. According to the World Bank, the youth unemployment rate in Kenya was 13.35 percent in 2022, among the highest in the world. The situation is worse in urban areas, where the youth unemployment rate was 19.1 percent in 2009, the latest year for which data is available.

The causes of youth unemployment are complex and multifaceted, ranging from a slow-growing economy, a mismatch between the skills of the labor force and the demands of the market, a lack of access to capital and credit, and a high population growth rate that outstrips the creation of new jobs. Moreover, the COVID-19 pandemic has exaggerated the problem, as many businesses have closed down or reduced their operations, leading to massive layoffs and income losses.

However, despite all these, there are also stories of hope and resilience among the Kenyan youth who are trying to overcome the barriers and create opportunities for themselves and others. Some of them have benefited from various initiatives and programs that aim to provide them with skills, training, mentorship and funding to start and grow their own businesses or find decent employment.

One such program is the Youth Enterprise Development Fund (YEDF), which was established by the government in 2006 to support youth entrepreneurship and innovation. The fund offers loans, grants and business development services to youth groups and individuals who have viable business ideas or existing enterprises. According to the fund's website, over 12 billion Kenyan shillings has been disbursed to more than 1.4 million youth since its inception.

One of the beneficiaries of the YEDF is Mary Wanjiku, a 24-year-old who runs a poultry farm in Kiambu County. She started her business in 2019 with 100 chicks, after receiving a loan of 50,000 shillings from the fund. She has since expanded her farm to 500 birds and sells eggs and chicken to local hotels and supermarkets. She has also employed two other young people to help her with the daily operations.

"I am very grateful to the YEDF for giving me this opportunity to start and grow my business. It has changed my life and given me a sense of purpose and dignity. I am able to support myself and my family, and also create jobs for other youth in my community," this is what she had to say in an interview with the Kenyan disclosure team.

This is just an example of how some Kenyan youth are coping with the challenge of unemployment and how some programs are trying to address it. However, there is still a lot that needs to be done to create more and better opportunities for the millions of young people who are still struggling to find their place in the society and the economy.

YEDF Testimonial video. Source: https://m.facebook.com/StateHouseKenya/videos/short-video-youth-enterprise-development-fund-yedf-beneficiaries/891250118940038/?locale=ms_MY

Photo gallery depicting the state of Unemployment in Kenya.

Kenyan youth protesting over increased unemployment. Source; Business Daily Newspaper, 2020.

Jobseekers wait to hand in their documents during recruitment at County Hall in Nairobi

Source; Nation Media Group, 2019.

Job seekers queuing for interviews in Nairobi. Source; The East African Newspaper.

Kenyan doctors protest against unemployment. Source; https://www.aa.com.tr

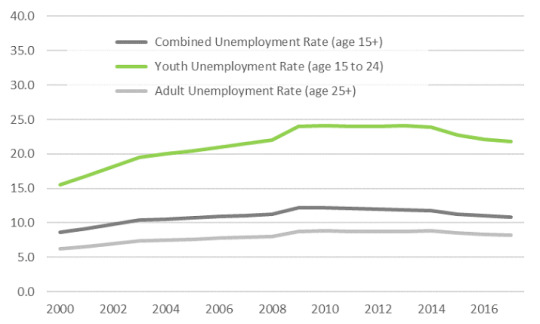

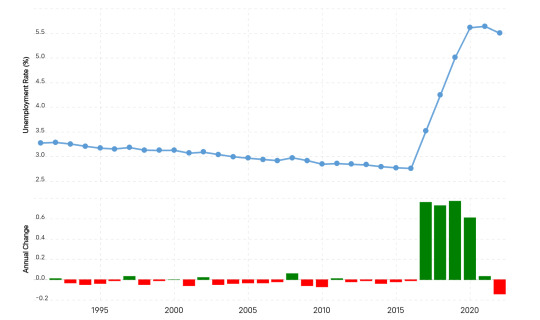

Unemployment rate in Kenya over the years.

The graphs below give a clear depiction of Kenya's state of employment over the years;

Source: <a href='https://www.macrotrends.net/countries/KEN/kenya/unemployment-rate'>Source</a>

Unemployment rate in Kenya from Q3 2019 to Q4 2022. Source; https://www.statista.com/statistics/1134370/unemployment-rate-in-kenya/

2 notes

·

View notes

Text

Go Solar in Dindigul: A Practical Guide to Solar Panel Installation

Dindigul, known for its rich culture and growing industries, is now witnessing a silent but powerful shift toward clean energy. Solar power is no longer a luxury—it’s a smart investment for both households and businesses. With abundant sunlight throughout the year, solar panel installation in Dindigul is gaining momentum as people seek affordable, eco-friendly alternatives to conventional electricity.

🌞 What Makes Dindigul Ideal for Solar Power?

1. High Solar Potential: Dindigul enjoys a warm climate with over 300 sunny days annually. This means solar panels here can operate at high efficiency year-round.

2. Increasing Power Needs: With rising urban development, Dindigul's power demand is steadily increasing. Solar energy offers a reliable backup and a sustainable way to manage costs.

3. Affordable Installation: Government incentives and falling solar technology prices have made installation accessible for common households, schools, and even small-scale industries.

🔍 Who Can Install Solar Panels in Dindigul?

Solar isn't just for big businesses. It’s now a practical solution for:

Individual houses

Apartments and residential complexes

Shops and hotels

Poultry farms and small-scale agro-units

Educational institutions

If your electricity bill is ₹1,500 or more per month, solar is a smart alternative that can reduce your power expense by up to 90%.

⚙️ Understanding the Installation Process

Here’s what you can expect during the solar panel installation journey in Dindigul:

Rooftop Assessment: Experts evaluate roof size, sunlight exposure, and your average power usage.

System Design & Quotation: A customized plan is shared with an estimated cost and subsidy benefit.

Government Subsidy Application: Installers assist with paperwork for MNRE/TEDA subsidies (up to 40%).

Installation Work: Solar panels, inverter, and wiring are installed—usually within 2–4 days.

Net Meter Connection: A bi-directional meter tracks how much power you generate and send back to the grid.

💰 Cost & Subsidy Overview in Dindigul

System SizeApprox. Cost (₹)After Subsidy (Residential)1 kW₹75,000₹45,0002 kW₹1,45,000₹87,0003 kW₹2,15,000₹1,29,0005 kW₹3,60,000₹2,16,000

Final prices may vary based on panel brand, installation quality, and accessories like batteries.

📈 Real Benefits of Going Solar in Dindigul

Zero Electricity Bill: Once installed, your monthly bill can drop drastically.

Eco-Friendly Living: Reduce your home or business’s carbon footprint.

Low Maintenance: Panels require minimal cleaning and occasional service.

Long-Term Investment: Enjoy 20–25 years of energy savings.

Boost Property Value: Homes with solar systems are more attractive to buyers.

👨🔧 Finding the Right Installer in Dindigul

Here are a few tips when selecting your solar partner:

✅ Choose MNRE/TEDA-approved vendors ✅ Ask for previous customer references ✅ Ensure post-installation support ✅ Clarify warranty (look for 25 years on panels, 5–10 years on inverter) ✅ Request a free rooftop assessment before committing

Many solar companies in Dindigul now offer EMI options and handle the entire subsidy process for you.

🏡 Local Success Stories

In areas like Begampur, Palani Road, and Gandhiji Street, residents are already enjoying the benefits of solar. Small business owners have also started using solar-powered systems to run freezers, lights, and equipment—cutting down diesel and power expenses.

✅ Final Thoughts

With the right support and planning, solar panel installation in Dindigul is one of the smartest decisions you can make in 2025. Whether you're a homeowner, a school, or a business, solar gives you freedom from fluctuating power prices while helping protect the environment.

Don’t wait for the perfect time—the sun is already shining. Start your solar journey today in Dindigul!

0 notes

Text

Your Complete Guide to Solar Panel Installation in Dindigul

As more residents across Tamil Nadu look for reliable, eco-friendly power solutions, solar panel installation in Dindigul has emerged as a top choice. With high sunlight availability, supportive government policies, and trusted local installers, it’s never been easier to switch to solar.

In this guide, we break down everything you need to know about going solar in Dindigul—cost, process, benefits, and top providers.

☀️ Dindigul + Solar = A Perfect Match

Why is Dindigul ideal for solar panel installations?

📍 Location Advantage – Over 280 sunny days per year means higher energy generation

⚡ High Grid Dependency – Rising TNEB charges make solar a cost-saving choice

🌱 Green Energy Push – Solar is clean, silent, and sustainable

Whether you’re in Palani, Nilakottai, Batlagundu, or Dindigul town, solar works efficiently for homes, businesses, and farms.

💡 How Does Solar Work?

A typical solar setup includes:

Solar Panels (monocrystalline/polycrystalline)

Inverter (converts DC to usable AC)

Net Meter (records how much power you send to the grid)

Optional Battery (for backup, in hybrid/off-grid setups)

You generate electricity during the day, use what you need, and export the rest to the grid—earning credits!

💰 Cost of Solar Panel Installation in Dindigul

System SizeApprox. Cost (Before Subsidy)Subsidy AvailableNet Cost1 kW₹70,000–₹80,000~₹28,000₹42,000–₹52,0003 kW₹2,10,000–₹2,40,000~₹78,000₹1,30,000–₹1,60,0005 kW₹3,40,000–₹4,00,000~₹1,00,000₹2,40,000–₹3,00,000

🟢 Farmers can get up to 70% subsidy on solar water pumps through agricultural schemes.

🛠 Trusted Solar Installers in Dindigul

Here are some top-rated service providers offering solar panel installation in Dindigul:

Smart Solar Dindigul – Known for smart metering and post-installation support

Naviksun Solar – TEDA-approved, subsidy experts, and agricultural solar specialists

Synergy Solar – Provides on-grid and hybrid solar systems with net metering setup

Kay Tech Solar – End-to-end solution provider, including panels, inverters, and permits

These companies handle everything—design, installation, TNEB approvals, and maintenance.

📋 What to Ask Before You Install

🔹 What brands of panels and inverters are used?

🔹 How long is the warranty?

🔹 Will you handle subsidy and net metering?

🔹 Do you offer EMI or maintenance plans?

A reliable installer will walk you through each step clearly.

🗣️ Local Impact Stories

“We went solar in 2023. Our 4 kW setup produces enough to cover our full usage—and we still get credit!” — Revathi M., Dindigul Town

“We installed solar for our poultry farm in Vadamadurai. It paid for itself in just 3 years.” — Arunraj, Farm Owner

✅ Summary: Why You Should Act Now

☀️ Use Dindigul’s sunlight to your advantage

💸 Save on your monthly electricity bill

📉 Get high government subsidies

🔧 Enjoy reliable installation and service from local experts

📞 Ready to Get Started?

If you're searching for solar panel installation in Dindigul, contact a local provider today. Book a site visit, get a quote, and start powering your life with sunshine.

0 notes

Text

Top Business Ideas That Qualify for PMEGP in Rural Areas – 2025 Edition

The Prime Minister's Employment Generation Programme (PMEGP) is the Government of India's main scheme for fostering self-employment and rural entrepreneurship. In 2025, the PMEGP will continue to offer large subsidies (up to 35%) for starting new businesses in rural and semi-urban areas. With the correct company idea, a comprehensive Project Report for the company, and the proper documentation, such as a DPR for Bank Loan or Detailed Feasibility Report, hopeful entrepreneurs can make their dreams come true.

Let's look at the top business ideas that qualify for PMEGP in rural India and how important tools like Startup India Registration, NLM Project Report, and income tax return filing can help you increase your chances of loan acceptance and long-term success.

1. Organic Farming and Vermicomposting

Organic farming is booming in India, especially with the government’s push toward sustainable agriculture. Vermicompost units, bio-fertilizer production, and organic vegetable farming are among the most approved projects under PMEGP in rural regions.

Prepare a Project Report for Business and a Project Report for Mudra Loan detailing cost, yield, and market reach.

A DPR for a Loan must include soil testing, organic input procurement, and a marketing plan.

Add your Startup India Registration to gain recognition and support.

A Detailed Feasibility Report and timely income tax return filing improve creditworthiness.

2. Dairy Farming and Milk Processing Units

Dairy farming remains one of the most viable business ideas for PMEGP in rural India. The demand for milk, ghee, curd, and paneer is consistent.

Use an NLM Project Report (National Livestock Mission format) to outline livestock procurement, feed cost, and profitability.

A DPR for a Bank Loan should also include cold storage and delivery logistics.

Don’t forget Startup India Registration to benefit from government mentoring and branding.

Keep income tax return filing records clean to prove income stability to banks.

3. Handicrafts and Handloom Production

Handmade goods such as jute bags, bamboo furniture, and handwoven textiles are PMEGP-favored due to their labor-intensive nature.

Draft a creative Project Report for Business highlighting local artisan engagement and export potential.

A Project Report for Mudra Loan can be submitted alongside PMEGP for dual support.

A solid, Detailed Feasibility Report with ROI projections is essential.

Ensure income tax return filing is consistent for subsidy release and future upgrades.

4. Poultry and Goat Farming

Animal husbandry, like broiler poultry and goat meat farming, is profitable in rural settings due to low startup costs and high demand.

Submit a detailed NLM Project Report under the PMEGP scheme.

Include biosecurity measures, vaccination plans, and sale agreements in your DPR for the Loan.

Add your Startup India Registration to avail benefits like IP facilitation and funding connections.

A Project Report for Mudra Loan can support working capital needs.

Maintain clear income tax return filing to stay compliant and trusted.

5. Mobile Repair and Digital Services Center

With rural digital penetration increasing, setting up digital seva kendras, mobile repair shops, or online service centers is a practical choice.

Draft a tech-oriented Project Report for Business focusing on services like PAN card, GST filing, and internet cafés.

A startup-focused Pitch Deck for a Startup will help pitch the idea to private investors, too.

Ensure the DPR for the Bank Loan includes training costs and software expenses.

Supplement the project with a Detailed Feasibility Report on demand and competition.

Register under Startup India to enhance visibility and credibility.

Keep up with income tax return filing to manage audit and compliance needs.

Essential Documents for PMEGP Approval

To qualify under PMEGP in rural areas, the following are mandatory:

Project Report for Business

NLM Project Report (for livestock businesses)

DPR for Loan and Detailed Feasibility Report

Valid Startup India Registration

The past two years of income tax return filing

Aadhaar, PAN, bank statements, and educational qualification

Final Thoughts

In 2025, PMEGP is a key enabler of rural entrepreneurship. The success of your application is largely determined by how well you present your proposal in a Project Report for Mudra Loan, a DPR for Bank Loan, and a detailed Feasibility Report. Additionally, frequent income tax return filing and registration under the Startup India plan contribute to long-term confidence with financial institutions and government organisations.

Whether you're starting a dairy farm, a mobile service centre, or a handicraft business, make sure your Project Report for Business is concise, data-driven, and relevant to rural requirements. Finaxis and Sharda Associates can assist you in preparing customised NLM Project Reports, Startup Pitch Decks, and full-scale DPRs for Loans to increase your chances of receiving PMEGP subsidies and loans. For additional information or assistance, please contact us at +91-8989977769.

0 notes

Text

Why Farmers and Rural Entrepreneurs Should Explore Loan Against Property and Agriculture Loan Schemes

Making smarter financial decisions in rural India

Access to timely credit can transform rural livelihoods. Whether you are a farmer looking to expand your cultivation or a small business owner in a village planning to scale up, the right loan can help you reach your goals without exhausting your savings.

In this article, we’ll explore how a Loan Against Property, various Agriculture Loan Schemes, and tailored Agriculture Loans offered by public sector banks like the Bank of Maharashtra can provide flexible, affordable financial support.

Using a Loan Against Property to meet large-scale financial needs

If you own land or property, you have access to one of the most powerful financial tools—Loan Against Property (LAP). This secured loan allows you to pledge your residential, commercial, or even agricultural land to raise a significant amount of capital.

Why it makes sense:

High loan amount: Get up to 60% of your property’s value.

Lower interest rate: Much cheaper than unsecured loans.

Flexible usage: Invest in your business, cover medical expenses, or even fund education.

Longer tenure: Repayment periods can go up to 10 years.

If you’re looking to start a dairy farm, set up a warehouse, or simply need a large fund for personal use, this is one of the best options—especially when you go with Bank of Maharashtra Loan Against Property, known for its low interest rates and minimal documentation.

Understanding Agriculture Loans – Fuel for India’s backbone

Agriculture remains the lifeblood of India, but farming requires constant investment in seeds, equipment, irrigation, labour, and more. This is where an Agriculture Loan becomes essential.

Bank of Maharashtra offers customised agriculture loans for:

Crop cultivation

Purchasing tractors and machinery

Buying seeds, fertilizers, and pesticides

Setting up irrigation systems

Horticulture and allied activities like dairy and poultry farming

Features include:

Flexible tenures matching cropping cycles

Subsidised interest rates

Easy repayment options

Minimal paperwork

With BoM, the entire process is transparent and rural-focused. These loans are designed with the farmer in mind—keeping seasonal income fluctuations and credit cycles in view.

Making the most of Government-Backed Agriculture Loan Schemes

The Government of India and RBI regularly introduce Agriculture Loan Schemes to help farmers access credit on favourable terms. Some popular schemes include:

1. Kisan Credit Card (KCC)

This flagship scheme allows farmers to take loans for crops, livestock, and allied activities at very low interest rates (as low as 4% with timely repayment). BoM actively supports KCC applications and renewals.

2. Interest Subvention Schemes

Farmers who repay on time are eligible for interest rebates of 2–3%. This can significantly lower the cost of borrowing.

3. PM Kisan Maan Dhan Yojana and Agri Infrastructure Fund

These schemes not only assist with working capital but also support long-term development such as cold storage units and primary processing.

When farmers approach Bank of Maharashtra for such schemes, they receive dedicated assistance in understanding eligibility and completing paperwork.

Combining LAP with Agri Finance – A hybrid solution

In certain cases, farmers who own property may benefit from a combination approach—taking a Loan Against Property to fund large investments, and using Agriculture Loan Schemes for operational needs.

For instance, a farmer could use a LAP to buy adjacent land and use a crop loan to finance sowing and harvesting on that land.

This layered approach provides long-term financial strength without putting day-to-day farm activities at risk.

Why Bank of Maharashtra is the preferred partner for rural credit

Here’s why farmers and rural entrepreneurs trust Bank of Maharashtra:

Low interest rates and transparent charges

Fast processing and minimal documentation

Dedicated agri-loan officers in rural branches

Access to all government schemes

User-friendly mobile and internet banking for rural users

BoM understands the unique credit needs of rural India and offers tailored financial products that go beyond just lending—they enable growth and prosperity.

Final thoughts – Choose the right tool for your financial growth

Whether you're a farmer preparing for the next sowing season or a rural entrepreneur looking to scale operations, understanding your credit options is key.

Use a Loan Against Property when you need a large, flexible fund.

Opt for an Agriculture Loan for crop and equipment financing.

Explore Agriculture Loan Schemes for interest rebates and long-term infrastructure support.

When you choose Bank of Maharashtra, you’re not just taking a loan—you’re gaining a reliable financial partner committed to rural India’s progress.

0 notes

Text

Veterinary PCD Franchise for Cattle, Poultry & Pet Segments

Veterinary PCD Franchise for Cattle, Poultry & Pet Segments - A Veterinary PCD Franchise is a business model that allows individuals to distribute veterinary pharmaceutical products for cattle, poultry, and pets. This creates a business opportunity in the animal healthcare market.

Vee Remedies is a leading Veterinary PCD Franchise in India that offers franchise business opportunities to interested entrepreneurs through providing them exclusive rights to market and sell their products without worrying about the perfect competition.

Here are the primary highlights of this Veterinary PCD Franchise business model

Product Range

Connecting with a reliable pharmaceutical company that specilaizes in the veterinary range is very crucial to establish a strong market presence and attain profitability.

A company like Vee Remedies is a specialized and leading veterinary pharma company that offers a diverse range of products. This will help in addressing different animal needs, including antibiotics, vaccines, parasiticides, and supplements.

Quality Assurance

Quality is another important aspect that needs consideration while selecting the top veterinary PCD franchise business. We at Vee Remedies are manufacturers and suppliers of DCGI-approved and quality-assured drugs. Our manufacturing practices follow GMP (Good Manufacturing Practices) and ISO standards, ensuring safety, efficacy, and reliability.

High-quality products not only build trust with veterinarians and animal owners but also boost brand credibility in the market.

Franchise Support

Getting proper support from the parent company plays a significant role in the success of a Veterinary PCD Franchise. Vee Remedies offers complete marketing support, promotional materials such as visual aids, visiting cards, catch covers, and product brochures. Franchise partners are also provided with monopoly rights in their territory, helping them grow without direct competition. Regular training, guidance, and updates about new products make the business smoother and more efficient.

Market Reputation

Partnering with a company that has a strong market reputation and positive customer feedback is essential. Vee Remedies has earned a trustworthy name in the veterinary pharma sector through years of commitment to quality, innovation, and customer satisfaction. Our existing network of satisfied clients across India is a testament to our consistent service and dependable products.

Investment

Starting a Veterinary PCD Franchise doesn't require a huge investment.

An initial investment of ₹3 to ₹6 lakhs is usually sufficient. This covers basic expenses such as business setup, obtaining licenses, marketing, stocking inventory, and maintaining a small buffer fund. Compared to other sectors, the veterinary segment offers a relatively low-risk, high-reward opportunity.

Marketing and Distribution

Success in this field also depends on how well you can market and distribute the products. Franchise partners are encouraged to build a strong distribution network and connect with local veterinary clinics, pet shops, dairy farms, and poultry farms. Effective offline and digital marketing strategies, including social media, local promotions, and word-of-mouth referrals, can help in expanding the customer base quickly.

Wrapping Up

If you are looking to start your own business in the growing field of animal healthcare, a Veterinary PCD Company is an excellent opportunity. With rising awareness about animal health and increased spending on veterinary care, the demand for quality products is constantly increasing.

Partnering with a reputable company like Vee Remedies gives you access to a wide product range, quality assurance, business support, and the potential for long-term profits. With the right approach and dedication, you can establish a successful franchise and make a meaningful contribution to the veterinary sector.

0 notes

Text

Layer Poultry Farming Guide: Start Your Egg Business Today - Gartech

Learn how to start and manage a successful layer poultry farming business with our step-by-step guide. From selecting breeds and building poultry sheds to feeding, disease control, and maximizing egg production, this comprehensive resource helps beginners and professionals boost productivity and profitability.

0 notes

Text

Today we are going to be sharing tips and tricks for small holder farmers:

🌱 1. Start Small, Grow Steady

Don’t try to plant too much at once. Start with what you can manage well. As you learn and earn, you can expand little by little.

---

🌾 2. Plant What Sells

Focus on crops or livestock that people in your area buy often. Ask around your local market to know what’s in high demand and low supply.

---

🌦 3. Time Your Planting

Plant with the seasons. For example, start planting early when the rainy season begins to make the most of natural water.

---

🐛 4. Control Pests Naturally

Use simple methods like neem leaves, ash, or pepper sprays to keep pests away instead of spending too much on chemicals.

---

💧 5. Save Water

Use methods like drip irrigation (even using old bottles with holes) to give water directly to plant roots and avoid waste.

---

🐄 6. Use Animal Waste as Fertilizer

Don’t throw away cow dung, poultry droppings, or compost. Use them to feed your soil instead of buying expensive fertilizer.

---

📘 7. Keep Good Records

Note what you plant, when you plant it, how much you harvest, and how much you sell. This helps you know what works and what doesn’t.

---

👥 8. Work with Others

Join a cooperative or group. You can share tools, buy inputs in bulk (cheaper), and even sell together to get better prices.

---

📚 9. Keep Learning

Attend local training programs, talk to extension officers, or even watch farming tips on YouTube. New knowledge means better results.

---

💰 10. Save and Reinvest

Don’t eat all your profits. Save some and use it to buy better seeds, tools, or animals for the next season.

Reminder: contact Dennis Ekwere Farms Ltd, Etinan LGA, Akwa lbom State, Nigeria for affordable business plan for any of your farm business with a professional touch!

#foodandagricultureorganization #foodandagriculture #WAYFARC #NABG #NABGroup #NigeriaAgribusinessGroup #NABG #BillandMelindaGatesFoundation #worldfoodprogramme #HortiNigeria #IFAD #africafoodchangemakers #dakkadaskillsacquisitioncentre #DASAC #undpnigeria #UNDPAfrica #UNDP #UNDPEUpartnership #unnigeria #UnitedNations.

0 notes

Text

A Feature On The Importance of Sourcing High-Quality Ingredients for Your Chicken Restaurant

In a competitive food market where taste, ethics, and transparency matter more than ever, sourcing high-quality ingredients isn't just a culinary decision—it’s a brand-defining strategy or a restaurant franchise. For chicken restaurants, where the main attraction is often a simple protein, the quality of each component can make or break the dining experience.

Here’s why it matters—and how to do it right.

✅ Why Ingredient Quality Matters Flavor Starts at the Farm The best recipes can’t mask poor-quality chicken. Sourcing fresh, responsibly raised poultry enhances flavor, texture, and juiciness—offering customers a noticeable difference in every bite.

Health and Safety High-quality suppliers adhere to strict food safety and animal welfare standards, reducing your risk of foodborne illness outbreaks or negative publicity.

Brand Loyalty and Transparency Today’s customers are ingredient-savvy and socially conscious. They appreciate transparency and are more likely to return when they know their food is ethically sourced.

🤝 Building Strong Relationships with Local Suppliers Visit Farms and Facilities Get to know where your food comes from. Visit poultry farms, produce suppliers, and grain mills. Observe their practices and ask questions about feed, handling, and processing.

Establish Long-Term Partnerships Building loyalty with local producers leads to better pricing, reliable supply, and the opportunity to co-create specialty items like custom spice blends or organic chicken.

Negotiate Transparently Be upfront about your quality standards, pricing expectations, and delivery needs. In return, respect your suppliers’ challenges with seasonality, labor, and logistics.

Attend Local Food Markets and Agriculture Events These are great opportunities to connect with small-scale producers and uncover new, high-quality products before they hit the mainstream.

🌿 Sourcing for Sustainability Choose Humanely Raised Poultry Look for certifications like Global Animal Partnership (GAP), Certified Humane, or USDA Organic. These ensure higher animal welfare and often better product quality.

Reduce Transportation Emissions Local sourcing cuts down on food miles, reducing your environmental impact while supporting your regional economy.

Use Whole Bird Practices Consider buying whole chickens and utilizing every part—breasts, thighs, wings, and even bones for stock. This reduces waste and can lower food costs.

Highlight Sustainable Practices on Your Menu Let customers know where their food comes from. Use phrases like “locally sourced,” “organic,” or “free-range” to showcase your commitment.

🔍 Final Tip: Always Audit Your Supply Chain Don’t just set it and forget it. Regularly review suppliers for consistency in quality, delivery, and ethical standards. As your restaurant grows, your supply chain must scale with it—without compromising on values.

In summary: Prioritizing high-quality, responsibly sourced ingredients isn’t just a feel-good move—it’s smart business. It elevates your food, builds trust with diners, and supports a more sustainable food ecosystem.

0 notes

Text

Bhabishyat Credit Card: A Helping Hand for New Businesses in West Bengal

As a banker, I often meet people with big dreams but limited resources. Some want to start their first business, while others wish to grow their small enterprises. Many times, they lack the funds to take that important first step. To help people like them, the West Bengal government has introduced the Bhabishyat Credit Card scheme. This program offers financial support to turn their dreams into reality.

an Indian small business owner holding Indian currency, thoughtfully considering financial options, with a thought bubble stating 'I want a loan.' It symbolizes the aspirations of entrepreneurs seeking support through the Bhabishyat Credit Card Scheme, which provides loans to empower businesses and foster growth.

What is the Bhabishyat Credit Card Scheme?

The Bhabishyat Credit Card Scheme (WBBCCS) is a program designed to help the rising entrepreneurs and small businessmen in West Bengal specially. This scheme provides financial assistance of up to ₹5 lakh to those who need funds to start or expand a business. The scheme came into effect from April 1, 2023 and will run for 5 years unless it is amended or withdrawn.

Objectives of the Scheme

The main objective of the Bhavishyat Credit Card Scheme is to make the youth of West Bengal self-reliant by setting up micro industries. By providing access to institutional finance, the scheme aims to help youth start and grow their business successfully, thereby not only strengthening their financial position but also contribute to the overall economic growth of the state. - Generate self-employment opportunities. - Create wealth and income for individuals and families. - Encourage further job creation in rural and urban areas. The scheme supports many industries like manufacturing, services, trading, and farming (dairy, poultry, fisheries, etc.). It also encourages new areas like technology and green energy to help both traditional and modern businesses grow.

Key Features and Benefits of Bhabishyat Credit Card Scheme

- Loan Amount: You can get a loan of up to ₹5 lakhs as financial assistance. - Government Subsidy: The government will give a subsidy of 10% of the project cost, with a maximum of ₹25,000. - No Collateral: You don’t need to provide any property or third-party guarantee. - Credit Guarantee: Your loan is fully covered by a 100% credit guarantee from the Credit Guarantee Trust Fund for MSEs (CGTMSE) and the State Government. - Low-Interest Rates: The loan comes with affordable interest rates, making repayment easier. - Eligibility for New and Existing Units: Both new and existing units can apply for term loans, working capital loans, or composite loans. Expansion support is available after two years. - Simple Application Process: You can apply online through a special portal. - Target Coverage: The scheme aims to help 2 lakh youth each year in both rural and urban areas.

Who Can Apply?

To be eligible for the Bhabishyat Credit Card Scheme, applicants must: - Must be Indian citizens and have lived in West Bengal for at least 10 years. - Must be between 18 and 45 years old. - There is no specific limit on the annual family income to qualify. - Applications submitted under the 'Karmasathi Prakalpa' scheme but not approved by April 1, 2023, will now be considered under this scheme. - You can apply if you have an income-generating project in areas like manufacturing, services, trading/business, or the farm sector (such as dairy, poultry, fisheries, piggery, etc.), and other similar sectors. - Both new and existing businesses can apply for loans (term loans, working capital loans, or combined loans). New businesses under this scheme can also apply for additional funds for expansion (like buying machinery or tools) after two years. Note: Employees of the central or state government and defaulters in any bank/financial institution are not eligible.

How to Apply for the Bhabishyat Credit Card

Follow these steps to apply: - Submit an Application: Fill out the online application form through the official portal or local advertisements, and if you are from rural areas then you can visit Panchayati Raj Institutions. - Applicants must submit a viable business plan as part of the application. If you need assistance in creating a detailed project report, you can use the Model Schemes/DPR provided by the government to draft a plan aligned with the scheme’s objectives. - You can apply for this scheme free of cost by visiting any "Duare Sarkar" camp in person. - Screening Process: Your application will be reviewed by committees at the block, subdivision, or municipal levels. - Approval and Sanction: Once approved, the application will be sent to banks, which will review the project and decide within 21 days. - Loan Disbursement: The subsidy will be directly credited to your account, and the loan will be disbursed accordingly. Also read: How to apply for the Bhabishyat Credit Card Scheme

Success Stories

The scheme has already inspired countless success stories. For instance: Priya, a young woman from a small village, started a dairy business with the help of the Bhabishyat Credit Card Scheme. Today, she runs a thriving enterprise and provides jobs to others in her community. A group of artisans used the loan to digitize their crafts, helping preserve traditional art forms while expanding their reach to customers across the country. Announcement https://youtube.com/shorts/7JZWQ6kGC94?si=qVAZRI91DCUzS_uF Source: https://financebarta.com/

Monitoring and Support

The scheme includes robust monitoring mechanisms: 1. Project Monitoring Units (PMU): These units assist with application forms, documentation, and project preparation. They also coordinate with banks to ensure smooth processing. 2.Grievance Redressal: A grievance cell resolves complaints within 72 hours, ensuring transparency and accountability. If you encounter any technical issues or difficulties while submitting your Bhabisyat Scheme Credit Card application, you can contact the support team: - Email: [email protected] - Call the helpline at 033 2262 2004 (available Monday to Friday, 10 AM to 5 PM, excluding holidays) - For any grievances, you can visit the official feedback page: https://bccs.wb.gov.in/home/feedback.html. The government monitors the scheme to see its impact and improve it. Beneficiaries can give feedback through the official website or helpdesk to make the program better for future applicants.

Latest Updates

- Extension of Application Deadline: The West Bengal government has announced an extension of the application deadline for the Bhabishyat Credit Card Scheme. Applications can now be submitted until April 1st, 2028. - New Eligibility Criteria Update: Recently, the eligibility for the scheme was expanded to include more sectors, with a focus on technology-driven businesses. - Online Helpdesk Launched: To provide better assistance, the scheme’s official website has introduced an online helpdesk. This service will assist applicants with queries regarding the application process and eligibility.

Official Sources

- Official website of Bhabishyat Credit Card Scheme - Official Notifications Memo No. 1499/MSMET-18011(11)/5/2023

Frequently Asked Questions (FAQs)

1. What if my application gets rejected?You can reapply with updated project details. Ensure your business plan is viable and aligns with the scheme’s guidelines.2. Are there specific sectors that get priority?Yes, projects in manufacturing, farming, trading, and services are encouraged.3. Is there an offline application process?Yes, you can also apply through local government offices or authorized centers.4. What is the interest rate on the loan?The interest rate is low and affordable, typically lower than standard market rates.5. Is the subsidy amount provided upfront?Yes, the government subsidy (up to ₹25,000) is credited directly to your account after loan approval.6. Can I use the loan for personal expenses?No, the loan must be used only for business-related expenses.7. What if I can’t repay the loan on time?Inform your bank and discuss options for loan restructuring or rescheduling.8. Can I apply if I already have other loans?Yes, as long as you meet the other eligibility requirements.

Final Thoughts

The bhabishyat Credit Card Scheme is a revolutionary step for the young industries of West Bengal. It gives everyone the opportunity to take control of their future by providing financial support and eliminating incentives such as guarantees. If you have a business idea but lack the funds to make it a reality, this program could be your first step towards success. Take the first step today and apply for the bhabishyat Credit Card Scheme. It could be the beginning of your success story. Read the full article

0 notes

Text

How to Start a Poultry Layer Farming Business in India

Poultry farming has always been an important part of the agriculture industry in India. In recent years, Poultry Layer Farming Business has gained huge popularity due to the growing demand for eggs and poultry products. This business not only supports food production but also opens up a stable income source for farmers, rural entrepreneurs, and even urban investors.

Whether you are a beginner or planning to expand your existing setup, getting into the Poultry Layer Farming Business can be a wise and rewarding decision. Let’s explore everything you need to know before starting your journey in this industry.

What is Poultry Layer Farming?

Poultry Layer Farming is a type of Poultry Farming Business where hens are raised specifically for egg production. These hens are known as ‘layers’ because they lay eggs regularly. With proper care, environment, and feed, a layer hen can produce a good number of eggs in its productive cycle.

This business usually focuses on long-term egg production, and the birds are kept for a longer duration compared to broiler farming, which is mainly for meat.

Why Start a Poultry Layer Farming Business?

The growing demand for protein-rich food and the rising awareness about nutrition have increased egg consumption in India. Eggs are not only affordable but also a rich source of protein and other nutrients. This makes the Poultry Layer Farming Business a stable and consistent source of income.

Here are a few reasons why this business is worth considering:

Steady demand for eggs throughout the year

Lower investment compared to some other livestock businesses

Quick returns on investment

Government support and subsidies available

Suitable for both rural and semi-urban areas

Key Requirements for Starting the Business

Starting a Poultry Layer Farming Business involves proper planning and setup. Some of the basic things you need include:

A clean and ventilated shed or poultry house

Quality layer chicks from trusted hatcheries

Good feed and clean drinking water

Basic medicines and vaccination schedule

Skilled workers or caretakers (if running on a large scale)

It's important to select a location that is well-connected but away from noise and pollution. Also, ensure proper waste disposal to maintain hygiene.

Understanding the Cost

The Poultry Layer Farming Cost can vary depending on the size of the farm, number of birds, location, and equipment. Some major costs include:

Cost of chicks

Construction and setup of poultry shed

Feed and water supply

Medicines and vaccines Labour and electricity

Although the initial investment may seem high, the running cost is manageable, and the returns start within a few months once the hens start laying eggs regularly.

Creating a Project Report

Before starting, preparing a Poultry Layer Farming Project Report is very important. This report includes cost estimates, profit margin, marketing strategy, and expected returns. A well-made project report helps in better planning and also plays a vital role if you are applying for bank loans or government subsidies.

Market and Selling Strategy

The success of the Poultry Layer Farming Industry depends not only on production but also on how effectively you sell the eggs. Local markets, schools, bakeries, and restaurants are common buyers. You can also tie up with local grocery stores or start your own small egg retail brand. Also, selling manure (from poultry waste) can add extra income to your business.

Conclusion

The Poultry Layer Farming Business is a great opportunity for anyone looking to start an agriculture-based venture with promising returns. With proper planning, care, and marketing, it can become a long-term and sustainable business.

If you’re interested, start small, learn the basics, and then scale up gradually. With growing health awareness and protein needs, the Poultry Layer Farming Industry is expected to grow even more in the coming years.

0 notes

Text

Darkling Beetle Mealworm Larvae: The Future of Sustainable Protein

In today’s rapidly evolving agricultural and nutritional landscapes, Darkling Beetle Mealworm Larvae are emerging as a powerful solution to sustainable protein needs. These tiny creatures pack an impressive nutritional punch and serve multiple industries, from animal feed to organic fertilizer and even human consumption. Let’s break down their potential, point by point.

1. What Are Darkling Beetle Mealworm Larvae?

Darkling Beetles belong to the Tenebrionidae family, and their larvae are commonly known as mealworms. Scientifically known as Tenebrio molitor, these larvae have gained massive attention in agriculture, pet care, and even gourmet food industries.

Relevant Keywords:

Mealworms

Tenebrio molitor

Darkling beetle lifecycle

2. Nutritional Profile: Why They Matter

Darkling Beetle Mealworm Larvae are rich in:

Protein (up to 55%)

Fatty acids

Fiber

Vitamins and minerals like zinc, copper, and magnesium

These nutrients make them an ideal ingredient in animal feed, especially for poultry, fish, reptiles, and exotic pets.

Relevant Keywords:

Insect protein

High-protein feed

Nutrient-dense mealworms

3. Mealworm Farming: A Low-Impact Industry

Mealworm farming requires minimal space, water, and feed, making it a sustainable alternative to traditional livestock. A small setup can produce thousands of larvae weekly, making it attractive for small-scale farmers and large industries alike.

Environmental Benefits:

Low greenhouse gas emissions

Efficient feed-to-protein conversion

Recyclable waste (frass used as fertilizer)

Relevant Keywords:

Mealworm farming

Sustainable farming

Eco-friendly protein

4. Use in Animal Feed Industry

Darkling Beetle Mealworm Larvae are increasingly used in the aquaculture, poultry, and pet food industries due to their excellent protein profile and digestibility.

Poultry: Increases egg production and growth rate

Fish farming: Enhances immunity and survival rate

Pets (birds, reptiles): A natural, enjoyable feed

Relevant Keywords:

Sustainable feed

Alternative protein sources

Animal nutrition

5. Human Consumption: The Next Superfood?

Yes, mealworms are edible for humans! Already consumed in parts of Asia, Europe is now embracing mealworms as a sustainable alternative protein source. They are available in protein bars, flours, and roasted snacks.

Health Benefits:

Cholesterol-friendly fats

Zero carbs when dried

Gluten-free and allergen-friendly (for most)

Relevant Keywords:

Edible insects

Mealworm protein bars

Human-grade insect protein

6. Organic Fertilizer: Black Gold from Larvae

The waste produced by mealworms, known as frass, is an excellent organic fertilizer. It is rich in nitrogen and beneficial microbes, perfect for organic farming.

Improves soil fertility

Enhances plant growth

Eco-friendly alternative to chemical fertilizers

Relevant Keywords:

Insect frass

Organic fertilizer

Sustainable agriculture

7. Lifecycle of the Darkling Beetle

Understanding their lifecycle helps optimize farming. The lifecycle includes:

Egg stage (4–7 days)

Larvae stage (8–10 weeks)

Pupa stage (1–3 weeks)

Adult beetle stage (2–3 months)

Each adult beetle can lay hundreds of eggs, ensuring a continuous cycle for mass production.

Relevant Keywords:

Darkling beetle eggs

Mealworm life cycle

Insect breeding

8. How to Start Mealworm Farming at Home

Getting started is easy and affordable.

Basic Requirements:

A container (drawer-style trays or bins)

Bran, oats, or wheat as bedding/feed

Controlled temperature (70–80°F)

Regular moisture source (carrots or potatoes)

You can produce your own Darkling Beetle Mealworm Larvae within weeks.

Relevant Keywords:

DIY mealworm farm

How to raise mealworms

Home insect farming

9. Commercial Opportunities and Market Growth

The global insect protein market is growing at over 25% CAGR. Mealworms, particularly Darkling Beetle Mealworm Larvae, are leading the trend.

Business Uses:

Livestock feed

Pet food manufacturing

Organic fertilizers

Health supplements

Investing now can yield high returns as the demand for eco-friendly protein sources soars.

Relevant Keywords:

Insect protein business

Sustainable agriculture startup

Mealworm production industry

10. Regulatory and Safety Considerations

Before scaling up, be aware of local regulations on:

Insect farming

Human consumption certifications

Animal feed ingredient lists

Most countries are now creating frameworks to support insect farming, making it easier to enter the market legally and safely.

Relevant Keywords:

Insect farming regulations

Food safety and insects

Livestock feed approval

Conclusion: Why Darkling Beetle Mealworm Larvae Are a Game-Changer

From nutrition and sustainability to economic opportunities, the Darkling Beetle Mealworm Larvae offer a versatile and eco-friendly solution to global protein demands. Whether you're an entrepreneur, farmer, or eco-conscious consumer, now is the perfect time to embrace this insect revolution.

Final Thoughts

The rise of Darkling Beetle Mealworm Larvae isn't just a trend—it’s a necessity in a world striving for balance between growth and sustainability. Their nutritional benefits, low environmental impact, and economic viability make them the protein of the future.

Meta Title: Darkling Beetle Mealworm Larvae: Sustainable Insect Protein Meta Description: Discover the benefits, uses, and farming techniques of Darkling Beetle Mealworm Larvae. Learn why they’re the future of sustainable protein and agriculture.

0 notes